Digital Financial Inclusion Sustainability in Jordanian Context

Abstract

1. Introduction

2. Literature Review

3. Theoretical Models

3.1. Technology Acceptance Model (TAM)

3.2. Mental Accounting Theory (MAT)

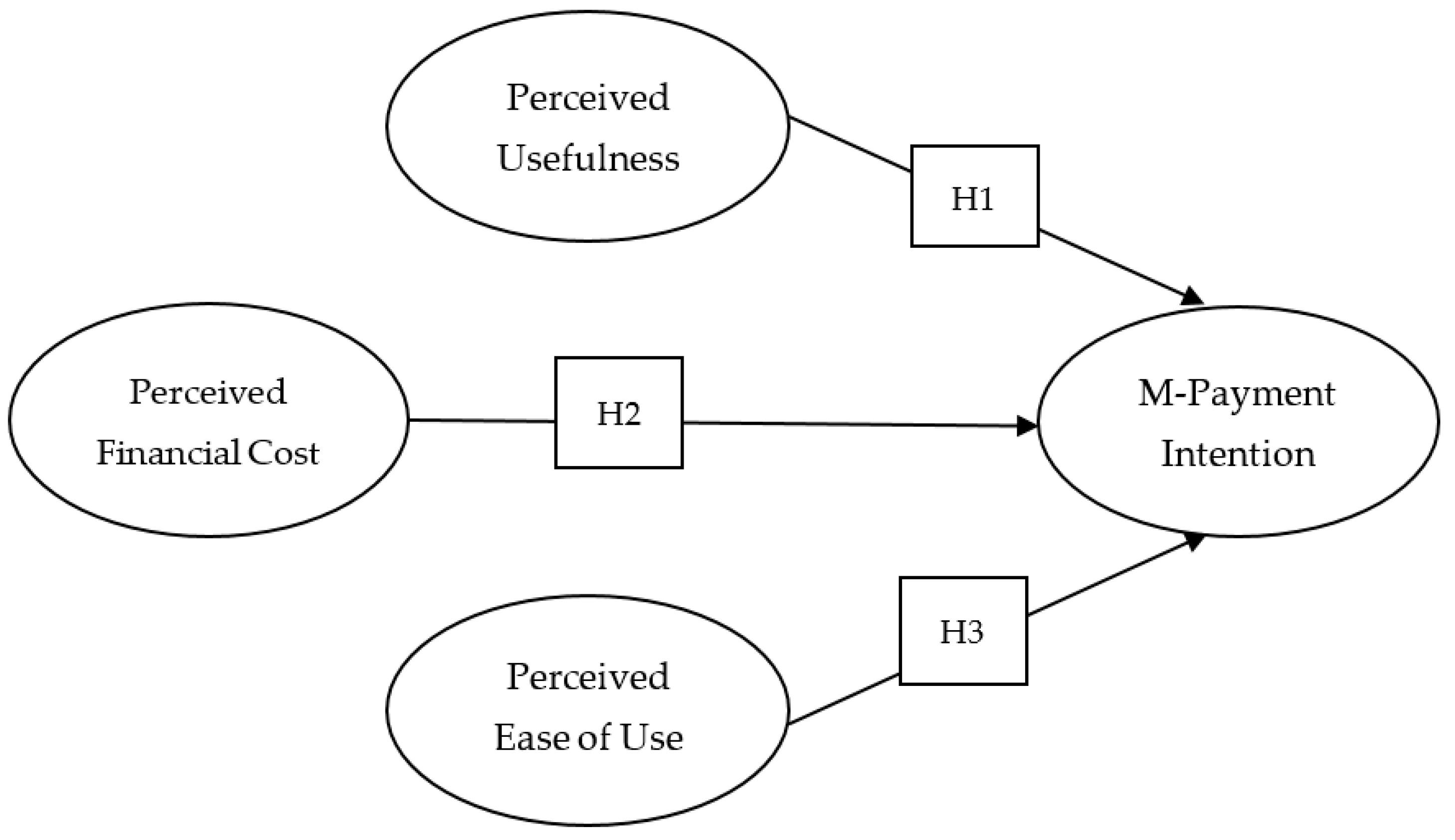

4. Research Model

4.1. Perceived Usefulness (PU)

4.2. Perceived Financial Cost (PFC)

4.3. Perceived Ease of Use (PEU)

5. Research Methodology

6. Data Analysis and Results

6.1. Measurement Model Assessment

6.2. Structural Model Assessment

7. Discussion and Implications

7.1. Discussion

7.1.1. The Effect of Perceived Usefulness on Intention to Use Mobile Payment System

7.1.2. The Effect of Perceived Financial Cost on Intention to Use Mobile Payment System

7.1.3. The Effect of Perceived Ease of Use on Intention to Use Mobile Payment System

7.2. Implications

8. Limitations and Recommendations

9. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | Code | Measurements Items | Sources |

|---|---|---|---|

| Perceived Usefulness | PU1 | Using the m-payment is useful in my daily life. | Davis [15] |

| PU2 | Using the m-payment system increases my productivity. | ||

| PU3 | Using the m-payment system saves my time. | ||

| PU4 | Using the m-payment system enhances my efficiency. | ||

| Perceived Financial Cost | PFC1 | M-payment system service is reasonably priced. | Venkatesh et al. [23] |

| PFC2 | M-payment system services are reasonably priced comparing with other systems (e.g., mobile banking systems). | ||

| PFC3 | M-payment system services is a good value for the fees. | ||

| PFC4 | At the current cost, I think m-payment system will provide a reasonable and good cost. | ||

| Perceived Ease of Use | PEU1 | I feel that the m-payment system is easy to use. | Davis [15] |

| PEU2 | I feel that the m-payment system is convenient. | ||

| PEU3 | Getting the information that I want from the m-payment system is easy. | ||

| PEU4 | The m-payment system requires no training. | ||

| Mobile Payment Intention | MBI1 | I am planning to use m-payment frequently. | Davis [15], Venkatesh et al. [23] |

| MBI2 | I expect that I would use m-payment system in the near future | ||

| MBI3 | It would be very likely that I will use m-payment system in the near future | ||

| MBI4 | I seriously intend to use m-payment system in the near future |

References

- Central bank of Jordan. Jordan Financial Stability Report-2017. Available online: http://www.cbj.gov.jo/Pages/viewpage.aspx?pageID=45 (accessed on 9 October 2019).

- Central bank of Jordan. Jordan Financial Stability Report-2016. Available online: http://www.cbj.gov.jo/EchoBusV3.0/SystemAssets/PDFs/EN/FINANCIAL%20STABILITY%20REPORT%202016.pdf (accessed on 9 October 2019).

- Central bank of Jordan. Jordan Financial Stability Report-2015. Available online: http://www.cbj.gov.jo/EchoBusV3.0/SystemAssets/PDFs/EN/FINANCIAL%20STABILITY%20REPORT%202015.pdf (accessed on 9 October 2019).

- Scharwatt, C.; Nautiyal, A. The Long Road to Interoperability in Jordan Lessons for the Wider Industry; Groupe Speciale Mobile Association (GSMA): London, UK, 2016; Available online: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2016/12/GSMA-case-study_Jordan_2016.pdf (accessed on 11 October 2019).

- Pousttchi, K.; Turowski, K. Mobile Economy: Transaktionen, Prozesse, Anwendungen und Dienste. Workshop Mob. Commerce 2004, 2, 3. [Google Scholar]

- Gharaibeh, M.K.; Arshad, M.R.M. Determinants of Intention to Use Mobile Banking in the North of Jordan: Extending UTAUT2 with Mass Media and Trust. J. Eng. Appl. Sci. 2018, 13, 2023–2033. [Google Scholar]

- Al-Okaily, A.; Al-Okaily, M.; Ai Ping, T.; Al-Mawali, H.; Zaidan, H. An empirical investigation of enterprise system user satisfaction antecedents in Jordanian commercial banks. Cogent Bus. Manag. 2021, 8, 1918847. [Google Scholar] [CrossRef]

- Central Bank of Jordan. Mobile Payment Service Instructions. Available online: https://procurementadmin.fhi360.org/Files/jomopay_instruction_635586593682135070.pdf (accessed on 9 October 2019).

- Sehwail, L.; Bahou, M. Interview with the Jordanian Official Television—Program Money and Business—Financial Inclusion [Video File]. 24 April 2017. Available online: https://www.youtube.com/watch?v=5ouJVc7nBqU (accessed on 18 June 2019).

- Al-Okaily, M.; Lutfi, A.; Alsaad, A.; Taamneh, A.; Alsyouf, A. The determinants of digital payment systems’ acceptance under cultural orientation differences: The case of uncertainty avoidance. Technol. Soc. 2020, 63, 101367. [Google Scholar] [CrossRef]

- Qasim, H.; Abu-Shanab, E. Drivers of Mobile Payment Acceptance: The Impact of Network Externalities. Inf. Syst. Front. 2016, 18, 1021–1034. [Google Scholar] [CrossRef]

- Al Shawwa, M. The 2nd Electronic and Mobile Payments in the Arab World Conference—Presentation on the Jordan Retail Banking Survey and Findings of the E & M Banking Services [Video File]. 7 May 2016. Available online: https://www.youtube.com/watch?v=WLeikg3AFA4 (accessed on 18 June 2019).

- Ghazal, M. Mobile Payment Transactions Reach 13498 Since Start of Year. The Jordan Times. 13 June 2017. Available online: http://www.jordantimes.com/news/local/mobile-payment-transactions-reach-13498-start-year (accessed on 21 August 2019).

- Shaw, N. The mediating influence of trust in the adoption of the mobile wallet. J. Retail. Consum. Serv. 2014, 21, 449–459. [Google Scholar] [CrossRef]

- Davis, F. Perceived usefulness, perceived ease of use and user acceptance of information technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Shankar, A.; Datta, B. Factors affecting mobile payment adoption intention: An Indian perspective. Glob. Bus. Rev. 2018, 19, 72–89. [Google Scholar] [CrossRef]

- Venkatesh, V.; Davis, F. A theoretical extension of the technology acceptance model: Four longitudinal field studies. Manag. Sci. 2000, 46, 186–204. [Google Scholar] [CrossRef]

- Moh’d Al-adaileh, R. An evaluation of information systems success: A user perspective-the case of Jordan Telecom Group. Eur. J. Sci. Res. 2009, 37, 226–239. [Google Scholar]

- Alalwan, A.A.; Baabdullah, A.M.; Rana, N.P.; Tamilmani, K.; Dwivedi, Y.K. Examining adoption of mobile internet in Saudi Arabia: Extending TAM with perceived enjoyment, innovativeness and trust. Technol. Soc. 2018, 55, 100–110. [Google Scholar] [CrossRef]

- Ross, I. An information processing theory of consumer. J. Mark. 1979, 43, 124–126. [Google Scholar] [CrossRef]

- Thaler, R.H. Mental accounting matters. J. Behav. Decis. Mak. 1999, 12, 183–206. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect theory: An analysis of decision under risk. In Handbook of the Fundamentals of Financial Decision Making: Part I; World Scientific: Singapore, 2013; pp. 99–127. [Google Scholar]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Ameen, N.; Tarhini, A.; Shah, M.H.; Madichie, N.; Paul, J.; Choudrie, J. Keeping customers’ data secure: A cross-cultural study of cybersecurity compliance among the Gen-Mobile workforce. Comput. Hum. Behav. 2020, 114, 106531. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Alqudah, H.; Matar, A.; Lutfi, A.; Taamneh, A. Dataset on the Acceptance of e-learning System among Universities Students’ under the COVID-19 Pandemic Conditions. Data Brief 2020, 32, 106176. [Google Scholar] [CrossRef]

- Venkatesh, V.; Thong, J.Y.; Xu, X. Consumer acceptance and use of information technology: Extending the unified theory of acceptance and use of technology. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef]

- Merhi, M.; Hone, K.; Tarhini, A.; Ameen, N. An empirical examination of the moderating role of age and gender in consumer mobile banking use: A cross-national, quantitative study. J. Enterp. Inf. Manag. 2020. [Google Scholar] [CrossRef]

- Al-Okaily, A.; Al-Okaily, M.; Shiyyab, F.; Masadah, W. Accounting Information System Effectiveness from an Organizational Perspective. Manag. Sci. Lett. 2020, 10, 3991–4000. [Google Scholar] [CrossRef]

- Singh, S.; Srivastava, R.K. Predicting the intention to use mobile banking in India. Int. J. Bank Mark. 2018, 36, 357–378. [Google Scholar] [CrossRef]

- Al-Okaily, A.; Abd Rahman, M.S.; Al-Okaily, M.; Ismail, W.N.S.W.; Ali, A. Measuring Success of Accounting Information System: Applying the DeLone and McLean Model at the Organizational Level. J. Theor. Appl. Inf. Technol. 2020, 98, 2697–2706. [Google Scholar]

- Alalwan, A.A.; Dwivedi, Y.K.; Rana, N.P. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. Int. J. Inf. Manag. 2017, 37, 99–110. [Google Scholar] [CrossRef]

- Sekaran, U.; Bougie, R. Research Methods for Business, 5th ed.; John Wiley & Sons, Inc.: New York, NY, USA, 2010. [Google Scholar]

- Alshira’h, A.F.; Al-Shatnawi, H.M.; Al-Okaily, M.; Lutfi, A.; Alshirah, M.H. Do public governance and patriotism matter? Sales tax compliance among small and medium enterprises in developing countries: Jordanian evidence. Eur. Med. J. Bus. 2020. [Google Scholar] [CrossRef]

- Lutfi, A.; Al-Okaily, M.; Alsyouf, A.; Alsaad, A.; Taamneh, A. The Impact of AIS Usage on AIS Effectiveness Among Jordanian SMEs: A Multi-group Analysis of the Role of Firm Size. Glob. Bus. Rev. 2020. [Google Scholar] [CrossRef]

- Sekaran, U. Research Methods for Business: A Skill Building Approach, 4th ed.; John Wiley & Sons: New York, NY, USA, 2003. [Google Scholar]

- Brislin, R.W. The Wording and Translation of Research Instruments; Sage Publications, Inc., Group European Journal of Scientific Research: London, UK, 1986; Volume 37, pp. 226–239. [Google Scholar]

- Al-Fraihat, D.; Joy, M.; Sinclair, J. Evaluating E-learning systems success: An empirical study. Comput. Hum. Behav. 2020, 102, 67–86. [Google Scholar] [CrossRef]

- Al-Qudah, A.A.; Al-Okaily, M.; Alqudah, H. The relationship between social entrepreneurship and sustainable development from economic growth perspective: 15 ‘RCEP’countries. J. Sustain. Financ. Investig. 2021, 1–18. [Google Scholar] [CrossRef]

- Ringle, C.M.; Sarstedt, M.; Straub, D.W. A Critical Look at the Use of PLS-SEM. MIS Q. 2012, 36, iii–xiv. [Google Scholar] [CrossRef]

- Gefen, D.; Rigdon, E.E.; Straub, D. Editor’s comments: An update and extension to SEM guidelines for administrative and social science research. MIS Q. 2011, 35, iii–xiv. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, J.G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); SAGE Publications, Inc.: Kennesaw, GA, USA, 2014. [Google Scholar]

- Valerie, F. Re-discovering the PLS approach in management science. Management 2012, 15, 101–123. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. Editorial-partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Plan. 2013, 46, 1–12. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed, a silver bullet. J. Mark. Theory Pract. 2011, 19, 139–152. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Karjaluoto, H.; Shaikh, A.A.; Leppäniemi, M.; Luomala, R. Examining consumers’ usage intention of contactless payment systems. Int. J. Bank Mark. 2019, 38, 332–351. [Google Scholar] [CrossRef]

- Karjaluoto, H.; Shaikh, A.A.; Saarijärvi, H.; Saraniemi, S. How perceived value drives the use of mobile financial services apps. Int. J. Inf. Manag. 2019, 47, 252–261. [Google Scholar] [CrossRef]

| Variables | Indicators | Reliability | Validity | |||

|---|---|---|---|---|---|---|

| Indicator Reliability | Internal Consistency Reliability | Convergent Validity | Discriminant Validity | |||

| Factor Loadings | Cronbach’s Alpha | CR | AVE | HTMT | ||

| Loading > 0.70 or >0.40 & Has No Impact on AVE and CR | α ≥ 0.70 | CR ≥ 0.70 | AVE ≥ 0.50 | HTMT < 0.90 | ||

| Perceived Usefulness | PU1 | 0.954 | 0.942 | 0.962 | 0.895 | Acceptable |

| PU2 | Dropped | |||||

| PU3 | 0.945 | |||||

| PU4 | 0.940 | |||||

| Perceived Financial Cost | PFC1 | 0.936 | 0.941 | 0.958 | 0.850 | Acceptable |

| PFC2 | 0.948 | |||||

| PFC3 | 0.919 | |||||

| PFC4 | 0.883 | |||||

| Perceived Ease of Use | PEU1 | Dropped | 0.921 | 0.944 | 0.849 | Acceptable |

| PEU2 | 0.926 | |||||

| PEU3 | 0.918 | |||||

| PEU4 | 0.920 | |||||

| Mobile Payment Intention | MBI1 | 0.927 | 0.957 | 0.969 | 0.885 | Acceptable |

| MBI2 | 0.957 | |||||

| MBI3 | 0.942 | |||||

| MBI4 | 0.936 | |||||

| No. | Relationship | Standard Beta | Standard Error | TV | PV | Sig. | Decision |

|---|---|---|---|---|---|---|---|

| IV→DV | |||||||

| H1 | PU→MPI | 0.193 | 0.073 | 2.633 | 0.008 | Sig. + | Accepted |

| H2 | PFC→MPI | 0.108 | 0.057 | 1.911 | 0.056 | Sig. + | Accepted |

| H3 | PEU→MPI | 0.017 | 0.040 | 0.414 | 0.679 | N.S. | Rejected |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lutfi, A.; Al-Okaily, M.; Alshirah, M.H.; Alshira’h, A.F.; Abutaber, T.A.; Almarashdah, M.A. Digital Financial Inclusion Sustainability in Jordanian Context. Sustainability 2021, 13, 6312. https://doi.org/10.3390/su13116312

Lutfi A, Al-Okaily M, Alshirah MH, Alshira’h AF, Abutaber TA, Almarashdah MA. Digital Financial Inclusion Sustainability in Jordanian Context. Sustainability. 2021; 13(11):6312. https://doi.org/10.3390/su13116312

Chicago/Turabian StyleLutfi, Abdalwali, Manaf Al-Okaily, Malek Hamed Alshirah, Ahmad Farhan Alshira’h, Thaer Ahmad Abutaber, and Manal Ali Almarashdah. 2021. "Digital Financial Inclusion Sustainability in Jordanian Context" Sustainability 13, no. 11: 6312. https://doi.org/10.3390/su13116312

APA StyleLutfi, A., Al-Okaily, M., Alshirah, M. H., Alshira’h, A. F., Abutaber, T. A., & Almarashdah, M. A. (2021). Digital Financial Inclusion Sustainability in Jordanian Context. Sustainability, 13(11), 6312. https://doi.org/10.3390/su13116312