Abstract

Smart beta strategy is an increasingly frequent approach to investment analysis for portfolio selection and optimization and it can be combined with environmental, social, and governance (ESG) considerations. In order to verify the impact of the integration between ESG and smart beta analysis, first we apply a portfolio rebalancing based on ESG scores on securities selected according to different smart beta strategies (ex-post ESG rebalancing approach). Secondly, we apply different smart beta approaches to sustainable portfolios, screened according to the issuers’ ESG scores (ex-ante ESG screening approach). We find that ESG rebalancing and screening are able to impact both on return and risk statistics, but with a different level of efficiency for each smart beta strategy. ESG rebalancing proves to be particularly efficient when it is applied to a “Value” portfolio. On the other hand, when smart beta is applied to ESG-screened portfolios, “Growth” is the strategy which shows the highest increase in risk-adjusted performance, particularly in the US. Minimum volatility proves to be the most efficient smart beta strategy for sustainable portfolios. In general, the increase in the level of sustainability does not deteriorate the risk-adjusted performances of most smart beta strategies.

1. Introduction

Socially responsible investing (SRI) is growing rapidly among investors and asset managers globally, partly in response to regulatory pressure [1,2]. SRI strategies integrate traditional financial analysis with environmental, social, and governance (ESG) considerations about securities’ issuers. Empirical analyses show that the integration of ESG issues in security selection and management can impact financial performance and help explain market risk, both at corporate level and at asset portfolios level, especially in the long run [3,4,5,6,7,8].

Regarding investment style for asset allocation, growing attention is paid to smart beta strategies, also referred to as alternative beta or factor investing. They are hybrid management strategies, halfway between active and passive investing. In smart beta approaches, investors build a financial portfolio which follows an index passively, but the weights of its constituents depend on systematic factors, which are alternative betas, such as value, quality, volatility, and size, instead of market capitalization. Portfolios based on weighting schemes other than market values involve, at least to some degree, active management and require active trading [9]. In other words, this investment style involves some active decisions in a passive strategy. Nevertheless, smart beta approaches try to outperform index benchmark without using market analysis, but simply applying a rules-based method. As a consequence, they try to offer the benefits of active strategies in terms of performance, while at the same time preserving many of the benefits of passive investing, such as low costs, liquidity, and transparency [10,11]. Boston Consulting Group [12] estimates smart beta has grown by 30 percent per year since 2012.

A study by FTSE Russell [13] shows the increasing convergence between smart beta and ESG strategies. Most of asset owners implementing smart beta approaches, or planning to do so in the near future, justify applying ESG considerations in their asset allocation choices not as a broad implementation of these principles across the whole range of their portfolios, but by the compatibility of ESG issues with smart beta allocation. They are motivated by the aim to avoid long term risk and improve performance, other than the sustainability of financial portfolios.

In this context, the aim of this paper is to verify whether the integration of ESG considerations into an equity portfolio based on a smart beta strategy affects its risk-adjusted return.

In particular, as an explorative study, it seeks to answer two research questions:

- (1)

- Is an ex-post ESG rebalancing able to affect the risk-adjusted performance of an equity portfolio based on a smart beta strategy?

- (2)

- Is an ex-ante ESG screening able to affect the risk-adjusted performance of an equity portfolio based on a smart beta strategy?

The results of our study empirically verify that the ESG profile of an equity portfolio built applying a smart beta strategy can be improved without reducing its risk-return performances, in particular when “Minimum volatility” or “Growth/Value” strategies are selected for smart beta allocation.

The empirical test is applied both to European and US financial markets, and achieves the main results independently of the geographical area involved. Our findings confirm, for smart beta portfolios, the results of past research on sustainable and responsible finance: The application of SRI strategies to smart beta portfolios can maximize returns for investors at the same or lower risk level [7,8].

We contribute to the wider literature on the impact of ESG considerations on returns and risks of financial portfolios by analyzing the effects on investments based on smart beta strategies. Our contribution is twofold. First, we test the contribution of an ESG rebalancing on portfolios built by applying several alternative betas. Moreover, we verify the effect of different smart beta strategies applied on financial portfolios previously screened according to the issuers’ ESG scores.

In the remainder of this paper, we proceed as follows. We begin in Section 2 by analyzing the relevant literature on the effects of ESG considerations on risk-adjusted performance, both at a company level and at an equity portfolio level. In Section 3, we present the methodologies applied to verify the role of ESG issues in portfolios allocated according to a smart beta strategy. In Section 4, we discuss our main results, and verify them with robustness tests. In Section 5, we conclude with practical implications of our approach and suggestions for future research.

2. Literature Review

There has been a great deal of research on the role of ESG issues in financial analysis, aimed at verifying whether ESG considerations can be value-additive or value-detracting in portfolio management. In particular, previous literature highlights the role of ESG factors in influencing performance, risk, and efficiency.

The relationship between ESG issues and risk adjusted performances has been studied both at corporate level [14,15] and at asset portfolio level, with specific reference to mutual funds [16].

Regarding individual firms, a study on European and American stocks verified the hypothesis of no differences in terms of risk and returns between sustainable and other stocks, demonstrating how sustainable stocks are correctly priced by the market, with no presence of abnormal returns [17]. This finding may be the result of the sum of systematic risk [18,19,20,21] and idiosyncratic risk [22]. In particular, Albuquerque et al. [23] present an industry equilibrium model where firms can choose to engage (or not) in responsible behavior. They show that the level of systematic risk is lower for those firms with higher responsible performances. Becchetti et al. [22] explore the relation between corporate behaviors regarding social responsibility and idiosyncratic volatility. Their main hypothesis is that the implementation of corporate social responsibility (CSR) implies a departure from standard profit maximization toward a more complex strategy of stakeholder satisfaction. The consequence is that the earnings of a responsible firm are less predictable or less likely to follow stock market dynamics common to the majority of non-responsible companies. The authors document that the social responsibility of individual firms is positively related with idiosyncratic volatility. Nevertheless, this does not make responsible stocks riskier, given that the higher attention to social, environmental, or governance issues can offer protection from other categories of risk, such as stakeholder risk [24,25,26,27,28], reputational risk [29], and operational risk [27,30].

The impact of ESG variables on risk, in terms of performance volatility, can be related to the economic phase. According to Paul [31], the financial performance of companies with high ethical standards is comparable to the financial performance of the market as a whole during times of economic expansion, but superior to the market during times of economic contraction. The results indicate that ESG tends to preserve value during economic downturn more than it adds value during economic expansion. Nofsinger and Varma [32] confirm that positive sustainability scores make companies less risky during financial crisis. Other studies emphasize that good governance practices, as well as corporate strengths related to social and environmental issues, can be useful to absorb market downturns and mitigate the effects on crash risks [32,33,34,35].

The impact of ESG responsibility on corporate risks is confirmed by a lower level of cost of equity [36,37,38] and a lower cost of debt for responsible firms [21,39,40].

Other than stock investing, ESG scores are able to impact on bond investing. The ESG scores are related to bond returns and include relevant information about the downside risk of companies, in particular small firms [41]. Therefore, the issuer’s ESG performance is correlated with the bond default rate. In particular, literature shows that the default rate in the corporate bond market is positively correlated with the firm’s energy consumption and negatively correlated with its attention to social issues, other than to financial measures [42,43]. The country’s ESG performance moderates this corporate social performance—credit risk relationship [44]. This has significant consequences both for bond investors and rating agencies.

Credit ratings take into account the sustainability performance measures, at least partially. Agencies tend to award relatively high credit ratings to companies with good social and environmental performance [45]. However, having a less consistent sustainability performance over time seems to have no effect on ratings [46]. Moreover, different CSR behaviors can impact short-term and long-term credit risks in different manner and direction [47].

This confirms that ESG scores are complementary to credit ratings to complete the information set on companies for predicting future bond returns, especially for firms with high information asymmetry [41].

The need for a comprehensive evaluation of ESG issues to analyze the corporate behaviors from various perspectives should also favor the full integration of sustainability principles into the corporate assessment process by ESG rating and information provider agencies [48,49]. Investigating the methodology for forecasting the ESG rating of companies, literature demonstrates that sectors and financial factors serve to find only large differences across firms regarding ESG, showing the relevance of detailed information on sustainable behaviors for reliable ESG scores [50].

Regarding portfolio/fund level, a wide strand of literature studies the effect of ESG factors on financial risks and returns.

Several authors divide portfolios/funds into two main categories, responsible and conventional. These studies aim to verify the effect of ESG screening on compromising diversification as well as to test whether and to what extent responsible investments can affect risk-adjusted returns [27,51,52,53,54,55,56]. Most researchers find no significant deviations between socially responsible funds and conventional ones in this comparison. The effect of ESG screening strategies is therefore minimal with regard to compromising diversification [57,58]. After an initial lowered level in return, applying more and more screening yields abnormal stock return, because the drop in the differentiation opportunity is offset by an improved quality of the stock remaining after the screening, which shows more solidity [59]. With specific reference to risks, a Morningstar study [60] analyzes 10,228 funds classified as sustainable and compares them to their peers in Morningstar categories. Empirical results show that over 60% of sustainable funds meet or fall below the median volatility of traditional funds. The performance of responsible funds can also be related to specific abilities of asset managers. Managers who follow ESG principles demonstrate deeper knowledge of market companies in which they invest, which leads to better management of financial portfolios [31,61].

Other authors have further distinguished responsible funds by considering the investment strategy implemented (positive or best-in-class screening criteria compared with a negative screening approach), studying the link between the strategic approach and the risk-adjusted performance of financial portfolios [59,62,63]. Trinks and Scholtens [56] find that the opportunity cost of negative screening depends on the investment categories to be excluded, which produce different impacts and deviations to the normal return trends. The financial loss associated with the screening methodology increases where screening is driven by environmental and labor criteria.

Deeper analysis on the relationship between the market risks of financial portfolios and their level of responsibility has been carried out by distinguishing portfolios according to their sustainability scores [60]. Morningstar’s [64] sustainability rating evaluates the potential risks of a controversy related to ESG issues affecting both a company and its stakeholders. Looking at the relationship between the number of globes assigned by Morningstar to mutual funds and their volatility, a strong negative relationship is found, which emphasizes the role of ESG-related concerns on market risk [64,65]. Moreover, the negative correlation between ESG score and stock volatility becomes even stronger when market volatility is higher. Further, securities with the highest ESG scores show the lowest residual volatility, whereas stocks with a poor ESG evaluation have greater unknown risk [65].

This impact can differ depending on the industry to which the company belongs [5,66]. Besides, several studies demonstrate the relevance of size in affecting results. On one hand, findings show that ESG screening procedures tend to exclude large capitalization companies, operating for example in petroleum or chemical industry [31]. On the other hand, large capitalization companies tend to be more sensitive to reputational risk, with higher potential negative impact on stock return and volatility. Indeed, reputational issues can have different effects on performance according to corporate size and visibility [67,68]. De Haan et al. [25], considering ESG factors based on corporate environmental measures, show that stakeholder risk betas increase as firm size increases. For this reason, large capitalization stocks should be more motivated to apply ESG principles and obtain higher sustainability ratings [31,64].

Lastly, empirical studies also relate the pricing anomalies of sustainable mutual funds to financial behaviors of responsible investors. The literature shows a reduced reaction to market shocks and a higher loyalty of investors in sustainable funds compared to investors in conventional ones, reducing the volatility of fund shares [55,69,70]. With specific reference to the environment, Flammer [70] shows that investors are willing to sell (buy) stocks of firms behaving irresponsibly (responsibly) on the basis of their environmental awareness, which affects their level of financial risk.

The link between pricing anomalies in financial markets and firms’ responsibility toward ESG issues has been used to study ESG as a new risk factor.

Several studies focus on the introduction of new risk factors linked to non-financial behaviors of firms in multi-factor models for asset pricing [20,24,25,37,55,71,72,73]. Continuing the tradition of asset pricing literature of searching for unexplained risk components, some authors have included in their multi-factor models a generic risk factor related to corporate social responsibility [24,55,71,73,74], as well as risk factors related to specific environmental or social issues [20,25,37,72]. This literature shows that ESG components provide insights over and above other traditional risk factors (e.g., size, value, growth, momentum, style, dividend yield).

These traditional factors can be used for determining weights in portfolio selection and optimization by the application of a smart beta strategy. ESG, as a new risk factor, could be used in conjunction with smart beta approaches.

Haugen and Baker [75] and Grinold [76] empirically highlight how market cap-weighted indices are not efficient benchmarks. These indices do not provide adequate compensation for the risk they entail. Therefore, over the years, new forms of indexing and innovative approaches to portfolio management have appeared to overcome these limits. Among these, one of the most successful is the smart beta approach. It includes all alternative strategies to the standard indexing method based on market capitalization. Across smart beta strategies, the investor aims to outperform a benchmark without adopting market-cap weighting. In particular, it is possible to distinguish two smart beta segments: factor and alternative investing. The latter one works on portfolio’s rebalancing across re-weighting systems based on strategies such as equal weighting, fundamental weighting, or criteria that rely on heuristics. On the other hand, factor investing is a portfolio strategy aimed at gaining exposure to one or more risk factors which are outside the plain-vanilla market portfolio. For example, a value smart beta strategy overweight companies with a low price-to-book ratio and underweights firms with a high price-to-book ratio. Current weighting schemes in factor investing focus on traditional risk variables that have been well documented, such as size [77], value [78], quality [79], momentum [80], and low risk [81].

Since ESG characteristics may be a new risk factor, our research aims to verify whether risk-adjusted performance of a smart beta strategy based on traditional factors can be improved by adding ESG considerations. In order to integrate ESG issues into asset allocation, we test both a pure factor investing strategy applied to a sustainability-screened portfolio, and a factor investing approach rebalanced across a re-weighting system based on ESG scores.

ESG issues are not independent from other risk factors; the literature shows correlations between ESG scores and traditional factors. In particular, ESG scores are correlated with size. Large corporates usually invest a higher amount of resources in improving ESG strengths, reducing ESG concerns, and increasing reporting on ESG issues. The literature confirms that smaller companies generally record lower ESG scores [82]. The literature also finds that sin stocks are characterized by lower valuations compared to the whole market [83]. Firms with higher employee satisfaction have higher earnings on average [84] and, in general, companies with higher ESG scores have a higher return on equity, which suggests there is a positive relationship between corporate responsibility and quality factors, as well as profitability. Lastly, ESG scores can be correlated with the momentum factor. The increased amount of funds addressed to socially responsible investing can impact specific companies with a good ESG evaluation, creating potential momentum effect [82].

In short, ESG considerations can lead to substantial biases in investment style, and large corporates with a good level of profitability are more exposed to this bias.

3. Methodology

In order to verify the effect of ESG integration on the risk-return performance of smart beta portfolios, we use two different approaches for asset allocation.

In the first approach, starting from the constituents of a market index, we built portfolios based on alternative betas, periodically selecting the first quartile of benchmark’s assets with the highest smart beta. Each portfolio was then periodically rebalanced on the basis of the issuers’ ESG scores.

In the second approach, starting from the constituents of a market index, we selected securities on the basis of their ESG scores, periodically selecting the first quartile of benchmark’s assets with the highest score. The screened assets were then periodically weighted according to a specific alternative beta.

For the ESG evaluation of companies, we used the ESG scores by Bloomberg, which collects ESG data for over 10,000 publicly listed companies globally and rates them annually. Bloomberg ESG score is a measure of the company’s environmental, social, and governance disclosure. Bloomberg collects public ESG information disclosed by companies through corporate social responsibility or sustainability reports, annual reports and websites, and other public sources, as well as through company direct contacts. This data covers 120 environmental, social, and governance indicators including: carbon emissions, climate change effect, pollution, waste disposal, renewable energy, resource depletion, supply chain, political contributions, discrimination, diversity, community relations, human rights, cumulative voting, executive compensation, shareholders’ rights, takeover defense, staggered boards, and independent directors. Bloomberg ESG ratings penalize companies for missing data. The score ranges from 0.1 for companies that provide a minimum amount of ESG data up to 100 for those that disclose each data point collected by Bloomberg. Each data point is weighted in terms of importance, with data such as greenhouse gas emissions carrying more weight than other publications. The score is also customized for different industrial sectors. In this way, each company is evaluated in terms of the relevant data for its industry sector.

The first and the second approach for portfolio selection are applied starting from the constituents of two different market indexes: S&P500 and Stoxx Europe 600. This way the analysis is focused on Europe and the US, the two areas that cover almost all ESG investments globally [2]. At the same time, European and North American asset owners show the highest rate of smart beta adoption and the largest increase in the recent past [13].

The analysis covers a five-year time horizon. Analyzing portfolios’ performances, we have noticed that the added value of the sustainable screening and rebalancing is visible in a long-time horizon, as suggested also by the literature. In the short term the selected portfolios’ returns are similar to or even lower than benchmarks. Unfortunately, Bloomberg provides a wide dataset of ESG scores starting from 2014, so we consider for the analysis a holding period equals to five years, from 31 December 2014 to 31 December 2019.

The empirical analysis was made across two Bloomberg functions: equity screening (EQS) and equity screening back-testing (EQBT). EQS is a customizable screening tool for portfolio construction through the application of investment strategies. It helps managers and investors to generate investment ideas, create list of securities to follow, and then validate new trade ideas by verifying how they performed historically. As an example, applying the US first-quarter earnings approach, the function can screen companies with faster one-year sales and earnings-per-share growth than the weighted average of their peer group. Criteria for screening include categories such as countries and sectors, along with data categories such as fundamentals, estimates, and financial ratios. Based on an investment idea, the function creates lists of securities and compares the screened items against a market index benchmark. It is possible to analyze growth, trends, and estimate revisions over time. The test updates the portfolio at user-defined historical intervals. We used a monthly frequency for updating the portfolios. The function shows the risk-return statistics of financial portfolios, compared with benchmarks.

EQBT makes it possible to analyze the performance of new investment ideas with historical data. Back-test simulates the investment decisions of the model (or screen/selection criteria) using Bloomberg historical database and computes the theoretical historical return profile. It is the main tool used to determine the value of a strategy by a fundamental or quantitative manager. EQBT function can rebalance a portfolio using specified criteria. The back-testing covers a time window with periodical rebalancing. We screened and rebalanced portfolios over a five-year window with monthly rebalancing.

The smart beta strategies applied for portfolio selection were the following:

- -

- Value, aimed to capture excess returns from stocks that have low price relative to their fundamental value;

- -

- Momentum, aimed to capture excess returns from stocks that have a persistent positive trend in time;

- -

- Minimum volatility, aimed to capture excess returns from stocks with lower volatility than average with respect to reference index;

- -

- Dividend yield, aimed to capture excess returns from stocks capable of regularly paying high dividends;

- -

- Growth, aimed to capture excess returns from stocks with an increasing price expectation.

These strategies were used to select securities and to define weights for the allocation of financial portfolios, starting from market indexes. These factors were the basis for the allocation of dynamic portfolios of equities which maximize the exposure to each factor. As an example, for the “Value” strategy, we used the price-to-book (P/B) ratio as a measure for asset allocation, overweighting securities with a low P/B ratio and underweighting assets with a high P/B ratio.

We excluded from our analysis alternative betas in which the ESG filter could produce biases. In particular, we did not apply ESG screening and rebalancing on portfolios based on quality and size factors. Smart beta strategies based on quality seek to capture excess returns from companies with good indicators of quality such as profitability, quality of earnings, operational efficiency, and managerial strength. On the other hand, strategy based on size seeks to capture excess returns from small capitalization shares. Literature shows that there are significant relationships between ESG and the traditional factors used in some of the most popular smart beta strategies [82,83,84]. A strong relationship has been found between ESG and corporate size, as well as between ESG and profitability. Since small and less profitable companies have generally lower scores, applying ESG considerations on a portfolio based on size and quality factor can produce investment biases.

In the first approach, we built portfolios based on the first quartile of a market index (respectively S&P500 and Stoxx Europe 600) according to a smart beta strategy, and then we applied a monthly ESG portfolio rebalancing (ex-post ESG rebalancing approach). In other words, starting from the constituents of a benchmark, the Bloomberg functions built financial portfolios based on alternative betas (for each smart beta strategy, a parameter or ratio to select stocks was chosen). Each portfolio was then rebalanced on the basis of the issuers’ ESG scores.

In the second approach, we built portfolios based on the first quartile of a market index (respectively S&P500 and Stoxx Europe 600) with the highest ESG score, and subsequently we applied a monthly smart beta rebalancing (ex-ante ESG screening approach). In other words, starting from the constituents of a benchmark, the Bloomberg functions selected securities on the basis of their ESG scores. Then, the screened assets were weighted according to a specific alternative beta.

Therefore, applying the two approaches, we obtain four portfolios’ categories:

- (1)

- Strictly smart beta;

- (2)

- Smart beta screened with ESG rebalancing;

- (3)

- Strictly ESG;

- (4)

- ESG based with smart beta rebalancing.

The basic statistical concept for portfolios’ construction is quartile. It divides an ordered statistical distribution into groups containing an equal number of data (Equation (1)).

The index from which constituents are extracted is previously ordered according to pre-set criteria (smart beta ratio or ESG score) and the first quartile is periodically taken, intended as the portion of the index that best meets the requirement. The first quartile is calculated every month. Then, each month the portfolio is rebalanced, in order to make it more consistent with the selected rebalancing criteria. Therefore, rebalancing the portfolio means changing its composition. This operation can be done by adding new securities and removing others, or by buying or selling shares in the initial portfolio in order to modify the “weights” of the different assets. The Bloomberg functions consider the costs of rebalancing portfolios and taxation on capital gains.

Table 1 shows the empirical analysis process based on Bloomberg functions for portfolio screening and rebalancing in the two approaches.

Table 1.

Empirical analysis process.

In both approaches, portfolios were built starting from an index and, after the screening and rebalancing, compared with the same index, used as benchmark.

In the first approach, the purpose is to verify the performance of the most common smart beta strategies, testing the efficacy of a rebalancing according to an ESG score. Applying EQBT, it was possible to evaluate how ESG rebalancing is able to impact risks and returns of strictly smart beta portfolios.

The second approach aims to verify the performance of a smart beta strategy applied to a sustainable portfolio, selected according to an ESG evaluation. For example, the eligible ESG universe was rebalanced according to the lowest monthly volatility or the lowest P/B ratio. Applying EQBT, it was possible to evaluate the impact of a smart beta rebalancing on a portfolio strictly sustainable. EQBT function allows you to verify whether the smart beta rebalancing is able to produce a rewarded risk premium exposure for a sustainable financial portfolio.

Both EQS function and EQBT one are applied monthly. Starting from the same index, the portfolios are monthly selected, and later monthly rebalanced. This produces a high portfolio turnover rate, especially in portfolios born from a first smart beta selection. In general, there is a high variability in portfolio composition. For this reason, descriptive statistics and comparison of assets in each portfolio are particularly hard to produce. To better understand the asset allocation and the differences between portfolios, we show the statistics for a specific smart beta strategy (minimum volatility). Other statistics are available from the authors on request.

Table 2 shows the number of incoming and outgoing assets for the final portfolios obtained with the minimum volatility selection and the ESG rebalancing (MIN VOL ESG), as well as with the ESG screening and the minimum volatility rebalancing (ESG MIN VOL), just for the year 2019, respectively for the European market and the American one.

Table 2.

Monthly portfolio turnover—Europe and US. ESG Minimum volatility portfolio and minimum volatility ESG portfolio—2019.

The strictly smart beta strategy involves a more variable portfolio than strictly ESG one. According to the specific strategy, the rate of turnover can be higher in Europe than US, or vice versa.

In order to describe the monthly return of portfolios built applying the two approaches, first with step one and then with step two, Table 3 presents the descriptive statistics of four portfolios:

Table 3.

Descriptive statistics of monthly portfolios’ returns—Europe and US (2014–2019).

- (1)

- The portfolio built considering the first quartile of securities with the minimum volatility (MIN VOL);

- (2)

- Starting from the previous portfolio, the financial portfolio rebalanced considering the firms’ ESG scores (MIN VOL ESG).

- (3)

- The portfolio built considering the first quartile of securities with the highest ESG scores (ESG);

- (4)

- Starting from the previous portfolio, the financial portfolio rebalanced considering the securities’ volatility (ESG MIN VOL).

Table 4 shows the correlation matrix between portfolios’ returns. Within the same geographical area, the performance of different portfolios are highly correlated. On the other hand, the correlation is limited when the portfolios related to different financial markets are compared.

Table 4.

Correlation matrix of monthly portfolios’ returns—Europe and US (2014–2019).

4. Main Results

Table 5 and Table 6 show the main results for the first approach, for S&P 500 and Stoxx 600, respectively.

Table 5.

Results for ex-post ESG rebalancing approach—S&P 500.

Table 6.

Results for ex-post ESG rebalancing approach—Stoxx 600.

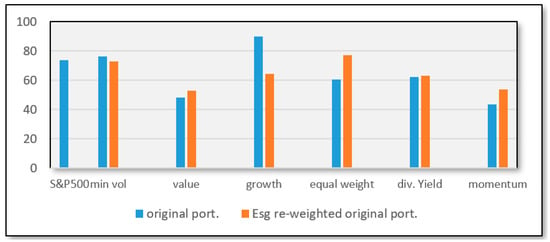

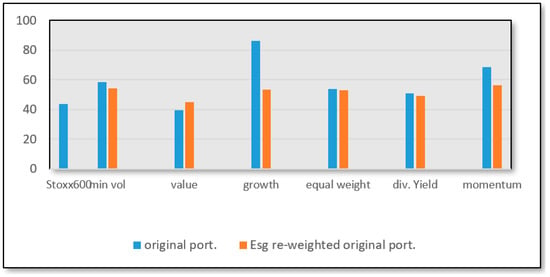

Analyzing returns, we observe that ex-post ESG rebalancing approach produced a higher compounded performance for four of the six smart-beta strategies in the case of the European index. The worst performance of ESG rebalancing was seen with the “Growth” strategy, as shown in Figure 1. For the American market, ESG-rebalancing was only useful in terms of returns in the case of the “Value” strategy, as shown in Figure 2, and here too, the worst effect in terms of returns was produced on portfolios weighted according to the “Growth” approach.

Figure 1.

The effect of ex-post ESG rebalancing approach on compounded returns—Stoxx600.

Figure 2.

The effect of ex-post ESG rebalancing approach on compounded returns—S&P500.

Nevertheless, these results have to be combined with statistics on risks, where the impact of ESG rebalancing was substantial.

Table 7 shows the comparison of the effect on standard deviation for both markets.

Table 7.

Standard deviation after ESG rebalancing—S&P500 and Stoxx 600.

ESG rebalancing is not always effective in profitability terms, but it can reduce risk level significantly. In terms of standard deviation, ESG rebalancing systematically reduces portfolio risk. There is just one exception; “Value” strategy, where the increase in risk level is justified by major returns. The risk premium per unit of risk for the different strategies can be analyzed using the Sharpe ratio. Table 8 compares the effect for the two markets.

Table 8.

Sharpe ratio after ESG rebalancing—S&P500 and Stoxx 600.

Applying the ex-post ESG rebalancing approach to a portfolio, the Sharpe ratio only decreases to a significant extent for the “Growth” strategy, for Europe and US. In the case of the “Growth” approach, the negative impact on returns after ESG rebalancing is stronger than the positive effect on risks. For all the other alternative betas, the Sharpe ratio improves or remains substantially unchanged. ESG rebalancing is able to increase the sustainability of asset portfolios without causing waivers in terms of risk-adjusted performance, except for the “Growth” strategy.

Different results were obtained on sustainable portfolios. Table 9 and Table 10 show the main findings for the second approach, in which smart beta strategies were applied to a sustainability-screened portfolio, for the European and the American financial markets, respectively.

Table 9.

Results for ex-ante ESG screening approach with smart beta rebalancing—S&P500.

Table 10.

Results for ex-ante ESG screening approach with smart beta rebalancing—Stoxx600.

For ESG-screened portfolios, the alternative beta that produces the highest total return is “Growth”. All ESG portfolios, with the sole exception of the “Value” strategy, outperform the benchmark represented by S&P500. For the American Stoxx600, whose total return in the period was equal to 43.76%, only the “Momentum” strategy shows a performance slightly lower.

These results show that where first ESG screening and later a smart beta strategy are applied, the selected portfolios outperform the benchmarks, with the two exceptions of value and momentum strategies in both US and European markets.

The Sharpe ratio (Table 11) yields some interesting results.

Table 11.

Sharpe ratio after smart beta rebalancing—S&P500 and Stoxx 600.

First, “Minimum volatility” is the smart beta strategy that increases the Sharpe ratio for sustainable portfolios on both European and American markets. “Minimum volatility” thus proves to be an efficient strategy for sustainable portfolios. Comparing “Value” and “Growth” strategy on sustainability-screened portfolios, “Value” produces a strong decrease in risk-adjusted performance, while “Growth” increases the Sharpe ratio for sustainable portfolios, in particular on the American market.

Comparing the two empirical approaches, ESG rebalancing proves to be particularly efficient in terms of risk-adjusted performance when it is applied to a “Value” portfolio. On the other hand, when smart beta is applied to ESG-screened portfolios, “Growth” is the strategy which shows the highest increase, particularly in the US.

Robustness Tests

In order to test the robustness of our results, we analyzed portfolios’ risk-adjusted performance by using the capital asset pricing model (CAPM). Since recent literature has expressed the convenience of adopting multi-factor models to exceed the weaknesses of the CAPM single index, we applied Fama and French five-factor model [85,86], one of the main methodologies used by influential papers that study financial portfolios’ performance [16]. Then, we used this multi-factor model to compare the risk-adjusted performance of financial portfolios built using the different approaches presented in the paper.

The five-factor model captures the size, value, profitability, and investment patterns on average stock returns, in addition to market risk. The idea behind this model is that smaller and value firms (with a low value of market price/book) are likely to outperform bigger and growth firms; besides, the best performers are firms with a high operating profitability; and, lastly, companies with the high total asset growth record poorer returns.

The Fama and French five-factor model is shown in Equation (2):

where: rpt represents the return on portfolio p considering month t, rft represents the return on risk-free (one-month), considering month t, rmt represents the portfolio’s benchmark, considering month t, αp gives the Jensen alpha, βp represents the beta of the portfolio p. It measures the portfolio’s risk in comparison to the market risk, SMBt represents the difference in return between a small cap portfolio and a large cap portfolio at time t, HMLt represents the difference in return at time t between a portfolio containing value stocks (with a high book-to-market ratio) and one consisting of growth stocks (with a low book-to-market ratio). RMWt represents the difference between the returns of robust and weak profitability stock portfolios, CMAt represents the difference between the returns of low (conservative) and high (aggressive) investment stocks portfolios. εpt represents the residual term considering period t.

rpt − rft = αp + βp(rmt − rft) + δpSMBt + ρpHMLt + φpRMWt + σpCMAt + εpt

SMB, HML, RMV, and CMA factors relating to American and European markets were downloaded from Kenneth R. French’s website (http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html).

Table 12 and Table 13 show the results of the five-factor model, respectively for the American and European market. The tables contain the coefficients for the different portfolios for which descriptive statistics have been presented.

Table 12.

5-factor model for ESG and minimum volatility approaches (S&P500)—five years and three years.

Table 13.

Five-factor model for ESG and minimum volatility approaches (Stoxx Europe 600)—five years and three years.

Each portfolio extracted from the benchmark is compared with the corresponding financial portfolio after the rebalancing activity (1 versus 2, as well as 3 versus 4). Moreover, the final rebalanced portfolio according to the two main approaches are compared (2 versus 4).

Lastly, in order to verify the results for different holding periods, the same regressions are applied considering five-year returns, as well as three-year returns.

This table (Table 12) reports the Ordinary Least Squares estimates for the sample of first quartile minimum volatility portfolio, the ESG rebalancing portfolio, the first quartile ESG portfolio, and the minimum-volatility rebalancing portfolio. The benchmark is represented by S&P500 index. We tested the equality of means with two-sample Z tests. “*”, “**”, “***” indicate 1%, 5%, 10% significance levels, respectively. Standard errors are in parenthesis.

The R squared spreads from 79% to 97%, indicating the passive nature of the different approaches. Each portfolio is a selection of the initial benchmark, so it well reflects the benchmark performance.

This table (Table 13) reports the OLS estimates for the sample of first quartile minimum volatility portfolio, the ESG rebalancing portfolio, the first quartile ESG portfolio, and the minimum-volatility rebalancing portfolio. The benchmark is represented by Stoxx Europe 600 Index. We tested the equality of means with two-sample Z tests. “*”, “**”, “***” indicate 1%, 5%, 10% significance levels, respectively. Standard errors are in parenthesis.

The R-squared for the European market is even higher, ranging from around 90% to 97%.

Results are similar for the two geographical areas, as well as for the two holding periods. The most significant difference between financial portfolios is related to market risk exposure (this variable is always significant at a very high level, as well as its difference between portfolios). On the other hand, no substantial difference is detected between the other Fama and French factors. SMB, HML, RMV, and CMA are often statistically not significant. The level of portfolio diversification is not compromised, and the analyzed portfolios do not show a specific investment strategy related to size, value, profitability, and investment pattern.

Minimum-volatility portfolios are more exposed to market risk than ESG rebalancing portfolios (only for the European market and the five-year holding period the coefficients are similar, before and after the rebalancing). ESG rebalancing is able to reduce the volatility of smart-beta portfolios selected according to the minimum volatility strategy.

Smart beta and ESG considerations can be effectively combined also with the second approach. The volatility of a sustainable portfolio, selected according to ESG scores, can be reduced by rebalancing the asset weights applying a smart-beta strategy. In particular, ESG portfolios are more exposed to market risk than minimum-volatility rebalancing portfolios.

If we compare the final portfolios achieved with the two approaches, it is possible to verify the higher effect on market risk produced by smart beta selection than ESG selection. When a minimum volatility strategy is applied to a portfolio, beta coefficient drops compared to an ESG portfolio. Nevertheless, the exposure to market risk is usually further reduced if an ESG-rebalancing is applied.

We obtained similar results for the other smart-beta strategies (they are available from the authors on request).

5. Conclusions

Globally, over half of asset owners anticipate applying sustainability considerations to smart beta strategies (more than 80% among EMEA asset owners) [13].

The growth of interest in ESG issues is also driven by regulatory reforms, in particular in Europe [87]. As an example, the IORP II Directive (UE 2016/2341) encourages pension funds to integrate ESG issues in both risk analysis and investment policies, and establishes specific disclosure measures in favor of beneficiaries. In 2018, The European Commission published an Action Plan for Sustainable Finance, aimed at improving the contribution of the financial sector to a sustainable and inclusive growth. The European Parliament and Council published the Regulation UE 2019/2088 which introduced new duties of disclosure on sustainability for financial services institutions. ESG factors were also introduced by EIOPA in 2019 in stress tests for assessing the resilience of European pension sectors to an adverse market scenario.

At the same time, smart beta strategies, an intermediate approach between active and passive strategies in portfolio management, are spreading widely among asset managers.

First, the purpose of this explorative study was to investigate the effects of an ex-post ESG portfolio rebalancing on risk-adjusted performance when different smart beta approaches are applied to portfolio selection. Secondly, the study aimed to verify the risk/return impact of ex-ante ESG-screened portfolios when several smart beta strategies are applied.

Our results show that some smart beta strategies can be efficiently combined with ESG rebalancing or ESG screening. For most smart beta strategies, adding ESG considerations for portfolio selection and optimization is able to improve the sustainability of the asset portfolios without reducing their efficiency. ESG rebalancing and screening impact on both return and risk statistics. When the compound return falls, financial risks are more than counterbalanced. However, the two approaches used for considering ESG factors (ex-post ESG rebalancing and ex-ante ESG screening) impact differently on the final risk-adjusted performances, and these differences possibly reflect the different levels of constraint imposed. The ESG screening approach imposes a first level of constraints in the selection of portfolio composition, by admitting only firms with the highest ESG score to the eligible universe. The smart beta strategy on the other hand entails other constraints related to the selected alternative beta. In the ESG rebalancing approach, the original eligible universe is wider and is not screened according to ESG characteristics. In this case, portfolio biases due to ESG issues do not affect asset selection, but ESG considerations are used simply to rebalance the weights of different assets in the smart-beta portfolio.

Starting from a sustainable portfolio, selected according to the ESG scores of the issuers, one of the most efficient smart beta strategies is minimum volatility. This is coherent with the recent introduction on financial markets of a low volatility index with ESG integration: MSCI Minimum Volatility ESG Target Index, designed to capture the performance of a strategy that seeks systematic integration of ESG scores in minimum volatility investing. MSCI methodology aims to minimize risk while improving the ESG profile of the asset portfolio. The methodology of MSCI construction, and portfolio construction, is similar to the second approach used in our analysis. A parent index is selected and all the securities in the parent index that are not involved in very severe ESG controversies are included in the eligible universe. The parent index is optimized by using an estimated co-variance matrix to produce a portfolio that has the lowest absolute volatility for a given set of constraints. This includes specific constraints for improving the ESG profile of the index relative to the underlying parent index.

Focusing on minimum volatility strategy, a Fama and French five-Factor model was applied to test the results of the study. The most significant difference between financial portfolios is related to market risk exposure. In particular, even if all the analyzed financial portfolios are characterized by a market beta inferior to one, some relevant differences are detected among the samples. The exposure to the market risk is higher for ESG portfolios than for minimum-volatility ones. Nevertheless, if an ESG-rebalancing is applied to a minimum-volatility portfolio, market risk further declines. The Fama and French five-factor models confirm the main findings of the previous methodology. Our results confirm that the lack of consideration of ESG variables in portfolio management makes performance more vulnerable.

The effects on risk-adjusted performances of ESG considerations for portfolio selection and optimization is a field which requires deeper investigation in the future.

Our analysis investigates a period when, because of the growth of SRI, a huge amount of cash flow was directed towards securities characterized by high ESG scores, and when there was also an increase in sustainable investments by traditional investors and funds. As a consequence, buying stocks with high socially responsible scores and selling stocks with low socially responsible scores could lead to high abnormal returns [62]. Because it is possible that a strategy may appear to be successful only because it is measured in a favorable period [88], future research will be required to test the persistency of our results.

Future studies will also be required to focus on different financial markets. Our research highlighted the effect of ESG on portfolios made up of European and US securities, the markets in which both SRI and smart beta strategies are most common. It is however the case that some factors can be more effective in smaller stocks and in less-liquid financial markets, such as those of developing countries.

Author Contributions

Conceptualization, P.C. and F.I.; methodology, P.C., F.I., P.Z.; validation, P.C., F.I.; investigation, P.Z.; data curation, P.Z.; writing—original draft preparation, F.I., P.Z.; writing—review and editing, F.I., P.Z.; supervision, F.I. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Eurosif. European SRI Study 2018. Available online: http://www.eurosif.org/wp-content/uploads/2018/11/European-SRI-2018-Study.pdf (accessed on 3 May 2020).

- Global Sustainable Investment Alliance. Global Sustainable Investment Review. 2018. Available online: http://www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf (accessed on 28 May 2020).

- Boutin-Dufresne, F.; Savaria, P. Corporate social responsibility and financial risk. J. Investig. 2014, 13, 57–66. [Google Scholar] [CrossRef]

- Brogi, M.; Lagasio, V. Environmental, social, and governance and company profitability: Are financial intermediaries different? Corp. Soc. Responsib. Environ. Manag. 2019, 26, 576–587. [Google Scholar] [CrossRef]

- Khan, S.; Bradbury, M.E. The volatility of comprehensive income and its association with market risk. Account. Financ. 2016, 56, 727–748. [Google Scholar] [CrossRef]

- Kotsantonis, S.; Pinney, C.; Serafeim, G. ESG integration in investment management: Myths and realities. J. Appl. Corp. Financ. 2016, 28, 10–16. [Google Scholar]

- Lo, K.Y.; Kwan, C.L. The effect of environmental, social, governance and sustainability initiatives on stock value–Examining market response to initiatives undertaken by listed companies. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 606–619. [Google Scholar] [CrossRef]

- Xie, J.; Nozawa, W.; Yagi, M.; Fujii, H.; Managi, S. Do environmental, social, and governance activities improve corporate financial performance? Bus. Strategy Environ. 2019, 28, 286–300. [Google Scholar] [CrossRef]

- Kahn, R.N.; Lemmon, M. The asset manager’s dilemma: How smart Beta is disrupting the investment management industry. Financ. Anal. J. 2016, 72, 15–20. [Google Scholar] [CrossRef]

- Dimson, E.; Marsh, P.; Staunton, M. Factor-based investing: The long-term evidence. J. Portf. Manag. 2017, 43, 15–37. [Google Scholar] [CrossRef]

- Kahn, R.N.; Lemmon, M. Smart Beta: The owner’s manual. J. Portf. Manag. 2015, 41, 76–83. [Google Scholar] [CrossRef]

- Boston Consulting Group. Global Asset Management 2018. The Digital Metamorphosis; BCG: Boston, MA, USA, 2018; Available online: BCG-The-Digital-Metamorphosis-July-2018-R_tcm30-197509.pdf (accessed on 16 May 2020).

- FTSE Russell. Smart Sustainability: 2020 Global Survey Findings from Asset Owners. 2020. Available online: https://www.ftserussell.com/index/spotlight/smart-sustainability-survey (accessed on 1 September 2020).

- La Torre, M.; Mango, F.; Cafaro, A.; Leo, S. Does the ESG index affect stock return? Evidence from the eurostoxx50. Sustainability 2020, 12, 6387. [Google Scholar] [CrossRef]

- De Lucia, C.; Pazienza, P.; Bartlett, M. Does good ESG lead to better financial performances by firms? Machine learning and logistic regression models of public enterprises in Europe. Sustainability 2020, 12, 5317. [Google Scholar] [CrossRef]

- Fabregat-Aibar, L.; Barberà-Mariné, M.G.; Terceno, A.; Pié, L. A bibliometric and visualization analysis of socially responsible funds. Sustainability 2019, 11, 2526. [Google Scholar] [CrossRef]

- Mollet, J.C.; Ziegler, A. Socially responsible investing and stock performance: New empirical evidence for the US and European stock markets. Rev. Financ. Econ. 2014, 23, 208–216. [Google Scholar] [CrossRef]

- Albuquerque, R.; Koskinen, Y.; Zhang, C. Corporate social responsibility and firm risk: Theory and empirical evidence. Manag. Sci. 2019, 65, 4451–4949. [Google Scholar] [CrossRef]

- Jin, X. How much does book value data tell us about systemic risk and its interactions with the macroeconomy? A Luxembourg empirical evaluation. Cent. Bank Luxemb. Work. Pap. 2018, 118, 1–52. [Google Scholar]

- Luo, H.A.; Balvers, R.J. Social screens and systematic investor boycott risk. J. Financ. Quant. Anal. 2017, 52, 365–399. [Google Scholar] [CrossRef]

- Oikonomou, I.; Brooks, C.; Pavelin, S. The effects of corporate social performance on the cost of corporate debt and credit ratings. Financ. Rev. 2014, 49, 49–75. [Google Scholar] [CrossRef]

- Becchetti, L.; Ciciretti, R.; Hasan, I. Corporate social responsibility, stakeholder risk, and idiosyncratic volatility. J. Corp. Financ. 2015, 35, 297–309. [Google Scholar] [CrossRef]

- Albuquerque, R.; Durnev, A.; Koskinen, Y. Corporate Social Responsibility and Asset Pricing in Industry Equilibrium. 2012. Available online: http://www.investlogic.ch/wp-content/uploads/2013/03/130319-Geneva-Symposium-Yrjo-Koskinen-corporate-social-responsability-and-asset-pricing-in-industry-equilibrium.pdf (accessed on 2 March 2019).

- Becchetti, L.; Ciciretti, R.; Dalò, A. Fishing the corporate social responsibility risk factors. J. Financ. Stab. 2018, 37, 25–48. [Google Scholar] [CrossRef]

- de Haan, M.; Dam, L.; Scholtens, B. The drivers of the relationship between corporate environmental performance and stock market returns. J. Sustain. Financ. Investig. 2012, 2, 338–375. [Google Scholar]

- Freeman, E.R. Strategic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Humphrey, J.E.; Lee, D.D. Australian socially responsible funds: Performance, risk and screening intensity. J. Bus. Ethics 2012, 102, 519–535. [Google Scholar] [CrossRef]

- Lioui, A.; Sisto, M. Corporate social responsibility and the cross section of stock returns. SSRN Electron. J. January 2016, 1–40. Available online: https://ssrn.com/abstract=2730722 (accessed on 10 June 2019). [CrossRef]

- Minor, D.; Morgan, J. CSR as reputation insurance: Primum non nocere. Calif. Manag. Rev. 2011, 53, 40–59. [Google Scholar] [CrossRef]

- McCormick, R. Legal Risk in the Financial Marktes; Oxford University Press: Oxford, UK, 2004; ISBN 978-0199575916. [Google Scholar]

- Paul, K. The effect of business cycle, market return and momentum on financial performance of socially responsible investing mutual funds. Soc. Responsib. J. 2017, 13, 513–528. [Google Scholar] [CrossRef]

- Nofsinger, J.; Varma, A. Socially responsible funds and market crises. J. Bank. Financ. 2014, 48, 180–193. [Google Scholar] [CrossRef]

- Kim, Y.; Li, H.; Li, S. Corporate social responsibility and stock price crash risk. J. Bank. Financ. 2014, 43, 1–13. [Google Scholar] [CrossRef]

- Lins, K.V.; Servaes, H.; Tamayo, A. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- Verheyden, T.; Eccles, R.G.; Feiner, A. ESG for all? The impact of ESG screening on return, risk, and diversification. J. Appl. Corp. Financ. 2016, 28, 47–55. [Google Scholar]

- Chava, S. Environmental externalities and cost of capital. Manag. Sci. 2014, 60, 2223–2247. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kim, H.; Park, K. Corporate environmental responsibility and the cost of capital: International evidence. J. Bus. Ethics 2018, 149, 335–361. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.; Mishra, D.R. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Goss, A.; Roberts, G.S. The impact of corporate social responsibility on the cost of bank loans. J. Bank. Financ. 2011, 35, 1794–1810. [Google Scholar] [CrossRef]

- Jiraporn, P.; Jiraporn, N.; Boeprasert, A.; Chang, K. Does corporate social responsibility (CSR) improve credit ratings? Evidence from geographic identification. Financ. Manag. 2014, 43, 505–531. [Google Scholar] [CrossRef]

- Jang, G.Y.; Kang, H.G.; Lee, J.Y.; Bae, K. ESG scores and the credit market. Sustainability 2020, 12, 3456. [Google Scholar] [CrossRef]

- Li, P.; Zhou, R.; Xiong, Y. Can ESG performance affect bond default rate? Evidence from China. Sustainability 2020, 12, 2954. [Google Scholar] [CrossRef]

- Zhao, C.; Guo, Y.; Yuan, J.; Wu, M.; Li, D.; Zhou, Y.; Kang, J. ESG and corporate financial performance: Empirical evidence from China’s listed power generation companies. Sustainability 2018, 10, 2607. [Google Scholar] [CrossRef]

- Stellner, C.; Klein, C.; Zwergel, B. Corporate social responsibility and Eurozone corporate bonds: The moderating role of country sustainability. J. Bank. Financ. 2015, 59, 538–549. [Google Scholar] [CrossRef]

- Attig, N.; El Ghoul, S.; Guedhami, O. Corporate social responsibility and credit ratings. J. Bus. Ethics 2013, 117, 679–694. [Google Scholar] [CrossRef]

- Cubas-Díaz, M.; Martínez Sedano, M.A. Do credit ratings take into account the sustainability performance of companies? Sustainability 2018, 10, 4272. [Google Scholar] [CrossRef]

- Truong, T.T.T.; Kim, J. Do corporate social responsibility activities reduce credit risk? Short and long-term perspectives. Sustainability 2019, 11, 6962. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Fernández-Izquierdo, M.A.; Ferrero-Ferrero, I.; Rivera-Lirio, J.M.; Muñoz-Torres, M.J. Rating the raters: Evaluating how ESG rating agencies integrate sustainability principles. Sustainability 2019, 11, 915. [Google Scholar] [CrossRef]

- Del Giudice, A.; Rigamonti, S. Does audit improve the quality of ESG scores? Evidence from corporate misconduct. Sustainability 2020, 12, 5670. [Google Scholar] [CrossRef]

- García, F.; González-Buno, J.; Guijarro, F.; Oliver, J. Forecasting the environmental, social, and governance rating of firms by using corporate financial performance variables: A rough set approach. Sustainability 2020, 12, 3324. [Google Scholar] [CrossRef]

- Bauer, R.; Derwall, J.; Otten, R. The ethical mutual fund performance debate: New evidence from Canada. J. Bus. Ethics 2007, 70, 111–124. [Google Scholar] [CrossRef]

- Capelle-Blancard, G.; Monjon, S. The performance of socially responsible funds: Does the screening process matter? Eur. Financ. Manag. 2014, 20, 494–520. [Google Scholar] [CrossRef]

- Haigh, M.; Hazelton, J. Financial markets: A tool for social responsibility? J. Bus. Ethics 2004, 52, 59–71. [Google Scholar] [CrossRef]

- Hamilton, S.; Joe, H.; Statman, M. Doing well while doing good? The investment performance of socially responsible mutual funds. Financ. Anal. J. 1993, 49, 62–66. [Google Scholar] [CrossRef]

- Renneboog, L.; Ter Horst, J.; Zhang, C. Socially responsible investments: Institutional aspects, performance, and investor behavior. J. Bank. Financ. 2008, 32, 1723–1742. [Google Scholar] [CrossRef]

- Trinks, P.J.; Scholtens, B. The opportunity cost of negative screening in socially responsible investing. J. Bus. Ethics 2017, 140, 193–208. [Google Scholar] [CrossRef]

- Ielasi, F.; Rossolini, M. Responsible or thematic? The true nature of sustainability-themed mutual funds. Sustainability 2019, 11, 3304. [Google Scholar] [CrossRef]

- Przychodzen, J.; Gómez-Bezares, F.; Przychodzen, W.; Larreina, M. ESG Issues among fund managers. Factors and motives. Sustainability 2016, 8, 1078. [Google Scholar] [CrossRef]

- Barnett, M.L.; Salomon, R.M. Beyond dichotomy: The curvilinear relationship between social responsibility and financial performance. Strateg. Manag. J. 2006, 27, 1101–1122. [Google Scholar] [CrossRef]

- Morningstar. The Morningstar Sustainable Investing Handbook. 2016. Available online: https://www.morningstar.com/content/dam/marketing/shared/Company/Trends/Sustainability/Detail/Documents/Morningstar-Sustainable-Investing-Handbook.pdf (accessed on 27 August 2019).

- Martin, W. Socially responsible investing: Is your fiduciary duty at risk? J. Bus. Ethics 2009, 90, 549–560. [Google Scholar] [CrossRef]

- Kempf, A.; Osthoff, P. The effect of socially responsible investing on portfolio performance. Eur. Financ. Manag. 2007, 13, 908–922. [Google Scholar] [CrossRef]

- Statman, M.; Glushkov, D. The wages of social responsibility. Financ. Anal. J. 2009, 65, 33–46. [Google Scholar] [CrossRef]

- Morningstar. Morningstar Sustainability Rating. 2019. Available online: https://www.morningstar.it/IntroPage.aspx?site=it&backurl=https%3A%2F%2Fwww.morningstar.it%2Fit%2Fnews%2F196978%2Fil-nuovo-morningstar-sustainability-rating.aspx (accessed on 8 August 2020).

- PRI. PRI Practical Guide to ESG Integration for Equity Investing. 2016. Available online: https://www.unpri.org/download?ac=10 (accessed on 22 September 2019).

- Auer, B.R.; Schuhmacher, F. Do socially (ir)responsible investments pay? New evidence from international ESG data. Q. Rev. Econ. Financ. 2016, 59, 51–62. [Google Scholar] [CrossRef]

- Morgan Stanley Institute for Sustainable Investing. Sustainable Reality: Understanding the Performance of Sustainable Investment Strategies. 2015. Available online: https://www.morganstanley.com/content/dam/msdotcom/ideas/sustainable-investing-offers-financial-performance-lowered-risk/Sustainable_Reality_Analyzing_Risk_and_Returns_of_Sustainable_Funds.pdf (accessed on 5 August 2019).

- Udayasankar, K. Corporate social responsibility and firm size. J. Bus Ethics 2008, 83, 167–175. [Google Scholar] [CrossRef]

- Bollen, N.P. Mutual fund attributes and investor behavior. J. Financ. Quant. Anal. 2007, 42, 683–708. [Google Scholar] [CrossRef]

- Flammer, C. Corporate social responsibility and shareholder reaction: The environmental awareness of investors. Acad. Manag. J. 2013, 56, 758–781. [Google Scholar] [CrossRef]

- Brammer, S.; Brooks, C.; Pavelin, S. Corporate social performance and stock returns: UK evidence from disaggregate measures. Financ. Manag. 2006, 35, 97–116. [Google Scholar] [CrossRef]

- Dowell, G.; Hart, S.; Yeung, B. Do corporate global environmental standards create or destroy market value? Manag. Sci. 2000, 46, 1013–1169. [Google Scholar] [CrossRef]

- Galema, R.; Plantinga, A.; Scholtens, B. The stocks at stake: Return and risk in socially responsible investment. J. Bank. Financ. 2008, 32, 2646–2654. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Radhakrishnan, S.; Tsang, A.; Yang, Y.G. Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. Account. Rev. 2012, 87, 723–759. [Google Scholar] [CrossRef]

- Haugen, R.A.; Baker, N.L. The efficient market inefficiency of capitalization-weighted stock portfolios. J. Portf. Manag. 1991, 17, 35–40. [Google Scholar] [CrossRef]

- Grinold, R.C. Are Benchmark portfolios efficient? J. Portf. Manag. 1992, 19, 34–40. [Google Scholar] [CrossRef]

- Banz, R.W. The relationship between return and market value of common stock. J. Financ. Econ. 1981, 9, 3–18. [Google Scholar] [CrossRef]

- Basu, S. The relationship between earnings’ yield, market value and the return for NYSE common stocks: Further evidence. J. Financ. Econ. 1983, 12, 129–156. [Google Scholar] [CrossRef]

- Novy-Marx, R. The other side of value: The gross profitability premium. J. Financ. Econ. 2013, 108, 1–28. [Google Scholar] [CrossRef]

- Jegadeesh, N.; Titman, S. Returns to buying winners and selling losers: Implications for stock market efficiency. J. Financ. 1993, 48, 65–91. [Google Scholar] [CrossRef]

- Frazzini, A.; Pedersen, L.H. Betting against Beta. J. Financ. Econ. 2014, 111, 1–25. [Google Scholar] [CrossRef]

- Alessandrini, F.; Jondeau, E. ESG investing: From sin stocks to smart Beta. Swiss Financ. Inst. Res. Pap. 2019, 19–16. Available online: https://ssrn.com/abstract=3357395 (accessed on 3 April 2020). [CrossRef]

- Hong, H.; Kacperczyk, M. The price of sin: The effects of social norms on markets. J. Financ. Econ. 2009, 93, 15–36. [Google Scholar] [CrossRef]

- Edmans, A. Does the stock market fully value intangibles? Employee satisfaction and equity prices. J. Financ. Econ. 2011, 101, 621–640. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. A five-factor asset pricing model. J. Financ. Econ. 2015, 116, 1–22. [Google Scholar] [CrossRef]

- Fama, E.; French, K.R. International tests of a five-factor asset pricing model. J. Financ. Econ. 2017, 123, 441–463. [Google Scholar] [CrossRef]

- Siri, M.; Zhu, S. Will the EU commission successfully integrate sustainability risks and factors in the investor protection regime? A research agenda. Sustainability 2019, 11, 6292. [Google Scholar] [CrossRef]

- Arnott, R.; Beck, N.; Kalesnik, V.; West, J. How Can ‘Smart Beta’ Go Horribly Wrong? 2016. Available online: https://www.researchaffiliates.com/en_us/publications/articles/442_how_can_smart_beta_go_horribly_wrong.html (accessed on 19 December 2019).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).