Abstract

This study investigated the potential financial benefits that private forest famers can derive when participating in a larch carbon sink plantation project in the northwestern Chinese province of Gansu. A decision matrix was developed to help forest farmers justify participation in forest carbon sink projects relative to the traditional land-use goal of timber production under various carbon trading prices, site conditions, and contract terms. The results showed that when the carbon trading price is at the theoretically optimal carbon price (CNY 110/tCO2e, equivalent to USD 17/tCO2e), Chinese business entities are willing to pay for forest carbon credits under the current global carbon emissions level, and forest farmers who participate in a 25-year forest carbon sink plantation project on high-productivity sites would generate the greatest financial benefit compared with the net income from pure timber production forests. Thus, the government does not need to provide a carbon sink subsidy for participating tree farmers. However, at the current average carbon trading price (CNY 19.8/tCO2e or USD 3/tCO2e) in the domestic market, a minimum additional subsidy of CNY 735/ha (USD 113/ha) is required upfront to motivate forest farmers to convert timber production forests into carbon sink forests. The results of this study can help policymakers and forest managers formulate optimal eco-compensation strategies for enrollment in forest-based carbon sequestration programs.

1. Introduction

To mitigate the continued increases in carbon dioxide (CO2) and other greenhouse gases (GHGs) in the atmosphere, many countries and regions worldwide have set carbon (C) emission targets and abatement strategies to reduce their GHGs emissions. In general, reducing CO2 emissions from the combustion of fossil fuels while concurrently seeking ways to sequester C in long-term storage components are considered two of the most effective ways to lower the CO2 level in the atmosphere [1,2]. Because trees and forests can take CO2 and other GHGs from the atmosphere through photosynthesis and sequester it in biomass and soils, forests have played an important role in mitigating global climate deterioration [3,4].

In China, forest C sink plantation projects have been one of the main complementary climate change-mitigation strategies promoted by government authorities in recent years to achieve the goals of C emission peak before 2030 and C neutrality by 2060 [5]. Forest C sink plantation projects comprise C sequestration and trading programs, in which forest farmers can sell C credits (which is a permit allowing the holder to emit CO2 or other GHGs) to large emitters seeking to offset their CO2 emissions [6]. In this system, both parties are committed to forest management activities with the main goal of increasing forest C sequestration in designated lands within a specific contract period (e.g., 20–60 years in China) [7]. During the contract period, forest farmers are not allowed to harvest trees and must follow a forest management plan to ensure that the increased C stock will be above and beyond the stock associated with current practices; in addition, farmers are responsible for the costs (i.e., C sink measurement, monitoring, and verification) associated with the C credits received from the projects [8]. On the other hand, the party seeking to lower its C emissions to within a specific limit purchases C credits from forest farmers who participate in forest C sink plantation projects in installments or at the expiration of the project and uses the C credits to offset the C emissions it generates in its production processes. Forest C sinks have become an important part of the C emission trading market and are generally considered a market-based eco-compensation mechanism in China [9].

A successful forest C sink project requires (1) that the financial benefit offered to induce potential forest C sink suppliers (e.g., private forest farmers, tree growers, and forestry cooperatives) to establish C sink forests must not be less than the cost of participation in the forest C sink projects and, more importantly, (2) that the net income from managing a C sink forest should be greater than the net income from operating a traditional timber production forest [10]. Specifically, only when the net income generated from managing a C sink forest is greater than the net income from managing a traditional timber production forest do forest farmers have the economic incentive to participate in forest C sink projects. Therefore, an economic model that quantifies the related benefits and costs from managing timber production forests and C sink forests would provide important guidance to forest farmers for making optimal forest management decisions.

In forestry investment analysis, there are several criteria for assessing the economic value of a growing forest and the optimal rotation age, including maximum sustainable yield, maximum annual average net income, single-period net present value, and land expectation value (LEV) [11]. LEV refers to the sum of the net present values of the income from an infinite number of rotations of continuous investment, starting from a state of bare land or a new forest on land that was not previously forested (e.g., row crops or pastureland). LEV is a theoretical estimate of the value of a forestland, which reflects the present value of all cash flows produced by an infinite series of harvests at a given rotation length under an assumed management regime [11]. In previous studies in China, the classic Faustmann model [12] has been frequently applied to assess multi-objective forest management from pure timber production to C sequestration benefits, including the use of Faustmann–Hartman [13] model in the economic analysis framework (see [14,15,16,17,18,19,20,21,22]). While these studies have provided valuable contributions with respect to understanding the effects of changes in C trading prices on the optimal rotation age, LEVs, and the supply of forest C sinks in China, the application of the classic Faustmann formula, which assumes that stumpage prices, stand volume, regeneration cost, and interest rate remain unchanged rotation after rotation, may not truly reflect the actual forest management regime, in which the majority of forest farmers are small-scale tree growers. Moreover, given that most of the forest C sink projects in China at present are in contract terms, and neither thinning nor harvesting of trees is allowed during the contract period, there is a need to specifically include the timber harvesting restrictions in the economic model for a better estimate of the LEVs of forest C sink projects. Last, while forest farmers who participate in forest C sink projects may benefit from selling the C credits on their forestlands over the use of their forestlands as timber production forests, they also bear the additional setup costs of the projects (e.g., C sink measurement, monitoring, and verification costs), which may be a disincentive to forest farmers if the enrollment costs are too high [23]. These three aspects have not been considered and discussed in previous studies.

To address the knowledge gaps that have been previously mentioned, the purpose of this paper was to investigate (at the stand level) the potential financial benefits that forest farmers (especially small-scale tree growers with only one stand) can realize when enrolling in a larch (Larix kaempferi (Lamb.) Car.) C sink plantation project in the northwestern Chinese province of Gansu by using the generalized Faustmann model developed by Chang [24,25]. A decision matrix was developed to help forest farmers justify participation in forest C sink plantation projects when comparing the LEVs of a timber production forest and a C sink forest under different biophysical and economic conditions (e.g., site conditions, C sink project periods, and C trading prices). The results of this study can help policymakers and forest managers formulate optimal eco-compensation strategies for enrollment in forest-based C sequestration programs.

2. Decision Model

2.1. The Generalized Faustmann Model

Under the classic Faustmann model, the LEV is expressed as

or

where represents the LEV per hectare of timber crop at age t, is the unit stumpage price, represents the stand volume (m3) at age t, is the average regeneration cost, and is the discount rate.

Under the classic Faustmann model, the parameters in Equation (1) remain the same from harvest to harvest. However, in the real timberland market, this stability is unlikely, especially for the management of nonindustrial forestlands. For example, after each harvest, the landowner may replant a new timber crop and encounter different stumpage prices, forest growth, regeneration costs, and discount rates. Thus, the optimal harvest is also expected to fluctuate from timber crop to timber crop. Moreover, forest farmers may convert forestland to other land uses, such as fruit orchards or agricultural crops, or even develop real estate. To make the classic Faustmann formula more realistically reflect the forestland value, Chang [24] first developed the generalized Faustmann formula, which allows the parameters in Equation (1) to change from rotation to rotation and accommodates land-use changes by permitting different types of crops, such as timber, fruit, or grain, for different harvest periods. Therefore, the LEV under the generalized Faustmann formula can be expressed as

Equation (3) can also be expressed as

in a dynamic programming format with the classical recursive relation, where represents the LEV at the beginning of the first rotation, and LEV2 is the LEV at the beginning of the second rotation. represents the stumpage price of the th timber crop at age , represents the stand volume at age , represents the annual net income from miscellaneous nontimber sources for age (such as from a C sink), represents the regeneration cost of the th timber crop, and represents the discount rate for the th timber crop.

Theoretically, Equation (3) indicates that the land expectation value at the beginning of the first timber crop (LEV1) includes the summation of the net present value at the beginning of the first timber crop and the land expectation value at the beginning of the second timber crop (and so on). Alternatively, LEV2 represents a single value that incorporates all of the optimal harvest age decisions for future timber crops, with the value obtainable from the forestland transaction market and exogenously determinable [24,25]. The Hartman [13] Model, which considers the net annual income from other miscellaneous sources, can be treated as a special case of Equations (3) or (4).

Empirically, the generalized Faustmann model has made the management of forestlands (including even-aged natural stands, even-aged plantations, and uneven-aged stands) more applicable in practice and offers much broader and richer interpretations relative to the classic Faustmann model; additionally, it has been employed to assess the effects of potential C benefits on optimal rotation ages of even and uneven-aged forest stands in the southern United States (e.g., [26,27,28]). Thus, the LEV derived from the generalized Faustmann model can provide more valuable information to help forest farmers in evaluating different management options of their forestlands.

2.2. Land Expectation Values for Timber Production Forests and C Sink Forests

In this study, we assumed that forest farmers face two alternative options for the management of their forestlands: (1) to manage their forestlands for timber production (considered the base case) or (2) to participate in a forest C sink plantation project with a minimum commitment of a 20-year contract term for the case in China. Thus, the reference year for evaluation is at the time of planting. To evaluate the economic attractiveness of these two forest management options, Equation (4) is slightly expanded and modified to costs and income specific to these two alternatives. Specifically, the maximum LEV of timber production forests can be expressed as

In Equation (5), denotes the LEV per hectare of timber forestland for optimal rotation age under the generalized Faustmann model, is the harvested log price of trees at age , represents the stand volume at age , is the expected merchantable roundwood (sawlog) yield rate of a stand, is the harvesting and transportation costs, is the annual tending cost per hectare at stand age , represents the regeneration cost per hectare of forestland (including site preparation and planting costs), and represents the LEV at the beginning of the second timber crop (and so on).

Depending on the contract terms and the installment plans for forest C sink projects, the optimal harvest age and corresponding maximum LEV for C sink forestland should be carefully considered. Specifically, when the optimal rotation of timber age is equal to or less than the length of the C sequestration contract n*k (with n being the total number of installment payments and k being the length of each payment period), the forest farmers have to finish the C sequestration contract first, and then, they can harvest the timber after the expiration of the C sink projects to realize the maximum revenue for the management of their forestlands (of course, forest farmers can also decide not to harvest timber and to keep their C sink forests intact after the expiration of the project. However, given the fact that forest farmers do not have an obligation to maintain the C stock and will not receive any payments for the additional C credits generated on their forestlands after the expiration of the project for most C sink projects in China, there is no penalty for timber harvesting after the contract. Thus, we assumed that a rational economic agent should consider harvesting trees to acquire the timber revenue, after which they can consider whether to enroll in a new forest C sink project to gain the additional revenue from the newly planted C sink forests). In this case, the optimal harvest age for C sink forests will be the year after the expiration of the C sink projects (i.e., , and the maximum generalized LEV of C sink forestland can be written as

If the optimal rotation of the timber age is longer than the length of the C sink project, the forest farmers can finish the C sink contract, after which they can wait until timber age to harvest the trees and start the next timber rotation. In this case, the maximum LEV of the C sink forests is

In Equations (6) and (7), is the price per metric ton of C dioxide equivalent (tCO2e), is the amount of C sequestered for each period of installment payments, is the total number of installment payments for C credits, is the setup cost of the forest C sink project (which mainly includes project preparation, C sink measurement, monitoring, and verification costs), and denotes the LEV at the beginning of the second rotation, which may or may not involve a C sink project. In addition, a C leakage factor (1 – α) is included in the third term on the right-hand side of Equations (6) and (7) to consider the potential C leakage effect (i.e., penalty, which refers to the process by which the C stored in living biomass is released to the atmosphere at the time of timber harvest) if the remaining treetops and slash are used as fuelwood in rural communities at the time of harvest.

In this study, we assumed that the LEV of the future C sink forest () will be identical to the LEV of the future timber production forest () due to the limited available transaction data for the C sink forests in the study area. This assumption allows us to specifically examine the effects that we can attribute to the potential benefits derived from the first plantation crop either used for timber production only or as a C sink. The value for LEV of future timber production forest was obtained from the timberland transactions of our study region (i.e., Gansu province) from the Chinese Forestland Trading Platform [29].

The economic attractiveness of participating in a forest C sink project can be evaluated by comparing the maximum LEVs at the optimal harvest age for the timber production forests and C sink forests. Taking timber production forest as an example, the optimal value of is calculated numerically by substituting the value of t1 from 5 to 60 years in Equation (5) until a maximum LEV is found. Specifically, the net financial benefits of program enrollment can be estimated by subtracting the LEV of timber production forests from the LEV of C sink forests to obtain the incremental LEV. If the incremental LEV is greater than zero, which means that the LEV of C sink forests outweighs the LEV of timber production forests, then participating in a C sink project can be supported on economic grounds. Otherwise, forest farmers should continue to manage their forestlands for timber production.

2.3. Eco-Compensation Standards for the C Sink Plantation Projects

The decision model developed in the previous section will help us further explore the government’s role in subsidizing forest C sink plantation projects. In China, the term “eco-compensation” is generally used to refer to a combination of ecological compensation and payments for ecological goods and services [30]. Specifically, if business entities’ willingness-to-pay for C credits from a C sink project is lower than the willingness-to-accept of a forest farmer willing to sell C credits, the forest C sink project cannot be realized. However, from a policymaker’s perspective, the government can support the emerging ecosystem market, such as forest C sink projects via eco-compensation. The role of the governments can also shift from the massive participation to a facilitator via market-based emission trading mechanisms. The subsidy for C sink projects to forest farmers can be set as the difference between the willingness-to-pay from those who need to purchase C credits and the willingness-to-accept from those who are willing to sell C credits. In forest C sink projects, buyers of C credits generally refer to the observed C trading price in markets to set the willingness-to-pay for C sink projects. Thus, we need to determine the minimum price that C credit sellers are willing to accept for each ton of C credit supply, which can be expressed as follows:

Solving for the minimum C credit price () required by sellers requires a solution for the C credit price in Equation (8); then, the optimal subsidy that the government should provide to incentivize forest farmers for program enrollment is the difference between the required minimum C credit price and the observed C trading price in markets (.

3. Empirical Analysis

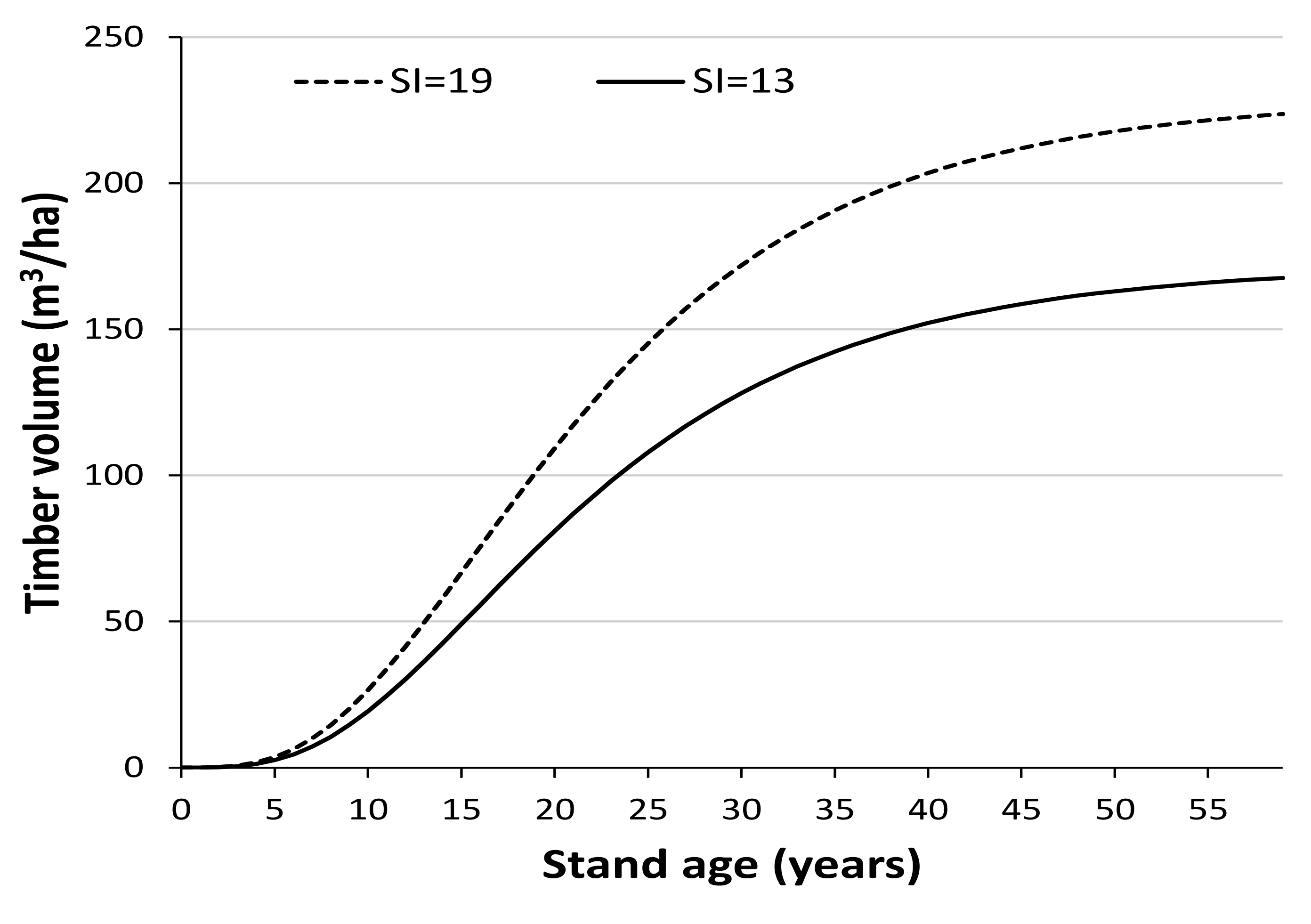

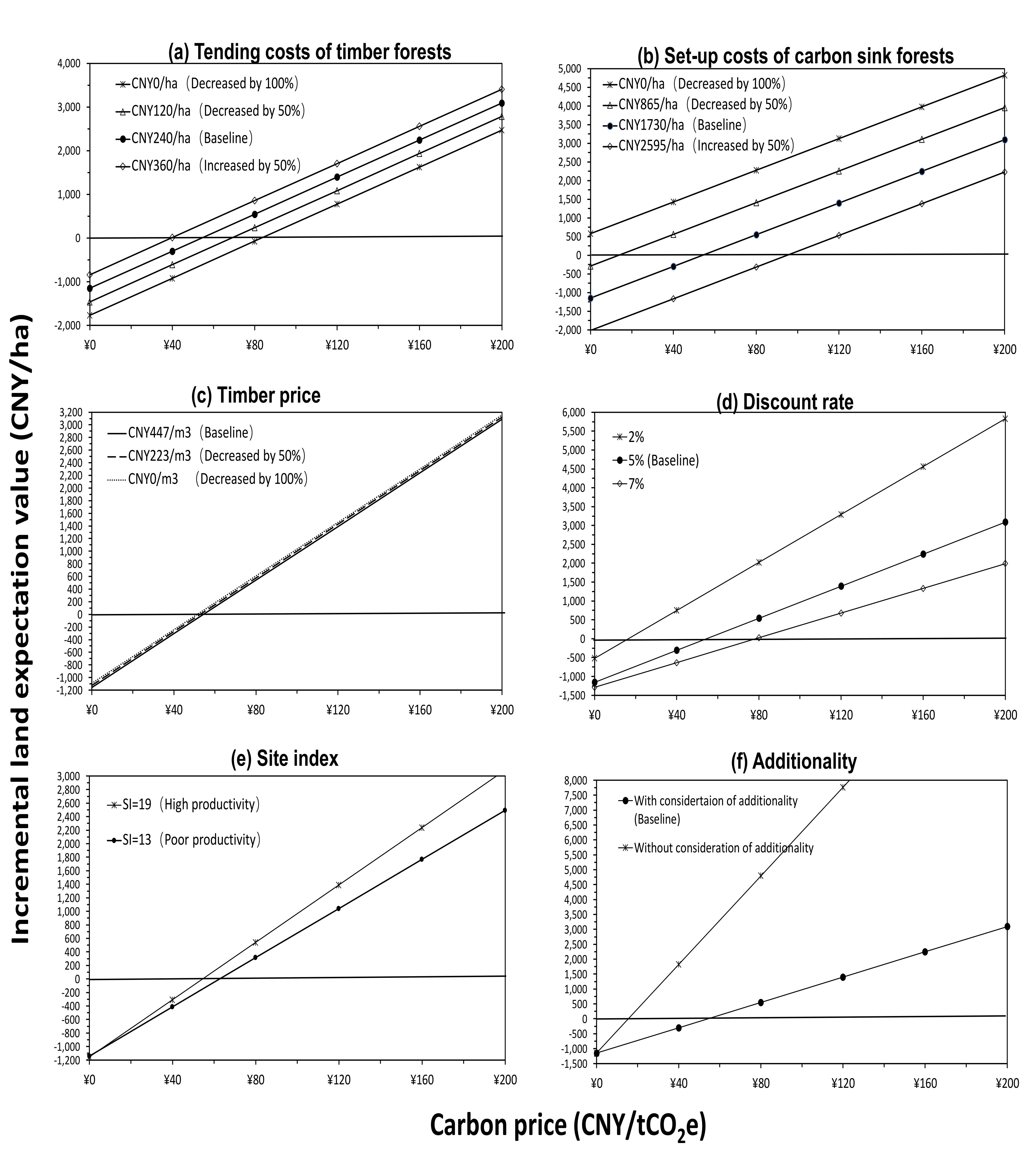

In this study, our study site for the C sink plantation projects in northwestern China was determined based on the following information. Larch, which is a common and fast-growing plantation species in the Xiao-Long-Shan forest district of Gansu Province, was used as the sample tree species for the simulation [31,32]. Furthermore, we assumed that forest farmers have the option to participate in forest C sink projects under three contract terms: 20 years, 25 years, or 30 years, covering most of the terms of forest C sink projects existing in China [10,23]. A tree growth and yield model developed by Jin et al. [33] was used to project the stand volume of even-aged larch stands under the following two site productivity levels: high (with site index (SI) 19 m at a breast height age of 18 years) and low (SI 13 m) productivity, which is presented in Figure 1 (see Appendix A for the functions used for tree growth and yield projections).

Figure 1.

Projected yields for larch under two site productivity levels (low and high) in Gansu, Northwest China. Site index (SI) represents the top height (in meters) at a breast height age of 18.

The measurement of forest C stock on site is an important basis for correctly assessing the LEV of C sink forests. In this paper, a C sink model was established following the Guidelines of C Sink Plantation Projects issued by the National Forestry and Grassland Administration of China [8]. In the biophysical model, the aboveground biomass, belowground biomass, dead wood, litter, and soil organic C stocks are considered the forest C pool (see Appendix B for the measurement of each C stock). Thus, a Larch C sink forest can sequester around 242 tons of CO2e at the tree age of 30 years on high-productivity sites in our study area. To ensure that there is additional C sequestered from the C sink plantation projects in comparison to the baseline scenario of timber production forests, the number of C credits earned from C sink projects is expressed as the difference between the amount of C sequestered from C sink forests and the baseline amount of C sequestered from timber production forests [8]. Without deducting the baseline C sink from timber production forests in the analysis (i.e., the issue of additionality), the predicted C credits available for trading from C sink projects would be overestimated and therefore could have a large effect on financial returns to forest farmers [23,34]. Moreover, given that forest management plans for C sink forests are similar to (or mimic) those of unmanaged natural forests in China to ensure that the increased C storage will exceed that associated with current practices in forestlands, the C sequestration ratio of a C sink forest to a baseline timber production forest in our study region was set as 1.40, following the suggestion from Guan et al. [32].

Table 1 presents the related numerical values of the economic parameters used in the generalized Faustmann model for simulation. Because the LEVs of C sink forests may fluctuate significantly due to C market dynamics, we conducted a sensitivity analysis with four C trading price scenarios (i.e., theoretically optimal, observed minimum, average, and maximum market prices) from the Shenzhen Emissions Exchange [35], the most vibrant emissions exchange market in China to investigate their effects on LEVs. The optimal C price, which is the theoretical C trading price that Chinese business entities are willing to pay for forest C credits with consideration of the current global C emission level, population, and China’s disposable personal income and its corporate social responsibility, was adopted from Long et al. [36]. Moreover, we assumed that the payment for C credits occurs every 5 years, which more realistically reflects the current situation in practice. Finally, a comparative static (sensitivity) analysis was conducted to investigate the impacts of important parameters that changed in the decision model (including discount rates, setup costs of a C sink project, tending costs, site conditions, and future LEVs) on the minimum willingness-to-accept for the C trading price and incremental net present values (NPVs) necessary for a forest farmer to participate in a C sink project.

Table 1.

Economic parameters and values used in the generalized Faustmann model.

4. Results

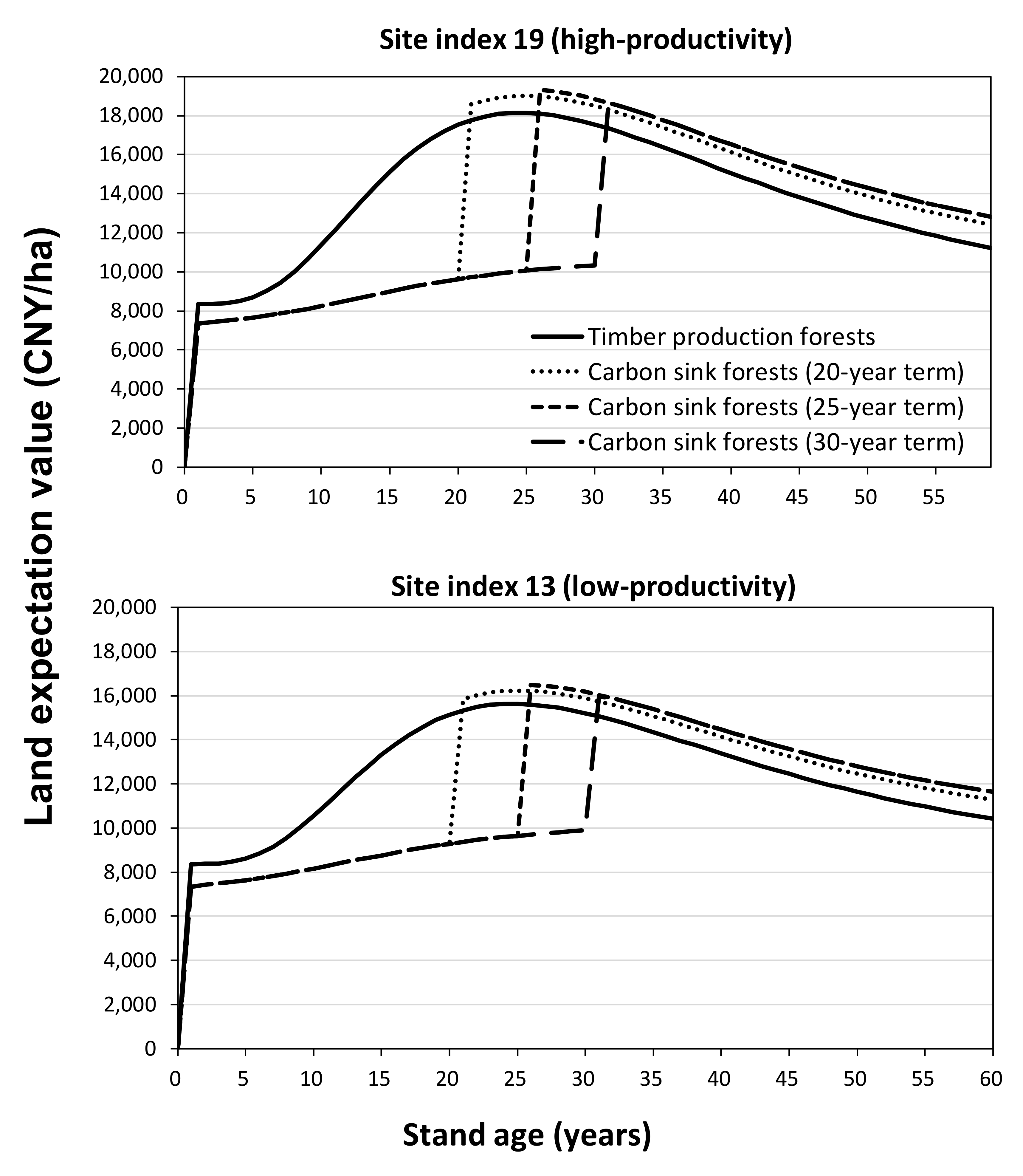

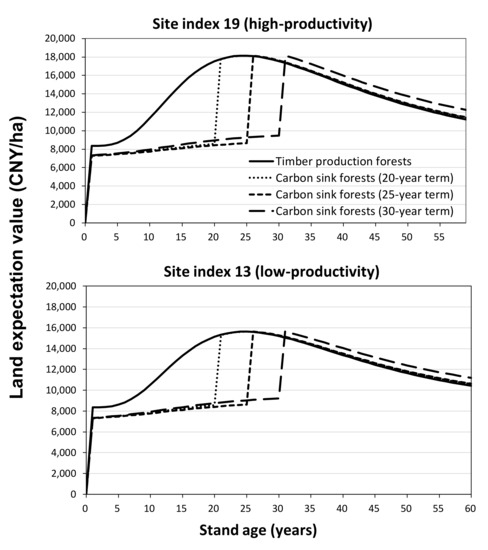

4.1. Land Expectation Values under the Optimal Carbon Price

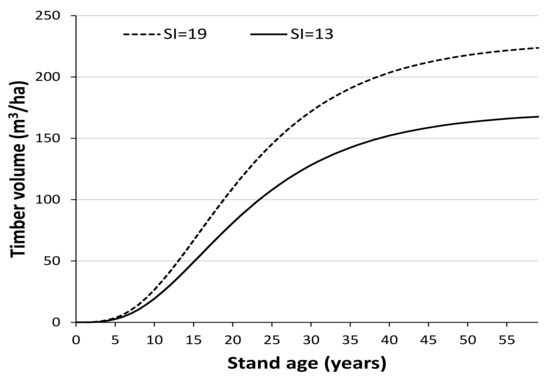

Figure 2 presents the estimated LEVs for larch timber production forests and C sink forests under 20-, 25-, and 30-year project terms in Gansu, Northwest China. First, the maximum LEV for timber production forests increased from CNY 15,630/ha (USD 2405/ha) on the poor-productivity sites to CNY 18,146/ha (USD 2792/ha) on the high-productivity sites, and the optimal harvest age remained in year 25. Moreover, our results show that the LEVs of C sink forests within the term of the C sink project are significantly less than the LEV of the timber production forest in the same period under the same site conditions. The main reason is that C sink forests are subject to regulations, and timber harvesting is not allowed during the project. In addition, the optimal economic rotation (that is, the maximum LEV) for a C sink forest with a project term of 20 years appears at stand age 25, with LEVs ranging from CNY 16,229/ha (USD 2497/ha) on low-productivity sites to CNY 19,022/ha (USD 2926/ha) on high-productivity sites. For a C sink forest with project terms of 25 and 30 years, the maximum LEV appears in years 26 and 31, respectively, which indicates that the net revenue from the timber harvesting after the expiration of C sink projects plays a more important role in the LEV than the pure revenue of selling C credits.

Figure 2.

Land expectation values for larch timber production forests and larch carbon sink forests in Gansu, Northwest China. The carbon sink forests were evaluated under a theoretically optimal carbon trading price (CNY 110/tCO2e). Site index (SI) represents the top height (in meters) at a breast height age of 18 years.

The results in Figure 2 also reveal that the maximum LEVs of C sink forests with a project term of 25 years tend to be higher than the maximum LEVs of C sink forests with a project term of 20 or 30 years under the same site conditions. For example, on a high-productivity site (SI 19 m), the maximum LEVs of C sink forests with 20-, 25-, and 30-year project terms were found to be CNY 19,022/ha (USD 2926/ha), CNY 19,325/ha (USD 2973/ha), and CNY 18,884/ha (USD 2905/ha), respectively. These results indicate that enrolling in a larch C sink project with 25-year term and harvesting timber at stand age 26 could generate the maximum financial revenue on forestlands compared with the other two contract terms.

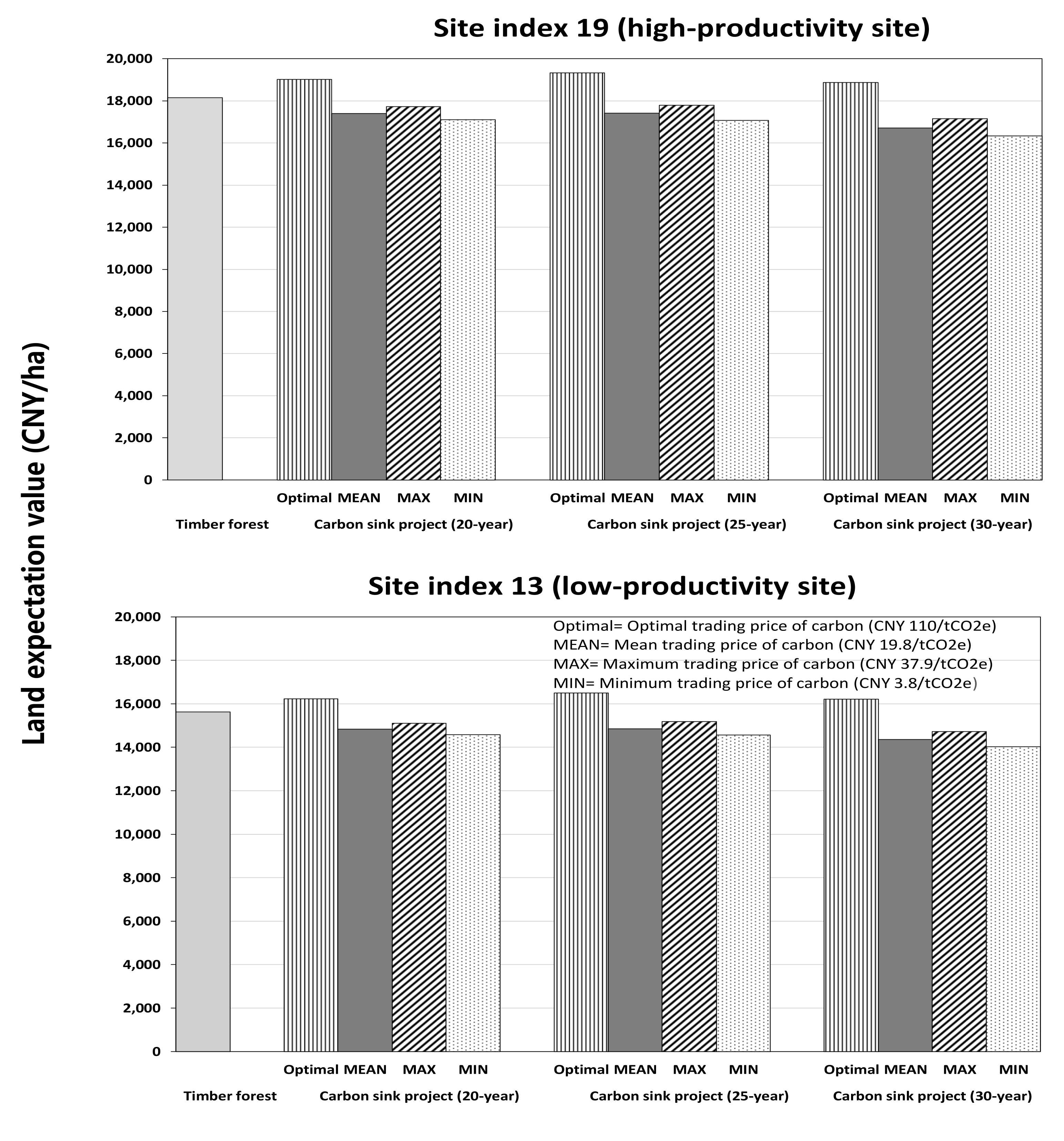

4.2. Financial Justification for Enrolling in a Larch Carbon Sink Project

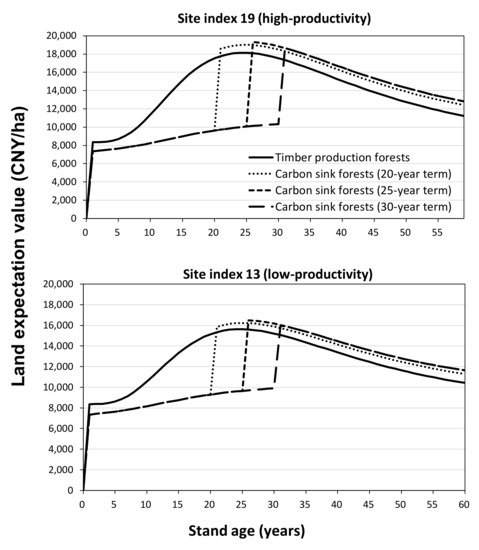

The results of the LEVs for C sink forests with varying C trading prices, contract terms, and site conditions are presented in Figure 3. Based on the results in Figure 3, a decision matrix is presented in Table 2 to help forest farmers justify the participation of a forest C sink project compared with the management goal of timber production. Specifically, our results showed that under the theoretically optimal C price of CNY 110/tCO2e (USD 17/tCO2e), the establishment of a larch C sink forest with project terms of 20, 25, and 30 years under any site conditions can generate more revenue than can forestland in timber production. For example, a larch C sink project with a 25-year term on a high-productivity site (SI = 19) can generate an additional CNY 1179/ha (USD 181/ha), relative to timber production forestland. However, Table 2 also shows that under the current C trading prices in market (including the minimum price of CNY 3.8/tCO2e, mean price of CNY 19.8/tCO2e, or maximum price of CNY 37.9/tCO2e), enrolling in a larch C sink project on any productivity sites generates more loss than the timber production forests. These results revealed that the conversion of the traditional timber production forests to C sink forests in the province of Gansu cannot be justified on economic grounds under the current conditions of the C emissions market in China. Moreover, the negative values in the cells of Table 2 represent the subsidies required by forest farmers to participate in forest C sink projects under the specific C trading prices indicated in the table.

Figure 3.

Maximum land expectation values of a larch timber production forest and a larch carbon sink forest at the optimal rotation age under different carbon trading prices and site conditions in Gansu, Northwest China.

Table 2.

Incremental land expectation values (net benefits) of enrolling in a larch carbon sink plantation project compared with managing the forestland for timber production in Gansu, Northwest China.

Table 3 presents the minimum C trading price required to break even for enrolling in C sink projects relative to timber production forests. These values also represent the threshold prices that forest farmers are willing to accept for participating in a larch C sink project, which can also be used by policymakers to determine the optimal eco-compensation standard for program enrollment. For example, the minimum required C credit prices per ton of C dioxide equivalent for forest farmers to participate in 25-year C sink projects on sites with high (SI 19 m) and low (SI 13 m) productivity were found to be CNY 54.4 and CNY 62.7, respectively. When the offered C trading price from buyers (e.g., our base case of CNY 110/tCO2e) is greater than the values shown in the cells, no subsidy is required from the government for forest farmers. Otherwise, a minimum compensation of the difference between the offered C prices (e.g., the current C trading prices in the market investigated in this study) and the threshold prices shown in Table 3 for each ton of C dioxide equivalent is needed to motivate forest farmers to participate.

Table 3.

Minimum carbon credit prices required to enroll in a larch carbon sink project under varying project terms and site conditions in Gansu, Northwest China.

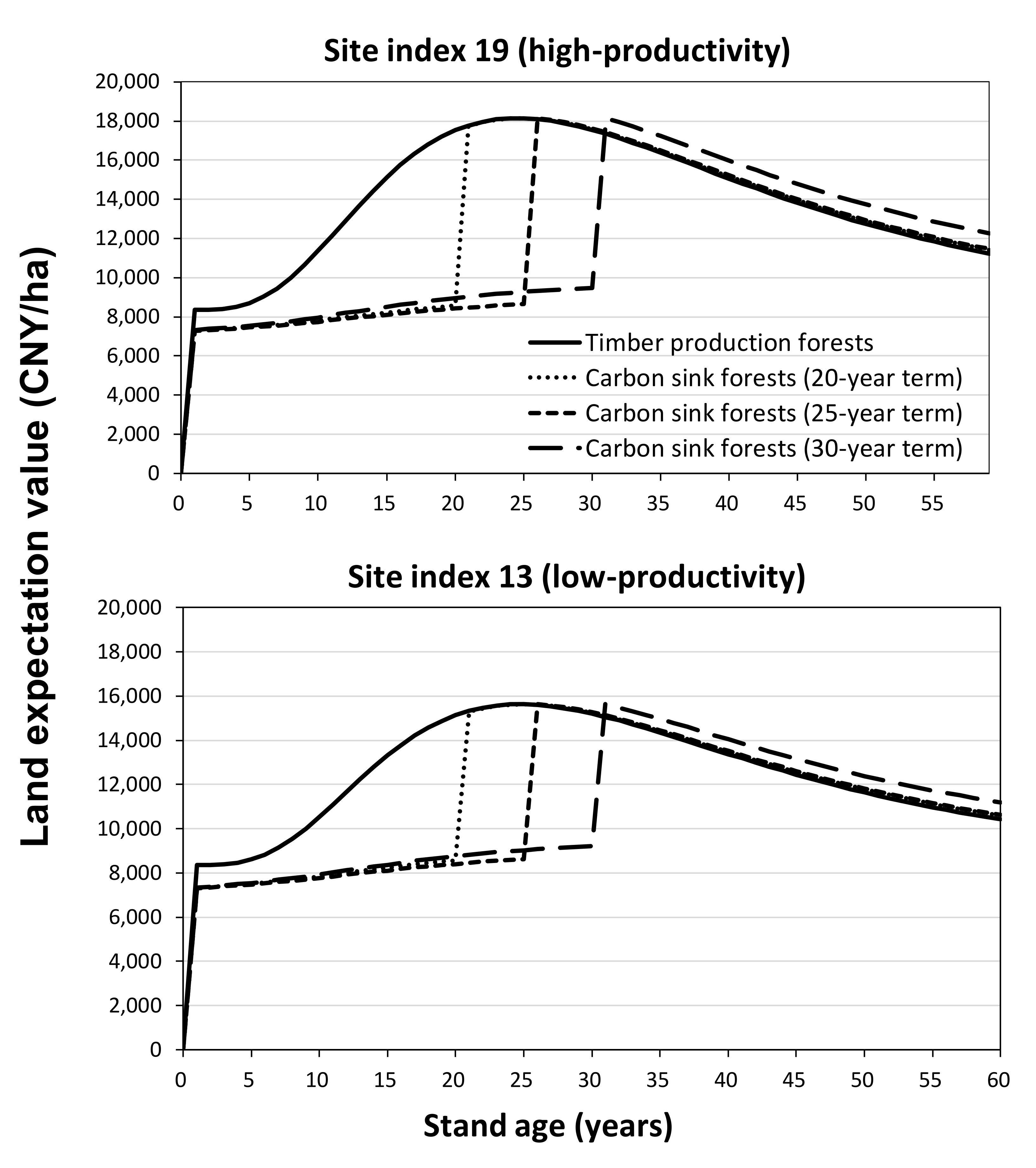

Figure 4 presents the LEVs of timber production forests and C sink forests after inputting the minimum required C credit prices from Table 3 into the generalized Faustmann model. These results indicated that relative to a 20-year or 25-year term contract, the participation in a larch C sink project with a 30-year term requires the highest threshold C sink prices to make the maximum LEVs at optimal rotation age 31 equal to the maximum LEV at optimal rotation age 25 for timber production forests.

Figure 4.

Land expectation values (LEVs) of larch forests for only timber production and for carbon sinks under varying carbon sink contract terms and site conditions in Gansu, Northwest China. The LEVs of carbon sink forests at the optimal rotation age were evaluated using the minimum carbon credit price required in Table 3 to break even for comparison with the maximum LEVs of timber production forests at the optimal rotation age 25.

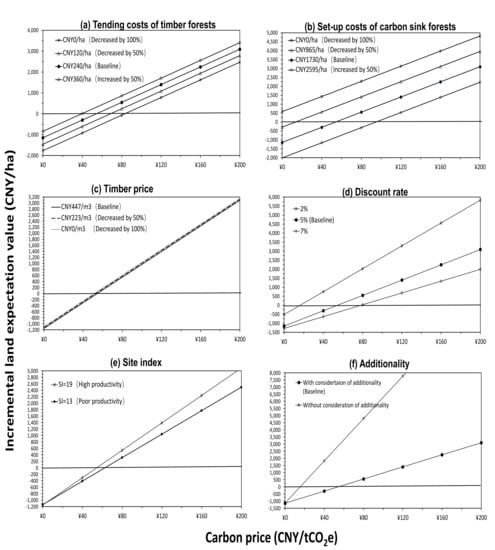

4.3. Comparative Static (Sensitivity) Analysis

Our previous results indicated that the C price plays an important role in the enrollment of forest C sink projects. As a result of this, Equation (8) can be rearranged into Equation (9) below to further examine the impacts of changes in important parameters on the minimum required C trading prices via a first-order condition. Equation (9) clearly shows that a one-time increase in LEVs for future timber production forests and setup costs of C sink projects would increase the minimum required C credit prices, whereas an increase in LEVs of future C sink forests, tending costs of timber production forests, and available C sinks on site would decrease the minimum required C credit prices for program enrollments. These results show that a reduction in the setup costs of C sink projects or increases in the future LEVs of C sink forests could effectively reduce the minimum required C credit prices to break even with the base case LEVs of timber production forests.

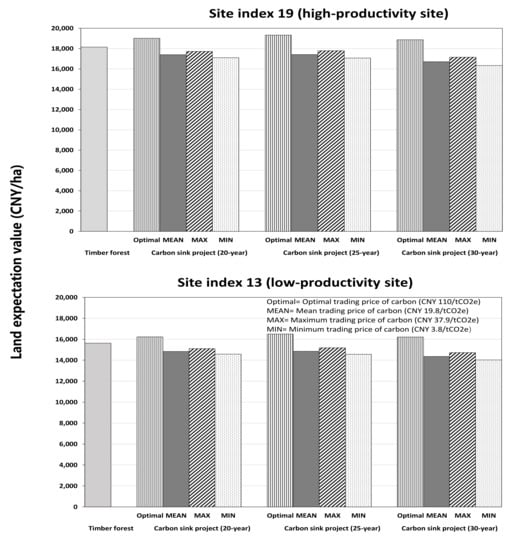

Figure 5 also presents the results of the comparative static (sensitivity) analysis of the effects of variation in important economic parameters (including tending costs of timber forests, setup costs of C sink forests, timber prices, and discount rates), related biophysical conditions and assumptions (i.e., site conditions and the available C offset credits for trading), and C credit prices on the incremental LEVs of enrolling in larch C sink plantation projects relative to using the forestland for only timber production. The results in Figure 5 indicate that increasing tending costs of timber forests, reducing setup costs of C sink projects, lowering discount rates, and siting C sink projects on high-productivity sites, all without considering the additionality of forest C sinks on sites, would have positive impacts on the incremental LEVs of C sink forests. However, the results of our sensitivity analysis also show that changes in timber prices have negligible impacts on the incremental LEVs of C sink forests. One primary reason for this is that owners of C sink forestland could also benefit from timber harvesting after the expiration of C sink contracts. Therefore, timber prices would concurrently affect the LEVs of both timber production forests and C sink forests and have minor impacts on the incremental LEVs of C sink forests (due to limited information on our study sites, this result assumes no difference in the wood quality of harvested logs between timber production forests and carbon sink forests, which may not be accurate; future research on wood quality under various forest management regimes is warranted.).

Figure 5.

Impacts of changes in important parameters in the decision model on the incremental land expectation values of carbon sink forests compared with timber production forests. In each of the panels of Figure 5, a horizontal line that intersects the y-axis at the incremental land expectation value of zero is used to identify the minimum required carbon price (break-even point) that would justify enrollment in a forest carbon sink project relative to the traditional land-use goal of timber production for a particular scenario. Note: Scenarios are evaluated based on a 25-year contract term (all subfigures), a site index of 19 m (a,b,c,d,f), and a 5% real discount rate (a,b,c,e,f), respectively.

5. Discussion

In this study, the generalized Faustmann model was applied as a decision-making tool to help private forest farmers in the northwestern Chinese province of Gansu evaluate the financial attractiveness of participating in a larch C sink plantation project relative to the traditional land-use goal of timber production. A number of important findings and policy implications was found regarding the supply of C sink forests and the optimal eco-compensation for program enrollment in the region. First, the results of our case study indicated that under the current C price rates in the market (including the maximum, mean, and minimum C prices), enrolling in a larch C sink project with any contract terms and site conditions could not be supported on economic grounds. These results suggest that the current C trading prices in China may still be too low; therefore, a subsidy or eco-compensation is required from the government to encourage forest farmers to enroll in these programs. However, the results of our case study also indicated that a forest farmers would have sufficient economic incentives and motivation to spontaneously participate in a forest C sink project with a 20-, 25-, or 30-year term under any site conditions when the C price is at the theoretically optimal level of CNY 110/tCO2e (equivalent to USD 17/tCO2e). As a result, the Chinese central or local governments could act as catalysts for the financial protection of forest C sink projects by continuously supporting the development of C exchange markets. For example, once the C price rates in China are similar to the global price levels of USD 40–80/tCO2e (equivalent to CNY 260–520/tCO2e) in 2020, as recommended by the High-Level Commission on C Prices [42], it is highly possible that participating in a forest C sink project could generate greater financial benefits than the timber production forests. Moreover, it may be socially optimal never to harvest the trees, as indicated by Hartman [13], if the values of standing forests (e.g., C sequestration, forest recreation, etc.) are high enough.

The results of our analysis also revealed that forest farmers who enroll in a 25-year term larch C sink plantation project would generate more revenue (or less loss) on their forestlands compared with the other two project terms investigated in this study. These results indicate that there exists an optimal contract term of C sink projects, and forest farmers could refer to the optimal economic rotation age of the selected tree species as a basis to choose a contract term for profit maximization. These findings also imply that each forest C sink project should be evaluated independently according to its biophysical (e.g., tree species, site conditions, C stock) and economic (e.g., C price rates, opportunity costs of original land-use goal) conditions. Thus, a “one-size-fits-all” policy on forest C sink-related issues may not be the best policy or preferred strategy for policy makers and forest managers. This aspect is vital, especially when governments give financial support in the form of subsidies or compensation to participating farmers.

The results of our analysis with consideration of C leakage penalty at the time of harvest (shown in Table 2) reveal that the potential C leakage penalty could exert the greatest effect on incremental benefits under the highest C price scenario in our analysis. For example, when comparing the results in Table 2 with the results evaluated under the scenario of no penalty for C leakage at harvest (see Table A3 in Appendix B), the incremental benefits of participating in a forest C sink project would be reduced by less than 3% under the minimum C trading price of CNY 3.8/tCO2e to more than 30% under the optimal C price rate of CNY 110/tCO2e. This result indicates that the issue of a C leakage penalty may discourage forest farmers from program enrollment if harvesting trees after the expiration of the contract term is an option and if the C trading prices would be increasing in the future. While the Chinese government does not currently charge a penalty on C leakage at the time of harvest, many studies tend to consider C leakage penalties that are incurred at tree harvest (e.g., [43]) and examine the leakage effects on LEV from society’s perspective. Therefore, policymakers should also design a better mechanism to incentivize forest farmers voluntary participation in forest C sink projects.

The potential net benefits of enrolling in a larch C sink plantation project compared with managing the forestland for timber production in the study region are thoroughly discussed and are presented in our decision matrix in Table 2 in order to guide policymakers toward the optimal eco-compensation of forest C sink projects. The minimum required C credit prices presented in our study also provide useful information for forest farmers in the evaluation of various scenarios for program participation. However, it should also be acknowledged that there is only one C price in the marketplace (i.e., the Law of One Price prevails), which would make it less likely and more difficult for forest farmers with poor-productivity sites to participate in forest C sink projects. Thus, caution must be taken when interpreting our results.

Finally, several important results emerged when examining the impacts of changes in parameters in the decision model on the net benefits of forest C sink projects. Specifically, from the benefit side, our results indicate that increasing the available C offset credits for trading has a large effect on financial returns to forest farmers (see Figure 5f), a scenario without consideration of additionality). From the cost side, reducing the setup costs of forest C sink projects could also significantly increase the net income from managing C sink forests (see Figure 5b). This information provides valuable insights for governments regarding the development and improvement of the forest C sink market, such as by building managerial capacity, establishing forest C sink cooperatives, and disclosing project information more transparently to reduce transaction costs. Moreover, it is important to note that a 100% reduction in tending costs of timber forests or initial setup costs of C forests is unrealistic in practice. Thus, our sensitivity analysis results may imply that the Chinese central government may need to intervene and pay for the C sequestered under the business-as-usual scenario (i.e., the land-use goal of timber production) and furthermore consider subsidizing the initial setup costs of forest C sink projects through public funding to incentivize the participation in forest C sink projects by forest farmers. As shown in Figure 5b, forest farmers would have enough economic incentives (with a gain of CNY 130/ha) to participate in a forest C sink project at the current average C price of CNY 19.8/tCO2e if the government could subsidize 50% of the setup costs of C sink projects. We consider this type of cost-sharing mechanism a more viable policy alternative for participation in forest C sink projects. Finally, we also propose that the government can conduct related measures to stabilize the price of C market. For instance, compensating forest farmers when C price in the market is below the minimum required (threshold) C prices as shown in Table 3 and adopting a lower discount rate (e.g., 1% or 2%) to increase forest asset values for private forest enterprises, as suggested by Sauter and Mußhoff [44], could significantly increase forest farmers’ interests of participation in such project. All of these measures could also help the Chinese government reach the C neutrality goals in 2060.

Although this study was conducted from the perspective of private forest farmers and specifically focused on small-scale tree growers who have only one stand to evaluate the potential financial benefits of the conversion of land from timber production forests to C sink forests, the analytical framework and economic model could be applied to other alternative land-use options. A further extension of the research would be an assessment of the Grain for Green program in China (The Grain for Green Project is a nationwide program in China in which the central government pays farmers to revert sloping or marginal farmland to forests or grass and is the largest ecological restoration and rural development program in the world. The objective of the program is to improve the ecological conditions and the livelihood of millions of people in rural China. See Delang and Yuan [45] for a review of the program). Future research directions include investigating the optimal subsidy or eco-compensation for farmers reverting sloping or marginal farmland to forests or grass, where timber harvesting or ranching is not allowed indefinitely. Analysis of factors influencing forest farmer’s decision-making behavior for program enrollment and the issue of available C offset credits for trading (i.e., additionality) on existing managed forestlands also warrant future research.

Author Contributions

Conceptualization, W.-Y.C.; methodology, W.-Y.C. and S.J.C.; validation, K.L. and S.J.C.; formal analysis, W.-Y.C. and Z.L.; data curation, Z.L.; investigation, W.-Y.C., Z.L., K.L., and S.J.C.; writing—original draft preparation, W.-Y.C. and Z.L.; writing—review and editing, S.J.C. and K.L.; supervision, S.J.C.; project administration, W.-Y.C.; funding acquisition, W.-Y.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Fundamental Research Funds for the Central Universities of Lanzhou University (No. 21lzujbkyxs011).

Acknowledgments

We thank two reviewers for the valuable comments and suggestions regarding this manuscript.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

Appendix A. Tree Growth and Yield Projections

Following Jin et al. [33], the Richards growth function of average larch tree height, diameter at breast height, and other related parameters used in this study under different site index in Gansu province are presented below (Table A1):

Table A1.

Regression parameters for a, b, and c under each site index.

Table A1.

Regression parameters for a, b, and c under each site index.

| Site Index | a | b | c |

|---|---|---|---|

| 13 | 22.153 | 1.471 | 0.07 |

| 19 | 29.524 | 1.422 | 0.07 |

Data Source: Jin et al. [33].

The tree growth and yield functions for larch are therefore specified as follows:

where , , and

represent the average tree heights (m) on low-productivity (SI 13 m) and high-productivity (SI 19 m) sites at age t and tree diameter at breast height (cm) at age t per stem, respectively.

Based on the timber yield function from Li and Zeng [46], the stand volume can be expressed as

where is the stand volume of larch per hectare at age t, in cubic meters (m3/ha), which includes bark but excludes the stump; and NTREE represents the planting density per hectare (stems/ha).

Appendix B. Measurement of C Stocks on Site

Following the Guidelines of Carbon Sink Plantation Projects from the National Forestry and Grassland Administration of China [8], the number of C credits earned from C sink projects is expressed as

where denotes the additional C sinks (tCO2e/ha/year) generated from the project at year , which also represents the carbon credits that forest farmers can earn when enrolling in a forest carbon sink project; is the amount of C sink at year from C sink forests, and represents the amount of baseline C sink at year from timber production forests.

The measurement of C stock of the project assumed that there are no natural disturbances (e.g., forest fires, pest outbreaks) on site that would alter the C stock. The inventory of C stock in all C pools can be determined as follows:

where , and represent the amounts of the C sequestered in tree biomass, shrubs, deadwood, litter, and soil at stand age t, respectively.

The estimation of C stock in tree biomass can be presented in Equations (A5)–(A7) below.

in Equation (A5) represents the aboveground tree biomass per stem (kg/stem) in year t, where the parameters used in the stem biomass function are from Cheng et al. [47]; in Equation (A6) denotes the tree biomass per hectare in year t, expressed in metric tons (ton/ha/year); is the ratio of belowground biomass to aboveground biomass; and represents the planting density per hectare (stems/ha). In Equation (A7), indicates the C stock in trees per hectare in year t (tCO2e/ha/year); represents the C fraction of tree biomass, and 44/12 represents the ratio of the molecular weight of CO2 to that of C.

The measurements of C stock in shrubs, dead wood, litter, and soil are described by Equations (A8) to (A12) below.

in Equation (A8) represents the biomass in shrubs per hectare in year t (ton/ha/year), represents the ratio of shrub biomass to the aboveground tree biomass per hectare in forest, and represents crown cover of shrubs in shrub biomass in year t;

in Equation (A9) is the C stock in shrubs per hectare in year t (tCO2e/ha/year), and represents the C fraction of shrub biomass, represents root-shoot ratio for shrubs; in Equation (A10) represents the C stock in dead wood per hectare in year t (tCO2e/ha/year), and represents C stock in dead wood as a percentage of C stock in tree biomass; in Equation (A11) represents the C stock in litter per hectare in year t (tCO2e/ha/year), and expresses C stock in litter as a percentage of C stock in tree biomass; in Equation (A12) is the C stock in soil per hectare in year t (tCO2e/ha/year), and represents the annual change in soil organic C stock in soil per hectare (ton C/ha/year). The definition of the input parameters and values used in the equations above are also shown in Table A2.

Table A2.

Parameters used for carbon stock measurement in larch at the study site.

Table A2.

Parameters used for carbon stock measurement in larch at the study site.

| Parameter | Definition (Unit) | Value |

|---|---|---|

| Ratio of belowground biomass to aboveground biomass (percent) | 21.5 | |

| Carbon fraction of tree biomass (percent) | 52.1 | |

| Planting density (stems/ha) | 2000 | |

| Carbon fraction of shrub biomass (precent) | 47 | |

| Root-shoot ratio for shrubs (percent) | 69 | |

| Ratio of shrub biomass per hectare to the aboveground tree biomass per hectare in forest (percent) | 10 | |

| Crown cover of shrubs in shrub biomass in year t (percent) | 10 | |

| Carbon stock in dead wood as a percentage of carbon stock in tree biomass (percent) | 3.11 | |

| Carbon stock in litter as a percentage of carbon stock in tree biomass (percent) | 4.0 | |

| Soil organic carbon stock per hectare per year (ton/ha/year) | 0.8 |

Data source: National Forestry and Grassland Administration of China [8].

Table A3.

Incremental land expectation values (net benefits) of enrolling in a larch carbon sink plantation project compared with managing the forestland for timber production in northwestern China (evaluated with no penalty on carbon leakage at the time of harvest).

Table A3.

Incremental land expectation values (net benefits) of enrolling in a larch carbon sink plantation project compared with managing the forestland for timber production in northwestern China (evaluated with no penalty on carbon leakage at the time of harvest).

| Carbon Trading Price | Term of Carbon Sink Project | Site Condition | |

|---|---|---|---|

| High Productivity (SI = 19) | Low Productivity (SI = 13) | ||

| Optimal carbon price (CNY 110/tCO2e) | 20 years | 1243 | 909 |

| 25 years | 1643 | 1251 | |

| 30 years | 1173 | 951 | |

| Maximum trading price of carbon (CNY 37.9/tCO2e) | 20 years | −298 | −413 |

| 25 years | −190 | −314 | |

| 30 years | −849 | −775 | |

| Mean trading price of carbon (CNY 19.8/tCO2e) | 20 years | −686 | −746 |

| 25 years | −651 | −708 | |

| 30 years | −1357 | −1209 | |

| Minimum trading price of carbon (CNY 3.8/tCO2e) | 20 years | −1028 | −1040 |

| 25 years | −1058 | −1055 | |

| 30 years | −1806 | −1592 | |

SI, site index (which represents the top height (in meters) at a breast height age of 18 years); tCO2e, tons of carbon dioxide equivalent. Note: Values are evaluated at a 5% discount rate. A gray cell represents an additional loss (less than CNY 0/ha) for participating in a forest carbon sink project compared with the land expectation value of timber production forestland (base case) under the corresponding site condition, carbon sink project term, and trading price of carbon. An unshaded cell indicates an additional benefit of enrolling in a larch carbon sink project relative to using forestland for timber production.

References

- Smith, P.; Davis, S.J.; Creutzig, F.; Fuss, S.; Minx, J.; Gabrielle, B.; Kato, E.; Jackson, R.B.; Cowie, A.; Kriegler, E.; et al. Biophysical and economic limits to negative CO2 emissions. Nat. Clim. Chang. 2016, 6, 42–50. [Google Scholar] [CrossRef]

- What Is Carbon Sequestration? Available online: https://www.usgs.gov/faqs/what-carbon-sequestration?qt-news_science_products=0#qt-news_science_products (accessed on 23 December 2021).

- Cook-Patton, S.C.; Leavitt, S.M.; Gibbs, D.; Harris, N.L.; Lister, K.; Anderson-Teixeira, K.J.; Briggs, R.D.; Chazdon, R.L.; Crowther, T.W.; Ellis, P.W.; et al. Mapping carbon accumulation potential from global natural forest regrowth. Nature 2020, 585, 545–550. [Google Scholar] [CrossRef] [PubMed]

- Kumar, D.A.; Kumar, M.; Pandey, R.; Yu, Z.D.; Cabral-Pinto, M. Forest soil nutrient stocks along altitudinal range of Uttarakhand Himalayas: An aid to Nature Based Climate Solutions. Catena 2021, 207, 105667. [Google Scholar] [CrossRef]

- Report of the People’s Republic of China on Climate Change (3rd Edition). Available online: http://www.ncsc.org.cn/SY/tjkhybg/202003/t20200323_770094.shtml (accessed on 23 December 2021).

- Thakur, U.; Bisth, N.S.; Kumar, A.; Kumar, H.; Sahoo, U.K. Regeneration Potential of Forest Vegetation of Churdhar Wildlife Sanctuary of India: Implication for Forest Management. Water Air Soil Pollut. 2021, 232, 373. [Google Scholar] [CrossRef]

- Crediting Period of Various Carbon Sink Projects. Available online: http://www.tanpaifang.com/tanhui/2017/0315/58771_6.html (accessed on 23 December 2021).

- National Forestry and Grassland Administration of China. The Guidelines of Carbon Sink Plantation Projects; National Forestry and Grassland Administration of China: Beijing, China, 2013. [Google Scholar]

- Zhang, G.L.; Zhang, N. The effect of China’s pilot carbon emissions trading schemes on poverty alleviation: A quasi-natural experiment approach. J. Environ. Manag. 2020, 271, 110973. [Google Scholar] [CrossRef]

- Gan, T.Y. Farmer’s participation in the carbon sink forestry. Rural Econ. 2020, 9, 117–122. [Google Scholar]

- Pearse, P.H. Introduction to Forestry Economics; University of British Columbia Press: Vancouver, BC, Canada, 1990. [Google Scholar]

- Faustmann, M. Calculation of the value which forest land and immature stands possess for forestry. In Economics of Forestry; Sedjo, R.A., Ed.; Ashgate: MI, USA, 2003; pp. 1–40. [Google Scholar]

- Hartman, R. The harvesting decision when a standing forest has value. Econ. Inq. 1976, 14, 52–58. [Google Scholar] [CrossRef]

- Shen, Y.Q.; Wang, F.; Zhang, Y.Q.; Zhu, Z.; Wang, X.L. Economic analysis of Chinese fir forest carbon sequestration supply in South China. Sci. Silvae Sin. 2013, 49, 140–147. [Google Scholar] [CrossRef]

- Wang, F.; Shen, Y.Q.; Zhu, Z.; Lin, J.H.; Wang, X.L. Economic analysis of Chinese fir forest carbon sequestration: Based on Zhejiang’s survey. J. Zhejiang AF Univ. 2012, 29, 762–767. [Google Scholar]

- Wang, F.; Shen, Y.Q.; Sun, Y.G. The study on carbon transaction price based on cost-profit ratio: The case of Chinese fir management in Zhejiang Province. Issues For. Econ. 2012, 32, 104–108. [Google Scholar] [CrossRef]

- Wang, X.L.; Shen, Y.Q.; Zhu, Z. The maximization of land expectation value (LEV) considering carbon benefits and its sensitivity analysis—Take Chinese fir and Masson pine for example. J. Nanjing For. Univ. (Nat. Sci. Ed.) 2013, 37, 143–148. [Google Scholar]

- Yu, J.N.; Yao, S.B. Optimal subsidy of SLCP in China from the perspective of carbon sequestration benefit. China Popul. Resour. Environ. 2012, 22, 34–39. [Google Scholar] [CrossRef]

- Zhang, W.W.; Gao, J.J. Analysis of the economic conditions of the carbon sink forest supply—also on the function of government in carbon sink Trading Mechanism. J. Northeast. Norm. Univ. (Philos. Soc. Sci.) 2019, 3, 177–183. [Google Scholar] [CrossRef]

- Zeng, C.; Shen, Y.Q.; Feng, N.N. Faustmann model: Origin development and application. In Proceedings of the 6th China Forestry Technology Economic Theory and Practice Forum-Low Carbon Economy and Green Development Conference, Ganzhou, Jiangxi, China, 17–18 November 2012. [Google Scholar]

- Zhu, Z.; Shen, Y.Q.; Zhang, Y.Q.; Shi, W.; Wang, F. Change of forestland expected value and carbon supply in the objective of carbon sequestration: Based on the Chinese fir plantation in bared land. Sci. Silvae Sin. 2012, 48, 112–116. [Google Scholar]

- Zhu, Z.; Shen, Y.Q.; Wu, W.G.; Xu, X.Y.; Zeng, C. Household optimal forest management decision and carbon supply: Case from Zhejiang and Jiangxi Provinces. Acta Ecol. Sin. 2013, 33, 2577–2585. [Google Scholar] [CrossRef][Green Version]

- Lv, Z. Forest Carbon Practices and Low Carbon Development in China; Peking University Press: Beijing, China, 2014. [Google Scholar]

- Chang, S.J. A generalized Faustmann model for the determination of optimal harvest age. Can. J. For. Res. 1998, 28, 652–659. [Google Scholar] [CrossRef]

- Chang, S.J. The generalized Faustmann formula. In Handbook of Forest Resource Economics, 1st ed.; Kant, S., Alavalapati, J., Eds.; Routledge: London, UK, 2014; pp. 26–49. [Google Scholar]

- Parajuli, R.; Chang, S.J. Carbon sequestration and uneven-aged management of loblolly pine stands in the Southern USA: A joint optimization approach. For. Policy Econ. 2012, 22, 65–71. [Google Scholar] [CrossRef]

- Susaeta, A.; Chang, S.J.; Carter, D.R.; Lal, P. Economics of carbon sequestration under fluctuating economic environment, forest management and technological changes: An application to forest stands in the southern United States. J. For. Econ. 2014, 20, 47–64. [Google Scholar] [CrossRef]

- Susaeta, A.; Adams, D.C.; Gonzalez-Benecke, C. Economic vulnerability of southern US slash pine forests to climate change. J. For. Econ. 2017, 28, 18–32. [Google Scholar] [CrossRef]

- Chinese Forestland Trading Platform Market Information. Available online: http://www.linquan88.com/assessment.do?method=query (accessed on 23 December 2021).

- Shang, W.X.; Gong, Y.C.; Wang, Z.J.; Stewardson, M.J. Eco-compensation in China: Theory, practices and suggestions for the future. J. Environ. Manag. 2018, 210, 162–170. [Google Scholar] [CrossRef]

- Wang, D.X. Restoring Reclaimed Land to Forests or Grasses and Approaches to Vegetation Reconstruction in Northwest China. Ph.D. Thesis, Northwest A&F Forestry University, Shaanxi, China, 2001. [Google Scholar]

- Guan, J.H.; Du, S.; Cheng, J.M.; Wu, C.R.; Li, G.Q.; Deng, L.; Zhang, J.G.; He, Q.Y.; Shi, W.Y. Current stocks and rate of sequestration of forest carbon in Gansu Province, China. Chin. J. Plant Ecol. 2016, 40, 304–317. [Google Scholar] [CrossRef]

- Jin, J.C.; Ma, J.W.; Zhang, S.Z.; Guo, X.L. Discussion on silvicultural aim of Larix leptolpis plantation in Xiaolongshan forest area. J. Gansu For. Sci. Technol. 2008, 33, 20–23, 47. [Google Scholar] [CrossRef]

- Asante, P.; Armstrong, G. Carbon sequestration and the optimal forest harvest decision under alternative baseline policies. Can. J. For. Res. 2016, 46, 656–665. [Google Scholar] [CrossRef]

- Shenzhen Emissions Exchange Market Information. Available online: http://www.cerx.cn/en/endaily/ (accessed on 23 December 2021).

- Long, F.; Shen, Y.Q.; Wu, W.G.; Zhu, Z.; Zhang, Z. Simulation research on the decision-making mechanism of regional forest carbon sequestration operation based on multi-agent system. J. Syst. Sci. Math. Sci. 2014, 34, 64–76. [Google Scholar]

- China Forestry Statistical Yearbook 2017. Available online: https://data.cnki.net/trade/Yearbook/Single/N2019060085?z=Z010 (accessed on 23 December 2021).

- Shi, L.; Tang, Y.H.; Zhang, J. Supply-demand analysis of the forest carbon sink market in China--illustrated by the Guangdong Chimelong carbon sink afforestation project. Chin. J. Environ. Manag. 2017, 9, 104–110. [Google Scholar] [CrossRef]

- Zhu, H.Y. Study on Growth Law and Optimal Management Model of Larix Kaempferi Plantations in Western of Qinling Mountains. Master’s Thesis, Northwest A&F Forestry University, Shaanxi, China, 2014. [Google Scholar]

- Wang, Z.X.; Jiang, Q.F. China forestry basic rate of discount. For. Econ. 2006, 6, 39–44. [Google Scholar]

- Li, T.M.; Du, X.K.; Yang, J.; Jia, F.H.; Ma, G.X. Timber yield rate of secondary Larch forest in North China. Shanxi For. Sci. Technol. 1995, 4, 13–16. [Google Scholar]

- Carbon Pricing Dashboard. Available online: https://carbonpricingdashboard.worldbank.org/what-carbon-pricing (accessed on 23 December 2021).

- Latta, G.; Adams, D.M.; Alig, R.J.; White, E. Simulated effects of mandatory versus voluntary participation in private forest carbon offset markets in the United States. J. For. Econ. 2011, 17, 127–141. [Google Scholar] [CrossRef]

- Sauter, P.A.; Mußhoff, O. What is your discount rate? Experimental evidence of foresters’ risk and time preferences. Ann. For. Sci. 2018, 75, 10. [Google Scholar] [CrossRef]

- Delang, C.O.; Yuan, Z. China’s Grain for Green Program: A Review of the Largest Ecological Restoration and Rural Development Program in the World, 1st ed.; Springer: Cham, Switzerland, 2015. [Google Scholar]

- Li, H.; Zeng, W. Validation and comparison of two-variable tree stand volume tables for Larix spp. in different regions of China. Sci. Silvae Sin. 2016, 6, 157–162. [Google Scholar]

- Cheng, T.; Ma, Q.; Feng, Z.; Luo, X. Research on forest biomass in Xiaolong Mountains, Gansu province. J. Beijing For. Univ. 2007, 29, 31–36. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).