Abstract

This study aims to review empirical research concerning the impact of green certificates on property cash flows and values, particularly from professional property investors’ perspective. The study uses discounted cash flows (DCF), a widely used property valuation method in income-generating properties, as a methodological framework. In this study, over 70 peer-reviewed studies were identified, categorized, and analyzed in the DCF framework. The reviewed studies indicated that certificates might increase the rental income and decrease the operating expenses, vacancy, and risks of a property. Together with the brand value of certificates, these enhancements should lead to an increase in property value. The number of studies has grown rapidly during the 2010s. Lately, studies have developed from asset-level to portfolio-level examinations. Although the reviewed studies found certification to be beneficial, the range of reported benefits was wide, and over half of the studies concentrated on U.S. commercial real estate markets, with a strong focus on LEED and ENERGY STAR certificates. From a property valuation perspective, applying these results to other markets and certificates might be challenging. Property values that fully reflect the environmental performance of properties would be a key to motivate mainstream investors to adopt sustainable property features.

1. Introduction

Urbanization is forecast to continue: in 2010, slightly over 50% of world’s population lived in urban areas, and by 2050, the corresponding figure is projected to be already over 66% [1]. Currently, cities and built environments use approximately 75% of generated energy and produce 60–70% of greenhouse gas emissions [2]. Buildings account for approximately 40% of energy use and carbon emissions [3]. At the same time, the real estate sector comprises approximately 60% of national, corporate, and individual wealth, totaling over $200 trillion [4]. Moreover, yearly construction-related global spending equals $10 trillion, corresponding approximately to 13% of GDP [5]. Thus, enhancing sustainability in built environments matters, and property investors can choose to make a change for the better by allocating assets to sustainable properties and enhancing the sustainability of their existing properties.

Property investors can show their engagement with the rules of sustainable development for instance by committing to responsible property investing (RPI). RPI, a part of responsible investment by the UN Environment Programme Finance Initiative [6], aims to minimize the societal and environmental impacts of investments while ensuring financial profitability [7]. One third of all assets (also other than properties) under management in Europe, the U.S., Canada, Japan, and Australia follows sustainable investment principles [8], which is currently a high priority item also on property investors’ agendas [9]. Furthermore, poor environmental performance is increasingly seen as an investment risk [10], which also encourages property investors to adopt sustainable building features. Besides acting responsibly, property investors are primarily interested in the financial performance of properties and the way in which sustainability can contribute to this, as they are in the business of securing income and capital appreciation. Accordingly, there is a growing number of studies researching the impact of sustainability enhancements on properties’ cash flows and values.

There are many reasons why property investors are interested in adopting sustainable investment principles in their investment strategies. The focus of this paper is mainly on the economic impacts of investing in enhanced sustainability. The enhanced sustainability of properties can be measured for instance by green building certificates and energy performance certificates (later referred to as green certificates). In this paper, sustainable properties are defined as properties that are certified by well-known and internationally widely-adopted green certificates used in commercial properties, such as LEED and BREEAM. As energy plays an important role in the sustainability of properties, also certificates that measure the energy efficiency of the buildings, such as ENERGY STAR and Energy Performance Certificate (EPC), were included in the current review. Some of the certificates focus on the environmental aspect of sustainability, while others consider also social and economic aspects. Certificates that measure for instance the healthiness of premises from tenants’ perspective or the sustainability of services and specific products used in the premises were excluded. Otherwise, there were no limitations regarding certificate types. In addition to asset-level studies that measure the sustainability of individual buildings, also portfolio-level examinations were included in the current review. Portfolio-level studies research the impact of sustainability on the financial performance of the portfolio. In addition to the number of green certificates in the assets of the portfolio, these portfolio-level studies use also other sustainability measures, such as environmental, social, and governance scores and different sustainability indices.

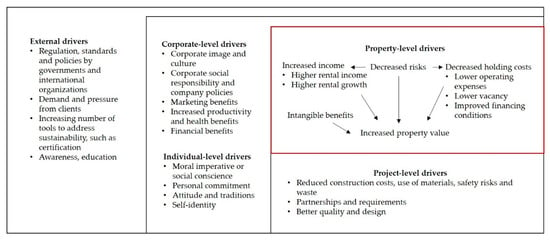

Figure 1 demonstrates the drivers that encourage sustainable building adoption [11,12]. The focus of this paper is on property-level economic drivers, which can be presented as components that form the cash flow of income-generating investment properties [12] and eventually the value of properties. Enhanced sustainability can increase the income and decrease the risks and operating costs of investment properties. These enhancements can lead to an increase in the value of the property, which is explained in more detail in the next section. In addition to property-level drivers, external drivers, corporate drivers, individual drivers, and project-level drivers influence sustainable building adoption [11]. These are not covered in detail in this paper, but are presented in order to provide a wider context for the study. External drivers, such as governmental regulations, policies, and incentives, international standards, and demand and pressure from clients, as well as rising awareness and the increase in the number of tools to implement sustainability have proven to be important drivers for companies to act sustainably (e.g., [13,14,15,16,17,18]). Sustainability is also a way to differentiate a company from competitors and enhance the corporate image [19]. As people are the ones making decisions within organizations, it is also important to understand what drives individuals to implement sustainable building practices in their projects and organizations [11,18].

Figure 1.

Drivers influencing sustainable building adoption according to Darko et al. [11] and Falkenbach et al. [12]. The focus of this paper is on property-level drivers, and especially on the parameters that form the cash flow and eventually the value of properties.

The purpose of this research is to review the existing empirical research on the impact of green certificates on property cash flows and values and categorize and analyze the findings of the reviewed studies from the perspective of the most important parameters that form the cash flows and eventually the value of properties. This study focuses particularly on professional real estate investors’ perspective in income-generating commercial investment properties, specifically on discounted cash flow (DCF) valuation, which is one of the most used property and investment valuation methods [20]. In DCF, the present value of a property is based on the sum of cash flows (rental income extracted by operating expenses and capital expenditure) and exit value, discounted to the present with a suitable discount rate [21]. In this study, the financial performance of properties is associated with changes in cash flow parameters or the value of properties. Previously, in 2017, Zhang et al. [22] conducted a green certificate review study, but that approached the matter from a building lifecycle perspective. Zhang et al. [22] concluded that better understanding of increased asset value would be central in understanding the financial implications of sustainable buildings (see Zhang et al. [22] and Figure 1). In this paper, the increased asset value aspect is examined in more detail. Falkenbach et al. [12] created a theoretical framework for sustainable building drivers from real estate investors’ perspective. To support their theoretical framework, the writers presented the research and industry reports published up until the date of their study. However, since 2010, the amount of research papers has increased extensively. The sustainable building driver framework was later extended by Darko et al. [11], but with a focus on recognizing sustainable building drivers on a general level. They did not break down the impact of property-level drivers at the same level of detail as this study.

According to the results of this study, green certificates likely benefit real estate investors financially. Most research papers found a positive relationship between green certificates and the cash flows and values of properties. In particular, studies consistently found rental, sale price, and occupancy premiums in certified buildings, spread across different markets, property types, and certificate types, as well as over time. However, results related to operating expenses were somewhat contradictory. Compared to the number of studies on certification benefits, the amount of research examining whether benefits outweigh the investments needed to achieve certification is limited. Besides extending geographical coverage, studies have developed from asset-level to portfolio-level examinations, especially with a growing interest in the performance and risk of listed sustainable real estate companies. The reviewed studies still heavily relied on U.S. real estate market data, and especially on LEED and ENERGY STAR certificates. Furthermore, the reported range of sustainable building benefits is rather wide, and in most real estate markets, the availability of data is limited. The results of the studies are therefore difficult to apply to other markets and certificate types. Thus, surveyors might, in practice, not be able to take fully into account sustainability investments in property valuations [23]. Market values that comprehensively reflect investments in sustainability would be an important motivator for real estate investors to “go green”. Accordingly, surveyors play an important role, either enabling or hindering sustainability investments.

The remainder of this paper is structured as follows: the methods and the framework according to which the review is conducted are presented in the next section. The third section describes the countries of origin, property types, certification types, and research approaches used in the reviewed studies. The fourth section presents the findings on the impact of green certificates on property values and cash flows. Lastly, the results are discussed.

2. Methods

This study was based on a systematic review of existing empirical academic research and conference proceedings on the financial benefits arising from adopting green certificates from the perspective of professional real estate investors. Industry reports were excluded, as only peer-reviewed research was included in this study. As this study focused on income-generating commercial investment properties, search results related to residential sector were excluded. Furthermore, other green building and energy efficiency or performance certificates were not included. The date range or geographical area of the selected studies was not limited in any way. Snowball sampling was used to collect the data for this study. The most cited studies formed the basis of the data collection. The search was performed using Google Scholar and Scopus. The following keywords were used in varying combinations:

- green certificate

- energy performance certificate

- sustainability

- property value: property value

- cash flow parameters: sales price, rent, vacancy, occupancy, capitalization rate, risk

- (green) premium

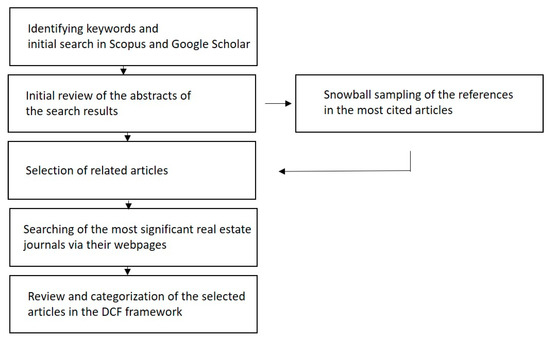

The references of the identified, relevant papers were examined to form a comprehensive picture of the relevant literature covering this topic. In addition to the snowball sampling, the most significant real estate research journals, such as Journal of Real Estate Finance and Economics, Journal of European Real Estate Research, Journal of Sustainable Real Estate, Journal of Real Estate Research, Journal of Real Estate Literature, and Journal of Portfolio Management, were searched via their webpages in order identify any relevant research that might have been missed by the initial snowball sampling. After filtering, 71 papers were selected to be included in the review. It is acknowledged that some relevant papers on this topic might not have been identified with the utilized methods. Figure 2 shows the process of identifying, selecting, and analyzing the studies that were included in the current review.

Figure 2.

The process of identifying, selecting, and analyzing the relevant articles that were included in the current review. DCF, discounted cash flow.

To provide a comprehensive view of the previous research that concerns the financial benefits of green certificates from the perspective of professional property investors, the review was conducted using a framework based on the parameters of DCF analysis. As explained before, DCF is one of the most widely used property valuation methods and is based on the discounted value of a property’s cash flows and exit value. In this paper, property valuation covered both investment and property valuation. Furthermore, directly considering and adjusting single valuation parameters is the most transparent method of taking (enhanced) sustainability into account in valuing properties [24]. The Royal Institution of Chartered Surveyors [25] also mentions that DCF might reflect sustainability issues faster than other property valuation methods and is the only way to consider value attributes that are not yet clearly evidenced in the markets, but might play an important role in the future.

The most important parameters forming the cash flow of a property are: rental income, rental growth, vacancy rate, operating and other expenses, capital expenditure, depreciation (physical deterioration and obsolescence [26]), and discount rate reflecting the relevant risks [21]. Inclusion or exclusion of inflation in the discount rate (in addition to yield) depends on the selection between nominal and real cash flows [27]. The adoption of certification might theoretically have the following effects on cash flow parameters [10,24,25,28]: an increase in rent levels and rental growth rates; a decrease in vacancy rates and operating expenses; and a decrease in risk (yields). Furthermore, the risk of obsolescence can be reduced by considering the growing future requirements of better environmental performance, including the ability to adapt and change [29,30]. These enhancements in cash flow parameters, together with the green signaling effect of certificates [31], should lead to better values and sales prices of properties. Each of the selected papers was analyzed and classified based on their empirical findings on the cash flow parameter impacts, methods, countries of origin (of the data), certification type, and property type.

3. Countries of Origin, Property Types, Certification Types, and Research Approaches of the Reviewed Studies

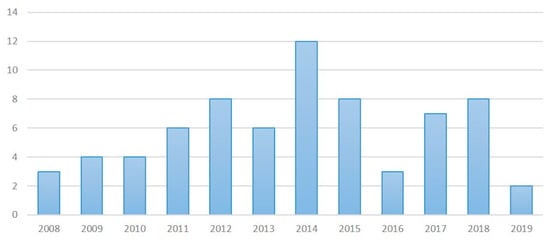

Most of the reviewed papers were published between 2012–2016, with a peak in 2014, as shown in Figure 3. The articles were published in a variety of journals from multiple fields. In Europe, the introduction of the energy performance of buildings directive (where EPCs are important instruments to enhance the energy performance of buildings) in 2002 and the revision in 2010 [32] likely increased the interest in the topic, the availability of data, and accordingly, the number of performed studies.

Figure 3.

Reviewed certificate publications by year (n = 71).

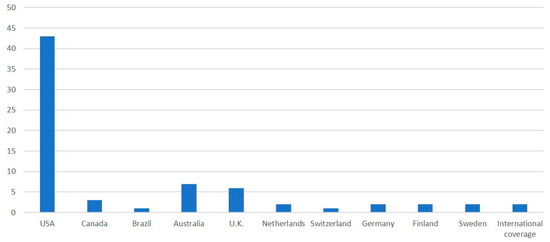

Although empirical studies on certification benefits have been geographically extended, most of the reviewed studies covered office markets in the U.S., typically relying on the CoStar database. Figure 4 shows the geographical distribution of the studies that were included in the current review study.

Figure 4.

Reviewed certificate publications by country (n = 71). International coverage means that a study covers several countries.

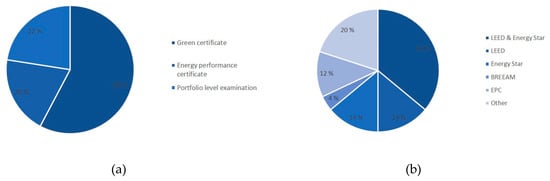

The reviewed studies mainly concerned green certificates (almost 60% of the published research), as Figure 5 shows. However, there was a growing number of studies examining the impact of energy performance certificates on property cash flows and values, as well as portfolio-level examinations, especially in listed real estate companies. In the portfolio-level examinations, sustainability was measured in several ways. Some of the studies used the number of green certificates as an indicator of sustainability, while some of the studies used environmental, social, and governance scores and different sustainability indices to measure the sustainability of the studied portfolios.

Figure 5.

Share of green certificate, energy efficiency, and portfolio-level examinations in the reviewed studies (n = 71) (a). Reviewed certificate publications by certificate type (n = 51) (b). EPC, Energy Performance Certificate.

Besides focusing on the U.S. markets, over 60% of the published research papers concerned LEED or ENERGY STAR certificates (or a combination of these) (Figure 5). This was mostly explained by the availability and quality of data. The CoStar database contained information on over five million properties in the U.S., Canada, and some countries in Europe [33]. The data included information on location, building type, and other attributes, as well as rental and sales information. The drawback with the majority of the existing research relying on the same data is that it may suffer from systematically biased results.

The vast majority of the certificate research was based on statistical analysis, namely hedonic regression developed by Rosen [34]. Rosen’s analytical framework was based on the assumption that any product or service is defined by certain characteristics, the contribution of which to the value of the product or service can be estimated, usually with the help of regression analysis. Although these certificate studies indicated a clear relationship between investments in sustainability and improved cash flows and values, it was challenging to apply the results of statistical analysis to individual properties due to the heterogeneity of assets. The results of regression analysis were strongly affected by the definition of comparable (non-certified) properties, as well as by how important property features (such as location, age, size, and building quality) were controlled. Furthermore, especially in small markets, an insufficient amount of comparable transactions limited the usability of statistical analysis. Therefore, it was also important to understand how sustainability should be taken into account in individual property valuations, which were often based on DCF. Applying the evidence found to green premiums required subjectively assessing how and to what extent the results of statistical analysis could be applied to each market, submarket, and individual property, especially when evaluating commercial properties. Despite the importance of understanding sustainability in the DCF context, empirical studies on this topic were very scarce. Vimpari and Junnila [35] and Christersson et al. [36] seemed to be the only practitioners that had explored in detail the value-influencing mechanism of green certificates and energy efficiency investments, respectively, in the discounted cash flow context.

4. The Impact of Certificates on the Financial Performance of Properties

Studies focusing on green certificates and energy efficiency labels indicated that green certificates had a positive impact on property cash flows and values in professionally managed income-generating commercial investment properties. With reference to the previously presented property-level drivers, Table 1 shows that properties with green certificates were reported to have higher rent levels and occupancy rates, as well as lower operating costs. Appendix A specifies the studies on which the figures of the table are based. Enhancements in these cash flow parameters, combined with decreased risk and the green signaling effect [31], led to the higher values (and better sales prices) of properties.

Table 1.

The effect of green certification on the cash flow parameters and sales prices of commercial investment properties. Appendix A specifies the studies on which the figures of the table are based.

4.1. Rental Premiums

Certified buildings have been reported to enjoy rental premiums varying between 0% and 23%, as Table 1 shows. Rent premiums act as an important market incentive for property developers and owners to invest in the better environmental performance of properties. The possibility to achieve higher rents encourages investors to develop green buildings, even if there might be a cost premium associated with the development of those buildings (e.g., [55]). Tenants’ willingness to pay higher rents in certified buildings is associated with improved productivity and other corporate-level benefits, as well as lower operating costs, if they are responsible for the operating expenses of leased premises [55,72,73]. The consideration of lease structures and inclusion of operating expenses affect the results of rent premium analysis, which is discussed in more detail later in this section and in Section 4.2.

Some studies found no statistically significant relationship between higher rents and certified assets [46,47,58]. Fuerst et al. [47] concluded that tenants might not be aware of the energy performance rating or energy efficiency was less relevant for them than for property owners, as the share of energy costs was rather small compared to a company’s other costs. They also mentioned that the small sample size could be an explanation for their study not finding a statistically significant relationship between energy performance and rents. Dixon et al. [46] explained their findings by the lack of financial salience and legal obligation (in Sydney, where the assets of their study were located).

Rental premiums have been shown to vary between market segments, as well as over time. Eichholtz et al. [55] found that rent premiums were higher in smaller or lower cost regions and less expensive parts of metropolitan areas. Robinson and McAllister [74] also observed that there were no rental premiums in (certified) high value buildings, whereas low and middle value buildings had premiums. They suggested that this might be due to the lower number of certificates in these segments compared to the high value segment. Having a certificate has become the norm in high-value buildings, and accordingly, it is no longer considered a differentiating factor in these buildings. Reichardt et al. [41] examined rent premiums between 2000 and 2010 and noted that rental premiums increased in ENERGY STAR properties between 2006 and 2008, but experienced a decline in 2008 due to the general economic downturn. They also found that the longer the building had been certified, the higher the rent premium in ENERGY STAR buildings. In LEED buildings, the relationship was reversed. The increasing supply of sustainable buildings was noted to decrease rent premiums over time [53,74,75]. Costa et al. [75] found that green certificates led to higher rental premiums in developing markets compared to more established markets, such as the U.S. and the U.K., potentially reflecting the relative scarcity of certificates and the lower sustainability standards in emerging economies. Oyedokun [76] claimed that, besides increasing the awareness of the benefits of sustainable properties, adopting a green building certification scheme would be the most important starting point for the development of markets for certified buildings in developing countries and measuring the green premium associated with certified buildings.

Do tenants pay for the certification itself or for other desirable building features? Some research has attempted to answer this question. Reichardt [42] found that savings in operating expenses explained approximately 50% of the rent premium. They suggested that the other half of the premium could be explained by intangible benefits such as increased employee productivity. Qiu et al. [17] also found that the rent premium was greater than the expected operating cost savings would indicate. Jang et al. [77] observed that certification increased a tenant’s willingness to rent, but higher certification scores did not lead to higher willingness. Robinson et al. [43] researched which sustainable building features tenants were most willing to pay for in their sample of almost 3000 leases in 300 buildings across the U.S. According to their results, tenants valued improved indoor air quality, access to natural light, and recycling possibilities most highly among the identified green features. The certification of buildings was ranked 14th out of 18 features. According to the results of Robinson et al. [78], access to public transportation, walking distance to services, access to natural light, premium HVAC systems, and electric car charging stations had significant independent rental premiums in their sample, which included almost 200 buildings and information on approximately 2250 leases. Karhu et al. [79] found similar indications in their study concerning the green preferences of commercial tenants in Helsinki, Finland. According to their results, location (in an environmental context) was ranked first, followed by energy efficiency and teleconferencing possibilities. Certification was ranked as the least important of the listed sustainable building features. Based on the reviewed studies, it seemed that tenants were willing to pay for desirable building features associated with sustainable buildings, not only certification itself. Furthermore, the potential decrease in operating expenses seemed not to be the only benefit of sustainable buildings that tenants appreciated. However, certification could be seen as an important differentiation factor, at least in other than high-value buildings, and the norm in high-value buildings.

The existing lease structure might affect tenants’ willingness to pay for green features [42,43,80,81]. In net lease structures, tenants are responsible for operating expenses in addition to base rent, which might motivate them to pay higher base rent due to possible savings in operating expenses. From the tenants’ point of view, it is the total amount of rent that matters. Reichhardt [42] found that LEED buildings with a gross lease structure had no significant rental premium, while LEED buildings with net lease structures enjoyed a rent premium of 8.6%. On the other hand, investors who are responsible for operating costs (in gross lease structures) might be more incentivized to invest in sustainability, as they directly benefit from the possible savings. Savings directly benefiting investors might also be easier to validate in the investment decision phase (and to verify afterwards) compared to possible rental premiums. In theory, investors are able to reduce rent levels due to savings in operating expenses in buildings with a gross lease structure, but it is questionable whether they would do so in reality. Regardless of the lease structure, investors will extract the same value from the property if the difference between gross and net rents equals the difference in operating expenses [42]. When researching historical statistics on rental premiums, lease structure matters. However, the current lease structure should not be used as an excuse, as it can (be agreed to) change over time. Green leases can serve as useful tools to share the benefits of sustainable buildings between owners and tenants [82]. The purpose of green leases is to enable tenants and landlords to agree (through the mechanisms of the lease) how to share the responsibilities and benefits that are related to enhancing the sustainability of the property and to work more co-operatively [83].

Reported rent premiums are often based on asset-level rents. Converting heterogeneous rent streams into one rent does not necessarily mean that there is a rent premium associated with the greenness of the property, but can be a result of factors such as the better market timing of some of the lease agreements. Asking rent has been a popular measure in rent premium studies (e.g., [37,55]), which does not necessarily indicate outcome, but rather expectations. Average rent has also been used as a dependent variable (e.g., [41]), but it does not cancel out the fact that some lease agreements have different market timing and rents might vary due to market conditions. Some studies use actual lease agreement data [46], which improves the reliability of the results.

4.2. Decreased Operating Expenses and Vacancy Rates

Compared to the number of studies concerning rental and sales price premiums, studies of operating expenses are relatively scarce and show contradictory findings. The impact of green certificates on properties’ operating expenses has been reported to vary between −14% and almost 30%, as Table 1 shows. Although certified buildings might save energy [64,84,85,86], lower energy costs are not necessarily a proof of lower total operating expenses [42,49,50]. Reichardt [42] examined the relationship between operating expenses and rents in ENERGY STAR and LEED certified buildings in the Central and Eastern U.S. He found that, in LEED certified buildings, operating costs were 5.40% lower than in non-certified buildings. Surprisingly, in ENERGY STAR buildings, operating costs were 3.90% higher than in non-certified buildings. Devine and Kok [54] reported similar results in their study using data from the U.S. and Canada. Szumilo [50] found that operating expenses were 11.2% higher in LEED or ENERGY STAR certified buildings in the four largest U.S. office markets. Interestingly, he observed that when the effect of energy cost savings was separated from the other studied coefficients, rent premiums in certified properties amounted to −3.4%. As the certification was associated with higher operating expenses, it was logical that the financial consequence was negative. However, considering other coefficients, they found a rent premium of 4.4%. He concluded that the main benefit of certification might not be related to reduced operating costs, but other benefits of certified buildings. Reichardt [42] also found that operating costs were 10.4% to 10.7% lower in buildings with net leases and claimed that tenants seemed to use space more efficiently when they were responsible for the costs.

There is some evidence of the impact of certificates on the occupancy rates of properties. Since certified buildings offer several benefits for tenants, justifiable reasons exist to expect that the occupancy rates of certified buildings should be higher than those of regular buildings. The findings of earlier research showed between 1% and 17% increased occupancy. Similarly to rental premiums, the positive impacts of green certificates on occupancy rates might not be uniform across all submarkets and assets. For instance, Fuerst and McAllister [63] observed that higher occupancy rates in ENERGY STAR buildings were statistically significant in the two worst performing deciles.

4.3. Decreased Risk

Decrease in initial yields (also known as capitalization rates), indicating lower risk, have been documented in asset-level empirical studies [40,47,65]. While the main focus of the empirical studies has been on the impact of certificates on rental income and sales prices, initial yield is an even more important determinant of properties’ capital value. Initial yields depend on capital markets, the risks associated with the property, local market conditions, and the investor’s expectations about market movements and the market position of the property [87]. While rental income and sales prices reflect a property’s current income and capital value, initial yield also takes into account these important expectations of its future market position, where sustainability might play an important role. Lower initial yield usually means lower investment risk, increased number of potential buyers, lower expected depreciation, and higher rental growth. Considering the vast amount of empirical literature on the determinants of initial yields (e.g., [27,88,89,90,91,92]), it is somewhat surprising that there has not been more empirical research on the relationship between sustainability and initial yields.

Szumilo and Fuerst [60] studied whether the rental and sales price premiums were due to improved efficiency or increased risk exposure. They hypothesized that sustainable properties attracted more occupant demand, which depended on market conditions, and increased exposure to market risk, while some part of the premiums were explained by improved efficiency, not increasing risk. They found support for both of these hypotheses. Certified properties seemed to enjoy a rental premium (which was, however, sensitive to market conditions and depended on the level of energy efficiency). The authors concluded that the overall effect of sustainability on risks was still positive.

Research into the relationship between risk and sustainability has been extended from the asset level to the corporate level, especially with growing interest in the performance of real estate investment trusts (REIT). Eicholtz et al. [93] found that REITs with a higher share of green properties had lower systematic risk (referred to as beta in portfolio theory), indicating that green portfolios were better protected against certain risks (such as rising energy prices and changing environmental legislation). Cajias and Bienert [94] found evidence of lower idiosyncratic risk in sustainable listed real estate companies in Europe. Geiger et al. [95] highlighted the benefits of sustainable real estate (from a portfolio theory point of view) for several investment strategies using data from the U.K.; sustainable real estate could be used to diversify overall portfolio risk in low-risk portfolios and could be used as the main allocated asset in higher risk portfolios. Geiger et al. [96] observed that sustainable real estate in the U.S. offered diversification benefits (especially in medium-risk portfolios), but noted that opportunistic investors were unlikely to add sustainable real estate to their portfolios. Newell [97] also highlighted the diversification benefits of sustainable REITs.

The lower risk of certified properties has also been studied through loan default rates. An and Pivo [98], in their study concerning commercial mortgage-backed security loans in the U.S., found that certified buildings had a 34% lower default risk than regular buildings. Furthermore, Kaza et al. [99] found that certified homes had significantly lower default and prepayment risks. Pivo [100] claimed that sustainable (measured not only by certification) residential properties had lower default risks than regular ones.

4.4. Other Benefits

In addition to asset-level benefits, portfolio-level benefits have been documented in earlier research. These studies did not limit their definition of sustainability to green certificates, but typically relied on multiple sustainability indices and scoring systems. Sustainable REITS have been proven to improve financial performance in the U.S. [93,101], Europe [102,103], Australia [97,104,105,106], Canada [107], and internationally [108,109]. However, the opposite results have also been found [110,111]. Interestingly, there is also some evidence that high sustainability ratings do not have a negative impact on returns. For instance, Cajias et al. [112] found that a negative sustainability rating had the strongest effect on company values; companies with a relatively high number of sustainability concerns seemed to have lower market values. Brounen and Marcato [113] also noted that sustainability premiums in REITs changed over time; negative coefficients were found in the early years of introducing sustainability consideration to markets, and positive coefficients were found in the most recent years. While REITs can benefit from sustainable investment through decreased operating expenses, enhanced reputation, and higher net cash flow, the market is only weak-form efficient, meaning that investors should be able to enjoy better risk-adjusted returns [114]. However, there is little research on risk-adjusted returns, with inconsistent results. For instance, Fuerst [108] found in an international study that REITs with higher green scores had higher asset and equity returns, while the stock market performance of REITs was not statistically as clear. However, when adjusted for risk, a positive relationship was found between stock market returns and better environmental performance. Westermann et al. [104] observed that REITs in Australia that were highly committed to sustainability seemed to provide investors with better risk-adjusted returns, while lower rated portfolios experienced increasingly poor risk-adjusted returns. In their later study, Westermann et al. [105] found that Australian green REITs seemed not to have better risk-adjusted returns, but that sustainability mitigated risks. However, they found that sustainable REITs might provide investors with better risk-adjusted returns during market downturns.

Besides financial indicators, Devine and Kok [54] documented intangible benefits such as a higher level of tenant satisfaction, a higher probability of renewing leases, and decreased tenant rent concessions in certified buildings compared to non-certified ones. These findings were consistent across both U.S. and Canadian data (including rental data and other information) from almost 300 buildings (2004–2013) provided by one of the largest asset management companies in North America. These intangible benefits ensured more stable cash flow and lower holding costs (and, accordingly, higher values for property investors). Furthermore, sustainable buildings produce lower carbon emissions and fewer negative social and environmental impacts [114]. In some markets, property investors might also enjoy tax benefits and other governmental incentives for going green [115]. Some studies found that sales processes are faster in certified buildings [116], while some did not [91]. Sustainable buildings might also benefit from better loan conditions [98,117,118], which also improves property investors’ net cash flow.

4.5. Sales Price Premium

Higher rents, lower vacancies and operating costs, lower risk, and other benefits should lead to increased sales prices in certified properties compared to regular ones. Several of the reviewed studies found evidence of sales price premiums that varied between 0% and 43% (as Table 1 indicates). Some studies found no statistically significant relationship between sustainability/energy efficiency and sales prices [45,47,58,71].

Compared to other premiums, the sales price premiums are rather large. This is probably due to the combined effects of the capitalized value of the enhanced cash flow parameters, the brand value of certificates, and lower capitalization rates (risk). For instance, Vimpari and Junnila [35] studied how cash flow parameters differed between certified and non-certified properties in the DCF context. The research was designed so that respondents representing different roles in the real estate industry (surveyors, investors, and developers) valued a hypothetical property located in a prime office area in the Helsinki metropolitan area, first without and then with a green certificate. All respondents used the same DCF model for both cases. It was found that all respondents valued the certified property higher than the non-certified property. The main reasons for the observed average value increase of 9% were improved net operating income and lower property yield. An alternative explanation for the sales premiums might be higher construction costs from meeting certification requirements [119].

The same question applies to sales price premiums as to rental premiums: What drives sales price premiums? Some research exists on the division between improved efficiency and the brand value of certificates. In their portfolio-level study, Eicholtz et al. [93] found that a greater share of certified properties in a portfolio positively correlated with better operating returns, but they did not evidence abnormal returns, indicating that the ability of green properties to provide investors with higher cash flows was fairly reflected in stock prices. However, some evidence has been found regarding the signaling power of green certificates. It is noteworthy that the evidence is from the residential sector that functions differently compared to the commercial property sector. Fuerst et al. [31] found that when capitalized energy cost savings were taken into account, a premium of 1.3% in sales price persisted in apartment transactions in Helsinki. Bond and Devine [120] studied comparable LEED certified and non-certified (but green) multifamily residential properties and found both to have rental premiums. Certified properties had an added 4% premium, suggesting that certifications had signaling power.

In the same way as rent premiums, sales price premiums have also been found to vary both between market segments and over time. Robinson and McAllister [74] found no sales price premiums in high-value buildings, whereas low- and medium-value buildings showed premiums. They concluded that this might be because, in high-value premium buildings, certification has already become the norm. Holtermans and Kok [39] noted that green premiums have changed over time. Although rents, sales prices, and occupancy rates have been higher in certified than in non-certified assets, they found that growth in those parameters has been higher in non-certified assets in the post-crisis period of 2009–2013. Moreover, they noted that, in LEED certified assets, the marginal of the certificate was higher in new buildings than in existing buildings, while in ENERGY STAR buildings, this trend was reversed.

4.6. Cost Versus Value of Certificates

In order for sustainability investments to be profitable, the aforementioned benefits must outweigh the costs. The evidence for this is very sparse. Dwaikat et al. [121] analyzed 17 empirical studies on sustainable building cost premiums and concluded that over 90% of cost premium results fell in the range of −0.4% to 21%. Based on their analysis of the empirical research, it is hard to say whether or not it costs more to build sustainable buildings. Some evidence supports the idea that sustainability can be achieved with very few (or no) additional costs. Kats et al. [122] found a cost premium of 1.8% for 33 LEED buildings in the U.S., stating at the same time that financial benefits during the lifecycle of the building were 10 times higher than investment costs. Later, Kats [123] estimated that sustainable building cost premiums ranged from 0% to 18%, with the majority (75%) of the cost premiums falling within 0%–4%. Matthiessen and Morrison [124] concluded that there was no statistical difference in the construction costs of LEED and conventional buildings when they compared 45 LEED buildings to 93 comparable conventional buildings in the U.S. In a later study, they confirmed these findings [125]. Rehm and Ade [126] compared the actual costs of 17 sustainable buildings in New Zealand to modelled construction costs of the same buildings and found no statistical difference.

Chegut et al. [119] were the first to use a large dataset to examine whether certified buildings were more expensive to build than non-certified ones. Their U.K. data sample comprised over 2000 observations. They found that sustainable building cost premiums were lower than the documented price premiums. The average cost premium amounted to 6.5% in the whole sample. The cost premiums were associated with buildings that achieved the highest rating scores (not those with good ratings or passing scores). They also noted that the cost premium was associated with the building, not with the building and land as the price premium in the earlier certificate studies. Although the costs seemed to be lower than sales price premiums, the adoption of sustainable buildings has not been as fast as expected. They also concluded that only higher design fees and building fittings and finishes seemed to correlate with the degree of sustainability of a building. Developers are those who need to pay for these higher design costs (averaging over 30%), usually using equity and in very early project stages. Furthermore, construction time seems to be longer in certified buildings, which means that sustainable building developers need to wait longer for the cash flow to turn positive.

5. Discussion

As buildings account for approximately 40% of energy usage and carbon emissions [3], the role of built environments in fighting climate change is indisputable. Accordingly, responsible investing is currently high on property investors’ agendas and is likely to become the norm in the near future. Besides acting responsibly, investors are primarily interested in the financial performance of properties. The aim of this study was to review empirical research concerning the impact of green certificates on the cash flows and values of income-generating investment properties, focusing on the perspective of professional real estate investors. Over 70 peer-reviewed studies were identified, categorized, and analyzed using the discounted cash flow framework. The effect of green certificates on different cash flow parameters (rents, operating expenses, vacancy rates, and yields) and eventually on property values was comprehensively analyzed and discussed.

While most of the earlier studies relied on data from the U.S. real estate market, there is a growing branch of research focusing on other markets. In the beginning, studies focused on sales and rental premiums in commercial assets in established markets, such as the U.S., Europe, and Australia. Later research activities were extended in terms of property type to cover residential properties, and geographically to cover countries located in Asia and in the smaller markets in Europe. Especially the increase in sales price premium studies in energy efficient residential properties has been rapid (see for instance a meta-analysis of 66 studies by Cespedes-Lopez et al. [127]). Analysis has also evolved from asset-level to portfolio-level, especially with a growing interest in listed real estate companies and REITs. In the portfolio-level studies, the definition of sustainability is not limited to green certificates, but is wider and typically uses different sustainability indices and sustainable scoring systems covering environmental, social, and governance aspects. Besides trying to determine whether certificates enhance the cash flow parameters of properties, scholars have investigated what portion of the premiums is associated with the improved efficiency of properties and what portion is associated with the brand value of certificates. There is also a growing interest in whether the reported certificate premiums are associated with certification itself or some desired sustainable features of properties. The effect of lease agreement structures (whether tenants are responsible for operating expenses or not) on certificate premiums has been widely discussed. The conclusion is that lease structures affect tenants’ willingness to pay for certifications and sustainable property features. However, property investors will extract the same value from the property if the difference between gross and net rents equals the difference in operating expenses, regardless of lease structure.

Based on the reviewed literature, sustainability is a significant success factor for real estate investors. Almost all the reviewed studies found that certification had positive effects on properties’ cash flows and values. The adoption of green certificates has been rapid, at least in the U.S. There are several studies examining the diffusion of green certificates and determinants of green building adoption (e.g., [39,128,129,130,131], but they were not covered in this review. For instance, Holtermans and Kok [39] observed that by 2014, almost 40% of the assets in the 30 largest U.S. office markets (measured by square feet) had been either LEED or ENERGY STAR certified. However, this is not the case in all property markets. There are several obstacles hindering the adoption of green certificates. First, while there is a broad consensus on the benefits of green certificates, the reported green premiums vary extensively, and compared to the number of green certificate benefit studies, the amount of research examining the cost effectiveness of the investments needed to achieve certification is limited. Second, each market actor blames others for their own lack of interest or investment in sustainability [10,132,133]. Lorenz [10] suggested that the vicious circle of blame must shift to a virtuous circle of positive feedback between investors, occupants, constructors, and developers, as well as certifiers, surveyors, advisors, researchers, educators, policy makers, banks, insurers, and owner associations. Third, pursuing and maintaining a certificate is costly and requires other resources, which makes the adoption of certificates possible for only a small share of properties. Fourth, certificates might not be equally valuable in all markets. For instance, in the Nordic countries, the quality of construction is high, and standards are tight even without certification. Thus, the information value of certificates might be lower than in some other markets, where the quality of construction varies more. Darko [134] and Matisoff et al. [115] also mentioned other possible obstacles to sustainable building adoption, such as lack of incentives, support, information, demand, regulation, and market failures.

There are some limitations in the reviewed research. Certified properties seem to be larger, taller (indicating a central location), constructed later, and of better quality than non-certified properties. For instance, Robinson and McAllister [74] observed that nearly 35% of properties with transaction prices over $60 million were certified, while the corresponding figure was only 2% for properties sold for under $26 million. As better buildings are more likely to be certified, the results of the reviewed studies were clearly biased. For instance, Olaussen et al. [135] studied apartment pricing before and after the introduction of energy performance certificates in Norway. They found that apartments that seemed to have a sales price premium associated with a better energy rating sold with a premium also before launching the energy certificate system in the market. Furthermore, other reviewed EPC studies found no relation between increased energy efficiency and sales prices [45,47,71]. Furthermore, the results of green premiums have varied widely according to model specifications and data. In real estate, finding comparable properties is difficult, as properties are heterogeneous. When employing statistical analysis, it matters how building attributes, quality, and location are controlled. Robinson and Sanderford [136] questioned the idea that sustainable buildings contain similar attributes to non-certified buildings. However, they found little evidence that building attributes are a good predictor for whether the property is certified or not. They concluded that their finding supported the view that green certificates generate premiums and the methods used by other researchers to determine the existence of green premiums are appropriate.

This study also has some limitations. First, it is possible that some relevant key words were inadvertently omitted in the initial search of relevant studies, and there was a risk that some of the relevant studies were therefore unintentionally excluded from this review. This risk was mitigated by using snowball sampling (i.e., the references of identified relevant studies worked as an important source of finding further studies) in addition to Scopus and Google Scholar searches. Second, the results of this review are applicable to income-generating commercial investment properties that are professionally managed, but there are limitations in the generalizability of the results. The results of the reviewed studies were clearly biased towards high-value properties, which are more likely to be certified than the rest of the building stock (certified properties are not a random sample of the entire building stock). Furthermore, the reviewed studies concerned specific property types, certificates, and markets, which limited the applicability of the results of the reviewed studies and this review, as well. As the majority of existing research focuses on the U.S. markets (and especially on LEED and ENERGY STAR certifications), different legislative requirements, varying quality of construction, and different market characteristics reduce the explanatory power of these studies for other markets and certificates. Furthermore, the range of premiums found was rather wide, making application of the findings for valuation purposes difficult.

There is a need to understand how surveyors consider the empirical findings of green premiums in practice, as investors are primarily interested in how their investments in sustainability are considered in the market values of properties. This is the key to motivating mainstream property investors to enhance the sustainability of their properties. There is evidence that surveyors are not fully reflecting sustainability investments in property valuations [23,133]. Accordingly, the obstacles to their work need to be understood and eased. Currently used valuation methods, and especially the definition of market value, exclude some key aspects of sustainability [10]: only direct monetary benefits affect the market value of a property. For instance, the intangible benefits of green certificates or carbon emission reductions, which might be important motivators for property investors, are usually ignored in valuations as their impacts are difficult to measure.

As sustainability becomes mainstream, it is not just a question of how much more valuable sustainable buildings are compared to regular buildings. Regular buildings are those that suffer from faster obsolescence and tightening regulations [24,25], which further increases the polarization between sustainable and non-sustainable assets. This means that sustainable properties will be even more valuable than currently. Thus, poor environmental performance should also be considered in various analyses and decision-making processes regarding properties. This is an important point for politicians as well. Wider consideration of sustainability issues for all properties, also by law, would increase the transparency of property markets. Furthermore, in many markets, there is a need for more detailed data and more systematic regulation for the gathering of sustainability information during the whole lifecycle of properties [137].

There are several avenues for future research. As most of the studies concerned the U.S. commercial market, further expanding the empirical evidence to other markets and certification types is necessary. As the majority of green premium research has been conducted in the early adoption years of green certificates, there is a need for continuous research to understand the growing (and perhaps changing) market dynamics. Future research could also attempt to further explain the premiums: Which parts of sales price premiums are explained by the capitalization of increased efficiency and other benefits, such as the brand value of the certificates? Furthermore, certification in existing buildings and green retrofits requires more attention. There is also a need to continue the work of Chegut et al. [120], who used a large dataset to study whether the benefits of green certification exceed the investments and costs needed to achieve the certification.

Author Contributions

As the first author, N.L. initiated the study, performed the analysis, and wrote the main body of the study. J.V. contributed to structuring the paper and provided advice on the research scope. S.J. supervised the study and provided advice on the conceptualization. All authors have read and agreed to the published version of the manuscript.

Funding

This study was funded by Aalto University’s Climapolis project funded by Business Finland [211694] and the Smart Land project funded by the Academy of Finland [13327800].

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Data resources of the effect of green certification on the cash flow parameters and sales prices of commercial investment properties.

Table A1.

Data resources of the effect of green certification on the cash flow parameters and sales prices of commercial investment properties.

| Research | Year | Country | Certificate Type | Rent Premium | Occupancy Premium | OPEX Effect | Sales Price Premium | Yield Effect |

|---|---|---|---|---|---|---|---|---|

| Bonde and Song [45] | 2013 | Sweden | EPC | 0.00% | ||||

| Chegut et al. [53] | 2014 | U.K. | BREEAM | 19.70% | 14.70% | |||

| Das and Wiley [68] | 2014 | USA | LEED | 16.40% | ||||

| Energy Star | 10.60% | |||||||

| Dermisi [69] | 2011 | USA | LEED | 23.00% | ||||

| Energy Star | 0.00% | |||||||

| Devine and Kok [54] | 2015 | USA | Energy Star | 3%–4% | 9.50% | 25.80% | ||

| USA | LEED | 10.20% | 4.00% | −14.30% | ||||

| Canada | Energy Star | 2.70% | ||||||

| Canada | LEED | 3.70% | 8.50% | −4.40% | ||||

| Dixon et al. [46] | 2014 | Australia | NABERS | 0.00% | ||||

| Eichholtz et al. [55] | 2010 | USA | Energy Star | 3.00% | 16.00% | |||

| LEED | 0.00% | 0.00% | ||||||

| Eichholtz et al. [56] | 2013 | USA | LEED | 7.90% | ||||

| Energy Star | 3.50% | 4.90% | ||||||

| LEED/Energy Star | 3.00% | 13.00% | ||||||

| Fuerst and McAllister [63] | 2009 | USA | LEED | 8.00% | ||||

| USA | Energy Star | 3.00% | ||||||

| Fuerst and McAllister [62] | 2009 | USA | LEED | 6.00% | 35.00% | |||

| USA | Energy Star | 6.00% | 31.00% | |||||

| Fuerst and McAllister [37] | 2011 | USA | LEED | 5.00% | 25.00% | |||

| Energy Star | 4.00% | 26.00% | ||||||

| Fuerst and McAllister [47] | 2011 | U.K. | EPC | 0.00% | 0.00% | |||

| Fuerst and van de Wetering [48] | 2013 | U.K. | EPC | 12.00% | ||||

| Fuerst and van de Wetering [52] | 2015 | U.K. | BREEAM | 23.00% | ||||

| Fuerst and McAllister [38] | 2011 | USA | Energy Star | 4.00% | 1.00% | 18.00% | ||

| LEED | 5.00% | 0.00% | 25.00% | |||||

| Energy Star + LEED | 9.00% | 28%-29% | ||||||

| Holtermans and Kok [39] | 2019 | USA | Energy Star | 1.50% | 6.20% | |||

| LEED | 1.90% | 15.50% | ||||||

| Energy Star + LEED | 3.40% | 20.10% | ||||||

| Kok and Jennen [138] | 2012 | Netherlands | EPC | 6.50% | ||||

| Kok et al. [51] | 2012 | USA | EBOM LEED | 7.00% | 2.00% | |||

| McGrath [65] | 2013 | USA | LEED + Energy Star | 0.36 bps | ||||

| Miller et al. [64] | 2008 | USA | LEED/Energy Star | 3.00% | 0.55 bps | |||

| Energy Star | 0.00% | 6.00% | ||||||

| LEED | 0.00% | 10.00% | ||||||

| Newell et al. [57] | 2014 | Australia | NABERS 5 star | 6.70% | 9.40% | |||

| Veld et al. [58] | 2014 | Netherlands | Dutch energy label | 0.00% | 0.00% | |||

| Ott and Hahn [59] | 2018 | Germany | Certified | 23.00% | 43.00% | |||

| Pivo [40] | 2008 | USA | Energy Star | 13.50% | ||||

| Pivo [49] | 2010 | Energy Star | 4.80% | 1.00% | −10.00% | 12.50% | ||

| Reichardt et al. [41] | 2012 | USA | Energy Star | 2.50% | 4.50% | |||

| USA | LEED | 2.90% | ||||||

| Reichardt [42] | 2014 | USA | Energy Star | 3.10% | 3.90% | |||

| USA | LEED | 7.00% | −5.40% | |||||

| Energy Star + LEED | 10.20% | |||||||

| Robinson et al. [43] | 2016 | USA | - | 9.30% | ||||

| Surmann et al. [71] | 2015 | Germany | EPC | 0.00% | ||||

| Szumilo and Fuerst [60] | 2017 | USA | Energy Star | 0.60% | ||||

| Szumilo [50] | 2014 | USA | Energy Star + LEED | 4.41% | 11.20% | |||

| Wiley et al. [44] | 2010 | USA | LEED | 15.2%–17.3% | 16.2%–17.9% | |||

| Energy Star | 7.3 %–8.9% | 10.2%–11% | ||||||

| Wiencke [61] | 2014 | Switzerland | 3.0% | 4.75% |

References

- UN. The Population Division of the Department of Economic and Social Affairs of the United Nations: 2018 Revision of World Urbanization Prospects. 2018. Available online: https://population.un.org/wup/ (accessed on 25 November 2019).

- Kammen, D.M.; Sunter, D.A. City-Integrated Renewable Energy for Urban Sustainability. Science 2016, 352, 922–928. [Google Scholar] [CrossRef] [PubMed]

- IEA. Towards a Zero-Emission, Efficient and Resilient Buildings and Construction Sector; 2018 Global Status Report; World Green Building Council: London, UK, 2018. [Google Scholar]

- Savills. Around the World in Dollars and Cents; Savills: London, UK, 2016. [Google Scholar]

- McKinsey Global Institute. Reinvesting Construction: A Route to Higher Productivity. 2017. Available online: https://www.mckinsey.com/~/media/McKinsey/Industries/Capital%20Projects%20and%20Infrastructure/Our%20Insights/Reinventing%20construction%20through%20a%20productivity%20revolution/MGI-Reinventing-Construction-Executive-summary.ashx (accessed on 25 November 2019).

- UN Environment Programme Finance Initiative. Responsible Property Investment. 2019. Available online: https://www.unepfi.org/investment/property/ (accessed on 25 November 2019).

- Pivo, G.; McNamara, P. Responsible Property Investing. Int. Real Estate Rev. 2005, 8, 128–143. [Google Scholar]

- Global Sustainable Investment Alliance. Global Sustainable Investment Review. 2018. Available online: https://www.ussif.org/files/GSIR_Review2018F(1).pdf (accessed on 25 November 2019).

- UN Environment Programme Finance Initiative. Responsible Property Investing: What the Leaders Are Doing? 2012. Available online: https://www.unepfi.org/fileadmin/documents/Responsible_Property_Investment_2_01.pdf (accessed on 28 March 2020).

- Lorenz, D.; Lützkendorf, T. Sustainability in Property Valuation: Theory and Practice. J. Prop. Invest. Financ. 2008, 26, 482–521. [Google Scholar] [CrossRef]

- Darko, A.; Zhang, C.; Chan, A.P.C. Drivers for Green Building: A Review of Empirical Studies. Habitat Int. 2017, 60, 34–49. [Google Scholar] [CrossRef]

- Falkenbach, H.; Lindholm, A.; Schleich, H. Review Articles: Environmental Sustainability: Drivers for the Real Estate Investor. J. Real Estate Lit. 2010, 18, 201–223. [Google Scholar]

- Sayce, S.; Ellison, L.; Parnell, P. Understanding Investment Drivers for UK Sustainable Property. Build. Res. Inf. 2007, 35, 629–643. [Google Scholar] [CrossRef]

- De Francesco, A.J.; Levy, D. The Impact of Sustainability on the Investment Environment. J. Eur. Real Estate Res. 2008, 1, 72–87. [Google Scholar] [CrossRef]

- Nousiainen, M.; Junnila, S. End-user Requirements for Green Facility Management. Facil. Manag. 2008, 6, 266–278. [Google Scholar] [CrossRef]

- Brown, N.; Malmqvist, T.; Wintzell, H. Owner Organizations’ Value-Creation Strategies through Environmental Certification of Buildings. Build. Res. Inf. 2016, 44, 863–874. [Google Scholar] [CrossRef]

- Qiu, Y.; Su, X.; Wang, Y.D. Factors Influencing Commercial Buildings to Obtain Green Certificates. Appl. Econ. 2017, 49, 1937–1949. [Google Scholar] [CrossRef]

- Braun, T.; Cajias, M.; Hohenstatt, R. Societal Influence on Diffusion of Green Buildings: A Count Regression Approach. J. Real Estate Res. 2017, 39, 1–37. [Google Scholar]

- Andelin, M.; Sarasoja, A.; Ventovuori, T.; Junnila, S. Breaking the Circle of Blame for Sustainable Buildings–Evidence from Nordic Countries. J. Corp. Real Estate 2015, 17, 26–45. [Google Scholar] [CrossRef]

- IPD Norden and KTI. Property valuation in the Nordic Countries. Written by IPD Norden and KTI Property Information (Finland) with Co-Operation in Royal Institution of Chartered Surveyors. 2012. Available online: https://kti.fi/en/property-valuation-in-the-nordic-countries/ (accessed on 23 November 2019).

- RICS. Discounted Cash Flow for Commercial Property Investments. RICS Guidance Note. 2010. Available online: https://www.rics.org/globalassets/rics-website/media/upholding-professional-standards/sector-standards/valuation/discounted-cash-flow-for-commercial-property-investments-1st-edition-rics.pdf (accessed on 1 October 2019).

- Zhang, L.; Wu, J.; Liu, H. Turning Green into Gold: A Review on the Economics of Green Buildings. J. Clean. Prod. 2018, 172, 2234–2245. [Google Scholar] [CrossRef]

- Warren-Myers, G. Is the Valuer the Barrier to Identifying the Value of Sustainability? J. Prop. Invest. Financ. 2013, 31, 345–359. [Google Scholar] [CrossRef]

- Lorenz, D.; Lützkendorf, T. Sustainability and Property Valuation: Systematisation of Existing Approaches and Recommendations for Future Action. J. Prop. Invest. Financ. 2011, 29, 644–676. [Google Scholar] [CrossRef]

- RICS. Sustainability and Commercial Property Valuation. Available online: http://jgoddardco.com/assets/rics-sustainability---the-valuation-of-commercial-property.pdf (accessed on 25 September 2019).

- Hoesli, M.; MacGregor, B.D. Property Investment; Pearson Education Limited: London, UK, 2000. [Google Scholar]

- Baum, A.E.; MacGregor, B.D. The Initial Yield Revealed: Explicit Valuations and the Future of Property Investment. J. Prop. Valuat. Invest. 1992, 10, 709–726. [Google Scholar] [CrossRef]

- Lützkendorf, T.; Lorenz, D. Sustainable Property Investment: Valuing Sustainable Buildings through Property Performance Assessment. Build. Res. Inf. 2005, 33, 212–234. [Google Scholar] [CrossRef]

- British Council of Offices. Change for the Good- Identifying Opportunities from Obsolescence. 2012. Available online: http://www.bco.org.uk/Research/Publications/Changefor2561.aspx (accessed on 2 February 2020).

- British Council of Offices. Mitigating Office Obsolescence: The Agile Future. 2017. Available online: http://www.bco.org.uk/Research/Publications/Mitigating_Office_Obsolescence.aspx (accessed on 2 February 2020).

- Fuerst, F.; Oikarinen, E.; Harjunen, O. Green Signalling Effects in the Market for Energy-Efficient Residential Buildings. Appl. Energy 2016, 180, 560–571. [Google Scholar] [CrossRef]

- Arcipowska, A.; Anagnostopoulos, F.; Mariottini, F.; Kunkel, S. Energy Performance Certificates across the EU; BPIE: Brussels, Belgium, 2014. [Google Scholar]

- CoStar. CoStar Webpages. 2019. Available online: https://www.costar.com/ (accessed on 12 November 2019).

- Rosen, S. Hedonic Prices and Implicit Markets: Product Differentiation in Pure Competition. J. Political Econ. 1974, 82, 34–55. [Google Scholar] [CrossRef]

- Vimpari, J.; Junnila, S. Value Influencing Mechanism of Green Certificates in the Discounted Cash Flow Valuation. Int. J. Strateg. Prop. Manag. 2014, 18, 238–252. [Google Scholar] [CrossRef]

- Christersson, M.; Vimpari, J.; Junnila, S. Assessment of Financial Potential of Real Estate Energy Efficiency investments–A Discounted Cash Flow Approach. Sustain. Cities Soc. 2015, 18, 66–73. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P. Green Noise or Green Value? Measuring the Effects of Environmental Certification on Office Values. Real Estate Econ. 2011, 39, 45. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P. Eco-Labeling in Commercial Office Markets: Do LEED and Energy Star Offices Obtain Multiple Premiums? Ecol. Econ. 2011, 70, 1220–1230. [Google Scholar] [CrossRef]

- Holtermans, R.; Kok, N. On the Value of Environmental Certification in the Commercial Real Estate Market. Real Estate Econ. 2019, 47, 685–722. [Google Scholar] [CrossRef]

- Pivo, G.; Fisher, J. Investment Returns from Responsible Property Investments: Energy efficient, Transit-Oriented and Urban Regeneration Office Properties in the U.S. from 1998–2007. 2008. Available online: http://reconnectingamerica.org/assets/Uploads/2008pivofisher.pdfa (accessed on 2 September 2019).

- Reichardt, A.; Fuerst, F.; Rottke, N.; Zietz, J. Sustainable Building Certification and the Rent Premium: A Panel Data Approach. J. Real Estate Res. 2012, 34, 99–126. [Google Scholar]

- Reichardt, A. Operating Expenses and the Rent Premium of Energy Star and LEED Certified Buildings in the Central and Eastern U.S. J. Real Estate Financ. Econ. 2014, 49, 413–433. [Google Scholar] [CrossRef]

- Robinson, S.; Simons, R.; Lee, E.; Kern, A. Demand for Green Buildings: Office Tenants’ Stated Willingness-to-Pay for Green Features. J. Real Estate Res. 2016, 38, 423–452. [Google Scholar]

- Wiley, J.; Benefield, J.; Johnson, K. Green Design and the Market for Commercial Office Space. J. Real Estate Financ. Econ. 2010, 41, 228–243. [Google Scholar] [CrossRef]

- Bonde, M.; Song, H. Is Energy Performance Capitalized in Office Building Appraisals? Prop. Manag. 2013, 31, 200–215. [Google Scholar] [CrossRef]

- Dixon, T.; Bright, S.; Mallaburn, P.; Gabe, J.; Regm, M. Do Tenants Pay Energy Efficiency Rent Premiums? J. Prop. Invest. Financ. 2014, 32, 333–351. [Google Scholar]

- Fuerst, F.; McAllister, P. The Impact of Energy Performance Certificates on the Rental and Capital Values of Commercial Property Assets. Energy Policy 2011, 39, 6608–6614. [Google Scholar] [CrossRef]

- Fuerst, F.; van der Wetering, J.; Wyatt, P. Is Intrinsic Energy Efficiency Reflected in the Pricing of Office Leases? Build. Res. Inf. 2013, 41, 373–383. [Google Scholar] [CrossRef]

- Pivo, G.; Fisher, J. Income, Value, and Returns in Socially Responsible Office Properties. J. Eur. Real Estate Res. 2010, 32, 243–270. [Google Scholar]

- Szumilo, N.; Fuerst, F. The Operating Expense Puzzle of U.S. Green Office Buildings. J. Sustain. Real Estate 2014, 5, 86–110. [Google Scholar]

- Kok, N.; Miller, N.; Morris, P. The Economics of Green Retrofits. J. Sustain. Real Estate 2012, 4, 4–22. [Google Scholar]

- Fuerst, F.; Van de Wetering, J. How does Environmental Efficiency Impact on the Rents of Commercial Offices in the UK? J. Prop. Res. 2015, 32, 193–216. [Google Scholar] [CrossRef]

- Chegut, A.; Eichholtz, P.; Kok, N. Supply, Demand and the Value of Green Buildings. Urban Stud. 2014, 51, 22–43. [Google Scholar] [CrossRef]

- Devine, A.; Kok, N. Green Certification and Building Performance: Implications for Tangibles and Intangibles. J. Portf. Manag. Spec. Real Estate Issue 2015, 41, 151–163. [Google Scholar]

- Eichholtz, P.; Kok, N.; Quigley, J.M. Doing Well by Doing Good? Green Office Buildings. Am. Econ. Rev. 2010, 100, 2492–2509. [Google Scholar] [CrossRef]

- Eichholtz, P.; Kok, N.; Quigley, J.M. The Economics of Green Building. Rev. Econ. Stat. 2013, 95, 50–63. [Google Scholar] [CrossRef]

- Dixon, T.; Bright, S.; Mallaburn, P.; Newell, G.; MacFarlane, J.; Walker, R. Assessing Energy Rating Premiums in the Performance of Green Office Buildings in Australia. J. Prop. Invest. Financ. 2014, 32, 352–370. [Google Scholar]

- Veld, H.O.; Vlasveld, M. The Effect of Sustainability on Retail Values, Rents, and Investment Performance: European Evidence. J. Sustain. Real Estate 2014, 6, 163–185. [Google Scholar]

- Ott, C.; Hahn, J. Green Pay Off in Commercial Real Estate in Germany: Assessing the Role of Super Trophy Status. J. Prop. Invest. Financ. 2018, 36, 104–124. [Google Scholar] [CrossRef]

- Szumilo, N.; Fuerst, F. Income Risk in Energy Efficient Office Buildings. Sustain. Cities Soc. 2017, 34, 309–320. [Google Scholar] [CrossRef]

- Wiencke, A. Willingness to Pay for Green Buildings: Empirical Evidence from Switzerland. J. Sustain. Real Estate 2014, 5, 111–130. [Google Scholar] [CrossRef]

- Fuerst, F.; McAllister, P. New Evidence on the Green Building Rent and Price Premium. 2009. Available online: http://centaur.reading.ac.uk/19816/ (accessed on 15 September 2019).

- Fuerst, F.; McAllister, P. An Investigation of the Effect of Eco-Labeling on Office Occupancy Rates. 2009. Available online: http://centaur.reading.ac.uk/27001/1/0809.pdf (accessed on 15 September 2019).

- Miller, N.; Spivey, J.; Florance, A. Does Green Pay Off? J. Real Estate Portf. Manag. 2008, 14, 385–400. [Google Scholar]

- McGrath, K.M. The Effects of Eco-Certification on Office Properties: A Cap Rates-Based Analysis. J. Prop. Res. 2013, 30, 345–365. [Google Scholar] [CrossRef]

- Cajias, M.; Piazolo, D. Green Performs Better: Energy Efficiency and Financial Return on Buildings. J. Corp. Real Estate 2013, 15, 53–72. [Google Scholar] [CrossRef]

- Dermisi, S. Effect of LEED Ratings and Levels on Office Property Assessed and Market Values. Sustain. Real Estate 2009, 1, 23–47. [Google Scholar]

- Das, P.; Wiley, J.A. Determinants of Premia for Energy-Efficient Design in the Office Market. J. Prop. Res. 2014, 31, 64–86. [Google Scholar] [CrossRef]

- Dermisi, S.; McDonald, J. Effect of “Green” (LEED and ENERGY STAR) Designation on Prices/Sf and Transaction Frequency: The Chicago Office Market. J. Real Estate Portf. Manag. 2011, 17, 39–52. [Google Scholar]

- Bonde, M.; Song, H.S. Does Greater Energy Performance have an Impact on Real Estate Revenues? J. Sustain. Real Estate 2014, 5, 171–182. [Google Scholar]

- Surmann, M.; Brunauer, W.; Bienert, S. How does Energy Efficiency Influence the Market Value of Office Buildings in Germany and does this Effect Increase Over Time? J. Eur. Real Estate Res. 2015, 8, 243–266. [Google Scholar] [CrossRef]

- Newsham, G.R.; Veitch, J.A.; Hu, Y. Effect of Green Building Certification on Organizational Productivity Metrics. Build. Res. Inf. 2018, 46, 755–766. [Google Scholar] [CrossRef]

- Livingstone, N.; Ferm, J. Occupier Responses to Sustainable Real Estate: What’s Next? J. Corp. Real Estate 2017, 19, 5–16. [Google Scholar] [CrossRef]

- Robinson, S.; McAllister, P. Heterogeneous Price Premiums in Sustainable Real Estate? an Investigation of the Relation between Value and Price Premiums. J. Sustain. Real Estate 2015, 7, 1–20. [Google Scholar]

- Costa, O.; Fuerst, F.; Spenser, J. Robinson and Wesley Mendes-Da-Silva Are Green Labels More Valuable in Emerging Real Estate Markets? 2017. Available online: https://ssrn.com/abstract=2982381 (accessed on 2 November 2019).

- Oyedokun, T.B. Green Premium as a Driver of Green-Labelled Commercial Buildings in the Developing Countries: Lessons from the UK and US. Int. J. Sustain. Built Environ. 2017, 6, 723–733. [Google Scholar] [CrossRef]

- Jang, D.; Kim, B.; Kim, S.H. The Effect of Green Building Certification on Potential Tenants’ Willingness to Rent Space in a Building. J. Clean. Prod. 2018, 194, 645–655. [Google Scholar] [CrossRef]

- Robinson, S.; Simons, R.; Lee, E. Which Green Office Building Features do Tenants Pay for? A Study of Observed Rental Effects. J. Real Estate Res. 2017, 39, 467–492. [Google Scholar]

- Karhu, J.; Laitala, A.; Falkenbach, H.; Sarasoja, A. The Green Preferences of Commercial Tenants in Helsinki. J. Corp. Real Estate 2012, 14, 50–62. [Google Scholar] [CrossRef]

- Liu, C.; Liu, P. Is What’s Bad for the Goose (Tenant), Bad for the Gander (Landlord)? A Retail Real Estate Perspective. J. Real Estate Res. 2013, 35, 1–17. [Google Scholar]

- Szumilo, N.; Fuerst, F. Who Captures the “green Value” in the US Office Market? J. Sustain. Financ. Invest. 2015, 5, 65–84. [Google Scholar] [CrossRef]

- Ratcliffe, J.; Stubbs, M.; Keeping, M. Sustainability and property development. In Urban Planning and Real Estate Development, 3rd ed.; Anonymous, Ed.; Routledge: New York, NY, USA, 2009; p. 299. [Google Scholar]

- Janda, K.B.; Bright, S.; Patrick, J.; Wilkinson, S.; Dixon, T.J. The Evolution of Green Leases: Towards Inter-Organizational Environmental Governance. Build. Res. Inf. 2016, 44, 660–674. [Google Scholar] [CrossRef]

- Amiri, A.; Ottelin, J.; Sorvari, J. Are LEED-Certified Buildings Energy-Efficient in Practice? Sustainability 2019, 11, 1672. [Google Scholar] [CrossRef]

- Newsham, G.R.; Mancini, S.; Birt, B.J. Do LEED-Certified Buildings Save Energy? Yes, but…. Energy Build. 2009, 41, 897–905. [Google Scholar] [CrossRef]

- Turner, C.; Frankel, M. Energy Performance Og LEED for New Construction Buildings. NBI New Build. Inst. 2008, 4, 1–42. [Google Scholar]

- Chaney, A.; Hoesli, M.E.R. Transaction-Based and Appraisal-Based Capitalization Rate Determinants. Int. Real Estate Rev. 2015, 18, 1–43. [Google Scholar] [CrossRef]

- McAllister, P.; Nanda, A. Does Foreign Investment Affect U.S. Office Real Estate Prices? J. Portf. Manag. 2015, 41, 38–47. [Google Scholar] [CrossRef]

- Sivitanidou, R.; Sivitanides, P. Office Capitalization Rates: Real Estate and Capital Market Influences. J. Real Estate Financ. Econ. 1999, 18, 297–322. [Google Scholar] [CrossRef]

- Chervachidze, S.; Wheaton, W. What Determined the Great Cap Rate Compression of 2000–2007, and the Dramatic Reversal during the 2008–2009 Financial Crisis? J. Real Estate Financ. Econ. 2013, 46, 208–231. [Google Scholar] [CrossRef]

- Oikarinen, E.; Falkenbach, H. Foreign Investors’ Influence on the Real Estate Market Capitalization Rate -Evidence Form a Small Open Economy. Appl. Econ. 2017, 49, 3141–3155. [Google Scholar] [CrossRef]

- Sivitanides, P.; Southard, J.; Torto, R.; Wheaton, W. The Determinants of Appraisal Based Capitalization Rates. Real Estate Financ. 2001, 18, 27–37. [Google Scholar]

- Eichholtz, P.; Kok, N.; Yonder, E. Portfolio Greenness and the Financial Performance of REITs. J. Int. Money Financ. 2012, 31, 1911–1929. [Google Scholar] [CrossRef]

- Cajias, M.; Bienert, S. Does Sustainability Pay Off for European Listed Real Estate Companies? the Dynamics between Risk and Provision of Responsible Information. J. Sustain. Real Estate 2011, 3, 211–231. [Google Scholar] [CrossRef]

- Geiger, P.; Cajias, M.; Bienert, S. The Asset Allocation of Sustainable Real Estate: A Chance for a Green Contribution? J. Corp. Real Estate 2013, 15, 73–91. [Google Scholar] [CrossRef]