Sustainability Practices and Stability in the Insurance Industry

Abstract

1. Introduction

2. Literature Review and Hypotheses

3. Methodology and Data

3.1. Empirical Methodology

3.2. Sample Description

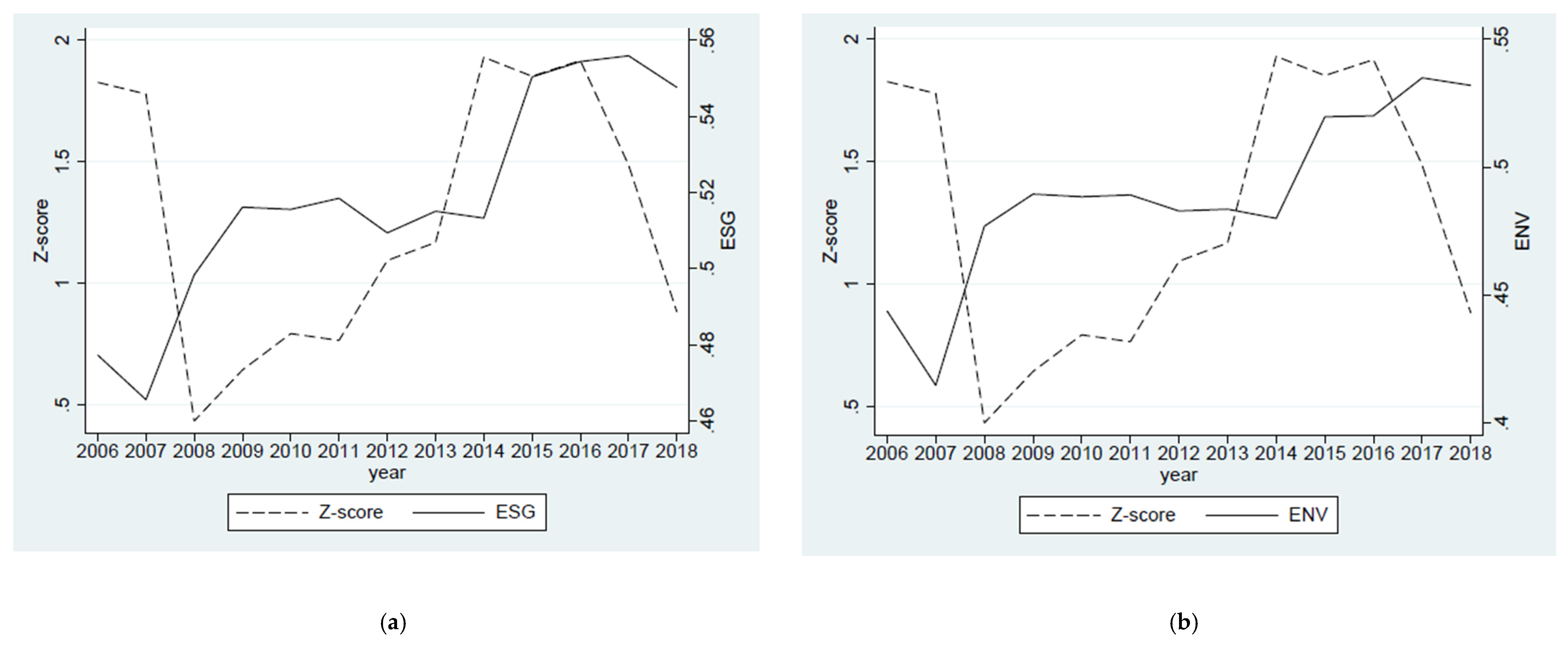

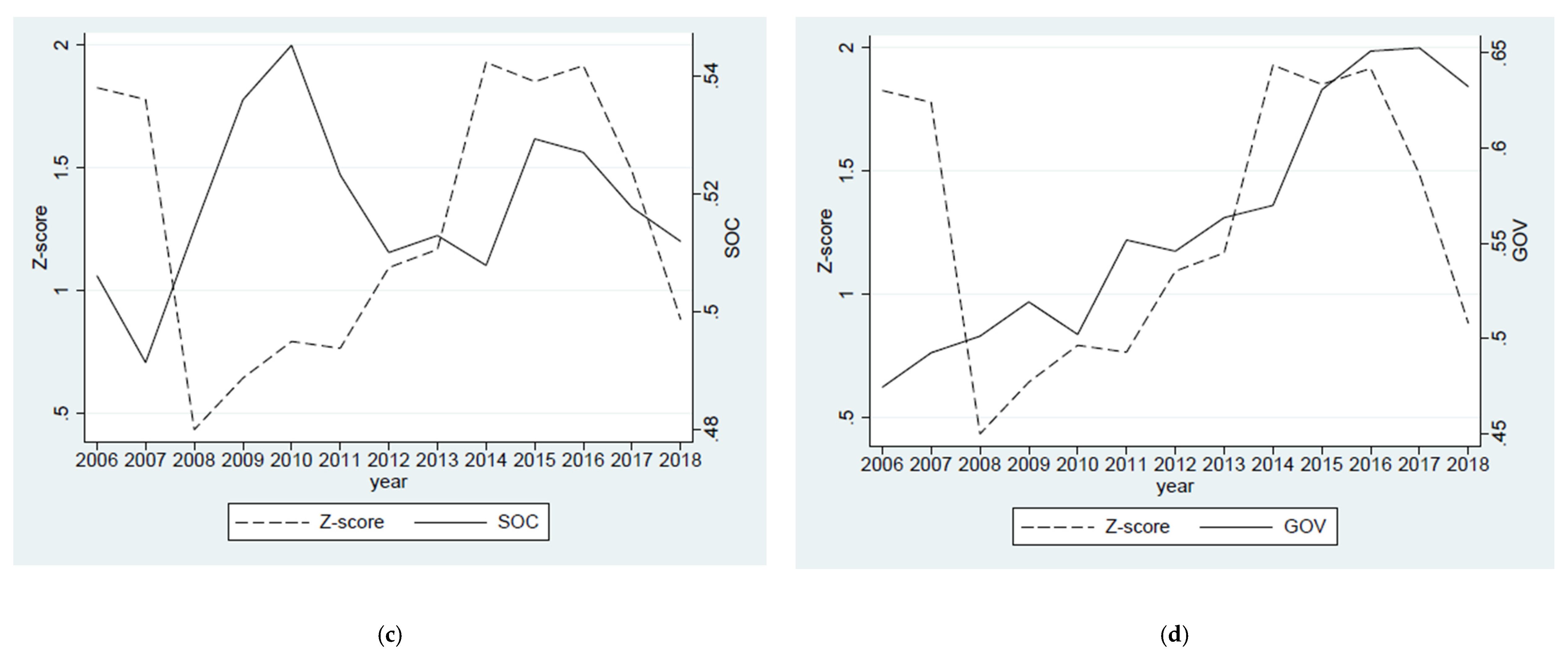

3.3. ESG Target Variables

4. Main Results

5. Additional Analysis: Life and Nonlife Insurance

6. Robustness Tests

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Pillars | 1. Environmental Score (ENV) | 2. Social Score (SOC) | 3. Governance Score (GOV) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Categories | Resource Use score Reflects a company’s performance and capacity to reduce the use of materials, energy or water, and to find more eco-efficient solutions by improving supply chain management. | Emissions score Measures a company’s commitment and effectiveness towards reducing environmental emission in the production and operational processes. | Innovation score Reflects a company’s capacity to reduce the environmental costs and burdens for its customers, and thereby creating new market opportunities through new environmental technologies and processes or eco-designed products. | Workforce score Measures a company’s effectiveness towards job satisfaction, healthy and safe workplace, maintaining diversity and equal opportunities, and development opportunities for its workforce. | Human Rights score Measures a company’s effectiveness towards respecting the fundamental human rights conventions. | Community score Measures the company’s commitment towards being a good citizen, protecting public health and respecting business ethics. | Product Resp. score Reflects a company’s capacity to produce quality goods and services integrating the customer’s health and safety, integrity, and data privacy. | Management score Measures a company’s commitment and effectiveness towards following best practice corporate governance principles. | Shareholders score Measures a company’s effectiveness towards equal treatment of shareholders and the use of anti-takeover devices. | CSR Strategy score Reflects a company’s practices to communicate that it integrates the economic (financial), social and environmental dimensions into its day-to-day decision-making processes. |

| Indicators | 19 | 22 | 20 | 29 | 8 | 14 | 12 | 34 | 12 | 8 |

| Total | 178 | |||||||||

| Weights | 0.110 (=19/178) | 0.120 (=22/178) | 0.110 (=20/178) | 0.160 (=29/178) | 0.045 (=8/178) | 0.080 (=14/178) | 0.070 (=12/178) | 0.190 (=34/178) | 0.070 (=12/178) | 0.045 (=8/178) |

| Total | 0.3400 | 0.3550 | 0.3050 | |||||||

| New Weights | 0.3235 (=0.110/0.340) | 0.3529 (=0.120/0.340) | 0.3235 (=0.110/0.340) | 0.4507 (=0.160/0.3550) | 0.1268 (=0.045/0.3550) | 0.2254 (=0.080/0.3550) | 0.1972 (=0.070/0.3550) | 0.6230 (=0.190/0.3050) | 0.2295 (=0.070/0.3050) | 0.1475 (=0.045/0.3050) |

| Calculation of scores | ENV = Resource Use score×0.3235 + Emission score × 0.3529 + Environmental Innovation score × 0.3235 | SOC = Workforce score × 0.4507 + Human Rights score × 0.1268 + Community score × 0.2254 + Product Responsibility score × 0.1972 | GOV = Management score × 0.6230 + Shareholders score × 0.2295 + CSR Strategy score × 0.1475 | |||||||

| ESG = (ENV × 0.3400) + (SOC × 0.3550) + (GOV × 0.3050) | ||||||||||

| Variables | DESG | DENV | DSOC | DGOV |

|---|---|---|---|---|

| (I) | (II) | (III) | (IV) | |

| SIZE (−1) | 1.682 *** | 1.682 *** | 1.682 *** | 1.682 *** |

| (0.162) | (0.162) | (0.162) | (0.162) | |

| LIQ (−1) | 3.655 ** | 3.655 ** | 3.655 ** | 3.655 ** |

| (1.547) | (1.547) | (1.547) | (1.547) | |

| CLAIMS GRW (−1) | 0.040 | 0.040 | 0.040 | 0.040 |

| (0.121) | (0.121) | (0.121) | (0.121) | |

| LEV (−1) | −0.671 * | −0.671 * | −0.671 * | −0.671 * |

| (0.354) | (0.354) | (0.354) | (0.354) | |

| PREMIUM GRW (−1) | −0.697 ** | −0.697 ** | −0.697 ** | −0.697 ** |

| (0.353) | (0.353) | (0.353) | (0.353) | |

| PROFIT (−1) | −3.525 *** | −3.525 *** | −3.525 *** | −3.525 *** |

| (0.607) | (0.607) | (0.607) | (0.607) | |

| HHI (−1) | −5.357 | −5.357 | −5.357 | −5.357 |

| (4.258) | (4.258) | (4.258) | (4.258) | |

| GDP GRW (−1) | 2.899 | 2.899 | 2.899 | 2.899 |

| (3.462) | (3.462) | (3.462) | (3.462) | |

| INFL (−1) | −16.14 | −16.14 | −16.14 | −16.14 |

| (22.01) | (22.01) | (22.01) | (22.01) | |

| Time FE | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes |

| Robust SE | Yes | Yes | Yes | Yes |

| N. of obs. | 994 | 994 | 994 | 994 |

| R-squared | 0.581 | 0.581 | 0.581 | 0.581 |

| Variables | Z-Score | |||

|---|---|---|---|---|

| (I) | (II) | (III) | (IV) | |

| Instruments for: ESG | 0.757 *** | |||

| (0.099) | ||||

| ENV | 0.670 *** | |||

| (0.074) | ||||

| SOC | 0.848 *** | |||

| (0.084) | ||||

| GOV | 0.453 * | |||

| (0.245) | ||||

| Controls (−1) | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes |

| Robust SE | Yes | Yes | Yes | Yes |

| N. of obs. | 526 | 526 | 526 | 526 |

| R-squared | 0.528 | 0.592 | 0.553 | 0.177 |

| F-Cragg Donald test | 22.60 *** | 40.00 *** | 27.45 *** | 19.00 *** |

| Panel A: Logit Model—Identifying Propensity Scores | ||||

| Variables | DESG | DENV | DSOC | DGOV |

| (I) | (II) | (III) | (IV) | |

| SIZE (−1) | 0.908 *** | 0.908 *** | 0.908 *** | 0.908 *** |

| (0.0514) | (0.0514) | (0.0514) | (0.0514) | |

| LIQ (−1) | 2.144 ** | 2.144 ** | 2.144 ** | 2.144 ** |

| (0.854) | (0.854) | (0.854) | (0.854) | |

| CLAIMS GRW (−1) | 0.0250 | 0.0250 | 0.0250 | 0.0250 |

| (0.0801) | (0.0801) | (0.0801) | (0.0801) | |

| LEV (−1) | −0.388 *** | −0.388 *** | −0.388 *** | −0.388 *** |

| (0.127) | (0.127) | (0.127) | (0.127) | |

| PREMIUM GRW (−1) | −0.766 *** | −0.766 *** | −0.766 *** | −0.766 *** |

| (0.217) | (0.217) | (0.217) | (0.217) | |

| PROFIT (−1) | −2.122 *** | −2.122 *** | −2.122 *** | −2.122 *** |

| (0.341) | (0.341) | (0.341) | (0.341) | |

| Time FE | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes |

| Robust SE | Yes | Yes | Yes | Yes |

| N. of obs. | 1151 | 1151 | 1151 | 1151 |

| R-squared | 0.591 | 0.591 | 0.591 | 0.591 |

| Panel B: Univariate Statistics—Effectiveness of Matching | ||||

| Variable | ESG (1) | No-ESG (2) | Difference (1–2) | p-values |

| SIZE | 14.552 | 14.546 | 0.006 | 0.797 |

| LIQ | 0.039 | 0.039 | 0 | 0.980 |

| CLAIMS GRW | 0.114 | 0.133 | −0.022 | 0.480 |

| LEV | 0.459 | 0.469 | −0.010 | 0.848 |

| PREMIUM GRW | 0.088 | 0.078 | 0.010 | 0.724 |

| PROFIT | 0.310 | 0.320 | −0.010 | 0.662 |

| Country | N. of obs. | Frequency |

|---|---|---|

| Bermuda | 54 | 12.0% |

| Brazil | 21 | 4.6% |

| Canada | 35 | 7.8% |

| Cayman Islands | 1 | 0.2% |

| Chile | 12 | 2.6% |

| Jamaica | 3 | 0.7% |

| Mexico | 15 | 3.3% |

| Peru | 12 | 2.6% |

| Trinidad and Tobago | 3 | 0.7% |

| .United States of America | 298 | 66.0% |

| Total | 453 | 100.0% |

References

- Kitzmueller, M.; Shimshack, J. Economic Perspectives on Corporate Social Responsibility. J. Econ. Lit. 2012, 50, 51–84. [Google Scholar] [CrossRef]

- Hasan, I.; Kobeissi, N.; Liu, L.; Wang, H. Corporate Social Responsibility and Firm Financial Performance: The Mediating Role of Productivity. J. Bus. Ethics 2018, 149, 671–688. [Google Scholar] [CrossRef]

- Revelli, C.; Viviani, J.L. Financial performance of socially responsible investing (SRI): What have we learned? A meta-analysis. Bus. Ethics Eur. Rev. 2015, 24, 158–185. [Google Scholar] [CrossRef]

- Brooks, C.; Oikonomou, I. The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. Br. Account. Rev. 2018, 50, 1–15. [Google Scholar] [CrossRef]

- Fatemi, A.; Fooladi, I.; Tehranian, H. Valuation effects of corporate social responsibility. J. Bank. Financ. 2015, 59, 182–192. [Google Scholar] [CrossRef]

- Cheung, A. Corporate social responsibility and corporate cash holdings. J. Corp. Financ. 2016, 37, 412–430. [Google Scholar] [CrossRef]

- Gangi, F.; Meles, A.; D’Angelo, E.; Daniele, L.M. Sustainable development and corporate governance in the financial system: Are environmentally friendly banks less risky? Corp. Soc. Responsib. Environ. Manag. 2019, 26, 529–547. [Google Scholar] [CrossRef]

- Baradwaj, B.; Dewally, M.; Shao, Y.; Liu, P. Corporate Social Responsibility, Disaster Experience, and Bank Stability. Presented at the 12th Edition of the International Risk Management Conference, Milan, Italy, 17–18 June 2019. [Google Scholar]

- Scholtens, B. Corporate Social Responsibility in the International Insurance Industry. Sustain. Dev. 2011, 19, 143–156. [Google Scholar] [CrossRef]

- Outreville, J.F. The relationship between Insurance and Economic Development: 85 empirical papers for a review of the Literature. Risk Manag. Insur. Rev. 2013, 16, 71–122. [Google Scholar] [CrossRef]

- Sarkis, J.; Dhavale, D.G. Supplier selection for sustainable operations: A triple-bottom-line approach using a Bayesian framework. Int. J. Prod. Econ. 2015, 116, 177–191. [Google Scholar] [CrossRef]

- Purvis, B.; Mao, Y.; Robinson, D. Three pillars of sustainability: In search of conceptual origins. Sustain. Sci. 2019, 14, 681–695. [Google Scholar] [CrossRef]

- Roman, R.M.; Hayibor, S.; Agle, B.R. The relationship between social and financial performance: Repainting a portrait. Bus. Soc. 1999, 38, 109–125. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Eccles, R.G.; Ioannou, I.; Serafeim, G. The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 2014, 60, 2835–2857. [Google Scholar] [CrossRef]

- Sharfman, M.; Fernando, C. Environmental risk management and the cost of capital. Strateg. Manag. J. 2008, 29, 569–592. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.; Mishra, D. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Attig, N.; El Ghoul, S.; Guedhami, O.; Suh, J. Corporate Social Responsibility and Credit Ratings. J. Bus. Ethics 2013, 117, 679–694. [Google Scholar] [CrossRef]

- Albuquerque, R.; Durnev, A.; Koskinen, Y. Corporate Social Responsibility and Asset Pricing in Industry Equilibrium. 2014. Working Paper, SSRN. Available online: https://www.semanticscholar.org/paper/Corporate-Social-Responsibility-and-Asset-Pricing-Albuquerque-Durnev/f5d56b1d3ec31896c171a3f63050bcbc703ddea1 (accessed on 2 June 2020).

- Becchetti, L.; Ciciretti, R.; Conzo, P. Legal origins and corporate social responsibility. Sustainability 2020, 12, 2717. [Google Scholar] [CrossRef]

- Simpson, W.G.; Kohers, T. The link between corporate social and financial performance: Evidence from the banking industry. J. Bus. Ethics 2002, 35, 97–109. [Google Scholar] [CrossRef]

- De la Cuesta-González, M.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á. Analysis of social performance in the Spanish financial industry through public data. A proposal. J. Bus. Ethics 2006, 69, 289–304. [Google Scholar] [CrossRef]

- Forcadell, F.J.; Aracil, E. European Banks’ reputation for corporate social responsibility. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 1–14. [Google Scholar] [CrossRef]

- Dell’Atti, S.; Trotta, A.; Iannuzzi, A.P.; Demaria, F. Corporate Social Responsibility Engagement as a Determinant of Bank Reputation: An Empirical Analysis. Corp. Soc. Responsib. Environ. Manag. 2017, 24, 589–605. [Google Scholar] [CrossRef]

- Maqbool, S.; Zameer, M.N. Corporate social responsibility and financial performance: An empirical analysis of Indian banks. Future Bus. J. 2018, 4, 84–93. [Google Scholar] [CrossRef]

- Berger, A.N.; Imbierowicz, B.R.; Rauch, C. The Roles of Corporate Governance in Bank Failures during the Recent Financial Crisis. J. Money Credit Bank. 2016, 48, 729–770. [Google Scholar] [CrossRef]

- Anginer, D.; Demirguc-Kunt, A.; Huizinga, H.; Ma, K. Corporate governance of banks and financial stability. J. Financ. Econ. 2018, 130, 327–346. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S.B. The corporate social performance—Financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Brogi, M.; Lagasio, V. Environmental, social, and governance and company profitability: Are financial intermediaries different? Corp. Soc. Responsib. Environ. Manag. 2019, 26, 576–587. [Google Scholar] [CrossRef]

- Pasiouras, F.; Gaganis, C. Regulations and soundness of insurance firms: International evidence. J. Bus. Res. 2013, 66, 632–642. [Google Scholar] [CrossRef]

- Caporale, G.M.; Cerrato, M.; Zhang, X. Analysing the determinants of insolvency risk for general insurance firms in the UK. J. Bank. Financ. 2017, 84, 107–122. [Google Scholar] [CrossRef]

- Gaganis, C.; Hasan, I.; Papadimitri, P.; Tasiou, M. National culture and risk-taking: Evidence from the insurance industry. J. Bus. Res. 2019, 97, 104–116. [Google Scholar] [CrossRef]

- International Association of Insurance Supervisors. Issues Paper on Climate Change Risks to the Insurance Sector; IAIS: Basel, Switzerland, 2018. [Google Scholar]

- Dowling, G. Reputation risk: It is the board’s ultimate responsibility. J. Bus. Strategy 2006, 27, 59–68. [Google Scholar] [CrossRef]

- Cummins, J.D.; Weiss, M.A. Analyzing Firm Performance in the Insurance Industry Using Frontier Efficiency and Productivity Methods. In Handbook of Insurance; Dionne, G., Ed.; Series on Risk, Insurance, and Economic Security 22; Springer: Dordrecht, The Netherlands, 2000; pp. 767–829. [Google Scholar]

- Anginer, D.; Demirguc-Kunt, A.; Mare, D.S. Bank capital, institutional environment and systemic stability. J. Financ. Stab. 2018, 37, 97–106. [Google Scholar] [CrossRef]

- Beck, T.; Laeven, L. Resolution of Failed Banks by Deposit Insurers: Cross-Country Evidence; Policy Research Working Paper Series 3920; The World Bank: Washington, DC, USA, 2006. [Google Scholar]

- Demirgüç-Kunt, A.; Huizinga, H. Bank activity and funding strategies: The impact on risk and returns. J. Financ. Econ. 2010, 98, 626–650. [Google Scholar] [CrossRef]

- Shim, J. An investigation of market concentration and financial stability in property–liability insurance industry. J. Risk Insur. 2017, 84, 567–597. [Google Scholar] [CrossRef]

- Laeven, L.; Levine, R. Bank governance, regulation and risk taking. J. Financ. Econ. 2009, 93, 259–275. [Google Scholar] [CrossRef]

- Li, K.; Griffin, D.; Yue, H.; Zhao, L. How does culture influence corporate risk-taking? J. Corp. Financ. 2013, 23, 1–22. [Google Scholar] [CrossRef]

- Liang, H.; Renneboog, L. On the Foundations of Corporate Social Responsibility. J. Financ. 2017, 72, 853–910. [Google Scholar] [CrossRef]

- Bassen, A.; Kovacs, A.M.M. Environmental, social and governance key performance indicators from a capital market perspective. Zeitschrift fur Wirtschafts-und Unternehmensethik 2008, 9, 182–192. [Google Scholar] [CrossRef]

- Oikonomou, I.; Brooks, C.; Pavelin, S. The Impact of Corporate Social Performance on Financial Risk and Utility: A Longitudinal Analysis. Financ. Manag. 2012, 41, 483–515. [Google Scholar] [CrossRef]

- Adams, M.B.; Burton, B.; Hardwick, P. The determinants of credit ratings in the United Kingdom insurance industry. J. Bus. Financ. Account. 2003, 30, 539–572. [Google Scholar] [CrossRef]

- Brotman, B.A. Reliability of best’s insurer ratings using financial information published in the annual report. J. Insur. 1989, 12, 58–70. [Google Scholar]

- Rosenbaum, P.; Rubin, D. The central role of the propensity score in observational studies for causal effects. Biometrika 1983, 70, 41–55. [Google Scholar] [CrossRef]

- Bhandari, A.; Javakhadze, D. Corporate social responsibility and capital allocation efficiency. J. Corp. Financ. 2017, 43, 354–377. [Google Scholar] [CrossRef]

- Certo, S.T.; Busenbark, J.R.; Woo, H.S.; Semadeni, M. Sample selection bias and Heckman model in strategic management research. Strateg. Manag. J. 2016, 37, 2639–2657. [Google Scholar] [CrossRef]

- Heckman, J.J. Dummy endogenous variables in a simultaneous equation system. Econometrics 1978, 46, 931–959. [Google Scholar] [CrossRef]

- Wu, M.W.; Shen, C.H. Corporate social responsibility in the banking industry: Motives and financial performance. J. Bank. Financ. 2013, 37, 3529–3547. [Google Scholar] [CrossRef]

- Bharath, S.T.; Dahiya, S.; Saunders, A.; Srinivasan, A. Lending relationships and loan contract terms. Rev. Financ. Stud. 2011, 24, 1141–1203. [Google Scholar] [CrossRef]

- Cummins, J.D.; Denenberg, H.S.; Scheel, W.C. Concentration in the U.S. life insurance industry. J. Risk Insur. 1972, 39, 177–199. [Google Scholar] [CrossRef]

| Variable Name | Definition | Source | Expected Sign |

|---|---|---|---|

| Dependent Variable | |||

| Z-score | A widely-used measure employed to predict the probability of default of a firm, based on accounting data. Higher scores indicate higher stability. It is computed as the sum of equity to total assets (ETA) and return on average assets (ROAA), scaled by the three-year standard deviation of the return on average assets (σROAA). Due to skewness, we use the natural logarithm of the resulting measure. | Thomson Reuters (raw data) Authors’ calculation of the final variable | / |

| Target Variables | |||

| ESG | The Environmental Social Governance (ESG) score is an overall company score based on self-reported information in the Environmental (ENV), Social (SOC), and corporate Governance (GOV) pillars. | Thomson Reuters See the Appendix for further details | Positive |

| ENV | The Environmental score is an overall company score based on the weighted average of self-reported information in the Resource Use score, Emissions score, and Environmental Innovation score. | Positive | |

| SOC | The Social score is an overall company score based on the weighted average of self-reported information in the Workforce score, Human rights score, Community score and Product Responsibility score. | Positive | |

| GOV | The Governance score is an overall company score based on the weighted average of self-reported information in the Management score, Shareholders score, Corporate Social Responsibility (CSR) Strategy score. | Positive | |

| Insurance Controls | |||

| SIZE | Natural logarithm of total premium. | Thomson Reuters (raw data) Authors’ calculation of the final variable | Positive/Negative |

| LIQ | Cash and equivalents to total assets. | Negative | |

| CLAIMS GRW | Change in net claims incurred. | Positive/Negative | |

| LEV | Total debt to equity. | Negative | |

| PREMIUM GRW | Change in net premium earned. | Positive/Negative | |

| PROFIT | Underwriting profit to total assets. | Positive | |

| Country Controls | |||

| HHI | The HHI is calculated as the sum of the squared market share value (in term of total assets) of all insurance firms in the country. | Thomson Reuters (raw data) Authors’ calculation of the final variable | Positive |

| GDP GRW | Annual change of Gross Domestic Product (GDP). | World Bank Financial Development | Positive/Negative |

| INFL | Annual inflation rate. | Negative | |

| Variables | Z-Score | |||

|---|---|---|---|---|

| (I) | (II) | (III) | (IV) | |

| ESG (−1) | 0.618 * | |||

| (0.374) | ||||

| ENV (−1) | 0.605 ** | |||

| (0.300) | ||||

| SOC (−1) | 0.878 *** | |||

| (0.328) | ||||

| GOV (−1) | −0.360 | |||

| (0.265) | ||||

| SIZE (−1) | −0.039 | −0.046 | −0.058 | 0.018 |

| (0.052) | (0.052) | (0.052) | (0.045) | |

| LIQ (−1) | −4.025 *** | −4.172 *** | −3.910 *** | −4.431 *** |

| (1.118) | (1.112) | (1.113) | (1.123) | |

| CLAIMS GRW (−1) | −0.070 | −0.061 | −0.076 | −0.055 |

| (0.062) | (0.061) | (0.061) | (0.061) | |

| LEV (−1) | −0.303 *** | −0.329 *** | −0.312 *** | −0.224 ** |

| (0.108) | (0.107) | (0.105) | (0.105) | |

| PREMIUM GRW (−1) | 0.027 | 0.019 | −0.0034 | −0.032 |

| (0.243) | (0.243) | (0.239) | (0.243) | |

| PROFIT (−1) | −0.304 | −0.227 | −0.359 | −0.203 |

| (0.370) | (0.366) | (0.370) | (0.378) | |

| HHI (−1) | 1.347 | 1.161 | 1.426 | 1.803 |

| (3.745) | (3.667) | (3.788) | (3.738) | |

| GDP GRW (−1) | −0.650 | −0.657 | −0.554 | −0.569 |

| (1.204) | (1.199) | (1.203) | (1.246) | |

| INFL (−1) | 5.781 | 6.211 | 5.884 | 6.080 |

| (9.465) | (9.565) | (9.456) | (9.720) | |

| Time FE | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes |

| Robust SE | Yes | Yes | Yes | Yes |

| N. of obs. | 453 | 453 | 453 | 454 |

| R-squared | 0.244 | 0.247 | 0.251 | 0.243 |

| Panel A: Logit Model—Identifying Propensity Scores | ||||

| Variables | D_LIFE | |||

| SIZE (−1) | −0.014 | |||

| (0.031) | ||||

| LIQ (−1) | −7.269 *** | |||

| (1.834) | ||||

| CLAIMS GRW (−1) | −0.0783 | |||

| (0.0898) | ||||

| LEV (−1) | 1.601 *** | |||

| (0.200) | ||||

| PREMIUM GRW (−1) | 0.167 | |||

| (0.225) | ||||

| PROFIT (−1) | −1.549 *** | |||

| (0.371) | ||||

| Time FE | Yes | |||

| Country FE | Yes | |||

| Robust SE | Yes | |||

| N. of obs. | 1081 | |||

| Pseudo R-Squared | 0.298 | |||

| Panel B: Univariate Statistics—Effectiveness of Matching | ||||

| Variables | Life (1) | Nonlife (2) | Difference (1)–(2) | p-values |

| SIZE | 14.236 | 14.544 | −0.307 | 0.270 |

| LIQ | 0.021 | 0.018 | 0.003 | 0.312 |

| CLAIMS GRW | 0.115 | 0.180 | −0.065 | 0.172 |

| LEV | 1.050 | 1.020 | 0.030 | 0.246 |

| PREMIUM GRW | 0.060 | 0.062 | −0.002 | 0.570 |

| PROFIT | 0.169 | 0.174 | −0.005 | 0.110 |

| Panel C: Propensity Score Matching (PSM) for Life vs. Nonlife | ||||

| Variables | Z-score | |||

| (I) | (II) | (III) | (IV) | |

| ESG (−1) | 1.424 ** | |||

| (0.666) | ||||

| ENV (−1) | 1.145 ** | |||

| (0.501) | ||||

| SOC (−1) | 2.152 *** | |||

| (0.593) | ||||

| GOV (−1) | −0.657 | |||

| (0.421) | ||||

| Controls (−1) | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes |

| Robust SE | Yes | Yes | Yes | Yes |

| N. of obs. | 171 | 171 | 171 | 171 |

| R-squared | 0.644 | 0.647 | 0.663 | 0.647 |

| Variables | Heckman | IV 2SLS | PSM | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (I) | (II) | (III) | (IV) | (I) | (II) | (III) | (IV) | (I) | (II) | (III) | (IV) | |

| ESG (−1) | 0.801 ** | 3.803 ** | 1.050 ** | |||||||||

| (0.400) | (1.900) | (0.521) | ||||||||||

| ENV (−1) | 0.888 *** | 2.800 ** | 0.828 ** | |||||||||

| (0.312) | (1.200) | (0.382) | ||||||||||

| SOC (−1) | 0.952 ** | 3.201 *** | 0.141 ** | |||||||||

| (0.373) | (1.000) | (0.055) | ||||||||||

| GOV (−1) | −0.402 | −4.490 | 0.246 | |||||||||

| (0.201) | (4.220) | (0.421) | ||||||||||

| Controls (−1) | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Robust SE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N. of obs. | 568 | 568 | 568 | 568 | 453 | 453 | 453 | 453 | 548 | 548 | 548 | 548 |

| R-squared | 0.110 | 0.150 | 0.172 | 0.162 | 0.322 | 0.314 | 0.346 | 0.284 | ||||

| IMR | 0.010 | 0.088 | 0.074 | 0.015 | ||||||||

| (0.0341) | (0.338) | (0.341) | (0.064) | |||||||||

| Sargan p-value | 0.191 | 0.100 | 0.104 | 0.210 | ||||||||

| Variables | Z-Score |

|---|---|

| ESG Comb (−1) | 1.501 *** |

| (0.301) | |

| Controls (−1) | Yes |

| Time FE | Yes |

| Country FE | Yes |

| Robust SE | Yes |

| N. of obs. | 453 |

| R-squared | 0.265 |

| Panel A: Level of Industry Concentration | ||||||||

| Variables | Z-Score | |||||||

| Above Median HHI | Below Median HHI | |||||||

| (I) | (II) | (III) | (IV) | (I) | (II) | (III) | (IV) | |

| ESG (−1) | 1.401 ** | 0.500 | ||||||

| (0.600) | (0.403) | |||||||

| ENV (−1) | 1.000 * | 0.713 | ||||||

| (0.601) | (0.632) | |||||||

| SOC (−1) | 1.702 *** | 0.621 | ||||||

| (0.600) | (0.324) | |||||||

| GOV (−1) | 0.201 | −0.501 | ||||||

| (0.303) | (0.301) | |||||||

| Controls (−1) | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Robust SE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N. of obs. | 126 | 126 | 126 | 126 | 327 | 327 | 327 | 327 |

| R-squared | 0.423 | 0.472 | 0.498 | 0.454 | 0.225 | 0.233 | 0.227 | 0.228 |

| Panel B: Level of inflation | ||||||||

| Variables | Z-score | |||||||

| Above Median INFLATION | Below Median Inflation | |||||||

| (I) | (II) | (III) | (IV) | (I) | (II) | (III) | (IV) | |

| ESG (−1) | 0.165 | 0.916 * | ||||||

| (0.518) | (0.503) | |||||||

| ENV (−1) | 0.178 | 0.948 ** | ||||||

| (0.499) | (0.367) | |||||||

| SOC (−1) | 0.451 | 1.100 ** | ||||||

| (0.483) | (0.442) | |||||||

| GOV (−1) | −0.171 | −0.534 | ||||||

| (0.389) | (0.352) | |||||||

| Controls (−1) | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Robust SE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N. of obs. | 168 | 168 | 168 | 168 | 285 | 285 | 285 | 285 |

| R-squared | 0.348 | 0.358 | 0.360 | 0.358 | 0.295 | 0.297 | 0.297 | 0.286 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chiaramonte, L.; Dreassi, A.; Paltrinieri, A.; Piserà, S. Sustainability Practices and Stability in the Insurance Industry. Sustainability 2020, 12, 5530. https://doi.org/10.3390/su12145530

Chiaramonte L, Dreassi A, Paltrinieri A, Piserà S. Sustainability Practices and Stability in the Insurance Industry. Sustainability. 2020; 12(14):5530. https://doi.org/10.3390/su12145530

Chicago/Turabian StyleChiaramonte, Laura, Alberto Dreassi, Andrea Paltrinieri, and Stefano Piserà. 2020. "Sustainability Practices and Stability in the Insurance Industry" Sustainability 12, no. 14: 5530. https://doi.org/10.3390/su12145530

APA StyleChiaramonte, L., Dreassi, A., Paltrinieri, A., & Piserà, S. (2020). Sustainability Practices and Stability in the Insurance Industry. Sustainability, 12(14), 5530. https://doi.org/10.3390/su12145530