Abstract

Renewable Energy Communities (RECs) play a vital role in driving the transition to sustainable energy systems by facilitating inclusive and cost-effective renewable energy production. They empower citizens to actively participate in the energy sector, promote local energy resource sharing, and improve local energy balancing efforts. This study presents a model for investment and operational decision-making within an REC framework, enabling multiple members to invest in renewable energy generation and battery energy storage systems. The model determines optimal capacities for each technology, facilitates energy sharing among members, and evaluates both individual and collective economic benefits through an internal electricity sharing price. By examining various scenarios within an established three-member REC, the research identifies key factors influencing the acceptance of a new member into the community. The findings indicate that the economic advantages of expanding the REC are significantly dependent on the characteristics of the prospective new member.

1. Introduction

Recognizing the imperative to transition away from fossil fuels, particularly in heating, cooling, and transport sectors, the European Union (EU) has set ambitious goals as part of the Clean Energy for All Europeans initiative [1]. These objectives aim to significantly reduce reliance on carbon-intensive energy sources, thereby mitigating carbon emissions and advancing towards a more sustainable energy landscape.

The EU implemented the concept of energy communities within its legislative framework of 2019, particularly focusing on citizen energy communities and Renewable Energy Communities (REC). Directives EU 2018/2001 [2] and EU 2019/944 [3] further amplify the significance of self-consumption (SC) and REC, boosting their role within the energy market. EU member states have aligned their national legislation to support and nurture these emerging entities. The legislation outlined in Portuguese Decree-Law 15/2022 [4] provides detailed guidelines on the conceptual, operational, and technical dimensions of self-consumption (SC) within REC. These guidelines cover various aspects such as proximity criteria, methods for sharing energy, surplus electricity management, grid tariff structures for SC, specifications regarding assets, licensing procedures, metering prerequisites, protocols for data exchange, and clarification of responsibilities among stakeholders engaged in REC activities.

Energy communities (EC) are getting increasing attention as innovative models for achieving sustainable energy transitions. The transition towards RECs represents a pivotal evolution in modern energy systems, aiming at decentralizing energy production, optimizing self-consumption, and promoting sustainable energy-sharing models. These communities provide environmental, economic, and social benefits, fostering a just and participatory energy transition. The introduction is divided into three major topics where the analysis ensures detailed coverage and thematic coherence across REC key research areas that are within this work scope: governance and social impact; renewable integration and storage; economic models, optimization and broader sustainability implications. The research topic addresses the identified knowledge gaps and highlights key advancements in this study, emphasizing their significance to the field.

1.1. Policy, Governance, and Social Implications

The concept of Renewable Energy Communities (RECs) has gained strong momentum in the European Union, supported by policies promoting citizen-driven energy production and self-consumption [5]. Their governance structures public-led, pluralist, or community-based address diverse operational needs [6]. A key dimension is energy justice, as RECs help mitigate energy poverty and foster inclusive participation, demonstrated in a study of 71 European cases [7]. However, policy frameworks reveal inconsistencies and regulatory barriers across countries [8]. Comparative analyses show that decentralized, community-led systems provide greater resilience and economic benefits than traditional centralized models [9], while cooperative participation remains essential for fair energy sharing and resource allocation [10].

Consumer engagement and social perception studies stress the importance of transparency for equitable benefit distribution [11]. Adoption is also shaped by regulatory incentives and local initiatives [12], although disparities arise from uneven transposition of EU policies at the national level, highlighting the need for harmonization [13]. Research further examines how policy design influences investment attractiveness and member participation [14]. A proposed roadmap outlines four implementation phases—feasibility, member aggregation, operation, and economic management—providing a standardized yet adaptable framework [15]. Finally, modeling studies in Portugal show that consumer behavior, technology choices, and market conditions critically affect REC performance, underscoring the value of tailored designs aligned with both innovation and stakeholder preferences [16].

1.2. Renewable Energy Integration, Planning, and Storage

A methodological framework for integrating renewables into REC planning has been proposed [17], emphasizing life cycle cost (LCC) analysis and carbon footprint reduction. Case studies confirm the socio-economic value of RECs: in Greece, financial sustainability was achieved through optimized self-consumption [18], while analyses of nearly zero-energy buildings (NZEBs) showed that aligning demand with renewable production improves investment returns [19]. Still, technical and financial barriers persist, especially in dense urban contexts [20].

Hybrid wind–PV systems contribute to energy security and grid stability [21], with urban design further influencing storage and utilization patterns [22]. Battery energy storage systems (BESS) are consistently identified as critical enablers of REC self-sufficiency and efficiency [23,24]. Their cost-effectiveness is particularly evident in islanded and remote contexts [25], as well as in industrial applications, where integration with PV has increased self-consumption by 14% and delivered annual savings of up to EUR 40,000 [26]. Although, in odder type of applications, BESS are emerging as cost-effective solutions, with [27] showing that solar PV–battery street lighting can reliably reduce grid dependence by matching daytime generation with nighttime demand.

Autonomous hybrid systems combining renewables, batteries, and hydrogen also improve reliability and long-term sustainability in rural electrification [28].

Advanced optimization approaches further strengthen REC performance. Machine learning enhances real-time distribution and reduces costs, while multi-objective algorithms define optimal PV and storage sizing [29]. Multi-vector hubs that integrate electricity, heating, and transport increase cost-effectiveness [30]. Cooperative and shared storage schemes [31] improve resilience through decentralized microgrids, and transactive frameworks [32] contribute to economic sustainability. Reviews of practical implementations show that REC participation in energy and flexibility markets depends on regulatory support and aggregation strategies [33].

Additional studies expand REC scope: desalination systems strengthen sustainability in islanded contexts by addressing water-energy interdependence [34], while energy-sharing optimization [35,36] improves fairness and cost savings. Cooperative storage schemes have also been explored, showing how competitive versus cooperative internal markets affect equity and efficiency [37,38].

1.3. Economic Models, Optimization Strategies, and Broader Impacts

Technological and market mechanisms are central to enhancing REC performance. Linear optimization studies confirm the economic viability of PV-battery investments in housing communities [39], while financial sustainability remains highly dependent on national incentives and regulatory mechanisms [40]. Business model analyses, including the canvas framework [41] identify revenue streams and cost structures, and industrial stakeholders are increasingly engaging in decentralized projects [42]. A three-stage optimization model combining self-consumption, energy sharing, and grid support demonstrates fair allocation of benefits in a Portuguese REC [43]. Another Portuguese study [44], show that collective self-consumption within REC enhances renewable investment and yields greater economic benefits compared to individual self-consumption.

Despite progress, barriers such as financial constraints, regulatory complexity, and technical limitations remain significant [45]. Grid-friendly optimization models show potential for emission reductions and peak demand minimization [46]. Comparative studies highlight cross-country differences: self-consumption models are viable in Italy due to incentives but remain financially challenging in Portugal [47]. In Russia, a bilevel optimization and reinforcement learning framework for microgrids achieved 20–40% cost reductions and improved reliability [48].

Equitable cost allocation is another focus. Game-theoretic mechanisms [49] and Shapley value applications [50] improve fairness in cooperative energy trading, while shared asset schemes for PV and storage enhance collaborative investment models [51]. Emerging digital solutions include AI- and blockchain-based transactive systems [52], which optimize real-time energy flows and ensure secure transactions. AI-based management also reduces costs and improves grid integration [34]. Cooperative frameworks further support grid resilience and decarbonization [53], and multi-criteria decision-making approaches promote fairness among heterogeneous REC members [54].

Broader reviews confirm that regulatory frameworks and financial incentives shape long-term REC sustainability [55]. Membership expansion strategies [56] and links with smart city development [57] highlight opportunities for scaling and integration. Market-based mechanisms and aligned energy policies are also critical for cross-border REC growth [58]. Reviews of BESS [59,60] reinforce their role in distributed renewable integration and demand-side management, while industry participation increasingly positions RECs as strategic procurement models [61]. Comprehensive reviews of REC trends, business models, and optimization frameworks [62,63] provide guidance for sustainable operation. Local electricity markets [64] further demonstrate how prosumer participation and distributed generation can be effectively integrated, despite regulatory challenges. Previous studies consistently show that collective self-consumption (CSC) within RECs yields superior outcomes compared with isolated individual self-consumption (ISC).

1.4. Research Contributions

Altogether, the reviewed studies outline the state-of-the-art in energy communities, combining methodologies, optimization models, technological innovations, and policy frameworks. They confirm RECs as promising solutions for sustainable and equitable energy systems. However, important research gaps remain, which this study addresses through the following contributions:

- (a)

- Scalability and optimization: existing models provide limited insight into multi-member investment strategies during REC expansion. This research proposes a new optimization framework that dynamically evaluates new member integration, considering both economic and technical parameters, thereby supporting sustainable growth.

- (b)

- Economic fairness and pricing mechanisms: few studies analyze the role of internal electricity sharing prices in long-term REC viability. This study introduces an adaptive pricing mechanism ensuring fair and efficient energy trading among members.

- (c)

- Regulatory adaptability: current approaches insufficiently capture region-specific policy constraints. This study leverages multi-objective decision-making to design adaptive solutions aligned with evolving regulatory contexts.

- (d)

- Technology integration: the integration of smart grid coordination and advanced BESS strategies remains underexplored. Our model incorporates BESS optimization and energy-sharing enhancements to improve efficiency and resilience.

Beyond these contributions, this research emphasizes individual level assessment, complementing earlier studies that focused mainly on collective REC performance. By evaluating the economic implications of member specific decisions and realistic constraints (e.g., PV installation limits), the model prevents inequitable outcomes relative to isolated self-consumption scenarios.

An in-depth case study with three REC members further explores the integration of a fourth participant, distinguishing between prosumer and consumer profiles. The decision-making model jointly addresses investment and operational strategies, incorporating an internal sharing price mechanism. This holistic approach optimizes both collective and individual outcomes while offering a structured pathway for community expansion.

Unlike much of the prior literature, which has been primarily conceptual or policy oriented, this work operationalizes REC expansion. By reconciling individual and community benefits through adaptive mechanisms, it delivers practical and scalable solutions for long-term REC sustainability.

It is worth noting that, for clarity of analysis, the integration of a new member (REC4) is modeled under two contrasting profiles—pure consumer and prosumer. While this simplification supports a clear comparison of outcomes, real-world communities often present hybrid or intermediate profiles (e.g., partial generation or flexible demand), which are left for future research extensions.

2. Methodology

The present study develops and implements an REC model that evolves from the modeling presented in [63]. This new setting enables all REC members to invest in renewable generation technologies, such as PV and wind, as well as in BESS. It also considers a post-processing module that computes individual outcomes based on a pre-defined internal energy sharing price.

The model determines the optimal investment decisions in renewables and storage of each REC member and the optimal destination for renewable electricity surplus of each REC member by minimizing the annualized costs of the electricity supply, as presented in the constrained optimization problem (1) to (12).

Subject to:

where is the objective function expressing the total annualized costs of electricity supply of the overall REC members, is the REC member index, is the renewable technology index (solar PV and wind), is the capital recovery factor of technology , is the capital expenditure of technology , is the capital recovery factor of , is the capital expenditure of technology , is the installed capacity of REC member in renewable technology , is the installed capacity of REC member , is the capital recovery factor of , is the capital expenditure of technology , is the energy storage capacity of REC member in , is the time period, is the electricity tariff of REC member in period , which includes both the electricity and grid components, is the electricity supplied from the grid to REC member in period , is the self-consumption tariff in period , is the variable cost of the Self-Consumption Managing Entity (), is the electricity shared from other REC members to member in period , is the fixed cost of the , is the DAM price for selling electricity surplus to the grid in period , is the electricity sold to the grid by REC member in period , is the electricity consumption of REC member in period , is the normalized generation profile of renewable technology in period , is the electricity shared by REC member with other REC members in period , is the electricity used for charging the battery of REC member in period , is the electricity used from discharging the battery of REC member in period , is the state of charge of REC member battery in period , is the round-trip efficiency of the , and are, respectively, the minimum and maximum installed capacity of REC member in renewable technology , and are, respectively, the minimum and maximum installed capacity of REC member in , and are, respectively, the minimum and maximum energy storage capacity of REC member in , and are binary variables for the charging and discharging status of from REC member in period .

The objective function , which we aim to minimize, includes: (i) the annualized investment costs of the installing renewables and BESS capacity of each REC member; (ii) the cost of the electricity sourcing form the grid; (iii) the variable costs of sharing electricity among the REC members that includes the managing entity variable costs and the grid tariff for self-consumption; (iv) the fixed cost of the ; and (v) the revenues coming from the surplus of electricity generation that is sold to the grid.

The problem constraints expressed by (2) to (13), represent: (2) the electricity balancing that equals the electricity demand of REC member in period to the renewable self-production, plus the electricity supply from the grid, plus the electricity shared by other REC members, minus the electricity surplus of REC i shared with other REC members and sold to the grid, minus the electricity used to charge batteries, plus the electricity coming from batteries discharging; (3) batteries state of charge dynamic equation which equals the SoC in period to the SoC in the previous period () plus the electricity input to the battery minus the electricity output from the battery; (4) that internal electricity exchanges among REC members in each period t must sum zero, that is, the overall incoming electricity supplied to REC members from other REC members in period t must be equal to the overall outgoing electricity supplied from the REC members to other REC members in period t; (5) the minimum and maximum capacity installed by REC member in renewable technology ; (6) the minimum and maximum capacity installed by REC member in BESS; (7) the minimum and maximum energy storage capacity of the BESS installed by REC member ; (8) the limit to the SoC in every period for the BESS installed by REC member ; (9) the limit of the REC member BESS charging in period t; (10) the limit of the REC member BESS discharging in period t; (11) the physical impossibility of BESS being simultaneously discharging and charging in period t; (12) the variables that must assume non-negative values.

Moreover, the capital recovery factor of each renewable technology ( and BESS () are given by:

where α is the discount rate, is the lifetime of technology r, and is the lifetime of BESS.

The optimization model described in (1) to (13) is implemented as a mixed integer linear programming problem using the General Algebraic Modeling System (GAMS) [65].

3. Case Study

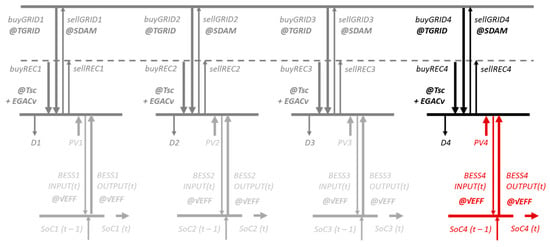

A real-world REC with four members (REC1, REC2, REC3, and REC4) is used as a case study in which we applied the model described in the previous section. In the present case study, REC members can invest in PV and in BESS to reduce electricity sourcing costs and increase the level of green energy. Additional benefits are achieved within the REC framework, as presented in Figure 1.

Figure 1.

Outline of the REC with energy flows and operational data.

REC4 is highlighted as it represents the additional member assessing the benefits of integration with the existing three REC members, namely REC1, REC2, and REC3.

3.1. Input Data

A normalized profile for the PV generation is used for a full year which is scaled-up according to the installed capacity of each member to determine the actual PV hourly generation.

The main features of the PV and BESS technologies are presented in Table 1.

Table 1.

Data used for PV and BESS technologies.

An arbitrary low value is assigned to the variable management fee and the self-consumption tariff is used as a mechanism to allow the CSC or to prevent the exchange of energy within the REC, limiting the model to ISC using an arbitrary high value for . The same electricity price from the grid supply is used for all REC member at a level of 100 €/MWh and an internal price of 70 €/MWh is considered for the energy shared among REC members.

The electricity price from the grid is taken from commercial offers of electricity suppliers and the internal electricity price applicable to electricity sharing among REC members can be set as a model parameter defined on a case-to-case basis. The considered 70 €/MWh intends to split the benefits among sellers and buyers of the electricity shared and was taken in between the grid supply price of 100 €/MWh and the LCOE from the self-generated electricity from solar PV.

The maximum installed capacity of solar PV at each member is limited to the contract consumption capacity, given in Table 2.

Table 2.

Upper limit for the solar PV capacity that can be installed at each member.

These upper limits for solar PV can be arbitrarily set to create a case study. In the present situation, they are inspired in the real case where the yearly consumption profiles were retrieved from 4 consumers. The solar PV upper limits match the installed capacities of each of those members as consumers.

3.2. Scenarios

A set of seven scenarios are simulated using the model described under adequate input data:

- S1.

- Base case without PV and BESS: this is the base case scenario in which none of the members invest either in PV or in BESS. This scenario evaluates the costs of electricity supply of each member before engaging in any kind of self-consumption and integration in an REC.

- S2.

- ISC with PV: this scenario considers the investment in solar PV to individual self-consumption. The investment is upper limited to a bound set for each member presented.

- S3.

- ISC with PV and BESS: this scenario considers the investment in BESS, in addition to the investment is solar PV to individual self-consumption of the previous scenario.

- S4.

- 3-member REC/REC4 Prosumer: this scenario considers that REC1, REC2, and REC3 create an REC with investment in solar PV and BESS in a collective self-consumption setting, and REC4 keeps its individual setting with investment in solar PV and BESS, being therefore a prosumer.

- S5.

- 4-member REC/REC4 Prosumer: this scenario considers that the 3-member REC of the previous scenario grows to integrate REC4 all investing in solar PV and BESS in a collective self-consumption setting.

- S6.

- 3-member REC/REC4 Consumer: this scenario considers that REC1, REC2, and REC3 create an REC with investment in solar PV and BESS in a collective self-consumption setting, and REC4 do not invest neither in solar PV nor in BESS, being therefore a (pure) consumer.

- S7.

- 4-member REC/REC4 Consumer: this scenario considers that the 3-member REC of the previous scenario grows to integrate REC4 in a collective self-consumption setting, being REC4 a (pure) consumer without investing in solar PV and BESS.

This section may be divided by subheadings. It should provide a concise and precise description of the experimental results, their interpretation, as well as the experimental conclusions that can be drawn.

4. Results

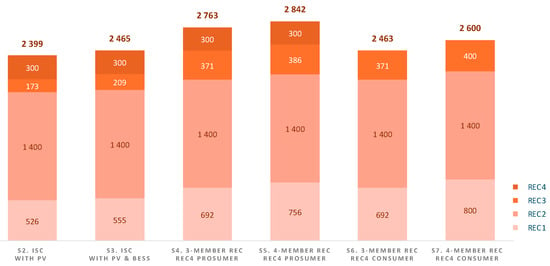

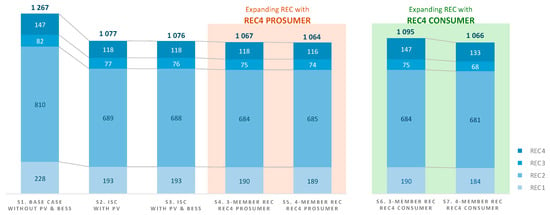

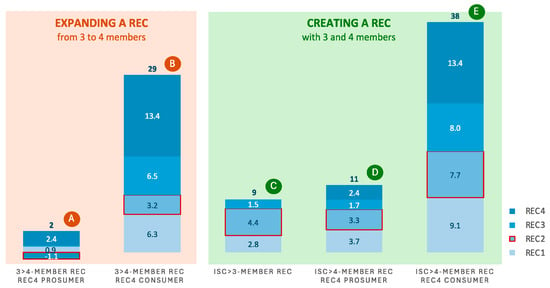

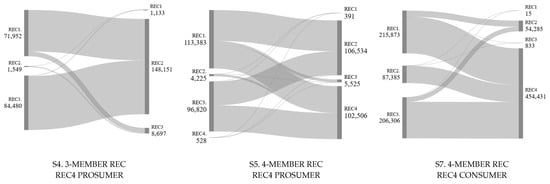

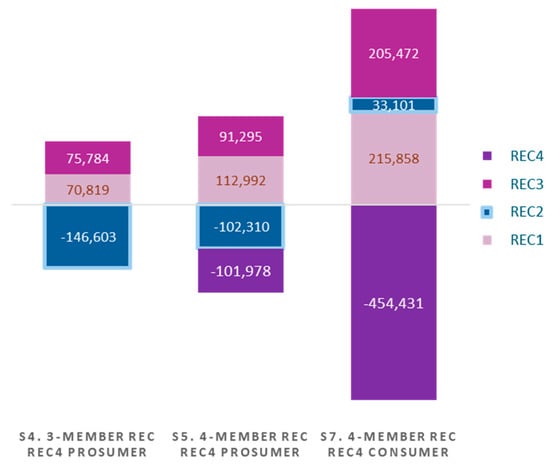

For the scenarios under consideration, simulations were conducted to obtain optimal investment decisions in solar PV (Figure 2) and BESS (Figure 3), the electricity supply costs (Figure 4) inclusive of revenues from shared electricity (considered as negative costs), the economic benefits from creating and enlarging an REC (Figure 5), and the electricity sharing among REC members (Figure 6 and Figure 7).

Figure 2.

Optimal decision for the installed solar PV capacity of each member (REC1, REC2, REC3, and REC4) for the simulated scenarios (kW).

Figure 3.

Optimal decision for the installed BESS of each member (REC1, REC2, REC3, and REC4) for the simulated scenarios (kWh-storage).

Figure 4.

Electricity supply costs of each member (REC1, REC2, REC3, and REC4) for the simulated scenarios (k€).

Figure 5.

Economic benefits from expanding a 3-member REC and creating new 3-member and 4-member REC (k€).

Figure 6.

Electricity sharing among REC members (kWh).

Figure 7.

Net electricity sharing among REC members (kWh).

Figure 2 illustrates that solar PV reaches maximum capacity for REC2 (1400 kW) and REC4 (300 kW) across all simulated scenarios, as well as for REC1 (800 kW) and REC3 (400 kW) in a 4-member REC with REC4 in a consumer profile (see scenario S7).

The transition from the ISC paradigm to REC encourages increased solar PV installation (see scenarios S3 versus S4 and S5), with the same trend observed during REC expansion, both in REC4 with a prosumer profile (see scenario S4 versus S5) and a consumer profile (see scenario S6 versus S7).

Furthermore, it is observed that the option to invest in BESS facilitates greater PV integration (see scenario S2 versus S3) within the ISC framework.

The optimal decision for BESS installation at each member, as depicted in Figure 3, indicates that moving from ISC to an REC opens the possibility of installing more BESS (as seen in scenario S3 versus S4). However, we observe rather asymmetric behavior among the members as the REC expands from 3 to 4 members, depending on the REC4 profile. In the REC4 prosumer profile, REC2 and REC3 increase their storage capacity, while REC1 slightly decreases (as seen in scenario S4 versus S5). Conversely, in the REC4 consumer profile, REC1 and REC3 decrease their storage capacity, whereas REC2 increases (as seen in scenario S6 versus S7).

Figure 4 presents the electricity supply costs of each member for the simulated scenarios.

The results clearly demonstrate that the primary benefit arises from individual self-consumption of solar PV, leading to total annual savings of € 190,000, which accounts for 15% of the total electricity supply costs of € 1,267,000 for the 4 members (refer to scenario S1 versus S2). Integrating REC1, REC2, and REC3 into a 3-member REC results in welfare improvement (cost reduction) for all members (refer to scenario S2 versus S3). However, the economic advantage of further expansion by integrating a fourth member (REC4) depends on the nature of this new member. Economic outcomes vary among members in the REC4 prosumer profile (refer to scenario S4 versus S5), while in the REC4 consumer profile, enlarging the REC improves welfare for all members (refer to scenario S6 versus S7).

This impact of the REC4 profile (prosumer versus consumer) on each member, quantified as the economic benefit (cost reduction), is illustrated in Figure 4 within the context of expanding an REC from 3 to 4 members and creating an REC with 3 or 4 members.

The economic benefits of expanding the 3-member REC to include REC4 are calculated as the difference between the outcomes of the 3-member REC and the 4-member REC with REC4 as a prosumer (refer to A in Figure 5, the difference between scenario S4 and S5) and as a consumer (refer to B in Figure 5, the difference between scenario S6 and S7).

The economic benefits of creating a 3-member REC (comprising REC1, REC2, and REC3) and a 4-member REC (comprising REC1, REC2, REC3, and REC4) are determined by the difference between the ISC scenario and the corresponding REC scenarios: ISC and 3-member REC (refer to C in Figure 5, the difference between scenario S3 and S4); ISC and 4-member REC with REC4 as a prosumer (refer to D in Figure 5, the difference between scenario S3 and S5); ISC and 4-member REC with REC4 as a consumer (refer to E in Figure 5, the difference between scenario S3 and S7). From the presented results, it is seen that expanding the REC from 3 to 4 members brings collective welfare improvements, particularly when REC4 operates with a consumer profile rather than a prosumer profile (compare A with B in Figure 5), with a payoff increase of 15 times (form 2 k€ to 29 k€). However, individual outcomes for members are not always positive with REC expansion. In the REC4 prosumer profile scenario, REC2 experiences a decrease in its benefits when REC4 is included, and REC3 does not see an improvement in benefits compared to the previous situation (refer to A in Figure 5). Only the integration of a pure consumer (REC4 with a consumer profile) unequivocally leads to improvements, both collectively and individually (refer to B in Figure 5). Consequently, it can be anticipated that REC2 may oppose the decision to integrate an REC4 prosumer, while REC3 might remain neutral in this process, whereas all members would approve the integration of an REC4 with a pure consumer profile.

To assess the extent to which the method of creating an REC influences each member’s position, we evaluated the economic benefits of directly establishing a 4-member REC instead of initially forming a 3-member REC and then considering the integration of a fourth member (REC4). The creation of both a 3-member REC and a 4-member REC leads to collective and individual welfare improvements, as all members benefit from joining together, whether REC4 is considered a prosumer or a consumer (refer to C, D, and E in Figure 5). The outcome of this greenfield creation of an REC, as opposed to the previous incremental approach of first establishing a 3-member REC and then integrating REC4, is particularly intriguing from the perspective of REC2. Initially integrated into the 3-member REC, REC2 might be inclined to reject the integration of an REC4 with a prosumer profile. However, REC2 would otherwise be quite favorable towards integrating a 4-member REC, even if one of the members is REC4 operating as a prosumer—a scenario that REC2 would have previously refused when coming from a 3-member REC situation. These findings underscore the need to investigate the incremental impact of each member within an REC, as aggregate benefits may hide competitive dynamics among certain REC members.

Figure 6 and Figure 7 illustrate the electricity sharing among REC members in the relevant scenarios of REC expansion (scenarios S4, S5, and S7), providing insights into the factors influencing the outcomes for REC2.

As observed from the electricity sharing among members (see Figure 6) and the net sharing (see Figure 7), where negative and positive values represent consumed and produced energy, respectively, in the 3-member REC arrangement, REC2 predominantly acts as a net buyer, being supplied by REC1 and REC3 in roughly equal measures. However, upon the inclusion of REC4 with a prosumer profile into this REC, REC2 competes with REC4 for the electricity shared by REC1 and REC3. Consequently, the shared electricity is divided almost equally between REC2 and the new member (REC4). This results in a loss for REC2 as it reduces its electricity procurement from the REC, which is priced lower than electricity obtained directly from the grid (€70/MWh from the REC versus €100/MWh from the grid).

Conversely, when the new member is a pure consumer (REC4 with a consumer profile), the cost-minimizing strategy of REC2 shifts, causing it to become a net seller to the REC. This shift is driven by the complementarity that emerges between REC4, which serves as a significant consumer within the REC, and all existing members, each possessing renewable generation. With increased renewable generation, the members aim to boost their self-consumption levels and the shared electricity within the REC. To provide an easier understanding of the differences between scenarios, results were synthetized in Table 3.

Table 3.

Summary of the results computed for different scenarios (S1 to S7).

Some sensitivity analyses were carried out and results showed that the solar PV limits have an impact on the overall outcomes. In fact, it is observed that raising the capacity limit results in a higher amount of power available for BESS charging or to be shared with other community members. In either case, if such was possible considering physical and infrastructure limitations, it would therefore reduce the grid energy demand to the REC and consequently improve the results. The opposite effect is also valid when lowering the upper limits.

5. Conclusions

Renewable Energy Communities represent a promising approach towards energy sustainability and resilience by encouraging local renewable electricity production, storage, and sharing. Managing electricity pricing and benefits distribution is crucial for maximizing economic viability and ensuring equitable participation and benefit distribution among REC members.

In this study, we developed and implemented an REC model that allows all members to invest in renewable generation technologies, such as solar PV and wind, as well as battery energy storage systems. A post-processing module computes individual outcomes based on a predefined internal electricity sharing price.

Results clearly show that major benefits come from individual self-consumption, leading to total annual savings of 190 k€, which accounts for 15% of the total electricity supply costs of 1267 k€ of the 4 members under study.

Moreover, the economic benefits of expanding the REC are contingent upon the characteristics of the prospective new member. Integrating a new member (REC4) with a pure consumer profile results in an increased collective payoff of 29 k€ from which 46% is captured by the new member, and all members benefit from this expansion. However, expanding the existing 3-member REC to incorporate an REC4 with a prosumer profile may yield mixed outcomes, with REC2 experiencing losses of 1.1 k€ in the REC expansion scenario. In fact, the inclusion of REC4 as a prosumer introduces competition dynamics in electricity sharing. On the other hand, the integration of an REC4 as a pure consumer exhibits complementarity with the renewable generation of existing members, increasing the economic benefits both collectively and for each individual member. These findings highlight the importance of accounting for individual circumstances and profiles among REC members when considering expansion decisions. Furthermore, they emphasize the role of pricing mechanisms and technological choices in shaping REC outcomes.

A limitation of this work is the binary characterization of new members as either pure consumers or prosumers. In practice, REC participants may adopt hybrid roles, combining partial generation, flexible demand, or evolving investment strategies. Future research will extend the proposed framework to capture these intermediate profiles and assess their impact on community expansion and benefit allocation.

Moreover, subsequent developments of this work will focus on assessing the incremental impact of individual members and exploring how adaptive internal electricity sharing prices can further balance benefits among REC members.

Author Contributions

Conceptualization, S.P. and J.S.; methodology, J.S. and S.P.; validation, S.P., J.S., C.V. and F.B.; writing—original draft preparation, J.S., C.V. and F.B.; writing—review and editing, S.P., J.S., C.V. and F.B.; All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by national funds through FCT, Fundação para a Ciência e a Tecnologia, under project UIDB/50021/2020 (https://doi.org/10.54499/UIDB/50021/2020).

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Nomenclature

| Indexes | |

| REC member | |

| RES technology | |

| Time period (h) | |

| Parameters | |

| Discount rate (€) | |

| (€/kW) | |

| (€/kWh-storage) | |

| (€) | |

| (€) | |

| (kWh) | |

| (kWh) | |

| (kWh) | |

| (kW) | |

| (kW) | |

| (kW) | |

| (kW) | |

| (kWh) | |

| (€) | |

| (€) | |

| DAM price for selling electricity to the grid (€) | |

| (€) | |

| (€) | |

| (years) | |

| (years) | |

| Variables | |

| (kWh) | |

| (kWh) | |

| (kWh) | |

| (kWh) | |

| Total annualized costs of electricity supplied to the overall REC members (€) | |

| (kWh) | |

| (kW) | |

| (kW) | |

| (kWh) | |

| (kWh) | |

| (kWh) | |

| Binary Variables | |

| Dis |

References

- European Commission. Directorate-General for Energy, Clean Energy for All Europeans; Publications Office: Luxembourg, 2019. [Google Scholar]

- European Parliament, Council of the European Union. European Parliament Directive (EU) 2018/2001; Council on the Promotion of the Use of Energy from Renewable; Sources; European Union Publications Office: Luxembourg, 2018. [Google Scholar]

- European Parliament, Council of the European Union. European Parliament Directive (EU) 2019/944; Council on Common Rules for the Internal Market for Electricity and Amending Directive 2012/27; European Union Publications Office: Luxembourg, 2019. [Google Scholar]

- Presidency of the Council of Ministers. Decree Law n. 15/2022 de 14 de Janeiro. Republic Diary, Portugal. 2022. Available online: https://diariodarepublica.pt/dr/en/detail/decree-law/15-2022-177634016 (accessed on 4 August 2025).

- Ahmed, S.; Ali, A.; Ciocia, A.; D’Angola, A. Technological Elements behind the Renewable Energy Community: Current Status, Existing Gap, Necessity, and Future Perspective—Overview. Energies 2024, 17, 3100. [Google Scholar] [CrossRef]

- De Vidovich, L.; Tricarico, L.; Zulianello, M. How Can We Frame Energy Communities’ Organisational Models? Insights from the Research ‘Community Energy Map’ in the Italian Context. Sustainability 2023, 15, 1997. [Google Scholar] [CrossRef]

- Hanke, F.; Guyet, R.; Feenstra, M. Do Renewable Energy Communities Deliver Energy Justice? Exploring Insights from 71 European Cases. Energy Res. Soc. Sci. 2021, 80, 102244. [Google Scholar] [CrossRef]

- Frieden, D.; Tuerk, A.; Antunes, A.R.; Athanasios, V.; Chronis, A.G.; D’herbemont, S.; Kirac, M.; Marouço, R.; Neumann, C.; Catalayud, E.P.; et al. Are We on the Right Track? Collective Self-Consumption and Energy Communities in the European Union. Sustainability 2021, 13, 12494. [Google Scholar] [CrossRef]

- Frieden, D.; Tuerk, A.; Neumann, C. Collective Self-Consumption and Energy Communities: Trends and Challenges in the Transposition of the EU Framework; Technical Report, H2020 Compile Project; Integrating Community Power in Islands: Luče, Slovenia, 2020. [Google Scholar] [CrossRef]

- Gasca, M.V.; Rigo-Mariani, R.; Debusschere, V.; Sidqi, Y. Fairness in Energy Communities: Centralized and Decentralized Frameworks. Renew. Sustain. Energy Rev. 2025, 208, 115054. [Google Scholar] [CrossRef]

- Bauwens, T.; Schraven, D.; Drewing, E.; Radtke, J.; Holstenkamp, L.; Gotchev, B.; Yildiz, Ö. Conceptualizing Community in Energy Systems: A Systematic Review of 183 Definitions. Renew. Sustain. Energy Rev. 2022, 156, 111999. [Google Scholar] [CrossRef]

- Gržanić, M.; Capuder, T.; Zhang, N.; Huang, W. Prosumers as Active Market Participants: A Systematic Review of Evolution of Opportunities, Models and Challenges. Renew. Sustain. Energy Rev. 2022, 154, 111859. [Google Scholar] [CrossRef]

- Lazdins, R.; Mutule, A.; Zalostiba, D. PV Energy Communities—Challenges and Barriers from a Consumer Perspective: A Literature Review. Energies 2021, 14, 4873. [Google Scholar] [CrossRef]

- Gianaroli, F.; Preziosi, M.; Ricci, M.; Sdringola, P.; Ancona, M.A.; Melino, F. Exploring the Academic Landscape of Energy Communities in Europe: A Systematic Literature Review. J. Clean Prod. 2024, 451, 141932. [Google Scholar] [CrossRef]

- Esposito, P.; Marrasso, E.; Martone, C.; Pallotta, G.; Roselli, C.; Sasso, M.; Tufo, M. A Roadmap for the Implementation of a Renewable Energy Community. Heliyon 2024, 10, e28269. [Google Scholar] [CrossRef]

- Belmar, F.; Baptista, P.; Neves, D. Modelling Renewable Energy Communities: Assessing the Impact of Different Configurations, Technologies and Types of Participants. Energy Sustain. Soc. 2023, 13, 18. [Google Scholar] [CrossRef]

- Karunathilake, H.; Perera, P.; Ruparathna, R.; Hewage, K.; Sadiq, R. Renewable Energy Integration into Community Energy Systems: A Case Study of New Urban Residential Development. J. Clean Prod. 2018, 173, 292–307. [Google Scholar] [CrossRef]

- Botsaris, P.N.; Giourka, P.; Papatsounis, A.; Dimitriadou, P.; Goitia-Zabaleta, N.; Patsonakis, C. Developing a Business Case for a Renewable Energy Community in a Public Housing Settlement in Greece—The Case of a Student Housing and Its Challenges, Prospects and Barriers. Sustainability 2021, 13, 3792. [Google Scholar] [CrossRef]

- Battaglia, V.; Vanoli, L.; Zagni, M. Economic Benefits of Renewable Energy Communities in Smart Districts: A Comparative Analysis of Incentive Schemes for NZEBs. Energy Build 2024, 305, 113911. [Google Scholar] [CrossRef]

- Lode, M.L.; te Boveldt, G.; Coosemans, T.; Ramirez Camargo, L. A Transition Perspective on Energy Communities: A Systematic Literature Review and Research Agenda. Renew. Sustain. Energy Rev. 2022, 163, 112479. [Google Scholar] [CrossRef]

- Mussawar, O.; Mayyas, A.; Azar, E. Energy Storage Enabling Renewable Energy Communities: An Urban Context-Aware Approach and Case Study Using Agent-Based Modeling and Optimization. Sustain. Cities Soc. 2024, 115, 105813. [Google Scholar] [CrossRef]

- Liu, M.; Zhang, B.; Wang, J.; Liu, H.; Wang, J.; Liu, C.; Zhao, J.; Sun, Y.; Zhai, R.; Zhu, Y. Optimal Configuration of Wind-PV and Energy Storage in Large Clean Energy Bases. Sustainability 2023, 15, 12895. [Google Scholar] [CrossRef]

- Li, J.; Zhu, Y.; Xiao, Y.; Lan, X. Optimized Configuration and Operation Model and Economic Analysis of Shared Energy Storage Based on Master-Slave Game Considering Load Characteristics of PV Communities. J. Energy Storage 2024, 76, 109841. [Google Scholar] [CrossRef]

- Perinhas, S.M.d.O.; de Sousa, J.A.M.; Viveiros, C.S.P.C.; Barata, F.A. de S.F. Techno-Economic Assessment of Battery Energy Storage Systems in Renewable Energy Communities. Int. J. Sustain. Energy Plan. Manag. 2025, 44, 59–72. [Google Scholar]

- Ahmed, S.; Ali, A.; D’Angola, A. A Review of Renewable Energy Communities: Concepts, Scope, Progress, Challenges, and Recommendations. Sustainability 2024, 16, 1749. [Google Scholar] [CrossRef]

- Mikulik, J.; Niekurzak, M. Assessment of the Profitability of a Photovoltaic Installation Cooperating with Energy Storage Using an Example of a Medium-Sized Production Company. Energies 2024, 17, 4740. [Google Scholar] [CrossRef]

- Lima, M.; Perinhas, S.; Sousa, J.; Viveiros, C.; Barata, F. Integration of Solar PV and Battery Energy Storage Systems Towards a Sustainable Street Lighting. In Proceedings of the International Conference on the European Energy Market, EEM, Lisbon, Portugal, 27–29 May 2025; IEEE Computer Society: Washington, DC, USA, 2025. [Google Scholar]

- Khan, S.A.; Tao, Z.; Agyekum, E.B.; Fahad, S.; Tahir, M.; Salman, M. Sustainable Rural Electrification: Energy-Economic Feasibility Analysis of Autonomous Hydrogen-Based Hybrid Energy System. Int. J. Hydrog. Energy 2025, 141, 460–473. [Google Scholar] [CrossRef]

- Bartolini, A.; Carducci, F.; Muñoz, C.B.; Comodi, G. Energy Storage and Multi Energy Systems in Local Energy Communities with High Renewable Energy Penetration. Renew. Energy 2020, 159, 595–609. [Google Scholar] [CrossRef]

- Faria, J.; Marques, C.; Pombo, J.; Mariano, S.; Calado, M.d.R. Optimal Sizing of Renewable Energy Communities: A Multiple Swarms Multi-Objective Particle Swarm Optimization Approach. Energies 2023, 16, 7227. [Google Scholar] [CrossRef]

- Piazza, G.; Delfino, F.; Bergero, S.; Di Somma, M.; Graditi, G.; Bracco, S. Economic and Environmental Optimal Design of a Multi-Vector Energy Hub Feeding a Local Energy Community. Appl. Energy 2023, 347, 121259. [Google Scholar] [CrossRef]

- Minetti, M.; Bonfiglio, A.; Procopio, R.; Petronijevic, M.P.; Radonjic, I. Optimal Sizing of Battery Energy Storage Systems for Renewable Energy Integration in Energy Communities; Institute of Electrical and Electronics Engineers (IEEE): Piscataway, NJ, USA, 2024; pp. 1–6. [Google Scholar]

- Cruz-De-Jesús, E.; Marano-Marcolini, A.; Martínez-Ramos, J.L. Participation of Energy Communities in Electricity Markets and Ancillary Services: An Overview of Successful Strategies. Energies 2024, 17, 4631. [Google Scholar] [CrossRef]

- Ahmed, S.; Măgurean, A.M. Renewable Energy Communities: Towards a New Sustainable Model of Energy Production and Sharing. Energy Strategy Rev. 2024, 55, 101522. [Google Scholar] [CrossRef]

- Llera-Sastresa, E.; Gimeno, J.Á.; Osorio-Tejada, J.L.; Portillo-Tarragona, P. Effect of Sharing Schemes on the Collective Energy Self-Consumption Feasibility. Energies 2023, 16, 6564. [Google Scholar] [CrossRef]

- Ferreira, E.; Sequeira, M.M.; Gouveia, J.P. Sharing Is Caring: Exploring Distributed Solar Photovoltaics and Local Electricity Consumption through a Renewable Energy Community. Sustainability 2024, 16, 2777. [Google Scholar] [CrossRef]

- Gianaroli, F.; Ricci, M.; Sdringola, P.; Alessandra Ancona, M.; Branchini, L.; Melino, F. Development of Dynamic Sharing Keys: Algorithms Supporting Management of Renewable Energy Community and Collective Self Consumption. Energy Build 2024, 311, 114158. [Google Scholar] [CrossRef]

- Tostado-Véliz, M.; Rezaee Jordehi, A.; Hasanien, H.M.; Khosravi, N.; Mansouri, S.A.; Jurado, F. On Different Collective Storage Schemes in Energy Communities with Internal Market. J. Energy Storage 2024, 75, 109699. [Google Scholar] [CrossRef]

- Radl, J.; Fleischhacker, A.; Revheim, F.H.; Lettner, G.; Auer, H. Comparison of Profitability of PV Electricity Sharing in Renewable Energy Communities in Selected European Countries. Energies 2020, 13, 5007. [Google Scholar] [CrossRef]

- Gjorgievski, V.Z.; Velkovski, B.; Francesco Demetrio, M.; Cundeva, S.; Markovska, N. Energy Sharing in European Renewable Energy Communities: Impact of Regulated Charges. Energy 2023, 281, 128333. [Google Scholar] [CrossRef]

- Neri, J.; Corsetti, E. Business Model for Renewable Energy Communities. In Proceedings of the 2024 AEIT International Annual Conference (AEIT), Trento, Italy, 25–27 September 2024. [Google Scholar]

- Sassone, A.; Ahmed, S.; D’Angola, A. A Profit Optimization Model for Renewable Energy Communities Based on the Distribution of Participants. In Proceedings of the Proceedings—24th EEEIC International Conference on Environment and Electrical Engineering and 8th I and CPS Industrial and Commercial Power Systems Europe, EEEIC/I and CPS Europe 2024, Rome, Italy, 17–20 June 2024; Institute of Electrical and Electronics Engineers Inc.: New York, NY, USA, 2024. [Google Scholar]

- Elshazly, A.A.; Badr, M.M.; Mahmoud, M.; Eberle, W.; Alsabaan, M.; Ibrahem, M.I. Reinforcement Learning for Fair and Efficient Charging Coordination for Smart Grid. Energies 2024, 17, 4557. [Google Scholar] [CrossRef]

- Carvalho, I.; Sousa, J.; Villar, J.; Lagarto, J.; Viveiros, C.; Barata, F. Optimal Investment and Sharing Decisions in Renewable Energy Communities with Multiple Investing Members. Energies 2025, 18, 1920. [Google Scholar] [CrossRef]

- Dioba, A.; Giannakopoulou, A.; Struthers, D.; Stamos, A.; Dewitte, S.; Fróes, I. Identifying Key Barriers to Joining an Energy Community Using AHP. Energy 2024, 299, 131478. [Google Scholar] [CrossRef]

- Mariuzzo, I.; Fina, B.; Stroemer, S.; Corinaldesi, C.; Raugi, M. Grid-Friendly Optimization of Energy Communities through Enhanced Multiple Participation. Renew. Sustain. Energy Rev. 2025, 208, 115028. [Google Scholar] [CrossRef]

- Lage, M.; Castro, R.; Manzolini, G.; Casalicchio, V.; Sousa, T. Techno-Economic Analysis of Self-Consumption Schemes and Energy Communities in Italy and Portugal. Sol. Energy 2024, 270, 112407. [Google Scholar] [CrossRef]

- Tomin, N.; Shakirov, V.; Kozlov, A.; Sidorov, D.; Kurbatsky, V.; Rehtanz, C.; Lora, E.E.S. Design and Optimal Energy Management of Community Microgrids with Flexible Renewable Energy Sources. Renew. Energy 2022, 183, 903–921. [Google Scholar] [CrossRef]

- Hupez, M.; Toubeau, J.F.; De Greve, Z.; Vallee, F. A New Cooperative Framework for a Fair and Cost-Optimal Allocation of Resources within a Low Voltage Electricity Community. IEEE Trans. Smart Grid. 2021, 12, 2201–2211. [Google Scholar] [CrossRef]

- Gomes, L.; Vale, Z. Costless Renewable Energy Distribution Model Based on Cooperative Game Theory for Energy Communities Considering Its Members’ Active Contributions. Sustain. Cities Soc. 2024, 101, 105060. [Google Scholar] [CrossRef]

- Guedes, W.; Oliveira, C.; Soares, T.A.; Dias, B.H.; Matos, M. Collective Asset Sharing Mechanisms for PV and BESS in Renewable Energy Communities. IEEE Trans. Smart Grid. 2024, 15, 607–616. [Google Scholar] [CrossRef]

- Khayyat, M.M.; Sami, B. Energy Community Management Based on Artificial Intelligence for the Implementation of Renewable Energy Systems in Smart Homes. Electronics 2024, 13, 380. [Google Scholar] [CrossRef]

- Barabino, E.; Fioriti, D.; Guerrazzi, E.; Mariuzzo, I.; Poli, D.; Raugi, M.; Razaei, E.; Schito, E.; Thomopulos, D. Energy Communities: A Review on Trends, Energy System Modelling, Business Models, and Optimisation Objectives. Sustain. Energy Grids Netw. 2023, 36, 101187. [Google Scholar] [CrossRef]

- Tomin, N.; Shakirov, V.; Kurbatsky, V.; Muzychuk, R.; Popova, E.; Sidorov, D.; Kozlov, A.; Yang, D. A Multi-Criteria Approach to Designing and Managing a Renewable Energy Community. Renew. Energy 2022, 199, 1153–1175. [Google Scholar] [CrossRef]

- Mostafaeipour, A.; Le, T. Evaluating Strategies for Developing Renewable Energies Considering Economic, Social, and Environmental Aspects: A Case Study. Environ. Sci. Pollut. Res. 2024, 31, 23697–23718. [Google Scholar] [CrossRef]

- Mustika, A.D.; Rigo-Mariani, R.; Debusschere, V.; Pachurka, A. New Members Selection for the Expansion of Energy Communities. Sustainability 2022, 14, 11257. [Google Scholar] [CrossRef]

- D’Adamo, I.; Gastaldi, M.; Koh, S.C.L.; Vigiano, A. Lighting the Future of Sustainable Cities with Energy Communities: An Economic Analysis for Incentive Policy. Cities 2024, 147, 104828. [Google Scholar] [CrossRef]

- Villar, C.H.; Neves, D.; Silva, C.A. Solar PV Self-Consumption: An Analysis of Influencing Indicators in the Portuguese Context. Energy Strategy Rev. 2017, 18, 224–234. [Google Scholar] [CrossRef]

- Hannan, M.A.; Wali, S.B.; Ker, P.J.; Rahman, M.S.A.; Mansor, M.; Ramachandaramurthy, V.K.; Muttaqi, K.M.; Mahlia, T.M.I.; Dong, Z.Y. Battery Energy-Storage System: A Review of Technologies, Optimization Objectives, Constraints, Approaches, and Outstanding Issues. J. Energy Storage 2021, 42, 103023. [Google Scholar] [CrossRef]

- Chatzigeorgiou, N.G.; Theocharides, S.; Makrides, G.; Georghiou, G.E. A Review on Battery Energy Storage Systems: Applications, Developments, and Research Trends of Hybrid Installations in the End-User Sector. J. Energy Storage 2024, 86, 111192. [Google Scholar] [CrossRef]

- Petrovich, B.; Kubli, M. Energy Communities for Companies: Executives’ Preferences for Local and Renewable Energy Procurement. Renew. Sustain. Energy Rev. 2023, 184, 113506. [Google Scholar] [CrossRef]

- Weckesser, T.; Dominković, D.F.; Blomgren, E.M.V.; Schledorn, A.; Madsen, H. Renewable Energy Communities: Optimal Sizing and Distribution Grid Impact of Photo-Voltaics and Battery Storage. Appl. Energy 2021, 301, 117408. [Google Scholar] [CrossRef]

- Sousa, J.; Lagarto, J.; Camus, C.; Viveiros, C.; Barata, F.; Silva, P.; Alegria, R.; Paraíba, O. Renewable Energy Communities Optimal Design Supported by an Optimization Model for Investment in PV/Wind Capacity and Renewable Electricity Sharing. Energy 2023, 283, 128464. [Google Scholar] [CrossRef]

- Faia, R.; Lezama, F.; Soares, J.; Pinto, T.; Vale, Z. Local Electricity Markets: A Review on Benefits, Barriers, Current Trends and Future Perspectives. Renew. Sustain. Energy Rev. 2024, 190, 114006. [Google Scholar] [CrossRef]

- GAMS Development Corporation. General Algebraic Modeling System (GAMS); GAMS Development Corp: Frechen, Germany, 2006. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).