Abstract

This paper focuses on the path of China’s participation in global value chain reconstruction and concludes three ways to reconstruct the global value chain: embedding in the global value chain, reconstructing the national value chain, and leading the regional value chain. Based on the value-added accounting system and the latest statistics of the TiVA database, we construct an index system for the path selection of global value chain reconstruction and put forward a more suitable path for different manufacturing industries in China. According to the VRCA index and ranking of each type of manufacturing industry, our study concludes that: transportation equipment manufacturing tends to embed in global value chains; textiles, clothing, leather, and related manufacturing; wood products, paper products, and printing; chemical and non-metallic mineral products; base metals and metal products; computer, electronic, and electrical equipment manufacturing; machinery and equipment manufacturing; and other manufacturing industries tend to dominate the regional value chains; and food and beverage manufacturing and tobacco industries tend to restructure national value chains. Finally, our paper gives suggestions and prospects for path upgrading; promoting the integrated development of e-commerce and the manufacturing industry can enhance the competitive advantages of China’s manufacturing industry and achieve path upgrading and optimization. Furthermore, the two-way nesting of the “Belt and Road” regional value chain and global value chain can help China’s manufacturing industry eliminate the dilemma of low-end lock-in and upgrade from the original low-end dependent embedding mode to the middle high-end hub embedding mode.

1. Introduction

The global economy has been undergoing profound changes and adjustments since the international financial crisis in 2008. The competitive advantage of each industry represented by the manufacturing industry is reshaping and showing a new evolutionary trend. The China–US trade war and COVID-19 pandemic may provide further impetus to the ongoing realignment of global value chains (GVCs) in different industries [1,2,3]. The trade frictions comprising the United States’ attempt to prevent the development of China’s manufacturing industry and subsequently curb China’s technological progress [4] will have a complex and far-reaching impact on China’s manufacturing industry development. Previous studies suggest that the impact of GVCs on domestic outcomes is conditional on the nature and position of the country’s participation in the value chains [5,6]. China has remained the most prominent manufacturing country since surpassing the United States for the first time in 2010 and deeply integrated into the global value chain through output supply and input demand. Despite the rapid formation of the status of “world factory”, the development of the manufacturing industry not only faces problems such as excessive resource consumption, environmental pollution, low added value, and lack of brand, but also suffers from the double dilemma of “low-end lock” and “high-end lock” in global value chain reconstruction [7]. At present, China’s economy is changing from a high-speed growth stage to a high-quality development stage, and the high-quality development of the manufacturing industry is the core of China’s economy. The quality of manufacturing development, a necessary standard to measure a country’s productive forces, represents the international competitiveness and comprehensive national strength. However, although the final product is mostly formed in China, its key technology and main added value are still controlled and acquired by foreign capital [8,9,10]. China’s manufacturing industry is still at the middle and low end of the global industrial value chain. Therefore, it is urgent to break the bottleneck of high-quality development of the manufacturing industry through independent technological innovation and structural upgrading in order to alleviate the two-way squeeze on China’s manufacturing industry caused by “high-end manufacturing reflux” in developed countries and “middle and low-end diversion” in developing countries. The continuous adjustment of the international division of labor pattern and the reconstruction trend of the global value chain provides a rare “window of opportunity” for China’s manufacturing industry to further embed itself in the global value chain and even move towards the middle and high-end links of the value chain [11]. Facing the opportunity and challenge of manufacturing global value chain reconstruction and international division of labor, how China’s manufacturing industry will participate in the global value chain reconstruction, how to choose the path of “reasonable growth of quantity” and “steady improvement of quality”, and how to achieve high-quality development around the value chain upgrade are questions that have attracted increasing attention from multiple parties [12]. In this context, the path selection of China’s manufacturing industry to participate in the global value chain reconstruction will be the basic premise and necessary basis for China to rapidly move towards the middle and high end of the global value chain. Based on the VRCA value-added index, our study constructs the index system of the Chinese manufacturing industry’s participation in the global value chain reconstruction path and designs an appropriate reconstruction path for the Chinese manufacturing industry to promote the comprehensive upgrading of the manufacturing value chain and advance into high-end manufacturing.

By combing the literature, we found that although scholars have studied the transformation of the global value chain, regional value chain, and national value chain, most of the research on the path of China’s manufacturing industry participating in GVC reconstruction use different methods and models to evaluate the position of China’s manufacturing industry in GVC. Some studies mainly stay at the theoretical and policy level and have not yet established a complete analytical framework to explore China’s manufacturing industry in the global value chain reconstruction of route choice. In addition, the existing literature lacks the process of quantifying the path conversion and selection criteria, and there are no publications to analyze the behavior and selection of the manufacturing industry under different paths. However, our research can fill in the gaps in this area to some extent.

The salient contributions of this study are outlined as follows:

- (1)

- A theoretical research framework of global value chain is summarized.

- (2)

- Three ways to participate in GVCs reconstruction: embedding in the global value chain, reconstructing the national value chain, and leading the regional value chain are summarized and studied in a unified standard framework.

- (3)

- An index system for route selection of GVC reconstruction is established.

- (4)

- The basis and criteria for the path selection of China’s manufacturing industry in the process of global value chain reconstruction are proposed, according to which the main conclusions are drawn.

- (5)

- The path upgrading suggestions and future prospects for China’s manufacturing industry to participate in the global value chain reconstruction are put forward.

The paper is structured as follows: Section 1 expounds the background and contribution of the research, reflecting its necessity and importance. Section 2 reviews the formation of the concept and theory of global value chain, analyzes the research framework of global value chain theory, and summarizes three ways to participate in the reconstruction of global value chain. Section 3 explains the VRCA index and data sources, calculates the VRCA index of various manufacturing industries in China, and lists the basis for various Chinese manufacturing industries to participate in the path of global value chain reconstruction. Section 4 shows the results of the research and makes detailed explanations in combination with the recent situation of various manufacturing industries. Section 5 discusses recommendations for path upgrading. Section 6 draws the main conclusion: transportation equipment manufacturing tends to be embedded in global value chains; Textile, clothing, leather, and related manufacturing; wood products, paper products, and printing; chemical and non-metallic mineral products; essential metals and metal products; computer, electronic, and electrical equipment manufacturing; machinery and equipment manufacturing; and other manufacturing industries tend to dominate the regional value chain; and food and beverage manufacturing and tobacco industries tend to restructure national value chains. This section also presents some prospects.

2. Theoretical Framework

2.1. The Formation of Global Value Chain Concept and Theory

Since the 1990s, the GVCs, the main mode of the international division of labor, have become the most prominent feature of world economic development. Ref. [13] initially put forward the concept of GVCs, which means a sequence of production activities that are spread across more than one country [13]. GVCs highlight mainly the relative value of those activities that are required to bring a product or service from conception through the different phases of production (involving a combination of physical transformation and the input of various producer services), delivery to final consumers, and final disposal after use [14]. The root of the global value chain is the value chain theory proposed and developed by international business researchers in the 1980s. Porter put forward the concept of “value chain” for the first time in his book Competitive Advantage and applied it to competitive advantage and corporate behavior [15]. Hopkins and Wallerstein proposed the concept of a “commodity chain” [16], and the idea of a commodity chain was subsequently widely used in the study of world-system theory. Kogut’s value chain thought also plays a critical role in forming global value chain theory. In his book Designing Global Strategy, it is mentioned in Value-added Chain of Comparison and Competition that a value chain is a process in which various production factors form various links. Each link produces final products through selective assembly and finally completes the value cycle through trading activities and consumption [17]. Kogut’s thought extends the value chain from the enterprise level to the national and regional level, highlights the reallocation of global space and the vertical separation of the value chain, and has a crucial influence on forming the global value chain theory. Based on the value chain theory, Gereffi proposed the concept of a “global commodity chain” in the increasing role of global buyers in the distribution system and cross-border production [18]. Gereffi divides the value chain into the purchaser-driven and producer-driven value chains according to the different driving forces of the value chain and makes a comparative study of the two [19]. In its Industrial Development Report 2000–2003—Competing through Innovation and Learning, the United Nations Industrial Development Organization (UNIDO) states: Global value chain is to point to in the global scope, to realize the value of goods or services and connecting the production and recycling process of global across the enterprise network organization, ranging from raw material collection and transportation, production and distribution, semi-finished products and finished products to final consumption and recycling of the entire process, including all the participants, production and sales activities such as organization and value, the distribution of the profits.

The global value chain theory is an emerging theory that integrates macro and micro perspectives to comprehensively review the development and evolution of economic organizations in globalization and can best reflect the practical process of how a country’s economy integrates into the world economic integration. The fragmentation and spatial reorganization of the value link enhance the explanatory ability of the theory to economic practice. Through many literature reviews, the current theoretical research on the global value chain mainly focuses on three aspects: first, the governance of the global value chain. The governance of the global value chain refers to the power distribution, organizational structure, and coordination among economic entities in the value chain. The theoretical research on GVC governance mainly focuses on governance mode. Although Kaplinsky and Morris draw on the principle of separation of powers in western society to put forward an analytical framework of value chain governance, the theory is still not perfect. The second aspect is about upgrading the global value chain, mainly studying the mechanism, type, and path of upgrading the global value chain. The third is about the generation and distribution of economic rent in the value chain, including barriers to entry, sources of economic rent, and rent distribution.

2.2. Theoretical Research Framework of the Global Value Chain

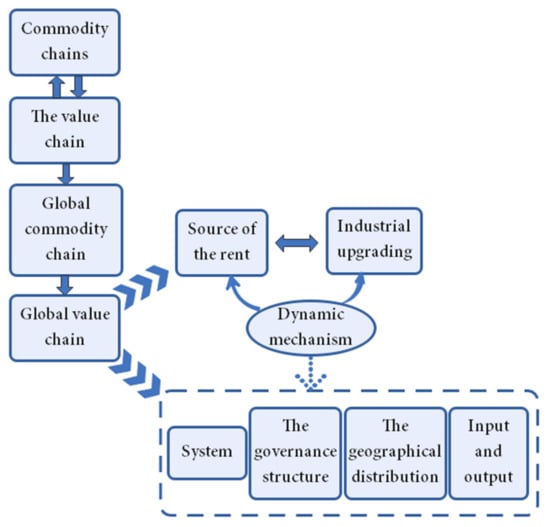

To start from the world system theory, the global value chain theory integrates the value chain, commodity chain, and globalization. In the mid-20th century, Gereffi revised and expanded the commodity chain model proposed by Hopkins and Wallerstein and proposed the “global commodity chain” based on the viewpoints of various scholars [20]. Firstly, the global commodity chain is proposed from three dimensions of input and output, regionalism, and governance structure, and then added into the institutional framework, resulting in four research perspectives: 1. Input and output structure research: Value chain is a series of processes connected by the sequence of value-added activities. 2. Regional research: As multinational companies and purchasers have outsourced links beyond the core competitiveness, all links in the value chain transcend national boundaries and disperse to different countries or regions in the world, thus forming a natural global production system. 3. Research on governance structure: A value chain is an industrial organization with specific functions composed of all corresponding links. The chain controller organizes, coordinates, and controls the chain uniformly. 4. Research on the institutional framework: how the domestic and international institutional background influences the value chain at each node [21]. In late 2000, the global value chain concept was put forward based on absorbing concepts such as commodity chain, value chain, global commodity chain, and global network. Since then, relevant research has progressed rapidly, and global value chain theory has become a vital force in studying globalization due to its inclusiveness and systematism. Governance, upgrading, and rental sources of GVCS are three key concepts of GVC theory [22]. Among them, most scholars believe that the governance of GVCS is the core issue in the theory of GVCS, and the dynamic mechanism of GVCS determines the “chain master” of GVCS, affects the governance structure, rent distribution, and upgrade path, and is the basis for studying the governance, upgrade and rent of GVCS. Ref. [23] noted that emerging and developing countries are all expected to improve efficiency in building their comparative advantage within the GVC framework. The main research framework is shown in Figure 1.

Figure 1.

The main framework of GVCS research. Source: Author based on data.

2.3. Participating in the Path Framework of Global Value Chain Restructuring

Based on the review of relevant literature, this study summarizes three ways of participating in GVC reconstruction: embedding in GVC, reconstructing the national value chain, and leading regional value chain. The method of active embedding in the value chain is to discuss the process upgrading (process upgrading), product upgrading, and function upgrading of a country embedded in the original value chain. The way of reconstructing the national value chain is to discuss how a country cannot complete industrial upgrading in the borderless production division network, so it tightens the business unit, simplifies the division of the value chain, and completes the task within a country. The path of leading regional value chain discusses that a country creates or dominates value chain across chains or industries.

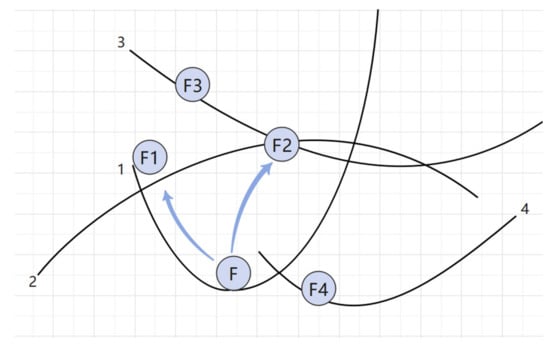

GVCs are not a single chain but are composed of different value chains. The GVCs shown in Figure 2 have a network structure. The value chains in the global value chain network are different in shape, length and interlacing. These different forms of chains constitute the value network, and then constitute the global value chain system. In Figure 2, chain 1 is the traditional form of a certain type of value chain, and F is the enterprise on the value chain. There are several manifestations of value chain reconstruction: (1) Along the direction of the original value chain, it climbs to the high end, as shown in Figure 2, F moves to F1, enhancing its value creation ability; (2) Due to industrial convergence and technological expansion, the form of traditional “smile” value chain 1 is deformed, and chain 2 is a new value chain. After the change of value chain form, although the comparative advantage and competitive advantage of enterprise F do not change, the profitability of its link becomes stronger; F’s position in the new chain 2 will be better than the original chain F2. (3) In the original global division of labor, enterprise F obtains the technology spillover effect from the enterprises of the investing country. However, in order to reduce the dependence on foreign technology and gain greater innovation capability, enterprise F tends to establish the national value chain. (4) If the country of enterprise F has relative competitive advantages in the international competition of the industry, but its position in the original value chain division is not high and the profit is not large, then F tends to establish and lead a new regional chain in F3 position based on the competitiveness and complementarity of different countries in the industry on chain 3.

Figure 2.

The framework of a country’s participation in GVC restructuring. Source: Author based on data. 1–4 are different forms of value chains. F is an enterprise on the value chain, and F1–F4 represents the different positions of F on each value chain.

To sum up, Figure 2 provides an analytical framework for the path selection of a country’s enterprises to participate in GVC reconstruction: The first path is embedded in GVCs, which is represented as F moves to F1 on chain 1 in the figure or F moves towards F2 due to a change in chain configuration. The second path is to build NVCs. F builds the NVCs on chain 4 in position F4. The third path is to dominate RVCs. F takes advantage of its new competitive advantage and chooses to dominate RVCs at the position of F3 in chain 3. The three paths are different in chain form, industrial development characteristics, development stage, and path selection requirements.

3. Method and Materials

3.1. Index Selection

The Explicit Comparative Advantage Index (RCA index) is a method used by Balassa Bela [24], an American economist, to measure the comparative advantage of trade in a particular industry of a country or region in 1965. The RCA index is expressed by the ratio of a country’s export industry share and industry share in the world’s total trade, excluding the influence of the fluctuation of the national and world total. It can better reflect the relative advantage of exporting a particular industry in a country compared with the world’s average export level. The calculation formula is as follows:

RCA is the index of explicit comparative advantage of J products of the country I (region), Xij represents the export volume of J products of the country I (region) to the world market, Xi represents the total export volume of J products of the country I (region) to the world market, Wj represents the export volume of J products in the world market, and W represents the total export volume of products in the world market. RCA index involves the share of different countries and products in the international market, focusing on the export performance. Xij/Xi refers to the proportion of product J in the country’s export. The more product J is exported, the larger the proportion is, and the more pronounced the comparative advantage is. The index of clear comparative advantage can reflect the competitive position of a country’s service in the world. This paper improves the RCA index based on value-added trade, replaces exports with value-added trade, and uses a value-added accounting system to reconstruct the index of explicit comparative advantage. The calculation formula is as follows:

VRCA refers to the share of the added value of a product’s export in the domestic value-added export relative to the share of the added value of the product’s export in the global value-added export. Where EVAij represents the value-added export of J product of country I, EVAi represents the value-added export of country I, EVAwj represents the value-added export of J product of the world, and EVAw represents the global value-added export. The evaluation criteria of VRCA index are different from those of RCA index, and the measurement criteria are set as follows: (1) If the VRCA index of an industry in a country is lower than the average level of the VRCA index of other countries in the world, the dominant advantage of the industry in the country is not apparent, and the country tends to build the national value chain and accumulate its own advantages; (2) If the VRCA index of an industry in a country is higher than the average level of the VRCA index of other countries in the world, the industry in that country has specific product competitive advantages and international competitiveness, and tends to build regional value chain to seek more profitable distribution links; and (3) If the VRCA index of an industry in a country is higher than the average level of the VRCA index of the top 5 countries in the statistics, the product of that country has significant comparative advantages and strong international competitiveness, and tends to dominate the global value chain.

3.2. Data Sources

This paper uses the latest statistics of the TiVA database jointly published by the Organization for Economic Cooperation and Development (OECD) and WTO, which covers bilateral VA data of 34 manufacturing sectors in 64 economies from 1995 to 2015. According to the definition of OECD and WTO, value-added trade refers to the part of domestic value-added in a country’s export trade, which can be regarded as the actual value of a country’s export trade and reflects the country’s ability to create value. The TiVA database, updated in 2018, provides indicators for 64 economies, including all OECD, EU28, G20 countries, most east and southeast Asian economies, and some South American countries. This paper calculates the VRCA index of China’s manufacturing industry based on the data of added value from 2012 to 2015, analyzes the international competitiveness of different industries reflected, and then gives path and development suggestions for China’s manufacturing industry to participate in the reconstruction of the global value chain.

3.3. Research Design

According to the ISIC Rev.4 definition of technology intensity, this paper divides the manufacturing industry into four types: high-tech manufacturing, medium-high technology manufacturing, medium-low technology manufacturing, and low-technology manufacturing. The names and technologies of manufacturing categories are shown in Table 1.

Table 1.

OECD manufacturing codes, names, and technology division.

According to the above theoretical analysis, there are three ways for a country’s industry to participate in the global value chain reconstruction. Therefore, the three ways for China’s manufacturing industry to participate in the global value chain reconstruction based on the differences in competitiveness are shown in Table 2.

Table 2.

The path to participate in global value chain reconstruction.

This paper first measures the VRCA index of different types of manufacturing industry and takes its average value as the measurement standard of international competitiveness of various manufacturing industries, as shown in Table 3.

Table 3.

Manufacturing VRCA index.

Based on the value-added trade analysis framework, the criteria for the path selection of the manufacturing industry participating in GVC reconstruction are shown in Table 4. Suppose VRCA ≥ the average VRCA level of the top five countries globally. This means that the export products of a particular type of manufacturing industry of a specific country have significant comparative advantages and strong international competitiveness compared with similar export products of other countries. The country tends to be embedded in the global value chain for this industry while pursuing independent innovation. If the average VRCA level in the world ≤ VRCA < the average level of VRCA in the top five countries in the world, it indicates that this kind of manufacturing industry has medium product competitive advantage and international competitiveness, tends to dominate the regional value chain, and seeks more profitable distribution links. If VRCA < the average VRCA level of all countries globally, it means that the apparent competitive advantage of products is weak. The country tends to reconstruct the national value chain, absorb the world’s advanced technology, and accumulate its advantages.

Table 4.

Value of VRCA and route selection.

4. Results

Transportation equipment manufacturing tends to be embedded in global value chains. Textile, clothing, leather and related manufacturing; wood products, paper products, and printing; chemical and non-metallic mineral products; essential metals and metal products; computer, electronic, and electrical equipment manufacturing; machinery and equipment manufacturing; and other manufacturing industries tend to dominate the regional value chain. Food and beverage manufacturing and tobacco industries tend to restructure national value chains. The path selection for China’s manufacturing subsectors to participate in GVC reconstruction is shown in Table 5 below.

Table 5.

VRCA index and reconstruction path selection of China’s manufacturing industry.

The VRCA index of the food and beverage manufacturing and the tobacco industry is 0.85, higher than the world average VRCA index of 0.72, ranking seventh among 63 countries or regions in the statistics. The path of participating in global value chain reconstruction is the leading regional value chain. Compared with the industry of different countries, China has a more robust product competitive advantage and international competitiveness. However, the VRCA index of this industry is lower than that of other industries in China. The VRCA index of other industries in China’s manufacturing industry is above 1, showing strong international competitiveness. In the double cycle and new consumption era, the development model of the whole industry chain from production to sales in the food and processing industry is undergoing profound changes. All links are integrated with the Internet, from the production source to the consumption terminal. Smart chemical plants and digital workshops are increasingly becoming the development hotspot in the food industry. Only by taking digitization, informatization, and intelligence as the breakthrough point can we further promote the digital transformation of food and processing enterprises, build a digital supply chain, and form a digital ecological system integrating upstream and downstream of the industrial chain and cross-industry, to lead the whole industry to a higher direction [25].

The VRCA index of the textile, clothing, leather, and related manufacturing industry is 1.09, higher than the world average VRCA index of 0.89, ranking third among 63 countries or regions. The path choice is to be embedded in the global value chain. This shows that China has a strong product competitive advantage and international competitiveness in this area. The global pandemic has brought significant uncertainties to the international and regional textile and garment supply chains, and the trend of transferring production capacity overseas has slowed down. As the center of the global textile and garment industry chain, China has strong resilience and comprehensive advantages, playing a vital role as stabilizer. The pandemic has had a profound impact on business models and consumer behavior. Cross-border e-commerce is growing rapidly and has become an essential channel for stable export. In the face of the complex international trade environment, the whole industry needs to make a long-term layout, actively respond, prevent trade risks, and explore new formats and models of foreign trade export [26].

The VRCA index of wood products, paper products, and the printing industry is 1.07, higher than the world average VRCA index of 0.94, ranking 11th among 63 countries or regions. Route selection is the dominant regional value chain. This shows that compared with the industry of different countries, China has a strong product competitive advantage and international competitiveness in this industry. Wood products, paper products, and printing industries should accelerate the adjustment of the existing industrial structure, promote the extension of the industrial chain up and down, vigorously develop the downstream industry and supporting industries, and promote the formation of a joint development pattern of the whole industrial chain linking up-, middle-, and downstream to achieve green and high-quality development of the whole industry in terms of scientific utilization of resources, expansion of industrial scale, enrichment of product types, improvement of product quality, and development of the whole industry chain.

The VRCA index of chemical and non-metallic mineral products is 1.07, higher than the world average VRCA index of 0.95, ranking 18th among 63 countries or regions. Route selection is the dominant regional value chain. Although it is higher than the world average VRCA level, the average VRCA level of the top five countries in the world is 1.30. It is undeniable that there is still a big gap between China’s chemical industry and developed countries in terms of industrial structure and product structure, especially in high-end manufacturing. The low-end, surplus high-end shortage is the most significant pain point of the chemical industry and the shortboard of high-quality development. Although the industrial chain of the chemical industry is complete, some links are still very fragile and need to “strengthen the chain”. In the process of “strengthening the chain”, there will be many new opportunities. The new development pattern of “double-cycle” is a critical development idea put forward by China in accordance with the situation. The whole industry should seize this strategic opportunity, provide sufficient guarantees for domestic supply through independent innovation, research, development, and production of high-end chemicals, and accumulate new advantages to cultivate high-quality development industries through coordination and docking of upstream and downstream industrial chains. By improving the level of industrial science and technology, the “double-cycle” capability and core competitiveness can be enhanced, and the “double-cycle” development pattern can be effectively helped to land [27].

The VRCA index of the base metals and metal products industry is 1.06, higher than the world average VRCA index of 0.94, ranking 17th among 63 countries or regions. Route selection is the dominant regional value chain. As China’s economy enters a new normal in recent years, China’s metal products industry is facing the challenge of transformation and upgrading. The metal products industry is basically the same as most manufacturing industries in the goal of transformation and upgrading, and they all pursue improving quality and efficiency. Compared with other manufacturing powers, the main goal of the domestic metal products industry in recent years focuses on improving product quality, controlling cost, and improving production efficiency. Intelligent technologies such as intelligent equipment based on information processing systems are changing traditional processing methods. Numerical control technology and automation are the keys to improving the manufacturing level of the metal products industry. Through the development of production and assembly robots, numerical control technology, and online quality management system for the application of small and medium-sized enterprises, it is more suitable due to the objective situation that China’s metal products industry can better meet the requirements of improving quality and efficiency and provide a solid foundation for the promotion of smart factory in the future.

The VRCA index of the computer, electronic, and electrical equipment manufacturing industry is 1.05, higher than the world average VRCA index of 0.94, ranking 21st among 63 countries or regions. Route selection is the dominant regional value chain. In recent years, under the global Internet trend, the computer, communication, and other electronic equipment manufacturing industry has developed rapidly, and Chinese enterprises have also made significant progress. In terms of industry, China’s computer, communication, and other electronic equipment manufacturing industry as a whole still has a high degree of agglomeration but presents a particular downward trend. In terms of regional distribution, the industrial advantages and contributions of the computer, communication, and other electronic equipment manufacturing industry in the east are still relatively high in recent years. At the same time, the share of output value in the central and western regions is still low. However, the overall growth is gradual, among which the western cities represented by Chongqing in Sichuan province have a strong trend of development. In the future, the whole industry should work to further enhance the western region industrial concentration, maximize play industry cluster effect, pay attention to the coordinated development of the region, promote industrial acceptance capability of collaboration and transfer, encourage industry development, cultivate new industry growth points, cultivate radiation impetus peripheral related industries, and realize the industrial upgrading transformation of low carbon high quality.

The VRCA index of the machinery and equipment manufacturing industry is 1.05, higher than the world average VRCA index of 0.91, ranking 11th among 63 countries or regions. Route selection is the dominant regional value chain. A number of statistics at home and abroad show that China has gradually shed the label of “low-end manufacturing” and become the world’s leading mechanical product manufacturer in many fields. In recent years, the overall manufacturing level of Chinese machinery and equipment has been improving, and the digital transformation of domestic machinery manufacturing enterprises is accelerating. Some equipment has reached the first-tier level in the world, but there is still a gap between high-end manufacturing and the first-tier level in the world. With the intensification of downstream market competition and the increasing requirements of end consumers for product quality, the whole industry still needs to constantly optimize advanced technology to accelerate the transformation of scientific and technological innovation achievements to improve core competitiveness. At the same time, it is also necessary to improve market concentration and build a high-end mechanical equipment manufacturing brand with international influence.

The VRCA index of the transportation equipment manufacturing industry is 1.15, higher than the world average VRCA index of 0.92, ranking sixth among 63 countries or regions. Route selection is the dominant regional value chain. This shows that compared with the industry of different countries, China has a strong product competitive advantage and international competitiveness. However, the VRCA index of this industry is lower than that of other industries in China. The VRCA index of other industries in China’s manufacturing industry is above 1, showing strong international competitiveness. China has long been a significant manufacturer of transportation equipment. However, the core competitiveness of independent brands is not robust, and many core components rely on imports, and other problems have been plaguing the development of related industries. At present, China’s transportation equipment manufacturing industry is in transition, and Chinese enterprises are steadily climbing to the world’s high-end manufacturing field. The road of catching up with China’s transportation equipment manufacturing industry is the road to prosperity for Chinese people.

The VRCA index of other manufacturing, repair, and installation of machinery and equipment is 1.08, higher than the world average VRCA index of 0.95, ranking eighth among 63 countries or regions in the statistics, with route selection as the dominant regional value chain. This shows that, compared with the industry of different countries, China has a strong product competitive advantage and international competitiveness.

5. Discussion: Path Upgrade Suggestions

The path selection for the manufacturing industry to participate in GVC reconstruction is divided according to the competitiveness of this kind of manufacturing industry. Therefore, to upgrade the path, improving competitiveness is the key. With the continuous transformation of the manufacturing structure, e-commerce has become a new engine of China’s economic development, a new format of industrial transformation, and a new window for opening to the outside world. E-commerce, like a “dark horse”, provides a new way for manufacturing export. It can effectively reduce enterprise costs, enhance R&D and innovation, change sales channels, expand the market scope, optimize business processes to change the competitive advantage of manufacturing, and play an essential role in enhancing the export advantage of manufacturing. Therefore, the manufacturing industry needs to take advantage of e-commerce to achieve industrial renewal and promote new trade competitiveness. In order to further stimulate the development vitality of e-commerce and promote the integrated development of e-commerce and the manufacturing industry, this paper puts forward the following suggestions.

5.1. Strengthen the Application of E-Commerce in the Manufacturing Industry Chain

At present, the application of e-commerce in the manufacturing industry is not in-depth. The National Industrial Economic Statistics Yearbook data show that the sales and operating income of e-commerce in China’s manufacturing industry account for less than 25%. Many small and medium-sized enterprises only regard e-commerce as a new sales model but ignore its essential impact on supply and demand channels, consumption patterns, and enterprise production. Therefore, the first step is to improve the manufacturing industry’s understanding of e-commerce and actively guide the combination of manufacturing and e-commerce through policies. Secondly, the application of the manufacturing industry to innovative e-commerce should be strengthened. The manufacturing industry can better adapt to the digital age through e-commerce, promoting the upgrade of its production mode and product form, improving production efficiency, carrying out technological transformations by using the thinking of the Internet and manufacturing industry, and promoting the active integration of intelligent platforms and manufacturing machinery and equipment, products, software, hardware, and human capital. Through the application of e-commerce in enterprise management, a more efficient organizational model is formed, and e-commerce and digital management are integrated into manufacturing enterprises to improve the efficiency of organizational structure. Finally, the e-commerce marketing model should be actively carried out. The Internet platform should be used to expand the market and new customers, build a new transaction structure in the manufacturing industry chain, promote the development of e-commerce in the manufacturing industry, and build the e-commerce model of the manufacturing industry through low cost, rapid transmission of information, and accurate grasp of data.

5.2. Develop an E-Commerce Strategy

5.2.1. Pay Attention to the Cultivation of Talent Elements

High-level human resources are the core of the innovation and development of the manufacturing industry. China’s manufacturing enterprises mainly operate and manage in a traditional mode, lacking a dynamic system and imperfect incentive mechanism, which is not conducive to improving employees’ enthusiasm for innovation. In addition, enterprises do not pay attention to improving and training staff ability. The talent management mechanism is highly restrictive. In this regard, enterprises should first increase cooperation with universities and research institutes, reasonably cultivate excellent talents in professional fields, and increase talent reserve. Second, the industry should improve the management system, establishing a performance system that can stimulate innovation and a fair promotion mechanism. Finally, it must introduce talents through relevant policies to provide learning opportunities for employees and prepare for long-term sustainable development of enterprises.

5.2.2. Strengthen Infrastructure Construction

Infrastructure is the foundation of the development of many industries. It can help manufacturing transportation, green, intelligent production, network management, and other fields, promote the transformation and upgrading of the manufacturing industry, and is closely related to the development of e-commerce. For the eastern region, emphasis should be placed on the layout of emerging industries based on existing infrastructure, to promote the combination of e-commerce and manufacturing, to promote digital development, and to apply cloud computing, big data, Internet of Things, and other new technologies to manufacturing through e-commerce. For the central and western regions, it is necessary to strengthen further the construction of traditional infrastructures such as the Internet and transportation, promote the informatization construction in the rural and remote areas of the central and western regions, and pave the way for e-commerce to penetrate the central and western regions.

5.2.3. Develop E-Commerce and Manufacturing Support Industries Vigorously to Create a Favorable Business Environment

Logistics, payment methods, warehousing, and other supporting industries are very beneficial to developing both e-commerce and manufacturing through establishing data and business cooperation between e-commerce supporting industries, building overseas cooperation platforms, and other ways of constantly improving the operation of payment platforms and logistics enterprises. At the same time, it is necessary to further improve the supervision system of e-commerce and customer information mechanism, reasonably understand the trend of consumers, implement intelligent management, and provide more comprehensive and optimized services.

6. Conclusions and Prospects

6.1. Conclusions

This article first examines the related research and reviews the concept and theory of the formation of a global value chain, and then summarizes three ways to participate in the global value chain reconstruction path; therefore, the added value of the dominant comparative advantage index system is set up. Based on the measurement of VRCA index, our paper puts forward the selection path for different manufacturing industries in China, and finally draws the following conclusion.

Against the backdrop of China–US trade frictions and the COVID-19 pandemic, the path selection of China’s manufacturing sector to participate in the restructuring of GVCS will be the basic premise and necessary foundation for China to move quickly to the middle and high end of GVCS. There are three ways to participate in reconstructing the global value chain: embedding in the global value chain, reconstructing the national value chain, and leading the regional value chain. Different ways are selected according to the VRCA index, reflecting the difference in the international competitiveness of a country’s industry.

Transportation equipment manufacturing tends to embed in global value chains. Textiles, clothing, leather, and related manufacturing; wood products, paper products, and printing; chemical and non-metallic mineral products; base metals and metal products; computer, electronic, and electrical equipment manufacturing; machinery and equipment manufacturing; and other manufacturing industries tend to dominate the regional value chains; food and beverage manufacturing and tobacco industries tend to restructure national value chains.

6.2. Prospects

Based on the above research, it can be seen that in the textiles, clothing, leather, and related manufacturing; wood products, paper products, and the printing industry; chemical industry, and primary metals and non-metallic mineral products; fabricated metal products; computer, electrical, and electronic equipment manufacturing; machinery manufacturing; and other manufacturing industries, a total of seven classpath choices of China’s manufacturing industry in the face of global value chain reconstruction tend to dominate the regional value chain. In addition, a wealth of studies found that the development of BRI contributes to the integration into GVCs from a single-country perspective. Refs. [28,29] noted that BRI catalyzes the development of Kazakhstan as an integrated transport complex, thus promoting the formation of a more complete supply chain [30,31]. Refs. [30,31] considered that the BRI and China–Pakistan Economic Corridor (CPEC) projects provide ample opportunity for Pakistan to integrate its industry and trade with the GVCs of China [30,31]. Participating in BRI benefits the integration of Russia’s transportation system into the logistics network of the Eurasian region and the infrastructure development of India [32,33]. Therefore, building a regional value chain centered on China will be significant. The proposal of BRI initiative provides an opportunity for China to participate in the construction of a regional value chain, and it has certain conditions to extend the national value chain and reconstruct the regional value chain by taking advantage of BRI platform.

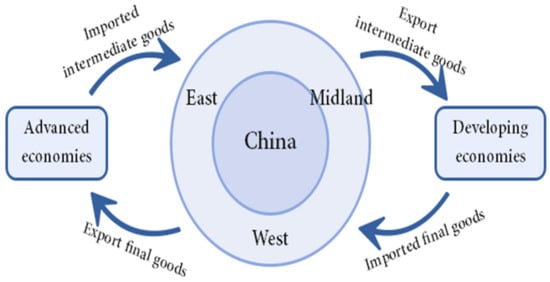

China’s manufacturing industry can also nest the “Belt and Road” regional value chain and the global value chain in a two-way strategy: relying on its super-scale economy and competitive industries, China will lead developing countries in building regional value chains in Central Asia, West Asia, Eastern Europe, and other countries along the Belt and Road. At the same time, China will embed itself in the global value chain division system led by developed countries such as the United States, Japan, and those in Europe, forming a new “two-way nesting” global value chain division. By upgrading from the low-end dependent embedding model to the medium-high-end hub embedding model, China can complement and rebalance the existing global value chain division of labor, eliminate the low-end lock-in dilemma, and lead developing countries along the routes to improve their international division of labor. As shown in Figure 3, regional value chains leading developing economies will be built while being integrated into the global innovation chain constructed by developed economies.

Figure 3.

New value chain circulation centered on manufacturing in China. Source: Author based on data.

In the “double circulation value chain” cycle, China connects developed economies and developing economies; Chinese manufacturing plays a bridge role in the hub-and-spoke trade pattern, developing and upgrading the new development pattern in which the major domestic cycle is the main body, and the domestic and international double-cycle promote one another.

6.3. Limitations

As the latest data have not been updated, we used data from 2012 to 2015, which are the most recent data available in TiVA database updated in 2018. In the future, we will follow up the data in real time to make further improvement and adjustment. Fortunately, due to the long process of GVC reconstruction, the path of participating in GVC reconstruction will not change much in this relatively short period, so the results of this study are still of great significance. In addition, the results will be demonstrated in the process of different types of manufacturing participating in GVC reconstruction.

6.4. Future Directions

In the future, we will study the impact of blockchains on the global value chain and explore ways to improve the current supply chain with blockchain technology, which can enable sustainable and high-quality economic development. With the widespread use of blockchain technology, a blockchain-based supply chain enables a new circular business model. While linear supply chains are mainly based on the take-make-dispose model, the blockchain-based supply chain allows the implementation of a make–use–recycle model. With the use of the blockchain, all products can be traced along the entire supply chain, from origin to the market and subsequent recycling. The advantage of this model is that all products are tracked with blockchain technology, and it is possible to provide a significant service to final consumers, such as guaranteeing the origin of the products. In addition, blockchain technology can effectively help address a range of challenges related to an unfavorable institutional environment, high costs, technological constraints, unequal power distribution among supply chain partners, and porosity and opacity of value delivery networks. Blockchain’s deployment in China is still in a nascent stage but is maturing at a fast pace. We believe that, in the near future, blockchains will play an important role in the sustainable development of China and even the world.

Author Contributions

Formal analysis, Q.C. and L.L.; Writing—original draft, Q.C. and L.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.oecd.org/industry/ind/measuring-trade-in-value-added.htm#access (accessed on 18 April 2022).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Amiti, M.; Redding, S.J.; Weinstein, D. The impact of the 2018 trade war on U.S. prices and welfare. J. Econ. Perspect. 2019, 33, 187–210. [Google Scholar] [CrossRef] [Green Version]

- Baldwin, R.; Tomiura, E. Thinking ahead about the trade impact of COVID-19. J. China Economic Report. 2020, 3, 138–144. [Google Scholar]

- Javorcik, B. Global supply chains will not be the same in the post-COVID-19 world. In COVID-19 and Trade Policy: Why Turning Inward Won’t Work, VoxEU.org eBook; Baldwin, R., Evenett, S., Eds.; CEPR Press: London, UK, 2020; pp. 111–116. [Google Scholar]

- Constantinescu, C.; Aaditya, M.; Michele, R. Does vertical specialization increase productivity. World Econ. 2019, 42, 2385–2402. [Google Scholar] [CrossRef] [Green Version]

- World Bank. World Development Report 2020: Trading for Development in the Age of Global Value Chains; World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Cheng, D.Z. China’s participation in global value chain division and its evolution trend: Based on cross-border input-output analysis. J. Econ. Res. J. 2015, 9, 4–16. [Google Scholar]

- Fuest, C. The Relative Sophistication of Chinese Exports: Comment on Peter Schott. J. Econ. Policy 2008, 53, 5–49. [Google Scholar]

- Johnson, R.C.; Noguera, G. Accounting for Intermediates: Production Sharing and Trade in Value Added. J. Int. Econ. 2012, 86, 224–236. [Google Scholar] [CrossRef] [Green Version]

- Theodore, M. Foreign Manufacturing Multinationals and the Transformation of the Chinese Economy. J. China’s Foreign Trade 2011, 15, 42–45. [Google Scholar]

- Wu, A.D.; Li, X. The dynamic impact of environmental regulation on quality development of manufacturing industry: An empirical study based on PVAR Model. J. Cent. South Univ. For. Technol. 2021, 15, 60–69. [Google Scholar]

- Zhang, W.X. The realistic situation, internal logic and prospect of global value chain reconstruction. J. Qinghai Soc. Sci. 2021, 2, 110–116. [Google Scholar]

- Gao, Y.S.; Yang, Y. Research on quality development of Manufacturing industry in China under the Background of global value Chain Reconstruction. J. Econ. 2020, 10, 65–74. [Google Scholar]

- Krugman, P.; Cooper, R.N.; Srinivasan, T.N. Growing world trade: Causes and consequences. Brook. Pap. Econ. Act. 1995, 1, 327–377. [Google Scholar] [CrossRef] [Green Version]

- Gereffi, G.; Humphrey, J.; Kaplinsky, R.; Sturgeon, T.J. Introduction: Globalisation, value chains and development. IDS Bull. 2001, 32, 1–8. [Google Scholar] [CrossRef] [Green Version]

- Zeng, H.P. A review of Global Value Chain Theory: From the perspective of export-oriented economic development in developing countries. J. Southwest Agric. Univ. 2012, 10, 13–16. [Google Scholar]

- Hopkins, T.; Wallerstein, I. Commodity Chains in the World Economy Prior to 1800. J. Review 1986, 10, 157–170. [Google Scholar]

- Kougut, B. Designing Global Strategies: Comparative and Competitive Value-added Chains. J. Sloan Manag. Rev. 1985, 26, 15–28. [Google Scholar]

- Gereffi, G.; Korzeniewicz, M. Commodity Chains and Global Capitalism; Praeger: London, UK, 1994. [Google Scholar]

- Gereffi, G. International Trade and Industrial Upgrading in the Apparel Commodity Chain. J. Int. Econ. 1999, 48, 37–70. [Google Scholar] [CrossRef]

- Gereffi, G.; Hamilton, G. Commodity chain and embedded networks: The economic organization of global capitalism. In Proceedings of the Annual Meeting of the American Sociological Association, New York, NY, USA, 16–20 August 1996. [Google Scholar]

- Xiong, Y.; Ma, H.Y.; Liu, Y.S. Global value chains, sources of rents and explanatory constraints: A Review of Global Value Chain Theory. J. Manag. Rev. 2010, 22, 120–125. [Google Scholar]

- Kaplinsky, R.; Morris, M. A Handbook for Value Chain Research; Institute of Development Studies, University of Sussex: Brighton, UK, 2002. [Google Scholar]

- Gurgul, H.; Lach, Ł. On using dynamic IO models with layers of techniques to measure value added in global value chains. Struct. Change Econ. Dyn. 2018, 47, 155–170. [Google Scholar] [CrossRef]

- Balassa, B. Trade Liberalization and “Revealed” Comparative Advantage. J. Manch. Sch. 1965, 2, 99–123. [Google Scholar] [CrossRef]

- Food and beverage start the journey of digital transformation. J. Mod. Manuf. 2021, 3, 34.

- China Chamber of Commerce for Import and Export of Textiles. New bureau of Stable chain of Textile and garment Trade. N. Int. Bus. Dly. 2021, A20, 10–15. [Google Scholar]

- A study on the influence of green chemical industry. J. State-Own. Enterp. Manag. 2021, 12, 48–56.

- Selmier, W.T. Kazakhstan as logistics linchpin in the Belt and Road Initiative. In Kazakhstan’s Diversification from the Natural Resource Sector: Geopolitical and Economic Opportunities; Heim, T., Ed.; Palgrave Macmillan: London, UK, 2019. [Google Scholar]

- Liu, H.M.; Fang, C.L.; Ren, Y.F. Logistics industry and cross-border electric business of Sino-Kazakhstan cooperation demonstration zone in Silk Road Economic Belt. Arid. Land Geogr. 2016, 5, 951–958. [Google Scholar]

- Irshad, M.S. One Belt and One Road: Does China-Pakistan economic corridor benefit for Pakistan’s economy? J. Econ. Sustain. Dev. 2015, 6, 200–207. [Google Scholar]

- Arrfat, Y. Aligning the global value chains of China and Pakistan in the context of the Belt and Road Initiative, and China Pakistan economic corridor. In Palgrave Macmillan Asian Business Series: China’s Belt and Road Initiative in A Global Context; Syed, J., Ying, Y.-H., Eds.; Palgrave Macmillan: London, UK, 2020; pp. 203–226. [Google Scholar]

- Makarov, I.; Sokolova, A. Coordination of the Eurasian Economic Union and the Silk Road Economic Belt: Opportunities for Russia. Int. Organ. Res. J. 2016, 11, 29–42. [Google Scholar]

- Banerjee, D. China’s One Belt One Road initiative—An Indian perspective. Perspective 2016, 14, 1–10. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).