Abstract

Corporate social responsibility (CSR) issues in developing markets have acquired a lot of attention. Organisations around the globe apply a diversified set of technologies to approaching customer expectations through banking performance. This study examines the impact of CSR on Lebanese banking performance. Primary data from questionnaires were used. A total of 1000 observations were collected using a 5-point Likert scale method adopted to formulate the items. The questionnaire was tested to assess its trustworthiness regarding data collection. Partial least square structural equation modelling (PLS-SEM) was used to test the hypothesis. The overall results demonstrated the significance of CSR in terms of meeting customers’ expectations and maintaining banking performance. All CSR dimensions demonstrated a positive impact on customer expectations and Lebanese banking performance. Moreover, customer expectations proved to be a mediator between CSR and banking performance, although there was partial mediation between CSR and banking performance.

1. Introduction

Over the last two decades, corporate social responsibility (CSR) has piqued the interest of both business practitioners and academics. With the quick expansion of developing countries and financial sectors, such as banks, which play a vital role in countries’ financial and economic development, there is a pressing need to examine how CSR activities are implemented in the banking industry on a worldwide scale. Commercial banks’ CSR initiatives have grown in importance since the financial crisis of 2008 [1]. To safeguard stakeholders’ interests, banks and other financial firms have been encouraged to operate in a more socially responsible and ethical manner during their investing, financing and lending activities.

Empirical research on CSR, bank reporting procedures and the influence of the stakeholders’ expectations is still sparse. The benefits of CSR for businesses, such as trust, customer loyalty, negative publicity mitigation, positive brand attitude and increased profits, have been well studied [2,3,4,5,6,7,8,9,10,11]. These benefits led to the adoption of CSR strategies by the international banking community. Numerous banking scandals ranging from probable criminal charges and interest rate manipulation to rogue trading and money laundering have been reported by worldwide media [2]. Banks lost a lot of their credibility as a result of the 2008 financial crisis. Following the financial crisis, the banking industry was accused of having too many moral flaws and engaging in risky speculations [12]. As such, CSR helps banks improve their financial performance while reducing risk [11,13].

Lebanon is a country in the midst of many crises, which has increased the focus on the financial sector’s need for accountability to improve stakeholder confidence and to increase transparency. Indeed, there is a growing need for ethical and responsible behaviour, which has led to financial industry practices that go above and beyond the expectations of their customers [14]. The main issue is that, despite the fact that scholars have engaged in several debates on CSR, the research on CSR and customer expectations in Lebanon’s banking industry is still limited [11,14,15]. As a result, the purpose of this research is to solve that specific issue.

The aim of this study is to assess existing CSR practices in Lebanon’s banking industry. Furthermore, this study also examines the link between customer expectations and CSR. This research seeks to give a preliminary evaluation of the extent to which consumers are aware of CSR concerns and to raise awareness of CSR activities and the advantages they would bring to the organisation’s overall performance. This study adds to the current literature and will aid in the development of a better understanding of the relevance of customer expectations in relation to CSR efforts. This study’s analysis will also add to the existing studies on the relevance of CSR and the characteristics of stakeholders, particularly customers. This is the first time these traits have been examined holistically. Furthermore, the present study also helps with identifying different characteristics of the individuals emphasised in the existing literature. The results will also contribute to the application, validation and extension of the theoretical model and will reflect the importance of CSR activities and how they can contribute to the growth of the banking sector in Lebanon.

2. Literature Review and Hypothesis Development

CSR refers to a company’s social, economic, legal, ethical and charitable obligations [16]. A socially responsible firm must create policies and procedures that go above the legal minimums and benefit its stakeholders [17]. According to [18] CSR should be viewed as a self-regulating system included in routine corporate business operations that verifies conformity with the law and ethical principles.

Customers’ positive expectations towards a business’s CSR activities may be considered an essential aspect of a business’s survival. According to [19], customers unsatisfied with a firm’s product or a certain behaviour may cause severe damage to a firm’s sales revenue. In the long run, this will harm its reputation and brand image [20]. Similarly, the stakeholders’ positive attitudes towards a business’s social activities may support the firm’s competitive advantage and attract a quality workforce [21] CSR initiatives directed towards employees, customers and society have been tested and found to be positively and significantly related to firm performance [22,23]. The study conducted by [24] indicated that secondary stakeholders, including governments, the media, communities and non-governmental organisations (NGOs), have the most significant influence on firms’ strategies [25] mentioned that studies in the banking sector suggested that reporting CSR activities can influence stakeholders’ perceptions of a company’s performance and increase its profitability [23]. Studies examining stakeholders’ perceptions and attitudes towards CSR in Lebanon are limited; only a few have attempted to study the perceptions and behaviours of stakeholders towards CSR.

According to [26] the initial conceptualisations of CSR refer to ethical, social, political and economic problems. A conceptualisation of the numerous CSR theories based on ethical, integrative, political and instrumental groups was proposed by [27]. In the last decade, this concept has begun to take on a social agenda with differentiations between moral obligations and voluntary practices [28]. With regard to the social implications, it has been argued that every organisation needs to integrate human rights as well as ethical, environmental and social concerns into its activities. Each of these concerns must be assessed by the developmental strategies, which are developed in close collaboration with stakeholders. Most studies today have argued that CSR incorporates activities primarily pertaining to society and the environment [4,29,30,31,32].

Research has shown that CSR, as a marketing strategy, is effective in acquiring the loyalty of customers [33,34] ith CSR compelling customers to stay attached to the company’s mission and create value via participatory and positive behaviours [35]. Research has also shown that customers could reciprocate CSR with loyalty, improvements in brand image, brand identification and trust. As such, companies partaking in CSR activities witness enhanced corporate performance because of enhanced banking performance [36,37] which, in turn, is transformed into a competitive advantage for most businesses engaging in CSR activities [25].

Banks have begun to address the issue of sustainability by first considering environmental and social issues and then attempting to incorporate them through the application of appropriate regulations. According to the research, banks have an influence on long-term development [34]. Stakeholder theory perfectly matches the banking industry’s approach to CSR, implying that banks’ CSR activities are the response to these organisations’ duty to society that extends far beyond their financial duties to shareholders. Banks use CSR to help meet customer expectations, which can lead to short- and long-term financial benefits [34]. Customers have received more attention from stakeholders, since their thoughts and expectations have been viewed as having a direct impact on the banks’ corporate strategies [11,34].

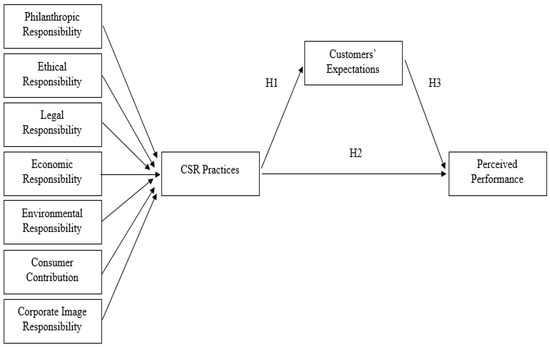

CSR practices in the banking sector emphasise responsibility in the areas of lending, investment and asset management, combined with key elements of anti-corruption and money laundering. Carroll’s CSR model in the financial sector [38] can be summarised by the following aspects: First, economic responsibility means that the main goal of banks is to improve their stakeholders’ welfare, profitability and growth. Banks employ financial innovation to cover individual requirements and corporate financial interests, which are constantly changing factors. The banking sector creates new opportunities for risk management and develops fresh products through interaction with stakeholders. Second, legal responsibility means that the banking industry is one of the safest economic sectors with a high degree of regulation, which minimises risk and increases confidence in the financial system for all parties. Therefore, statutes, supervisory bodies and controlling public and private entities provide guidelines for internal and external governance at the national and international levels. Third, ethical responsibilities are ethical standards that might be understood through individual integrity and stakeholders’ expectations. Each bank promotes basic ethical principles to increase its customers’ trust. These principles are represented by the code of ethics that represents controlled restrictions and fundamental principles, such as integrity, fair conduct, respect and transparency in the market. Fourth, discretionary (philanthropic) responsibility means that a bank’s business activities and clientele increase the bank’s reputation in the financial sector. This includes offering secure products and providing appropriate information. Figure 1 explains the study’s conceptual framework, which includes the proposed hypotheses. Based on the theoretical background and previous studies, we developed our hypotheses:

Figure 1.

Conceptual framework of the proposed study.

Hypothesis 1 (H1).

There is a positive relationship between CSR practices and customers’ expectations.

Hypothesis 2 (H2).

There is a positive relationship between customers’ expectations and the performance of Lebanese banks.

Hypothesis 3 (H3).

Customers’ expectations mediate the relationship between CSR activities and the performance of Lebanese banks.

3. Data and Methodology

3.1. Data Overview

Questionnaires were used as the survey tool, and a 5-point Likert scale method was adopted to formulate the items. The questionnaire was tested to assess its trustworthiness with regard to the data collection. The aim of these tests was to help determine the questionnaire’s reliability and validity [39]. Both reliability and validity are integral to a questionnaire’s development. It has been posited that an instrument’s trustworthiness is based on its validity, which in turn is linked to reliability. The questionnaire (see Appendix B) was uploaded to Google Forms, allowing the researcher to access far more participants than would be otherwise possible. Moreover, with COVID-19 restrictions, uploading it online was the best method due to social distancing measures already in place. These surveys were sent to participants that the researcher knew, who were then asked to circulate the survey among their colleagues in the banking industry.

A sample of 1000 banking customers across Lebanon was acquired. The sampling technique used was a mixture of convenience and snowball sampling. Since the researcher had limited access to banking customers, convenience sampling helped as some customers then reached out to friends and family, among whom were some customers or someone who knew a customer. From there, snowball sampling came into effect as already-recruited participants helped identify other participants that they knew to be banking customers across Lebanon. Snowball sampling can be an effective way to study hard-to-reach groups. Once researchers gain the trust of a few members of a group, those people can help the researchers recruit other people. In this study, we chose those who were regular customers of banks and had bank accounts that were at least 3 years old. Data were statistically analysed using descriptive and correlational methods. Sample questionnaires are attached in Appendix B.

3.2. Descriptions of Variables

Bank performance was treated as a dependent variable that was measured by the customers’ feedback in the questionnaires. These questions were based on the customers’ feedback on banking agreements for environmental protection. Banks participate in these agreements in terms of lending to investors who then invest in green initiatives. Banks also give benefits in terms of loans or discounts to customers or investors, and these banks have positive relationships with their customers and their social responsibilities.

CSR practices were treated as independent variables. This study assessed all aspects of CSR, including economic, legal, social, environmental, ethical and customer protection factors. These were based on questionnaires whose questions are attached in the Appendix B.

The last variable was customer expectation, which is a mediator variable based on questionnaires. These questions were about customer expectations with banking staff, such as behaviour, customer service, competence, professionalism, branches, fee rates and banking convenience for the customers.

3.3. Methodology

The research process comprised of a variety of elements, and almost all constituted different options, which combined to give a broad scope of methodological alternatives. This led to the emergence of different variations in the research techniques from which the researchers chose what applied best to their study [40].

Partial Least Squares Structural Equation Modelling (PLS-SEM)

The desire to verify entire hypotheses and notions fuelled the development of structural equation modelling (SEM) [41]. This method’s capacity to evaluate the measurement of latent variables while simultaneously examining the connections between latent variables accounts for a large part of SEM’s effectiveness [42]. Although the method was designed to be used with a covariance-based (CB) approach, researchers can alternatively use the variance-based partial least squares (PLS) methodology.

According to [43], PLS is an SEM technique based on an iterative strategy that optimises the explained variance of endogenous variables and was first proposed by [44]. Unlike CB-SEM, which seeks to validate theories by assessing how effectively a model can estimate a covariance matrix for the sample data, PLS-SEM works similarly to multiple regression analysis [45]. PLS-SEM is especially useful for exploratory research because of this feature; PLS is best used in research situations that are both data rich and theory skeletal at the same time.

PLS-SEM is frequently a more feasible technique than CB-SEM since it does not require these stringent distributional assumptions. Another significant benefit of PLS-SEM is that it allows for the use of formative measurements that differ significantly from reflective measures. For research aimed at understanding and forecasting crucial variables, such as the causes of competitive advantage or business performance, formatively assessed conceptions are particularly relevant [46].

The following econometric equation was solved to derive the results of this study:

4. Estimation Results

4.1. Demographic Coverage

In this study, gender, academic qualification, age and years of association with the concerned bank were treated as the control variables [47] for the analysis of customer expectation level and CSR. In the analysis in Table 1, male respondents were slightly dominant at 62.0% versus females at 38.0%, and the academic qualifications of most were undergraduate at 52.2% and graduate at 32.8%. The respondents’ years of association with the concerned banks were 5–7 years (41.0%) and 2–4 years (17.6%), respectively, and their ages ranged between 31–35 years (25%) and 25–30 years (29.8%). Table 1 below depicts a detailed descriptive analysis of the respondents.

Table 1.

Summary of respondents.

4.2. PLS-SEM Results

This study applied SEM-PLS for the estimation of a research model by using Smart-PLS 3.0 software [48]. SEM-PLS involves two steps of evaluation: (i) the evaluation of the measurement model and (ii) the evaluation of the structural model [49,50]. We followed this two-step evaluation approach, as it is more reliable than a single-step evaluation method. The measurement model was used to explain the measurements of constructs, and the structural model was used to test the proposed hypotheses and describe the relationship between the models [50].

4.3. Measurement Model Assessment

The measurement model was used to assess the construct validity and reliability by calculating the factor loadings (FD), Cronbach’s alpha, construct reliability (CR), average variance extracted (AVE), cross-loadings, the Fornell–Larcker criterion and heterotrait–monotrait (HTMT) ratio. To estimate the convergent validity, FD, Cronbach’s alpha, CR and AVE measures were used [51], whereas to measure the discriminant validity of constructs, cross-loadings, the Fornell–Larcker criterion and HTMT ratios were required. Thus, confirmatory factor analysis (CFA) and explanatory factor analysis (EFA) were performed to confirm each indicator’s construct. Furthermore, the Fornell–Larcker criterion has performance issues in measuring discriminant validity, which has been criticised by [52], who argue that the HTMT ratio is more feasible for estimating the discriminant validity of constructs.

4.4. Convergent Validity

Convergent validity evaluates the degree of positive correlation among variables and alternative measures for identical constructs [53]. The degree of correlation among variables describes the variance between items [50]. Factor loadings of indicators explain the reliability of constructed items, i.e., how much each item is reliable for measuring constructs. Hence, all items in Table 2 have a value greater than 0.7 and depict an acceptable level of reliability [54].

Table 2.

Measurement model.

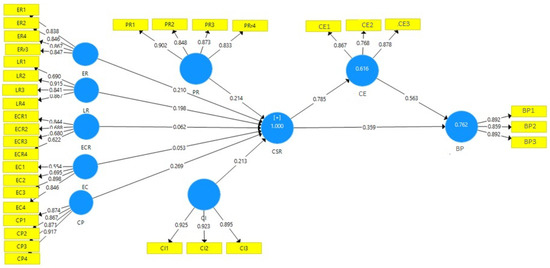

Cronbach’s alpha and composite reliability are commonly used to assess the internal consistency reliability of constructs [50]. As such, Cronbach’s alpha is considered the lower limit, and composite reliability is considered the upper limit, in terms of internal consistency and reliability of constructs [50] A value between 0.6 and 0.7 for Cronbach’s alpha and composite reliability is considered acceptable, whereas values from 0.7 to 0.95 describe more satisfactory results [50] and values greater than 0.95 are not feasible [55,56] PSL algorithm results are illustrated in the Figure 2.

Figure 2.

PLS algorithm results for measurement analysis.

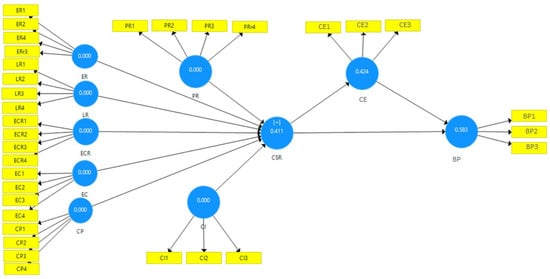

Thus, Figure 3 and Figure 4 depicted the results of Cronbach’s alpha and composite reliability which were satisfactory, as all the values were higher than 0.7. Convergent validity in Table 2 was measured by AVE, which is estimated by taking the mean squared loadings of each item in the construct [50]. The acceptable AVE threshold level is 0.5 or greater, which explains why the constructs have 50% or more than 50% variance in their items on average [50]. This demonstrates the reliability of all of the constructs, as they had acceptable values according to the predetermined thresholds.

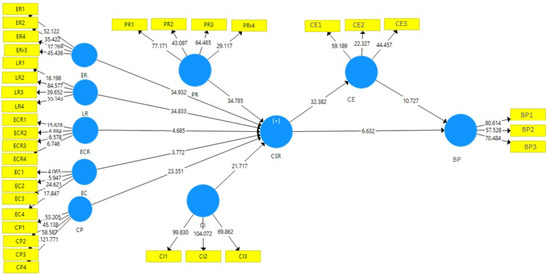

Figure 3.

Bootstrapping for the structural model.

Figure 4.

Predictive accuracy of the model.

4.5. Discriminant Validity

Discriminant validity reveals a distinctive property that explains to what extent constructed items differ from one another [50]. Usually, cross-loadings, the Fornell–Larcker criterion and HTMT ratios are used to assess discriminant validity. In the Fornell–Larcker criterion, the discriminant validity is estimated by comparing the diagonal values of correlation and the square root of AVEs. The suggested threshold is that all digital values have to be greater than the values below, as the ground value illustrates a strong correlation among the constructs. However, Table 3 shows Fornell–Larcker criterion which has performance issues when measuring the discriminant validity, which has been criticised by [52], who argue that the HTMT ratio is more feasible for estimating the discriminant validity of constructs.

Table 3.

Fornell–Larcker criterion.

The HTMT ratio is more acceptable, as it indicates the mean correlation of items across constructs relative to the geometric mean correlation of the same constructs [57]. The value of an HTMT ratio greater than 0.90 depicts a lack of discriminant validity among constructs, so the valid assessment value of the HTMT ratio is 0.85 [52]. Hence, all the HTMT ratio values in Table 4 were satisfactory, as all values fulfilled the predetermined criteria.

Table 4.

HTMT ratio.

Collinearity among each item of the constructs was evaluated by the variance inflation factor (VIF). A higher VIF value demonstrates a stronger level of collinearity between items of constructs. A VIF value greater than 0.5 is the most acceptable [50]. Table A1 (see Appendix A) presents the VIF values that explain the collinearity of each item.

4.6. Structural Model Assessment

The structural model was used to test the proposed hypotheses. The following evaluation criteria for a structural model were proposed by [57] estimation of β, R2 corresponding t-values and f2. The most appropriate procedure, i.e., bootstrapping, was proposed by [52] to assess structural models with a subsample of 5000, which shows greater significance than the Sobel test [50]. The values of f2 report the size effect, and, according to [58] recommendation values, 0.02, 0.15 and 0.35 describe small, medium and large size effects, respectively.

In this section, we test the variables by path analysis, which comprised path coefficients and significance levels. The Table 5 given the results which revealed that customer expectation has a direct relationship with Lebanese banking performance ( The relationship between CSR and corporate image was observed to be significantly positive (. CSR is positively related to banking performance (. CSR was found to have a significant positive relationship with consumer protection ( Similarly, CSR has a positive relationship with customer expectations (. The above results confirm that CSR has a positive and significant impact on customer expectations.

Table 5.

Direct and indirect path analysis.

Moreover, CSR has a positive relationship with environmental contributions (. The results showed a positive relationship between CSR and economic responsibility ( The results of CSR and ethical responsibility ( showed a significant impact on ethical responsibility. Corporate social responsibility was found to be positively related to legal responsibility (. Hence, the results ( show that CSR has a positive impact on philanthropic responsibility.

The mediating hypothesis was also tested. CSR was found to be a potential mediator between environmental contributions and customer expectations (. CSR mediates the relationship between consumer protection and customer expectation ( CSR mediates the relationship between ethical responsibility and bank performance ( Similarly, CSR was found to be a significant mediator between philanthropic responsibility and bank performance (. Customer expectation was studied as a mediator, and the results ( highlight that customer expectations strongly mediate the relationship between CSR and bank performance. CSR significantly mediates the relationship between legal responsibility and bank performance (. CSR ( mediates the relationship between economic responsibility and customer expectations, between ethical responsibility and customer expectations ( and between philanthropic responsibility and customer expectations (. The results showed that CSR strongly mediates the relationship between corporate image and banking performance (, and CSR significantly mediates the relationship between economic responsibility and banking performance ( CSR is also an effective mediator between legal responsibility and customer expectations ( and between environmental contributions and banking performance (. Furthermore, the study also confirmed the significance of CSR and its mediating relationship between consumer protection and banking performance (, between corporate image and customer expectations ( and between environmental contributions and customer expectations (

The serial mediation hypothesis was also tested. The results demonstrated ( that serial mediation exists between consumer protection, CSR, customer expectations and banking performance. The results ( confirmed that significant serial mediation exists among legal responsibility, CSR, customer expectation and bank performance. The results ( showed that serial mediation exists between ethical responsibility, CSR, customer expectations and bank performance. Similarly, serial mediation between philanthropic responsibility, CSR, customer expectation and bank performance was also tested (. CSR and customer expectation were also studied as serial mediation factors between environmental contribution, CSR, customer expectations and bank performance (). There was found to be a potential serial mediation between corporate image, CSR, customer expectations and bank performance ( The results ( showed a serial mediation level equal to that between economic responsibility, CSR, customer expectation and bank performance. These results confirm that significant serial mediation exists between consumer protection, CSR, customer expectation and bank performance ( These results support our proposed hypothesis. Specifically, H1 is supported: there is a positive relationship between CSR practices and the customers’ expectations. H2 is also supported: there is a positive relationship between the customers’ expectations and the performance of Lebanese banks. H3 is supported as well: the customers’ expectations mediate the relationship between CSR activities and the performance of Lebanese banks.

5. Conclusions

Customer expectations and bank performance are two widespread factors that are critical for business success. Organisations around the globe have been applying a diversified set of technologies to satisfy their customers and earn their loyalty for life. This study examined the link between customers’ perceptions of corporate social obligations and underlying variables such as an organisation’s age, the degree to which it is active in the community and its cultural diversity. Questionnaires were used as the survey tool, with a 5-point Likert scale method adopted to formulate the items. The questionnaire was tested to assess its trustworthiness regarding data collection. The tests aimed to help determine the questionnaire’s reliability and validity [39].

The overall results demonstrated the significance of CSR in terms of meeting customers’ expectations and Lebanese banking performance. All CSR dimensions demonstrated a positive impact on customer expectations and banking performance. Moreover, customer expectations proved to be a mediator between CSR and bank performance, although a partial mediation existed between CSR and banking performance. Interestingly, serial mediation was also tested, and a partial serial mediation existed between CSR dimensions and banking performance. The results positively verified H1: CSR and customer expectations have a positive relationship; H2: Customer expectation has a positive impact on banking performance; and H3: The customers’ expectations have a positive impact on CSR activities and the performance of Lebanese banks. These results were also validated with empirical studies [58,59].

Managerial Implications

The business activities in Lebanon in relation to CSR positively affect both society and the environment. In other words, the interactions between businesses and society are important, as they generate more positive externalities and minimise negative ones within the businesses operating in the Lebanese market, as is the case for all other businesses around the world. A responsible attitude toward society and the environment can increase competitiveness between businesses in Lebanon, thus attracting more consumers while allowing the best employees better opportunities [60].

Theoretical Implications

CSR refers to a company’s societal, economic, legal, ethical and charitable obligations. A socially responsible firm must create policies and procedures that go above the legal minimums and benefit its stakeholders. CSR should be viewed as a self-regulating system included in routine corporate business operations that verifies conformity with the law and ethical principles. To maintain a high level of legitimacy through which society supports an organisation’s survival, the organisation must guarantee that these conditions are not violated.

Limitations and Future Research

Due to the current Lebanese economic and financial crises, limited secondary data were available, so our calculations were based on primary data. Future research may focus on more sophisticated variables of CSR to study the banking sectors of transition economies.

Author Contributions

Z.H. contribute in all chapters and M.Y. supervise this article and proofread. All authors have read and agreed to the published version of the manuscript.

Funding

There is no funding available for this study.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Primary data is used and questionnaires are attached in Appendix A and Appendix B.

Conflicts of Interest

There is no any conflict of interest between the authors.

Appendix A

Table A1.

VIF values.

Table A1.

VIF values.

| Items | VIF |

|---|---|

| CI1 | 1.833 |

| CI1 | 2.520 |

| CI2 | 2.414 |

| CI2 | 1.716 |

| CI3 | 2.480 |

| CI3 | 2.448 |

| BP1 | 2.212 |

| BP2 | 1.941 |

| BP3 | 2.364 |

| CP1 | 2.538 |

| CP1 | 1.801 |

| CP2 | 2.442 |

| CP2 | 2.291 |

| CP3 | 2.610 |

| CP3 | 2.801 |

| CP4 | 2.464 |

| CP4 | 1.948 |

| CE1 | 1.858 |

| CE2 | 1.452 |

| CE3 | 1.910 |

| EC1 | 1.814 |

| EC2 | 2.140 |

| EC3 | 2.037 |

| EC3 | 2.167 |

| EC4 | 2.028 |

| EC4 | 2.165 |

| ECR1 | 1.119 |

| ECR1 | 1.607 |

| ECR2 | 2.654 |

| ECR2 | 2.543 |

| ECR3 | 2.848 |

| ECR3 | 2.154 |

| ECR4 | 1.479 |

| ER1 | 1.964 |

| ER1 | 2.064 |

| ER2 | 2.140 |

| ER2 | 1.533 |

| ER4 | 2.313 |

| ER4 | 2.571 |

| ER3 | 2.106 |

| ER3 | 2.611 |

| LR1 | 1.383 |

| LR1 | 2.575 |

| LR2 | 2.699 |

| LR2 | 1.838 |

| LR3 | 2.110 |

| LR3 | 2.481 |

| LR4 | 2.898 |

| LR4 | 2.256 |

| PR1 | 2.976 |

| PR1 | 2.914 |

| PR2 | 2.241 |

| PR2 | 2.854 |

| PR3 | 2.460 |

| PR3 | 1.544 |

| PR4 | 2.049 |

| PR4 | 2.791 |

Table A2.

Cross-loadings.

Table A2.

Cross-loadings.

| CI | BP | CP | CE | CSR | EC | ECR | ER | LR | PR | |

|---|---|---|---|---|---|---|---|---|---|---|

| CI1 | 0.925 | 0.741 | 0.814 | 0.697 | 0.775 | 0.184 | 0.385 | 0.512 | 0.547 | 0.564 |

| CI1 | 0.925 | 0.741 | 0.814 | 0.697 | 0.775 | 0.184 | 0.385 | 0.512 | 0.547 | 0.564 |

| CI2 | 0.923 | 0.792 | 0.792 | 0.791 | 0.764 | 0.220 | 0.361 | 0.533 | 0.524 | 0.545 |

| CI2 | 0.923 | 0.792 | 0.792 | 0.791 | 0.764 | 0.220 | 0.361 | 0.533 | 0.524 | 0.545 |

| CI3 | 0.895 | 0.740 | 0.797 | 0.706 | 0.736 | 0.182 | 0.297 | 0.502 | 0.496 | 0.522 |

| CI3 | 0.895 | 0.740 | 0.797 | 0.706 | 0.736 | 0.182 | 0.297 | 0.502 | 0.496 | 0.522 |

| BP1 | 0.785 | 0.891 | 0.812 | 0.779 | 0.758 | 0.191 | 0.349 | 0.562 | 0.554 | 0.569 |

| BP2 | 0.669 | 0.860 | 0.646 | 0.735 | 0.651 | 0.135 | 0.267 | 0.533 | 0.512 | 0.480 |

| BP3 | 0.732 | 0.892 | 0.726 | 0.714 | 0.681 | 0.217 | 0.233 | 0.493 | 0.500 | 0.508 |

| CP1 | 0.692 | 0.710 | 0.875 | 0.656 | 0.767 | 0.252 | 0.293 | 0.585 | 0.575 | 0.579 |

| CP1 | 0.692 | 0.710 | 0.875 | 0.656 | 0.767 | 0.252 | 0.293 | 0.585 | 0.575 | 0.579 |

| CP2 | 0.723 | 0.694 | 0.867 | 0.636 | 0.743 | 0.243 | 0.344 | 0.510 | 0.548 | 0.538 |

| CP2 | 0.723 | 0.694 | 0.867 | 0.636 | 0.743 | 0.243 | 0.344 | 0.510 | 0.548 | 0.538 |

| CP3 | 0.833 | 0.735 | 0.870 | 0.690 | 0.738 | 0.207 | 0.335 | 0.484 | 0.492 | 0.505 |

| CP3 | 0.833 | 0.735 | 0.870 | 0.690 | 0.738 | 0.207 | 0.335 | 0.484 | 0.492 | 0.505 |

| CP4 | 0.840 | 0.785 | 0.917 | 0.793 | 0.834 | 0.207 | 0.417 | 0.600 | 0.598 | 0.640 |

| CP4 | 0.840 | 0.785 | 0.917 | 0.793 | 0.834 | 0.207 | 0.417 | 0.600 | 0.598 | 0.640 |

| CE1 | 0.710 | 0.726 | 0.726 | 0.867 | 0.707 | 0.205 | 0.283 | 0.557 | 0.536 | 0.540 |

| CE2 | 0.574 | 0.642 | 0.538 | 0.768 | 0.508 | 0.120 | 0.164 | 0.436 | 0.324 | 0.349 |

| CE3 | 0.717 | 0.753 | 0.704 | 0.879 | 0.722 | 0.235 | 0.278 | 0.553 | 0.601 | 0.566 |

| EC1 | 0.079 | 0.046 | 0.082 | 0.058 | 0.109 | 0.535 | 0.106 | 0.063 | 0.083 | 0.098 |

| EC2 | 0.059 | 0.046 | 0.092 | 0.092 | 0.092 | 0.679 | 0.056 | 0.013 | 0.096 | 0.042 |

| EC3 | 0.232 | 0.244 | 0.288 | 0.239 | 0.297 | 0.906 | 0.058 | 0.209 | 0.220 | 0.182 |

| EC3 | 0.232 | 0.244 | 0.288 | 0.239 | 0.297 | 0.906 | 0.058 | 0.209 | 0.220 | 0.182 |

| EC4 | 0.184 | 0.167 | 0.207 | 0.207 | 0.225 | 0.853 | 0.004 | 0.127 | 0.203 | 0.114 |

| EC4 | 0.184 | 0.167 | 0.207 | 0.207 | 0.225 | 0.853 | 0.004 | 0.127 | 0.203 | 0.114 |

| ECR1 | 0.436 | 0.408 | 0.481 | 0.330 | 0.529 | 0.099 | 0.845 | 0.351 | 0.436 | 0.414 |

| ECR1 | 0.436 | 0.408 | 0.481 | 0.330 | 0.529 | 0.099 | 0.845 | 0.351 | 0.436 | 0.414 |

| ECR2 | 0.119 | 0.051 | 0.090 | 0.099 | 0.185 | -0.032 | 0.690 | 0.155 | 0.115 | 0.174 |

| ECR2 | 0.119 | 0.051 | 0.090 | 0.099 | 0.185 | -0.032 | 0.690 | 0.155 | 0.115 | 0.174 |

| ECR3 | 0.138 | 0.107 | 0.129 | 0.148 | 0.181 | -0.001 | 0.680 | 0.118 | 0.105 | 0.138 |

| ECR3 | 0.138 | 0.107 | 0.129 | 0.148 | 0.181 | -0.001 | 0.680 | 0.118 | 0.105 | 0.138 |

| ECR4 | 0.153 | 0.070 | 0.114 | 0.076 | 0.148 | 0.006 | 0.616 | 0.042 | 0.127 | 0.104 |

| ER1 | 0.522 | 0.554 | 0.564 | 0.526 | 0.765 | 0.109 | 0.280 | 0.838 | 0.655 | 0.773 |

| ER1 | 0.522 | 0.554 | 0.564 | 0.526 | 0.765 | 0.109 | 0.280 | 0.838 | 0.655 | 0.773 |

| ER2 | 0.437 | 0.478 | 0.491 | 0.483 | 0.717 | 0.139 | 0.270 | 0.846 | 0.717 | 0.655 |

| ER2 | 0.437 | 0.478 | 0.491 | 0.483 | 0.717 | 0.139 | 0.270 | 0.846 | 0.717 | 0.655 |

| ER4 | 0.454 | 0.505 | 0.533 | 0.564 | 0.760 | 0.195 | 0.259 | 0.867 | 0.742 | 0.728 |

| ER4 | 0.454 | 0.505 | 0.533 | 0.564 | 0.760 | 0.195 | 0.259 | 0.867 | 0.742 | 0.728 |

| ER3 | 0.500 | 0.507 | 0.513 | 0.524 | 0.728 | 0.133 | 0.232 | 0.847 | 0.667 | 0.677 |

| ER3 | 0.500 | 0.507 | 0.513 | 0.524 | 0.728 | 0.133 | 0.232 | 0.847 | 0.667 | 0.677 |

| LR1 | 0.394 | 0.416 | 0.402 | 0.404 | 0.615 | 0.179 | 0.208 | 0.644 | 0.690 | 0.572 |

| LR1 | 0.394 | 0.416 | 0.402 | 0.404 | 0.615 | 0.179 | 0.208 | 0.644 | 0.690 | 0.572 |

| LR2 | 0.514 | 0.565 | 0.590 | 0.557 | 0.791 | 0.197 | 0.336 | 0.743 | 0.915 | 0.691 |

| LR2 | 0.514 | 0.565 | 0.590 | 0.557 | 0.791 | 0.197 | 0.336 | 0.743 | 0.915 | 0.691 |

| LR3 | 0.490 | 0.446 | 0.497 | 0.477 | 0.710 | 0.159 | 0.289 | 0.661 | 0.841 | 0.631 |

| LR3 | 0.490 | 0.446 | 0.497 | 0.477 | 0.710 | 0.159 | 0.289 | 0.661 | 0.841 | 0.631 |

| LR4 | 0.496 | 0.535 | 0.583 | 0.521 | 0.767 | 0.203 | 0.373 | 0.677 | 0.867 | 0.706 |

| LR4 | 0.496 | 0.535 | 0.583 | 0.521 | 0.767 | 0.203 | 0.373 | 0.677 | 0.867 | 0.706 |

| PR1 | 0.556 | 0.528 | 0.625 | 0.541 | 0.803 | 0.155 | 0.338 | 0.726 | 0.687 | 0.902 |

| PR1 | 0.556 | 0.528 | 0.625 | 0.541 | 0.803 | 0.155 | 0.338 | 0.726 | 0.687 | 0.902 |

| PR2 | 0.466 | 0.517 | 0.546 | 0.518 | 0.745 | 0.111 | 0.289 | 0.732 | 0.663 | 0.848 |

| PR2 | 0.466 | 0.517 | 0.546 | 0.518 | 0.745 | 0.111 | 0.289 | 0.732 | 0.663 | 0.848 |

| PR3 | 0.565 | 0.537 | 0.583 | 0.509 | 0.783 | 0.165 | 0.361 | 0.708 | 0.681 | 0.873 |

| PR3 | 0.565 | 0.537 | 0.583 | 0.509 | 0.783 | 0.165 | 0.361 | 0.708 | 0.681 | 0.873 |

| PR4 | 0.465 | 0.459 | 0.462 | 0.461 | 0.723 | 0.126 | 0.287 | 0.727 | 0.679 | 0.834 |

| PR4 | 0.465 | 0.459 | 0.462 | 0.461 | 0.723 | 0.126 | 0.287 | 0.727 | 0.679 | 0.834 |

Appendix B

Questionnaires

RESEARCH QUESTIONNAIRE

DEPARTMENT OF BUSINESS ADMINISTRATION, INSTITUTE OF

GRADUATE STUDIES AND RESEARCH, CYPRUS INTERNATIONAL

UNIVERSITY, LEFKOŞA 99510, TURKEY

Topic: Corporate Social Responsibility (CSR) Practices and Customers’ Expectations: The Lebanese Perspective in the Banking Sector

We are collecting data for research purposes to complete my study, which is compulsory for my degree. These data will help to complete my research. We will save your data in a confidential manner. Your answers will be helpful for other people who will read this research. Your participation in this research study is voluntary. You may choose not to participate, and you may withdraw your consent to participate at any time. You will not be penalised in any way should you decide not to participate in or to withdraw from this study.

| Age _______ Gender Male □ / Female □ | |||||||

| Variables | Items | Coded | Strongly Disagree | Disagree | Neutral | Agree | Strongly Agree |

| Limit object of the study | 1. Are you living or working in Lebanon? | -- | |||||

| 2. Have you ever used banking services in Lebanon? | -- | ||||||

| Corporate image and understanding of CSR | 3. Have you ever heard of the concept ‘corporate social responsibility’? | -- | |||||

| 4. Corporate social responsibility is tax responsibility. | CSR01 | ||||||

| 5. Corporate social responsibilities include environmental protection, customer-centric policies, philanthropy and other aspects that society expects from corporations. | CSR02 | ||||||

| 6. Corporate social responsibility is about the maximisation of profits and dividends. | CSR03 | ||||||

| Environmental Contribution | 7. Bank X reduces electricity and power consumption. | EC01 | |||||

| 8. Bank X uses environmentally friendly products. | EC02 | ||||||

| 9. Bank X uses recyclable materials. | EC03 | ||||||

| 10. Bank X has the proper pollution control measures. | EC04 | ||||||

| 11. Bank X keeps the internal environment neat and clean. | EC05 | ||||||

| 12. Bank X keeps the external environment neat and clean. | EC06 | ||||||

| Customer Expectations | 13. Bank X’s staff are efficient, reliable, competent and well dressed. | CE01 | |||||

| 14. Bank X’s staff have a polite attitude and behaviour. | CE02 | ||||||

| 15. Bank X is recruiting more staff for customer service. | CE03 | ||||||

| 16. Bank X focuses on opening new branches and increasing its services range. | CE04 | ||||||

| 17. Bank X gives customers high returns and charges lower fees on various transactions. | CE05 | ||||||

| 18. Banks should introduce new ways of convenient banking, such as mobile or internet banking. | CE06 | ||||||

| Philanthropic Responsibility | 19. Bank X is involved in organising different funds. | PR01 | |||||

| 20. Bank X raises funding for art exhibitions. | PR02 | ||||||

| 21. Bank X takes measures to deliver free financial planning knowledge to the public. | PR03 | ||||||

| 22. Bank X opens accounts for regularly donating money to orphanages. | PR04 | ||||||

| 23. Bank X provides poor children in remote areas with school supplies and nutritional lunches. | PR05 | ||||||

| 24. Bank X opens accounts in case of disaster for collecting and donating money in disasters. | PR06 | ||||||

| Bank Performance | 25. I choose bank X because it enacts environmental protection procedures. | BP01 | |||||

| 26. I choose bank X because it takes care of customers’ benefits. | BP02 | ||||||

| 27. I choose bank X because it is actively involved in philanthropic activities. | BP03 | ||||||

| 28. Corporate social responsibility influences my decision when considering a bank. | BP04 | ||||||

| 29. I do not choose banks based on whether they carry out their corporate social responsibilities. | BP05 | ||||||

| Ethical Responsibility | I think banking organisations should conduct risk assessment of financial products. | ER01 | |||||

| I think frontline staff of banking organisations should deeply understand complex financial services before offering them to customers. | ER02 | ||||||

| I feel banking organisations should protect the rights of customers when providing details of financial products. | ER03 | ||||||

| I think banking organisations should strengthen business ethics training for staff. | ER04 | ||||||

| Legal Responsibility | I think banking organisations should strengthen business ethics training for staff. | LR01 | |||||

| I think banking regulators should examine the suitability of advertisements of financial products to ensure the fulfilment of social responsibility. | LR02 | ||||||

| I think transparency regarding the monitoring of financial products by banking organisations to the public is lacking. | LR03 | ||||||

| I think banking organisations should show a bad attitude toward supporting greener industries. | LR04 | ||||||

| Economic Responsibility | I think banking organisations should provide lending options to low-income individuals and small businesses. | ER01 | |||||

| I think banking organisations should engage in community development. | ER02 | ||||||

| I think banking organisations should bring forth programs and policies to enrich the finance knowledge of banking service staff. | ER03 | ||||||

| I think banking organisations should be accountable for their performance. | ER04 | ||||||

| Consumer Protection | The Iinformation provided is clear and understandable. | CP01 | |||||

| The bank does not deduct money from hidden charges. | CP02 | ||||||

| The bank sends all necessary information to the customer. | CP03 | ||||||

| I think banking regulators should examine the suitability of advertisements of financial products to ensure the fulfilment of social responsibility. | CP04 | ||||||

References

- Vogler, D.; Gisler, A. The effect of CSR on the media reputation of the Swiss banking industry before and after the financial crisis 2008. UmweltWirtschaftsForum 2016, 24, 201–206. [Google Scholar] [CrossRef]

- McDonald, L.M.; Rundle-Thiele, A.S. Corporate social responsibility and bank customer satisfaction: A research agenda. Int. J. Bank Mark. 2008, 26, 170–182. [Google Scholar] [CrossRef] [Green Version]

- Bravo, R.; Matute, J.; Pina, J.M. Corporate Social Responsibility as a Vehicle to Reveal the Corporate Identity: A Study Focused on the Websites of Spanish Financial Entities. J. Bus. Ethics 2012, 107, 129–146. [Google Scholar] [CrossRef]

- Mocan, M.; Rus, S.; Draghici, A.; Ivascu, L.; Turi, A. Impact of Corporate Social Responsibility Practices on the Banking Industry in Romania. Proc. Econ. Finance 2015, 23, 712–716. [Google Scholar] [CrossRef] [Green Version]

- Kilic, M. The Effect of Board Diversity on the Performance of Banks: Evidence from Turkey. Int. J. Bus. Manag. 2015, 10. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Aracil, E. European Banks’ Reputation for Corporate Social Responsibility. Corporate Soc. Respons. Environ. Manag. 2017, 24, 1–14. [Google Scholar] [CrossRef]

- Ali, W.; Frynas, J.G.; Mahmood, Z. Determinants of Corporate Social Responsibility (CSR) Disclosure in Developed and Developing Countries: A Literature Review. Corporate Soc. Respons. Environ. Manag. 2017, 24, 273–294. [Google Scholar] [CrossRef]

- Benlemlih, M.; Girerd-Potin, I. Corporate social responsibility and firm financial risk reduction: On the moderating role of the legal environment. J. Bus. Finance Account. 2017, 44, 1137–1166. [Google Scholar] [CrossRef]

- Platonova, E.; Asutay, M.; Dixon, R.; Mohammad, S. The Impact of Corporate Social Responsibility Disclosure on Financial Performance: Evidence from the GCC Islamic Banking Sector. J. Bus. Ethics 2018, 151, 451–471. [Google Scholar] [CrossRef] [Green Version]

- Orazalin, N. Corporate governance and corporate social responsibility (CSR) disclosure in an emerging economy: Evidence from commercial banks of Kazakhstan. Corporate Govern. 2019, 19, 490–507. [Google Scholar] [CrossRef]

- Chedrawi, C.; Osta, A.; Osta, S. CSR in the Lebanese banking sector: A neo-institutional approach to stakeholders’ legitimacy. J. Asia Bus. Stud. 2020, 14, 143–157. [Google Scholar] [CrossRef]

- Bennett, R.; Kottasz, R. Public attitudes towards the UK banking industry following the global financial crisis. Int. J. Bank Mark. 2012, 30, 128–147. [Google Scholar] [CrossRef]

- Ayadi, M.A.; Kusy, M.I.; Pyo, M.; Trabelsi, S. Corporate Social Responsibility, Corporate Governance, and Managerial Risk-Taking. In Proceedings of the Canadian Academic Accounting Association (CAAA) Annual Conference 2015, Toronto, ON, Canada, 28–31 May 2015. [Google Scholar]

- Chedrawi, C.; Osta, S. ICT and CSR in the Lebanese Banking Sector, towards a Regain of Stakeholders’ Trust: The Case of Bank Audi. 2018. Available online: http://www.unep.org/ (accessed on 4 October 2021).

- Macaron, L.F. Impact of CSR activities on Organizational Identification (OI) and Job Satisfaction (JS) in Lebanese Commercial Banks. Int. J. Adv. Eng. Manag. Sci. 2019, 5, 35–47. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate social responsibility: Evolution of a definitional construct. Bus. Soc. 1999, 38, 268–295. [Google Scholar] [CrossRef]

- Taiwo Adewale, M.; Adeniran Rahmon, T. Does Corporate Social Responsibility Improve an Organization’s Financial Performance?—Evidence from Nigerian Banking Sector. IUP J. Corporate Govern. 2014, XIII, 52–60. [Google Scholar]

- Dujmović, M.; Vitasović, A. Tourism product and destination positioning. Mediterr. J. Soc. Sci. 2014, 5, 570–579. [Google Scholar] [CrossRef] [Green Version]

- 19. Brunk, K H. Exploring origins of ethical company/brand perceptions—A consumer perspective of corporate ethics. J. Bus. Res. 2010, 63, 255–262. [CrossRef]

- Alrumaihi, A.; Aaro, H. Corporate Social Responsibility in the Banking Industry in Kuwait Item Type Thesis. Available online: http://hdl.handle.net/10454/14866 (accessed on 4 October 2021).

- Dusuki, A.W. Corporate Social Responsibility of Islamic Banks in Malaysia: A Synthesis of Islamic and Stakeholders’ Perspectives. Ph.D. Thesis, Loughborough University, Loughborough, UK, 2005. [Google Scholar]

- Bai, X.; Chang, J. Corporate social responsibility and firm performance: The mediating role of marketing competence and the moderating role of market environment. Asia Pac. J. Manag. 2015, 32, 505–530. [Google Scholar] [CrossRef]

- Lam, A. The Impact of Corporate Social Responsibility on Customer Loyalty: A Study of the Banking Industry. Ph.D. Thesis, Heriot-Watt University, Edinburgh, UK, 2016. [Google Scholar]

- Abu-Arja, A. The Role of Jordanian Multinationals in Countering Terrorism and Enhancing Security: A Stakeholder Approach. Ph.D. Thesis, Manchester Metropolitan University, Manchester, UK, 2019. [Google Scholar]

- Lourenço, I.C.; Branco, M.C.; Curto, J.D.; Eugénio, T. How does the market value corporate sustainability performance? J. Bus. Ethics 2012, 108, 417–428. [Google Scholar] [CrossRef]

- Islam, T.; Islam, R.; Pitafi, A.H.; Xiaobei, L.; Rehmani, M.; Irfan, M.; Mubarak, M.S. The impact of corporate social responsibility on customer loyalty: The mediating role of corporate reputation, customer satisfaction, and trust. Sustain. Prod. Consum. 2021, 25, 123–135. [Google Scholar] [CrossRef]

- Garriga, E. Corporate Social Responsibility Theories: Mapping the Territory. J. Bus. Ethics 2004, 53, 51–71. [Google Scholar] [CrossRef]

- Maon, F.; Lindgreen, A.; Swaen, V. Organizational stages and cultural phases: A critical review and a consolidative model of corporate social responsibility development. Int. J. Manag. Rev. 2010, 12, 20–38. [Google Scholar] [CrossRef]

- Burianova, L.; Paulik, J. Corporate Social Responsibility in Commercial Banking—A Case Study from the Czech Republic. J. Compet. 2014, 6, 50–70. [Google Scholar] [CrossRef] [Green Version]

- Cheema, S.; Afsar, B.; Javed, F. Employees’ corporate social responsibility perceptions and organizational citizenship behaviors for the environment: The mediating roles of organizational identification and environmental orientation fit. Corporate Soc. Respons. Environ. Manag. 2020, 27, 9–21. [Google Scholar] [CrossRef]

- Menichini, T.; Rosati, F. A Fuzzy Approach to Improve CSR Reporting: An Application to the Global Reporting Initiative Indicators. Proc.-Soc. Behav. Sci. 2014, 109, 355–359. [Google Scholar] [CrossRef] [Green Version]

- Mosca, F.; Civera, C. The Evolution of CSR: An Integrated Approach, Symphonya. Emerg. Issues Manag. 2017, 16. [Google Scholar] [CrossRef] [Green Version]

- Li, Y.; Liu, B.; Huan, T.C. Renewal or not? Consumer response to a renewed corporate social responsibility strategy: Evidence from the coffee shop industry. Tourism Manag. 2019, 72, 170–179. [Google Scholar] [CrossRef]

- Raza, A.; Saeed, A.; Iqbal, M.K.; Saeed, U.; Sadiq, I.; Faraz, N.A. Linking corporate social responsibility to customer loyalty through co-creation and customer company identification: Exploring sequential mediation mechanism. Sustainability 2020, 12, 2525. [Google Scholar] [CrossRef] [Green Version]

- Luu, T.T. CSR and Customer Value Co-creation Behavior: The Moderation Mechanisms of Servant Leadership and Relationship Marketing Orientation. J. Bus. Ethics 2019, 155, 379–398. [Google Scholar] [CrossRef]

- Hur, W.M.; Kim, H.; Kim, H.K. Does customer engagement in corporate social responsibility initiatives lead to customer citizenship behaviour? The mediating roles of customer-company identification and affective commitment. Corporate Soc. Respons. Environ. Manag. 2018, 25, 1258–1269. [Google Scholar] [CrossRef]

- Iglesias, O.; Markovic, S.; Bagherzadeh, M.; Singh, J.J. Co-creation: A Key Link Between Corporate Social Responsibility, Customer Trust, and Customer Loyalty. J. Bus. Ethics 2020, 163, 151–166. [Google Scholar] [CrossRef]

- Decker, S.; Sale, C. An analysis of corporate social responsibility, trust and reputation in the banking profession. In Professionals Perspectives of Corporate Social Responsibility; Springer: Berlin/Heidelberg, Germany, 2010; pp. 135–156. [Google Scholar] [CrossRef]

- Majid, M.A.A.; Othman, M.; Mohamad, S.F.; Lim, S.A.H.; Yusof, A. Piloting for Interviews in Qualitative Research: Operationalization and Lessons Learnt. Int. J. Acad. Res. Business Soc. Sci. 2017, 7. [Google Scholar] [CrossRef] [Green Version]

- Kumar, N. Corporate Social Responsibility: An Analysis of Impact and Challenges in India. Int. J. Social Sci. Manag. Entrepreneur. 2019, 3, 53–63. [Google Scholar]

- Rigdon, E.E. The equal correlation baseline model for comparative fit assessment in structural equation modeling. Struct. Equat. Model. 1998, 5, 63–77. [Google Scholar] [CrossRef]

- Babin, B.J.; Joseph, F.H.; Boles, J. Publishing research in marketing journals using structural equation modeling. J. Mark. Theory Pract. 2008, 16, 279–286. [Google Scholar] [CrossRef]

- Fornell, C.; Bookstein, F.L. Two structural equation models: LISREL and PLS applied to consumer exit-voice theory. J. Mark. Res. 1982, 19, 440–452. [Google Scholar] [CrossRef] [Green Version]

- Wold, H. Causal flows with latent variables: Partings of the ways in the light of NIPALS modelling. Eur. Econ. Rev. 1974, 5, 67–86. [Google Scholar] [CrossRef]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Albers, S. PLS and Success Factor Studies in Marketing. In Handbook of Partial Least Squares; Springer: Berlin/Heidelberg, Germany, 2010; pp. 409–425. [Google Scholar]

- Chung, K.-H.; Yu, J.-E.; Choi, M.-G.; Shin, J.-I. The Effects of CSR on Customer Satisfaction and Loyalty in China: The Moderating Role of Corporate Image. J. Econ. Bus. Manag. 2015, 3, 542–547. [Google Scholar] [CrossRef] [Green Version]

- Ringle, C.M.; Sarstedt, M.; Straub, D.W. Editor’s comments: A critical look at the use of PLS-SEM in MIS Quarterly. MIS Quart. 2012, 36, iii–xiv. [Google Scholar] [CrossRef] [Green Version]

- Anderson, J.C.; Kellogg, J.L.; Gerbing, D.W. Structural Equation Modeling in Practice: A Review and Recommended Two-Step Approach. Psychol. Bull. 1988, 103, 411. [Google Scholar] [CrossRef]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial Least Squares Structural Equation Modeling. In Handbook of Market Research; Springer International Publishing: Cham, Switzerland, 2017; pp. 1–40. [Google Scholar] [CrossRef]

- Gholami, Y.; Brossier, R.; Operto, S.; Ribodetti, A.; Virieux, J. Which parameterization is suitable for acoustic vertical transverse isotropic full waveform inversion? Part 1: Sensitivity and trade-off analysis. Geophysics 2013, 78, R81–R105. [Google Scholar] [CrossRef]

- Henseler, J.; Hubona, G.; Ray, P.A. Using PLS path modeling in new technology research: Updated guidelines. Ind. Manag. Data Syst. 2016, 116, 2–20. [Google Scholar] [CrossRef]

- Isaac, O.; Aldholay, A.; Abdullah, Z.; Ramayah, T. Online learning usage within Yemeni higher education: The role of compatibility and task-technology fit as mediating variables in the IS success model. Comp. Educ. 2019, 136, 113–129. [Google Scholar] [CrossRef]

- Kannan, V.R.; Tan, K.C. Just in time, total quality management, and supply chain management: Understanding their linkages and impact on business performance. Omega 2005, 33, 153–162. [Google Scholar] [CrossRef]

- Diamantopoulos, A.; Sarstedt, M.; Fuchs, C.; Wilczynski, P.; Kaiser, S. Guidelines for choosing between multi-item and single-item scales for construct measurement: A predictive validity perspective. J. Acad. Mark. Sci. 2012, 40, 434–449. [Google Scholar] [CrossRef] [Green Version]

- Kline, R.B. Principles and Practice of Structural Equation Modeling; Guilford Press: New York, NY, USA, 2015. [Google Scholar]

- Correll, J.; Mellinger, C.; McClelland, G.H.; Judd, C.M. Avoid Cohen’s ‘Small’, ‘Medium’, and ‘Large’ for Power Analysis. Trends Cogn. Sci. 2020, 24, 200–207. [Google Scholar] [CrossRef]

- Demirgiic, A.; Huizinga, H. Determinants of Commercial Bank Interest Margins and Profitability: Some International Evidence. World Bank Econ. Rev. 1999, 13, 379–408. [Google Scholar] [CrossRef] [Green Version]

- Wu, M.W.; Shen, C.H. Corporate social responsibility in the banking industry: Motives and financial performance. J. Bank. Finance 2013, 37, 3529–3547. [Google Scholar] [CrossRef]

- Maria, C. Corporate Social Responsibility Practices in the Lebanese Banking Sector: A Reality or a Myth? Ph.D. Thesis, Notre Dame University-Louaize, Zouk Mosbeh, Lebanon, 2020. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).