Abstract

In this paper, we integrate technological, institutional, and financial approaches towards expansion of the smart grid technology. We turn to China as the major producer and consumer of energy with an increasing focus on renewables. China’s electricity market has experienced a number of reforms while trying to address the economic and environmental challenges. In order to identify the basic requirements for the Chinese power sector, we look into the underlying trends of the energy mix, regulatory policies, and financial flows. Understanding these facets allows one to suggest directions for the further development of the Chinese power sector in the light of the smart grid concept. Indeed, the smart grid concept has no strict definition and, therefore, requires simultaneous consideration of multiple factors. The analysis shows that ensuring smooth transfer of electricity across the regions is a quintessential condition for smart grid development and the promotion of renewable energy in China. As the role of the state-owned enterprises still remains the most important one in the sector, private initiatives should be supported. Therefore, financial incentives are needed to guide the shifts in the energy mix and maintain efficient energy generation and consumption in China.

1. Introduction

The goals of sustainability have been becoming more and more important across different economic activities and geographic locations [1,2,3,4]. China has emerged as the world’s largest primary energy consumer and greenhouse gas (GHG) emitter [5,6,7,8]. Given the importance of the Chinese energy sector, the reforms taking place there are likely to have considerable impacts on the trends in energy generation and consumption, economic activities, and the associated environmental pressures. Therefore, there is a need to analyse the performance of the Chinese power sector and identify the main shifts in policies shaping decisions on development thereof. Such an analysis might be helpful in identifying the major achievements and guidelines for further development in the sector.

There have been several major factors shaping the policy regarding energy sector in China. Domestically, economic growth and urbanization have appeared as important drivers for growing energy demand China [9]. Moreover, regulatory reforms have taken place in China [10,11,12] as well as in many other countries [13]. Internationally, concerns about climate change have resulted in the adoption of a number of international initiatives on the mitigation of GHG emissions. For instance, the United Nations Framework Convention on Climate Change Kyoto Protocol, Copenhagen Accord, Cancún Agreements, and Paris Agreement are notable instances of initiatives towards climate change mitigation. Furthermore, economic research has been initiated to model underlying trends in the economy‒energy‒environment context [14].

Since the economic reforms of the early 1980s, China has seen remarkable economic growth. Indeed, the annual growth rate of 9% has been maintained for the GDP due to both increasing amounts of inputs and gains in the total factor productivity [15]. Economic structure is also an important facet of energy demand [16]. Among the factor inputs, energy plays an important role, especially in the manufacturing sector. Therefore, economic growth has been related to increasing energy use in China. British Petroleum [17] reported that China and the United States (USA) consumed 23% and 17.8% of global energy consumption. As regards energy-related CO2 emissions, China emitted 9135 million tons CO2, whereas the USA emitted 5176 million tons CO2 in 2014 [18]. These volumes correspond to 28.2% and 16.2% of the global CO2 emissions from fuel combustion, respectively. Therefore, the energy mix in China, still dominated by fossil fuels, highlights the difference in the global shares of energy consumption and CO2 emissions. This implies a need for further improvements in energy transformation in order to adhere to the goals of sustainability and climate change mitigation.

Urbanization has emerged as an important factor shaping energy demand and transformation in China. Furthermore, these issues have been linked to GHG emissions [15,19,20,21]. For instance, the five largest cities in China (Beijing, Tianjin, Shanghai, Chongqing, and Guangzhou) have reached a population of over 99 million (i.e., over 7% of the total population of China), whereas the Gross Domestic Product (GDP) generated there exceeded 14% of the China’s total GDP, as of 2011 [20]. These figures confirm the importance of the major urban areas in China, as labour productivity in these areas appears to be twice as high as that in the rest of the country. In general, the expansion of cities is evident in terms of growing population, land use, and economic activity. The infrastructure of the urban areas impacts the energy transformation and demand. Therefore, adaptation of the urban energy infrastructure to the needs of the contemporary economy and climate change mitigation goals is an important task for both local and central governments. Private economic agents can also benefit by exploiting more energy-efficient low-carbon technologies.

Following the international trends and practice in electricity power market liberalization, China has also started reforms that seek to delineate state and state and business functions [10] on the one hand and introduce competition in the generation and sales business [11] on the other hand. Following the economic reforms under the opening-up policy, China faced a shortage of electricity. As a result, corporate and foreign entities were allowed to invest in the power generation sector in 1985. This allowed for raising capital and commissioning new power plants. In 2002, the generation of power was opened up to competition between five newly established generation companies and two transmission companies. The competition in the Chinese electricity market was further deepened in 2015 by instituting power market facilities, furthering price deregulation and stressing the priority of switching to renewable energy sources [12]. These changes affect electricity pricing, which, in turn, impacts the behaviour of both residents and business entities. Recently, Ming et al. [22] noted that there has been overcapacity in the coal-fired power plant industry. These findings demand further research into streamlining the power generation sector in China.

In spite of the tremendous increase in the installed capacity of renewable electricity, China mainly relies on coal and hydro energy [11,23]. Indeed, a similar pattern is likely to persist in the near future as well. Specifically, Ngan (2010) reported that the installed capacity of coal-fired power plants was 325 GW as of 2004, with an expected increase up to 360 GW in 2020. Hydro power plants ranked second with an installed capacity of 108 GW in 2004 and an expected installed capacity of 246 GW in 2020. Zhou et al. [23] reported estimates of the installed capacities of wind and solar power of 200 GW and 100 GW, respectively, by 2020. The total share of the two energy sources is expected to remain at around 87% in 2020, with the rest of power generation being based on gas, nuclear, and other renewable energy. According to Xu and Chen [10], the loci of energy sources and consumption are distributed in a rather uneven manner across China. For instance, coal resources are mainly located in the north and northwest of China. Turning to the hydro power resources, they are mainly located in western and southwestern China. However, the most economically developed areas are those located in east and central China. Therefore, there is a need for the development of a single electricity market and ultra-high voltage transmission lines in China [24].

As regards climate change considerations, these have been shaping China’s international commitments and policy of development of the power generation sector. Specifically, China agreed to curb the carbon intensity as measured by carbon emissions per unit of GDP by 40–45% if compared to the 2005 level. The corresponding goals have been transferred to the 11th and 12th Five-Year Plans (2006–2010 and 2011–2015, respectively). The 11th Five-Year Plan includes targets for a carbon intensity reduction of 20% (2010 compared to 2005), whereas the 12th Five-Year Plan set a further reduction in carbon intensity of 17% along with a reduction in energy consumption of 16% [25]. The use of renewable energy sources—a major means of curbing carbon emissions—has been promoted by adopting the Renewable Energy Law in 2005 as well as rules for the Energy Conservation Dispatch in 2007 [12]. These documents stressed the importance of renewables and assigned them priority in the energy dispatch. These decisions have fuelled the development of renewable energy in China. According to Zhang et al. [26], the share of renewable energy sources other than hydro in China’s energy mix should increase from 8% in 2006 up to 15% in 2020, which corresponds to a twofold increase. Whereas hydro power has long been established as an important energy source in China, solar [27,28], wind [29], and wind‒solar [30] energy generation systems still account for a less significant share in the total energy mix in China. Public support for and application of storage technologies, among other factors, increased the rate of growth in the installed capacity of wind and solar power, which exceeded that for power in general [23].

Development of smart grid technology can alleviate a number of economic and ecological issues. As Eid et al. [31] pointed out, smart grids contribute to decarbonisation, reliability, and efficiency in the electricity sector. This can be achieved by ensuring two-way communication between energy users and producers (in contrast to the one-way power flow in conventional grids). Thus, consumers might even become prosumers in a smart grid. The use of information technologies allows planning institutions to impact the behaviour of consumers by means of tailored pricing or support schemes. However, an exact definition of smart grids is not available [32,33] and, what is more, varies within the context of the region of implementation [26]. Smart grid technologies can be applied in power generation, transmission, transformation, distribution, storage, and consumption [33]. Surveys on smart grid development in China have been presented by Yu et al. [33] and Yuan and Hu [5], whereas Zhang et al. [34] and Eid et al. [31] compared China to other countries in terms of the pathways of smart grid development.

Given the rapid pace of development of both the economy and energy infrastructure in China, there is a need to identify the possible benefits of the smart grids for economy and environment. What is more, the development of smart grids (and energy infrastructure in general) requires considerable investments, which are even higher for recent technologies. Thus, the government needs to intervene in the processes of the development of the smart grids in order to ensure proper rates of return, energy security, and climate change mitigation. However, much of the literature has addressed separate facets of the development of the smart grid technology in China without providing an overarching framework. This paper, therefore, addresses the issue of smart grid development trends in China by conducting a survey of the underlying trends in Chinese electricity power generation and discussing the volume and nature of financial measures for development of smart grids in China, along with technological and institutional arrangements.

The paper proceeds as follows: Section 2 presents the main drivers and shifts in electricity generation in China with much emphasis on the renewables. Section 3 presents the changes in the institutional settings of the power sector. Section 4 presents the concept of the smart grids and their implementation in China. Section 5 analyses investments into the power sector in light of the smart grid promotion in China. Finally, Section 6 concludes.

2. Recent Trends in Electricity Generation in China

Globally, the fuel combustion sector (fossil fuel combustion for power generation, transportation, and heating) is the key source of GHG emissions. Furthermore, this is likely to continue in the near future due to economic growth and urbanization. Indeed, the International Energy Outlook 2016 (reference scenario) suggests energy-related CO2 emissions are likely to increase from 32.3 billion metric tons in 2012 up to 35.6 billion metric tons in 2020, with a further upturn to 43.2 billion metric tons in 2040 [26,35], which implies logged rates of growth of 9.7% and 19.3% for 2012–2020 and 2020–2040, respectively. Therefore, energy generation is likely to increase and the associated environmental pressures are likely to increase as well. In this regard, the situation in China deserves much attention.

Liu et al. [28] noticed that China’s non-renewable energy resources (fossil fuels and uranium) are likely to be depleted within 20 to 50 years as the efficiency of the exploitation of the resources thereof is less than 50% at most. These findings call for a transition towards renewable energy sources in China. In any case, the transition towards cleaner energy is required in order to meet the goals of climate change mitigation. However, the situation in rural areas is rather different from the structure of the overall energy mix as these areas use straw, firewood, and coal for 90% of their final energy consumption [28]. Therefore, there are considerable differences in the structure of the energy mix across Chinese regions. Liu et al. [6] have also identified switching from a coal-based energy mix towards one involving renewable energy sources as a vital measure towards achieving a low-carbon economy. Following Yuan et al. [36], electricity consumption is likely to range between 7000 TWh and 11000 TWh in China by 2030, with fossil fuels still dominating the supply. However, Ming et al. [22] noticed that the total electric power consumption stood at 5550 TWh in 2015, the lowest annual rate of growth during the previous 40 years. Zhou et al. [23] compared per capita power consumption in China to the corresponding figures in the developed countries and assumed it should increase up to 7550 kWh in 2050.

In China, the share of primary energy consumed by the power generation sector went up from 20.6% in 1980 up to 39% in 2010 [33]. The consumption of electricity and power generation capacities have also been increasing in China. This indicates a need for streamlining the processes of development and aligning them to the requirements of climate change mitigation policies. Coal-fired and hydro power plants dominate the electricity generation sector in China. Zhang et al. (2017) reported that the primary energy supply increased from 627.7 million tce up to 3600 million tce (i.e., more than five-fold) in China during 1978–2014. The share of the crude oil in the primary energy structure continued declining, with the absolute amount being more or less fixed during the said period. As a result, power generation from renewable energy sources has gained momentum in 2005 and increased by 3-fold during 2005–2013 (from 401.7 billion kWh up to 1101 billion kWh). The generation capacity has also seen a sharp increase in China (from 66 GW up to 1360 GW during 1980‒2014), thus reaching a per-capita supply rate of 1 kW [36]. The data provided by Yuan et al. [36] also suggest that the share of thermal power in the capacity mix is lower than its share in the fuel mix (68% and 75% for 2014, respectively). The total electricity consumption increased by 18-fold with a varying rate of growth: 1980–2000 saw an increase of 8% p.a., whereas a higher rate of 12% p.a. was observed for 2000–2010 [36]. The subsequent period experienced an increasing extent of decoupling (e.g., electricity consumption increased by 3.8% along with an increase in GDP of 7.4% during 2014) as the economic structure and activity level have changed. Yuan et al. [36] noted that electricity consumption by households has been increasing in China (12.5% of the total electricity consumption in China as of 2014).

2.1. Thermal Power

Coal appears as the main energy source in China. More specifically, coal accounted for more than 60% of the primary energy consumption in China as of 2016, with an even higher share prior to that year [30,37]. The capacity of thermal power plants has been expanding and, eventually, amidst the decrease in electricity consumption in 2015, overcapacity has occurred [22]. This process can be attributed to institutional and economic factors. Specifically, deregulation of the electricity generation sector meant that the right to commission thermal power plants has been transferred from the central government to local governments. Economically, low prices of carbon implied high returns on equity for thermal power plants (even after adjustments of feed-in tariffs). Ming et al. [22] noted that the annual growth rate in Chinese thermal power plant capacity reached 7.8%, whereas demand went up by just 0.5% as of 2015. Consequently, utilization hours have been declining in China since 2011, when they exceeded 5000 h, and reached 4329 h in 2015—the lowest value since 1969. During 2010–2015, investments into thermal power plants amounted to 92.16–144.16 billion RMB each year, resulting in a newly added capacity of 34.5–63.68 GW [22]. Yuan et al. [36] noted that the average capacity of the newly installed thermal power plants has increased recently. For instance, thermal power plants with a capacity of less than 300 MW constituted more than 70% of the total thermal power plant capacity in China, while this share dropped to 25% in 2012. Such an increase in the average thermal power plant capacity has led to overcapacity on the one hand and increase in efficiency on the other hand. As regards the efficiency of energy transformation, Yuan et al. [36] reported a decrease in the heat rate of power supply from 470 gce/kWh in 1980 down to 392 gce/kWh in 2000 and, finally, down to 318 gce/kWh in 2014. However, certain regional disparities continue to persist in Chinese thermal power generation.

Mou [24] carried out an efficiency analysis of thermal power plants in China by compiling the data for 2009–2011. Thermal power plants in the six power grids in China have been compared; the results suggested that Dongbei (Northeast) grid (Liaoning, Jilin, and Heilongjiang provinces) was the least efficient, whereas Huadong (East China) grid (Shanghai, Jiangsu, Zhejiang, and Anhui provinces) appeared to be the most efficient. The operation of thermal power plants in China has also caused severe air pollution (haze). It was reported by Yuan et al. [36] that the Chinese power industry is responsible for 23% of national particle material emissions, 45% of SO2 emissions, 64% of NOx emissions, and 44% of CO2 emissions. Therefore, energy planning needs to be improved to ensure the economic, technical, and environmental efficiency of the thermal power plants in China.

There have also been differences in the newly added capacities, total installed capacities, and power generation across the Chinese provinces [22]. As regards the newly installed capacity, Henan, Anhui, Xinjiang, Zhejiang, and Shanxi were the five provinces where it exceeded 5 GW in 2015. Indeed, these five provinces accounted for 45% of the total increase in the installed capacity of the thermal power plants. The distribution of the installed capacity depends on both the sources of energy (coal) and the concentration of the demand for power [22]. Accordingly, the installed capacity of the thermal power plants exceeded 50 GW in the provinces of Jiangsu, Shandong, Guangdong, Inner Mongolia, Zhejiang, Henan, and Shanxi. The spatial distribution of the electricity power generation basically corresponds to that of the installed capacity. However, only eight provinces showed an increase in thermal power generation in 2015 [22].

2.2. Hydropower

Hydropower is the second most important component in the energy mix in China. According to China’s Medium- and Long-term Development Plan for Renewable Energy, adopted in 2007, the share of hydropower and other renewables should be further increased in the energy mix. Li et al. [38] noted that China lags behind the developed countries in terms of the utilization of the hydropower resources: the average level of exploitation has reached 60%, whereas China exploits 46% of the hydropower resources. Therefore, there is still room for improvement in the level of hydropower exploitation in China. As Li et al. [39] argued, hydropower plants are multifunctional facilities as they contribute to irrigation and flood control, thereby improving transportation and contributing to economic growth. However, the operation of large hydropower stations might affect local ecosystems and becomes problematic during the rainy season as excessive electricity generated is wasted.

Li et al. [38] and Zhang et al. [26] reported a theoretical hydropower potential in China of 694 GW. Technically, feasible installed capacity equals 542 GW, with an annual generation of 2470 TWh per year. As regards the economically feasible installed capacity and annual generation, these are 402 GW and 1750 TWh per year, respectively. Li et al. [39] showed that there are differences in the regional hydropower endowments and a further differentiation in terms of technically and economically feasible generation volumes. For instance, southwest China possesses the largest hydropower resources and its theoretical generation accounts for 70.6% of the national theoretical annual generation, yet the corresponding economically feasible share is 58.9%. At the other end of the spectrum, central China possesses a theoretical generation contributing to 5.1% of the national annual generation, whereas its economically feasible generation comprises 12.3% of the national economically feasible generation. Note that these figures are relative to the absolute generation capacities (which are either technically or economically feasible) and reflect the underlying average generation costs in their essence.

The installed capacity of the hydropower plants increased from 79 GW in 2000 to 320 GW in 2015 [39]. The generation of hydropower went from 397 billion kWh in 2005 to 911.6 billion kWh in 2013 [26]. As of 2014, hydropower accounted for 22.25% of the total electricity generated and 22.24% of the total installed capacity [26].

The installation of hydropower plants faces a number of obstacles as they not only bring benefits, but might also affect the environment and even require resettlement. Furthermore, the slow pace of development of the hydropower projects encourages thermal power plants to expand and meet the demand for power in China. As most of China’s hydropower resources are located in the southwest, there is an imbalance between power generation and demand there. In order to reduce the amount of unused power, grids need to be more integrated and, in particular, hydro pumped power storage (HPPS) plants need to be constructed [39]. The 13th Five-Year Plan projects an increase in the installed capacity of the HPPS plants up to 400 GW in 2020 [39]. These issues also demonstrate the need for improvements in power generation and transmission in China.

2.3. Wind Electricity

Wind energy is an important renewable energy source in China [40]. Zhang et al. [26] reported that the exploitable capacity of onshore and offshore wind power is 600–1000 GW and 400–500 GW, respectively. Liu and Wang [30] argued that 50% of the territory of China features a wind energy density of 150–50 W/m2, whereas 26% of the area shows higher values. Development of the wind power plants has accelerated since the introduction of the Renewable Energy Law in 2005 and the subsequent setting up of feed-in tariffs. More specifically, the installed capacity of wind power plants was just 224 MW in 1998 and increased to 764 MW in 2004 [30]. However, the installed capacity increased to 1266 MW in 2005 and further to more than 110 GW in 2014 [26]. Zhang et al. [26] also noted that China was ranked first in the world according to the newly installed capacity of wind power plants. Wind power generation went from 1.9 TWh in 2005 to 131.9 TWh in 2013 [26]. Hong et al. [41] reported a capacity factor for wind power of 21.7% for China as opposed to 31.8% for the United States.

Hong et al. [41] reported that there have been several stages in the regulation of wind electricity prices. Before 2003, the power purchase agreements between wind electricity producers and governments set up the purchase prices. During 2003–2008, the wind concession program was in action. In the latter case, tendering was applied with bidding prices set for the first 30,000 full load hours of a wind power plant and local power tariffs applies afterwards. However, the bidding process created extremely low wind electricity prices, which curbed the development of wind power. Finally, regional feed-in tariffs were set up in 2009.

However, the distribution of wind power plants is uneven and does not correspond to the patterns of electricity demand as many of the wind power plants are located in northern China (Inner Mongolia and Gansu provinces), which, indeed, is less developed economically. The share of on-grid wind power plant capacity needs to be increased in China [41]. The failures of the transmission system caused the loss of some 10 TWh of the wind electricity (i.e., 12% of the total generation in the analysed regions) in 2011 [41]. Yu et al. [42] also stressed the issue of wind energy curtailment in the context of ongoing reforms in the Chinese electricity market. Therefore, the growth in the installed capacity of the wind power plants offers a promising perspective for an increase in the production of the renewable energy, yet electricity grids need to be developed in order to ensure transmission of the wind power across China.

2.4. Solar Electricity

Solar energy has been used for power generation, water heating, and infrastructure (lighting) in China [30]. Indeed, solar energy has been underutilized in China prior to the establishment of feed-in tariffs for solar electricity in 2011 [41]. Liu and Wang [30] reported that China possessed 63.1% of the world’s total solar water heating capacity in 2005.

Liu and Wang [30], Liu et al. [28], and Liu and Chu [43] discussed the spatial differences in solar energy availability across different regions of China. China comprises a total area of some 9.6 million km2 and 67% of the area is suitable for the operation of solar power plants (more than 2200 h of sunshine and irradiance of more than 5000 MJ/m2 per year). Following Zhang et al. [35], the highest solar irradiance is observed in the Tibetan plateau (irradiance of more than 1750 kWh/m2 per year).

As already mentioned, momentum for the development of the solar electricity sector increased in 2011. Accordingly, the installed capacity of the solar power plants was just 140 MW in 2008 and went up to 43 GW in 2015 [35]. As regards the generation of solar electricity, it stood below 1 billion kWh until 2011 and reached 11.9 billion kWh in 2013. The data from the International Renewable Energy Agency [44] suggest that the installed capacity of solar generation further increased to 130 GW in 2017. Therefore, there has been a robust increase in both capacity and generation due to policy reforms associated with the solar power sector. Hong et al. [41] reported the capacity factor for solar energy was 14.8% in China (as compared to 24% in the United States).

As was the case with the wind power generation, increasing integration of solar power plants into the electricity grids is required to satisfy the objectives associated with energy demand and sustainability. What is more, solar power needs to be combined with other energy sources in certain instances. Liu and Wang [30] stressed the need for applying combined solar‒wind systems for road lighting and irrigation.

2.5. Biomass Power

Biomass sector has great potential in China as agricultural residues and municipal waste are available in large quantities there. Zhang et al. [35] identified four general options for biomass-based power generation in China: (i) direct combustion; (ii) gasification power generation (including direct gasification power and gasification combined cycle generation); (iii) biomass‒coal co-firing generation (including biomass‒coal direct combustion generation and biomass‒coal co-gasification generation); and (iv) biogas power generation.

Biomass power generation has great potential in China as the agricultural sector can provide substantial amounts of residues that serve as a source of primary energy. Zhang et al. [35] reported that agricultural residues can provide energy equal to some 440 million tce per annum. Another 28 million tce can be obtained annually by utilizing manure. Forest residues is another important source of input for the biomass power sector which, in China, comprises some 350 tce per year. The potential contribution of the municipal waste is 12 million tce per year.

The installed capacity of the biomass power plants grew from 2500 MW up to 7800 MW in China during 2006–2013 [45]. However, a decrease in newly installed capacity has been observed since 2011 [35]. Liu et al. [46] and Lin and He [45] summarized the support measures for the biomass sector in China. These include price support via the feed-in tariffs, tax reductions, connection fee subsidies, and financial measures. The feed-in tariff for biomass sector was available during 2006–2010. Contrary to the situation in regards to other types of energy, the biomass power sector in China shows a higher share of private investment [45].

Hong et al. [41] reported that the biomass capacity factor in China (74.2%) is higher than that in the USA (64.6%). In this regard, only nuclear power is superior to biomass power in China. Similar findings are reported by Lin and He [45], considering the average equivalent full load operating hours. Lin and He [45] noted that the rate of growth in the installed capacity of the biomass power plants lags behind those of other renewables. Therefore, the biomass sector in China still requires attention in order to fully exploit its potential and contribute towards the implementation of China’s commitments towards climate change mitigation.

China has great potential for improving its energy mix in the sense of commitment to reductions in GHG emissions. However, the spatial discrepancies between energy supply and demand require development of the electricity grid. Such development can be guided by the government through regulation of the feed-in tariffs [9] and other means of support.

2.6. Nuclear Power

Nuclear power plants are mainly located in coastal regions in China due to a lack of other energy sources there [47]. There have been several stages in the development of nuclear energy in China, which marked the expansion of the installed capacities. As a result, the share of nuclear electricity in the total electricity production fluctuated slightly above 1% during 1997–2002, stayed around 2% during 2003–2012, and gained momentum afterwards, peaking at 3.56% in 2016 [48]. Therefore, nuclear energy has recently been promoted as a clean energy type in China and saw an increase in the installed capacity as well as in the share of the total electricity production.

3. Electricity Market Reform in China

Similar to the trends prevailing across the world, China has sought to both increase competition in the electricity market and switch to cleaner electricity. The legal, economic, and technical issues underlying the electricity reform in China were discussed by Xu and Chen [10], Ngan [11], and Li et al. [49]. Ma [9] and Zhang et al. [26] focused on issues of renewable energy in the latter context.

There can be several phases of electricity market reform outlined in China. During the state monopoly stage (1949–1985), the central government was responsible for both the regulation and operation of the power sector. The second stage (1985–1997) saw a partial deregulation, allowing investors to enter the power generation. The third stage (1997–2002) meant separation of regulation and production functions in regards to the government. During the fourth stage (2002–2013), the state monopoly was disintegrated by restructuring the State Power Corporation. Since 2014, the policy has been aiming at eradication of the “relative monopoly,” i.e., ensuring more competition in the generation and retail activities.

The period 1949–1985 marked the absolute domination of the central government in the power sector. Indeed, the government was responsible for both the planning and the operations of the power sector. Ma [9] termed this situation the dual role of the government. The central government would pass certain duties to the regional government, where the same duality persisted. Therefore, the development of the power sector was completely dependent on the decisions taken by the government agencies. As the government controlled all the elements of the power supply chain (i.e., the complete vertical integration was maintained), no serious measures for on-grid tariff regulation were taken [9]. As a result, electricity prices remained rather stable during 1949–1985. This impeded efficient resource allocation to a certain extent. As a result, a shortage of investments in the power sector occurred [10]. The enduring underinvestment led to electricity shortages, which, in turn, threatened economic growth in general. On the other hand, the implementation of opening-up policies fueled economic growth and a demand for power. Such a situation triggered the need for investment-oriented reforms in the power sector.

During 1985–1997, the government remained the key player in the power sector, yet investors were allowed to enter the sector too. This was basically an attempt to create conditions for private (both domestic and foreign) investments and regional-level initiatives. In order to secure the pay-off of the investments, the on-grid tariffs had to be adjusted. The turning point was the adoption of the Provisional Regulations on promoting Fundraising for Investment in the Power Sector and Implementing Different Power prices by the State Council in 1985. Basically, business operations were no longer solely under the control of the Chinese government as independent power producers (IPP) were allowed to enter the market (specifically, they were granted access to the grid and allowed to supply the electricity at the adjusted tariffs). This had to be in parallel with shifts in regulatory policies [10]. In 1987, the Guidance for the Implementation of Multiple On-Grid Tariffs was jointly adopted by several government agencies. These guidelines allowed for 12–15% rates of return [9]. Such a setting allowed for construction of new power plants, but did not guarantee allocation efficiency. In any case, the power shortage ceased to exist in 1997. The interests of the government-run vertical electricity power monopoly clashed with those of the new IPPs. As a result, power trade at the interprovincial level was rather complicated. What is more, the application of the adjusted electricity tariffs led to serious increases in electricity prices.

The Chinese government sought to separate the administrative and business operation activities during 1997‒2002. These reforms were mainly implemented by establishing the State Power Corporation to carry out business activities and the State Economic and Trade Commission and the State Development planning Commission. The Electric Power Law of the People’s Republic of China of 1995 (effective since 1996) marked an initial stage of the policy, setting reasonable electricity tariffs and performing regulation of the power sector in general. Several provinces attempted to dissolve the vertical monopoly [10]. The power price was related to interest payments over a certain period of operation and thus offered a more fair treatment of different types of investors. The newly established State Power Corporation still controlled more than 50% of the power generation assets along with power transmission, distribution, and sales. Such a situation caused certain difficulties in spite of the progress achieved due to institutional end economic reforms. Indeed, the government remained the main administrator of the power sector. This implied a lack of competition and, therefore, lower efficiency [10]. In addition, cross-provincial transmission and effective investment incentives remained issues to be tackled. The aforementioned shortcomings and failures required decisions regarding the further modernization of the Chinese power sector.

The subsequent dismantling of the state electricity sector monopoly took place in 2002–2013. The State Council issued a Plan of Reform of the Power Industry (so-called Document No. 5). As Xu and Chen [10] reported, the State Power Corporation controlled 46% of the total installed capacity in China, along with 90% of the transmission assets. The aforementioned shortcomings of the Chinese electricity market were to be tackled by further breaking down the State Power Corporation into three parts: (i) generation assets were distributed among the five companies (“the big five”); (ii) transmission and distribution assets were shared between the two companies (State Grid Corporation and China Southern Power Grid); and (iii) the four service companies [49]. In this way, the vertical monopoly was eliminated. Most importantly, the separation of generation and transmission was ensured. The State Electric Regulatory Commission has been instituted to oversee the power sector in China. In general, the reforms carried out in 2002 can be summarized under the three goals of restructuring, regulation, and competition [10]. However, the dismantling of the State Power Corporation still left the government with decision-making power regarding the operations of the power sector. Li et al. [49] noted that “the big five” companies managed to increase the share of the total installed capacity in China under their control during 2003–2010 in spite of the reforms aimed at attracting new investors and de-monopolization. Therefore, the state-owned companies controlled some 60% of the national installed capacity as of 2010 [50]. This situation was termed a relative monopoly [50]. Turning to the retail operations, the Chinese power sector still maintained a single-buyer model. In particular, the government was responsible for setting on-grid tariffs and retail prices, besides being the owner of many of the generation assets. Such a situation increased the importance of the government in the power sector, which was contradictory to the goals of de-monopolization. The next round of reforms aimed to tackle these shortcomings.

The period starting in 2014 can be described as focusing on breaking the relative monopoly [49]. Reforms pertaining to the most recent period have gained momentum in 2015 as the Several Opinions of the CPC Central Committee and the State Council on Further Deepening the Reform of the Electric Power System (Document No. 9) was released. A thorough survey of the recent policy developments has been prepared by Pollitt et al. [51]. The following goals of the reforms can be identified in Document No. 9 [51]: (i) improving power pricing, (ii) establishing effective power trading systems, (iii) improving power generation, (iv) creating institutions for electricity trading, (v) improving power distribution and sales, (vi) ensuring access to grid, and (vii) improving power planning. There are three stages of the most recent reform stipulated by Document No. 9 [42]. First, large customers can access the grid. In the second stage, retail electricity market allows all the users to buy power from independent companies. The third stage involves the so-called energy Internet, whereby electricity consumers are allowed to interact with the electricity grid and combine the use of electricity with other sources of energy. Besides market-oriented incentives, the government should foster such technologies as energy storage and conversion in this stage. Shenzhen was the first city to implement the competitive retail electricity market with separation of generation and retail from transmission and distribution functions. As a result, the transmission‒distribution and retail prices went down there [51].

Keeping the structure of a fuel mix fixed, an increase in energy consumption leads to proportional increase in energy-related GHG emissions. Jia et al. [52] carried out pinch analysis for optimization of Chinese energy mix and suggested that a transition from a coal-based energy mix should take place in order to meet the carbon reduction targets for 2020 and 2050. Amidst the power market reforms, environmental concerns have emerged. In particular, the Renewable Energy Law adopted in 2005 stressed the importance of renewables and clean energy. The Medium- and Long-Term Development Plan for Renewable Energy was adopted in 2007 with targets for different sources of energy. Note that the targets for wind energy were met rapidly. Later on, the Circular Economy Promotion Law of 2009 contributed to the exploitation of the biomass energy. In order to promote the use of renewables, the Renewable Energy Law Amendments of 2009 envisaged a corresponding quota. Furthermore, the Energy Conservation Dispatch was introduced in 2007 [12]. The highest priority in terms of the energy dispatch was given to renewable energy sources (with intermittent ones placed ahead of non-intermittent ones), with nuclear power plants coming next. Cogeneration plants and coal-fired plants with improvements regarding by-product abatement, gas turbines, and coal-gasification power plants were also assigned priority over conventional coal-fired power plants. The coal-fired power plants were further prioritized in regard to their heat rates and emission levels.

The overview of the development of the electricity market in China suggests several implications. First, the basic needs of securing the substantial electricity supply have been successfully achieved by means of the market-oriented measures in China. Second, dismantling government-owned companies has led to only a limited competitive market. Thirdly, environmental concerns have been shaping the Chinese power sector recently.

4. Smart Grids in China

Moretti et al. [32] noted that most of the prevailing electricity networks were constructed in the 20th century. The radial electricity flow is the underpinning principle of these networks. What is more, power generation is mainly based on fossil fuels or nuclear energy. Economic growth and imbalances in the spatial distribution of energy sources and energy demand renders congestion and, thus, blackouts. Therefore, the current requirements of sustainable development are in conflict with the existing electricity network structures. Smart grids have been proposed as an alternative to the existing network concept, allowing for increased use of renewables and interactions between the grid and consumers.

The very definition of a smart grid cannot be given explicitly. However, certain basic properties delineating smart grids from the concept of the conventional electricity network can be outlined. First, a smart grid allows for two-way communication in the grid, i.e., consumers may return information and/or electricity to the grid in addition to the conventional consumption of electricity [31]. Second, a more flexible pricing system may be developed to manage the electricity demand. In this regard, the use of smart meters is particularly important [31,53]. From an economic point of view, consumer independence is also important (however, this is not a distinctive feature of the smart grid). Moretti et al. [32] summarized the properties of the smart grids in the following manner: (i) streamlining power generation; (ii) curbing transmission and distribution loss; (iii) ensuring rapid damage control; and (iv) allowing for off-grid energy sources (e.g., renewables). Zhang et al. [34] proposed the following attributes of the smart grids: compatibility (supporting all means of generation); flexibility (dynamic power resources in line with improved infrastructures); efficiency (improved technologies allow for better resource management and operation efficiency); serviceability (new services and products); safety (resilience and improved reliability; self-repair); and interoperability (smart metering, information technologies).

As Eid et al. [31] put it, smart grids essentially aim at the “decarbonisation, reliability, and (economic) efficiency” of the power sector. As one can see, these aims correspond to the environmental challenges imposed by the sustainable development objectives and energy retail economic growth through installation of smart technologies and extension of the energy mix. The real-time operation of smart technologies ensures that interactive operation of the grid may be achieved. Anyway, the conventional grids also feature certain technologies related to the smart grids, e.g., sensor and control systems in the high-voltage systems [31]. Yu et al. [33] provided an even greater number of options for contrasting the traditional and smart grids.

Smart grids are related to the institutional arrangement of the power sector. Basically, the power sector can act as a vertically integrated monopoly at one end of the spectrum and as a retail competition at the other end of the spectrum. These arrangements imply the peculiarities of implementation of the smart grids, first of all by differences in the possible tariff setting. The cases of a single buyer and multiple ones fall in between these extreme situations.

As Eid et al. [31] noted, both capital investments and operational expenses may increase in case of smart grid development under vertical integration. In this case, the regulating authority should acknowledge the corresponding capital investments as the appropriate ones in order to ensure the development of smart grids. However, the price of the electricity is not competitively set under the vertical monopoly and interactive technologies might not be properly perceived by the consumers. This, indeed, might reduce the spread of innovations.

Similar reasoning applies to situation where distribution service operators are established in order to allow for retail choice. These entities should be allowed to invest in smart grids without being affected in the incentive regulation process. Otherwise, the development of smart grids might also be dampened as the installation and operation costs may increase [31]. In case generation and distribution companies are completely unbundled, the effects of the smart grids upon each actor need to be determined.

In the case of complete competition, retailers can definitely benefit from the development of smart grids. As Eid et al. [31] argue, insights into consumption patterns and price elasticity allow retailers to develop proper solutions for both supply and demand management of the electricity. Therefore, no specific incentives for smart grids (as far as they are related to the retail activities) are needed in this case.

Energy service companies can also emerge under the presence of smart grids. These companies allow for aggregating different services (electricity, heating, etc.). By doing this, they enhance the flexibility of the grid. As regards consumers, they face differences in their consumption due to dynamic pricing and similar instruments. Indeed, they can decide on the consumption and production of electricity given the prices. Real-time information about the energy system allows them to make decisions regarding the consumption and production of electricity under specific conditions at a certain time. This further affects the energy costs and emissions.

In spite of the reforms discussed in Section 3, China basically follows the virtual integration model as the largest share of generation, transmission, and distribution activities is controlled by state-owned companies. The rate of return principle is followed for regulatory purposes. Therefore, the incentive to develop smart grids lies with the government in general. As Zhang et al. [34] pointed out, residential electricity consumption is relatively low in China (some 15% of the total electricity consumption in 2014) compared to the developed countries. Another feature of the Chinese electricity network is the need for long-distance transmission lines (see Section 2) due to discrepancies among energy sources and demand spots. Taking the institutional approach, the power grid is centrally controlled in China [34]. These circumstances have shaped the direction and extent of implementation of smart grid technologies in China.

In China, the two grid companies—State Grid Corporation of China and China Southern Power Grid—control the transmission and distribution as well as much of the retail. These companies are exclusive in terms of their areas of service and, thus, face no competition. State Grid Corporation of China, indeed, is much larger (it serves 26 provinces) and is the major supporter of smart grid development in China.

Yu et al. [33] reported that the State Grid Corporation of China supported pilot projects covering different parts of the electricity network (transmission, distribution, consumption, electric vehicles, etc.). Generation is also covered by smart grid projects [31], with a particular interest in including renewables in the energy mix. In order to integrate remote sources of energy into the grid, ultra-high voltage lines are being developed. However, appliances such as smart meters are not given priority when sketching smart grid projects in China. Therefore, dynamic pricing also remains an important issue for future research.

Yuan and Hu [5] also identified the need for ensuring both the supply-side and the demand-side efficiency of the grid. A grid comprising optimization of both supply-side and demand-side improvements has been termed a super smart grid. Whereas the supply-side improvements have been discussed above, demand-side improvements involve feedback technologies, smart buildings, electric vehicle charging technologies, etc. [5].

Electricity pricing provides the major means for adjusting the energy mix on the supply side and improves the energy efficiency on the demand side. Smart grids provide more opportunities for real-time pricing and, thus, further gains in efficiency. Menezes and Zheng [54] provided a survey of the power pricing in China. Generation prices generally rely on the decisions of the National Development and Reform Commission as the direct sales to end-users remain meager. Transmission and distribution prices are calculated residually, yet a cost-plus-return principle should be implemented in the future. The retail pricing in China differentiates between the residential, agricultural, and industrial sectors, with the former two sectors receiving lower-than-average prices. In general, cross-subsidizing prevails in China, with the residential sector being subsidized [54,55].

The residential sector is subject to the three-tiered electricity pricing adopted in 2012 [55]. The voltage and time of use determine the electricity price for the residential users. The industrial users are also subject to electricity price differentiation depending on the energy efficiency [54]. Sun [56] argues that the residential pricing system can be further improved by increasing consumer awareness and adjusting the policies to different groups of consumers. The use of the smart grids may contribute to shaping the pricing of the electricity by implementing real-time (dynamic) pricing. Wang et al. [57] presented a simulation that indicated possible gains from real-time pricing in China. The examples of dynamic pricing for China’s case were presented by, e.g., He and Zhang [58] and Ma et al. [59]. The adjustments in pricing and implementation of smart grids (including support schemes) can be made by considering the demand response functions involving inefficiency term, as suggested by Broadstock et al. [60].

A crucial element of the effective smart grids is distributed energy storage. This technology requires both technological and economic arrangements. Zheng et al. [61] developed the concept of coordinated energy storage dispatch for distributed units. Milis et al. [62] discussed the issues of the capacity tariff setting. Wu and Lin [63] and Yang and Zhao [64] showed that the distributed energy storage can improve the reliability and profitability of the smart grid in China.

The strategy for the development of the Chinese power sector post-2014 basically corresponds to the concept of the smart grid. The centralized control of the electricity sector in China implies both benefits and drawbacks. Currently, smart grid development in China focuses on large-scale projects without serious consideration of consumer-side optimization [31,34], yet some applications of, e.g., smart meters have been reported [33]. However, there has been a lack of clear objectives for smart grids in China. Therefore, certain technical barriers persist that imply further operation of a system mainly based on the thermal and hydro power plants. The concentration of the control of the electricity sector, nevertheless, allows for rapid implementation of the smart grid projects [31]. To conclude, identification of clear objectives for the energy policy and inclusion of consumers in decision-making regarding energy consumption and production would allow for the creation of a more advanced electricity sector in China.

5. Financial Investments and Performance of the Electricity Sector in China

The financial aspects of energy sector development in China have been discussed by, e.g., Zhang et al. [26] and Pollitt et al. [51]. In this section, we further discuss the trends in the performance of the Chinese energy sector with a particular focus on investment in electricity generation (production) and supply business. Pollitt et al. [51] reported that many of the investments into the electricity sector were dedicated to distribution activities. Therefore, the development of smart grids in China might be fuelled by these financial flows.

The supply side of the power generation in China is governed by a feed-in tariff system. The resulting feed-in prices for 2013–2017 are given in Table 1. Out of the different energy types, only biomass showed an increasing trend in the feed-in price. The steepest decline is observed for coal power, solar power, and hydro power. However, solar power maintains a much higher average tariff for 2013–2017 (977.11 CNY/MWh) as opposed to, e.g., coal power (392.97 MWh).

Table 1.

Feed-in electricity prices in China (national averages), 2013–2017 (in CNY/MWh).

As regards the demand side, the electricity sales price plays an important role. See Wang et al. [55] for a survey of the residential tiered electricity pricing in China. The average data for China are presented in Table 2. As one can see, the price of electricity for residential users declined at a faster pace (−1.56% p.a.) than the average price (−1.36% p.a.).

Table 2.

Average electricity sales price and average residential electricity prices in China (national averages), 2013–2017 (in CNY/MWh).

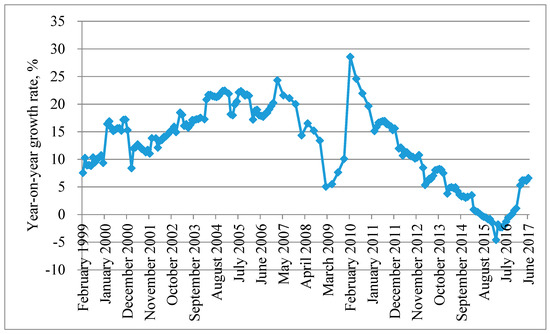

The Chinese energy sector has faced changes in the industrial structure that have affected the demand for energy and electricity in particular. As Figure 1 suggests, there had been a slowdown in the growth of the income of electricity generation and supply companies during 2010–2015. In particular, 2015 marked a decrease in income. This can be attributed to decreasing demand by energy-intensive heavy industries (e.g., steel production). Therefore, power generation is becoming a less important problem compared to the development of grid systems.

Figure 1.

The dynamics in income of electricity and heat generation and supply companies in China. Note: the data come from the National Bureau of Statistics of China.

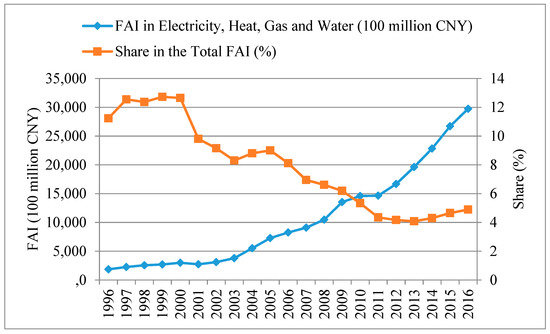

Investments in fixed assets in the electricity sector have been increasing since 1996, with a slowdown in 2010 (Figure 2 presents the results for electricity and other utilities due to data availability). Specifically, the investments in fixed assets went up from 186 billion CNY in 1996 to 2973 billion CNY in 2016. However, the share of investments in fixed assets in the electricity and other utilities sector (compared to investments in all sectors) went down from 11% in 1996 to 4.9% in 2016. However, a slight rebound has been observed since 2012. Therefore, investments in the electricity sector grew dramatically during 2011–2016, yet the relative importance of such investments has decreased in general. These patterns indicate that an increase in investments in grid developments is possible if a higher share of the total investments is diverted there. As mentioned before, the establishment of smart grids requires the aggregation of different sources of energy (i.e., different types of utilities).

Figure 2.

Fixed asset investments (FAI) in production and supply of electricity, heat, gas, and water (in urban areas), 1996–2016. Note: the data come from the National Bureau of Statistics of China.

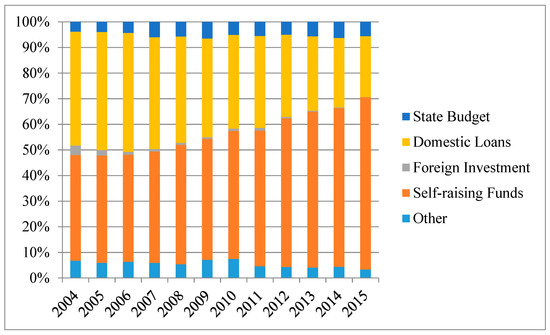

We further look into the sources of investments in fixed assets (Figure 3). A key trend is that the role of the self-raising funds has become more important. Specifically, the share of the investments facilitated by self-raised funds grew from 41.4% in 2004 to 67.3% in 2015. The share of domestic loans decreased from 44.5% to 23.7% during the same time period. Therefore, the latter source lost its position as the primary source of fixed asset investments in production and supply of electricity, heat, gas, and water. The share of investments financed by the state budget increased from 3.8% to 5.6%. The share of foreign investments went down from 3.6% to 0.01%. Therefore, self-raised funds remain the most important source of investment in energy infrastructure. This suggests that the development of smart grids in China will be closely related to the performance of domestic companies. Support based on public funds remains less important, but has been associated with an increasing relative contribution. Note that these findings are related to investments in both electricity and other utilities.

Figure 3.

Fixed asset investments (FAI) in production and supply of electricity, heat, gas, and water (in urban areas), 1996–2016. Note: the data come from the National Bureau of Statistics of China.

The sources of energy comprise an important facet of smart grid development. In particular, the increasing share of renewables in electricity generation is a key trend underpinning modern energy policy. We further review the dynamics of the newly installed capacities in China in 2008–2016 to reveal the implications for the development of the smart grids here. The financial costs incurred due to the construction are also analysed.

The investments in electricity generation and grid construction are further analysed in Table 3. Investments in electricity generation are broken down by the energy type. As one can see, the investments in the power supply grid infrastructure tended to increase by 19.65 billion CNY a year on average. The rate of change for investments in the grid infrastructure was higher (23.16 billion CNY a year). Prior to 2012, the volume of investments in the grid infrastructure was lower than that of investments in supply generation, yet the trend has reversed thereafter. This indicates more efforts going into the construction of the grids. The latter situation is favourable in the sense of smart grid development in China. Hydro power and thermal power saw the steepest decrease in investment, whereas wind power exhibited the highest increase. As a result, the structure of investment in the new energy capacity shifted during 2008–2016, with investment in wind energy rising to second place from third.

Table 3.

Completed investments in power supply and grid infrastructure in China (100 million CNY), 2008–2016.

Table 4 presents the dynamics of newly installed capacity for different types of energy. Among the energy types considered, wind and solar power plants showed the highest increase in installed capacity (as indicated by average annual rates of change of 2.1 GW p.a. and 3.4 GW p.a.). Thermal power plants showed the steepest decline in the newly installed capacity of 2 GW p.a. Even though the newly installed capacity of the nuclear power plants increased in both absolute and relative terms, it comprised 6% of the total newly installed capacity in 2016. Note that a surge in nuclear expenses during 2012 was observed during post-Fukushima restrictions. Even though thermal power plants dominated the structure of newly installed capacity, there has been a clear trend of switching to renewables. Specifically, the share of solar power plants in the newly installed capacity increased up to 29% in 2016, putting it in second place among the types of energy covered in the analysis. On the contrary, the share of thermal power plants dropped from 71% to 40%. The share of hydro power plants also declined by some 13 pp.

Table 4.

Newly-added installed capacity of power generation in China (GW), 2008–2016.

The dynamics of the investment in different types of energy are partially impacted by the prevailing installation costs. By combining the data in Table 3 and Table 4, we obtain the installation costs for different types of energy in CNY per 1 kW (see Table 5 for the resulting costs). The decline in newly installed capacity of hydro power plants can be related to the rather high installation costs of this type of energy. In particular, 2015–2016 marked an increase in the hydro power installation costs, which made it the most expensive energy in this regard. The rate of change for the latter type of energy is also positive, indicating that such a trend is not likely to be reversed in the near future. Thermal power remains the cheapest energy in terms of installation costs, yet thermal power plants are not developed in the first place due to new policies regarding environmental pressures and the promotion of non-fossil energy. Wind power showed the lowest rate of change, indicating the highest reduction in installation price. As it was already mentioned, hydro power became the most expensive energy in terms of the installation costs, which indicates the increased attractiveness of the wind power plants.

Table 5.

Installation costs for different types of energy in China (CNY/kW), 2008–2016.

6. Conclusions and Policy Implications

In the future, the development of the Chinese energy sector will require us not only to simply address the demand of energy consumers, but also to streamline the planning and operation of the energy sector. This needs to be done with respect to the diverse requirements of economic activities (i.e., changes in the economic structure and its spatial distribution) and global commitments to climate change mitigation. These issues can be successfully addressed by implementing smart grid technology in China. Therefore, the central government should focus on an integrated approach towards the development of smart grid systems by ensuring financial, institutional, and technological guidance.

Looking at the demand side, the Chinese power sector is dominated by industrial consumers. Removal of backward capacity and slowdown of energy-intensive economic activities has pushed the demand for electricity down in the recent years. This implies certain directions for development of smart grids in China. In particular, transmission activities will receive much attention in terms of investments and technological advancement. Transmission is important to address the discrepancies between factor endowments and energy demand centres in China. Without the expansion of smart metering system in China, the dynamic pricing of electricity would not overtake the currently applied rate of return principle.

Smart grids remain important to tackle dynamic patterns of energy demand driven by economic growth and urbanization. The analysis carried out on financial flows showed that investments in electricity generation and grid infrastructure have been steadily increasing in China during 1996–2016, yet the relative share of such investments in the total investments into fixed assets declined. Therefore, the promotion of the smart grids can be fuelled by encouraging investments via public support and tax incentives. The analysis showed that domestic companies have appeared as the main source of investments following 2012. The increasing shares of the renewables in the newly installed capacities basically correspond to the goals of the development of smart grids in China.

As China has approached a “new normal,” the structural development of the economy and energy system is required to maintain a balance between economic growth, social objectives, and environmental pressures. In this regard, sustainable power grids may offer a solution. Successful implementation of the sustainable power grids in China requires technological development (including decision support systems) and public support schemes. In the economic dimension, improvements in the tariff system are also topical. These adjustments should be made with regards to the needs of different groups in society. The use of cleaner technologies on the smart grid will allow for achieving environmental sustainability.

This study features certain limitations. First, the determinants of electricity demand and investments into different technologies have not been explicitly modelled in this study. Second, the paper discusses the trends in the “new normal” period without undertaking forecasting. However, the rapid development of renewables in China makes this task rather complicated. Third, the discussion is mostly limited to China. Therefore, further studies may embark on international comparisons.

Author Contributions

Writing—original draft, T.B.; Writing—review & editing, D.Š.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Galvão, J.R.; Galvão, J.R.; Moreira, L.; Moreira, L.; Gaspar, G.; Gaspar, G.; Vindeirinho, S.; Vindeirinho, S.; Leitão, S.; Leitão, S. Energy system retrofit in a public services building. Manag. Environ. Q. 2017, 28, 302–314. [Google Scholar] [CrossRef]

- Zhao, Q.R.; Chen, Q.H.; Xiao, Y.T.; Tian, G.Q.; Chu, X.L.; Liu, Q.M. Saving forests through development? Fuelwood consumption and the energy-ladder hypothesis in rural Southern China. Transform. Bus. Econ. 2017, 16, 199–219. [Google Scholar]

- Chodakowska, E.; Nazarko, J. Environmental DEA method for assessing productivity of European countries. Technol. Econ. Dev. Econ. 2017, 23, 589–607. [Google Scholar] [CrossRef]

- Simionescu, M.; Albu, L.L.; Szeles, M.R.; Bilan, Y. The impact of biofuels utilisation in transport on the sustainable development in the European Union. Technol. Econ. Dev. Econ. 2017, 23, 667–686. [Google Scholar] [CrossRef]

- Yuan, J.; Hu, Z. Low carbon electricity development in China—An IRSP perspective based on Super Smart Grid. Renew. Sustain. Energy Rev. 2011, 15, 2707–2713. [Google Scholar] [CrossRef]

- Liu, Z.; Guan, D.; Crawford-Brown, D.; Zhang, Q.; He, K.; Liu, J. Energy policy: A low-carbon road map for China. Nature 2013, 500, 143–145. [Google Scholar] [CrossRef]

- Hu, Y.; Cheng, H. Displacement efficiency of alternative energy and trans-provincial imported electricity in China. Nat. Commun. 2017, 8, 14590. [Google Scholar] [CrossRef] [PubMed]

- Mi, Z.F.; Meng, J.; Guan, D.B.; Shan, Y.L.; Song, M.L.; Wei, Y.M.; Liu, Z.; Hubacek, K. Chinese CO2 emission flows have reversed since the global financial crisis. Nat. Commun. 2017, 8, 1712. [Google Scholar] [CrossRef] [PubMed]

- Ma, J. On-grid electricity tariffs in China: Development, reform and prospects. Energy Policy 2011, 39, 2633–2645. [Google Scholar] [CrossRef]

- Xu, S.; Chen, W. The reform of electricity power sector in the PR of China. Energy Policy 2006, 34, 2455–2465. [Google Scholar] [CrossRef]

- Ngan, H.W. Electricity regulation and electricity market reforms in China. Energy Policy 2010, 38, 2142–2148. [Google Scholar] [CrossRef]

- Ho, M.S.; Wang, Z.; Yu, Z. China’s Power Generation Dispatch; Resources for the Future (RFF): Washington, DC, USA, 2017. [Google Scholar]

- Williams, J.H.; Ghanadan, R. Electricity reform in developing and transition countries: A reappraisal. Energy 2006, 31, 815–844. [Google Scholar] [CrossRef]

- Wei, Y.M.; Mi, Z.F.; Huang, Z. Climate policy modeling: An online SCI-E and SSCI based literature review. Omega 2015, 57, 70–84. [Google Scholar] [CrossRef]

- Zhao, H.R.; Zhao, H.R.; Han, X.Y.; He, Z.H.; Guo, S. Economic Growth, Electricity Consumption, Labor Force and Capital Input: A More Comprehensive Analysis on North China Using Panel Data. Energies 2016, 9, 891. [Google Scholar] [CrossRef]

- Feng, T.; Sun, L.; Zhang, Y. The relationship between energy consumption structure, economic structure and energy intensity in China. Energy Policy 2009, 37, 5475–5483. [Google Scholar] [CrossRef]

- British Petroleum. BP Statistical Review of World Energy. June 2015. Available online: http://www.bp.com/content/dam/bp/pdf/energy-economics/statistical-review-2015/bp-statistical-review-of-world-energy-2015-full-report.pdf (accessed on 1 February 2019).

- IEA. CO2 Emissions from Fuel Combustion; IEA: Paris, France, 2016. [Google Scholar]

- Wang, S.; Fang, C.; Guan, X.; Pang, B.; Ma, H. Urbanisation, energy consumption, and carbon dioxide emissions in China: A panel data analysis of China’s provinces. Appl. Energy 2014, 136, 738–749. [Google Scholar] [CrossRef]

- Wang, S.; Fang, C.; Wang, Y.; Huang, Y.; Ma, H. Quantifying the relationship between urban development intensity and carbon dioxide emissions using a panel data analysis. Ecol. Indic. 2015, 49, 121–131. [Google Scholar] [CrossRef]

- Wang, J.; Lv, K.; Bian, Y.; Cheng, Y. Energy efficiency and marginal carbon dioxide emission abatement cost in urban China. Energy Policy 2017, 105, 246–255. [Google Scholar] [CrossRef]

- Ming, Z.; Ping, Z.; Shunkun, Y.; Hui, L. Overall review of the overcapacity situation of China’s thermal power industry: Status quo, policy analysis and suggestions. Renew. Sustain. Energy Rev. 2017, 76, 768–774. [Google Scholar] [CrossRef]

- Zhou, S.; Wang, Y.; Zhou, Y.; Clarke, L.E.; Edmonds, J.A. Roles of wind and solar energy in China’s power sector: Implications of intermittency constraints. Appl. Energy 2018, 213, 22–30. [Google Scholar] [CrossRef]

- Mou, D. Understanding China’s electricity market reform from the perspective of the coal-fired power disparity. Energy Policy 2014, 74, 224–234. [Google Scholar] [CrossRef]

- Wang, K.; Wei, Y.M.; Huang, Z. Potential gains from carbon emissions trading in China: A DEA based estimation on abatement cost savings. Omega 2016, 63, 48–59. [Google Scholar] [CrossRef]

- Zhang, D.; Wang, J.; Lin, Y.; Si, Y.; Huang, C.; Yang, J.; Huang, B.; Li, W. Present situation and future prospect of renewable energy in China. Renew. Sustain. Energy Rev. 2017, 76, 865–871. [Google Scholar] [CrossRef]

- Zhang, S.; He, Y. Analysis on the development and policy of solar PV power in China. Renew. Sustain. Energy Rev. 2013, 21, 393–401. [Google Scholar] [CrossRef]

- Liu, L.Q.; Wang, Z.X.; Zhang, H.Q.; Xue, Y.C. Solar energy development in China—A review. Renew. Sustain. Energy Rev. 2010, 14, 301–311. [Google Scholar] [CrossRef]

- Liao, Z. The evolution of wind energy policies in China (1995–2014): An analysis based on policy instruments. Renew. Sustain. Energy Rev. 2016, 56, 464–472. [Google Scholar] [CrossRef]

- Liu, L.Q.; Wang, Z.X. The development and application practice of wind–solar energy hybrid generation systems in China. Renew. Sustain. Energy Rev. 2009, 13, 1504–1512. [Google Scholar] [CrossRef]

- Eid, C.; Hakvoort, R.; de Jong, M. The Political Economy of Clean Energy Transitions; Arent, D., Arndt, C., Miller, M., Tarp, F., Zinaman, O., Eds.; Oxford University Press: Oxford, UK, 2017. [Google Scholar]

- Moretti, M.; Djomo, S.N.; Azadi, H.; May, K.; De Vos, K.; Van Passel, S.; Witters, N. A systematic review of environmental and economic impacts of smart grids. Renew. Sustain. Energy Rev. 2017, 68, 888–898. [Google Scholar] [CrossRef]

- Yu, Y.; Yang, J.; Chen, B. The smart grids in China—A review. Energies 2012, 5, 1321–1338. [Google Scholar] [CrossRef]

- Zhang, Y.; Chen, W.; Gao, W. A survey on the development status and challenges of smart grids in main driver countries. Renew. Sustain. Energy Rev. 2017, 79, 137–147. [Google Scholar] [CrossRef]

- El-Hawary, M.E. The smart grid—State-of-the-art and future trends. Electr. Power Compon. Syst. 2014, 42, 239–250. [Google Scholar] [CrossRef]

- Yuan, J.; Na, C.; Lei, Q.; Xiong, M.; Guo, J.; Hu, Z. Coal use for power generation in China. Resour. Conserv. Recycl. 2018, 129, 443–453. [Google Scholar] [CrossRef]

- Wang, B.; Wang, Q.; Wei, Y.M.; Li, Z.P. Role of renewable energy in China’s energy security and climate change mitigation: An index decomposition analysis. Renew. Sustain. Energy Rev. 2018, 90, 187–194. [Google Scholar] [CrossRef]

- Li, Y.; Li, Y.; Ji, P.; Yang, J. The status quo analysis and policy suggestions on promoting China׳ s hydropower development. Renew. Sustain. Energy Rev. 2015, 51, 1071–1079. [Google Scholar] [CrossRef]

- Li, X.Z.; Chen, Z.J.; Fan, X.C.; Cheng, Z.J. Hydropower development situation and prospects in China. Renew. Sustain. Energy Rev. 2018, 82, 232–239. [Google Scholar] [CrossRef]

- Sahu, B.K. Wind energy developments and policies in China: A short review. Renew. Sustain. Energy Rev. 2018, 81, 1393–1405. [Google Scholar] [CrossRef]

- Hong, L.; Zhou, N.; Fridley, D.; Raczkowski, C. Assessment of China’s renewable energy contribution during the 12th Five Year Plan. Energy Policy 2013, 62, 1533–1543. [Google Scholar] [CrossRef]

- Yu, D.; Qiu, H.; Yuan, X.; Li, Y.; Shao, C.; Lin, Y.; Ding, Y. Roadmap of retail electricity market reform in China: Assisting in mitigating wind energy curtailment. In Proceedings of the International Conference on Energy Engineering and Environmental Protection (EEEP2016), Sanya, China, 21–23 November 2016. [Google Scholar]

- Liu, P.K.; Chu, P.H. Renewables finance and investment: How to improve industry with private capital in China. J. Mod. Power Syst. Clean Energy 2018, 1–14. [Google Scholar] [CrossRef]

- IRENA. Renewable Energy Statistics 2018; The International Renewable Energy Agency: Abu Dhabi, UAE, 2018. [Google Scholar]

- Lin, B.; He, J. Is biomass power a good choice for governments in China? Renew. Sustain. Energy Rev. 2017, 73, 1218–1230. [Google Scholar] [CrossRef]

- Liu, J.; Wang, S.; Wei, Q.; Yan, S. Present situation, problems and solutions of China׳ s biomass power generation industry. Energy Policy 2014, 70, 144–151. [Google Scholar] [CrossRef]

- World Nuclear Association. Nuclear Power in China. 2018. Available online: http://www.world-nuclear.org/information-library/country-profiles/countries-a-f/china-nuclear-power.aspx (accessed on 1 February 2019).

- IAEA. Power Reactor Information System. 2018. Available online: https://www.iaea.org/PRIS/CountryStatistics/CountryDetails.aspx?current=CN (accessed on 1 February 2019).

- Li, Q.; Ma, Z.; Jørgensen, N. Discussion on China’s Power Sector Reforms and where to next? In Proceedings of the 13th International Conference on the European Energy Market (EEM), Porto, Portugal, 6–9 June 2016; pp. 1–5. [Google Scholar] [CrossRef]

- Wang, Q.; Chen, X. China’s electricity market-oriented reform: From an absolute to a relative monopoly. Energy Policy 2012, 51, 143–148. [Google Scholar] [CrossRef]

- Pollitt, M.G.; Yang, C.H.; Chen, H. Reforming the Chinese Electricity Supply Sector: Lessons from International Experience; EPRG Working Paper 1704; Cambridge Working Paper in Economics 1713; Energy Research at the University of Cambridge: Cambridge, UK, 2017. [Google Scholar]

- Jia, X.; Li, Z.; Wang, F.; Foo, D.C.; Tan, R.R. Multi-dimensional pinch analysis for sustainable power generation sector planning in China. J. Clean. Prod. 2016, 112, 2756–2771. [Google Scholar] [CrossRef]

- Pollitt, M. The socio-economics of the smart grid—An introduction. In Smart Grid Handbook; Liu, C.-C., McArthur, S., Lee, S.-J., Eds.; John Wiley and Sons: Chichester, UK, 2016; pp. 1529–1536. [Google Scholar]

- Menezes, F.M.; Zheng, X. Regulatory incentives for a low-carbon electricity sector in China. J. Clean. Prod. 2018, 195, 919–931. [Google Scholar] [CrossRef]

- Wang, C.; Zhou, K.; Yang, S. A review of residential tiered electricity pricing in China. Renew. Sustain. Energy Rev. 2017, 79, 533–543. [Google Scholar] [CrossRef]

- Sun, C. An empirical case study about the reform of tiered pricing for household electricity in China. Appl. Energy 2015, 160, 383–389. [Google Scholar] [CrossRef]

- Wang, H.; Fang, H.; Yu, X.; Liang, S. How real time pricing modifies Chinese households’ electricity consumption. J. Clean. Prod. 2018, 178, 776–790. [Google Scholar] [CrossRef]

- He, Y.; Zhang, J. Real-time electricity pricing mechanism in China based on system dynamics. Energy Convers. Manag. 2015, 94, 394–405. [Google Scholar] [CrossRef]

- Ma, T.; Wu, J.; Hao, L.; Yan, H.; Li, D. A Real-Time Pricing Scheme for Energy Management in Integrated Energy Systems: A Stackelberg Game Approach. Energies 2018, 11, 2858. [Google Scholar] [CrossRef]

- Broadstock, D.C.; Li, J.; Zhang, D. Efficiency snakes and energy ladders: A (meta-) frontier demand analysis of electricity consumption efficiency in Chinese households. Energy Policy 2016, 91, 383–396. [Google Scholar] [CrossRef]

- Zheng, M.; Wang, X.; Meinrenken, C.J.; Ding, Y. Economic and environmental benefits of coordinating dispatch among distributed electricity storage. Appl. Energy 2018, 210, 842–855. [Google Scholar] [CrossRef]

- Milis, K.; Peremans, H.; Van Passel, S. Steering the adoption of battery storage through electricity tariff design. Renew. Sustain. Energy Rev. 2018, 98, 125–139. [Google Scholar] [CrossRef]

- Wu, W.; Lin, B. Application value of energy storage in power grid: A special case of China electricity market. Energy 2018, 165, 1191–1199. [Google Scholar] [CrossRef]

- Yang, F.F.; Zhao, X.G. Policies and economic efficiency of China’s distributed photovoltaic and energy storage industry. Energy 2018, 154, 221–230. [Google Scholar] [CrossRef]