Abstract

Mainstream strategies for protecting wealth from inflation involve diversification into traditional assets like common stocks, gold, fixed-income securities, and real estate. However, a significant contributor to inflation has been the rising energy prices, which have been the main underlying cause of several past recessions and high inflation periods. Investments in distributed generation with solar photovoltaics (PV) present a promising opportunity to hedge against inflation, considering non-taxed profits from PV energy generation. To investigate that potential, this study quantifies the return on investment (ROI), internal rate of return (IRR), payback period, net present cost, and levelized cost of energy of PV by running Solar Alone Multi-Objective Advisor (SAMA) simulations on grid-connected PV systems across different regions with varying inflation scenarios. The case studies are San Diego, California; Boston, Massachusetts; Santiago, Chile; and Buenos Aires, Argentina. Historical inflation data are also imposed on San Diego to assess PV system potential in dynamic inflammatory conditions, while Boston and Santiago additionally analyze hybrid PV-battery systems to understand battery impacts under increasing inflation rates. Net metering credits vary by location. The results showed that PV could be used as an effective inflation hedge in any region where PV started economically and provided increasingly attractive returns as inflation increased, particularly when taxes were considered. The varying values of the ROI and IRR underscore the importance of region-specific financial planning and the need to consider inflation when evaluating the long-term viability of PV systems. Finally, more capital-intensive PV systems with battery storage can become profitable in an inflationary economy.

1. Introduction

Inflation, the increase in price over a given period of time and the corresponding decline in purchasing power, is a significant economic phenomenon that has both short-term and long-term effects on markets and individual financial stability [1]. The government identifies the most commonly purchased goods and services to measure the average consumer’s cost of living over a specific time period and is referred to as the consumer price index (CPI) [1]. Inflation is measured by the percentage change in the CPI over a specific period of time, typically one year. High inflation is characterized by a rapid increase in these prices over the same time period that results in a decline in the purchasing power of money [2].

In North America, inflation trends have historically centered around the Federal Reserve’s target of maintaining a 2% inflation rate, a benchmark considered optimal for balancing economic growth and maintaining purchasing power [3]. Recent years have seen deviations from this target; however, due to unprecedented events like the COVID-19 pandemic, which led to significant economic disruptions [4,5]. In order to reduce the economic distress of working-class households due to the surge of unemployment during COVID-19, the U.S. government introduced a USD $1.9 trillion stimulus package following past economic models that had worked before during times of financial crisis [6]. This influx of capital, combined with supply side disruptions such as labor shortages and shifts from service to goods consumption, propelled inflation rates well beyond the Federal Reserve’s 2% target. By March 2021, inflation had escalated to 7% by the end of the year and climbed up to 9% by mid-2022 [6]. Moreover, geopolitical conflicts such as the Russia–Ukraine war further exerted inflationary pressures by disrupting global grain and energy supplies [7,8]. These factors have not only challenged the Federal Reserve’s capacity to control inflation, but also heightened investors’ anxiety, who are growing more concerned about the sustained inflation threat in the future [9].

Whether the inflation rate increases in the near future or not, it raises the question of what the average investor should do to hedge against inflation or, rather, what the best method is to secure a positive real return [10]. This is especially important for emerging market economies where inflation acceleration is likely to be greater than that in developed countries due to the significant role of food in their economies and their generally higher growth rates [11]. Latin American countries like Argentina, Brazil, Chile, Mexico, and Peru have had average annual inflation rates of 347%, 345%, 56%, 28%, and 343%, respectively, since 1970, and continue to face a high risk of inflation in the face of external shocks and political instability [10]. The triple-digit inflation numbers have been seen again in Argentina, rising to 276.2% in February 2024, leading to a cost-of-living crisis plunging the population deeper into poverty [12]. With the elections coming up, the inflation could worsen due to uncertainty, as usually seen in such regions due to inflation being intertwined with political cycles [12]. While the current inflationary scenario in other Latin American countries is not as bad, they still suffer from political environments and institutional frameworks similar to Argentina that can trigger hyperinflation in the future, underscoring the importance of inflation hedges in these economies [10,13,14].

Mainstream strategies for protecting wealth from inflation involve diversification into traditional assets like common stocks, gold, fixed-income securities, and real estate because these assets have received the most significant attention in the literature [15,16,17]. Historically, gold has been advertised as an ideal inflation hedge; however, gold’s effectiveness as an inflation hedge has been uncertain post the 2008 financial crisis, with studies suggesting varying outcomes, with some arguing that outliers influenced the positive relationship between gold and inflation [15]. On the other hand, real estate, especially indirect instruments like real estate investment trusts (REITs) that pool investor funds to invest in income-producing mortgages, may serve as a partial inflation hedge in the long run [15]. Stocks are also commonly used as an inflation hedge, and studies show that while stocks appear to perform poorly as an inflation hedge in the short run [18], several studies since the 1990s have presented more favorable evidence for hedging for long-term horizons of at least 5 years [15].

As studies have shown, there is no universal strategy to protect against inflation and the results vary for different investors seeking different returns for different time frames [19]. Moreover, there remains a noticeable gap in the literature regarding inflation hedge effectiveness in emerging and frontier markets where these hedges are of much more importance for protection against the worst effects of inflation on poverty (i.e., Argentina). Most of the studies testing the effectiveness of traditional hedges are limited to regions in developed countries, namely USA, UK, Canada, and Japan [15]. This can be partly attributed to the lack of these traditional financial instruments to hedge with. For instance, countries like Argentina and Chile did not even have an equity index during hyperinflation periods in the past [10]. While countries like Chile and Mexico have developed 30-year government bond indices, offering some long-term investment and hedging opportunities, most of the nations in the region do not have such instruments [10]. The only bond market available to investors in these countries is the world bond index in local currency [10]. This gap underscores the importance of exploring alternative unconventional inflation hedges that can perform under a broader range of economic scenarios.

A significant contributor to inflation has been the rising energy prices which have been the main underlying cause in several recessions and high inflation situations in the past. The energy price shock during 1973–1974 was the leading cause of triggering the deep recession and high inflation of the mid-1970s [20]. This energy price shock had a significant impact on the overall price level. In fact, the abnormal inflation of 1974 can be fully explained by this event, along with the removal of general price controls. When the Iraq War started in 2003, there was a clear trend reversal in energy prices, especially oil [21]. This shift highlighted the strong connection between oil prices and the global balance of its supply and demand. Energy prices are highly volatile and responsive to changes in market conditions, such as oil price fluctuations, geopolitical tensions, or supply chain disruptions [22]. The energy inflation rate can sometimes account for more than half of the overall inflation rate when it spikes [22,23]. As energy costs are an integral component of production and transportation costs, increases in energy prices can lead to higher costs of goods and services across the economy, creating a ripple effect and increasing inflationary pressures across a broad range of sectors.

Investments in distributed electrical general of technology, particularly solar photovoltaics (PV), present a promising opportunity to hedge against inflation, specifically inflation related to energy costs [24]. The potential of PV as an inflation hedge, however, has not been explored fully in the literature, despite it being a very accessible form of investment throughout the world, offering considerable returns on investment [25,26]. By generating their own electricity, homeowners can avoid the rising costs of energy from traditional sources of energy by locking in a price per kilowatt-hour that will not change for the lifetime of the system no matter the inflation. Moreover, apart from being a potential inflation hedge, the adoption of PV systems also offers substantive reductions in carbon emissions and other environmental benefits [27,28].

In order to overcome these past limitations, this study quantifies the return on investment on PV by running simulations on grid-connected PV systems across different regions with varying inflation scenarios. Case studies are presented for San Diego, California; Boston, Massachusetts; Buenos Aires, Argentina; and Santiago, Chile. Inflation is the primary factor for grid electricity price escalation, with future grid prices assumed to increase at the same rate as the annual average inflation. Historical inflation data are projected for San Diego to assess PV system potential in current and future conditions, while Boston and Santiago also analyze hybrid PV-battery systems to understand battery impacts under increasing inflation rates. Net metering credits vary by location. Simulations are conducted using Solar Alone Multi-Objective Advisor (SAMA) software V1.03, with input parameters including meteorological data, grid escalation rates, residential load data, and economic factors. Inflation rates are modeled to increase from 0% to 10% over the project’s lifetime (flat rates). Economic profitability is evaluated using internal rate of return (IRR), payback period (PP), return on investment (ROI), net present cost (NPC), and levelized cost of energy (LCOE). These metrics provide insights into the financial performance of PV systems under varying inflation scenarios, investigating the effectiveness of PV as an inflation hedge. Simulation results and SAMA outputs are presented in Section 3 in tables and cash flow charts to show how varying inflation can affect PV economic profitability. In Section 4, using Tornado plots, the results are then compared to returns on other traditional hedges over similar time horizons and the use of PV as an inflation hedge is discussed.

2. Methods

2.1. Case Studies

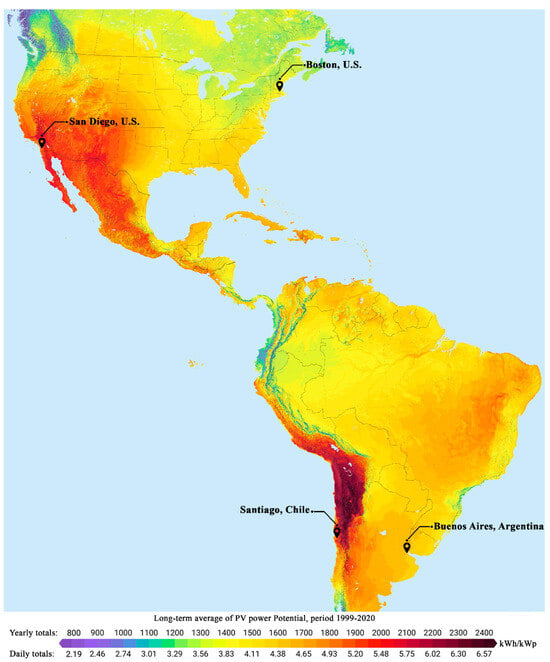

Investigating the impact of inflation on the economic behavior of PV systems, several case studies across the American continent are chosen, as pointed out in Figure 1. The inflation rate is considered the main driver of the escalation of grid electricity prices, i.e., grid prices are considered to increase at the same rate as annual average inflation in the future. A grid-connected PV system is investigated in San Diego, California; Boston, Massachusetts; Buenos Aires, Argentina; and Santiago, Chile. San Diego, CA, is run using the historical data on inflation, in order to quantify the potential of PV in the current and future inflationary climate. In Boston, U.S, and Santiago, Chile, in addition to the grid-connected PV system, a hybrid grid-connected PV and battery system is also investigated to observe the impact of batteries when inflation rates are increasing. Net metering credits for Buenos Aires [29] and Santiago [30] are composed of a one-to-one exchange, while for San Diego they are true up rates [31], and in Boston [32] they comprise 60% of the sum of the following per kWh charges: basic service charge, distribution charge, transmission charge, and transition charge. Examining these varied contexts aims to provide a comprehensive understanding of how grid inflation rates influence the adoption and economic viability of PV systems across different geographical, climatic, and regulatory landscapes.

Figure 1.

Case study locations across the American continent on the PVOUT map using SolarGIS [33].

2.2. Simulations

Solar Alone Multi-Objective Advisor (SAMA) software V1.03, an open-source microgrid optimizer [34,35,36,37], is used for the analysis. The input parameters are listed in Table 1. Other inputs not mentioned in Table 1, such as the capital costs of PV and battery systems, are derived from a previous study [34].

Table 1.

Input data for SAMA optimizations and simulations.

2.3. Economic Analysis

Anticipating that grid electricity prices will annually rise with inflation (at the same rate over the lifetime of the project), average inflation rates will increase annually from 0% to 10% for the U.S. (i.e., if 2% annual average inflation rate inflation is considered, then each year, onward electricity prices will increase by 2%). In this economic analysis, the concept of electricity price increase based on inflation simulates the impact of inflation on project costs. The value 0% to 10% for inflation rates in the U.S. is chosen based on looking into historical trends of inflation rates [62]. The forecasted inflation rate for U.S. is 2% [50]. U.S. average inflation rate scenarios listed below correspond to historical periods, when U.S. experienced almost the same inflation rates (based on the data in [63]), except for the 8–10% scenarios, which are considered as hypothetical excessive inflation conditions:

- 0% average inflation: the Great Depression (1921–1945).

- 2% inflation: Federal Reserve Target (1996–2020).

- 4% inflation: the Great Moderation (1980–2004).

- 6% inflation: the Great Inflation (1967–1991).

- 8–10% inflation: excessive inflation hypothetical scenarios.

Given that the U.S. has experienced all these scenarios (except for the excessive inflation conditions), the results presented in this paper can provide valuable insights that guide future investments in PV systems, especially in the context of economic uncertainty. Similarly to the U.S., inflation has increased from 0% to 10% for Chile analysis considering historical inflation trends there [52] and a forecasted inflation rate of 3% [52]. In contrast, Argentina, with historically higher inflation rates, had its inflation rates increased from 7.5% to 20%, aligning with a forecasted future inflation rate of 10% [51].

To evaluate the economic profitability of PV systems, IRR, PP, and ROI are used in addition to the NPC and LCOE, considering the real discount rate, which is discussed in the following paper [34]. For economic analysis, the costs are the energy system costs accumulated over its lifetime, while revenues are savings from not buying the electricity from the grid due to PV energy generation. The IRR is calculated by setting the net present value (NPV) to zero, as shown in the following formula, where represents the net cash flow during period t.

Net cash flow () is determined using Equation (2), where ICost is the initial investment at the start of the project (t = 0), MCost is the maintenance and operation costs of energy system parts over their lifetime, RCost includes costs for replacing system components over the project lifetime, GCost represents costs or revenues from grid usage (positive values indicate costs, negative values indicate revenues), salvage value () represents the remaining value of a power system component at the end of the project’s lifetime, and ACost is the savings from not purchasing electricity from the grid or from selling to the grid due to the hybrid energy system generation, as calculated by Equation (3). All the above-mentioned costs are in USD. stands for electrical load in each hour (h) in kWh, presents the hourly electrical rate in USD/kWh, is grid adjustment costs in USD/kWh, is the grid monthly costs (service charges) in USD, Rtax represents the grid sale tax rate, and Rrebate is the electricity rebate rate.

Discounted PP is calculated using Equation (5), where is the net cash flow (revenues minus costs) in year i, and CCFt is the cumulative cash flow at year t, calculated using Equation (4). CCFt is the sum of all net cash flows from the start of the project up to year t.

ROI is calculated using Equation (6), whereas total net profits (VP) is calculated using Equation (7) in USD, and total costs () are all costs (ICost + MCost+ RCost + GCost) accumulated through life time of project in USD. Total avoided costs () stands for all ACost accumulated over the lifetime of the project, and grid revenues () are the revenues achieved through the grid (if any, when GCost is negative).

The ROI looks at the return over the PV’s lifetime, while the IRR only provides a year of return.

3. Results

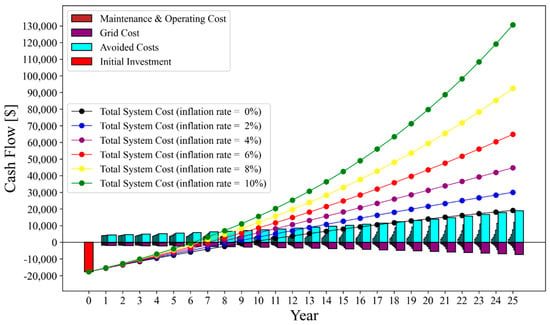

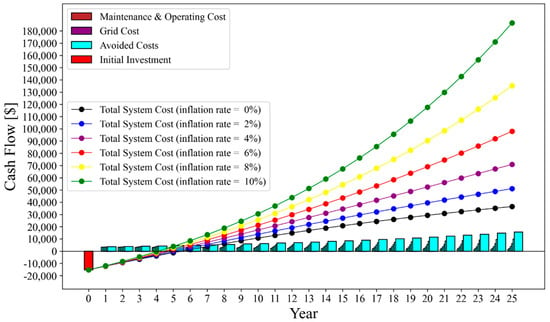

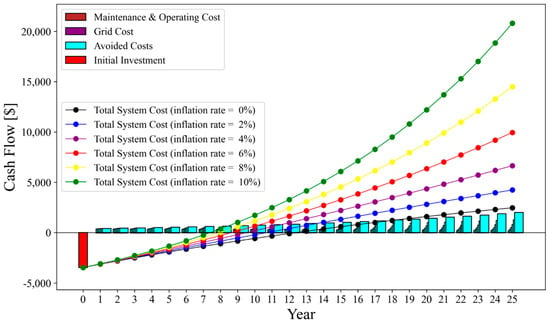

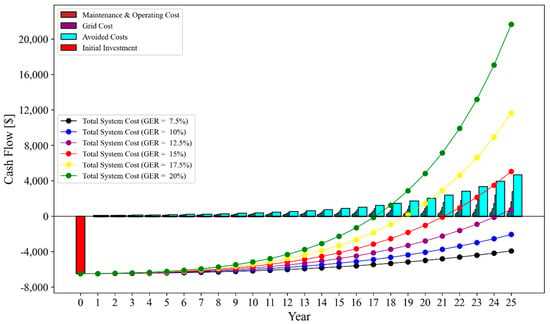

The PV on the grid results from the SAMA analysis are shown for San Diego, California (Figure 2); Boston, Massachusetts (Figure 3); Santiago, Chile (Figure 4); and Buenos Aires, Argentina (Figure 5). All the figures show the cash flow as a function of year over the lifetime of a PV system (25 years). Figure 2 is instructive for how a PV investment operates. In year zero, the large negative red value is from the initial investment of the system. Then, for years 1 through 25, small negative maintenance and operating costs are dwarfed by the avoided grid costs by supplying solar electricity (the amount saved compared to when the user’s electricity provision fully relied on the grid). On top of this, a basic line graph is also used to show the total system costs with different grid inflation rates reflecting both costs and revenues (avoided costs). For example, in Figure 2, considering a grid inflation rate of 2% in San Diego (which is typical for grid inflation rates based on the target inflation rate in U.S. [50]), the blue line crossing the zero of the y-axis indicates that the PV system has paid for itself—and then earns increasingly large quantities of money (profit) after the 9th year of operation. Also, in this case, the total accumulated profit of the PV system in San Diego can reach up to USD 30,000. If the solid line never crosses the zero y-axis, the PV system never pays for itself. Similar results are shown for Boston (Figure 3), where inflation rates of 2% yield for 6 years, instead of the 9 years for San Diego. This is due to the higher net metering (NM) credits offered in Boston. In both Figure 2 and Figure 3 for the U.S., by increasing inflation rates from 0% to 10%, the economic profitability of PV systems is increased, as grid users need to pay more expensive prices for grid electricity each year. The increase in inflation rates from 0% to 10% leads to reducing the PP of the project from 10 years to 6 years in San Diego and 6 years to 5 years in Boston. These same trends continue in Santiago, Chile (Figure 4), where the PV project is profitable, exhibiting a PP of 13 years for 0% and 8 years for 10%. However, Argentina’s economic situation is different due to higher inflation rates. Considering average lifetime inflation rates ranging from 7.5% up to 20% for Buenos Aires, Argentina, shown in Figure 5, it can result that the PV project is not reaching profit and PP is not observed until inflation rates reach 12.5%. The reason behind this is the low-cost electricity prices in Argentina (USD 0.02/kWh) and grid credits for NM.

Figure 2.

Cash flow chart of PV-grid system for different inflation rates in San Diego, CA.

Figure 3.

Cash flow chart of PV-grid system for different inflation rates in Boston, MA.

Figure 4.

Cash flow chart of PV-grid system for different inflation rates in Santiago, Chile.

Figure 5.

Cash flow chart of PV-grid system for different inflation rates in Buenos Aires, Argentina.

North American cities, particularly Boston and San Diego, benefit from stable economic conditions, higher electricity prices, and favorable NM credits, resulting in quicker payback periods and higher profitability. In North America, increasing inflation rates from 0% to 10% significantly enhances profitability, reducing the payback period more effectively in Boston than in San Diego. Santiago, Chile, follows a similar trend to North American cities like San Diego and Boston, though one less pronounced. Like the North American case studies, Santiago benefits from abundant solar resources and high grid electricity prices. These factors make grid-tied PV systems profitable in Chile. Buenos Aires, however, requires higher inflation rates to reach profitability due to lower baseline electricity prices. South American cities, specifically Buenos Aires, face solar economic challenges even with high inflation, as low electricity prices delay profitability.

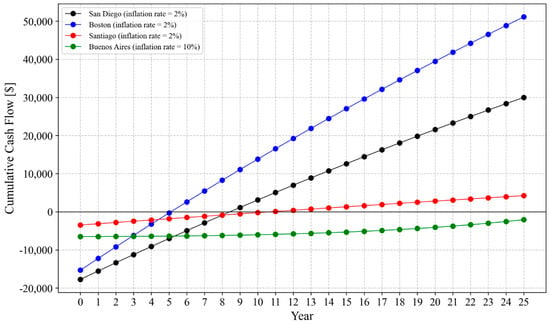

Table 2 presents the simulation results of different case studies for on-grid PV systems (detailed simulation results for PV-grid system are reported in Table A1 in Appendix A). The optimal system size in San Diego is 8.8 kW PV with a 7.3 kW inverter. The data reveals that inflation significantly impacts the NPC and LCOE. For instance, at a 0% inflation rate, the NPC is USD 48,049, which rises to USD 117,330 at a 10% rate. The LCOE follows a similar trend, increasing from USD 0.15/kWh to USD 0.37/kWh as inflation escalates from 0% to 10%. This is because the NM credit per kWh sold to the grid for grid-connected PV is relatively inexpensive, and users on optimum PV systems still need to pay USD 25,731 over 25 years to the utility provider. Increasing the inflation rate can escalate this amount even more, where with 10% yearly inflation, users would have to pay USD 95,000. In contrast, Boston’s optimal system size is slightly smaller, at 7.6 kW PV with a 6.3 kW inverter. The NPC for Boston remains relatively stable across different inflation rates, starting at USD 19,287 for 0% inflation and only increasing to USD 19,290 at 10% inflation. This is because the grid-connected PV system benefits from favorable NM credits by offsetting grid costs (Boston exhibits almost zero grid costs). With an optimal system size of 1.2 kW PV and a 1 kW inverter, Santiago, Chile, also enjoys low grid payments in different inflation scenarios (USD 16 for a 0% inflation rate and USD 60 for 10% inflation over the project’s lifetime). Like Boston, this leads to slight increases in NPC from USD 4151 at 0% inflation to USD 4195 at 10%, and the LCOE remains constant at USD 0.07/kWh. Buenos Aires, Argentina, presents a different scenario with higher inflation rates and less annual electrical consumption, with an optimal system size of 2.25 kW PV and a 1.9 kW inverter. The higher inflation rates in Argentina, starting at 7.5% and going up to 20%, impact the NPC and LCOE slightly due to the NM credits earned by the PV system. For instance, the NPC increases from USD 7978 at 7.5% to USD 8037 at 20%. The LCOE remains constant at USD 0.07/kWh despite these higher inflation rates. Figure 6 compares the cumulative cash flows of different case studies for the PV-grid system considering the forecasted inflation rates. As can be seen, Boston is the most financially favorable location, followed by San Diego and Santiago.

Table 2.

Impact of different inflation rates on PV-grid system.

Figure 6.

Cumulative cash flow of different case studies for PV-grid system (based on forecasted inflation rates).

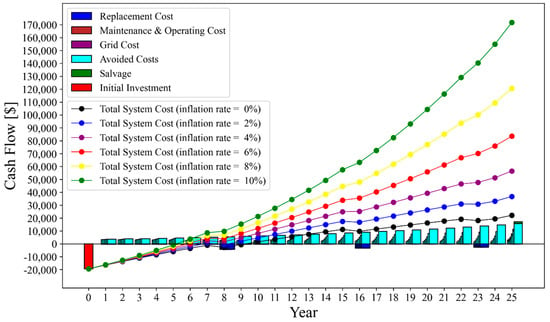

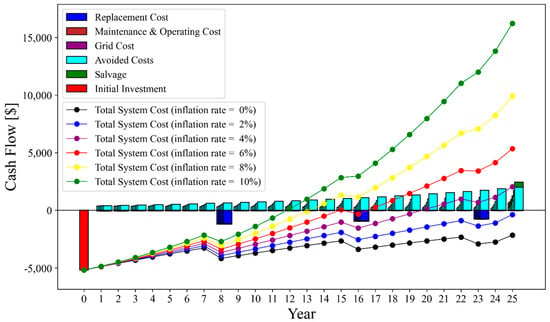

If utilities alter rate structures to discourage distributed generation [64], it may become advantageous for prosumers to add batteries to the system to enable greater self-consumption. This can be seen in the reduction in PV system size for Boston, Massachusetts, and Santiago, Chile, as seen in Table 3. The optimum PV system size shrunk from 8.8 to 7.7 kW for Boston. The PV system size reduction came with the additional costs of a battery of 11 kWh and 3 kWh for Boston and Santiago, respectively. These batteries need to be replaced every 7.5 years. The impact this has on the economics can be observed in Figure 7 for Boston, showing a system with PV on the grid with battery and a PV-BT-grid system for Santiago, Chile (Figure 8). In both cases, a saw-tooth pattern is observed in the total system cost due to the battery replacement costs. This can cause some interesting phenomena, such as the 6% inflation rate in Santiago, where the payback time is the first 15 years. Then, a battery must be purchased, which pushes the total cost to negative values but is quickly recovered so that, after the 17th year, a profit is made on the system. Comparing Figure 2, Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7 and Figure 5, Figure 6, Figure 7 and Figure 8 so that the impacts of batteries can be discerned shows an increase in the payback time and a decrease in the total value of the system over time. The inflating economy (increasing inflation rates) can potentially make PV-battery systems profitable; however, PV-grid-tied systems remain more economical than PV-BT-grid systems. This is due to batteries’ high capital costs and short replacement cycles. Notably, inflation and the resulting increase in inflation rates have a more intense impact on the profitability of PV-BT-grid systems in Boston and Santiago. Comparing PV-grid systems with PV-BT-grid systems reveals that increasing inflation rates reduces the payback period (PP) more significantly for PV-BT-grid systems. In Boston, the PP for PV-grid systems decreases from 6 to 5 years (a 1-year reduction), while for PV-BT-grid systems, it decreases from 10 to 6 years (a 4-year reduction). Similarly, in Santiago, the PP for PV-BT-grid systems decreases from 20 to 12 years (an 8-year reduction), compared to a 5-year decrease for PV-grid systems. This indicates that in the future, with reduced battery costs and extended lifetimes, the self-consumption profit provided by batteries could make these systems even more profitable.

Table 3.

Impact of different inflation rates on PV-battery-grid system.

Figure 7.

Cash flow chart of PV-battery-grid system for different inflation rates in Boston, MA.

Figure 8.

Cash flow chart of PV-battery-grid system for different inflation rates in Santiago, Chile.

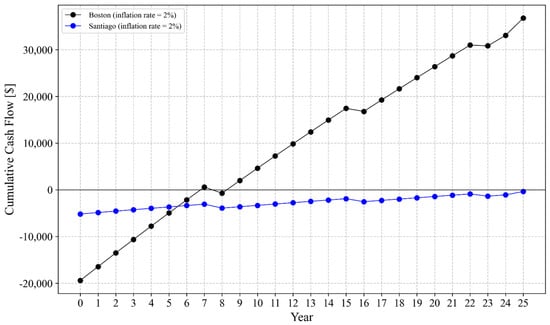

Table 3 lists the simulation results of different case studies in detail for on-grid PV-battery systems (detailed simulation results for the PV-battery-grid system are reported in Table A2 in Appendix A). In Boston, the optimal system size for a PV-battery-grid setup is 7.7 kW PV with an 11 kWh battery and a 6.88 kW inverter. Santiago’s optimal configuration is smaller due to the lower electrical load, with a 1.25 kW PV, 3.006 kWh battery, and a 1.07 kW inverter. The NPC for Boston starts at USD 33,602 with 0% inflation and rises to USD 34,092 at 10% inflation. Santiago’s NPC starts at USD 8759 with 0% inflation and increases to USD 8765 at 10% inflation. These slight increases in NPC are because of low grid payments in both case studies. LCOE for both case studies remains constant at USD 0.16/kWh in Boston and USD 0.18 in Santiago. Grid-connected PV-battery systems exhibit higher NPC and LCOE compared to only systems due to batteries’ initial and lifetime replacement costs being added. Figure 9 compares the cumulative cash flows of the PV-battery-grid system in Boston and Santiago. The results indicate that battery integration enhances the economic viability of PV systems in Boston. In Santiago, however, the system does not achieve economic profitability under the projected inflation rate (10%).

Figure 9.

Cumulative cash flow of different case studies for PV-battery-grid system (based on forecasted inflation rates).

4. Discussion

According to the results in the previous section, investing in PV systems can indeed be considered an inflation hedge, particularly in regions where electricity prices are high and expected to rise due to inflation. The paper’s analysis demonstrates that as inflation rates increase, the economic profitability of PV systems generally improves because users save more on grid electricity costs, which tend to rise with inflation. In areas where energy costs are high and rising, investing in PV systems can lock in lower and more stable electricity prices compared to volatile fossil fuel markets for the next 20 years and act as a hedge. Furthermore, countries or regions with supportive regulatory frameworks offering rebates and incentives for PV adoption can make them more effective as an inflation hedge. The paper would encourage emerging market economies that face rising traditional energy costs and have abundant solar resources to benefit from PV adoption.

Inflation plays a crucial role in the financial viability of grid-connected PV systems, with varying impacts across different locations. It significantly affects the financial viability of PV systems, with higher inflation generally improving total net profit, ROI, and IRR but also increasing NPC, LCOE, and operating costs. San Diego, Boston, and Santiago exhibit significant positive impacts from inflation, while Boston maintains stable payback periods, and Buenos Aires presents opportunities under higher inflation rates.

In San Diego, a substantial rise in costs when inflation increases underscores the importance of accounting for inflation in financial models and planning. Despite this, the PV system in San Diego still shows favorable financial performance due to sizable, avoided costs offered by the PV system, which is USD 67,167 at 0% inflation increased to USD 248,014 at 10% yearly inflation. PV economics in San Diego enjoys higher IRR and net profit, along with a shorter payback period compared to only relying on the grid in an inflationary environment, highlighting the resilience and long-term benefits of PV-grid-connected investments in this region. At 0% inflation, grid-connected PV exhibits an IRR of 8.03% with an ROI of 39.79%, while they are increased to 19.67% and 111.38%, respectively, if the inflation rate is 10%. Additionally, PP decreased from 10 years to 7 years with an increasing inflation rate to 10%, indicating quicker recouping of investment costs. Boston’s PV systems are less sensitive to inflation as NPC and LCOE, and the project’s payback period (5-6 years) are not affected by inflation that much, making it a lower-risk environment for investment. At 0% inflation, the IRR and ROI of the project are 16.17% and 189.11%, respectively, which are increased to 28.41% and 967.36% in the presence of 10% inflation. These metrics highlight Boston as a favorable environment for grid-connected PV, with consistent tolerance on inflationary pressure and even much higher profits.

Like San Diego and Boston in the U.S., Santiago’s financial metrics benefit significantly from higher inflation rates. This suggests that inflation can be leveraged for better financial returns. The IRR and ROI metrics improve with higher inflation rates, reaching 16.6% and 495.9%, respectively, at 10% inflation. This indicates that while the initial costs and NPC are relatively low, the financial returns improve significantly in a higher inflation environment, making PV investments more attractive over time. Inflation’s impact on Buenos Aires’ financial metrics is more volatile. Higher inflation rates can transform the financial outlook from negative to highly positive, emphasizing the need for thorough risk assessments. In scenarios with higher inflation, avoided costs increase substantially from (USD 4049 of 0% to USD 29,692 of 10% yearly inflation), leading to improved IRR (up to 7.86%) and shorter payback periods (up to 18 years). This volatility necessitates strategic investments and the close monitoring of local economic indicators and inflation trends to make informed decisions. Investors should consider higher inflation scenarios to leverage improved financial returns.

Boston’s IRR for grid-connected PV-battery systems improves with inflation, going from 8.94% at 0% inflation to 22.25% at 10% inflation. Santiago’s IRR also increases, albeit starting from a negative value at lower inflation rates and reaching 10.2% at 10% inflation. This trend indicates that higher inflation can enhance the financial attractiveness of hybrid PV-battery systems, especially in Boston. The payback period for Boston decreases from 10 years at 0% inflation to 6 years at 10% inflation, while Santiago’s payback period becomes feasible only at higher inflation rates, reducing from 20 years at 4% inflation to 12 years at 10% inflation. These figures highlight how inflation can accelerate the return on investment for hybrid PV-battery systems, particularly in Boston. Finally, ROI for Boston rises from 63.2% at 0% inflation to 482% at 10% inflation. Santiago’s ROI improves from 23.3% to 176% over the same range. This underscores the superior economic performance of the PV-battery in inflationary contexts, especially in regions like Boston with higher initial costs and energy prices. When comparing the PV-grid system with the PV-battery-grid system, only the PV system offers superior financial performance in both case studies and higher returns compared to the PV-BT-grid system, while PV with a battery provides enhanced energy self-consumption. Battery storage adds substantial initial investment costs and replacement costs to the project, making the PV-BT-grid system less attractive than a PV-grid system. However, it is still profitable in an inflammatory economy.

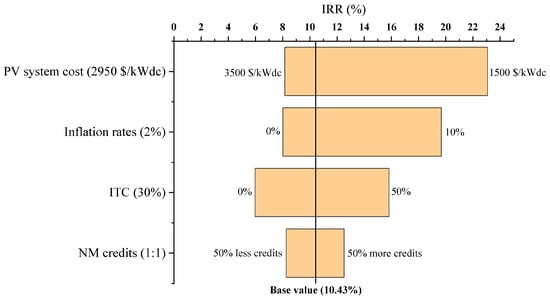

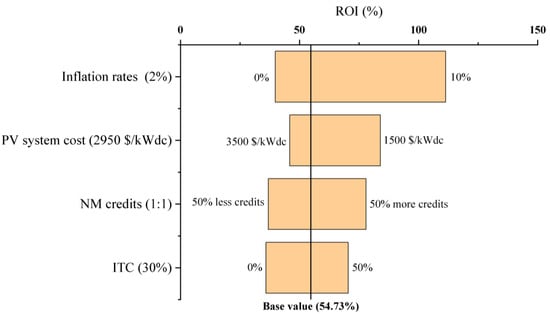

4.1. Sensitivity Analysis

PV-battery systems exhibit higher sensitivity to inflation changes compared to grid-connected PV systems, with greater improvements in total net profit, IRR, ROI, and reductions in PP under high inflation scenarios. Figure 10 illustrates the results of a sensitivity analysis on IRR for a PV system in San Diego, CA, with a base value IRR of 10.4% (vertical axis is plotted). The PV system cost, set at a base of USD 2950/kWdc (shown in parentheses according to the NREL 2022 benchmark [65]), shows that an increase to USD 3500/kWdc significantly decreases the IRR, indicating that higher initial costs negatively affect profitability. Conversely, a reduction in cost to USD 1500/kWdc (due to the ongoing trend in PV cost reductions [66,67,68,69]) substantially increases the IRR, demonstrating that lower costs greatly enhance profitability. Inflation rates, with a base of 2%, also influence the IRR; a rate of 0% results in a decrease, reflecting lower electricity price increases over time, whereas a rate of 10% boosts the IRR, showing that higher inflation, leading to higher electricity prices, improves the economic attractiveness of the PV system. ITC set at a base of 30% (currently offered by U.S. government [70]), is another crucial factor. A drop to 0% significantly decreases the IRR, highlighting the importance of this incentive in making PV investments highly attractive. An increase to 50% raises the IRR, further illustrating the positive impact of higher tax credits on PV system profitability. NM credits, with a base assumption of a 1:1 ratio, also play a role. Reducing the credits by 50% (mimicking recent NM credit reductions [71,72,73]) results in a decrease in IRR, indicating that less favorable net metering policies negatively affect the financial returns of the PV system, while increasing the credits by 50% results in an increase, showing that more favorable net metering policies enhance the financial attractiveness of the system. The sensitivity analysis demonstrates that the IRR of the PV system is most sensitive to changes in the system cost and inflation rates, followed by ITC and net metering credits.

Figure 10.

Impact of varying parameters on IRR.

Figure 11 presents a sensitivity analysis on ROI for a PV system in San Diego, CA, with a base value ROI of 54.7% (the respective axis is plotted). Starting with inflation rates, set at a base of 2% (shown in parentheses), the analysis shows that eliminating inflation (0%) decreases the ROI, reflecting the reduced financial benefit of avoiding higher electricity prices. On the other hand, an inflation rate of 10% significantly boosts the ROI, indicating that higher inflation rates enhance the economic attractiveness of PV investments due to increased savings from avoided electricity costs. The cost of the PV system is another critical factor. With a base cost of USD 2950/kWdc, an increase to USD 3500/kWdc markedly reduces the ROI, demonstrating the negative impact of higher initial costs on the investment’s profitability. Conversely, lowering the cost to USD 1500/kWdc substantially increases the ROI, underscoring the importance of cost reductions in improving the financial returns of PV systems. NM credits, assumed at a 1:1 ratio in the base scenario, also influence the ROI. A reduction in credits by 50% results in a decreased ROI, showing that less favorable net metering policies diminish the financial benefits of PV systems. Conversely, increasing the credits by 50% enhances the ROI, indicating that more favorable net metering policies improve the investment’s attractiveness. The ITC is set at 30% in the base case, significantly impacting the ROI. Eliminating the ITC (0%) leads to a considerable drop in ROI, highlighting this incentive’s crucial role in financially viable PV investments. Increasing the ITC to 50% raises the ROI, further emphasizing the positive effect of higher tax credits on the profitability of PV systems. The sensitivity analysis reveals that the ROI of the PV system is highly sensitive to changes in inflation rates and PV system costs, followed by net metering credits and the ITC. Higher inflation rates, lower system costs, and more favorable net metering policies and tax credits significantly improve the ROI, making PV investments more attractive. This analysis highlights the importance of financial incentives, cost reductions, and inflation considerations in promoting the adoption of PV systems.

Figure 11.

Impact of varying parameters on ROI.

4.2. Tax Advantages of PV Systems: Enhancing Their Role as a Robust Inflation Hedge

The impact of taxes further enhances the attractiveness of PV systems as an inflation hedge. When an investor invests in traditional financial instruments like savings accounts, bonds, or stocks, they are required to pay taxes on the profits earned. These taxes can significantly reduce the net returns on these investments, especially in an inflationary environment where maintaining the value of your returns is crucial. In contrast, the profits from PV electricity generation in any type of net metering arrangement do not incur taxes. When users generate their own electricity with a PV system, they effectively save on the cost of purchasing electricity from the grid. This cost-saving is not considered taxable income, making the net benefit of PV systems even more favorable. This tax advantage means that the savings realized from avoiding the inflated electricity prices of the grid are fully retained by the investor, amplifying the overall financial benefit of the PV system.

For instance, in the case of Boston, for a grid-connected PV system and considering a 2% annual inflation rate, the user will benefit from USD 51,108.65 net profits over 25 years. While if they have gained this amount by investing in a saving account and interest profits are earned in each year, they needed to pay USD 7666 in taxes, considering the 10% federal tax rate on interests and the fact that each year’s gains are less than USD 11,600 [74,75], and 5% state tax [76]. Considering these taxes on the investment can reduce IRR of project from 18.7% (which is for tax-free PV investment) to 15.5% (which is for normal saving account investment subject to tax) and ROI from 265% to 225.2%. Similarly, considering gaining this profit by long-term investing in bonds or stocks will contribute to 15% federal capital gain taxes [77] and 5% state tax [76], which equals to USD 10,222. This will reduce IRR to 14.4% and ROI to 212% compared to tax-free PV investment.

This tax-free profit makes PV systems an even more compelling investment in inflationary periods. The study already demonstrates that PV systems offer significant economic benefits by reducing payback periods and increasing profitability as inflation rises. When one factor in the tax advantage, the case for PV systems becomes even stronger. Not only do they provide a hedge against rising electricity costs, but they also offer a tax-efficient way to improve financial returns, further enhancing their role as a robust inflation hedge.

4.3. Historical Inflation Projection (Verification of Average Inflation Projection)

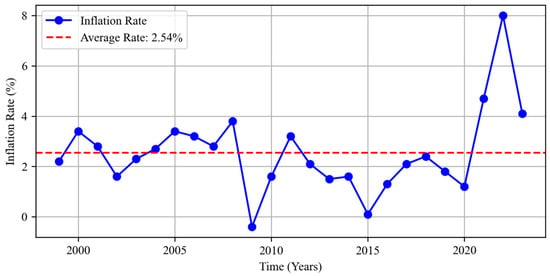

Two distinct approaches were compared in Table 4 for the San Diego, U.S. case study: one using a flat escalation rate based on the average inflation rate from 1999 to 2023, and another employing a historical inflation projection that considers year-by-year inflation data [63] over the same period, illustrated in Figure 12. The analysis revealed that both methods—escalating grid prices with a flat rate of 2.54% (the average inflation rate) and using detailed historical inflation projections (Figure 12)—produced similar results. This similarity in outcomes provides strong verification for using the average inflation rate as a valid and reliable method in economic analyses of grid-connected PV systems. The comparable results indicate that the flat average inflation rate simplifies the projection process and effectively mirrors the more detailed historical approach.

Table 4.

Historical year-by-year inflation projection vs. average inflation projection.

Figure 12.

Inflation in the U.S. from 1999 to 2023 (based on the data from [63]).

This verification is particularly important because it confirms that previous analyses conducted with the average inflation rate are sound and reflective of real-world economic conditions. The finding that the historical inflation projection yields similar results to the average rate reinforces the robustness of the earlier analyses and supports the continued use of this method in future studies. Moreover, the analysis underscores the potential of PV investments as a hedge against inflation. The IRR of 10.98% and the ROI of 11.07% achieved under the historical inflation scenario demonstrate the financial stability and resilience of PV systems in an inflationary environment. This further validates the effectiveness of using an average inflation rate in economic projections, as it captures the long-term financial benefits of PV investments.

4.4. Limitations and Future Studies

This study has several limitations. The geographic scope is limited to specific regions (San Diego, Boston, Buenos Aires, and Santiago), which may not be generalizable to other locations with different economic conditions and inflation rates. The inflation modeling assumes an increase from 0% to 10% over the project’s lifetime, which may not capture more complex inflation scenarios or sudden economic shocks, such as the COVID-19 economic shock [78,79,80].

Additionally, the study assumes that future grid prices will increase at the same rate as the average annual inflation, which may not accurately reflect future market dynamics. It is well known that inflation is not the only parameter affecting the escalation of electricity prices. Other parameters, such as oil price shocks [81,82,83] and supply chain issues [84], could also affect electricity prices. When considering grid-connected PV with battery storage, the initial high costs, replacement costs and lifetime of batteries are highlighted as challenges, and the analysis might not fully account for future technological advancements [85,86] and cost reductions [87,88,89,90,91,92,93] in battery storage. For San Diego, historical inflation data are used to assess PV system potential, which might not fully represent future economic conditions, as future inflation is uncertain [94,95].

These limitations underscore the need for caution when generalizing the findings and suggest areas for further research to provide a more comprehensive understanding of the impact of inflation on PV systems. The results demonstrate the clear ability for PV to act as inflation hedges and underscores further potential to expand the size of a PV system and thus the investment by increasing the load of the individual residence or business. This can be performed in three ways: (i) use the PV to charge an electrical vehicle (EV), individually [96,97] or a fleet of EVs [98,99], (ii) use the PV electricity to power a heat pump to enable solar to offset heating loads [100] even at the residential level [101,102,103], or (iii) use additional PV power to perform computations (e.g., for cryptocurrency mining [104,105] or other types of computing like AI). Future studies on this topic could leverage Monte Carlo simulation [106,107,108,109] to account for complex scenarios for future inflation, thus considering uncertainty in economic conditions. This approach would enable a more robust risk assessment, helping to identify the likelihood of various outcomes and providing deeper insights into the resilience of PV investments under different inflation scenarios.

5. Conclusions

This study highlights the potential of PV systems as a viable inflation hedge across diverse geographic regions—San Diego (California), Boston (Massachusetts), Santiago (Chile), and Buenos Aires (Argentina). The study reveals that while PV investments generally demonstrate significant profitability as an inflation hedge, the extent of this profitability is highly dependent on local economic conditions, particularly inflation rates, electricity prices, and NM policies.

Regions with high grid electricity prices and strong policy incentives, such as San Diego, Boston, and Santiago, show the most favorable financial outcomes. In these locations, PV systems provide a relatively short payback period, high IRR, and substantial cost savings. Buenos Aires presents a more complex scenario where lower electricity rates delay profitability, but high inflation rates eventually make PV investments viable. The findings highlight that inflation impacts PV economics differently depending on regional grid pricing structures and policy environments.

The study also examines PV-battery-grid systems and finds that while hybrid systems enhance self-consumption, they currently face longer payback periods due to high initial and replacement costs. Inflation does improve their financial viability, particularly in markets like Boston and Santiago, but PV-only systems remain the more attractive option in most cases. As battery costs decline and their lifespan increases, however, PV-battery systems become a stronger competitor to grid-only PV installations.

A sensitivity analysis reveals that system costs, inflation rates, and policy incentives such as tax credits and net metering credits significantly influence PV profitability. Higher system costs reduce IRR and ROI, while stronger incentives improve financial returns. These findings suggest that policymakers can support PV adoption by ensuring stable incentives and favorable net metering policies.

This study underscores the potential for PV systems to serve as a robust hedge against inflation, particularly in regions with supportive regulatory frameworks and rising electricity costs, the importance of region-specific economic models, and the need to consider inflationary trends when evaluating the long-term viability of PV systems. Future research should explore more complex inflation scenarios and consider technological advancements in battery storage to provide a more comprehensive understanding of the impact of inflation on PV systems.

Author Contributions

Conceptualization, J.M.P.; methodology, J.M.P.; software, S.A.S.; validation, S.A.S., K.M. and J.M.P.; formal analysis, S.A.S., K.M. and J.M.P.; investigation, S.A.S., K.M. and J.M.P.; resources, J.M.P.; data curation, S.A.S., K.M. and J.M.P.; writing—original draft preparation, S.A.S., K.M. and J.M.P.; writing—review and editing, S.A.S., K.M. and J.M.P.; visualization, S.A.S., K.M.; supervision, J.M.P.; project administration, J.M.P.; funding acquisition, J.M.P. All authors have read and agreed to the published version of the manuscript.

Funding

This work was funded by the Thompson Endowment and the Natural Sciences and Engineering Research Council of Canada.

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

SAMA simulation results for PV-grid system (San Diego (SD), Boston (Bo), Santiago-Chile (Sa), Buenos Aires-Argentina (Ag).

Table A1.

SAMA simulation results for PV-grid system (San Diego (SD), Boston (Bo), Santiago-Chile (Sa), Buenos Aires-Argentina (Ag).

| Inflation Rates (U.S. and Chile) | 0% | 2% | 4% | 6% | 8% | 10% |

|---|---|---|---|---|---|---|

| Inflation Rates (Argentina) | 7.5% | 10% | 12.5% | 15% | 17.5% | 20% |

| NPC [USD] | SD: 48,049.46 | SD: 54,802.68 | SD: 63,952.89 | SD: 76,447.45 | SD: 93,617.3 | SD: 117,330.17 |

| Bo: 19,287.38 | Bo: 19,287.68 | Bo: 19,288.09 | Bo: 19,288.65 | Bo: 19,289.42 | Bo: 19,290.49 | |

| Sa: 4151.35 | Sa: 4155.64 | Sa: 4161.48 | Sa: 4169.49 | Sa: 4180.52 | Sa: 4195.8 | |

| Ag: 7978.74 | Ag: 7982.98 | Ag: 7989.43 | Ag: 7999.27 | Ag: 8014.3 | Ag: 8037.21 | |

| Total Solar Cost [USD] | SD: 22,318.37 | SD: 22,318.37 | SD: 22,318.37 | SD: 22,318.37 | SD: 22,318.37 | SD: 22,318.37 |

| Bo: 19,286.22 | Bo: 19,286.22 | Bo: 19,286.22 | Bo: 19,286.22 | Bo: 19,286.22 | Bo: 19,286.22 | |

| Sa: 4135.37 | Sa: 4135.37 | Sa: 4135.37 | Sa: 4135.37 | Sa: 4135.37 | Sa: 4135.37 | |

| Ag: 7969.51 | Ag: 7969.51 | Ag: 7969.51 | Ag: 7969.51 | Ag: 7969.51 | Ag: 7969.51 | |

| NPC for only grid-connected system [USD] | SD: 67,167.22 | SD: 84,795.5 | SD: 108,680.77 | SD: 141,295.99 | SD: 186,115.35 | SD: 248,014.3 |

| Bo: 55,761.52 | Bo: 70,396.33 | Bo: 90,225.64 | Bo: 117,302.45 | Bo: 154,511.01 | Bo: 205,898.87 | |

| Sa: 6609.79 | Sa: 8387.22 | Sa: 10,804.39 | Sa: 14,116.19 | Sa: 18,681.23 | Sa: 25,003.42 | |

| Ag: 4049.17 | Ag: 5908.46 | Ag: 8737.75 | Ag: 13,053.52 | Ag: 19,641.7 | Ag: 29,692.92 | |

| Total grid avoidable cost [USD] | SD: 69,183.06 | SD: 87,340.4 | SD: 111,942.53 | SD: 145,536.61 | SD: 191,701.1 | SD: 255,457.77 |

| Bo: 53,768.92 | Bo: 67,880.77 | Bo: 87,001.49 | Bo: 113,110.74 | Bo: 148,989.68 | Bo: 198,541.23 | |

| Sa: 6609.79 | Sa: 8387.22 | Sa: 10,804.39 | Sa: 14,116.19 | Sa: 18,681.23 | Sa: 25,003.42 | |

| Ag: 4049.17 | Ag: 5908.46 | Ag: 8737.75 | Ag: 13,053.52 | Ag: 19,641.7 | Ag: 29,692.92 | |

| Total grid unavoidable cost [USD] | SD: −2015.84 | SD: −2544.91 | SD: −3261.76 | SD: −4240.62 | SD: −5585.75 | SD: −7443.47 |

| Bo: 1992.59 | Bo: 2515.56 | Bo: 3224.14 | Bo: 4191.71 | Bo: 5521.33 | Bo: 7357.64 | |

| Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | |

| Ag: 0 | Ag: 0 | Ag: 0 | Ag: 0 | Ag: 0 | Ag: 0 | |

| Total costs avoided by hybrid energy system [USD] | SD: 67,167.22 | SD: 84,795.5 | SD: 108,680.77 | SD: 141,295.99 | SD: 186,115.35 | SD: 248,014.3 |

| Bo: 55,761.52 | Bo: 70,396.33 | Bo: 90,225.64 | Bo: 117,302.45 | Bo: 154,511.01 | Bo: 205,898.87 | |

| Sa: 6609.79 | Sa: 8387.22 | Sa: 10,804.39 | Sa: 14,116.19 | Sa: 18,681.23 | Sa: 25,003.42 | |

| Ag: 4049.17 | Ag: 5908.46 | Ag: 8737.75 | Ag: 13,053.52 | Ag: 19,641.7 | Ag: 29,692.92 | |

| Total grid earning for PV system [USD] | SD: 11,320.65 | SD: 14,291.8 | SD: 18,317.52 | SD: 23,814.63 | SD: 31,368.68 | SD: 41,801.39 |

| Bo: 37,621.68 | Bo: 47,495.63 | Bo: 60,874.24 | Bo: 79,142.66 | Bo: 104,246.87 | Bo: 138,917.69 | |

| Sa: 4376.23 | Sa: 5553.03 | Sa: 7153.4 | Sa: 9346.09 | Sa: 12,368.52 | Sa: 16,554.34 | |

| Ag: 2385.08 | Ag: 3480.26 | Ag: 5146.79 | Ag: 7688.91 | Ag: 11,569.54 | Ag: 17,490.01 | |

| Total grid costs for PV system [USD] | SD: 36,552.75 | SD: 46,146.15 | SD: 59,144.65 | SD: 76,894.02 | SD: 101,284.95 | SD: 134,970.68 |

| Bo: 37,622.84 | Bo: 47,497.08 | Bo: 60,876.11 | Bo: 79,145.1 | Bo: 104,250.07 | Bo: 138,921.95 | |

| Ag: 2394.31 | Ag: 3493.73 | Ag: 5166.72 | Ag: 7718.67 | Ag: 11,614.33 | Ag: 17,557.71 | |

| Sa: 4392.2 | Sa: 5573.3 | Sa: 7179.51 | Sa: 9380.21 | Sa: 12,413.67 | Sa: 16,614.77 | |

| Total grid credits [USD] | SD: 2015.84 | SD: 2544.91 | SD: 3261.76 | SD: 4240.62 | SD: 5585.75 | SD: 7443.47 |

| Bo: 0 | Bo: 0 | Bo: 0 | Bo: 0 | Bo: 0 | Bo: 0 | |

| Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | |

| Ag: 0 | Ag: 0 | Ag: 0 | Ag: 0 | Ag: 0 | Ag: 0 | |

| LCOE [USD/kWh] | SD: 0.15 | SD: 0.17 | SD: 0.2 | SD: 0.24 | SD: 0.3 | SD: 0.37 |

| Bo: 0.07 | Bo: 0.07 | Bo: 0.07 | Bo: 0.07 | Bo: 0.07 | Bo: 0.07 | |

| Sa: 0.07 | Sa: 0.07 | Sa: 0.07 | Sa: 0.07 | Sa: 0.07 | Sa: 0.07 | |

| Ag: 0.07 | Ag: 0.07 | Ag: 0.07 | Ag: 0.07 | Ag: 0.07 | Ag: 0.07 | |

| LCOE for only grid-connected system [USD/kWh] | SD: 0.48 | SD: 0.61 | SD: 0.78 | SD: 1.02 | SD: 1.34 | SD: 1.79 |

| Bo: 0.37 | Bo: 0.47 | Bo: 0.6 | Bo: 0.78 | Bo: 1.03 | Bo: 1.38 | |

| Sa: 0.18 | Sa: 0.23 | Sa: 0.29 | Sa: 0.38 | Sa: 0.51 | Sa: 0.68 | |

| Ag: 0.06 | Ag: 0.08 | Ag: 0.12 | Ag: 0.18 | Ag: 0.27 | Ag: 0.41 | |

| Grid avoidable cost per kWh | SD: 0.5 | SD: 0.63 | SD: 0.81 | SD: 1.05 | SD: 1.38 | SD: 1.84 |

| Bo: 0.36 | Bo: 0.45 | Bo: 0.58 | Bo: 0.76 | Bo: 1.0 | Bo: 1.33 | |

| Sa: 0.18 | Sa: 0.23 | Sa: 0.29 | Sa: 0.38 | Sa: 0.51 | Sa: 0.68 | |

| Ag: 0.06 | Ag: 0.08 | Ag: 0.12 | Ag: 0.18 | Ag: 0.27 | Ag: 0.41 | |

| Grid unavoidable cost per kWh | SD: −0.01 | SD: −0.02 | SD: −0.02 | SD: −0.03 | SD: −0.04 | SD: −0.05 |

| Bo: 0.01 | Bo: 0.02 | Bo: 0.02 | Bo: 0.03 | Bo: 0.04 | Bo: 0.05 | |

| Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | |

| Ag: 0 | Ag: 0 | Ag: 0 | Ag: 0 | Ag: 0 | Ag: 0 | |

| Solar cost per kWh | SD: 0.09 | SD: 0.09 | SD: 0.09 | SD: 0.09 | SD: 0.09 | SD: 0.09 |

| Bo: 0.11 | Bo: 0.11 | Bo: 0.11 | Bo: 0.11 | Bo: 0.11 | Bo: 0.11 | |

| Sa: 0.11 | Sa: 0.11 | Sa: 0.11 | Sa: 0.11 | Sa: 0.11 | Sa: 0.11 | |

| Ag: 0.11 | Ag: 0.11 | Ag: 0.11 | Ag: 0.11 | Ag: 0.11 | Ag: 0.11 | |

| Operating cost | SD: 1826.17 | SD: 2232.87 | SD: 2783.92 | SD: 4422.79 | SD: 4570.4 | SD: 5998.46 |

| Bo: 239.02 | Bo: 239.03 | Bo: 239.06 | Bo: 239.09 | Bo: 4254.43 | Bo: 239.2 | |

| Sa: 38.74 | Sa: 38.99 | Sa: 39.32 | Sa: 39.77 | Sa: 40.4 | Sa: 41.27 | |

| Ag: 71.28 | Ag: 71.49 | Ag: 71.79 | Ag: 72.27 | Ag: 72.99 | Ag: 74.09 | |

| Initial cost | SD: 17,726.05 | SD: 17,726.05 | SD: 17,726.05 | SD: 17,726.05 | SD: 17,726.05 | SD: 17,726.05 |

| Bo: 15,318.53 | Bo: 15,318.53 | Bo: 15,318.53 | Bo: 15,318.53 | Bo: 15,318.53 | Bo: 15,318.53 | |

| Sa: 3470.13 | Sa: 3470.13 | Sa: 3470.13 | Sa: 3470.13 | Sa: 3470.13 | Sa: 3470.13 | |

| Ag: 6492.74 | Ag: 6492.74 | Ag: 6492.74 | Ag: 6492.74 | Ag: 6492.74 | Ag: 6492.74 | |

| Total operation and maintenance cost | SD: 4592.32 | SD: 4592.32 | SD: 4592.32 | SD: 4592.32 | SD: 4592.32 | SD: 4592.32 |

| Bo: 3967.7 | Bo: 3967.7 | Bo: 3967.7 | Bo: 3967.7 | Bo: 3967.7 | Bo: 3967.7 | |

| Sa: 665.24 | Sa: 665.24 | Sa: 665.24 | Sa: 665.24 | Sa: 665.24 | Sa: 665.24 | |

| Ag: 1476.77 | Ag: 1476.77 | Ag: 1476.77 | Ag: 1476.77 | Ag: 1476.77 | Ag: 1476.77 | |

| Total money paid to the grid (25 years) [USD] | SD: 25,731.09 | SD: 32,484.31 | SD: 41,634.52 | SD: 54,129.08 | SD: 71,298.93 | SD: 95,011.8 |

| Bo: 1.16 | Bo: 1.46 | Bo: 1.87 | Bo: 2.43 | Bo: 3.2 | Bo: 4.27 | |

| Sa: 15.97 | Sa: 20.27 | Sa: 26.11 | Sa: 34.12 | Sa: 45.15 | Sa: 60.43 | |

| Ag: 9.23 | Ag: 13.47 | Ag: 26.11 | Ag: 29.76 | Ag: 44.79 | Ag: 67.7 | |

| Total net profit (VP) [USD] | SD: 19,117.76 | SD: 29,992.82 | SD: 44,727.89 | SD: 64,848.54 | SD: 92,498.05 | SD: 130,684.13 |

| Bo: 36,474.14 | Bo: 51,108.65 | Bo: 70,937.54 | Bo: 98,013.80 | Bo: 135,221.59 | Bo: 186,608.38 | |

| Sa: 2458.45 | Sa: 4231.57 | Sa: 6642.90 | Sa: 9946.70 | Sa: 14,500.71 | Sa: 20,807.62 | |

| Ag: −3929.58 | Ag: −2074.52 | Ag: 748.32 | Ag: 5054.24 | Ag: 11,627.40 | Ag: 21,655.70 | |

| IRR (%) | SD: 8.03 | SD: 10.43 | SD: 12.78 | SD: 15.10 | SD: 17.39 | SD: 19.67 |

| Bo: 16.17 | Bo: 18.66 | Bo: 21.12 | Bo: 23.56 | Bo: 25.99 | Bo: 28.41 | |

| Sa: 5.36 | Sa: 7.68 | Sa: 9.95 | Sa: 12.18 | Sa: 14.40 | Sa: 16.60 | |

| Ag: −4.83 | Ag: −2.03 | Ag: 0.58 | Ag: 3.07 | Ag: 5.49 | Ag: 7.86 | |

| Payback period [years] | SD: 10 | SD: 9 | SD: 8 | SD: 8 | SD: 7 | SD: 7 |

| Bo: 6 | Bo: 6 | Bo: 5 | Bo: 5 | Bo: 5 | Bo: 5 | |

| Sa: 13 | Sa: 11 | Sa: 10 | Sa: 9 | Sa: 8 | Sa: 8 | |

| Ag: None | Ag: None | Ag: 25 | Ag: 22 | Ag: 19 | Ag: 18 | |

| ROI (%) | SD: 39.79 | SD: 54.73 | SD: 69.94 | SD: 84.83 | SD: 98.80 | SD: 111.38 |

| Bo: 189.11 | Bo: 264.98 | Bo: 367.78 | Bo: 508.14 | Bo: 701.01 | Bo: 967.36 | |

| Sa: 59.22 | Sa: 101.83 | Sa: 159.63 | Sa: 238.56 | Sa: 346.86 | Sa: 495.92 | |

| Ag: −49.25 | Ag: −25.99 | Ag: 9.37 | Ag: 63.18 | Ag: 145.08 | Ag: 269.44 | |

| PV power [kWh/yr] | SD: 14,873.44 | SD: 14,873.44 | SD: 14,873.44 | SD: 14,873.44 | SD: 14,873.44 | SD: 14,873.44 |

| Bo: 10,475.02 | Bo: 10,475.02 | Bo: 10,475.02 | Bo: 10,475.02 | Bo: 10,475.02 | Bo: 10,475.02 | |

| Sa: 2182.23 | Sa: 2182.23 | Sa: 2182.23 | Sa: 2182.23 | Sa: 2182.23 | Sa: 2182.23 | |

| Ag: 3637.54 | Ag: 3645.62 | Ag: 3645.62 | Ag: 3645.62 | Ag: 3645.62 | Ag: 3645.62 | |

| Annual power bought from grid | SD: 4736.43 | SD: 4736.43 | SD: 4736.43 | SD: 4736.43 | SD: 4736.43 | SD: 4736.43 |

| Bo: 5845.21 | Bo: 5845.21 | Bo: 5845.21 | Bo: 5845.21 | Bo: 5845.21 | Bo: 5845.21 | |

| Sa: 1395.45 | Sa: 1395.45 | Sa: 1395.45 | Sa: 1395.45 | Sa: 1395.45 | Sa: 1395.45 | |

| Ag: 2069.58 | Ag: 2069.58 | Ag: 2069.58 | Ag: 2069.58 | Ag: 2069.58 | Ag: 2069.58 | |

| Annual power sold to grid | SD: 10,647.42 | SD: 10,647.42 | SD: 10,647.42 | SD: 10,647.42 | SD: 10,647.42 | SD: 10,647.42 |

| Bo: 6881.70 | Bo: 6881.70 | Bo: 6881.70 | Bo: 6881.70 | Bo: 6881.70 | Bo: 6881.70 | |

| Sa: 1390.37 | Sa: 1390.37 | Sa: 1390.37 | Sa: 1390.37 | Sa: 1390.37 | Sa: 1390.37 | |

| Ag: 2061.60 | Ag: 2061.60 | Ag: 2061.60 | Ag: 2061.60 | Ag: 2061.60 | Ag: 2061.60 | |

| RE (%) | SD: 75.09 | SD: 75.09 | SD: 75.09 | SD: 75.09 | SD: 75.09 | SD: 75.09 |

| Bo: 63.22 | Bo: 63.22 | Bo: 63.22 | Bo: 63.22 | Bo: 63.22 | Bo: 63.22 | |

| Sa: 60.02 | Sa: 60.02 | Sa: 60.02 | Sa: 60.02 | Sa: 60.02 | Sa: 60.02 | |

| Ag: 62.79 | Ag: 60.12 | Ag: 60.12 | Ag: 60.12 | Ag: 60.12 | Ag: 60.12 |

Table A2.

SAMA simulation results for PV-battery-grid system (Boston (Bo), Santiago-Chile (Sa)).

Table A2.

SAMA simulation results for PV-battery-grid system (Boston (Bo), Santiago-Chile (Sa)).

| Escalation Rates | 0% | 2% | 4% | 6% | 8% | 10% |

|---|---|---|---|---|---|---|

| NPC [USD] | Bo: 33,602.37 | Bo: 33,650.12 | Bo: 33,714.82 | Bo: 33,803.16 | Bo: 33,924.56 | Bo: 34,092.22 |

| Sa: 8759.37 | Sa: 8759.93 | Sa: 8760.69 | Sa: 8761.73 | Sa: 8763.17 | Sa: 8765.17 | |

| Total Solar Cost [USD] | Bo: 19,714.94 | Bo: 19,714.94 | Bo: 19,714.94 | Bo: 19,714.94 | Bo: 19,714.94 | Bo: 19,714.94 |

| Sa: 4306.24 | Sa: 4306.24 | Sa: 4306.24 | Sa: 4306.24 | Sa: 4306.24 | Sa: 4306.24 | |

| NPC for only grid-connected system [USD] | Bo: 55,761.52 | Bo: 70,396.33 | Bo: 90,225.64 | Bo: 117,302.45 | Bo: 154,511.01 | Bo: 205,898.87 |

| Sa: 6609.79 | Sa: 8387.22 | Sa: 10,804.39 | Sa: 14,116.19 | Sa: 18,681.23 | Sa: 25,003.42 | |

| Total grid avoidable cost [USD] | Bo: 53,768.92 | Bo: 67,880.77 | Bo: 87,001.49 | Bo: 113,110.74 | Bo: 148,989.68 | Bo: 198,541.23 |

| Sa: 6609.79 | Sa: 8387.22 | Sa: 10,804.39 | Sa: 14,116.19 | Sa: 18,681.23 | Sa: 25,003.42 | |

| Total grid unavoidable cost [USD] | Bo: 1992.59 | Bo: 2515.56 | Bo: 3224.14 | Bo: 4191.71 | Bo: 5521.33 | Bo: 7357.64 |

| Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | |

| Total costs avoided by hybrid energy system [USD] | Bo: 55,761.52 | Bo: 70,396.33 | Bo: 90,225.64 | Bo: 117,302.45 | Bo: 154,511.01 | Bo: 205,898.87 |

| Sa: 6609.79 | Sa: 8387.22 | Sa: 10,804.39 | Sa: 14,116.19 | Sa: 18,681.23 | Sa: 25,003.42 | |

| Total grid earning for PV-BT system [USD] | Bo: 22,111.54 | Bo: 27,914.8 | Bo: 35,777.86 | Bo: 46,514.84 | Bo: 61,269.44 | Bo: 81,646.66 |

| Sa: 1985.8 | Sa: 2519.79 | Sa: 3245.99 | Sa: 4240.96 | Sa: 5612.45 | Sa: 7511.84 | |

| Total grid costs for PV-BT system [USD] | Bo: 22,293.47 | Bo: 28,144.48 | Bo: 36,072.24 | Bo: 46,897.56 | Bo: 61,773.56 | Bo: 82,318.44 |

| Sa: 1987.88 | Sa: 2522.44 | Sa: 3249.4 | Sa: 4245.42 | Sa: 5618.34 | Sa: 7519.73 | |

| Total grid credits [USD] | Bo: 0 | Bo: 0 | Bo: 0 | Bo: 0 | Bo: 0 | Bo: 0 |

| Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | |

| LCOE [USD/kWh] | Bo: 0.16 | Bo: 0.16 | Bo: 0.16 | Bo: 0.16 | Bo: 0.16 | Bo: 0.16 |

| Sa: 0.18 | Sa: 0.18 | Sa: 0.18 | Sa: 0.18 | Sa: 0.18 | Sa: 0.18 | |

| LCOE for only grid-connected system [USD/kWh] | Bo: 0.37 | Bo: 0.47 | Bo: 0.6 | Bo: 0.78 | Bo: 1.03 | Bo: 1.38 |

| Sa: 0.18 | Sa: 0.23 | Sa: 0.29 | Sa: 0.38 | Sa: 0.51 | Sa: 0.68 | |

| Grid avoidable cost per kWh | Bo: 0.36 | Bo: 0.45 | Bo: 0.58 | Bo: 0.76 | Bo: 1 | Bo: 1.35 |

| Sa: 0.18 | Sa: 0.23 | Sa: 0.29 | Sa: 0.38 | Sa: 0.51 | Sa: 0.68 | |

| Grid unavoidable cost per kWh | Bo: 0.01 | Bo: 0.02 | Bo: 0.02 | Bo: 0.03 | Bo: 0.03 | Bo: 0.05 |

| Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | Sa: 0 | |

| Solar cost per kWh | Bo: 0.11 | Bo: 0.11 | Bo: 0.11 | Bo: 0.11 | Bo: 0.11 | Bo: 0.11 |

| Sa: 0.11 | Sa: 0.11 | Sa: 0.11 | Sa: 0.11 | Sa: 0.11 | Sa: 0.11 | |

| Operating cost | Bo: 791.0 | Bo: 857.71 | Bo: 861.61 | Bo: 866.93 | Bo: 874.24 | Bo: 884.34 |

| Sa: 203.46 | Sa: 203.49 | Sa: 203.54 | Sa: 203.6 | Sa: 203.68 | Sa: 203.79 | |

| Initial cost | Bo: 19,407.85 | Bo: 19,407.85 | Bo: 19,407.85 | Bo: 19,407.85 | Bo: 19,407.85 | Bo: 19,407.85 |

| Sa: 5181.74 | Sa: 5181.74 | Sa: 5181.74 | Sa: 5181.74 | Sa: 5181.74 | Sa: 5181.74 | |

| Total operation and maintenance cost | Bo: 5924.62 | Bo: 5924.62 | Bo: 5924.62 | Bo: 5924.62 | Bo: 5924.62 | Bo: 5924.62 |

| Sa: 1235.69 | Sa: 1235.69 | Sa: 1235.69 | Sa: 1235.69 | Sa: 1235.69 | Sa: 1235.69 | |

| Total money paid to the grid (25 years) [USD] | Bo: 181.93 | Bo: 229.68 | Bo: 294.38 | Bo: 382.72 | Bo: 504.12 | Bo: 671.78 |

| Sa: 2.08 | Sa: 2.64 | Sa: 3.41 | Sa: 4.45 | Sa: 5.89 | Sa: 7.88 | |

| Total net profit (VP) [USD] | Bo: 22,159.15 | Bo: 36,746.21 | Bo: 56,510.82 | Bo: 83,499.29 | Bo: 120,586.45 | Bo: 171,806.64 |

| Sa: −2149.58 | Sa: −372.71 | Sa: 2043.70 | Sa: 5354.46 | Sa: 9918.06 | Sa: 16,238.25 | |

| IRR (%) | Bo: 8.94 | Bo: 11.84 | Bo: 14.58 | Bo: 17.21 | Bo: 19.76 | Bo: 22.25 |

| Sa: −4.23 | Sa: −0.57 | Sa: 2.50 | Sa: 5.26 | Sa: 7.82 | Sa: 10.26 | |

| Payback period | Bo: 10 | Bo: 7 | Bo: 7 | Bo: 6 | Bo: 6 | Bo: 6 |

| Sa: None | Sa: None | Sa: 20 | Sa: 15 | Sa: 14 | Sa: 12 | |

| ROI (%) | Bo: 63.15 | Bo: 104.58 | Bo: 160.53 | Bo: 236.61 | Bo: 340.53 | Bo: 482.88 |

| Sa: −23.32 | Sa: −4.04 | Sa: 22.16 | Sa: 58.06 | Sa: 107.53 | Sa: 176.02 | |

| PV power [kWh/yr] | Bo: 10,612.85 | Bo: 10,612.85 | Bo: 10,626.64 | Bo: 10,626.64 | Bo: 10,626.64 | Bo: 10,626.64 |

| Sa: 2273.16 | Sa: 2273.16 | Sa: 2273.16 | Sa: 2273.16 | Sa: 2273.16 | Sa: 2273.16 | |

| Annual power bought from grid [kWh] | Bo: 3144.40 | Bo: 3144.40 | Bo: 3144.40 | Bo: 3144.40 | Bo: 3144.40 | Bo: 3144.40 |

| Sa: 631.57 | Sa: 631.57 | Sa: 631.57 | Sa: 631.57 | Sa: 631.57 | Sa: 631.57 | |

| Annual power sold to the grid [kWh] | Bo: 4027.37 | Bo: 4027.37 | Bo: 4027.37 | Bo: 4027.37 | Bo: 4027.37 | Bo: 4027.37 |

| Sa: 630.91 | Sa: 630.91 | Sa: 630.91 | Sa: 630.91 | Sa: 630.91 | Sa: 630.91 | |

| RE (%) | Bo: 75.88 | Bo: 75.88 | Bo: 75.42 | Bo: 75.42 | Bo: 75.42 | Bo: 75.42 |

| Sa: 76.87 | Sa: 76.87 | Sa: 76.87 | Sa: 76.87 | Sa: 76.87 | Sa: 76.87 |

References

- International Monetary Fund. Inflation: Prices on the Rise. Available online: https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Inflation (accessed on 12 August 2024).

- Dekimpe, M.G.; van Heerde, H.J. Retailing in Times of Soaring Inflation: What We Know, What We Don’t Know, and a Research Agenda. J. Retail. 2023, 99, 322–336. [Google Scholar] [CrossRef]

- Federal Reserve. Why Does the Federal Reserve Aim for Inflation of 2 Percent over the Longer Run? Available online: https://www.federalreserve.gov/faqs/economy_14400.htm (accessed on 12 August 2024).

- Goel, R.K.; Saunoris, J.W.; Goel, S.S. Supply Chain Performance and Economic Growth: The Impact of COVID-19 Disruptions. J. Policy Model. 2021, 43, 298–316. [Google Scholar] [CrossRef]

- Yu, Z.; Razzaq, A.; Rehman, A.; Shah, A.; Jameel, K.; Mor, R.S. Disruption in Global Supply Chain and Socio-Economic Shocks: A Lesson from COVID-19 for Sustainable Production and Consumption. Oper. Manag. Res. 2022, 15, 233–248. [Google Scholar] [CrossRef]

- Eichengreen, B. The Return of Inflation. Curr. Hist. 2024, 123, 9–13. [Google Scholar] [CrossRef]

- Maurya, P.K.; Bansal, R.; Mishra, A.K. Russia–Ukraine Conflict and Its Impact on Global Inflation: An Event Study-Based Approach. J. Econ. Stud. 2023, 50, 1824–1846. [Google Scholar] [CrossRef]

- Liu, N.; Su, Y. Russia-Ukraine War’s Effects on the World Economy. Highlights Bus. Econ. Manag. 2024, 24, 1105–1113. [Google Scholar] [CrossRef]

- Salzer, A. Energy Could Be the Hedge of a Decade for Investors as Inflation Stays High. Available online: https://financialpost.com/investing/hedge-investors-inflation-energy-industry (accessed on 12 August 2024).

- Bruno, S.; Chincarini, L.B. Hedging Inflation Internationally. SSRN 2010. [Google Scholar] [CrossRef][Green Version]

- Amenc, N.; Martellini, L.; Ziemann, V. Inflation-Hedging Properties of Real Assets and Implications for Asset-Liability Management Decisions. J. Portf. Manag. 2009, 35, 94–110. [Google Scholar] [CrossRef]

- Otaola, J.; Bianco, M.L. Argentina Inflation, World’s Highest, Slows down in Boost for Milei. Reuters. 2024. Available online: https://www.reuters.com/world/americas/argentina-inflation-cools-more-than-expected-february-hits-276-annually-2024-03-12/ (accessed on 12 August 2024).

- Schmidt-Hebbel, K.; Werner, A.; Hausmann, R.; Chang, R. Inflation Targeting in Brazil, Chile, and Mexico: Performance, Credibility, and the Exchange Rate on JSTOR. Economía 2002, 2, 31–89. [Google Scholar] [CrossRef]

- Bianco, M.L.; Otaola, J. Argentina Inflation Hits 124% as Cost-of-Living Crisis Sharpens. Reuters. 2023. Available online: https://www.reuters.com/markets/argentine-shoppers-face-daily-race-deals-inflation-soars-above-100-2023-09-13/ (accessed on 12 August 2024).

- Arnold, S.; Auer, B.R. What Do Scientists Know about Inflation Hedging? N. Am. J. Econ. Financ. 2015, 34, 187–214. [Google Scholar] [CrossRef]

- Mahlstedt, M.; Zagst, R. Inflation Protected Investment Strategies. Risks 2016, 4, 9. [Google Scholar] [CrossRef]

- Martin, G.A. The Long-Horizon Benefits of Traditional and New Real Assets in the Institutional Portfolio. J. Altern. Invest. 2010, 13, 6–29. [Google Scholar] [CrossRef]

- Bodie, Z. Common Stocks as a Hedge Against Inflation. J. Financ. 1976, 31, 459–470. [Google Scholar] [CrossRef]

- D’Amico, S.; King, T.B. One Asset Does Not Fit All: Inflation Hedging by Index and Horizon. FRB Chic. 2023. [Google Scholar] [CrossRef]

- Mork, K.; Hall, R.E. Energy Price, Inflation and Recession, 1974–1975. Energy J. 1980, 1, 31–63. [Google Scholar] [CrossRef]

- Fan, Y.; Xu, J.-H. What Has Driven Oil Prices since 2000? A Structural Change Perspective. Energy Econ. 2011, 33, 1082–1094. [Google Scholar] [CrossRef]

- Schnellhammer, P. Inflation Hedging—Renewables Make the Difference; Aquila Capital: Hamburg, Germany, 2021. [Google Scholar]

- Chatham House—International Affairs Think Tank. How Policymakers Should Tackle Energy Price Inflation. Available online: https://www.chathamhouse.org/2022/02/how-policymakers-should-tackle-energy-price-inflation (accessed on 25 April 2024).

- Sommerfeldt, N.; Pearce, J.M. Can Grid-Tied Solar Photovoltaics Lead to Residential Heating Electrification? A Techno-Economic Case Study in the Midwestern U.S. Appl. Energy 2023, 336, 120838. [Google Scholar] [CrossRef]

- Black, A.J. Why Is a Solar Electric Home Worth More? Present. Sol. 2004, 408, 428–0808. [Google Scholar]

- Yang, D.; Latchman, H.; Tingling, D.; Amarsingh, A.A. Design and Return on Investment Analysis of Residential Solar Photovoltaic Systems. IEEE Potentials 2015, 34, 11–17. [Google Scholar] [CrossRef]

- O’Flaherty, F.J.; Pinder, J.A.; Jackson, C. The Role of Photovoltaics in Reducing Carbon Emissions in Domestic Properties. In Sustainability in Energy and Buildings, Proceedings of the SEB 2019, Madeira, Portugal, 18–20 September 2024; Howlett, R.J., Jain, L.C., Lee, S.H., Eds.; Springer: Berlin/Heidelberg, Germany, 2009; pp. 107–115. [Google Scholar]

- Sadat, S.A.; Nazififard, M. Introducing a Novel Hybrid Mobile Energy Storage System for Vulnerable Community Resilience Support. In Proceedings of the 2020 6th International Conference on Electric Power and Energy Conversion Systems (EPECS), Istanbul, Turkey, 5–7 October 2020; pp. 46–51. [Google Scholar]

- PV and Prices, the (Not so Fast) Uptake of Solar in Argentina and Chile—Pv Magazine International. Available online: https://www.pv-magazine.com/2024/03/22/pv-and-prices-the-not-so-fast-uptake-of-solar-in-argentina-and-chile/#:~:text=Netmeteringcreditscanbe,interconnectionfeeinmanycases (accessed on 8 July 2024).

- IEA. Net Metering (Regulation on Distributed Generation)—Policies. Available online: https://www.iea.org/policies/5735-net-metering-regulation-on-distributed-generation-2014 (accessed on 8 July 2024).

- San Diego Gas & Electric. Excess Generation. Available online: https://www.sdge.com/residential/savings-center/solar-power-renewable-energy/net-energy-metering/billing-information/excess-generation (accessed on 14 June 2024).

- Net Metering FAQs. Available online: https://www.eversource.com/content/residential/about/doing-business-with-us/interconnections/massachusetts/net-metering/faq (accessed on 14 June 2024).

- SOLARGIS. Solar Resource Maps of North America. Available online: https://solargis.com/maps-and-gis-data/download/north-america (accessed on 14 June 2024).

- Ali Sadat, S.; Takahashi, J.; Pearce, J.M. A Free and Open-Source Microgrid Optimization Tool: SAMA the Solar Alone Multi-Objective Advisor. Energy Convers. Manag. 2023, 298, 117686. [Google Scholar] [CrossRef]

- Sadat, S.A. SAMA (Solar Alone Multi-Objective Advisor) GitHub Repository. Available online: https://Github.Com/Sas1997/SAMA (accessed on 21 July 2024).

- Sadat, S.A.; Pearce, J.M. SAMA (Solar Alone Multi-Objective Advisor) OSF Repository. 2023. Available online: https://osf.io/geqwf/ (accessed on 21 July 2024).

- Sadat, S.A.; Pearce, J.M. Techno-Economic Evaluation of Electricity Pricing Structures on Photovoltaic and Photovoltaic-Battery Hybrid Systems in Canada. Renew. Energy 2025, 242, 122456. [Google Scholar] [CrossRef]

- National Solar Radiation Database (NSRDB). Solar Resource Maps and Data. Available online: https://nsrdb.nrel.gov/data-viewer (accessed on 7 November 2022).

- Solar Panel Angles for San Diego, California. Available online: https://solarific.co/us/ca/san-diego (accessed on 26 April 2024).

- Solar Panel Angles for Boston, Massachusetts. Available online: https://solarific.co/us/ma/boston (accessed on 26 April 2024).

- Solar Panel Angles for Adrogue, Buenos Aires, AR. Available online: https://solarific.co/ar/buenos-aires/adrogue (accessed on 11 June 2024).

- Solar Panel Angles for Santiago, Región Metropolitana, CL. Available online: https://solarific.co/cl/region-metropolitana/santiago (accessed on 12 June 2024).

- NREL. System Advisor Model (SAM). Available online: https://github.com/NREL/SAM (accessed on 12 November 2024).

- Ong, S.; Clark, N. Commercial and Residential Hourly Load Profiles for All Tmy3 Locations in the United States; DOE Open Energy Data Initiative (OEDI); National Renewable Energy Lab. (NREL): Golden, CO, USA, 2014. [Google Scholar]

- Lapillonne, B.; Sudries, L.; Labarbe, P. Enerdata, Energy Efficiency Trends by Sector. In Proceedings of the Third Meeting of the BIEE-ROSE Project on Energy Efficiency and SDG7 monitoring in Latin America and the Caribbean Virtual Conference, Virtual Conference, 7 July 2021. [Google Scholar]

- Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Available online: https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics (accessed on 11 August 2023).

- YCharts. US Discount Rate Market Daily Insights: H.15 Selected Interest Rates. Available online: https://ycharts.com/indicators/us_discount_rate (accessed on 26 April 2024).

- Argentina Cuts Interest Rate for Sixth Time to 40% as Inflation Slows. 2024. Available online: https://www.bloomberg.com/news/articles/2024-05-14/argentina-cuts-interest-rate-for-sixth-time-to-40-as-inflation-slows (accessed on 13 August 2024).

- Countryeconomy.Com. Chile Central Bank Key Rates 2024. Available online: https://countryeconomy.com/key-rates/chile (accessed on 12 June 2024).

- Congressional Budget Office. The Economic Outlook for 2023 to 2033 in 16 Charts. Available online: https://www.cbo.gov/publication/58957 (accessed on 4 September 2023).

- Argentina—Inflation Rate 2004–2029. Available online: https://www.statista.com/statistics/316750/inflation-rate-in-argentina/ (accessed on 11 June 2024).

- Chile—Inflation Rate 1987–2029. Available online: https://www.statista.com/statistics/370367/inflation-rate-in-chile/ (accessed on 12 June 2024).

- San Diego Gas & Electric. Total Electric Rates. Available online: https://www.sdge.com/total-electric-rates (accessed on 30 August 2023).

- California Department of Tax and Fee Administration. Energy Resources (Electrical Energy) Surcharge Rate. Available online: https://www.cdtfa.ca.gov/formspubs/l886.pdf (accessed on 13 August 2024).

- California Public Utilities Commission. Division of Water and Audits State Regulatory Fee in California for Electricity. Available online: https://files.cpuc.ca.gov/WaterAdviceLetters/Water_Division/Advice_Letters/2022/Class_A/California-American_Water_Co/AL_1399_-_Update_CPUC_User_Fee_-_2023.pdf (accessed on 13 August 2024).

- San Diego Gas & Electric. Electric Franchise Fees. Available online: https://www.sdge.com/rates-and-regulations/miscellaneous-tariff-related-information/electric-franchise-fees (accessed on 30 August 2023).

- San Diego Gas & Electric. You’re Helping to Fight Climate Change. Available online: https://www.sdge.com/climatecredit (accessed on 2 September 2023).

- Mass.Gov. TIR 90-7: Taxation of Sales and Use of Gas, Steam, Electricity, and Heating Fuel. Available online: https://www.mass.gov/technical-information-release/tir-90-7-taxation-of-sales-and-use-of-gas-steam-electricity-and-heating-fuel (accessed on 30 August 2023).

- Rates & Tariffs. Eversource. Available online: https://www.eversource.com/content/residential/account-billing/manage-bill/about-your-bill/rates-tariffs (accessed on 30 August 2023).

- Argentina Electricity Prices, September 2023. Available online: https://www.globalpetrolprices.com/Argentina/electricity_prices/ (accessed on 11 June 2024).

- Chile Electricity Prices, September 2023. Available online: https://www.globalpetrolprices.com/Chile/electricity_prices/ (accessed on 12 June 2024).

- U.S. Inflation Rate by Year: 1929 to 2024. Available online: https://www.investopedia.com/inflation-rate-by-year-7253832 (accessed on 8 July 2024).

- US Inflation Calculator Historical Inflation Rates: 1914–2024. Available online: https://www.usinflationcalculator.com/inflation/historical-inflation-rates/ (accessed on 12 August 2024).

- Prehoda, E.; Pearce, J.M.; Schelly, C. Policies to Overcome Barriers for Renewable Energy Distributed Generation: A Case Study of Utility Structure and Regulatory Regimes in Michigan. Energies 2019, 12, 674. [Google Scholar] [CrossRef]

- Ramasamy, V.; Zuboy, J.; O’Shaughnessy, E.; Feldman, D.; Desai, J.; Woodhouse, M.; Basore, P.; Margolis, R. US Solar Photovoltaic System and Energy Storage Cost Benchmarks, with Minimum Sustainable Price Analysis: Q1 2022; National Renewable Energy Lab. (NREL): Golden, CO, USA, 2022. [Google Scholar]

- Khalilpour, K.R.; Vassallo, A. Technoeconomic Parametric Analysis of PV-Battery Systems. Renew. Energy 2016, 97, 757–768. [Google Scholar] [CrossRef]

- Bertsch, V.; Geldermann, J.; Lühn, T. What Drives the Profitability of Household PV Investments, Self-Consumption and Self-Sufficiency? Appl. Energy 2017, 204, 1–15. [Google Scholar] [CrossRef]

- Han, X.; Garrison, J.; Hug, G. Techno-Economic Analysis of PV-Battery Systems in Switzerland. Renew. Sustain. Energy Rev. 2022, 158, 112028. [Google Scholar] [CrossRef]

- Stephan, A.; Battke, B.; Beuse, M.D.; Clausdeinken, J.H.; Schmidt, T.S. Limiting the Public Cost of Stationary Battery Deployment by Combining Applications. Nat. Energy 2016, 1, 16079. [Google Scholar] [CrossRef]

- Internal Revenue Service. Residential Clean Energy Credit. Available online: https://www.irs.gov/credits-deductions/residential-clean-energy-credit (accessed on 28 June 2024).