Abstract

The 2030 Agenda for Sustainable Development brought the critical challenge of how private capital can support its new goals—the Sustainable Development Goals (SDGs)—to the attention of finance, business and policy actors. Impact finance instruments, which aim to obtain both financial and positive social/environmental returns simultaneously, can serve as effective institutional mechanisms to support the financing of SDGs. Social impact bonds (SIBs) are part of this emerging field. SIBs represent multi-stakeholder partnerships, built on outcome-based contracts, designed to harness private impact-oriented investors, service providers and public entities to address social or environmental problems. SDG 17 considers partnerships priority instruments for the achievement of SDs targets. This paper provides an exploratory analysis into the field of Social Impact Bonds and aims to (i) understand how such instruments are suitable for involving sustainable economy actors in SDG-based partnerships; (ii) determine the interplay between SIBs and SDGs. In order to address these questions, the article presents a multiple case study that includes a cross case analysis of four SIBs experienced in different social policy areas and different countries. As secondary step, the study matches phases and activities of SDG-based financial partnerships derived from a literature review with those experienced by each SIB case study. The results show that SIBs are fully compliant with SDG-based financial partnership structures derived from the literature, and their architecture reveals a high degree of SDG investment readiness. The originality of the research consists of including SIBs in the analysis of the new financial tools for the achievement of the SDGs, and extending them into the field of partnerships for the Goals, at the center of SDG 17. The paper fills the significant gap in the current research related to the issues of financing sustainable development and financial sector instruments on sustainability.

1. Introduction

The 2030 Agenda for Sustainable Development brought the critical challenge of how to finance actions needed to support the Sustainable Development Goals (SDGs) to the attention of finance, business and policy actors. Sustainable finance (SF) is emerging as effective institutional mechanism to help finance the SDGs, because such a financial approach aims to achieve positive social and environmental outcomes, while pursuing, simultaneously, financial returns [1,2,3]. More generally, SF considers how financial instruments interact with economic, social and environmental issues [4,5]. SF covers different topics, ranging from sustainable and responsible investing (SRI) [6] to microfinance [7], social impact investing (SII) [8], social banking [9], environmental crowdfunding [10] or green finance [11]. Investor appetite in such kinds of emerging SF tools is increasing, and such interest represents a catalyst for behavioral change, both in the investment industry, as well as in the classical financial theoretical research [5,12].

Within the wide range of SF approaches and instruments, SII emerged as the most debated and growing field under both the empirical and research sides [13,14]. Social impact bonds (SIBs) are part of this relatively new financial field of study. SIBs represent multi-stakeholder partnerships that combine social/environmental objectives with mainstream financial tools [15]. In more detail, SIBs are designed to harness capital and knowledge from private actors and public entities to address social and, more recently, environmental problems [16]. Briefly, SIBs are performance-based contracts, where private investors provide the funding and are repaid later by the government, along with a potential profit only if the service meets agreed-on qualitative and quantitative performance targets [17,18]. SIBs, therefore, represents an emergent form of financial innovation derived from the inclusion of third-party investors, which provide money to fund the operations of a social service program [19,20]. The ongoing significant amounts of money investors are putting into SIBs would suggest that they are widely regarded as the future of impact investing [21]. Furthermore, by combining usual aspects of finance with social welfare, social impact bonds imply new financial practices, but also a new way of thinking of the concept of return on a financial investment [22].

Since their introduction in 2010 to the end of December 2019, 138 SIBs have been set up worldwide, addressing diverse policy areas such as homelessness, healthcare, education, unemployment, environment, criminal justice [23,24]. SIBs’ applications in development countries are labelled development impact bonds (DIBs) [25]. Within these countries, DIBs are intended to produce an impact in the areas of education, healthcare or humanitarian challenges [21].

Sustainable Development Goal 17 is totally dedicated to strengthening global partnerships for SDGs that are seen as important vehicles for mobilizing and sharing knowledge, expertise and financial resources to support their achievement. In this light, partnerships are considered a crosscutting fundamental tool to bridge the financial gap needed in the achievement of SDGs [26]. Pinpointing which factors characterize financial partnerships for SDGs and assessing the correspondence between partnership for SDGs and SIBs is an important step towards empowering practitioners, policy makers and researchers to devise solutions to overcome financial gap and accelerate the adoption of SIBs under SDG 17. This study, therefore, aims to provide more detailed knowledge about the following research questions: are SIBs suitable to involve sustainable economy actors in financial partnerships for SDGs? What is the possible and observable interplay between SIBs and SDGs? The article does so by addressing two gaps in the literature, in relation to these research questions.

First, the relatively few SIBs studies that are reported in the literature tend to focus on the study of individual cases [27,28], technical elements [29] or on the financialization of welfare [30]. A broader perspective based on empirical studies with multiple cases across sectors and geographical areas that consider SIBs within the SDGs arena is generally lacking, with a few notable exceptions [31]. The study take steps to alleviate this gap in the literature, by providing an empirical foundation for a cross-case analysis of four SIBs experienced across different social issue areas and geographical contexts, which can provide first insights into the importance of SIBs in relation to the achievement of SDGs targets. Second, previous reviews of the literature regarding SIBs [32] have drawn on the literature from a range of related research fields, but no studies specifically on SIBs relating to partnerships for SDGs have been reported in the literature up until now. It remains unclear whether the main features and characteristics of financial partnerships for SDGs drawn from related streams of the literature from the broader field of finance for development are in accordance with those experienced specifically in SIBs. This article aims to assess the correspondence between the main features of financial partnerships for SDGs drawn from the literature and the partnership models experienced specifically in the SIBs, and thus aims to address this gap in the SF literature.

On the basis of these considerations, the paper provides an exploratory analysis into the field of the social impact bond. In more detail, this work aims to (i) understand how such instruments are suitable to involve sustainable economy actors in SDG-based partnerships; (ii) determine the interplay between SIBs and SDGs.

The remainder of the article is organized as follows: Section 2 offers an overview of key theoretical backgrounds about SF for sustainable outcomes and SIBs. Section 3 describes methodological approaches applied in the research. Section 4 and Section 5 present and discuss the results; Section 6 provides conclusions. The study provides novel insights that encourage further research, and proposes suggestions and implications for scholars and practitioners.

2. Financial Innovation for Sustainable Outcomes: An Overview

Over the past decade, there have been increasing efforts by practitioners, financial institutions and regulators to align the financial system with long-term sustainable development. The need of democratizing access to finance and the barriers to access to conventional finance instruments faced by those enterprises sustainability-oriented increased attention to the value of sustainability factors in capital allocation and to the delivery of risk-adjusted returns [33]. According to Ziolo et al. [34], a greater inclusion of sustainable financial instruments in the financial system contributes to enhance the sustainability of the financial system by mitigating negative externalities, both in the social and environmental dimension. In this light, the emerging role of finance in promoting the achievement of sustainable outcomes confirms the relationship finance has with social and environmental development. To a larger extent, the introduction of new definitions, concepts an tools may attribute to SF a new role able to “deliver practical proposals to reform financial system structure, policies, instruments, and governance in order to ensure societal resilience.” [35] (p. 4).

The introduction of solidarity and reciprocity features in the financial sphere represents precise signals, in this sense [36]. The turn towards alternative forms of finance is increasingly prompting the adoption of new financial innovation tools commonly included in Academia under the umbrella term of sustainable finance [37,38]. In other terms, SF introduced a paradigm shift in the supply, intermediation and demand of capitals for “sustainability” [19,39]. More generally, SF considers how investments interact with economic, social and environmental issues [4,5]. However, so far, a single, universally recognized, SF definition has been the subject of different conceptualizations in the last decade. In more detail, SF moved from the initial identification of investments into socially responsible organizations [40], identified by negative screenings models, to a holistic concept that aligns positive economic, environmental and social dimensions with classical financial rationalities [41]. The SF efforts by the various private actors are consistent with the Sustainable Development Goals, but need to be leveraged further to achieve stronger outcomes [1,42]. Scholars have recognized different degrees and approaches to the integration of social and environmental outcomes on the part of investors as the fundamental methodology for the realization of SDGs and their ambition [1,4,43]. The spectrum of revenue models ranges from social return only, with little or no profit through blended models, to the socially motivated businesses with market-based financial returns, with a financial viability in the long run. According to Rizzi et al. [39] two main segments of SF represent the leading approach best integrating the simultaneous production of positive social/environmental impact, as well as financial returns: ethical banking and social impact investments. Since the beginning of the articulation of the SDGs, investors have seemed rather keen to focus on impact investing as the SF strategy that is best able to embody the attainment of the goals [44,45]. Social impact bonds represent one of the most debated and studied instruments within the impact investing field, and have been identified as one of the emerging and promising financial innovation tools for society [19].

Social Impact Bonds: Collaborative Cross-Sector Partnerships for Social Outcomes

SIBs are a specific form of payment by results [46,47], and are a strong example of financial innovation that can bring improvements to society [48]. Unlike traditional payment by results tools, SIBs involve private investors in support of a public private partnerships built on outcome-based contracts [49]. They engage public sector, social and solidarity enterprises and impact investors in the delivery of social programs [50] in the areas of healthcare, environment, workforce development or humanitarian challenges [51]. The SIB commissioners, usually national or local public entities, once determined a social outcomes targets, partner with private investors to finance interventions to tackle social problems delivered by social service providers, over a long term period of (usually) minimum three years [17,50]. In other words, SIBs can offer multiple benefits [52] through an alignment between the interests of different actors [20,53], in response to a social need [16]. Indeed, the design of a SIB intervention is frequently based on the scale of evidence based policies but, in some case, SIBs are designed to fund high innovative interventions aimed at both the prevention and reduction of negative impacts of a specific social problems [32]. It is important to note that the achievement of such outcomes correspond to a generation of future savings in public service budgets [54]. In a SIB contractual scheme, the investors provide the up-front finance for the intervention. Investors will receive back their capital, with a pre-defined return on investment, only if expected social outcomes are met [30,55]. On the base of these considerations, SIBs do not follow a classical bond financial logic [15] and some authors have labelled them hybrid impact finance instruments, as they embed both equity and debt logics [56]. The amount of capital returned to investors, commonly identified with the term “outcome payments”, is directly determined on the base of estimations of the public savings generated by the reduction of the costs that the public commissioner dedicate to solve the same social challenge [57]. Moreover, a typical SIB scheme may include a specialized SIB intermediary, an impact finance specialized organization, as well as an independent evaluator responsible for measuring and certifying the impact of the intervention over the target population on the base of pre-defined impact evaluation methods [56,58].

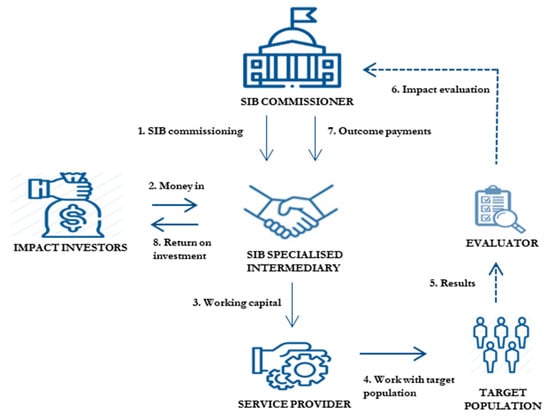

Figure 1 shows the main actors involved in an SIB. In more detail, (i) a commissioner (e.g., the government), identifies the social need and, at the end of the program, provides outcome payments in case of program success; (ii) investors provide the working capital needed for the financing of the project; (iii) a SIB specialized intermediary meets the needs of actors involved in the partnership, for the definition of the transaction agreements, as well as for the raising of capital [49]; (iv) a service provider (e.g., social enterprises) provides the service to the beneficiaries of the SIB [59]; (v) an independent evaluator, assesses the impact of the program [51] and communicates the results to the commissioner.

Figure 1.

The social impact bond (SIB) model. Source: author’s elaboration

In the SIB partnership, each actor in the system are crucial for the achievement of the agreed performance, derived from the measurement and evaluation of results. Such a final step is necessary to determine the success or not of a SIB intervention, even if has raised many doubts [47,60,61]. The timeline of a SIB includes the following necessary steps: assessment, implementation and evaluation. In summary, SIB models represent complex cross-sectoral and multi-stakeholder partnerships with a strong commitment to deliver improved outcomes, measure their progress and pay for outcomes only in case of success.

Since the launch of the first SIB in 2010, 138 impact bonds have been launched to date [62]. In particular, 130 are SIBs, compared to eight DIBs. The nations with the most SIBs launched are: the United Kingdom (47), the USA (26), the Netherlands (11) and Australia (10). SIB model applications adopted in developing countries are known as development impact bonds [25]. However, unlike the SIB model, DIBs are designed to mobilize resources to finance more complex interventions to development problems faced by developing countries. According to [63]: “Unlike Social Impact Bonds, DIBs have an aid agency or a philanthropic foundation as the outcome payer, rather than a government, and are specific to low- and middle-income countries (LMICs)” (p.4). Moreover, also in the DIB applications, private investors take on a significant portion of the risk for the project’s success, that, in other aid instruments, are generally held by public commissioner or donor agencies. In the present work, for the sake of simplicity, DIBs will be defined as social impact bonds, in the awareness of the difference described above.

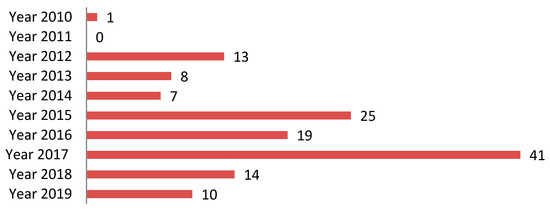

Figure 2 shows, for each year from 2010 to the end of December 2019, the number of SIBs launched worldwide.

Figure 2.

Number of SIBs per year launched worldwide. Source: author’s elaboration from the Social Finance database [62].

From a geographical point of view, Europe has the highest number of SIBs launched (79), including 47 launched in the United Kingdom. Although, in some European countries, such as Italy and Spain, there have still been no SIBs launched to date. Europe is followed by America (32), Oceania (12), Asia (6) and Africa (1).

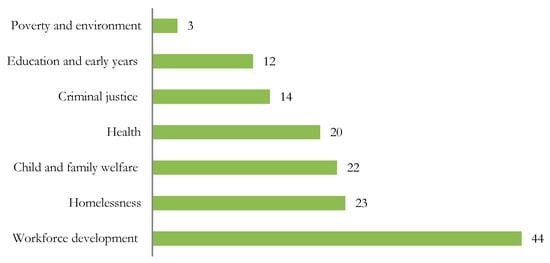

The total number of SIBs launched embrace different social issues concerning workforce development, homelessness, child and family welfare, health, criminal justice, education and early years, and poverty and environment. As we can see, the largest number by social issue concerns the workforce development, followed by homelessness, child and family welfare, and health. On the contrary, those with the lowest number of SIBs are criminal justice, education and early years and poverty and environment. Figure 3 shows the number of SIBs by social issues.

Figure 3.

Number of SIBs by social issues, as of 31 December 2019. Source: author’s elaboration from Social Finance database [62].

3. Methodology

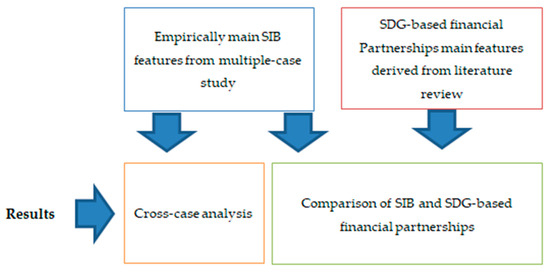

The empirical study of SIBs as suitable models of partnership for SDGs was designed as exploratory research, and organized as a longitudinal, multiple-case study. The unit of analysis was SIB partnership processes and flows analyzed in four different social issues. This research design allowed the researchers to examine the SIB partnership extensively across the entire life cycle, from the design and assessment to the final evaluation, and to collect rich data about the encountered features [64,65] by opening new insights that see SIBs as partnership for transformative outcomes suitable for SDGs targets. Figure 4 illustrates the different elements of our research. The top left corner of the figure illustrates our empirical study, which leads to our first result, namely a cross-case analysis of the 4 SIB cases (cf. Section 4.5). The empirical study, together with our literature review, focused on partnerships for SDGs, illustrated in the top right corner of Figure 4, leads to our second result, which is a comparison of the empirically derived features and the features found in the literature that focused on SDG-based investment partnerships (cf. Section 5.2).

Figure 4.

Overview of the methodological process.

3.1. Literature Review about Partnership for SDGs

As part of this study, a literature review was conducted to identify the main features of SDGs partnerships in the literature. As a first step, a search was conducted in Web of Science (WoS), Scopus and Google Scholar (first 200 results), combining the subject keywords partnerships, finance and SDGs/Sustainable Development Goals, to capture as much of the relevant literature as possible. The search included all peer-reviewed articles in English, and resulted in a total of 986 articles (WoS (776), Scopus (10) and Scholar, (limited to the first 200)) that were examined, based on the title and abstract, to single out those that dealt specifically with partnership in relation to the adoption of financial resources in the SDG context. Only 15 of them were considered relevant to the theme of the study. Applying a snowball sampling approach [66], references from these articles were examined in the same fashion, and 47 further references, essentially the grey literature, were enfolded in the review. The articles that resulted after this process were studied in full, and 24 of these proved relevant to financial partnership in the SDG context. In summary, in the review performed in this study, we finally considered 39 references.

3.2. Case Selection and Data Collection

In case study research, it is typical to select cases by applying specific criteria, instead of selecting a random or stratified sample [67]. For the purpose of this research, four case studies (two SIBs and two DIBs) were selected. The final sample of SIBs was selected by including the following criteria: (i) the presence in the sample of both SIBs and DIBs; (ii) the selection of only concluded SIB/DIB projects; (iii) SIB/DIB projects issued in different social issues. The choice to select both SIBs and DIBs stems from the fact that, with the former being addressed to developed countries and the latter to developing countries, this would have allowed us to have a complete vision of the different social issues dealt with in the different countries. Furthermore, at the date of 31 December 2019, the number of SIB projects concluded was 34, while only two DIBs had been completed [24,68]. The choice to select only completed cases is due to the fact that it allows a full understanding of the effects that SIBs have had on the various social issues addressed, which is not possible in the case of SIBs in the implementation stage. In addition to the two DIBs completed, another two SIBs were selected in the sample, excluding SIBs concluded with anticipated terms (such as Peterborough SIB and New York Able SIB) [24], and selecting only those cases presenting large and available information [69]. Therefore, the cases were selected through a specific selection of criteria, rather than through a randomized selection of the sample [67]. The four final cases selected, focused on different social issues (homelessness, employment, education and agriculture) and possibly fell into different geographical areas (UK, Peru and India). The large variation between the cases allowed the authors to obtain information about the significance of various circumstances for SIB process and outcome [70], and, thus, to begin to examine the effect of characteristics such as actors involved, expected and effective outcomes, financial investments and returns on the encountered features through literal and theoretical replication [65]. Case study data were captured with a document analysis of official documents, such as reports and company websites, and in some cases with peer reviewed articles focusing on a single case [27,28]. An overview of selected cases is illustrated in Table 1.

Table 1.

Selected cases.

3.3. Data Analysis

The empirical data was analyzed using an inductive approach, where a list of common features were first identified for each SIB. Features of a similar character were grouped into one heading and organized into features within the emergent categories of actors involved, financial flows, social outcome and presented with a cross-case analysis. The common core elements of partnerships for SDGs found in the literature were grouped into pre-assessment activities, implementation activities, evaluation activities. In the common features of partnerships for SDGs from the literature with empirically derived features of SIBs, we have looked for both direct comparisons and closely related issues. The comparison of empirically derived common SIB features and the common features of financial partnership for the SDGs described in the literature is shown in Table 6 and discussed in Section 5.2.

4. Case Studies

Four case studies (two DIBs and two SIBs) were analyzed. The two DIBs (educate girls and the Asháninka) were launched in India and Peru, respectively, in 2015. The two SIBs (Department for Work and Pensions (DWP) Innovation Fund Round II—Greater Manchester (Teens and Toddlers) and the London Homelessness Social Impact Bond (St Mungo’s/Street Impact) were implemented in 2012 in the UK. The SIBs and the DIBs examined were both completed. Table 1 provided an overview of the selected cases.

4.1. London Homelessness Social Impact Bond (St Mungo’s/Street Impact)

The London Homelessness Social Impact Bond (hereinafter LH SIB) was launched in London in 2012 [71,72,73]. The aim of the program is to support to help persistent rough sleepers [71]. It is the first initiative in the world to be completed in 2015 and the first to address homelessness [71]. At the end of the SIB (2015) the SIB concluded with positive performance and, thus, investors returned on their investment [71].

4.2. DWP Innovation Fund Round II - Greater Manchester (Teens and Toddlers)

The Teens and Toddlers Social Impact Bond (T&T SIB) represents one of the 10 SIBs of the pilot innovation fund launched in the UK in 2012 by the Department for Work and Pensions [74]. T&T SIB aimed to support young people between 14 and 15 years of age at risk of becoming Not in Education, Employment or Training (NEET), in order to achieve educational and behavioral improvements [75]. The program was completed in 2015, becoming the first in the world to fully achieve all the objectives [76].

4.3. Educate Girls

The educate girls development impact bond (EG DIB) was launched in India in 2015 [77]. The aim of EG DIB was to increase the percentage of girls’ enrolment, and to improve schooling for both boys and girls in an area of Rajasthan [78]. The program was the first DIBs to be launched in 2015 in a developing country [79]. The program was successfully completed in 2018 [80].

4.4. The Asháninka DIB

The Asháninka DIB was launched in 2015 in Peru. The aim of the program was both to improve the economic situation and to increase the cocoa and coffee crops of the Asháninka farmers in the Peruvian Amazon [81]. The Asháninka DIB was the first DIB dedicated to the agricultural sector to be launched in a developing country [81]. The program started in January 2015 and was completed 10 months later [82]. The program has achieved three out of four objectives [83].

4.5. Cross-Case Analysis

The following areas of interest emerge from the cross-case analyses: (i) partnerships, (ii) financial flows and (iii) social impact.

4.5.1. Partnerships

With regard to LH SIB, the Greater London Authority commissioned the program [71]. The parties involved in SIB are different. The intermediary of the SIB was Triodos Bank [17], and ethical and sustainable Dutch bank [84]. Several investors are involved in the program, including the service provider that has invested in SIB, as well as a foundation, a social enterprise and other individual investors [62]. The service provider was St Mungo’s Broadway, which, in addition to offering the service, invested in SIB.

With regard to T&T SIB, the UK Department for Work and Pensions commissioned the program [85]. The intermediary was Social Finance UK [86], a non-profit organization that supports the UK Government in the realization of a social finance market [39]. Investors include not only certain foundations (such as Impetus-PEF), but also the private market investor Bridges. The service provider was Teens and Toddlers (now called Power2) [68].

With regard to EG SIB, the Children’s Investment Fund Foundation commissioned the program. The intermediary of the program was Instiglio. UBS Optimus Foundation was the investor of the SIB. The service provider was the educate girls. The intermediary was IDinsight [78].

With regard to Asháninka DIB, the commissioner was The Common Fund for Commodities [87], an autonomous and intergovernmental financial institution. The investor was a foundation (The Schmidt Family Foundation). Three different partners (e.g., Rainforest Foundation UK) acted as service providers. The evaluator of the program was the Royal Tropical Institute (KIT) [28,68].

As emerged from the case studies, it was possible to highlight which are the different actors involved in both SIBs and DIBs, and what their functions are, with the exception that, in DIBs, it is possible to take over investors, service providers, commissioners and evaluators who are international rather than national organizations, as in the case of SIBs. In more detail, from the case under review, a set of actors emerged that played a specific role, as highlighted in Table 2.

Table 2.

Partnerships involved in the SIBs.

In more detail, with regards to the service provider, in the Asháninka DIB there are three different service providers. With regards to the investors, the LH SIB and T&T SIB involve plural investors. Moreover, in the LH SIB, the service provider (St Mungo’s Broadway) also acted as an investor. With regards to the commissioners, in the two SIBs they are identified with national public entities bodies in the country where SIBs were launched, while the DIBs’ commissioners are impact oriented international organizations.

4.5.2. Financial Resources

In order to analyze, in detail, the financial aspects with regard to the amount of capital raised, the maximum outcome payment and the payment achieved, we have adopted the euro currency, using the exchange rate as at 30 April 2020.

With regard to LH SIB, a capital of EUR 1,341,330 was raised [62]. The duration of the SIB was 3 years. The expected maximum outcome payment was capped to twice the initial investment (EUR 2,682,660) [68]. At the end of the program (2015), SIB investors obtained the maximum return on their investment [71].

With regard to T&T SIB, the capital raised was EUR 894,220. The duration of the program was 3.5 years. The expected maximum outcome payment was capped AT EUR 3,688,657.50. At the end of the program, investors have received full redemption with the expected maximum final returns [88].

With regard to EG DIB, EUR 301,569.75 was invested over three years, with a possible maximum payment of EUR 471,342.35. The program was successfully completed in 2018 and provided an IRR of 15% [68].

With regard to the Asháninka DIB, an investment of EUR 100,866.53 was raised. The duration was over a period of 10 months. Given the pilot phase of the DIB, the maximum outcome payment corresponding to the return of principal. However, a total of EUR 75,600 was paid out against EUR 100,866.53 [82]. This meant that only a partial amount of the entire principal was returned to investors, with a loss of 25% of the capital invested [28]. Table 3 shows the financial dimension.

Table 3.

Financial dimension.

4.5.3. Social Impact

With regard to LH SIB, the program aimed to provide holistic support to help persistent rough sleepers. The target of population was 416 persistent rough sleepers. The metrics to calculate the achievement of the result were as follows: (i) reduction of rough sleepers; (ii) sustained accommodation, to be understood as maintaining a lease at 12 and 18 months; (iii) sustained reconnection, to be understood as the reconnection of non-British foreigners in their countries of origin; (iv) promote employment, education and training; and (v) improve health and wellbeing [17]. With regards to the first parameter, although the number of rough sleepers has been reduced, the program has largely failed to achieve its objectives, as the people who have remained on the streets are well established subjects with little commitment to change. The results of remaining metrics resulted within the thresholds [71] The impact measurement method used was quasi-experimental and validated the administrative data [68].

With regards to T&T SIB, the program aimed to support young people between 14 and 15 years of age at risk of becoming NEET, in order to achieve educational and behavioral improvements [75]. The target population was 1100 disadvantaged young people. The following measures were established for the calculation of the results: (i) improved school behavior; (ii) achievement of qualifications; and (iii) occupational integration [17]. A total of 59% had improved their school behavior, 58% improved their attitude, school attendance improved by 32%, 73% obtained a first level qualification (QCF), while 32% obtained a first level qualification and 18% obtained a second level qualification. [88]. The impact measurement method used was validated administrative data [68].

With regard to EG DIB, the program aimed to increase the percentage of girls’ enrolment and to improve schooling for both boys and girls in an area of Rajasthan. The target population was 7300 children. The metrics used to calculate the result were as follows: (i) increase in enrolment; and (ii) improve school learning [79]. EG DIB increased the percentage of school enrolments by 92% [82]. EG DIB exceeded the DIB’s target for both learning and enrollment. The students involved in the project reached 8940 Annual Status of Education Report (ASER) learning levels, 60% above the threshold set by the DIB. In addition, 768, or 92% of the total number of unregistered girls identified as eligible for enrolment, were enrolled. [80]. The impact measurement method used was a randomized control trial [68].

With regards to the Asháninka DIB, the program aimed to improve the economic situation and to increase the cocoa and coffee crops of the Asháninka farmers. The target of population was 99 Asháninka families. The impact parameters chosen in the program were: (i) increase in the supply of Kemito Ene by 60%; (ii) increase to 600 kg/ha or more in production by at least for the 60% of the members; (iii) transfer of at least thirty-five tons of cocoa during the last year of the project; and (iv) at least 40 producers have 0.5 ha of resistant coffee [83]. The final results for the above parameters were as follows: the first parameter was achieved for 45% compared to 60% required; the second parameter (increase to 600 kg/ha or more in production) did not achieve its target, as only 15% of members increased production compared to 60% required. It should be noted that the failure to reach the second parameter was as much due to an optimistic estimate of yield as to the Mazorquero parasite that affected the harvest in 2015 [83]. The third and fourth parameters exceeded the required thresholds, respectively: 35 against 52 tonnes of cocoa required (third parameter), and 40 against 62 farmers who now have an area of 0.5 hectares (fourth parameter) [83]. Table 4 shows the social impact features of the four cases.

Table 4.

Social impact.

5. Results and Discussion

This section presents the results of the literature review. The aim of the literature review is to compile a comprehensive list of distinguishing elements of SDG based financial partnerships described in the literature, and to discuss the derived results, in order to address the research questions of this paper.

5.1. SDG Based Financial Partnerships: Conceptualizations and Main Distinguishing Elements Identified in Literature

The concept of partnerships as a vehicle for supporting public policy led actions in the achievement of the development goals evolved over the last two decades [80]. Since the adoption of the Millennium Development Goals in 2000, partnerships, as a tool of implementation, have been increasingly recognized in different UN summit, conferences and documents such as, for example, the Addis Ababa Action Agenda and the 2030 Agenda for Sustainable Development in 2015. After the beginning of the SDG era partnership have been recognized as important vehicles to “strengthen the means of implementation and revitalize the global partnership for sustainable development” as stated by SDG 17 [84,89]. The focus of SDG 17 concerns the mobilization of efforts of international communities to work together, to share experience and technologies or financial resources from multiple sources to deliver on all SDGs. In other words, the universality of SDGs in terms of sectors and countries requires the sharing, as widely as possible, of expertise, knowledge, technologies and financial resources to have an impact on a global scale [87,90]. In this light, multi-stakeholder partnerships are seen as the ideal means to mobilize such resources [91].

The mobilization of financial resources for SDG based investment partnerships depends on the scale and nature of the required investments [92]. Financing can come in the form of private and public providers that seek a market rate return or below-market rates of return [31,93,94]. However, the involvement of public and private actors in such forms of investment partnerships can be extremely complex to design [95,96], given the high risk of misalignment between the private incentives of businesses and the social objective of sustainable developments [97]. The literature reporting different experiences in the development of investment partnerships reveals three main common characteristics. In more detail, SDG based investment partnerships are essentially, (i) multi-stakeholders; (ii) cross-sectoral; and (iii) focused on solving a complex long-term investment challenge [98]. It is important to note that each social issue area of investment requires precise strategies for success, and a one-size-fits-all model of partnerships cannot be considered [99]. However, it is possible to distinguish some basic types of partnerships along a spectrum, which is useful for visualizing the different purposes of the collaboration between partners. On the left side of the spectrum, partnerships that originated with the focus to exchange resources and skills are identified. On the right side, partnerships focused on collective action to tackle complex challenges through positive impact on the systems they operate are identified. Positioned in the middle are partnerships that are not limited to an exchange of resources, as in the first case, and that are, at the same time, not fully oriented to transformation, bringing a value to partners higher than each could deliver alone [100,101]. Following this point of view, in such kinds of partnerships, it is also possible to identify two levels of value creation by differentiating the collective value of partnerships from the value gained by each individual partner [102]. The latter form of value creation is more predominant in partnerships for impact, while in the partnerships based essentially on exchanging resources the value gained by the organization itself is predominant. Table 5 highlights 10 core processes through which SDG-based partnerships can create additional value.

Table 5.

Core phases and activities of Sustainable Development Goal (SDG)-based financial partnerships.

As can be observed, the three main blocks of partnership processes have been identified: a phase of definition and assessment of the collaborative advantage of the partnership; the second phase, concerning the structuring funding and implementation of the partnership; and a final phase focused on the measure and evaluation of the delivered value. Before structuring a partnership, the value addressed is jointly defined and assessed, in an explicit process of collaboration involving all the partners. In particular, in this phase, all the partners are involved in the predictive value assessment of the expected outcomes and their indicators and targets. The second main block of activities aim to provide an opportunity to review initial expectations or checking that the implementation of the partnership project is on track and, in case, introduce adaptations. The final review phase includes the overall assessment of achieved value and lesson learnt.

5.2. Comparison between SIB and SDG-Based Financial Partnerships

On the base of the results derived in Section 5.1, it is possible to highlight the differences and similarities between SDG-based partnerships and SIBs. From the analysis of the cases, as represented in Table 2, it is possible to identify which are the different actors involved in both SIBs and DIBs and what are their functions. The key actors in an impact bond are commissioners, investors, the service provider, SIB intermediaries and impact evaluators. In the typical structure of a SIB, intermediaries work with the commissioner to structure and design the bonds, raise capital and arrange negotiations with investors and service providers. Investors provide upfront capital to the service provider, who then delivers services to a population in need. Upon the achievement of pre-agreed impact metrics, the commissioner will repay the investor their initial capital, plus a return. The evaluator verifies if the outcomes have been achieved. In SIB schemes, therefore, focus on outcomes are evidenced by the attention to certain results, by placing greater incentives on reaching them. At the same time, the focus on results emerges from the financing mechanism at the base of SIBs, which align all the actors to ensuring that interventions are focused on the achievement of the pre-agreed outcomes. In this light, monitoring and evaluation is driven by the need to demonstrate the achievement of results. A rigorous evaluation evidence that compares the same intervention with and without an impact bond, gives confirmation that SIBs reduce risk for government, because, where the results were not achieved, the government did not pay for the results. For the same reasons, SIBs encourage collaboration across the public and private sectors, both horizontally and vertically. From the perspective of the finance sector, SIBs represent a novelty in financing approaches for development, traditionally adopted by a line of credit through development financial institutions.

As emerges from the empirical insights over case studies, SIBs and DIBs are therefore of interest as financial tools suitable for finance development, and have many elements in common with traditional financial tools for development. In other terms, they bring in private public sector collaborations (PPPs), mobilize private money and are outcome based. Thus, for the purpose of this study, we compared the type of SDG-based partnerships’ phases and activities derived from the literature with those experienced by each SIB case studies, in order to provide an answer to one of the two research questions concerning the classification or not of SIBs under the SDG-based partnership schemes. The results of this analysis are illustrated in Table 6.

Table 6.

Comparison between SDG-based partnership models derived from the literature review and SIBs.

It is clear from Table 6 that the stages and activities of the partnerships resulting from the literature coincide perfectly with those of each case study analyzed. This allows us to show how SIBs can be included among the financial partnership schemes for SDGs.

5.3. Design of SDG-Based Investment Partnership with SIBs

In the previous section, we identified SIBs as fully compliant with SDG-based financial partnership structures derived from literature. In this section are derived results adapt to answer if SIBs are suitable to design sustainable development goal-based investment partnerships. In more detail, from the comparison between the four cases showed, the SIB reviewed a deal with different social issues, such as education, agriculture, employment and homelessness. In each social issue addressed, a precise intervention was determined by identifying target population, metrics and relative financial resources, as illustrated in Section 4.5.

For the purpose of this study, we tried to match the social outcomes results that emerged from case studies with the corresponding SDG and specific target within the goal, although they all have SDG 17 (which concerns partnerships for the goals) in common. Then, we added information about the financial resources dedicated to each SIB to achieve the expected outcomes now expressed also with SDG target indicators. The results of this analysis are illustrated in Table 7.

Table 7.

Issue area, goals and specific target of SDGs, capital raised and duration included in the SIB.

As can be observed from Table 5, social outcomes addressed by the SIBs under review can be overlapped with specific SDG and relative indicators. For this reason, SIBs are naturally suited to address SDG 17, by allowing the mobilization of private financial resources through partnerships for SDGs. Therefore, it is also possible to identify SIBs as new financial tools suitable for the identification of investment areas for the SDGs. From the analysis, it could be argued that, in the future, SIBs could largely be designed to target directly one or more specific SDG targets.

6. Conclusions

In this article, by addressing specific gaps in the literature, we answered the following research questions: are SIBs suitable to involve sustainable economy actors in financial partnerships for SDGs? What is the possible and observable interplay between SIBs and SDGs? The first gap was that the SIB studies tend to focus SIBs by privileging individual cases, technical elements or narrative questions, such as the financialization of welfare. A broader perspective based on empirical studies with multiple cases across social sectors and geographical areas that considered SIBs within the SDGs arena was generally lacking. To help alleviate this gap in the literature, the article presented an in-depth multiple-case study across four SIBs that were experienced in different social issues and countries, to ensure a broad and rich empirical foundation for the analysis of the main SIB characteristics, and to begin to understand the similarities and differences between SIBs and SDG-based partnerships. The analysis showed that SIBs can be perfectly overlapped with other SDG-based partnerships models. The comparison of SIBs issued in different social issue areas and geographies showed that these projects experienced the same distinguishing phases, activities and corresponding actors. This implies that different SIBs goals and partners do not influence such similar factors and, thus, the SIB mechanism. The second gap addressed in this article was that, until now, the current literature that specifically addressed SIBs as an innovative tool that lends itself perfectly to the realization of SDGs. This gap was examined by matching social outcomes elements emerged from each case studies with the correspondent SDG and specific target indicators within the goal, although they all have SDG 17 (which concerns partnerships for the goals) in common. In summary, through an analysis based on multiple case studies and a literature review, this research contributes to the extension of the existing literature on social impact bonds and SDGs in several aspects. The originality of this work lies in the fact that, to our knowledge, it is the first work that provides a complete analysis of how SIBs are perfectly compliant with SDG-based financial partnership models. It also contributes by compiling SIB overviews existing in the literature, by pointing out a new empirical SIB conceptualization not previously reported in related studies.

Limitations of this study involve, as in each research based on case study method, the issues of reliability, validity and generalizability. As observed, “the case study has basically been faulted for its lack of representativeness” [109]. The selection process of our sample reduced the number of case studies analyzed. The paper elaborates mostly on publicly available information and four case studies. However, the results derived in this paper could offer the potential for a meta-analysis, in order to conduct a more in-depth empirical analysis. Thus, considering the scarcity of information on SIBs that could limit a meta-analysis process, research derived from benchmarks could be also a viable plan to follow in future research. Furthermore, in order to enhance the generalizability of the insights presented in this paper, future studies on this issue could attempt to perform analyses extended to all of the social areas where SIBs operate.

Our findings provide suggestions that are useful for practitioners and policy makers to consider that adoption of SIBs can not only mitigate and reduce negative social and environmental externalities, but could also to see SIBs as new financing tools, with a good degree of SDG investment readiness, with high potential for projects in developing countries. Therefore, the need for innovation in SDG-based financial solutions derived from the cooperation, at global level, between key actors with experience in the field, such as banks, foundations, social enterprises, can be satisfied with the adoption of such financial impact based partnerships. It is largely possible to conclude that the issue of SIBs, as well as DIBs, directly targeted to a specific SDG could be considered from policy makers within existing financial alternatives for development. Furthermore, as one academic recently suggested, “the relevant question is not whether the EU—or the world—can finance the EGD agenda, but whether sufficient real resources—labor, equipment, and technology—will be available to tackle the climate crisis and achieve SDGs” [41] (p.20). In this light, the research provides to policy makers and practitioners a complete and substantiated representation about how SIBs could be considered promising sustainable financial practices for the mobilization of such resources needed to face the major emerging challenges summarized in 2030 Agenda for Sustainable Development.

Author Contributions

Conceptualization, A.R.; methodology, A.R. and A.K.; formal analysis, A.R. and A.K.; investigation, A.R. and A.K.; resources, A.K.; data curation, A.K.; writing—original draft preparation, A.R. and A.K.; writing—review and editing, A.R. and A.K.; visualization, A.K.; supervision, A.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Trabacchi, C.; Buchner, B. Unlocking Global Investments for SDGs and Tackling Climate Change. In Achieving the Sustainable Development Goals through Sustainable Food Systems; Springer: Cham, Switzerland, 2019; pp. 157–170. [Google Scholar]

- UN Inter-Agency Task Force on Social and Solidarity Economy. Social and Solidarity Economy and the Challenge of Sustainable Development. 2014. Available online: http://unsse.org/wp-content/uploads/2014/08/Position-Paper_TFSSE_Eng1.pdf (accessed on 28 January 2020).

- Utting, P. Achieving the Sustainable Development Goals through Social and Solidarity Economy: Incremental versus Transformative Change. UNIRSD. 2018. Available online: http://www.unrisd.org/80256B3C005BCCF9/(httpAuxPages)/DCE7DAC6D248B0C1C1258279004DE587/$file/UNTFSSE---WP-KH-SSE-SDGs-Utting-April2018.pdf (accessed on 29 January 2020).

- Fatemi, A.M.; Fooladi, I.J. Sustainable finance: A new paradigm. Glob. Financ. J. 2013, 24, 101–113. [Google Scholar] [CrossRef]

- Ziolo, M.; Fidanoski, F.; Simeonovski, K.; Filipovski, V.; Jovanovska, K. Sustainable finance role in creating conditions for sustainable economic growth and development. In Sustainable Economic Development; Springer: Cham, Switzerland, 2017; pp. 187–211. [Google Scholar]

- Soppe, A. Sustainable finance as a connection between corporate social responsibility and social responsible investing. Indian Sch. Bus. Wp Indian Manag. Res. J. 2009, 1, 13–23. [Google Scholar]

- Robinson, M.S. The Microfinance Revolution: Sustainable Finance for the Poor; The World Bank: Washington, DC, USA, 2001. [Google Scholar]

- Weber, O.; Duan, Y. Socially responsible finance and investing: Financial institutions, corporations, investors, and activists. In Social Finance and Banking; John Wiley & Sons: New York, NY, USA, 2012; Volume 160, p. 180. [Google Scholar]

- Weber, O.; Remer, S. Social Banks and the Future of Sustainable Finance; Routledge: London, UK, 2011. [Google Scholar]

- Belleflamme, P.; Lambert, T.; Schwienbacher, A. Individual crowdfunding practices. Ventur. Cap. 2013, 15, 313–333. [Google Scholar] [CrossRef]

- Perez, O. The New Universe of Green Finance: From Self-Regulation to Multi-Polar Governance. 2007. Available online: http://www.biu.ac.il/law/unger/wk_papers.html (accessed on 12 April 2020).

- Paranque, B.; Pérez, R. “Finance Reconsidered: New Perspectives for a Responsible and Sustainable Finance”, Finance Reconsidered: New Perspectives for a Responsible and Sustainable Finance (Critical Studies on Corporate Responsibility, Governance and Sustainability); Emerald Group Publishing Limited: Bingley, UK, 2016; Volume 10, pp. 3–13. [Google Scholar]

- Chowdhry, B.; Davies, S.W.; Waters, B. Investing for impact. Rev. Financ. Stud. 2019, 32, 864–904. [Google Scholar] [CrossRef]

- Agrawal, A.; Hockerts, K. Impact investing: Review and research agenda. J. Small Bus. Entrep. 2019, 1–29. [Google Scholar] [CrossRef]

- Albertson, K.; Fox, C. Payment by Results and Social Impact Bonds: Outcome-Based Payment Systems in the UK and US; Policy Press: Bristol, UK, 2018. [Google Scholar]

- La Torre, M.; Trotta, A.; Chiappini, H.; Rizzello, A. Business models for sustainable finance: The case study of social impact bonds. Sustainability 2019, 11, 1887. [Google Scholar] [CrossRef]

- Gustafsson-Wright, E.; Gardiner, S.; Putcha, V. The Potential and Limitations of Impact Bonds: Lessons from the First Five Years of Experience woRldwide. Global Economy and Development at Brookings. 2015. Available online: https://www.brookings.edu/research/the-potential-and-limitations-of-impact-bonds-lessons-from-the-first-five-years-of-experience-worldwide/ (accessed on 25 January 2020).

- Bergfeld, N.; Klausner, D.; Samel, M. Improving Social Impact Bonds: Assessing Alternative Financial Models to Scale Pay-for-Success. Annu. Rev. Policy Des. 2019, 7, 1–20. [Google Scholar]

- Shiller, R.J. Finance and the Good Society; Princeton University Press: Princeton, NJ, USA, 2013. [Google Scholar]

- Maier, F.; Meyer, M. Social Impact Bonds and the perils of aligned interests. Adm. Sci. 2018, 7, 24. [Google Scholar] [CrossRef]

- Clifford, J.; Jung, T. Exploring and understanding an emerging funding approach. In Handbook of Social and Sustainable Finance; Routledge: London, UK, 2016; pp. 161–176. [Google Scholar]

- Edmiston, D.; Nicholls, A. Social Impact Bonds: The Role of Private Capital in Outcome-Based Commissioning. J. Soc. Policy 2018, 47, 57–76. [Google Scholar] [CrossRef]

- Dey, C.; Gibbon, J. New development: Private finance over public good? Questioning the value of impact bonds. Public Money Manag. 2018, 38, 375–378. [Google Scholar] [CrossRef]

- Rania, F.; Trotta, A.; Carè, R.; Migliazza, M.C.; Kabli, A. Social Uncertainty Evaluation of Social Impact Bonds: A Model and Practical Application. Sustainability 2020, 12, 3854. [Google Scholar] [CrossRef]

- Tan, S.; Fraser, A.; McHugh, N.; Warner, M. Widening perspectives on social impact bonds. J. Econ. Policy Reform 2019, 39, 1–10. [Google Scholar] [CrossRef]

- MacDonald, A.; Clarke, A.; Huang, L. Multi-stakeholder partnerships for sustainability: Designing decision-making processes for partnership capacity. J. Bus. Ethics 2019, 160, 409–426. [Google Scholar] [CrossRef]

- Gallucci, C.; Santulli, R.; Tipaldi, R. Development impact bonds to overcome investors-services providers agency problems: Insights from a case study analysis. Afr. J. Bus. Manag. 2019, 13, 415–427. [Google Scholar]

- Belt, J.; Kuleshov, A.; Minneboo, E. Development impact bonds: Learning from the Asháninka cocoa and coffee case in Peru. Enterp. Dev. Microfinance 2017, 28, 130–144. [Google Scholar] [CrossRef]

- Schinckus, C. The valuation of social impact bonds: An introductory perspective with the Peterborough SIB. Res. Int. Bus. Financ. 2018, 45, 1–6. [Google Scholar] [CrossRef]

- Cooper, C.; Graham, C.; Himick, D. Social impact bonds: The securitization of the homeless. Account. Organ. Soc. 2016, 55, 63–82. [Google Scholar] [CrossRef]

- Méndez-Suárez, M.; Monfort, A.; Gallardo, F. Sustainable Banking: New Forms of Investing under the Umbrella of the 2030 Agenda. Sustainability 2020, 12, 2096. [Google Scholar] [CrossRef]

- Fraser, A.; Tan, S.; Lagarde, M.; Mays, N. Narratives of promise, narratives of caution: A review of the literature on Social Impact Bonds. Soc. Policy Adm. 2018, 52, 4–28. [Google Scholar] [CrossRef]

- Unruh, G.; Kiron, D.; Kruschwitz, N.; Reeves, M.; Rubel, H.; Zum Felde, A.M. Investing for a sustainable future: Investors care more about sustainability than many executives believe. MIT Sloan Manag. Rev. 2016, 57, 27–42. [Google Scholar]

- Ziolo, M.; Filipiak, B.Z.; Bąk, I.; Cheba, K.; Tîrca, D.M.; Novo-Corti, I. Finance, Sustainability and Negative Externalities. An Overview of the European Context. Sustainability 2019, 11, 4249. [Google Scholar]

- Lagoarde-Segot, T.; Martinez, E. Ecological Finance Theory: New Foundations. Available online: https://ssrn.com/abstract=3612729 (accessed on 30 May 2020).

- Lagoarde-Segot, T.; Paranque, B. Finance and sustainability: From ideology to utopia. Int. Rev. Financ. Anal. 2018, 55, 80–92. [Google Scholar] [CrossRef]

- Lehner, O.M. Routledge Handbook of Social and Sustainable Finance; Routledge: London, UK, 2016. [Google Scholar]

- Lagoarde-Segot, T. Sustainable finance. A critical realist perspective. Res. Int. Bus. Financ. 2019, 47, 1–9. [Google Scholar] [CrossRef]

- Rizzi, F.; Pellegrini, C.; Battaglia, M. The structuring of social finance: Emerging approaches for supporting environmentally and socially impactful projects. J. Clean. Prod. 2018, 170, 805–817. [Google Scholar] [CrossRef]

- Sparkes, R.; Cowton, C.J. The maturing of socially responsible investment: A review of the developing link with corporate social responsibility. J. Bus. Ethics 2004, 52, 45–57. [Google Scholar] [CrossRef]

- Kuzmina, J.; Lindemane, M. Development of Investment Strategy Applying Corporate Social Responsibility. Trends Econ. Manag. 2017, 11, 37–47. [Google Scholar] [CrossRef]

- Lagoarde-Segot, T. Financing the Sustainable Development Goals. Sustainability 2020, 12, 2775. [Google Scholar] [CrossRef]

- Van Duuren, E.; Plantinga, A.; Scholtens, B. ESG integration and the investment management process: Fundamental investing reinvented. J. Bus. Ethics 2016, 138, 525–533. [Google Scholar] [CrossRef]

- Wendt, K. (Ed.) Positive Impact Investing: A Sustainable Bridge between Strategy, Innovation Change and Learning; Springer: Cham, Switzerland, 2019. [Google Scholar]

- Balkin, J. Investing with Impact: Why Finance Is a Force for Good; Routledge: New York, NY, USA, 2016. [Google Scholar]

- Rizzello, A.; Caridà, R.; Trotta, A.; Ferraro, G.; Carè, R. The use of payment by results in healthcare: A review and proposal. In Social Impact Investing beyond the SIB; Palgrave Macmillan: London, UK, 2018; pp. 69–113. [Google Scholar]

- Fox, C.; Albertson, K. Payment by results and social impact bonds in the criminal justice sector: New challenges for the concept of evidence-based policy? Criminol. Crim. Justice 2011, 11, 395–413. [Google Scholar] [CrossRef]

- Schinckus, C. Financial innovation as a potential force for a positive social change: The challenging future of social impact bonds. Res. Int. Bus. Financ. 2017, 39, 727–736. [Google Scholar] [CrossRef]

- Galitopoulou, S.; Noya, A. Understanding Social Impact Bonds; Organisation for Economic Co-Operation and Development: Paris, France, 2016. [Google Scholar]

- Warner, M.E. Private finance for public goods: Social impact bonds. J. Econ. Policy Reform 2013, 16, 303–319. [Google Scholar] [CrossRef]

- Pendeven, B.L. Social impact bonds: A new public management perspective. Financ. Contrôle Strat. 2019, NS-5. Available online: http://journals.openedition.org/fcs/3119 (accessed on 5 April 2020). [CrossRef]

- Goodall, E. Choosing Social Impact Bonds: A Practitioner’s Guide; Bridges Ventures: London, UK, 2014. [Google Scholar]

- Mohamad, S.; Lehner, O.M.; Khorshid, A. A Case for an Islamic Social Impact Bond. 2015. Available online: https://ssrn.com/abstract=2702507 (accessed on 5 April 2020).

- Scognamiglio, E.; Di Lorenzo, E.; Sibillo, M.; Trotta, A. Social uncertainty evaluation in Social Impact Bonds: Review and framework. Res. Int. Bus. Financ. 2019, 47, 40–56. [Google Scholar] [CrossRef]

- Nicholls, A.; Tomkinson, E. The Peterborough Pilot Social Impact Bond. 2015. Available online: http://eureka.sbs.ox.ac.uk/id/eprint/5929 (accessed on 4 April 2020).

- Arena, M.; Bengo, I.; Calderini, M.; Chiodo, V. Social impact bonds: Blockbuster or flash in a pan? Int. J. Public Adm. 2016, 39, 927–939. [Google Scholar] [CrossRef]

- Nazari Chamaki, F.; Jenkins, G.P.; Hashemi, M. Social impact bonds: Implementation, evaluation, and monitoring. Int. J. Public Adm. 2019, 42, 289–297. [Google Scholar] [CrossRef]

- Jackson, E.T. Evaluating social impact bonds: Questions, challenges, innovations, and possibilities in measuring outcomes in impact investing. Community Dev. 2013, 44, 608–616. [Google Scholar] [CrossRef]

- Del Giudice, A. La Finanza Sostenibile; Giappichelli Editore: Turin, Italy, 2019. [Google Scholar]

- Sinclair, S.; McHugh, N.; Huckfield, L.; Roy, M.; Donaldson, C. Social impact bonds: Shifting the boundaries of citizenship. Soc. Policy Rev. 2014, 26, 119–136. [Google Scholar]

- McHugh, N.; Sinclair, S.; Roy, M.; Huckfield, L.; Donaldson, C. Social impact bonds: A wolf in sheep’s clothing? J. Poverty Soc. Justice 2013, 21, 247–257. [Google Scholar] [CrossRef]

- SIB Database. Available online: https://sibdatabase.socialfinance.org.uk/ (accessed on 30 April 2020).

- Oroxom, R.; Glassman, A.; McDonald, L. Structuring and Funding Development Impact Bonds for Health: Nine Lessons from Cameroon and beyond; Center for Global Development: Washington, DC, USA, 2018; Available online: https://www.cgdev.org/sites/default/files/structuring-funding-development-impact-bonds-for-health-nine-lessons.pdf (accessed on 30 April 2020).

- Orum, A.M. Case Study: Logic. In International Encyclopedia of the Social and Behavioral Sciences; Smelser, N., Baltes, P.B., Eds.; Elsevier: Amsterdam, The Netherlands, 2001; pp. 1509–1513. [Google Scholar]

- Yin, R.K. Case Study Research: Design and Methods (Applied Social Research Methods); Sage Publications: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- Bryman, A. Social Research Methods, 4th ed.; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Eisenhardt, K.M. Building theories from case study research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- GO Lab Projects Database. Available online: https://golab.bsg.ox.ac.uk/knowledge-bank/project-database/ (accessed on 30 April 2020).

- Patton, M.Q. Qualitative Research and Evaluation Methods; Sage: Thousand Oaks, CA, USA, 2002. [Google Scholar]

- Flyvbjerg, B. Five Misunderstanding About Case-Study Research. Qual. Inq. 2006, 12, 219–245. [Google Scholar] [CrossRef]

- Mason, P.; Lloyd, R.; Nash, F. Qualitative Evaluation of the London Homelessness Social Impact Bond (SIB): Final Report. Department of Communities and Local Government. 2017. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/658921/Qualitative_Evaluation_of_the_London_Homelessness_SIB.pdf (accessed on 10 February 2020).

- Triodos Bank. Social Impact Bonds. 2017. Available online: https://www.triodos.co.uk/articles/2018/social-impact-bonds (accessed on 18 February 2020).

- Mason, P.; Lloyd, R.; Nash, F. A Navigator Model for Addressing Rough Sleeping: Learning from the Qualitative Evaluation of the London Homelessness Social Impact Bond. Department of Communities and Local Government. 2017. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/658939/Commissioning_Social_Impact_Bonds.pdf (accessed on 20 February 2020).

- Thomas, A.; Griffiths, R.; Pemberton, A. Innovation Fund Pilots Qualitative Evaluation: Early Implementation Findings. Department for Work and Pensions. 2014. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/329168/if-pilots-qual-eval-report-880.pdf (accessed on 20 February 2020).

- Bridges Fund Management. Bridges Ventures and Impetus Trust Support Teens and Toddlers Successful Bid for DWP Innovation Fund. Available online: https://www.bridgesfundmanagement.com/bridges-ventures-and-impetus-trust-support-teens-and-toddlers-successful-bid-for-dwp-innovation-fund/ (accessed on 9 April 2020).

- Power2. We Are the First in the World to Meet the Outcome Target of a Social Impact Bond. Available online: https://www.power2.org/we-are-the-first-in-the-world-to-meet-the-outcome-target-of-a-social-impact-bond (accessed on 9 April 2020).

- Go Lab. Case Studies: Educate Girls. 2019. Available online: https://golab.bsg.ox.ac.uk/knowledge-bank/case-studies/educate-girls/ (accessed on 13 April 2020).

- Instiglio. Educate Girls Development Impact Bond: Improving Education for 18,000 Children in Rajasthan. 2015. Available online: http://instiglio.org/educategirlsdib/wp-content/uploads/2016/03/EG-DIB-Design-1.pdf (accessed on 13 April 2020).

- IDinsight. Educate Girls Development Impact Bond: Final Evaluation Report. 2018. Available online: https://static1.squarespace.com/static/5b7cc54eec4eb7d25f7af2be/t/5dce708f3c7fd22c0bb30f1a/1573810490043/EG_Final_reduced.pdf (accessed on 13 April 2020).

- Long, G.; Clough, E.; Rietig, K. A Study of Partnerships and Initiatives Registered on the UN SDG Partnerships Platform. 2019. Available online: https://sustainabledevelopment.un.org/content/documents/21909Deliverable_SDG_Partnerships_platform_Report.pdf (accessed on 14 April 2020).

- Go Lab. Case Studies: Asháninka—Peru Development Impact Bond. 2019. Available online: https://golab.bsg.ox.ac.uk/knowledge-bank/case-studies/ash%C3%A1ninka-dib/ (accessed on 14 April 2020).

- Gustafsson-Wright, E.; Boggild-Jones, I.; Segell, D.; Durland, J. Impact Bonds in Developing Countries: Early Learning from the Field. Global Economy and Development at Brookings. 2017. Available online: https://www.brookings.edu/wp-content/uploads/2017/09/impact-bonds-in-developing-countries_web.pdf (accessed on 2 April 2020).

- KIT. Autonomous and Sustainable Cocoa and Coffee Production by Indigenous Asháninka People of Peru. 2015. Available online: http://www.common-fund.org/wp-content/uploads/2017/05/Verification_Report.pdf (accessed on 14 April 2020).

- Schmidt-Traub, G.; Sachs, J.D. Financing Sustainable Development: Implementing the SDGs through Effective Investment Strategies and Partnerships. 2015. Available online: https://pdfs.semanticscholar.org/13c6/00f92da7e447cf34d6125d323da743f08b98.pdf (accessed on 14 April 2020).

- Social Finance. The Energise and Teens Toddlers Programmes 2012–2015. 2016. Available online: https://www.socialfinance.org.uk/sites/default/files/publications/tt-and-adviza_report_final.pdf (accessed on 9 April 2020).

- Bridges Fund Management. Teens and Toddlers Innovation: Partnering Vulnerable Young People with a Toddler to Mentor, Creating Transformational Change in the Young Person’s Life. Available online: https://www.bridgesfundmanagement.com/portfolio/teens-toddlers-innovation/ (accessed on 14 April 2020).

- Salazar, V.A.; Katigbak, J.J.P. Financing the Sustainable Development Goals through Private Sector Partnership. 2016. Available online: https://think-asia.org/bitstream/handle/11540/6722/FSI-CIRSS%202016-07.pdf?sequence=1 (accessed on 15 April 2020).

- Social Impact Bonds: The Early Years. Available online: https://socialfinance.org/wp-content/uploads/2016/07/SIBs-Early-Years_Social-Finance_2016_Final.pdf (accessed on 29 April 2020).

- Mawdsley, E. From billions to trillions’ Financing the SDGs in a world ‘beyond aid. Dialogues Hum. Geogr. 2018, 8, 191–195. [Google Scholar] [CrossRef]

- Olsen, S.H.; Zusman, E.; Miyazawa, I.; Cadman, T.; Yoshida, T.; Bengtsson, M. Implementing the Sustainable Development Goals (SDGs): An Assessment of the Means of Implementation (MOI); Institute for Global Environmental Strategies: Kanagawa, Japan, 2014. [Google Scholar]

- UNDP. Partnerships: Finance and Private Sector Engagement for the SDGs. Available online: https://www.undp.org/content/undp/en/home/2030-agenda-for-sustainable-development/partnerships/sdg-finance--private-sector.html (accessed on 18 April 2020).

- Steiner, A. Innovative Partnerships for SDG Financing. UNDP. Available online: https://www.undp.org/content/undp/en/home/news-centre/speeches/2018/innovative-partnerships-for-sdg-financing.html (accessed on 16 March 2020).

- Pineiro, A.; Dirheixh, H.; Dhar, A. Financing the Sustainable Development Goals: Impact Investing in Action. GIIN. 2018. Available online: https://thegiin.org/assets/Financing%20the%20SDGs_Impact%20Investing%20in%20Action_Final%20Webfile.pdf (accessed on 18 April 2020).

- Bull, B.; Miklian, J. Towards global business engagement with development goals? Multilateral institutions and the SDGs in a changing global capitalism. Bus. Politics 2019, 21, 445–463. [Google Scholar] [CrossRef]

- Gundogdu, A.S. Determinants of Success in Islamic Public-Private Partnership Projects (PPPs) in the Context of SDGs. Turk. J. Islamic Econ. 2019, 6, 25–43. [Google Scholar] [CrossRef]

- Rashed, A.H.; Shah, A. The role of private sector in the implementation of sustainable development goals. Env. Dev. Sustain. 2020, 1–18. [Google Scholar] [CrossRef]

- Jung, J.; Jeong, J.; Lee, J.; Yoo, A. Mobilizing Finance for SDGs: Issues and Policy Implication. [KIEP] World Econ. Brief 2019, 19, 1–5. [Google Scholar]

- MacDonald, A.; Clarke, A.; Huang, L.; Roseland, M.; Seitanidi, M.M. Multi-stakeholder partnerships (SDG# 17) as a means of achieving sustainable communities and cities (SDG# 11). In Handbook of Sustainability Science and Research; Springer: Cham, Switzerland, 2018; pp. 193–209. [Google Scholar]

- Florini, A.; Pauli, M. Collaborative governance for the sustainable development goals. Asia Pac. Policy Stud. 2018, 5, 583–598. [Google Scholar] [CrossRef]

- Pattberg, P.; Widerberg, O. Transnational multistakeholder partnerships for sustainable development: Conditions for success. Ambio 2016, 45, 42–51. [Google Scholar] [CrossRef] [PubMed]

- Rosenstock, T.S.; Lubberink, R.; Gondwe, S.; Manyise, T.; Dentoni, D. Inclusive and adaptive business models for climate-smart value creation. Curr. Opin. Env. Sustain. 2020, 42, 76–81. [Google Scholar] [CrossRef]

- Berrone, P.; Ricart, J.E.; Duch, A.I.; Bernardo, V.; Salvador, J.; Piedra Peña, J.; Rodríguez Planas, M. EASIER: An Evaluation Model for Public–Private Partnerships Contributing to the Sustainable Development Goals. Sustainability 2019, 11, 2339. [Google Scholar] [CrossRef]

- Andonova, L.B. The power of the public purse: Financing of global health partnerships and agenda setting for sustainability. Chin. J. Popul. Resour. Env. 2018, 16, 186–196. [Google Scholar] [CrossRef]

- Kumar, S.; Kumar, N.; Vivekadhish, S. Millennium development goals (MDGS) to sustainable development goals (SDGS): Addressing unfinished agenda and strengthening sustainable development and partnership. Indian J. Community Med. Off. Publ. Indian Assoc. Prev. Soc. Med. 2016, 41, 1. [Google Scholar] [CrossRef] [PubMed]

- Stibbe, D.T.; Reid, S.; Gilbert, J. Maximising the Impact of Partnerships for the SDGs; The Partnering Initiative and UN DESA: New York, NY, USA, 2018. [Google Scholar]

- Humphreys, D.; Singer, B.; McGinley, K.; Smith, R.; Budds, J.; Gabay, M.; Satyal, P. SDG 17: Partnerships for the Goals-Focus on Forest Finance and Partnerships; Cambridge University Press: Cambridge, UK, 2019. [Google Scholar]

- United Nations Global Compact. Scaling Finance for the Sustainable Development Goals. Available online: https://sdghub.com/project/scaling-finance-for-the-sustainable-development-goals-foreign-direct-investment-financial-intermediation-and-public-private-partnerships/ (accessed on 16 March 2020).

- United Nations Global Compact and UNEP Finance Initiative. SDG BONDS: Leveraging Capital Markets for the SDGs. Available online: https://sdghub.com/project/sdg-bonds-leveraging-capital-markets-for-the-sdgs/ (accessed on 17 March 2020).

- Hamel, J.; Dufour, S.; Fortin, D. Case Study Methods; SAGE Publications: New York, NY, USA, 1993; Volume 32. [Google Scholar]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).