Abstract

Acquisition processes are aimed at achieving value based on synergistic effects. One of the most important obstacles in achieving value is the manner of conducting post-transaction integration—a risk area often ignored. This study assumes that a factor that may be important for the course of integration after the acquisition of enterprises may be the fact of personal connections through interlocking directorates between transaction partners of acquisitions. The research was carried out in two stages. The first was to identify the scope of connections by interlocking between WSE-listed companies participating in acquisition transactions. This stage was implemented using the social network analysis method (SNA) and covered 188 companies. In the second stage, research was conducted using semi-structured interview techniques with the CEOs of the acquiring companies. The aim of the study was to identify the relationship between personal relations and the course of post-transaction integration. The analysis focused primarily on two factors: the dynamics of integration activities and their centralization. The research covered 38 companies that were included in the sample in the first stage of the research (including 19 personally related companies and, for comparison, in 19 unrelated companies). Studies have shown that the fact of connecting through interlocking affects the post-transaction integration model in the analyzed group. The dynamically centralized model dominates in enterprises related by particular persons. Many integration activities are carried out in the first 100 days. The factor affecting the implemented integration model is the durability of connections between participants before and after the transaction is conducted and the position in the network of connections determined by such sociometric measures as the centrality of proximity and own vector. Enterprises connected with long-term relationships usually demonstrate high dynamics of integration activities, which are conducted by joint teams whose group employees represent each of the merging enterprises. In addition, the CEOs surveyed from this group of companies declare having an integration plan with different levels of detail in each case.

1. Introduction

The goal of the acquisition processes of enterprises is to achieve value thanks to synergy effects as its source. In economics, the concept of synergy appears in connection with the improvement of work and production processes [1] and it is assumed to be a consequence of combining resources. The need to search for synergistic effects implies recommendations for shaping the acquisition process in such a manner so that it entails increasing the value of the company. The analyses performed so far regarding the impact of mergers on the value of enterprises and that have participated in transactions indicate that the shareholders of target companies always benefit from acquisitions, while the profit of the shareholders of the acquiring companies is small or such companies even incur losses due to the aforementioned transactions [2,3]. The researchers, who, among other authors, noticed the loss of value of the acquiring companies in the several years after the transaction were Mitchell and Stafford [4], Rosen [5], Czerwonka [6]. As a result of the acquisition, the acquiring enterprise obtains two value chains—its own and the one of the acquired company. Therefore, there is a need to decide on their modification or integration. Effective post-transaction integration is the most ignored risk area and, at the same time, one of the most important obstacles to the full value of the transaction. The most common causes of failure include a slow pace of integration [7], no integration plans or other integration problems [8]. Decisions regarding the course of integration activities are usually taken in the post-transaction stage. It is particularly important to determine which processes are the source of value and to what extent and dynamics they should be integrated. In this study, it is assumed that a factor that may be relevant to the acquisition process is possibly the fact of personal relationships through interlocking directorate between the companies involved in transactions. Continuous interaction and long-term relationships between management boards which require a strategic and tactical-operational approach contribute to achieving better financial and non-financial results for the company and affect their long-term value. This approach fits perfectly in the sustainable business model [9]. The concept of networking between enterprises through interlocking directorates is of interest to many modern researchers. It is an indicator of the functioning of enterprises in a network of social relations that enable related organizations to implement a certain shared strategic idea which increases their overall effectiveness. Networking mechanisms are explained as part of transaction cost theory [10] and also within resource theory [11] agency theory [12], stakeholder theory [13], network theory [14], as well as game theory [15]. This problem is also analyzed as part of embeddedness theory [16], in which it is emphasized that the behavior of economic entities always occurs in a specific social context. Quick access to relevant information on the strategy of other enterprises, planned investments or data illustrating the real economic situation is of particular value for companies who base their strategy on exogenous development implemented through acquisitions of other companies. The problem of connections through interlocking and its impact on the course of integration is rarely addressed both from the theoretical and cognitive viewpoint as well as from the empirical side or the field of its implications. In the studies of the problem of acquisition of enterprises, the emphasis is placed primarily on strategic or financial issues. There are no analyses of the relationships between enterprises participating in acquisitions at the time of concluding the transaction and the course of the post-transnational integration process. A failure to recognize the issue of the impact of personal relationships between the management boards of merging enterprises on the implemented post-transaction model of integration thus constitutes a visible research gap and has become the motivation for addressing this matter. This article attempts to fill this gap and its purpose is to present the results of the analysis of the relationship between the linking of enterprises participating in acquisitions through interlocking directorates and the post-transaction integration model. These studies are of an exploratory nature and concern companies operating in Poland, which is an additionally new research context. The vast majority of previous work on interlocking directorates in acquisition processes concerns companies operating in developed western markets. For the purpose of this study, a two-stage methodology was adopted. The first involved identifying relationships between enterprises listed on the Warsaw Stock Exchange (WSE). The study covered 188 listed companies that participated in acquisitions between 2012 and 2014 implemented on the Polish capital market. The research applied the social network analysis (SNA) method. In the second stage, the research was carried out using the semi-structured interviews with Polish CEOs from acquiring companies—the purpose of which was to identify the model of post-transaction integration which was used in both related and unrelated enterprises. The integration model was developed as a result of a desk-research type of examination. The model focuses on two selected parameters significant from the point of view of the integration process in the context of achieving the assumed transaction objectives i.e., the dynamics and centralization of integration activities. In the studies on the subject, these parameters are indicated as key success factors in acquisition transactions [17,18,19]. The research system designed in such a way is the first empirical and cognitive analysis of the acquisition processes which take place between companies listed on the Polish capital market. In order to determine the course of post-transaction integration, an original model—used in the conducted empirical studies— was built. At the stage of research conceptualization, attention was also paid to determinants that may affect the implemented model. In the examined group of 188 listed companies, a transaction took place between enterprises connected through interlocking directorate (which accounts for 17%) in the case of 32 acquisitions. In the group of personally related enterprises, it was possible to conduct research in the second stage in 19 enterprises that participated in the acquisition transaction between the years 2012 and 2014. To compare the relationship between the connection and the integration process, a study was also conducted on a group of 19 companies included in the sample of WSE-listed companies participating in transactions not related through interlocking directorates. A time perspective of three years was adopted from the date of the acquisition transaction for the assessment of integration activities, hence the second stage of the study was conducted between 2015 and 2017. The research was carried out to find answers to the following questions: What is the scope of interlocking directorates in WSE-listed companies participating in acquisitions? How does the relationship through interlocking directorates between transaction partners affect the implemented model of post-acquisition integration? How does the stability of the relationship through interlocking directorates affect the implemented model of post-transaction integration? How does interlocking directorates affect the assessment of a completed transaction?

This article contributes to the literature on strategic management from a relational perspective by identifying the correlation between the personal relationships of management board members of companies involved in takeover transactions and the implemented post-transaction integration model. The course of post-transaction integration is a key factor in achieving synergy and creating value. It extends the current state of knowledge by describing the importance of interlocking in the processes of acquisition of enterprises. However, the scope of reasoning is limited due to the small research sample.

2. Literature Review

2.1. Interlocking Directorates in Acquisition Processes

Interlocking directorates is a situation where the same person or a group of persons appearing on the board of one company sits on the board of directors or the supervisory board of another company [20]. In recent years, interlocking directorates has become a widespread phenomenon across the world. Research shows that around 72.13% of companies listed on the Shanghai Stock Exchange and the Shenzhen Stock Exchange have at least one joint member of the board of directors [21]. In Poland, the scope of interconnection through interlocking is definitely smaller. Research conducted by Zdziarski [22] among companies listed on the Warsaw Stock Exchange showed that 42% of the surveyed population do not have a single relationship established by any member of their management board or supervisory board. One of the basic functions of interlocking is to reduce uncertainty and mitigate the risk of business activities thanks to accessing information by connecting with the boards of other companies [23,24]. Serving on the supervisory board or management board of another company is treated as a way of dealing with uncertainty in the environment [25], as an element of risk mitigation providing access to the relevant strategic information [26] but also facilitating obtaining the necessary funds [27]. Studies show that the relations with the management board affect the financial arrangements between the parties in the acquisition processes [28,29].

The subject of analysis under this article is inter-organizational interlocking, which primarily allows access and an exchange of information enabling each party to formulate and effectively apply an appropriate competition strategy [30]. Corporate social relationships (i.e., the relations of management board members presented by related managements) influence business decision making and the value of the company, including decisions on acquisitions. Interlocking directorates in acquisition processes is treated primarily as a risk-mitigating factor. This approach is in line with the views developed within the theory of resource dependence, which assumes that management boards and supervisory boards control the external environment and perform a kind of scanning of the strategy of other companies by persons serving on the management boards or supervisory boards of other companies [31]. Cukurova [32] conducted a study among American listed companies and found that, compared to other companies, companies linked through interlocking with the acquiring company demonstrate a higher probability of being acquired. The study of the impact of the relational network on the acquisition decisions made was the subject of Wu’s analysis [33], which proves the hypothesis that relation-based connections create communication channels and, as a consequence, enable the acquisition of a company on more favorable terms. Other studies show that they allow hostile takeovers to be made [34]. The companies that were located in the center of the inter-organizational network more often acted as the acquiring company [35]. Cai and Sevilir [16] note that purchasers operating in a network of connections incur significantly lower costs associated with investment consulting. In addition, they stated that relations with management play an important positive role in creating value for mergers and acquisitions.

2.2. Determinants of Post-Transaction Integration

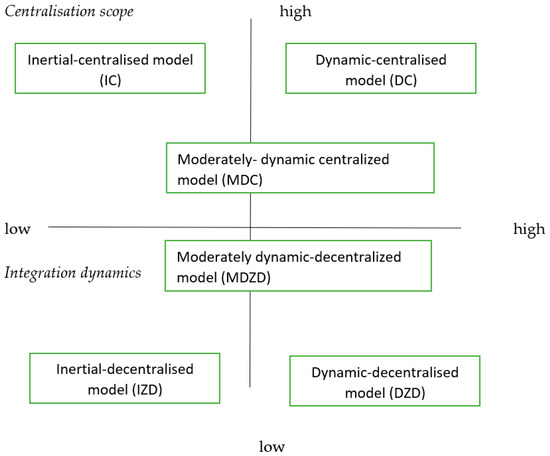

Schnlau and Singh [36] draw attention to the relationship between personal connections between transaction partners and the course and dynamics of the post-transaction integration process. The post-merger integration is a process that develops after closing a transaction to reconfigure merging companies by reimplementing, adding, or disposing of resources, product lines, or entire companies to achieve the expected benefits of merging [37]. Integration is one of the most risky and expensive stages of the entire acquisition transaction. Its course is a critical factor in the success of post-acquisition processes [38]. A common mistake at the stage of making a decision about entering into a transaction is valuing the acquired resources without taking into account the real costs of their integration. Pablo [39] asserts that integration is associated with the introduction of changes in all areas of functional activity, organizational structures, as well as systems and cultures of merging organizations in order to facilitate their consolidation into one functioning entity. It is a “continuous, interactive process in which people with the two merging organizations are learning to work together and cooperate in the transfer of strategic capabilities” [40]. It is assumed that the success of integration is determined by two key factors: the time in the field of speed of action to obtain benefits and the added value resulting from the acquisition and prudence that underlies taking rational, planned actions implemented without undue haste also taking into account the interests of the transaction partner [17]. For the purposes of this study, it was assumed—based on the research of Cording, Christman, King [18]—that the integration pace is defined as the time from closing the transaction to the completion of the integration process. The issues of integration dynamics have been the subject of studies of, among others, Chase [41]; Schlaepfer et al. [42]; Bauer, Degischer, and Matzler [43]. However, the research conducted so far has not brought a clear position on the optimal pace of integration. Angwin [44]; Homburg and Bucerius [45]; Cording, Christman, and King [18] point out that the impact of high dynamics of integration on the success of the transaction is positive. Bijlsm-Frankema [8] and Olie [46] studies demonstrated the negative influence and studies by Bauer and Matzler [47] indicate that this parameter has no significant impact. The optimal pace of integration depends on the similarity of internal and external conditions in which the companies participating in the transactions operate. If companies were characterized by a significant level of similarity in the area of such internal factors (e.g., management style, strategic orientation, performance) but the similarity of external connections was low (e.g., sales markets and serviced customers), then the high pace had a positive impact on the success of integration. If the similarity in the area of internal factors was low, then the high pace of integration had negative effects [48]. The pace should be primarily determined by the nature of the transaction. If the essence of the discussed process is the transfer of material resources, then quick action is beneficial. If the transfer is to be carried out at the level of people’s know-how, then it is slow integration that gives time for learning. The acquiring company’s experience in conducting acquisition processes, the good or bad condition of the acquired company, as well as the financial and human resources at the disposal of the transaction partners are also important. A significant factor influencing the course of integration is the level of centralization of the discussed process. The key task from the point of view of effective integration is the appointment of an integration manager for a limited period of time. Typically, such a manager sets up a team that should consist of representatives of both combined units and has project management experience [49] in the field of acquisition and operational skills. In a situation where such employees cannot be found in the organization, it should be decided to employ external specialists. The establishment of one joint integration team results in the centralization of the integration process. The integration team should not be too large as it hinders, among others, effective work during meetings and slows down the decision-making process. On the other hand, however, its composition should be constant. Team members should have knowledge regarding the motives of the transaction and their relationship with the company’s strategy, key success factors and potential threats, their place in the team, and importance in the process of achieving goals, the role of other team members and possible bonuses for completed tasks [48]. In the present study, many factors that may have an impact on the course of post-acquisition integration have highlighted two parameters that constitute the author’s model: i.e., the dynamics of integration activities and their level of centralization. Taking into account the fact that the dynamics of operations can be high, moderate, or low and the level of centralization may be high or low, six different models can be distinguished. They are presented in Figure 1.

Figure 1.

Post-trade integration models verified in the surveyed enterprises.

The inertial-centralized (IC) model assumes the conduct of integration activities stretched in the long term. After three years of functioning in the post-merger structure, the scope of integration is small. For the purpose of conducting slow integration activities, a common team consisting of employees joining the organization is established. In the inertial-decentralized (IZD) model, integration activities are implemented with low dynamics in each of the merged enterprises separately. At the other extreme are dynamic models. These assume a high scope of integration activities, which had already been introduced in the first 100 days and subsequently throughout the year. These activities can be described in the form of a centralized dynamic model (DC) which describes the high pace of integration activities implemented by one joint team grouping representatives of each of the transaction partners or a decentralized one (DZD) which assumes great freedom for integration activities conducted separately within each of the entities of the acquisition. The dynamics of integration activities can also be moderate but are conducted by the integration team (DDC model) or separately in each of the enterprises participating in the transaction (MDZD model). In models assuming moderate dynamics of activities, integration activities are usually spread over a period of three years.

3. Methodology

3.1. Sample

In the first stage, the subject of examination was the relationship through director interlocking between companies listed on the stock exchange that took part in the acquisitions carried out between 2012 and 2014. The research was conducted using the Euromoney Institutional Investor Company (EMIS) DealWatch database, out of which transactions that meet the adopted criteria were selected. Data on members of management boards and supervisory boards was obtained from the INOFERITI database. The research was conducted using the method of SNA (social network analysis) and covered 188 companies. The examined group included 43 companies participating in the acquisition transaction in 2012, 84 companies that participated in acquisitions in 2013, and 61 companies in 2014. Enterprises surveyed in the first stage were contacted during the second stage—implemented three years after the transaction was carried out—based on the adopted methodology adopted. It was assumed that such a time perspective is necessary to evaluate the integration process. The research was, therefore, retrospective. The discussed stage of the study was conducted between 2015 and 2017. It was assumed that in the study group all enterprises associated personally through interlocking and, for comparison in the same number, unrelated enterprises will be included. The difficulties that arose during the implementation of the second stage research meant that the final analysis of stock exchange transactions made for the purposes of this study concerns 38 acquisitions. In this group, half (i.e., 19 companies) were related through interlocking directorates. Initially, it was assumed that the research would be treated as a whole and would cover all companies analyzed in the first stage of the research. However, as attempts to contact potential respondents were usually unsuccessful, it was decided to verify this assumption. Ultimately, the selection for the sample was purposeful, taking into account the criterion of availability of respondents. The research was carried out using a semi-structured interview technique. The adopted methodology, therefore, assumed triangulation of methods (the multiple, heterogeneous approach including the SNA quantitative method as well as the qualitative method). The characteristics of the surveyed enterprises are presented in Table 1.

Table 1.

Characteristics of enterprises of participants of the acquisition transaction examined in the second stage.

According to the Polish Classification of Activities (PKD), the surveyed enterprises belonged to two branches: industrial manufacturing (35) and construction (4). All transactions analyzed were industry-related and were an example of horizontal concentration.

To identify the organizational model of post-acquisition integration, semi-structured interviews with the CEOs of the acquiring companies were carried out (presidents, vice presidents, general directors, managing directors). The job profile of the respondents is presented in Table 2.

Table 2.

Job profile of respondents.

The surveyed group of respondents representing personally related enterprises included two presidents and one vice president of the management board, ten managing directors and six general directors. The sample of unrelated enterprises examined included one president and one vice president of the management board, nine managing directors, and eight general directors.

3.2. Method of Research

The process of researching acquisitions was complex and prolonged. It was conducted in two stages using the triangulation of research methods. In the first stage of the research, the method applied was SNA (Social Network Analysis). SNA is a set of research methods belonging to the category of quantitative methods, which—in a uniform and comprehensive manner—deals with many issues of varying degrees of complexity in the network [49]. SNA is distinguished from conventional social research tools by the fact that the focus of this method is the so-called relational data, not attributes [50]. This tool allows both internal and external inter-organizational relationships to be analyzed, including capital connections or personal connections of enterprises through interlocking directorate. The method also allows knowledge that facilitates the identification of organizations that create the greatest value to be obtained as well as comparing the potential of this type of relationships between major competitors [51]. As a result, an easier task is to identify companies—potential acquisition targets and partners to form business associations. SNA allows inter-organizational relationships as well as personal relationships between companies that are created to be measured, for example by managerial interlocking, i.e., sitting on the management boards or supervisory boards of other companies. Research on the impact of the relational network on the acquisition decisions made was the subject of Yang’s analysis [32]. Studies show that relational connections create a communication channel and, as a consequence, enable a company to be taken over on more favorable terms or enable hostile takeovers [35]. Knowledge brought about by the use of SNA also brings the answer to the question, ‘at which level of the organizational structure should post-transactional integration be conducted?’, and allows the types of networks that are the easiest to undergo the integration process to be determined. It also allows key people for work coordination and the flow of information and knowledge as well as the opportunity to properly use their potential when merging organizations after the transaction to be identified. This is important, among others, from the point of view of identifying people who could be entrusted with the role of integration manager. As a result of the SNA study, it is possible to identify relationships that increase work efficiency—the activation of which may support both the transition process and permanently increase the company’s resources after the merger. The second stage of the study was carried out based on the qualitative method. The second stage of the research was carried out based on the qualitative method using semi-structured interviews. The implementation of this stage was preceded by the assumption that a specific time perspective is necessary for the assessment of the integration process. As a result of the literature research, it was concluded that the optimal time horizon was 36 months after the transaction was closed. Although quantitative analyses predominate among methods of testing acquisition processes in various areas, there is a clearly outlined group of supporters of qualitative analyses among researchers. Miles and Huberman [52] ought to be mentioned here as an example of researchers who suggested that, in the case of examination of acquisitions, there is a need for deep understanding and contextualization; therefore, qualitative research methods are optimal. A similar position is represented by Larson and Lubatkin [53], who stress that qualitative research is especially dedicated to testing acquisitions and integration due to the need for detailed descriptions of sensitive contextual data. In the second stage of the study, a semi-structured interview technique was applied, which was conducted with managerial staff from the CEO level. This form of interview makes it possible to understand the complex combination of the factors that accompany integration processes and to capture their multidimensionality. The analyzed post-trade integration processes are approached in retrospective categories which are primarily based on the questions of “how” and “why” [54]. The choice of such a research technique resulted from the exploratory character of the examination—the subject of which is a problem that has not been clearly defined so far. The advantage of semi-structured interviews is the possibility of using open-ended questions to obtain more information and a deeper ‘insight’ into the problem. Providing respondents with the possibility of free answers allows the views of respondents to be identified without forcing them into the researcher’s train of thought. The disadvantage of semi-structured interviews is primarily the subjectivity of respondents in the perception of the described phenomenon [54]. This technique provided information on the course of post-transactional integration, its scope, dynamics, and the level of centralization of activities. The collection of this information was based on open-ended questions. The interview also included closed questions, presented in the form of a five-point Likert scale. This concerned the personal assessment, by the staff of the CEO of acquiring companies, of the effectiveness of integration activities and the importance of selected factors affecting the course of integration such as the integration plan, dynamics of activities and the level of centralization for achieving the original goals determined by the acquisition transaction. Collecting the opinions of staff from the CEO level is one way to evaluate the effectiveness of acquisitions in merger and acquisition processes [19]. Interviews were conducted in the offices of companies and were preceded by a letter of invitation to the study. Additionally, contact by phone was made to determine the details of the meeting. Due to the very low interest from potential respondents, personal contacts were also used to reach respondents. The choice of a semi-structured interview as a research technique was conditioned by the advantage of this form of interview, i.e., the ability to deepen one’s knowledge about the issue studied. It gives the researcher quite a lot of freedom in distributing accents during the interview. The respondents had a deep knowledge of the subject of the study. Interviews were conducted with 38 top-level managers. In this group, 22 people represented enterprises with Polish private capital, 14 respondents the State Treasury Company. Only two CEOs represented international corporations. Given that the research sample was small, the key issue remains the number of interviews enabling knowledge saturation and meeting the requirement of methodological rigor. The source literature on the subject lacks clarity regarding the number of interviews that must be carried out to meet these requirements. Some authors indicate 15 respondents [54], while others mention the number of 12 interviews with a homogeneous group in order to achieve knowledge saturation [55]. It should be emphasized that the examination of processes that are carried out in the post-transaction phase is complicated in the field of methodology. It is difficult to separate actions and their effects, being only the effect of post-transaction integration, and to separate them from actions resulting from other conditions. Acquisition processes are extremely complex and multi-layered and are, therefore, accompanied by methodological dilemmas.

4. Methods of Data Analysis

Quantitative and qualitative research was used to meet the assumed goal. Quantitative research based on SNA allowed the scope of connections through interlocking directorates, relationship durability and network position—determined by such sociometric measures as a measure of closeness centrality and a measure of eigenvector centrality—to be determined. The first measure indicates the position of the node in the network and indicates the possibility of information inflow transmitted on short paths, which is important from the point of view of information transfer time. The second of the analyzed sociometric measures determines the ability to transmit information by connecting to nodes with a large number of relationships. In business networks, an enterprise with a high intrinsic value of eigenvector has relationships with nodes (other entities) that perform an important function in the network (e.g., have key resources, are a source of innovation, or have a large market share). The analyzed measures in each case account to values in the range <0–1>. In the case of the measure of centrality of closeness of relations, values close to zero mean a low position of the closeness of the node in the network. The value ‘1’ means that a given node is in the closest distance from all nodes in the network. In the first stage, the respondents were looking for answers to:

- • Research Question 1: What is the scope of interlocking directorates in the acquisition processes of companies listed on the stock exchange? In the second stage of the study, the model of own authorship was built, dedicated to identifying the process of post-transaction integration in the time perspective of three years after the acquisition was conducted.

The following further research questions were the focus of this stage of the study:

- Research Question 2: How does the relationship through interlocking directorates between transaction partners affect the implemented model of post-acquisition integration?

- Research Question 3: How does the stability of the relationship through interlocking directorates affect the implemented model of post-transaction integration?

- Research Question 4: How does interlocking directorates affect the assessment of a completed transaction?

5. Analysis of the Approach to Post-Transaction Integration and Its Determinants

5.1. Scope of Relationships through Interlocking Directorates

In the audited period from 2012–2014, 188 acquisitions of companies listed on the Warsaw Stock Exchange took place. In this group, 37 enterprises were related through interlocking directorates. The level of cross-linking was 19.7%. The essential sociometric measures subjected to analysis were closeness centrality of relations and eigenvector centrality. The measure of closeness centrality of relations reached an average value of 0.42 (the minimum value was 0.02 while the maximum value was 0.66). This means a moderate position of the node’s closeness in the network. A detailed analysis of the paths between pairs of enterprises in the network demonstrated a moderate level of centrality, which may mean access to information sent by other nodes in the network to a moderate extent. The second of the measures analyzed also achieved a low average value of 0.36 (minimum value 0.08, maximum 0.54), which indicates a moderate level of connections between the surveyed enterprises with companies holding central positions in the network. This situation can potentially result in moderate access to information resources on the network. They are presented in Table 3.

Table 3.

Selected sociometric measures describing the network of relationships between companies participating in acquisitions on the WSE in 2012–2014.

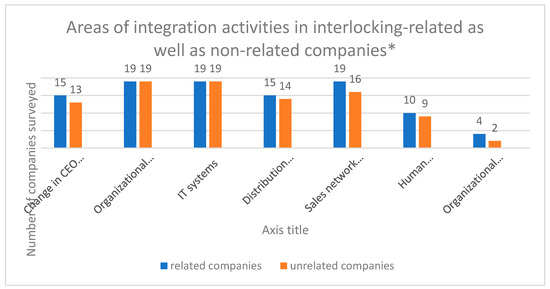

In a group of 19 companies connected through interlocking directorates, the second stage of the survey was carried out (and, for the purpose of comparison, also in 19 unrelated companies). In the research, it was important to identify the areas in which integration activities were carried out. Studies have shown that after 36 months from the date of the transaction, full integration usually only took place in the so-called ‘hard’ areas such as IT systems, budgeting, marketing, and sales. Integration was less common in the introduction of new products. In 12 cases, it was noted that before the formal conclusion of the transaction in the company being acquired, adjustment activities were carried out. This allowed significant acceleration of the integration after acquisitions in the area of budgeting and IT systems. They are presented in Figure 2.

Figure 2.

Areas subjected to post-acquisition integration in related and unrelated companies. They are presented in Figure 2. * = the results do not add up because the respondents had the opportunity to indicate several variants of the answer.

Conducting an overall assessment of the scope of integration after three years of functioning in the structure—after mergers—in companies related through interlocking directorates. In 10 cases, it was described as high, in 6 as moderate, and in 3 transactions indicated as low. In the case of unrelated enterprises, in the CEO’s assessment, a high scope was indicated in seven cases, moderate in eight, while a low scope of integration activities was indicated in four cases. Detailed lists of the assessment of the scope of integration activities in individual areas are presented in the Table 4.

Table 4.

Declared scope of integration in selected functional areas three years after the acquisition in enterprises in interlocking related and unrelated enterprises.

Studies have shown that the highest scope of integration occurred in the case of IT systems and accounting procedures. They are intended to secure core operations. In the 28 transactions analyzed, they were carried out within the first 100 days after the merger. A very important area—from the point of view of integration priorities—in almost every transaction examined is marketing and sales. This is justified by the respondents’ assumed integration motives. In acquisition transactions, it is important to conduct changes in this area at an early stage of the integration project to reduce the period of uncertainty for both external and internal clients. However, it should be emphasized that the sales area contains elements that may be beyond the purchaser’s control. This may include issues such as customer loyalty, market dynamics, and competitive responses [56]. It is important to analyze integration priorities in the area of marketing and sales in connection with the motives of an acquisition transaction. In 12 cases, the acquisition caused a problem of partial or total overlap of the product portfolio of the acquiring and acquired company. As a result, in each case a marketing plan, which assumed the integration of the portfolio of transaction partners’ offers, was prepared. In seven cases, the prepared marketing strategy assumed the creation of a completely new portfolio of offers. This was in line with the transaction motive, i.e., expansion into new markets and reaching a new group of customers. The integration in the area of marketing and sales in many companies results in the necessity of adopting a multi-brand strategy and enforces competence in managing the portfolio of offers of combined organizations. In 14 cases, no changes were planned to the product on offer. It should be emphasized that the decision on the brand strategy after the acquisition is conditioned by the company adopting the market strategy. When a market gap is identified and it is possible to fill it in, a new brand is often created together. However, in the case of developed markets, for a new company created after the merger, the existing brands that have their established position are usually left. The strategy of integrating the portfolio of offers after the merger should be prepared in the pre-transaction phase—especially if the acquiring company assumes expansion into new markets and reaching a new group of customers. In the analyzed transactions, full integration of brands took place in 14 cases (in 8 interlock-related and 6 unrelated companies). Integration in this area was associated with such transaction motives as the increase in goodwill after the merger (nine indications including five in related companies and three in unrelated companies), increasing the entry barrier (eight indications including four in related companies and four in unrelated companies) or increasing market share (10 responses, 6 in related companies and 4 in unrelated companies). The largest differences in integration between related and unrelated companies concerned ‘soft’ areas such as organizational culture and human resources management. In each case, in the study conducted among the CEOs it was emphasized that cultural integration is a very complex problem—an emotional one which raises the question of whether it should actually be conducted. G. Schweiger and J. Walsh [57] note that from the point of view of acquisition efficiency, the decisive problem describing integration issues in the cultural area is not how diverse the cultures of the merged enterprises are, but whether maintaining these differences in the long run will prove beneficial. The problem of cultural integration is particularly complex, among others, due to the fact that there may be several subcultures within one enterprise. This way of thinking about the multilevel of organizational subcultures is also found in the sociological concept of Cuche [58]. In the research on acquisitions in the area of cultural considerations, the paradigm based on the traditional approach assuming the ‘uniformity’ and ‘monolithism’ of corporate culture dominates, apart from the fact that organizations may consist of fragmented cultures [59]. In the cultural aspect, it is assumed that “the greater the cultural discrepancy between the organizations involved, the worse the performance of the terms of the contract” [60]. Meanwhile, in the literature on the subject, there is no clarity regarding the impact of cultural differences between transaction partners on acquisition efficiency. Whilst Datta [61], Chatterjee et al. [62], and Weber and Camerer [63] build the conclusion that this influence is negative, Krishnan et al. [64] demonstrated a positive relationship between the differences and the financial result of the acquisition. In the absence of a clear conclusion, it seems that the issue of ‘depth of integration’ must be treated with extreme caution. At this point one should stop at the methodology of conducting research on the relationship between the depth of integration in the cultural dimension and the effectiveness of this process. Usually, the subject of analyses is the inter-cultural differences between management teams. This shows the difficulties in capturing cultural differences in the acquisition processes. In this regard, Teerikangas and Vera [65] pose the question: “In the final analysis, the question arises - whether the research really touched upon the essence of organizational culture; what are the researchers actually measuring? How is organizational culture conceptualized: as differences in the management team’s culture?” Riad [66] criticizes existing research on culture in takeover processes and emphasizes the need to force what he describes as a “binary opposition” between the coherence of culture on the one hand and the pluralism of cultures on the other. Riad warns against tradition in the literature on acquisitions to categorize cultures into certain types or to focus on ‘differences’ between cultures. He asks whether cultures and their potential differences cannot simply be taken into account as such in times of mergers and acquisitions as they are in multicultural societies.

5.2. The Model of Post-Transaction Integration and Its Determinants

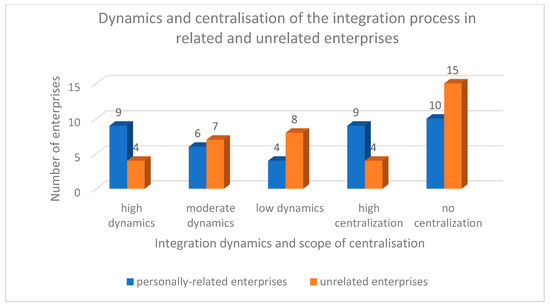

Identifying the dynamics of integration was a key issue from the point of view of the research goal. In the literature on the subject, there is no unequivocal view on the most favorable dynamics of the integration process. It is usually emphasized that pace is important from the point of view of behavioral psychology because rapid integration reduces uncertainty among employees. Quick integration also allows the initial enthusiasm associated with mergers to be used, which is usually short-lived. The high dynamics of integration is also important for the marketing and sales area because it helps reduce customer uncertainty. The advantage of slow integration is, above all, minimizing conflicts between partners and building trust between transaction partners. Low integration dynamics also allow potential disruptions in the processes carried out with each of the transaction partners to be limited. An overall assessment of the dynamics of integration indicated in 13 cases that it was high and in 13 cases that it was moderately dynamic. In 12 transactions, the integration dynamics after acquisition was assessed as low. Studies have shown that dynamics is conditioned by the fact of personal connections between transaction partners. In the case of enterprises related through interlocking directorates, in 9 cases out of 19, respondents declared high dynamics of integration activities (in the group of unrelated enterprises high integration dynamics was declared in four cases). The second parameter describing the research model was the centralization of integration activities. They are presented in Figure 3.

Figure 3.

Dynamics and scope of centralization of the post-acquisition integration process in enterprises related through interlocking directorates and in unrelated enterprises.

Analysis of the two parameters constituting the adopted working model of post-transaction integration, i.e., the dynamics and centralization of integration activities showed that the surveyed companies carried out integration activities in line with the following models:

- Dynamic-centralized (DC) is the dominant model in persons linked by direct interlocking (nine cases analyzed). In unrelated enterprises, the model stated occurred in four cases.

- Moderately dynamic-decentralized (MDDZ) occurred in six examined interlocking-related companies and seven unrelated companies.

- Inertial-decentralized (IDZ) describes integration activities implemented in four companies related through interlocking and in eight unrelated companies.

Research has shown that the dominant model of post-transaction integration in related enterprises is the dynamic-centralized (DC) model. It occurred in nine transactions. For comparison, the discussed model occurred in the case of four transactions in the surveyed unrelated enterprises. Integration activities were entrusted to an operational team, grouping representatives of each of the combined organizations. The study additionally showed that in 13 transactions out of 38 respondents, integration activities were decentralized and were carried out separately.

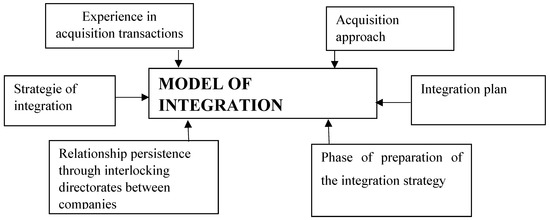

The research pointed to several factors that may affect the implemented integration model. They are presented in the Figure 4.

Figure 4.

Determinants of the post-transaction integration model included in the study.

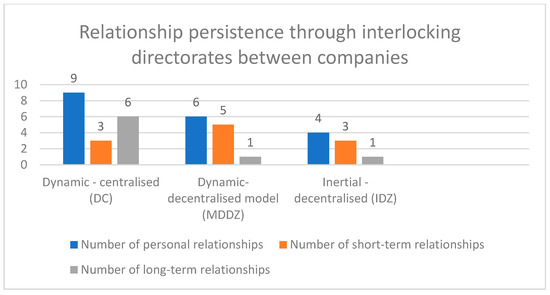

An important factor, from the point of view of the course of integration, is the stability of the relationship between transaction participants. Stahl, Kremershof and Larsson [67] note that inter-organizational relationships between partners build trust before concluding transactions and this element is treated as a critical success factor in post-acquisition integration processes. The analysis shows how long before and after the transaction the relationship between companies takes place through interlocking directorates. For the purposes of these studies, it was assumed that the short-term relationship lasts less than one year. Relationships over one year are long-term relationships. To determine the length of the relationship, both the duration of the relationship before and after the transaction was analyzed in the case of the tested connections, the average length of the relationship was 496 days. They are presented in Figure 5.

Figure 5.

Relationship persistence through interlocking directorates between companies, acquisition partners and the implemented model of post-transaction integration.

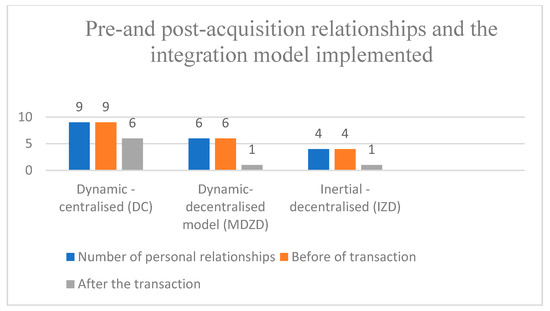

The research demonstrated that enterprises connected with long-term relationships usually demonstrate high dynamics of integration activities which are conducted by teams grouping employees representing each of the merging enterprises. In addition, the CEOs surveyed from this group of companies declare having an integration plan with different levels of detail in each case. An important parameter analyzed was also the period of occurrence of relationships. The study sought the answer to the question: how long before the conclusion of the acquisition transaction and after its completion did personal connections occur through interlocking directorates? In the analyzed transactions, if the durability of connections after the merger was low, then the decentralization of the integration process took place more often. They are presented in Figure 6.

Figure 6.

Pre-and post-acquisition relationships and the integration model implemented.

From the point of view of the efficiency of the post-acquisition stage, previous experience in conducting acquisition transactions may be relevant. Despite a significant number of studies on this subject, there is no clear evidence of a link between experience in acquisition and achievement of effects [68]. Studies have shown that this is an insignificant factor [69] with a negative impact [70] or a positive impact [71]. In the presented research, the experience in the area of acquisitions was declared in the case of 15 companies whose representatives emphasized that the acquisitions were part of the adopted and implemented development strategy of the enterprise. At the same time, 18 CEO respondents declared personal experience in acquisition transactions. Each of the respondents who declared previous experience in takeover processes emphasized that this is a factor that translates positively into the efficiency of the post-transaction integration process and the effectiveness of the takeover process. The summary of declared enterprise experience and the level of centralization and dynamics of integration activities are presented in Table 5.

Table 5.

Experience in acquisitions and implemented integration model in personally related and unrelated enterprises.

The marginalization of post-transaction integration issues is visible at the stage of preparing the plan on the basis of which integration will be carried out. In the examined group, the integration plan was prepared in one-third of transactions. Typically, the plan was prepared after the transaction (10 cases) and was characterized by a high level of generality (7 cases). The preparation of a detailed plan was declared in only one case and in four cases a detailed plan was prepared for selected functional areas that were directly related to the motives of conducting a takeover transaction. The identified trend is very worrying. It seems that integration planning already at the stage of due diligence is associated with a reduction in business risk that accompanies these transactions. The relationship between the integration process and having a plan is presented in Table 6.

Table 6.

The integration plan and its characteristics and the model of post-transaction integration.

Studies have shown that having an integration plan translates into higher dynamics and centralization of integration activities. The relationship between the implemented integration model and the circumstances in which the transaction was concluded remains interesting. The question was asked whether the acquisition was a tool for implementing the company’s development strategy or for seizing the opportunity. In 26 cases, it was declared that the transaction was included in the strategy. In five cases, that the opportunity was used, while in seven it was confirmed that the acquisition was included in the company’s growth strategy but the opportunity was taken and carried out at the right time. The relationship between the integration model used in related and unrelated companies and the circumstances of the transaction are presented in Table 7.

Table 7.

Model of post-transaction integration and circumstances of concluding acquisition transactions.

Including the acquisition into the company’s development strategy translates into the dynamics of the discussed process in the case of the examined transactions. In the static model, acquisition was often the result of using an emerging opportunity or included in the strategy, but using the opportunity. An opportunity-based approach that results in high-level dynamics on the level of due diligence and in the transaction phase raises the risk of a lack of preparation of internal processes that justifies, to some extent, the low dynamics of integration activities. Another element analyzed was the relationship between the fact of having an integration strategy and the moment when it was created and the implemented integration model. The obtained results are presented in Table 8.

Table 8.

Integration model applied and the phase of preparation of the integration strategy.

Possession of an integration strategy in the form of a document was declared in eight surveyed enterprises. They contained sub-strategies for selected functional areas in which the potential to achieve synergies was recognized. In 18 cases, attention was drawn to the fact that the strategy was functioning but was not prepared in the form of a document. It was emphasized that during the three years analyzed since the transaction, the integration strategy was subject to many modifications. For the remaining 12 transactions, no integration strategy was prepared and if there was a need for integration activities, they were implemented on an ongoing basis. In the case of implementing integration based on the DC model (dynamic-centralized), the strategy—in the form of a framework document—was prepared during the pre-transactional stage.

The last area subjected to analysis was the assessment of the effectiveness of the integration process and giving importance to individual elements describing its course by respondents. As observed by Zollo and Meier [72], about 14% of all articles devoted to the effectiveness of mergers and acquisitions were based on the subjective assessment of the managerial staff. There is also literature confirming the positive correlation of research results based on interviews with research results based on objective market and accounting data [73]. The use of CEO staff’s opinions for the purposes of assessing effectiveness is justified by the problem of obtaining objective, reliable, and current measures of selected aspects of the acquisition processes [19]. During the interview, participants were asked to assess the significance of selected elements describing the process of post-transaction integration, which in the literature are treated as key success factors. The assessment concerned parameters such as integration dynamics, its scope, level of centralization, integration plan, and the experience of companies in conducting transactions. The questions also concerned assessing the importance of interlocking for post-transaction integration. An overall assessment of satisfaction with the completed post-transaction integration model was attempted to be identified by asking the question, ‘how do you assess the level of achievement of the goals set for the analyzed transaction in a perspective of three years from the date of the transaction?’. For 12 evaluated transactions, it was declared that the goals were achieved, in 19 transactions not all of the assumed goals were achieved but the most important goals were achieved. In seven cases, no answer was given. It can therefore be assumed that in 12 transactions the assumed goals were achieved and this translated into a high level of satisfaction with the acquisition transactions. The level of satisfaction with the acquisition transaction carried out in personally related and unrelated companies is presented in Table 9.

Table 9.

Declared level of satisfaction with the implemented model of post-transaction integration in enterprises related through interlocking directorates and in unrelated enterprises.

A higher level of satisfaction with the achieved transaction goals was observed in personally related companies (seven responses). In unrelated companies, the level of satisfaction was usually defined as moderate. This concept hinted at a partial implementation of the assumed acquisition goals. The parameter that was important for assessing the satisfaction of the transaction was the position in the network of connections determined by the indicator of closeness centrality and the eigenvector. Seven companies that declared a high level of achievement of the objectives achieved an average closeness centrality indicator of 0.6 (with the average for the related companies surveyed 0.42). Also, the eigenvector index reached an average higher than the average for the whole group of related companies, which was 0.58 (the average for the group was 0.36). This may mean better access to information in this group of companies than for the other surveyed companies related through interlocking. The research assumed that several factors influence the course of post-transaction integration, which in the literature are indicated as key success factors in the acquisition processes. The surveyed CEOs were asked to assess the significance of several selected factors such as experience in acquisition processes, having an integration plan, dynamics of integration activities and their centralization, their approach to acquisition in terms of strategy or market opportunity. The obtained results are presented in Table 10.

Table 10.

Assessment of the importance of selected elements in the process of post-transaction integration in personally related and unrelated enterprises.

When assessing these factors, none of the CEOs surveyed indicated their low importance. The difference in the perception of significance in related and unrelated companies concerned such factors as the significance of experience in conducting acquisitions which, in unrelated companies, was defined as moderate. A similar assessment in this group of enterprises also concerned the importance of the dynamics of integration activities, having an integration plan or the approach to acquisition in terms of an instrument for implementing the growth strategy or taking advantage of the market opportunity.

6. Conclusions

In this article, attempts were made to determine—based on empirical data—the impact of personal connections between the management boards of companies involved in the acquisition and the post-transaction integration model, based on which the process of merging organizations was carried out in the listed companies under examination. All of the analyzed transactions were carried out on the Polish capital market, were industry acquisitions and constituted an example of horizontal concentration. The conducted research, the results of which have been presented as part of this study, has shown that the scope of personal relationships between companies and acquisition transaction partners is low. In the analyzed companies, the relationship through interlocking directorates translates into a higher integration dynamics, a higher level of centralization of activities and a higher declared satisfaction with the acquisition. An important factor for the process of post-transaction integration is the durability of relationships between transaction partners and the position held in the network of connections. If relationships are long-term, it is important for faster integration of business processes. Also, higher than the average value for the examined group of companies were measures of closeness centrality and eigenvector. These can mean better access to information, translate into higher dynamics and centralization of integration activities in personally related companies. As a result of the conducted research, it is possible to formulate recommendations of directing enterprises towards the exploitation of personal relations between management boards for those companies which have based their strategic development on mergers and acquisitions. Since interlocking connections have an impact on the higher dynamics of integration activities, personal connections would be primarily recommended for those enterprises which the pace business process integration is important, from the point of view of rapid achievement of the assumed integration goals. It is important that these relationships are long-term (in the presented studies, the average length of relationship was 496 days). The requirement of a long-term relationship, fulfilled long before the transaction is concluded, builds trust; and this element is treated as a critical success factor in post-acquisition integration processes. It seems that it would be worthwhile to continue researching this issue in the future. It would be interesting to identify trends in interlocking directorates in acquisition processes in Poland in the long term. It would also be worth expanding the scope of research using the adopted methodology to other countries in Central and Eastern Europe. Undoubtedly, an interesting direction of further research would be financial analyses which show the relationship between interlocking and the implemented post-transaction integration model and the impact on the financial effect of acquisition transactions. An undoubted limitation for the research conducted was the incompleteness of the Euromoney Institutional Investor Company (EMIS) database, based on which the analyses were conducted. The dedicated database of all operations that took place between the years 2012 and 2014 on the Warsaw Stock Exchange and New Connect, although treated as the most comprehensive source of information on acquisitions carried out on capital markets, contained many data gaps that hindered the analysis. Restrictions also appeared during the stage of collecting opinions in studies using semi-structured interviews. Difficulties in reaching respondents resulted in the need to launch informal channels to reach them. Unfortunately, achieving representativeness in the analyzed studies turned out to be impossible.

Funding

This research received no external funding.

Conflicts of Interest

The author declare no conflict of interest.

References

- Pool, R. Training for Results: Innovative Synergy between Learning and Business Performance. Ind. Commer. Train. 2011, 43, 31–37. [Google Scholar] [CrossRef]

- Pun, K.F. A Conceptual Synergy Model of Strategy Formulation for Manufacturing. Int. J. Oper. Prod. Manag. 2004, 24, 912–918. [Google Scholar]

- Anand, M.; Singh, J. Impact of Merger Announcements on Shareholders’ Wealth: Evidence from Indian Private Sector Banks. Vikalpa 2008, 33, 35–54. [Google Scholar] [CrossRef]

- Mitchell, M.L.; Stafford, E. Managerial Decisions and Long-Term Stock Price Performance. J. Bus. 2000, 52, 1765–1790. [Google Scholar] [CrossRef]

- Rosen, R.J. Merger Momentum and Investor Sentiment the Stock Market Reaction to Merger Announcements. J. Bus. 2006, 79, 987–1017. [Google Scholar] [CrossRef]

- Czerwonka, L. Długookresowy wpływ połączeń przedsiębiorstw na wartość spółek przejmujących. Rynek Kapitałowy 2010, 10, 35–36. [Google Scholar]

- Rappaport, A. Creating Shareholder Value: A Guide for Managers and Investors; The Free Press: Richmond, VA, USA, 1998. [Google Scholar]

- Bijlsma-Frankema, K. On managing cultural integration and cultural change processes in mergers and acquisitions. J. Eur. Ind. Train. 2001, 25, 192–207. [Google Scholar] [CrossRef]

- Svenson, G.; Wood, G.; Callaghan, M. A corporate model of sustainable business practices: An ethical perspective. J. World Bus. 2010, 45, 338. [Google Scholar] [CrossRef]

- Miozzo, M.; Walsh, V. International Competitiveness and Technological Change; Oxford University Press: Oxford, UK, 2006. [Google Scholar]

- Hatch, M.J. Teoria Organizacji; Wydawnictwo Naukowe PWN: Warszawa, Poland, 2001. [Google Scholar]

- Jensen, M.C. Agency Costs of Free Cash Flow, Corporate Finance and Takeovers. Am. Econ. Rev. 1986, 76, 323–329. [Google Scholar]

- Harrison, J.S.; Bosse, D.A.; Phillips, R.A. Managing for stakeholders, stakeholder utility functions, and competitive advantage. Strateg. Manag. J. 2010, 31, 58–74. [Google Scholar] [CrossRef]

- Myerson, R.B. Game Theory. Analysis of Conflict; Harvard University Press: Cambridge, MA, USA, 1997. [Google Scholar]

- Granovetter, M. Economic Action and Social Structure: The Problem of Embeddedness. Am. J. Sociol. 1985, 91, 481–510. [Google Scholar] [CrossRef]

- Cai, Y.; Sevilir, M. Board connections and M&A transactions. J. Financ. Econ. 2012, 103, 327–349. [Google Scholar] [CrossRef]

- Chwistecka-Dudek, H. Dywersyfikacja. Strategia Rozwoju Przedsiębiorstwa; Wyższa Szkoła Biznesu w Dąbrowie Górniczej: Dąbrowa Górnicza, Poland, 2009. [Google Scholar]

- Cording, M.; Christman, P.; King, D.R. Reducing Causal Ambiguity in Acquisition integration: Intermediate Goals as Mediators of Integration Decision and Acquisition Performance. Acad. Manag. J. 2008, 51, 744–767. [Google Scholar] [CrossRef]

- Schoenberg, R. Measuring the Performance of Corporate Acquisitions: An Empirical Comparison of Alternative Metrics. Br. J. Manag. 2006, 17, 361–370. [Google Scholar] [CrossRef]

- Mizruchi, M. What Do Interlocks Do? An Analysis, Critique and Assessment of Research on Interlocking Directorates. Annu. Rev. Sociol. 1996, 22, 271–298. [Google Scholar] [CrossRef]

- Zhang, Q. A Comparative Study of the Effect of Interlocking Directorates on Merger Target Selection under Different Merger and Acquisition Modes. Am. J. Ind. Bus. Manag. 2016. [Google Scholar] [CrossRef]

- Zdziarski, M. Elita wewnętrznego kręgu i centralne firmy. Wyniki badań relacji przez rady nadzorcze w polskich spółkach giełdowych. Organizacja i Kierowanie 2012, 1, 23–39. [Google Scholar]

- Perez-Calero, L.; Barossa, C. It is useful to consider the interlocks according to the type of board member (executive or non-executive) who possesses them? Their effect on firm performance. Rev. Eur. Dir. Econ. Empres. 2015, 24, 130–137. [Google Scholar]

- Simoni, M.; Caiazza, R. Interlocking directorates’ effects on economic system’s competitiveness. Bus. Strategy Ser. 2013, 14, 30–35. [Google Scholar] [CrossRef]

- Bodner, J. Post-merger integration. J. Organ. Des. 2018, 7, 1–20. [Google Scholar] [CrossRef]

- Chuluun, T.; Prevost, A.; Puthenpurackal, J. Board Ties and the Cost of Corporate Debt. Financ. Manag. 2014, 43. [Google Scholar] [CrossRef]

- Zona, F.; Gomez-Mejia, L.; Withers, M. Board Interlocks and Firm Performance. J. Manag. 2018, 44, 589–618. [Google Scholar] [CrossRef]

- Engelberg, J.; Gao, P.; Parsons, C.A. Friends with money. J. Financ. Econ. 2012, 103, 169–188. [Google Scholar] [CrossRef]

- Palmer, D. Broken Ties: Interlocking Directorates and Intercorporate Coordination. Adm. Sci. Q. 1983, 28, 40–55. [Google Scholar] [CrossRef]

- Yang, Y.; Lütge, C.; Yang, H. Organizational culture affecting post-merger integration. Rev. Int. Bus. Strategy 2019, 29, 139–154. [Google Scholar] [CrossRef]

- Yang, H.; Lin, Z.; Peng, M. Behind Acquisitions of Alliance Partners: Exploratory Learning and Network Embeddedness. Acad. Manag. J. 2011, 54, 1069–1080. [Google Scholar] [CrossRef]

- Cukurova, S. Interlocking Directors and Target Selection in Mergers and Acquisitions. Available online: www.igier.unibocconi.it/files/Cukurova.pdf (accessed on 24 September 2019).

- Wu, Q. Information Conduit or Agency Cost: Top Management and Director Interlock between Acquirers and Targets. SSRN Electron. J. 2017. [Google Scholar] [CrossRef]

- Cremers, K.J.; Nair, V.B.; Kose, J. Takeovers and the Cross-section of Returns. Rev. Financ. Stud. 2005, 22, 1409–1445. [Google Scholar] [CrossRef]

- Sleptov, A.; Anand, J.; Vasudeva, G. Relational configurations with information intermediaries: The effect of firm-investment bank ties on expected acquisition performance. Strateg. Manag. J. 2013, 34, 957–977. [Google Scholar] [CrossRef]

- Schonlau, R.; Singh, P. Board Networks and Merger Performance, 2009, 4–14. Available online: https://ssrn.com/abstract=1322223 (accessed on 20 September 2019).

- Habeck, M.H.; Kroger, F.; Trum, M.R. After the Mergers: Seven Rules for Successful Post-Merger Integration; Prentice Hall: New York, NY, USA; Financial Times: London, UK, 2000. [Google Scholar]

- Gomes, E.; Angwin, D.; Weber, Y.; Tarba, S. Critical Success Factors through the Mergers and Acquisitions Process: Revealing Pre- and Post-M&A Connections for Improved Performance. Thunderbird Int. Bus. Rev. 2013, 55. [Google Scholar] [CrossRef]

- Pablo, A. Determinants of Acquisitions Level: A Decision making Perspective. Acad. Manag. J. 1994, 4, 803–836. [Google Scholar]

- Haspeslagh, P.C.; Jemison, D. Managing Acquisitions: Creating Value through Corporate Renewal; The Free Press: NewYork, NY, USA, 1991; p. 106. [Google Scholar]

- Chase, B. National city’s latest mergers put premium on fast execution. Am. Bank. 1998, 3–4, 163. [Google Scholar]

- Schlaepfer, R.; di Paola, S.; Kupiers, R.; Brauchli-Rohrer, B.; Marti, A.; Brun, P.; Baldinger, G. How can leadership make a difference—An integration survey. PWC 2008, 143, 1–16. [Google Scholar]

- Bauer, F.; Degischer, D.; Matzler, K. Is Speed of Integration in M&A Learnable? The Moderating Role of Organizational Learning on the Path of Speed of Integration on Performance. Zadar, Croatia, 2013. Available online: http://www.toknowpress.net/ISBN/978-961-6914-02-4/papers/ML13-299.pdf (accessed on 24 September 2019).

- Angwin, D. Speed in M&A integration: The first 100 days. Eur. Manag. J. 2004, 22, 418–430. [Google Scholar]

- Homburg, C.; Bucerius, M. Is speed of integration really a success factor of mergers and acquisitions? An analysis of the role of internal and external relatedness. Strateg. Manag. J. 2006, 27, 347–367. [Google Scholar] [CrossRef]

- Olie, R. Shades of culture and institutions in international mergers. Organ. Stud. 1994, 15, 381–405. [Google Scholar] [CrossRef]

- Bauer, F.; Matzler, K. Antecedents of M&A success: The role of strategic complementarity, cultural fit, and degree and speed of integration. Strateg. Manag. J. 2013. [Google Scholar] [CrossRef]

- Silverman, D. Prowadzenie Badań Jakościowych; Wydawnictwo Naukowe PWN: Warszawa, Poland, 2019. [Google Scholar]

- Kawa, A. Orientacja Sieciowa Przedsiębiorstw Branży Usług Logistycznych; Wydawnictwo Uniwersytetu Ekonomicznego w Poznaniu: Poznań, Poland, 2017. [Google Scholar]

- Scott, J. Social Network Analysis. A Handbook; SAGE Publications: London, UK, 2000. [Google Scholar]

- Stankiewicz-Mróz, A. Analiza sieci społecznych jako narzędzie optymalizacji przebiegu integracji po przejęciach przedsiębiorstw. Zesz. Nauk. Politech. Łódzkiej 2016, 1209, 107–121. [Google Scholar]

- Miles, M.B.; Huberman, A.M. Qualitative Data Analysis. An Expanded Sourcebook; Sage: BeverlyHills, CA, USA, 1994. [Google Scholar]

- Larsson, R.; Lubatkin, M. Achieving acculturation in mergers and acquisitions: An international case survey. Hum. Relat. 2001, 54, 1573–1607. [Google Scholar] [CrossRef]

- Bertaux, D. From the Life-history Approach to the Transformation of Sociological Practice. In Biography and Society: The Life History Approaches in the Social Sciences; Bertaux, D., Ed.; Sage Publications: Beverly Hills, CA, USA, 1981; pp. 29–45. [Google Scholar]

- Guest, G.; Bunce, A.; Johnson, L. How many interviews are enough? An experiment with data saturation and variability. Field Methods 2006, 18, 59–82. [Google Scholar] [CrossRef]

- Risks of the Modern Merger and Acquisition Market. Report from the Crowe Horwath and FERF 2017 Survey. Available online: https://www.tgc.eu/media/publikacje/Mergers&Acquisitions.pdf (accessed on 24 September 2019).

- Schweiger, D.M.; Walsh, J.P. Mergers and Acquisitions: An Interdisciplinary View. In Research in Personnel and Human Resources Management; Shaw, B.B., Beck, J.E., Eds.; JAI Press: Greenwich, CT, USA, 1990; Volume 8, pp. 41–107. [Google Scholar]

- Cuche, D. La Notion de Culture dans les Sciences Sociales. Découverte Rev. Française Sociol. Année 2001, 41, 170–172. [Google Scholar]

- Vaara, E. Cultural Differences and Post-Merger Problems: Misconceptions and Cognitive Simplifications. Organisasjonsstudier 1999, 1–2, 59–88. [Google Scholar]

- Teerikangas, S.; Very, P. The Culture-Performance Relationship in M&A: From Yes/No to How. Br. J. Manag. 2006, 17, 31–48. [Google Scholar]

- Datta, D.K. Organizational Fit and Acquisition Performance: Effects of Post-Acquisition Integration. Strateg. Manag. J. 1991, 12, 281–297. [Google Scholar] [CrossRef]

- Chatterjee, S.; Lubatkin, M.H.; Schweiger, D.M.; Weber, Y. Cultural Differences and Shareholder Value in Related Mergers: Linking Equity and Human Capital. Strateg. Manag. J. 1992, 13, 319–334. [Google Scholar] [CrossRef]

- Weber, R.A.; Camerer, C.F. Cultural Conflict and Merger Failure: An Experimental Approach. Manag. Sci. 2003, 49, 400–415. [Google Scholar] [CrossRef]

- Krishnan, H.A.; Miller, A.; Judge, W.Q. Diversification and Top Management Team Complementarity: Is Performance Improved by Merging Similar or Dissimilar Teams? Strateg. Manag. J. 1997, 18, 361–374. [Google Scholar] [CrossRef]

- Faulkner, D.; Teerikangas, S.; Joseph, R. (Eds.) Culture in M&A—A critical synthesis and steps forward. In Handbook of Mergers and Acquisitions; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Riad, S. Of Mergers and Cultures: “What Happened to Shared Values and Joint Assumptions?”. J. Organ. Chang. Manag. 2007, 20, 26–43. [Google Scholar] [CrossRef]

- Stahl, G.; Kremershof, J.; Larsson, R. Trust Dynamics in Mergers and Acquisitions. A Case Survey; Human Resources Management; INSEAD: Fontainebleau, France, 2011; Volume 50, pp. 575–603. [Google Scholar]

- Barkema, H.G.; Schijven, M. A How do firms learn to make acquisitions? A review of past research and an agenda for the future. J. Manag. 2008, 34, 594–634. [Google Scholar] [CrossRef]

- Barkema, H.G.; Bell, J.H.; Pennings, J.M. Foreign entry, cultural barriers, and learning. Strateg. Manag. J. 1996, 12, 151–166. [Google Scholar] [CrossRef]

- Ellis, K.M.; Reus, T.H.; Lamont, B.T.; Ranft, A.L. Transfer effects in large acquisitions: How size-specific experience matters. Acad. Manag. J. 2011, 54, 1261–1276. [Google Scholar] [CrossRef]

- Reus, T.H.; Lamont, B.T.; Ellis, K.M. A darker side of knowledge transfer following international acquisitions. Strateg. Manag. J. 2016, 37, 932–944. [Google Scholar] [CrossRef]

- Zollo, M.; Meier, D. What is M&A performance? Acad. Manag. Perspect. 2008, 22, 55–77. [Google Scholar]

- Dess, G.; Robinson, R.B. Measuring Organizational Performance in the Absence of Objective Measures: The Case of the Privately-held Firm and Conglomerate Business Unit. Strateg. Manag. J. 1984, 5, 265–273. [Google Scholar] [CrossRef]

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).