Abstract

The continued growth for both smartphone usage and mobile applications (apps) innovations has resulted in businesses realizing the potential of this growth in usage. Hence, the study investigates the antecedents of customer satisfaction due the usage of mobile commerce (m-commerce) applications (MCA) by Millennial consumers in South Africa. The conceptual model antecedents were derived from the extended Technology Acceptance Model (TAM). The research made use of self-administered questionnaires to take a cross section of Millennial MCA users in South Africa. The sample comprised of nearly 5500 respondents and the data was analyzed via structural equation and generalized linear modeling. The results revealed that trust, social influence, and innovativeness positively influenced perceived usefulness; perceived enjoyment, mobility, and involvement positively influenced perceived ease of use; and perceived usefulness and perceived ease of use were positive antecedents of customer satisfaction. Several usage and demographic characteristics were also found to have a positive effect on customer satisfaction. It is important for businesses to improve customer experience and satisfaction via MCA to facilitate a positive satisfaction and social influence among young technologically savvy consumers.

1. Introduction

Globally, electronic commerce (e-commerce) and mobile commerce (m-commerce) sales are estimated to reach nearly USD 4.9 trillion in 2021, which is a 14% increase compared to 2020 [1]. The increase in mobile app engagement has led to businesses around the world utilizing mobile commerce applications (MCA) as an additional business channel. MCA used for business-to-consumer commerce such as banking, e-hailing, retail, and order and delivery services have provided customers with a convenient way to search, order, locate, or transact anywhere and anytime via their smartphones. Additionally, the lockdown restrictions due to the COVID-19 pandemic have irrevocable altered the global shopping landscape, which has resulted in a number of consumers using digital shopping platforms for the first time, and many are still anxious about returning to brick-and-mortar stores [1,2]. Wurmser [2] predicts that the effect of the COVID-19 pandemic will increase mobile usage and activities over the long-term, but some of the m-commerce gains received during the lockdowns will not endure once these restrictions are lifted. It is estimated that by 2023, there will be around 1.3 billion mobile payment users globally [3].

There are a number of studies that encouraged further research since there are uncertainties regarding some factors, such as customer drivers to engage in m-commerce, the benefits that customers believe mobile shopping delivers, the post-purchase shopper experience of MCA, and the how perceived benefits compared to other channels [4,5,6,7,8,9,10]. Kalinić et al. [8], Liébana-Cabanillas et al. Kalinić [11], Veerasamy and Govender [12], and Pipitwanichakarn and Wongtada [13] propose that empirical studies on consumer adoption of mobile distribution channels and factors, which influence consumer attitudes, need to be conducted to contribute to the m-commerce body of literature. The literature shows that retailers need to understand mobile commerce channels, the lifestyle of their customers, and smartphone features, in that there is a potential to revolutionize the shopping experience. These studies were mostly conducted in developed countries and among younger consumers. Consequently, developing countries have experienced high penetration of smartphones as well as mobile internet connectivity, and have young consumer populations with different social and ethnic backgrounds. Hence, further research is encouraged in developing countries such as South Africa to ascertain if the outcomes are analogous [12,13,14,15,16,17,18].

The e-commerce penetration rate was 58% (in 2020) and more than 50% of e-commerce occurs via mobile payments in South Africa [19,20]. South Africa’s e-commerce is forecasted to reach almost USD 4.6 billion in 2021 and will grow to USD 6.3 billion by 2025, and so it has become a very important market to South African businesses [19]. South Africa has the third highest global percentage (169%) of mobile connections in comparison to the country’s population. South Africans spend almost 5 h a day using the internet via mobile devices versus the global average of 4 h, which is indicative of consumers’ reliance on mobile devices to participate in e-commerce and m-commerce activities in South Africa [20]. The revenue from mobile apps is estimated to reach USD 51 million by the end of 2021, and mobile app revenue is predicted to reach USD 71 million by the end of 2024 in South Africa [21]. Furthermore, South Africans exhibited: the second highest usage of mobile banking apps (64%) versus the global average of 39%; the fourth highest usage of mobile payment apps (42%) versus the global average of 31%; the eighth highest usage of e-hailing service apps (37%) versus the global average of 28%; and the eleventh highest usage of online food delivery service app (56%) versus the global average of 55% in 2020 [20]; therefore, it is imperative for South African businesses to embrace m-commerce and develop MCA. Furthermore, although the m-commerce industry has experienced a growth in current times, research studies among South African market has not kept up with the pace of this growth, so further empirical studies among Millennials within developing countries are suggested [12,13,14,15,16,17,18,22,23,24,25,26,27,28]. In addition, retaining customers is crucial for business; therefore, businesses should include m-commerce providers in their distribution strategies since appealing to prospective customers can be a costly exercise for businesses. However, interaction with customers might not lead to future purchases if customer satisfaction is not achieved. Consequently, it is essential for marketers to understand customer behavioral intentions and experiences through the m-commerce channel [7,8,9,10]. A number of recent international mobile commerce-related studies considered various aspects of customer satisfaction antecedents, namely, trust, social influence, perceived usefulness, perceived enjoyment, mobility, ease of use, innovativeness, and involvement [6,26,27,28,29,30,31,32,33,34,35,36,37,38,39].

The Technology Acceptance Model (TAM) is a theoretical model developed to determine workers’ acceptance and adoption of information technology systems, which is influenced by two primary factors, viz. perceived ease of use and usefulness [40,41]. The TAM has been revised and expanded over the past three decades, but included two major upgrades, viz. the revised TAM2 [42] and the extended TAM3 [43], which incorporated a number of other variables to consider consumer technology usage and acceptance. A number of recent studies used TAM, TAM2, TAM3, and various versions of the extended TAM (in full or in conjunction with other theoretical models) to consider usage, acceptance and adoption of m-commerce-related topics across multiple contexts [18,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76]. However, much of the extant research used a variety of antecedents to consider the usage and acceptance of m-commerce and MCA in terms of behavioral intentions, adoption and/or usage behavior, whereas the focus of this study is on customer satisfaction as a result of MCA usage.

Several studies included customer satisfaction as a predictor and outcome variables to assess the influence on behavioral intentions/adoption and/or usage behavior [10,77,78,79,80,81,82,83,84,85,86,87], but few inquiries considered customer satisfaction as the primary outcome variable owing to MCA usage and m-commerce [6,88,89]. Kamdjoug et al. [88] considered the association between exploitative use and user satisfaction regarding the adoption of mobile banking apps in Cameroon, but also assessed a number of other outcome variables. McLean et al. [89] investigated the influence of customer experience on customer satisfaction levels due to retailers’ MCA among UK consumers, but also examined many other independent variables. Marinković and Kalinić [6] examined the effect of trust, social influence, perceived usefulness, mobility, and perceived enjoyment on customer satisfaction owing to m-commerce among Serbian consumers, but did not consider the perceived ease of use, social influence, innovativeness, and involvement variables coupled with the use of a very simple revised TAM. Hence, the aforementioned studies did not consider the influence of both perceived ease of use and perceived usefulness on customer satisfaction due to MCA usage among Millennials. Therefore, this study seeks to expand on prior research and make an original contribution to the extended TAM via the introduction of additional antecedents (trust, social influence, perceived enjoyment, mobility, innovativeness, and involvement) and the corresponding associations on perceived ease of use and perceived usefulness. The perceived ease of use and perceived usefulness influence will then be examined in terms of the effect on customer satisfaction owing to MCA usage among South African Millennials. The study will also determine if various MCA usage and demographic characteristics have an effect on customer satisfaction among Millennials, which will make an additional contribution to the extended TAM and Generation Cohort Theory (GCT) from an African developing country context.

The literature review section provides an overview of MCA and the Millennial cohort, which is followed by the theoretical framework and hypothesis development section that includes a discussion on the development of TAM, extant research on the extended TAM, hypothesis development discourse, and the conceptual model, viz. the MCA customer satisfaction model. The materials and methods section provides a description of the sample, research instrument and statistical methods, which is followed by the data analysis and results section that assesses the validity and reliability analysis, model fit, SEM analysis, and the generalized linear model. The discussion section compares this study’s results to existing research, as well presents contributions to theory and practice. The conclusions section includes a summary of the main findings, limitations, and future research directions.

2. Literature Review

2.1. Mobile Commerce Apps

MCA (also referred to as mobile shopping apps) are utilized as a digital marketing channel, which offers consumers another channel to interact with brands [90]. Consumers who want to engage with MCA are able to download the mobile app from their mobile device application store. Across the world, downloads of MCA have reached 5.7 billion users in 2018 especially via the two largest mobile app stores, namely, Google Play and Apple’s App Store [91]. Retailers have numerous options for selling operations including mobile apps, mobile websites and the retailer web applications, which are accessed via the mobile browser. Purchasing a brand’s offerings through a mobile device is a convenient way to make purchases, in that the access is either through tablets or smartphones or other mobile devices [92]. MCA have similar functionalities as personal computer web pages, such as viewing business offerings, interacting with different offerings through visuals, finding business contact information and business locations, and to place and pay for orders. McLean et al. [62] assert that after customers have initially tried or used MCA, their purchase frequency using the app, and their attitude towards MCA, increases gradually. However, mobile customer retention has become a concern that marketers need to prioritize since 80% of all mobile apps are abandoned within 3 months [93].

The study collectively considers five popular MCA categories among Millennials, viz. mobile banking, e-hailing taxi services, online retail stores, retail stores, and food outlets and delivery. Banks have invested in mobile technologies in order to conduct business with their customers, while providing them with benefits and satisfaction from the use of the mobile banking apps [94]. Clothing and accessories are by far the most purchased product category among many product categories sold through m-commerce [95]. The growth of smartphone usage globally has led to a higher demand for e-hailing mobile apps, such as Uber, Taxify, Did, Lyft and Kuaidi among other e-hailing providers [96]. Kaushik and Rahman [97] believe that the increased use or adoption of m-commerce within previously traditional in-store retail environment has been influenced by the growing usage of self-service technologies. Wulfert [98] states that in order for retailers to increase their service quality they need to provide customers with a mobile companion application, which consists of multiple features that will allow customer engagement. A mobile app for online retailers aids the shopping process because of elements such as convenience and search features, which MCA possess [99]. Many South African consumers are using mobile banking apps and other mobile apps such as SnapScan (increase of 15%), Instant Money (6% increase), and MasterPass (30% increase) to facilitate digital payments, since consumers switched to online digital payment platforms in order to find a safer way to shop during the lockdown in South Africa [100]. Online retailer stores e-commerce and m-commerce increased by more than 450%, supermarkets by 140%, bookstores by 292%, clothing stores by 103%, and 79% on local travel in 2020, and the increase in MCA usage continues to be growing trend across all business categories [100].

2.2. Millennial Cohort

Millennial (also referred to as Generation Y) cohort members refers to those who were born in 1982 until after the turn of the 21st century [101,102]. Stats SA [103] shows that those in the age group 15 to 34 years comprise approximately 17.8 million members, which accounts for about 25% of the total population in South Africa. In the global marketplace, Millennial consumers have emerged as a significant market, given that they are arguably the largest group of consumers in any economy. They also grew up in a consumption-driven contemporary society and have more money at their disposal than any other group in history. Millennials’ direct purchasing power is in the region of USD 600 billion per annum; this cohort will comprise 75% of the worldwide workforce by 2023, and account for 65% of Africa’s USD 1.3 trillion purchasing power directly by influencing household purchases [102,104,105,106].

Millennials grew up in a time of advancements and technology and are in the frontline of the digital era. This generational cohort outnumbers all other age groups regarding mobile minutes (voice) used, text messages, and data bandwidth usage and are known to be early adopters of technology [17]. Millennials’ mobile phone usage is not only restricted to mobile shopping, but to various mobile platforms such as social media, where they are most likely to be exposed to social influences on the type of purchases they decide to make [17,107]. Muñoz et al. [107] found that Millennials prefer a smartphone device above other technological devices such as desktops, laptops, or tablet computers. They also on their smartphones continually and these mobiles devices are at their bedside table when they sleep. Globally, Millennial consumers have the highest incidence when it comes to mobile application adoption, engagement, and continued usage; hence, they are the target research group in this study.

Millennials are described as omni-channel who are content to shop online and in-store, and the largest e-commerce cohort, with up to half of their purchases taking place online [108]. As mentioned above, global e-commerce (and m-commerce) is forecast to grow to USD 4.9 trillion by the end of 2021, which has resulted in an incremental growth in MCA usage, especially owing to 3.2 billion smartphones and 1.14 billion tablet users and the growing purchasing power of Millennials [1,109]. Nearly 80% of global Millennial users participate in e-commerce and over half of the time online occurs via mobile devices, with 60% of Millennials using MCA to search for information and make purchases [20,108]. Millennials also showed the highest use of mobile banking apps (±34%), mobile payments apps (±33%), e-hailing service apps, (±32%), and online food delivery service apps (±60%) [20].

Over 650 million Africans own smartphones, which has resulted in large increase of MCA downloads by Millennials [110]. E-commerce is forecasted to be USD 75 billion in Africa owing to the growth of mobile money apps that are largely used by Millennials [111]. South African e-commerce revenue was estimated to be ZAR 4.1 billion in 2020 and predicted to grow to ZAR 6.3 billion by 2025 [112]. Mobile online shopping grew by over 150% and MCA usage increased by over 90% in 2020 in South Africa [113,114]. Besides the switch to e-commerce owing to the adherence of social distancing and lockdown stipulations, the rapid growth of online sales can also attributed to the large increase (55%) in South African Millennial online shoppers who demonstrated the highest propensity for e-commerce and m-commerce compared to other the cohorts in 2020 [114]. More than 50% of e-commerce comes from purchases via smartphones in South Africa; hence, it is important for businesses to ensure that their online platforms are m-commerce friendly in order to optimize online sales [112]. Thus, Millennials represent a massive global, African, and South African market, which can be targeted via MCA to stimulate m-commerce, but additional research is necessary to determine Millennials attitudes towards MCA in terms of customer satisfaction.

Several other studies also used different versions of the TAM or the extended TAM to examine Millennials in terms of the usage and acceptance of m-commerce and MCA. Sarmah et al. [67] established that perceived ease of use positively influenced perceived usefulness regarding m-commerce among Indian Millennial consumers, whereas trust favorably influenced m-commerce behavioral intentions among Indian Millennial consumers. Hur et al. [55] found that technological innovativeness resulted in positive associations with perceived ease of use, perceived usefulness, and playfulness (enjoyment) owing to the use of mobile fashion search apps among South Korean Millennials. Kim et al. [115] revealed positive perceived ease of use, perceived and perceived enjoyment associations in terms of mobile communication and m-commerce among US Millennials. However, the aforementioned research focused on behavioral and/or usage intentions as the outcome variable, and did not consider the influence of customer satisfaction among Millennials, so this study seeks to build on prior research by considering customer satisfaction as the outcome variable owing to MCA usage by Millennials in an African developing country context.

3. Theoretical Framework and Hypothesis Development

3.1. Extended Technology Acceptance Model

The TAM was based on the Theory of Reasoned Action (TRA), the Theory of Planned Behavior (TPB), and Information Systems Success Models, which posited that perceived ease of use and perceived usefulness were positive associated with consumers attitudes toward information technology systems usage and adoption [40,41]. However, the TAM did not take social factors into consideration, which was revised by Venkatesh and Davis [42] in the TAM2 via the inclusion of image, subjective norms, voluntariness, output quality, job relevance, and result demonstrability. Venkatesh and Bala [43] further extended the model via the more comprehensive extended TAM3, which also considered external control perceptions, computer self-efficacy, computer playfulness, computer anxiety, objective usability, and perceived enjoyment. Subsequently, a number of other studies included a number of different variables and alternative extensions of the TAM to consider m-commerce and MCA [18,39,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76,116,117].

Chhonker et al. [49] reviewed over 200 journal articles and found that the TAM was the most popular (nearly 70%) theoretical framework to investigate m-commerce adoption. Chhonker et al. [49] suggest that m-commerce is still in a developmental stage and incrementally receiving academic attention owing to the rapid growth rate of m-commerce usage and a number of variables that impact consumer attitudes and behavioral intentions. The study revealed that perceived ease of use, perceived usefulness, social influence, perceived enjoyment, and innovativeness were popular constructs used to investigate m-commerce. Liu et al. [60] used meta-analysis to consider a number of studies regarding the variables that significantly influence mobile payments. The study identified a number of prevalent variables, namely, perceived ease of use, perceived usefulness, social influence, trust, and innovativeness, which were used to assess US, Asian, European, and Oceanian m-commerce extant research. Marinković and Kalinić [6] considered the influence of perceived usefulness, perceived enjoyment, social influence, trust, and mobility on customer satisfaction due m-commerce among Serbian consumers via a very simplified extended TAM. Natarajan et al. [82] used the extended TAM to assess the influence of perceived enjoyment, perceived ease of ease of use, perceived usefulness, customer satisfaction, and innovativeness on intention to use MCA among Indian consumers. Ghazali et al. [53] considered trust, innovativeness, perceived ease of use, and perceived usefulness impact on Malaysian consumer m-commerce intentions. Liébana-Cabanillas et al. [11] utilized the extended TAM to investigate predictor variables such as perceived ease of use, perceived usefulness mobility, trust, and involvement effect on m-commerce behavioral intentions among Serbian consumers. So, this study adopted the above named variables, namely, trust, social influence, perceived usefulness, perceived enjoyment, mobility, ease of use, innovativeness, and involvement in order to consider associations, via an adaptation of extended TAM, on customer satisfaction due to MCA usage among Millennials in an African developing country.

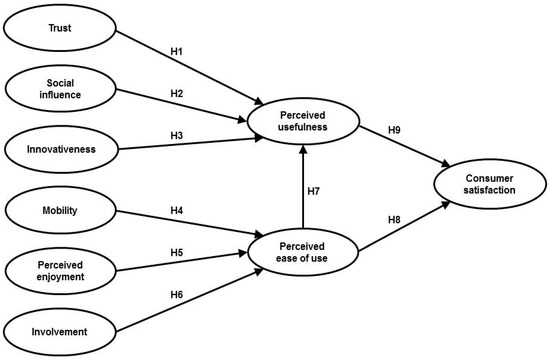

Some recent inquiries considered customer satisfaction, via the extended TAM and integration with other theoretical models, in order to establish the influence on m-commerce and/or MCA adoption or behavioral intentions. As previously mentioned, Marinković and Kalinić [6] used a simplified extended TAM to consider several variables includes on customer satisfaction due to m-commerce adoption in Serbia. McLean et al. [89] examined customer satisfaction based on customer experiences regarding MCA in the UK. Kamdjoug et al. [88] investigated user satisfaction in terms of mobile banking app adoption among Cameroonian consumers. Alalwan [77] considered customer satisfaction due to food MCA continued use among Jordanian customers. Chen (2018) investigated the influence of MCA usage on customer satisfaction among Taiwanese consumers. Do et al. [79] examined customer satisfaction owing to the use of augmented-reality MCA. Humbani and Wiese (2019) considered customer satisfaction in terms of mobile payment apps via the extended expectation–confirmation theoretical model. Malik et al. [81] postulated that customer satisfaction should be employed as a variable to assess the usage of MCA. Natarajan et al. [82] studied customer satisfaction in terms of intention to use mobile apps among Indian consumers. Shang and Wu [83] investigated consumer satisfaction based on m-commerce adoption among Chinese consumers. Singh et al. [84] explored consumer behavioral intention and customer satisfaction due to mobile wallet services usage among Indian consumers. However, most of the aforementioned studies assessed a number of divergent independent variables and variations of the extended TAM, with few examining customer satisfaction as the main outcome variable due to MCA usage. So, this investigation endeavors to make a noteworthy contribution to the extended TAM by drawing from the limited extant inquiry in order to consider customer satisfaction as a result of MCA usage among Millennials in an African developing country. Refer to Figure 1 for an overview of the proposed MCA customer satisfaction conceptual model.

Figure 1.

MCA customer satisfaction conceptual model.

3.2. Hypothesis Development

Customer trust towards a business increases the intention for a customer to buy a service or product [118,119,120]. Business trustworthiness perceptions can increase customer loyalty and ultimately repeat purchase [121,122,123]. A number of studies considered trust as an antecedent when examining m-commerce and MCA adoption [6,10,11,18,51,53,54,56,60,63,67,73,86,87,124], and three m-commerce-related inquiries investigated the trust and perceived usefulness association [46,65,71]. Pipitwanichakarn and Wongtada [65] determined that trust positively influenced perceived usefulness regarding m-commerce usage intentions in Thailand. Sun and Chi [71] established that US consumers’ trust sentiments positively influenced perceived usefulness regarding apparel m-commerce. Chawla and Joshi [46] confirmed that perceived usefulness was favorably associated with trust among Indian consumers regarding m-commerce. Hence, it is proposed that:

Hypothesis (H1).

Trust positively influences perceived usefulness due to the use of MCA.

Social influence can also be described as a driver for consumers to uphold a particular status or image in their social circles, which influences their decisions [76]. Venkatesh et al. [125] asserted that social influence is the degree to which individuals believe that others, who are important are them, and influence them to use new innovations and technology. Venkatesh and Davis [42] included social influence in the revised TAM2 by incorporating voluntariness, image, and subjective norms. Singh et al. [84] revealed that social influence is one of the drivers of m-commerce adoption, and influences the intent to engage in mobile shopping. Several inquiries assessed the social influence as an antecedent in terms of an assortment of mobile technology-related topics [6,54,60,68,73,74,77,84], and some also assessed the social influence and perceived useful association [76,126,127,128]. Xia et al. [76] ascertained that social influence positively influenced perceived usefulness due to Chinese consumers’ smartphone app online experiences. Lu et al. [126] revealed that social influence positively influenced perceived ease of use in terms of online mobile technology adoption among MBA students in the US. Son et al. [127] found that social influence was favorably associated with perceived usefulness regarding mobile computer device (smartphones) adoption in the South Korean construction industry. López-Nicolás et al. [128] also found that social influence had a positive impact on perceived usefulness in terms of advanced mobile services usage in the Netherlands. Thus, for this study, the following is hypothesized:

Hypothesis (H2).

Social influence positively influences perceived usefulness due to MCA.

Thakur and Srivastava [129] found consumer innovativeness to be a key variable to improve online shopping adoption intention, both directly and by its positive influence in reducing consumers’ perceived risk for using the online channel to purchase products. Alalwan et al. [130] state that innovativeness has a positive influence on customer intent to adopt the mobile internet in Saudi Arabia. There is a significant positive influence of ease of use, perceived usefulness, attitude, innate innovativeness and domain-specific innovativeness on consumers’ adoption intention for online banking [131]. Several investigations examined innovativeness as an antecedent in terms of mobile technology, m-commerce, and/or MCA usage [48,53,82,84], and others explored the innovativeness and perceived usefulness association [55,60,71,126]. Lu et al. [126] found that innovativeness positively affected perceived usefulness regarding online mobile technology usage adoption among American students. Hur et al. [55] revealed that innovativeness resulted in a positive association with perceived usefulness owing to the use of mobile fashion search apps among South Korean Millennials. Sun and Chi [71] ascertained that innovativeness positively affected perceived usefulness in terms of apparel m-commerce among US consumers. Liu et al. [60] determined that perceived usefulness was positively associated with innovativeness in a global meta-analysis of m-commerce studies. Hence, this research study hypothesizes the following:

Hypothesis (H3).

Innovativeness positively influences perceived usefulness due to MCA.

Mallat et al. [132] suggested that the best quality for mobile technology is the mobility aspect, which refers to the ability for individuals to access services universally, while on the move, and via wireless networks using different types of mobile devices. Mobility is often an essential driver of mobile commerce acceptance, and mobility is a noteworthy construct with regards to attitudes towards intent to use, and usage within mobile payment services [15,36]. Liébana-Cabanillas et al. [11] asserted that there was limited inquiry, which considered mobility as a predictor variable regarding m-commerce adoption. Mobility influences customer attitudes in terms of usage, usage intent, and usefulness of mobile shopping [14,15]. Schierz et al. [15] stated that perceived mobility is regarded as an important mobile shopping adoption driver. Some inquires considered mobility as an antecedent regarding m-commerce and/or MCA adoption [6,11,14,15,40,133], and others investigated the mobility and perceived usefulness association [134,135]. Liébana-Cabanillas et al. [11] reported that mobility did not have a significant influence on m-commerce adoption among Serbian consumers. Yen and Wu [134] revealed that mobility positively influenced perceived ease of use due to mobile financial service usage in Taiwan. Nikou and Economides [135] ascertained that mobility was positively associated with perceived ease of use due to mobile-based assessment usage intentions among Greek students. Hence, the following is proposed in this study:

Hypothesis (H4).

Mobility positively influences perceived ease of use due to MCA.

MCA are mostly developed for consumer entertainment purposes, such as social networking, mobile videos, and mobile gaming. Thus, perceived enjoyment is an essential influence on continuance intent to engage in m-commerce [16]. Alalwan [77] and Avornyo et al. [136] suggested that perceived enjoyment is a significant driver of m-commerce acceptance. Perceived enjoyment is also a significant predictor of the intention to use MCA [137]. Chan and Chong [138] stated that the enjoyment construct has a noteworthy relationship with mobile commerce adoption and certain functionalities such as location-based services, content delivery, entertainment, and financial transactions. A number of studies assessed perceived enjoyment as an antecedent while examining m-commerce and MCA usage [6,48,54,59,62,79,82,89], and several inquiries also considered the perceived enjoyment and perceived ease of use association [58,115]. Kim et al. [115] revealed a positive perceived ease of use and perceived enjoyment association in terms of mobile communication and m-commerce among US Millennials. Kumar et al. [58] did not find a significant association between perceived ease of use and perceived enjoyment regarding mobile app adoption among Indian consumers. Thus, the above leads to the following hypothesis:

Hypothesis (H5).

Perceived enjoyment positively influences perceived ease of use due to MCA.

Holmes et al. [4] asserted that highly involved consumers use smartphones to shop since they value the accessibility and convenience. The main driver for mobile hotel app usage is customer involvement followed by perceived personalization and app-related privacy concerns [139]. Customization and customer involvement are the most significant antecedents of the intention to use m-commerce [11,30,140]. Liébana-Cabanillas et al. [11] affirmed that few studies used customer involvement as predictor variables regarding m-commerce adoption, and also revealed that customer involvement was positively associated with m-commerce adoption among Serbian consumers. Taylor and Levin [141] found that the level of involvement or interest in a retail mobile app positively affected consumers’ intention to participate in both information-sharing activities and purchasing among US consumers. Kang et al. [142] ascertained that involvement was positively associated with retail location-based MCA usage intentions among US consumers. Liébana-Cabanillas et al. [11] noted that customer involvement was one of strongest predictors of m-commerce usage intentions among Serbian consumers. Thus, the following is hypothesized:

Hypothesis (H6).

Involvement positively influences perceived ease of use due to MCA.

A person’s perception of the ease of use of a system is aptly called the perceived ease of use construct [40]. Many inquiries found a positive perceived ease of use and perceived usefulness association due to m-commerce and MCA adoption [45,46,47,48,50,52,53,58,60,63,65,67,70,71,72,76,80,82,83,115,116,127,134,143]. Leong et al. [143] found that a positive perceived ease of use and perceived usefulness association, and past usage behavior as factors that influence Malaysian mobile entertainment adoption. Jaradat and Al-Mashaqba [39] adopted the extended TAM3 and determined that perceived ease of use positively influenced perceived usefulness in terms of the use of m-commerce among Jordanian students. Kim et al. [115] revealed a positive perceived ease of use and perceived usefulness association in terms of mobile communication and m-commerce among US Millennials. Muñoz-Leiva et al. [63] affirmed a positive perceived ease of use perceived usefulness association owing to the use of banking MCA in Spain. Liu et al. [60] revealed that perceived usefulness was positively associated with perceived ease of use and innovativeness in a global meta-analysis of m-commerce studies. However, Chen and Tsai [47] found that there was not a significant association between perceived ease of use and perceived usefulness due to mobile tourism app adoption among in Taiwan. Choi [48] also found that perceived ease of use did not have a significant influence on perceived usefulness regarding smartphone m-commerce among Korean students. Therefore, the following hypothesis is proposed:

Hypothesis (H7).

Perceived ease of use positively influences perceived usefulness due to MCA.

Perceived ease of use is one of the strongest influencing antecedents on the continuance intent to use new technologies [77,144]. Hanjaya et al. [27], Humbani [28], and Isrososiawan et al. [29] stated that perceived ease of use of mobile payment technology positively influences the perceived usefulness and satisfaction of the mobile payment technology usage. Perceived ease of use also drives customer satisfaction in online shopping [38,81,84]. Shang and Wu [83] found that perceived ease of use had a positive influence on consumer satisfaction due to the use of mobile commerce among Chinese consumers. Nikou and Economides [135] showed a positive perceived ease of use and satisfaction association regarding mobile-based assessments usage intention among Greek students. Singh et al. [85] established a positive association between customer satisfaction and perceived ease of use in terms of m-commerce usage among Indian consumers. Humbani and Wiese [80] ascertained that perceived ease of use of mobile payment apps had a positive effect on customer satisfaction. Trivedi and Yadav [87] ascertained that perceived ease of use positively influenced customer satisfaction regarding e-commerce among Indian Millennials. However, Do et al. [79] determined that perceived ease of use did not have a significant influence on customer satisfaction owing to the use of augmented-reality MCA. Son et al. [127] also revealed that perceived ease of use did not influence user satisfaction due to mobile computer device usage in the South Korean construction industry. So, it is hypothesized that:

Hypothesis (H8).

Perceived ease of use positively influences customer satisfaction due to MCA.

Perceived usefulness is known as one of the factors that contribute towards consumer attitudes [40]. Therefore, this motivates consumers to start using innovative and user-friendly systems that enable freedom with regards to payments, transactions, and more [145]. Mobile banking apps are seen as convenient when it comes to the cost and time associated, since it is very useful because users can perform several activities that lead to costs and time being saved [146,147]. Marinković and Kalinić (2017) established that perceived usefulness positively influenced customer satisfaction due to m-commerce among Serbian consumers. Humbani and Wiese [80] ascertained that perceived usefulness had a positive effect on customer satisfaction due mobile payment apps. Son et al. [127] established that perceived usefulness was positively associated with user satisfaction due to mobile computer device usage in the construction industry in South Korea. Do et al. [79] revealed that perceived usefulness had a positive influence on customer satisfaction owing to the use of augmented-reality MCA. Singh et al. [85] revealed a favorable customer satisfaction and perceived usefulness association in terms of m-commerce adoption among Indian consumers. Isrososiawan et al. [29], Choi et al. [148], and Li and Fang [149] revealed that perceived usefulness influences continuance intention for branded mobile apps directly or indirectly through customer satisfaction. However, Shang and Wu [83] found that perceived usefulness was not found to have a significant influence on customer satisfaction owing to m-commerce usage among Chinese consumers. Hence, it is hypothesized that:

Hypothesis (H9).

Perceived usefulness positively influences customer satisfaction due to MCA.

Additionally, a majority of the aforementioned studies only consider the various MCA usage (MCA categories, mobile device access, length of usage, mobile shopping engagement, usage hours, marketing communication response, and m-commerce spending) and demographic characteristics (gender, age, education level, and employment) from a descriptive statistical perspective, so this study will ascertain whether these independent variables have an effect on customer satisfaction due to MCA usage among African Millennials.

4. Materials and Methods

4.1. Sample Description

A combination of the convenience and snowballing sampling techniques were employed to survey Millennial MCA users residing in South Africa. The combination of the two methods allows for a large number of respondents to be interviewed, with information being collected more simply, quickly, and inexpensively. Initially, convenience sampling was used to target university students in South Africa via paper based questionnaires (fieldworkers were used to collect the data, so the anonymity was maintained). Thereafter, respondents were requested to recommend other potential Millennial respondents who used MCA and resided in South Africa. The recommended respondents were contacted via SMS, WhatsApp, email, social media, and other platforms to complete an online version of the questionnaires. Then, upon completion of the survey, the process was repeated in terms of requesting other potential respondents who used MCA. Prior to commencing the fieldwork, a pilot study, consisting of a sample size of 50, was used to test the data collection process and the measuring tool. During the pilot study, the researcher tested the questionnaire logic, flow, and ambiguities. Amendments were made as per the outcome of the pilot study. Additionally, ethical clearance for the study was received from the Cape Peninsula University of Technology Research Ethics Committee prior to the commencement of the research.

Ultimately, a sample size of 5497 useable questionnaires (103 questionnaires were discarded due to incomplete information and other errors, including 10 due to outlying responses) was achieved using the abovementioned sampling and data collection techniques. Refer to the MCA questionnaire, which is available as Supplementary Material. The MCA app usage characteristics revealed the following: mobile banking showed the highest level of customer engagement; smartphones were the most commonly used mobile device; a vast majority used MCA for ≤1 to 3 years; over 7 out of 10 Millennials engaged in mobile shopping sometimes and often; an overwhelming majority used MCA for <½-to-1 h a day; more than half of Millennials responded to MCA marketing communication rarely and sometimes; and an overwhelming majority of m-commerce spending ranged from ≤ZAR 1000 to ZAR 2000 (refer to Table 1). The demographic characteristics were as follows: six out of ten of the Millennial respondents were female; a large percentage of the Millennials were aged 18–27 years; a majority had completed grade 12 or post-matric/diploma/certificate; and over half were employed part-time or full-time (refer to Table 1).

Table 1.

Millennial mobile commerce app usage and demographic characteristics descriptive statistics.

4.2. Research Instrument

The research instrument used for this study took the form of a questionnaire, which consisted of four sections, namely, screening, mobile shopping usage factors (mobile platform, type of mobile device, length of usage, frequency of usage, monetary spending value), and demographic details (gender, age, employment, and level of education) [150,151,152]. The Likert scale sections consisted of statements to be measured via a 5-point scale, with 1 indicating strong disagreement and 5 indicating strong agreement with each particular statement.

The different constructs were adapted from the following studies: Marinković and Kalinić [6], San-Martín and Lopez-Catalan [153]—customer satisfaction; Marinković and Kalinić [6], Chong et al. [154], and Zarmpou et al. [155]—trust; Marinković and Kalinić [6], Chan and Chong [138], and Chong et al. [154]—social influence; Marinković and Kalinić [6] and Kim et al. [14]—mobility; Marinković and Kalinić [6] and Chan and Chong [138]—perceived usefulness; Marinković and Kalinić [6] and Chan and Chong [138]—perceived enjoyment; and perceived ease of use, innovativeness, and involvement [153,156].

4.3. Statistical Analysis

The collected data was captured, coded, and analyzed by cross tabulating the results by performing statistical techniques using SPSS (version 25) and Amos statistical software. The data analysis took the form of means, standard deviations, frequencies, percentages, principle component analysis (PCA), reliability and validity analysis, structural equation modeling and generalized linear modelling. A PCA was first conducted to analyze the data in term of validity and reliability via SPSS. The eigenvalues and the sum of explained variance of the factors were considered to ensure acceptable correlation in the PCA. The Kaiser–Meyer–Olkin test was used to assess the sampling adequacy the factorability of correlation matrix, which was assessed via Bartlett’s Sphericity Test. The Kolmogorov–Smirnov tests and Q-Q plots were used to consider factors in terms of data distribution, as well as the Cook’s Distance test to identify and eliminate outlying responses to improve the normality of the data distribution [157]. Cronbach’s α and composite reliability (CR) were computed to ensure that all of the constructs showed acceptable reliability levels, which should be >0.7 [158]. The convergent validity measures, namely, factor loadings and average variance extracted (AVE) were assessed to ensure acceptable levels of >0.5 [158]. Discriminant validity was assessed by utilizing the square root AVE for each factor, which should be larger than the correlations between the constructs [159]. SPSS was also used to calculate the descriptive statistics, viz. means, standard deviations, frequencies, and percentages.

Amos was utilized for the structural equation model (SEM) analysis, which was assessed to ensure goodness-of-fit statistics a good overall measurement model fit regarding χ2//df (<5), RMSEA (<0.08), NFI (>0.9), TLI/NNFI (>0.9), CFI (>0.9), GFI (>0.9), and SRMR (<0.08) according to the minimum thresholds reported by Hooper’s [160]. The SEM attitudinal constructs were assessed via a multi-collinearity test to establish whether the scales were not over correlated to one another, which might unfavorably affect the reliability of the regression coefficients in terms of tolerance (>0.1) and variation inflation factors (VIF) (<5). Lastly, the study also employed a generalized linear model statistical test, which included the Wald’s Chi-square tests and the Bonferroni pairwise comparisons post ad hoc tests, to ascertain if there was a significant difference between the customer satisfaction construct and the various MCA usage and demographic variables.

5. Data Analysis and Results

5.1. Validity and Reliability Analysis

A PCA produced nine factors where the eigenvalues were larger than one, which explained variance of 10.912%, 2.412%, 2.346%, 2.000%, 1.423%, 1.335%, 1.240%, 1.169%, and 1.131%, respectively (refer to Table 2 to view the nine MCA factors). The total factors sum explained 77.318% of the variance, which is indicative of very good correlation in the PCA. The Kaiser–Meyer–Olkin test revealed excellent sampling adequacy with a value of 0.927. The factorability of correlation matrix was assessed via Bartlett’s Sphericity Test, which was found to be adequate at p < 0.001. The Kolmogorov–Smirnov tests were significant (p < 0.001) for the nine factors, which indicate a non-normal data distribution, but are common for large samples sizes [157]. However, an inspection of the normal Q-Q plots revealed relatively straight lines, which suggests a normal data distribution. Additionally, the Cook’s Distance test was implemented to identify outlying Millennial attitudinal responses and ten were eliminated prior to finalizing the sample, which served to further improve the normality of the data distribution.

Table 2.

Mobile Commerce Application Measures.

Cronbach’s α and composite reliability (CR) measures all exhibited acceptable reliability levels of >0.7 (refer to Table 2). The MCA antecedent convergent validity measures, namely, factor loadings and average variance extracted (AVE) displayed acceptable levels of >0.5 (refer to Table 2). Discriminant validity was assessed by utilizing the square root AVE for each MCA antecedent, which was larger than the correlations between the constructs (refer to Table 3).

Table 3.

Component correlation matrix.

5.2. Model Fit

The structural equation model (SEM) analysis goodness-of-fit statistics showed a good overall measurement model fit: χ2/df = 3.604; RMSEA = 0.035; NFI = 0.981; TLI/NNFI = 0.972; CFI = 0.983; GFI = 0.977; and SRMR = 0.050. The SEM attitudinal constructs were assessed via a multi-collinearity test to establish whether the scales were too correlated to one another, which might negatively affect the reliability of the regression coefficients. The attitudinal constructs tolerance ranged from 0.667 to 0.915 (>0.1) and the variation inflation factors (VIF) ranged from 1.093 to 1.500 (<5), which indicated that there was a moderate correlation between the constructs (refer to Table 4).

Table 4.

Multi-collinearity statistics.

5.3. SEM Analysis

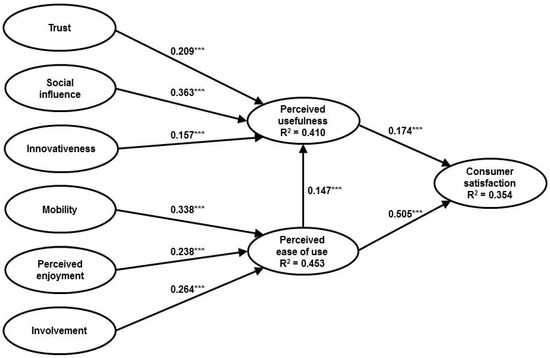

The SEM analysis was utilized to test the MCA constructs’ hypothesized relationships. The SEM analysis standardized path beta coefficients (β), significance (p) and variance are depicted in Figure 2. Trust, social influence, and innovativeness explained 41.0% of perceived usefulness variance; mobility, perceived enjoyment, and involvement explained 45.3% of perceived ease of use variance; and perceived usefulness and perceived ease of use explained 35.4% of customer satisfaction variance among South African Millennials. The standardized path coefficients exhibited a significant favorable effect for trust→perceived usefulness (β = 0.209, t = 13.767, p < 0.001); social influence→perceived usefulness (β = 0.363, t = 19.962, p < 0.001); innovativeness→perceived usefulness (β = 0.157, t = 11.028, p < 0.001); mobility→perceived ease of use (β = 0.338, t = 19.707, p < 0.001); perceived enjoyment→perceived ease of use (β = 0.238, t = 13.903, p < 0.001); involvement→perceived ease of use (β = 0.264, t = 18.645, p < 0.001); perceived ease of use→perceived usefulness (β = 0.147, t = 10.275, p < 0.001); perceived ease of use→customer satisfaction (β = 0.505, t = 33.419, p < 0.001); and perceived usefulness→customer satisfaction (β = 0.174, t = 12.853, p < 0.001) relationships. Hence, all nine of the hypotheses were supported (refer to Figure 2 and Table 5).

Figure 2.

SEM analysis significant standardized coefficients. Notes: *** = significant at 0.001.

Table 5.

Hypotheses.

5.4. Generalized Linear Model

A generalized linear model, via the Wald Chi-Square and Bonferroni pairwise correction post hoc measures, were used to ascertain the influence of South African respondents’ MCA usage and demographic characteristics on Millennials’ customer satisfaction predispositions (refer to Table 6).

Table 6.

Influence of usage and demographic variables on customer satisfaction attitudinal responses.

- Mobile commerce app categories (most engaged) (p < 0.01): Millennials who used mobile banking (M = 3.80, SE = 0.037) and e-hailing taxi services (M = 3.79, SE = 0.042) exhibited more positive customer satisfaction attitudinal responses compared to retail stores (M = 3.64, SE = 0.050) MCA.

- Mobile device access (p < 0.001): Millennials who accessed MCA via tablets (M = 3.76, SE = 0.046) and smartphones (M = 3.76, SE = 0.036) showed more favorable customer satisfaction attitudinal responses compared to those who accessed through feature phones (M = 3.56, SE = 0.054).

- Length of usage (p < 0.001): Millennials who used MCA for less than one year (M = 3.56, SE = 0.047), 2 years (M = 3.56, SE = 0.045), and 3 years (M = 3.66, SE = 0.046) showed less favorable customer satisfaction attitudinal responses compared to those who used MCA for 4 years (M = 3.83, SE = 0.052) and 5 years (M = 3.83, SE = 0.050).

- Mobile shopping engagement (p < 0.001): Millennials who engage in MCA sometimes (M = 3.72, SE = 0.045), often (M = 3.77, SE = 0.045), and always (M = 3.79, SE = 0.049) showed more favorable customer satisfaction attitudinal responses compared to those who rarely engage in MCA (M = 3.54, SE = 0.051).

- Marketing communication response (p < 0.01): Millennials who often (M = 3.77, SE = 0.051) and sometimes (M = 3.74, SE = 0.043) responded to marketing commination through MCA exhibited more positive customer satisfaction attitudinal responses compared to those who never (M = 3.61, SE = 0.048) responded to marketing communication via MCA.

- M-commerce spending (p < 0.001): Millennials who spent between ZAR 2001 and ZAR 3000 per month (M = 3.83, SE = 0.049) via MCA showed more favorable customer satisfaction attitudinal responses compared to those who spent between ZAR 1001 and ZAR 2000 (M = 3.67, SE = 0.043), and less than ZAR 1000 (M = 3.61, SE = 0.043) per month.

- Age (p < 0.01): 28–32-year-old respondents (M = 3.66, SE = 0.046) showed less favorable customer satisfaction attitudinal responses compared to 18–22-year-old respondents (M = 3.78, SE = 0.044).

- Education level (p < 0.05): Millennials who had a post-graduate degree (M = 3.79, SE = 0.050), post-matric/diploma or certificate (M = 3.75, SE = 0.043), and a degree (M = 3.74, SE = 0.047) displayed more positive customer satisfaction attitudinal responses compared to those who completed Grade 8–11 (M = 3.60, SE = 0.069).

- Employment (p < 0.001): Less favorable customer satisfaction attitudinal responses were evident among Millennials who were unemployed (M = 3.63, SE = 0.045) compared to those who were self-employed (M = 3.80, SE = 0.053), employed full-time (M = 3.77, SE = 0.041), and employed part-time (M = 3.73, SE = 0.046).

6. Discussion

6.1. Key Findings

This study found that MCA resulted in a positive trust→perceived usefulness association among the Millennial cohort. The results are in agreement with some studies such as Chawla and Joshi [46], Pipitwanichakarn and Wongtada [65], and Sun and Chi [71] who also established that trust positively influenced perceived ease of use and perceived usefulness regarding m-commerce adoption and/or usage intentions. This finding supports the results of the current study, although they did not specifically consider the influence of MCA among Millennials. Many other studies also revealed positive associations between trust and various behavioral intention antecedents regarding MCA usage or m-commerce adoption [6,10,11,18,51,53,54,56,60,63,67,73,86,87,117,124,161,162,163], which further justify the results of this inquiry.

The research revealed that MCA caused a positive social influence and perceived usefulness association among Millennials. These findings in accord with several other mobile technology-related inquires such as Xia et al. [76], Lu et al. [126], Son et al. [127], and López-Nicolás et al. [128] ascertained that social influence positively influenced perceived usefulness due the usage of mobile technology, devices and/or services. Singh et al. [84] reported that social influence was one of the primary drivers of m-commerce adoption, and positively influenced mobile shopping in terms of engagement intentions. However, Tarhini et al. [73] ascertained that social influence did not have a significant influence on m-commerce usage intentions among Oman consumers, but the focus was not on MCA. Several other m-commerce and mobile technology-related investigations also found that social influence resulted in positive behavioral intentions in term of mobile device adoption or m-commerce [6,54,60,68,74,77,84,164,165], which align with this studies results.

This inquiry ascertained that innovativeness was favorably associated with perceived usefulness due to MCA usage among South African Millennials. Ghazali et al. [53] found that innovativeness positively influenced Malaysian consumer m-commerce intentions. Lu et al. [126] also ascertained that that innovativeness positively impacted perceived usefulness due to online mobile technology adoption among students in the US. Sun and Chi [71] ascertained a positive innovativeness and perceived usefulness association due apparel m-commerce adoption by consumers in the US. Hur et al. [55] also reported a favorable innovativeness and perceived usefulness association due to mobile fashion search apps usage among Millennials in South Korea. Liu et al. [60] conducted a global meta-analysis of m-commerce studies and revealed positive association between innovativeness and perceived usefulness. Furthermore, several investigations revealed positive innovativeness associations mainly regarding behavioral intentions of mobile technology, m-commerce and/or MCA usage [34,49,82,84,126,129,130,131,164,166], which further explain this study’s results.

This research revealed a positive mobility and perceived ease of use association owing to MCA usage among the Millennial cohort. Several studies investigated mobility and confirmed positives associations in terms of m-commerce and/or MCA usage [6,14,15,36,40,133,136,137,138,167], but not specifically in terms of the mobility and perceived ease of use relationship. Mobility is considered an important driver of m-commerce adoption with regards to usage intentions regarding mobile shopping and mobile payments [14,15,38]. Yen and Wu [134] and Nikou and Economides [135] both confirmed positive mobility perceived ease of use association in mobile usage-related studies, but Liébana-Cabanillas et al. [11] ascertained that mobility did not significantly affect Serbian m-commerce adoption. However, Liébana-Cabanillas et al. [11] asserted that more inquiry was necessary to consider mobility in as predictor variables regarding m-commerce, so this study fulfills this mandate.

This investigation determined that MCA had a positive effect on the perceived enjoyment and perceived ease of use association among Millennials in South Africa. Chong [16] noted that perceived enjoyment was important regarding m-commerce engagement continuance intentions, which was supported by several studies that affirmed perceived enjoyment was an important predictor of MCA usage intentions [77,136]. A number of studies disclosed positive perceived enjoyment associations regarding m-commerce adoption and MCA usage [6,13,16,31,38,48,55,59,62,77,79,82,89,130,133,138], whereas Hasan and Gupta [54] did not find a significant association when investigating perceived enjoyment’s impact on m-commerce behavioral intentions among Indian tourists. Kumar et al. [58] also did not determine a significant association between perceived ease of use and perceived enjoyment due Indian mobile app adoption. However, Kim et al. [115] found a favorable perceived ease of use and perceived enjoyment association with regards to m-commerce and mobile communication among Millennials in the US. Additionally, Chhonker et al. [49] reviewed more than 200 journal articles and found perceived enjoyment was an important constructs to investigate m-commerce. Hence, this study’s results are in agreement with Kim et al. [115], who also investigated Millennials (though in a developed country).

This study determined a positive involvement and perceived ease of use association owing to MCA usage among the South African Millennials. Morosan and DeFranco [139] found that customer involvement was the most important driver of mobile hotel app usage. Liébana-Cabanillas et al. {11], Mou and Zhu [30], and Cheng et al. [140] affirmed that customer involvement was an important driver of the m-commerce and MCA usage intention. Taylor and Levin [141] and Kang et al. [142] revealed positive associations with regards to MCA usage intentions among US consumers. Some other m-commerce and MCA investigations also found positive involvement associations regarding or m-commerce and MCA [4,30,32], but not in terms of perceived ease of use. Liébana-Cabanillas et al. [11] also noted that there was a lack of research that considered customer involvement due to m-commerce usage, so this inquiry assists in the realization of this recommendation.

This research ascertained that MCA had a positive effect on the perceived ease of use and perceived ease of use association among Millennials. Although, Chen and Tsai [47] and Choi [48] did not find significant associations between perceived ease of use and perceived usefulness owing to mobile app and smartphone m-commerce adoption in Asia. On the other hand, Bailey et al. [45] and Chi [48] ascertained that perceived ease of use positively influence perceived usefulness owing to m-commerce among US and Chinese consumers. Natarajan et al. [82] determined that there was a favorable perceived usefulness perceived and ease of ease of use association regarding MCA usage among Indian consumers. The perceived ease of use and perceived usefulness association was also positive in terms of branded MCA usage intentions among UK consumers [70]. A number of other investigations also found positive perceived ease of use and perceived usefulness associations due to mobile technology, m-commerce and/or MCA adoption [45,46,50,52,53,58,60,63,65,67,71,72,76,80,83,115,116,127,134,143]. Therefore, this study’s result is in agreement with a vast majority of the above-mentioned studies results.

This research determined that perceived ease of use was positively associated with customer satisfaction due to MCA usage by the Millennial cohort in an African developing country. Perceived ease of use was found to be a strong driver customer satisfaction in online commerce [38,81,84]. Alalwan [77] and Ramos-de-Luna et al. [144] confirm that perceived ease of use is an important driver of continuance of usage intentions regarding new technology. However, several studies found that that perceived ease of use did not have a significant influence on customer satisfaction owing to MCA mobile device usage in Asia [79,127]. Trivedi and Yadav [87] and Nikou and Economides [135] reported positive perceived ease of use and customer satisfaction associations owing to e-commerce-related and mobile-based assessments among Millennials. Shang and Wu [83] and Singh et al. [85] also revealed that perceived ease positively influenced consumer satisfaction due to among Chinese and Indian consumers. Another study found a favorable perceived ease of use and customer satisfaction association owing to mobile payment app adoption [80]. Other studies also found positive relationships for perceived ease of use and customer satisfaction due to mobile payments [27,28,29], so this study’s result is in consensus with most of the aforementioned inquiries findings.

This research revealed a significant positive perceived usefulness and customer satisfaction association due to MCA usage among Millennials. Several studies found a positive relationship between perceived usefulness and behavioral intentions or adoption of mobile apps [63,149,164,168], but these studies did not consider the antecedents on customer satisfaction. Other studies ascertained that usefulness influences customer satisfaction, which has a positive impact branded mobile apps usage continuance intentions [29,148,149,169]. However, a study indicated that perceived usefulness did not have a significant impact on customer satisfaction due to mobile shopping in China [83]. Marinković and Kalinić [6] and Singh et al. [85] suggested favorable perceived usefulness and customer satisfaction associations due to m-commerce adoption among Serbian and Indian consumers. Do et al. [79] and Humbani and Wiese [80] also revealed that perceived usefulness positively affected customer satisfaction owing to due augmented-reality and mobile payment apps. Hence, this investigation’s results support a majority of the above-mentioned findings.

The research also revealed the Millennials who used mobile banking and e-hailing taxi services MCA display more positive customer satisfaction attitudinal responses than those who use traditional retail store MCA. Millennials respondents who accessed MCA via tablets and smartphones showed more favorable customer satisfaction attitudinal tendencies than those who used feature phones. Natarajan et al. [82] did not find a significant difference in terms of the type of device used to access MCA among Indian consumers, but the study considered several cohorts. Millennials who engaged in mobile shopping for 4+ years displayed positive customer satisfaction inclinations compared to those who engaged in mobile shopping for fewer years. Millennials who frequently engage in m-commerce activities displayed positive customer satisfaction attitude levels in comparison to those who rarely engage in mobile shopping. Millennials who spent higher amounts through MCA showed positive customer satisfaction attitudinal tendencies compared to those who spent lesser amounts. Millennials who frequently responded to MCA marketing communication displayed more positive customer satisfaction attitudinal responses in comparison to those who seldom responded. The study also found that Millennials who were younger, had higher education levels, and were employed exhibited favorable customer satisfaction attitudinal tendencies due to MCA usage. Natarajan et al. [82] found higher satisfaction among older Indian consumers (>35 years) regarding MCA usage, but did not specifically consider the Millennial cohort. Singh et al. [85] revealed that young consumers exhibited high satisfaction levels owing to m-commerce, which supports the findings of this inquiry. Few studies have conducted cross-tabulation in terms of the MCA usage and demographic variables, especially with regard to customer satisfaction, so this study makes a noteworthy contribution to m-commerce the extended TAM discourse.

6.2. Theoretical Implications

The TAM is an expansion of the TRA and TPB models [170,171], which was originally developed to examine workplace information system technology [40,41] but has become one of the most globally accepted models. The TAM has been used to investigate a number of different areas and sectors, which includes a wide variety of online platforms, social media, mobile and electronic commerce conduits, new technology, and many other online digital platforms. As mentioned in prior text, the TAM has been modified on several occasions to consider the acceptance of a divergent array of technology via the addition of a number of other external variables, additional attitudinal responses and applicable associations [42,43]. Consequently, numerous inquiries have used many different variables and extensions of TAM to consider m-commerce and MCA [44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76], but a majority of the extant research considered behavioral behavior and usage intentions, whereas this investigation’s outcome variable was customer satisfaction and thereby makes a novel contribution to the TAM framework.

This investigation included additional variables (trust, social influence, perceived enjoyment, mobility, innovativeness, and involvement) and examined there corresponding associations on perceived ease of use and perceived usefulness, which were retained from the original the TAM. The results indicated that trust, social influence, and innovativeness were positively associated with perceived usefulness; perceived enjoyment, mobility, and involvement were favorably associated with perceived ease of use; and perceived usefulness and perceived ease of use were positive antecedents of customer satisfaction owing to MCA usage among South African Millennials. Hence, this inquiry made an original contribution to the extended TAM by drawing from the limited extant inquiry in order to consider customer satisfaction as a result of MCA usage among the Millennial cohort in an African developing country. The study also made a further theoretical contribution to the GCT by investigating the differences within a cohort regarding MCA usage (MCA categories, mobile device access, length of usage, mobile shopping engagement, usage hours, marketing communication response and m-commerce spending) and demographic characteristics (gender, age, education level, and employment) on customer satisfaction among the Millennials.

6.3. Practical Implications

The fourth industrial revolution brought about technological advancements that cannot be ignored by businesses globally. Additionally, the COVID-19 lockdown restrictions have resulted in South African businesses stimulating their uptake of MCA among other digital commerce platforms. Thus, businesses should focus on improving customer experience by developing MCA that take into account the needs of their customers, especially among the younger cohorts whose spending power have significantly increased in recent years. This study revealed some significant findings which businesses should take into consideration when targeting Millennials via MCA so as to stimulate customer satisfaction and ultimately grow m-commerce. The businesses should ensure that their MCA transactions are safe, secure, and private (trust); stimulate young people to use the MCA in their social circle (to create positive electronic word-of-mouth); are able to be used anywhere and anytime (mobility); are fun, enjoyable, and engaging (perceived enjoyment); stimulate interest in products and services offered over the mobile devices and apps (involvement); and encourage the use of new technology (innovativeness), which will facilitate positive ease of use and usefulness. The businesses should also make certain that their MCA are easy to use, understandable, and not cognitively taxing (perceived easy to use); and improve work performance, productivity efficiency (perceived usefulness), which will meet customer expectations and ultimately create positive experiences (customer satisfaction). It is also essential to take into consideration which mobile devices customers use to access MCA; how long they have been engaging with MCA; the frequency of use per shopping occasion; the average monthly spend through the mobile app channel; and whether customers respond to marketing communication delivered via MCA. When defining a target market, marketers should also keep in mind that certain demographic variables have a significant influence on customer satisfaction owing to MCA usage. The age of the customer is one of the key influential demographic variables, since younger customers are most satisfied with mobile apps; the education level is important in understanding literacy and functionalities of technological advancements; and employment status of customer should be taken into consideration, which goes hand in hand with young economically active customers who possess huge buying power.

7. Conclusions

7.1. Summary of the Study

The study was promoted by the increase in usage and appetite for engaging with mobile apps, which has led to businesses around the world increasing their MCA utilization as an additional business channel. Mobile apps used specifically for business-to-consumer commerce such as banking, e-hailing, retail, and order and delivery services have provided customers with a convenient way to search, order, locate, or transact through their smartphones anywhere and anytime. Millennial consumers are said to be the most innovative cohort and are addicted to mobile devices, such as smartphones, which they continually use. Millennial consumers have the largest buying power; although some might not be the primary earners of the money, they also influence and conduct the most transactions within households. The TAM is one of the most extensively used and accepted models, and a number of recent studies use various versions of the extended TAM to consider a wide array of m-commerce and MCA-related topics via divergent antecedents. Although, few have directly considered Millennials, developing countries (especially in Africa) and customer satisfaction as the solitary outcome variable. Hence, this study investigated the antecedents of customer satisfaction due the usage of MCA by Millennial consumers in South Africa.

This study developed a new model, viz. the MCA customer satisfaction model, which showed that trust, social influence, and innovativeness were positively associated with perceived usefulness; perceived enjoyment, mobility, and involvement were positively associated with perceived ease of use; and perceived usefulness and perceived ease of use were positively associated with customer satisfaction. So, this investigation established a novel MCA model, which was derived from the extended TAM. Few MCA studies conducted cross-tabulation with regards to usage and demographic characteristics, which were mainly used to describe the sample, but are important to advance GCT. To address this research gap, this study considered the influence of these independent variables on customer satisfaction. The study found that mobile banking and e-hailing taxi services resulted in the greater Millennial customer satisfaction than the traditional retail store MCA. The use of tablets and smartphones also resulted in higher customer satisfaction among Millennials in comparison to feature phones. More experienced Millennial MCA users brought about greater customer satisfaction sentiment compared to less experienced Millennial MCA users. Higher levels of mobile shopping engagement caused the most favorable customer satisfaction predispositions among South African Millennials versus lower levels. Increased spending via MCA resulted in greater customer satisfaction in comparison to those that spent lesser amounts among Millennials. Higher MCA marketing communication response rates caused more positive Millennial customer satisfaction than lower response rates. Higher levels of education, younger, and employed Millennials displayed greater customer satisfaction due to MCA usage than Millennials with lower education levels, who were older, and unemployed. To conclude, this study makes a unique contribution to m-commerce and MCA extended TAM in the form of a new MCA customer satisfaction model, as well as furthers the GCT by revealing differences within the Millennial cohort from an African developing country context.

7.2. Limitations

The current study collectively reported on mobile app business categories (mobile banking, e-hailing services, food delivery services, online-based retailers, and traditional brick and mortar retailer MCA), whereas many studies analyze these MCA as separate entities. This research was only conducted among Millennials, whereas a majority of other studies did not distinguish between the different cohorts. Non-probability sample methods were used to select the respondents and the research methodology was quantitative in nature. The questionnaire for this study was designed only to measure the objects of study for a given time period via a cross sectional deign, whereas several other inquires used a longitudinal approach. The sample consisted only of South African respondents, whereas several other researchers conducted cross-country research.

7.3. Future Research

Future research could individually consider mobile app business categories (mobile banking, e-hailing services, food delivery services, online-based retailers, and traditional brick and mortar retailer mobile apps) in terms of the MCA customer satisfaction model to ascertain if these would result in different outcomes. Further inquiry could investigate different cohorts, such as Generation X and Generation Z [172], or compare differences between the various generations. Investigations in the future could replicate this study and apply a probability sampling technique in order to get a more representative sample for generalization purposes. Future research could be qualitative in nature to allow for a deeper understanding of the antecedents of customer satisfaction within MCA. A longitudinal design would allow researchers to track how variables change over time. Future research could focus on different individual countries for comparison purposes [173] or could conduct cross-country research (and compare developed and developing countries) to establish if there were significant differences in terms of the new MCA customer model and the Millennial cohort.

Supplementary Materials

The following is available online at https://www.mdpi.com/article/10.3390/su13115973/s1: mobile commerce apps (MCA) questionnaire.

Author Contributions

Conceptualization, A.N. and R.D.; methodology, A.N. and R.D.; software, R.D.; validation, R.D.; formal analysis, A.N. and R.D.; investigation, A.N. and R.D.; resources, A.N. and R.D.; data curation, A.N. and R.D.; writing—original draft preparation, A.N.; writing—review and editing, R.D.; visualization, A.N.; supervision, R.D.; project administration, R.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted according to the guidelines of the Declaration of Helsinki, and approved by the Cape Peninsula University of Technology Research Ethics Committee (FOBREC521 and 2 May 2018).

Informed Consent Statement

Informed consent was obtained from all respondents involved in the study.

Data Availability Statement

The data presented in this study is available on request from the corresponding author. The data is not publicly available due to assured participant confidentiality.

Conflicts of Interest

The authors declare no conflict of interest.

References

- eMarketer (Ed.) Worldwide Ecommerce will Approach $5 Trillion This Year. Available online: https://www.emarketer.com/content/worldwide-ecommerce-will-approach-5-trillion-this-year?ecid=NL1014 (accessed on 10 May 2021).

- Wurmser, Y. Mobile Shopping Gains Are Likely to Stick in the Future. Available online: https://www.emarketer.com/content/mobile-shopping-gains-likely-stick-future (accessed on 7 April 2021).

- De Best, R. Mobile Payments Worldwide-Statistics & Facts. Available online: https://www.statista.com/topics/4872/mobile-payments-worldwide/ (accessed on 16 March 2021).

- Holmes, A.; Byrne, A.; Rowley, J. Mobile shopping behaviour: Insights into attitudes, shopping process involvement and location. Int. J. Retail. Distrib. Manag. 2013, 42, 25–39. [Google Scholar] [CrossRef]

- Kuo, T.; Tsai, G.Y.; Lu, I.Y.; Chang, J.S. Relationships among service quality, customer satisfaction and customer loyalty: A case study on mobile shopping APPs. In Proceedings of the 17th Asia Pacific Industrial Engineering and Management System Conference, Taipei, Taiwan, 7–10 December 2016; pp. 7–10. [Google Scholar]

- Marinkovic, V.; Kalinic, Z. Antecedents of customer satisfaction in mobile commerce. Online Inf. Rev. 2017, 41, 138–154. [Google Scholar] [CrossRef]

- Chung, K.C. Transaction Utility Perspective of Customer Satisfaction towards M-Commerce in Taiwan. In Proceedings of the 2019 5th International Conference on E-business and Mobile Commerce-ICEMC 2019, Taichung, Taiwan, 22–24 May 2019; Association for Computing Machinery (ACM): New York, NY, USA, 2019; pp. 1–5. [Google Scholar]

- Kalinić, Z.; Marinković, V.; Djordjevic, A.; Liebana-Cabanillas, F. What drives customer satisfaction and word of mouth in mobile commerce services? A UTAUT2-based analytical approach. J. Enterp. Inf. Manag. 2019, 33, 71–94. [Google Scholar] [CrossRef]

- Thakur, R. The moderating role of customer engagement experiences in customer satisfaction–loyalty relationship. Eur. J. Mark. 2019, 53, 1278–1310. [Google Scholar] [CrossRef]

- Marinao-Artigas, E.; Barajas-Portas, K. Precedents of the satisfaction of mobile shoppers. A cross-country analysis. Electron. Commer. Res. Appl. 2020, 39, 100919. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Marinković, V.; Kalinić, Z. A SEM-neural network approach for predicting antecedents of m-commerce acceptance. Int. J. Inf. Manag. 2017, 37, 14–24. [Google Scholar] [CrossRef]