Examining the Role of Renewable Energy, Technological Innovation, and the Insurance Market in Environmental Sustainability in the United States: A Step toward COP26 Targets

Abstract

:1. Introduction

2. Materials and Methods

2.1. Modeling and Data

2.2. Methods of Estimations

3. Results and Discussion

3.1. Empirical Results

3.2. Discussion of Findings

4. Conclusions

- Greener growth strategies should be pursued by the US government. Technology innovation should be leveraged in environmentally friendly sectors to increase the LC. Policies that can contribute to green growth in the US economy include carbon capture technologies, the cost reduction of renewable energy technologies, more high-tech and efficient solar panels, and wind turbine incentives. In the same way, the US government can limit the decline in the LC by imposing environmental taxes on polluting companies and groups. There is evidence that a significant improvement in the IM promotes new investment activities that will adversely affect the environment by promoting fossil fuel utilization.

- To promote LC growth, the government should enhance its investment, innovation, and infrastructure spending on renewable energy. Policymakers should increase the share of renewables in terms of total energy. SDG-7—regarding clean and affordable energy—is associated with renewable resources; therefore, SDG-7 can strengthen the LC. Governments need to make renewable resources more cost-effective in this context. Moreover, the government should promote RE in households and industries through environmental awareness programs. With the use of renewables, the US can improve environmental quality, as well as create jobs and increase energy security.

- Third, the policymakers must use the development of the insurance sector to promote the environment. Therefore, clean energy sources must be effectively financed by the insurance industry in the US. Additionally, insurers should facilitate environmental technology development and reduce costs by creating a stable and risk-free investment environment. Insurers may harm their own interests if they act without regard for the environment since having a poorer environment has a negative impact on society’s health and economy. As a result, governments must take action to expand green insurance financing options. In the US, the current insurance activities reduce the LC. Non-green insurance investments and activities need to be limited by governments. In addition, financial incentives should be provided for sustainable green insurance investments.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kumar Rai, P.; Singh, J.S. Invasive alien plant species: Their impact on environment, ecosystem services and human health. Ecol. Indic. 2020, 111, 106020. [Google Scholar] [CrossRef] [PubMed]

- Jahanger, A.; Ali, M.; Balsalobre-Lorente, D.; Samour, A.; Joof, F.; Tursoy, T. Testing the impact of renewable energy and oil price on carbon emission intensity in China’s transportation sector. Environ. Sci. Pollut. Res. 2023, 30, 82372–82386. [Google Scholar] [CrossRef] [PubMed]

- Landrigan, P.J.; Stegeman, J.J.; Fleming, L.E.; Allemand, D.; Anderson, D.M.; Backer, L.C.; Brucker-Davis, F.; Chevalier, N.; Corra, L.; Czerucka, D.; et al. Human health and ocean pollution. Ann. Glob. Health 2020, 86, 151. [Google Scholar] [CrossRef] [PubMed]

- Khan, S.A.R.; Godil, D.I.; Quddoos, M.U.; Yu, Z.; Akhtar, M.H.; Liang, Z. Investigating the nexus between energy, economic growth, and environmental quality: A road map for the sustainable development. Sustain. Dev. 2021, 29, 835–846. [Google Scholar] [CrossRef]

- Reddy, V.R.; Behera, B. Impact of water pollution on rural communities: An economic analysis. Ecol. Econ. 2006, 58, 520–537. [Google Scholar] [CrossRef]

- Dharwal, M.; Parashar, D.; Shuaibu, M.S.; Abdullahi, S.G.; Abubakar, S.; Bala, B.B. Water pollution: Effects on health and environment of Dala LGA, Nigeria. Mater. Today Proc. 2020, 49, 3036–3039. [Google Scholar] [CrossRef]

- Qin, G.; Niu, Z.; Yu, J.; Li, Z.; Ma, J.; Xiang, P. Soil heavy metal pollution and food safety in China: Effects, sources and removing technology. Chemosphere 2021, 267, 129205. [Google Scholar] [CrossRef]

- Samour, A. Testing the impact of banking sector development on turkey’s CO2 emissions. Appl. Ecol. Environ. Res. 2019, 17, 6497–6513. [Google Scholar] [CrossRef]

- Zafar, M.W.; Saleem, M.M.; Destek, M.A.; Caglar, A.E. The dynamic linkage between remittances, export diversification, education, renewable energy consumption, economic growth, and CO2 emissions in top remittance-receiving countries. Sustain. Dev. 2022, 30, 165–175. [Google Scholar] [CrossRef]

- Samour, A.; Adebayo, T.S.; Agyekum, E.B.; Khan, B.; Kamel, S. Insights from BRICS-T economies on the impact of human capital and renewable electricity consumption on environmental quality. Sci. Rep. 2023, 13, 5245. [Google Scholar] [CrossRef]

- Rees, W.E. Revisiting carrying capacity: Area-based indicators of sustainability. Popul. Environ. 1996, 17, 195–215. [Google Scholar] [CrossRef]

- Destek, M.A.; Sinha, A. Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: Evidence from organisation for economic Co-operation and development countries. J. Clean. Prod. 2020, 242, 118537. [Google Scholar] [CrossRef]

- Pata, U.K. Renewable and non-renewable energy consumption, economic complexity, CO2 emissions, and ecological footprint in the USA: Testing the EKC hypothesis with a structural break. Environ. Sci. Pollut. Res. 2021, 28, 846–861. [Google Scholar] [CrossRef] [PubMed]

- Pata, U.K. Do renewable energy and health expenditures improve load capacity factor in the USA and Japan? A new approach to environmental issues. Eur. J. Health Econ. 2021, 22, 1427–1439. [Google Scholar] [CrossRef] [PubMed]

- Siche, R.; Pereira, L.; Agostinho, F.; Ortega, E. Convergence of ecological footprint and emergy analysis as a sustainability indicator of countries: Peru as case study. Commun. Nonlinear Sci. Numer. Simul. 2010, 15, 3182–3192. [Google Scholar] [CrossRef]

- Kivyiro, P.; Arminen, H. Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: Causality analysis for Sub-Saharan Africa. Energy 2014, 74, 595–606. [Google Scholar] [CrossRef]

- Kartal, M.T.; Samour, A.; Adebayo, T.S.; Kılıç Depren, S. Do nuclear energy and renewable energy surge environmental quality in the United States? New insights from novel bootstrap Fourier Granger causality in quantiles approach. Prog. Nucl. Energy 2023, 155, 104509. [Google Scholar] [CrossRef]

- Li, X.; Ozturk, I.; Ullah, S.; Andlib, Z.; Hafeez, M. Can top-pollutant economies shift some burden through insurance sector development for sustainable development? Econ. Anal. Policy 2022, 74, 326–336. [Google Scholar] [CrossRef]

- Pata, U.K.; Samour, A. Assessing the role of the insurance market and renewable energy in the load capacity factor of OECD countries. Environ. Sci. Pollut. Res. 2023, 30, 48604–48616. [Google Scholar] [CrossRef]

- Pata, U.K.; Samour, A. Do renewable and nuclear energy enhance environmental quality in France? A new EKC approach with the load capacity factor. Prog. Nucl. Energy 2022, 149, 104249. [Google Scholar] [CrossRef]

- Hao, Y.; Zhang, Z.-Y.; Yang, C.; Wu, H. Does structural labor change affect CO2 emissions? Theoretical and empirical evidence from China. Technol. Forecast. Soc. Chang. 2021, 171, 120936. [Google Scholar] [CrossRef]

- Kartal, M.T.; Depren, S.K.; Kirikkaleli, D.; Depren, Ö.; Khan, U. Asymmetric and long-run impact of political stability on consumption-based carbon dioxide emissions in Finland: Evidence from nonlinear and Fourier-based approaches. J. Environ. Manag. 2022, 321, 116043. [Google Scholar] [CrossRef] [PubMed]

- Kirikkaleli, D.; Güngör, H.; Adebayo, T.S. Consumption-based carbon emissions, renewable energy consumption, financial development and economic growth in Chile. Bus. Strateg. Environ. 2022, 31, 1123–1137. [Google Scholar] [CrossRef]

- Nurgazina, Z.; Guo, Q.; Ali, U.; Kartal, M.T.; Ullah, A.; Khan, Z.A. Retesting the influences on CO2 emissions in China: Evidence from dynamic ARDL approach. Front. Environ. Sci. 2022, 10, 868740. [Google Scholar] [CrossRef]

- Isiksal, A.Z.; Samour, A.; Resatoglu, N.G. Testing the impact of real interest rate, income, and energy consumption on Turkey’s CO2 emissions. Environ. Sci. Pollut. Res. 2019, 26, 20219–20231. [Google Scholar] [CrossRef]

- Shahzad, U.; Elheddad, M.; Swart, J.; Ghosh, S.; Dogan, B. The role of biomass energy consumption and economic complexity on environmental sustainability in G7 economies. Bus. Strateg. Environ. 2023, 32, 781–801. [Google Scholar] [CrossRef]

- Wang, Q.; Yang, T.; Li, R.; Wang, L. Population aging redefines the economic growth-carbon emissions nexus, energy consumption-carbon emissions nexus—Evidence from 36 OECD countries. Energy Environ. 2022, 34, 946–970. [Google Scholar] [CrossRef]

- Yang, X.; Li, N.; Mu, H.; Zhang, M.; Pang, J.; Ahmad, M. Study on the long-term and short-term effects of globalization and population aging on ecological footprint in OECD countries. Ecol. Complex. 2021, 47, 100946. [Google Scholar] [CrossRef]

- Hassan, T.; Song, H.; Khan, Y.; Kirikkaleli, D. Energy efficiency a source of low carbon energy sources? Evidence from 16 high-income OECD economies. Energy 2022, 243, 123063. [Google Scholar] [CrossRef]

- Sun, Y.; Guan, W.; Razzaq, A.; Shahzad, M.; Binh An, N. Transition towards ecological sustainability through fiscal decentralization, renewable energy and green investment in OECD countries. Renew. Energy 2022, 190, 385–395. [Google Scholar] [CrossRef]

- Sharif, A.; Raza, S.A.; Ozturk, I.; Afshan, S. The dynamic relationship of renewable and nonrenewable energy consumption with carbon emission: A global study with the application of heterogeneous panel estimations. Renew. Energy 2019, 133, 685–691. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Sharif, A.; Golpîra, H.; Kumar, A. A green ideology in Asian emerging economies: From environmental policy and sustainable development. Sustain. Dev. 2019, 27, 1063–1075. [Google Scholar] [CrossRef]

- Sharif, A.; Baris-Tuzemen, O.; Uzuner, G.; Ozturk, I.; Sinha, A. Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: Evidence from Quantile ARDL approach. Sustain. Cities Soc. 2020, 57, 102138. [Google Scholar] [CrossRef]

- Ali, U.; Guo, Q.; Kartal, M.T.; Nurgazina, Z.; Khan, Z.A.; Sharif, A. The impact of renewable and non-renewable energy consumption on carbon emission intensity in China: Fresh evidence from novel dynamic ARDL simulations. J. Environ. Manag. 2022, 320, 115782. [Google Scholar] [CrossRef]

- Amin, S.; Mehmood, W.; Sharif, A. Blessing or curse: The role of diversity matters in stimulating or relegating environmental sustainability—A global perspective via renewable and non-renewable energy. Renew. Energy 2022, 189, 927–937. [Google Scholar] [CrossRef]

- Pata, U.K.; Isik, C. Determinants of the load capacity factor in China: A novel dynamic ARDL approach for ecological footprint accounting. Resour. Policy 2021, 74, 102313. [Google Scholar] [CrossRef]

- Abdulmagid Basheer Agila, T.; Khalifa, W.M.S.; Saint Akadiri, S.; Adebayo, T.S.; Altuntaş, M. Determinants of load capacity factor in South Korea: Does structural change matter? Environ. Sci. Pollut. Res. 2022, 29, 69932–69948. [Google Scholar] [CrossRef]

- Kartal, M.T.; Pata, U.K.; Kılıç Depren, S.; Depren, Ö. Effects of possible changes in natural gas, nuclear, and coal energy consumption on CO2 emissions: Evidence from France under Russia’s gas supply cuts by dynamic ARDL simulations approach. Appl. Energy 2023, 339, 120983. [Google Scholar] [CrossRef]

- Appiah-Otoo, I.; Acheampong, A.O. Does insurance sector development improve environmental quality? Evidence from BRICS. Environ. Sci. Pollut. Res. 2021, 28, 29432–29444. [Google Scholar] [CrossRef]

- Rizwanullah, M.; Nasrullah, M.; Liang, L. On the asymmetric effects of insurance sector development on environmental quality: Challenges and policy options for BRICS economies. Environ. Sci. Pollut. Res. 2022, 29, 10802–10811. [Google Scholar] [CrossRef]

- Perron, P.; Vogelsang, T.J. Nonstationarity and Level Shifts With an Application to Purchasing Power Parity. J. Bus. Econ. Stat. 1992, 10, 301–320. [Google Scholar] [CrossRef]

- Zivot, E.; Andrews, D.W.K. Further Evidence on the Great Crash, the Oil-Price Shock, and the Unit-Root Hypothesis. J. Bus. Econ. Stat. 2002, 20, 25–44. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- McNown, R.; Sam, C.Y.; Goh, S.K. Bootstrapping the autoregressive distributed lag test for cointegration. Appl. Econ. 2018, 50, 1509–1521. [Google Scholar] [CrossRef]

- Sam, C.Y.; McNown, R.; Goh, S.K. An augmented autoregressive distributed lag bounds test for cointegration. Econ. Model. 2019, 80, 130–141. [Google Scholar] [CrossRef]

- Narayan, P.K. The saving and investment nexus for China: Evidence from cointegration tests. Appl. Econ. 2005, 37, 1979–1990. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Sofuoğlu, E.; Ojekemi, O. Does patents on environmental technologies matter for the ecological footprint in the USA? Evidence from the novel Fourier ARDL approach. Geosci. Front. 2023, 14, 101564. [Google Scholar] [CrossRef]

- Li, S.; Samour, A.; Irfan, M.; Ali, M. Role of renewable energy and fiscal policy on trade adjusted carbon emissions: Evaluating the role of environmental policy stringency. Renew. Energy 2023, 205, 156–165. [Google Scholar] [CrossRef]

- Samour, A.; Joof, F.; Ali, M.; Tursoy, T. Do financial development and renewable energy shocks matter for environmental quality: Evidence from top 10 emitting emissions countries. Environ. Sci. Pollut. Res. 2023, 30, 78879–78890. [Google Scholar] [CrossRef]

| Variable | Variable Description | Source |

|---|---|---|

| This indicator is captured by dividing the biocapacity and EF per capita (global-hectares) | Global Footprint Network (2023) | |

| The total insurance as a percentage of GDP | OECD (2023) | |

| TI | Total patents (addition of resident and nonresident patents) | World Bank (2023) |

| Renewable energy per capita | Our World in Data (2023) | |

| GDP per capita (Constant-2015 United States-dollars) | World Bank (2023) |

| LC | GDP | REC | TI | IM | |

|---|---|---|---|---|---|

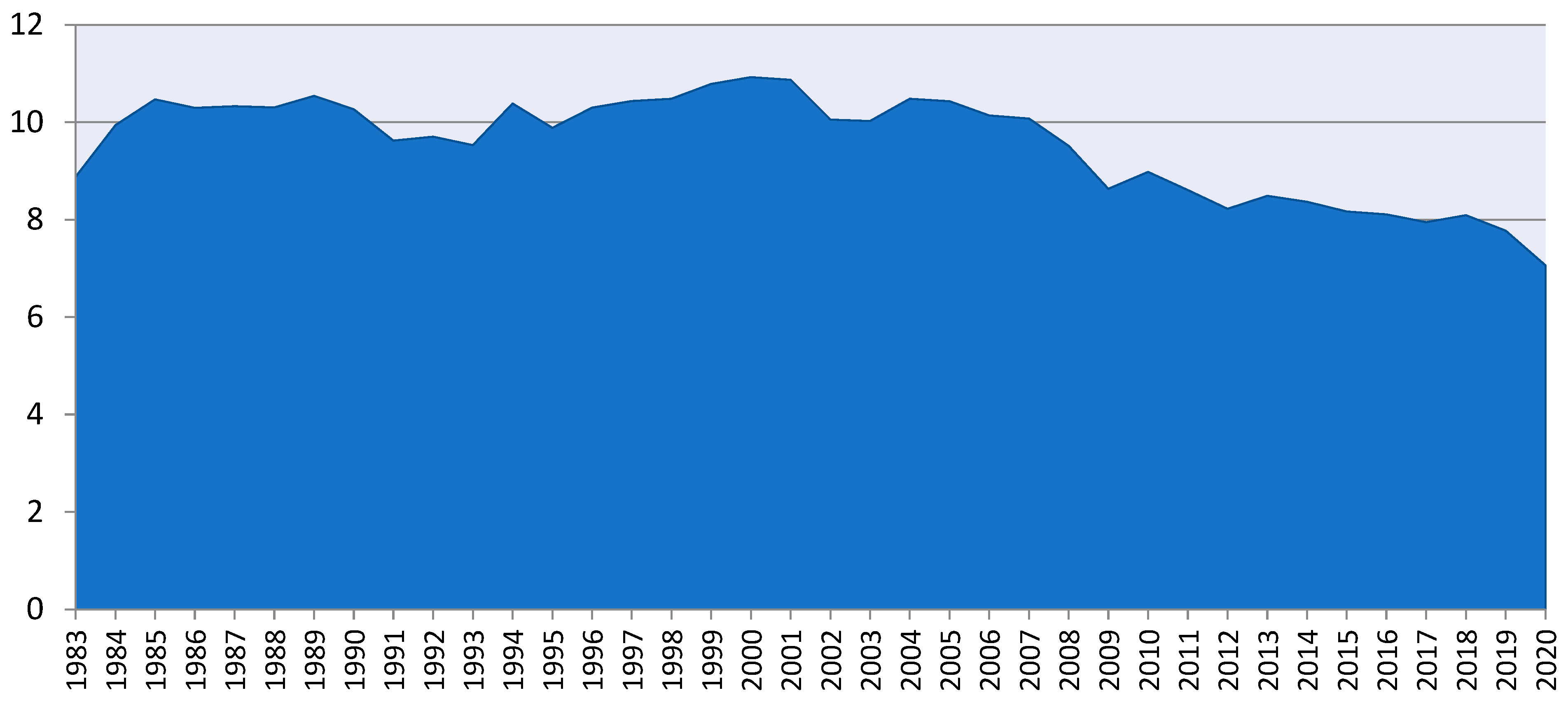

| Mean | −0.825898 | 10.75480 | 1.528109 | 316030.8 | 13.96549 |

| Median | −0.809167 | 10.79795 | 1.461889 | 280829.0 | 14.06364 |

| Maximum | −0.634108 | 11.01367 | 2.042558 | 606956.0 | 14.89216 |

| Minimum | −0.971521 | 10.37015 | 1.133224 | 58457.76 | 12.43639 |

| Std. Dev. | 0.092004 | 0.181216 | 0.229573 | 177414.9 | 0.719693 |

| P.V. Assessment | Level | . | |||

| Variables | SC | SC | |||

| lnLC | −2.476986 | 2011 | lnLC | −6.399919 *** | 2008 |

| lnGDP | −3.901480 | 1996 | lnGDP | −6.122386 *** | 2008 |

| lnREC | −2.684303 | 2010 | lnREC | −7.757725 *** | 2001 |

| lnTI | −2.087935 | 2018 | lnTI | −9.564790 *** | 2019 |

| lnIM | −1.965517 | 1996 | lnIM | −13.43329 *** | 1988 |

| ZA Test | Level | ||||

| Variables | SC | SC | |||

| lnLC | −2.949537 | 1993 | lnLC | −5.968805 *** | 1993 |

| lnGDP | −2.619507 | 1996 | lnGDP | −5.318506 *** | 2007 |

| lnREC | −3.487440 | 1998 | lnREC | −6.780444 *** | 1991 |

| lnTI | −1.903031 | 2014 | lnTI | −6.392394 *** | 1998 |

| lnIM | −2.568962 | 2009 | lnIM | −5.483452 *** | 1997 |

| Test ‘Statistics’ | |||||||

|---|---|---|---|---|---|---|---|

| 6.904689 | −4.712924 | 7.347993 | |||||

| critical values | ‘1%’ | ‘5%’ | ‘10%’ | ||||

| 3. | 5. | 2.86 | 4. | 2. | 3. | [46] | |

| −3. | −4. | −2. | −3.99 | −2. | −3. | [43] | |

| 3. | 5. | 2. | 4. | 1. | 3. | [45] | |

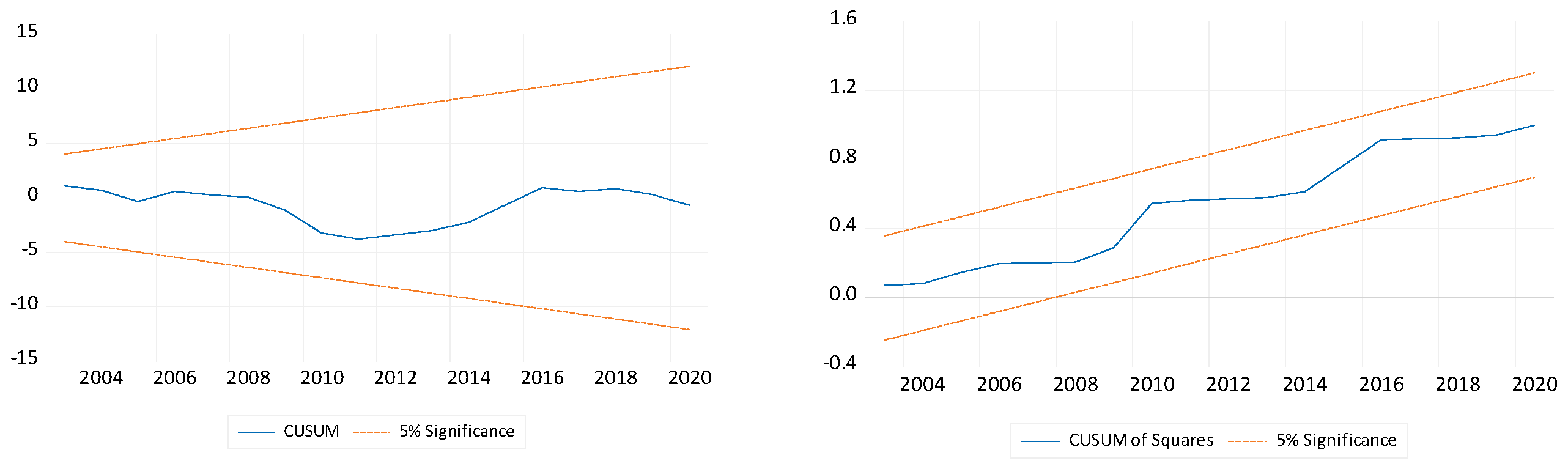

| Diagnostic | |||||||

| Tests | Tests | ||||||

| Rams | 1.444687 | 0.1667 | ARC | 0.157629 | 0.6942 | ||

| Normalit’ | 1.873994 | 0.3918 | Heteroskedasticit | 1.344302 | 0.2737 | ||

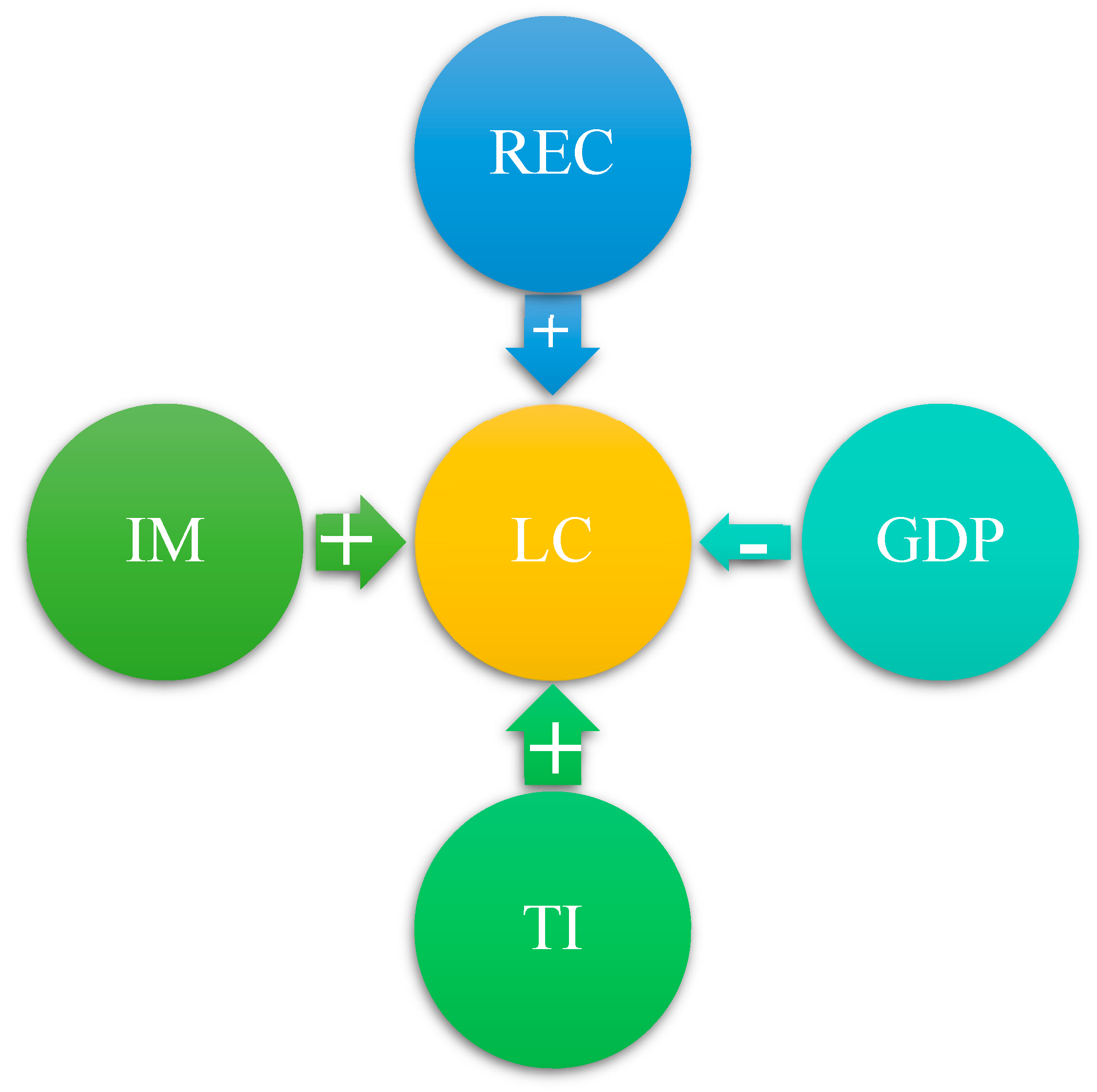

| Variable | Coefficient | . | Prob. | |

|---|---|---|---|---|

| Short term | ||||

| lnGDP | −1.514703 *** | 0.421614 | −3.592632 | 0.0021 |

| lnREC | 0.263253 *** | 0.061561 | 4.276310 | 0.0005 |

| lnTI | 0.102612 | 0.090170 | 1.137992 | 0.2700 |

| lnIM | 0.359209 ** | 0.130039 | 2.762324 | 0.0128 |

| Long term | ||||

| lnGDP | −2.128675 *** | 0.389068 | −5.471218 | 0.0000 |

| lnREC | 0.369961 *** | 0.032510 | 11.37996 | 0.0000 |

| lnTI | 0.144205 ** | 0.054742 | 2.634267 | 0.0168 |

| lnIM | 0.504811 *** | 0.105952 | 4.764546 | 0.0002 |

| −0.711571 *** | 0.107131 | −6.642070 | 0.0000 |

| Causality | p-Value | |

|---|---|---|

| GDP→LC | 7.71175 | 0.0089 |

| LC→GDP | 0.02474 | 0.8759 |

| REC→LC | 6.62543 | 0.0146 |

| LC→REC | 0.14208 | 0.7086 |

| TI→LC | 0.35140 | 0.5572 |

| LC→TI | 2.22689 | 0.1448 |

| IM→LC | 6.78676 | 0.0135 |

| LC→IM | 1.13586 | 0.2940 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Samour, A.; Mehmood, U.; Radulescu, M.; Budu, R.A.; Nitu, R.M. Examining the Role of Renewable Energy, Technological Innovation, and the Insurance Market in Environmental Sustainability in the United States: A Step toward COP26 Targets. Energies 2023, 16, 6138. https://doi.org/10.3390/en16176138

Samour A, Mehmood U, Radulescu M, Budu RA, Nitu RM. Examining the Role of Renewable Energy, Technological Innovation, and the Insurance Market in Environmental Sustainability in the United States: A Step toward COP26 Targets. Energies. 2023; 16(17):6138. https://doi.org/10.3390/en16176138

Chicago/Turabian StyleSamour, Ahmed, Usman Mehmood, Magdalena Radulescu, Radu Alexandru Budu, and Rares Mihai Nitu. 2023. "Examining the Role of Renewable Energy, Technological Innovation, and the Insurance Market in Environmental Sustainability in the United States: A Step toward COP26 Targets" Energies 16, no. 17: 6138. https://doi.org/10.3390/en16176138

APA StyleSamour, A., Mehmood, U., Radulescu, M., Budu, R. A., & Nitu, R. M. (2023). Examining the Role of Renewable Energy, Technological Innovation, and the Insurance Market in Environmental Sustainability in the United States: A Step toward COP26 Targets. Energies, 16(17), 6138. https://doi.org/10.3390/en16176138