Abstract

According to the 2030 Agenda, gender equality plays a central role in achieving social development, expanding economic growth and improving business performance. From this perspective, many studies claim that a more balanced presence of women on Board of Directors (BoD) could have a positive impact on firms’ financial performance, but the effect of such diversity on sustainability performance is still underexplored. The purpose of this paper is to investigate how gender composition of BoD affects the corporate sustainability practices. In particular, we focused on the relationship between board gender composition and ESG (Environmental, Social and Governance) performance, by verifying if and to what extent there is a moderation effect due to the presence of CEO duality. We used the ESG index, provided by Bloomberg Data Service, as a proxy of sustainability performance and the Blau index as a measure of gender diversity in the BoD. The empirical analysis was carried out on a sample of Italian non-financial companies listed on Mercato Telematico Azionario (MTA) and includes a total of 128 observations. Results has shown that a greater gender diversity on BoD has an overall positive influence on ESG performance, while CEO duality negatively moderates the foregoing relationship.

1. Introduction

The issues of gender equality have been gaining considerable importance over the last years, especially in management studies [1,2,3,4,5]. Several researches paid attention on board composition and firm performance, particularly on the role that female directors played in value creation processes, whose positive effect on firm performance was confirmed by empirical evidence.

Not surprisingly, UN Sustainable Development Goals (SDGs) have prompted many firms to adopt ethical and sustainable practices, ensuring equal participation of women in firm organization in order to achieve gender equality and female empowerment. According to the 2030 Agenda, gender inequalities hinder the sustainable development, the economic growth and the achievement of equal opportunities between genders, whereas a full and effective women’s participation in decision-making processes at all levels plays a crucial role in firms’ value creation process. Moreover, if only a few independent directors are involved and the role of CEO and chairperson is held by the same person, the performance of the firm could be negatively affected.

While a large number of analyses examined the relationship between firm characteristics and financial performance, little attention has been devoted to verify how board gender composition can affect sustainability performance.

Accordingly, the main aim of the present study is to investigate the relationship between board gender diversity and sustainable performance and the moderation effect exerted by CEO duality.

In particular, we ran multiple regression models on a sample of Italian non-financial companies to examine the relation between ESG (Environmental, Social and Governance) performance (computed by ESG score) and gender diversity on BoD (measured by Blau index) and the extent to which it is contingent upon the presence of CEO duality.

To put it simply, our work lies in the following research question: To what extent does gender diversity affect ESG performance? Is the relationship moderated by CEO duality? Additionally, in the companies where CEO and board chairman are the same person, is this power concentration able to affect the former relationship?

Our hypothesis, that gender diversity in the boardroom has a positive influence over ESG performance, was confirmed by empirical evidence. Moreover, CEO duality negatively moderated the above relationship.

The work is organized as follows: Section 2 provides both the literature background on BoD composition and ESG performance and the formulation of the research hypotheses; Section 3 describes the quantitative analysis with regard to (a) the sample selection, (b) the choice of the variables (i.e., dependents, independents and control), (c) the econometric models and the robustness tests; Section 4 sets out the findings; Section 5 provides the discussion of findings and conclusions.

2. Literature Review and Research Hypothesis Development

Over the last decades, the relationship between corporate governance and firm performance (latu sensu) has been widely examined by international literature [6,7,8,9], focusing on different specific topics. Previous studies mostly analyzed the influence of BoD composition on financial performance.

Over recent years, there has been a growing interest on the effects of corporate governance on welfare-oriented practices adopted by companies. Several studies—conducted mainly in the developed markets (i.e., the United States)—showed that the compliance with the most virtuous practices, in terms of CSR and ESG, has relevant positive effects on corporate performance, increasing firm reputation, improving investors’ perception of risk and reducing the cost of capital. The legitimacy of the corporation in adopting virtuous practices [10] usually implies an increase of business profitability [11,12,13]. A recent research has shown that the most effective incidence of ethical practices is particularly evident for those companies with higher levels of ESG scores with respect to industry averages (so called “abnormal ESG performance”), which constitutes a competitive advantage against their competitors [14].

A responsible attitude in terms of social, environmental and governance responsibility is usually considered an investment that increases firm performance [15], as it represents the capability to create a successful balance between the pursuit of profit and the respect for social welfare [16]. Nevertheless, recent studies focused on specific issues and/or conducted on different markets (i.e., developing countries) led to counterintuitive results. In this regard, it is useful to highlight that the influence of governance structure on corporate performance (also in terms of ESG responsibility) significantly depends on the observed context (national or transnational) [17].

In other words, studies conducted in specific geographical contexts (i.e., developing countries) highlighted findings that are often at odds with the generality of research conclusions. This is due to the influence exerted by “environmental factors” such as the different degree of protection of stakeholders, the functioning of capital market, the characteristics of companies, the ownership structure and the corporate governance pattern [18].

In this perspective, our research—based on the relationship between board gender diversity and ESG performance in the Italian context—proved to be worthwhile because of the specific characteristics of the Italian companies; and considering that, as far as we know, few studies investigated this specific issue, in particular whether board gender diversity can affect firms’ sustainability performance.

The paper assumes relevance also considering that the principal variables observed (gender diversity and ESG performance) represent parts of Sustainable Development Goals (SDG) indicated by United Nations (UN), designed to promote prosperity while protecting the planet. In particular, SDG 5 encourages gender equality and, with regard to the specific issues of our study, brings “(...) women’s full and effective participation and equal opportunities for leadership at all levels of decision-making in political, economic and public life” (SDG 5.5).

In the past, different characteristics of corporate governance pattern were observed to ascertain their influence on company performance. The incidence of board size, gender diversity, CEO duality and the percentage of independent directors have been already investigated [19,20,21].

Recently, gender diversity gained a more relevant role within the broad category of academic researches by analyzing the influence of corporate governance on firm performance, with findings not always univocal [22,23,24]. The studies usually showed a positive relationship between the presence of women on BoD and company performance, in terms of both financial profitability [25,26,27,28,29,30,31,32] and CSR (and ESG) disclosure [3,33,34].

Other works, centered on the idea that diversity leads to disagreements and conflicts between board members, highlighted a negative effect on both financial performance [35,36,37,38] and CSR compliance (in particular, referring to ESG disclosure [17,39]). Still, further researches postulated the absence of significant effects of board gender diversity on corporate performance [19,40,41,42].

Our study, in line with the bulk of previous analyses, assumes that the appointment of women increases the dialogue within the BoD, improving the quality of the decision-making process and increasing the likelihood of implementing innovative and competitive business strategies [43,44].

The effect of women on BoD generally lies on the most common theories adopted to examine the potential influence of BoD on company performance [1]. In this perspective, according to agency theory [45], it can be argued that gender diversity increases the attitude of board members to control executive directors, with positive impact on corporate outcomes [46].

Starting from a different perspective, our research, based on the Resource Dependence Theory (RDT) [47,48,49], postulates that the presence of women on BoD provides critical resources for the company, improving its competitive profile and performance [50].

With specific reference to ESG compliance, it can be assumed that the presence of women on BoD also involves an increase of CSR performance on the basis of the following reasons [5,51].

First of all, the positive influence of gender diversity stems from the different perception women have about their leadership role within companies [2,52]; while men are generally focused on the preeminent needs of shareholders, women seem more willing to pay their attention to stakeholders’ interests [53,54,55].

Secondly, women have psychological attitudes more likely to reduce information asymmetries with other stakeholders and with market [56]; they also have wider knowledge in different fields [55] because of their occupational background (i.e., as business support specialists or community influential, more than business experts or insiders) [57]; this circumstance fosters the attitude to propose alternative solutions and to manage firm’s social and environmental challenges [27,51].

Moreover, the presence of women on the BoD is usually perceived as a signal of compliance with the expectations expressed by the market and the surrounding environment [34,58]. Finally, the different background leads women, more frequently than men, to be involved and to make relevant contributions to the decision-making process concerning CSR issues [34,59,60,61,62].

On the basis of the theoretical framework described above, our research aims to test if the gender diversity on BoD can positively affect ESG performance. Therefore, the following first hypothesis was posited:

Hypothesis (H1).Gender diversity has a positive influence on ESG performance.

A governance attribute that potentially affects the relationship between BoD composition and ESG performance is represented by CEO power, generally associated with the presence of CEO duality, namely when CEO also serves as chair on BoD.

Several studies highlighted that CEO duality usually constrains company financial performance [63,64]. According to agency theory [45], the rationale behind this evidence resides in the concentration of power, in charge of CEO, that limits the control function of other directors and shareholders; firm decisions are therefore not always geared towards the growth of business value and respect for stakeholders’ wealth. Moreover, the presence of CEO duality also implies negative effects on ESG performance [65,66].

Some studies also examined CEO duality as a moderation factor rather than an antecedent. These researches investigated the moderation effect of CEO duality within the relationship between ESG scores and financial performance. The findings show that the positive effect of ESG compliance on financial performance is amplified by the increased power exercised by the CEO [67,68,69].

Another study [70] investigated the moderation effect by CEO power with reference to the relationship between shareholder activism and environmental performance. The related findings showed a negative influence of CEO power.

Therefore, according to agency theory, our research aims also to test if the relationship between gender diversity and ESG performance can be constrained by the presence of CEO duality. Accordingly, we formulated the second hypothesis:

Hypothesis (H2).CEO duality negatively moderates the relationship between gender diversity and ESG performance.

3. Methods

3.1. Sample Selection

The Italian equity market serves as context to explore and test the theoretical speculations. Italy represents an ideal setting for this investigation because firms are sensitive to corporate social themes embedding them into strategic actions and exhibit superior level of stakeholders’ engagement [71].

In accordance with the European Directive 2014/95/UE, the Italian Legislative Decree 254/2016 [72,73] introduced the non-financial disclosure as compulsory in order to guarantee comparability and homogeneity across firms. We collected data for two years (2017 and 2018) because, at the time of writing, data for the fiscal year 2019 was not fully available yet, as the COVID-19 pandemic postponed shareholders’ meetings.

Data for environmental, social and governance disclosure score (ESG score) are retrieved from Bloomberg Data Service. The availability of ESG score on that database serves as starting point for our sampling procedure. Specifically, we searched for all Italian-listed firms with at least two consecutive years of data available. At the end of 2017 and 2018, 244 firms were listed on the Mercato Telematico Azionario (MTA), the main market of the Italian Stock Market (Borsa Italiana). Excluding financial firms (based on US-SIC code), we obtained a final sample of 64 unique firms, of which 18 firms belong to STAR segment of the MTA, while the others are listed on the Standard segment of the MTA. STAR contains midsize companies (market cap less than 1 billion €) which, on voluntary base, provide higher transparency and disclosure of their information, maintain high liquidity (free float >35) and adopt the best corporate governance standards. Bloomberg is also used for financial information, while governance data are hand-collected for each firm from the annual governance report.

3.2. Empirical Specification

To test our theoretical model, which claims that firms with a greater gender diversity and the separation of chair and CEO roles exhibit a superior level of ESG score, we used the following empirical specification that accounts for variables of interest and control, as well as for governance factors and firm characteristics.

To reduce potential endogeneity between gender diversity and ESG score, independent variables are one-year lagged. An intragroup estimation, the random effect approach, is employed according to Hausman test [74] that results in test statistics equal to 8.88 and a p-value of 0.45. Correcting for residual heteroscedasticity issues, Equation (1) is estimated with robust standard error.

Dependent variable. In deciphering the impact of board gender diversity on corporate sustainability practices, we consider ESG score as a dependent variable. This score relates to three fundamental dimensions: environmental, social and governance, and it has also the merit of capturing firm disclosure activity adjusted for the disclosure activity of firms operating in the same industry [75]. In each dimension, the score ranged from 0 to 100, the highest value representing the highest level of corporate sustainability. The ESG score, based on 120 qualitative and quantitative measures computed by using a proprietary method based only on public information, indicates “the degree to which a company is reporting on ESG information” [76].

Independent variables. Board gender diversity is operationalized using Blau index [77]. As argued by previous literature, such measure considers simultaneously the number of represented genders (male and female) and the evenness of the distribution of Board Directors in each category. According to [28], Blau_index is operationalized as follow: 1, where i represents different genders available in the board (male and female, n assumes thus value of 2) and p is the fraction of directors of gender i.

Blau index ranges from 0, when board of director is homogeneous (only one gender is present), to 0.5, when board is perfectly heterogeneous (male and female genders are equally represented). So, higher value of the index means more diversity in the boardroom.

CEO_duality acts as a moderator. This variable is codified as binary: 1 if there is no role separation, 0 if such roles are bipartite.

Finally, the Interaction (Blau_index*CEO_duality) is considered. Aiming at reducing multicollinearity, independent variables are mean-centered before considering their interaction [78].

Control variables. We also performed a conventional variables’ control at both firm and board level because corporate sustainability practices, captured by ESG score, might be influenced by firms’ characteristics as well as board configuration in terms of gender diversity, which is the underlying motive of this investigation.

At firm level, we controlled size, leverage, age, profitability and risk: size is proxied with total sales computed as logarithm to reduce skewness; leverage considers all non-equity liabilities over the book value of equity; age is the time elapsed since its foundation; profitability taken as Return on Asset (ROA) is the net operating income over total asset; risk considers the beta factor (Beta) as a proxy for systematic risk computed with standard CAPM model.

At the board level, size and independence are employed: board size (Bod_size) is the logarithmic transformation of the number of directors sitting in the boardroom; board independence (Bod_indep) is the ratio of independent directors over total directors.

4. Results

Table 1 reports descriptive statistics. Data reveal that board composition is substantially homogeneous (i.e., equal presence of women and men directors) from a gender perspective; indeed, Blau_index has a mean value of 0.446 and a standard deviation of 0.149. Such composition is in line with the overall Italian-listed firms, whose boards, in 2018, were composed of nearly 42% by female directors [79]. Interestingly, following the Corporate Governance Code that suggests to avoid CEO duality, firms opt for the role separation of CEO and president since the mean value of CEO_duality is 0.219 (S.D. 0.415). The firms in our sample show a board numerosity, on average, of 11 directors (mean 10.656 and S.D. 2.505). As for the governance profile, nearly half of the board members are independent (mean 0.496 and S.D. 0.152). Considering the characteristics of the firms, our sample reveals that corporations are less risky than the market because β-factor is lower than 1 (mean 0.786 and S.D. 0.216) and they are equally financed by equity and debt, as the Leverage mean value of 0.501 (S.D. 0.606) confirms. Operating profitability, proxied by ROA, is on average 4% with a S.D. of 6.31. Size and Age indicate, on average, mature medium-large firms.

Table 1.

Descriptive statistics and correlation.

Hierarchical regressions in Table 2 (shown in the following page) display empirical outcomes. Model 1 considers only the variable of interest, Blau_index, that positively impact on ESG score (0.276 p < 0.05). In Model 2, the battery of control variables is added. Larger firms with larger board have greater ESG score (Size, 0.00791 p < 0.1; Bod_size, 0.148 p < 0.01). Such results are in line with previous literature reporting that “larger firms have more resources and more often use reporting tools to provide ESG data” [80], and that those firms are more diversified and use corporate social responsibility to strengthen their corporate reputation [81].

Table 2.

Main results.

As for the board numerosity, the positive impact roots on the following theoretical insight: larger boards simplify the connection between firm and its external environment and pay greater attention to stakeholders [5]. Independent board members positively affect ESG score (Bod_indep 0.369 p < 0.01); this is coherent with agency arguments predicting that independent directors foster long-term strategies such as those related to ESG, maintaining a great attention towards legitimacy and external environment [51], which complies with the resource dependence theory. Beta assumes positive and statistically significant value (0.127 p < 0.05); it would suggest that riskier firms would increase their transparency attitude towards ESG items [5].

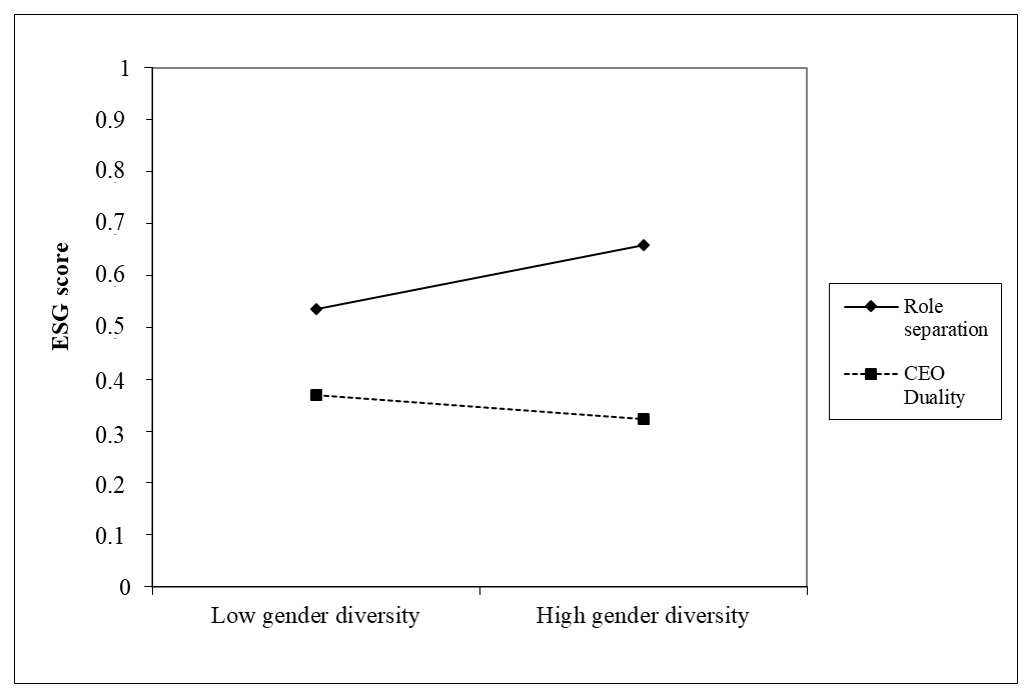

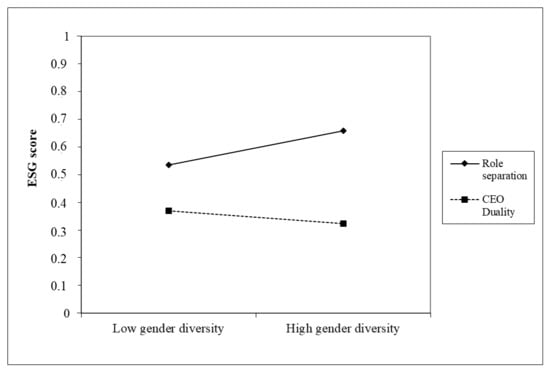

In Model 3, CEO_duality acts as a moderator, with a positive but non-significant impact, and all other variables maintain the above descripted signs and significance. Full model, as expressed in Equation (1), can be found in column 4. Gender diversity at board level is positively related to ESG score (0.408 p < 0.01) while the interaction (Blau_index*CEO_duality, −0.562 p < 0.01) has a negative impact.

Considering the significance levels of Blau_index across all the models, we can confirm the first hypothesis: gender diversity has a positive impact on ESG score, that is, the greater presence of female directors in the boardroom, the higher the ESG score.

Results confirm the second hypothesis: CEO duality negatively moderates the positive impact of female directors on ESG score. Therefore, it seems that any positive aspects of greater board gender diversity are outweighed by the negative aspects of CEO duality.

To rule out multicollinearity, VIF values are computed in the last column. They indicate that multicollinearity is not a concern since all values are below the threshold of 4 [82].

Figure 1 offers a graphical interpretation of the moderating effect.

Figure 1.

Moderating effect.

Robustness Tests

To strengthen the validity of previous findings, we measure gender diversity by means of Shannon index [83] (Shannon_index). This alternative proxy is computed, in line with [28], as follows: , where i is the gender category (n is equal to 2, male and female) and p the percentage of directors in each category.

Such index is equal to 0 when gender diversity is absent while it is equal to 0.69 when both genders are equally represented in the board. Although the properties of the two indexes are qualitatively the same for its logarithmic nature, Shannon index seems more sensitive to small differences in board gender diversity than Blau index [28,84].

This sensitivity test supports our results as showed in Table 3. Model (1) presents only a variable of interest (Shannon_index, 0.242 p < 0.05), Model (2) adds control variables but the significance and the magnitude of board gender diversity remains almost unchanged (0.252 p < 0.05). The moderator, CEO_duality, enters in Model (3) with a positive but non-significant impact on ESG score, while Shannon_index confirm its effect (0.253 p < 0.05). In Model (4), interaction (Shannon_index*CEO_duality) is introduced. Results in this Model confirm that in boards where the CEO and president roles are unified, gender diversity has a negative impact on ESG score (−0.480 p < 0.01).

Table 3.

Robustness test.

Despite the robustness of our results and despite the widely acknowledged validity of Shannon and Blau indexes [28], they appear an appropriate empirical tool when the relative proportions of men and women are a relevant consideration, but they seem less appropriate if the size of such sub-groups is taken into consideration [85]. In this light, critical mass theory [86] suggests that the size of the minority group—women—cannot be ignored [87]. Namely, to assess if results are contingent by the size of female directors, we employ the “critical mass” variable as explicative variable. It is equal to 1 if at least three women sit on the board [87]. Findings, available upon request and not reported for the sake of brevity, are qualitatively unchanged.

5. Discussion

The empirical evidence supports both our research hypothesis; indeed, main findings show that the presence of women on BoD has a positive impact on ESG score and that CEO duality negatively moderates the foregoing relationship.

In accordance with other previous studies [56,88], findings support our first research hypothesis and suggest that ESG performance is positively influenced by the presence of female directors.

The empirical evidence is also consistent with the 2030 Sustainable Agenda adopted by the UN and confirms that a full and effective presence of women on BoD is an important trigger for corporate governance mechanisms able to influence value creation processes and, more specifically, firm sustainability performance.

Furthermore, findings show that CEO duality negatively moderates the positive influence of female directors on ESG performance: when one person holds both the CEO and chairman positions, the risks of conflict of interest, abuse of power and lack of participation in the decision-making process by other directors can increase, therefore, reducing the representation of the other stakeholders on BoD and negatively affecting firm sustainability performance. In this perspective, such a result can contribute to the academic debate by demonstrating that in Italy, a country characterized by concentrated ownership structure, low independence of BoD and where a low number of women hold influential positions in corporate governance pattern, gender diversity could play a pivotal role in firm value creation process, enhancing sustainability performance.

More specifically, our findings are consistent with resource dependence theory. Indeed, diversity on BoD allows companies to have different skills, experiences and expertise, reduces firm uncertainty [47], generates lower transaction costs [89] and improves corporate value.

Whereas previous studies focused on the link between female director and financial performance [50], the present work has shown that a more balanced representation on BoD enhances sustainability practices and non-financial performance. In other words, we demonstrated that a greater participation of women in the decision-making process allows to fulfill the stakeholder expectations, with respect to ESG issues. Furthermore, our findings support agency theory, as we found a negative influence exerted by CEO duality on the aforementioned relationship between the presence of females on BoD and ESG performance.

Agency theory argues that the role of CEO and chairperson should be separated to avoid potential conflict of interest. Moreover, managers may pursue their self-interest, negatively affecting other stakeholders. Therefore, our findings confirm the foregoing theoretical construct. Indeed, in the Italian context, the duality status, the increasing concentration of power in a single person, and the agency problems negatively affect the relationship between gender diversity and ESG performance.

6. Conclusions

The present study investigated the influence of BoD composition on sustainable performance. Our findings reveal that gender diversity positively impacts on ESG score, showing how a more balanced number of male and female directors in the board of companies played an important role in sustainability performance. Moreover, our analysis points out that the CEO duality negatively moderates the relationship between gender diversity and ESG performance, demonstrating that the CEO duality negatively moderates the positive impact of female directors on ESG score.

As far as we know, this is the first research that analyzed these relationships; several studies have observed the correlation between gender diversity and financial performance, demonstrating how women positively affect the BoD in terms of financial results.

Further researches have shown a negative effect of CEO duality on financial performance [63,64], because the concentration of power in the same person limits the control by Board Directors, investors and other stakeholders. However, our study demonstrates that a more balanced gender composition of BoD has a positive impact on the sustainability performance and that this relationship is negatively moderated by CEO duality. In this perspective, the theoretical implication of our research is represented by a development of the current body of knowledge on the role of board composition on sustainable performance.

This study has important implications in many respects. The empirical evidence could be conducive for regulators and policy-makers in order to enhance corporate governance practices, by encouraging BoD diversity and avoiding the power concentration in the boardroom. From a managerial point of view, our analysis confirms the importance of a gender-balanced board and the separation of duties between the Chief Executive Officer and the Chairperson of the Board in value creation processes. Therefore, to enhance sustainability performance, companies should pay greater attention to the composition, structure, duties and powers of the Board of Directors.

Finally, from a social point of view, our research underlines the importance of the role played by women in the value creation process. Despite the recent improvement of the rules regarding gender equality in the BoD, our analysis suggests that there is still unequal treatment between women and men. In this perspective, companies should adopt internal policies and procedures to guarantee the same rights and opportunities for women.

This paper has some limitations. First of all, we are conscious, on par with prior studies [90,91,92], that the relationship between board characteristics and corporate social performance could be affected by endogeneity bias. In the near future, research could be improved by adopting different models (i.e., Structural Equation Model) to control the potential endogeneity of the relationship [51].

Moreover, we analyzed BoD composition by considering only female presence and CEO duality. Future studies might be based on other characteristics, such as age, nationality, professional expertise, networking, etc. Yet, the sample size could be extended, i.e., by carrying out a cross-country analysis centered on other European or developed areas, and a deeper exploration of CEO characteristics could be performed. In this vein, CEOs’ gender could hamper or strengthen the baseline relationship (BoD diversity and ESG performance). However, due to the low presence of female CEOs in the Italian market [79], the latter issue should be read as a suggestion for forthcoming explorations.

Author Contributions

Conceptualization, M.R., A.C., C.F. and A.N.; methodology, C.F. and A.C.; software, C.F. and A.N.; validation, M.R. and A.N.; formal analysis, C.F. and A.N.; investigation, C.F. and A.N.; resources, A.N. and A.C.; data curation, A.N.; writing—original draft preparation, A.N. and C.F.; writing—review and editing, C.F. and A.N.; visualization, A.N.; supervision, M.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Arena, C.; Cirillo, A.; Mussolino, D.; Pulcinelli, I.; Saggese, S.; Sarto, F. Women on board: Evidence from a masculine industry. Corp. Gov. Int. J. Bus. Soc. 2015, 15, 339–356. [Google Scholar] [CrossRef]

- Glass, C.; Cook, A.; Ingersoll, A.R. Do women leaders promote sustainability? Analyzing the effect of corporate governance composition on environmental performance. Bus. Strategy Environ. 2016, 25, 495–511. [Google Scholar] [CrossRef]

- Velte, P. Women on management board and ESG performance. J. Glob. Responsib. 2016, 7. [Google Scholar] [CrossRef]

- Vathunyoo Sila; Angelica Gonzalez, Jens Hagendorff, Women on board: Does boardroom gender diversity affect firm risk? J. Corp. Financ. 2016, 36, 26–53. [CrossRef]

- Manita, R.; Bruna, M.G.; Dang, R.; Houanti, L.H. Board gender diversity and ESG disclosure: Evidence from the USA. J. Appl. Account. Res. 2018, 19, 206–224. [Google Scholar] [CrossRef]

- Brown, L.D.; Caylor, M.L. Corporate Governance and Firm Performance. 2004. Available online: https://ssrn.com/abstract=586423 (accessed on 10 September 2020).

- Bauer, R.; Guenster, N.; Otten, R. Empirical evidence on corporate governance in Europe: The effect on stock returns, firm value and performance. J. Asset Manag. 2004, 5, 91–104. [Google Scholar] [CrossRef]

- Bhagat, S.; Bolton, B. Corporate governance and firm performance. J. Corp. Financ. 2008, 14, 257–273. [Google Scholar] [CrossRef]

- Arora, A.; Sharma, C. Corporate governance and firm performance in developing countries: Evidence from India. Corp. Gov. 2016, 16, 420–436. [Google Scholar] [CrossRef]

- Mio, C.; Venturelli, A.; Leopizzi, R. Management by objectives and corporate social responsibility disclosure. Account. Audit. Account. J. 2015, 28, 325–364. [Google Scholar] [CrossRef]

- Camilleri, M.A. Environmental, social and governance disclosures in Europe. Sustain. Account. Manag. Policy J. 2015, 6, 224–242. [Google Scholar] [CrossRef]

- Jizi, M.I.; Salama, A.; Dixon, R.; Stratling, R. Corporate governance and corporate social responsibility disclosure: Evidence from the US banking sector. J. Bus. Ethics 2014, 125, 601–615. [Google Scholar] [CrossRef]

- Salama, A.; Anderson, K.; Toms, J.S. Does community and environmental responsibility affect firm risk? Evidence from UK panel data 1994–2006. Bus. Ethics: A Eur. Rev. 2011, 20, 192–204. [Google Scholar] [CrossRef]

- Taliento, M.; Favino, C.; Netti, A. Impact of environmental, social, and governance information on economic performance: Evidence of a corporate ‘sustainability advantage’ from Europe. Sustainability 2019, 11, 1738. [Google Scholar] [CrossRef]

- Jizi, M.; Nehme, R.; Salama, A. Do social responsibility disclosures show improvements on stock price? J. Dev. Areas 2016, 50, 77–95. [Google Scholar] [CrossRef][Green Version]

- Sundarasen, S.D.D.; Je-Yen, T.; Rajangam, N. Board composition and corporate social responsibility in an emerging market. Corp. Gov. Int. J. Bus. Soc. 2016, 16, 35–53. [Google Scholar] [CrossRef]

- Husted, B.W.; de Sousa-Filho, J.M. Board structure and environmental, social, and governance disclosure in Latin America. J. Bus. Res. 2019, 102, 220–227. [Google Scholar] [CrossRef]

- Arya, B.; Zhang, G. Institutional reforms and investor reactions to CSR announcements: Evidence from an emerging economy. J. Manag. Stud. 2009, 46, 1089–1112. [Google Scholar] [CrossRef]

- Carter, D.A.; D’Souza, F.; Simkins, B.J.; Simpson, W.G. The gender and ethnic diversity of US boards and board committees and firm financial performance. Corp. Gov. Int. Rev. 2010, 18, 396–414. [Google Scholar] [CrossRef]

- O’Connell, V.; Cramer, N. The relationship between firm performance and board characteristics in Ireland. Eur. Manag. J. 2010, 28, 387–399. [Google Scholar] [CrossRef]

- Jermias, J.; Gani, L. The impact of board capital and board characteristics on firm performance. Br. Account. Rev. 2014, 46, 135–153. [Google Scholar] [CrossRef]

- Rao, K.; Tilt, C. Board composition and corporate social responsibility: The role of diversity, gender, strategy and decision making. J. Bus. Ethics 2016, 138, 327–347. [Google Scholar] [CrossRef]

- Joecks, J.; Pull, K.; Vetter, K. Gender diversity in the boardroom and firm performance: What exactly constitutes a “critical mass”? J. Bus. Ethics 2013, 118, 61–72. [Google Scholar] [CrossRef]

- Terjesen, S.; Sealy, R.; Singh, V. Women directors on corporate boards: A review and research agenda. Corp. Gov. Int. Rev. 2009, 17, 320–337. [Google Scholar] [CrossRef]

- Mahadeo, J.D.; Soobaroyen, T.; Hanuman, V.O. Board composition and financial performance: Uncovering the effects of diversity in an emerging economy. J. Bus. Ethics 2012, 105, 375–388. [Google Scholar] [CrossRef]

- Torchia, M.; Calabrò, A.; Huse, M.; Brogi, M. Critical Mass Theory and Women Directors’ Contribution to Board Strategic Tasks. Corp. Board Roleduties Compos. 2010, 6, 42–51. [Google Scholar] [CrossRef]

- Lückerath-Rovers, M. Women on boards and firm performance. J. Manag. Gov. 2013, 17, 491–509. [Google Scholar] [CrossRef]

- Campbell, K.; Mínguez-Vera, A. Gender diversity in the boardroom and firm financial performance. J. Bus. Ethics 2008, 83, 435–451. [Google Scholar] [CrossRef]

- Francoeur, C.; Labelle, R.; Sinclair-Desgagné, B. Gender diversity in corporate governance and top management. J. Bus. Ethics 2008, 81, 83–95. [Google Scholar] [CrossRef]

- Smith, N.; Smith, V.; Verner, M. Do women in top management affect firm performance? A panel study of 2,500 Danish firms. Int. J. Product. Perform. Manag. 2006, 55, 569–593. [Google Scholar] [CrossRef]

- Carter, D.A.; Simkins, B.J.; Simpson, W.G. Corporate governance, board diversity, and firm value. Financ. Rev. 2003, 38, 33–53. [Google Scholar] [CrossRef]

- Erhardt, N.L.; Werbel, J.D.; Schrader, C.B. Board of director diversity and firm financial performance. Corp. Gov. Int. Rev. 2003, 11, 102–111. [Google Scholar] [CrossRef]

- Giannarakis, G.; Konteos, G.; Sariannidis, N. Financial, governance and environmental determinants of corporate social responsible disclosure. Manag. Decis. 2014, 52, 1928–1951. [Google Scholar] [CrossRef]

- Bear, S.; Rahman, N.; Post, C. The impact of board diversity and gender composition on corporate social responsibility and firm reputation. J. Bus. Ethics 2010, 97, 207–221. [Google Scholar] [CrossRef]

- Ahern, K.R.; Dittmar, A.K. The changing of the boards: The impact on firm valuation of mandated female board representation. Q. J. Econ. 2012, 127, 137–197. [Google Scholar] [CrossRef]

- Bøhren, Ø.; Strøm, R. Governance and Politics: Regulating Independence and Diversity in the Board Room. J. Bus. Financ. Account. 2010, 37, 1281–1308. [Google Scholar] [CrossRef]

- Adams, R.B.; Ferreira, D. Women in the boardroom and their impact on governance and performance. J. Financ. Econ. 2009, 94, 291–309. [Google Scholar] [CrossRef]

- Shrader, C.B.; Blackburn, V.B.; Iles, P. Women in management and firm financial performance: An exploratory study. J. Manag. Issues 1997, 9, 355–372. [Google Scholar]

- Cucari, N.; Esposito De Falco, S.; Orlando, B. Diversity of board of directors and environmental social governance: Evidence from Italian listed companies. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 250–266. [Google Scholar] [CrossRef]

- Rose, C. Does female board representation influence firm performance? The Danish evidence. Corp. Gov. Int. Rev. 2007, 15, 404–413. [Google Scholar] [CrossRef]

- Randøy, T.; Thomsen, S.; Oxelheim, L. A Nordic perspective on corporate board diversity. Age 2006, 390, 1–26. [Google Scholar]

- Farrell, K.A.; Hersch, P.L. Additions to corporate boards: The effect of gender. J. Corp. Financ. 2005, 11, 85–106. [Google Scholar] [CrossRef]

- Adams, R.B.; Funk, P. Beyond the glass ceiling: Does gender matter? Manag. Sci. 2012, 58, 219–235. [Google Scholar] [CrossRef]

- De Cabo, R.M.; Gimeno, R.; Escot, L. Disentangling discrimination on Spanish boards of directors. Corp. Gov. Int. Rev. 2011, 19, 77–95. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of ownership and control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Ntim, C.G. Board diversity and organizational valuation: Unravelling the effects of ethnicity and gender. J. Manag. Gov. 2015, 19, 167–195. [Google Scholar] [CrossRef]

- Pfeffer, J. Size and Composition of Corporate Boards of Directors: The Organization and its Environment. Adm. Sci. Q. 1972, 17, 218–229. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G.R. The External Control of Organisations: A Resource Dependence Perspective; Harper & Row: New York, NY, USA, 1978. [Google Scholar]

- Hillman, A.J.; Dalziel, T. Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Acad. Manag. Rev. 2003, 28, 383–396. [Google Scholar] [CrossRef]

- Arnegger, M.; Hofmann, C.; Pull, K.; Vetter, K. Firm size and board diversity. J. Manag. Gov. 2014, 18, 1109–1135. [Google Scholar] [CrossRef]

- Shaukat, A.; Qiu, Y.; Trojanowski, G. Board attributes, corporate social responsibility strategy, and corporate environmental and social performance. J. Bus. Ethics 2016, 135, 569–585. [Google Scholar] [CrossRef]

- Wood, W.; Eagly, A.H. Gender Identity. In Handbook of Individual Differences in Social Behavior; Leary, M.R., Hoyle, R.H., Eds.; The Guilford Press: New York City, NY, USA, 2009; pp. 109–125. [Google Scholar]

- Adams, R.B.; Licht, A.N.; Sagiv, L. Shareholders and stakeholders: How do directors decide? Strateg. Manag. J. 2011, 32, 1331–1355. [Google Scholar] [CrossRef]

- Krüger, P. Corporate Social Responsibility and the Board of Directors. Job Market Paper. Toulouse Sch. Econ. Fr. 2009. [Google Scholar] [CrossRef]

- Singh, V.; Terjesen, S.; Vinnicombe, S. Newly appointed directors in the boardroom: How do women and men differ? Eur. Manag. J. 2008, 26, 48–58. [Google Scholar] [CrossRef]

- Zhang, J.Q.; Zhu, H.; Ding, H.B. Board composition and corporate social responsibility: An empirical investigation in the post Sarbanes-Oxley era. J. Bus. Ethics 2013, 114, 381–392. [Google Scholar] [CrossRef]

- Hillman, A.J.; Cannella, A.A., Jr.; Harris, I.C. Women and racial minorities in the boardroom: How do directors differ? J. Manag. 2002, 28, 747–763. [Google Scholar] [CrossRef]

- Hillman, A.J.; Shropshire, C.; Cannella Jr, A.A. Organizational predictors of women on corporate boards. Acad. Manag. J. 2007, 50, 941–952. [Google Scholar] [CrossRef]

- Nielsen, S.; Huse, M. The contribution of women on boards of directors: Going beyond the surface. Corp. Gov. Int. Rev. 2010, 18, 136–148. [Google Scholar] [CrossRef]

- Ciocirlan, C.; Pettersson, C. Does workforce diversity matter in the fight against climate change? An analysis of Fortune 500 companies. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 47–62. [Google Scholar] [CrossRef]

- Ben-Amar, W.; McIlkenny, P. Board effectiveness and the voluntary disclosure of climate change information. Bus. Strategy Environ. 2015, 24, 704–719. [Google Scholar] [CrossRef]

- Rodriguez-Dominguez, L.; Gallego-Alvarez, I.; Garcia-Sanchez, I.M. Corporate governance and codes of ethics. J. Bus. Ethics 2009, 90, 187. [Google Scholar] [CrossRef]

- Iyengar, R.J.; Zampelli, E.M. Self-selection, endogeneity, and the relationship between CEO duality and firm performance. Strateg. Manag. J. 2009, 30, 1092–1112. [Google Scholar] [CrossRef]

- Rechner, P.L.; Dalton, D.R. CEO duality and organizational performance: A longitudinal analysis. Strateg. Manag. J. 1991, 12, 155–160. [Google Scholar] [CrossRef]

- Naciti, V. Corporate governance and board of directors: The effect of a board composition on firm sustainability performance. J. Clean. Prod. 2019, 237, 117727. [Google Scholar] [CrossRef]

- Shahbaz, M.; Karaman, A.S.; Kilic, M.; Uyar, A. Board attributes, CSR engagement, and corporate performance: What is the nexus in the energy sector? Energy Policy 2020, 143, 111582. [Google Scholar] [CrossRef]

- Velte, P. Does CEO power moderate the link between ESG performance and financial performance? Manag. Res. Rev. 2019, 43, 497–520. [Google Scholar] [CrossRef]

- Javeed, S.A.; Lefen, L. An analysis of corporate social responsibility and firm performance with moderating effects of CEO power and ownership structure: A case study of the manufacturing sector of Pakistan. Sustainability 2019, 11, 248. [Google Scholar] [CrossRef]

- Li, Y.; Gong, M.; Zhang, X.Y.; Koh, L. The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. Br. Account. Rev. 2018, 50, 60–75. [Google Scholar] [CrossRef]

- Walls, J.L.; Berrone, P. The power of one to make a difference: How informal and formal CEO power affect environmental sustainability. J. Bus. Ethics 2017, 145, 293–308. [Google Scholar] [CrossRef]

- Perrini, F.; Russo, A.; Tencati, A. CSR strategies of SMEs and large firms. Evidence from Italy. J. Bus. Ethics 2007, 74, 285–300. [Google Scholar] [CrossRef]

- Doni, F.; Martini, S.B.; Corvino, A.; Mazzoni, M. Voluntary versus mandatory non-financial disclosure. Meditari Account. Res. 2019, 28, 781–802. [Google Scholar] [CrossRef]

- Pizzi, S.; Venturelli, A.; Caputo, F. The “comply-or-explain” principle in directive 95/2014/EU. A rhetorical analysis of Italian PIEs. Sustain. Account. Manag. Policy J. 2020. [Google Scholar] [CrossRef]

- Hausman, J. Specification Tests in Econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- McBrayer, G.A. Does persistence explain ESG disclosure decisions? Corp. Soc. Responsib. Environ. Manag. 2018, 25, 1074–1086. [Google Scholar] [CrossRef]

- Eccles, R.; Ioannou, I.; Serafeim, G. The Impact of Corporate Sustainability on Organizational Processes and Performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Blau, P.M. Inequality and Heterogeneity; The Free Press: New York, NY, USA, 1977. [Google Scholar]

- Aiken, L.S.; West, S.G.; Reno, R.R. Multiple Regression: Testing and Interpreting Interactions; SAGE: Thousand Oaks, CA, USA, 1991. [Google Scholar]

- CONSOB (The National Commission for Companies and the Stock Exchange). Report on Corporate Governance of Italian Listed Companies. 2019. Available online: http://www.consob.it/documents/46180/46181/rcg2019.pdf/941e4e4e-60db-4f89-afb3-32bddb8488e0 (accessed on 10 September 2020).

- Drempetic, S.; Klein, C.; Zwergel, B. The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings under Review. J. Bus. Ethics 2019, 167, 333–360. [Google Scholar] [CrossRef]

- Branco, M.C.; Rodrigues, L.L. Factors influencing social responsibility disclosure by Portuguese companies. J. Bus. Ethics 2008, 83, 685–701. [Google Scholar] [CrossRef]

- O’Brien, R.M. A caution regarding rules of thumb for variance inflation factors. Qual. Quant. 2007, 41, 673–690. [Google Scholar] [CrossRef]

- Shannon, C.E. A mathematical theory of communication. Bell Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Gordini, N.; Rancati, E. Gender diversity in the Italian boardroom and firm financial performance. Manag. Res. Rev. 2017, 40, 75–94. [Google Scholar] [CrossRef]

- Rushton, M. A note on the use and misuse of the racial diversity index. Policy Stud. J. 2008, 36, 445–459. [Google Scholar] [CrossRef]

- Kanter, R.M. Men and women of the corporation revisited. Manag. Rev. 1987, 76, 14. [Google Scholar]

- Torchia, M.; Calabrò, A.; Huse, M. Women directors on corporate boards: From tokenism to critical mass. J. Bus. Ethics 2011, 102, 299–317. [Google Scholar] [CrossRef]

- Post, C.; Rahman, N.; Rubow, E. Green Governance: Diversity in the Composition of Board of Directors and Environmental Corporate Social Responsibility (ECSR). Bus. Soc. 2011, 51. [Google Scholar] [CrossRef]

- Williamson, Ó. Transaction-Cost Economics: The Governance of Contractual Relations. J. Law Econ. 1979, 22, 233–261. [Google Scholar] [CrossRef]

- Hermalin, B.E.; Weisbach, M.S. Board of directors as an endogenously determined institution: A survey of the economic literature. Econ. Policy Rev. 2003, 9. [Google Scholar] [CrossRef]

- Johnson, S.G.; Schnatterly, K.; Hill, A.D. Board composition beyond independence: Social capital, human capital, and demographics. J. Manag. 2013, 39, 232–262. [Google Scholar] [CrossRef]

- Hambrick, D.C. Upper Echelons Theory: An Update. Acad. Manag. Rev. 2007, 32, 334–343. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).