1. Introduction

The global energy transition, driven by the urgent need to mitigate greenhouse gas emissions and reduce reliance on fossil fuels, has underpinned the growing integration of renewable energy sources (RES) in electricity systems [

1]. The intermittent and non-dispatchable nature of RES—particularly solar photovoltaic (PV) and wind—poses substantial challenges for balancing supply and demand, raising concerns about stability, flexibility, and reliability in modern power grids [

1]. Energy storage systems (ESS) have thus emerged as critical enablers for large-scale renewable integration, offering multifaceted functions such as energy arbitrage, frequency regulation, and black-start capabilities [

2,

3].

Despite this potential, the economic viability and deployment of ESS face barriers across technical, regulatory, and market dimensions [

4,

5]. High capital expenditures (CAPEX), operational expenditures (OPEX), battery degradation uncertainties, and limited grid access constrain commercial scalability [

4]. In deregulated markets like Spain, empirical analysis suggests that arbitrage alone is not economically sufficient unless cycling costs fall below specific thresholds for profitable utilization [

4].

Recent technological advances and cost reductions in lithium-ion batteries—over 80% in the past decade—offer hope for improved feasibility [

3,

6]. Hybrid energy storage systems (HESS), combining complementary technologies, also show promise in enhancing performance and reliability [

7]. Moreover, revenue stacking approaches, including participation in capacity markets, ancillary services, and arbitrage, are recognized as essential to improve the profitability for ESS [

8]. Yet, structural limitations remain, particularly in market design and regulation; many European ancillary and reserve markets still exclude batteries or impose aggregation constraints [

4].

The literature shows clear consensus on the necessity of storage for achieving high RES penetration [

1,

3]. However, disagreements persist around the most cost-effective technologies (HESS vs. stand-alone Li-ion), optimal storage sizing (short vs. seasonal storage), and the reliance on revenues from arbitrage versus capacity/reserve payments [

4,

7,

8].

Against this backdrop, Spain presents a compelling case for scholarly analysis. With renewable electricity generation reaching ~50% in 2024 and installed capacity of ~86.6 GW—including ~33.7 GW solar and ~31.7 GW wind according with Red Eléctrica de España—Spain stands at the forefront of the green energy transition in Europe [

9]. However, this growth has triggered issues such as plummeting wholesale prices, frequent zero-price events, and grid instability—culminating in the significant 28 April 2025 Iberian blackout, which highlighted the urgent need for storage and grid resilience.

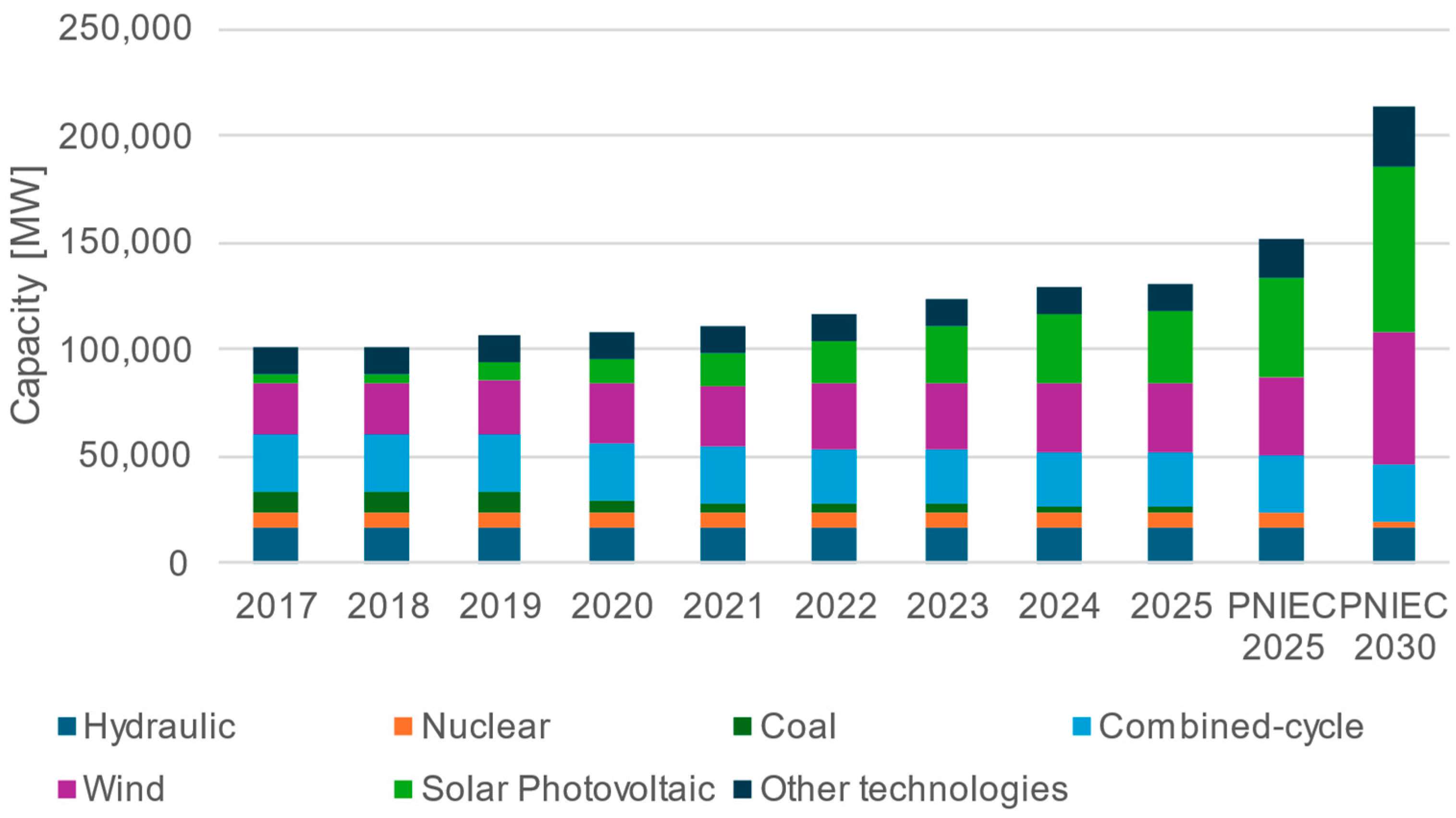

In response, Spain’s 2023 National Integrated Energy and Climate Plan (PNIEC) targets ~22.5 GW of equipment storage by 2030 to support the projected 76 GW solar and 62 GW wind capacities (Figure 1) [

10]. The government has also allocated €150 million to catalyze storage projects linked to renewable installations and launched targeted tenders. Regulatory developments such as a proposed capacity market mechanism and enhanced transparency for grid connection rights indicate significant evolution in the policy environment

Nevertheless, Spain still lags behind peers such as the UK (5 GW Battery Energy Storage Systems, BESS) and Italy (1 GW) in installed battery capacity, with only ~60 MW online until April 2025 [

11,

12]. Moreover, permitting delays, grid bottlenecks, and insufficient compensation for services such as black-start and frequency control remain substantial obstacles. The blackout further underscored deficiencies in grid inertia and storage readiness.

In this context, this study aims to critically analyze the economic viability, technical feasibility, and regulatory readiness of lithium-ion battery ESS co-located with renewable generation—particularly PV and run-of-river hydro—in the Spanish context. By reviewing current captured price dynamics, storage-revenue interactions, system-level feedback effects (e.g., price flattening), and the maturity of remuneration mechanisms, we identify key drivers and constraints affecting ESS deployment. This analysis is significant for policymakers, grid operators, developers, and researchers working on storage integration in high-renewable electricity systems. This manuscript quantifies the economic synergy between PV and battery storage under Spanish market conditions, demonstrates the dynamic feedback loop between storage deployment and intraday price signal strength, and evaluates the adequacy of current and proposed regulatory frameworks (capacity market, transparency, hybrid prioritization). We conclude that PV–BESS configurations currently offer the most viable deployment pathway, but that sustainability and ramp-up of ESS critically depend on nuanced market design, regulatory innovation, and holistic infrastructure planning. Broader implications extend to other high-renewable systems in Europe, providing transferable lessons for accelerating storage commercialization.

While this study focuses on the Spanish power system, similar challenges are emerging globally as renewable penetration accelerates. The rapid deployment of grid-scale battery energy storage systems is transforming electricity markets in countries such as the United States, the United Kingdom, Germany, and Australia, where specific market products for fast-frequency response, capacity remuneration, and ancillary services have already been implemented [

13,

14,

15]. According to [

16] the total power capacity requirement for energy storage across the European Union is estimated to reach around 200 GW by 2030, reflecting a shift toward flexibility-oriented market designs. The Spanish case thus provides an illustrative example of how national policies and market structures can adapt to integrate storage effectively within a rapidly decarbonizing European framework.

2. Energy Storage in the Clean Energy Transition

2.1. Definition and Classification of Energy Storage Technologies

Energy storage (ES) constitutes a key enabling technology for ensuring the stability, efficiency, and sustainability of electricity systems increasingly reliant on renewable energy sources. Its primary function is to accumulate energy during periods of surplus generation and release it during peak demand, thereby supporting the balance between supplay and demand [

17,

18,

19,

20].

Energy storage technologies can be classified according to the physical form in which energy is stored. Each category comprises a range of methods with distinct technical properties and application niches.

2.1.1. Electrical and Electromagnetic Storage

This category stores energy directly in electric or magnetic fields. Supercapacitors deliver extremely high power density and rapid response, making them ideal for smoothing short fluctuations, although their energy density is very low. Superconducting Magnetic Energy Storage (SMES) also offers millisecond-scale response and very high efficiency but remains limited by high costs and low energy density. Both technologies are primarily suited to power quality and stability services rather than bulk storage [

17].

2.1.2. Electrochemical Storage (Batteries)

Electrochemical systems dominate today’s stationary storage deployments. Lithium-ion batteries are the most mature, combining high energy and power density with declining costs, which explains their rapid adoption in grid applications. Alternative chemistries such as sodium–sulfur and vanadium redox flow batteries extend duration or lifetime, while lead–acid batteries remain widely used in legacy and low-cost applications. Each technology involves trade-offs between cost, lifetime, energy density, and safety, but all provide modularity and fast response that match well with renewable integration needs [

18].

2.1.3. Mechanical Storage

Mechanical methods convert electricity into potential or kinetic energy. Pumped hydro energy storage (PHES) is by far the most deployed technology worldwide, offering gigawatt-scale capacity and long lifetimes, though constrained by geography and high upfront costs. Compressed air energy storage (CAES) provides a bulk alternative where suitable caverns exist. At smaller scale, flywheels offer high efficiency and long cycle life, excelling in short-duration, high-power applications rather than long-term storage [

18].

2.1.4. Thermal Storage

Thermal Energy Storage (TES) systems retain energy as heat or cold. Sensible heat storage, often using water or molten salts, is widely applied in concentrated solar power plants. Latent heat storage relies on phase-change materials to achieve higher energy density, while thermochemical storage promises even higher densities and seasonal operation, though it remains at early stages of development [

18].

2.1.5. Hydrogen and Power-to-Gas

Hydrogen is increasingly considered a complementary storage vector. Produced via electrolysis, it can be stored as compressed gas, cryogenic liquid or solid-state hydrides. Its round-trip efficiency is lower than that of batteries, but the possibility of long-duration and even seasonal storage makes hydrogen a key option for decarbonizing sectors where flexibility is scarce [

18].

The choice of a specific storage technology depends on parameters such as capacity, efficiency, cost, and technological maturity [

17,

20].

Table 1 summarizes the main technical indicators based on average values reported in the literature:

However, although stationary energy storage today is largely dominated by electrochemical systems, for applications requiring multi-hour to long-duration (>10–100 h) supply continuity—such as mitigating prolonged renewable intermittency, seasonal deficits, or ensuring reliability under extreme weather conditions—emerging long-duration energy storage (LDES) technologies become increasingly relevant. According to [

21], such systems could enable grids with higher renewable penetration by combining time-shift, capacity payments, and backup value, although at higher capital cost and typically lower round-trip efficiency. These include technologies beyond conventional electrochemical batteries (e.g., compressed air, thermal storage, pumped hydro, other chemistries) which, while still developing, offer promising pathways for expanding storage duration and resilience.

2.2. The Role of Storage in Renewable Energy Integration

Renewable energy sources such as solar and wind exhibit variable and non-dispatchable generation profiles, which hinders alignment with electricity demand patterns [

16,

22,

23,

24]. This mismatch compromises the stability of the power system. In this context, ESS emerge as essential and effective solutions to mitigate intermittency, optimize energy management, and ensure a reliable and controllable supply when required [

17,

22]. Beyond enhancing energy efficiency, ESS also contribute to reducing greenhouse gas emissions [

19].

Energy storage additionally fulfills several critical functions to optimize renewable energy integration and enhance the flexibility and resilience of power systems. These include: (i) temporal energy shifting (load shifting); (ii) peak shaving and valley filling; (iii) minimizing renewable curtailment; and (iv) maximizing and optimizing self-consumption in distributed generation contexts, thereby reducing dependency on external grids [

16,

17,

18,

19,

23]. By performing these functions, storage smooths the daily load curve, absorbing sur-pluses during off-peak hours and releasing them during peak demand, ultimately improving network performance and reducing operating costs.

Electrochemical storage systems, particularly lithium-ion batteries, also provide advanced grid services that are critical for system stability. These include frequency regulation, black-start capability, intraday and seasonal arbitrage, and support for conventional generation assets [

25].

2.3. Market Opportunities and Challenges for BESS Deployment

The deployment of energy storage technologies is shaped by a complex interplay of opportunities and barriers [

15,

26,

27,

28]. On the opportunity side, the sustained reduction in costs is particularly significant—lithium-ion batteries, for instance, have experienced cost declines exceeding 80% over the past decade. This trend is largely driven by industrial-scale production and the rising demand from the electric mobility sector [

19]. Further cost reductions are being reinforced by advances in manufacturing, materials, recycling, and second-life applications [

15].

Institutional support also plays a crucial role. Climate objectives, public funding, and incentive policies act as catalysts for deployment [

15,

16]. Moreover, new business models and applications are emerging, enabling ESS to participate in grid services, capacity markets, and aggregation schemes [

18,

27].

Nevertheless, substantial challenges persist. Initial capital costs remain high for several applications, particularly for long-duration storage technologies such as Compressed Air Energy Storage (CAES) or flow batteries. These solutions require stable regulatory and financial frameworks to secure economic viability and attract investment [

5,

15]. Another significant challenge lies in the cost of electricity once stored and discharged, with the charged price being a decisive factor [

29]. The energy recovered from ESS typically incurs higher levelized costs than direct generation due to round-trip efficiency losses, high capital investments, and operating expenses related to system degradation [

30,

31]. This economic barrier limits the competitiveness of storage-based solutions in current markets, especially in the absence of adequate price signals, business models, incentives, or supportive regulatory frameworks [

32]. Additionally, persistent concerns exist regarding lifespan, recyclability, and the environmental impact of critical raw materials [

15,

18,

19,

20].

At the regulatory level, the absence of a clear legal definition for energy storage, uncertainties regarding system service remuneration, and regulatory heterogeneity across countries hinder full ESS integration into electricity markets [

15,

18,

28]. Many regulatory frameworks remain designed for centralized systems, complicating the deployment of distributed ESS. Furthermore, inconsistencies across jurisdictions restrict interoperability and scalability of projects [

4,

8,

28].

In countries such as Spain, high solar irradiance enables higher energy yields and therefore greater production for the same level of investment. However, many Ready-to-Build (RtB) projects already holding grid access and connection permits have saturated transmission and distribution nodes [

33]. Despite securing grid connection rights, a considerable share of these projects is currently not economically viable under pre-vailing market conditions—discussed in subsequent sections—yet they continue to occupy valuable grid capacity. This situation constitutes a barrier to the development of other potentially strategic projects, such as large-scale energy storage systems.

The large-scale deployment of storage is thus fundamental to advancing a decarbonized and resilient power grid. Overcoming current barriers will require a coordinated approach involving strategic investment, adequate policy frameworks, and continuous technological innovation to achieve a sustainable and economically viable energy system.

2.4. Energy Storage and Market Flexibility

Flexibility refers to the ability of the power system to adapt to rapid changes in generation and demand [

15]. In contexts with high renewable penetration, ESS provide this capability by effectively decoupling the timing of generation from consumption [

15,

27].

Flexibility is expressed in three dimensions: temporal (ranging from milliseconds to seasonal storage), spatial (centralized or distributed systems), and functional (ancillary services such as frequency regulation, voltage support, and reserve provision) [

15,

24,

28,

34,

35,

36,

37]. BESS offer rapid response capabilities that stabilize frequency through adaptive state-of-charge control [

36,

37]. Collectively, these services mitigate renewable intermittency, expand operational capacity, strengthen energy security, and facilitate a smoother transition toward a clean and dynamic electricity model.

3. Overview of the Spanish Energy Market

3.1. Structure of the Electricity Market in Spain

The Spanish electricity market operates within a liberalized framework aligned with the directives of the EU internal energy market [

38,

39]. It is structured around the unbundling of activities—generation, transmission, distribution, and retailing—under a model designed to foster competition and efficiency. The legal foundation is established by Law 24/2013, which consolidates the principles of competition and liberalization introduced by the 1997 Electricity Sector Law.

The wholesale market functions under a marginal pricing system. Energy is traded daily and intraday through the Iberian Electricity Market (MIBEL), managed by OMIE (Operador del Mercado Ibérico de Energía) [

40]. The commonly referenced Spanish electricity price corresponds to the day-ahead market clearing price, which opens at noon and matches 24 hourly products for the following day based on economic merit order [

4]. The transition to 15 min settlement intervals in the day-ahead market is scheduled for 30 September 2025, in accordance with EU Regulation 2017/2195 [

41].

Transmission is a regulated natural monopoly managed by Red Eléctrica de España (REE), which also acts as the transmission system operator (TSO). Distribution remains regulated as well and is carried out by several distribution system operators (DSOs). Remuneration for transmission and distribution is determined annually by the national energy regulator, the Comisión Nacional de los Mercados y la Competencia (CNMC), through methodologies established in Circulars 5/2019 and 6/2019, and implemented by resolutions such as RAP/DE/024/24 (transmission) and RAP/DE/025/24 (distribution), both issued in January 2025.

Retail supply is liberalized, allowing consumers to choose between regulated tariff contracts (PVPC) and free-market options. Market liberalization in Spain began with the 1997 Electricity Sector Law, which introduced competition in generation while maintaining transmission and distribution as regulated natural monopolies. This reform aligned with the EU’s internal market framework initiated by Directive 96/92/EC, which established common rules to promote competition and unbundling across Member States [

38,

42].

The final electricity price paid by consumers is not determined solely by wholesale market outcomes. Instead, the electricity bill in Spain is structured around three components: the energy price, tolls and charges, and taxes. Energy costs are derived from wholesale market prices, while access tolls cover transmission and distribution costs, both regulated by the CNMC. Charges are government-determined contributions that fund surcharges for renewable generation, high-efficiency cogeneration, waste-to-energy facilities, remuneration for generation in non-peninsular territories, and the repayment of system deficits.

This pricing framework is directly affected by the increasing penetration of renewable energy. Solar and wind generation exert downward pressure on wholesale prices during high production periods, but their variability drives demand for flexibility mechanisms and balancing services. These services, critical for maintaining grid stability and managing deviations, constitute a significant portion of the final electricity cost.

The importance of balancing services in the Spanish market was highlighted as early as 2008, when frequency and voltage control were identified as essential for system reliability in a liberalized context [

43]. Since then, this framework has evolved significantly alongside the integration of variable renewables, leading to greater sophistication in balancing markets and higher participation to ensure system stability.

Market liberalization thus introduced competition in generation and retailing, shifting price-setting mechanisms from state regulation to market-based structures. Since the early 2000s, regulatory reforms have increasingly focused on aligning with EU decarbonization goals and promoting renewable integration [

44]. This shift has amplified the need for flexibility mechanisms—chief among them, energy storage—to address the inherent variability of non-dispatchable renewable resources.

Day-Ahead vs. Intraday Trading in MIBEL and Implications for Storage

In the Iberian market, the single day-ahead coupling (SDAC) establishes the baseline 24 h schedule for the following day, whereas intraday markets (auction-based IDAs and the continuous intraday) provide rolling opportunities to correct forecast deviations and adjust positions closer to real time. In practice, day-ahead outcomes anchor the system schedule, while intraday venues absorb new information about demand, renewable output, interconnection availability, and outages. The role of Spain’s intraday market as a corrective layer between day-ahead scheduling and balancing actions has been long recognized. As described by Lobato Miguélez et al. 2008 [

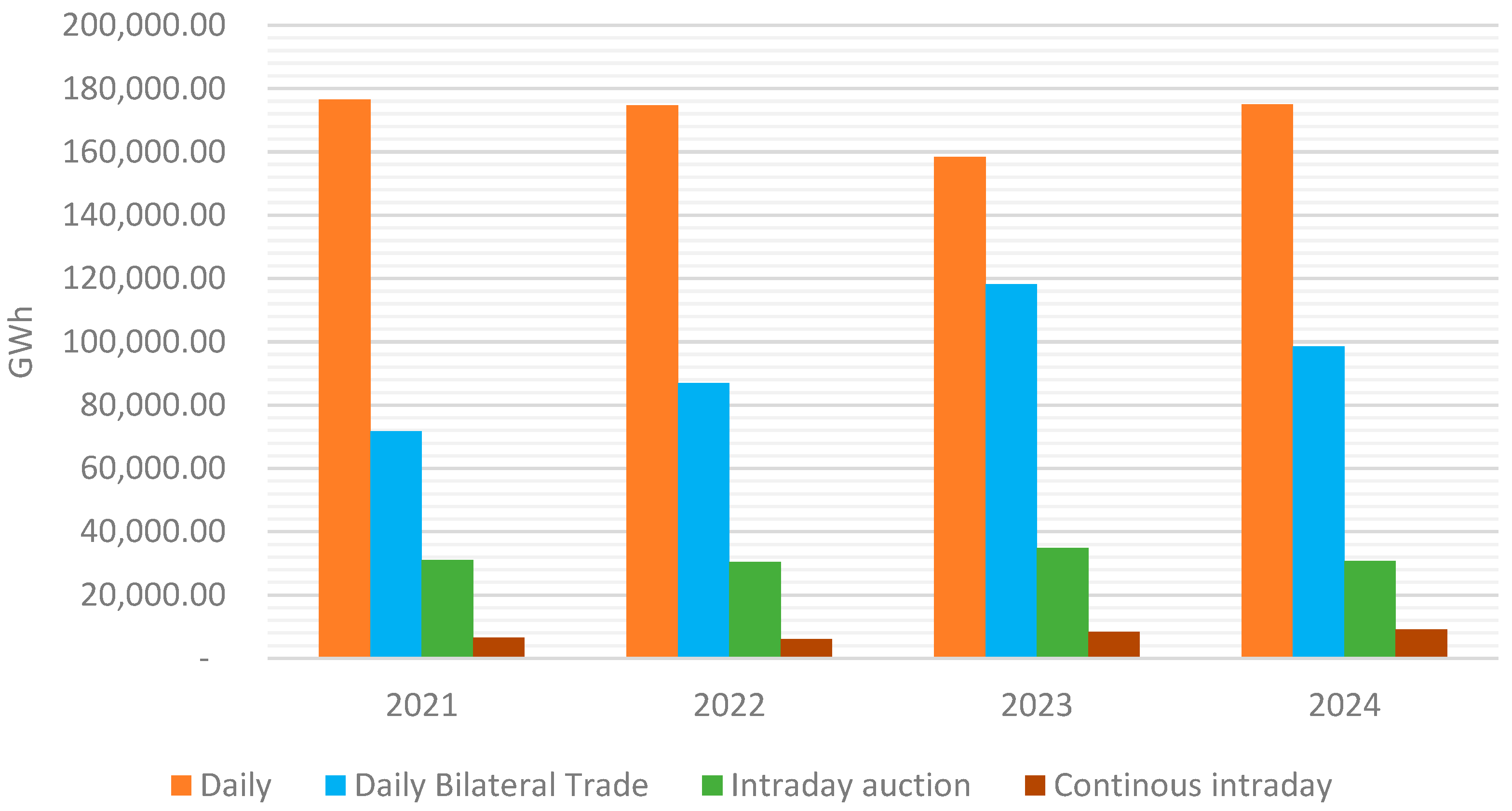

43], the six sequential intraday sessions already provided a structured venue for market agents to adjust deviations before ancillary services were activated. Recent market statistics indicate that intraday markets account for a material but minority share of traded energy—e.g., ≈16.5% of total energy traded on OMIE in 2024—with the remainder cleared day-ahead; nonetheless, intraday liquidity has trended upward with the growth of variable renewables and cross-border coupling (

Figure 1). These roles and volumes frame where batteries can monetize forecast-correction value and spread opportunities within the Iberian design [

45].

From a price-formation perspective, intraday prices are correlated with day-ahead outcomes but exhibit higher sensitivity to short-horizon forecast errors (cloud transients for PV, wind ramps) and congestion/availability signals near real time. For co-located PV + BESS, this implies value in (i) firming and ramp management against intraday gate closures and (ii) opportunistic intra-day shifting when realized spreads justify cycling. For merchant BESS, the arbitrage problem hinges on probabilistic spreads between day-ahead awards and intraday re-pricing, subject to cycling costs and degradation [

46]. As documented in

Section 3.4 and

Section 4, the increasing incidence of low-price hours and steep evening ramps strengthens the role of storage in Spain, with intraday markets providing the mechanisms to re-optimize dispatch as uncertainty resolves. While intraday spreads create clear opportunities for active BESS trading, current volumes remain modest relative to the scale of projected PV additions. This implies that storage value will increasingly depend on multi-market strategies (capacity, reserves, ancillary services) rather than day-ahead/intraday arbitrage alone.

A forthcoming change in particular relevance to storage is the scheduled transition of MIBEL’s market time unit from hourly to 15 min intervals in September 2025, in line with the European electricity balancing regulation. This shift will significantly increase the granularity of price signals, allowing ramping events and short-lived imbalances to be reflected more explicitly in clearing prices. As a result, intra-hour volatility is expected to rise, with larger spreads between consecutive quarters of an hour compared to the current hourly aggregation. For battery operators, this regulatory change expands the scope for short-duration arbitrage, ramp-rate services, and reserve alignment, thereby reinforcing the value of fast-response technologies. From a system perspective, it also improves the accuracy of demand–supply balancing and enhances cross-border harmonization with other European markets operating at quarter-hourly granularity [

47].

In parallel to market design changes, access regulation in Spain also constrains the effective operation windows of storage. A recent CNMC draft resolution (RDC/DE/005/24) defines standardized patterns of injection and absorption (“arbitrage windows”) to be applied in access and connection studies for distribution networks. Under these patterns, batteries are allowed to inject power from 00:00 to 10:59 and from 18:00 to 23:59, and to absorb power from 00:00 to 07:59 and from 11:00 to 17:59. While conceived as a transitional measure until more flexible access rules are implemented, this framework illustrates how regulatory definitions can shape the temporal arbitrage space available to storage operators, beyond pure market price signals [

48].

3.2. Uncertainity in Variable RES and the Operational Value of Storage

The operational contribution of storage is tightly linked to the time scale of uncertainty in variable renewable generation. For PV, forecast errors are dominated by cloud dynamics and aerosol/irradiance variability, wind uncertainty stems from atmospheric stability and mesoscale phenomena. Errors tend to decrease as the horizon shortens (day-ahead → intraday → nowcasting), but ramp risks and tail events remain non-negligible at sub-hourly granularity [

49,

50].

Batteries translate these uncertainty profiles into services: (i) ramp-rate control and output firming for co-located PV/wind, limiting forecast deviations at gate closure and reducing imbalance exposure; (ii) frequency restoration reserves (aFRR/mFRR) and contingency response, where response speed and accuracy are valued; (iii) intra-day arbitrage and spread capture when stochastic supply depresses mid-day prices and sharpens evening peaks; and (iv) grid-forming/black-start capabilities in low-inertia conditions, when enabled by converter controls and market access [

51].

From a system perspective, the marginal value of storage increases with (i) the variance of short-term net-load, (ii) the steepness of structural ramps, and (iii) the frequency of low/zero-price hours that signal curtailment risk or surplus energy. These features have intensified in Spain with fast PV deployment, making BESS particularly effective for co-location firming and reserve provision, while preserving optionality for energy shifting when spreads justify cycling [

9].

Forecast uncertainty remains one of the main operational challenges in integrating variable renewable generation. For photovoltaic plants, day-ahead forecast errors typically range between 5 and 10% of installed capacity, mainly due to cloud dynamics and irradiance variability, while wind generation errors are generally higher, around 10–20%, reflecting mesoscale atmospheric phenomena [

50]. These errors tend to decline toward intraday horizons as short-term weather updates improve accuracy, although sharp ramp events can still induce residual deviations and price volatility. Similar magnitudes of forecast uncertainty have been reported in other European markets, such as the UK and the Nordic region, reinforcing the importance of fast-response storage for mitigating imbalance exposure and enhancing system flexibility [

52].

3.3. Energy Mix and Renewable Penetration Trends

Historically, the Spanish energy system has relied on a combination of conventional technologies, primarily combined-cycle plants, coal-fired thermal power plants, and nuclear energy, with hydropower playing a complementary role. However, in recent decades, this energy mix has undergone a profound transformation, characterized by the near-total phase-out of coal as a generation source and the rapid expansion of renewable technologies, particularly wind and photovoltaic solar power.

From the perspective of power system management, this transition represents a shift from controllable generation sources—capable of modulating their output according to demand—to non-dispatchable technologies, whose production depends on intermittent natural resources. While conventional thermal power plants can respond almost immediately to sudden increases in demand through scheduled activation, renewable sources such as wind and especially solar photovoltaic generation only produce electricity under favorable wind or solar radiation conditions, regardless of real-time system demand.

As a result, renewable generation does not always coincide with consumption needs. In this regard, REE estimates that by 2030, approximately 20% of annual hours will experience combined wind and solar production exceeding national demand. This structural misalignment between supply and demand leads to significant imbalances in the electricity market, frequently resulting in zero or near-zero marginal prices, particularly during midday hours when photovoltaic generation reaches its peak.

In this decarbonization context, the Government of Spain has adopted the PNIEC as its strategic instrument to align national energy and climate policy through 2030. The PNIEC aims to modernize the economy, reduce external energy dependence, and foster sustainable employment [

10]. The plan has recently been updated to increase ambition across all dimensions, in line with the European objectives outlined in the Fit for 55 package [

53] and REPowerEU [

54].

The 2023 update of the PNIEC [

10] establishes highly ambitious goals, including the deployment of more than 100 GW of additional renewable capacity by 2030 (

Figure 2). Nonetheless, significant technical and economic barriers persist, most notably permitting bottlenecks and a limited number of Power Purchase Agreements (PPAs), which undermine project bankability. Despite these obstacles, long-term growth is expected to be driven by the electrification of end uses, the development of green hydrogen, the expansion of electric mobility, and the increasing digitalization of energy systems. This transformation will demand a power system capable of managing higher levels of variability and intermittency.

While the PNIEC outlines ambitious renewable energy deployment objectives, it also faces structural challenges. One of the most pressing concerns is Spain’s dependency on imported critical raw materials—such as lithium, cobalt, nickel, and rare earth elements—which are indispensable for technologies including photovoltaic solar panels, wind turbines, and battery storage [

55]. This dependency entails both geopolitical and economic risks due to price volatility and the geographical concentration of supply chains [

56]. Additionally, the environmental and ethical implications of mineral extraction raise fundamental questions regarding the sustainability of the energy transition [

57].

At the same time, the rapid expansion of variable renewable generation requires a deep transformation of Spain’s electricity infrastructure [

58]. The current grid must be modernized to accommodate intermittent and decentralized resources, supported by both large- and small-scale stationary storage and smart grid technologies [

5,

59]. These developments involve substantial investment requirements and raise concerns about affordability and social equity. Furthermore, the PNIEC must also address the socio-economic consequences of industrial restructuring and ensure that innovation in emerging technologies is pursued within a framework of a just and balanced transition.

3.4. Electricity Price Dynamics and Volatility

The integration of storage systems into photovoltaic solar plants is becoming an increasingly pressing necessity. This trend is largely explained by the continuous decline in the photovoltaic capture price, defined as the ability of solar plants to obtain competitive spot market revenues. As PV penetration increases, generation becomes increasingly concentrated during daylight hours, leading to supply saturation and a substantial reduction in marginal prices during those periods. Consequently, the profitability of standalone solar plants is being eroded, thereby incentivizing hybridization with battery storage as a strategy to shift energy delivery to higher-value hours.

The following analysis combines publicly available datasets from the Spanish electricity market operator (OMIE) and the transmission system operator (Red Eléctrica de España, REE) covering the 2020–2025 period. Hourly day-ahead and intraday prices, demand profiles, and renewable generation data (PV and wind) were processed to characterize the variability and complementarity of these sources. Technology cost benchmarks for lithium-ion batteries were obtained from International Renwable Energy Agency and the Comisión Nacional de los Mercados y la Competencia reports, while regulatory parameters and policy targets were drawn from Ministerio para la Transición Ecológica y Reto Demográfico (MITECO) documentation. The coordination between BESS and renewable generation was assessed through a simplified hourly dispatch framework capturing state-of-charge constraints and market price spreads, consistent with established approaches in techno-economic storage modeling. This framework enables the evaluation of storage operation patterns and revenue dynamics under realistic Spanish market conditions, providing a basis for the policy and investment discussion presented in

Section 6.

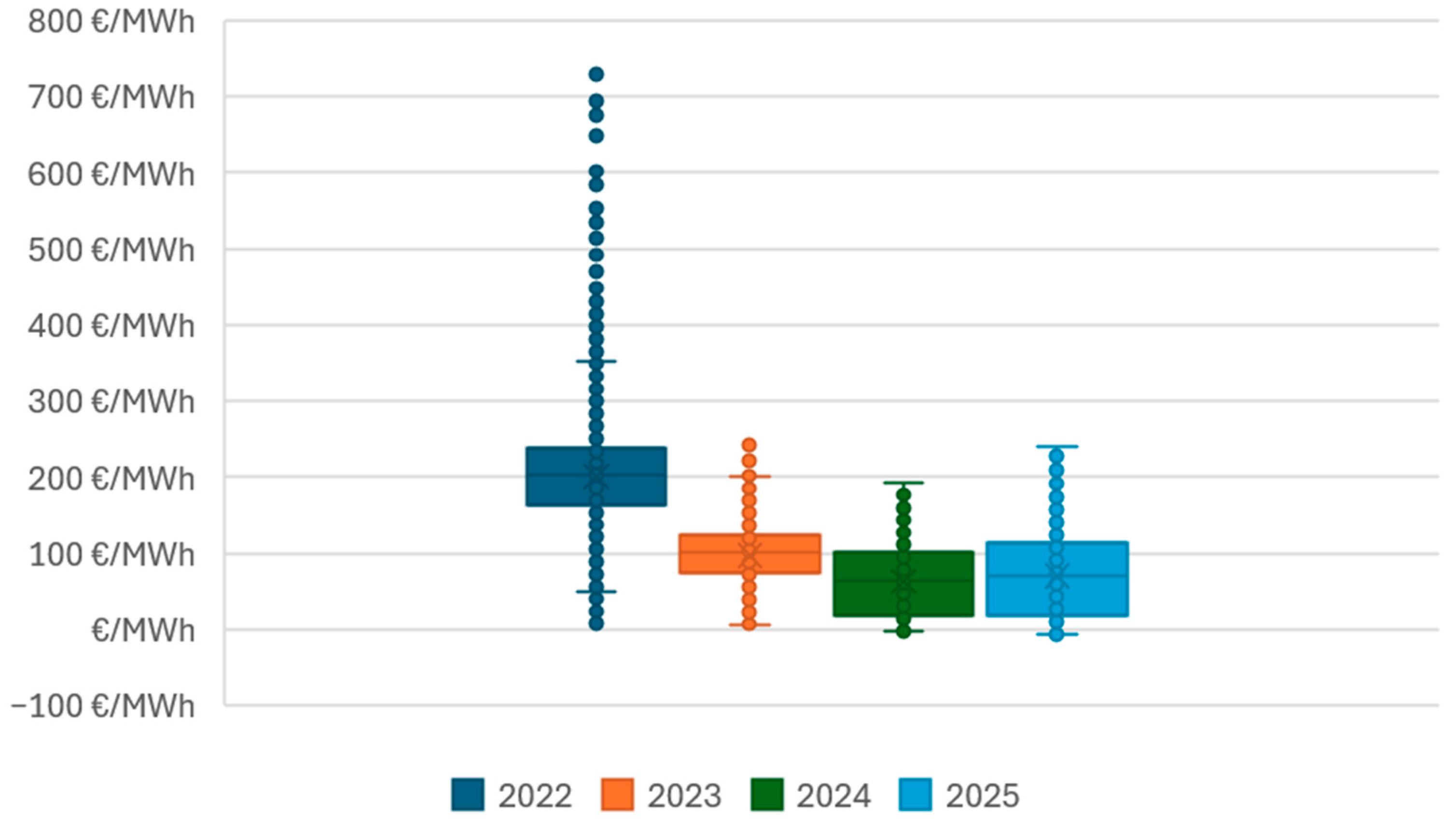

The Spanish spot electricity market has entered a new phase characterized by heightened volatility and a persistent structural downward pressure on prices (

Figure 3). Although temporary price spikes continue to occur—primarily as a result of geopolitical tensions or extreme weather events—the prevailing trend indicates a sustained decline in average market prices. This structural shift is largely attributable to three interrelated factors:

The increasing penetration of renewable energy sources with near-zero marginal costs, particularly photovoltaic (PV) solar generation (

Table 2).

The so-called cannibalization effect during solar hours, whereby the simultaneous output of numerous PV plants significantly depresses marginal prices in those periods.

The reduced reliance on thermal generation, which is progressively restricted to covering peak demand or compensating for insufficient renewable resource availability.

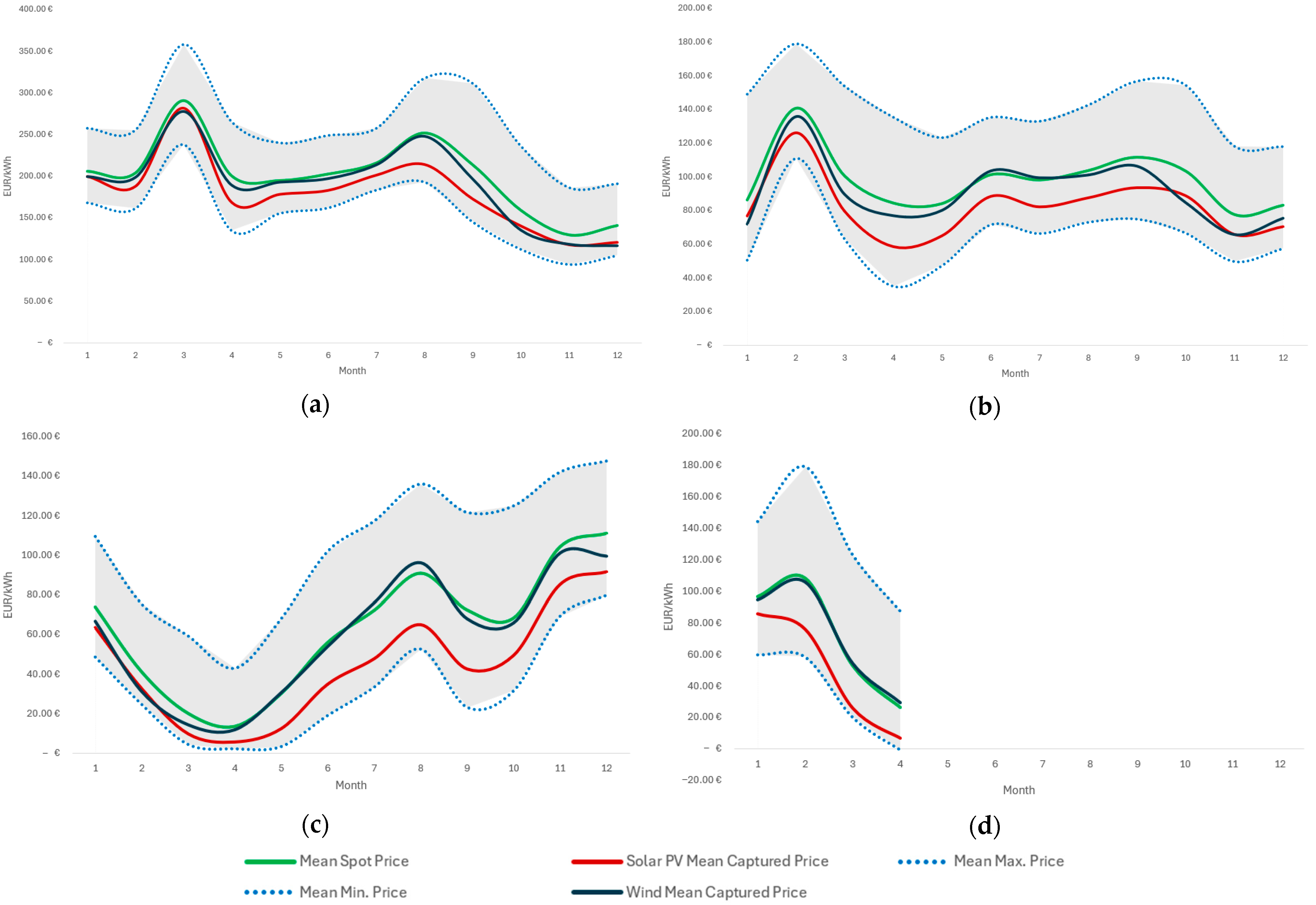

Figure 4 illustrate the evolution of spot market prices, the price spread, and the captured prices for both solar photovoltaic and wind generation. Photovoltaic energy exhibits a more pronounced decline in captured prices, primarily due to increased price volatility in the spot market and frequent energy curtailments during periods of oversupply. In contrast, wind power maintains relatively more stable revenues, as it typically operates during non-solar hours, avoiding the most saturated periods of generation.

Moreover, the intra-day price spread—defined as the difference between the lowest and highest hourly prices within a single day—has widened substantially. This trend presents both opportunities and challenges for the electricity system:

Opportunities for storage and hybridization: Technologies such as batteries, pumped hydro storage, or hybrid systems (e.g., PV combined with small-scale hydropower) can leverage price differentials through energy arbitrage.

Challenges for flat-generation profiles: Technologies with constant or non-dispatchable output face growing risks of reduced capture prices and higher curtailment rates.

On days with high solar irradiance and low demand, the spread between midday solar hours and evening peak demand hours can exceed 100€/MWh. This evolving economic environment increasingly supports the competitiveness of storage and hybrid systems, potentially even in the absence of direct subsidies.

The analysis of hourly market data indicates that intraday price volatility remains significant, although some normalization had occurred during 2023–2024. The average day-ahead price spread between mid-day hours (11:00–15:00) and the evening peak (18:00–22:00) decreased from around 105 €/MWh in 2022 to approximately 71 €/MWh in 2024. However, up to 30 April 2025, the spread rebounded to an average of 98 €/MWh, compared with only 52 €/MWh over the same period in 2024. This renewed widening suggests a resurgence of intraday price differentials, likely driven by higher gas prices, seasonal hydrological constraints, and increasing solar penetration accentuating evening ramp effects. Despite year-to-year fluctuations, the persistence of substantial hourly spreads continues to underscore the economic relevance of storage and hybrid systems for price arbitrage and flexibility provision in the Spanish electricity market.

Figure 5 presents the captured prices for PV and Wind energy. The capture is defined as the average remuneration received by producers for energy sold on the spot market, as declined significantly relative to the average pool price. In 2024, the capture factor for PV producers is already observed to be in the range of 75–80%, meaning that for a market price of 50 €/MWh, photovoltaic producers effectively receive only 37–40 €/MWh. This growing discount reflects the increasing saturation of solar generation during peak hours and highlights the revenue challenges faced by PV assets under current market conditions. This phenomenon is primarily driven by the high simultaneity of solar generation during specific hours, combined with limited demand-side flexibility and insufficient storage capacity.

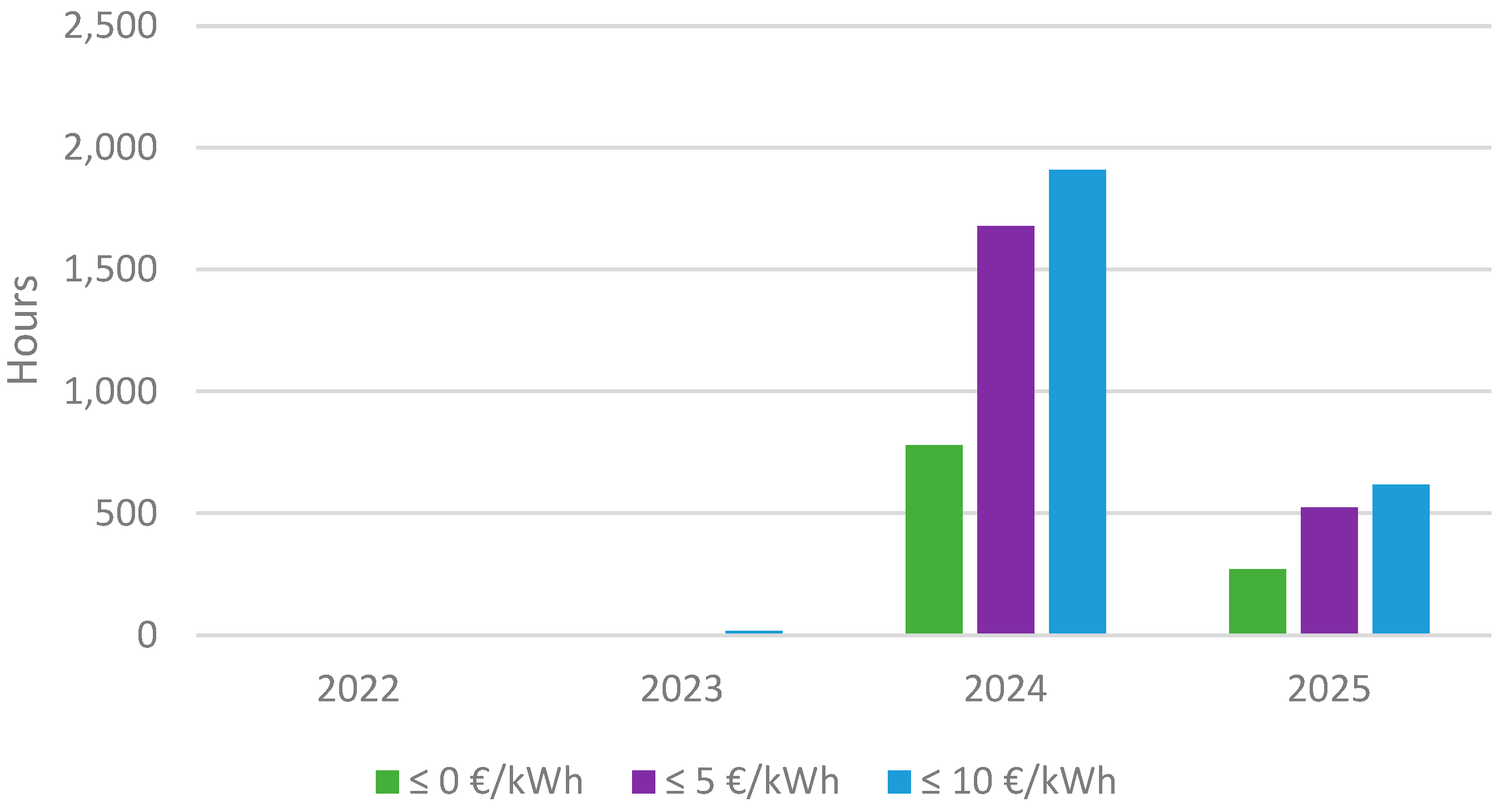

Low-price events—defined as hours with market prices at or below 0 €/MWh—have become structurally recurrent between March and September, totaling 779 h in 2024 and 271 h up to 30 April 2025 (

Figure 6). These conditions exert a significant impact on the profitability of renewable energy projects, particularly in the absence of storage systems or flexible demand management strategies.

Zero or even negative price episodes are increasingly frequent as a result of three structural drivers:

Excess renewable generation during certain periods—particularly midday—when supply significantly exceeds demand.

Limited system flexibility, since electricity demand cannot easily be shifted and large-scale storage deployment remains insufficient.

Inflexibility of conventional generation, as technologies such as nuclear or must-run thermal plants face technical and economic constraints in rapidly reducing output.

Consequently, some generators are willing to pay to inject electricity into the grid rather than shut down operations or forfeit revenues linked to subsidies or support schemes. Whereas zero-price events were once rare and seasonal, they have now become structurally recurrent during specific months—particularly in markets such as Spain and Germany—and are expected to occur daily in certain time slots as renewable penetration continues to rise [

60].

Zero-price events affect not only wind, solar photovoltaic, and thermal power producers but also exert a significant impact on run-of-river hydroelectric plants. These facilities are often compelled to curtail operations during periods of null or negative prices, resulting in the irreversible loss of available hydrological resources that cannot be stored for later use. This issue is particularly concerning given that run-of-river hydropower represents a low Levelized Cost of Energy (LCOE) renewable technology which, beyond providing clean electricity, also delivers valuable ancillary services to the grid, including inertia and frequency stability.

4. Regulatory Framework for Energy Storage and Renewable Integration

The regulatory framework for energy storage in Spain has undergone a significant evolution, moving from an initial stage of general recognition to a more advanced phase of strategic and technical integration within the power system (

Table 3).

This process can be broadly divided into three phases, reflecting both market maturity and regulatory requirements.

Recognition Phase (2009–2019). Early European directives—most notably RED I—and national legislation such as Law 24/2013 established a general framework for renewables and the electricity sector but did not include explicit provisions for energy storage.

Formalization and Strategic Planning (2019–2021). Energy storage was formally recognized as an independent activity within the electricity sector through Royal Decree-Law 23/2020. Subsequent regulations, including Royal Decree 1183/2020 and CNMC Circular 1/2021, defined procedures for grid access and connection, thereby facilitating the initial deployment of storage projects.

Integration and Market Design (2022–present). The most recent phase focuses on the effective integration of storage into electricity markets and system operations, addressing both market participation and technical interoperability.

A key initiative in this context is the definition of operating patterns proposed by the CNMC [

48], designed to characterize typical injection and withdrawal profiles. These patterns aim to ensure consistent treatment by grid operators, improve predictability, and optimize access to the transmission and distribution networks.

In the context described above, the core challenge for achieving the objectives of the PNIEC lies not primarily in curtailment, but rather in the declining capture prices received by each technology, which critically undermine both investment viability and long-term project operation. Under current market conditions—marked by high price volatility and structurally re-current low-price events—project developers increasingly rely on Power Purchase Agreements (PPAs) with large consumers to hedge against revenue uncertainty and secure financial stability.

Energy storage emerges as a key enabling technology for the energy transition, as it enables renewable generation to shift output toward higher-value periods, thereby mitigating the cannibalization effect on prices. However, in the absence of regulatory support, the large-scale development of merchant storage projects remains unlikely. To overcome this barrier, policy incentives will be essential, including regulatory mechanisms and potential capital expenditure subsidies such as those available under the 2021–2027 European Regional Development Fund (ERDF).

The CNMC, Spain’s national regulatory authority, has been actively shaping the regulatory landscape to foster effective energy storage integration. A central element under development is the proposed capacity mechanism [

61], currently undergoing public consultation. This mechanism would allow all market participants—including demand aggregators—to participate, provided they comply with an emission factor threshold. The initiative complements the growing role of storage in existing capacity remuneration frameworks [

44].

The definition and evolution of capacity markets and ancillary services are pivotal. While Spain’s wholesale market incentivizes competitive bidding from generators, renewable energy—once supported through regulated feed-in tariffs under the “special regime” (Law 54/1997)—is now integrated into the market via auction-based remuneration schemes (Royal Decree 413/2014) [

40,

44].

Notable progress has also been made in the recognition of voltage and frequency regulation as remunerable ancillary services. CNMC has proposed amendments to operational procedures to enable market-based compensation for real-time voltage control, building on pilot projects carried out by Red Eléctrica de España (2022–2023), which demonstrated the capacity of battery storage to provide both frequency (FCR/aFRR) and non-frequency services.

The growing share of variable renewable energy sources underscores the critical importance of enhancing system flexibility in Spain [

62]. This reality highlights the fundamental role of capacity markets and balancing services in enabling the large-scale deployment of energy storage technologies [

4]. As a result, Spain’s regulatory evolution has progressed from a legal vacuum to a structured framework that strategically positions energy storage as a cornerstone of the energy transition.

5. Current Applications and Business Models

5.1. Business Models and Applications

The global energy transition, driven by the imperative to reduce greenhouse gas emissions and the growing dependence on fossil fuels, has positioned ESS as a fundamental enabler for the large-scale integration of RES and for enhancing the flexibility, reliability, and stability of power grids [

15,

26,

27,

63]. ESS are critical for mitigating the intermittent nature of RES, such as solar and wind, which pose significant challenges to maintaining the balance between electricity supply and demand [

8].

It is important to distinguish between the technical use of ESS—aimed at ensuring the optimal operation of the power system—and their commercial exploitation, which seeks to monetize storage capabilities [

64]. Nonetheless, technical services are often, and in many cases increasingly, remunerated through market mechanisms, such as operational procedures.

Energy storage systems provide a wide range of practical applications. One of the most fundamental—forming the basis of any economic-financial analysis—is time-shifting or price arbitrage, which consists of charging during periods of low prices (typically during low demand or high renewable generation) and discharging during high-price periods. This mechanism operates both in wholesale markets [

4,

65] and at smaller scales through dynamic tariffs or optimized self-consumption strategies [

19].

Another key application is renewable energy support, whereby ESS store excess solar or wind generation during periods of high output and release it during periods of low production or high demand. This increases grid flexibility and resilience while reducing renewable curtailment [

15,

35,

66,

67].

Frequency and voltage regulation represent another essential technical function. ESS—such as batteries equipped with Power Conversion Systems (PCS) or grid-forming inverters, as well as supercapacitors and flywheels—can provide synthetic inertia and frequency regulation services, which are crucial in a context of declining rotational inertia due to the reduction in conventional synchronous generation [

67,

68,

69].

Peak shaving focuses on reducing demand peaks by discharging stored energy during high-load periods. This helps lower costs related to contracted capacity and maximum demand, while also reducing stress on grid infrastructure—particularly in industrial environments [

65]. Additionally, it can avoid investment in equipment such as frequency converters required to address instantaneous power peaks caused by the start-up of electric machinery.

In emergency situations, ESS equipped with grid-forming PCS can provide black start capability, enabling grid restoration after a blackout without external support, and serve as backup in case of unexpected failures, thereby enhancing system resilience [

28].

The virtual power plant (VPP) concept enables the aggregation of multiple distributed resources, including small-scale ESS, under common management. This allows participation in ancillary service markets through aggregated capacity, even if individual units do not meet market entry thresholds. In parallel, virtual storage models enable users to lease capacity from centralized units, thereby optimizing physical infrastructure [

8,

15,

70]. In Spain, however, the regulatory framework for independent aggregators is not yet developed.

Given the wide array of applications and services offered by ESS, several business models have emerged, generally structured around revenue stacking to make investments viable, since price arbitrage alone is rarely sufficient. Broadly, two categories can be distinguished depending on the battery’s position relative to the grid: front-of-the-meter (generation-side) and behind-the-meter (self-consumption) models [

71].

As previously discussed, price volatility and the low capture prices of PV generation severely limit the viability of the merchant model, in which generation assets participate directly in wholesale markets without PPAs or futures contracts. For ESS, a viable approach involves hybridization with renewable plants, enabling revenue maximization through a combination of arbitrage and ancillary service provision, thereby enhancing revenue stacking [

8,

64]. This approach is particularly relevant for microgrids combining PV, wind, and storage [

27,

65].

In Spain, the PERTE ERAH [

72] (Strategic Project for Renewable Energies, Green Hydrogen, and Storage), framed within the Plan de Recuperación, Transformación y Resiliencia (PRTR) and funded by NextGenerationEU and ERDF 2021–2027, has stimulated the development of the stand-alone model. This model is based on grid-charged storage systems without associated generation assets. As with hybrid models, revenue stacking relies on wholesale market participation through arbitrage and ancillary services.

Driven by growing interest in storage, other emerging but less mature business models are also being explored. Some investment funds are experimenting with PPA-based financing structures for BESS, while others are developing Storage-as-a-Service (SaaS) models, whereby companies provide storage capacity without requiring end-users to invest in physical assets [

70].

For self-consumption models, business strategies are generally more straightforward. With the exception of applications requiring uninterruptible power supply (UPS)—where economic profitability is secondary—BESS are almost always paired with PV systems [

73]. In this case, revenues are generated primarily through savings: optimizing solar energy use during non-solar hours, reducing reactive energy charges (some inverters allow power factor adjustment), and lowering contracted power demand via peak shaving [

74].

It is worth noting that many applications require constant, real-time interaction with the market operator (OMIE). In this regard, the integration of artificial intelligence (AI) enables more efficient and predictive ESS management, optimizing performance and integration with RES [

15]. These trends highlight the complexity and dynamism of the energy storage market, where technological innovation and evolving regulatory and market frameworks must continuously adapt to unlock the full potential of ESS.

5.2. Economic Viability and Business Challenges

The growing role of ESS in renewable energy integration and power system stabilization is indisputable. However, their economic viability and large-scale commercial deployment continue to face significant challenges, arising both from the inherent characteristics of the technology and from prevailing market conditions and regulatory frameworks [

15,

28].

Among the key factors conditioning economic feasibility are the high capital expenditures (CAPEX), operational expenditures (OPEX), uncertainties related to battery degradation, and regulatory instability. In Spain, an additional bottleneck is the limited availability of grid capacity in the transmission and distribution networks, which constrains investor appetite.

Despite continuous technological advances, high upfront installation costs remain a major barrier [

15]. These costs are compounded by operation and maintenance expenses, as well as degradation-related losses that directly affect profitability [

28,

34]. In grid-connected applications, the progressive reduction in usable storage capacity due to degradation can jeopardize the viability of business models such as energy arbitrage. Consequently, ongoing research efforts are focusing on improving thermal stability, charging speed, and battery lifetime [

4,

22].

The lack of regulation in certain market segments, such as grid stability services, further limits the monetization potential of ESS. In Europe, for example, batteries cannot participate in manual reserve or capacity markets [

67]. Smaller storage units also face barriers to market entry unless integrated into aggregation schemes [

8]. Moreover, the remuneration of storage services is often limited, particularly in energy arbitrage markets, where profitability can only be achieved under high-demand scenarios for flexibility [

4].

Conversely, several factors may improve ESS viability. The development of specific regulatory frameworks and the standardization of safety and operational criteria are essential for scalability [

15]. Technological innovation has already enabled an over 80% reduction in lithium-ion battery costs over the past decade, a trend expected to continue. Research into new chemistries, solid electrolytes, and advanced materials seeks to further enhance efficiency, energy density, and sustainability [

15]. In addition, fiscal incentives, such as investment tax credits, can mitigate initial financial barriers [

35].

New markets and flexibility schemes, operating outside traditional energy markets, are also emerging, facilitating models such as storage-as-a-service [

8]. Initiatives like the European Union Emissions Trading System (EU ETS) provide additional revenue opportunities through the monetization of carbon credits [

35]. Similarly, the aggregation of small-scale ESS enables access to services previously un-available to individual units [

8].

To address economic and commercial challenges, companies are adopting various strategies, including the implementation of long-term contracts (PPAs) and the use of futures markets, which provide greater predictability for investors, although such instruments are not yet fully developed for storage applications [

16,

67].

Taken together, these strategies—supported by a more favorable regulatory environment and continued technological progress—are essential for energy storage to achieve commercial maturity and to play a strategic role in the global energy transition.

6. Discussion and Policy Recommendations

The Spanish electricity market faces two principal challenges for the development of renewable energy projects. First, the combination of low average spot market prices and reduced capture prices for non-dispatchable technologies undermines project profitability and weakens investment incentives. Second, project developers encounter substantial difficulties in securing transmission and distribution grid access rights, due to administrative delays and network saturation.

In this context, energy storage emerges as a potential short-term solution to mitigate these constraints, particularly by enhancing price arbitrage opportunities and system flexibility. Nevertheless, large-scale deployment will depend on clarifying the market frameworks governing storage asset participation. While both capacity markets and balancing services represent promising avenues for battery storage, their effectiveness will largely depend on market design. In particular, transitioning from a pay-as-bid to a pay-as-cleared capacity remuneration scheme could strengthen investment signals and provide greater certainty for storage projects.

The findings for Spain mirror broader European trends. As in Germany and the United Kingdom, the absence of well-defined capacity mechanisms and long-term flexibility products continues to delay large-scale BESS investment, even under conditions of increasing price volatility and renewable curtailment [

13,

25]. Coordinated market reforms across Europe could therefore accelerate storage deployment in line with the 22.5 GW target of Spain’s updated PNIEC. Harmonizing flexibility markets and capacity remuneration schemes would also help align investor expectations and reduce regulatory risk, ultimately fostering a more integrated and resilient European power system.

To overcome land acquisition barriers, it has been proposed that storage installations be granted public utility status, thereby facilitating the expropriation process where necessary. Furthermore, a revision of dispatch priority regulations is required to ensure that hybrid installations operate under the same dispatch conditions as standalone renewable plants, guaranteeing a level playing field and maximizing system efficiency.

Addressing the second major challenge—network access and connection—requires improving transparency regarding the saturation levels of distribution grid nodes. This goal is expected to be achieved through the implementation of RDC/DE/002/25, which obliges distribution system operators (DSOs) to publish access and connection information on their websites, in line with Article 18 and Annex III of Circular 1/2024.

However, greater transparency alone may not suffice. Reinforcement of both transmission and distribution infrastructure will be essential to accommodate the expected growth in renewable generation. In this regard, one proposed measure is the removal of expenditure caps imposed on DSOs, combined with policies that stimulate electricity demand growth. Such a dual approach would enable network expansion without disproportionately increasing grid tariffs for industrial consumers.

In parallel, regulatory adjustments could improve grid utilization without requiring extensive new infrastructure. One such measure involves optimizing the connection point utilization factor, as outlined in Circular 1/2021, which facilitates the hybridization of renewable assets without necessitating additional connection capacity requests.

Given current spot market dynamics and the high degree of uncertainty ahead, fully merchant business models—once viable for photovoltaic and wind projects—have largely disappeared. At present, only developers that hybridize generation assets with ESS may still consider merchant approaches. In most cases, projects now rely on mixed models, combining PPAs or participation in forward markets. Yet even these alternatives face barriers: persistently low market prices complicate PPA negotiations and limit the ability to secure sufficient forward market revenues to justify the required investments.

Finally, the consolidation and implementation of the European Critical Raw Materials Act, the Green Deal Industrial Plan, and the Net-Zero Industry Act will be essential. These policy frameworks are crucial for ensuring the resilience and long-term viability of the entire energy storage value chain—from the secure supply of critical raw materials to the large-scale deployment of storage infrastructure—thus strengthening the strategic autonomy and industrial competitiveness of the European energy sector.

7. Conclusions

Based on current captured price data (

Figure 4), the most economically viable model for lithium-ion BESS is their integration with PV plants. This is primarily due to the high predictability of solar resource availability and the feasibility of performing daily charge–discharge cycles throughout the year. Given current captured PV prices in the Spanish electricity market, many solar projects may not achieve economic viability without the deployment of co-located storage systems.

For run-of-river hydropower, the profitability of integrated BESS depends largely on the availability and seasonality of the hydrological resource, which directly influences the frequency and regularity of battery cycling. In terms of revenue streams, while energy arbitrage can provide meaningful income, it is unlikely to be sufficient on its own to secure an acceptable internal rate of return (IRR). Consequently, participation in capacity remuneration mechanisms and ancillary service markets will be necessary to strengthen the economic performance and bankability of storage-enabled renewable projects.

At the system level, the large-scale deployment of BESS is expected to progressively flatten the intra-day price curve, thereby reducing the very price differentials that constitute a major source of storage revenues. These dynamic highlights a direct and mutually reinforcing relationship between storage and PV generation: the greater the installed storage capacity, the higher the average captured price for PV energy, ultimately enhancing the economic viability and deployment rate of new solar projects.

In summary, while battery storage is a critical enabling technology for the decarbonization of the Spanish electricity system, it cannot on its own provide the level of system firmness required for long-term reliability. It is therefore essential to advance toward a diversified and flexible energy mix, supported by a progressive and well-calibrated regulatory framework that ensures the full integration and market participation of BESS.

Overall, the results demonstrate that the coordinated operation of BESS with variable renewable generation enhances both economic efficiency and system resilience under Spanish market conditions. Storage mitigates imbalance exposure, smooths renewable output, and captures value from increasing intraday volatility. Yet, realizing this potential will depend on regulatory and market frameworks that reward flexibility and enable long-term revenue stability. In this sense, Spain’s experience provides a valuable reference for other European systems facing similar integration challenges, underscoring the need for coherent market reforms that align technical flexibility with sustainable investment signals.

8. Future Works

The results presented in this study highlight the central role of energy storage in Spain’s decarbonization pathway, but they also expose open challenges that require further research. Building on the results of this study, we outline a research agenda along five axes that couple market design, optimization, and system integration under Spanish conditions:

8.1. Advanced Storage Technologies and Hybridization Strategies

Beyond lithium-ion batteries, emerging chemistries such as sodium-ion, solid-state, and zinc-based systems offer potential advantages in cost, safety, and sustainability. Comparative techno-economic assessments under Spanish market conditions, together with analyses of hybrid configurations (e.g., Li-ion combined with flow batteries or supercapacitors), are necessary to determine optimal portfolios for both short-duration and long-duration applications.

In addition, future research should incorporate case studies of real-world hybrid projects. For example, detailed analyses of PV–storage, wind-storage and run-of-river hydro–storage plants already deployed in Spain can provide empirical insights into cost structures, operating strategies, and market participation outcomes. These domestic findings should be complemented with international benchmarks—drawing on global experiences in markets such as the UK, Germany, and the U.S.—to identify transferable lessons and highlight context-specific barriers. Such comparative evidence would not only validate model-based conclusions but also refine policy and investment recommendations by grounding them in operational practice.

8.2. Grid Integration and Flexibility Services

Further research should focus on quantifying the value of BESS in providing ancillary services, black-start capability, synthetic inertia, and congestion relief. The design of market mechanisms that remunerate these services remains an open issue, and pilot projects—especially in frequency regulation and capacity markets—are essential to generate empirical evidence.

8.3. Decentralized Scheduling Under MIBEL with Privacy-Preserving Coordination

Extend decentralized optimization to explicitly reflect MIBEL trading rules by modeling generators, BESS operators, retailers/aggregators, and the TSO/DSOs as autonomous agents. Modify the DJAD-ADMM scheme to use a bi-objective social function—maximize storage revenues + minimize network losses—subject to (i) intraday noon price constraints representative of PV cannibalization, and (ii) real-time adjustment windows for aFRR/FCR participation. Benchmark centralized vs. decentralized scheduling on realistic Spanish nodes to quantify the privacy/arbitrage trade-off and revenue uplift from ancillary services [

75].

8.4. Linearized Power Flow for Scalable Arbitrage and Commitment Studies

Following the current-oriented linearized Distflow (CLD) philosophy, introduce an auxiliary “power–voltage ratio” variable tailored to the Spanish distribution network and parameterized with branch R/X data. Use this linearization to (i) co-optimize day-ahead and intraday arbitrage, (ii) embed grid constraints in market optimization at scale, and (iii) compare pre/post-linearization solve times to document speed-accuracy trade-offs for large BESS fleets [

76].

In sum, advancing the Spanish storage market requires a multidimensional research agenda that integrates technology, regulation, business models, and sustainability. Addressing these open questions will be critical to transform storage from a promising enabler into a fully embedded cornerstone of Spain’s clean energy future.