Abstract

Amidst the ongoing European energy crisis, the EU has proposed a legislative package to enhance gas independence from Russia, diversify energy supplies, and increase renewable energy targets. However, the urgency for energy security has led some countries to prioritise gas independence over decarbonisation, potentially sacrificing or delaying EU targets. Considering this framework, this article contributes to the body of knowledge by examining the electricity mix of the six most significant EU countries in terms of generation capacity, considers their alignment with 2025 energy transition goals, and analyses the latest legislative trends to evaluate their compatibility with EU objectives. The findings from these analyses indicate that EU members are currently prioritising gas independence, which has led to re-starting or extending the lifespan of coal-fired power plants and an increasing interest in nuclear energy as a low-carbon alternative. These findings have significant implications as they reveal how countries are being steered away from their pre-crisis energy transition paths, resulting in the formation of new perspectives for both the short and long term.

1. Introduction

The ongoing energy crisis in Europe has compelled the European Union (EU) to take new measures in hastening the transition towards a secure and sustainable energy system, free from external vulnerabilities. The EU has experienced an unprecedented surge in electricity prices, primarily due to the Ukraine war, which led to a sudden decline in the availability of Russian supplies [1]. Prior to the conflict, 43% of total natural gas imports originated from Russia [2], a percentage that had been rising as EU countries shifted from coal to natural gas for decarbonisation purposes [3]. Initially viewed as a transitional fuel [4], the EU’s energy transition plan did not account for a reduction in natural gas usage. However, the current situation requires a shift away from Russian gas, ensuring energy independence and fostering stability and security in energy markets.

The EU introduced the REPowerEU package as a new energy policy initiative [5]. It aims to complement existing efforts in energy transition and decarbonisation by enhancing energy independence, diversifying gas supply, and expanding renewable energy targets. The urgency of the situation, combined with the REPowerEU package, is driving EU Member States (MSs) to swiftly implement actions and measures, potentially paving the way for a more sustainable energy system. However, some of these measures are controversial and could hinder the decarbonisation process, as discussed in [6], where electricity markets are analysed from an economic perspective, highlighting the possibility of a resurgence of coal usage. Moreover, Ref. [7] analyses CO2 emissions in 2022, revealing a trend towards transitioning from gas to coal, leading to increased emissions from coal that offset the reductions achieved through natural gas.

Considering the environmental deterioration caused by climate change [8], it is crucial not to overlook this aspect. As emphasised in [9], the successful deployment of a new energy system heavily relies on the policies implemented in individual countries. Hence, understanding the current energy situation and legislative trends in EU countries is paramount for shaping the future. While [10] analyses low-carbon pathways globally, it addresses Europe as a whole without delving into specific country initiatives. Similarly, Ref. [11] addresses the conflict between energy security and decarbonisation, but it does not examine the actual situation in the EU and its countries; instead, it focuses on potential new policies to tackle the challenges. Additionally, Ref. [12] proposes solutions and alternative paths for the energy crisis in Europe but does so based on the analysis of a single country, without considering the overall situation in the EU. The same applies to [13], which focuses solely on the challenges faced by Italy. To bridge this gap and offer a comprehensive understanding of the energy situation in Europe, this article aims to analyse initiatives and policies in multiple countries using consistent methodology, thereby providing detailed insights without losing sight of the broader context. As of now, no study has thoroughly examined the initiatives of various countries to assess whether current policy trends could potentially jeopardise energy transition and decarbonisation goals.

To achieve this aim, the study begins by examining the current electricity mix in different countries and comparing it with the pre-crisis decarbonisation targets. For a comprehensive overview, we focus on the EU countries that contribute significantly to the EU-27 electricity generation capacity. By comparing the current situation with the pre-crisis targets, we can identify the actions that would be or would have been necessary to achieve those objectives, which have been impacted by the energy crisis. Subsequently, we conduct a detailed analysis of the new initiatives and policy trends in the studied countries to assess their alignment with the EU framework. Therefore, the main contributions of this paper to the existing knowledge are as follows:

- Analysis of the current electricity mix situation, comparison with objectives stated before the energy crisis, and evaluation of actions that would be or would have been required to meet the objectives.

- Compilation and interpretation of the latest policies initiatives emerging from the energy crisis and the Russian gas dependence.

- Identification of strategic paths and associated technologies for the fulfilment of countries’ objectives.

- Evaluation of the likelihood of meeting global decarbonisation and energy independence targets considering the new initiatives aiming at ensuring security of supply.

The rest of the paper is organised as follows. Section 2 exposes the methodology followed in the paper to evaluate current and future energy trends. Section 3 depicts nowadays’ energy mix and decarbonisation targets, and Section 4 presents an introduction to the energy crisis and its causes. Countries’ policy trends, actions and initiatives consequence of the crisis are detailed in Section 5, and in Section 6 we carry out a discussion on how the latest policy changes modify the energy framework and whether this modification is aligned with decarbonisation and independence objectives. Lastly, Section 7 exposes the conclusions of this work.

2. Methodology

As commented on in the previous section, the first step for carrying out the proposed analysis was to tackle the current capacity mix of the relevant EU-27 countries. This was achieved by gathering data on generation plants available in the Transparency Platform (TP), a platform created by ENTSO-e to share all available data on European power systems [14]. In this platform, up-to-date information regarding generation capacity per technology, bidding zone demand, transmission capacity, and power plant outages among others can be retrieved. This paper collected, analysed, and summarised the data from the TP during autumn and winter 2022, and therefore the situation here exposed as “current” is that which existed at the end of 2022.

The current situation, understood as countries’ energy mix obtained from the TP data, is compared with the objectives gathered by the Ten Year Network Development Plan (TYNDP) [15] in 2020 for 2025 considering environmental EU goals and National Energy and Climate Plans (NECPs), that is, in their National Trends scenario. In the TYNDP, the target energy mix per country appears and is taken as reference for the comparison with the current situation. The TYNDP and the TP, however, do not have a common classification for generation technologies and therefore it is required to group different generation technologies to allow for comparison. As the objective of this paper is to gather a general overview illustrative enough to elaborate a detailed discussion, generation technologies are grouped as exposed in Table 1. These generation technologies account for 97% of total generation capacity in the EU. Due to the complexity of TYNDP technology groups, their description is available in Appendix A.

Table 1.

Classification of generation technologies: Nomenclature used in this paper vs. TP and TYNDP.

Following the comparison between the current situation and the objectives of the TYNDP, the most recent legislation and policy initiatives are considered and analysed. At this point, an analysis of the causes of the energy crisis is also carried out in order to identify the policy trends that address them more precisely. This analysis is carried out through a literature search including articles from 2022 and the beginning of 2023 related to the aforementioned topic. After this bibliographic analysis of the causes of the energy crisis, a bibliographic search is also carried out in which the initiatives from the EU and laws and proposed laws from the countries analysed are collected, as well as the economic incentives related to energy investment and the decisions to commission/decommission power plants from the beginning of the energy crisis, in 2021, until the beginning of 2023. Based on the collected data, strategic trends are identified and a discussion is carried out to appreciate whether these will modify the previously foreseen energy system and market and if it will be possible to achieve both decarbonisation and energy-independence objectives.

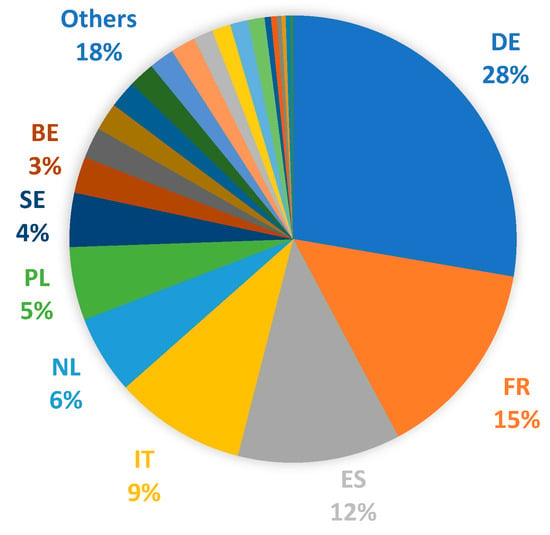

The EU framework analysed in this paper is constituted by 27 countries. As mentioned before, the ones more relevant from the point of view of generation capacity were chosen to carry out the proposed analyses. Considering the interconnectivity between them in the union framework, these allow to generate a general overview of the situation in the EU. To choose the specific countries, a threshold of 5% was selected: those countries which own more than 5% of the total generation capacity in the EU were analysed. Figure 1 illustrates this share of capacities, which was obtained through TP data. The ones with more than 5% are Germany (DE), France (FR), Spain (ES), Italy (IT), The Netherlands (NL), and Poland (PL).

Figure 1.

Share of generation capacity in the EU-27.

3. Current Situation

Current generation capacities for each country are gathered from TP and capacity objectives for 2025 are obtained from the TYNDP National Trends scenario [16]. Table 2 shows these capacities and the percentual difference between both of them. This section depicts the relative positions of the countries in comparison with 2025 targets.

Table 2.

Generation capacities: current and TYNDP 2025 forecast.

For gas generation, all countries have more gas capacity than the stated objective for 2025. The amount of gas plants that would need to be decommissioned is significant, reaching 46% in Poland. Regarding coal, the situation is slightly different. Germany and France would still need to decommission an important part of their coal power plants. France decided to close all of them, whereas Germany still would need to reduce its capacity by 69%. In contrast, Spain and Poland have almost reached their objectives and The Netherlands has already less coal generation capacity than initially stated. This is due to the Dutch government’s plan to phase out all coal power plants by 2030, which was decided by the end of 2021 [17]. The oil case is more similar to the gas one, as most countries would still need to decommission an important part or even all of their oil-burning facilities. For nuclear generation, almost no change is foreseen for 2025 in France, Italy, The Netherlands, Poland, and Spain. However, Germany stated as an objective the decommissioning of all its nuclear power plants according to the amendment performed on its Atomic Energy Act on 30 June 2011 to gradually phase out nuclear power generation by the end of 2022 at the latest [18].

Regarding renewable energies, which include wind, solar, and hydro generation, Germany and France would need to significantly increase their generation capacity in all the technologies to reach pre-energy crisis 2025 objectives. Italy would also require installing more wind and solar power plants, increasing solar capacity by 416%. This figure depicts the deceleration in Italy’s renewable energy plans. The policy implemented before 2014 placed it as the second EU country in the deployment of renewable capacity generation. However, there is currently a dismantling of the support scheme for renewable energies focused mainly on photovoltaics (PV) [19] which has caused the country to fall behind their objectives on solar energy. Italy’s position is however different for hydropower. Hydro generation has been historically important in the country and covers approximately 15% of the total demand [20]. Therefore, Italy has continued to invest in this technology, creating 172 new hydro implants between 2018 and 2020 [21,22] and surpassing initial expectations. The Netherlands is more advanced in its renewable energy plans, with wind capacity already at the target level and more solar capacity than expected to balance the rapid phase-out of coal facilities. Indeed, The Netherlands’ solar market is rapidly growing, having deployed almost 3 GW of PV systems only during 2020 as a consequence of schemes such as the SDE+ (Stimulering Duramen Energieproductie), which is the main driver for planned and contracted PV capacity in the country [23,24]. Poland is also in a favourable position regarding renewables, having surpassed stated objectives for all technologies. Actually, renewable energy sources’ capacity increased by 31% only in 2021. The highest increase is in prosumer PV, which accounts for almost 80% of total installed PV capacity [25]. This increase is a consequence of strong regulatory support that includes subsidies, net metering, direct tax reduction, and offset of personal income tax [26]. The case of Spain is more similar to the Italian one, with less generation capacity than foreseen in the wind and solar sectors and more in hydropower. Hydropower in Spain is also historically important given the country’s terrain and a large number of existent dams [27], although in 2021 more than 100 dams were demolished as part of the national strategy for the recovery of rivers, which doesn’t support the promotion of this type of installation in the country [28,29]. Regarding solar and wind power generation, Spain was formerly a pioneer country in their adoption but has also carried out a dismantling of renewable energy policies, falling behind the objectives stated during the peak policy support period [30].

With this analysis it is possible to appreciate that although countries were doing an effort towards decarbonisation before the energy crisis by dismantling fossil fuel-fired power plants and implementing renewable energy sources, most of them were still a long way from 2025 objectives.

4. A Switch on the Foreseen Way: Energy Crisis and Policy Reaction in Europe

The beginning of the energy crisis in Europe can be placed in mid or late-2021. By that time, global economies were recovering from the COVID-19 pandemic which caused a low demand, and therefore low supply and energy prices. The fast economic recovery in countries created a rapid increase in energy demand that disrupted a supply side still not recovered from the pandemic. This crisis, which also generated supply chain disruptions and high volatility, affected mainly the oil and natural gas markets [31]. Simultaneously, France started to unexpectedly shut-down nuclear reactors due to security issues, which aggravated the energy crisis in Europe [32]. In late 2022, France still had 32 of its 56 nuclear reactors shut down due to corrosion, small cracks in cement works, or maintenance [33]. This situation already created stress in the electricity market in Europe, drastically increasing electricity prices and market uncertainty. Moreover, the gas storage levels were at their lowest 10-year filling level, creating a higher risk from the existent uncertainty [34]. The framework worsened at the beginning of 2022 with the deployment of Russian troops towards Ukraine. Several countries started negotiations to avoid a war situation but this did not solve the Russia–Ukraine crisis, and the United States responded by imposing sanctions on the Nord Stream 2 gas pipeline, which directly connects Russia with Germany for natural gas supply [35]. On February 24, Putin announced the invasion of Ukraine, and in March the United Nation members voted to condemn Russia’s offensive [36]. As a response to Russia’s invasion of Ukraine, the EU adopted several packages of sanctions which included restrictions on economic relations, economic sanctions covering the finance, energy, transport, and technology sectors, prohibition on transactions with the Russian central bank, prohibition on all transactions with state-owned enterprises, prohibition on new investments in the Russian energy sector, prohibition on import of coal, closure of ports to Russian vessels, etc. [37]. These sanctions directly affected the trading in natural gas between Russia and Europe. In 2021, Russia supplied the EU with more than 40% of its total gas imports, and some countries, such as Slovakia, had a dependence of almost 80% on oil imports from Russia. For this reason, the sanctions were likely to increase the consequences of the existing energy crisis [38]. The described situation did indeed cause an important impact on the electricity market, with a 500% increase in wholesale electricity prices from 2021 until mid-2022 [39].

Until now, the EU based its energy landscape and planning on four policy packages:

- Energy Union Strategy [40]: Published for the first time in 2015, this strategy aims to provide secure, affordable and clean energy through five dimensions: (1) security, solidarity and trust, (2) integrating the internal energy market, (3) improving energy efficiency, (4) decarbonising the economy, and (5) enhancing research, innovation and competitiveness.

- Clean Energy for all Europeans [41]: Firstly proposed in 2016, this package generated laws to address energy efficiency and renewable generation, creating a binding target of 32% renewable energy sources in the EU’s energy mix by 2030 and an increase in energy efficiency by at least 32.5%.

- European Green Deal [42]: This package, adopted in 2019, aims to reduce 55% the greenhouse gas emissions compared to 1990 level by 2030 and make Europe the first climate-neutral continent by 2050.

- Fit for 55 [43]: Published in 2021, this package was generated to push and reinforce measures to achieve the 55% reduction goal by 2030.

These energy packages focus on the energy transition by encouraging the reduction in emissions through decreasing the use of fossil fuels, deploying renewable energies, and increasing energy efficiency. With the current energy crisis, a new policy package was announced in February 2022: REPowerEU [44]. This package is a response to the disruption caused in the energy market by Russia’s invasion of Ukraine. It aims at diversifying the energy supply, moving away from Russian dependence and modifying the transition path depicted before the energy crisis, also enhancing a stronger deployment of alternative energy sources [45]. The main energy proposals that appear in REPowerEU are:

- Natural gas supply diversification: To analyse the possibility to import more gas from other countries and evaluate new gas alliances as well as coordinate with other gas buyers.

- Boosting renewable energies: A new proposal for increasing the renewable energies target to 45%. Special focus on solar PV to install new 320 GW by 2025, creating an EU Solar Strategy and a European Solar Rooftop Initiative. Also, the EU will study the declaration of ‘go-to’ areas for a fast approval process for renewables deployment.

- Hydrogen promotion: A proposal for a target production of 10 million tonnes of domestic renewable hydrogen by 2030 and the creation of a European hydrogen bank.

- Biomethane: An initiative to boost sustainable biomethane production to 35 bcm by 2030.

- Increase the binding target in the Energy Efficiency Directive to 13%.

The application of this policy package will require an additional investment of EUR 210 billion between 2022 and 2027 compared to the investment for previous energy packages [5]. The EU suggest that the MS integrate the REPowerEU policies into their existing recovery and resilience plans (RRPs) to accelerate the energy transition [46]. Although the process for the modification of the RRPs has not been completed, MS are already taking measures and drafting a policy line focused on the mitigation of the impact of the energy crisis. However, as previously stated targets for decarbonisation are still valid, currently there are contradictory objectives appearing in some situations which require the implementation of trade-off solutions.

5. Countries’ Policy Trends

In this section, the current policy trends emerging in Germany, France, Spain, Italy, The Netherlands, and Poland are analysed to evaluate whether these policies are likely to fulfil the new REPowerEU and previous decarbonisation objectives.

5.1. Germany

Germany has developed an important dependence on natural gas imports from Russia, which supplied 55% of total German natural gas imports in 2020 [47]. Germany has now set the target to reduce natural gas imports from Russia to a maximum of 10% by 2024 [48]. To do so, the country has recently approved a package to reduce the consumption of gas. This package includes measures such as the diversification of gas supply and the reactivation of coal-fired power plants [49]. In fact, some hard coal-fired power stations have already restarted operations in August 2022 and the German government is preparing a regulation to restart also lignite-fired power plants which were shut down [50]. German’s energy policy is also considering the use of oil-fired power plants although it is currently not its main focus [51]. Despite these actions, natural gas will not go out of the picture for the German energy system. The country has started (in December 2022 and January 2023) the operations of two new floating liquified natural gas terminals for the import of natural gas and four more are planned to be completed by the end of 2023 [52].

The debate has been more intense in the field of nuclear power. As exposed in previous sections, Germany had the objective to decommission all nuclear power plants by the end of 2022. However, the energy crisis caused the government to announce its plan to keep two of the three existing nuclear power plants online at the beginning of September 2022 [53]. This lifetime extension was concluded in April 2023, when all German nuclear power plants were finally shut down [54].

Regarding renewables, in April 2022 the government launched a comprehensive legislation package called the “Easter package” which revises the following acts aiming to accelerate the transition to renewables: the Renewable Energy Sources Act, the Offshore Wind Energy Act, the Industry Act, the Federal Requirements Plan Act, the Grid Expansion Acceleration Act, and further laws and ordinances in the field of energy legislation [55]. As objectives the “Easter package” sets the achievement of 80% renewable power in the mix by 2030 and 100% by 2035, with an onshore wind capacity of 115 GW and 215 GW of PV by 2030. The policies supporting the deployment of renewables include freeing up new land for green power production, speeding up permit procedures and grid connection, higher remuneration and subsidies for PV generation, new distance rules for onshore wind plants, and reduction in financing needs for offshore wind [56]. The “Easter package” also includes incentivisation measures for the production and use of biomethane in highly flexible plants although the use of biomass for power production will be superseded by its direct use in transport and industry. Although the policy regarding hydrogen and biogas enhancement has not been a special focus of interest in this last package, Germany is planning to import green gas from third countries such as Canada [4]. In addition, Germany has recently commissioned the biggest green hydrogen plant (8.75 MW) in the country [57].

Germany is making an effort to gain independence from Russian gas although it is currently still relying on emitting energy sources such as coal and gas from different countries. Policy support has been developed to deploy solar and wind generation which will probably grow in next years and alleviate the situation.

5.2. France

The French National Assembly has recently approved a package containing several measures focused on energy tariffs and energy security. The text proposes action in natural gas infrastructure investment by building new floating LNG import terminals to be commissioned over 2023 [58]. The French government is also planning to re-activate abandoned pipelines to send natural gas to Germany and to strengthen the interconnection capabilities with other countries [59]. Also, regarding the operation of natural gas power plants, the state can order them to function under the orders of designated operators and is enhancing operators to fill gas storage and build security stocks [60]. For coal, the French government is planning to re-start a coal-fired power plant in north-eastern France which was already closed. Nonetheless, the government claims that these modification in the decommissioning process of coal power plans will not affect the complete phase-out of coal-fired power plants expected by 2025 [61].

The energy crisis is also being tackled by a more intense use of the available nuclear power plants at the moment. In fact, the French Nuclear Safety Authority granted a temporary waiver allowing five nuclear plants across the country to dispense more than the authorised amounts of hot water into rivers, breaking the established environmental rules [62]. Although this allowance lasted only a few days, it is a symptomatic demonstration of the priority of energy welfare over environmental protection.

For the future, the government proposes to rapidly exit gas, coal, and oil energy production by building new nuclear power plants. The latest proposal performed is the construction of six new nuclear reactors and the study for the possible development of another eight reactors [63]. The French energy ministry also tried to persuade the EU to include nuclear among energy sources for the production of the so-called green hydrogen [64]. However, the EU defined renewable or green hydrogen as that derived from renewable sources, granting different names, and therefore different funding opportunities, to hydrogen coming from other sources such as nuclear [65,66].

Concerning renewables, France is encountering difficulties in their deployment, and investments are at risk due to inflation and higher commodity costs [67]. In [68] it is claimed that 13 GW of renewable energy projects may not go ahead because of the current economic environment. To address this issue, in August 2022 the French Energy Regulatory Commission published a modified version of all the specifications for two calls for tenders aiming to accelerate the commissioning of 6 GW of renewable production including wind, hydroelectric, and self-consumption [69]. These modifications included the possibility for the new installations to sell electricity directly on the market for 18 months and that projects can increase their capacity by 40% before their completion. Nonetheless, these measures do not tackle general renewable deployment but only specific tenders, and measures for the enhancement of renewables have not been announced during recent months. The industrial network in France is also reacting to the proposal of defining ‘go-to areas’ from the EC with moderate enthusiasm, proclaiming that the idea is well-intentioned but drawing on a bad intuition and pointing out the difficulty of its implementation due to complex procedures related with the urban development law [70].

In summary, France is pushing hard towards the deployment of more nuclear power plants to reach decarbonisation while building a stronger gas infrastructure to exchange gas and future hydrogen with other countries, while the deployment of renewables is currently not a policy support focus.

5.3. Spain

Spain’s natural gas imports accounted for 30% of total Europe liquified natural gas (LNG) imports in 2022; 20% of what the country received was exported directly to the EU [71]. This gas mainly came from North Africa and the United States. The Iberian country also accounts for one third of the total storage and regasification capacity of Europe, although the interconnection with the rest of the continent limits the usage of these resources [72]. For this reason, the Spanish government has created a plan to increase the export capacity with other EU countries [73]. This plan includes the restart of a regasification plant in January 2023, the increase in the compression capacity of current pipelines to France, boosting supply to Italy through small LNG vessels, and new gas pipelines to France and Italy [74]. Given the relatively favourable gas situation of Spain, no change in the Spanish policy is foreseen neither regarding the closure of gas-fired power plants nor of oil-fired plants; it will continue with the plan foreseen before the REPowerEU package. For coal, the Spanish government is modifying the decommissioning plan of one of its most important coal-fired power plants due to the energy situation, closing only two of the planned four generation groups [75]. A coal-fired plant of 589 MW, which was also on its way to definitive decommission, was put into activity to avoid a higher increase in the electricity price during 2022 [76]. Regarding nuclear power, Spain currently has seven nuclear reactors. All of them are planned to be decommissioned between 2027 and 2035 [77]. Although there are voices in the government requesting to consider an extension of the lifetime of the plants [78], the government reaffirms that the option of prolonging the operation of nuclear power plants is not on the table [79].

In terms of renewable energies, in May 2022 Spain approved a new package of measures to boost green energies including solar, wind, and hydrogen technologies [80]. This package includes a new regulatory framework for floating PV, regulations for the renewable gases’ pipelines, the release of 10% of grid access capacity to absorb 7 GW for renewables under a self-consumption regime, and an accelerated temporary process until the end of 2024 to obtain environmental approval of new wind and solar parks. Spain is also planning to prepare the network for the connection and integration of renewables to achieve 70% in 2026 and also to multiply the production of renewable gases by 4. These measures, which address not only solar and wind generation but also hydrogen and green gases, are a reflection of the interest of Spain to build a gas infrastructure and become an hydrogen hub in the future [81]. In June 2021 a new Royal Decree-Law was published in which a promotion of self-consumption including storage capacity appeared and where subsidies were defined for different types of consumers, from big enterprises to individuals and public administrations [82].

Regarding hydro power, the Spanish government is drafting a regulatory plan to guarantee the existence of investments in hydro power plants at the end of the license awarded to current management enterprises to assure their continuity [83]. The strategy to foster energy transition focuses on the development of pumped storage facilities. However, these storage plants have to undergo a process restricted by the national plan for the recovery and maintenance of rivers, and projects which introduce new obstacles to the water flow are being rejected [84]. Indeed, the national plan for the recovery of rivers will probably cause a decrease in the installed capacity of hydro power given the current trend of demolishing damns, in which Spain is in the European lead position [85].

These policy trends outline the interest of Spain to become a green gas hub in Europe, being able to generate green hydrogen from renewable energy sources and exporting them to the rest of Europe. The Spanish government is also strongly supporting the deployment of renewables with new incentives including storage and pumped storage, which will allow to create the needed flexibility in the system.

5.4. Italy

Italy is a strong gas-burning country 45% of whose total gas imports came from Russia before the Ukraine conflict [86]. As a consequence of the crisis and the increasing electricity prices, in February 2022 the Italian government approved a decree to maximise the production of thermoelectric power plants with a capacity higher than 300 MW [87]. This plan envisions a 25% increase in the production of six coal and one oil power plant. Nonetheless, Enel, the biggest energy company in the country, is considering the possibility to convert coal-fired power plants to gas [88] and a new combined cycle power plant is planned for completion by 2025 which will be able to be fired with up to 30% of hydrogen [89]. This increase in the gas capacity would be possible thanks to the gas supply diversification effort of the government. There is already an agreement to increase the gas supply from Algeria, which will become the main exporter to Italy, and also an agreement with Egypt to provide LNG [90].

Regarding nuclear energy, the situation in Italy is complex due to the historical opposition of the population to nuclear power. There was a strong anti-nuclear movement in the country in the 1980s as a consequence of worldwide accidents [91]. A referendum was carried out in 1987 which resulted in the decommissioning of the five nuclear power plants that Italy had. Despite the nuclear debate having been re-opened between 2005 and 2008, a new referendum in 2011 rejected nuclear power with 94.9% of the votes [92]. Nonetheless, nuclear power is in the political plans of several parties [93], and the government has identified 14 possible sites for the commissioning of new nuclear power plants [94]. Indeed, companies with expertise in the nuclear field have already signed a letter of intend to analyse new nuclear developments in Europe including also Italy [95].

For renewables, Italian’s RRP establishes the achievement of 70 GW of renewables for 2026 as an objective [96]. However, nowadays Italy’s renewable capacity is 33 GW and has been growing the last six years at a rate of 0.85 GW per year [97]. The 2022 budget for the country included incentives for citizens for the energy re-qualification of buildings and also for the installation of renewable energies, being able to obtain a subsidy of up to 50% for rooftop PV [98]. The Italian government also approved a renewable bonus for the installation of storage systems together with renewable energies, although the beneficiaries can only be individuals. Enterprises and energy communities can instead benefit from a PV incentive promote the deployment of solar power generation [99]. The national strategy for hydrogen provides some guidelines for the deployment of this energy carrier, and sets a 2030 generation capacity target of 5 GW [100]. To reach this objective, in January 2022 the Official Gazette published a bidding procedure for projects for the production and distribution of green hydrogen [101] and in February 2022 the Italian government announced that it will execute a program agreement with the National Agency for New Technologies, Energy and Sustainable Development covering research and development activities on hydrogen through the RRP funds.

According to these policy trends, Italy is currently employing other emitting energy sources to compensate for the high price of gas, while it is approving measures for renewables, mainly focused on solar energy.

5.5. The Netherlands

The Netherlands is putting an emphasis on the diversification of the gas supply. The country deployed two new LNG terminals in September 2022, which were supposed to double its importing capacity [102]. Despite these efforts in obtaining gas at a lower price, The Netherlands is also currently opting to increase the operation of its coal-fired power plants. The government has recently removed the 35% production cap on these plants [103] and is extending the lifetime of some coal-fired power plants longer than planned [104]. Nonetheless, the government reaffirms that all coal-fired power plants will be shut down before 2030. For nuclear power, the Minister of Climate and Energy has recently announced plans for the construction of two new nuclear power stations [105] and for extending the lifetime of existing nuclear plants to 2033 [106]. These nuclear initiatives appear in the country’s budget, were funds are being set aside for the construction of the new nuclear power plants [107].

Regarding renewables, the Dutch government proposes aggressive renewable energies support strategies and is currently working towards having 21 GW of offshore wind energy operational by 2030 [108]. There are already projects under construction off the coast which include 1.5 GW of wind, 1 MW of floating solar panels, and a platform to convert electricity to hydrogen [109]. To promote individuals’ self-consumption, the VAT rate on residential solar panels has been lowered down to 0%, and the SDE++ scheme for 2023 is subsidising companies and organisations that increase their renewable energy production or implement CO2 reduction techniques [110].

Hydrogen also appears as a strong energy vector in Dutch initiatives. The Netherland’s current objective on hydrogen production capacity is 500 MW by 2025 and 3–4 GW by 2030 and, to reach it, the government is launching initiatives for the regulation of the hydrogen market, market development, and infrastructure [111]. Also, some of the offshore wind capacity is planned to be directly used for large-scale green hydrogen production [112]. The Netherlands is working not only to produce hydrogen but also to import it and supply it to other European countries. Indeed, the country has already signed a memorandum of understanding to establish a green hydrogen supply chain between Ireland and Europe through the Port of Amsterdam [113].

Therefore, The Netherlands is employing coal-fired power plants for the moment waiting for the deployment of new sources including nuclear power and renewable energies together with a hydrogen market and infrastructure.

5.6. Poland

At the beginning of 2022, Poland was planning to double the capacity of its gas-fired power plants to stop its dependence on coal and construct a transition path before switching completely to nuclear and renewables [114]. Several gas turbines are under construction [115], some of them to be commissioned in 2025 [116]. To ensure gas supply, Poland has been increasing imports of LNG from Qatar and the United States and has opened the Baltic Pipe in October 2022, connecting the country directly to Norway [117,118]. However, during 2022 coal-fired generation was cheaper than gas-fired generation, which resulted in an increase in the use of coal-fired capacity and the commission of a new unit of a lignite-fired power plant [25]. In fact, Ref. [119] analyses the investment in natural gas in Poland and reaches the conclusion that gas investments are not economically justified in the economic climate at present, suggesting that the coal phase-out may be treated flexibly at the current stage.

Regarding nuclear power, Poland plans to build six nuclear energy reactors [120]. In order to accelerate the implementation of these nuclear power plants, the Council of Ministers has recently amended a law to ease nuclear energy investments [121].

For renewables, Poland has been Europe’s fastest growing solar PV market during recent years [122]. Nonetheless, the government implemented new regulations in April 2022 which make home installations more complex and financially less attractive and which have caused a decrease in the demand for solar panels [123]. The government is also planning to develop the first offshore wind farm of the country at the Baltic coast. Specifically, a 1.2 GW offshore project is under construction 23 km north of the coastline which will be commissioned in 2026 [124]. However, general developments of wind farms are inhibited by the regulatory framework and the forecast for increasing internal grid connectivity may be a barrier for the deployment of this type of renewables [125]. Hydroelectric power has also been a topic of interest during recent months. The Polish government announced investments to convert existent hydroelectric plants into pumped storage facilities [126] and works have been resumed on what will be the largest hydroelectric plant of the country, which will also be reversible [127].

Apart from its reputation as coal-fired country, Poland is also the third country in Europe and the fifth in the world in the production of hydrogen, although it is not green. The Council of Ministers has recently adopted the “Polish Hydrogen Strategy until 2030 with Outlook until 2040”. As a consequence, plans and funds are set aside for the first hydrogen production plant [128]. The green hydrogen which could be produced in Poland is especially attractive since it can be one of the most competitive in Europe together with hydrogen from Sweden, Croatia, and Ireland [129]. The government is also introducing the hydrogen vector in the new gas-fired power plants of the country, some of them being planned to be able to run entirely on hydrogen in the future [117].

From these developments, it can be concluded that Poland has drawn a transition path which starts with gas-fired power plants, which is uncertain, but which will continue with nuclear and renewables.

6. Discussion

This section discusses the previously described countries’ actions and legislation trends considering decarbonisation and energy independence objectives. The objectives of the EU relative to the electricity sector supply which appear in its energy policy packages can be very briefly summarised as:

- Reduction in emissions by decommissioning fossil fuel-fired power plants.

- Generation of green electricity through the deployment of renewable energies.

- Generation of green fuel such as hydrogen and biogas to support the decarbonisation of different sectors, including the electric one.

Table 3 exposes a qualitative evaluation for each country and energy generation technology regarding whether policy trends on these technologies are aligned with the EU energy packages. The topics at hand were thoroughly examined through an extensive discourse among the paper’s authors. They have drawn upon their individual experiences and the insights gained from direct research related to the submitted article. One author’s expertise lies in energy management, energy mixes, the environmental impact of energy, and sustainability aspects, while another has contributed knowledge on public and private funding streams and projects pertaining to energy management and exploitation. The third author has provided valuable insights into the European Union’s interests in driving research initiatives. The last two rows of the table indicate the main objectives of the EC, decarbonisation and energy independence from Russia, and the evaluation on whether, based on the trends for the rest of the technologies, these objectives are likely to be achieved or not. The legend of the table is available as table footer. The legend is a qualitative categorical classification, grouping tendencies and initiatives in three different states to appreciate the alignment of countries’ paths with EC objectives. Also, and despite the EU not defining a specific position regarding nuclear power, this technology has been included in the analysis adding a scale whose meaning can also be found in the footnotes. The following paragraphs discuss the findings that can be obtained from Table 3.

Table 3.

Alignment evaluation of countries’ policy trends with EU energy packages 1,2.

Given the current energy situation and the significance of gas supply as a crucial concern in the EU, a clear conclusion drawn from the policy analysis is that most countries are prioritising the avoidance of using gas from Russia, even if the actions taken result in higher emissions compared to the gas alternative. This can be observed in Table 3, specifically in the “coal” row; it was foreseen in [6] and can be confirmed with the information gathered in this paper. It is evident that, apart from Poland, all countries are opting to extend the lifespan and maximise generation from coal and lignite-fired power plants or are even reactivating mothballed units to rely on this more affordable energy source. Conversely, Poland is taking a different approach by currently commissioning new gas-fired power plants to steer clear of coal usage.

A common trend observed across all countries, evident in the last row of Table 3, is the concerted effort to diversify gas supply and enhance gas connectivity with other regions. Despite the need to diversify gas supply having been raised before the energy crisis [130], only when the crisis began took an increasing effort to diversify gas supply [131]. This is particularly pronounced in France, Spain, Germany, and The Netherlands, where they are actively developing new LNG terminals and planning for additional gas pipelines. While these measures contribute significantly to the goal of achieving energy independence, they also pose a potential threat to decarbonisation objectives. The increased utilisation of energy sources that are more pollutant than gas results in higher emissions, which can undermine efforts to reduce carbon footprints.

Nuclear power has also experienced a change due to the current energy crisis. The objective for 2025 proposed in the TYNDP was the maintenance of current nuclear power plants or the decommissioning of all of them. However, France, The Netherlands and Poland are clearly planning the commissioning of new nuclear power plants, as can be seen in the “Nuclear power promotion” row of Table 3. The situation in Italy and Spain is more complex and uncertain, since there are diversified opinions and the continuity or the commissioning of new nuclear power plants depends on the specific political situation of the moment. Despite the commissioning of this type of power plants requiring time and the possibility of them not being completed by 2025, it is highly probable that the nuclear generation capacity of some countries will increase considerably by 2050. Extending the operation of nuclear power plants or introducing new reactors can lead to reduced emissions and promote decarbonisation, given that nuclear power is a low-carbon technology [132]. This is precisely why the “Decarbonisation” row in Table 3, which assesses the likelihood of achieving decarbonisation targets, shows positive outcomes for France and The Netherlands. France benefits from its robust nuclear support, which contributes significantly to its decarbonisation efforts. Similarly, The Netherlands shows promise due to its strong focus on renewables and recent momentum in adopting nuclear technology as part of its decarbonisation strategy. Indeed, nuclear power plays a crucial role in providing a stable base load and serves as a complement to intermittent renewable energy sources. However, and as mentioned in [133], it is essential to acknowledge that challenges persist concerning energy security and waste disposal. Aside from these aspects, achieving nuclear power independence remains a priority for countries as expressed in [134], considering that the fuel used in nuclear reactors is still sourced from third-party nations. For instance, while Spain possesses its own uranium reserves, it currently relies on imports from various countries, with Russia, Canada, Niger, and Kazakhstan being the main suppliers. This highlights the need for continued efforts to enhance energy security and establish sustainable solutions [134].

Regarding renewables, the approach followed by countries is more diversified and can be appreciated in Table 3’s rows “Wind generation”, “Solar energy”, and “Hydro power”. On the one hand, The Netherlands and Germany have presented strong policy support during recent years and will continue to do so in all renewable energy types. In fact, The Netherlands has already achieved the 2025 target and with the current strategy is likely to keep the sector growing. Poland has also prioritised a strong increase in renewables and specially in solar PV. Nonetheless, the country has now disincentivised solar PV investment and is trying to promote other types of renewables such as wind and hydroelectric generation. Spain, despite the deceleration of support policies wants to take action again and has proposed a wide package of measures to promote renewable energy deployment. In contrast, Italy which also suffered a deceleration in support policies, is carrying out some actions focused on solar energy although they might not be enough to achieve the stated 2025 target. All these countries initiatives are aligned both with decarbonisation and energy dependency objectives and try to achieve the more exigent objectives of the REPowerEU package. However, it is still unclear whether the implemented proposals will be more effective at accelerating decarbonisation compared to pre-existent plans and if the targets can be achieved through these measures [135]. Also, it has to be considered that the proposed rapid growth of renewable energies will face challenges in a not yet stable supply chain, which is not directly addressed in the proposed legislation packages [136]. On the other hand, despite France having implemented some measures to improve the situation of investment in renewable energies, it has not presented a clear strategy on how to accelerate the implementation of renewables to achieve the targets and is in a situation where it might be difficult to do so.

The objective of this article was to comprehensively analyse initiatives and policies in multiple EU countries and to evaluate whether current trends in energy policy could pose a risk to energy transition and decarbonisation goals. This approach provides a more comprehensive understanding compared to focusing solely on individual countries’ analyses or considering the EU as a whole with unique policy initiatives. Based on the findings and analyses presented, it appears likely that the EU will achieve energy independence from Russia in the near future, thanks to supply diversification and the activation of alternative power plants. However, achieving decarbonisation objectives proves to be more challenging and varies depending on each country’s specific strategy. This conclusion has been derived from a meticulous examination of various countries, representing diverse potential positions within the EU, thereby addressing the research gap that previously existed in the literature on this matter.

Looking at the detail of the countries analysed, Poland will probably reach decarbonisation later than stated by the EU due to its current movement towards gas as a bridge between its current coal situation and a future with renewables and nuclear power. In contrast, France is basing its energy strategy on nuclear power which does not cause emissions and thus is closer to the achievement of decarbonisation. Germany and Spain are currently relying mainly on the deployment of renewables to achieve decarbonisation and are generating a strong policy support strategy to speed up their implementation. Nonetheless, they require further developments to maintain system stability. This can be achieved by adapting the current infrastructure and deploying system flexibility measures by the intensive use of high-power electronic inverters with the renewable energy power systems and green hydrogen. Given the fact that green hydrogen and system flexibility are still at an early maturity stage, their full contribution to the energy system will be feasible only in the medium to long-term [137,138]. Therefore, coal-fired power plants, hydroelectric power, and nuclear power plants are still necessary to keep system stability. For Italy the achievement of decarbonisation objectives is harder than for other countries as it is not strongly supporting renewables nor another type of low-carbon energy source and the new government has not yet drafted a clear energy strategy. In contrast, The Netherlands is encouraging renewables with several incentives and is also planning the commissioning of nuclear power plants, and therefore may have a low-carbon economy soon enough to meet stated objectives.

7. Conclusions

This paper provides an analysis of Europe’s energy crisis. In response to the current geopolitical situation, the EU has introduced a new energy package called REPowerEU to achieve energy independence from Russian gas and increase renewable energy targets. However, attaining both energy independence and decarbonisation objectives has led to conflicting situations that each member state must address. In this paper, the current specific situation of the six most significant MSs in the EU from a generation capacity point of view has been analysed. The analysis shows that despite efforts in progressing toward the achievement of a secure and sustainable energy systems, their current energy mix is still considerably distant from EU and national plans’ objectives drafted in the pre-crisis stage. With the new energy crisis and more exigent targets regarding decarbonisation and independence, preferences have changed significantly. The latest legislative trends in the countries analysed lead to new strategic directions that can be captured in these general conclusions:

- The priority in EU countries is nowadays to gain independence from Russian supplies, even though achieving this causes negative effects on other objectives. This can be concluded from the fact that some countries prefer to re-start or extend the lifetime of coal power plants, creating more emissions, rather than continue a dependence on Russian gas.

- The prioritisation of energy independence and security of supply is modifying the electricity mix foreseen before the energy crisis. Since gas was foreseen as a transition gas, it had a crucial role in the way to decarbonisation. However, the sudden cut of this energy source from Russia is forcing countries to re-design their transition paths, investing in different energy sources or returning to more pollutant power plants.

- The accomplishment of decarbonisation objectives depends on the technologies promoted.

- o

- The promotion of renewables together with nuclear power provides a suitable framework to reach a low-carbon economy in the short to medium term, as concluded by several studies in the literature and also supported by the strategic paths chosen by some of the countries analysed.

- o

- The promotion of renewables without nuclear power currently implies the use of fossil fuel technologies since an adapted infrastructure, hydrogen, biogas, and flexibility options are not implemented at a large scale, as can be seen in the countries in which no nuclear power exists at the moment This makes it harder to achieve decarbonisation in the short-term but could allow to achieve it in the long-term if additional energy system measures are implemented.

- o

- From the two points above, it can be directly concluded that technological decisions based on day-to-day politics can affect how and when decarbonisation and energy independence goals are achieved.

- The path selected by each country depends on its historical background and supply infrastructure.

- o

- Countries with ease for the obtention of gas from different sources are more likely to still rely on this energy carrier. This has been seen in countries such as Italy, with a good connection to Africa; or in Poland, with a good potential connection with Norway.

- o

- Countries with a strong nuclear background, like France, are likely to continue with a nuclear strategy.

Given this overall picture, it becomes evident that achieving environmental sustainability in the short term is uncertain and will require a substantial shift away from fossil fuels. To expedite the journey towards sustainability, it is imperative to identify and implement viable alternatives. Hydrogen, biogas, and system flexibility offer promising support for renewable energy sources, which remain a key focus in the pursuit of sustainable solutions. However, their current maturity level limits their immediate capacity to fully bolster renewables, making them more suitable for medium to long-term implementation.

To progress towards a sustainable energy system, it is crucial to engage in discussions and establish a realistic energy mix for the short term. Promoting these desirable alternatives requires proactive efforts in creating the necessary market structures, developing robust infrastructure, and enacting supportive legislation to facilitate their rapid deployment. By embracing and accelerating the adoption of cleaner energy options, alongside continued encouragement of renewables, we can chart a course towards a greener future, where environmental sustainability becomes an attainable reality.

This study has presented evidence of the shifting energy landscape; however, it was not without its inherent limitations. One constraint is related to the data sourced from power plants, which might have certain delays due to data processing, data verification, and confidentiality processes. Furthermore, energy policies are highly dynamic and change with public opinion and as new events become known. Particularly during this energy crisis, it is challenging to predict the exact path that countries can take, which strongly dependents on day-to-day governmental decisions that affect the current and future energy mix. Although this study has indeed shed light on countries deviating from their previous plans, the current data and situation do not allow to state whether environmental objectives will be achieved. Nonetheless, the study has made it possible to conclude that environmental objectives are not the highest priorities for countries, and therefore they are not likely to be achieved if other critical factors appear on the way to decarbonisation. Nevertheless, despite the mentioned constraints, the research serves as a stepping stone for new research directions, such as delving into modelling the potential new European energy system, considering projected technological changes, and investigating the specific implications of these transformations.

Author Contributions

Conceptualisation, E.M.U., K.K. and L.R.; Funding Acquisition, E.M.U. and L.R.; Methodology, E.M.U.; Resources, E.M.U.; Software, E.M.U.; Supervision, K.K. and L.R.; Validation, E.M.U.; Visualisation, E.M.U.; Writing—Original Draft, E.M.U.; Writing—Review and Editing, K.K. and L.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research has been funded by the European Social Fund and the Secretariat of Universities and Research of Catalonia.

Data Availability Statement

Generation capacity data used in this paper have been obtained from the ENTSO-e Transparency Platform (https://transparency.entsoe.eu/dashboard/show accessed on 15 September 2022) and the TYNDP (https://tyndp.entsoe.eu/ accessed on 15 September 2022). All information is publicly available.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

This appendix exposes the definition of the generation technology groups from TYNDP. Information has been gathered from [139,140].

Table A1.

Description of TYNDP generation technology groups.

Table A1.

Description of TYNDP generation technology groups.

| TYNDP Technology Group | Description |

|---|---|

| Hard coal new | Generation with coal with approx. 46% of efficiency |

| Hard coal new bio | Generation with biomass as a substitute to coal with approx. 38% of efficiency |

| Hard coal old 1 | Generation with coal with approx. 35% of efficiency |

| Hard coal old 1 bio | Generation with Biomass as a substitute to Coal with approx. 32% of efficiency |

| Had coal old 2 | Generation with biomass with approx. 40% of efficiency |

| Hard coal old 2 bio | Generation with biomass as a substitute to coal with approx. 38% of efficiency |

| Lignite new | Generation with lignite with approx. 46% of efficiency |

| Lignite old 1 | Generation with lignite with approx. 35% of efficiency |

| Lignite old 1 bio | Generation with biomass as a substitute to lignite with approx. 25% of efficiency |

| Lignite old 2 | Generation with lignite with approx. 40% of efficiency |

| Lignite old 2 bio | Generation with biomass as a substitute to lignite with approx. 35% of efficiency |

| Heavy oil old 1 | Generation with heavy oil with approx. 35% of efficiency |

| Heavy oil old 1 bio | Generation with biofuel with approx. 35% of efficiency |

| Heavy oil old 2 | Generation with heavy oil with approx. 40% of efficiency |

| Light oil | Generation with light oil with approx. 35% of efficiency |

| Oil shale new | Generation with oil shale with approx. 39% of efficiency |

| Oil shale new bio | Generation with oil shale with approx. 29% of efficiency |

| Oil shale old | Generation with oil shale with approx. 29% of efficiency |

| Nuclear | Nuclear power generation. |

| Gas CCGT new | Combined-cycle gas turbine powered with methane with approx. 60% of efficiency |

| Gas CCGT old 1 | Combined-cycle gas turbine powered with methane with approx. 40% of efficiency |

| Gas CCGT old 2 | Combined-cycle gas turbine powered with methane with approx. 48% of efficiency |

| Gas CCGT old 2 bio | Combined-cycle gas turbine powered with biomethane with approx. 48% of efficiency |

| Gas CCGT present 1 | Combined-cycle gas turbine powered with methane with approx. 56% of efficiency |

| Gas CCGT present 2 | Combined-cycle gas turbine powered with methane with approx. 58% of efficiency |

| Gas OCGT new | Open-cycle gas turbine powered with methane with approx. 42% of efficiency |

| Gas OCGT old | Open-cycle gas turbine powered with methane with approx. 35% of efficiency |

| Gas conventional old 1 | Conventional gas-fired generation with methane with approx. 36% of efficiency |

| Gas conventional old 2 | Conventional gas-fired generation with methane with approx. 41% of efficiency |

| Gas conventional old 2 bio | Conventional gas-fired generation with biomethane with approx. 48% of efficiency |

| Offshore wind | Wind electricity generation at sea locations |

| Onshore wind | Wind electricity generation on land sites |

| Solar PV | Generation of electricity from sunlight through the photovoltaic effect |

| Solar thermal | Generation of thermal power from sunlight |

| Reservoir | Hydraulic generation of electricity in which storage of water in a reservoir is used |

| Run-of-river | Hydraulic generation of electricity which relies on the natural flow of rivers without storing water |

References

- Statement by President von der Leyen on Energy. Available online: https://ec.europa.eu/commission/presscorner/detail/en/SPEECH_22_5389 (accessed on 13 September 2022).

- From Where do We Import Energy? Available online: https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-2c.html (accessed on 29 September 2022).

- Ziouzios, D.; Karlopoulos, E.; Fragkos, P.; Vrontisi, Z. Challenges and opportunities of coal phase-out in western Macedonia. Climate 2021, 9, 115. [Google Scholar] [CrossRef]

- Germany. Canada Establish ‘International Trade Corridor’ for Clean Hydrogen. Available online: https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/energy-transition/082422-germany-canada-establish-international-trade-corridor-for-clean-hydrogen (accessed on 29 September 2022).

- European Commission. REPowerEU: A Plan to Rapidly Reduce Dependence on Russian Fossil Fuels and Fast forward the Green Transition; European Commission: Brussels, Belgien, 2022. [Google Scholar]

- Ari, M.A.; Arregui, M.N.; Black, M.S.; Celasun, O.; Iakova, M.D.; Mineshima, M.A.; Mylonas, V.; Parry, I.W.; Teodoru, I.; Zhunussova, K. Surging Energy Prices in Europe in the Aftermath of the War: How to Support the Vulnerable and Speed up the Transition Away from Fossil Fuels; International Monetary Fund: Washington, DC, USA, 2022. [Google Scholar]

- CO2 Emissions in 2022. Available online: https://www.iea.org/news/global-co2-emissions-rebounded-to-their-highest-level-in-history-in-2021 (accessed on 29 September 2022).

- Abbass, K.; Qasim, M.Z.; Song, H.; Murshed, M.; Mahmood, H.; Younis, I. A review of the global climate change impacts, adaptation, and sustainable mitigation measures. Environ. Sci. Pollut. Res. 2022, 29, 42539–42559. [Google Scholar] [CrossRef] [PubMed]

- Abbass, K.; Sharif, A.; Song, H.; Ali, M.T.; Khan, F.; Amin, N. Do geopolitical oil price risk, global macroeconomic fundamentals relate Islamic and conventional stock market? Empirical evidence from QARDL approach. Resour. Policy 2022, 77, 102730. [Google Scholar] [CrossRef]

- Fragkos, P.; van Soest, H.L.; Schaeffer, R.; Reedman, L.; Köberle, A.C.; Macaluso, N.; Evangelopoulou, S.; De Vita, A.; Sha, F.; Qimin, C.; et al. Energy system transitions and low-carbon pathways in Australia, Brazil, Canada, China, EU-28, India, Indonesia, Japan, Republic of Korea, Russia and the United States. Energy 2021, 216, 119385. [Google Scholar] [CrossRef]

- Mišík, M. The EU needs to improve its external energy security. Energy Policy 2022, 165, 112930. [Google Scholar] [CrossRef]

- Toth, A.N.; Fenerty, D.K.; Sztermen, G., Jr. Another Way to Alleviate Europe’s Energy Crisis. In Proceedings of the 48th Workshop on Geothermal Reservoir Engineering, Stanford, CA, USA, 6–8 February 2023. [Google Scholar]

- Frilingou, N.; Xexakis, G.; Koasidis, K.; Nikas, A.; Campagnolo, L.; Delpiazzo, E.; Chiodi, A.; Gargiulo, M.; McWilliams, B.; Koutsellis, T.; et al. Navigating through an energy crisis: Challenges and progress towards electricity decarbonisation, reliability, and affordability in Italy. Energy Res. Soc. Sci. 2023, 96, 102934. [Google Scholar] [CrossRef]

- Hirth, L.; Mühlenpfordt, J.; Bulkeley, M. The ENTSO-E Transparency Platform—A review of Europe’ s most ambitious electricity data platform. Appl. Energy 2018, 225, 1054–1067. [Google Scholar] [CrossRef]

- About the TYNDP. Available online: https://web.archive.org/web/20220326071443/https://tyndp.entsoe.eu/about-the-tyndp/ (accessed on 26 July 2023).

- TYNDP 2020 Scenario Report. Available online: https://2020.entsos-tyndp-scenarios.eu/ (accessed on 16 September 2022).

- Netherlands to Phase out Coal by 2030. Available online: https://www.energylivenews.com/2021/10/15/netherlands-to-phase-out-coal-by-2030/ (accessed on 9 September 2022).

- The Federal Office for Radiation Protection (Bundesamt für Strahlenschutz—BfS), (Atomic Energy Act). 2016. Available online: https://www.base.bund.de/SharedDocs/Downloads/BASE/EN/hns/a1-english/A1-07-16-AtG.pdf?__blob=publicationFile&v=2 (accessed on 8 August 2023).

- Prontera, A. The dismantling of renewable energy policy in Italy. Environ. Polit. 2021, 30, 1196–1216. [Google Scholar] [CrossRef]

- How Much Hydroelectric Energy Is Produced in Italy and Where. Available online: https://www.enelgreenpower.com/learning-hub/renewable-energies/hydroelectric-energy/italy (accessed on 29 September 2022).

- RAPPORTO STATISTICO 2018: Energia da Fonti Rinnovabili in Italia. Available online: https://www.europeanbiogas.eu/eba-statistical-report-2019/ (accessed on 29 September 2022).

- Gestore Servizi Energetici. Rapporto Statistico 2020 Energia da Fonti Rinnovabili in Italia; Gestore Servizi Energetici: Roma, Italy, 2022. [Google Scholar]

- Stimulating the Growth of Solar Energy. Available online: https://www.government.nl/topics/renewable-energy/stimulating-the-growth-of-solar-energy (accessed on 12 September 2022).

- Netherlands Deployed 2.93 GW of Solar in 2020. Available online: https://www.pv-magazine.com/2021/01/21/netherlands-deployed-2-93-gw-of-solar-in-2020/ (accessed on 12 September 2022).

- Poland—Country Commercial Guide. Available online: https://www.trade.gov/country-commercial-guides/poland-energy-sector (accessed on 12 September 2022).

- Zdonek, I.; Tokarski, S.; Mularczyk, A.; Turek, M. Evaluation of the Program Subsidizing Prosumer Photovoltaic Sources in Poland. Energies 2022, 15, 846. [Google Scholar] [CrossRef]

- Renewable Energy and Jobs Annual Review. Available online: http://www.irena.org/rejobs.pdf (accessed on 29 September 2022).

- Estrategia Nacional de Restauración de Ríos. Available online: https://www.miteco.gob.es/es/agua/temas/delimitacion-y-restauracion-del-dominio-publico-hidraulico/estrategia-nacional-restauracion-rios/ (accessed on 12 September 2022).

- España está Destruyendo más Presas y Embalses que Nadie en Europa. Son Buenas y Malas Noticias. Available online: https://www.xataka.com/ecologia-y-naturaleza/espana-esta-destruyendo-presas-embalses-que-nadie-europa-buenas-malas-noticias (accessed on 29 September 2022).

- Gürtler, K.; Postpischil, R.; Quitzow, R. The dismantling of renewable energy policies: The cases of Spain and the Czech Republic. Energy Policy 2019, 133, 110881. [Google Scholar] [CrossRef]

- Gilbert, A.; Bazilian, M.D.; Gross, S. The Emerging Global Natural Gas Market And The Energy Crisis of 2021–2022. Foreign Policies at BROOKINGS, December 2021; 2022; pp. 1–11. Available online: https://www.brookings.edu/wp-content/uploads/2021/12/FP_20211214_global_energy_crisis_gilbert_bazilian_gross.pdf (accessed on 29 September 2022).

- France’s EDF Takes More Nuclear Reactors Offline after Faults Found. Available online: https://www.reuters.com/markets/europe/edf-extend-civaux-nuclear-outage-shut-down-reactors-chooz-safety-measures-2021-12-15/ (accessed on 29 September 2022).

- France’s Nuclear Fleet Receives Another Blow. Available online: https://www.lemonde.fr/en/economy/article/2022/08/26/edf-s-nuclear-fleet-receives-another-blow_5994861_19.html (accessed on 29 September 2022).

- Lessons Learned from the Crisis: Insights on Three Newly Introduced EU Emergency Gas Measures. Available online: https://fsr.eui.eu/lessons-learned-from-the-crisis-insights-on-three-newly-introduced-eu-emergency-gas-measures/ (accessed on 1 May 2023).

- Conflict in Ukraine. Available online: https://www.cfr.org/global-conflict-tracker/conflict/conflict-ukraine (accessed on 29 September 2022).

- General Assembly Resolution Demands and to Russian Offensive in Ukraine. Available online: https://news.un.org/en/story/2022/03/1113152 (accessed on 20 September 2022).

- EU Response to Russia’s Invasion of Ukraine. 2022. Available online: https://www.consilium.europa.eu/en/policies/eu-response-ukraine-invasion/ (accessed on 20 September 2022).

- Russia Sanctions: How Can the World Cope without Its Oil and Gas? Available online: https://www.bbc.com/news/58888451 (accessed on 30 September 2022).

- Economic Bulletin Issue 4. 2022. Available online: https://www.ecb.europa.eu/pub/economic-bulletin/articles/2022/html/ecb.ebart202204_01~7b32d31b29.en.html (accessed on 30 September 2022).

- Energy Union. Available online: https://energy.ec.europa.eu/topics/energy-strategy/energy-union_en (accessed on 20 April 2023).

- Clean Energy for All Europeans Package. Available online: https://energy.ec.europa.eu/topics/energy-strategy/clean-energy-all-europeans-package_en (accessed on 29 April 2023).

- A European Green Deal. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal_en (accessed on 29 April 2023).

- Fit for 55. 2022. Available online: https://www.consilium.europa.eu/en/policies/green-deal/fit-for-55-the-eu-plan-for-a-green-transition/ (accessed on 10 October 2022).

- REPowerEU Plan. Available online: https://ec.europa.eu/commission/presscorner/detail/es/ip_22_3131 (accessed on 29 April 2023).

- REPowerEU: Affordable, Secure and Sustainable Energy for Europe. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/repowereu-affordable-secure-and-sustainable-energy-europe_en (accessed on 13 September 2022).

- European Commission. Commission Notice. Guidance on Recovery and Resilience Plants in the Context of REPowerEU; European Commission: Brussels, Belgien, 2022; Available online: https://commission.europa.eu/publications/guidance-recovery-and-resilience-plans-context-repowereu-1_en (accessed on 8 August 2023).

- BP Statistical Review of World Energy; BP Plc: London, UK, 2021.

- Halser, C.; Paraschiv, F. Pathways to Overcoming Natural Gas Dependency on Russia—The German Case. Energies 2022, 15, 4939. [Google Scholar] [CrossRef]

- El Gobierno Alemán Aprueba Activar las Centrales de Carbón para Ahorrar Gas. Available online: https://www.larazon.es/economia/20220713/pa4amvayf5gqbivnemoj7bzv3m.html (accessed on 10 October 2022).

- Germany’s Energy U-Turn: Coal Instead of Gas. Available online: https://www.dw.com/en/germanys-energy-u-turn-coal-instead-of-gas/a-62709160 (accessed on 10 October 2022).

- Berlin Eyes Oil-Fired ‘Powerships’ to Secure Electricity for the Winter. Available online: https://www.euractiv.com/section/energy/news/berlin-eyes-oil-fired-powerships-to-secure-electricity-for-the-winter/ (accessed on 10 October 2022).

- Yafimava, K. EU Solidarity at a Time of Gas Crisis: Even with a Will the Way Still Looks Difficult; Oxford Institute for Energy Studies: Oxford, UK, 2023; Available online: https://www.oxfordenergy.org/publications/eu-solidarity-at-a-time-of-gas-crisis/ (accessed on 1 May 2023).

- Germany: Dispute over Nuclear ‘Reserve’ Deepens. Available online: https://www.dw.com/en/germany-dispute-over-nuclear-reserve-deepens/a-63047247 (accessed on 10 October 2022).

- Germany Shuts Down Its Last Nuclear Power Stations. Available online: https://www.dw.com/en/germany-shuts-down-its-last-nuclear-power-stations/a-65249019 (accessed on 29 April 2023).

- BMWK. Overview of the Easter Package; BMWK: Berlin, Germany, 2022. [Google Scholar]

- Germany Boosts Renewables with ‘Biggest Energy Policy Reform in Decades’. Available online: https://www.cleanenergywire.org/news/germany-boosts-renewables-biggest-energy-policy-reform-decades (accessed on 10 October 2022).

- Siemens Commissions 8.75 MW Green Hydrogen Plant in Germany. Available online: https://energydigital.com/renewable-energy/siemens-commissions-8-75mw-green-hydrogen-plant-in-germany (accessed on 10 October 2022).

- France Approves Purchasing Power Bill including Energy Security Measures. Available online: https://www.enerdata.net/publications/daily-energy-news/france-approves-purchasing-power-bill-including-energy-security-measures.html (accessed on 10 October 2022).

- France Is Reviving a Disused Gas Pipeline to Help out Energy-Strapped Germany after Russia Shut down Fuel Flows. Markets Insider. 2022. Available online: https://markets.businessinsider.com/news/commodities/france-will-revive-abandoned-gas-pipeline-send-gas-to-germany-2022-9 (accessed on 10 October 2022).

- France Approves Draft Gas Security of Supply Law. Available online: https://www.argusmedia.com/en/news/2353633-france-approves-draft-gas-security-of-supply-law (accessed on 10 October 2022).

- Ukraine War Pushes France to Rethink Coal Power Station Closure. Available online: https://www.france24.com/en/live-news/20220626-ukraine-war-pushes-france-to-rethink-coal-power-station-closure (accessed on 10 October 2022).

- Europe’s Energy Crisis Has Gotten So Bad That French Power Stations Are Being Allowed to Break Environmental Rules as a Fresh. Available online: https://www.businessinsider.com/energy-french-power-stations-environmental-rules-heatwave-europe-2022-8 (accessed on 10 October 2022).

- French President Macron Promises to Exit Oil, Coal and Gas. Available online: https://energy.economictimes.indiatimes.com/news/oil-and-gas/french-president-macron-promises-to-exit-oil-coal-and-gas/90887914?redirect=1 (accessed on 10 October 2022).

- France Urges Brussels to Label Nuclear—Produced Hydrogen ‘Green’. Available online: https://www.euractiv.com/section/energy/news/leak-france-urges-brussels-to-label-nuclear-produced-hydrogen-green/ (accessed on 10 October 2022).

- New Definitions for Blue and Green Hydrogen: The European Commission’s Package on Hydrogen and Decarbonized Gas Markets. Available online: https://www.insideenergyandenvironment.com/2022/01/new-definitions-for-blue-and-green-hydrogen-the-european-commissions-package-on-hydrogen-and-decarbonized-gas-markets/ (accessed on 10 October 2022).

- Commission Sets Out Rules for Renewable Hydrogen. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_23_594 (accessed on 10 October 2022).

- France to Introduce Unprecedented Measures to Cushion Energy Crisis. Available online: https://balkangreenenergynews.com/france-to-introduce-unprecedented-measures-to-cushion-energy-crisis/ (accessed on 10 October 2022).

- Energy Security: France Takes Emergency Measures to Boost Renewables. Available online: https://windeurope.org/newsroom/news/energy-security-france-takes-emergency-measures-to-boost-renewables/ (accessed on 10 October 2022).

- Excepcional Measures to Accelerate the Deployment of Renewable Energies in France. Available online: https://www.twobirds.com/en/insights/2022/france/exceptional-measures-to-accelerate-the-deployment-of-renewable-energies-in-france (accessed on 10 October 2022).

- Énergies Renouvelables: La Fausse Bonne Idée des ‘Zones Propices’ Européennes? Available online: https://www.euractiv.fr/section/energie/news/energies-renouvelables-la-fausse-bonne-idee-des-zones-propices-europeennes/?_ga=2.102548102.60611377.1663758908-691505119.1663248973 (accessed on 10 October 2022).

- Teresa Ribera: ‘España será Solidaria con la UE, pero no Aceptaremos Obligaciones por Encima de lo que nos Corresponde en Términos de Esfuerzo’. Available online: https://www.lamoncloa.gob.es/serviciosdeprensa/notasprensa/transicion-ecologica/paginas/2022/200722-riberagas.aspx (accessed on 13 September 2022).