Abstract

The aim of this study was to present factors shaping biodiesel production in Poland influenced by the Common Agricultural Policy (CAP) of the European Union (EU). The performance of Polish biodiesel producers was analyzed. A regression model was built to identify the factors that impacted biodiesel production in Poland. The Farm Accountancy Data Network (FADN) was the main source of information about Polish biodiesel farmers. The FADN is the most comprehensive and detailed source of economic and agricultural data in Poland. Changes in the number of biodiesel producers in the Polish market were analyzed with the use of indicators. In the last stage of the study, the impact of selected variables on the performance of rapeseed farms was determined in a regression analysis. The second source of information was Eurostat data, which provided information about pure biodiesel production in the European Union (EU) countries from 2004 to 2019. The biggest producers of pure biodiesel in the European Union are Germany, France, Spain, and Italy. Poland is also an important producer of biodiesel in the European Union (EU). Both descriptive statistics and statistical analyses are presented. First, we used descriptive statistics to present changes in pure biodiesel production in the European Union. Second, we used statistical analyses to present factors shaping the economic performance of biodiesel producers in Poland. The study demonstrated that the number of rapeseed producers in Poland has increased and that farm performance has improved during the period analyzed. Rapeseed farms have increased their land area and the value of fixed and current assets. The land area under rapeseed cultivation has increased after Poland joined the EU, which suggests a positive response to a growing demand for biofuels.

1. Introduction

Fossil fuels are the main source of energy being used in the world today. That is why countries with low resources of oil must import it. However, this source of energy is responsible for the contamination of the environment, the fossil fuel crisis, and the increase in global temperature [1].

Developed and developing countries are consuming energy for heating homes and to achieve better standards of living in society. The development of a given country depends on electricity production. Electricity consumption has an impact on the standard of living for people as well as the state of the environment. The increase in population has an impact on electricity consumption and economic conditions [2]. The demand for energy is the result of increased urbanization and population growth [3]. There is a strong relationship between energy consumption from nonrenewable and renewable sources, carbon dioxide (CO2) emission, and economic growth [4,5,6].

Fossil fuels are the main contributors to global warming, resulting in increased interest in moving to renewable energy sources (RES), including stable biomass, sun, wind, and geothermal [7,8,9]. The use of fossil fuels is considered to be environmentally stressful [10]. This situation led to the current focus on the use of RES. The RES are often called green energy and they are considered to be non-exhaustible, lower in carbon footprint, more sustainable, and can replace fossil fuels or at least partly fulfil the demand for energy [11]. Wang et al. [12] found that the use of RES should be promoted for more sustainable development. Sustainable development helps to create jobs and to create cohesion between energy development and industrial progress [13].

Higher demand for RES, particularly biofuels can increase competition for agricultural land between rapeseed farmers and farmers producing cereals and other crops. This process can lead to the intensification of agricultural production or the cultivation of rapeseed on nonarable land [14]. As a result, greenhouse gas emissions could increase in the transformed land areas and in regions with large coal deposits. To minimize these risks, the EU adopted Directive 2015/1513/EC to promote the use of advanced biofuels characterized by low greenhouse gas emissions and to limit competition with land used for food crops. The share of energy from conventional biofuels was limited to 7% in the final consumption of energy in transport, and the minimum share of advanced biofuels in diesel production was set at 0.5% (reference value) [14,15].

Diesel derived from fossil fuel resources was compared to RES, such as photovoltaics (PV). Both diesel and PV have high capital costs. Diesel has higher operating costs and maintenance requirements compared to PV. The energy delivered from diesel is constant, whereas PV depends on radiation from the Sun [16]. The demand for diesel should be reduced when the photovoltaics (PV) sources increase [17].

Different models have been used in the literature to measure the development of RES. Martinez et al. [18] used linear multiple regression to predict the daily average ammonia concentration in rearing tanks in aquaculture. Autoregressive integrated moving average models were used by Maleki et al. [19] in predicting failures in computer networks.

The challenges related to energy needs, biodiesel, and RES have been recognized in the literature. Dai and Zhu [20] measured the dynamic relationships among WTI crude oil, gas, and the Chinese stock markets related to BRI, including CNI Electric Utilities (EU), CNI Highspeed Railway (HSR), CNI Ferrous Metals (FM), CNI Infrastructure (INF), CNI Agriculture (AGR), and CNI Communications (COM). Their research and analysis pointed to a strong relationship between analyzed variables and concluded that high hedging effectiveness could be achieved by investments.

Dai, Zhu and Zhang [21] analyzed the dynamic spillover effects and portfolio strategies between crude oil, gold, and Chinese stock markets related to new energy vehicles. They found that the crude oil and gold were the net receivers of systemic shocks, while all of the analyzed stock markets were the net transmitters of systemic shock.

Moreover, Dai, Li and Yang [22] used forecasting stock return volatility and measured the role of shrinkage approaches in a data-rich environment. They found that an elastic net has the best predicting ability for stock return volatility. They also found that the shrinkage strategies obtained better results than single predictors in the portfolio.

Bórawski et al. [23] measured the opportunities for biodiesel production in Poland after accession into the European Union (EU). The authors of the paper used three scenarios, increasing biodiesel production, decreasing biodiesel production, and no change in production within Poland. They found that the production of biodiesel was likely to increase. This increase is particularly important during the war between Russia and Ukraine, which caused the threats to global energy markets.

Currently, little information is available about the economic performance of rapeseed producers. This paper will help to fill in the gap existing in the literature. Both the sown land areas and the total rapeseed harvest are increasing in Poland. Increasingly, rapeseed is used for biodiesel production of biofuel rather than for edible oil production. Moreover, the price of rapeseed is also increasing. In August 2022, the price of rapeseed reached the level of PLN 4.900 per ton—two times higher than just two years prior. Additionally, the war between Russia and Ukraine caused global disruptions in the energy sector. The European Union (EU) is suffering from low deliveries of gas, petrol, and other sources of energy from Russia. These shortages should help to encourage farmers to produce more rapeseed for biodiesel production in Poland and the rest of the EU.

The aim of this study was to evaluate factors shaping the economic performance of biodiesel production in Poland under the Common Agricultural Policy of the European Union (EU). An attempt was made to answer the following questions:

- How many rapeseed producers in Poland are participating in the Farm Accountancy Data Network?

- What incomes are generated by Polish rapeseed producers?

- Which factors influence income levels in the Polish rapeseed segment?

The following research hypotheses were formulated based on a review of the literature:

Hypothesis 1 (H1).

The incomes and competitiveness of Polish rapeseed farmers have improved after accession to the European Union (EU) as a result of specific policies or actions that positively impact the biodiesel market and its producers.

Hypothesis 2 (H2).

The number of rapeseed farms in Poland has increased due to the increased demand for biofuels and the implementation of energy policies of the European Union (EU) that improve the economic situation.

2. Literature Review

2.1. The Impact of Common Agricultural Policy (CAP) on Energy Sector

The Common Agricultural Policy (CAP) has stabilized the prices of agricultural commodities and materials in the EU and other countries in the world [24]. The CAP promotes sustainable rural development by improving agricultural productivity, creating new jobs, protecting the environment, promoting sustainable land management, and enhancing social balance and equity [25]. Farm consolidation and large-scale farming contribute to improvements in agricultural productivity.

The CAP provides support for rapeseed producers. An EU-funded support program for energy crop farmers was introduced in Poland on 1 January 2007. Producers of energy crops, including rapeseed, agrimony, rye, maize, flax, sugar beets, and soybean, as well as perennial crops, such as willow, can apply for subsidies that are calculated based on the land area farmed [26]. Farmers apply for payments with the Agency for the Restructuring and Modernization of Agriculture (ARMA). Only owners of cropped land with a minimum area of 1 ha are eligible to apply.

In the EU, there are no tariffs or import quotas to protect European producers of oilseed crops. Only the EU olive oil market is protected against external competition. After Poland joined the EU, oilseed crop farmers ceased to be protected against competitors from other countries. Seed and meal imports are exempt from custom duties, and import duties on vegetable oil are low. In Poland, customs duties on oilseed crops and products imported from other EU Member States were reduced from 86% to 0% for rapeseed oil, from 40% to 0% for margarine, and from 27% to 0% for rapeseed [27,28].

Rapeseed prices on the European market are shaped by the interactions between demand and supply [29]. The performance of the EU rapeseed market is indirectly influenced by Directive 2009/30/EC [30], which promotes the use of renewable fuels and places all EU Member States under the obligation to blend higher levels of biofuel components into diesel. This regulation has increased the demand for rapeseed, the main component of biofuels produced in Poland [29].

Poland adopted the Act of 25 August 2006 on biocomponents, liquid biofuels, and the fuel quality monitoring system to comply with EU regulations. The above legal act laid the foundations for the introduction of the National Biofuel Targets. In 2013, the share of biocomponents in diesel was set at 7.1% [31,32].

In 2007, the Council of Ministers adopted the multi-year program for the promotion of biofuels and other renewables for 2008–2014, which was an important milestone in Poland’s road towards renewable energy production. As a result, biocomponents for fuel production were exempt from excise duty amounting to PLN 879 million in 2008 [31].

In December 2008, the EU adopted the climate and energy package (known as the 3 × 20 package) to counteract climate change. The package was made up of complementary legislation (Decision No. 406/2009/EC, Directive 2003/87/EC, Directive 2009/28/EC, Directive 2009/29/EC, and Regulation 443/2009), which introduced specific actions and targets that should be met by 2020 [33]. The main goals of the climate and energy package were to: reduce primary energy use by 20% relative to 1990 levels (and improve energy efficiency by 20%), reduce greenhouse gas emissions by at least 20%, increase the share of RES consumption to 20% (this target was determined individually by each Member State, and it was set at 18% in Germany and at 15% in Poland), and increase the share of liquid biofuels in diesel production to 10% [33,34].

The need to protect the environment caused many nations to act globally. Since 1995, annual meetings of the United Nations Framework Convention on Climate Change (UNFCCC) have been helped in at least 196 countries. As a result of these meetings, the Kyoto protocol was created with the goal of reducing greenhouse gas emissions (GHGs). In 2015, in Paris, a new protocol was established with the goal of keeping global warming below 2 degrees Celsius above the preindustrial level by 2100 [35]. It is not clear if all countries, especially the biggest emitters of pollutions, will ratify the agreement. The problem is described in the literature, and it shows the relationship between real income, CO2 (carbon dioxide) emissions, and aggregate energy consumption [36].

2.2. Factors That Influence the Performance of Rapeseed Producers

Factors that affect the performance and income of rapeseed producers have been analyzed by numerous authors. Berbeka and Bugdol [37] demonstrated that farm household income is influenced mainly by direct payments, as well as payments targeting areas with natural or other specific constraints (ANCs) [38]. Factors that influence agricultural incomes were divided into endogenous (internal, representing farm resources) and exogenous (external) factors by Ślusarz et al. [39]. According to Ślusarz et al. [40], exogenous determinants of farm income include economic, demographic, political, social, natural, and technological factors. Marks-Bielska and Zielińska [41] noted that agricultural producers can increase their output and productivity mainly by enlarging farmland area. An increase in farm size is the key factor that drives changes in the structure of agricultural producers in Poland and other EU countries. Land and farm size exert the greatest effect on agricultural development and farm incomes [42]. Land resources are responsible for the production of nearly 95% of food and feedstuffs [43]. Poland, Romania, Hungary, and Czechia are characterized by smaller farms and lower incomes in agriculture [44]. However, the number of small farms has decreased, while the largest agricultural enterprises continued to increase their land resources in these countries [45]. In Poland, the transfer of land from small to large farms is a slow process. Land is handed down mainly to family members because Polish farmers have a long tradition of keeping land in the family. For this reason, small farms often lease or share agricultural machinery [46]. The CAP and EU programs supporting rural development have increased the demand for agricultural land in Poland and other EU countries. However, the decision to sell or lease land is ultimately made by the farm owners [47].

Access to external sources of capital is an important determinant of productivity and performance in the agricultural sector. According to Wasilewski [48], farms rarely apply for bank loans and implement low-risk financial strategies due to high credit costs. High debt can be indicative of structural dependency on external financing because a farm’s assets are financed largely from external sources of capital. In turn, low debt supports a farm’s financial independence because its assets are financed from the owner’s equity [40]. The CAP is a source of cheap capital for agricultural producers. Some of these funds are distributed under the Rural Development Program, which enables producers to invest in farms and improve their performance with low financial risk [49].

Farm size can also be expanded through leasing land [41]. In the studied farms, nearly 31% of farming operations operated with some leased land in 2017. Leasing land is an attractive option because the price of agricultural land is high in Poland and other EU countries. In Poland, the average price of privately owned farmland increased from PLN 5753/ha to PLN 39,706/ha (690.2%) between 2004 and 2016. In that same period, the price of land owned by the Agricultural Property Agency increased from PLN 3736/ha to PLN 32,255/ha (791%). The Rural Development Program was introduced to improve the competitiveness of agriculture, and it has led to an increase in farmland prices and, consequently, the growing popularity of farmland leasing. The program has enabled agricultural producers to invest and enlarge their farms but, in many regions, these opportunities are limited due to the low supply of agricultural land for sale [50,51].

3. Materials and Methods

3.1. Data Sources

We used two sources of data: European Union Statistics (EUROSTAT) and Farm Accountancy Data Network (FADN). The Eurostat data was necessary to combine the biodiesel production in the European Union (EU). We presented average biodiesel production in thousand tons. Moreover, we have analyzed the descriptive statistics for biodiesel production in the EU from 2004 to 2019.

The second source of data was the Farm Accountancy Data Network (FADN), and it was the main source of data for this study. This data was used for the main analysis, the comparison of groups of farms, and the statistical analysis and regression.

The studied population was Polish rapeseed producers who participated in the FADN. Two types of biodiesel farms were analyzed: farms where rapeseed was grown at least once during the studied period, and farms where rapeseed was produced in successive years of the studied period (Table 1). The number of farms that grew rapeseed at least once and participated in the FADN increased from 1679 in 2005 to 3478 in 2019 (107.15%). In turn, the number of farms that participated in the FADN and produced rapeseed continuously increased from 684 in 2005 to 870 in 2019 (27.19%). These results indicate that Polish farmers have a growing interest in rapeseed production.

Table 1.

Number of Polish biodiesel farms participating in FADN from 2005 to 2019.

3.2. Methods

Dependent variables were selected based on their significance for the development of rapeseed farms and companies producing edible oil and biofuel. Independent variables were chosen by determining their impact on the dependent variable. Endogenous and exogenous factors were taken into account. Variables displaying autocorrelation were then eliminated. Explanatory variables in the model had the following properties:

- Had sufficiently high volatility;

- Were strongly correlated with the explained variable;

- Were strongly correlated with other non-fulfilling variables;

- Explanatory variables explained the dependent variable;

- Explanatory variables were related to the explained variable.

The final dataset was composed of several variables that significantly influenced the dependent variable.

In rapeseed farms participating in the FADN, farm household income (Y1) was the dependent variable and farm characteristics (X1–X7) were the explanatory variables. It was assumed that the explanatory variables directly affected income in farms that produced rapeseed continuously. Changes in these parameters were examined relative to the baseline year of 2005. Chain-linked indices were not used in the process of building statistical models because the coefficients of determination (R2) obtained in forward selection multiple regression models were lower than fixed-base indices. The significance of regression coefficients (Student’s t-test), statistical significance (p-value), standard error of the mean, and correlation coefficients were calculated. Data were determined to be statistically significant at p ≤ 0.05.

In order to analyze the results, we presented two models for each group of farms. The first model was classical regression and the second was the forward stepwise regression.

The model can be described by a formula of multivariable regression. This regression shows the impact of independent variables on the dependent variable (farm household income). The method is widely used to analyze the results.

The multivariable regression function can be written as follows [51]:

where:

Y = α0 + α1X1 + α2X2 + … + αkXk + ξ

Y—dependent variable;

Xi—explanatory variables (i = 1, 2, …, k);

ξ—random component;

α0—intercept of regression function;

αi—structural parameters of the model (i = 1, 2, …, k).

We used the method of least squares to perform the regression analysis. We used the Statistica 13 program for data analysis.

The selection of dependent variables resulted from their importance for rapeseed producers. The selection of the independent variables was made on the basis of the substantive justification of their impact on the farm household income of rapeseed producers. In this respect, exogenous variables were taken into account. Then, from the set of presented variables, variables with high autocorrelation were eliminated [23]. Ultimately, the sets of variables were limited to a few that had a statistically significant effect on the farm household income.

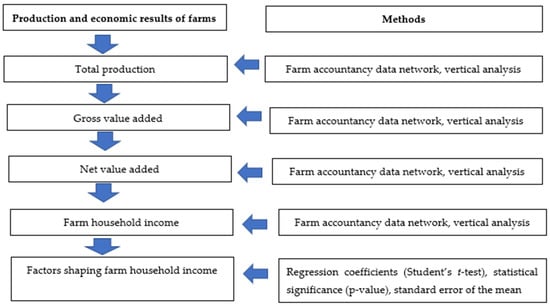

The set of variables that influence farm household incomes comprised the following fixed-base indices (Figure 1):

X1—total labor in LU;

X2—land area in rapeseed production in hectares (ha);

X3—fixed assets in PLN;

X4—current assets in PLN;

X5—total liabilities in PLN;

X6—gross investments in PLN;

X7—direct payments in PLN.

The explained variable was: Y1—farm household income in PLN.

Figure 1.

Production and economic results and the methods used to calculate them. Source: own elaboration based on FADN data [52].

4. Results

4.1. Biodiesel Production in the EU

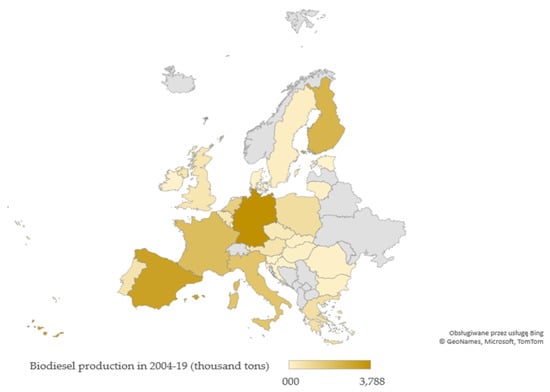

Biodiesel production differs across EU regions. Figure 2 shows the arithmetic mean of a set of numbers, which was the sum of these numbers divided by the sum of the numbers. The arithmetic mean enabled us to present the average number of biodiesel production in the European Union (EU) countries for 2004–2019. Average biodiesel production was highest in Germany, Spain, and France. Biodiesel was not produced by Denmark or Luxembourg. The coefficient of variation was highest in Malta, Romania, and Slovenia (Figure 2). Such high variations in biodiesel production in the EU resulted from differences in the availability of farmland.

Figure 2.

Average pure biodiesel production in EU in 2004–2019 (thousand tons). Source: own elaboration based on Eurostat data [52].

Table 2 depicts descriptive statistics for pure biodiesel production in the EU. The highest coefficient of variation was found in Malta, Romania, and Slovenia. Such results demonstrate the biggest changes in the production of biodiesel in these countries. Denmark, Estonia, and Luxembourg did not produce biodiesel and their coefficient of variation was 0.

Table 2.

Descriptive statistics for biodiesel production in the European Union (EU) from 2004 to 2019 (thousand tons).

The asymmetry described by skewness and kurtosis was negative, suggesting that the data were on the right side of the graph and the tail was spread on the left side.

4.2. Changes in the Value of Assets of Polish Rapeseed Farms Participating in the FADN

Changes in asset value of Polish rapeseed farms that participated in the FADN in 2005–2019 were analyzed. Changes in agricultural land area were noted in the examined period (Table 3). Agricultural land area was lowest in 2005 (71.9 ha) and highest in 2019 (83.13 ha). In the evaluated period, agricultural land area increased by 115.62%.

Table 3.

Agricultural land (ha) and fixed-base indices of changes in agricultural area in biodiesel farms participating in the FADN.

The area of leased land varied in the studied period and was smallest in 2017 (18.6 ha) and largest in 2005 (30.0 ha). These results indicate that the availability of farmland for rent continues to decline in Polish rural areas. The rate of change in leased land reached 63.67% in the analyzed period.

The size of farms continuing rapeseed production and participating in the FADN increased from 31.5 ha in 2005 to 71.5 ha in 2019 (by 126.98%). In this group of farms, the area of leased land was highest in 2012 (23.9 ha) (Table 3).

These results indicate that the studied farms have opportunity for development and can generate substantial profits if effectively managed.

Total labor inputs were also analyzed in this study. Using the FADN data, total labor is expressed in annual work units (AWU), which corresponds to full-time equivalent employment [52]. Total labor includes family labor and hired labor. Total labor inputs were highest in 2007 at 2.34 full-time equivalent employees. This parameter continued to decrease in the following years due to progressive mechanization in the agricultural sector. The amount of labor contributed by family members is expressed in terms of family work units (FWU) for all the non-salaried workers (mainly family members) [25]. In 2005–2017, FWU remained fairly stable at 1.7 to 1.8. In turn, hired labor decreased from 0.6 full-time equivalent employees in 2007 to 0.3 in 2015.

Total assets were divided into fixed and current assets (Table 4). In the studied farms, total assets were lowest in 2005 and highest in 2019. Total assets in Polish rapeseed farms increased by 248.85% between 2005 and 2019.

Table 4.

Total assets (PLN), including fixed-base and chain-linked indices of changes in the value of total assets, in biodiesel farms participating in the FADN.

In farms that participated in the FADN and produced rapeseed in successive years of the examined period, total assets increased by 143.19% between 2005 and 2019. Fixed assets increased by 154.01% in the studied period. The observed increase in total assets resulted from fixed asset investments. Fixed assets accounted for 81% of the total assets in 2005 and 93.1% in 2019. Fixed assets are essential for farming operations, and their value is generally high in the agricultural sector. Fixed assets have a physical form that does not change over time. They are depreciated gradually over their life cycle, their value is transferred to the produced goods, and they are replaced at the end of their service life [53,54]. The systematic reduction in the value of fixed assets is known as depreciation [55].

The value of all fixed assets increased in the studied period. The greatest changes were noted in the value of land, which can be attributed to the growing demand for farmland after Poland joined the EU. In 2017, land accounted for nearly 70% of the total fixed assets. Between 2005 and 2019, the greatest increase (958%) was observed in the value of land and permanent crops. A considerable increase was also noted in the value of breeding stock (102.4%), agricultural machinery, equipment and means of transport (97.1%), and buildings (27.9%). Building value was highest in 2016, whereas the value of machinery and equipment peaked in 2019. An increase in the value of agricultural machinery and equipment suggests that rapeseed farms invested in new technologies to improve their productivity and performance. In Poland, the total value of fixed asset investments in agriculture and hunting increased from PLN 112 million in 2005 to PLN 144 million in 2017 [56]. These changes have contributed to technological progress in agriculture [57,58].

The value of fixed assets in Polish rapeseed farms was analyzed by Skarżyńska et al. in 2016 [59]. The study involved 140 farms and showed that an increase in rapeseed production was accompanied by investments in machinery and equipment. The value of fixed assets was 2.9 times higher in large farms (20–60 ha) than in farms where rapeseed was cultivated on an area of 2–6 ha. In large farms, machinery and equipment were the largest category of fixed assets (40.6%), whereas buildings and structures accounted for only 29.5% of total fixed assets in this group.

Current assets are assets that are used up within one year from the reporting date. Current assets played an important role in the studied rapeseed farms. These assets were used in different stages of production. The value of current assets is transferred to the produced goods. Current assets are used up completely, and their physical form changes during the production process [55]. In farms, the main categories of current assets include mineral fertilizers, plant protection products, and certified seeds that determine a farm’s productivity and crop yields [49,60].

Stocks of products of plant and animal origin were the largest current asset items in the studied farms [52]. According to the Institute of Agricultural and Food Economics, the value of stocks changed in the evaluated period. The value of agricultural stocks was lowest in 2005 (PLN 61,434.56) and highest in 2015 (PLN 153,815.80), for an increase of 150.4%.

4.3. Changes in the Crop Production Profile

The rapeseed farms also produced other crops to diversify their sources of income and maintain healthy soils with crop rotation. In the studied farms, the land under cereal production increased by 5.4% between 2005 and 2019, which could suggest that cereals are an attractive option for agricultural producers. The land area under cereal production was largest in 2016 (53.2 ha). Cereals were selected as an additional crop mostly due to relatively low diversity in agricultural land use. Farms that do not produce livestock are also simpler to manage [61]. Cereal production is the least challenging and guarantees profits in most years. The land area under cereal production also increased due to a rise in prices and higher demand. Most producers generated higher profits by selling grain rather than using it for livestock raised on the farm.

In the analyzed period, changes were also observed in the land under production for the remaining field crops, which, based on the FADN methodology, include legumes, potatoes, sugar beets, herbs, oilseed and fiber crops, hops, tobacco, and other industrial crops. The land area for these crops was smallest in 2005 (19.1 ha) and largest in 2019 (33.1 ha), showing an increase of 72.8%. The land under production of fodder crops decreased by 3.5% between 2005 and 2017. This parameter was highest in 2016 (5.1 ha) and lowest in 2009 (4.1 ha).

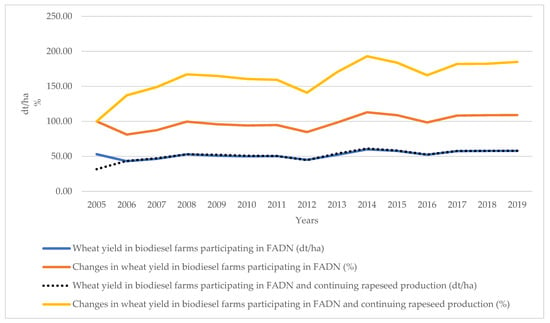

Wheat and maize were the predominant cereal crops, and their yields fluctuated in the examined period (Figure 3). Wheat yields were highest in 2014 (60.0 dt/ha). In comparison with the baseline year of 2005, the greatest increase in wheat yields (112.89%) was noted in 2014 due to favorable weather conditions. Maize yields peaked in 2019 (27.9 dt/ha), and this year was characterized by the highest increase (116.28%) in maize production relative to 2005.

Figure 3.

Wheat yields, including fixed-base indices of changes in crop yields, in biodiesel farms participating in the FADN. Source: own elaboration based on FADN data [52].

Similar changes were observed in the group of farms that participated in the FADN and produced rapeseed in successive years of the analyzed period. Wheat yields were highest in 2014 (61.2 dt/ha), whereas maize yields peaked in 2019 (32.1 dt/ha).

According to Skarżyńska et al. [59], rapeseed yields reached 25.8 dt/ha in small farms (rapeseed land area of 2–6 ha), 28.6 dt/ha in large farms (rapeseed land area of 20–60 ha), and 28.3 dt/ha in medium-sized farms (rapeseed land area of 8–16 ha) [59]. Rapeseed yields are influenced by numerous factors. Groth et al. [62] divided these factors into controllable (fertilizer rate and preceding crop) and uncontrollable factors (agronomic conditions).

4.4. Production and Costs in Polish Rapeseed Farms

Changes in the performance of Polish rapeseed farms participating in the FADN were determined by analyzing the value of agricultural production and the associated costs. Total production varied considerably in the studied period (Table 5). Agricultural production decreased in 2008–2009, after which it continued to increase until 2012. Production decreased in the following years and rose again in 2016. Total production was lowest in 2005 (PLN 244,900) and highest in 2012 (PLN 423,600). In 2019, total production reached PLN 344,000. In general, the value of agricultural production in the studied farms increased by 36% between 2005 and 2019. The observed improvement could be attributed to more effective use of natural resources and capital, direct payments, and other benefits of EU membership.

Table 5.

Total production (PLN) in Polish biodiesel farms from 2005 to 2019.

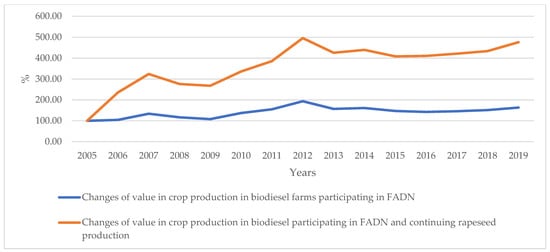

Changes in the value of crop production in the studied rapeseed farms are presented in Figure 4. Crop production is a very important part of agricultural production because crops can be sold to generate income or can be used as feed for farm with an animal production enterprise. Crop production is also very important for keeping land in good condition because it prevents water evaporation and soil erosion. The EU has undertaken special actions for greening the agriculture to keep land in better condition by utilizing different crops. Crop production was lowest in 2005 (PLN 160 thousand) and highest in 2012 (PLN 311 thousand). The value of crop production reached PLN 262 thousand in 2019.

Figure 4.

Changes in the value of crop production in Polish biodiesel farms in 2005–2019 [%]. Source: own elaboration based on FADN data [52].

Cereals generated the highest income crop production. Cereal production was lowest in 2005 (PLN 84 thousand) and highest in 2012 (PLN 247 thousand). The value of cereal production increased by 134.5% between 2005 and 2019. An increase in cereal production usually results from an improvement in yield, which, in turn, is determined by technological progress, climate, and changes in the production technology [63].

The production of oilseed crops increased steadily until 2014, and then fluctuated considerably in the following years of the studied period. Oilseed production was lowest in 2005 (PLN 33 thousand) and highest in 2019 (PLN 123 thousand). Oilseed production increased by 271.07% in the studied period.

Sugar beets were the third most important group of crops in the studied farms. Sugar beet production was lowest in 2008 (PLN 13 thousand) and highest in 2012 (PLN 32 thousand). Sugar beet production increased by 5.16% between 2005 and 2019. In Poland, total sugar beet output increased by 14.5% between 2004 (11.8 million tons) and 2017 (13.512 million tons), due to higher yields, increased land area in sugar beet production, and a decrease in the number of sugar beet farms. Average sugar beet yield increased from 40.7 t/ha in 2004 to 66.5 t/ha in 2017 (by 63.5%), due to the introduction of high-yielding varieties and higher fertilizer efficiency [64]. The number of sugar beet farms decreased from 86,000 in 2004 to 34,701 in 2017 (by 60.4%). Similar trends in agricultural production were noted for other EU countries, in particular, in France and Germany [65].

Protein crops also accounted for a large part of the income associated with crop production in the studied farms. The production of protein crops was lowest in 2008 (PLN 521) and highest in 2016 (PLN 7424.3). Production increased by 507.0% between 2005 and 2019. In turn, the production of energy crops ranged from 0 in 2005 to PLN 1566.3 in 2013.

Total costs included direct costs, general farm overhead, depreciation, and external costs [52]. In the studied farms, total costs ranged from PLN 203,700 in 2005 to PLN 309,400 in 2019. The greatest increase in total costs (151.7%) was observed between 2005 and 2019. Intermediate costs include direct costs and general farm overhead associated with business operations in a given financial year [52]. Intermediate costs were highest in 2019 (PLN 232,000) and lowest in 2005 (PLN 154 000). The greatest increase in intermediate costs (149.9%) was noted between 2005 and 2019.

The costs reported by rapeseed farms participating in the FADN are presented in Table 6. Total costs were lowest in 2005 (PLN 119 thousand) and highest in 2019 (PLN 395 thousand). The greatest increase in direct costs (232%) was observed between 2005 and 2019.

Table 6.

Total costs (PLN) in Polish biodiesel farms from 2005 to 2019.

Rapeseed production costs are difficult to assess based on FADN data. However, the costs associated with rapeseed production in 2016 were analyzed by Skarżyńska et al. [59]. In the cited study, rapeseed production costs were lowest (PLN 3714/ha) in medium-sized farms (rapeseed area of 8–16 ha), where they totaled PLN 131.1/dt of seeds. Production costs accounted for 83.7% of the rapeseed direct production costs in medium-sized farms and for 93.6% of rapeseed direct production costs in small farms (2–6 ha).

4.5. Debt and Investments in Rapeseed Farms

The continued growth and financing capabilities of agricultural farms are determined mainly by the owner’s equity, namely total assets minus long-term and short-term debt. In order to be successful, farmers need to invest in their farms. However, on some farms, income levels are too low for reinvestment in the farm and owners need to borrow money in order to operate. Land, machinery, buildings, and other fixed assets are financed through long-term loans.

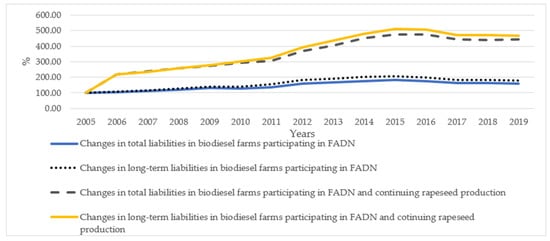

Between 2005 and 2019, the studied farms increased their total liabilities by 301.3% (Figure 5). In the first group of farms, long-term liabilities were highest in 2015 (PLN 226 thousand). In the group of farms that produced rapeseed continuously, long-term liabilities were also highest in 2015 (PLN 282 thousand). These results demonstrate that farmers took on long-term debt at the end of Rural Development Program (RDP) for 2007–2014. This program required 50% co-financing from the owner’s capital and after the investment half of the money was refunded.

Figure 5.

Changes in long-term liabilities in Polish biodiesel farms in 2005–2019 [%]. Source: own elaboration based on FADN data [52].

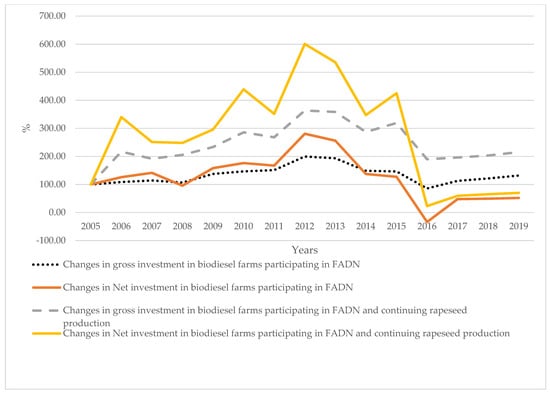

Investment is also very important in rapeseed farms because it can have positive impact on the development of farms and can increase the scale of production for both plants and animals. In the studied rapeseed farms, gross investments were lowest in 2005 (PLN 52 thousand) and highest in 2012 (PLN 105 thousand) (Figure 6). Net investments are calculated by subtracting depreciation from gross investments. Net investments were lowest in 2016 (-PLN 6945) and highest in 2012 (PLN 58 thousand). The value of investments decreased after 2013, which can be associated with the end of the Regional Development Program for 2007–2014. The investment after 2014 was much lower; however, they increased in later years. This is a typical situation that happens between when the first program period ends (2007–2014) and the second starts (2015–2022). Breaks in programs mirror a break in investment at the farm level.

Figure 6.

Changes in investments in Polish biodiesel farms in 2005–2019 [%]. Source: own elaboration based on FADN data [52].

In farms that continued to produce rapeseed in successive years of the studied period, gross investments were highest in 2012 (PLN 114 thousand) and lowest in 2005 (PLN 31 thousand). Negative net investment was not reported in this group of rapeseed producers.

4.6. Changes in the Performance of Rapeseed Producers

The results of the present study indicate that significant changes in livestock production did not take place on Polish rapeseed farms participating in the FADN. These findings could be attributed to Polish farmers’ conservative business strategies, fear of change, and reluctance to modify their production profiles [66]. The prices offered by the Agricultural Property Agency were lower than those noted in private transactions [67]. Average agricultural land area in the studied farms exceeded the national average of 10.65 ha in 2017 [68]. Direct payments were introduced to compensate for the decline in farming incomes resulting from the gradual decrease in the prices of agricultural commodities [69].

In the first group of rapeseed producers, the highest increase in gross value added (193.7%) was observed between 2005 and 2012. This parameter was lowest in 2005 (PLN 128,000). In 2012, gross value added reached PLN 249,000.

Net value added is a basic indicator of economic activity (Table 7). Net value added is calculated by subtracting depreciation from gross value added. Net value added was highest in 2012 (PLN 202 thousand), when it increased by 209% from 2005.

Table 7.

Gross value added and net value added per Polish biodiesel farm from 2005 to 2019 (PLN).

In the group of farmers who continued to produce rapeseed in the studied period, gross value added was highest in 2012 (PLN 259 thousand) and lowest in 2005 (PLN 76 thousand). Net value added was also highest in 2012 (PLN 211 thousand) and lowest in 2005 (PLN 55 thousand) (Table 7).

The performance of agricultural holdings is determined by farm household income, namely the income from farming operations minus production costs [52]. The generated income can be used to cover the living expenses of the farmer’s family or invested in agricultural production [49].

Farm household incomes were lowest in 2005 (PLN 74 thousand). The greatest increase in incomes (245.9%) was observed between 2005 and 2012 (Table 8). A similar trend was noted in the incomes generated per full-time employee, which increased by 229.1% between 2005 (PLN 36 thousand) and 2012 (PLN 121 thousand).

Table 8.

Farm household income (PLN) per Polish biodiesel farm from 2005 to 2019.

In farms that produced rapeseed in successive years of the studied period, the highest farm household income (PLN 191 thousand) and the highest income per full-time employee (PLN 117 thousand) were noted in 2012.

An analysis of farm household income from 2005 to 2019 indicated that Polish rapeseed farms improved their performance in the studied period. This improvement can be attributed to the overall improvement in agricultural performance after Poland joined the EU. The key factors that contributed to an increase in farm household income were direct payments, a more rapid increase in agricultural income compared to production costs, and effective farm management.

The effect of selected variables on the performance of Polish rapeseed producers participating in the FADN was analyzed in this study. The results are presented in Table 9. Farm household income (Y1) was the explained variable. The explanatory variables were presented in the Materials and Methods section. We presented two models for each group of farms. The first model was classical regression and the second was the forward stepwise regression.

Table 9.

Results of the multiple regression analysis investigating the relationship between the dependent variable Y1 (farm household income) and the explanatory variables.

In the studied group of rapeseed producers, farm household income using classical regression was influenced in biodiesel farms participating in FADN by the following variables (Table 9): X2—land area under rapeseed production, X4—current assets, and X5—total liabilities. The results demonstrate the standard factors which are important for farms in general. Land area under rapeseed production (X2) is particularly important for the farm household income. Farmers with more land can plant more rapeseed and increase income. The next factor, current assets, became particularly important after Polish accession to the European Union (EU) impacted the scale of production. The last factor: X5—total liabilities, may decrease income. The interpretation of the regression equation can be as follows: the increase in land area created PLN 2.83 thousand income per hectare. The increase in current assets for PLN 1 thousand creates the PLN 2.18 thousand income. The developed model fitted the data well, as evidenced by a high R2 (R2 = 0.93; F = 16.29).

The regression equation can be presented as follows:

Y1 = 87,510.34 + 2.83X1 − 3.0X2 + 1.90X3 + 2.18X4 − 1.30X5 + 1.63X6 − 0.157X7

The second model for biodiesel farms participating in FADN was run using forward stepwise regression, similar to the first model with classical regression.

The results for biodiesel farms participating in FADN and continuing rapeseed production were similar for both the classical and the forward stepwise regression. For the classical regression, the model fitted the data well, as evidence by the R2 (R2 = 0.86; F = 14.31).

The regression equation can be presented as follows:

Y1 = −56,915.18 − 0.82X1 + 0.89X2 – 0.20X3 + 1.47X4 − 0.74X5 + 0.13X6 + 0.24X7

The most important variable was X4—current assets, which caused an increase in farm household income in both models for biodiesel farms participating in FADN and using continuous rapeseed production.

5. Discussion

Our research shows that fixed assets are an important resource for rapeseed farms. Fixed assets include land, buildings, machinery, and breeding stock. Investments in fixed assets improve working conditions and productivity in farms [49]. The value of fixed assets in agriculture has increased after Poland joined the EU. The programs and financial incentives offered under the CAP have enabled Polish producers to invest in their farms. Technological progress and mechanization increase labor efficiency, whereas advances in biotechnology improve land productivity [70,71,72,73].

Gross and net investments also play an important role in the performance of surveyed biodiesel producers. According to Józwiak at al. [74], investments enable farmers to expand their production capacity, modernize their farms, and maximize yields and returns per hectare. These processes lead to structural changes on a macroeconomic scale, and they enable Polish farmers to catch up with technological advances in agriculture [75]. Sadowski [76] has argued that investments are indispensable for the growth and development of agricultural holdings. Investments in fixed assets enable farmers to replace dilapidated machinery and contribute to the growth of capital stock [77]. The purpose of investments is to procure fixed assets of sufficient quantity and quality to increase farming income [78].

Poland and other EU Member States are eligible to participate in rural development programs [79]. These programs enable Polish biodiesel producers to invest in their holdings, increase farming income and productivity, improve animal welfare, promote modernization, and introduce sustainable agricultural practices [80]. Most surveyed farms took part in the program and received financial support for their investments.

The main production costs in rapeseed farms are associated with the purchase of fertilizers, plant protection products, feed, and machinery. Agricultural inputs are largely dependent on the applied production technology [81].

Crop production plays an important role in the performance of rapeseed farms. The percentage of farms specializing in dedicated crops has increased after Poland joined the EU. Most crop producers do not rear livestock, and continuous cropping decreases the organic matter content of soil and lowers yields. Cereals dominate in these agricultural holdings [82]. However, the EU’s energy policy has contributed to a decrease in the land area under cereal production and to an increase in the land area under rapeseed production for biodiesel production [83].

Labor and workforce productivity play an important role in the operations and development of rapeseed farms [84]. These factors determine the competitiveness of agricultural holdings. Employment in agriculture remains high in Poland. In 2009, nearly 13.3% of the Polish workforce was employed in agriculture as compared with only 3–6% in the more developed EU-15 countries [85]. According to Statistics Poland [2018], the EU countries with the highest employment in agriculture include Romania (23%), Bulgaria (18%), Poland (12%), and Greece (11%). A decline in agricultural employment improves workforce productivity [86].

Decisions regarding the main sources of funding influence the performance of biodiesel producers [87]. Gill et al. [88] examined the effect of short-term debt on the returns of service providers and reported a positive correlation between capital structure and profitability. The debt-to-equity ratio was negatively correlated with the profitability of selected companies [89].

6. Conclusions

The results indicate that significant changes in livestock production did not take place in Polish rapeseed farms participating in the FADN. These findings could be attributed to Polish farmers’ conservative business strategies, fear of change, or reluctance to modify their production profiles [66]. The prices offered by the Agricultural Property Agency were lower than those noted in private transactions [67]. The average agricultural area in the studied farms exceeded the national average of 10.65 ha in 2017 [68]. Direct payments were introduced to compensate for the decline in farming income resulting from the gradual decrease in the prices of agricultural commodities [69].

Only minor differences in performance were observed between farms that produced rapeseed occasionally and those that cultivated rapeseed in successive years of the studied period. The performance of both groups of rapeseed farmers was generally influenced by macroeconomic factors associated with the CAP and direct payments for agricultural producers. The production of pure biodiesel increased in the EU from 21,161.491 thousand tons in 2011 to 21,794.254 thousand tons in 2019. The increase in production can be attributed to improved performance of producers in the EU [90].

The number of occasional rapeseed farms was three times higher than the number of farms where rapeseed was cultivated continuously. Farm size ranged from 61.4 ha to 83.13 ha in the first group, and from 31.5 ha to 71.5 ha in the second group. These results point to greater variations in the size of farms where rapeseed was grown on an annual basis. Long-term rapeseed production systems are established to maximize incomes. However, if prolonged rapeseed cultivation fails to generate the anticipated profits, then many farmers abandon this type of activity.

In both groups of rapeseed producers, farm household incomes were highest in 2012, which can be attributed to favorable market factors in that year. Farm household incomes were affected by direct payments, land area under rapeseed cultivation, and the value of fixed assets on the farm. These results indicate that the performance of rapeseed farms was largely influenced by financial support from the EU. Agricultural livelihoods in Poland are increasingly dependent on direct payments. Fixed assets, including farmland, are the second group of factors that affect the performance of rapeseed farms. The land area under rapeseed cultivation in Polish farms suggested that this crop generated profits for agricultural holdings.

Our results should have an impact on the policy of the European Union (EU). First, the war between Russia and Ukraine caused increasing demand for energy from various sources. Second, rapeseed can play a very important role, providing the biodiesel used as components of diesel fuel. Third, additional compensation for biodiesel producers should be encouraged because the increased production may help to overcome current energy shortages. Ukraine is a very important producer and exporter of oils. However, because of the war, some land is excluded from production. That is why the increasing global demand can be fulfilled, either fully or partially, by increased production of rapeseed in Poland and other countries of the European Union (EU).

The price of rapeseed is also very important. The war between Russia and Ukraine doubled the prices of rapeseed in the European Union (EU) and other countries in the world. The CAP can establish the maximum price of rapeseed and improve compensation to farmers. The maximum price established should not be so high as to cause excessive volatility and lower prices in the market.

The development of RES, including biodiesel, should receive more focus. This includes not only economic incentives but also better education through schools. This will create more awareness by society for the importance of using renewable energy. Education about RES will create more sustainable development, and society could better understand the need to protect the environment.

Development of RES should include expansion of biofuels in the EU. Biofuels are alternatives to fossil fuels and can reduce the greenhouse gas emission and improve the security of energy supply. Each year, the European Union is increasing the use of biofuels, particularly the second and third biofuels, which are more advanced. The European Union (EU) is supporting the development of RES through the revised Renewable Energy Directive 2018/2001. Rapeseed and corn used for biofuel production uses cropland which can be used to grow food for humans and feed for animals. The increase in biofuels may lead to indirect land use change (ILUC) and release CO2 stored in trees and soil. The EU countries have to calculate their targets when calculating their national share of renewables in transport.

The European Union (EU) introduced the Commission adopting the Delegated Regulation on indirect land-use change (2019/807) and continuing expansion of the production area into land and to set criteria for certifying low ILUC-risk biofuels. Moreover, the report on the status of production expansion of relevant food and feed crops worldwide (COM/2019/142) was used to certify low ILUC-risk fuels.

China is a very big producer of biofuels. The Chinese strategy has included more than 45 policies for biofuel production and use. The Chinese government introduced policies to change biofuels from first to second generation. China has a State Council to promote biodiesel policies, and the National Development and Reform Commission under the State Council burdened most of the responsibilities of policy implementation. The evolution of policies helped to establish a system of technology and product innovation [91].

The regulations concerning biofuel production are different in the United States of America (USA). In the USA, the renewable fuels standard is a federal program that requires fuel sold in the United States to contain a minimum volume of renewable fuels. It originated in 2005 with the Energy Policy Act, was expanded in 2007 with the Energy Independence and Security Act, and has requirements for 36 billion gallons of renewable fuels in 2022. The Environmental Protection Agency has the authority to set the levels of renewable fuels required after 2022 [92]. Additionally, the Biomass Crop Assistance Program (BCAP) provides financial assistance to landowners and operators that establish, produce, and deliver biomass feedstock crops for advanced biofuel production facilities. Qualified feedstock producers may be reimbursed for up to 50% of biomass crop establishment and payment of USD 1 to USD 20 per dry ton from a qualified advanced biofuel production facility. Funding for this program is highly variable, subject to congressional appropriations.

Author Contributions

Conceptualization, A.B.-B.; methodology A.B.-B. and P.B.; software, A.B.-B. and P.B.; validation, A.B.-B. and P.B.; formal analysis, A.B.-B. and P.B.; investigation, A.B-.B.; resources, A.B.-B.; data curation, A.B.-B. and P.B.; writing—original draft preparation, A.B.-B., P.B., L.H., T.R. and B.K.; writing—review and editing, A.B.-B., P.B., L.H., T.R. and B.K.; visualization, A.B.-B. and P.B.; supervision, A.B.-B. and P.B.; project administration, A.B.-B. and P.B.; funding acquisition, A.B.-B., P.B. and B.K. All authors have read and agreed to the published version of the manuscript.

Funding

The publication was written as a result of the author’s internship at Pennsylvania State University, co-financed by the European Union under the European Social Fund (Operational Program Knowledge Education Development), carried out in the project Development Program at the University of Warmia and Mazury in Olsztyn (POWR.03.05. 00–00-Z310/17). The results presented in this paper were obtained as part of a comprehensive study financed by the University of Warmia and Mazury in Olsztyn, Faculty of Agriculture and Forestry, Department of Agrotechnology and Agribusiness (Grant. No 30.610.012–110).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Nomenclature

| °C | Degrees Celsius |

| AGR | CNI Agriculture |

| ANCs | Area with natural and other specific constraints |

| ARMA | Agency for Restructuring and Modernization of Agriculture |

| AWU | Annual work unit |

| CAP | Common Agricultural Policy |

| CO2 | Carbon dioxide |

| COM | CNI Communications. |

| EC | European Commission |

| EU | CNI Electric Utilities |

| EU | European Union |

| FADN | Farm Accountancy Data Network |

| FM | CNI Ferrous Metals |

| FWU | family work unit |

| Ha | Hectares |

| HSR | CNI Highspeed Railway |

| INF | CNI Infrastructure |

| LU | Livestock units |

| MM | Millimeters, used to define rainfall |

| PLN | Polish currency zloty |

| PV | Photovoltaics |

| RED | Renewable energy directive |

| RES | Renewable energy sources |

| UAA | Utilized agricultural land area |

References

- Ioannou, K.; Tsantopoulos, G.; Arabatzis, G.; Andreopoulou, Z.; Zafeiriou, E. A Spatial Decision Support System Framework for the Evaluation of Biomass Energy Production Locations: Case Study in the Regional Unit of Drama, Greece. Sustainability 2018, 10, 531. [Google Scholar] [CrossRef]

- Jamil, R. Hydroelectricity consumption forecast for Pakistan using ARIMA modeling and supply-demand analysis for the year 2030. Renew. Energy 2020, 154, 1–10. [Google Scholar] [CrossRef]

- Ozturk, S.; Ozturk, F. Forecasting energy consumption of Turkey by ARIMA model. J. Asian Sci. Res. 2018, 8, 52–60. [Google Scholar] [CrossRef]

- Boontome, P.; Therdyothin, A.; Chontanawat, J. Investing the casual relationship between non-renewable and renewable energy consumption, CO2 emissions and economic growth in Thailand. Energy Procedia 2017, 138, 925–930. [Google Scholar] [CrossRef]

- Mardani, A.; Streimikiene, D.; Cavallaro, F.; Loganathan, N.; Khoshnoudi, M. Carbon dioxide (CO2) emissions and economic growth: A systematic review of two decades of research from 1995 to 2017. Sci. Total Environ. 2019, 649, 31–49. [Google Scholar] [CrossRef]

- Guan, D.; Comite, U.; Sial, M.S.; Salman, A.; Zhang, B.; Gunnlaugsson, S.; Mentel, U.; Mentel, G. The Impact of Renewable Energy Sources on Financial Development, and Economic Growth: The Empirical Evidence from an Emerging Economy. Energies 2021, 14, 8033. [Google Scholar] [CrossRef]

- International Energy Agency. The World Energy Production Sources. Available online: https://www.iea.org/reports/key-world-energy-statistics-2020 (accessed on 1 October 2022).

- Ozturk, S.; Ozturk, F. Prediction of energy consumption of Turkey on sectoral bases by Arima model. Energy Econ. Lett. 2019, 5, 23–30. [Google Scholar] [CrossRef]

- Huiyu, J.; Meng, Z. Comprehensive Evaluation of the New Energy Power Generation Development at the Regional Level: An Empirical Analysis from China. Energies 2019, 12, 4580. [Google Scholar] [CrossRef]

- Roberts, J.T.; Steinberger, J.K.; Dietz, T.; Lamb, W.F.; York, R.; Jorgenson, A.K.; Givens, J.E.; Baer, P.; Schor, J.B. Four agendas for research and policy on emissions mitigation and well-being. Glob. Sustain. 2019, e3, 1–7. [Google Scholar] [CrossRef]

- Aasim Singh, S.N.; Mohapatra, A. Repeated wavelet transform based ARIMA model for very short-term wind speed forecasting. Renew. Energy 2019, 136, 758–768. [Google Scholar] [CrossRef]

- Wang, Z.; Zhang, B.; Wang, B. Renewable energy consumption, economic growth and human development index in Pakistan: Evidence form simultaneous equation model. J. Clean. Prod. 2018, 184, 1081–1090. [Google Scholar] [CrossRef]

- Budak, G.; Chen, X.; Celik, S.; Ozturk, B. A systematic approach for assessment of renewable energy using analytic hierarchy process. Energy Sustain. Soc. 2019, 9, 37. [Google Scholar] [CrossRef]

- Klepacka, A.M.; Mączyńska, J. Wpływ unijnych dyrektyw w zakresie wykorzystania biopaliw na rozwój obszarów wiejskich w Polsce. Rocz. Nauk. SERiA 2018, 20, 84–90. (In Polish) [Google Scholar]

- Directive (EU) 2015/1513 of the European Parliament and of the Council of 9 September 2015 amending Directive 98/70/EC relating to the quality of petrol and diesel fuels and amending Directive 2009/28/EC on the promotion of the use of energy from renewable sources. Off. J. Eur. Union 2015, 239, 1–19.

- Rehman, S. Hybrid power systems—Sizes, efficiencies, and economics. Energy Explor. Exploit. 2020, 39, 3–43. [Google Scholar] [CrossRef]

- Shahid, H.; Ahmad, A.; Ahmad, U.; Gulfam, R.; Rashid, M.; Kazmi, M. Thermal stabilization, energy, cost and life analyses of hybrid photovoltaic-phase change composite system—Part 1. J. Energy Storage 2022, 52, 104771. [Google Scholar] [CrossRef]

- Martínez, M.V.; De Ahumada, L.M.F.; García, M.F.; García, P.F.; De la Torre, F.C.; López-Luque, R. Characterization of an experimental agrivoltaic installation located in an educational centre for farmers in Cordoba (Spain). In Proceedings of the 20th International Conference on Renewable Energies and Power Quality, Vigo, Spain, 27–17 July 2022. [Google Scholar] [CrossRef]

- Maleki, A.; Nasseri, S.; Aminabad, M.S.; Hadi, M. Comparison of ARIMA and NNAR Models for Forecasting Water Treatment Plant’s Influent Characteristics. KSCE J. Civ. Eng. 2018, 22, 3233–3245. [Google Scholar] [CrossRef]

- Dai, Z.F.; Zhu, H.Y. Time-varying spillover effects and investment strategies between WTI crude oil, Natural Gas and Chinese stock markets related to Belt and Road initiative. Energy Econ. 2022, 107, 105883. [Google Scholar] [CrossRef]

- Dai, Z.F.; Zhu, H.Y.; Zhang, X. Dynamic spillover effects and portfolio strategies between crude oil, gold and Chinese stock markets related to new energy vehicle. Energy Econ. 2022, 109, 105959. [Google Scholar] [CrossRef]

- Dai, Z.F.; Li, T.; Yang, M. Forecasting stock return volatility: The role of shrinkage approaches in a data-rich environment. J. Forecast. 2022, 41, 980–996. [Google Scholar] [CrossRef]

- Bórawski, P.; Bórawski, M.B.; Parzonko, A.; Wicki, L.; Rokicki, T.; Perkowska, A.; Dunn, J.W. Development of Organic Milk Production in Poland on the Background of the EU. Agriculture 2021, 11, 323. [Google Scholar] [CrossRef]

- Krzyżanowski, J.T. Wspólna Polityka Rolna Unii Europejskiej w Polsce; Wydawnictwo Cedewu Sp. zo.o.: Warsaw, Poland, 2018. (In Polish) [Google Scholar]

- Kharazishvili, Y.; Kwilinski, A.; Dzwigol, H.; Liashenko, V. Strategic European Integration Scenarios of Ukrainian and Polish Research, Education and Innovation Spaces. Virtual Econ. 2021, 4, 7–40. [Google Scholar] [CrossRef]

- Carneiro, M.L.N.; Gomes, M.S.P. Energy, exergy, environmental and economic analysis of hybrid waste-to-energy plants. Energy Convers. Manag. 2019, 179, 397–417. [Google Scholar] [CrossRef]

- Navarro, A.; López-Bao, J.V. Towards a greener Common Agricultural Policy. Nat. Ecol. Evol. 2018, 2, 1830–1833. [Google Scholar] [CrossRef] [PubMed]

- Szczerbowski, R. Energetyka Wyzwania Prawno-Instytucjonalne—Wpływ Uwarunkowań Prawnych Dotyczących Ochrony Środowiska na Produkcję Energii Elektrycznej w Polsce; FNCE: Poznań, Poland, 2018. (In Polish) [Google Scholar]

- Dubis, B.; Jankowski, K.J.; Załuski, D.; Bórawski, P.; Szempliński, W. Biomass production and energy balance of Miscanthus over a period of 11 years: A case study in a large-scale farm in Poland. GCB Bioenergy 2019, 11, 1187–1201. [Google Scholar] [CrossRef]

- Commission (EU) 2022/603 on the approval of the KZR INiG system with regard to the demonstration of compliance with the requirements laid down in Directive (EU) 2018/2001 of the European Parliament and of the Council for biofuels, bioliquids, biomass fuels, renewable liquid and gaseous fuels of non-biological origin and recycled carbon fuels. Off. J. Eur. Union 2022, 114, 185–187.

- Ministerstwo Klimatu i Środowiska. Polityka Energetyczna Polski do 2040 r; Ministerstwo Klimatu i Środowiska: Warsaw, Poland, 2021. (In Polish)

- Hamulczuk, M.; Makarchuk, O.; Sicac, E. Searching for market integration: Evidence from Ukrainian and European Union rapeseed markets. Land Use Policy 2019, 87, 104078. [Google Scholar] [CrossRef]

- Stępień, S.; Czyżewski, B.; Sapa, A.; Borychowski, M.; Poczta, W.; Poczta-Wajda, A. Eco-efficiency of small-scale farming in Poland and its institutional drivers. J. Clean. Prod. 2021, 279, 123721. [Google Scholar] [CrossRef]

- Olczak, K. Odnawialne źródła energii jako przesłanka prawna bezpieczeństwa energetycznego. Wyda. Uniw. Warm.-Mazur. W Olszt. 2020, 117, 115–128. (In Polish) [Google Scholar] [CrossRef]

- Isik, C.; Ongan, S.; Özdemir, D. The economic growth/development and environmental degradation: Evidence from the US state-level EKC hypothesis. Environ. Sci. Pollut. Res. 2019, 87, 30772–30781. [Google Scholar] [CrossRef] [PubMed]

- Scarlat, N.; Dallemand, J.F.; Fahl, F. Biogas: Developments and perspectives in Europe. Renew. Energy 2018, 129, 457–472. [Google Scholar] [CrossRef]

- Berbeka, K.; Bugdol, M. Administrative Efficiency of Environmental Protection Funds in Poland in the Years 2006–2019. Pol. J. Environ. Stud. 2022, 31, 585–594. [Google Scholar] [CrossRef]

- Berbeka, K.; Bhulai, S.; Magiera, E. Decision support system for water adapting pricing policy. Inf. Syst. Manag. 2018, 7, 97–107. [Google Scholar] [CrossRef]

- Ślusarz, G.; Gołębiewska, B.; Cierpiał-Wolan, M.; Twaróg, D.; Gołębiewski, J.; Wójcik, S. The Role of Agriculture and Rural Areas in the Development of Autonomous Energy Regions in Poland. Energies 2021, 14, 4033. [Google Scholar] [CrossRef]

- Ślusarz, G.; Gołębiewska, B.; Cierpiał-Wolan, M.; Gołębiewski, J.; Twaróg, D.; Wójcik, S. Regional Diversification of Potential, Production and Efficiency of Use of Biogas and Biomass in Poland. Energies 2021, 14, 742. [Google Scholar] [CrossRef]

- Marks-Bielska, R.; Zielińska, A. Leasing of agricultural land versus agency theory: The case of Poland. Ekon. I Prawo. Econ. Law 2018, 11, 83–102. [Google Scholar] [CrossRef]

- Sebego, R.; Atlhopheng, J.; Chanda, R.; Mulale, K.; Mphinyane, W. Land use intensification and implications on land degradation in the Boteti area: Botswana. Afr. Geogr. Rev. 2019, 38, 32–47. [Google Scholar] [CrossRef]

- Ballabio, C.; Panagos, P.; Lugato, E.; Huang, J.-H.; Orgiazzi, A.; Jones, A.; Fernández-Ugalde, O.; Borrelli, P.; Montanarella, L. Copper distribution in European topsoils: An assessment based on LUCAS soil survey. Sci. Total Environ. 2018, 636, 282–298. [Google Scholar] [CrossRef]

- Grznár, M.; Szabo, L. On some potential competitive advantages of the Slovak agricultural enterprises in the EU. Agric. Econ. 2018, 52, 471. [Google Scholar] [CrossRef]

- Mickiewicz, P.; Nowak, M.J.; Mickiewicz, B.; Zvirbule, A. Environmental protection and integrated development planning in local spatial policy on the example of Poland. Ann. Univ. Apulensis Ser. Oeconomica 2020, 22, 11–17. [Google Scholar]

- Brodzinska, K.; Gotkiewicz, W.; Mickiewicz, B.; Pawlewicz, A. The chosen socio-economic problems of protecting valuable agricultural land in natura 2000 areas in Poland. Eur. Res. Stud. J. 2020, 23, 228–245. Available online: https://www.um.edu.mt/library/oar/handle/123456789/57321 (accessed on 1 October 2022). [CrossRef][Green Version]

- Siebert, R. The Differential Impact of Subsidies on Product Improvements. J. Inst. Theor. Econ. JITE 2019, 175, 583–616. [Google Scholar] [CrossRef]

- Zabolotnyy, S.; Wasilewski, M. Dźwignia operacyjna i finansowa jako miary ryzyka w przedsiębiorstwach rolniczych. Zagadnienia Ekon. Rolnej 2018, 1, 113–128. (In Polish) [Google Scholar] [CrossRef]

- Rokicki, T.; Perkowska, A.; Klepacki, B.; Bórawski, P.; Bełdycka-Bórawska, A.; Michalski, K. Changes in Energy Consumption in Agriculture in the EU Countries. Energies 2021, 14, 1570. [Google Scholar] [CrossRef]

- Bórawski, P.; Bełdycka-Bórawska, A.; Szymańska, E.J.; Jankowski, K.J.; Dunn, J.W. Price volatility of agricultural land in Poland in the context of the European Union. Land Use Policy 2019, 82, 486–496. [Google Scholar] [CrossRef]

- McKenna, R.; Hernando, D.A.; ben Brahim, T.; Bolwig, S.; Cohen, J.J.; Reichl, J. Analyzing the energy system impacts of price-induced demand-side-flexibility with empirical data. J. Clean. Prod. 2021, 279, 123354. [Google Scholar] [CrossRef]

- Wyniki Standardowe 2019 Uzyskane Przez Gospodarstwa Rolne Uczestniczące w Polskim FADN; Instytut Ekonomiki Rolnictwa i Gospodarki Żywnościowej—Pańtwowy Instytut Badawczy: Warshaw, Poland, 2021. (In Polish)

- Latysheva, L.A.; Piterskaya, L.Y.; Sklyarov, I.Y.; Sklyarova, Y.M.; Batishcheva, E.A. The Reproduction of Fixed Assets in Agriculture. In The Challenge of Sustainability in Agricultural Systems; Lecture Notes in Networks and Systems; Bogoviz, A.V., Ed.; Springer: Cham, Switzerland, 2021; Volume 205. [Google Scholar] [CrossRef]

- Cholewa, I.; Smolik, A. Other gainful activities directly related to the agricultural holding according to the Polish FADN. Probl. Agric. Econ. 2021, 4, 78–94. [Google Scholar] [CrossRef]

- Mączyńska, E. Ekonomia i Polityka; Wydawnictwo Naukowe PWN: Warshaw, Poland, 2019. (In Polish) [Google Scholar]

- Statistics Poland 2005–2018; GUS: Warsaw, Poland, 2020.

- Rico, P.; Cabrer-Borrás, B. Intangible capital and business productivity. Econ. Res.-Ekon. Istraživanja 2020, 33, 3034–3048. [Google Scholar] [CrossRef]

- Rico, P.; Cabrer-Borrás, B. Entrepreneurial capital and productive efficiency: The case of the Spanish regions. Technol. Econ. Dev. Econ. 2019, 25, 1363–1379. [Google Scholar] [CrossRef]

- Skarżyńska, A. Economic size and production efficiency of farms specializing in field crops in Poland. Probl. Agric. Econ. 2019, 1, 64–87. [Google Scholar] [CrossRef]

- Sokolova, A.P.; Litvinenko, G.N. Innovation as a source of agribusiness development. IOP Conf. Ser. Earth Environ. Sci. 2020, 421, 022053. [Google Scholar] [CrossRef]

- Kalinowska, B.; Bórawski, P.; Bełdycka-Bórawska, A.; Klepacki, B.; Perkowska, A.; Rokicki, T. Sustainable Development of Agriculture in Member States of the European Union. Sustainability 2022, 14, 4184. [Google Scholar] [CrossRef]

- Groth, D.A.; Sokólski, M.; Jankowski, K.J. A Multi-Criteria Evaluation of the Effectiveness of Nitrogen and Sulfur Fertilization in Different Cultivars of Winter Rapeseed—Productivity, Economic and Energy Balance. Energies 2020, 13, 4654. [Google Scholar] [CrossRef]

- Wicki, L. The Role of Technological Progress in Agricultural Output Growth in the NMS Upon European Union Accession. Ann. Pol. Assoc. Agric. Agribus. Econ. 2021, 13, 82–96. [Google Scholar] [CrossRef]

- Rocznik Statystyczny Przemysłu; GUS: Warsaw, Poland, 2018. (In Polish)

- Kapusta, F. Fifteen Years of Polish Agriculture in The European Union. Probl. Agric. Econ. 2021, 4, 5–24. [Google Scholar] [CrossRef]

- Kusz, D. Pomoc Publiczna a Proces Modernizacji Rolnictwa; Oficyna Wydawnicza Politechniki Rzeszowskiej: Rzeszów, Poland, 2018. (In Polish) [Google Scholar]

- Juchniewicz, M.; Podstawka, M. Accumulation and Depreciation in the Case of Individual Farms of the Polish FADN. Probl. Agric. Econ. 2021, 2, 73–83. [Google Scholar] [CrossRef]

- Agencja Restrukturyzacji i Modernizacji Rolnictwa. Available online: https://www.arimr.gov.pl/pomoc-krajowa/srednia-powierzchnia-gospodarstwa.html (accessed on 30 December 2018). (In Polish)

- Kutkowska, B.; Pilawka, T.; Rybchak, V.; Rybchak, O. The differentiation in the level of socioeconomic development of rural areas of the lower Silesian Province in the years 2002 and 2010. Ann. Pol. Assoc. Agric. Agribus. Econ. 2019, 21, 170–187. [Google Scholar] [CrossRef]

- Krasowicz, S.; Matyka, M. Market Output as a Criterion for the Use of Agricultural Potential in Different Regions of Poland. Probl. Agric. Econ. 2021, 2, 48–72. [Google Scholar]

- Herbut, E. Modern animal production and animal welfare. Agric. Eng. 2018, 22, 3. [Google Scholar] [CrossRef]

- Produkt Krajowy Brutto i Wartość Dodana Brutto 30.09.2019 r—W Przekroju Regionów w 2017r; GUS: Warsaw, Poland, 2019. (In Polish)

- Liu, J.; Wang, M.; Yang, L.; Rahman, S.; Sriboonchitta, S. Agricultural Productivity Growth and Its Determinants in South and Southeast Asian Countries. Sustainability 2020, 12, 4981. [Google Scholar] [CrossRef]

- Józwiak, W.; Sobierajska, J.; Zielinski, M.; Zietara, W. The level of labour profitability and development opportunities of farms in Poland. Probl. Agric. Econ. 2019, 2, 28–42. [Google Scholar] [CrossRef]

- Czubak, W.; Pawłowski, K.P.; Sadowski, A. Outcomes of farm investment in Central and Eastern Europe: The role of financial public support and investment scale. Land Use Policy 2021, 108, 105655. [Google Scholar] [CrossRef]

- Mikolajczyk, J.; Wojewodzic, T.; Sroka, W. The scale of investment activity of commercial farms in metropolitan areas. Ann. Pol. Assoc. Agric. Agrobusiness Econ. 2019, 21, 3. [Google Scholar] [CrossRef][Green Version]

- Sadowski, A.; Wojcieszak-Zbierska, M.M.; Beba, P. Territorial differences in agricultural investments co-financed by the European Union in Poland. Land Use Policy 2021, 100, 104934. [Google Scholar] [CrossRef]

- Pawłowski, K.P.; Czubak, W.; Zmyślona, J.; Sadowski, A. Overinvestment in selected Central and Eastern European countries: Production and economic effects. PLoS ONE 2021, 16, e0251394. [Google Scholar] [CrossRef] [PubMed]

- Dvouletý, O.; Blažková, I. The Impact of Public Grants on Firm-Level Productivity: Findings from the Czech Food Industry. Sustainability 2019, 11, 552. [Google Scholar] [CrossRef]

- Mickiewicz, A.; Mickiewicz, B. Activities in second priority range of rural development program 2014–2020. Sci. Pap. High. Econ.-Soc. Sch. Ostrol. 2017, 24, 1. [Google Scholar]

- Niezgoda, D.; Anna Nowak, A.; Ewa Wójcik, E. Efektywność substytucji pracy strumieniem kapitału w towarowych gospodarstwach rolnych o różnym potencjale produkcyjnym. Rocz. Nauk. Stowarzyszenia Ekon. Rol. Agrobiz. 2018, 20, 31. [Google Scholar] [CrossRef][Green Version]

- Ziętara, W.; Zieliński, M. Competitiveness of Polish and German farms specialized in field crops. J. Agribus. Rural Dev. 2019, 53, 281–290. [Google Scholar] [CrossRef]

- Gradziuk, P.; Gradziuk, B.; Trocewicz, A.; Jendrzejewski, B. Potential of Straw for Energy Purposes in Poland—Forecasts Based on Trend and Causal Models. Energies 2020, 13, 5054. [Google Scholar] [CrossRef]

- Kozera-Kowalska, M.; Uglis, J. Agribusiness as an Attractive Place to Work––A Gender Perspective. Agriculture 2021, 11, 202. [Google Scholar] [CrossRef]

- Grain and Feed Annual. 2022. Available online: https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Annual_Madrid_European%20Union_E42022-0029 (accessed on 1 October 2022).

- Škare, M.; Sinković, D.; Parada-Rochoń, M. Financial development and economic growth in Poland 1990–2018. Technol. Econ. Dev. Econ. 2019, 25, 103–133. [Google Scholar] [CrossRef]

- Franc-Dąbrowska, J.; Mądra-Sawicka, M.; Milewska, A. Energy Sector Risk and Cost of Capital Assessment—Companies and Investors Perspective. Energies 2021, 14, 1613. [Google Scholar] [CrossRef]

- Gill, A.; Heller, D. Intellectual Property and Leverage: The Role of Patent Portfolios (31 May 2019). In Proceedings of the Paris December 2019 Finance Meeting EUROFIDAI—ESSEC, Paris, France, 19 December 2019. [Google Scholar] [CrossRef]

- Qayyumi, N.; Noreen, Q. Impact of Capital Structure on Profitability: A Comparative Study of Islamic and Conventional Banks of Pakistan. J. Asian Financ. Econ. Bus. 2019, 6, 65–74. [Google Scholar] [CrossRef]

- Average Pure Biodiesel Production in EU in 2004–2019. Available online: https://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=nrg_inf_lbpc&lang=en (accessed on 11 March 2022).

- Chung Ch Zhang, Y.; Liu, L.; Wang, Y.; Wei, Z. The Evolution of Biodiesel Policies in China over the Period 2000–2019. Processes 2020, 8, 948. [Google Scholar] [CrossRef]

- The Renewable Fuel Standard (RFS): An Overview. Congressional Research Service. Updated 10 August 2022. Available online: https://sgp.fas.org/crs/misc/R43325.pdf (accessed on 27 September 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).