Abstract

This study evaluates whether an AI-built DeFi website case can match professionally developed DeFi platforms in digital marketing performance, innovation-related strategic behavior, and entrepreneurial impact. Using a multi-method design, we compare five established DeFi websites (Aave, Lido, Curve, MakerDAO, Uniswap) against one AI-built interface (Nexus Protocol). The analysis is designed as a five-platform benchmarking study of established professional DeFi websites, complemented by one AI-built case (Nexus Protocol) used as an illustrative comparison rather than a representative class of AI-built interface. The objectives are to (i) test differences in traffic composition and acquisition strategies, (ii) quantify how engagement signals predict authority and branded traffic, (iii) examine cognitive processing and trust-cue attention via eye tracking, and (iv) model emergent engagement and authority dynamics using agent-based simulation (ABM). Web analytics (March–October 2025) show significant variation in traffic composition across professional platforms (ANOVA F = 3.41, p = 0.0205), while regression models indicate that time on site and pages per visit positively predict Authority Score (R2 = 0.61) and Branded Traffic (R2 = 0.55), with bounce rate exerting an adverse effect. PCA and k-means clustering identify three strategic archetypes (innovation-driven, balanced-growth, efficiency-focused). Eye-tracking results show that professional interfaces generate tighter fixation clusters and shorter scan paths, indicating higher cognitive efficiency. In contrast, fixation on key UI elements and trust cues is comparable across interface types. ABM outputs further suggest that reduced engagement depth in the AI-built interface yields weaker long-run branded-traffic and authority trajectories. Overall, the study provides an integrated evaluation framework and evidence-based implications for AI-driven interface design in high-trust fintech environments.

1. Introduction

1.1. Digital Marketing Analytics & Acquisition Strategies in DeFi Ecosystems

Decentralized finance (DeFi) platforms rely heavily on digital marketing analytics to attract, convert, and retain users in highly competitive, risk-sensitive markets. Acquisition channels such as direct, organic search, referral traffic, and social media exposure serve as indicators of platform maturity, ecosystem integration, and user trust [1]. Empirical studies show that mature blockchain platforms typically exhibit diversified inbound traffic portfolios, reflecting the interplay between technical robustness, community endorsement, and public credibility [2]. Within competitive digital ecosystems, multi-channel acquisition not only influences visibility but also functions as a strategic asset that shapes entrepreneurial positioning and platform legitimacy [3]. For DeFi platforms, where perceived risk is high, and user onboarding is often complex, diversified traffic sources indicate resilience and innovation-driven strategic behavior [4].

Given these dynamics, traffic composition becomes a powerful proxy for strategic differentiation. Understanding whether AI-built interfaces replicate or deviate from these strategic patterns provides insight into the entrepreneurial viability of AI-built financial platforms.

Following this contextual background, the paper proceeds as follows: Section 2 develops the theoretical underpinnings and hypotheses and the methodology; Section 3 includes the statistical analysis, neuromarketing testing, and ABM simulation. Section 4 discusses their implications for digital entrepreneurship, AI-based interface design, and DeFi performance. Section 5 concludes with theoretical contributions, practical implications, limitations, and directions for future research.

1.2. Engagement Metrics, UX Quality & Digital Authority Formation

User engagement metrics, session duration, pages per visit, and bounce rate serve as fundamental behavioral indicators of perceived credibility and platform trustworthiness. Research consistently demonstrates that deeper engagement reflects stronger cognitive involvement, reduced uncertainty, and increased perceived legitimacy [5]. More extended navigation depth is associated with heightened cognitive fluency, which improves user comprehension and enhances perceived platform expertise, especially in complex financial environments [6,7]. Within digital commerce and fintech ecosystems, engagement metrics are directly associated with authority-building mechanisms, influencing ranking, reputation, and branded revisit intentions [8].

Bounce rate, conversely, has been shown to disrupt trust and brand association pathways by signaling cognitive friction or design inefficiency [9]. In the context of DeFi, where risk perception is inherently high, and users must evaluate credibility rapidly, these metrics provide insights into how interface structure and content quality shape user trust and entrepreneurial visibility. Thus, testing whether an AI-built platform replicates the engagement–authority dynamics of professional platforms becomes essential for evaluating its strategic viability.

Taken together, this body of work establishes that diversified acquisition structures, deeper engagement, and lower bounce rates are reliable behavioral signals of trust, perceived legitimacy, and successful onboarding in DeFi and broader fintech ecosystems [10,11,12,13]. However, these studies primarily focus on professionally engineered or organically evolved platforms; they do not examine whether interfaces generated through automated or AI-driven pipelines can reproduce similar trust and onboarding dynamics. This gap motivates the present study’s focus on comparing professional DeFi websites with an AI-built case in terms of traffic composition, engagement quality, and authority formation.

1.3. Innovation Archetypes & Behavioral Segmentation in Digital Platforms

Digital platforms tend to differentiate into strategic archetypes based on behavioral signatures that emerge from user navigation, traffic variability, and engagement intensity. Platform strategy research shows that behavioral clustering often reveals innovation-driven, efficiency-driven, and balanced-growth archetypes, each reflecting different entrepreneurial logics and resource configurations [14]. PCA and cluster analysis are widely used to identify such hidden structures, particularly in fast-evolving digital ecosystems where traditional performance indicators may not capture underlying behavioral complexity [15].

In the context of DeFi, where innovation cycles are rapid and competition is decentralized, behavioral segmentation provides an essential mechanism for evaluating which platforms exhibit entrepreneurial strengths, user-centric design, and market resilience. By modeling these archetypes, the study evaluates whether AI-built interfaces reproduce the same innovation signals observed in professionally built platforms, thereby informing debates around AI’s capacity to support entrepreneurial competitiveness.

1.4. Neuromarketing, Cognitive Processing & Visual Attention in Fintech Interfaces

Neuromarketing research offers a powerful lens for evaluating cognitive efficiency, visual hierarchy, and trust formation. Eye-tracking studies show that well-structured interfaces produce centralized fixation clusters and shorter scan paths, reflecting reduced cognitive load and more efficient information processing [16]. In financial and DeFi contexts, where users must rapidly evaluate credibility and risk, efficient gaze patterns indicate strong UI architecture and lower cognitive friction.

At the same time, certain UI elements, call-to-action buttons, key metrics, risk disclosures, and audit badges attract robust fixation levels regardless of design quality due to their inherent salience in financial decision-making [17]. Trust cues consistently draw user attention, functioning as stabilizing signals in high-uncertainty environments [18]. Neuroscientific evidence confirms that affective risk cues activate rapid processing mechanisms, shaping perceived trustworthiness and influencing behavioral outcomes [19,20].

This study extends existing research on DeFi marketing, fintech UX, and AI-built interface design by offering a multi-method evaluation of AI-built versus professionally developed DeFi websites. Specifically, it (i) integrates web analytics, neuromarketing evidence, and ABM to connect micro-level cognitive processing with macro-level entrepreneurial performance outcomes; (ii) quantifies the engagement–authority–brand pathway in a high-uncertainty DeFi setting; and (iii) identifies reusable innovation archetypes through PCA and clustering, providing a benchmarking template for platform strategy and interface competitiveness. By explicitly bridging DeFi trust and adoption research with these emerging insights on generative AI interface pipelines, the study positions AI-built DeFi websites within a clearly defined theoretical context rather than treating them as purely technical novelties.

Beyond traditional UX engineering, recent work has explored generative AI pipelines that automatically generate interface layouts, components, and content for web applications [21]. Early studies in HCI and design evaluation suggest that such AI-generated interfaces can approach, but not always match, the usability and trust outcomes of professionally designed systems, especially in complex decision contexts such as finance [12,21]. At the same time, most of this emerging research evaluates generic productivity or content applications rather than high-risk, high-uncertainty domains like DeFi. Consequently, there is limited empirical evidence on how AI-built financial interfaces perform in terms of trust-sensitive behaviors, onboarding efficiency, and entrepreneurial competitiveness compared to established, professionally developed DeFi platforms.

2. Materials and Methods

2.1. Methodological Framework

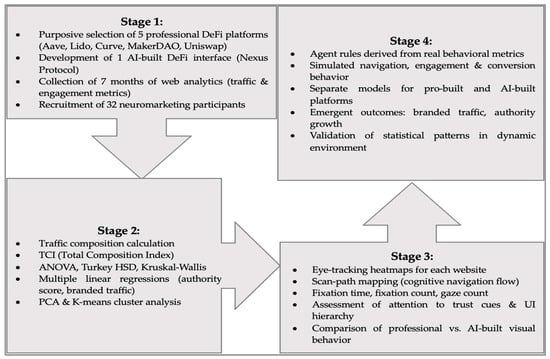

This study adopts a multi-method research design that integrates web analytics, neuromarketing experimentation, and agent-based simulation (ABM) to evaluate the entrepreneurial and innovation-related performance of professionally developed DeFi websites relative to an AI-built alternative. The methodological framework unfolds across four sequential stages, as presented in Figure 1.

Figure 1.

Conceptual Framework.

First, a purposive sampling strategy was used to conduct a benchmarking analysis across five professionally developed DeFi platforms (Aave, Lido, Curve, MakerDAO, Uniswap). In addition, one AI-built website (Nexus Protocol) is included as an illustrative case to explore feasibility and directional differences. Accordingly, inferences regarding “professional platforms” are based on the five-platform benchmark. At the same time, findings for the AI-built condition are interpreted as case-specific and hypothesis-generating rather than generalized to all AI-built DeFi interfaces. The AI-built DeFi interface (Nexus Protocol) was developed through a controlled generative design workflow to represent emerging automated website construction methods, as described in Table A1 and Table A2 in the Appendix A and Appendix B. Web analytics for the professional platforms were collected over seven months (March–October 2025), while the AI-built platform served as the focal point of the neuromarketing stages.

The second stage involved the statistical evaluation of the web analytics dataset. For clarity, the study tests the following hypotheses (the complete theoretical grounding and extended formulation are provided in Section 2.3):

- H1: “Professional DeFi websites differ significantly in their web traffic composition (Direct, Organic, Referral, Social, Email), reflecting differentiated innovation and user-acquisition strategies.”

- H2: “Higher engagement metrics are positively associated with Authority Score, indicating that optimized UX enhances reputational authority and entrepreneurial visibility.”

- H3: “Longer session duration and higher Pages per Visit significantly predict greater branded traffic, implying trust-based conversion behavior.”

- H4: “Differences in traffic variability and engagement metrics represent unique innovation archetypes, forming an entrepreneurial innovation index within DeFi ecosystems.”

- H5: “Professional websites exhibit more centralized fixation clusters and shorter scan paths, indicating optimized information hierarchy and cognitive economy.”

- H6: “Dwell time and fixation count on key UI elements do not differ between the two website types.”

- H7: “There is no difference in attention allocated to trust cues.”

The primary dependent variables in the web-analytics stage are: (i) the Total Composition Index (TCI), which summarizes the diversification of traffic across Direct, Organic Search, Referral, Social, and Email channels; (ii) Authority Score, a composite domain-level indicator of reputational strength and search visibility on a 0–100 scale provided by a third-party web-analytics platform; (iii) Branded Traffic, the estimated monthly volume of visits originating from branded queries that contain the platform’s name; and (iv) engagement metrics including average session duration (in seconds), Pages per Visit, and Bounce Rate (percentage of single-page sessions). Each observation in the dataset corresponds to a platform–month pair, so the web analytics data have a short panel (repeated-measures) structure with five platforms observed over multiple periods.

Traffic channels (Direct, Referral, Organic Search, Social, Email) were normalized to compute the Total Composition Index (TCI) to test hypothesis H1. Inferential analysis included ANOVA with Tukey HSD post hoc comparisons, robustness tests (Shapiro–Wilk, Levene, Kruskal–Wallis), and multiple regression models for H2 and H3 to estimate the predictive role of engagement metrics (session duration, pages per visit, bounce rate) on Authority Score and Branded Traffic. To address H4, principal component analysis (PCA) and k-means clustering were applied to identify innovation-oriented archetypes based on engagement behavior and traffic diversification.

The third stage consisted of a controlled neuromarketing experiment involving an eye-tracking task with a sample of 32 participants familiar with digital platforms and basic cryptocurrency concepts. Using the SeeSo Web Analysis [22] environment, each participant viewed all six interfaces under calibrated conditions and was instructed to explore them as if deciding whether to use the protocol. The tool recorded gaze continuously and provided AOI-level summaries (number of fixations and cumulative dwell time) for predefined functional areas: (i) navigation/header (logo, main menu, wallet/connect controls), (ii) hero/value proposition section, (iii) core DeFi interaction module (e.g., staking, swapping), (iv) trust and risk cues (audits, security statements, documentation), and (v) footer/secondary information. Heatmaps and scan-path visualizations, interpreted together with these AOI summaries, formed the empirical basis for assessing H5–H7 on information hierarchy, cognitive efficiency, and attention to trust-related cues.

The final stage of the framework employed agent-based simulation (ABM) to dynamically model how behavioral parameters extracted from the analytics and neuromarketing stages influence system-level patterns of navigation, authority formation, and branded-traffic accumulation. The ABM incorporated micro-rules derived from empirical metrics, time on site, pages per visit, bounce probability, and reproduced emergent behavioral trajectories for both professional and AI-built environments. The simulation enabled examination of how interface architecture shapes user pathways over time and provided a complementary behavioral perspective that supported hypotheses H1–H4 without interpreting their outcomes. Finally, to help the reproducibility of the ABM model, we document part of the Java code for the simulation in Table A3 of Appendix C.

2.2. Sample Retrieval

The empirical analysis in this study is based on a two-part sample comprising (a) web analytics data collected from five professionally developed DeFi platforms (Aave, Lido, Curve, MakerDAO, and Uniswap) (see Supplementary Materials), and (b) neuromarketing data obtained from a study involving an additional AI-built DeFi website case (Nexus Protocol). The selection of the five professional platforms followed a purposive sampling strategy, targeting well-established protocols with high total value locked (TVL) and stable user communities, ensuring that the captured behavioral patterns represent mature, real-world DeFi ecosystems [23]. Web analytics data were gathered over seven months (March to October 2025) to ensure temporal stability and reduce seasonality. For the neuromarketing component, a convenience sample of 32 participants was recruited, all of whom reported familiarity with digital platforms and a basic understanding of cryptocurrency concepts. Participants were exposed to the six interfaces via the web platform SeeSo Web Analysis [22], and their gaze behavior was captured using calibrated eye-tracking instrumentation. This dual-sample approach allowed the study to integrate large-scale behavioral analytics with controlled cognitive-processing measures, providing complementary evidence for the hypotheses under investigation.

2.3. Research Hypotheses

As summarized in Section 2.1, hypotheses H1–H7 guide the empirical analysis; this section provides their theoretical grounding and complete formulation. The development of the research hypotheses is grounded in the contemporary literature on digital marketing analytics, user experience (UX), neuromarketing, and behavior on decentralized finance (DeFi) platforms. Prior studies highlight that traffic composition, engagement depth, cognitive processing patterns, and trust-based interactions are central mechanisms shaping performance outcomes in digital ecosystems. In DeFi environments, where user interactions occur within high-uncertainty, information-dense interfaces, traffic diversity, interface efficiency, and trust cues play critical roles in shaping conversion pathways and authority signals. Building on these theoretical foundations, the following hypotheses were formulated to examine behavioral, cognitive, and structural differences between professionally designed DeFi websites and AI-built ones.

Digital marketing research shows that traffic composition is a reliable indicator of acquisition strategy, platform maturity, and orientation toward innovation. Platforms with a more substantial brand presence typically display diversified acquisition funnels (direct, organic, referral, social) and stable traffic patterns, reflecting greater market legitimacy [24]. Recent academic and industry work on DeFi and blockchain marketing shows that successful projects rely on multi-channel strategies that combine content marketing, social platforms, crypto news sites, and community channels to attract, educate, and retain users [25,26]. In the broader digital-asset context, studies also document how search and social media dynamics strongly shape user attention and behavior around cryptocurrencies [27].

H1.

“Professional DeFi websites differ significantly in their web traffic composition (Direct, Organic, Referral, Social, Email), reflecting differentiated innovation and user-acquisition strategies.”

Engagement metrics such as session duration, navigation depth, and bounce rate have been shown to strongly predict website authority, credibility, and brand strength, as they reflect how users actively interact with and trust digital content [28]. Contemporary UX research further demonstrates that well-structured, cognitively efficient interfaces increase user engagement and reinforce perceptions of legitimacy and competence, particularly in financial and high-stakes digital environments [29]. In DeFi contexts, characterized by elevated uncertainty and information asymmetry, engagement depth acts as a behavioral proxy for trust formation and perceived platform expertise [30]. SEO research also indicates that platform authority rises with stronger engagement signals, as these reflect relevance, transparency, and a user-centred design approach [31].

H2.

“Higher engagement metrics are positively associated with Authority Score, indicating that optimized UX enhances reputational authority and entrepreneurial visibility.”

Behavioral analytics research increasingly shows that trust-driven engagement behaviors play a central role in shaping return visits and direct navigation patterns, particularly when users develop confidence and familiarity with a digital platform [32]. Longer engagement sessions also enhance cognitive fluency and reduce uncertainty during online interactions, increasing the likelihood of brand recall and repeated direct access [33]. In financial and high-risk digital environments, sustained exposure to platform content and interface structures supports users’ confidence in decision-making. It strengthens return intentions, aligning with findings from broader research on digital platforms and engagement, as well as enterprise performance [34]. Furthermore, recent evidence from digital service environments confirms that deeper interaction with platform elements, such as extended navigation or repeated viewing, positively influences behavioral intentions and recognition-based responses that translate into branded search or direct revisits [35].

H3.

“Longer session duration and higher Pages per Visit significantly predict greater branded traffic, implying trust-based conversion behavior.”

Recent research in digital strategy demonstrates that user-behavioral patterns and traffic variability play a central role in distinguishing innovation approaches among online platforms. Cluster-based analyses increasingly reveal that digital ecosystems tend to form distinct strategic archetypes, such as innovation-driven, efficiency-driven, or agility-oriented organizations, based on behavioral signatures captured through engagement metrics, navigational depth, and interaction patterns [36]. Similarly, work on digital transformation has shown that archetype identification helps explain how platforms differ in terms of their structural choices, user experience design, and value-creation logic [37]. These insights support the analytical reasoning for classifying DeFi platforms by patterns of traffic diversification, variability in engagement, and authority-building dynamics, which reflect underlying differences in innovation orientation and competitive positioning within decentralized digital ecosystems.

H4.

“Differences in traffic variability and engagement metrics represent unique innovation archetypes, forming an entrepreneurial innovation index within DeFi ecosystems.”

Eye-tracking research increasingly shows that professionally structured and visually coherent digital interfaces tend to produce more centralized fixation clusters and shorter scan paths, reflecting reduced exploration effort and clearer visual hierarchy. Recent methodological work demonstrates that efficient interface layouts guide users’ attention more predictably, generating concentrated heatmap patterns and lowering the cognitive complexity of the viewing process [38]. Experimental findings further indicate that the order of the interface layout and structural clarity directly influence fixation distribution, with simplified, well-organized designs yielding shorter gaze trajectories and faster attentional convergence [39]. Studies examining online usability also highlight that visually optimized environments reduce cognitive load and support more effective navigation behavior, often reflected in more stable fixation sequences and improved task orientation [40]. These mechanisms align with neuromarketing perspectives on the visual economy, in which shorter gaze paths and reduced dispersion signify more efficient information architecture and more intuitive user interaction [33].

H5.

“Professional websites exhibit more centralized fixation clusters and shorter scan paths, indicating optimized information hierarchy and cognitive economy.”

Eye-tracking research increasingly shows that core interface regions, such as primary titles, calls to action, key metrics, and central value propositions, attract consistent dwell times and fixation counts regardless of broader design differences. Recent empirical work demonstrates that users anchor their attention on visually and semantically dominant elements due to predictable bottom-up salience and task-driven expectations [41]. Studies evaluating web interface usability similarly report that fixation clusters tend to form around functional or task-relevant nodes, even when overall layout quality varies, indicating that user attention is guided by informational priority rather than full-screen exploration [42]. This pattern is consistent with neuromarketing perspectives on attentional anchoring, in which essential UI regions reliably capture gaze behavior across interfaces of varying complexity [33].

H6.

“Dwell time and fixation count on key UI elements do not differ between the two website types.”

Trust-related interface cues, such as audit seals, security certifications, risk statements, and compliance information, consistently attract user attention in environments characterized by uncertainty or financial risk. Recent eye-tracking research shows that users preferentially fixate on such elements because they serve as signals of credibility and reassurance during decision-making [18]. Experimental studies of high-stakes digital systems further reveal that trust-calibration processes increase attentional load in security-relevant areas, irrespective of layout differences, reflecting the central role of risk reduction in user behavior [43]. Within fintech-oriented interfaces, fixation patterns similarly converge on trust-critical nodes, as users cognitively prioritize elements associated with safety, verification, and platform legitimacy [44]. These results align with neuromarketing findings showing that trust cues evoke automatic visual responses that stabilize attention in uncertain digital decision environments.

H7.

“There is no difference in attention allocated to trust cues.”

3. Results

3.1. Statistical Analysis

This section presents the statistical procedures applied to examine variations in traffic composition, engagement patterns, authority signals, and strategic website groupings among professional DeFi platforms. For the analysis of traffic composition (H1), channel shares were calculated for every observation using normalized proportions across Direct, Referral, Organic Search, Social (organic and paid), and Email traffic. The Direct traffic share, for example, was computed as:

With similar computations made for the rest of the traffic [referral, organic search, social (organic and paid social), email]. Then, the TCI (Total Composition Index) is calculated:

where = share of channel c for observation i, and = overall mean share of that channel across all websites and periods. Subsequent analyses included ANOVA tests, multiple regression models, principal component analysis (PCA), and k-means clustering, each reported in the tables below.

The one-way ANOVA, with TCI as the dependent variable and platform as the factor, indicated differences in traffic composition across the five professional DeFi websites. However, tests of assumptions indicated heteroskedasticity and non-normality, and the corresponding non-parametric Kruskal–Wallis test did not reach significance (H = 3.38, p = 0.496). Accordingly, H1 receives only weak and exploratory support: descriptive patterns point to heterogeneous acquisition strategies, but these differences cannot be treated as statistically robust given the small number of platforms and the violated ANOVA assumptions. Tukey HSD post hoc comparisons identified multiple pairwise differences. The complete test results appear in Table 1.

Table 1.

ANOVA, Turkey HSD for TCI website (H1 test).

The regression model assessing predictors of Authority Score produced R2 = 0.61 (Adj. R2 = 0.57) with F(3,31) = 16.11, p < 0.001. Time on Site, Pages per Visit, and Bounce Rate all entered the model as statistically significant predictors. Coefficients, standard errors, t-values, p-values, and VIF diagnostics are reported in Table 2.

Table 2.

Authority score linear regression model (H2 test).

The regression model predicting Branded Traffic resulted in R2 = 0.55 (Adj. R2 = 0.51), with an overall model significance of F(3,31) = 12.57, p < 0.001. All three engagement metrics—Time on Site, Pages per Visit, and Bounce Rate—were statistically significant contributors. Detailed parameter estimates and multicollinearity diagnostics are shown in Table 3.

Table 3.

Branded traffic linear regression model (H3 test).

Principal component analysis yielded two components that explained a cumulative 67.0% of the total variance. PC1 (43.4%) was associated with engagement and authority metrics, while PC2 (23.6%) captured patterns related to traffic diversification. Variable loadings and component interpretations are summarized in Table 4. Using PCA scores, a k-means model with k = 3 was estimated to identify recurring strategic profiles among the websites. The resulting clusters included three distinct groups characterized by differences in engagement, authority, and traffic composition. Cluster characteristics and dominant website representatives are presented in Table 5.

Table 4.

PCA and Cluster Summary (H4 test).

Table 5.

K-means (k = 3) on PCA scores.

3.2. Neuromarketing Test

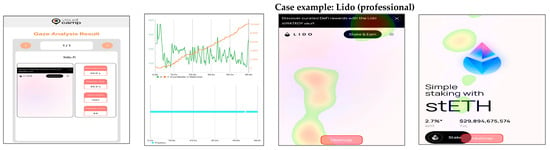

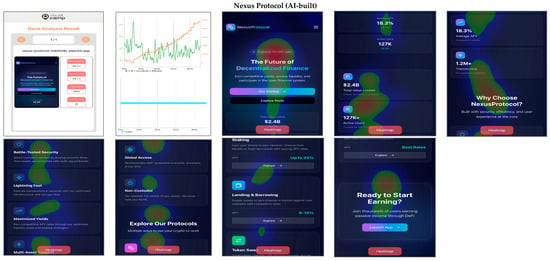

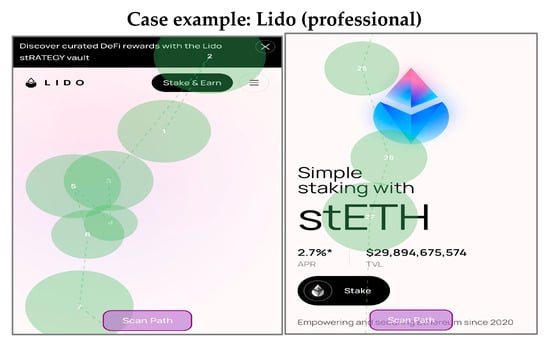

To complement the statistical analysis, a neuromarketing experiment was conducted using eye-tracking to capture visual behavior across the five professional DeFi platforms and the AI-built Nexus Protocol interface. Eye-tracking is widely regarded as an effective method for assessing website usability, cognitive processing efficiency, and attentional distribution [33,45,46]. For each platform, heatmaps and scan-path visualizations were generated to document fixation density, sequence, dwell-time distribution, and gaze transitions, metrics essential for interpreting design structure, interface hierarchy, and user trust formation [47,48]. Figure 2 and Figure 3 present the heatmaps and scan-path diagrams for all six platforms and constitute the basis for examining the behavioral patterns associated with hypotheses H5–H7.

Figure 2.

Heatmaps of professional case example and AI-built DeFi platforms.

Figure 3.

Scan Paths of professional case example and AI-built DeFi platforms.

The heatmaps across the professional platforms (Aave, Lido, Curve, MakerDAO, and Uniswap) show high concentrations of fixation in their primary hero sections, typically centered on key value propositions, metric displays, and actionable elements such as “Connect Wallet,” “Stake,” or “Swap.” These areas exhibit warm color zones, indicating strong attentional pull. Across platforms, fixation density also extends to informational blocks containing APY values, total value locked (TVL), and security-related statements. In contrast, lower sections of the pages show more dispersed or cooler areas, reflecting reduced attention allocation as users scroll. These patterns provide a basis for examining whether more established platforms yield more centralized fixation clusters or shorter cognitive processing routes, as outlined in H5.

Scan-path diagrams further illustrate the sequencing and directional flow of gaze behavior. Professional platforms generally display structured scan paths that begin in the primary title area and progress toward CTAs or navigation menus. The paths frequently demonstrate short saccades and limited detour patterns, indicating a guided visual hierarchy. Variations emerge among platforms: some exhibit compact triangular or F-shaped patterns, while others display linear top-to-bottom movements. These differences enable a comparative analysis of scan-path length, dispersion, and concentration, which are relevant to the evaluation of the information hierarchy and visual efficiency described in H5.

The visual recordings also provide insights into the distribution of dwell time across key UI components, including hero messages, staking or swapping modules, metric displays, and navigation elements. In several professional platforms, dwell time appears concentrated on central functional components, while secondary elements attract minimal fixation. These observations relate directly to H6, which examines whether dwell time and fixation count on core UI regions differ between professional websites and the AI-built interface. The heatmaps for the Nexus Protocol interface display extensive focus on its introductory section and core descriptive elements, with dwell time heavily clustered around the headline, subheadline, and primary functional block. Comparing these patterns with those of professional platforms enables assessment of the relative emphasis placed on key visual elements relevant to decision-making.

Finally, the heatmaps and scan paths also highlight users’ attention to trust cues. Across professional platforms, trust-related content, such as security audits, insurance statements, risk disclosures, or protocol longevity, is consistently represented by clear warm areas or repeated fixations. Two professional websites show notable fixation clusters on audit statements or long-term operation indicators. These patterns serve as empirical input for evaluating H7, which concerns the degree of attention allocated to trust-building elements across website types. The scan-paths show users transitioning toward trust cues either early or midway through their visual journey, enabling a comparison with the Nexus Protocol interface, where trust components occupy different visual positions and may be attended to in other sequences.

At this stage, the analysis remains primarily descriptive: AOI-level fixation and dwell-time distributions were used to compare how attention is concentrated across functional regions, but no formal inferential tests or effect sizes are reported, given the modest sample and platform constraints.

3.3. ABM Simulation

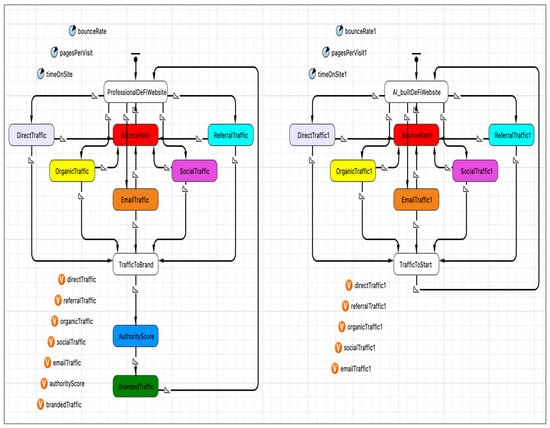

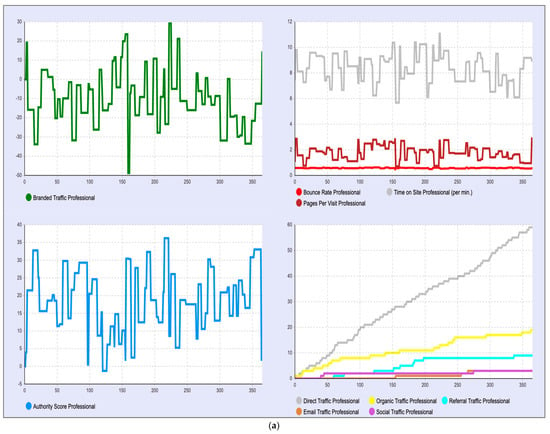

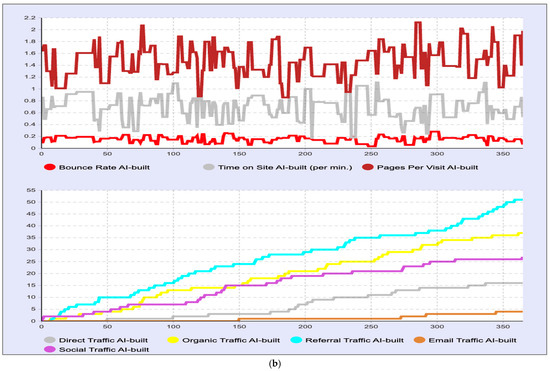

The agent-based simulation (ABM) extends statistical analysis by modelling how users interact with professional and AI-built DeFi websites under controlled, repeatable conditions. ABM has recently reemerged as a core methodological tool for analyzing complex digital environments because it captures micro-level behavioral rules and reveals emergent, system-level patterns that traditional descriptive analytics cannot fully expose [49,50,51]. In this study, the ABM framework mirrors the behavioral mechanisms identified in the empirical dataset, including traffic inflows, engagement responses, and branding-related interactions, allowing a dynamic comparison of how interface architecture influences user behavior across the two website types. Figure 4 displays the structure of the behavioral model. In contrast, Figure 5 visualizes how simulated agents distribute attention, transition between traffic channels, and generate branded engagement in both the professional and the AI-constructed settings.

Figure 4.

ABM development framework.

Figure 5.

ABM simulation output. (a) denotes the professional website visitors’ behavior simulation, and (b) the simulation of the AI-built website visitors’ behavior.

Table 6 lists the behavioral parameters used in the simulation. The professional websites exhibit substantially higher interaction depth, with a mean time on site of 521 s (SD = 86.77), compared to 39.8 s (SD = 12.4) for the AI-built counterpart. Pages per Visit follow a similar pattern, with professional sites generating 1.89 pages (SD = 0.50) relative to 1.47 pages (SD = 0.32) for the AI-built website. Bounce Rate also differs, with the professional platforms displaying 0.57 (SD = 0.03) in contrast to the markedly lower 0.148 (SD = 0.049) of the AI-built versions. These three variables, session duration, navigation depth, and early abandonment, form the behavioral core of the simulation model, shaping how agents progress through the system.

Table 6.

Professional & AI website gathered behavioral analytics.

For each scenario, the model was executed multiple times with different random seeds, and Table 6 reports the mean and standard deviation of time on site, pages per visit, and bounce rate, which were used as inputs to the Normal distribution function to simulate these metrics across runs. We also performed simple one-parameter sensitivity checks by shifting the bounce and engagement parameters within plausible ranges; these tests did not alter the qualitative ordering between the professional and AI-built scenarios, suggesting that the main conclusions are robust to moderate parameter perturbations.

In the ABM, bounce rate is defined as the probability that a newly arrived agent leaves the system after visiting only the initial (landing/hero) page and not proceeding to any further interaction step. Conditional on not bouncing, the expected number of page transitions and dwell steps is governed by the time-on-site and pages-per-visit parameters, which control how long and how deeply agents explore the interface before exiting. For the professional benchmark, these parameters are initialized from the empirical web analytics profiles described in Section 3.1. For the AI-built case, they were calibrated to reflect their lower engagement depth and more focused interaction patterns, consistent with the descriptive analytics from the neuromarketing evidence.

The model also highlights more rapid stabilization in bounce-related behaviors, even though these have lower bounce probabilities, translating into fewer opportunities for deep exploration. This aligns with findings from behavioral web studies, where shorter exposure windows reduce the likelihood of trust-based interactions or brand-reinforcing navigation loops.

The simulation output in Figure 5a demonstrates that professional websites generate a progressively increasing accumulation of branded traffic, consistent with the empirical regression findings highlighting the predictive role of engagement metrics (linked with H2 and H3). As time elapses in the simulation, longer time on site and richer page-traversal behaviors feed into incremental growth in authority-score dynamics and branded-traffic loops. This pattern emerges because agents encountering richer UX environments generate repeated return behavior and more diverse pathway completions, an effect previously described in digital trust and navigation literature.

Traffic channels also diverge over time, with the model showing a steady increase in organic and referral flows, while direct traffic grows more gradually. This behavior aligns with the observed heterogeneity in traffic composition across professional sites, reflecting the differentiated acquisition strategies described in H1 and further elaborated in the PCA clustering results (H4). ABM visually reinforces these strategic distinctions by showing how diverse channels accumulate momentum in a professional interface architecture.

Figure 5b presents the AI-built platform simulation, in which behavioral outcomes follow distinct dynamics. Due to considerably lower time-on-site and page-depth parameters, branded-traffic accumulation progresses at a notably slower pace, and oscillations in authority-score development appear flatter and less responsive. The traffic-channel curves show a more linear and less diversified progression, indicating fewer opportunities for agents to transition across acquisition pathways. This reproduces the statistical observation of reduced engagement-driven effects in the empirical dataset and aligns with the conceptual expectations behind H2–H4, without assessing their validity.

Although the AI-built scenario exhibits lower simulated time on site and bounce rate than the professional benchmark (Table 6), its bounce rate is also lower. This is because simulated bounce rate and time on site were based on the participants’ sample from the neuromarketing test, which included way fewer cases than the web analytics sample, and due to the nature of the test (participants were free to explore the AI website and opted not to abandon the site early and spend less time on-site). Whereas, in the web analytics sample that fueled the simulation of professional websites, bounce rate and time on site showed higher values due to the uncharted relationships visitors to the DeFi websites exhibited.

4. Discussion

The findings of this study reveal apparent differences between a professionally developed and an AI-built DeFi platform across traffic composition, engagement behavior, cognitive processing, and entrepreneurial visibility. While descriptive TCI differences hint at heterogeneous acquisition strategies, the non-significant robust test for H1 implies that these patterns should be interpreted as exploratory rather than statistically confirmed. This partly aligns with research that identifies diversified acquisition channels as a hallmark of platform maturity and strategic sophistication [52,53]. The PCA and K-means clustering results identified three distinct behavioral archetypes, innovation-driven, balanced-growth, and efficiency-focused, which are consistent with established theories suggesting that platform ecosystems naturally segment into strategic innovation patterns based on behavioral signatures [54].

The regression models used to test H2 and H3 highlight the central role of engagement metrics in shaping digital authority and branded traffic. The finding that session duration and pages per visit significantly predict Authority Score mirrors broader evidence that engagement depth reflects perceived credibility and content legitimacy [32,35]. This relationship is further reinforced by studies on digital transformation, which show that greater platform involvement enhances perceived competence and supports positive user evaluations [29]. Branded traffic showed similar dependencies: more extended engagement and lower bounce rates predicted greater branded navigation, consistent with models of cognitive fluency and trust-based revisitation [33,55].

The neuromarketing analysis for H5–H7 introduced cognitive evidence on how users process differently structured interfaces. Heatmaps and scan paths show that professional platforms produce tightly clustered fixations and shorter attentional routes, consistent with the principles of visual hierarchy, structured information flow, and cognitive efficiency [38,40]. In contrast, the AI-built interface generated more dispersed gaze paths and greater exploratory behavior, reflecting weaker structural guidance. Even so, dwell time and fixation count on primary UI elements were similar across platforms, supporting H6 and aligning with evidence that key UI elements attract reliable attention across interface types due to innate salience and task expectancy [41,42]. Additionally, trust cues, such as security assurances, risk warnings, or audit signals, received consistent attentional priority in both interface types, supporting H7 and reflecting well-established findings that risk-reducing cues automatically draw the user’s attention in financial decision contexts [56,57,58].

The ABM simulation deepened these insights by illustrating how micro-level behaviors aggregate into macro-level entrepreneurial performance. Professional websites generated more stable, upward trajectories in engagement, branded traffic, and authority score under simulation, whereas the AI-built interface produced flatter engagement cycles. These results align with prior ABM research demonstrating that interface structure and information architecture can produce different emergent behavioral equilibria [59,60,61]. Overall, the combined evidence indicates that AI-built interfaces, though flexible and cost-effective, require additional refinement to match the cognitive and behavioral efficiencies of professionally developed platforms.

5. Conclusions

This study provides a comprehensive assessment of the behavioral, cognitive, and strategic differences between a professionally developed and an AI-built DeFi website case. By integrating statistical modelling, neuromarketing evidence, and agent-based simulation, the findings show that professionally engineered platforms consistently outperform the AI-built interface across multiple dimensions of digital entrepreneurial performance. These results align with emerging research demonstrating that mature DeFi ecosystems rely on diversified acquisition structures and optimized interface design to support growth and legitimacy [52,53]. The distinct behavioral archetypes identified in this study further reinforce theories of platform innovation that describe how digital ecosystems differentiate themselves through traffic diversity, engagement patterns, and strategic orientation [54,55].

Beyond reporting performance differences, the study contributes theoretically by showing how (a) traffic composition and engagement depth function as observable signals of platform maturity and entrepreneurial competitiveness in DeFi, (b) cognitive efficiency (fixation clustering and scan-path structure) complements behavioral analytics as an explanatory layer for authority and branded-traffic formation, and (c) ABM can translate empirically observed UX and engagement parameters into interpretable long-run dynamics, supporting theory building on AI-driven interface viability in high-trust financial environments.

The analysis also highlights the central role of engagement metrics, especially session duration and navigation depth, as predictors of platform authority and branded return behavior. These findings are consistent with broader research showing that engagement depth signals perceived competence and strengthens user trust in digital financial environments [32,34,35]. The adverse effect of bounce rate on authority and brand navigation is consistent with theories of cognitive fluency and commitment formation, whereby sustained exposure improves perceived stability and reduces uncertainty [33,55]. In this context, the neuromarketing results add a critical cognitive dimension: professionally structured DeFi interfaces produced more centralized fixation clusters and shorter scan paths, reflecting greater attentional efficiency and a stronger information hierarchy [38,40]. At the same time, the consistent attentional priority given to trust cues in both types affirms well-established findings that security signals and risk disclosures automatically command user attention in high-uncertainty financial decision-making [56,57,58].

From a practical perspective, these findings provide several insights for developers, product architects, and DeFi entrepreneurs. While AI-built interfaces offer rapid deployment and cost-effective experimentation, they currently lack the structural clarity and behavioral optimization exhibited by mature, professionally developed platforms. The results suggest that enhancing visual hierarchy, strengthening call-to-action placement, improving onboarding flow, and emphasizing trust cues may significantly improve AI-built interface performance. The agent-based simulation component offers additional strategic value by demonstrating how micro-level cognitive and behavioral decisions aggregate into long-term authority-building and branded traffic patterns, thereby informing platform evolution and competitive positioning [59,60,61]. Based on the multi-method findings, three concise, evidence-based guidelines emerge for DeFi interface design and digital entrepreneurship:

- Prioritization of engagement depth over raw traffic volume. The web analytics results show that higher time on site and pages per visit are strongly associated with higher authority score and branded traffic, indicating that deeper on-site interaction strengthens reputational authority and brand-based navigation.

- Structured navigation and hero sections concentrate attention while making trust cues salient. The eye-tracking patterns indicate that professionally developed interfaces channel fixations along shorter, more efficient scan paths across navigation, hero, and core content while still maintaining visibility of trust and risk elements, suggesting a balance between cognitive economy and reassurance.

- Usage of scenario-based thinking assesses long-run effects of design changes. The ABM simulations illustrate how different combinations of engagement depth and bounce rate translate into divergent long-run trajectories for authority and branded traffic, emphasizing the value of stress-testing interface strategies under alternative behavioral parameters before large-scale deployment.

Despite its contributions, the study faces several limitations. A key limitation is that the AI-built condition comprises a single case; therefore, the observed differences in the AI-built interface should be interpreted as illustrative rather than generalizable to the broader population of AI-built DeFi websites. The neuromarketing experiment, though methodologically strong, involved a modest sample size, which may restrict generalizability across larger or more diverse user populations. A further limitation is that the neuromarketing component relies on AOI-level inspection of fixation and dwell-time patterns without complete inferential testing, which could be addressed by using different or modified software. Only one AI-built interface was evaluated, and other AI design tools may yield different outcomes. Web analytics span a fixed period, and longer-term, seasonal, or market-driven variations may reveal additional patterns in traffic and authority dynamics. The simulation, while theoretically grounded, necessarily simplifies user behavior and does not incorporate emotional, cultural, or economic variables that influence decision-making in real-world DeFi environments.

Future research: Several extensions can strengthen the generalizability and explanatory power of these findings. First, future studies should evaluate multiple AI-built DeFi websites produced through different generative pipelines (prompting strategies, component libraries, and deployment stacks) to avoid reliance on a single case. Second, the benchmark set of professional platforms should be expanded across DeFi categories and maturity levels (e.g., DEX, lending, staking, stablecoins) and examined longitudinally to capture iterative design evolution and time-lagged authority/brand formation. Third, the experimental component can be enhanced with standardized task-based protocols (e.g., connect wallet, execute swap, locate audits/risks) and reporting of AOI-based gaze metrics and effect sizes. Finally, ABM can be strengthened through calibration, repeated runs with uncertainty bounds, and scenario testing under market and trust shocks (e.g., volatility or security incidents) to assess robustness of long-run engagement and competitive trajectories.

Supplementary Materials

The following supporting information can be downloaded at: https://files.fm/f/g33taeykmv (accessed on 27 September 2025). Moreover, due to the size of the figures on the professional DeFi websites, they were not included in the paper but are available upon request from the corresponding author.

Author Contributions

Conceptualization, N.T.G., D.P.S. and N.K.; methodology, N.T.G., D.P.S. and N.K.; software, N.T.G., D.P.S. and N.K.; validation, N.T.G., D.P.S. and N.K.; formal analysis, N.T.G., D.P.S. and N.K.; investigation, N.T.G., D.P.S. and N.K.; resources, N.T.G., D.P.S. and N.K.; data curation, N.T.G., D.P.S. and N.K.; writing—original draft preparation, N.T.G., D.P.S. and N.K.; writing—review and editing, N.T.G., D.P.S. and N.K.; visualization, N.T.G., D.P.S. and N.K.; supervision, N.T.G., D.P.S. and N.K.; project administration, N.T.G., D.P.S. and N.K.; funding acquisition, N.T.G., D.P.S. and N.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and the protocol was approved by the Ethics Committee of the Agricultural University of Athens (114/2025) on 9 December 2025.

Informed Consent Statement

The participants of the study were verbally informed and consented to their involvement.

Data Availability Statement

The complete data presented in this study is available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

AI-built DeFi website development workflow.

Table A1.

AI-built DeFi website development workflow.

| Section | Category | Specification | Details |

|---|---|---|---|

| Technology Stack | Platform | Base44 | Cloud-based web application platform with built-in backend services |

| Frontend Framework | React 18+ | Component-based UI library with hooks | |

| Styling | Tailwind CSS | Utility-first CSS framework for responsive design | |

| UI Components | shadcn/ui | Pre-built accessible component library | |

| Icons | Lucide React | Open-source icon library | |

| State Management | TanStack Query | Server state management and data fetching | |

| Routing | React Router DOM | Client-side navigation | |

| Authentication | Base44 Auth | Email-based authentication system | |

| Database | Base44 Entities | NoSQL entity management system | |

| Additional Libraries | date-fns, recharts, react-markdown | Date formatting, charts, markdown rendering | |

| Design System | Theme | Dark Mode Premium | Futuristic DeFi aesthetic |

| Primary Colors | Purple to Cyan Gradient | #6B46C1 → #06B6D4 | |

| Background | Dark Gradient | #0A0E27 → #1a1f3a | |

| Typography | System Font Stack | Responsive sizing (mobile-first approach) | |

| Layout System | CSS Grid & Flexbox | Responsive 1–4 column layouts | |

| Design Style | Glass Morphism | Translucent cards: rgba(255, 255, 255, 0.03) | |

| Visual Effects | Glow & Gradients | box-shadow: 0 0 30 px rgba (107, 70, 193, 0.3) | |

| Animations | Hover & Float Effects | hover: scale-105, translateY animations | |

| Core Features | Landing Page | Marketing Interface | Hero section, statistics, features, protocol overview |

| Dashboard | Portfolio Management | Portfolio overview, active positions, transactions, quick actions | |

| Staking | DeFi Protocol | Token staking with APY rewards and flexible lock periods | |

| Lending/Borrowing | DeFi Protocol | Supply assets to earn interest or borrow against collateral | |

| Token Swap | Trading Protocol | Instant token exchange with real-time rate calculation | |

| Transaction History | Activity Tracking | Real-time user activity monitoring and logging | |

| Authentication | Security Layer | Email-based sign-in with session management | |

| Data Architecture | Asset Entity | Cryptocurrency Data | name, symbol, price_usd, total_supply, category |

| StakingPool Entity | Staking Opportunities | name, asset_symbol, apy, tvl, lock_period_days, status | |

| UserPosition Entity | User Investments | position_type, asset_symbol, amount, value_usd, apy, rewards_earned, status | |

| Transaction Entity | Activity Log | type, asset_symbol, amount, value_usd, status, tx_hash | |

| User Entity | Account Management | email, full_name, role (admin/user)—Built-in entity | |

| Built-in Attributes | Auto-generated Fields | id, created_date, updated_date, created_by (all entities) | |

| Responsive Design | Mobile | <640 px | 1–2 columns, vertical stacking, full-width cards |

| Tablet (sm) | ≥640 px | 2 columns, side-by-side layouts | |

| Desktop (md) | ≥768 px | 2–3 columns, standard desktop view | |

| Large Desktop (lg) | ≥1024 px | 3–4 columns, wide screen optimization | |

| Approach | Mobile-First | Progressive enhancement from smallest to largest screens | |

| Touch Targets | Accessibility | Minimum 44 × 44 px tap targets on mobile devices | |

| UI/UX Principles | Glass Morphism | Translucent Effects | backdrop-filter: blur(20 px), border: rgba(255, 255, 255, 0.1) |

| Gradient Accents | Color Transitions | Purple-cyan gradients on buttons, icons, and highlighted text | |

| Micro-interactions | User Feedback | Scale transforms, hover states, smooth transitions | |

| Accessibility | WCAG Compliance | Semantic HTML, ARIA labels, keyboard navigation support | |

| Consistency | Design Language | Unified spacing system (4 px grid), consistent border-radius | |

| Visual Hierarchy | Information Architecture | Clear headings, card-based layouts, color-coded categories | |

| Performance | Query Caching | TanStack Query | Reduced API calls, automatic background refetching |

| Optimistic Updates | React Mutations | Instant UI feedback before server confirmation | |

| Code Splitting | React.lazy() | Faster initial page load, on-demand component loading | |

| Image Optimization | External CDN | Unsplash CDN for faster image load times | |

| Bundle Size | Optimized | Tree-shaking, minification, lazy loading | |

| Security | Authentication | Base44 Auth System | Secure email-based login with JWT token management |

| Data Validation | JSON Schema | Type-safe entity operations and data integrity checks | |

| Access Control | Role-Based (RBAC) | Permission-based feature access (admin/user roles) | |

| Transaction Safety | Frontend Simulation | Demo mode without real cryptocurrency or blockchain interaction | |

| Data Privacy | User Isolation | User-specific data filtering (user_email attribute) | |

| Architecture | File Structure | Component-Based | Organized: pages/, components/, entities/ directories |

| State Management | Hybrid Approach | TanStack Query for server state, React hooks for local state | |

| API Layer | Base44 SDK | Pre-initialized client (base44.entities, base44.auth) | |

| Routing Strategy | Client-Side SPA | React Router with createPageUrl() utility function | |

| Component Pattern | Reusable Components | Atomic design: pages → components → UI elements | |

| Platform Inspiration | Aave | Lending Protocol | Lending/borrowing markets, supply APY display patterns |

| Lido | Staking Protocol | Staking interface design, rewards tracking mechanisms | |

| Uniswap | DEX Protocol | Token swap interface, rate calculation, slippage settings | |

| Curve Finance | Analytics | Pool statistics, TVL displays, utilization metrics | |

| MakerDAO | Design Reference | Clean card-based layouts, professional dark theme | |

| Key Metrics | Total Value Locked | Platform Stats | $2.4 B (simulated metric) |

| Active Users | User Base | 127,000+ users (simulated) | |

| Average APY | Yield Rates | 18.3% average across all pools (simulated) | |

| Total Transactions | Platform Activity | 1.2 M+ transactions processed (simulated) | |

| Supported Assets | Asset Diversity | 5 tokens (ETH, BTC, USDC, DAI, USDT) | |

| 24h Volume | Trading Activity | $124 M daily swap volume (simulated) | |

| Staking Pools | Available Options | Multiple pools with varying APY (5–24%) |

Appendix B

Table A2.

AI-built DeFi website Development Prompts Sequence.

Table A2.

AI-built DeFi website Development Prompts Sequence.

| Step | Prompt Category | Exact Prompt/Request | Output/Result | |

|---|---|---|---|---|

| Phase 1: Project Initialization | ||||

| 1 | Initial Brief | “Create a DeFi (Decentralized Finance) web application similar to Aave, Lido, Curve, MakerDAO, and Uniswap. Include staking, lending/borrowing, token swaps, and a dashboard.” | Project plan and feature outline | |

| 2 | Design Direction | “Use a premium dark theme with futuristic design, purple-to-cyan gradients, glass-morphism effects, and a clean modern look like top DeFi platforms.” | Design system established | |

| Phase 2: Data Structure | ||||

| 3 | Asset Entity | “Create an Asset entity to store cryptocurrency data, including name, symbol, icon_url, price_usd, total_supply, and category (stablecoin, cryptocurrency, governance).” | entities/Asset.json created | |

| 4 | Staking Entity | “Create a StakingPool entity with name, asset_symbol, apy, tvl, min_stake, lock_period_days, and status.” | entities/StakingPool.json created | |

| 5 | Position Entity | “Create a UserPosition entity to track user investments with position_type (staking/lending/borrowing), asset_symbol, amount, value_usd, apy, rewards_earned, pool_id, start_date, and status.” | entities/UserPosition.json created | |

| 6 | Transaction Entity | “Create a Transaction entity to log user activity with type (stake/unstake/lend/borrow/repay/swap/withdraw), asset_symbol, amount, value_usd, status, and tx_hash.” | entities/Transaction.json created | |

| 7 | Sample Data | “Populate the Asset entity with sample cryptocurrencies: ETH, BTC, USDC, DAI, USDT with realistic prices.” | Sample asset records created | |

| 8 | Sample Pools | “Create sample staking pools for different assets with varying APY rates (5–24%), TVL amounts, and lock periods.” | Sample staking pool records created | |

| Phase 3: Navigation & Layout | ||||

| 9 | App Layout | “Create a navigation layout with links to Home, Dashboard, Stake, Lend, and Swap pages. Include the NexusProtocol logo, user authentication status, and sign-in/sign-out buttons.” | Layout.js created | |

| 10 | Mobile Menu | “Make the navigation mobile-responsive with a hamburger menu that shows all navigation links and user info.” | Mobile navigation added to Layout. | |

| Phase 4: Home Page | ||||

| 11 | Hero Section | “Create a hero section with a headline ‘The Future of Decentralized Finance’, subtitle about competitive yields, Get Started and Explore Pools buttons, and floating stat cards showing TVL, APY, and Active Users.” | components/home/HeroSection.jsx created | |

| 12 | Stats Section | “Create a stats section displaying Total Value Locked ($2.4B), Active Users (127K+), Average APY (18.3%), and Total Transactions (1.2M+) with icons and descriptions.” | components/home/StatsSection.jsx created | |

| 13 | Features Section | “Create a features section highlighting Battle-Tested Security, Lightning Fast, Maximized Yields, Multi-Asset Support, Global Access, and Non-Custodial features with icons and descriptions.” | components/home/FeaturesSection.jsx created | |

| 14 | Protocol Section | “Create a protocol section showcasing Staking, Lending/Borrowing, and Token Swap with their APY rates, descriptions, and Explore buttons linking to respective pages.” | components/home/ProtocolSection.jsx created | |

| 15 | Home Assembly | “Assemble the Home page using HeroSection, StatsSection, FeaturesSection, and ProtocolSection components with a CTA section and footer.” | pages/Home.js created | |

| Phase 5: Dashboard Page | ||||

| 16 | Portfolio Overview | “Create a portfolio overview component showing Total Portfolio Value, Total Rewards Earned, Average APY, and Active Positions with gradient cards and icons.” | components/dashboard/PortfolioOverview.jsx created | |

| 17 | Positions List | “Create a positions list component displaying all active user positions with asset symbol, amount, value in USD, APY, start date, and rewards earned.” | components/dashboard/PositionsList.jsx created | |

| 18 | Transactions List | “Create a recent transactions component showing the last 10 transactions with type, asset, amount, value, status badge, and timestamp.” | components/dashboard/RecentTransactions.jsx created | |

| 19 | Quick Actions | “Create quick action buttons to navigate to Stake, Lend, and Swap pages with icons and descriptions.” | components/dashboard/QuickActions.jsx created | |

| 20 | Dashboard Assembly | “Assemble the Dashboard page fetching user positions and transactions from the database, displaying portfolio overview, quick actions, positions, and recent activity.” | pages/Dashboard.js created | |

| Phase 6: Staking Page | ||||

| 21 | Pool Cards | “Create staking pool cards displaying pool name, asset icon, APY, TVL, lock period, min stake, status badge, and a Stake Now button.” | components/stake/StakingPoolCard.jsx created | |

| 22 | Stake Modal | “Create a stake modal where users can enter the amount to stake, see pool details, estimated rewards, and confirm the transaction.” | components/stake/StakeModal.jsx created | |

| 23 | Staking Page | “Create the Stake page, fetching staking pools from the database, displaying stats (Highest APY, Total Pools, Total TVL, Active Stakers), and showing pool cards in a grid. Handle stake transactions by creating UserPosition and Transaction records.” | pages/Stake.js created | |

| Phase 7: Lending Page | ||||

| 24 | Markets Table | “Create a lending markets component displaying assets in a table format (desktop) and cards (mobile) with columns for Asset, Price, Supply APY, Borrow APY, Utilization, and action buttons for Supply/Borrow.” | components/lend/LendingMarkets.jsx created | |

| 25 | Lend Modal | “Create a lending modal for supply/borrow actions where users enter the amount, see market details, estimated annual interest, and confirm the transaction.” | components/lend/LendModal.jsx created | |

| 26 | Lending Page | “Create the Lend page fetching assets, calculating random supply/borrow APY rates, displaying stats (Total Supply, Total Borrowed, Avg Supply APY, Assets Listed), and showing the lending markets component.” | pages/Lend.js created | |

| Phase 8: Swap Page | ||||

| 27 | Swap Interface | “Create a swap interface with two token selectors (from/to), amount inputs, a switch button, rate display, network fee, slippage tolerance, and a Swap button. Calculate exchange rates based on asset prices.” | components/swap/SwapInterface.jsx created | |

| 28 | Swap Page | “Create the Swap page fetching assets, displaying stats (24h Volume, Total Swaps, Avg Speed, Supported Assets), and showing the swap interface. Handle swap transactions by creating Transaction records.” | pages/Swap.js created | |

| Phase 9: Authentication & Security | ||||

| 29 | Auth Integration | “Use Base44 authentication system. Show ‘Sign In’ button for non-authenticated users, display user email when logged in, add Sign Out button, and redirect to login when accessing protected pages.” | Authentication is integrated across all pages. | |

| 30 | Protected Routes | “Make Dashboard, Stake, Lend, and Swap require authentication. Redirect unauthenticated users to the login page with return URL.” | Protected routes implemented | |

| 31 | Demo Notice | “Add a notice on the homepage explaining this is a DeFi simulation platform using email authentication, not real cryptocurrency or Web3 wallets.” | Demo notice added (later removed) | |

| 32 | Remove Demo Notice | “Remove the demo platform notice from the homepage.” | Demo notice removed from HeroSection | |

| Phase 10: Responsive Optimization | ||||

| 33 | Mobile Optimization | “Optimize the entire website for mobile devices with responsive typography (text-3xl → text-5xl), adaptive layouts (1 column mobile → 4 columns desktop), touch-friendly buttons, mobile-first card views for tables, reduced padding on small screens, and scaled icons.” | All pages and components are optimized for mobile. | |

| 34 | Breakpoint Testing | “Ensure all pages work perfectly on mobile (<640 px), tablet (≥640 px), desktop (≥768 px), and large screens (≥1024 px).” | Responsive design verified | |

| Phase 11: Polish & Refinement | ||||

| 35 | Loading States | “Add skeleton loaders for all data fetching operations on Dashboard, Stake, Lend, and Swap pages.” | Loading states implemented | |

| 36 | Error Handling | “Display empty states when users have no positions or transactions with helpful messages.” | Empty states added | |

| 37 | Animations | “Add hover effects (scale-105), float animations, smooth transitions, and micro-interactions throughout the app.” | Animations implemented | |

| 38 | Icons & Emojis | “Use emoji icons for crypto assets (⟠ for ETH, ₿ for BTC,  for USDC, etc.) and Lucide React icons for UI elements.” for USDC, etc.) and Lucide React icons for UI elements.” | Icon system implemented | |

| 39 | Final Testing | “Test all features: authentication flow, staking transactions, lending operations, token swaps, dashboard data display, and mobile responsiveness.” | Full platform testing completed. | |

Appendix C

Table A3.

Java output of the ABM simulation for professional vs. AI-built websites.

Table A3.

Java output of the ABM simulation for professional vs. AI-built websites.

| @AnyLogicInternalCodegenAPI |

| private void enterState( statechart_state self, boolean _destination ) { |

| switch( self ) { |

| case ProfessionalDeFiWebsite: |

| logToDBEnterState(statechart, self); |

| // (Simple state (not composite)) |

| statechart.setActiveState_xjal( ProfessionalDeFiWebsite ); |

| transition11.start(); |

| transition12.start(); |

| transition13.start(); |

| transition14.start(); |

| transition15.start(); |

| return; |

| case OrganicTraffic: |

| logToDBEnterState(statechart, self); |

| // (Simple state (not composite)) |

| statechart.setActiveState_xjal( OrganicTraffic ); |

| { |

| organicTraffic++ |

| ;} |

| transition3.start(); |

| transition7.start(); |

| return; |

| case BounceRate: |

| logToDBEnterState(statechart, self); |

| // (Simple state (not composite)) |

| statechart.setActiveState_xjal( BounceRate ); |

| transition.start(); |

| return; |

| case TrafficToBrand: |

| logToDBEnterState(statechart, self); |

| // (Simple state (not composite)) |

| statechart.setActiveState_xjal( TrafficToBrand ); |

| { |

| bounceRate = normal(0.03, 0.57); |

| pagesPerVisit = normal(0.5, 1.89); |

| timeOnSite = normal(86.77, 521.03) |

| ;} |

| transition6.start(); |

| return; |

| case AuthorityScore: |

| logToDBEnterState(statechart, self); |

| // (Simple state (not composite)) |

| statechart.setActiveState_xjal( AuthorityScore ); |

| { |

| authorityScore = 28.42 + 0.031*timeOnSite + 4.87*bounceRate − 15.92*pagesPerVisit |

| ;} |

| transition36.start(); |

| return; |

| case BrandedTraffic: |

| logToDBEnterState(statechart, self); |

| // (Simple state (not composite)) |

| statechart.setActiveState_xjal( BrandedTraffic ); |

| { |

| brandedTraffic = −58.27 + 0.142*timeOnSite − 89.73*bounceRate + 16.11*pagesPerVisit |

| ;} |

| transition1.start(); |

| return; |

| case SocialTraffic: |

| logToDBEnterState(statechart, self); |

| // (Simple state (not composite)) |

| statechart.setActiveState_xjal( SocialTraffic ); |

| { |

| socialTraffic++ |

| ;} |

| transition5.start(); |

| transition8.start(); |

| return; |

| case DirectTraffic: |

| logToDBEnterState(statechart, self); |

| // (Simple state (not composite)) |

| statechart.setActiveState_xjal( DirectTraffic ); |

| { |

| directTraffic++ |

| ;} |

| transition2.start(); |

| transition9.start(); |

| return; |

| case ReferralTraffic: |

| logToDBEnterState(statechart, self); |

| // (Simple state (not composite)) |

| statechart.setActiveState_xjal( ReferralTraffic ); |

| { |

| referralTraffic++ |

| ;} |

| transition4.start(); |

| transition10.start(); |

| return; |

| case EmailTraffic: |

| logToDBEnterState(statechart, self); |

| // (Simple state (not composite)) |

| statechart.setActiveState_xjal( EmailTraffic ); |

| { |

| emailTraffic++ |

| ;} |

| transition16.start(); |

| transition17.start(); |

| return; |

| default: |

| return; |

| } |

| } |

| @AnyLogicInternalCodegenAPI |

| private void exitState( statechart_state self, Transition _t, boolean _source ) { |

| switch( self ) { |

| case ProfessionalDeFiWebsite: |

| logToDBExitState(statechart, self); |

| logToDB(statechart, _t, self); |

| // (Simple state (not composite)) |

| if ( !_source || _t != transition11) transition11.cancel(); |

| if ( !_source || _t != transition12) transition12.cancel(); |

| if ( !_source || _t != transition13) transition13.cancel(); |

| if ( !_source || _t != transition14) transition14.cancel(); |

| if ( !_source || _t != transition15) transition15.cancel(); |

| return; |

| case OrganicTraffic: |

| logToDBExitState(statechart, self); |

| logToDB(statechart, _t, self); |

| // (Simple state (not composite)) |

| if ( !_source || _t != transition3) transition3.cancel(); |

| if ( !_source || _t != transition7) transition7.cancel(); |

| return; |

| case BounceRate: |

| logToDBExitState(statechart, self); |

| logToDB(statechart, _t, self); |

| // (Simple state (not composite)) |

| if ( !_source || _t != transition) transition.cancel(); |

| return; |

| case TrafficToBrand: |

| logToDBExitState(statechart, self); |

| logToDB(statechart, _t, self); |

| // (Simple state (not composite)) |

| if ( !_source || _t != transition6) transition6.cancel(); |

| return; |

| case AuthorityScore: |

| logToDBExitState(statechart, self); |

| logToDB(statechart, _t, self); |

| // (Simple state (not composite)) |

| if ( !_source || _t != transition36) transition36.cancel(); |

| return; |

| case BrandedTraffic: |

| logToDBExitState(statechart, self); |

| logToDB(statechart, _t, self); |

| // (Simple state (not composite)) |

| if ( !_source || _t != transition1) transition1.cancel(); |

| return; |

| case SocialTraffic: |

| logToDBExitState(statechart, self); |

| logToDB(statechart, _t, self); |

| // (Simple state (not composite)) |

| if ( !_source || _t != transition5) transition5.cancel(); |

| if ( !_source || _t != transition8) transition8.cancel(); |

| return; |

| case DirectTraffic: |

| logToDBExitState(statechart, self); |

| logToDB(statechart, _t, self); |

| // (Simple state (not composite)) |

| if ( !_source || _t != transition2) transition2.cancel(); |

| if ( !_source || _t != transition9) transition9.cancel(); |

| return; |

| case ReferralTraffic: |

| logToDBExitState(statechart, self); |

| logToDB(statechart, _t, self); |

| // (Simple state (not composite)) |

| if ( !_source || _t != transition4) transition4.cancel(); |

| if ( !_source || _t != transition10) transition10.cancel(); |

| return; |

| case EmailTraffic: |

| logToDBExitState(statechart, self); |

| logToDB(statechart, _t, self); |

| // (Simple state (not composite)) |

| if ( !_source || _t != transition16) transition16.cancel(); |

| if ( !_source || _t != transition17) transition17.cancel(); |

| return; |

| default: |

| return; |

| } |

| } |

| @AnyLogicInternalCodegenAPI |

| private void exitInnerStates( statechart_state _destination ) { |

| statechart_state _state = statechart.getActiveSimpleState(); |

| while( _state != _destination ) { |

| exitState( _state, null, false ); |

| _state = _state.getContainerState(); |

| } |

| } |

| @AnyLogicInternalCodegenAPI |

| private void enterState( statechart1_state self, boolean _destination ) { |

| switch( self ) { |

| case AI_builtDeFiWebsite: |

| logToDBEnterState(statechart1, self); |

| // (Simple state (not composite)) |

| statechart1.setActiveState_xjal( AI_builtDeFiWebsite ); |

| transition29.start(); |

| transition30.start(); |

| transition31.start(); |

| transition32.start(); |

| transition33.start(); |

| return; |

| case OrganicTraffic1: |

| logToDBEnterState(statechart1, self); |

| // (Simple state (not composite)) |

| statechart1.setActiveState_xjal( OrganicTraffic1 ); |

| { |

| organicTraffic1++ |

| ;} |

| transition21.start(); |

| transition25.start(); |

| return; |

| case BounceRate1: |

| logToDBEnterState(statechart1, self); |

| // (Simple state (not composite)) |

| statechart1.setActiveState_xjal( BounceRate1 ); |

| transition18.start(); |

| return; |

| case TrafficToStart: |

| logToDBEnterState(statechart1, self); |

| // (Simple state (not composite)) |

| statechart1.setActiveState_xjal( TrafficToStart ); |

| { |

| bounceRate1 = normal(0.049, 0.148); |

| pagesPerVisit1 = normal(0.32, 1.47); |

| timeOnSite1 = normal(12.4, 39.8) |

| ;} |

| transition19.start(); |

| return; |

| case SocialTraffic1: |

| logToDBEnterState(statechart1, self); |

| // (Simple state (not composite)) |

| statechart1.setActiveState_xjal( SocialTraffic1 ); |

| { |

| socialTraffic1++ |

| ;} |

| transition23.start(); |

| transition26.start(); |

| return; |

| case DirectTraffic1: |

| logToDBEnterState(statechart1, self); |

| // (Simple state (not composite)) |

| statechart1.setActiveState_xjal( DirectTraffic1 ); |

| { |

| directTraffic1++ |

| ;} |

| transition20.start(); |

| transition27.start(); |

| return; |

| case ReferralTraffic1: |

| logToDBEnterState(statechart1, self); |

| // (Simple state (not composite)) |

| statechart1.setActiveState_xjal( ReferralTraffic1 ); |

| { |

| referralTraffic1++ |

| ;} |

| transition22.start(); |

| transition28.start(); |

| return; |

| case EmailTraffic1: |

| logToDBEnterState(statechart1, self); |

| // (Simple state (not composite)) |

| statechart1.setActiveState_xjal( EmailTraffic1 ); |