Abstract

In the present research the financial convenience of refurbishment investments concerning residential properties located in the Italian territory was analyzed. The study aimed at determining the unit profit range for a potential investor deriving from the refurbishment of residential properties and contextualizing the analysis to the Italian provincial capitals. With reference to the three macro-areas that for geographic and socio-economic differences define the Italian territory, namely the North, Center, South and Islands, three financial convenience maps were elaborated with the aim of providing a useful support in the investment choices of private and public operators. In particular, the financial convenience maps could guide the private operators in their investment decisions through a higher awareness of the achievable earnings and could help to identify the optimal allocation of financial resources due to the increase in the market value of the refurbished property. For the public administrations, instead, the study will be a useful reference for the calibration of the fiscal policy decisions regarding the incentives for building refurbishment at the different territorial scales and of the tax revenues related to the increase in the market value of the refurbished properties.

1. Introduction

The issue of building redevelopment concerns the need for renovation and securing of the existing property stock, both physical and functional, due to the building age, the widespread lack of maintenance, the energy dispersion and the high consumption. With reference to goal number 11 defined by 2030 Agenda for Sustainable Development (“Make cities and human settlements inclusive, safe, resilient and sustainable”) [1], the recovery and regeneration initiatives in the urban environment, in contrast to new construction, would make it possible to achieve a better livability level of the cities. Furthermore, with reference to climate change problems, the improvement of the energy performance of buildings plays a significant role, linking to different sustainability goals, such as the overcoming of traditional and polluting production energy sources, the development of renewable sources, the positive effects for the communities related to possible savings and the growth of the local economy.

In the Italian context, during recent years, investments aimed at redeveloping the existing housing stock have been the main driver of the national construction sector, representing 38% of the total value of the investments [2].

In general terms, between 2007—the year of the beginning of the global economic crisis generated by the American subprime mortgages—and 2017, the value of the production in the construction sector decreased by 11.9%; new buildings recorded a dramatic contraction of 51.3%, whereas the building redevelopment activity grew by 12.4%. As regards the residential market, new constructions recorded a significant contraction in investments equal to 64.4%, whereas the extraordinary maintenance on the existing property stock increased by 25.9% [3]. New construction constitutes 15% of the transactions that occurred in 2017, whereas the sales of refurbished apartments were 346,000, representing 61.8% of the total sales, with an increase of 0.9% from 2016 [2].

In 2017, out of the total of 560,000 transactions that occurred, 130,000 residential properties (23.2% of the total) were affected by a refurbishment process, with an increase of 36.8% compared to 2016. Furthermore, the data highlighted the importance attributed by the buyers to the residential properties to be restructured. The main reasons for the implementation of refurbishment work on a residential property are linked to i) the improvement of the living conditions of the users, ii) the possibility to take advantage of specific tax deductions, iii) the increase in the value of the refurbished property up to 30–35% compared to the ones to be restructured [4]. Moreover, the possibility of a discount on the selling price due to the cost of future refurbishment, the increase in the value of the capital invested following the refurbishment and the opportunity to customize the property itself are some of the factors that induce buyers to prefer the purchase of a property to be refurbished. The topic of the redevelopment of the property assets—individual buildings/apartments or entire neighborhoods—was one of the main issues of the economic and strategic policies of the Italian government. The authorities have activated several measures at the national level aimed at encouraging this particular construction sector, placing the emphasis on the environmental sustainability of the interventions, as well as on the economic advantages related to the tax deductions. In fact, there are numerous national directives that promulgated with the aim of raising the awareness of the safety and energy efficiency of the existing property assets. Among these directives, some concern the tax deductions, introduced by the Stability and Budget Laws of the years 2014–2020 (Law No. 147/ 2013; Law No. 190/2014; Law No. 208/2015; Law No. 232/2016; Law No. 205/2017; Law No. 145/2018; Law No. 160/2019), which have provided a tax deduction equal to 50% for building refurbishment costs up to an amount not exceeding €96,000 per property unit, and the same tax deduction, up to €10,000 per property unit, for the purchase of furniture and big appliances of a class not lower than A/A+. The 2017 Budget Law (Law No. 232/2016), moreover, introduced important changes due to damages derived from different seismic events that affected the territory. For these reasons, refurbishment interventions that include the adoption of anti-seismic measures have been induced by a tax deduction of 70% (transition to a lower risk class) or of 75% (transition to two lower risk classes) of the total expenses for the improvement of the static condition.

The facilities provided for the energy requalification of buildings consist of tax deductions equal to 50% of the incurred expenses, to be divided into annual instalments of the same amount, within a different maximum limit in relation to each of the expected interventions (reduction of energy needs for heating, €100,000; thermal improvement of the building, €60,000; installation of solar panels for the production of hot water, €60,000; etc.). The introduction of tax deductions for these types of interventions reveals the importance and the necessity for a share of the Italian property assets that recorded a growth equal to +40.7% in 2016 [4].

Definitely, the growing interest in building refurbishment activities is boosted by several factors, such as the following:

- the obsolescence of materials, components and systems of the building products that make ordinary and extraordinary maintenance interventions mandatory to ensure adequate functionality;

- the spread of standards, technologies and housing models that encourage the implementation of redevelopment interventions aimed at improving the level of the living conditions;

- the revealed preference of potential buyers of “old” houses over new ones, due to the possibility of obtaining a discount on the selling price and of the refurbishment in accordance with their specific needs.

2. Background on the Construction and Refurbishment Costs and Their Relation with the Housing Prices

The topic of the costs, with reference to the property assets, is an important assessment issue, especially regarding the procedures for estimating the costs of a building transformation intervention.

In the international context, the ISO 15686:2017 standard, “Buildings and constructed assets—service-life planning, Part 5: Life cycle costing”—represents the regulatory document for the relevant costs of buildings and constructed property assets and their parts (new or existing), elaborated by the Technical Committee ISO/TC 59/SC 14, Design life. This document provides requirements and guidelines for performing a series of different life-cycle cost analyses, among which life-cycle costing (LCC) is a methodology for the systematic economic evaluation that can address a period of analysis that covers the entire life cycle or selected stage or periods of interest [5]. During the entire life cycle of the property, in fact, the different components of the total construction cost are related to: i) the initial design and the promotion of the intervention (land and enabling works, user support costs, etc.), ii) the production (land acquisition costs, suitability and/or remediation, actual construction), iii) the subsequent management of the property, following the performance of the functions for which it was built (ordinary and extraordinary maintenance costs) and, finally, iv) the redevelopment, adaptation or complete demolition of the structure (disposal inspection, disposal and demolitions, reinstatement to meet contractual, etc.).

With regard to the costs relating to new construction interventions, numerous studies have been carried out with the aim of estimating the monetary amounts necessary for the realization of the project, both in terms of realization ex-novo [6,7,8,9,10] that of reconstruction following seismic events [11,12,13,14,15,16]. The process of defining a project involves further categories of costs whose analysis and estimate allows one to provide a more comprehensive economic framework. These include management costs to maintain the asset’s ability to be functional and usable for its original uses and/or those for energy efficiency, to reduce the expected maintenance costs (NZEB buildings) [17,18,19,20,21,22,23,24]. A separate mention is deserving for the assessment of the depreciation of the property, mainly due to the functional obsolescence, physical wear or loss of income, and carried out through the depreciated reproduction cost [25,26].

With reference to the construction costs of an artefact, the reference literature focuses mainly on the definition and testing of cost estimation methods, as synthetic procedures or analytical ones (e.g., estimative metric calculation). The former is used to determine the order of magnitude of the expenditure of the intervention (budget), aimed at comparing the design alternatives and choosing the “best” solution. The latter are aimed at determining the order of magnitude of the monetary amount of the construction cost of the workings [27].

In the reference assessment literature, the study of the cost is not limited only to the aforementioned issues but is also addressed in the search for the existence of a possible variation in the housing selling prices generated by the amount of the construction costs needed for the realization of the building. Concerning the study of socio-economic factors that are most influential in the formation mechanisms of the housing prices, including per capita income, population growth, property taxes, mortgage interest rates, land prices, vacancy, unemployment rates and their lagged variable, several authors have stated the existence of a functional correlation between the construction costs and the selling prices of the properties [28,29,30,31,32,33,34,35,36,37,38,39,40].

In particular, Case and Shiller [41] found that housing prices are positively correlated with the variation of the construction costs, population growth and income.

Zhou [42], analyzing the functional relationship between construction costs and housing prices in four Chinese cities between June 2001 and August 2004, highlighted that for two of the four selected cities, the most important factors affecting the housing prices were the value expectation and the construction costs.

The results achieved by empirical studies [43] examining the boom in housing prices in America since the third quarter of 1996 pointed out that the phenomenon cannot be explained by the rising of the real construction costs. This consideration is in contrast among the conventional view of economists, for which housing prices are primarily driven by construction costs (this view was neatly laid out in 1956 by Grebler et al. [44]).

Deng et al. [45], referring to a sample of provincial level data in China from 2000 to 2005, observed that housing prices are significantly affected by construction costs as well as by the household per capita income, land prices, the new-build supply, the number of housing units sold per year, the rent, the unemployment rates and the stock market returns. In particular, a change in construction costs equal to 10% led to an increase of 15.30% in housing prices. With regard to the other socio-economic variables that generally affect housing price formation, the authors found that interest rates and population growth could not explain the variation of the housing prices in China.

Xu and Tang [46] applied a cointegration approach to examine the determinants of UK housing prices based on quarterly data from 1971 to 2012, concluding that construction costs, credit, GDP, interest rates and unemployment rates had a positive impact on housing prices, whereas the per capita income and the money supply were negatively correlated with them.

In order to examine the dynamics of housing prices and residential land prices from 1927 to 2012 in Italy, Cannari and D’Alessio [47] observed that housing prices increased more than threefold in that period and more than fivefold in large cities. This contingence was considerably more than real construction costs, which only doubled.

However, while the aforementioned studies have outlined an influence of the construction costs on housing prices, they have not dealt with the analysis of the correlation between the refurbishment costs and the selling prices. In the reference literature, in fact, the functional correlation existing between the costs necessary for the implementation of a refurbishment and the housing prices does not appear to be a topic whose study has been extensively treated. With reference, instead, to the determination of the necessary costs for refurbishment actions, this issue is considered a critical task for the public administrations, which operate on limited budgets. Some authors, in fact, have defined specific decision-making tools capable of supporting the public subjects in defining a list of evaluation criteria that identify the project in which to invest or to provide systematic means for priority ranking of maintenance activities on different buildings. In the first case, Lai et al. [48], in 2008, proposed a procedure to assess the budgets for public building construction projects using the analytic hierarchy process (AHP) approach in order to weigh the several assessment criteria. In the second case, Shohet [49], in 2003, adopted a comprehensive key performance indicator for building performance evaluation concerning different hospital buildings. A further application of AHP was presented by Sasmal et al. [50] in 2007; this study dealt with the problem of prioritizing existing old bridges that need specific refurbishment interventions.

The authors stressed that this method, and in general a decision support tool, would help the decision makers (both public and private) in determining a ranking of those projects that need to be developed, especially those concerning refurbishment, resulting in a reduction in the number of failures and in the better use of the available financial resources.

3. Aim of the Work

The present research is part of the framework outlined. In accordance with the 2030 Agenda for Sustainable Development Goals, with reference to the Italian context, the research has two objectives. Firstly, the existence and the extent of the functional correlation between the refurbishment costs in the residential property segment and the relative selling prices was investigated. The analysis was carried out on a case study of 965 recently refurbished residential properties by considering the provincial capital as a unit of territorial investigation due to the different incidences of the production factors—materials, labor, freight and transport, overhead, builder’s profit—and the per capita income in the definition of the local refurbishment costs.

In order to standardize the analysis outputs, the “ordinary” refurbishment costs were considered for each city, referring to a standard restoration initiative that consists of the complete reconstructing of the floors, plasters, fixtures and windows and systems (water, heating and electric systems). The implementation of a genetic algorithm on the case study, divided into three territorial macro-areas—North, Center, South Italy and Islands (source: www.istat.it [51])—aims at explaining the different functional correlations between the refurbishment costs and the housing prices. The choice to consider three macro-areas of investigation is aimed at precluding that the econometric analysis is influenced by the differences in the costs and the income that characterize the Italian territory. The second aim concerns the elaboration of the financial convenience maps in order to prefigure the profit margins for a potential investor following the refurbishment workings on the residential properties located in different territorial areas. In particular, the financial convenience was determined, for each city, in differential terms, i.e., comparing the results with a “reference situation” identified by the city in which the lower unit cost of refurbishment was detected.

The three financial convenience maps obtained, respectively, for North, Center, South Italy and Islands, constitute a useful support for the investment choices of the public and private operators. In particular, the private investors (real estate funds or individuals owners of properties) will be able to guide their choices, through a higher awareness of the earnings that can be generated, and to identify the optimal location of the initiative to be activated according to the increase of the property market value following its refurbishment; the public administrations will instead be able to calibrate their tax policy decisions in terms of i) incentives for the building refurbishments at municipal, regional and national levels and ii) tax revenues connected to the increase in the refurbished property value following the refurbishment. It should be added that in the context of the recent policies relating to the assignment of the tax credit, for which a higher tax deduction is associated with a lower risk of its recovery (Articles 1260–1267 of the Italian Civil Code 1942; Articles 10 of the Growth Decree 2019; Circulars 11, 17/E and 84 issued by the Revenue Agency in the year 2018), the analysis provides a useful support to entrepreneurs or builder–developer companies for the choices relating to the building refurbishment interventions. Finally, the financial convenience maps will allow the banks to monitor the reliability of the loans to the private subjects (builder–developer companies and property owners) who intend to activate refurbishment initiatives in the geographical areas where the highest surplus values are expected. In this sense, the increase in value generated by the refurbishment intervention, reducing the risk of a failure to return the capital, makes the property more attractive on the market, thus constituting an important guarantee for the bank for the recovery of the loaned monetary amount.

The paper is structured as follows: In Section 4, the case study relating to the three property samples located in the three macro-areas mentioned is introduced. The explanatory variables considered are presented and the main descriptive statistics are analyzed; in addition, the analysis of the geographical distribution of the variables “unit restructuring cost” and “per capita income” is illustrated by highlighting the uniformity and the dissonance of the values of the two variables in the three macro-areas examined. Section 5 describes the logical–operational methodology adopted for the analysis. Section 6 illustrates the application to the case study, and the results are interpreted. In Section 7, the conclusions of the work are discussed.

4. Case Study

The case study concerns three samples of residential properties bought and sold in the first half of 2019 and located in the 103 provincial capitals considered for the three macro-areas (443 properties for the 46 provincial capitals of Northern Italy, 210 properties for the 21 provincial capitals of Central Italy and 312 for the 36 provincial capitals of Southern Italy and the Islands). Within each macro-area, the properties considered are flats, i.e., single residential units, located in multi-floor buildings and equally distributed in the three urban areas (central, semi-central and peripheral). Each residential unit has an excellent state of conservation, as it has recently been renovated, and an energy performance certificate (EPC), which stands at a medium-high level (A+, A, B).

4.1. Variables

For each residential unit, the total selling price expressed in euros (Y), obtained by consulting the main operators of the local real estate market, and the factors considered by buyers and sellers in the negotiation phases were detected. These factors constitute the main technological and socio-economic characteristics whose contribution to the housing price were determined in the various territorial contexts. The variables considered are listed and described below:

- the total surface (S) of the property, expressed in square meters of gross floor area of the property;

- the floor on which the property is located (Lp);

- the presence of a lift (A). In the model, this variable is considered as a dummy variable, where the absence of the service is indicated with the value “zero“, whereas the presence is represented by the value “one“;

- the presence of parking (Pa). In the model, this variable is interpreted as a dummy variable, in particular the value “zero“ indicates the absence of a parking space, whereas the value “one“ denotes its presence;

- the “ordinary“ unit cost of restructuring (Cr) at the municipal level expressed in euro per m2 with reference to what is reported in the CRESME database (source: www.cresme.it [52]). Specifically, in the category of ordinary restructuring intervention all the operations relating to the complete reconstructing of the floors, plasters, fixtures and windows and systems (water, heating and electrical) with medium-high finishing level are included;

- the per capita income (R), determined on the number of inhabitants in each municipality, expressed in euro per year (source: www.finanze.gov.it [53]);

- the municipal trade area in which the property is located, considering the geographical distribution developed by the Italian Revenue Agency (source: http://www.agenziaentrate.gov.it [54]), because of the different location characteristics that contribute to the formation of the selling prices. In particular, three trade areas are considered among those defined by the Italian Revenue Agency: “central” (Zc), ”semi-central” (Zs), ”peripheral” (Zp). For each property, the score ”one” is assigned if the property belong to the specific trade area, whereas the score ”zero” is reported for all the remaining locational factors.

Table 1, Table 2 and Table 3 show the main descriptive statistics of the selling prices and the influencing factors for the three macro-areas analyzed.

Table 1.

Descriptive statistics of the variables for the Northern Italy macro-area.

Table 2.

Descriptive statistics of the variables for the Central Italy macro-area.

Table 3.

Descriptive statistics of the variables for the Southern Italy and Islands macro-area.

4.2. Sample Data Analysis

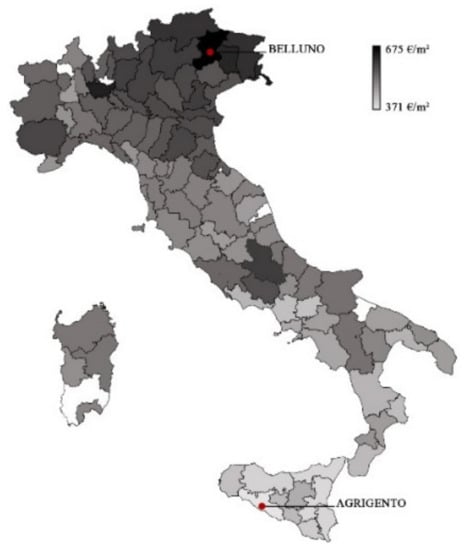

In Figure 1 and Figure 2a–c, the distributions on the national territory of the unit restructuring cost per provincial capital (source: www.cresme.it) and of the per capita income (source: www.finanze.gov.it [53]) are respectively represented. The provincial capitals that were not considered in the paper were highlighted by a white color, as they were not present in the CRESME database used to collect the data relating to the unit restructuring cost (specifically, the following provincial capitals: Monza for Northern Italy, Fermo for Central Italy; Barletta–Andria–Trani and South Sardinia for Southern Italy and Islands).

Figure 1.

Distribution in the national territory of the values of the unit restructuring cost per provincial capital.

Figure 2.

Distribution of the values of the unit restructuring cost in the (a) Northern, (b) Central and (c) Southern Italy.

Figure 1 outlines an uneven distribution of the unit restructuring costs over the national territory. In fact, for the provincial capitals located in Southern Italy and in the Islands, the unit restructuring costs were lower than those observed for the provincial capitals of Central and Northern Italy. Specifically, the city of Belluno (Northern Italy) had the highest unit restructuring cost (675 €/m2), which was 31% higher than the average unit cost found at the national level (514 €/m2). As for the lower unit restructuring cost, however, it should be noted that in the city of Agrigento, with the unit cost of 371 €/m2, there was a difference of –45% compared to the maximum recorded unit restructuring cost (Belluno) and –38% compared to the national average (514 €/m2).

The analysis of the distribution of the unit restructuring costs within each macro-area showed specific situations. Within the macro-area of Northern Italy (Figure 2a), Belluno was the city with the maximum unit restructuring cost, equal to 675 €/m2. This city was also the one for which there was the maximum unit restructuring cost at the national level, deviating by +41% compared to the lowest unit restructuring cost of the city of Imperia, equal to 478 €/m2, and +20% compared to the average unitary data of the Northern Italy macro-area (564 €/m2).

For the macro-area of Central Italy (Figure 2b), the maximum unit restructuring cost of 568 €/m2 was recorded in the city of Frosinone, which differed by +31% compared to the lowest unit cost recorded in the city of Latina, equal to 434 €/m2, and showed a difference of +15% compared to the average unitary data of the macro-area (495 €/m2).

Finally, the macro-area of Southern Italy and the Islands (Figure 2c) had the maximum unit cost in the city of L’Aquila with 544 €/m2, equal to +47% compared to the lowest one, recorded for the city of Agrigento (371 €/m2), and a difference of +19% compared to the average unitary data of the macro area (459 €/m2).

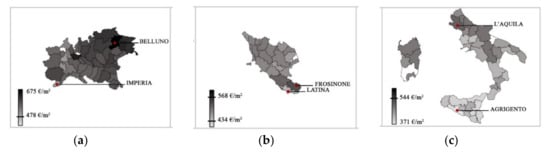

The distribution of the per capita income at the national level shown in Figure 3 was almost consistent with what has already been reported for the unit restructuring cost (cited in Figure 1). In fact, it should be noted that the per capita income levels of the provincial capitals of Northern Italy were higher than those of the Center and those of Southern Italy and Islands, which, on the contrary, showed the minimum values. The maximum per capita income was recorded for the city of Milan (30,707 €/year), whereas the minimum was for the city of Crotone (15,553 €/year). The average per capita income recorded in Northern Italy was 22,996 €/year, slightly higher than the average per capita income of Central Italy, equal to 20,181 €/year, and the average per capita income of Southern Italy and the Islands, equal to 19,161 €/year, which in turn was 11% less than the national average value.

Figure 3.

Distribution of the values of the per capita incomes of the national territory.

Finally, the analysis conducted outlined a substantial uniformity of the restructuring costs and per capita income variables within each of the three territorial macro-areas considered.

5. Methodology

The methodology implemented in the present research was a genetic algorithm called evolutionary polynomial regression (EPR). It is an econometric methodology, which integrates the best features of the numerical regression with the genetic programming [55,56]. This data-driven hybrid technique combines the polynomial structures with an evolutionary search in order to obtain symbolical expressions with exponents of polynomial form by means of a simple genetic algorithm engine. Each term that appears is composed of the combinations, with a different degree of complexity, of the input variables selected by the user. The general symbolic expression generated by EPR is shown in Equation (1):

where l is the number of additive terms, ai are numerical parameters to be valued, Xi are candidate explanatory variables, (i, n), where n = (1, …, 2j) is the exponent of the n-th input within the i-th term in Equation (1), and f is a function selected by the user between a set of different mathematical expressions. The exponents (i, n) are also selected by the user from a set of values belonging to the set of real numbers.

The EPR application allows one to obtain different models whose functional form is the best combination of the input variables Xi, identifying for each one the exponents (i, n) and the numerical coefficients ai, which are estimated by solving a least squares linear problem. The algebraic complexity and the number of models generated by EPR depends on the maximum number of terms and on the possible exponents through which the variables are elevated, set by the user during the preliminary phase of the implementation of the data-driven technique.

The choice of the best model is performed through the calculation of the coefficient of determination (COD) for each equation, defined in Equation (2) as the coefficient that varies between 0 and 1. The fitting of a model is higher when the COD is close to the unit value.

where ye are the values of the dependent variable estimated by the methodology, yd are the collected values of the dependent variable, N is the sample size in analysis. The fitting of a model is higher when the COD is close to the unit value.

Therefore, the methodology leads to several models, each one characterized by a more or less complex algebraic form and by a different level of statistical accuracy in terms of COD. The user selects and chooses the most suitable model according to the specific purpose of the analysis, the knowledge of the phenomenon and the type and quantity of experimental data used.

Application of the Methodology

The EPR methodology was implemented considering the structure of the generic model identified in Equation (1) without function f selected and with the dependent variable P (total selling price). Each additive monomial term of the mathematical expression was assumed as a combination of the inputs—the explanatory variables Xi—raised to the proper numerical exponents. In particular, the candidate exponents selected belonged to the set (0; 0.5; 1; 2) and the maximum number l of additive terms in final expressions was assumed to be ten. The use of these exponents allowed the model to consider the variable in its original form (exponent equal to 1), not to consider the variable (exponent equal to 0), to consider it elevated to the square (exponent equal to 2) to make it the square root (exponent equal to 0.5).

The implementation of the econometric method for each of the macro-areas generated several models, each one structured with a different number of additive terms, combination of the variables and a different level of COD. The three models chosen between those provided by the EPR technique and then, chosen by the user, respectively, for the Northern, Central and Southern Italy and Islands macro-areas are shown in Equations (3)–(5).

The models were characterized by a different complex algebraic form and an average COD equal to about 70% (69.02% Northern Italy, 73.24% Central Italy, 61.30% Southern Italy and Islands). The performance indicators showed a good statistical reliability of the models; the root mean square error (RMSE), which is the square root of the mean of the squared errors between the prices of the original sample and the values estimated through the model, was equal to 3.97% (Northern Italy), 3.55% (Central Italy) and 4.15% (Southern Italy and Islands); the mean absolute percentage error (MAPE), which is the average percentage error between the detected prices and the values estimated, was equal to 2.78% (Northern Italy), 2.34% (Central Italy) and 3.04% (Southern Italy and Islands); the maximum absolute percentage error (MaxAPE), which is the maximum percentage error between the detected prices and the values estimated through the model, was equal to 9.17% (Northern Italy), 8.43% (Central Italy) and 10.04% (Southern Italy and Islands). For each macro-area considered, the model characterized by the lowest AIC (Akaike information criterion) was selected in order to give credit for the equations that reduce the error sum of squares and to build in a penalty for models that bring in too many parameters. In all the three models, the coefficient of correlation between the dependent variable (the selling price) and the per capita income was the highest one, respectively equal to 0.55 for the “Northern Italy” model, 0.58 for the “Central Italy” model and 0.44 for the “Southern Italy and Islands” model. Regarding the variable “unit cost of restructuring”, the coefficients of correlations were always positive and equal to 0.47 (Northern Italy), 0.35 (Central Italy) and 0.29 (Southern Italy and Islands).

In order to analyze the stability of the functional model selected and to flag problems like overfitting (or selection bias), a ten-fold cross-validation test [57] was implemented on the starting database of each considered macro-area. The results obtained confirmed the good prediction performance of the functional models. As seen in Table 4, the average percentage errors between the detected prices and the estimated prices in the training set and in the validation set of each iteration were reported. In all the tests the statistical indicator was less than 5.0%, outlining a good reliability of the statistic performance of the models obtained.

Table 4.

Average percentage errors (%) between the detected prices and the estimated prices (for each macro-area) obtained through a ten-fold cross-validation test.

Each equation had direct and indirect functional relationships between the dependent variable (total selling price) and the independent variables chosen for the analysis. In particular, the three models of Equation (3)–(5) were identified as the best ones because were i) defined by additive terms of simple empirical interpretation, not much more complicated than the other models generated by the EPR technique for each macro-area, ii) characterized by a good level of statistical accuracy and iii) structured with terms that included explanatory variables of particular interest for the aim of this research.

The variables simultaneously selected in the three macro-areas by the methodology as the most influential on the selling prices in the residential market considered for the present analysis (recently renovated properties) were the unit restructuring cost (Cr), the per capita income (R) and the total surface of the property (S). The other variables selected for the Northern Italy macro-area, in addition to the previous ones, were the presence of a lift (A), the “central” (Zc) trade area, the floor on which the property is located (Lp) and the “semi-central” (Zs) trade area. Regarding the other variables selected by the model for the other two macro-areas, in addition to the unit restructuring cost (Cr), the per capita income (R) and the total surface of the property (S), they were the “peripherical” (Zp) trade area for the Central Italy macro-area; the presence of a lift (A), the “central” (Zc) trade area, the floor on which the property is located (Lp) and the presence of parking (Pa) for the Southern Italy and Islands macro-area.

It should be noted that this research constitutes the first application of the EPR technique to the construction cost sector for convenience assessments. EPR, in fact, with reference to the real estate sector, has so far been generally used to investigate the function of the price Y = f(x1, x2, … xn) and to identify the explanatory factors most influential in the mechanisms for the formation of the housing prices in different territorial contexts [58,59] and to determine the marginal contribution of each of them on the prices. The application of EPR to the construction cost sector, therefore, reveals interesting and unexplored potentialities.

6. Results Interpretation

In order to verify the empirical coherence of the functional relationships between the variables in each model and to explicate the quantitative contribute of the influencing factors considered on the selling price formation, an exogenous approach was developed by providing the variation of the i-th variable analyzed in the variation interval of the observed macro-area and keeping constant and equal to the respective average value the terms of the other variables.

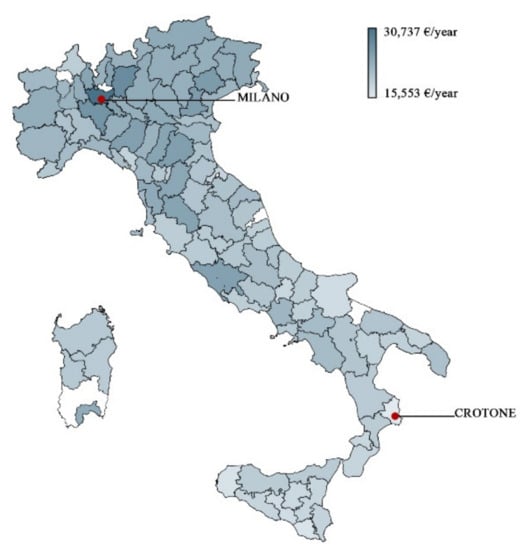

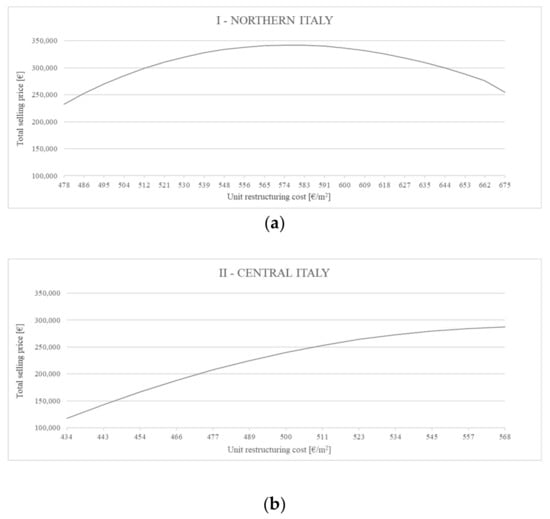

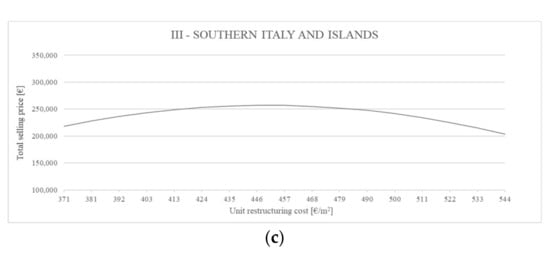

It should be firstly outlined that the results obtained confirm the empirical coherence of the explanatory variables selected by the models with the dependent variable of the total selling price. According to the models generated for the three macro-areas, the functional relationship between the dependent variable Y (total selling price) and the independent variable analyzed (unit restructuring cost) is not linear for all three macro-areas. The graphs of Figure 4a–c show the functional links between the total selling price and the unit restructuring cost detected for each macro-area (Northern, Central, Southern Italy and Islands).

Figure 4.

Functional relationships between the dependent variable total selling price and the independent variable unit restructuring cost in the three macro-areas of Northern Italy (a), Central Italy (b) and Southern Italy and Islands (c).

In particular, the graphs that express the total selling price evolution for an increase of the unit restructuring cost are parabolic. This trend for the macro-areas of Northern Italy and Southern Italy and Islands indicates that for a growth of the unit restructuring cost, the total selling price increases until it reaches a maximum value beyond which, while continuing to increase the unit restructuring cost, the total selling price decreases. In particular, the curve of the Northern Italy macro-area shows a parabolic trend that is more emphasized than the curves related to the other two macro-areas; in fact, the extreme values of the total selling price range (minimum price detected, and maximum price detected) are more discordant in absolute terms. For the Central Italy macro-area, the curve shown in Figure 4b, on the other hand, highlights an initial increase in the total selling price while growing the unit restructuring cost and, subsequently, an attenuation of the growth corresponding to the highest unit restructuring costs. Therefore, the analysis points out that a higher unit restructuring cost does not necessarily correspond to a constant increase in the dependent variable, because there may be other factors—positional, socio-economic and technological—in the selling price formation that can be more relevant. Among these, it is known that a significant contribution is provided by the characteristics of the urban context in which the property is located (extrinsic factors), such as accessibility, presence of green spaces, level of security, etc., which, compared to the variable of the unit restructuring cost, can have a higher influence by reducing the significance of this variable. Finally, it should be taken into account that the demand for the renovated properties in each local residential market in the three macro-areas is directly linked to the willingness to pay of the buyers and that this condition is pursued by the per capita income, which is higher in the Northern Italy macro-area than the Central Italy and Southern Italy and Islands ones.

6.1. The Procedure for The Definition of the Convenience Maps for Each Macro-Area

Following the definition of the price function for each macro-area, the construction of the financial convenience maps was carried out through the phases described below:

- with reference to each city, the total average selling price was determined by replacing the detected values of the per capita income and the unit restructuring cost in Equations (3)–(5);

- the percentage differential value between the total selling price of each city and the estimated selling price for the capital with the lowest unit restructuring cost (“reference situation“) was determined;

- the assessment of the total surplus value generated by the restructuring intervention was carried out by considering in incremental terms the differential value and the differential cost appropriately determined for each city. The first was estimated through the algebraic product between the assessed total selling price and the previously defined percentage differential value; the second was calculated by means of the algebraic difference between the total restructuring cost of the specific city and the total restructuring cost of the “reference situation“.

- Finally, the three financial convenience maps were developed on the basis of the unit surplus values defined by the ratio between the total surplus value and the average floor surface of the macro-area.

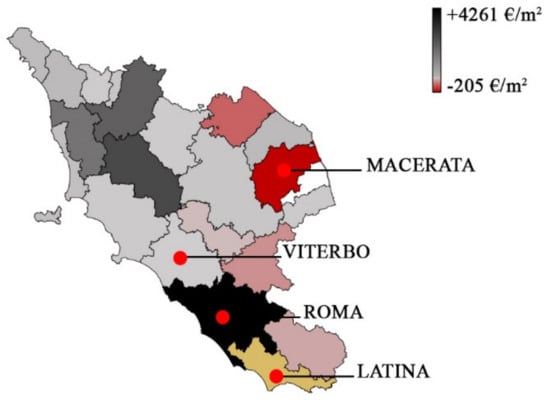

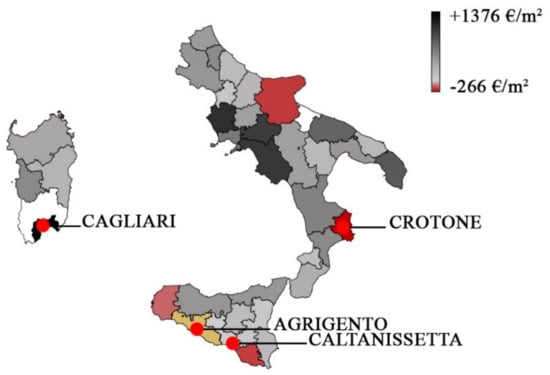

The graphs of Figure 5, Figure 6 and Figure 7 show the financial convenience maps elaborated for each of the territorial contexts analyzed (Northern, Central, Southern Italy and Islands). Within each macro-area and with reference to the cities considered, the unitary differential profit that a generic investor could obtain from the implementation of an ordinary refurbishment intervention compared to the same one carried out in the city where the unit restructuring cost was the lowest—the so-called “reference situation”—was reported. The provincial capitals that represented the “reference situation”, i.e., characterized by the lowest unit restructuring cost, in each macro-area were as follows: the city of Imperia (Cr = 478 €/m2) for Northern Italy, the city of Latina (Cr = 434 €/m2) for Central Italy and the city of Agrigento (Cr = 371 €/m2) for Southern Italy and Islands.

Figure 5.

Financial convenience map of the Northern Italy macro-area.

Figure 6.

Financial convenience map of the Central Italy macro-area.

Figure 7.

Financial convenience map of the Southern Italy macro-area.

NORTHERN ITALY—First macro-area

CENTRAL ITALY—Second macro-area

SOUTHERN ITALY—Third macro-area

The results obtained for Northern Italy were consistent with the expected outputs. Firstly, the average unit surplus value deriving from an ordinary refurbishment intervention carried out in this macro-area, compared to the same intervention carried out in the city of Imperia (“reference situation”), was equal to approximately +1000 €/m2.

The convenience map in Figure 5 shows that the highest increase in the unit value for the city of Milan was equal to 6128 €/m2. In other words, the city of Milan is characterized by the condition of maximum financial convenience for the investor. The city of Asti was the one with the lowest unit surplus value (+174 €/m2). A different situation occurred for the city of Gorizia, the only one in the macro-area for which the model identified the presence of a unit decrease generated by the refurbishment intervention, equal to –519 €/m2. The reasons for this phenomenon could be related to different factors, among which is the level of the per capita income of the city, which is the lowest in the entire macro-area. Therefore, the investor will not obtain a convenience to activate an ordinary refurbishment intervention in the city of Gorizia rather than in the city of Imperia (the “reference situation“ of the macro-area).

The macro-area of Central Italy showed an average unit surplus value generated by an ordinary restructuring intervention equal to +899 €/m2 compared to the city of Latina, in which the detected unit restructuring cost was the lowest one (“reference situation“ for this macro-area).

The financial convenience map in Figure 6 highlights that the maximum unit surplus value of the cluster (+4261 €/m2) occurred for the city of Rome. For the investor, it is the city in which he/she can obtain the maximum convenience, deriving from an ordinary refurbishment compared to the convenience obtained in the “reference situation“. For the city of Viterbo, on the other hand, the minimum surplus value of the cluster was recorded (+45 €/m2), and therefore the condition of minimum convenience was associated. Furthermore, the model identified in the cities of Terni, Macerata, Pesaro–Urbino, Rieti and Frosinone a lack of financial convenience for the private entrepreneur due to the assessment of a unit decrease equal to –76 €/m2. In particular, the city of Macerata was the one with the highest unit decrease in the macro-area (–205 €/m2). The existence of this condition could be generated by several reasons, related to the level for each city of the per capita income (R) and the absence or scarcity of the demand for renovated properties in the local residential market of each cities.

With reference to the macro-area of Southern Italy and Islands, the average unit surplus value associated with an ordinary refurbishment was equal to +447 €/m2, compared to the surplus value given by the same intervention in the city of Agrigento (“reference situation”).

The convenience map obtained for the macro-area allowed us to identify the city of Cagliari as the city with the highest surplus value of the macro-area (+1376 €/m2). Therefore, in this case the investor will find the condition of maximum convenience for an ordinary restructuring intervention. The city of Caltanissetta was characterized by the minimum surplus value generated by the ordinary refurbishment (+61 €/m2). In this city, the convenience for the investor was the lowest of the entire macro-area. The model identified a different situation for the city of Crotone, for which the decrease in unit profit was the maximum of the entire macro-area and was equal to –266 €/m2. Furthermore, the model verified a lack of convenience in the refurbishment interventions in the cities of Ragusa, Trapani and Foggia, with an average unit decrease of approximately –174 €/m2. The occurrence of this condition could be due to several reasons related to the level for each city of the per capita income (R) and the absence or scarcity of the demand for renovated properties in the local residential market.

6.2. Summary of the Results Obtained

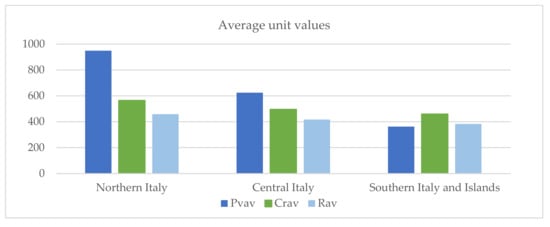

The results of the unit profit variation obtained through the implementation of the proposed algorithm and the following development of the convenience maps were consistent with the expected phenomena in the three macro-areas considered.

The resulting analysis outlined, in fact, that the average unit profit variation value (Pvav) determined for each macro-area was consistent with the average unit restructuring cost (Crav) and the per capita income (Rav). The graph in Figure 8 pointed out that the average unit profit variation was higher in Northern Italy, where the average unit restructuring cost and the average per capita income were also higher than both Central Italy and Southern Italy and Islands. The lowest average value of the unit profit variation obtained, on the other hand, was verified for the macro-area of Southern Italy and Islands, for which the average unit restructuring cost and per capita income was also the lowest at the national level.

Figure 8.

Comparison of the average values of the unit differential profit (Pvav), the unit restructuring cost (Crav) and the per capita income (Rav) for the Italian macro-areas.

From the comparison between the average values of Pvav, Crav and Rav for the three macro-areas, it should be highlighted that, although Northern Italy includes the city of Milan for which the highest unit surplus value of the entire national territory was detected, in this macro-area, the city of Gorizia, which had the highest unit decrease on the national territory, is located.

The city of Cagliari in the macro-area of Southern Italy and Islands, on the other hand, showed the lowest unit surplus value of the case study, equal to approximately –78% compared to the highest unit surplus value for the city of Milan.

7. Conclusions

In the context of the widespread importance attributed to the redevelopment initiatives at the national level, the significant role played by the sector of the existing housing stock renovation is attested by the renewal of tax incentive policies aimed at increasing the interventions to improve the residential properties’ maintenance conditions, with a focus on the housing strategies oriented towards sustainability principles.

With reference to 965 residential properties sold in 2019 and located in the provincial capitals of the three different macro-areas into which the Italian territory is commonly divided (Northern Italy, Central Italy, Southern Italy and Islands), an econometric analysis was implemented with two specific aims. The first one concerned the definition of the functional relationship between the restructuring costs and the selling prices in the three territorial macro-areas; the second one was related to the elaboration of convenience maps for the refurbishment investments, on the basis of the profit margins that the generic entrepreneur could obtain from the implementation of an “ordinary” renovation of the residential properties located in the different territorial areas. In particular, the financial convenience was determined, for each city, in differential terms, that is, with respect to a “reference situation” identified by the city in which the lowest unit restructuring cost was detected.

Among the models provided by the proposed methodology, the three ones chosen, respectively, for the three macro-areas differ from the others for a better statistical accuracy and are structured by additive terms that include explanatory variables of specific interest for the research. The presence of the explanatory variable of the unit restructuring cost, among the socio-economic ones considered, in each model chosen for the three macro-areas, has allowed us both to analyze the functional correlation existing between the total selling price and the restructuring cost and to determine the unit surplus value obtainable by a generic investor following the described “ordinary” refurbishment.

The definition of a logical-operational methodology, through which it was possible to determine the amount of the unit profit and to develop the financial convenience maps of each macro-area, constitutes a useful tool for the public and private operator’s investment choices.

In particular, the results of the research can represent a useful support i) for private investors, by directing their refurbishment decisions towards the cities for which the highest unit plus values are assessed and ii) for public administrations, by identifying new incentive policies for the redevelopment in the cities where there is a lower convenience for the private in terms of economic returns. These policies could focus on initiatives aimed at raising the awareness of the community and the investors through information campaigns in order to promote a higher knowledge of the different current tax incentives.

Future insights of this research may concern the convenience assessment for an investor deriving from the refurbishment interventions carried out on properties to be restructured, in order to determine the profit margins in absolute terms achievable in each territorial context and to compare the outputs with other areas.

Author Contributions

The paper is to be attributed in equal parts to the authors. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- United Nations. Agenda 2030. 2015. Available online: www.un.org/ga/search/view_doc.asp?symbol=A/RES/70/1&Lang=E (accessed on 18 November 2019).

- Scenari Immobiliari. Secondo Rapporto Sul Recupero Edilizio in Italia E Nuovi Format Digitali. 2018. Available online: www.scenari-immobiliari.it (accessed on 22 October 2019).

- Camera dei Deputati, in Collaborazione con CRESME. Il recupero e la Riqualificazione Energetica del Patrimonio Edilizio: Una Stima Dell’impatto delle Misure di Incentivazione, Prima Edizione, n.3. 2018. Available online: https://temi.camera.it/leg18/dossier/OCD18-13087/il-recupero-e-riqualificazione-energetica-del-patrimonio-edilizio-stima-impatto-misure-incentivazione-5.html (accessed on 16 July 2019).

- CRESME & Symbola. Una Nuova Edilizia Contro la Crisi—Il Primo Ciclo Dell’ambiente Costruito: Innovazione, Risparmio, Sicurezza, Qualità. 2017. Available online: www.cresme.it (accessed on 25 July 2019).

- ISO. ISO 15686-5: 2017—Buildings and Constructed Assets—Service Life Planning—Part 5: Life Cycle Costing; ISO: Geneva, Switzerland, 2017; Available online: www.iso.org (accessed on 20 July 2019).

- Zhang, S.; Migliaccio, G.; Zandbergen, P.A.; Guindani, M. Empirical Assessment of Geographically Based Surface Interpolation Methods for Adjusting Construction Cost Estimates by Project Location. J. Constr. Eng. Manag. 2014, 140, 04014015. [Google Scholar] [CrossRef]

- Del Giudice, V.; Torrieri, F.; De Paola, P. The Assessment of Damages to Scientific Building: The Case of the “Science Centre” Museum in Naples, Italy. Adv. Mater. Res. 2014, 1030, 889–895. [Google Scholar] [CrossRef]

- Budayan, C.; Dikmen, I.; Birgonul, M.T. Construction cost map of European countries. Eng. Econ. 2019, 1–23. [Google Scholar] [CrossRef]

- Velumani, P.; Nampoothiri, N.V.N. Analysis of construction cost prediction studies—Global perspective. Int. Rev. Appl. Sci. Eng. 2019, 10, 275–281. [Google Scholar] [CrossRef]

- Zhao, L.; Zhang, W.; Wang, W. Construction Cost Prediction Based on Genetic Algorithm and BIM. Int. J. Pattern Recognit. Artif. Intell. 2019, 2059026. [Google Scholar] [CrossRef]

- Daria, B.; Umberto, P.; Alessandro, P.; Fabio, S. LCA (life cycle assessment) in disaster waste management: Emilia-Romagna earthquake, an Italian case study. In Proceedings of the 18th Summer School Francesco Turco, Senigallia, Italy, 11–13 September 2013; pp. 11–13. [Google Scholar]

- Liel, A.B.; Corotis, R.B.; Camata, G.; Sutton, J.; Holtzman, R.; Spacone, E. Perceptions of Decision-Making Roles and Priorities that Affect Rebuilding after Disaster: The Example of L’Aquila, Italy. Earthq. Spectra 2013, 29, 843–868. [Google Scholar] [CrossRef]

- Ascione, F.; Bianco, N.; De Masi, R.F.; Mauro, G.; Vanoli, G. Cost-Effective Refurbishment of Italian Historic Buildings. In Cost-Effective Energy Efficient Building Retrofitting; Woodhead Publishing: Sawston/Cambridge, UK, 2017; pp. 553–600. [Google Scholar]

- Polese, M.; Di Ludovico, M.; Prota, A. Post-earthquake reconstruction: A study on the factors influencing demolition decisions after 2009 L’Aquila earthquake. Soil Dyn. Earthq. Eng. 2018, 105, 139–149. [Google Scholar] [CrossRef]

- Vitiello, U.; Ciotta, V.; Salzano, A.; Asprone, D.; Manfredi, G.; Cosenza, E. BIM-based approach for the cost-optimization of seismic retrofit strategies on existing buildings. Autom. Constr. 2019, 98, 90–101. [Google Scholar] [CrossRef]

- Ramos, J.S.; Domínguez, S.Á.; Moreno, M.P.; Delgado, M.G.; Rodríguez, L.R.; Ríos, J.A.T. Design of the Refurbishment of Historic Buildings with a Cost-Optimal Methodology: A Case Study. Appl. Sci. 2019, 9, 3104. [Google Scholar] [CrossRef]

- Ramesh, T.; Prakash, R.; Shukla, K. Life cycle energy analysis of buildings: An overview. Energy Build. 2010, 42, 1592–1600. [Google Scholar] [CrossRef]

- Becchio, C.; Dabbene, P.; Fabrizio, E.; Monetti, V.; Filippi, M. Cost optimality assessment of a single family house: Building and technical systems solutions for the nZEB target. Energy Build. 2015, 90, 173–187. [Google Scholar] [CrossRef]

- Ashrafian, T.; Yilmaz, A.Z.; Corgnati, S.P.; Moazzen, N. Methodology to define cost-optimal level of architectural measures for energy efficient retrofits of existing detached residential buildings in Turkey. Energy Build. 2016, 120, 58–77. [Google Scholar] [CrossRef]

- Fregonara, E. Methodologies for Supporting Sustainability in Energy and Buildings. The Contribution of Project Economic Evaluation. Energy Procedia 2017, 111, 2–11. [Google Scholar] [CrossRef]

- Fregonara, E.; Ferrando, D.G.; Pattono, S. Economic–Environmental Sustainability in Building Projects: Introducing Risk and Uncertainty in LCCE and LCCA. Sustainbility 2018, 10, 1901. [Google Scholar] [CrossRef]

- Mørck, O.; Gutierrez, M.S.M.; Thomsen, K.E.; Wittchen, K.B. Life-cycle cost and environmental assessment of nearly zero-energy buildings (NZEBs) in four European countries. In IOP Conference Series: Materials Science and Engineering; IOP Publishing: Bristol, UK, 2019; Volume 609, p. 072005. [Google Scholar]

- Sağlam, N.G.; Yılmaz, A.Z.; Corgnati, S.P. Identification of the Retrofit Actions to Achieve Cost-Optimal and NZEB Levels for Residential Buildings in Istanbul Considering the Remaining Building Lifetime. In E3S Web of Conferences; EDP Sciences: Ulis, France, 2019; Volume 111. [Google Scholar]

- Asdrubali, F.; Baggio, P.; Prada, A.; Grazieschi, G.; Guattari, C. Dynamic life cycle assessment modelling of a NZEB building. Energy 2020, 191, 116489. [Google Scholar] [CrossRef]

- Baum, A. Property Investment Depreciation and Obsolescence; Thomson Learning Emea: London, UK, 1991. [Google Scholar]

- Smith, B.C. Economic Depreciation of Residential Real Estate: Microlevel Space and Time Analysis. Real Estate Econ. 2004, 32, 161–180. [Google Scholar] [CrossRef]

- Manganelli, B.; Morano, P.; Tajani, F. An empirical analysis of winning bids in public procurement in the Italian construction sector. WSEAS Trans. Bus. Econ. 2016, 13, 129–137. [Google Scholar]

- Poterba, M.J.; Weil, D.N.; Shiller, R.J. Housing Price Dynamics: The Role of Tax Policy and Demography: Comments and Discussion. Book. Pap. Econ. Act. 1991, 2, 143–148. [Google Scholar] [CrossRef]

- Potepan, M.J. Explaining Intermetropolitan Variation in Housing Prices, Rents and Land Prices. Real Estate Econ. 1996, 24, 219–245. [Google Scholar] [CrossRef]

- Jud, G.D.; Winkler, D.T. The dynamics of metropolitan housing prices. J. Real Estate Res. 2002, 23, 29–46. [Google Scholar]

- Capozza, D.R.; Hendershott, P.H.; Mack, C.; Mayer, C.J. Determinants of Real House Price Dynamics; National Bureau of Economic Research: Cambridge, MA, USA, 2002; Volume 9262. [Google Scholar]

- Shen, Y.; Liu, H.Y. Housing Précis and Economic Fundamentals: A Cross City Analysis of China for 1995–2002. Econ. Res. 2004, 6, 78–86. [Google Scholar]

- Jayantha, W.M.; Lau, S.S. Causality Relationship between Housing Prices and Construction Costs. Int. J. Urban Sci. 2008, 12, 85–103. [Google Scholar] [CrossRef]

- Zhang, J.; Liu, H. The determinants of inter-metropolitan variation in house prices and land prices. Stat. Res. 2010, 27, 37–44. [Google Scholar]

- Bourassa, S.C.; Hoesli, M.; Scognamiglio, D.; Zhang, S. Land leverage and house prices. Reg. Sci. Urban Econ. 2011, 41, 134–144. [Google Scholar] [CrossRef]

- Li, Q.; Chand, S. House prices and market fundamentals in urban China. Habitat Int. 2013, 40, 148–153. [Google Scholar] [CrossRef]

- Mansur, S.A.; Abdul Hamid, A.R.; Yusof, N.A. Rising trend in construction cost and housing price. J. Adv. Res. Bus. Man. Stud. 2016, 3, 94–104. [Google Scholar]

- Zainal, R.; Teng, T.C.; Mohamed, S. Construction costs and housing prices: Impact of goods and services tax. Int. J. Econ. Financ. Issues 2016, 6, 16–20. [Google Scholar]

- Squires, G.; Heurkens, E.W.; Peiser, R.B. Routledge Companion to Real Estate Development; Routledge: London, UK, 2017. [Google Scholar]

- Zbyrowski, R. Long-Term Dependence of Housing Prices and Construction Costs in Eastern Poland. Metody Ilościowe w Badaniach Ekonomicznych 2018, 19, 92–103. [Google Scholar] [CrossRef]

- Case, K.; Shiller, R.J. Forecasting Prices and Excess Returns in the Housing Market. Real Estate Econ. 1990, 18, 253–273. [Google Scholar] [CrossRef]

- Zhou, J.K. Currency Policy, Bank Loan and Housing Prices—Empirical Study of the Four Cities. Financ. Econ. 2005, 5, 22–27. [Google Scholar]

- Shiller, R.J. Understanding Recent Trends in House Prices and Home Ownership; National Bureau of Economic Research: Cambridge, MA, USA, 2007; Volume 1355, pp. 89–123.

- Grebler, L.; Blank, D.M.; Winnick, L. Capital Formation in Residential Real Estate: Trends and Prospects; National Bureau of Economic Research: Cambridge, MA, USA, 1956.

- Deng, C.; Ma, Y.; Chiang, Y.M. The dynamic behavior of Chinese housing prices. Int. Real Estate Rev. 2009, 12, 121–134. [Google Scholar]

- Xu, L.; Tang, B. On the determinants of UK house prices. Int. J. Econ. Res. 2014, 5, 57–64. [Google Scholar]

- Cannari, L.; D’Alessio, G.; Vecchi, G. House prices in Italy, 1927-2012. Riv. di Storia Econ. 2016, 32, 381–402. [Google Scholar]

- Lai, Y.-T.; Wang, W.-C.; Wang, H.-H. AHP- and simulation-based budget determination procedure for public building construction projects. Autom. Constr. 2008, 17, 623–632. [Google Scholar] [CrossRef]

- Shohet, I.M. Building evaluation methodology for setting maintenance priorities in hospital buildings. Constr. Manag. Econ. 2003, 21, 681–692. [Google Scholar] [CrossRef]

- Sasmal, S.; Ramanjaneyulu, K.; Lakshmanan, N. Priority ranking towards condition assessment of existing reinforced concrete bridges. Struct. Infrastruct. Eng. 2007, 3, 75–89. [Google Scholar] [CrossRef]

- Istituto Nazionale di Statistica. Available online: www.istat.it (accessed on 27 September 2019).

- Centro Ricerche Economiche, Sociologiche e di Mercato. Available online: www.cresme.it (accessed on 15 April 2019).

- Dipartimento delle Finanze. Available online: www.finanze.gov.it (accessed on 30 October 2019).

- Agenzia delle Entrate. Available online: www.agenziaentrate.gov.it (accessed on 15 July 2019).

- Rezania, M.; Javadi, A.A.; Giustolisi, O. An evolutionary-based data mining technique for assessment of civil engineering systems. Eng. Comput. 2008, 25, 500–517. [Google Scholar] [CrossRef]

- Giustolisi, O.; Savic, D. Advances in data-driven analyses and modelling using EPR-MOGA. J. Hydroinformatics 2009, 11, 225–236. [Google Scholar] [CrossRef]

- Efron, B. Estimating the error rate of a prediction rule: Improvement on cross-validation. J. Am. Stat. Assoc. 1983, 78, 316–330. [Google Scholar] [CrossRef]

- Tajani, F.; Morano, P.; Torre, C.M.; Di Liddo, F. An analysis of the influence of property tax on housing prices in the Apulia region (Italy). Buildings 2017, 7, 67. [Google Scholar] [CrossRef]

- Morano, P.; Guarini, M.R.; Tajani, F.; Di Liddo, F.; Anelli, D. Incidence of Different Types of Urban Green Spaces on Property Prices. A Case Study in the Flaminio District of Rome (Italy). In Proceedings of the 19th International Conference on Computational Science and Its Applications (ICCSA 2019), Saint Petersburg, Russia, 1–4 July 2019; pp. 23–34. [Google Scholar]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).