Abstract

This paper conducts a bibliometric review of global research on the role of boards of directors in corporate governance. Boards of directors play a crucial role in the corporate governance of publicly traded firms, as they monitor the performance of top executives on behalf of shareholders and help to set the firm’s overall strategic direction. Our review documents most influential articles, authors, and journals in this area. The bibliometric analysis highlights the multi-disciplinary nature of research on boards of directors, covering the fields of finance and economics, accounting and auditing, and management and strategy. Furthermore, co-citation analyses reveal the core theoretical and conceptual articles on agency theory and ownership structure that provide the foundation for research on corporate governance and boards of directors. The review shows that, despite its practical importance, studies on how boards of directors contribute to corporate sustainability represent only a small fraction of the articles in this literature. This highlights the need for more research on this particular topic in the coming years. Moreover, the keyword co-occurrence analysis suggests other emerging research topics in the BDCG knowledge base are in the areas of gender diversity, CSR, and innovation, which pinpoints possible future research directions for scholars in the field.

1. Introduction

The role of boards of directors is an essential part of the literature on corporate governance. Oversight and monitoring by the board serve as a vital mechanism to control the top executives on behalf of shareholders. Good corporate governance is essential for the sustainable success of corporations [1,2]. This is especially the case with respect to large listed firms in the United States and other developed countries where firm ownership and control are usually separated. In cases where the firm is effectively owned and managed by a founding family or a large business group, as is more typical in developing countries, independent directors can monitor the managers/owners on behalf of minority shareholders and other stakeholders [3,4].

Boards of directors play a crucial role in corporate governance, as they monitor top executives and help to set the firm’s overall strategic goals [5]. In principle, scholars recommend that boards should be vigilant monitors of top management on behalf of shareholders and other stakeholders. Nonetheless, in practice, boards have been described as passive prisoners of management [6]. Thus, a well-composed and effective board of directors is generally considered a reflection of good corporate governance. In turn, good corporate governance is essential for the firm’s sustainability [1,2].

The emergence of corporate governance as an area of study can be traced to the publication of the Cadbury Report (1992) in the United Kingdom (UK), followed by the Principles of Corporate Governance (1999) by the OECD (OECD refers to the Organization for Economic Co-operation and Development). These documents introduced new guidelines and laws designed to improve the governance of publicly traded firms. The subsequent impetus for the development of ‘good governance’ came after several large global corporations collapsed due to accounting irregularities and fraud, including HIH Insurance and One-Tel in Australia for example. Other prominent failures were Enron and WorldCom in the United States (USA), which finally led to the passing of the Sarbanes–Oxley Act in 2002 in the USA to better protect investors against fraud and to strengthen corporate governance. The topic of corporate governance became even more popular after the financial crisis in 2008, in which a lack of good corporate governance in the financial industry came to the broader attention of the public.

The contemporary corporate governance literature cuts across disciplinary boundaries of economics, business, and management. A majority of studies focus on the association between corporate governance and firm attributes, such as firm performance [7,8], voluntary disclosure [9,10], and earnings management [11,12]. Other lines of related research have studied the connection between corporate governance and stakeholder relations and corporate social responsibilities [13,14,15]. Moreover, some scholars have also looked into the relationship between corporate governance and top executive compensation [16,17].

The purpose of this review of research was to examine the theoretical evolution and intellectual structure of the knowledge base on the role of boards of directors in corporate governance (BDCG). We consider practices associated with corporate governance essential to the concept of sustainability since they intersect with both economic and ethical-social responsibilities of companies. The review addresses the following research questions:

- What are the overall volume and distribution by time, geographic source, and venues of published BDCG studies?

- What authors, institutions, and research papers have had the most significant influence on BDCG research?

- What is the intellectual structure of the BDCG knowledge base?

- What research topics have attracted attention among scholars in the BDCG knowledge base in the past and present?

In order to address these research questions, the authors analyze 6302 peer-reviewed journal articles drawn from the Scopus index. This review adopts bibliometric methods [18,19,20] to synthesize the knowledge base on corporate governance and boards of directors. Bibliometric methods incorporate citation analysis, co-citation analysis, and keyword co-occurrence analysis to map out the intellectual structure of a knowledge base. The value of bibliometric methods lies in the ability to document the evolution of literature over time and reveal the intellectual relationship of the existing knowledge base. Thus, this research seeks to illuminate one of the key domains of sustainability in research on corporate governance.

This paper contributes to the literature by providing a bibliometric review of the BDCG literature, which has not been done since Durisin and Puzone in 2009 [21]. A bibliometric review, which is different from a typical literature review, identifies the most influential articles, journals, authors and topics in a body of knowledge. The results provide guidance for new researchers in the area about the core articles and authors that have been cited most frequently, and how they are linked. Moreover, a keyword co-occurrence analysis highlights the most frequently studied topics in this literature, and how the popularity of topics has shifted through the years, which provides a valuable reference for scholars about emerging areas of interest.

2. Materials and Methods

Critical synthesis and meta-analysis have been the most widely adopted review methods in corporate governance research [5,22,23,24,25,26]. These methods of systematic review use various techniques to synthesize substantive findings located in identified bodies of related research. In contrast, bibliometric reviews use a range of quantitative methods to analyze the bibliographic metadata associated with published papers in a discipline or line of inquiry. These analyses aim to reveal relevant features that shape knowledge production. Although management scholars have conducted bibliometric reviews in fields such as strategic management [27,28], mergers and acquisitions [29], knowledge management [30], and accounting [31], the application of bibliometric analysis in corporate governance research is limited [21]. Thus, this bibliometric review of research was designed to complement, not replace or validate, findings from previous reviews of research.

2.1. Identification of Sources

Although the Web of Science (WoS) citation database is a popular choice among scholars conducting bibliometric reviews, the Scopus citation database has a broader coverage in social science, especially in the years since 1996 [32]. As interest in corporate governance has evolved mainly since the late 1990s, the SCOPUS index, published by Elsevier, was considered most suitable for the purposes of this review. This conclusion is supported by other management scholars [33].

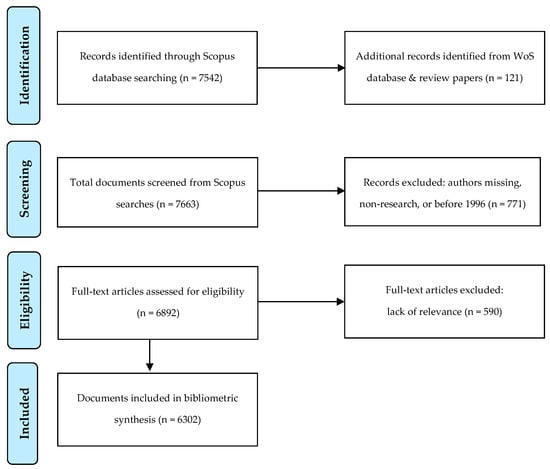

We followed the PRISMA (Preferred Reporting Items for Systematic Reviews and Meta-Analyses) guidelines for conducting systematic research reviews of Moher, Liberati, Tetzlaff, & Altman [34]. PRISMA specifies four steps to follow and report when identifying and extracting information for a bibliometric review: see Figure 1.

Figure 1.

PRISMA flow diagram showing the four steps for identifying, screening and including articles for the bibliometric review [34].

The first step aimed to identify the full set of articles related to the board of directors within the scope of the BDCG literature. An initial search was conducted in the Scopus database for articles featuring “boards of directors” in the title, abstract or keywords. In addition, articles including both “corporate governance” and either the words “board” or “director” in the title, abstract or keywords, were included in the search. Furthermore, articles including both “governance” and “board structure”, “board characteristic”, or “board composition” were included. Finally, articles mentioning both “board” and “CEO” were included. The search terms had to be set quite broadly because some key articles in this literature, such as “A Theory of Friendly Boards” by Adams & Ferreira [35], only include the words “board” and “CEO” in the title and abstract, while not explicitly mentioning the terms “boards of directors” or “corporate governance”.

The authors conducted the initial literature search on 19 January 2019, yielding a total of 7542 journal articles in the English language. We limited this review to journal articles for two reasons. First, peer-reviewed journal articles tend to demonstrate a more consistent degree of quality than other types of documents. Second, Scopus provides less comprehensive and systematic coverage of books, book chapters, and conference papers. Since the SCOPUS database contains some errors (misclassifications) and may not cover all relevant research on the topic, the authors cross-checked the reference lists of the top 60 most highly cited review papers in the database and were able to identify 113 additional articles that were not identified in the initial search (these 60 review papers had at least 1 citation in the Scopus database, serving as the cutoff point). In addition, we also performed a search in the Web of Science database using the same search criteria. This led to the identification of eight additional relevant articles.

In the next step, documents without author names were excluded from the database, as well as documents merely being a board of directors’ report or statement, rather than a research article. Moreover, we excluded all documents published before 1996, as Scopus is known to have a weak coverage of pre-1996 publications in economics and the social sciences [36]. Furthermore, we exclude articles from the ongoing year 2019, so the scope of the review is limited to 1996 through 2018. After excluding 771 articles based on these grounds, 6892 articles were left in the database. Then the titles and abstracts of the remaining 6892 articles were scanned manually to ascertain their relevance to this review. This led to the exclusion of an additional 590 documents comprised of articles that were incorrectly included by Scopus and some duplicates. The process resulted in a final database of 6302 peer-reviewed journal articles on BDCG published since 1996.

2.2. Data Extraction

The SCOPUS database of 6302 BDCG-related journal articles was downloaded in a .csv (comma separated value) file format according to the requirements of VOSviewer, the program used for data analysis. The data retrieved includes author names and affiliations, article title, keywords, abstract, and citation data, including the reference list of all articles. The same information on the 6302 articles was also saved in Excel format and later imported into the Tableau software for topographical analysis.

2.3. Data Analysis

Data analysis relied on quantitative methods for both topographical analysis and bibliometric analysis. First, the authors employed descriptive statistics in Excel to generate a series of graphs and tables intended to identify patterns within the database, such as the most frequently cited articles and authors (e.g., see Table 1, Table 2, Table 3 and Table 4).

Table 1.

The 20 most active journals publishing BDCG articles ranked by volume of articles, 1996–2018 (n = 6302).

Table 2.

The 20 most influential journals publishing BDCG articles ranked by Scopus citations, 1996–2018 (n = 6302).

Table 3.

The 20 most influential authors publishing BDCG articles ranked by Scopus citations, 1996–2018 (n = 6302).

Table 4.

The 20 most influential BDCG-related journal articles ranked by Scopus citations, 1996–2018.

Both citation analysis and ‘co-citation’ analysis were employed to illuminate features of the BDCG knowledge base [37]. Citation analysis examines the number of times a given document in the review database has been cited by other documents located in Scopus. Thus, citation analysis was used to calculate the number of citations of authors, documents and journals contained in our review database. Since citations are accepted as a means of establishing scholarly impact, these analyses were used to identify influential authors, articles, and journals within the domain of BDCG scholarship (e.g., see Table 1, Table 2, Table 3 and Table 4).

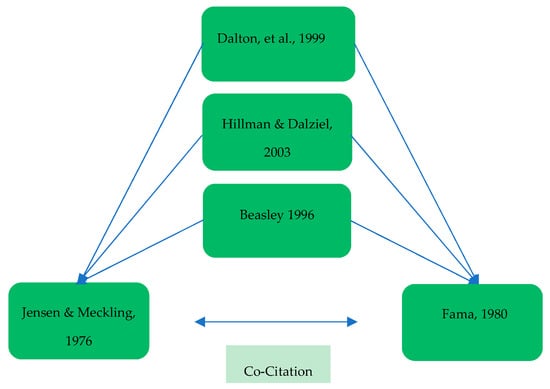

Co-citation analysis [38] offers a complementary perspective on scholarly impact by highlighting relationships among authors, documents or journals within a field of study. Co-citation is defined as the frequency at which two documents are cited together by other documents in the field [39]. For example, in Figure 2, the articles by Jensen and Meckling [40] and Fama [41] are considered “co-cited documents” because they are both cited in the reference lists of three documents in the authors’ database [25,42,43]. In co-citation analysis, these two articles are considered ‘similar’ or ‘intellectually related’ because they tend to be co-cited together by other studies in the field [44]. In Figure 2, each of the two co-cited documents receives three co-citations.

Figure 2.

Example from the corporate governance and board attributes literature of document co-citation in science mapping.

It is important to note that the articles authored by Jensen and Meckling [40] and Fama [41] are not in our literature database, as they were published prior to 1996. Moreover, the Fama [41] article is not even in the Scopus database, due to its limited coverage prior to 1996. Nonetheless, these journal articles featured prominently in our co-citation analysis because they are included in the reference lists of many documents in our database. This example highlights the unique ability of co-citation analysis to reach far beyond the original 6302 articles in our database and beyond Scopus, thereby providing a complimentary, and arguably more comprehensive, approach to traditional citation analysis.

Several different types of co-citation analysis can be conducted: author co-citation analysis (ACA), journal co-citation analysis (JCA), and document co-citation analysis (DCA). ACA shows how frequently two authors have been co-cited and points to the intellectual structure of disciplines and main lines of inquiry [20,45,46]. JCA can reveal similarities in topical foci among the journals as well as their relative impact in a field of inquiry [47]. For DCA, the underlying assumption is that the most frequently co-cited papers represent the key concepts, methods, and empirical findings in a field [39].

3. Results

The results of the bibliometric analysis are presented in this section following the pattern of the research questions regarding published BDCG research.

3.1. Volume and Geographic Distribution of Published Studies

Our first analyses concern the volume of the BDCG literature. The total of 6302 relevant, peer-reviewed journal articles represents a substantial body of knowledge. This conclusion takes on further meaning when we consider that the articles identified in our database only commenced publication in 1996 and that they do not include the full corpus of BDCG studies. For example, our database did not include books, book chapters, conference papers, graduate dissertations, or technical reports. If it had, we believe that the total would approach 10,000 documents. We suggest that it is unusual for such a large body of knowledge to accumulate over such a short period of time.

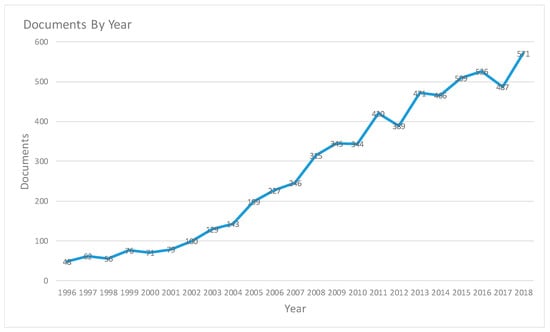

Evolution of this literature was further analyzed in terms of the longitudinal progression of annual publication volume of BDCG research (see Figure 3). The theoretical foundations of BDCG research were formed in the early 1970s by key works on agency theory [40,48]. However, at that time, few empirical studies examined agency conflicts between principals and agents in public companies. This was due, in part, to the fact that there were no journals explicitly devoted to corporate governance until 1993 when Corporate Governance: An International Review was introduced by Blackwell. Indeed, the introduction of Corporate Governance: An International Review and the Asian financial crisis in 1997 combined to generate some increased interest in this topic during the late 1990s (see Figure 3). Data presented in Figure 3 further document 2002 as a ‘tipping point’ in the evolution of the BDCG literature.

Figure 3.

Change in BDCG publication volume over time, 1996–2018 (6302 articles).

In 2002, the Sarbanes–Oxley Act (SOX Act) was passed in the USA following the collapse of several large multinational corporations due to failures in corporate governance. This brought the topic of American corporate governance into the global spotlight. In spite of the good intentions of its sponsors, the passage of the SOX Act was not without controversy. Scholars identified a range of potential costs and benefits of its adoption. This led to an immediate increase in the number of studies related to corporate governance in the USA. Shortly after passage of the SOX Act in the USA, similar laws were quickly adopted in other developed countries (Canada, 2002; Germany, 2002; France, 2003; Australia, 2004). Finally, the 2008 international financial crisis generated even more interest in the topic. The continuing failure of corporate governance and lack of oversight by boards in the financial sector was widely considered to be one of the causes for this crisis.

In sum, as shown in Figure 3, the evolution of this research literature can be linked to events in international policy and practice. The growth of scholarly interest in this topic started from modest beginnings (i.e., 1996–2001) when annual publication volume never exceeded 80 Scopus-indexed journal articles. A series of corporate crises in different countries not only spurred the passage of legislation but also scholarly interest in how boards of directors shape corporate governance practices. This was reflected in steadily accelerating annual publication volume between 2002 when 100 articles were published and 2018 when 571 articles appeared in print.

Figure 4 reveals the geographical distribution of this literature (note that VOSviewer bases the count on the national affiliation of the first author). The map suggests that this is a truly global knowledge base, covering 105 countries and all continents. At the same time, we note that developed nations dominate the corporate governance literature with the USA (1994), the UK (780), and Australia (533) leading the field in terms of academic output. While noteworthy, this finding is not surprising. The UK became a pioneer in corporate governance with the issuance of the Cadbury report in 1992. The USA and Australia both experienced some of the largest corporate scandals in the early 2000s and were among the first to adopt legislation to address corporate governance issues. Aside from those three nations, most of the literature from developed economies come from Europe where the OECD has emerged as a strong advocate for good corporate governance practices.

Figure 4.

Global distribution of Scopus-indexed journal articles on boards of directors and corporate governance, 1996–2018 (n = 6302 articles).

While the volume is significantly lower, the topic of corporate governance and boards of directors has also drawn attention among scholars in emerging markets. This is particularly noticeable in the Asia-Pacific region where reverberations from the 1997 Asian financial crisis raised the long-term salience of this topic. For example, as indicated in Figure 4, Malaysia, China, India, Hong Kong, and Taiwan have each generated more than 100 relevant articles. In sum, despite the dominance of scholarship from Western developed societies in this literature, the global relevance of this topic is affirmed by this analysis of the literature’s global distribution.

3.2. Journals

The next goal is to illuminate the journal venues of BDCG publications. Data presented in Table 1 reveal that the journal publishing the largest number of articles in this field is Corporate Governance: An International Review by Wiley-Blackwell. In general, journals focused specifically on corporate governance feature at the top of the list: Corporate Ownership and Control (number 2), Corporate Governance: The International Journal of Business in Society published by Emerald (number 3). Ranked fourth is the Journal of Business Ethics, due to the close link between ethics, corporate social responsibility, and corporate governance. The Journal of Corporate Finance, ranked fifth, is the first journal on the ranking not specifically focused on governance or business ethics. The remainder of the list also includes some of the top journals in finance and management, such as the Journal of Financial Economics (#8) and the Strategic Management Journal (#9), illustrating the multi-disciplinary nature of the topic.

Interestingly, in 2017 Scopus stopped coverage of the two journals Corporate Ownership and Control (#2) and Corporate Board: Role, Duties and Composition (#7), belonging to the publishing house Virtus Inter Press in Ukraine. According to De Jager, de Kock, & van der Spuy [49], Virtus Inter Press has been flagged as a potential predatory or low-quality publisher by Beall’s list and the Journal Quality List of the Australian Business Deans Council. Our data reveal an interesting pattern whereby these two journals published a relatively high number of articles, but with the lowest citation count per document (CPD) among the top 20 journals (i.e., average CPD = 1.5). Hence, despite their abundance, articles published in these two journals have had a very low impact within the field. Authors searching for a suitable outlet for BDCG scholarship should be aware of this.

Thus, after excluding the two above-mentioned journals, Corporate Governance: An International Review, Corporate Governance: The International Journal of Business in Society, the Journal of Business Ethics, the Journal of Corporate Finance and the Journal of Management and Governance represent the most active journals publishing BDCG scholarship.

Table 2 shows the journals ranked based on the total number of Scopus citations received. The journal citation count includes only citations to articles within our BDCG database, rather than all articles published in those journals. The Journal of Financial Economics is, without doubt, the journal where the highest impact papers in this field have been published, based on its total citations count of 18,789. The specialized field journal Corporate Governance: An International Review follows with 14,565 total citations. The Journal of Business Ethics also appears in the top 10 based on total citations, with 5790 citations. Apart from that, the top 10 most cited journals in Table 2 are all leading journals in finance, accounting, management, and strategy, illustrating the multi-disciplinary nature of the BDCG knowledge base.

A comparison between Table 1 and Table 2 reveals that although journals that focus directly on corporate governance research publish a large share of the articles in this field, they do not necessarily generate the highest citation impact. Instead, a relatively smaller number of articles published in broad-based finance, management and accounting journals have generated the greatest citation impact based on total citations and CPD (e.g., Journal of Financial Economics, Strategic Management Journal, Academy of Management Journal, Journal of Finance, Journal of Accounting and Economics, Administrative Science Quarterly). This highlights the centrality of BDCG studies to three major fields in business, namely finance, management, and accounting.

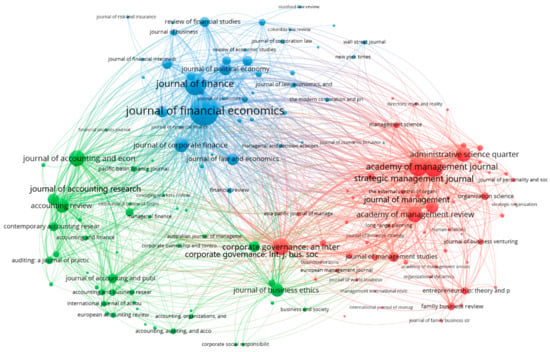

Figure 5 shows a journal co-citation analysis (JCA) map, which complements the results of the journal citation analysis. The size of the bubbles or nodes on the map reflect the relative number of co-citations associated with a given journal. Journals located closely together in a JCA map are frequently co-cited [37], implying overlap or similarity in article contents. Links offer an additional indication of co-citations between articles published in the related journals. Assignment of color to nodes is based on the frequency of co-citation of articles published in the related journals. Thus, a cluster of journals with a common color can be interpreted as sharing similarity in their published contents.

Figure 5.

The network map of journal co-citations based on 59,862 journals (threshold 20 citations, display top 150 journals).

The JCA generated three distinct and coherent clusters of journals on the network map. As Figure 5 shows, the BDCG knowledge base is co-cited in three unique but interconnected groups of journals. The red cluster is related to Management and Strategy, the green cluster consists mostly of Accounting and Auditing journals, and journals in the blue cluster focus primarily on Finance and Economics. Located in the center of the map are Corporate Governance: An International Review and the Journal of Business Ethics, having links to journals in all of the major disciplines (Management & Strategy, Accounting & Auditing, and Finance & Economics).

The result of the JCA in Figure 5 reaffirms findings from the journal citation analysis in Table 2 which highlighted the areas of Management & Strategy, Finance & Economics, and Accounting & Auditing, in addition to specialized governance journals. Moreover, the relative size of the three clusters in Figure 5 also matches with the journal citation analysis. Nine out of the 20 top journals in Table 2 judged by total citations are Management & Strategy journals, representing 46% of the total citations, 6 out of the 20 top journals are Finance & Economics journals, representing 38% of the total citations, and 5 out of the 20 top journals are Accounting & Auditing journals, representing 16% of the total citations.

Finally, judging from co-citation impact, the Journal of Financial Economics is the most influential journal in this literature. Furthermore, Corporate Governance: An International Review is located in a central location on the map and is frequently co-cited with journals from all three clusters. From the dual perspectives of co-citation impact (i.e., number of co-citations) and boundary-spanning influence (i.e., links to journals across clusters), the Journal of Financial Economics and Corporate Governance: An International Review can be classified as the most influential journals in this field of study.

3.3. Influential Authors and Articles

Another distinctive feature of bibliometric reviews is the ability to identify scholars and documents that have shaped discourse within a discipline or line of inquiry. Citation analysis is used to determine the most highly cited authors and documents, which reveals the intellectual leadership in the field of study. Co-citation analysis, on the other hand, offers deeper insights into the breadth of scholarly impact and the intellectual structure of literature [19].

Table 3 lists the most influential authors ranked by the number of Scopus-indexed citations. Consistent with the earlier reported statistics on geographical distribution, the ranking reveals the intellectual leadership of American scholars. For example, 16 of the top 20 authors are from the United States. The top three authors based on total citations are James Westphal, Catherine Daily (Dalton), and David Yermack. The most influential authors based on citations per documents are April Klein, David Yermack, and John Core. In terms of institutional contributions, Indiana University, University of Arkansas, and New York University stand out in Table 3.

We then applied document citation analysis to identify the most prominent documents in the field to further define the most influential authors and articles. Table 4 lists the most highly cited documents by the number of Scopus citations.

The result reconfirms the intellectual leadership of David Yermack, John Core and April Klein [8,50,51]. Moreover, Table 4 also reconfirms the dominant position of the Journal of Financial Economics in this field, as 7 out of 20 top-cited documents were published in this journal. David Yermack [50] was among the first scholars to study the relation between board composition and the market value of the firm. He found that companies with a small board of directors have a higher market value in the United States, suggesting that small boards are more effective. Core et al. [8] extended the literature by studying the relation between corporate governance, CEO compensation, and firm performance. Their findings show that CEOs at firms with relatively weak governance earn greater compensation, whereas the performance of these firms is typically poorer, indicative of serious agency problems. Klein [51] studies how board of directors and audit committee attributes influence reported earnings, finding that earnings management is substantially lower when the audit committee and the board contain more outside directors, suggesting more effective monitoring by independent directors.

Next, to get a broader and deeper insight into the structure of the knowledge base, the authors conducted a document co-citation analysis (DCA). DCA is performed on the much broader literature consisting of a total 259,685 papers in the document co-citation network, based on the reference lists of the 6302 articles included in our database. The top 20 co-cited documents are shown in Table 5.

Table 5.

The 20 most influential documents based on document co-citation analysis of the BDCG literature.

The data in Table 5 indicates that the Fama and Jensen [64] paper “Separation of Ownership and Control” is the most highly co-cited document in the literature. This “canonical paper” [38] provided the theoretical foundation of the corporate governance literature, together with Jensen and Meckling’s [40] paper “Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure”, and Fama’s [41] paper “Agency Problems and The Theory of the Firm”. Importantly, these papers were not included in our Scopus-indexed BDCG database. Nonetheless, they were frequently co-cited as key conceptual works on agency theory and the separation of ownership and control in the reference lists of articles in our database.

Apart from theoretical works, a number of empirical studies are also listed among the most co-cited documents in Table 5. More specifically, the co-citation analysis affirms the intellectual leadership of David Yermack, April Klein, and Michael Weisbach in shaping discourse in the BDCG knowledge base. Finally, two other widely co-cited articles deserve mention: “A Survey of Corporate Governance” by Andrei Shleifer and Robert Vishny [26], and “Management Ownership and Market Valuation” by Morck, Shleifer, and Vishny [65]. Finally, the data in Table 5 further support the premier position of the Journal of Financial Economics in the corporate governance literature as 7 out of 20 top co-cited documents were published in this venue.

3.4. Schools of Thought in the BDCG Literature

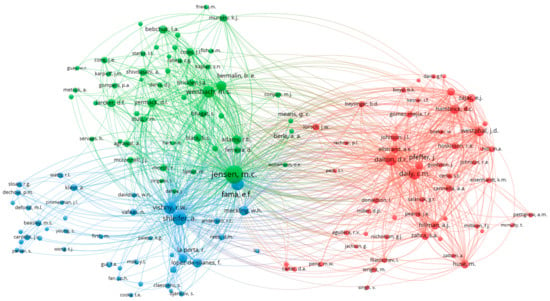

Next, we apply the author co-citation analysis (ACA) to reveal the structure of the BDCG knowledge base. ACA groups authors into clusters on a network map based on the similarity of their co-citations [38,73]. The ACA map is interpreted using the same guidelines listed for the JCA map. However, the ACA network map also serves as the basis for illuminating different schools of thought, or sub-fields within the BDCG knowledge base [20,38].

Out of the total 91,000 authors in the author co-citation network (i.e., authors listed in the reference lists of documents in our BDCG database), 4862 authors met the initial threshold of at least 20 author co-citations. Figure 6 displays the 150 most frequently co-cited authors in a network map. Figure 6 reveals three clusters, or schools of thought, comprising the BDCG knowledge base. These schools of thought are revealed as coherent clusters with dense connections among the three schools. These characteristics of the ACA map suggest that the BDCG knowledge base has evolved into a distinctive field of inquiry, with Michael Jensen, William Meckling, and Eugene Fama clearly located in the center of the map. These three authors have provided the theoretical foundations of corporate governance studies with their contributions to agency theory, and the separation of ownership and control in large firms [40,41,64,66,74].

Figure 6.

Author co-citation map based on 91000 authors (threshold 20 co-citations, display top 150 authors).

The green cluster, led by Michael Jensen, David Yermack, Michael Weisbach, and Benjamin Hermalin, focuses on the interconnection between corporate governance, agency problems, and firm performance. These scholars are mostly in the fields of finance and economics. The relatively large size of the nodes shows that scholars in this cluster have had a strong influence on the literature [66,75,76]. Many of the authors in this Finance & Economics school of thought study board composition and its implications for firm valuation and performance [50,75,76,77]. On the top left corner of the green cluster, the authors John Core, David Larcker, and Wayne Guay, have extensively studied the linkage between corporate governance and executive compensation, and the incentives that various forms of compensation provide to executives [8,78,79].

Another prominent topic in the green “Finance & Economics” cluster is the process influencing board selection itself [56]. A widely cited article by Hermalin and Weisbach [56] provides a formal model of the board selection process, where board characteristics such as independence arise endogenously as the outcome of a bargaining process between the CEO and the board. Two influential authors close to the center of the graph, Renee Adams and Daniel Ferreira, introduced the theory of “friendly boards” [35,80,81]. They show how the board’s dual role as advisor and monitor of management can give rise to less independent and more management-friendly boards, which improves information sharing between the CEO and the board. Furthermore, Renee Adams and Daniel Ferreira are among the first and most influential authors to investigate the effects of women on the board (diversity) [57].

Another group of authors located on the top middle corner of the green cluster, led by Jeffrey Coles, have recently published on “co-opted” boards [82], where co-option is defined as a director appointed by the currently serving CEO. Their study [82] shows that CEO compensation tends to be higher at firms with more co-opted directors, while the link between CEO pay and performance is weaker, regardless of whether the co-opted directors are independent or not. This fuels the ongoing debate about whether (and which) “independent directors” are truly independent, and how that affects corporate governance [67,83].

The blue cluster is led by Rafael La Porta, Andrei Shleifer, Robert Vishny, and Florencio Lopez-de-Silanes. These four authors co-authored the “Law and Finance” article, a highly cited paper [84]. Authors in this cluster have also contributed key scholarship on ownership concentration and the control of corporations around the world [3,4]. On the far left of the blue cluster is a small sub-group of authors including April Klein, Patricia Dechow, and Mark Beasley. These authors are all in the area of accounting and auditing. Their key works focus on the determinants of earnings management and financial statement fraud, including the role of boards of directors [42,51,52]. Overall, the authors in this Law & Accounting school of thought focus on the legal system and shareholder protection [84,85], and how these factors shape firm ownership concentration [3,4]. Furthermore, authors in the Law & Accounting school study the role of good governance in mitigating earnings manipulation and promoting quality financial statement disclosure [42,51,52]. We note that size of the nodes for Andrei Shleifer and Robert Vishny are larger than other scholars due to the fact that they also co-authored one of the most highly cited review papers on corporate governance, “A Survey of Corporate Governance” [26].

The red cluster consists primarily of authors specializing in Management and Strategy. Dan Dalton, Catherine Daily (Dalton), Jonathan Johnson, and James Westphal are among the most important authors in this cluster. This Management & Strategy school focuses primarily on the interrelation between board composition, strategic leadership, and executive performance [86,87,88,89]. Among authors in this Management and Strategy school of thought, a prominent subgroup at the right top corner of the red cluster consists of Donald Hambrick, Edward Zajac, and James Westphal. These authors are frequently co-cited due to their focus on the power balance between the board and top executives, as well as upper echelons theory [90,91,92]. Westphal and Zajac [93] have also demonstrated that firms sometimes decouple governance policy from actual practice, trying to placate shareholders with purely symbolic governance actions.

Another prominent group of co-cited authors is located at the bottom of the red cluster, mainly consisting of Shaker Zahra, John Pearce, Amy Hillman, and Morten Huse. These three authors’ primary contribution is on highlighting the service role of the board, which involves representing the firm’s interests in the community and linking the firm to its external environment [94,95,96]. Related, Amy Hillman has contributed to the resource dependence theory view on the role of boards, which contends that an important function of directors is to provide the firm access to crucial external resources [43,97,98]. For example, firms operating in strictly regulated industries may appoint ex-politicians to their board to manage their relationship with the government [99], whereas an “outside director” categorization motivated by agency theory (implying better monitoring) would not capture the actual role played by such a director. Finally, authors in this cluster have also studied how governance affects entrepreneurship [100,101], which also depends on the expertise and resources provided by the board [102].

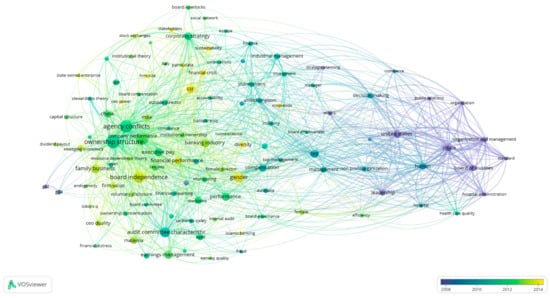

3.5. Topical Focus of the BDCG Knowledge Base

In order to address the final research question, we employed a keyword co-occurrence analysis to identify frequently studied topics in the BDCG knowledge base, as well as their underlying relationship. The rationale behind a keyword co-occurrence analysis, or co-word analysis, is best explained by Zupic and Čater [37]: “When words frequently co-occur in documents, it means that the concepts behind those words are closely related. The output of the co-word analysis is a network of themes and their relations that represent the conceptual space of a field” (p. 435). Because a keyword co-occurrence analysis reveals which keywords are often jointly mentioned (i.e., combined) by authors, it reveals patterns and trends in the topics studied within a particular knowledge base [103,104].

The keyword co-occurrence analysis was set to “All Keywords”, and totally 115 keywords were identified. The top five most co-occurring keywords were “corporate governance” (3542 cases), “board characteristics” (2039 cases), “ownership structure” (355 cases), “company performance” (349 cases), and “agency conflicts” (343 cases). These results reveal that studies on BDCG also often consider the closely related issue of ownership structure, whereas agency theory provides the dominant theoretical framework applied in the BDCG knowledge base. Finally, the implications for company performance are the key focus for a large number of BDCG studies.

Another vital contribution of keyword co-occurrence analysis lies in its ability to identify the “emerging research topics” both within the subject area itself and in directly related areas [105]. The authors used VOSviewer to generate a keyword co-occurrence map for the BDCG literature database, where the threshold for display in the figure was set to at least 30 cases of co‑occurring keywords. To get a clearer picture of emerging topics, the authors removed the top two keywords from the map, namely “corporate governance” and “board characteristics”, due to their extremely frequent co-occurrence (3542 cases for corporate governance and 2039 cases for board characteristics). The keyword co-occurrence map visualizes two things: (1) frequently occurring keywords, based on their prevalence, and (2) how the popularity of keywords changes across specific periods of time [37]. Figure 7 shows the most frequently co-occurring keywords throughout the past decades of BDCG research.

Figure 7.

Temporal overlay on a keyword co-occurrence map for the BDCG knowledge base published from 1996–2018 (threshold 30 co-occurrences, display 113 keywords).

The emerging research areas in the BDCG knowledge base in the past few years are displayed with light green and yellow colors in Figure 7. Ranked by recency and frequency, the research areas that have drawn significant attention in the last few years are gender (205 cases), corporate social responsibility or CSR (160 cases), diversity (71 cases), financial crisis (67 cases), sustainability (50 cases), and innovation (43 cases). This result suggests the current research directions and recent topics of interest among global scholars on BDCG.

Gender diversity at the board level has been studied for some time [57,106,107], but the empirical evidence about its effect on firm value is still mixed and inconclusive according to Kim and Starks [108]. Furthermore, women today are still greatly underrepresented on corporate boards, especially compared to their overall workforce participation rate [108], which has stimulated an academic debate about whether governments should implement boardroom gender policies [109].

An important emerging topic is how boards and corporate governance in general influence corporate social responsibility [110,111], and in turn how CSR affects firm performance [112,113]. Furthermore, the effects of the new practice of linking executive compensation to CSR performance has recently been analyzed [114,115]. Moreover, the effect of corporate governance on firm sustainability has received relatively little attention in past studies and is clearly an emerging topic [1,116,117,118].

Recent studies have also investigated how corporate governance affects innovation, both empirically [119] and using new theoretical models [120]. Finally, any new empirical study linking corporate governance mechanisms to relevant outcome variables such as innovation, sustainability, or firm performance should be concerned about potential reverse causality effects and endogeneity problems [121,122]. We note that the keyword “endogeneity” shows up directly next to “firm value” in Figure 7. For example, a widely cited recent study by Wintoki, Linck, and Netter [123] finds no causal relation between board structure and firm performance, when using a dynamic panel generalized method of moments (GMM) estimator to deal with endogeneity problems.

4. Limitations

The purpose of this research review was to empirically document the volume, growth trajectory, geographical distribution, and intellectual structure of the BDCG knowledge base. Using data drawn from the Scopus citation database, the authors analyzed 6302 journal articles published between 1996 and 2018. Our analyses included a combination of topographical and bibliometric review methods.

One limitation of the review is that, although the Scopus database covers the majority of peer-reviewed journals in economics and social science since 1996, it may omit some relevant research on the topic. This limitation was partially alleviated through our use of co-citation analysis, which extends far beyond the research available in the Scopus database, as demonstrated by our results.

Another limitation is that our bibliometric approach does not analyze the substantive findings of the articles. Keeping this in mind, our review was designed to enable future research that synthesizes the findings from key BDCG studies identified in this bibliometric review.

5. Conclusions

This bibliometric review reveals that the BDCG knowledge base has grown exponentially from the first year of our search in 1996, into a large body of 6302 journal articles in 2018. Moreover, as indicated by the co-citation analyses, the full literature stretches well beyond the papers analyzed in this review. These findings affirm that concerns for corporate sustainability have driven scholars to embrace research on the role of boards of directors in corporate governance as a legitimate topic of study in the domains of management, economics, finance, and accounting.

Our analysis of the geographical distribution of the BDCG knowledge base found that the majority of articles were authored in Anglo-Saxon countries. In response to various corporate scandals, these were among the first nations to adopt codes of good corporate governance (e.g., United States, Canada, United Kingdom, and Australia). At the same time, however, our citation analysis uncovered a global literature comprised of articles authored in 105 different countries. Thus, numerous developing and non-Western societies (e.g., Malaysia, China, India, Taiwan, Hong Kong) have also made significant contributions to this literature, a trend we expect to continue and strengthen in the coming decade.

The journal citation analysis and document co-citation analysis together clearly demonstrate the multi-disciplinary nature of the BDCG knowledge base. Our database included key journals from disciplines such as finance and economics, accounting and auditing, and management and strategy. Our journal analyses highlighted the most active and influential journals publishing BDCG research. The review identified two influential journals that specifically target corporate governance and business ethics issues, namely Corporate Governance: An International Review and the Journal of Business Ethics. Notably, these journals occupied central positions in this multi-disciplinary field. However, remarkably, the most influential articles in the knowledge base were all published in top field journals such as the Journal of Financial Economics, Strategic Management Journal, and the Journal of Accounting and Economics. The Journal of Financial Economics clearly leads the field in terms of citations and the number of influential articles. These results suggest potential publishing venues for scholars in this research area.

Our findings also demonstrate that the role of boards of directors in corporate governance is a key topic across several different business and management disciplines. A compelling reason is that corporate governance practices can significantly influence many aspects of a business, such as financial performance, earnings management, accounting fraud, executive compensation, strategy, leadership, diversity, and corporate social responsibility. Taken together, these features of corporate governance and practice lay the foundations for firm sustainability.

Another relevant feature of science mapping lies in the ability to identify “canonical documents” that have made significant, long-lasting contributions to the literature. Analysis of their contributions can point towards the origins of the field and unpack its theoretical foundations. Our co-citation analysis revealed the seminal works of Berle and Means [124], Jensen and Meckling [40], Fama [41], and Fama and Jensen [64,74] on agency theory and the theory of the modern firm as theoretical foundation stones of the BDCG knowledge base. Original contributions by Andrei Shleifer and Robert Vishny (and their collaborators) on law and finance [84] and ownership concentration [3] have also provided another foundation stone in the intellectual structure of the BDCG knowledge base. Notably, co-citation analysis identified these older articles through their frequent co-citation on the reference lists of documents located in our review database.

In terms of influential scholars, our analyses highlighted the contributions of David Yermack, April Klein, Catherine Dalton (Daily), Dan Dalton, Michael Weisbach, Jonathan Johnson, Alan Ellstrand, and John Core. Their key works focus on the connection between board composition and firm performance, earnings management, accounting fraud, CEO compensation, as well as examining the complex relationship between the CEO and the board. In addition, several of these authors have contributed key review articles to the BDCG literature [5,22,23,24].

Another significant contribution of bibliometric methods lies in the ability to identify distinct sub-fields and themes within a knowledge base. Our journal co-citation analysis revealed that the BDCG knowledge base is composed of several identifiable clusters of journals, each with a distinct focus within the literature. The journal clusters are Finance & Economics, Management & Strategy, and Accounting & Auditing. In addition, the author co-citation analysis revealed three distinctive schools of thought, which are coherent with the three journal clusters, namely the Finance & Economics school of thought, the Management & Strategy school, and the Law & Accounting school of thought. The three distinctive clusters and their influential representative authors provide clear guidance for scholars conducting corporate governance research aiming to explore and connect different areas within this multi-disciplinary field. New scholars in this area will also be easily able to identify the theoretical foundations of the field. Previous review articles, such as [22] and [23], provided a synthesis of the articles within one or two particular sub-fields, whereas our bibliometric review was able to show the connections between these fields.

Moreover, the geographical distribution of literature suggests that there is still potential for more research on corporate governance in emerging economies, where the total volume of BDCG research is relatively low, but the growth trajectory is remarkable. Emerging economies are different from developed countries due to their relatively weak legal protection and enforcement [54,84,85], while concentrated ownership is prevailing [3,4]. Scholars could further test the effectiveness of the Anglo-Saxon and the Continental European styles of corporate governance in these emerging economies.

Our keyword co-occurrence analysis highlights a number of emerging topics in BDCG research that have been gaining interest in the last few years: among the most prominent are diversity, gender and corporate social responsibility (CSR), as well as the effect of governance on innovation. Finally, we would like to suggest another possible avenue for future research in the field of corporate governance and boards of directors. Although corporate and environmental sustainability is clearly dependent on good governance practices and adequate leadership by the board of directors, there is a dearth of articles on this topic within the knowledge base. Although some past contributions [1,2,125,126] and recent articles [127,128,129] on the roles of boards of directors in enabling sustainability are available, works on sustainability represent only a tiny fraction of the articles in the knowledge base, leaving ample room for further research on this important topic.

Author Contributions

C.Z. and R.K. together conceptualized the study. C.Z. gathered the document database and analyzed the data. C.Z. prepared the original draft. R.K. rewrote the article and supervised the project.

Funding

This research was funded by a grant from the Thailand Sustainable Development Foundation, Bangkok, Thailand.

Acknowledgments

Special thanks to Philip Hallinger for all his guidance and encouragement during the project. We would like to thank three anonymous reviewers for their comments and suggestions.

Conflicts of Interest

There were no conflicts of interest among the authors.

References

- Aras, G.; Crowther, D. Governance and sustainability: An investigation into the relationship between corporate governance and corporate sustainability. Manag. Decis. 2008, 46, 433–448. [Google Scholar] [CrossRef]

- Elkington, J. Governance for sustainability. Corp. Gov. Int. Rev. 2006, 14, 522–529. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. Corporate ownership around the world. J. Financ. 1999, 54, 471–517. [Google Scholar] [CrossRef]

- Claessens, S.; Djankov, S.; Lang, L.H. The separation of ownership and control in East Asian corporations. J. Financ. Econ. 2000, 58, 81–112. [Google Scholar] [CrossRef]

- Johnson, J.L.; Daily, C.M.; Ellstrand, A.E. Boards of directors: A review and research agenda. J. Manag. 1996, 22, 409–438. [Google Scholar] [CrossRef]

- Elson, C.M. Director Compensation and the Management-Captured Board—The History of a Symptom and a Cure. SMU Law Rev. 1997, 50, 127. [Google Scholar]

- Bhagat, S.; Bolton, B. Corporate governance and firm performance. J. Corp. Financ. 2008, 14, 257–273. [Google Scholar] [CrossRef]

- Core, J.E.; Holthausen, R.W.; Larcker, D.F. Corporate governance, chief executive officer compensation, and firm performance. J. Financ. Econ. 1999, 51, 371–406. [Google Scholar] [CrossRef]

- Eng, L.L.; Mak, Y.T. Corporate governance and voluntary disclosure. J. Account. Public Policy 2003, 22, 325–345. [Google Scholar] [CrossRef]

- Forker, J.J. Corporate governance and disclosure quality. Account. Bus. Res. 1992, 22, 111–124. [Google Scholar] [CrossRef]

- Cornett, M.M.; Marcus, A.J.; Tehranian, H. Corporate governance and pay-for-performance: The impact of earnings management. J. Financ. Econ. 2008, 87, 357–373. [Google Scholar] [CrossRef]

- Xie, B.; Davidson, W.N., III; DaDalt, P. Earnings management and corporate governance: The role of the board and the audit committee. J. Corp. Financ. 2003, 9, 295–316. [Google Scholar] [CrossRef]

- Campbell, J.L. Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Freeman, R.E.; Evan, W.M. Corporate governance: A stakeholder interpretation. J. Behav. Econ. 1990, 19, 337–359. [Google Scholar] [CrossRef]

- Freeman, R.E.; Reed, D.L. Stockholders and stakeholders: A new perspective on corporate governance. Calif. Manag. Rev. 1983, 25, 88–106. [Google Scholar] [CrossRef]

- Armstrong, C.S.; Ittner, C.D.; Larcker, D.F. Corporate governance, compensation consultants, and CEO pay levels. Rev. Account. Stud. 2012, 17, 322–351. [Google Scholar] [CrossRef]

- Conyon, M.J.; He, L. Executive compensation and corporate governance in China. J. Corp. Financ. 2011, 17, 1158–1175. [Google Scholar] [CrossRef]

- Boyack, K.W.; Klavans, R. Co-citation analysis, bibliographic coupling, and direct citation: Which citation approach represents the research front most accurately? J. Am. Soc. Inf. Sci. Technol. 2010, 61, 2389–2404. [Google Scholar] [CrossRef]

- Gmür, M. Co-citation analysis and the search for invisible colleges: A methodological evaluation. Scientometrics 2003, 57, 27–57. [Google Scholar] [CrossRef]

- McCain, K.W. Mapping authors in intellectual space: A technical overview. J. Am. Soc. Inf. Sci. 1990, 41, 433–443. [Google Scholar] [CrossRef]

- Durisin, B.; Puzone, F. Maturation of corporate governance research, 1993–2007: An assessment. Corp. Gov. Int. Rev. 2009, 17, 266–291. [Google Scholar] [CrossRef]

- Adams, R.B.; Hermalin, B.E.; Weisbach, M.S. The role of boards of directors in corporate governance: A conceptual framework and survey. J. Econ. Lit. 2010, 48, 58–107. [Google Scholar] [CrossRef]

- Daily, C.M.; Dalton, D.R.; Cannella, A.A., Jr. Corporate governance: Decades of dialogue and data. Acad. Manag. Rev. 2003, 28, 371–382. [Google Scholar] [CrossRef]

- Dalton, D.R.; Daily, C.M.; Ellstrand, A.E.; Johnson, J.L. Meta-analytic reviews of board composition, leadership structure, and financial performance. Strateg. Manag. J. 1998, 19, 269–290. [Google Scholar] [CrossRef]

- Dalton, D.R.; Daily, C.M.; Johnson, J.L.; Ellstrand, A.E. Number of directors and financial performance: A meta-analysis. Acad. Manag. J. 1999, 42, 674–686. [Google Scholar]

- Shleifer, A.; Vishny, R.W. A survey of corporate governance. J. Financ. 1997, 52, 737–783. [Google Scholar] [CrossRef]

- Nerur, S.P.; Rasheed, A.A.; Natarajan, V. The intellectual structure of the strategic management field: An author co-citation analysis. Strateg. Manag. J. 2008, 29, 319–336. [Google Scholar] [CrossRef]

- Nerur, S.; Rasheed, A.A.; Pandey, A. Citation footprints on the sands of time: An analysis of idea migrations in strategic management. Strateg. Manag. J. 2016, 37, 1065–1084. [Google Scholar] [CrossRef]

- Ferreira, M.P.; Santos, J.C.; de Almeida, M.I.R.; Reis, N.R. Mergers & acquisitions research: A bibliometric study of top strategy and international business journals, 1980–2010. J. Bus. Res. 2014, 67, 2550–2558. [Google Scholar]

- Ribière, V.; Walter, C. 10 years of KM theory and practices. Knowl. Manag. Res. Pract. 2013, 11, 4–9. [Google Scholar] [CrossRef]

- Merigó, J.M.; Yang, J.B. Accounting research: A bibliometric analysis. Aust. Account. Rev. 2017, 27, 71–100. [Google Scholar] [CrossRef]

- Vieira, E.S.; Gomes, J.A. A comparison of Scopus and Web of Science for a typical university. Scientometrics 2009, 81, 587. [Google Scholar] [CrossRef]

- Mongeon, P.; Paul-Hus, A. The journal coverage of Web of Science and Scopus: A comparative analysis. Scientometrics 2016, 106, 213–228. [Google Scholar] [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. Int. J. Surg. 2010, 8, 336–341. [Google Scholar] [CrossRef] [PubMed]

- Adams, R.B.; Ferreira, D. A theory of friendly boards. J. Financ. 2007, 62, 217–250. [Google Scholar] [CrossRef]

- Harzing, A.-W.; Alakangas, S. Google Scholar, Scopus and the Web of Science: A longitudinal and cross-disciplinary comparison. Scientometrics 2016, 106, 787–804. [Google Scholar] [CrossRef]

- Zupic, I.; Čater, T. Bibliometric methods in management and organization. Organ. Res. Methods 2015, 18, 429–472. [Google Scholar] [CrossRef]

- White, H.D.; McCain, K.W. Visualizing a discipline: An author co-citation analysis of information science, 1972–1995. J. Am. Soc. Inf. Sci. 1998, 49, 327–355. [Google Scholar]

- Small, H. Co-citation in the scientific literature: A new measure of the relationship between two documents. J. Am. Soc. Inf. Sci. 1973, 24, 265–269. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Fama, E.F. Agency problems and the theory of the firm. J. Political Econ. 1980, 88, 288–307. [Google Scholar] [CrossRef]

- Beasley, M.S. An empirical analysis of the relation between the board of director composition and financial statement fraud. Account. Rev. 1996, 71, 443–465. [Google Scholar]

- Hillman, A.J.; Dalziel, T. Boards of directors and firm performance: Integrating agency and resource dependence perspectives. Acad. Manag. Rev. 2003, 28, 383–396. [Google Scholar] [CrossRef]

- Hallinger, P.; Suriyankietkaew, S. Science Mapping of the Knowledge Base on Sustainable Leadership, 1990–2018. Sustainability 2018, 10, 4846. [Google Scholar] [CrossRef]

- Culnan, M. The intellectual development of management information systems, 1972–1982: A co-citation analysis. Manag. Sci. 1986, 32, 156–172. [Google Scholar] [CrossRef]

- Culnan, M. Mapping the intellectual structure of MIS, 1980–1985: A co-citation analysis. MIS Q. 1987, 11, 341–353. [Google Scholar] [CrossRef]

- McCain, K.W. Mapping economics through the journal literature: An experiment in journal cocitation analysis. J. Am. Soc. Inf. Sci. 1991, 42, 290–296. [Google Scholar] [CrossRef]

- Ross, S.A. The economic theory of agency: The principal’s problem. Am. Econ. Rev. 1973, 63, 134–139. [Google Scholar]

- De Jager, P.; De Kock, F.; Van der Spuy, P. Do not feed the predators. S. Afr. J. Bus. Manag. 2017, 48, 35–45. [Google Scholar] [CrossRef][Green Version]

- Yermack, D. Higher market valuation of companies with a small board of directors. J. Financ. Econ. 1996, 40, 185–211. [Google Scholar] [CrossRef]

- Klein, A. Audit committee, board of director characteristics, and earnings management. J. Account. Econ. 2002, 33, 375–400. [Google Scholar] [CrossRef]

- Dechow, P.M.; Sloan, R.G.; Sweeney, A.P. Causes and consequences of earnings manipulation: An analysis of firms subject to enforcement actions by the SEC. Contemp. Account. Res. 1996, 13, 1–36. [Google Scholar] [CrossRef]

- Agrawal, A.; Knoeber, C.R. Firm performance and mechanisms to control agency problems between managers and shareholders. J. Financ. Quant. Anal. 1996, 31, 377–397. [Google Scholar] [CrossRef]

- Djankov, S.; La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. The law and economics of self-dealing. J. Financ. Econ. 2008, 88, 430–465. [Google Scholar] [CrossRef]

- Bebchuk, L.; Cohen, A.; Ferrell, A. What matters in corporate governance? Rev. Financ. Stud. 2008, 22, 783–827. [Google Scholar] [CrossRef]

- Hermalin, B.E.; Weisbach, M.S. Endogenously chosen boards of directors and their monitoring of the CEO. Am. Econ. Rev. 1998, 88, 96–118. [Google Scholar]

- Adams, R.B.; Ferreira, D. Women in the boardroom and their impact on governance and performance. J. Financ. Econ. 2009, 94, 291–309. [Google Scholar] [CrossRef]

- Coles, J.L.; Daniel, N.D.; Naveen, L. Boards: Does one size fit all? J. Financ. Econ. 2008, 87, 329–356. [Google Scholar] [CrossRef]

- Forbes, D.P.; Milliken, F.J. Cognition and corporate governance: Understanding boards of directors as strategic decision-making groups. Acad. Manag. Rev. 1999, 24, 489–505. [Google Scholar] [CrossRef]

- Carter, D.A.; Simkins, B.J.; Simpson, W.G. Corporate governance, board diversity, and firm value. Financ. Rev. 2003, 38, 33–53. [Google Scholar] [CrossRef]

- Eisenberg, T.; Sundgren, S.; Wells, M.T. Larger board size and decreasing firm value in small firms. J. Financ. Econ. 1998, 48, 35–54. [Google Scholar] [CrossRef]

- Fan, J.P.; Wong, T.J.; Zhang, T. Politically connected CEOs, corporate governance, and Post-IPO performance of China’s newly partially privatized firms. J. Financ. Econ. 2007, 84, 330–357. [Google Scholar] [CrossRef]

- Mizruchi, M.S. What do interlocks do? An analysis, critique, and assessment of research on interlocking directorates. Annu. Rev. Sociol. 1996, 22, 271–298. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Separation of ownership and control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Morck, R.; Shleifer, A.; Vishny, R.W. Management ownership and market valuation: An empirical analysis. J. Financ. Econ. 1988, 20, 293–315. [Google Scholar] [CrossRef]

- Jensen, M.C. The modern industrial revolution, exit, and the failure of internal control systems. J. Financ. 1993, 48, 831–880. [Google Scholar] [CrossRef]

- Weisbach, M.S. Outside directors and CEO turnover. J. Financ. Econ. 1988, 20, 431–460. [Google Scholar] [CrossRef]

- Lipton, M.; Lorsch, J.W. A modest proposal for improved corporate governance. Bus. Lawyer 1992, 48, 59–77. [Google Scholar]

- Gompers, P.; Ishii, J.; Metrick, A. Corporate governance and equity prices. Q. J. Econ. 2003, 118, 107–156. [Google Scholar] [CrossRef]

- Demsetz, H.; Lehn, K. The structure of corporate ownership: Causes and consequences. J. Political Econ. 1985, 93, 1155–1177. [Google Scholar] [CrossRef]

- Vafeas, N. Board meeting frequency and firm performance. J. Financ. Econ. 1999, 53, 113–142. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Agency theory: An assessment and review. Acad. Manag. Rev. 1989, 14, 57–74. [Google Scholar] [CrossRef]

- Börner, K.; Chen, C.; Boyack, K.W. Visualizing knowledge domains. Annu. Rev. Inf. Sci. Technol. 2003, 37, 179–255. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Agency problems and residual claims. J. Law Econ. 1983, 26, 327–349. [Google Scholar] [CrossRef]

- Hermalin, B.E.; Weisbach, M.S. The effects of board composition and direct incentives on firm performance. Financ. Manag. 1991, 20, 101–112. [Google Scholar] [CrossRef]

- Hermalin, B.E.; Weisbach, M.S. Boards of directors as an endogenously determined institution: A survey of the economic literature. Econ. Policy Rev. 2003, 9, 7–26. [Google Scholar]

- Bhagat, S.; Black, B. The Non-Correlation between Board Independence and Long-Term Firm Performance. J. Corp. Law 2002, 27, 231. [Google Scholar] [CrossRef]

- Core, J.; Guay, W. The use of equity grants to manage optimal equity incentive levels. J. Account. Econ. 1999, 28, 151–184. [Google Scholar] [CrossRef]

- Core, J.E.; Guay, W.R.; Larcker, D.F. Executive equity compensation and incentives: A survey. Econ. Policy Rev. 2003, 9, 27–50. [Google Scholar]

- Adams, R.B.; Almeida, H.; Ferreira, D. Powerful CEOs and their impact on corporate performance. Rev. Financ. Stud. 2005, 18, 1403–1432. [Google Scholar] [CrossRef]

- Adams, R.; Almeida, H.; Ferreira, D. Understanding the relationship between founder–CEOs and firm performance. J. Empir. Financ. 2009, 16, 136–150. [Google Scholar] [CrossRef]

- Coles, J.L.; Daniel, N.D.; Naveen, L. Co-opted boards. Rev. Financ. Stud. 2014, 27, 1751–1796. [Google Scholar] [CrossRef]

- Brickley, J.A.; Coles, J.L.; Terry, R.L. Outside directors and the adoption of poison pills. J. Financ. Econ. 1994, 35, 371–390. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R.W. Law and Finance. J. Political Econ. 1998, 106, 1113–1155. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R.W. Legal determinants of external finance. J. Financ. 1997, 52, 1131–1150. [Google Scholar] [CrossRef]

- Baysinger, B.D.; Kosnik, R.D.; Turk, T.A. Effects of board and ownership structure on corporate R&D strategy. Acad. Manag. J. 1991, 34, 205–214. [Google Scholar]

- Rechner, P.L.; Dalton, D.R. CEO duality and organizational performance: A longitudinal analysis. Strateg. Manag. J. 1991, 12, 155–160. [Google Scholar] [CrossRef]

- Daily, C.M.; Johnson, J.L.; Ellstrand, A.E.; Dalton, D.R. Compensation committee composition as a determinant of CEO compensation. Acad. Manag. J. 1998, 41, 209–220. [Google Scholar]

- Westphal, J.D. Collaboration in the boardroom: Behavioral and performance consequences of CEO-board social ties. Acad. Manag. J. 1999, 42, 7–24. [Google Scholar]

- Hambrick, D.C.; Mason, P.A. Upper echelons: The organization as a reflection of its top managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Finkelstein, S.; Hambrick, D.C. Top-management-team tenure and organizational outcomes: The moderating role of managerial discretion. Adm. Sci. Q. 1990, 35, 484–503. [Google Scholar] [CrossRef]

- Westphal, J.D.; Zajac, E.J. Who shall govern? CEO/board power, demographic similarity, and new director selection. Adm. Sci. Q. 1995, 40, 60. [Google Scholar] [CrossRef]

- Westphal, J.D.; Zajac, E.J. The Symbolic Management of Stockholders: Corporate Governance Reforms and Shareholder Reactions. Adm. Sci. Q. 1998, 43, 127–153. [Google Scholar] [CrossRef]

- Zahra, S.A.; Pearce, J.A. Boards of directors and corporate financial performance: A review and integrative model. J. Manag. 1989, 15, 291–334. [Google Scholar] [CrossRef]

- Pearce, J.A.; Zahra, S.A. Board composition from a strategic contingency perspective. J. Manag. Stud. 1992, 29, 411–438. [Google Scholar] [CrossRef]

- Huse, M. Boards, Governance and Value Creation: The Human Side of Corporate Governance; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Pfeffer, J.; Salancik, G.R. The External Control of Organizations: A Resource Dependency Perspective; Harper and Row: New York, NY, USA, 1978. [Google Scholar]

- Hillman, A.J.; Cannella, A.A.; Paetzold, R.L. The resource dependence role of corporate directors: Strategic adaptation of board composition in response to environmental change. J. Manag. Stud. 2000, 37, 235–256. [Google Scholar] [CrossRef]

- Hillman, A.J. Politicians on the board of directors: Do connections affect the bottom line? J. Manag. 2005, 31, 464–481. [Google Scholar] [CrossRef]

- Zahra, S.A. Governance, ownership, and corporate entrepreneurship: The moderating impact of industry technological opportunities. Acad. Manag. J. 1996, 39, 1713–1735. [Google Scholar]

- Zahra, S.A.; Neubaum, D.O.; Huse, M. Entrepreneurship in medium-size companies: Exploring the effects of ownership and governance systems. J. Manag. 2000, 26, 947–976. [Google Scholar] [CrossRef]

- Daily, C.M.; Dalton, D.R. The relationship between governance structure and corporate performance in entrepreneurial firms. J. Bus. Ventur. 1992, 7, 375–386. [Google Scholar] [CrossRef]

- Callon, M.; Courtial, J.P.; Laville, F. Co-word analysis as a tool for describing the network of interactions between basic and technological research: The case of polymer chemsitry. Scientometrics 1991, 22, 155–205. [Google Scholar] [CrossRef]

- Cambrosio, A.; Limoges, C.; Courtial, J.; Laville, F. Historical scientometrics? Mapping over 70 years of biological safety research with coword analysis. Scientometrics 1993, 27, 119–143. [Google Scholar] [CrossRef]

- Bhattacharya, S.; Basu, P.K. Mapping a research area at the micro level using co-word analysis. Scientometrics 1998, 43, 359–372. [Google Scholar] [CrossRef]

- Campbell, K.; Mínguez-Vera, A. Gender diversity in the boardroom and firm financial performance. J. Bus. Ethics 2008, 83, 435–451. [Google Scholar] [CrossRef]

- Francoeur, C.; Labelle, R.; Sinclair-Desgagné, B. Gender diversity in corporate governance and top management. J. Bus. Ethics 2008, 81, 83–95. [Google Scholar] [CrossRef]

- Kim, D.; Starks, L.T. Gender diversity on corporate boards: Do women contribute unique skills? Am. Econ. Rev. 2016, 106, 267–271. [Google Scholar] [CrossRef]

- Adams, R.B. Women on boards: The superheroes of tomorrow? Leadersh. Q. 2016, 27, 371–386. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. The causal effect of corporate governance on corporate social responsibility. J. Bus. Ethics 2012, 106, 53–72. [Google Scholar] [CrossRef]

- Chan, M.C.; Watson, J.; Woodliff, D. Corporate governance quality and CSR disclosures. J. Bus. Ethics 2014, 125, 59–73. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. Corporate governance and firm value: The impact of corporate social responsibility. J. Bus. Ethics 2011, 103, 351–383. [Google Scholar] [CrossRef]

- Arora, P.; Dharwadkar, R. Corporate governance and corporate social responsibility (CSR): The moderating roles of attainment discrepancy and organization slack. Corp. Gov. Int. Rev. 2011, 19, 136–152. [Google Scholar] [CrossRef]

- Hong, B.; Li, Z.; Minor, D. Corporate governance and executive compensation for corporate social responsibility. J. Bus. Ethics 2016, 136, 199–213. [Google Scholar] [CrossRef]

- Ikram, A.; Li, Z.F.; Minor, D. CSR-contingent executive compensation contracts. J. Bank. Financ. 2019. forthcoming. [Google Scholar] [CrossRef]

- Kolk, A. Sustainability, accountability and corporate governance: Exploring multinationals’ reporting practices. Bus. Strategy Environ. 2008, 17, 1–15. [Google Scholar] [CrossRef]

- Michelon, G.; Parbonetti, A. The effect of corporate governance on sustainability disclosure. J. Manag. Gov. 2012, 16, 477–509. [Google Scholar] [CrossRef]

- Hussain, N.; Rigoni, U.; Orij, R.P. Corporate governance and sustainability performance: Analysis of triple bottom line performance. J. Bus. Ethics 2018, 149, 411–432. [Google Scholar] [CrossRef]

- O’Connor, M.; Rafferty, M. Corporate governance and innovation. J. Financ. Quant. Anal. 2012, 47, 397–413. [Google Scholar] [CrossRef]

- Sapra, H.; Subramanian, A.; Subramanian, K.V. Corporate governance and innovation: Theory and evidence. J. Financ. Quant. Anal. 2014, 49, 957–1003. [Google Scholar] [CrossRef]

- Roberts, M.R.; Whited, T.M. Endogeneity in empirical corporate finance. In Handbook of the Economics of Finance; Elsevier: Amsterdam, The Netherlands, 2013; Volume 2, pp. 493–572. [Google Scholar]

- Li, F. Endogeneity in CEO power: A survey and experiment. Investig. Anal. J. 2016, 45, 149–162. [Google Scholar] [CrossRef]

- Wintoki, M.B.; Linck, J.S.; Netter, J.M. Endogeneity and the dynamics of internal corporate governance. J. Financ. Econ. 2012, 105, 581–606. [Google Scholar] [CrossRef]

- Berle, A.; Means, G. Private Property and the Modern Corporation; Macmillan: New York, NY, USA, 1932. [Google Scholar]

- Ricart, J.E.; Rodríguez, M.A.; Sánchez, P. Sustainability in the boardroom: An empirical examination of Dow Jones Sustainability World Index leaders. Corp. Gov. Int. J. Bus. Soc. 2005, 5, 24–41. [Google Scholar] [CrossRef]

- Cartwright, W.; Craig, J.L. Sustainability: Aligning corporate governance, strategy and operations with the planet. Bus. Process Manag. J. 2006, 12, 741–750. [Google Scholar] [CrossRef]

- Klettner, A.; Clarke, T.; Boersma, M. The governance of corporate sustainability: Empirical insights into the development, leadership and implementation of responsible business strategy. J. Bus. Ethics 2014, 122, 145–165. [Google Scholar] [CrossRef]

- Shrivastava, P.; Addas, A. The impact of corporate governance on sustainability performance. J. Sustain. Financ. Investig. 2014, 4, 21–37. [Google Scholar] [CrossRef]

- Salvioni, D.; Gennari, F.; Bosetti, L. Sustainability and convergence: The future of corporate governance systems? Sustainability 2016, 8, 1203. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).