Abstract

Despite the need for large-scale retrofit of UK housing to meet emissions reduction targets, progress to date has been slow and domestic energy efficiency policies have struggled to accelerate housing retrofit processes. There is a need for housing retrofit policies that overcome key barriers within the retrofit sector while maintaining economic viability for customers, funding organizations, and effectively addressing UK emission reductions and fuel poverty targets. In this study, we use a simple assessment framework to assess three policies (the Variable Council Tax, the Variable Stamp Duty Land Tax, and Green Mortgage) proposed to replace the UK’s current major domestic retrofit programme known as the Energy Company Obligation (ECO). We show that the Variable Council Tax and Green Mortgage proposals have the greatest potential for overcoming the main barriers to retrofit policies while maintaining economic viability and contributing to high-level UK targets. We also show that, while none of the assessed schemes are capable of overcoming all retrofit barriers on their own, a mix of all three policies could address most barriers and provide key benefits such as wide coverage of property markets, operation on existing financial infrastructures, and application of a “carrot-and-stick” approach to incentivize retrofit. Lastly, we indicate that the specific support and protection of fuel-poor households cannot be achieved by a mix of these policies and a complementary scheme focused on fuel-poor households is required.

1. Introduction

With domestic buildings accounting for 30% of the UK’s final energy consumption [1] and 25% of UK carbon emissions [2], energy efficiency improvements in residential housing could deliver carbon savings of 24 Mt CO2 per annum by 2030 [3]. The potential for domestic energy efficiency interventions to generate emission reductions and improve welfare has prompted urgent calls for progressing the large-scale retrofit of the UK housing stock. In 2017, the UK Committee on Climate Change called for a “major overhaul” of domestic energy efficiency policy as one of a portfolio of measures proposed to close the forecasted gap in meeting the UK’s 5th carbon budget (100–170 Mt CO2e per year) [4].

The urgency of progressing housing retrofit is also rooted in the slow progress to date of UK policy schemes, which have aimed to accelerate domestic energy efficiency improvements. However, they have fallen short of achieving their targets. One recent example is the Green Deal, which is a pay-as-you-save loan scheme that, despite initial plans to retrofit 14 million homes between 2013 and 2020 [5], was only taken up by 16,000 households [3] and saved 0.4 Mt CO2 over three years of its operation [5]. This was largely due to the high interest rates of loans offered to residents, which renders many retrofit measures unaffordable [6].

Such policy shortfalls are identified by applying various policy assessment methods in which most currently focus on techno-economic evaluation and fail to apply a holistic approach toward identifying non-economic barriers to policy success. In this study, we propose a simple policy assessment framework to holistically assess the suitability of energy efficiency policies for overcoming barriers and meeting stakeholder needs in the UK housing and retrofit sectors. Our approach combines a profit-and-loss analysis with a qualitative stakeholder analysis and assesses the performance of the policy proposals in light of the results. By incorporating stakeholder needs, the framework seeks to apply a more holistic approach toward assessing the performance of policies in a complex sector populated by diverse actor groups. The application of a more holistic approach means that assessment methods such as the one presented in this manuscript can help identify potential policy failures and develop recommendations grounded in a systemic view of the barriers, opportunities, and needs that co-exist in the UK retrofit sector. Ultimately, this study aims to contribute to policy assessment research by exemplifying a framework that incorporates a systemic view of barriers in the retrofit sector as well as by discussing how this approach can provide better insight for developing future policy recommendations.

We apply the above approach to analyze three policies recently proposed as replacements for the Energy Company Obligation (ECO), which is the UK’s current major energy efficiency program and suggest how these policies might contribute to the acceleration of housing retrofit in the UK. In the rest of this paper, we present the assessment framework (Section 2), introduce the policy proposals and detail the assessment methodology (Section 3), and present and discuss the results of the assessment (Section 4). Section 5 concludes of the paper by interpreting the results and provides some recommendations for future policy design.

2. Background

There are a large number of policy evaluation methods, which provide detailed assessment at the technical, economic, and institutional levels of the retrofit sector [7,8,9,10]. However, these assessments focus mainly on overcoming technological (i.e., barriers related to the technical characteristics of retrofit measures such as lifetime) and economic barriers (i.e., barriers related to the economic characteristics of retrofit measures such as cost) and rarely incorporate the barriers and opportunities perceived by factors in the sector [11] especially non-economic barriers (i.e., barriers not directly related to the technical or economic characteristics of retrofit measures such as the level of political commitment to housing retrofit measures). The need for identifying and overcoming non-economic barriers has been recognized and most recently highlighted in recommendations for the development of future energy efficiency policies in the UK [12]. An increased focus on the wider societal benefits of domestic energy savings also calls for a better understanding of factors such as the value that they place on the non-economic benefits of retrofit [13]. Overall, the importance of understanding and incorporating the perspectives of factors into effective policy design requires innovation in the policy assessment [14].

The number of factors within the retrofit sector and the complexity of their relationships calls for a systemic view in policy assessment, which can incorporate the needs of these factors [15]. The need for this systemic view has been described in References [8,9] as twofold: (i) building knowledge of the cognitive processes underpinning energy conservation activity (not directly relevant to this research) and (ii) creating room for stakeholder cooperation by adopting a systems’ view of their needs and relationships. Incorporating an all-inclusive view of stakeholder needs in the energy efficiency policy assessment is challenging and, therefore, most assessment frameworks so far have focused on specific stakeholders or levels of the sector. For example, the Scottish Government’s ISM (Individual, Social and Material) contexts tool is a qualitative framework that evaluates how well policies encourage changes in energy consumption behavior among residents [16]. In contrast [17], we developed a quantitative framework that assesses policies based on their compliance with the energy supplier obligation rationale (e.g., achieving actual energy savings or business model innovation) and alignment with policy success criteria (e.g., cost effectiveness or deliverability). Therefore, these two different assessment frameworks could produce different outcomes when evaluating the same policy and neither uses a holistic approach to represent stakeholders operating in a complex system.

By applying a narrow focus, the above-described methodologies address specific areas of performance, which risks ignoring barriers and drivers in the wider system in which the policy is deployed. There is a current need for research that assesses policy through a holistic approach by incorporating barriers and drivers from across multiple levels and stakeholder groups in the sector. This paper aims to address this research gap by presenting a simple policy assessment framework, which looks beyond techno-economic evaluation and the needs of a single stakeholder group. Using insight from research on socio-technical systems (STS) [18,19,20,21,22], the framework aims to fulfill three main conditions, which are outlined below.

- (i)

- The technical and economic constraints of retrofit measures must be accounted for.

- (ii)

- The interests of actors and their relationships within the system retrofit system must be described and analyzed [23,24].

- (iii)

- System-level drivers (e.g., long-term political goals, supranational policies, and existing infrastructure) must be incorporated [10].

From these conditions, the policy assessment framework is centered on three main questions:

- What are the non-economic barriers to retrofit, perceived by stakeholders, and how well do the policies perform in overcoming these barriers?

- What are the wider governmental objectives linked to energy and climate policies of national and international interest and how well do the policies align with these objectives?

- What are the costs and payback times of retrofit measures to residential energy consumers and organizations delivering the policies under different retrofit policies and the associated techno-economic assumptions?

By addressing these questions, the proposed framework expands the focus of the assessment to include non-economic stakeholder barriers and governmental objectives, which are analyzed in parallel with the economic aspects of the policies. This allows us to address the previously mentioned shortcomings of current policy assessment methods, which tend to focus only on one dimension of the sector, e.g., the economic aspects of retrofit or the needs of a single stakeholder groups. The questions are addressed—in sequence—through a three-step assessment methodology.

- A literature review and small-scale stakeholder analysis to identify the main barriers and the wider governmental objectives, which should be addressed by each policy.

- An assessment of the costs to consumers and funding organizations of conducting housing upgrades under each policy.

- A simple ex-ante assessment of each policy based on the performance of the policy in maintaining economic viability, addressing stakeholder barriers, and contributing to the achievement of wider governmental objectives.

3. Materials and Methods

3.1. Introduction

In the UK, the advancement of domestic energy efficiency through housing retrofit measures has primarily occurred through large-scale, government-implemented schemes. Of these, the Energy Company Obligation (ECO) has been the main domestic energy efficiency scheme [17], which functions as an obligation on large energy suppliers to subsidize energy-saving retrofits on households within their customer base. Suppliers are required to meet a target number of “ECO points”, which are gained by retrofitting energy-saving measures to a property and thus upgrading the property’s Energy Performance Certificate (EPC) band, a standardized measure of energy efficiency performance for British buildings which ranges from A (best performance) to G (worst performance) [25,26]. The costs of installing retrofit measures are passed on to consumers through their energy bills [25].

Over its lifetime, the ECO has been amended several times in attempts to boost its effectiveness, with the current revision in force as an 18-month transitory phase [27] ahead of the proposed ECO3 start in October 2018 [28]. Currently, the performance of the ECO is assessed against two ‘pillars’: (i) its ability to reduce household energy-related CO2 emissions and (ii) its ability to contribute to the elimination of fuel poverty (fuel-poor households are defined as those with energy costs above the national median and whose residual income would be below the national poverty line after paying these energy costs [29]). By 2015, the ECO had succeeded in generating approximately £6.2 billion in national lifetime savings on energy bills for low-income, vulnerable households. This was projected to achieve a total emissions reduction of 33.7 Mt CO2 by 2017, which is substantially less than the scheme’s predecessors known as the Carbon Emissions Reduction Target and Community Energy Saving Program, which generated combined savings of 313.21 Mt CO2 over five years [30]. The improvement of solid wall (SW) properties was below the initial targets. The contribution to fuel poverty alleviation was indiscernible and overall the scheme was less cost-effective than originally hoped [26]. At the same time, the UK government’s commitment to the Clean Growth Strategy, which sets out an ambitious plan for meeting carbon reduction targets while reducing consumer costs and increasing socio-economic benefits calls for improvement in the effectiveness and impact of domestic energy efficiency policies including the flagship ECO [31].

3.2. Policy Proposals Selected for Assessment

The issues experienced by the ECO scheme led to several proposals for successor policies being put forward by academic and industry bodies. This study assesses three of these policy proposals (Table 1) by using the method described in Section 2 and is further detailed in Section 3.3. The proposals were based on EPC upgrades, which means that financial incentives or penalties were tied to a household’s EPC rating. It should be noted that there are other policies proposed to replace the ECO, which are not based on EPC upgrades, but rather on the deployment of individual energy-saving measures. For the purpose of comparability in this analysis, all assessed policies were selected to be based on EPC upgrades.

Table 1.

Policy proposals chosen for assessment.

For simplification, all properties were standardized in this analysis to semi-detached, gas-heated households, which are a common type of UK domestic property [32].

3.3. Methodology

3.3.1. Stakeholder Analysis

In the first step, a stakeholder analysis is conducted in order to identify the barriers perceived by different actors in the retrofit system. In the case of a residential housing system, the main actors in the retrofit sector, aside from residential energy consumers, fulfill the functions of property construction, design, maintenance, and use (Table 2). Since these actors coexist in a state of relative coordination within the retrofit sector [18], the barriers which they perceive can disrupt the retrofit supply and management chains by causing over-supply or under-supply of materials and skills. Therefore, identifying what barriers stakeholders need support in overcoming is important for designing effective and impactful policies for the housing retrofit sector.

Table 2.

Main actors in the UK retrofit sector (adapted from [23]).

In this analysis, stakeholders are asked to assign a perceived importance to a range of barriers for domestic retrofit procedures in the UK identified through an earlier-conducted literature review (Table 3). The analysis is conducted through 13 semi-structured interviews with expert stakeholders from the 10 main actor groups operating in the UK retrofit sector who are asked to score their perceived importance of each barrier ranging from “not at all important” to “very important.” The most widely cited and highest-ranked barriers are then used to develop a list of policy “attributes,” which stakeholders expect to see demonstrated in domestic retrofit programs.

Table 3.

Barriers related to retrofit uptake (not including customer-related barriers) [3,40,41,42,43].

The stakeholder analysis, therefore, uses a pre-identified set of barriers to assess the needs of actors in the retrofit sector. Akin to the economic analysis, this methodological step aims to create a set of common performance criteria, which allows for the policies to be compared. Although the above set of barriers is specific to the UK, it can be adjusted according to the national and sectoral context where any policy is proposed for deployment.

The policy attributes highlighted by stakeholders are supplemented by a number of objectives outlined in the UK government’s 2017 Clean Growth Strategy [31]. These are not directly included in the stakeholder analysis, i.e., stakeholders were not asked to score their importance but rather are included in the assessment as attributes in which policies would need to demonstrate the fulfillment of the needs of the UK government.

The following main attributes for policy assessment are identified as:

- The ability to mobilize the solid wall insulation (SWI) market.

- CO2 abatement potential.

- The ability to specifically support fuel-poor households.

The results of this first assessment stage are outlined in Section 4.1.

3.3.2. Economic Analysis

The second step in the methodology is to assess the costs of each policy proposal to consumers (residents) and funding organizations (the UK government and mortgage lending institutions) based on a simple profit-and-loss analysis used previously in ex ante policy assessments such as in References [44,45,46]. For clarity, the profits and losses to funding organizations are termed “systemic profits” and “systemic losses”, respectively.

Annual consumer losses are defined as the sum of retrofit costs (the cost of upgrading an EPC band) and policy-related costs (e.g., penalties for non-compliance along with loan and interest repayments), and profits as the sum of direct revenue (e.g., rewards for compliance and subsidies or incentives) and indirect revenue (e.g., energy bill savings) under each policy proposal. The increase in property value linked to EPC upgrades (see Section 4 of Supplementary Materials) is not directly accounted for in the economic analysis but rather is assessed as a separate performance criterion (Section 4.1). Annual systemic losses are defined as the sum of policy delivery costs to the funding organizations (cost of conducting EPC assessments in all targeted households, rewards for efficient properties, loans, and marketing and administrative costs) and profits as the sum of policy-related revenue (penalties for inefficient properties, loan repayments, and interest). The profits and losses of each scheme are calculated based on the costs (capital and operating) and lifetime of a number of well-established retrofit measures, which are frequently used to upgrade a property’s EPC band (see Supplementary Materials). An eligible customer base is pre-defined for the schemes and annual uptake is estimated based on existing literature (see Supplementary Materials). These constraints are not binding, but have been defined for the purpose of conducting this analysis based on the design of the original policy proposals.

It should be noted that, for households of EPC band E or above, the upgrade between EPC bands has the same cost for SW and cavity wall (CW) properties. This is because the energy-saving measures typically recommended for upgrading between EPC bands above band E are the same for SW and CW properties as opposed to those recommended for upgrading between EPC bands below band E, which involve different types of wall insulation (see Supplementary Materials).

This economic viability assessment, therefore, creates simple metrics to compare policy performance. If under a proposed scheme, the capital cost and payback times of upgrading an EPC band is reasonable, this scheme is deemed to be financially viable for consumers. Financial viability of the policies is assessed for both SW and CW households to determine how much the consumer burden varied between hard-to-treat and easy-to-treat properties, respectively. From the systemic perspective, if the annual cost of deploying the proposed policy is less than the annual budget of the ECO3 (as the program being proposed to be replaced), the scheme is considered financially viable towards the funding organizations. The annual budget of the ECO3 is estimated at £640 million [28].

The results of the profit-and-loss analysis are outlined in Section 4.2.

3.3.3. Final Assessment

The results of the stakeholder and economic analyses are combined to conduct a simple ex-ante assessment of overall performance of the schemes based on projected economic feasibility (the ability to reduce retrofit costs to customers and funding bodies) and whether the policies demonstrated the attributes important to stakeholders and aligned with wider governmental objectives. The performance of policies based on this assessment is discussed in Section 4.3.

4. Results and Discussion

The following sections present and discuss the results of applying the proposed assessment methodology to the selected policy proposals.

4.1. Stakeholder Analysis

Based on the analysis outlined in Section 3.3.1, the barriers most consistently ranked as “very important” or “important” by stakeholders are presented in Table 4. Lack of certainty in established schemes is perceived as the most important barrier by most stakeholders. It is closely followed by the inadequate compliance of retrofit services with existing business models and lack of long-term government planning.

Table 4.

Perceived importance of retrofit barriers across stakeholder groups.

Several barrier categories (customer, installation, and political barriers) are consistently perceived as being important by most stakeholders. All but one stakeholder group considers more than one category of barriers as the most important one, which reinforces the idea that the retrofit sector is complex and experiences barriers at various levels. In addition, the barriers rated highly and most consistently by stakeholders tend to be barriers involving more than one actor group (e.g., the split responsibility between those with investment decision-making power such as landlords and those receiving the benefits such as tenants) and often affecting the whole sector (such as the lack of certainty in established energy efficiency schemes).

It should be noted that the corresponding policy attributes are not defined as simply the “ability to overcome the barrier.” Rather, they are defined as an ability to address the relevant barrier without dependence on government legislation or events in the wider energy efficiency landscape. For example, the ability of a retrofit policy proposal to be compatible with other policies reduces the dependence on established schemes, which are prone toward uncertainty as governmental priorities and the supra-national landscape change. If a policy proposal is more easily embedded into established schemes or infrastructures such as public tax schemes, it is more likely that the policy can survive a change in national energy efficiency priorities and overcome the risk of uncertainty in existing energy efficiency policies. Similarly, a lack of long-term governmental planning for transitioning the housing stock cannot be directly overcome by the retrofit sector itself but rather needs buy-in and long-term alignment from multiple governmental departments. However, improving coordination within the retrofit supply chain by building local multi-stakeholder consortia addresses the lack of long-term planning by building resilience into the supply chain and reducing the dependence on government planning of the longevity of retrofit initiatives.

The remainder of this section assesses the policy proposals with respect to their demonstration of the attributes outlined in Table 4 It should also be noted that the performance of policies against certain high-level drivers (contribution towards achieving UK carbon targets, mobilization of the SWI market, and protection of fuel-poor consumers) is dependent on the coverage, reward and penalty levels, and length of the schemes. The potential for policy performance to change if these policy characteristics are altered is highlighted in the discussion presented in the rest of this section.

The lack of certainty in established schemes, which is a political barrier widely cited by the interviewed stakeholders, can be overcome by policies that are compatible with long-running schemes. All three tested policies show promise for compatibility since they are built on the infrastructure of existing tax and mortgage schemes employed across the UK. In particular, the tax-based policies can successfully complement other potential policies, but care must be taken to avoid overlap on financial incentives [12]. Furthermore, all schemes could also effectively complement rather than replace a new phase of the ECO especially the VCT: ECO3, the ECO’s newest revision, which proposes to allow suppliers to meet 25% of their obligations by delivering measures to households identified by local authorities [28]. Simultaneous deployment of the VCT could align well with this proposal for extended collaboration particularly as both the VCT and the ECO would require the identification of fuel-poor and low-income properties in order to exempt or discount their penalization and avoid policy regression (in the case of the former policy) and accurately identify the target population of households for ECO3. The fuel-poor homes exempted from VCT penalties by a local authority could become the target population of households for delivering ECO3 measures.

For compliance with business models of delivering agents, the VCT and VSDLT were both rated as ‘certain’ to overcome this barrier. For the former, local authorities delivering the policy could easily adapt their Council Tax liabilities system to include EPC ratings of properties. Similarly, the management of the VSDLT via a secure online platform could ensure rapid implementation of changes to the Stamp Duty scheme to reflect the EPC rating of properties. The GM scheme is very likely to comply with stakeholder business models since it reduces risk for lending organisations by increasing mortgage allocation security. However, its implementation could prove challenging to the flexibility of lenders’ business models.

Even though all policies rate well in their compliance with delivering agents’ models, it is possible that some flexibility should be introduced in order to comply with the business models of other stakeholders in the supply chain. For example, energy companies have been encouraged to focus on innovations to generate energy savings with the ECO3 revision proposing to allow between 10% and 20% of supplier obligations to come from “innovative measures” [28]. The transition to a “smart energy system” is also being encouraged through the mandated roll-out of smart meters by energy companies in the UK [47]. All assessed policy proposals would benefit from incorporating a wider range of energy-saving measures including innovative measures such as smart heating controls in which installation would generate an EPC band upgrade. The VCT and VSDLT are likely to be able to accommodate an additional budget devoted to the subsidization of “innovative measures” within the annual budget limits of the ECO3. However, the GM would likely need to either restrict its coverage or increase mortgage repayment rates in order to accommodate potentially more expensive measures such as smart home technologies or heat pumps.

In order to address the lack of long-term planning from government, better coordination from stakeholders is required in order to unify and grow the retrofit market. All three policies performed well against this criterion due to their potential to boost demand for retrofit measures and, therefore, mobilize streamlined activity in the retrofit market, which reduces the fragmentation of the supply chain. The VCT has high potential for improving coordination among stakeholders, which is delivered through local authorities in conjunction with the closely monitored Council Tax schemes. Locally administered schemes are also considered more effective than centralized schemes at reducing fuel poverty [12] and a policy delivered through a local authority could, therefore, serve to bolster stakeholder confidence and improve coordination. However, renovating properties at the point of sale often involves packages of retrofit measures conducted simultaneously in order to save costs and time. Programs such as the GM could, therefore, serve to incentivize multiple retrofit measures particularly due to the two-band minimum upgrade, which could improve coordination in the supply chain by demanding more collaboration between manufacturers, designers, and installers. The VSDLT also offers point-of-sale retrofit incentives. However, the rewards are likely to be too low to incentivize extensive retrofit improvements and change the coordination of retrofit stakeholders.

Because of its potential contribution to overcoming the landlord-tenant split incentive barrier and relatively consistent importance assigned by stakeholders, the reflection of retrofit in property value was considered to be a performance criterion. All policy proposals performed well against this criterion by linking EPC upgrades to favorable tax or mortgage rates. However, some policy proposals promise to perform better than others. In the case of the VCT, a retrofitted property will be valued more highly by landlords only if the positive impact on long-term running costs of the property is acknowledged, which is something many landlords fail to consider [48]. The generally low level of long-term investment planning among many landlords [48] means that accurately reflecting retrofit in a property’s long term running costs and, therefore, in the attractiveness of the investment, is dependent on a more general culture change among landlords. However, in the case of the GM and VSDLT, retrofit is more likely to be directly reflected in the property’s actual asking price due to the fact that retrofit tends to be conducted in tandem with large-scale renovations undertaken for the purpose of boosting the market value of the property at the time of sale. Certain high-visibility retrofit measures such as smart heating controls or energy efficient appliances may boost prices further by increasing the attractiveness of the property to potential buyers viewing the property. Overall, the GM and VSDLT both perform better against this criterion because they incentivize retrofit at the point of sale, which returns the benefit of increased prices to the sellers within the timeframe of the transaction. It should be noted that, because it incentivizes minimum 2-band upgrades, retrofit under the GM would result in a comparatively higher increase in property value than under the VSDLT. In contrast, under the VCT, the benefit of increased property value is returned within a more extended timeframe unless the long-term running costs are accurately considered in the landlords’ investment planning.

The remainder of this section discusses the performance of the policies in relation to the wider governmental objectives outlined in Section 3.3.1.

The lack of focus on hard-to-treat properties, which would serve to mobilize the SWI market, caused all policy proposals to be rated poorly in their performance against this assessment criterion. The GM scheme was ranked as ‘possible’ to mobilize the SWI market due to the attractive mortgage and low-interest loan offers able to cover the high upfront costs of SWI. However, to avoid unaffordable monthly installments, the repayment periods for these incentives would have to be designed to be a minimum of 20 years. Other schemes were rated as ‘unlikely’ to mobilize the SWI market due to the low reward levels and long payback times. Under the proposed policy designs, individually, the policies would likely not have a significant impact on the mobilization of the SWI market and, if integrated into a policy mix, they would need to ring-fence and share policy revenue in order to achieve a higher rate of subsidies for SWI. Alternatively, the policies could, individually or as a mix, complement another scheme, which includes a specific target or subsidy level for SWI. The ECO3 scheme has proposed a target of 17,000 solid-walled homes each year [28]. It should be noted that the performance of assessed policies against this criterion is dependent on the ultimate reward and penalty levels as well as the length of policy duration, which have been assumed according to the original policy designs. If these assumptions are relaxed, the performance of policies in mobilizing the SWI market would likely be different.

The VCT, VDSLT, and GM can all make positive contributions to the UK’s carbon reduction targets because they are not optional and they are attached to well-established tax or mortgage infrastructures. The VCT scheme is likely to drive the biggest decrease in carbon emissions with the original analysis suggesting that the VCT could save between 812,000 and 2.23 million t CO2 per year [36]. The VSDLT is estimated to generate a reduction of between 208,000 and 417,000 t CO2 per year [36], which is substantially lower than the VCT due to the scheme’s lower coverage. It should be noted that the performance of the policy proposals against this driver is reliant on the assumptions of policy coverage, which have been introduced for the purpose of this analysis but could be relaxed in the final policy design. Independent of coverage constraints, the non-compulsory nature of the GM means that this policy would likely generate the lowest reductions in CO2 emissions of the assessed policies. In order to make significant progress towards UK carbon reduction targets, more effort would likely be needed to link up GM with existing government policies, e.g., by increasing minimum efficiency standards for rental properties [49], which was recently implemented in the UK [50].

In all policy proposals, easy-to-treat households are at a financial advantage to hard-to-treat households, which translates into a financial advantage of able-to-pay over fuel-poor consumers since 94% of the latter group tends to be primarily resident in the least-efficient properties [51]. In the least-efficient households, these cost differences cause a discrepancy in customer burden between easy-to-treat and hard-to-treat homes. This must be acknowledged and resolved through the differentiation of incentives in policies targeting both types of households such as those whose funding allocation mechanisms are based on lifetime CO2 emissions savings.

Out of the assessed policies, the VCT and VSDLT could protect fuel-poor households from penalization by exempting them from penalties for low efficiency, which is assumed in the calculations for this study. In the case of the VCT, the UK Green Building Council suggests that existing Council Tax exemptions would protect vulnerable households [36]. In addition, local authorities already collect information from households by applying Council Tax reductions or exemptions usually on the basis of low income. It could be possible to extend the collection of information to include the fuel poverty status of the property for exemption from the VCT. In the case of the VSDLT, accurate identification and exemption from penalties of households at risk of fuel poverty is reliant on the robust assessment of a property’s running energy costs and assessment of the relevant buyers’ income, which is assessed as part of determining whether a stamp duty tax relief is applicable. Further research is needed to determine how much the imposition of this higher tax would impact the revenue of the property seller and whether fuel-poor sellers would, therefore, need to be excluded from the target population.

If the VCT and VSDLT were altered to exclude fuel-poor households, they would perform best in incentivizing customer demand without being regressive. They have large customer bases and incorporate exemptions and reliefs that fit to the existing tax infrastructure. However, they would need to be supplemented by other grant-based policies to specifically improve fuel-poor households. The GM does not protect fuel-poor households from receiving relatively worse mortgage rates and would, therefore, need to be supplemented by revenue recycling or a separate scheme to support the improvement of properties being mortgaged to low-income buyers, e.g., the UK Help to Buy scheme [52]. If the constraint of fuel-poor household exclusion is not applied and the final design of the VCT and VSDLT does not include an exemption of fuel-poor households, these programs would perform poorly in protecting fuel-poor households and would require specific support for low-income residents, which is similar to the GM.

4.2. Economic Analysis

As outlined in Section 3.3.2, the economic viability of each policy proposal is analyzed from the perspective of the customers and the funding organizations. The results for each policy are presented in Section 4.2.1 and 4.2.2.

4.2.1. Customer Profit-And-Loss Analysis

Variable Council Tax

In the case of the VCT, it is found that solid wall (SW) households upgrading from the “penalty zone” (band E downwards) are unlikely to be incentivized by this policy due to high capital costs and unrealistic payback times (Table 5) likely to be much longer than the lifetime of the policy. For CW households, payback times can be as low as one year, which likely makes upgrades for inefficient households more appealing. The policy presents the potential to be regressive (i.e., disproportionately affecting lower-income groups) because it risks imposing higher customer costs on SW properties, which are traditionally inhabited by lower-income residents, than on CW properties, which are generally inhabited by higher-income residents [51].

Table 5.

Capital cost and payback times of EPC upgrades under the VCT scheme.

Although payback times for households upgrading within the “discount zone” (i.e., band E or above, see Section 3.2.1) are identical for SW and CW properties, they are still quite long and certainly longer than the projected lifetime of the policy. Retrofit could, therefore, be incentivized only if tax adjustment rates are high enough and if discounts are dependent on the households’ active undertaking of upgrades rather than simply existing in the discount zone at the start of the scheme (which would eliminate the risk of penalization and an incentive to upgrade for already-efficient households).

Variable Stamp Duty Land Tax

For the VSDLT, the results show that the proposed SDLT adjustments (penalties and discounts applied to the tax rate) also fall short of creating realistic payback times for most EPC upgrades with SW households being at a financial disadvantage (Table 6). The proposed adjustments in SDLT rates are relatively low and unlikely to offer the property seller an incentive to retrofit for the purpose of making their property more appealing to buyers. However, if the energy efficiency of a property is accurately reflected in the price of a property, it could generate an increase in capital value and offers financial gains at the point of sale and potentially serves as a driver for retrofit. This policy also presents a risk of being regressive with higher costs being imposed on SW than on CW properties.

Table 6.

Capital cost and payback times of EPC upgrades under the VSDLT scheme.

Green Mortgage

In the GM scheme, the upgrade of low-efficiency properties results in significantly higher monthly mortgage repayments for SW properties (Table 7), which risks to exclude fuel-poor households situated in bands G and F. This is due to high capital costs and low mortgage rewards but also due to the fact that homeowners are expected to undertake minimum two-band upgrades to take full advantage of the re-mortgage offer.

Table 7.

Monthly instalments and energy bill savings for upgrading between different bands.

Although more efficient households are not subject to discrepancies between SW and CW instalment rates, the investment in retrofit measures is unlikely to be incentivized by bill savings and mortgage rewards alone. Similar to the VSDLT, it is likely that the upgrade must be reflected in the capital value of the property in order to incentivize these more efficient households both in the case of sellers looking to benefit from attractive mortgage rates and buyers looking to extend their mortgages under the scheme. For the latter group, this potential increase in capital value will only become an incentive if homeowners are planning to re-sell their property.

4.2.2. Systemic Profit-And-Loss Analysis

Variable Council Tax

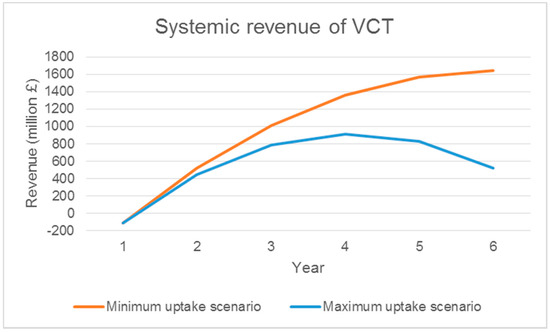

Over its lifetime, the VCT scheme generates revenue of £1.6 billion and £521 million in the case of minimum uptake and maximum uptake scenarios, respectively (Figure 1), for the funding organization (the UK government). Systemic losses accrue over time and are driven by a gradual transition towards more efficient housing and fewer penalizations and more rewards to households. Due to this accrual, the maximum uptake scenario is ultimately less profitable than the minimum uptake scenario since the number of households upgrading their EPC ratings and entering the “discount zone” over the lifetime of the policy is higher.

Figure 1.

Systemic revenue of the Variable Council Tax (VCT) over the duration of the policy.

The potential for fiscal neutrality of the VCT scheme was recognized in the original policy proposal [37]. However, this study predicts lower cumulative systemic revenue than the original designers of the scheme. The is likely due to (i) the inflated costs of delivery associated with the mandatory provision of EPC assessments to fuel-poor households assumed in this study (see Supplementary Materials) and (ii) differences in the number of households in each EPC band between the time of the policy proposal and the time of writing, which may have affected the expected amount of penalties and rewards distributed.

Variable Stamp Duty Land Tax

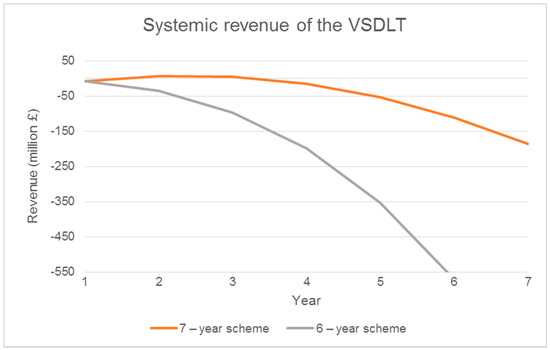

In the case of the VSDLT, there is a significant divergence between the two uptake scenarios (Figure 2) with the seven-year scheme remaining revenue neutral for the first three years and the six-year scheme incurring losses from the start of deployment. By the end of their lifetimes, the minimum and maximum uptake scenarios incur overall systemic losses of about £291 and £697 million, respectively. Fiscal neutrality over the lifetime of the schemes can only be achieved by reducing SDLT rebates to 1% per EPC upgrade or supplementing government spending with external investments to the policies. However, the policy costs in both uptake scenarios are within the boundaries of the annual ECO3 budget and stamp duty rebates could be increased both in the minimum and maximum uptake cases.

Figure 2.

Systemic revenue of the Variable Stamp Duty Land Tax (VSDLT).

The results of this analysis are in contrast to those postulated by the original policy authors, which state that fiscal neutrality is possible [36]. The same authors expect annual gross revenue to the government to range between £404 and £807 million. In contrast, this study found gross revenue to the government to range between £7 million and £49 million. These differences are not trivial and, while they are likely also associated with differences in the number of households in receipt of stamp duty and in each EPC band, further research is needed to determine the impact of these changes.

Green Mortgage

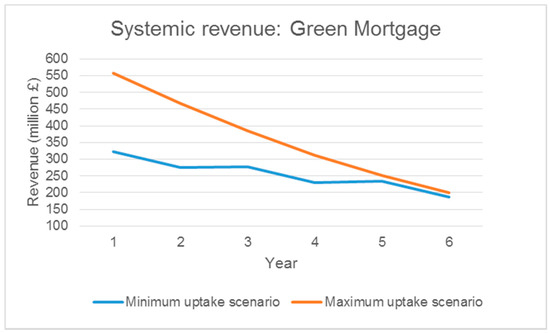

Under the two uptake scenarios of the GM scheme, total lender revenue at year 10 of repayment decreases over the duration of the scheme (Figure 3) due to the increase in efficiency of participating households and a fall in profits as the housing stock in G, F, and E bands becomes more efficient, which provides lower interest revenue due to shorter repayment periods.

Figure 3.

Trajectory of systemic revenue generated by the Green Mortgage (GM) as profits generated in year 10 of loan repayment for upgrades undertaken in year 1–6. Note that the irregular shape of the minimum uptake curve is due to the rate at which households are assumed to undertake upgrades.

The gradual shrinking of repayment profits could introduce a regressive tendency of lenders trying to maintain a balance between efficient and less-efficient properties in their investment portfolio. This could lead to decreases in the size or availability of mortgage ‘rewards’ for potential buyers. This could imply either less attractive mortgage rewards overall or a decrease in mortgage offers for less efficient properties, which require more investment. External funding aid would be required to maintain the appeal of the scheme to homeowners.

4.2.3. Summary of Economic Analysis

The financial burden on consumers, qualified as a level of impact (This level of impact was based on the payback times and capital costs to residents of retrofit measures installed under the different schemes compared to that of the other schemes) differs between policy proposals, which is shown in Table 8. The VSDLT due to the low level of reward has the highest customer burden while the VCT and GM generate reasonable costs and payback times to consumers. It should be noted that the qualifications of customer financial burden are indicative only and significant variation within each policy proposal is expected due to the cost differences between SW and CW properties.

Table 8.

Summary of consumer financial burden, systemic costs of deployment, and funding sources of policy proposals.

There is variation in the financial burden that the policies place on consumers. The VCT poses the least cost to customers followed by the GM, which shows the most promise in reducing upfront retrofit costs by virtue of monthly repayment schedule. The VCT also has the potential to reduce upfront installation costs. However, the reward or subsidy levels are dependent on available public funding and are limited in the support offered to customers. The VSDLT is unlikely to reduce upfront costs significantly due to the rebate being applied to the buyer rather than to the seller of the property (the party undertaking the retrofit). However, linking the reduced tax rate to increased property value and increased competitiveness in the property market, is an asset that could offset the low reward levels of the VSDLT (and improve the attractiveness of the GM) in the long-term. Lastly, all policy proposals would likely require a specific focus on hard-to-treat properties where the upfront costs to customers are higher and generate increased capital expenditure and payback times.

From a systemic perspective, the analysis shows that, in principle, the government-funded policies are economically viable while the GM proposal would require more funding to achieve the proposed retrofit coverage. The VSDLT shows the lowest relative costs of deployment and could significantly reward the customer base while still maintaining its systemic losses within the budget of the ECO3. However, the scheme does not generate any revenue for funding organizations by the end of its lifetime. However, the VCT and GM schemes have higher annual deployment costs but generate profit to the funding organizations by the end of their lifetimes. Furthermore, the profit generated by the VCT would ensure cost-neutrality of the scheme to the UK government as well as raise extra public funds, which could be earmarked for further retrofit upgrades. The VSDLT has the potential to reduce its systemic financial burden by inflating penalty rates for inefficient households. However, since it already has a high financial burden on customers, this is unlikely.

The economic viability analysis reviews the ability of each policy proposal to reduce upfront retrofit costs and incentivize uptake within the limits of their budget. In this context, this ability is mostly related to the amount of financial support each scheme can offer to residents either to reduce costs (subsidies or loans for installation) or to incentivize uptake (rebates, discounts, and increases in property value). It should be highlighted that cost reduction alone will not necessarily generate a respective increase in the demand for retrofit. To achieve a wider increase in demand, schemes that generate customer cost reductions should be coupled to other forms of retrofit incentives such as either market-based solutions (for example, an increase in property value) or legislated solutions (such as targeted grant schemes or minimum energy efficiency standards), which is highlighted in Section 4.1. In the following sections, we review our economic and stakeholder analyses side by side in order to holistically assess the policies’ performance in the context of the UK retrofit sector.

4.3. Final Assessment

When combining the stakeholder and economic viability analyses of the policy proposals outlined in Section 3.3.3, a complex picture emerges. All policies demonstrate satisfactory potential to overcome the main political barriers identified by stakeholders, but the VCT and the GM stand out as having particularly effective potential for creating demand including for multi-measure retrofits, which enables coordination in the supply chain, Additionally, being easily aligned with existing schemes helps overcome the main political barriers. In addition, the VCT could serve to empower local authorities to work more closely in delivering retrofit schemes and address fuel poverty. The GM has advantages over the other two policies with respect to the customer-related issue of reflecting the value of retrofit in property value. The ability to extend mortgages and attract better repayment rates could incentivize property buyers looking to subsequently let their property, known as the fast-growing “Buy-to-Let” demographic, install retrofit measures even though the energy cost reductions do not directly benefit them. By investing in the property and collecting mortgage-based rewards, property owners can benefit from increased value of their property to potential tenants even without reaping any benefits from energy bill savings. The performance of policies against certain governmental objectives (contribution to carbon savings, mobilization of the SWI market, and protection of fuel-poor households) is reliant on characteristics of the original policy design such as policy coverage, which could be altered. However, against the original policy design and characteristics of the UK housing sector, it is found that the VCT performs better than the GM in protecting fuel-poor consumers and contributes towards national carbon savings targets while none of the policies perform well in mobilizing the SWI market. In light of this, the VCT scheme is considered the best-performing policy at addressing stakeholder barriers and drivers closely followed by the GM and, finally, by the VSDLT.

Financially, the VCT and GM impose the lowest burdens on customers (with the incorporated repayment schedule of the GM making it potentially more attractive) and generate revenue to their funding organizations under the assumptions of this study. However, the GM cannot be deployed within the boundaries of the ECO3 budget and, as such, the assumption on policy budget constraints would need to be relaxed in order for this policy to be financially viable from a systemic perspective. If the policy budget constraint cannot be relaxed, the value of GM mortgage extensions and associated rewards would need to be reduced. However, this creates a trade-off with higher burdens on consumers and, therefore, potentially lowers demand for the scheme altogether. The VSDLT imposes a high financial burden on customers due to the low penalty and reward levels assumed in the original policy design. These penalty and reward levels of the VSDLT could be increased substantially while still maintaining systemic losses within the annual budget of ECO3. This could increase demand but would create a trade-off with the alternative use of an extra budget to support fuel-poor households or hard-to-treat homes or an increase in the coverage of the scheme, which would contribute more towards UK carbon targets.

Overall, none of the policies are able to overcome all the barriers and capitalize on all the drivers present in the UK retrofit sector, which is shown by their different performances with respect to many of the attributes expected by the stakeholders. While the performance of policies against certain criteria is dependent on assumptions about policy coverage and techno-economic aspects of the retrofit measures, the ability of policies to overcome most barriers and capitalize on most drivers is a result of the intrinsic policy design independent of these assumptions. The selection of the VCT and GM as the best-performing policies is due to their ability to overcome most stakeholder barriers independent of their original design characteristics. If these design characteristics are set to maximize the coverage, the duration, and the reward levels within the policy’s budget performance, the impact of these policies could be further enhanced. These results indicate that, while it is possible to identify high-performing policies for overcoming certain barriers for retrofit measures, correctly identifying the perceived importance of these barriers is important. Should a decision-maker focus solely on one category of barriers or on those with high perceived importance to one stakeholder alone, applying this policy assessment methodology would yield different results and recommendations. Further research should be conducted to validate the importance of stakeholder barriers including a sensitivity analysis of policy performance under variable prioritization of these criteria. Additional research is also recommended to quantify the predicted policy performance against high-level criteria such as CO2 emissions reductions for which an accurate quantification was outside the scope of this paper.

Within the research area of energy efficiency policy evaluation, the need for multi-criteria assessment incorporating non-economic barriers has been highlighted in case studies from various Western European countries. For example, in Reference [53], the authors introduce a multi-criteria policy assessment framework to the KfW Energy Efficient Refurbishment and Construction programs in Germany. The authors focus on policy success characteristics such as transferability, innovation, and cost-effectiveness without explicitly incorporating the performance of the programs against sectoral barriers. In Reference [54], the authors also emphasize the need for expanding policy design and assessment to include non-economic aspects, e.g., the ability to improve user comfort. They identify a gap in addressing these aspects within the Norwegian residential energy efficiency policy but suggest a strengthening of regulatory measures and customer-focused awareness-raising programs rather than financial instruments such as those evaluated in our study.

The broader literature on energy efficiency policy instruments, however, frequently highlights the use of financial instruments as potentially effective mechanisms for addressing the complex set of barriers in the retrofit sector. Tax-based policies have long been highlighted as an increasingly attractive replacement for direct subsidies. At the same time, the pressure on public finance has led to an increase in policies designed to be based on private investment, which is the case of the GM [55]. The ability to provide positive returns on investment, as the VCT and GM do, has been highlighted as an important policy characteristic for governments whose energy efficiency budgets are under pressure such as the UK’s ECO budget [56]. In Reference [57], the authors highlight broader tax credit mechanisms as popular and effective retrofit incentive methods in France. However, concerns are raised around the ability of these mechanisms to promote deep renovation such as the installation of insulation around their potential regressive nature [57].

A study on British and German energy efficiency policy highlighted both the need for protecting and benefitting lower-income households as well as the importance of long-term scheme certainty independent of changes in political commitment. The need for additional funding to make up the shortfall in deployment of costly retrofit measures (such as SWI in the UK) was also highlighted in both policy landscapes [58]. In Reference [59], the authors find that an increasing number of measures are encouraging local approaches for refurbishment such as those at a public authority level as well as putting in place provisions for low-income households, which is a recommendation highlighted in Reference [60]. The importance of involving local authorities in the delivery of energy efficiency programs is discussed in Reference [61], which corroborates our interpretation that the VCT would benefit the residential retrofit supply chain by involving public authorities more comprehensively.

The ability of the GM scheme to reduce risk in investments by mortgage lenders and, therefore, incentivize uptake has been highlighted in Reference [62] while case studies from the Netherlands find that programs offering mortgage-backed securitization of the most energy efficient properties has boosted investor confidence [63]. However, in Reference [64], the authors recommend a government-led move towards introducing price premiums (“sale-ability”) for more energy efficient properties as a precursor to incentivizing mortgage lenders towards private investment in energy-efficiency schemes. According to this view, an introduction of the GM at a national level would, therefore, be dependent on the roll-out of the VSDLT scheme as a primer for involvement from lending institutions.

Lastly, in a specifically UK-focused study, comprehensive recommendations are provided for implementation of the VSDLT by highlighting its potential for wide coverage and a positive impact. The study reviews the VCT as being challenging to implement with the appropriate safeguards [63]. These recommendations are not in line with our findings that the VCT performs better than the VSDLT primarily due to the fact that, in Reference [60], the VCT is not assumed to be necessarily supported by the central government funding and, as such, is viewed as risky for the budgets of local councils, which are already under pressure. In our study, the policy is assumed to be supported by the central government with local authorities as potential delivering agents. However, when it comes to green mortgage schemes, our findings are in line with those of Reference [60] who recommend changes in the Mortgage Market Review to include more accurate energy cost calculations in mortgage affordability assessments and provide mortgage extensions for financing retrofit installations.

5. Conclusions and Policy Recommendation

In this paper, we propose and apply a simple policy assessment to three policies proposed as replacements for the UK’s current major energy efficiency program. The proposed method assesses the performance of policies against three dimensions including economic viability, the ability to overcome stakeholder barriers, and alignment with wider governmental objectives. The final section of this paper offers some concluding remarks including recommendations for future research and proposes a policy mix to overcome the trade-offs between the individually assessed policies.

A simple assessment of the VCT, GM, and VSDLT proposals shows that all policies have the potential to reduce the cost of retrofit and overcome the barriers identified by actors in the UK residential retrofit system. However, none of them have been designed to overcome all the barriers and capitalize on all the drivers present in the UK retrofit sector. Furthermore, the original design of the policies including characteristics on policy coverage, duration, and the value of rewards and penalties means that the policies’ economic performance as well as their performance against several governmental objectives could be improved if these characteristics are changed.

In combination, these three policies perform well in addressing customer-related issues, incentivizing residents and landlords directly through a “carrot-and-stick” approach, and covering the rental and sales market in their combined customer base. The combination also offers good prospects for compliance with the business models of delivering organizations and the development of expertise in a fragmented supply chain. In addition, it is aligned with existing tax and lending infrastructures, which potentially minimize administrative costs and increase demand. It also offers opportunities for addressing customer-related, political, economic, and supply chain barriers in tandem.

Although the individual policies offer good prospects for contributing to national carbon reduction targets, they are less able to contribute to the significant reduction of retrofit costs for hard-to-treat homes and, therefore, to the mobilization of the SWI market. In addition, none of the policies promise the specific targeting of fuel-poor households. A separate policy scheme would likely be required to boost the installation of SWI and support fuel-poor housing more actively. These features are present in the most recent proposal for the next phase of the UK’s ECO. As such, the suggested policy mix would likely need to be deployed alongside the ECO or a similar grant-based program with set targets for supporting fuel-poor households and for installing SWI. However, this would mean that the systemic cost of deploying the policies would likely exceed the annual budget of the ECO3.

Future policy designs could, therefore, consider a lower-coverage mix of these schemes deployed in parallel and funded through both government and lending institutions spending by paying attention to the risk of overlap between incentives [53]. In the case of the VSDLT and GM, which target the same groups (property buyers) and, therefore, run the risk of overlap [65], design features should be introduced to ensure that the effectiveness of the policy mix is at least the same as that of the individual policies. In addition, trade-offs between policy success factors must be acknowledged at the design stage. For example, the policies assessed in this study are longer-running than the other proposals (ECO3 is designed to run for 3.5 years), which offers a marginal benefit of long-term certainty along with a penalty of high lifetime costs due, in part, to their length. Another example is that, while the operation of all three policies on established financial infrastructures could increase demand, using exclusively private or public funding for each scheme could be questioned when the demand for financial innovation and public-private partnerships in delivering decarbonisation programs increases [66,67].

Existing research on energy efficiency policy evaluation shows a broad consensus on the suitability of tax-based mechanisms for incentivizing retrofit processes. This is in line with our findings regarding the benefits of positive financial returns, involvement of local actors, and the operation of a pre-existing tax infrastructure of the VCT. Similarly, the GM is highlighted as a recommendation for future UK energy efficiency policy given its ability to attract private investment and reflect the value of retrofit in a property’s cost. However, there are some discrepancies between existing research and our findings that the VSDLT is the worst-performing policy of those assessed in this study. These discrepancies would need to be investigated further under different policy funding scenarios. Further evaluation of the VCT, VSDLT, and GM policies would also need to assess the suitability of regulatory mechanisms and information campaigns in place in the UK as supporting structures for deploying financial policy instruments.

The research presented in this study has several limitations, which should be considered within policy recommendations or when planning future research. First, in further work, the number of stakeholders included in the analysis could be increased to produce a more representative assessment of the importance of retrofit barriers and drivers in the UK. Second, to further refine future policy recommendations and to better analyze intrinsic policy shortfalls, the policy performance under different sets of assumptions or constraints could be undertaken. Finally, the nature of this study is such that it was limited to the analysis and comparison of only three policies. Other policy proposals could be incorporated into future research to provide current and robust recommendations for an optimal future policy mix. As highlighted in Section 4.3, it is recommended that incorporation of these other policy proposals focuses on regulatory instruments and awareness-raising programs as key components of an effective policy mix.

This study provides insight into the attributes that new retrofit policy proposals should demonstrate such as the reduction of costs to customers and funders, the alignment with high-level drivers of the sector, and the removal of the barriers perceived by stakeholders. By acknowledging the range of these necessary attributes, future policies can be designed to prioritize certain features and balance trade-offs between stakeholders and governmental and customer needs, which increases overall effectiveness. A combined delivery of policies could widen the target base of retrofit schemes while allowing for the involvement of several institutions such as local authorities and mortgage lenders, which could aid the ‘bottom-up’ development of the retrofit supply chain. This serves to address the fragmentation of the retrofit supply chain and show increased resilience in the face of long-term political uncertainties and an enhanced ability to effectively target sector barriers. Overall, conducting policy assessments based on economic and non-economic criteria alike and acknowledging the diversity of needs and preferences of actors in the sector can serve to better identify the gaps, opportunities, and potential policy mixes for delivering impactful and effective domestic energy efficiency programs in the UK and around the world.

Supplementary Materials

Supplementary File 1Author Contributions

Conceptualization, N.W., L.M.M., C.M. and J.H. Methodology, N.W. and L.M.M. Formal Analysis, N.W. and L.M.M. Writing—Original Draft Preparation, N.W. and L.M.M. Supervision, C.M. and J.H. Writing—Review and Editing, L.M.M., C.M., J.H., A.H. Funding Acquisition, A.H.

Funding

L.M.M. is supported in this research by the UK Natural Environment Research Council (NERC) under the “Science and Solutions for a Changing Planet” Doctoral Training Programme (DTP) delivered by the Grantham Institute—Climate Change and Environment. The funding reference for the DTP training grant is NE/L002515/1. J.H. is supported in this research by Economic and Social Research Council (ESRC) under the funding reference ES/M500562/1. A.H. is supported in this research by Engineering and Physical Sciences Research Council (EPSRC) under the funding reference EP/N021479/1.

Acknowledgments

The authors acknowledge the reviewers of this article for their valuable comments and insights, and the editors of the “Energies” journal for their administrative support in production of this publication.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Department for Energy and Climate Change. Energy Consumption in the UK (2015); Department for Energy and Climate Change: London, UK, 2015.

- Webber, P.; Gouldson, A.; Kerr, N. The Impacts of Household Retrofit and Domestic Energy Efficiency Schemes: A Large Scale, Ex Post Evaluation. Energy Policy 2015, 84, 35–43. [Google Scholar] [CrossRef]

- Howard, R. Efficient Energy Policy: How to Encourage Improvements in Domestic Energy Efficiency; Policy Exchange: London, UK, 2016. [Google Scholar]

- Committee on Climate Change. Meeting Carbon Budgets: Closing the Policy Gap; Committee on Climate Change: London, UK, 2017. [Google Scholar]

- Gooding, L.; Gul, M.S. Achieving Growth within the UK’s Domestic Energy Efficiency Retrofitting Services Sector, Practitioner Experiences and Strategies Moving Forward. Energy Policy 2017, 105, 173–182. [Google Scholar] [CrossRef]

- Thorpe, D. Why the UK Green Deal Failed and Why It Needs a Replacement. Available online: http://energypost.eu/uk-green-deal-failed-needs-replacement (accessed on 27 October 2017).

- Brown, H.S.; Vergragt, P.J. Bounded Socio-Technical Experiments as Agents of Systemic Change: The Case of a Zero-Energy Residential Building. Technol. Forecast. Soc. Chang. 2008, 75, 107–130. [Google Scholar] [CrossRef]

- Nye, M.; Whitmarsh, L.; Foxon, T. Sociopsychological Perspectives on the Active Roles of Domestic Actors in Transition to a Lower Carbon Electricity Economy. Environ. Plan. A 2010, 42, 697–714. [Google Scholar] [CrossRef]

- Vergragt, P.J.; Brown, H.S. The Challenge of Energy Retrofitting the Residential Housing Stock: Grassroots Innovations and Socio-Technical System Change in Worcester, MA. Technol. Anal. Strateg. Manag. 2012, 24, 407–420. [Google Scholar] [CrossRef]

- Moore, T.; Horne, R.; Morrissey, J. Zero Emission Housing: Policy Development in Australia and Comparisons with the EU, UK, USA and California. Environ. Innov. Soc. Transit. 2014, 11, 25–45. [Google Scholar] [CrossRef]

- Platt, R.; Aldridge, J.; Washan, P.; Price, D. Help to Heat: A Solution to the Affordability Crisis in Energy; Institute for Public Policy Research (IPPR): London, UK, 2013. [Google Scholar]

- Parliamentary Office of Science and Technology (POST). Future Energy Efficiency Policy; POST: London, UK, 2017. [Google Scholar]

- Wade, J.; Eyre, N. Energy Efficiency Evaluation: The Evidence for Real Energy Savings from Energy Efficiency Programmes in the Household Sector; UK Energy Research Centre: London, UK, 2015. [Google Scholar]

- Electronic Temperature Instruments. Smart Systems and Heat: Consumer Challenges for Low Carbon Heat; ETI: Worthing, UK, 2015. [Google Scholar]

- Arup Group. Towards the Delivery of a National Residential Energy Efficiency Programme; ARUP: London, UK, 2016. [Google Scholar]

- Darnton, A.; Horne, J. Influencing Behaviours: Moving Beyond the Individual. A User Guide to the ISM Tool; Scottish Government: Edinburgh, UK, 2013.

- Roberts, S.; Redgrove, Z.; Blacklaws, K.; Preston, I. Beyond the ECO: An Exploration of Options for the Future of a Domestic Energy Supplier Obligation; Centre for Sustainable Energy: Bristol, UK, 2014. [Google Scholar]

- Geels, F.W. Technological Transitions as Evolutionary Reconfiguration Processes: A Multi-Level Perspective and a Case-Study. Res. Policy 2002, 31, 1257–1274. [Google Scholar] [CrossRef]

- Geels, F.W. From Sectoral Systems of Innovation to Socio-Technical Systems Insights about Dynamics and Change from Sociology and Institutional Theory. Res. Policy 2004, 33, 897–920. [Google Scholar] [CrossRef]

- Geels, F.W. Ontologies, Socio-Technical Transitions (to Sustainability), and the Multi-Level Perspective. Res. Policy 2010, 39, 495–510. [Google Scholar] [CrossRef]

- Markard, J.; Raven, R.; Truffer, B. Sustainability Transitions: An Emerging Field of Research and Its Prospects. Res. Policy 2012, 41, 955–967. [Google Scholar] [CrossRef]

- Van den Bergh, J.C.J.M.; Truffer, B.; Kallis, G. Environmental Innovation and Societal Transitions: Introduction and Overview. Environ. Innov. Soc. Transit. 2011, 1, 1–23. [Google Scholar] [CrossRef]

- Annunziata, E. Energy Efficiency Governance in Buildings: A Multi-Level Perspective; Scuola Superiore Sant’Anna: Pisa, Italy, 2013. [Google Scholar]

- Tambach, M.; Hasselaar, E.; Itard, L. Assessment of Current Dutch Energy Transition Policy Instruments for the Existing Housing Stock. Energy Policy 2010, 38, 981–996. [Google Scholar] [CrossRef]

- National Audit Office (NAO). Green Deal and Energy Company Obligation—Report Summary; NAO: London, UK, 2016. [Google Scholar]

- Building Research Establishment (BRE). Energy Performance Certificates for Existing Dwellings; BRE: Glasgow, UK, 2012. [Google Scholar]

- Ofgem. Energy Company Obligation. Available online: https://www.ofgem.gov.uk/environmental-programmes/eco (accessed on 29 October 2017).

- Department for Business, Energy and Industrial Strategy (BEIS). Energy Company Obligation; BEIS: London, UK, 2018.

- Hills, J. Fuel Poverty: The Problem and Its Measurement; Council for Advancement and Support of Education: London, UK, 2011. [Google Scholar]

- Department of Energy and Climate Change. Evaluation of the Carbon Emissions Reduction Target and Community Energy Saving Programme: Executive Summary Research Undertaken for DECC by Ipsos MORI, CAG Consultants, UCL and Energy Saving Trust; Department of Energy and Climate Change: London, UK, 2014.

- HM Government. The Clean Growth Strategy: Leading the Way to a Low Carbon Future; HM Government: London, UK, 2018.

- Randall, C.; Beaumont, J. Housing; Office for National Statistics: Newport, UK, 2011.

- Association for the Conservation of Energy (ACE). Fiscal Incentives—Encouraging Retrofitting; ACE: London, UK, 2011. [Google Scholar]

- Energy Saving Trust. Select Committee on Science and Technology Minutes of Evidence: Memorandum by the Energy Saving Trust; Energy Saving Trust: London, UK, 2005. [Google Scholar]

- Dresner, S.; Ekins, P. Economic Instruments for a Socially Neutral National Home Energy Efficiency Programme; PSI: London, UK, 2004. [Google Scholar]

- UK Green Building Council. Retrofit Incentives; UK Green Building Council: London, UK, 2013. [Google Scholar]

- Constructing Excellence. EPCs & Mortgages: Demonstrating the Link between Fuel Affordability and Mortgage Lending; CE: Cardiff, UK, 2015. [Google Scholar]

- Murray, J. Nationwide Launches New Green Home Loan. Available online: https://www.businessgreen.com/bg/news/2242368/nationwide-launches-new-green-home-loan (accessed on 29 October 2017).

- Griffiths, R.; Hamilton, I.; Huebner, G. The Role of Energy Bill Modelling in Mortgage Affordability Calculations; UK Green Building Council: London, UK, 2015. [Google Scholar]

- Britnell, J.; Dixon, T. Retrofitting in the Private Residential and Commercial Property Sectors—Survey Findings. Available online: http://www.retrofit2050.org.uk/sites/default/files/resources/WP20111.pdf (accessed on 7 August 2018).

- Dowson, M.; Poole, A.; Harrison, D.; Susman, G. Domestic UK Retrofit Challenge: Barriers, Incentives and Current Performance Leading into the Green Deal. Energy Policy 2012, 50, 294–305. [Google Scholar] [CrossRef]

- Warren, A.; Steven, A.; Knauf, H.; Aecb, D.P.; Whitefield, J.; Smith, L.; Bba, J.A.; Barnham, J.; Goodfellow, B.; Prewett, R.; et al. An Industry Review of the Barriers to Whole House Energy Efficiency Retrofit and the Creation of an Industry Action Plan; Energy Efficiency Partnership for Buildings: Milton Keynes, UK, 2013. [Google Scholar]

- Technology Strategy Board. Retrofit for the Future; Technology Strategy Board: Swindon, UK, 2014. [Google Scholar]

- Fisher, B.S.; Barrett, S.; Bohm, P.; Kuroda, M.; Mubazi, J.K.E.; Haites, E.; Hinchy, M.; Thorpe, S. An Economic Assessment of Policy Instruments for Combatting Climate Change. In Climate Change 1995: Economic and Social Dimensions of Climate Change; Bruce, J.P., Lee, H., Haites, E.F., Eds.; Cambridge University Press: Cambridge, UK, 1996. [Google Scholar]

- Arcadis. Economic Assessment of Policy Measures for the Implementation of the Marine Strategy Framework Directive; Arcadis: London, UK, 2012. [Google Scholar]

- Estrada, F.; Botzen, W.J.W.; Tol, R.S.J. A Global Economic Assessment of City Policies to Reduce Climate Change Impacts. Nat. Clim. Chang. 2017, 7, 403–406. [Google Scholar] [CrossRef]

- Bergman, N.; Foxon, T.J. Reorienting Finance towards Energy Efficiency: The Case of UK Housing. SSRN Electron. J. 2018, 1, 359–368. [Google Scholar] [CrossRef]

- Platinum Property Partners. Landlords’ Failure to Measure Portfolio Performance Effectively; Platinum Property Partners: Bournemouth, UK, 2015. [Google Scholar]

- Matikainen, S. Consultation Response: House of Commons Environmental Audit Committee’s “Green Finance” Inquiry. Available online: http://www.lse.ac.uk/GranthamInstitute/wp-content/uploads/2017/12/Consultation-response-green-finance-enquiry.pdf (accessed on 7 August 2018).

- UK Government. The Private Rented Property Minimum Standard—Landlord Guidance Documents. Available online: https://www.gov.uk/government/publications/the-private-rented-property-minimum-standard-landlord-guidance-documents (accessed on 14 June 2018).

- Department for Business, Energy and Industrial Strategy. Annual Fuel Poverty Statistics Report (2016 Data); BEIS: London, UK, 2018.

- HM Government. Affordable Home Ownership Schemes. Available online: https://www.gov.uk/affordable-home-ownership-schemes (accessed on 26 June 2018).

- Tholen, L.; Kiyar, D.; Venjakob, M.; Xia, C.; Thomas, S.; Aydin, V. What Makes a Good Policy? Guidance for Assessing and Implementing Energy Efficiency Policies. In European Council for an Energy Efficient Economy Summer Study; Wuppertal Institute for Climate, Environment and Energy: Wuppertal, Germany, 2013. [Google Scholar]

- Karlstrom, H.; Ryghaug, M.; Sorensen, K.H. Towards New National Policy Instruments for Promoting Energy Efficiency in Norway. In European Council for an Energy Efficient Economy Summer Study; Wuppertal Institute for Climate, Environment and Energy: Wuppertal, Germany, 2013. [Google Scholar]

- Chair, A.C.; Al-Moneef, M.; Barnés De Castro, F.; Bundgaard-Jensen, A. Energy Efficiency Policies around the World: Review and Evaluation; World Energy Council: London, UK, 2008. [Google Scholar]

- Kerr, N.; Gouldson, A.; Barrett, J. The Rationale for Energy Efficiency Policy: Assessing the Recognition of the Multiple Benefits of Energy Efficiency Retrofit Policy. Energy Policy 2017, 106, 212–221. [Google Scholar] [CrossRef]

- Fawcett, T.; Gavin, K.; Janda, K. Building Expertise: Identifying Policy Gaps and New Ideas in Housing Eco-Renovation in the UK and France. In European Council for an Energy Efficient Economy Summer Study; Wuppertal Institute for Climate, Environment and Energy: Wuppertal, Germany, 2013. [Google Scholar]

- Rosenow, J. Home Energy Efficiency Policy in Germany and the UK. In Low Carbon Development: Key Issues; Urban, F., Nordensvard, J., Eds.; Routledge: Abingdon, UK, 2013; pp. 309–320. [Google Scholar]