Abstract

Financial performance is an indicator of the financial stability and the health of a firm. It is a measure of how well a firm uses its assets to generate revenues, a firm’s credibility, and its ability to pay off debts. To study the theoretical development, empirical examinations, and growing trend of financial performance research, this study reviewed the financial performance literature based on 875 journal articles sourced from the Web of Science, ACM, and Scopus databases from 2005 to 2019. To carry out the review, we applied Cite Space and Ucinet software for visualization and social network analysis, statistical analysis, co-occurrence analysis, and other research methods. We obtained a panoramic depiction of the posts, authors, journals, and keywords, and also reviewed financial performance using the field of knowledge maps. Accordingly, this study highlighted the recent and future research trends, and found that corporate social responsibility, and the green and sustainable corporate environment are potential research areas. These findings, through the combination of bibliometric methods and a systematic review, provide a better understanding of the development of corporate financial performance for both researchers and practitioners.

1. Introduction and Scope of Review

Financial management is an essential part of corporations, and performance management is an integral part of financial management. The intellectual roots of the financial performance literature originate with Taylor’s “principles of scientific management [1]; the Dupont method to decompose the return on the equity of an enterprise into the product of multiple financial indicators [2]; and the association of multiple market indicators with the Dupont method [3]. More recent research includes, from a qualitative perspective [4,5,6]. Literature associated with contextual factors includes [7,8]. Reference [9] Contended that the centralized approach to manage corporations was well suited for the period of two–three decades after the Second World War: “The principal challenge of top management then was to achieve the huge economies of scale in manufacturing and marketing that were available to firms finding opportunities for growth in the same or closely related businesses”.

With the advent of globalization, enterprises have more sources of capital, more competition among themselves, and diversified perspectives of financial performance evaluation. Reference [10] proposed Economic Value Add (EVA), a financial performance evaluation system based on the idea of residual income that corrects the defects of residual income as a financial performance evaluation index and presents a way for institutions to run businesses in accordance with basic microeconomic and corporate finance principles. The EVA “closed-loop” method of decision-making emphasizes the self-regulated and self-motivated internal governance system and ensures that the Chief Executive Officer (CEO) is not solely accountable for the failure and the success of the enterprise. (Kaplan and Norton 1996) [11] put forward the concept of the balanced scorecard, which is a comprehensive consideration of the financial and non-financial indicators to reveal the implementation of all aspects of enterprise performance evaluation.

Past researchers have conducted a number of reviews of the literature of financial performance. Most of these reviewed studies were conducted in the early 1970s and 1980s and were based on qualitative design [4,5,12,13,14,15]. In the view of these studies, the quantitative comparison of different studies was not realistically possible because of complex modeling and different operationalization of explanatory and dependent variables. Later, review studies of financial performance examined the nexus of different internal and external factors of the firm; for example, reference [16] conducted a review study of the nexus between the board of directors and financial performance. They identified an integrative model which was previously missing in studies of the relationship between the board of directors and financial performance. Moreover, reference [8] conducted a meta-analysis on financial performance in relation to environmental and strategic organization factors. In this study, they evaluated the consistent and inconsistent results of these factors of an organization and financial performance. In recent times, several review papers have been published on corporate social performance (CSP) and corporate financial performance (CFP) linkages [17,18,19,20,21]. Most of these studies concluded that the inconsistent relationship between CSP and CFP was due to operationalization of CSP and methodological differences. However, a comprehensive review study based on quantitative design is needed to encompass the horizon of financial performance alone and provide the potential nexus for future studies.

Therefore, the current review paper aims to summarize the most recent developments in the area of financial performance in relation to diverse internal or external organizational factors. This review relies on 875 journal articles that are extracted from the Web of Science, Scopus, and ACM for the period 2005 to 2019. This review paper employs a quantitative research design and advanced techniques to determine the recent trends in the field of financial performance research. Three methods are used to achieve the research objectives: the bibliometric research method, knowledge mapping, and co-occurrence analysis. Cite Space and Ucinet software are used for statistical, visualization, social networking, and co-occurrence analysis to enable a panoramic depiction of the posts, authors, journals, and keywords, and the construction of a knowledge map in the field of financial performance. This review paper also identifies the key research areas of financial performance and recommends the most recent combinations. The results show that defining corporate social responsibility and establishing green and sustainable corporate environments represent the potential nexus of financial performance for future research. The current review paper contributes to the literature of financial performance in terms of using quantitative research design with more advanced techniques. Furthermore, the combination of a systematic literature review and a bibliometric research method provides more detailed information about the progress of research in the field of financial performance to researchers and practitioners. Finally, on the basis of knowledge mapping, social networking analysis, and co-occurrence analysis, this paper identifies the future potential combinations for financial performance, such as environmental management, corporate social responsibility, and quality management.

2. Method and Data Description

In this review, we mainly used three research methods. The first was the bibliometrics method [22,23] which is derived from the quantitative analysis method. It uses characteristics and the bibliometrics literature system as a research object to construct the discipline structure of the areas of a particular research topic for researchers to investigate the impact of these topics or the specific result of a paper, or to identify individual impactful documents for a particular field of research. The second approach was the knowledge mapping method, which is an intuitive and efficient method to reveal the relationships between concepts. The knowledge graph is composed of nodes and edges. A node represents the research concept, an edge represents the relationship between corresponding connected concepts, and the edge weight generally represents the number of concept co-occurrences. Knowledge nodes with high centrality can be found through topology analysis. Network path analysis can identify the development track of a specific domain. Network clustering analysis can reveal the knowledge units that are closely related. The third method, co-occurrence analysis, has the core idea that if two concepts always exist in the same text at the same time, the probability of the two concepts is relatively high. This method can exclude weak correlation by selecting a co-occurrence threshold, and can also combine similarity coefficients, co-occurrence networks, and cluster analysis to distinguish the relationship.

To apply these methods, we mainly used two pieces of research software. The first was Cite Space, which is a visualization information software developed [24]. This analyzes the characteristics of diversified literature, including keywords, authors, cited research, and periodicals. It presents a visual form of dynamic knowledge, keyword cluster map, time zone distribution map, co-authored network, and co-cited network. The second program was Ucinet, developed [25] which is social network analysis software that shows the complex relationship between nodes in the form of a visual network. This review applied Ucinet to convert the keyword co-occurrence matrix into a keyword co-occurrence network for visual description and centrality analysis. To present the highly representative literature in the field of financial performance, this review extracted 875 journal articles, after removing duplications, for the period of January 2005 to September 2019 from the sources of Web of Science, Scopus, and ACM. Table 1 presents the summary.

Table 1.

Summary of search details.

3. Results and Analysis

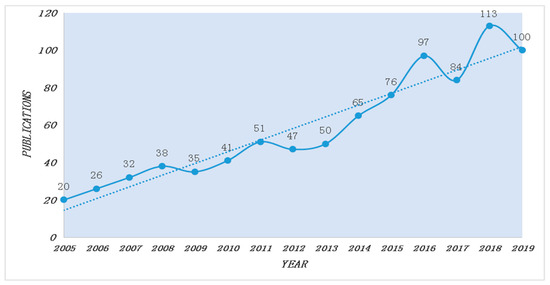

The number of publications for each year is presented in Figure 1. In general, the number of publications showed a rising trend with slight fluctuation. From 2005 to 2013, the publication curve grew slowly, with the number of publications climbing slightly year by year, indicating that the research in the field was increasing gradually. From 2013 to 2019, financial performance literature rose rapidly. It is worth noting that although the number of articles published in 2019 has decreased, this may be caused by the lag of the publication time of the literature, which needs to be supplemented for follow-up data observation. The dotted line is a linear regression curve fitted according to the annual number of articles published, which shows the growing trend of academic research on financial performance.

Figure 1.

Number of publications.

Table 2 presents the highest frequency of cited articles. We find that the most-cited articles mainly used empirical analyses. The trends of high-frequency articles relate to social responsibility or the impact of information disclosure on improving corporate financial performance [26,27,28]. Reference [21] examined the relationship of corporate responsibility and financial performance. References [29,30,31,32] noted that the stakeholder perspective, diversity on boards, and environmental disclosure practices improved financial performance.

Table 2.

Top 10 most-cited articles.

3.1. Mapping and Analysis of Countries

Figure 2 shows the 36 nodes and 31 links in the partner countries formed a network from 2005 to 2019. The lines between two nodes represent collaboration links, the intensity of which is proportional to the thickness of the line. Ten countries in the region dominate. The circle size describes the central country with different time zones, which have different colors.

Figure 2.

Joint mapping of productive countries.

Table 3 shows the total publications. The United States has published 309 papers, making the most significant contribution. As a developed state, the US has a long history of improving financial management systems through different theories and methods, e.g., EVA, and of empirically examining the impact on the financial performance of enterprises. This trend is followed in China as one of the swiftly growing economies, in addition to the other countries reported in Table 3.

Table 3.

Top 10 most-productive countries.

3.2. Mapping and Analysis of Authors and Cited Authors

The analysis of research authors helps understand the high-yield authors in the field of financial performance. As one of the classical laws of bibliometrics, Price’s law is used to measure the distribution of literature authors in various disciplines. It is defined as “in the same topic, half of the papers are written by a group of high-productivity authors whose number is approximately equal to the square root of the total number of authors”, and can be expressed mathematically as:

where max is the number of papers published by the most productive authors among the outstanding scientists, and m is the number of papers published by the least productive authors among the outstanding scientists; that is, the number of papers published by the high-yielding authors is at least m.

The 875 papers reviewed had a total of 2122 authors and 796 first authors. The degree of cooperation was 2.43 (2122/875); that is, each paper was completed by 2.43 authors with a high degree of cooperation. In studies related to financial performance, the number of author appearances was up to 11 times (m = 0.749 × 11^1/2 = 2.484152 ≈ 2), and authors who published more than two papers can be regarded as a high-yielding author (Table 4). In the field of financial performance, there were 60 high-yielding authors with 210 publications. Most of the first published years were from 2008 to 2015, which was the growing stage of financial performance research, and a large number of excellent experts emerged, echoing the results described in Figure 1. University researchers have become the main force in the field of financial performance research, followed by some research institutes and government departments, indicating that a good research platform is more conducive to researchers to carry out relevant research. The most productive authors, which included Weech-Maldonado, R., followed by Lee, S., focused on privatization, ownership, franchises, organizational and market factors, the role of the board of directors, dimensions of corporate social responsibility, and the relationship of financial performance.

Table 4.

Most productive authors list.

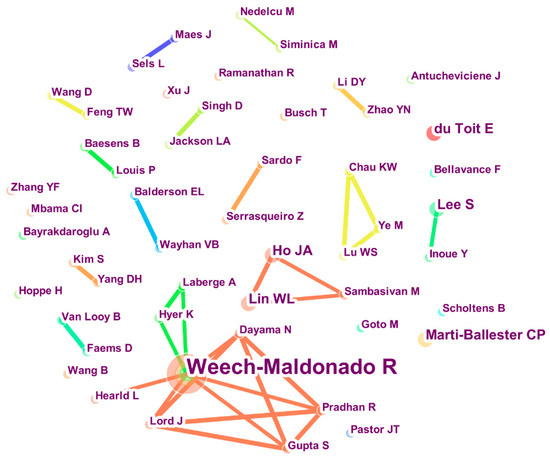

The authors’ co-occurrence can directly show the cooperation of academic groups in the field of financial performance. We ran Cite Space, selecting “Author” for node type, and setting the threshold selection method “TOPN” and the value to 10 without network pruning. We thus obtained the authors’ co-occurrence, as shown in Figure 3. The nodes in the diagram represent the authors, and the connections between nodes represent co-authors. The network had a total of 51 nodes and 31 pairs of connections. Isolated nodes accounted for the largest proportion in the graph, indicating that most authors were in a “lone wolf” state. Overall, there was not a stable relationship in the field of financial performance. The author collaboration network was loosely connected, with an unstable structure, suggesting the financial performance research should be explored.

Figure 3.

Map of authors’ co-occurrence.

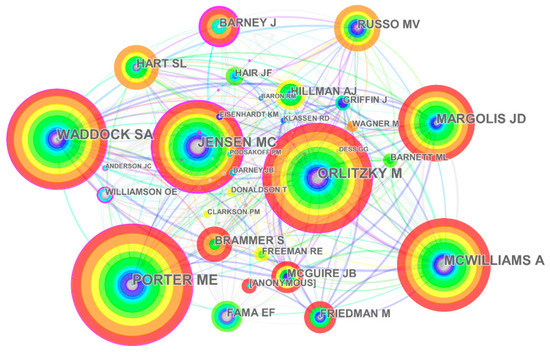

Figure 4 shows certain authors quoted by other authors in this field, which indicates that they played a reference role for the cited author in theory or method. Therefore, analysis based on the number of cited authors in this field can reflect the contribution and centrality of the cited author in this field. The term “cited by the same author” means that two or more authors were cited in the same paper, which indicates that the cited objects were relevant in research direction, method, and technology. The network of those cited by the same author further highlights academic groups in the research field in the form of a network. Using Cite Space, anonymously cited authors (“anonymous”) were excluded, and the literature collection was selected. The period was from 2005 to 2019, and the time-division "Year per Slice" was one year (that is, each year was a time unit). Cited Author referred to “Node Type” and “Cited Author”. The threshold selection method was set as “TOPN”, and the value set as 10. The network pruning algorithm was selected as “Pathfinder” to trim the segmentation and the whole network. The other options were left unchanged to conduct a co-cited analysis of the authors and construct the map of co-cited knowledge.

Figure 4.

Map of authors’ co-citation.

In Figure 4, nodes represent cited authors, and connections between nodes represent the relationship between authors and cited authors. The size of nodes is proportional to the number of citations by authors, and the warmer the ring color of nodes, the closer it appears. Table 5 lists 25 cited authors whose citation frequency was greater than 10. According to the table, most of the cited authors in the field of financial performance were foreign scholars, among which Porter ME, Orlitzky M, and Waddock were cited the most, with more than 150 citations. These were closely associated with other cited scholars and distributed. Most authors with a high number of publications may not be cited as often. The reason for this phenomenon may be that these authors first published their articles relatively late and were not familiar to other scholars in the field.

Table 5.

High-frequency cited authors.

3.3. Mapping and Analysis of Journals

The number of articles published in journals is an important index for the analysis of literature information. According to the frequency statistics of journals in the field of financial performance from 2005 to 2019, the total number of journals in this field is 335, among which 11 journals have published 10 or more articles. There were 27 journals that had published 5–9 articles, and 297 journals that had published fewer than five articles. Journals with a published volume of 10 or more articles (Table 6) contained 220 articles, 25.14% (220/875) of the total literature, indicating that the source journals were relatively concentrated.

Table 6.

Source journals with article publications ≥ 10.

Journal citation frequency refers to the total number of citations of papers contained in journals in a certain period. Generally speaking, the more cited the articles, the higher the academic value of the journal. Table 7 shows the top 10 most-cited journals. Most of these journals are related to management. In this study, there were 55,523 citations, 17,680 of which were cited in the top 10 journals, which is 19.39% of the total citations. It can be seen that the core journals in the field of financial performance are highly concentrated.

Table 7.

Top 10 most-cited journals.

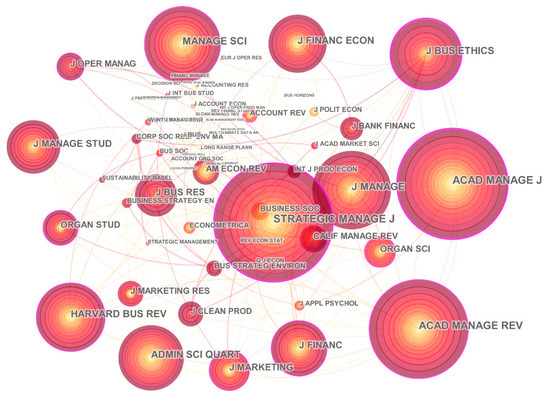

To further show the distribution of the journals in the field of achievement transformation, the same citation network of journals was drawn. Referring to the above-mentioned procedure, Cite Space was run, the node type selected was “Cited Journal” and the threshold selection method “TOPN” was set as 20. The network pruning algorithm was selected as “Minimum Spanning Tree”. Thus, 61 journals were obtained (Figure 5) and 175 journals with the cited relationship were identified with the cited knowledge graph. As shown in Figure 5, the node rings from the center to the edge are mostly cool colors to warm colors, indicating that these journals run through the whole process of financial performance, appearing early and continuing till today. The cited journals mainly focus on marketing and financial management, supplemented by another commercial, management, and economic journals, presenting a “multi-core and multi-strong” situation, indicating that financial performance is a multidisciplinary integration field.

Figure 5.

Journals in the cited network.

3.4. Mapping and Analysis of Keywords

3.4.1. High-Frequency Keywords

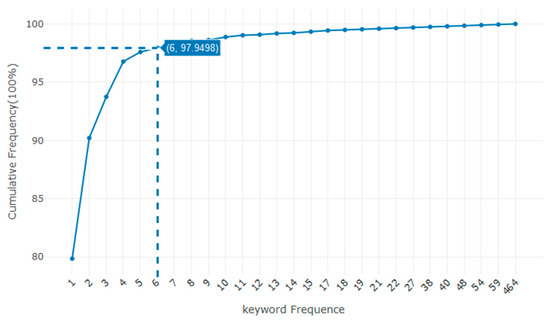

After the word frequency of each keyword was determined, considering the low influence and high interference of low-frequency keywords, a threshold value of high-frequency keywords was selected to screen keywords, observing the distribution rule of cumulative keyword frequency (Figure 6). The abscissa of the figure is keyword frequency, and the ordinate is increasing keyword frequency. When the word frequency was 6, the curve suddenly changed, and the cumulative rate of keywords reached 97.95%. Therefore, the occurrence of frequency ≥ 6 was used to define high-frequency keywords, and a total of 48 high-frequency keywords were obtained (Table 8). The frequency summation of high-frequency keywords was 1044, accounting for 28.11% of the total frequency of all keywords, and reflecting the representativeness of the selected high-frequency keywords.

Figure 6.

The curve of keywords’ cumulative frequency.

Table 8.

High-frequency keywords.

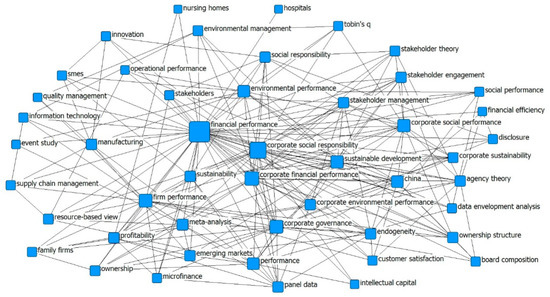

To describe the relationships between high-frequency keywords, the co-occurrence matrix of high-frequency keywords was constructed. The elements in the matrix were the co-occurrence times of the corresponding row and column keywords in the document collection. The co-occurrence matrix was taken as an adjacency matrix and imported into Ucinet to construct a high-frequency keyword co-occurrence network (Figure 7). The size of the nodes in the network is directly proportional to the centrality of the points, and the connection is directly proportional to the co-occurrence frequency.

Figure 7.

Co-occurrence network of high-frequency keywords.

Network centrality analysis is one of the conventional methods of social network analysis. The actors in the center must be the most active in a certain sense and have the most relationships compared with other actors in the network. Therefore, it is often used to measure the importance of network nodes. In this study, network centrality was analyzed with three classical indexes, namely, point centrality, intermediate centrality, and proximity centrality, and the importance of high-frequency keywords was weighted quantitatively.

1 Degree Centrality

The edge weight and the number of connected edges were combined to describe the degree distribution of the co-word network more accurately. The calculation method of the point degree centrality of network nodes was as follows:

where ωij is the weight between node i and node j, that is, the co-occurrence count of corresponding keywords.

2 Closeness Centrality

Proximity centrality reflects the proximity of one node to other nodes. When this node is closer to other nodes, it is more independent in the process of information dissemination. A non-core node, on the other hand, must pass through other nodes to disseminate information, and is easily subject to other nodes. The node’s proximity to the center is defined as:

where dij is the shortest path length from node i to node j.

3 Betweenness Centrality

Compared with proximity centrality, intermediary centrality considers the node with the highest cost performance to spread to the farther, larger, and more complete network. It describes the importance of nodes by the number of shortest paths passing through them. When a node is on many short paths, it can control the access times of others to information resources and restrict information transfer between nodes. Intermediary centrality is defined as:

where SPjk represents whether the shortest path between node j and node k passes through node i, in which case SP = 1; otherwise SP = 0.

Table 9 shows the top 10 nodes in the co-occurrence of keywords in the network centrality of Chinese researchers and their counterparts. It appears that nodes with a high point-centered degree and intermediary center degree overlap and repeat; e.g., financial performance, corporate social responsibility, corporate financial performance, corporate governance, sustainable development, and other core concepts frequently appear and play an intermediary role in the network of strong control in keyword nodes. The degree of proximity reflects the closeness between the nodes. The closer the node to others, the more independent; e.g., financial efficiency, innovation, in-depth interviews, and operational performance have a high degree of closeness to the center, which indicates that these nodes are a short distance from other keywords in the network.

Table 9.

Top 10 nodes of high-frequency keyword centrality.

3.4.2. Extraction of Financial Performance Based on Keywords

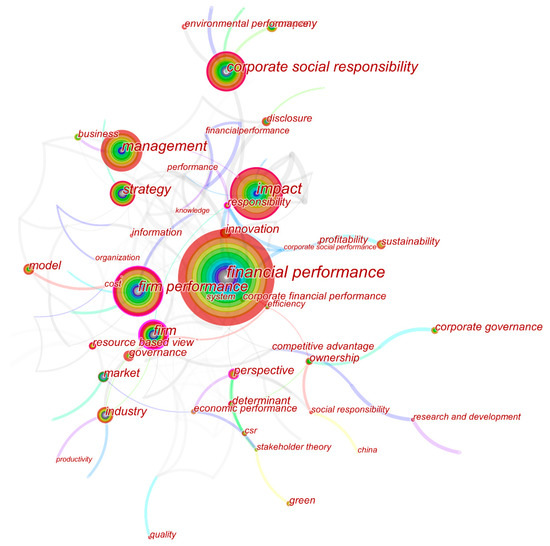

Keywords are the most concise expression of the topic of a document. Therefore, we attempted to explore the research topics and dynamic changes in the field of financial performance through keyword analysis. We imported the properly processed document collection in Cite Space, selected the time from 2005 to 2019, and set the time partition “Year Per Slice” to one year. “Keyword” was selected for node type, and “Author Keyword (DE)” was selected. After repeated debugging, the threshold selection method was set as “TOPN”, and the value set as 20. After the initial process, it was found that some keywords had the same meaning but different expressions due to manual annotation (e.g., firm financial performance and corporate financial performance). Hence, synonyms were merged to ensure normative research was reflected in the knowledge graph of financial performance research based on keywords (Figure 8), with 115 nodes and 207 connections.

Figure 8.

Knowledge graph of financial performance research keywords.

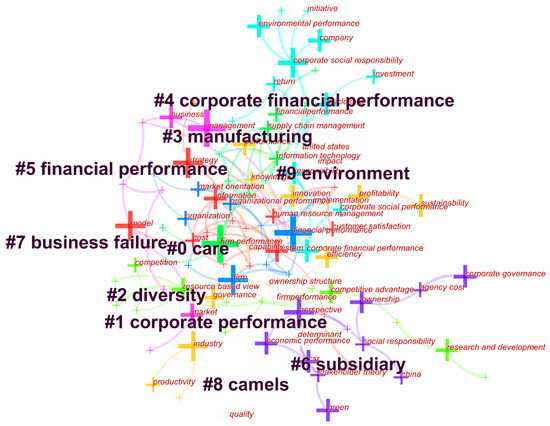

To explore further study, we used Cite Space’s “Cluster View” to conduct cluster analysis on the keyword knowledge map, and the software clustered the keywords into 10 cluster groups (Figure 9). Nodes of the same color represent a class cluster, named after the core keyword node (Table 10).

Figure 9.

Cluster graph of financial performance research keywords.

Table 10.

Ten cluster groups of the keyword nodes.

Cluster-ID #0 was the largest cluster with a tag of corporate atmosphere, mainly including human resource management, care, perception, organizational climate, cost, and customer satisfaction. Knowledge economy means core competitiveness comes not only from physical capital, but also the intangible capital created by human beings. The relationship between human resource factors and financial management is widely concerned with the theoretical and practical perspectives. This topic discusses the guiding role of human resource management based on enterprise atmosphere in performance management. It puts forward specific ideas, methods, and suggestions on how to improve customer satisfaction and reduce cost input from the perspective of the enterprise atmosphere. For example, reference [33] developed and tested a model of how supportive human resource management (HRM) improved firms’ financial performance perceived by marketing managers through fostering the implementation of a customer-oriented strategy. The study illustrated the implication of a customer-oriented approach for HRM and revealed the importance of HRM in strategy implementation. Reference [34] conducted a survey and concluded that the total quality management (TQM) practices have a positive and significant relationship with financial performance through competitive strategies. The results might help managers to implement TQM practices in order to allocate resources and enhance financial performance effectively.

The second was Cluster-ID #1, with a tag of ownership concentration, mainly including ownership structure and corporate performance, small business, profitability, and innovation. Ownership concentration, as an essential and significant part of corporate governance research, has always had a considerable research focus on the relationship between ownership concentration and financial performance. There is debate among scholars about how to improve the operations and effectiveness of corporate governance in order to improve organizational performance. For example, reference [35] studied corporate social performance and financial performance based on a sample of firms listed on the Taiwanese stock exchange from the period from 1996 to 2006. The results of the empirical analysis showed that the divergence between control rights and the cash flow rights of controlling owners negatively moderates the link between social and short- and long-run financial performance.

The third was Cluster-ID #2, with a tag of diversity assessment, mainly including strategic management, competitive advantage, shareholder value, diversity, international diversification, and personality. In the final analysis, these diversity factors all include innovation, because innovation can enable enterprises to obtain and strengthen competitive advantages, and eventually form sustainable competitive advantages, which are conducive to the long-term development of enterprises. This topic discusses the influence of individuation and diversity on team performance, and whether the increase of diversity on board enhances shareholder value. For example, reference [31] combined the conflicting results of 140 studies on the relationship between diversity on the board and financial performance, and found that these results differed from firm to firm according to the regulatory and socio-culture context. They concluded that diversity on boards is positively linked with accounting returns, and this results in greater strength in countries that focus on shareholder protections.

The fourth was Cluster-ID #3, with a tag of supply chain management, mainly including supply chain management, antecedent, product development, and linkage. In the 21st century, market competition has shifted from inter-firm competition to supply between the chains; for example, [36,37,38,39]. Supply chain management can cause high efficiency and low costs, and create maximum value for customers and firms. The firm’s control support in this process, supply chain operation reference (SCOR) models, and supply chain strategy are significantly and positively associated with environmental, operational, and financial performance. Reference [40] examined the relationship between sustainable supply chain management (SSCM) and sustainable environmental, social, and governance (ESG) practices. They enhanced the findings of [41,42] confirming that SSCM increases the firm’s sustainability practices with a two-year lead effect.

The fifth was Cluster-ID #4, with the tag corporate financial performance, mainly including corporate social responsibility, corporate financial performance, empirical analysis, and time series. Based on the essential characteristics of performance evaluation, an evaluation system and indicators are established, and each element in the network is given corresponding weight, such as empirical analysis and time-series analysis. Reference [43] found that financial performance evaluation is a critical process among other assessment tools of a firm. For assessing and clustering financial performance, they proposed an integrated evaluation approach applying a Fuzzy C-Mean-additive ratio assessment (FCM-ARAS) and correlation coefficient standard deviation (CCSD) method. In examining the relative importance of criteria that lead to higher accuracy of evaluation by removing subjective assessment, they concluded that return on assets and the debt ratio are the critical criteria of financial performance.

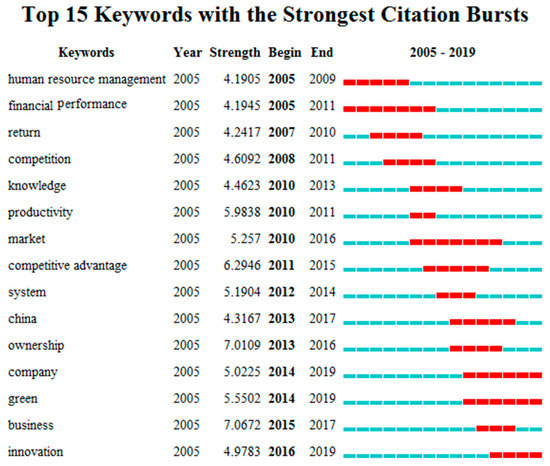

To further clarify the differences between domestic and foreign research, the analysis of emergence words, as shown in Figure 10, was carried out. Cite Space provides burst detection options, which can extract those terms from the literature to profile cutting-edge topics in the field. Based on this function of Cite Space, the emergence words in the field of financial performance were obtained. Keywords in the figure are sorted according to the year in which they appeared. The higher the strength, the greater the degree of emergence. The position and length of the red color block represents the highlighted interval of the keyword. Among the 15 emergence words, 11 appeared after 2010, which indicates the importance of the financial performance research; this is consistent with [44,45,46].

Figure 10.

Glossary of financial performance research highlights.

3.4.3. Theme Evolution Trend Based on Keywords

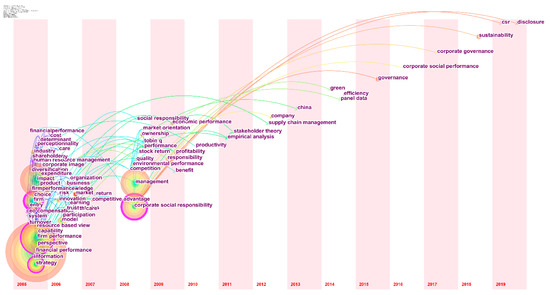

With the continuous development of financial performance research, different variables will appear at various times to improve it. Cite Space’s Time Zone View was used to construct the Time Zone distribution map of keywords in the form of time evolution (Figure 11) to explore the theme changes in the field of financial performance during the past 15 years. In the figure, years are plotted on the y-axis from 2005 to 2019, the time partition ‘Year per Slice’ is set to 1, and each node presents a keyword, which is placed in different time intervals according to the time when it appears. The node connections represent the co-occurrence between corresponding keywords.

Figure 11.

Time zone distribution map of financial performance research keywords.

Figure 11 presents the centrality and frequency of keywords, such as financial performance, enterprise performance, performance management, and corporate image, which were high at the beginning of the sample years. Corporate social responsibility, environmental performance, quality management, and other subjects began to appear on a large scale and became the mainstream of research from 2009 onward. Scholars began to pay attention to new models and recommend practices to improve financial performance through the theories empirically, emphasizing the existing and new methods (e.g., disclosure practices, environmental protections, and green finance), which opened up new ways to improve financial performance. Combined with the cluster map, we can surmise that environmental management factors, disclosure practices, corporate social responsibility, and financial performance quality management are the prominent factors that improve financial performance.

4. Conclusions

The objective of this paper was to conduct a comprehensive literature review based on a single keyword, i.e., financial performance. Unlike previous review studies of financial performance, this paper used a quantitative research design. Furthermore, this review paper employed three different methods to evaluate the progression of financial performance research. First, it applied a bibliometric research method to identify the individual impactful documents available in the literature of financial performance. Second, the paper employed a knowledge mapping technique to measure the relationship between corresponding connected concepts of financial performance through nodes and edges. Third, the paper used the co-occurrence method to present the relative probability of financial performance with other concepts. This review presents the financial performance literature based on 875 journal articles sorted from the Web of Science, ACM, and Scopus from 2005 to 2019. With the help of Cite Space and Ucinet software, this review highlighted the recent and future research trends in the field of financial performance and identified the most demanded connected nodes, including corporate social responsibility and the green and sustainable corporate environment.

Through the perspective of authors, journals, and keywords, this review highlighted the cutting-edge and evolving trends in the field of financial performance, that show a gradually increasing trend and tend to be mature. The degree of cooperation between scientific research institutions and scholars is not high, although the cooperation network is developing. The growing trends in the financial performance literature identified through yearly mapping present a recent development to measure performance in terms of: environmental and social practices [44,45,46] supply chain management practices [40] diverse board and shareholder value [31] effective corporate governance [35]. These findings provide a better understanding of the development of financial performance research for both researchers and practitioners.

It is also important to mention the limitations of this research and the remaining issues that need to be addressed in future research. Broadly, the remaining problems that require examination could also contribute to the literature. For example, this research examined the knowledge mapping of the financial research keywords only in terms of their relationships with other variables reported in the literature. Thus, more research is needed to explore the extent of these keywords that enhance financial performance in different ways, e.g., by extending the types of performance models, authors, co-authors, samples, yearly observations, and methods. In so doing, this and future research can help identify those factors that address the indirect links or attributes that improve financial performance.

Author Contributions

W.X. proposed the main research idea, detailed literature review, analysis of results through the employed software’s following conclusion and recommendations. H.L. acted in the supervisory role and reviewed the manuscript. R.A. contributed to the writing, editing, and revised the manuscript. R.U.R. contributed to the revised this manuscript. Lastly, thanks to anonymous reviewers whose useful suggestions added significant value in the document. All authors have read and agreed to the published version of the manuscript.

Funding

There is no external funding available for this research.

Acknowledgments

Authors would like to thank Youyuan Zheng from the School of Economics and Management for his assistance with the data analysis.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Taylor, F.W. The Principles of Scientific Management; Harper & Brothers: New York, NY, USA, 1911. [Google Scholar]

- Johnson, H.T. Management Accounting in an Early Integrated Industrial: E. I. duPont de Nemours Powder Company, 1903–1912. Bus. Hist. Rev. 1975, 49, 184–204. [Google Scholar] [CrossRef]

- Beaver, W.; Kettler, P.; Scholes, M. The association between market determined and accounting determined risk measures. Account. Rev. 1970, 45, 654–682. [Google Scholar]

- Vernon, J.M. Market Structure and Industrial Performance; Allyn and Bacon: Boston, MA, USA, 1972. [Google Scholar]

- Dalton, D.R.; Todor, W.D.; Spendolini, M.J.; Fielding, G.J.; Porter, L.W. Organization structure and performance: A critical review. Acad. Manag. Rev. 1980, 5, 49–64. [Google Scholar] [CrossRef]

- Capon, N.; Jhon, U.; Farley, J.M.H. Corporate Financial Performance and the Role of Envirnoment, Strategy, and Organization; Columbia University Working Paper; Columbia University: New York, NY, USA, 1987. [Google Scholar]

- Gale, B.T.; Branch, B.S. Concentration versus market share: Which determines performance and why does it matter. Antitrust Bull. 1982, 27, 83. [Google Scholar]

- Capon, N.; Farley, J.U.; Hoenig, S. Determinants of financial performance: A meta-analysis. Manag. Sci. 1990, 36, 1143–1159. [Google Scholar] [CrossRef]

- Chandler, A. The Continental Bank Middle Market Roundtable. J. Appl. Corp. Financ. 1991, 4, 6–29. [Google Scholar]

- Stern, J.M.; Stewart, G.B., III; Chew, D.H. The EVA® financial management system. J. Appl. Corp. Financ. 1995, 8, 32–46. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Using the Balanced Scorecard as a Strategic Management System; Harvard Business Review: Boston, MA, USA, 1996. [Google Scholar]

- Lenz, R.T. ‘Determinants’ of organizational performance: An interdisciplinary review. Strateg. Manag. J. 1981, 2, 131–154. [Google Scholar] [CrossRef]

- White, R.E.; Hamermesh, R.C. Toward a model of business unit performance: An integrative approach. Acad. Manag. Rev. 1981, 6, 213–223. [Google Scholar] [CrossRef]

- Arlow, P.; Gannon, M.J. Social responsiveness, corporate structure, and economic performance. Acad. Manag. Rev. 1982, 7, 235–241. [Google Scholar] [CrossRef]

- Venkatraman, N.; Ramanujam, V. Measurement of business performance in strategy research: A comparison of approaches. Acad. Manag. Rev. 1986, 11, 801–814. [Google Scholar] [CrossRef]

- Zahra, S.A.; Pearce, J.A. Boards of directors and corporate financial performance: A review and integrative model. J. Manag. 1989, 15, 291–334. [Google Scholar] [CrossRef]

- Orlitzky, M.; Benjamin, J.D. Corporate social performance and firm risk: A meta-analytic review. Bus. Soc. 2001, 40, 369–396. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. Misery loves companies: Rethinking social initiatives by business. Adm. Sci. Q. 2003, 48, 268–305. [Google Scholar] [CrossRef]

- Callan, S.J.; Thomas, J.M. Corporate financial performance and corporate social performance: An update and reinvestigation. Corp. Soc. Responsib. Environ. Manag. 2009, 16, 61–78. [Google Scholar] [CrossRef]

- Wang, Q.; Dou, J.; Jia, S. A meta-analytic review of corporate social responsibility and corporate financial performance: The moderating effect of contextual factors. Bus. Soc. 2016, 55, 1083–1121. [Google Scholar] [CrossRef]

- Otlet, P. Traité de Documentation: Le Livre Sur le Livre, Théorie et Pratique; Editiones Mundaneum: Bruxelles, Belgium, 1934. [Google Scholar]

- Pritchard, A. Statistical bibliography or bibliometrics. J. Doc. 1969, 25, 348–349. [Google Scholar]

- Chen, C. CiteSpace II: Detecting and visualizing emerging trends and transient patterns in scientific literature. J. Am. Soc. Inf. Sci. Technol. 2006, 57, 359–377. [Google Scholar] [CrossRef]

- Borgatti, S.P.; Everett, M.G.; Freeman, L.C. Ucinet for Windows: Software for social network analysis. Harvard MA Anal. Technol. 2002, 88. [Google Scholar]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strateg. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- Barnett, M.L.; Salomon, R.M. Does it pay to be really good? Addressing the shape of the relationship between social and financial performance. Strateg. Manag. J. 2012, 33, 1304–1320. [Google Scholar] [CrossRef]

- Inoue, Y.; Lee, S. Effects of different dimensions of corporate social responsibility on corporate financial performance in tourism-related industries. Tour. Manag. 2011, 32, 790–804. [Google Scholar] [CrossRef]

- Flammer, C. Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Manage. Sci. 2015, 61, 2549–2568. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Post, C.; Byron, K. Women on boards and firm financial performance: A meta-analysis. Acad. Manag. J. 2015, 58, 1546–1571. [Google Scholar] [CrossRef]

- Qiu, Y.; Shaukat, A.; Tharyan, R. Environmental and social disclosures: Link with corporate financial performance. Br. Account. Rev. 2016, 48, 102–116. [Google Scholar] [CrossRef]

- Lin, C.; Sanders, K.; Sun, J.; Shipton, H.; Mooi, E.A. From customer-oriented strategy to organizational financial performance: The role of human resource management and customer-linking capability. Br. J. Manag. 2016, 27, 21–37. [Google Scholar] [CrossRef]

- Herzallah, A.M.; Gutiérrez-Gutiérrez, L.; Munoz Rosas, J.F. Total quality management practices, competitive strategies and financial performance: The case of the Palestinian industrial SMEs. Total Qual. Manag. Bus. Excell. 2014, 25, 635–649. [Google Scholar] [CrossRef]

- Peng, C.-W.; Yang, M.-L. The effect of corporate social performance on financial performance: The moderating effect of ownership concentration. J. Bus. Ethics 2014, 123, 171–182. [Google Scholar] [CrossRef]

- Stewart, G. Supply-chain operations reference model (SCOR): The first cross-industry framework for integrated supply-chain management. Logist. Inf. Manag. 1997. [Google Scholar] [CrossRef]

- Pyke, D.; Johnson, M. Supply Chain Management: Integration and Globalization in the Age of eBusiness. SSRN Electron. J. 2001. [Google Scholar] [CrossRef]

- Huang, S.H.; Sheoran, S.K.; Keskar, H. Computer-assisted supply chain configuration based on supply chain operations reference (SCOR) model. Comput. Ind. Eng. 2005, 48, 377–394. [Google Scholar] [CrossRef]

- Flynn, B.; Wu, S.; Melnyk, S. Operational capabilities: Hidden in plain view. Bus. Horiz. 2010, 53, 247–256. [Google Scholar] [CrossRef]

- Torres, I.; Gutierrez Gutierrez, L.; Ruiz-Moreno, A. Boosting sustainability and financial performance: The role of supply chain controversies. Int. J. Prod. Res. 2018, 1–16. [Google Scholar] [CrossRef]

- Pomering, A.; Dolnicar, S. Assessing the Prerequisite of Successful CSR Implementation: Are Consumers Aware of CSR Initiatives? J. Bus. Ethics 2009, 85, 285–301. [Google Scholar] [CrossRef]

- Vanhamme, J.; Lindgreen, A.; Reast, J.; Popering, N. To Do Well by Doing Good: Improving Corporate Image Through Cause-Related Marketing. J. Bus. Ethics 2012, 109. [Google Scholar] [CrossRef]

- Heidary Dahooie, J.; Zavadskas, E.K.; Vanaki, A.S.; Firoozfar, H.R.; Lari, M.; Turskis, Z. A new evaluation model for corporate financial performance using integrated CCSD and FCM-ARAS approach. Econ. Res. Istraživanja 2019, 32, 1088–1113. [Google Scholar] [CrossRef]

- Miroshnychenko, I.; Barontini, R.; Testa, F. Green practices and financial performance: A global outlook. J. Clean. Prod. 2017, 147, 340–351. [Google Scholar] [CrossRef]

- Vu, M.-C.; Phan, T.; Le, N. Relationship between board ownership structure and firm financial performance in transitional economy: The Vietnamese transition. Res. Int. Bus. Financ. 2017, 45. [Google Scholar] [CrossRef]

- Liao, Z. Corporate culture, environmental innovation and financial performance. Bus. Strateg. Environ. 2018, 27. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).