Abstract

The ongoing COVID-19 pandemic has disrupted global economic activity in all sectors, including forest industries. Changes in demand for forest products in North America over the course of the pandemic have affected both primary processors and downstream industries reliant on residues, including wood pellet producers. Wood pellets have become an internationally traded good, mostly as a substitute for coal in electricity generation, with a significant proportion of the global supply coming from Canadian producers. To determine the effect of the COVID-19 pandemic on the Canadian wood pellet industry, economic and market data were evaluated, in parallel with a survey of Canadian manufacturers on their experiences during the first three waves of the pandemic (March 2020 to September 2021). Overall, the impact of the pandemic on the Canadian wood pellet industry was relatively small, as prices, exports, and production remained stable. Survey respondents noted some negative impacts, mostly in the first months of the pandemic, but the quick recovery of lumber production helped to reduce the impact on wood pellet producers and ensured a stable feedstock supply. The pandemic did exacerbate certain pre-existing issues, such as access to transportation services and labour availability, which were still a concern for the industry at the end of the third wave in Canada. These results suggest that the Canadian wood pellet industry was resilient to disruptions caused by the pandemic and was able to manage the negative effects it faced. This is likely because of the integrated nature of the forest sector, the industry’s reliance on long-term supply contracts, and feedstock flexibility, in addition to producers and end-users both being providers of essential services.

1. Introduction

Despite health measures implemented to mitigate the effects of the ongoing COVID-19 pandemic, the disease has significantly disrupted economic activity around the globe. In Canada, production, employment, shipping, and consumption patterns have changed in response to “work-from-home” mandates, lay-offs, border closures, and stimulus investments (e.g., the Canadian Emergency Response Benefit) [1,2]. Some industries profited from these shifts, (e.g., increased demand for home-cleaning products in early 2020 [3]), whereas others have had a harder time adjusting to the various shocks caused by COVID-19 (e.g., decline in demand for travel and hospitality services [4]). Indeed, the pandemic has had a variety of effects on many industries and their related supply chains [5].

Canada’s forest sector was affected by the drastic changes in demand for forest products over the course of the pandemic, a trend also observed in the United States [6]. Although the Canadian forest sector is well acquainted with market shocks and had taken steps to mitigate anticipated risks [7,8], it was unclear how exactly the sector would be affected at the onset of the COVID-19 pandemic and how these impacts would spill over into related industries. Early analysis of forest-related industries suggests varied experience; despite initial slowdowns, the lumber industry experienced a boom as consumers invested in home improvement projects, while the decline in the pulp and paper industry accelerated as demand for office printing supplies decreased [3]. Shifting consumption patterns also impacted energy markets [9], which suggested possible repercussions on biofuel production and use in Canada. Analyses of biomass supply chains globally [10], and within the United States [6] have found that although there were some minor disruptions, namely due to labour shortages, biomass supply for bioenergy was relatively resilient to the effects of the pandemic. However, no study directly addressed how the Canadian wood pellet industry has been impacted by the shocks experienced in the forest sector and volatility observed on energy markets due to the COVID-19 pandemic. This topic is of particular interest as wood pellets, a solid biofuel used for bioenergy (bioelectricity or bioheat) generation, are a growing source of renewable fuel globally [11].

This analysis aims to provide insights into effects of the COVID-19 pandemic on the Canadian wood pellet industry. The objectives were to (1) assess the impact of the pandemic on the industry, and identify strengths and weaknesses revealed via the constraints imposed by the pandemic, and (2) highlight lessons learned and how they might be applied to enhance supply chain resilience. Combining observations on the industry, available statistics, and survey data, a detailed description of how the pandemic and related health measures affected the Canadian wood pellet industry is presented.

1.1. The Canadian Wood Pellet Industry and Its Integration within the Forest Sector

Although relatively young in the context of the Canadian forest sector, the wood pellet industry has expanded across the country, and represents a small but non-negligible proportion of forestry-based production in Canada (approximately 1.5% of forest product exports in 2019) [12,13]. Wood pellet production has grown from a few hundred thousand tonnes per year in the early 2000s to more than 3.5 million tonnes produced at 49 mills in 2020 [14]. Almost 90% was exported in bulk shipments to feed a growing demand for renewable energy internationally, while the remainder is used domestically [14] in pellet stoves or boilers for space or water heating (residential and institutional buildings). The global demand for solid biofuels has increased consistently through the last decade, as changes in foreign energy policies make wood pellets a more attractive fuel for electricity generation [15].

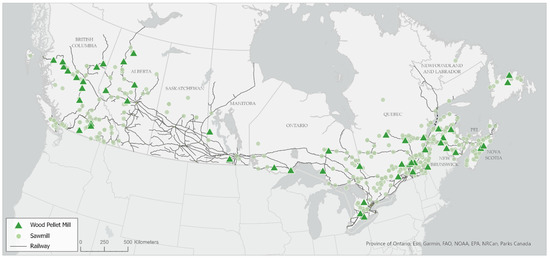

The wood pellet industry is largely integrated with other forest industries [16], drawing on residues from processing operations as feedstock. Sawmill residues, mainly sawdust and shavings, make up the large majority of all wood pellet feedstock, while remaining inputs include harvest residues (tree-tops, branches and low-quality logs that are not used by other wood product manufacturing facilities) [17]. Hence, biomass supply for wood pellets in Canada is similar to that is most other large producing countries such as Sweden and Germany [18]. Supply in the United States differs, with a larger share of roundwood and other residuals such as logging residues and unmerchantable wood used [19]. While some feedstock are purchased on the open market, most wood pellet producers have long-term contracts with sawmills and forest operators for biomass supply [20]. Although other sources of wood fibre such as degraded or dead wood from insect epidemics are being considered for wood pellet production, the cost of harvesting such trees was found to be a challenge in the provinces of British Columbia [8] and Québec [21]. Feedstock procurement represents roughly a third of total delivered costs, with production and distribution making similar contributions [22]. Wood pellet mills are generally located near existing sawmill facilities to minimize feedstock delivery costs [23] and are concentrated in regions with a historically strong forest sector. However, stability of supply and cost are not the only factors considered by wood pellet producers when determining optimum blends of feedstock, with moisture content and composition (e.g., ash content, concentration of metals) having a significant influence on wood pellet quality [24]. Wood pellet mills also tend to be close to railways or ports to improve access to export markets and limit associated costs and emissions (Figure 1).

Figure 1.

Location of wood pellet mills and sawmills in Canada, operational at end of 2020.

Although Canadian wood pellet production is largely driven by long-term take-or-pay contracts with foreign electricity producers in Europe and Asia [25], the industry is still subject to various shocks and disruptions, including natural disturbances (e.g., wildfire, pest outbreaks, and severe weather), anthropogenic events (e.g., trade barriers, sustainability requirements, transportation disruptions, and shifts in demand [26]) and climate change. Due to the highly integrated nature of the forest sector, and limited amount of residue produced, the cost and availability of residues for wood pellet production may be impacted by shifts in demand or production of other products that either generate (e.g., lumber) or use wood residues (e.g., particleboard and fibreboard) [8].

Generally, firms are aware of their vulnerability to various shocks and disruptions, although they may or may not take action to mitigate the likelihood of a disrupting event [27]. Evidence suggests that the North American forest sector is typically risk averse [28] and is likely to take action to mitigate risk exposure. Strategies to mitigate risk in the wood pellet industry include securing access to large amounts of sawmill residues by co-locating with sawmills, establishing long-term supply contracts [20], employing alternative feedstock (e.g., harvest residues undesired by competing industries [17]), and sourcing fibre from a large area or several suppliers [29]. Incidentally, it has been demonstrated that tactical, strategic, and operational decisions relative to the harvesting and transportation of logs and other raw materials play an important role in optimizing the economic, environmental and social performance of the forest supply chain [30].

Bioenergy, including wood pellets, is expected to play a crucial role in net-zero and energy transition plans around the globe [31] and can also make a meaningful contribution in the post COVID-19 economic recovery [10]. Given the rising importance of wood pellets as a renewable fuel, it is useful to understand how the sector responds to disturbances and identify opportunities to improve resilience to future shocks [6].

1.2. The COVID-19 Pandemic in Canada

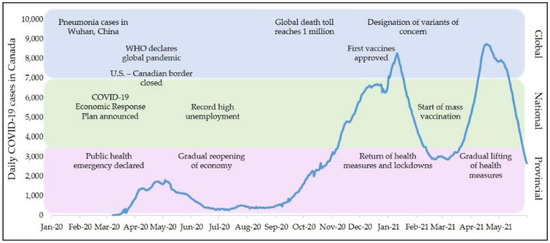

The COVID-19 pandemic in Canada has been characterized by waves. Increasing infection numbers triggered public health measures designed to reduce transmission (thus decreasing the impact of the disease) and protect the capacity in the health care system. Although Canada’s federal government remains heavily involved in the national response effort, provincial and territorial measures largely dictated the spatial pattern of pandemic effects. Figure 2 highlights the timeline of major Canadian pandemic-related events since early 2020, including the first, second, and third waves of the pandemic.

Figure 2.

Timeline for the COVID-19 pandemic in Canada.

The first wave of COVID-19 infections in March 2020 was initially localized in Québec and Ontario, Canada’s most populated provinces [32]. The rapid rise in cases nationally and concerns over hospital capacity resulted in provincial stay-at-home orders, layoffs, recommendations against international travel, and a closure of the border with the United States. The federal government announced financial support in mid-March for employees laid off from businesses impacted by mandated closures, and an emergency wage subsidy in support of businesses still operating as part of Canada’s COVID-19 Economic Response Plan [33]. Provincial and territorial governments also implemented emergency response measures related to health care, business and workplace closures, and school and daycare operations. The forest sector, deemed an essential service throughout the pandemic, was largely exempt from mandated closures [34].

Measures gradually relaxed starting in May 2020, only to be reinstated with a rise in infections in the fall of 2020, triggering the second and third waves of the pandemic. Although all provinces and territories experienced an increase in cases, provincial efforts to limit travel-related transmission were met with some success (e.g., the “bubble” approach adopted by Canada’s Atlantic provinces [35]). In late 2020, vaccine campaigns targeting vulnerable populations, in conjunction with reinstated public health measures, prevented the rapid rise of cases among them [36]. However, the virus spread to other groups, generating an increase in case numbers until provincial vaccine campaigns expanded to include the broader population throughout the spring and summer of 2021. The impact of the pandemic varied between provinces and sectors but overall, mandated closures and other measures had a significant impact on the national [4] and global economy [37].

2. Materials and Methods

The impact of the COVID-19 pandemic on the Canadian wood pellet industry was examined by analyzing industry statistics and market data representative of the situation before and during the pandemic, as well as through a survey on the experiences of Canadian wood pellet producers during the first, second, and third waves of the pandemic. Analyzing the impact of the COVID-19 pandemic as it unfolded presented obvious challenges. The rapidly evolving nature of the pandemic and public health measures made it difficult to evaluate wood pellet industry-related impacts in a timely manner. The lag between collection and publication of relevant data by Statistics Canada (the Canadian national statistical office) also impeded efforts to link current observations by industry to available macroeconomic data. Furthermore, although the collection of detailed data on the wood pellet industry (e.g., production, employment, feedstock supply) in the United States allowed Kline et al. [6] to consider official statistics in assessing the influence of the COVID-19 pandemic on the US southeast wood pellet supply chain, equivalent information is not collected by Statistics Canada. To address these challenges, a two-pronged approach was adopted, whereby the comparison of available industry statistics and market data prior to and during the pandemic was complemented with a survey of Canadian wood pellet producers that directly gathered more detailed and timely data on their operations during the first, second, and third waves of the pandemic.

2.1. Forest Industry Statistics Analysis

The domestic forest industry and wood pellet production were examined, accounting for pre-existing conditions and trends. In order to capture pandemic-related changes in the forest sector, lumber production levels and prices were considered, along with the Gross Domestic Product (GDP) of relevant forest industry subsectors. Wood pellet feedstock prices, wood pellet prices, and wood pellet exports were included as a complement to forest industry statistics. To compare industry subsectors across different scales and units, relevant datasets were indexed based on a pre-pandemic reference period, 2017 to 2019 in most cases. Further details relevant to the indexing of each dataset are provided below.

With sawmill residues making up the majority of wood pellet feedstock, lumber production levels have a direct impact on feedstock availability and operations at wood pellet mills. Hence, changes in lumber production were evaluated in parallel with lumber prices to get a sense of the availability of sawmill residues for pellet producers. Lumber production values were obtained from the Statistics Canada monthly sawmill survey, which measures quantities of lumber produced and shipped by Canadian manufacturers [38]. The Random Lengths framing lumber composite index [39] was chosen to reflect overall market prices on the North American market. Monthly lumber production during the pandemic was compared to levels during the the corresponding month of the reference period (2017–2019 average values) to account for seasonal variations in lumber production. Monthly lumber prices, which display less seasonal fluctuation, were compared to the overall 2017–2019 average.

Other forest industries also consume sawmill residues and may compete with wood pellet producers for feedstock. To determine how these other subsectors fared throughout the pandemic, their economic activity was evaluated. Unfortunately, detailed production data for the other residue-using industries is not collected through national surveys, so was unavailable. Thus, monthly GDP was used as a proxy measure of forest sector activity, focusing on sawmills and wood preservers; veneer, plywood and engineered wood product producers; and pulp, paper, and paperboard producers. The corresponding NAICS (North American Industry Classification System) codes are: 3211 (sawmills and wood preservers), 3212 (veneer, plywood and engineered wood producers), and 3221 (pulp, paper and paperboard producers). Because pellet producers can also use harvest residues as a source of pellet feedstock, the monthly GDP measure for the forestry and logging subsector (NAICS code 113: forestry and logging) was included to assess impacts on harvesting operations and possible harvest residue supplies. Monthly estimates of national GDP by industry are released by Statistics Canada as part of the Canadian System of Macroeconomic Accounts [40]. As for lumber production, monthly GDP for all subsectors was compared to levels for the corresponding month during the reference period (2017–2019 average values), to consider seasonal variations.

In addition to subsector GDP, wood pellet-specific market data was gathered from various sources. Canadian wood pellet feedstock price data was obtained from the Forisk Wood Fibre Review [41], industrial wood pellet prices were sourced from Hawkins Wright (at Amsterdam, Rotterdam, and Antwerp ports, reflecting European spot market prices) [42], and monthly export levels came from the Canadian International Merchandise Trade (CIMT) database [13]. As feedstock prices remained fairly stable throughout 2019, the average value for that year was used as the reference point. Conversely, industrial wood pellet prices at Amsterdam, Rotterdam and Antwerp ports were trending downward after reaching a historical high in February 2019. To account for this, the average of the three months preceding the pandemic (December 2019, January and February 2020) was used as the reference point. Although spot market prices in Europe do provide an indication on the profitability of the pellet industry, it is important to note that most mills exporting to Europe have long-term contracts, and that mills in eastern Canada also export to the United States, for which no price data is readily available. Given the short time period of the study, all prices are reported in nominal Canadian dollars (unadjusted for inflation). The analysis does not include the period after the second half of 2021 for which higher inflation rates were observed.

2.2. Wood Pellet Producer Survey

The second part of the analysis involved a bilingual (French and English) survey of the Canadian wood pellet industry. Collection of firm-level information was essential to describe drivers, perceptions, and consequences of prevailing conditions in the industry, especially given the limitations identified with published statistical and market data. Other studies have followed a similar approach, using surveys [43] or interviews [44] to collect information directly from wood pellet producers on their operations, including feedstock sourcing practices. With the assistance of the Wood Pellet Association of Canada (WPAC), the majority of operating domestic wood pellet manufacturers (informally referred to as mills) were invited to participate in a two-part survey on the impact of the COVID-19 pandemic on their operations. Thirty-four medium and large size mills (over 15,000 tons of annual production capacity) and three smaller mills were invited to participate, representing 91% of national production capacity. The first phase of the survey captured the effects of the first wave of the pandemic in Canada (March 2020 to September 2020), while the second phase addressed the second and third waves (October 2020 to April 2021). All mills that completed the first survey were invited to complete the second survey.

Surveys explored the impact of the pandemic in six areas: (1) feedstock supply; (2) transportation of inputs and finished products; (3) labour; (4) production levels, including closures; (5) operating procedures; and (6) reliance on government support programs. The first survey phase ran from 23 October to 6 December 2020 and consisted of 20 questions. The second survey, implemented from 14 May to 15 June 2021, contained 22 questions. Slight differences in the second survey (compared to the first survey) were intended to assess how business practices had changed as a result of increased COVID-19-related knowledge (both English surveys are available in the Supplementary Materials S1 and S2).

To capture the main impacts of the pandemic under a limited set of indicators, the results of certain questions were combined under four topics. Answers were classified into three impact categories (positive, not significant and negative; see Table 1).

Table 1.

Classification of topics and answers used to aggregate survey results.

The surveys were administered by using AllCounted, an online survey development and delivery portal that provides results analyses (AllCounted Inc., Rockville, MD, USA, 2021). In addition to the analyses provided by AllCounted, survey results were analyzed by using SAS (Statistical Analysis Software, SAS Institute Inc., Cary, CA, USA, Version 9.4). The SAS statistical output is available in a publicly accessible repository. Results that are statistically different between regions or between surveys at an alpha level of 0.05 are indicated as such in the results (more details available in Appendix A).

3. Results

Results are described into two sections. The first section provides relevant forest industry statistics and wood pellet market data, illustrating the effects of the pandemic on the sector as a whole. The second section highlights key results from the surveys.

3.1. Forest Industry Economic Trends

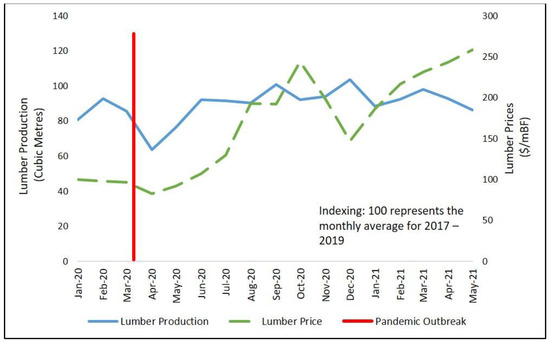

Sawmill production and lumber prices from January 2020 to May 2021 are illustrated in Figure 3. At the national level, softwood lumber production during the pandemic was lower than over the reference period. This is mostly due to a gradual decline of production over the last years in British Columbia, because of factors unrelated to the COVID-19 pandemic (e.g., large forest fires, mountain pine beetle epidemic) that have reduced the volume of standing trees available for harvest. During the first wave of the pandemic (March to May, 2020), lumber producing mills responded to the pandemic via temporary shutdowns and curtailments, as stay-at-home directives reduced the immediate demand for lumber by shuttering construction sites.

Figure 3.

Monthly lumber production and lumber prices.

After a sharp decline in April 2020, softwood lumber production quickly rebounded with increased expenses in construction and renovation, spurring a slow recovery in wood product prices that accelerated over the course of the summer. Sawmills responded by restarting and a vast majority of sawmills and panel mills had reopened by June 2020. Home sales and housing starts continued to increase into the summer of 2020, reflecting pent-up demand for new housing and relaxed stay-at-home restrictions. Construction restarts pushed lumber prices higher, reaching record levels in August 2020 due to a combination of increased demand and low supply levels. Unprecedented lumber prices drove production above 2019 levels, suggesting that the pandemic only had a temporary impact on feedstock availability (sawmill residues) for wood pellet producers.

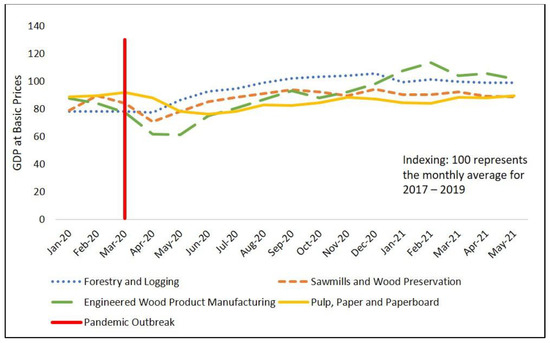

Figure 4 provides monthly GDP for the main subsectors of interest: forestry and logging; sawmills and wood preservers; pulp, paper and paperboard producers; veneer, plywood and engineered wood products. Overall, trends within the forest sector economic statistics do not indicate large amounts of sawmill residue surpluses or deficits on the market, with all subsectors faring relatively well throughout the pandemic. Forestry and logging GDP levels were relatively constant before the pandemic, and remained stable until April 2020. At this point, GDP rose steadily, peaking the following January and corresponding to the increase in lumber production observed in Figure 3. This suggests a rise in sawmill and harvest residues as harvesting activities increased in response to demand. This shift is also visible within the sawmill and wood preservation sector. Despite an initial decline in GDP as mills curtailed production levels in anticipation of depressed demand and market uncertainty, GDP rose in the months following the pandemic outbreak as shifts in lumber demand increased softwood lumber production. Veneer, plywood and engineered wood product manufacturing subsector GDP fell sharply in April 2020, remained low for a short period of time, recovered to pre-pandemic levels later in the year and continued to rise into the following year. This pattern is likely linked to an increased demand not only for lumber, but wood products in general, spurred by high renovation and construction activity [3].

Figure 4.

Monthly gross domestic product (GDP) for forest industry subsectors.

The pulp, paper, and paperboard subsector is the only subsector that had not returned to pre-pandemic GDP levels by the following year. Although GDP remained relatively high during the first month of the pandemic in response to increased demand for tissue and toilet products, demand returned to normal levels by May 2020. A depressed demand for graphic paper products accelerated, with paper and newsprint further declining as school, conferences, and advertising moved online [3]. Paper mills (including newsprint facilities) curtailed their production lines in response to the decline in demand. In contrast, mills producing pulp and packaging experienced temporary increases in demand as consumer spending habits shifted towards cleaning products (i.e., tissues and towels) and online purchases.

Monitoring of mill curtailments and closures performed at the Canadian Forest Service generally align with macroeconomic statistics. At the height of the first wave of the pandemic, approximately 60 sawmills, 15 pulp and paper mills, and 20 panel mills (structural and non-structural) were impacted via shutdowns or curtailments. A vast majority of sawmills reopened by June 2020. By the end of the 2020, out of the facilities that curtailed at the onset of the pandemic, only three sawmills and four pulp and paper mills were still closed. These closures are likely due to factors other than the COVID-19 pandemic, such as reduced annual allowable cut levels or structural decline of the newsprint and printing and writing paper market [45].

In response to the pandemic and safety concerns, the forest industry implemented protocols to mitigate the risk of virus transmission among employees. Few cases of COVID-19 were reported in the industry between March and September, 2020. As the pandemic progressed into 2021, the forest industry experienced fewer COVID-19-related shocks than in 2020; high lumber prices continued; and production levels remained relatively constant to meet an elevated demand over this period due to continued interest in renovations and an increased number of housing starts. Some facilities were impacted by local COVID-19 cases and closed for a brief period of time, although safety protocols, vaccinations, and provincial health measures appear to have limited these types of disruptions. Lumber demand remained high, and despite a decline in lumber prices in October 2020, the industry outlook remained positive.

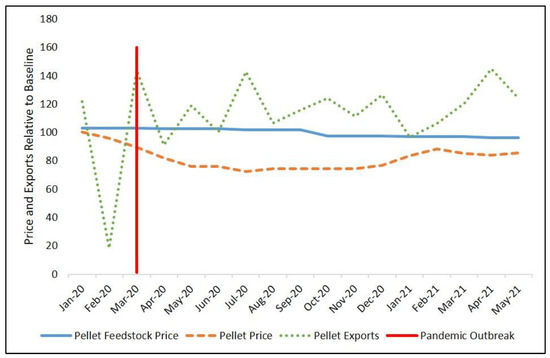

Focusing on the wood pellet industry specifically, Figure 5 provides further insights into market conditions, illustrating average domestic pellet feedstock prices, wood pellet prices on the European spot market, and Canadian wood pellet exports during the pandemic.

Figure 5.

Canadian monthly wood pellet feedstock prices, wood pellet prices and wood pellet exports.

Although, the COVID-19 pandemic is ongoing at the time of writing, it does not appear to have significantly impacted Canadian wood pellet producers as wood pellet prices and export volumes remained relatively stable. Compared to pre-pandemic conditions, wood pellet prices declined slightly and exports increased, in continuation with existing trends. Feedstock prices slightly decreased in late 2020 and early 2021, likely tied to the increase in sawmill production and lumber prices during the same time period. At a national level, average wood pellet feedstock prices remained relatively constant throughout 2020 and into 2021, implying that most wood pellet mills likely had little to no difficulty sourcing feedstock. Wood pellet prices continued on their downtrend until plateauing in June, coinciding with lockdown measures, but recovered in fall 2020 and winter 2021. However, industrial wood pellet prices did not go back to end of 2019 levels, most likely because of factors external to COVID-19 such as additional global production capacity. As a majority of Canadian wood pellet mills exporting to Europe have long-term contracts, the lower prices for industrial wood pellets experienced through the pandemic most likely did not impact the profitability of producers. While wood pellet exports show large month-over-month variability, they remained above the reference period average level throughout the pandemic, with total exports in 2020 being 10% higher in volume than in the previous year.

3.2. Survey Results: COVID-19 Impacts on Wood Pellet Facility Operations

Based on data provided by WPAC, 37 pellet-producing mills were invited to participate in the surveys; 31 mills completed the first survey and 23 mills completed the second (see Table 2 for a breakdown of survey respondents and their locations). As only the mills that responded to the first survey were invited to respond to the second survey, the response rate for both surveys is similar (respectively 83% and 74%).

Table 2.

Respondents to the first and second survey, by province or region.

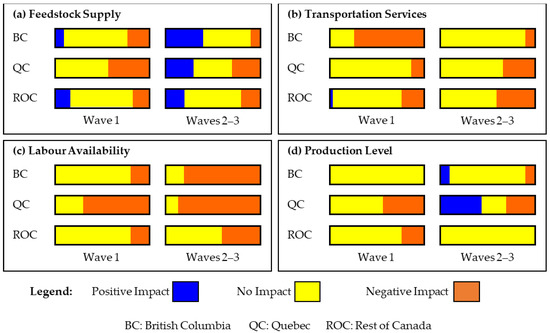

Overall, the survey results indicated that the first, second, and third waves of the COVID-19 pandemic had a mixed impact on the Canadian wood pellet industry (Figure 6). Detailed survey responses compiled by province or region are provided for the first and second surveys, respectively in Supplementary Materials S3 and S4. Certain mills in Québec and British Columbia indicated that they experienced negative impacts during the first wave of the pandemic; the remainder reported no significant impacts. Most mills outside of these provinces were unaffected. During the second and third waves, wood pellet mills generally experienced fewer negative impacts and reported some positive impacts, a trend seen in the main wood pellet producing regions of the country. These outcomes can be traced to key changes in feedstock (Figure 6a), transportation (Figure 6b), labour (Figure 6c), and production (Figure 6d). Further details related to these components are described below.

Figure 6.

Survey results summary dashboard.

3.2.1. Feedstock Supply

Results from the first survey (administered after the first wave of the pandemic) suggest that roughly half of the mills (52%) did not experience changes in feedstock availability. However, 34% reported reduced raw material availability, with reductions being most common in Québec. Outside of Québec, some pellet producers (13%) reported an increase in feedstock availability. Responding mills reported a common sequence of events: early curtailments and sawmill shutdowns reduced available sawmill residues, followed by a rapid rebound in lumber demand, which encouraged sawmills to restart, thus alleviating feedstock supply shortages. One company described feedstock availability in the first wave this way: “Initially, sawmills were quick to shut in response to anticipated reduced demand for lumber. This caused us to find harvest residues. However, lumber demand improved and sawmills restarted, thus restoring sawmilling residues”.

Initial feedstock shortages and prices changes were experienced differently across the country and encouraged some mills to shift their feedstock mix towards harvest residues. Although most of the mills (55%) maintained their original feedstock mix, a third of the mills (29%, mostly from British Columbia) reported increased use of non-sawmill residues, and a sixth of the mills, mostly located in Québec, decreased their use of non-sawmill residues. In Québec, certain wood pellet mills reported closures of wood product manufacturing sites. When asked about their pre-COVID forecasts of feedstock supply mix, many mills indicated that they had planned on maintaining their current mix (68%); the remaining mills planned to either increase (19% of the mills) or decrease (13%) their use of non-sawmill residues. Thus, only about 10% of respondents used more non-sawmill residues than they had planned to use prior to the onset of the pandemic whereas the feedstock mix otherwise remained unchanged relative to what companies had planned.

Despite the contraction in feedstock supply and a shift in source for some mills, most (77%) reported that feedstock prices remained the same (a ±5% change in price, compared to the pre-pandemic anticipated price) over this time period. A moderate increase in feedstock price (a 5 to 20% increase in price) was reported by 16% of respondents, most of which were located in Québec, although increases were also observed in British Columbia. Unsurprisingly, few mills (7%) reported a decrease in feedstock prices (a 5 to 20% decline in price).

The second survey suggested that the overall accessibility of feedstock increased during the second and third waves of the pandemic. An increase in feedstock availability was reported by most mills across the country (65%), and only one facility reported a decrease. The second wave of lockdowns and stay-at-home orders continued to spur lumber demand, driving increased lumber and sawmill residue production. A company based in British Columbia reported that “sawmills are running more shifts as a result of the lumber prices”. Increased feedstock availability did not appear to result in lower feedstock prices. Most respondents (70%) to the second survey reported little to no change in feedstock prices. The remainder reported a price increase; 21% of the mills surveyed reported a moderate increase (between 5% and 20%), and two respondents reported a significant price increase of more than 20% compared to pre-COVID anticipated prices. Although many mills (44%) again reported no change in their feedstock mix during the second and third waves, the same proportion of mills reported increased use of sawmill residues, and respondents indicated that high production levels at residue-supplying sawmills boosted the availability of this type of feedstock.

3.2.2. Transportation Services

Over the period covered by the first survey, roughly half the mills (55%) surveyed indicated that they experienced no changes in availability of transportation services for inputs and/or outputs. Most of the remaining mills that did experience transportation disruptions were located in British Columbia; these mills experienced disruptions associated with transporting feedstock both to and from their facilities.

Fewer transportation disruptions were reported in the second survey. The majority of the mills (78%) surveyed reported no disruptions. Mills that experienced transportation issues over the period captured by the second survey (13%) indicated that those issues had worsened compared to the period covered by the first survey, though they did not report the reason behind that situation.

3.2.3. Labour Availability

In the first survey, most mills (68%) reported that they experienced no labour shortages. Most mills that did experience labour shortages were located in Québec. Of note, Québec reported the most per capita cases of COVID-19 of all Canadian provinces during the first wave and had some of the most stringent lockdown rules. Several Québec-based respondents suggested that they were unable to find suitable employees, in part because of the federal Canada Emergency Response Benefit, a federal subsidy intended to support employed and self-employed Canadians negatively impacted by the pandemic [33]. Certain mills in British Columbia and Alberta reported multiple temporary employee disruptions in the first survey due to COVID-19 testing and isolation protocols, with one mill stating that it “lost one or more people at various times as they were told to stay home for precautionary reasons”.

In the second survey, the number of mills reporting labour shortages increased; more than two-thirds of the mills (70%) reported at least minor labour disruptions. Although reported labour issues were generally short-lived and localized, they occurred across the country, with the majority of mills in British Columbia and Québec reporting issues. Survey respondents suggested that most of their labour challenges were due to isolation requirements imposed by COVID-19 testing and contact tracing. In a few cases, large numbers of COVID-19 cases among employees led to facility shutdowns.

3.2.4. Direct COVID-19 Impacts on Production Level

- Closures and Slowdowns

Only four of the mills surveyed reported closures and six reported production slowdowns during the first wave. Two of the four mills that did close shuttered for 1 to 4 weeks and were located in Québec. The third was located in British Columbia and the fourth was in the Atlantic region. Production slowdowns occurred during the same period in Québec and British Columbia; respondents indicated that these production declines were a direct result of sawmill closures, and uncertainty related to feedstock supplies. Additional reasons for production slowdowns, as indicated by respondents, included labour shortages, a decline in wood pellet demand, and transportation issues (incidents at shipping ports and feedstock supply interruptions).

In comparison, the second phase of the survey suggested a relatively stable period. Only one mill reported a closure during this time, whereas four mills experienced an increase in production and three mills saw production levels decline. The majority of these changes were reported by Québec mills. At the same time, there was a large variability between the mills, with one mill reporting that “in terms of production, the first wave only affected us a little. During the second and third wave, labour availability put a lot of pressure on our operations.”

- COVID-19 Assistance Programs

Results from the first phase of the survey indicate that about a third of the mills surveyed (28%) took advantage of the wage subsidy programs offered by the federal government. Two additional mills made use of loans, loan guarantees, or emergency financing, also from the federal government. Thirteen mills relied on the provincial programs available to them (mostly port-fee deferral programs, but also wage subsidy, income tax deferral, and credit programs).

The second phase of the survey indicated over a third of the mills (40%) continued to rely on federal assistance (mostly wage subsides). This type of support was particularly common in Québec.

- Health and Safety Adaptations

The second survey asked the respondents to reflect on the operational adaptations made because of COVID-19. Most mills (75%) implemented additional health and safety measures in response to COVID-19, reorganized staffing (38%), or invested in equipment to replace labour (6%).

4. Discussion

This analysis shows that the impact of the pandemic on wood pellet production in Canada was small, with the most significant repercussions limited to the first few months. Overall, no notable impact was observed on wood pellet prices, feedstock prices, or exports, although negative repercussions were identified for certain mills because of regional or local conditions. The results of the analysis suggest that Canadian wood pellet supply chains have generally been resilient to the disruptions caused by the pandemic, with wood pellet mills largely able to continue operating and shipping their products to market. The factors that contributed to the observed resilience are discussed below, in conjunction with the implications for the energy sector and the role of wood pellets as a growing source of renewable energy.

First, the ability of some mills to shift their feedstock mix to include more harvest residues when numerous sawmills closed during the first wave allowed them to adapt quickly. With feedstock prices following an upward trend for several years prior to the COVID-19 pandemic [41] due to sawmill shutdowns and curtailments in British Columbia, several mills had already invested in upgrades to allow more feedstock flexibility [46]. This was noted by certain survey respondents during the first wave of the pandemic, with pellet producers pivoting to source more fibre from harvest residues when sawmill production was curtailed. The quick recovery of lumber production after initial sawmill closures also minimized impacts on producers and stabilized feedstock supply.

In addition to a relatively stable ability to supply pellets, the demand for wood pellets continued to grow. With wood pellets becoming increasingly important as a renewable fuel for electricity generation in the United Kingdom and Asia, demand for Canadian wood pellets has been largely driven by long-term contracts with power plants in those regions [25]. The long-term pellet supply contracts that Canadian firms have with power producers (considered an essential service during the pandemic) insulated pellet producers to some extent. Although demand for electricity declined as the global economy slowed [9], contractual agreements for industrial wood pellet delivery used in power plants was unaffected. Looking ahead, global demand for wood pellets is expected to continue to grow in 2022, especially because of markets in the United Kingdom, South Korea, and Japan, creating a favorable environment for Canadian wood pellet production and exports to continue on their upward trend [47].

In contrast with other forms of intermittent renewable energy (e.g., wind, solar), wood pellets provide a dispatchable source of renewable electricity (i.e., supply to the grid can be adjusted on demand). As such, power plants fueled by wood pellets play an important role in generating both baseload and peak electricity. Stability of fuel price and supply contribute to meeting electricity demand without large fluctuations in electricity prices. Hence, the resilience of wood pellet supply chains, and associated price stability also enhances the attractiveness of wood pellets relative to fossil fuels for electricity generation. Throughout the pandemic, crude oil prices have shown high volatility [48] and by the end of 2021, natural gas prices in the United Kingdom had reached a record high [49]. With more than 40% of electricity generated from natural gas in the United Kingdom in 2021, this resulted in an increase in electricity prices and a record level of renewable electricity production. Although fluctuations in natural gas prices at the end of 2021 are likely related to factors other than the COVID-19 pandemic, the volatility in fossil energy prices further highlights the significance and importance of resilient wood pellet supply chains.

Another factor that contributed to the resilience observed in the Canadian wood pellet sector was the designation of the forest and energy sectors as essential, which allowed mills to continue operation through the shutdowns mandated early in the pandemic. The strategic location of pellets mills close to established transportation routes and export channels also likely helped to maintain exports despite transportation disruptions noted by some mills.

The most important factor diminishing the resilience of the pellet sector was labour shortages. Although labour does not appear to have impacted national pellet production levels or prices, it was noted by survey respondents as a significant challenge that worsened as the pandemic wore on. There are likely many reasons for the noted labour shortages, including the availability of the Canada Emergency Response Benefit, the need for specialized workers, as well as infections and outbreaks among mill operators. In this context, the high vaccination rates observed in Canada could help alleviate labour shortages in wood pellet facilities and in the biomass supply chain upon which they rely. However, other challenges remain, and the pandemic has helped to expose this potential vulnerability in the wood pellet sector. To address these challenges, industry and government could support the training of workers for the specialized skills required in the forest sector, and encourage young workers to consider a career in forestry and other specialized trades [6]. In addition to labour availability, it has been shown that the pandemic exacerbated the difficulty of accessing freight transportation services, which existed in certain regions prior to the pandemic [50].

Other analyses of biomass supply chains for bioenergy drew similar conclusions. Kline et al. [6] noted comparable results in the Southeastern United States wood pellet industry, citing minimal pandemic-related impacts. The authors reported early issues associated with labour availability, but found the wood pellet industry to be resilient, with increased production levels over the course of the pandemic, likely due to stable demand driven by long-term contracts. Similarly, Kulisic et al. [10] observed few changes within the global bioeconomy as a result of the pandemic. The authors noted early issues related to transportation logistics and labour; however, the bio-based industries generally adapted quickly, suggesting an inherent resilience to shocks. This study also highlighted the potential contribution of investments in biomass supply chains to economic recovery under four different scenarios for the COVID-19 pandemic.

Although the two-pronged approach (industry data and surveys) used for this analysis addresses most limitations associated with either approach on its own, there are still some caveats. Most importantly, it was not always possible to separate the impact of the pandemic on the wood pellet industry from other pre-existing factors such as the lumber trade dispute with the United States and the related impacts on lumber production [51], freight rail access issues [50], or restrictions on harvesting levels [52], which prevail across the country but especially in British Columbia. Additionally, due to data and time limitations, it was not possible to explore the full effect of the pandemic on forest subsectors that compete for wood pellet feedstock (e.g., composite panel producers). Changing fortunes within these subsectors could create regional feedstock supply issues for wood pellet producers beyond what has been considered here, but the survey results suggest this has not been the case so far. Finally, the analysis largely focused on the supply of pellets from Canadian producers; a more detailed analysis on the demand for wood pellets in different end-use sectors or geographies is warranted, but beyond the scope of this study.

5. Conclusions

This analysis indicates that the Canadian pellet industry was relatively resilient to the disruptions caused by the first three waves of the COVID-19 pandemic. Producers were generally able to source needed sawmill and harvest residues, and some shifted their feedstock mix to adapt to changes in local availability. Recognition of the Canadian forest sector, including wood pellet producers, as an essential service contributed to its insulation from most of the negative impacts of the pandemic and allowed individual producers to quickly adapt to changing conditions. Additionally, stable demand driven by long-term contracts for industrial pellets used for heat generation guaranteed sales. For the most part, negative impacts on the wood pellet industry experienced early in the pandemic (e.g., access to transportation services and reduced feedstock availability), subsided by the time the second and third waves hit, but labour availability remained an ongoing challenge.

This study highlighted key features of resilient supply chains, including integration with other industries, flexibility regarding feedstock and long-term contracts, that may help other companies and sectors be more resilient to unanticipated shocks. It also highlights the need for continued efforts to train and retain skilled labourers. The fact that wood pellet prices remained stable throughout a period of major global disruption, when fossil fuel prices exhibited higher volatility, points to their reliability as a source of renewable energy

Since this study was completed, Canada experienced a fourth wave, driven by the COVID-19 Delta variant, and is slowly coming out of a fifth wave caused by the Omicron variant, which resulted in record daily cases of COVID-19. Although the exact short- and mid-term impacts of the fifth wave cannot be predicted at the time of writing, the results of this study indicate that wood pellet producers are overall in a good position to address the challenges caused by the rising prevalence of COVID-19 in communities across the country. However, short-term interruptions of operations remain possible in situations where vaccines are less effective against emerging variants, thus exacerbating existing labour shortages.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/en15093179/s1, S1: First survey questionnaire, S2: Second survey questionnaire, S3: First survey responses by province or region, S4: Second survey responses by province or region.

Author Contributions

Conceptualization, B.G., H.M., E.H. and D.W.M.; Data curation, B.G., H.M., E.H. and M.J.B.; Formal analysis, B.G., H.M., E.H. and M.J.B.; Investigation, B.G., H.M. and E.H.; Methodology, B.G., H.M., E.H. and D.W.M.; Software, H.M.; Validation, B.G., H.M. and E.H.; Visualization, B.G., E.H. and M.J.B.; Writing—original draft, B.G., H.M., E.H. and M.J.B.; Writing—review & editing, B.G., H.M., E.H., M.J.B. and D.W.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by IEA Bioenergy Task 43: Biomass supply chains for bioenergy within bioeconomy (2019–2021).

Institutional Review Board Statement

Not applicable. Ethical review and approval is not required for this type of study under the Canadian Tri-Council Policy Statement: Ethical Conduct for Research Involving Humans.

Informed Consent Statement

Not applicable.

Data Availability Statement

Publicly available datasets: results of statistical analysis. This data can be found here: DOI 10.17605/OSF.IO/96WMG.

Acknowledgments

The authors acknowledge the support of Nathan Murray at the Canadian Forest Service, Natural Resources Canada, for providing information related to the monitoring of curtailed and closed Canadian forest product facilities. The authors would also like to acknowledge the support of the Wood Pellet Association of Canada for the distribution of the surveys and the contribution of the wood pellet producers who answered the surveys.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

Appendix A

Statistical Analysis: Two waves of surveys were administered using AllCounted (AllCounted Inc. 2021). The analysis of survey results conducted in SAS (Statistical Analysis Software, SAS Institute Inc., Version 9.4) using PROC FREQ, including the RISKDIFF option, to generate confidence intervals for the difference between the following two groups:

- British Columbia versus Québec mills (for questions with a minimum of 5 to 10 positive responses for British Columbia or Québec);

- Survey 1 responses versus Survey 2 responses (for questions repeated in both waves of the survey with a sufficient number of positive responses).

The z test was implemented to test the difference between these two proportions, and an alpha level of 0.05 was selected as the definition of statistical significance.

Presentation of Results: The statistical analysis is presented for (a) British Columbia versus Québec—Survey 1; (b) British Columbia versus Québec—Survey 2; and (c) Survey 1 versus Survey 2 overall. CI limits not including zero represent significant non-zero differences at the 0.05 alpha level.

References

- Rothengatter, W.; Zhang, J.; Hayashi, Y.; Nosach, A.; Wang, K.; Oum, T.H. Pandemic Waves and the Time after COVID-19—Consequences for the Transport Sector. Transp. Policy 2021, 110, 225–237. [Google Scholar] [CrossRef]

- Beckman, J.; Countryman, A.M. The Importance of Agriculture in the Economy: Impacts from COVID-19. Am. J. Agric. Econ. 2021, 103, 1595–1611. [Google Scholar] [CrossRef] [PubMed]

- Stanturf, J.A.; Mansuy, N. COVID-19 and Forests in Canada and the United States: Initial Assessment and Beyond. Front. For. Glob. Chang. 2021, 4, 101. [Google Scholar] [CrossRef]

- Statistics Canada COVID-19 in Canada: A One-Year Update on Social and Economic Impacts. Available online: https://www150.statcan.gc.ca/n1/pub/11-631-x/11-631-x2021001-eng.htm (accessed on 19 December 2021).

- Golan, M.S.; Jernegan, L.H.; Linkov, I. Trends and Applications of Resilience Analytics in Supply Chain Modeling: Systematic Literature Review in the Context of the COVID-19 Pandemic. Environ. Syst. Decis. 2020, 40, 222–243. [Google Scholar] [CrossRef]

- Kline, K.L.; Dale, V.H.; Rose, E. Resilience Lessons from the Southeast United States Woody Pellet Supply Chain Response to the COVID-19 Pandemic†. Front. For. Glob. Chang. 2021, 4, 674138. [Google Scholar] [CrossRef]

- Kidon, J.; Fox, G.; McKenney, D.; Rollins, K. Economic Impact of the 1998 Ice Storm on the Eastern Ontario Maple Syrup Industry. For. Chroni. 2001, 77, 667–675. [Google Scholar] [CrossRef][Green Version]

- Lloyd, S.A.; Smith, C.T.; Berndes, G. Potential Opportunities to Utilize Mountain Pine Beetle-Killed Biomass as Wood Pellet Feedstock in British Columbia. For. Chron. 2014, 90, 80–88. [Google Scholar] [CrossRef]

- Mofijur, M.; Fattah, I.M.R.; Alam, M.A.; Islam, A.B.M.S.; Ong, H.C.; Rahman, S.M.A.; Najafi, G.; Ahmed, S.F.; Uddin, M.A.; Mahlia, T.M.I. Impact of COVID-19 on the Social, Economic, Environmental and Energy Domains: Lessons Learnt from a Global Pandemic. Sustain. Prod. Consump. 2021, 26, 343–359. [Google Scholar] [CrossRef]

- Kulisic, B.; Gagnon, B.; Schweinle, J.; Van Holsbeeck, S.; Brown, M.; Simurina, J.; Dimitriou, I.; McDonald, H. The Contributions of Biomass Supply for Bioenergy in the Post-COVID-19 Recovery. Energies 2021, 14, 8415. [Google Scholar] [CrossRef]

- Schipfer, F.; Kranzl, L.; Olsson, O.; Lamers, P. The European Wood Pellets for Heating Market—Price Developments, Trade and Market Efficiency. Energy 2020, 212, 118636. [Google Scholar] [CrossRef]

- Natural Resources Canada; Canadian Forest Service. The State of Canada’s Forests: Annual Report 2020; Natural Resources Canada/Canadian Forest Service: Ottawa, ON, Canada, 2020; p. 88. [Google Scholar]

- Statistics Canada Canadian International Merchandise Trade Web Application. Available online: https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2021004-eng.htm (accessed on 29 December 2021).

- Watters, A. Canada: Wood Pellets for Heat and Power; United States Department of Agriculture Foreign Agricultural Service: Ottawa, ON, Canada, 2021.

- Visser, L.; Hoefnagels, R.; Junginger, M. Wood Pellet Supply Chain Costs—A Review and Cost Optimization Analysis. Renew. Sustain. Energy Rev. 2020, 118, 109506. [Google Scholar] [CrossRef]

- Bogdanski, B.; Sun, L.; Peter, B.; Stennes, B. Markets for Forest Products Following a Large Disturbance: Opportunities and Challenges from the Mountain Pine Beetle Outbreak in Western Canada; Natural Resources Canada/Canadian Forest Service: Victoria, BC, Canada, 2011; ISBN 978-1-100-18286-5. [Google Scholar]

- Boukherroub, T.; LeBel, L.; Lemieux, S. An Integrated Wood Pellet Supply Chain Development: Selecting among Feedstock Sources and a Range of Operating Scales. Appl. Energy 2017, 198, 385–400. [Google Scholar] [CrossRef]

- Thrän, D.; Peetz, D.; Schaubach, K. Global Wood Pellet Industry and Trade Study 2017; IEA Bioenergy: Paris, France, 2017; ISBN 978-1-910154-32-8. [Google Scholar]

- U.S. Energy Information Administration Monthly Densified Biomass Fuel Report. Available online: https://www.eia.gov/biofuels/biomass/#table_data (accessed on 31 March 2022).

- Akhtari, S.; Sowlati, T.; Griess, V.C. Optimal Design of a Forest-Based Biomass Supply Chain Based on the Decision Maker’s Viewpoint Towards Risk. For. Sci. 2020, 66, 509–519. [Google Scholar] [CrossRef]

- Béland, M.; Thiffault, E.; Barrette, J.; Mabee, W. Degraded Trees from Spruce Budworm Epidemics as Bioenergy Feedstock: A Profitability Analysis of Forest Operations. Energies 2020, 13, 4609. [Google Scholar] [CrossRef]

- Mobini, M.; Sowlati, T.; Sokhansanj, S. A Simulation Model for the Design and Analysis of Wood Pellet Supply Chains. Appl. Energy 2013, 111, 1239–1249. [Google Scholar] [CrossRef]

- Simet, A. Sawdust Strategies. Available online: http://biomassmagazine.com/articles/17694/sawdust-strategies (accessed on 19 December 2021).

- Thiffault, E.; Barrette, J.; Blanchet, P.; Nguyen, Q.N.; Adjalle, K. Optimizing Quality of Wood Pellets Made of Hardwood Processing Residues. Forests 2019, 10, 607. [Google Scholar] [CrossRef]

- Thrän, D.; Schaubach, K.; Peetz, D.; Junginger, M.; Mai-Moulin, T.; Schipfer, F.; Olsson, O.; Lamers, P. The Dynamics of the Global Wood Pellet Markets and Trade—Key Regions, Developments and Impact Factors. Biofuels Bioprod. Biorefin. 2019, 13, 267–280. [Google Scholar] [CrossRef]

- Abbott, B.; Stennes, B.; Cornelis van Kooten, G. Mountain Pine Beetle, Global Markets, and the British Columbia Forest Economy. Can. J. For. Res. 2009, 39, 1313–1321. [Google Scholar] [CrossRef]

- Tang, C.S. Robust Strategies for Mitigating Supply Chain Disruptions. Int. J. Logist. Res. Appl. 2006, 9, 33–45. [Google Scholar] [CrossRef]

- Janssen, M.; Stuart, P. Drivers and Barriers for Implementation of the Biorefinery. Pulp Paper Can. 2010, 111, 6. [Google Scholar]

- Booth, D.; Vertinsky, I. Strategic Positioning in a Turbulent Environment: An Empirical Study of Determinants of Performance in the North American Forest Industry. For. Sci. 1991, 37, 903–923. [Google Scholar] [CrossRef]

- Baghizadeh, K.; Zimon, D.; Jum’a, L. Modeling and Optimization Sustainable Forest Supply Chain Considering Discount in Transportation System and Supplier Selection under Uncertainty. Forests 2021, 12, 964. [Google Scholar] [CrossRef]

- International Energy Agency. Net Zero by 2050: A Roadmap for the Global Energy Sector; IEA Publications: Paris, France, 2021. [Google Scholar]

- Post, L.; Boctor, M.J.; Issa, T.Z.; Moss, C.B.; Murphy, R.L.; Achenbach, C.J.; Ison, M.G.; Resnick, D.; Singh, L.; White, J.; et al. SARS-CoV-2 Surveillance System in Canada: Longitudinal Trend Analysis. JMIR Public Health Surveill. 2021, 7, e25753. [Google Scholar] [CrossRef] [PubMed]

- Government of Canada Canada’s COVID-19 Economic Response Plan. Available online: https://www.canada.ca/en/department-finance/economic-response-plan.html (accessed on 19 December 2021).

- Government of Canada Guidance on Essential Services and Functions in Canada during the COVID-19 Pandemic. Available online: https://www.publicsafety.gc.ca/cnt/ntnl-scrt/crtcl-nfrstrctr/esf-sfe-en.aspx (accessed on 19 December 2021).

- The Council of Atlantic Premiers Atlantic Provinces Form Travel Bubble. Available online: https://cap-cpma.ca/atlantic-provinces-form-travel-bubble-amended-version/ (accessed on 19 December 2021).

- Detsky, A.S.; Bogoch, I.I. COVID-19 in Canada: Experience and Response to Waves 2 and 3. JAMA 2021, 326, 1145–1146. [Google Scholar] [CrossRef]

- Ali, M.J.; Bhuiyan, A.B.; Zulkifli, N.; Hassan, M.K. The COVID-19 Pandemic: Conceptual Framework for the Global Economic Impacts and Recovery. In Towards a Post-COVID Global Financial System; Kabir Hassan, M., Muneeza, A.M., Sarea, A., Eds.; Emerald Publishing Limited: Bingley, UK, 2022; pp. 225–242. ISBN 978-1-80071-625-4. [Google Scholar]

- Statistics Canada Table 16-10-0017-01 Lumber Production, Shipments, and Stocks by Species, Monthly. Available online: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1610001701 (accessed on 29 December 2021).

- Fastmarkets RISI Random Lengths Weekly Report. Available online: https://www.risiinfo.com/product/random-lengths-price-and-news-service/ (accessed on 19 December 2021).

- Statistics Canada Table 36-10-0434-01 Gross Domestic Product (GDP) at Basic Prices, by Industry, Monthly. Available online: https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610043401 (accessed on 29 December 2021).

- Forisk Consulting Forisk Wood Fiber Review. Available online: https://forisk.com/product/forisk-wood-fiber-review/ (accessed on 29 December 2021).

- Hawkins Wright Forest Energy Monitor Market Report. Available online: https://www.hawkinswright.com/biomass/forest-energy-monitor (accessed on 29 December 2021).

- Nunes, L.J.R.; Casau, M.; Ferreira Dias, M. Portuguese Wood Pellets Market: Organization, Production and Consumption Analysis. Resources 2021, 10, 130. [Google Scholar] [CrossRef]

- Kittler, B.; Stupak, I.; Smith, C.T. Assessing the Wood Sourcing Practices of the U.S. Industrial Wood Pellet Industry Supplying European Energy Demand. Energy Sustain. Soc. 2020, 10, 23. [Google Scholar] [CrossRef]

- Størdal, S.; Lien, G.; Trømborg, E. Impacts of Infectious Disease Outbreaks on Firm Performance and Risk: The Forest Industries during the COVID-19 Pandemic. J. Risk Financ. Manag. 2021, 14, 318. [Google Scholar] [CrossRef]

- Copley, A. Canadian Wood Fiber: Availability and Impacts. Available online: http://biomassmagazine.com/articles/17003/canadian-wood-fiber-availability-and-impacts (accessed on 17 February 2022).

- Strauss, W. 2022 Wood Pellet Markets Outlook. Available online: https://www.canadianbiomassmagazine.ca/2022-wood-pellet-markets-outlook/ (accessed on 22 February 2022).

- Christopoulos, A.G.; Kalantonis, P.; Katsampoxakis, I.; Vergos, K. COVID-19 and the Energy Price Volatility. Energies 2021, 14, 6496. [Google Scholar] [CrossRef]

- Department for Business, Energy and Industrial Strategy UK Energy in Brief. 2021. Available online: https://www.gov.uk/government/statistics/uk-energy-in-brief-2021 (accessed on 17 February 2022).

- Canadian Transportation Agency Inquiry Report—2019 Vancouver Freight Rail Investigation. Available online: https://otc-cta.gc.ca/eng/inquiry-report-2019-vancouver-freight-rail-investigation-revised (accessed on 29 December 2021).

- Li, X.; Mokhtarzadeh, F.; Kooten, G.C. van A Gravity Model of Softwood Lumber Trade: An Application to the Canada-U.S. Trade Dispute. J. For. Econ. 2021, 36, 351–381. [Google Scholar] [CrossRef]

- Government of British Columbia Modernizing Forest Policy in British Columbia. Available online: https://www2.gov.bc.ca/assets/gov/farming-natural-resources-and-industry/forestry/competitive-forest-industry/modernizing_forestry_in_bc_report.pdf (accessed on 29 December 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).