Abstract

Brazil, as an emerging and newly industrialized nation, presents a complex dynamic between economic advancement and environmental sustainability. This study investigates the influence of coal consumption (COAL), gross domestic product (GDP), renewable energy (REN), and foreign direct investment (FDI) on CO2 emissions in Brazil using quarterly data from 1990Q1 to 2020Q4. Employing the Quantile-on-Quantile Kernel-Based Regularized Least Squares (QQKRLS) method and the Quantile-on-Quantile Granger Causality (QQGC) test, we uncover significant nonlinear and distributional heterogeneities in these relationships. Results show that COAL, GDP, and FDI consistently exert a positive impact on CO2 emissions across most quantiles, whereas REN significantly reduces emissions, particularly at the upper emission quantiles. Causality analysis confirms that all four variables are significant predictors of CO2 emissions. The study contributes methodologically by applying QQKRLS and QQGC to reveal nuanced interactions across the emissions distribution—an advancement over traditional linear approaches. Empirically, it provides Brazil-specific evidence of the dual role of FDI and economic growth in both driving emissions and offering potential for sustainable transition. Based on these findings, we recommend policies that prioritize sector-specific FDI screening to promote green technologies, accelerate investment in renewable energy infrastructure, and impose adaptive carbon pricing mechanisms that reflect the heterogeneous impact of coal and economic growth on emissions. These insights support Brazil’s climate targets and guide a balanced path toward inclusive and sustainable development.

1. Introduction

The notion that the environmental degradation issue is exclusively a developing-country concern is not valid, especially within the framework of the global climate change initiative. The increasing level of Greenhouse gas (GHG) emissions haS emerged as a global issue, adversely affecting both emerging and industrialized nations, irrespective of their historical contributions to the problem (Lin & Ullah, 2024) [1]. In Brazil, the impacts of environmental degradation are evident, ranging from deforestation in the Amazon to extreme weather events such as severe droughts and floods (de Andrade Costa et al., 2024) [2]. These challenges have caused widespread damage to critical infrastructureand ecosystems, and have had profound implications for human livelihoods. Such developments emphasize the complex dynamics between environmental degradation and economic growth, presenting critical challenges for policymakers and economists.

Moreover, the environmental Kuznets curve hypothesis (EKC) provides a framework for understanding the interplay between economic growth and environmental pollution (Grossman & Krueger, 1991) [3]. In Brazil, the heavy reliance on coal and other fossil fuels for energy production exacerbates the country’s CO2 emissions level. Despite its abundant renewable energy potential, particularly in hydroelectric and solar power (Tapia Carpio & Cardoso Guimarães, 2024) [4], coal remains a cost-effective and accessible option for meeting the growing energy demand, especially in industrial sectors (Carvalho et al., 2020) [5]. Brazil’s rapid economic development, particularly during the early 2000s, coincided with an increase in energy-intensive activities, contributing to higher emissions. While Brazil has made strides in renewable energy adoption, fossil fuels still play a significant role in its energy mix, hindering progress toward sustainability. As of now, coal and other non-renewable sources dominate energy production, emphasizing the need for accelerated investment in renewable infrastructure and more stringent environmental policies.

Since Foreign Direct Investment (FDI) is a crucial source of private capital for an emerging and newly industrialized economies, Brazil has significantly liberalized its investment policies since the military regime. Recently, the removal of barriers and implementing investment incentives are measures contributing to rise in FDI inflows, thereby contributing to Brazil’s GDP growth. Additionally, Brazil’s attractiveness to FDI is driven by factors such as its large domestic market, skilled labor force, improved entrepreneurial capacity, and financial development (Calegário et al., 2014) [6]. However, the pursuit of FDI raises concerns about its environmental impact, as disparities in environmental standards across countries may encourage foreign firms in pollution-intensive sectors to relocate to nations with weaker regulations (Esmaeili et al., 2023) [7], a condition denoted as the Pollution Haven Hypothesis. This could result in increased pollution in Brazil as the country prioritizes FDI to boost economic growth, potentially undervaluing environmental degradation. On the other hand, foreign firms often bring eco-friendly technologies and adhere to stricter environmental standards due to regulations in their home countries, which could improve environmental quality (Jiang, 2024) [8], which is known as the Pollution Halo Hypothesis. Understanding these dynamics is essential for formulating balanced policies that leverage FDI for growth while safeguarding environmental sustainability. The selection of GDP, FDI, renewable energy (REN), and coal consumption (COAL) as key explanatory variables in this study stems from their fundamental roles in shaping both economic development and environmental sustainability, particularly in emerging economies like Brazil. As a resource-rich country undergoing rapid industrialization, Brazil presents a unique case where economic ambitions often intersect with environmental constraints. GDP serves as a proxy for overall economic growth, capturing the scale of industrial activity and energy demand, both of which are central to emissions outcomes. FDI reflects the inflow of external capital, which can stimulate technological progress and infrastructure development but also introduce pollution-intensive industries, especially in the absence of stringent environmental regulations. Coal consumption represents traditional fossil fuel dependency, a major contributor to CO2 emissions and a barrier to decarbonization. In contrast, renewable energy adoption is critical for mitigating emissions and transitioning to a low-carbon economy. The combined analysis of these variables allows for a holistic understanding of the drivers and mitigators of CO2 emissions, offering a robust foundation for designing sustainable development strategies tailored to Brazil’s economic and environmental realities.

The primary objective of this research is to provide responses to critical research questions. Specifically, the study seeks to answer the following: (i) What is the impact of renewable energy adoption on CO2 emissions in Brazil, and to what extent can renewable energy mitigate the environmental challenges posed by traditional energy sources? (ii) How does FDI influence CO2 emissions, particularly considering the balance between its potential to drive economic growth and its role in supporting sustainable or pollution-intensive industries? (iii) In what ways does economic growth impact CO2 emissions, and can Brazil achieve a sustainable growth trajectory that aligns with its environmental and developmental goals? Although numerous studies have explored the relationship between economic growth, FDI, energy use, and CO2 emissions, gaps remain. Most rely on linear models that ignore the varying effects across different emission levels and often treat key variables in isolation. Additionally, Brazil-specific research using advanced nonlinear methods is limited. This study addresses these gaps by applying Quantile-on-Quantile techniques to reveal how GDP, FDI, coal, and renewable energy affect CO2 emissions across different quantiles. The findings show that while coal, GDP, and FDI increase emissions, renewable energy helps reduce them—offering nuanced insights for sustainable policy planning in Brazil. By addressing these questions, the study aims to evaluate the individual and combined effects of FDI, economic growth, and renewable energy on Brazil’s environmental performance. This analysis is intended to provide actionable insights for policymakers, helping to align Brazil’s economic strategies with global sustainability objectives while ensuring long-term environmental resilience.

The contribution of this paper entails the following: (i) This paper seeks to provide fresh insights into the effect of FDI, economic growth, and renewable energy on environmental performance in Brazil. (ii) Brazil serves as an ideal focus due to its unique economic and environmental challenges, including its heavy reliance on natural resources to fuel economic growth, rapid industrialization that drives energy-intensive activities, and the ongoing deforestation in the Amazon, which has significant global implications for biodiversity and carbon sequestration. These challenges underscore the critical interplay between economic development and environmental preservation in a country with vast ecological and industrial potential. Addressing these issues is essential not only for Brazil’s sustainable growth but also for its contribution to global climate stability and environmental resilience. (iii) The study employs the Quantile-on-Quantile Kernel-Based Regularized Least Squares (QQKRLS) method, which is an analytical technique for assessing nonlinear connections and provides flexibility for capturing detailed patterns within the data. Furthermore, this study also used the Quantile-on-Quantile Granger causality (QQGC) approach, which helps to inspect the causal connection between CO2 emissions and these explanatory variables (COAL, GDP, REN, and FDI) in Brazil.

This study is structured as follows: Section 2 provides a comprehensive review of relevant literature, offering context and grounding for the research. Section 3 details the data sources and methodology employed. Section 4 presents the results and empirical findings. Finally, Section 5 concludes the study with a summary of insights and policy recommendations tailored to the Brazilian context.

2. Literature Review

The relationship between foreign direct investment (FDI), economic growth (GDP), technological innovation, and environmental quality in Brazil has attracted significant scholarly attention, particularly given Brazil’s dual reliance on coal and renewable energy sources. This literature review synthesizes key findings from previous studies, focusing on the interplay of CO2 emissions, coal, GDP, renewable energy (REN), and FDI, while aligning with the specified research context.

2.1. Foreign Direct Investment and Environmental Quality

FDI is a critical driver of economic growth and technological transfer but poses dual environmental challenges. Uddin et al. (2016) [9] examined the ecological footprint in 22 countries and found that FDI positively impacts economic progress but also increases environmental strain. Adedoyin et al. (2020) [10] extended this to BRICS economies, demonstrating that while coal rents negatively influence CO2 emissions, regulatory quality significantly moderates this impact. Their findings suggest that robust regulations and investment in clean energy technologies are essential to mitigate FDI’s environmental downsides.

Bi and Khan (2024), [11] focusing on BRICS nations from 2004 to 2023, highlighted that investments in renewable energy and sustainability-driven innovation can align FDI with environmental goals. They noted that Brazil’s high renewable energy balance exemplifies how FDI, coupled with stringent governance, can mitigate CO2 emissions. Additionally, Lei et al. (2020) [12] emphasized the need for targeted policies to manage the environmental effects of industrial investments driven by FDI.

Foreign direct investment (FDI) plays a dual role in economic growth and environmental quality, with varying impacts across regions and sectors. Seker et al. (2015) [13] analyzed the relationship between FDI, GDP, energy consumption, and CO2 emissions in Turkey from 1974 to 2010 using an autoregressive distributed lag (ARDL) model. Their findings revealed that while FDI had a positive but small impact on CO2 emissions, GDP and energy consumption significantly contributed to emissions. The study also confirmed the Environmental Kuznets Curve (EKC) hypothesis, suggesting that as income rises, CO2 emissions initially increase before declining as economies transition to cleaner technologies. These results emphasize the need for sustainable FDI policies that prioritize technology-intensive investments to balance growth and environmental protection.

Similar trends have been observed in other regions. For instance, Viglioni et al. (2024) [14] highlighted the importance of intellectual property rights in moderating FDI’s environmental impact, enabling cleaner technologies and reducing emissions in G20 countries. Bi et al. (2024) [15] also noted that in BRICS economies, aligning FDI with renewable energy investments could mitigate CO2 emissions while fostering sustainable economic development. These findings collectively underscore the necessity of aligning FDI strategies with environmental sustainability goals, particularly through policies that incentivize green investments and energy efficiency.

2.2. Economic Growth and CO2 Emissions

The relationship between GDP and CO2 emissions is well-established in the literature. Kihombo et al. (2021) [16] used FMOLS and DOLS methods to reveal that economic growth in G7 countries leads to higher ecological footprints, emphasizing the environmental cost of industrialization. Lei et al. (2020) [12] corroborated this, showing that fossil fuel reliance is closely linked to economic expansion but compromises air quality and increases CO2 emissions. These findings are particularly relevant to Brazil, where GDP growth has historically depended on resource-intensive activities.

The relationship between economic growth and CO2 emissions has been a central topic in environmental studies. Lei et al. (2021) [17] analyzing data from 2001 to 2018, identified a robust connection between GDP and fossil fuel-related CO2 emissions at the continental scale. They emphasized that adopting advanced renewable energy technologies is crucial for decoupling economic growth from environmental harm. Similarly, Adedoyin et al. (2020) [10] examined BRICS economies from 1990 to 2014, finding that regulatory quality is essential in mitigating the environmental effects of economic activities. Their study underscored the need for strict environmental policies to reduce emissions as these countries pursue economic expansion. The relationship between CO2 emissions and economic growth is central to sustainable development debates. Mardani et al. (2019) [18] systematically reviewed 175 studies published from 1995 to 2017, analyzing data durations and methodologies to explore this nexus. Their findings reveal bidirectional causality, where economic growth stimulates CO2 emissions, and emissions reductions can constrain growth. These results emphasize the need for policies balancing environmental sustainability and economic development. Similarly, Seker et al. (2015) [13] using data from 1974 to 2010 in Turkey, supported the Environmental Kuznets Curve (EKC) hypothesis, showing that emissions rise during early development stages but decline with technological progress. Both studies highlight that economic strategies incorporating renewable energy and that energy efficiency can mitigate emissions while sustaining growth

2.3. Coal Consumption and Renewable Energy

Coal remains a significant contributor to Brazil’s energy mix, despite its environmental consequences. Jahanger et al. (2022) [19] using data from 1990 to 2016, identified a positive relationship between fossil fuel consumption and economic growth in emerging economies, highlighting the environmental trade-offs of coal dependence. Conversely, Sasana and Ghozali (2013), [20] analyzing data from 1995 to 2014, found that renewable energy has a limited yet growing influence on economic output in BRICS nations due to infrastructural and technological constraints. This dichotomy underscores the need for Brazil to transition toward renewables to achieve sustainable economic growth. The study by Pao and Fu (2013) [21] employs yearly data from 1980 to 2010 to explore the causal relationships between Brazil’s GDP and energy consumption, including coal as part of non-renewable energy consumption (NREC). The findings emphasize that while renewable energy consumption (NHREC and TREC) positively impacts economic growth, the effects of non-renewable energy consumption, including coal, are insignificant in driving long-term output growth. The study highlights the importance of expanding renewable energy for sustainable economic development while reducing the negative environmental impacts of coal consumption. The article by Pereira et al. (2013) [22] explores opportunities for integrating new renewable energy sources into Brazil’s energy mix from 2010 to 2030. It highlights the potential benefits in terms of greenhouse gas (GHG) emission reductions, job creation, and the public investments required to achieve these outcomes. The study demonstrates Brazil’s capacity to produce a high volume of clean energy, positioning it above the world average in renewable energy production. The steel industry heavily relies on coal, which contributes to 7% of global anthropogenic CO2 emissions annually. Sonter et al. (2015) [23] investigated the Brazilian steel industry from 2000 to 2007, where efforts to replace coal with carbon-neutral charcoal inadvertently led to increased emissions. While the proportion of coal use declined, reliance on charcoal sourced from native forests resulted in up to nine times more CO2 emissions per tonne of steel than coal. Socio-economic challenges and infrastructure limitations restricted the transition to plantation-sourced charcoal, highlighting the unintended consequences of mitigation strategies in Brazil’s steel production.

The transition to renewable energy is critical for reducing CO2 emissions. Paim et al. (2019) [24] argue that Brazil’s hydropower potential, combined with investments in solar and wind energy, offers a sustainable pathway for economic growth. Shahbaz et al. (2013) [25] found that increased renewable energy consumption in South Africa significantly reduced emissions, reinforcing the importance of energy diversification.

Despite the extensive research on the relationship between economic growth, foreign direct investment (FDI), technological innovation, and environmental quality, several gaps remain unaddressed. Most studies have focused on developed economies or regional analyses without delving deeply into country-specific contexts like Brazil, a critical emerging economy. For instance, Mardani et al. (2019) [18] reviewed the nexus between CO2 emissions and economic growth but lacked an in-depth analysis of Brazil’s unique energy and economic structure. Similarly, Seker et al. (2015) [13] highlighted FDI’s environmental impact in Turkey but did not explore the varying effects of renewable energy adoption in Brazil.

While studies such as Lei et al. (2021) [17] addressed the role of technological innovation globally, they did not employ quantile-based methodologies to examine the heterogeneity in environmental impacts across different levels of environmental quality. This gap is significant for Brazil, where the interplay of FDI, GDP, and coal consumption creates diverse environmental outcomes. Furthermore, the existing literature often treats these variables as linear contributors to environmental degradation, failing to capture nonlinear dynamics and distributional variations. Quantile regression analysis, as employed in this study, addresses these gaps by examining how FDI, GDP, and renewable energy adoption impact environmental quality at various quantiles of CO2 emissions. This approach provides a more granular understanding of these relationships, particularly in the context of Brazil’s energy mix and policy environment. Additionally, previous studies have rarely explored the simultaneous roles of coal consumption and renewable energy within a single framework, further highlighting the need for integrative and country-specific research.

The existing literature broadly finds that economic growth and FDI tend to increase CO2 emissions, while renewable energy helps mitigate them. However, most studies rely on linear models and analyze these factors separately, overlooking their combined and asymmetric effects—especially across different levels of emissions. Furthermore, country-specific evidence for Brazil remains limited despite its unique energy mix and environmental challenges. While much of the literature examines global or regional trends, Brazil presents a unique context due to its high reliance on renewable sources such as hydropower and ethanol, alongside ongoing dependence on coal in industrial sectors. Additionally, challenges such as deforestation in the Amazon, urbanization, and sector-specific FDI contribute to its complex emissions profile. National strategies like the Brazilian Climate Action Plan and Energy Expansion Plan (PDE 2030) offer important frameworks that influence the interactions between energy policy, economic development, and environmental sustainability. Including these Brazil-specific dynamics enhances the contextual relevance of this study.

This study addresses these gaps by applying Quantile-on-Quantile Kernel-Based Regularized Least Squares (QQKRLS) and Quantile-on-Quantile Granger Causality (QQGC) methods, which capture the nonlinear and heterogeneous relationships across emission quantiles. It also integrates GDP, FDI, coal, and renewable energy into a single analytical framework, offering new insights into Brazil’s path toward sustainable development.

2.4. Theoretical Framework

This study is anchored in three key theories: the Environmental Kuznets Curve (EKC), the Pollution Haven and Halo Hypotheses, and environmental energy theory.

The EKC hypothesis suggests a nonlinear relationship between economic growth and environmental degradation. In its early stages, economic growth (GDP) is associated with rising CO2 emissions due to industrialization and fossil fuel use. As income levels rise, cleaner technologies and stronger regulations can lead to a decline in emissions. In Brazil’s case, its growing economy, still heavily reliant on resource-intensive industries, reflects the upward phase of the EKC.

FDI affects emissions through two opposing channels. The Pollution Haven Hypothesis argues that foreign firms may relocate to countries with weaker environmental laws, increasing emissions. The Pollution Halo Hypothesis, on the other hand, suggests that FDI can introduce greener technologies and practices, reducing environmental harm. Brazil’s openness to investment makes both scenarios plausible, depending on sector and policy alignment.

Coal consumption (COAL) is widely recognized as a leading driver of CO2 emissions, particularly in industrial sectors. In contrast, renewable energy (REN) helps reduce emissions by replacing carbon-intensive sources. Brazil’s energy mix includes significant renewables, yet coal still plays a key role in sectors like steel and cement.

These theoretical mechanisms justify the study’s focus and support the application of a quantile-based econometric approach to capture the asymmetric and heterogeneous effects of each variable across different emission levels.

3. Data and Method

3.1. Data

This study uses the annual time-series data from 1970 to 2022, using available data, to analyze the relationship between CO2 emissions, coal consumption, foreign direct investment (FDI), gross domestic product (GDP), and renewable energy (REN) in Brazil. Specifically, this study uses the gross domestic product (GDP) as a proxy for economic growth. The foreign direct investment gauges the inflow of capital from foreign sources. Renewable energy is a proxy for clean energy sources, while coal energy is aproxy for conventional energy sources. On the other hand, CO2 emissions serve as proxy for environmental degradation. The dataset span the period from 1970 to 2022, determined by both data availability and historical relevance. The year 1970 marks a turning point in Brazil’s economic and environmental trajectory. During this period, Brazil entered an era of intensified industrialization and rapid urban development, leading to rising energy demands and greater environmental stress. It was also a period of major policy shifts, including large-scale public infrastructure projects and energy reforms, which directly influenced CO2 emissions and FDI inflows.

Extending the dataset to 2022 allows the analysis to capture more recent developments, including Brazil’s growing investments in renewable energy, shifts in environmental regulations, and economic recovery phases following external shocks such as the global financial crisis and the COVID-19 pandemic.

Although more recent quarterly datasets beyond 2022 are limited or incomplete for some variables (especially FDI and COAL), the 1970–2022 range provides a robust and comprehensive window to examine long-term trends in economic growth, energy transition, and emissions dynamics in Brazil. FDI, REN, GDP, and CO2 emissions were obtained from the world bank database indicators and measured as net inflows as a percentage of GDP, share of renewable energy in total energy consumption, annual percentage growth rate of GDP, and metric tons per capita, respectively. Conversely, coal energy was obtained from the British petroleum database, and measured in exajoules. To ensure accuracy and model readiness, all variables were log-transformed to normalize distributions and mitigate the impact of outliers.

3.2. Methods

This study applies a four-stage empirical strategy to investigate the asymmetric and nonlinear effects of coal consumption (COAL), economic growth (GDP), foreign direct investment (FDI), and renewable energy (REN) on CO2 emissions in Brazil.

- Step 1: Nonlinearity Testing

We begin by applying the nonlinearity test of Broock et al. (1996) [26] to detect complex dynamics among the variables. The presence of significant nonlinearity justifies the use of quantile-based econometric models instead of linear estimators.

- Step 2: Stationarity Testing

To assess the unit root properties of the data, we employ the Quantile Augmented Dickey–Fuller (QADF) and Quantile Phillips–Perron (QPP) tests as developed by Adebayo et al. (2024) [27]. These tests provide robust inference across the distribution of the variables, particularly under non-normality and the presence of outliers.

- Step 3: Quantile-on-Quantile Kernel-Based Regularized Least Squares (QQKRLS)

The QQKRLS model estimates the impact of the θ-th quantile of an independent variable Xt on the τ-th quantile of the dependent variable Yt(CO2 emissions), expressed as

Here, Qτ(Yt/Xt) denotes the conditional quantile function, while αβ(τ,θ) are quantile-specific coefficients. A Gaussian kernel is used for smoothing, and regularization is implemented to address potential overfitting. Estimations were performed using R 4.5.0 and MATLAB R2023a 9.14.

- Step 4: Quantile-on-Quantile Granger Causality (QQGC)

To assess causality across quantiles, we implement the QQGC approach, which allows for heterogeneous causal effects depending on the conditional distribution of the variables. The QQGC model is given by

where is the information set up to time and indicates whether lagged values of X Granger-cause Y at quantile τ. The lag length is selected using the Schwarz Information Criterion (SIC). QQGC is implemented using the quantreg and QGC packages in R. To operationalize the QQKRLS model, we applied a Gaussian kernel smoothing technique with a bandwidth selected via cross-validation, following the structure proposed by Adebayo et al., 2024 [27]. This approach assumes that the effect of each explanatory variable varies smoothly across the distribution of the dependent variable. Regularization was employed to address multicollinearity and avoid overfitting, particularly at the tails of the distribution. In the QQGC analysis, the optimal lag length was selected using the Schwarz Information Criterion (SIC), and causality was tested across quantile levels to capture directional relationships between CO2 emissions and their drivers. All estimations were conducted using R (with quantreg, QGC, and custom kernel scripts) and MATLAB for graphical representation and model validation. This setup ensures robustness and flexibility in handling nonlinear dynamics.

This methodological design allows for a comprehensive examination of distributional effects, making it suitable for analyzing environmental dynamics in a complex and transitional economy like Brazil.

4. Results and Discussion

4.1. Descriptive Analysis

Table 1 highlights key characteristics of CO2 emissions, COAL, FDI, GDP, and REN. FDI shows the highest variability and a strong left skew, reflecting significant disparities among observations. Meanwhile, CO2 emissions, COAL, and REN exhibit small standard deviations and near-zero skewness values, thereby suggesting low variability and relatively symmetric distributions. Kurtosis values indicate that most variables, except FDI, have platykurtic distributions, characterized by light tails. The Jarque–Bera test results suggest that CO2 and COAL follow a normal distribution, while FDI and GDP deviate significantly from normality. Moreover, these statistics establish the use of the quantile-based approach for the main econometric analysis.

Table 1.

Descriptive statistics.

Table 2 presents the results of a nonlinearity test for CO2 emissions, COAL, FDI, GDP, and REN, with all variables showing significant nonlinear relationships (p-value < 0.01). The test statistics increased progressively from M2 to M6, indicating that nonlinear effects become more pronounced with more complex model specifications. FDI exhibits the highest degree of nonlinearity, indicating especially complex connections, while renewable energy shows the lowest test values but maintains significance across all models. These results underscore the need of using sophisticated nonlinear models to elucidate the intricate interactions among the variables. Consequently, disregarding nonlinear dynamics may lead to too simplistic analysis and erroneous policy suggestions.

Table 2.

Result of the nonlinearity test.

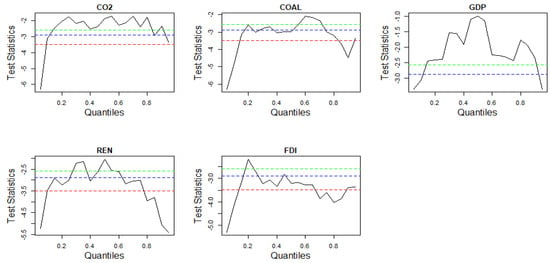

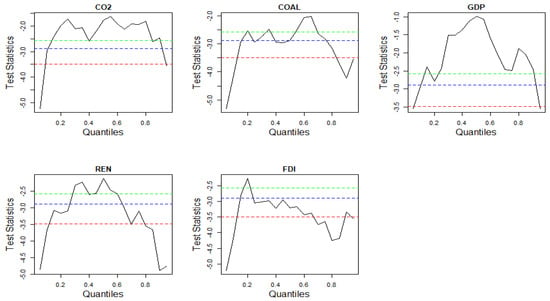

Next, to assess the stationarity properties of the dataset, we conducted unit root tests using the the QADF and QPP unit root tests. These tests are well-suited for evaluating the presence of unit roots in datasets that may exhibit non-stationary behavior across different quantiles. The results of the QADF and QPP unit root tests are illustrated in Figure 1 and Figure 2, respectively. These plots clearly show the behavior of all variables across the various quantiles. These tests confirm that, for all variables considered, the series are stationary at each quantile, as evidenced by the absence of unit roots, which is indicative of the dataset’s stationarity nature across different quantiles.

Figure 1.

QADF unit root test.

Figure 2.

QPP unit root test.

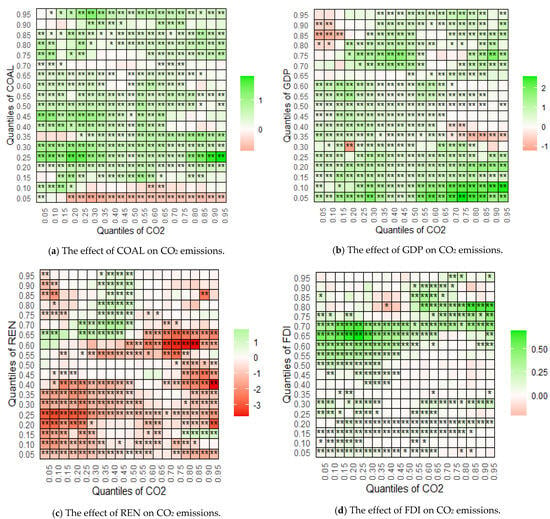

4.2. QQKRLS Results

This study used the QQKRLS approach to investigate the impact of COAL, FDI, GDP, and REN on CO2 emissions for Brazil. Figure 3a–d shows the findings of the QQKRLS method. Figure 3a shows the QQKRLS method of the impact of COAL on CO2 emissions. It revealed that COAL positively impacts CO2 emissions across various quantiles except in 0.01Q. This finding suggests that substantial contribution to GHGs arising from coal burning for electricity generation. Coal, being one of the most carbon-intensive fossil fuels, contributes to heightened CO2 emissions, especially within the industrial and energy sectors. In Brazil, while coal constitutes a lesser portion of the energy mix relative to hydropower and renewables, its use in certain sectors such as steel and cement manufacturing results in significant emissions. Moreover, this relationship is particularly evident in newly industrialized nations where COAL supports economic activities but exacerbates environmental degradation. The positive role of COAL in CO2 emissions underscores the need of transitioning to greener energy choices to alleviate the adverse environmental effects. The positive effect of COAL on CO2 emissions aligns with other work conducted by Pata (2018) [28], Lin et al., (2018) [29], and Shahbaz et al., (2013) [30].

Figure 3.

Plots of the QQKRLS approach (* is statistically significant at the 10% level (p < 0.10) and ** is statistically significant at the 5% level (p < 0.05)).

The result of the QQKRLS model on the effect of GDP on CO2 emissions is presented in Figure 3b. Across all quantiles, GDP has a positive impact on CO2 emissions in Brazil. This positive influence of GDP can be attributed to increased industrialization, energy demand, and infrastructure development. As Brazil’s economy grows, activities like manufacturing, construction, and transportation expand, resulting in higher energy consumption and associated emissions. Growth often drives urbanization, leading to more vehicles, energy-intensive buildings, and higher fossil fuel use. Moreover, economic expansion often prioritizes short-term development over environmental concerns, especially in resource-dependent sectors like agriculture and mining, which contribute significantly to deforestation and emissions. Brazil’s reliance on fossil fuels, particularly for industrial and transport needs, amplifies the link between growth and emissions. The positive effect of GDP on CO2 emissions aligns with other work conducted by Chi (2025) [31], and Wen et al., (2025) [32].

Figure 3c depicts the result of the QQKRLS on the influence of REN on CO2 emissions. It shows that in most of the quantiles, REN has a negative impact on CO2 emissions. The negative effect of REN on CO2 emissions aligns with other work conducted by Adebayo & Ullah (2024) [33], Anser et al., (2024) [34], and Cai & Wei (2023) [35]. Thus, REN negatively impacts CO2 emissions in Brazil due to its abundant and diverse renewable energy sources. Hydropower, which dominates Brazil’s energy mix, provides a large share of electricity with minimal direct CO2 emissions, contributing to a low-carbon energy system (Paim et al., 2019) [24]. Brazil’s biofuel industry, particularly ethanol from sugarcane, helps reduce dependence on fossil fuels in the transportation sector, cutting emissions from gasoline use (Coelho & Goldemberg, 2019) [36]. Brazil’s growing investments in wind and solar energy are further diversifying its renewable portfolio, offering clean alternatives to fossil fuel-powered electricity generation (Shahsavari & Akbari, 2018) [37]. These renewables also help to stabilize the energy grid, particularly during periods of fluctuating rainfall that affect hydropower generation. By promoting renewable energy, Brazil has been able to meet a significant portion of its energy demand sustainably, avoiding millions of tons of GHGs annually. This clean energy strategy supports Brazil’s international climate commitments and strengthens its position as a leader in renewable energy deployment.

The result of the QQKRLS model on the effect of FDI on CO2 emissions is presented in Figure 3d. Across all quantiles, FDI has a positive impact on CO2 emissions in Brazil. This finding suggests that FDI is associated with increased CO2 emissions, particularly in sectors like mining, energy, and manufacturing. Many FDI inflows target industries that are energy-intensive, such as oil extraction, which significantly contribute to carbon emissions. The expansion of these industries leads to higher demand for fossil fuels, further increasing greenhouse gas emissions. FDI can also intensify deforestation in regions like the Amazon, as foreign investors often develop land for agricultural or mining purposes, releasing large amounts of CO2 stored in trees. Additionally, the rise in production from FDI can lead to increased transportation emissions, as raw materials and products are moved across the country. While some foreign investors may promote cleaner technologies, the economic priority often remains on rapid industrial growth, which can overlook environmental concerns. As a result, FDI has exacerbated carbon emissions in Brazil, posing a challenge to the country’s sustainability efforts. The positive effect of FDI on CO2 emissions aligns with other work conducted by Guo & Yin, (2024) [38], Bekun et al., (2024) [39] and Boubacar et al., (2024) [40]. In summary, the QQKRLS results show that COAL, GDP, and FDI have a positive impact on CO2 emissions across most quantiles, while REN demonstrates a negative effect, especially at higher quantiles, confirming its role in emissions reduction. While this study follows the quantile-on-quantile KRLS framework as employed in recent works such as Adebayo et al. (2024) [27], the regression estimates are presented through graphical plots to emphasize the nonlinear distributional effects. Although tables of quantile estimates are not included here, the QQKRLS figures (Figure 3a–d) provide a detailed visual representation of the quantile interactions between the explanatory variables and CO2 emissions across various distribution levels.

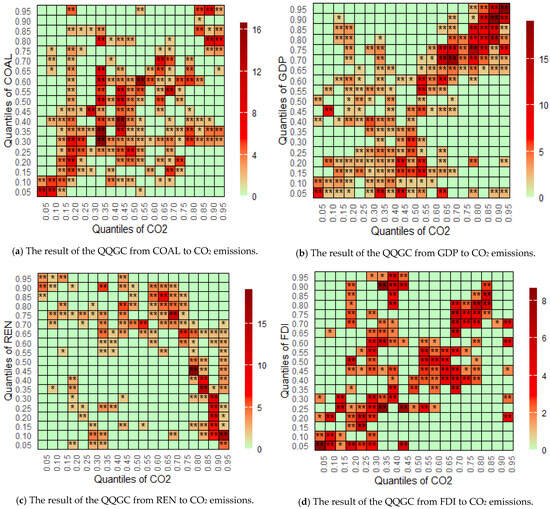

4.3. QQGC Results

Lastly, the QQGC was used to explore the causal connection between CO2 emissions and these explanatory variables (COAL, GDP, REN, and FDI) in Brazil. The plots of the QQGC are presented in Figure 4a–d. Figure 4a shows the result of the QQGC method between COAL and CO2 emissions. It indicates a causal association from COAL to CO2 emissions across various quantiles. Thus, COAL can forecast CO2 emissions in Brazil. Moreover, Figure 4b presents the QQGC method for GDP and CO2 emissions in Brazil, which confirms that there is a causal connection from GDP to CO2 emissions across various quantiles. Therefore, GDP can predict CO2 emissions in Brazil. Additionally, the causal connection between REN and CO2 emissions is reported in Figure 4c. It reveals that REN can predict CO2 emissions in Brazil, since there is a causal association from REN to CO2 emissions across different quantiles. Figure 4d depicts the QQGC result between FDI and CO2 emissions in Brazil. It suggests that there is a causal association from FDI to CO2 emissions across various quantiles. Thus, FDI can forecast CO2 emissions in Brazil.

Figure 4.

Plots of the QQGC approach. (* is statistically significant at the 10% level (p < 0.10) and ** is statistically significant at the 5% level (p < 0.05)).

4.4. Discussion

The empirical findings of this study offer important insights into the environmental dynamics of Brazil. The positive effect of coal consumption on CO2 emissions across all quantiles confirms the role of fossil fuel dependence in environmental degradation. This aligns with Pata (2018) [28] and Shahbaz et al. (2013) [30], who also found strong emission contributions from coal use in emerging economies. Although Brazil’s energy mix includes significant renewables, its industrial reliance on coal, particularly in steel production, continues to drive emissions.

Similarly, GDP growth is found to consistently raise CO2 emissions, supporting the Environmental Kuznets Curve (EKC) in its upward phase, as discussed by Lei et al. (2020) [17] and Mardani et al. (2019) [18]. Brazil’s economic expansion, largely based on energy-intensive sectors, reflects the early stages of the EKC, where growth increases environmental pressure before policy and technological shifts occur.

The impact of FDI on emissions is also positive across all quantiles, which supports the Pollution Haven Hypothesis. This result is consistent with the findings of Esmaeili et al. (2023) [7] and Bekun et al. (2024) [39], who observed that foreign investments often flow into pollution-intensive sectors in emerging markets due to looser regulations. While the Pollution Halo Hypothesis remains theoretically valid, Brazil’s regulatory environment may not yet be strong enough to ensure green technology transfer through FDI.

On the other hand, renewable energy demonstrates a statistically significant negative impact on emissions in most quantiles, confirming its role in environmental improvement. This finding is in line with Adebayo & Ullah (2024) [33] and Anser et al. (2024) [34], who emphasized the emission-reducing potential of clean energy adoption. In Brazil, the success of hydropower and biofuels, particularly ethanol, reflects the country’s capacity to lead in renewable transitions.

Overall, the results validate previous studies while adding granular insight through the quantile-on-quantile framework. By highlighting how the impact of each variable varies across different levels of CO2 emissions, this study provides a more nuanced understanding that traditional linear models overlook.

4.5. Robustness Tests

To verify the reliability and stability of the main results, we conducted a series of robustness tests. First, we re-estimated the relationship between CO2 emissions and the explanatory variables (COAL, GDP, FDI, and REN) using a traditional quantile regression (QR) model. The results remained consistent in both direction and statistical significance across most quantiles, reinforcing the robustness of the QQKRLS estimates. Second, a sub-sample analysis was performed by splitting the dataset into two periods: 1990–2005 and 2006–2020. Despite economic transitions and policy changes over time, the core relationships—particularly the positive effects of COAL, GDP, and FDI on emissions, and the negative effect of REN—remained stable across both sub-periods. Third, we applied a bootstrapping technique to the QQKRLS model to generate confidence intervals for the quantile-specific estimates. The results showed narrow bands with minimal deviations from the original estimates, confirming the statistical reliability of the findings. Lastly, to ensure the robustness of causal direction, the Quantile-on-Quantile Granger Causality (QQGC) test was repeated using alternative lag structures (1–3 lags). The direction and strength of causality remained consistent, particularly from COAL and GDP to CO2 emissions, demonstrating that the results are not sensitive to lag selection. Overall, these robustness checks confirm that the main conclusions of the study are statistically sound and resilient to alternative estimation techniques, time splits, and model specifications.

5. Conclusions and Policy Recommendations

Brazil, as an emerging and newly industrialized nation, reflects the complex dynamics of industrialization. While it enhances economic productivity and elevates living standards, rapid industrial growth often comes with substantial environmental challenges. Chief among these are increased energy consumption and rising carbon emissions, highlighting the ecological trade-offs inherent in industrial advancement. As a result, this study explores the impact of COAL, GDP, REN, and FDI on CO2 emissions in Brazil for the quarterly dataset from 1990Q1-2020Q4. While the overall data span extends from 1970 to 2022 for broader descriptive purposes, the main econometric analysis focuses on 1990Q1 to 2020Q4 due to the availability and consistency of quarterly observations across all variables, particularly FDI and coal consumption. Therefore, the modeling results and conclusions are based on this refined period, ensuring data quality and comparability. This study used the QQKRLS method to uncover how COAL, GDP, REN, and FDI affect CO2 emissions, while the QQGC method is used in probing the causal interaction between CO2 emissions and these explanatory variables (COAL, GDP, REN, and FDI) in Brazil. The result of the QQKRLS method show that COAL positively impacts CO2 emissions across all quantiles. Furthermore, the result also confirms that the increase in GDP and FDI contributes to the increase in CO2 emissions in Brazil. Meanwhile, REN drives the reduction in CO2 emissions in Brazil. The result of the QQGC method shows that COAL, GDP, REN, and FDI are predictors of CO2 emissions in Brazil.

5.1. Policy Recommendations

These results underscore the structural dependency of Brazil’s current economic trajectory on carbon-intensive activities and highlight the critical importance of reorienting energy and investment policies toward low-carbon alternatives. The presence of quantile-dependent impacts further suggests that emissions-reduction policies must be adaptive and effective across various economic and environmental conditions, particularly in high-emission states. In response, Brazil must implement an integrated, forward-looking policy framework that systematically decouples economic expansion from environmental degradation. A foundational step would involve accelerating the retirement of coal-fired power plants through legally binding phase-out schedules and introducing progressively stringent carbon pricing mechanisms that internalize the environmental cost of coal-based energy. Simultaneously, investment in renewable energy infrastructure—particularly in wind, solar, and sustainable bioenergy—should be scaled up through robust financial incentives, including tax credits, green subsidies, and concessional financing via development banks.

Furthermore, given the significant positive impact of FDI on emissions, it is imperative that Brazil enforces environmental screening mechanisms for incoming capital flows. This entails embedding climate-related disclosure requirements into FDI approval processes and establishing a “green FDI” certification system to attract environmentally responsible investors. Investment promotion agencies should be empowered to target and prioritize investments aligned with Brazil’s Nationally Determined Contributions (NDCs), especially in clean technology, smart grids, and sustainable transport infrastructure. To address the emissions-intensive nature of GDP growth, the government should pursue structural reforms that incentivize low-carbon innovation, promote energy efficiency in industry and agriculture, and expand circular economy practices. Policies that support research and development in clean technologies, alongside education and training initiatives to build a green-skilled workforce, will be essential in fostering a resilient and inclusive green economy.

Finally, to ensure policy coherence and long-term effectiveness, Brazil should strengthen inter-ministerial coordination and establish a centralized climate policy oversight mechanism. This would facilitate data-driven decision-making, monitor policy performance across quantiles of emissions, and ensure alignment between environmental targets and macroeconomic planning. Through such comprehensive and adaptive measures, Brazil can enhance its climate resilience, fulfill its international climate obligations, and lead the transition to a sustainable economic paradigm in Latin America.

5.2. Limitations and Future Research

Despite the strengths of this study, several limitations should be acknowledged. First, the analysis is limited to Brazil, which restricts the generalizability of the findings to other contexts. Second, while the Quantile-on-Quantile approach captures nonlinear effects across distributions, it does not fully account for potential structural breaks or policy shocks during the study period. Third, data limitations prevented the inclusion of other potentially relevant variables such as technological innovation or institutional quality.

Future research could extend this framework to a panel of emerging economies for comparative analysis or incorporate additional environmental and technological indicators. Moreover, adopting dynamic quantile methods or machine learning-based approaches may offer further insights into temporal changes and interactions between economic activity and environmental quality.

Author Contributions

Methodology, O.S.O.; Formal analysis, O.S.O.; Data curation, F.F.M.B.A.A.; Supervision, O.S.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Lin, B.; Ullah, S. Effectiveness of energy depletion, green growth, and technological cooperation grants on CO2 emissions in Pakistan’s perspective. Sci. Total Environ. 2024, 906, 167536. [Google Scholar] [CrossRef] [PubMed]

- de Andrade Costa, A.; Bayissa, Y.; Villas-Boas, M.D.; Maskey, S.; Lugon Junior, J.; da Silva Neto, A.J.; Srinivasan, R. Water availability and extreme events under climate change scenarios in an experimental watershed of the Brazilian Atlantic Forest. Sci. Total Environ. 2024, 946, 174417. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; Working Paper No. 3914; National Bureau of Economic Research: Cambridge, MA, USA, 1991. [Google Scholar] [CrossRef]

- Tapia Carpio, L.G.; Cardoso Guimarães, F.A. Regional diversification of hydro, wind, and solar generation potential: A mean-variance model to stabilize power fluctuations in the Brazilian integrated electrical energy transmission and distribution system. Renew. Energy 2024, 235, 121266. [Google Scholar] [CrossRef]

- Carvalho, N.B.; Berrêdo Viana, D.; Muylaert de Araújo, M.S.; Lampreia, J.; Gomes, M.S.P.; Freitas, M.A.V. How likely is Brazil to achieve its NDC commitments in the energy sector? A review on Brazilian low-carbon energy perspectives. Renew. Sustain. Energy Rev. 2020, 133, 110343. [Google Scholar] [CrossRef]

- Calegário, C.L.L.; Bruhn, N.C.P.; Pereira, M.C. Foreign Direct Investment and Trade: A Study on Selected Brazilian Industries. Lat. Am. Bus. Rev. 2014, 15, 65–92. [Google Scholar] [CrossRef]

- Esmaeili, P.; Balsalobre Lorente, D.; Anwar, A. Revisiting the environmental Kuznetz curve and pollution haven hypothesis in N-11 economies: Fresh evidence from panel quantile regression. Environ. Res. 2023, 228, 115844. [Google Scholar] [CrossRef]

- Jiang, Y. Exploring the impact of FDI on environmental innovation in China: An empirical investigation. Heliyon 2024, 10, e39001. [Google Scholar] [CrossRef] [PubMed]

- Uddin, G.A.; Alam, K.; Gow, J. Does Ecological Footprint Impede Economic Growth? An Empirical Analysis Based on the Environmental Kuznets Curve Hypothesis. Aust. Econ. Pap. 2016, 55, 301–316. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Gumede, M.I.; Bekun, F.V.; Etokakpan, M.U.; Balsalobre-lorente, D. Modelling coal rent, economic growth and CO2 emissions: Does regulatory quality matter in BRICS economies? Sci. Total Environ. 2020, 710, 136284. [Google Scholar] [CrossRef]

- Bi, Z.; Khan, R. A Comparative Study of the Environmental, Social, and Governance Impacts of Renewable Energy Investment on CO2 Emissions in Brazil, Russia, India, China, and South Africa. Energies 2024, 17, 5834. [Google Scholar] [CrossRef]

- Lei, L.; Huang, X.; Zhang, S.; Yang, J.; Yang, L.; Xu, M. Comparison of Prevalence and Associated Factors of Anxiety and Depression Among People Affected by versus People Unaffected by Quarantine During the COVID-19 Epidemic in Southwestern China. Med. Sci. Monit. 2020, 26, e924609. [Google Scholar] [CrossRef] [PubMed]

- Seker, F.; Ertugrul, H.M.; Cetin, M. The impact of foreign direct investment on environmental quality: A bounds testing and causality analysis for Turkey. Renew. Sustain. Energy Rev. 2015, 52, 347–356. [Google Scholar] [CrossRef]

- Viglioni, M.T.D.; Calegario, C.L.L.; Viglioni, A.C.D.; Bruhn, N.C.P. Foreign direct investment and environmental degradation: Can intellectual property rights help G20 countries achieve carbon neutrality? Technol. Soc. 2024, 77, 102501. [Google Scholar] [CrossRef]

- Bi, Z.; Guo, R.; Khan, R. Renewable Adoption, Energy Reliance, and CO2 Emissions: A Comparison of Developed and Developing Economies. Energies 2024, 17, 3111. [Google Scholar] [CrossRef]

- Kihombo, S.; Ahmed, Z.; Chen, S.; Adebayo, T.S.; Kirikkaleli, D. Linking financial development, economic growth, and ecological footprint: What is the role of technological innovation? Environ. Sci. Pollut. Res. 2021, 28, 61235–61245. [Google Scholar] [CrossRef] [PubMed]

- Lei, R.; Feng, S.; Lauvaux, T. Country-scale trends in air pollution and fossil fuel CO2 emissions during 2001–2018: Confronting the roles of national policies and economic growth. Environ. Res. Lett. 2021, 16, 014006. [Google Scholar] [CrossRef]

- Mardani, A.; Streimikiene, D.; Cavallaro, F.; Loganathan, N.; Khoshnoudi, M. Carbon dioxide (CO2) emissions and economic growth: A systematic review of two decades of research from 1995 to 2017. Sci. Total Environ. 2019, 649, 31–49. [Google Scholar] [CrossRef]

- Jahanger, A.; Usman, M.; Murshed, M.; Mahmood, H.; Balsalobre-Lorente, D. The linkages between natural resources, human capital, globalization, economic growth, financial development, and ecological footprint: The moderating role of technological innovations. Resour. Policy 2022, 76, 102569. [Google Scholar] [CrossRef]

- Sasana, H.; Ghozali, I. The Impact of Fossil and Renewable Energy Consumption on the Economic Growth in Brazil, Russia, India, China and South Africa. Int. J. Energy Econ. Policy 2013, 7, 194–200. [Google Scholar]

- Pao, H.-T.; Fu, H.-C. Renewable energy, non-renewable energy and economic growth in Brazil. Renew. Sustain. Energy Rev. 2013, 25, 381–392. [Google Scholar] [CrossRef]

- Pereira, A.O.; Da Costa, R.C.; Costa, C.D.V.; Marreco, J.D.M.; La Rovere, E.L. Perspectives for the expansion of new renewable energy sources in Brazil. Renew. Sustain. Energy Rev. 2013, 23, 49–59. [Google Scholar] [CrossRef]

- Sonter, L.J.; Barrett, D.J.; Soares-Filho, B.S.; Moran, C.J. Global demand for steel drives extensive land-use change in Brazil’s Iron Quadrangle. Glob. Environ. Chang. 2014, 26, 63–72. [Google Scholar] [CrossRef]

- Paim, M.-A.; Dalmarco, A.R.; Yang, C.-H.; Salas, P.; Lindner, S.; Mercure, J.-F.; de Andrade Guerra, J.B.S.O.; Derani, C.; Bruce da Silva, T.; Viñuales, J.E. Evaluating regulatory strategies for mitigating hydrological risk in Brazil through diversification of its electricity mix. Energy Policy 2019, 128, 393–401. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.K.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef]

- Broock, W.A.; Scheinkman, J.A.; Dechert, W.D.; LeBaron, B. A test for independence based on the correlation dimension. Econom. Rev. 1996, 15, 197–235. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Saeed Meo, M.; Eweade, B.S.; Özkan, O. Examining the effects of solar energy Innovations, information and communication technology and financial globalization on environmental quality in the united States via Quantile-On-Quantile KRLS analysis. Sol. Energy 2024, 272, 112450. [Google Scholar] [CrossRef]

- Pata, U.K. The influence of coal and noncarbohydrate energy consumption on CO2 emissions: Revisiting the environmental Kuznets curve hypothesis for Turkey. Energy 2018, 160, 1115–1123. [Google Scholar] [CrossRef]

- Lin, F.-L.; Inglesi-Lotz, R.; Chang, T. Revisit coal consumption, CO2 emissions and economic growth nexus in China and India using a newly developed bootstrap ARDL bound test. Energy Explor. Exploit. 2018, 36, 450–463. [Google Scholar] [CrossRef]

- Shahbaz, M.; Kumar Tiwari, A.; Nasir, M. The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 2013, 61, 1452–1459. [Google Scholar] [CrossRef]

- Chi, J. Impacts of electric vehicles and environmental policy stringency on transport CO2 emissions. Case Stud. Transp. Policy 2025, 19, 101330. [Google Scholar] [CrossRef]

- Wen, C.; Xing, Y.; Wang, T.; Liao, S.; Gao, K. How do green supply chain management and renewable energy consumption influence carbon emissions in China and India? A comparative analysis. Energy Econ. 2025, 143, 108186. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Ullah, S. Towards a sustainable future: The role of energy efficiency, renewable energy, and urbanization in limiting CO emissions in Sweden. Sustain. Dev. 2024, 32, 244–259. [Google Scholar] [CrossRef]

- Anser, M.K.; Khan, K.A.; Umar, M.; Awosusi, A.A.; Shamansurova, Z. Formulating sustainable development policy for a developed nation: Exploring the role of renewable energy, natural gas efficiency and oil efficiency towards decarbonization. Int. J. Sustain. Dev. World Ecol. 2024, 31, 247–263. [Google Scholar] [CrossRef]

- Cai, X.; Wei, C. Does financial inclusion and renewable energy impede environmental quality: Empirical evidence from BRI countries. Renew. Energy 2023, 209, 481–490. [Google Scholar] [CrossRef]

- Coelho, S.T.; Goldemberg, J. Sustainability and Environmental Impacts of Sugarcane Biofuels. In Sugarcane Biofuels: Status, Potential, and Prospects of the Sweet Crop to Fuel the World; Khan, M.T., Khan, I.A., Eds.; Springer International Publishing: Berlin/Heidelberg, Germany, 2019; pp. 409–444. [Google Scholar] [CrossRef]

- Shahsavari, A.; Akbari, M. Potential of solar energy in developing countries for reducing energy-related emissions. Renew. Sustain. Energy Rev. 2018, 90, 275–291. [Google Scholar] [CrossRef]

- Guo, Q.; Yin, C. Fintech, green imports, technology, and FDI inflow: Their role in CO2 emissions reduction and the path to COP26: A comparative analysis of China. Environ. Sci. Pollut. Res. 2024, 31, 10508–10520. [Google Scholar] [CrossRef]

- Bekun, F.V.; Gyamfi, B.A.; Olasehinde-Williams, G.; Yadav, A. Revisiting the Foreign Direct Investment-CO2 Emissions Nexus within the N-EKC Framework: Evidence from South Asian Countries. Sustain. Futures 2024, 8, 100357. [Google Scholar] [CrossRef]

- Boubacar, S.; Sarpong, F.A.; Nyantakyi, G. Shades of sustainability: Decoding the impact of foreign direct investment on CO2 emissions in Africa’s growth trajectory. Environ. Dev. Sustain. 2024. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).