Abstract

The significance of internal auditing and its quality cannot be overstated, making it essential to investigate the factors influencing this quality. This study, employing a cross-sectional analysis, aims to assess how the characteristics of external auditors affect the perceived quality of internal audits in Iranian and Iraqi banks. In 2024, data regarding the attributes of external auditors and the perceived quality of internal audits were collected through a questionnaire distributed to external auditors from various banks in Iran and Iraq. The data analysis was conducted using Partial Least Squares Structural Equation Modeling (PLS-SEM). The study reveals a positive relationship between external auditors’ competence and independence and the perceived quality of internal audits, while it shows a negative impact of external audit methodologies on this perceived quality. These findings highlight the importance of external auditors’ independence as a key determinant of perceived internal audit quality.

1. Introduction

Today, public companies face a significant number of stakeholders and, therefore, need to implement many controls to ensure that the company’s resources are used properly and the rights of these stakeholders are not violated. Many efforts have been made in this regard, and internal audit, as one of the internal mechanisms of corporate governance, has played a valuable role in this regard (Mashayekhi et al., 2023). With the onset of financial crises in the 1980s and the emergence of a new wave of studies on corporate governance, the issue of internal audit quality has been repeatedly discussed and examined (Abdullah et al., 2018). Then, with the occurrence of financial problems around the world during 2007–2008, special attention was paid to improving the quality of corporate governance, and subsequently, with the increasing importance of internal audits, a growing need arose to familiarize with the quality of internal audits in the context of corporate governance (Boskou et al., 2019).

Studying internal audit quality is important because numerous positive consequences have been observed in previous studies. For instance, high-quality internal audits can increase corporate governance quality (Lenz & Hahn, 2015), achieved by helping management improve internal controls (IIA, 2015). Additionally, qualified internal audits lead to growth and prosperity in organizations by ensuring the proper functioning of internal controls as a mechanism for protecting assets and preventing the wastage of limited organizational resources, as well as gaining confidence in management’s performance in line with organizational goals (Arel et al., 2012). Many studies have confirmed the positive impact of high-quality internal audits on the quality of the internal control system (Mazza & Azzali, 2015). Additionally, in companies with higher-quality internal audits, lower earnings management and higher-quality financial figures are observed (Prawitt et al., 2009).

In addition to all of this, internal audit quality is also essential for external auditors. External auditors rely on internal auditors when internal auditors are sufficiently objective and competent and, consequently, of high quality (Pizzini et al., 2015). Some studies have concluded that high-quality internal auditing increases the external auditor’s reliance on the internal audit function. Greater reliance on the services of internal auditors is likely to lead to a reduction in the work of external auditors and, consequently, to a reduction in fees (Mat Zain et al., 2015) and a reduction in the delay of external audits (Abbott et al., 2012b).

According to professional standards and previous research by Prawitt et al. (2009), the quality of internal audits encompasses specific characteristics of both organizations and internal audit practitioners, including their competence. It also considers the nature and scope of audit activities, such as how thoroughly the correction of previously identified control deficiencies is monitored. Additionally, there are criteria for assessing internal audit quality based on the six components outlined in SAS No. 65 concerning the role of internal audits in the financial reporting process. These components include (1) experience, (2) professional certifications, (3) training, (4) emphasis on financial audit work, (5) reporting lines, and (6) the size of the internal audit unit (Prawitt et al., 2009).

Internal audit quality has implications for a wide range of stakeholders, yet existing literature primarily focuses on how this concept is defined by a specific group of corporate governance participants—external auditors. A likely reason for this emphasis is that external auditors are often responsible for assessing internal audit quality (Messier et al., 2011) and benefit significantly from it, as internal audit reports play a crucial role in the audit of financial statements (Gramling & Vandervelde, 2006).

Given this context, it is important to study internal audit quality from the perspective of external auditors, specifically their perception of internal audit quality. Additionally, understanding the factors that influence this perceived quality can be beneficial. This study aims to evaluate how external auditors perceive the quality of internal audits and investigate how their attributes affect this perception.

The banking system is a vital part of every economy, so banks’ performance can greatly impact it. On the other hand, in the rapidly changing landscape of the banking sector, the quality of internal audits has become a crucial factor in determining organizational effectiveness and financial integrity (Hazaea et al., 2020; Basel Committee, 2012). In recent years, the Central Bank of Iran has seriously looked at the banking sector’s effective corporate governance system (Mashayekhi et al., 2024), particularly focusing on the quality and effectiveness of internal auditing within the country’s banking sector. Moreover, given Iran’s political situation, particularly the sanctions that foreign countries have imposed in recent decades, the Iranian environment presents a unique opportunity for a deeper examination of financial oversight, especially in the realm of the internal audit function (Mashayekhi et al., 2022). However, more studies need to be conducted in this area within Iran, highlighting the need for such research.

Likewise, according to Waheed and Sfan (2024), qualified internal audit is crucial in Iraq, particularly within the banking sector, as it enhances confidence in financial reports, reduces fraud risk, and consequently contributes significantly to Iraq’s economic stability and development. Additionally, considering the many similarities in the economic, religious, and cultural systems of Iran and Iraq and the increasing economic interactions between these neighboring countries in recent years, there is a strong justification for conducting a joint study on this topic in both countries. According to the authors’ search, no research has examined the question discussed in this study in banks in the countries in question.

This study aims to assess the impact of external auditors’ attributes on the perceived quality of internal audits in Iranian and Iraqi banks. For this purpose, we utilize external auditors’ competence, independence, and audit methodologies as their characteristics. We also consider the perceived quality of internal audit procedures and reporting practices and their overall effectiveness as proxies of perceived internal audit quality.

To address the research questions, data on the characteristics of external auditors and the perceived quality of internal auditing were gathered from external auditors at various banks in Iran and Iraq through a questionnaire in 2024. The collected data were analyzed using Partial Least Squares Structural Equation Modeling (PLS-SEM).

Extensive research has been conducted on the quality of internal audits and the performance of external auditors. However, the impact of external auditor characteristics on the perceived quality of internal audits has not yet been explored. This study aims to fill that gap in the existing body of knowledge by examining how the attributes of external auditors influence the perceived quality of internal audits. This analysis is particularly relevant as it focuses on the relationship between these factors within the economic contexts of two neighboring countries with similar cultural and religious backgrounds who have developed strong ties in recent years.

External auditors will find the results of this study invaluable. By understanding the critical role of attributes such as competence and independence, as well as increasing collaboration with internal auditors, they can take proactive steps to enhance the perceived quality of internal audits. This empowerment to make a difference in the field is a significant benefit of these insights.

The paper is structured as follows. The second section reviews the relevant literature, and the third section outlines the research hypotheses. Subsequently, in Section 4, the research methodology, including the research population, sample, method, and variables, is described. The fifth section presents the data analysis, leading to compelling conclusions in the final section.

2. Literature Review

Internal audits are essential for maintaining transparency and trustworthiness in financial statements, as well as ensuring reliable governance within a company. Previous studies have provided insights into the various aspects and standards that are crucial for evaluating the quality of internal audits (Noordin et al., 2022). The occurrence of financial crises in some reputable companies has shaken investors’ confidence in the accuracy and reliability of financial reporting, the health and integrity of managers, and particularly the adequacy and effectiveness of internal controls required to prevent fraudulent behavior (Rezaee, 2005). In this context, the role of internal audits, considered an effective corporate governance mechanism in protecting investors, has come under scrutiny. This has led to a surge in studies exploring various dimensions of internal audit quality, as it is crucial in preventing fraudulent behavior and maintaining the integrity of financial reporting.

Previous studies have underscored the pivotal role of the internal audit manager’s personal characteristics, such as competence and organizational position, in shaping the quality of internal audits (Erasmus & Coetzee, 2018). The absence or inadequacy of the requisite talent and skills in the internal auditor can pose a threat to the fulfillment of their mission. Furthermore, the backing and authority of senior management can significantly enhance the quality of internal audits (Samagaio & Felício, 2023). Jiang et al. (2018) demonstrated that while independence and organizational commitment bolster internal audit quality, the time constraints imposed on internal auditors can diminish it. Other factors influencing the quality of internal audits include the utilization of information technology by internal auditors (Deribe & Regasa, 2014), the performance quality of the audit committee, and its level of involvement in internal audit planning and reporting (Abdullah et al., 2018), the size of the internal audit unit (Erasmus & Coetzee, 2018), and the uncertainty and complexity of the company’s environment (Jiang et al., 2018).

Several previous studies have demonstrated that high-quality internal audits can significantly enhance the quality of corporate governance (Lenz & Hahn, 2015). This is achieved by assisting management in enhancing internal controls (IIA, 2015). A high-quality internal audit can also yield positive outcomes by ensuring the effective operation of internal controls as a means of safeguarding assets, preventing the misuse of limited organizational resources, and ensuring that management’s performance aligns with organizational objectives. This, in turn, fosters growth and prosperity within organizations (Arel et al., 2012). Numerous studies have validated the favorable impact of high-quality internal audits on the quality of the internal control system (Mazza & Azzali, 2015). Furthermore, companies with high-quality internal audits exhibit lower levels of earnings management and higher-quality financial figures (Prawitt et al., 2009). External auditors also rely on internal auditors when they are sufficiently impartial and competent and, thus, of high quality (Pizzini et al., 2015). Increased reliance on internal auditor services is likely to lead to a reduction in the workload of external auditors and, consequently, a decrease in fees (Mat Zain et al., 2015) and a reduction in the delay of external audits (Abbott et al., 2012b).

Perceived internal audit quality refers to the subjective assessment of the effectiveness and reliability of an internal audit function as viewed by various stakeholders, such as external auditors, management, and audit committees. This perception can significantly influence how internal audits are valued within an organization and their overall impact on governance and control processes. Internal audit quality perceptions can vary among stakeholders based on their experiences and expectations. Management may focus on the effectiveness of the audit in identifying risks, while audit committees prioritize compliance with standards and the auditor’s independence. Moreover, external auditors perceive internal audit quality through various lenses, influenced by factors such as competence, independence, and the effectiveness of the internal audit function (Samagaio & Felício, 2023).

External auditors play a crucial role in ensuring accurate financial reporting for organizations. By conducting independent examinations of financial statements, records, and processes, they verify that numbers are truthful and that rules are followed. This duty supports fiscal transparency and strengthens faith in reports (Alhazmi et al., 2024). Past research shows that external auditors’ characteristics are among the factors affecting the perceived quality of internal auditing.

In previous literature, many things have been considered characteristics of external auditing, and in this study, three characteristics are considered: external auditor’s competence and independence and external auditing methodology. External audit competence encompasses professional knowledge, technical skills, analytical abilities, ethical standards, communication skills, industry-specific knowledge, continuous professional development, and problem-solving capabilities. These attributes collectively ensure that external auditors can conduct thorough and reliable audits that meet stakeholder expectations and regulatory requirements (Mansouri et al., 2009).

External audit independence is essential for allowing auditors to perform their work without influence or bias. This principle is crucial for maintaining the integrity of the audit process and directly impacts stakeholders’ trust in financial statements. Ensuring this independence fosters essential confidence and transparency in the financial landscape (Stewart & Subramaniam, 2010).

External auditing methodology, a systematic approach, is the cornerstone of evaluating an organization’s financial statements and related processes. This comprehensive process, which includes planning, evidence gathering, performing audit procedures, evaluating findings, reporting results, and follow-up actions, ensures that audits are thorough and that stakeholders, as key participants, can trust the information provided in financial statements (Appelbaum et al., 2018). Hamza and Damak-Ayadi (2023) state that effective audit procedures and methodologies are essential for comprehensive and systematic auditing. These procedures encompass planning, risk assessment, audit execution, and documentation. Standardized methodologies, including those outlined in the International Standards for the Professional Practice of Internal Auditing (ISPPIA), provide a framework that promotes high-quality audits (Bae et al., 2021). Moreover, Noordin et al. (2022) found that the thoroughness of audit procedures directly impacts the quality of audit outcomes.

3. Hypothesis Development

3.1. External Auditors’ Competency and Perceived Internal Audit Quality

External auditors with esteemed qualifications, such as a CPA (Certified Public Accountant) or CIA (Certified Internal Auditor), possess a level of expertise that significantly enhances their evaluation of internal audit findings. These professional certifications are not just badges of honor; they represent a steadfast commitment to upholding the highest auditing standards, thereby building trust in the integrity of the internal audits they assess (AL Fayi, 2022). Furthermore, the years of experience external auditors bring to the table are directly related to their ability to pinpoint potential issues within internal audits. External auditors with extensive experience have a deeper understanding of specific industry risks and subtleties, equipping them to make well-informed judgments about the reliability of internal audit work (Zhang et al., 2024; Alhazmi et al., 2024). As Nurdiono and Gamayuni (2018) highlight, highly competent external auditors are more inclined to trust the findings and recommendations provided by internal audits. This trust leads to improved efficiency in the overall audit process and enhances internal audits’ credibility in the eyes of stakeholders. When external auditors recognize and appreciate the quality of internal audit work, it casts a positive light on the entire internal audit function. Additionally, external auditors are tasked with evaluating the effectiveness and objectivity of internal audit functions. A skilled and knowledgeable external auditor is better equipped to identify high-quality internal audits, which ultimately boosts stakeholder confidence in financial reporting and governance processes (Zhang et al., 2024; AL Fayi, 2022).

Moreover, skilled external auditors play a critical role in identifying gaps or weaknesses in internal audit reporting practices. With their extensive knowledge and keen analytical skills, they can evaluate whether internal audit reports clearly and effectively convey their findings, recommendations, and proposed action plans. When external auditors pinpoint these deficiencies and work to rectify them, it not only leads to significant enhancements in the quality of internal audit reporting but also positively impacts how such reports are perceived over time (Usman et al., 2023). Therefore, in this study, we state the first hypothesis as follows:

H1:

There is a positive relationship between the competence of external auditors and the perceived internal audit quality.

3.2. External Auditors’ Independence and Perceived Internal Audit Quality

When external auditors are viewed as truly independent, they significantly enhance trust in the evaluations of internal audits. Stakeholders are far more likely to consider internal audit findings credible and trustworthy when they believe external auditors have performed their assessments free from external pressures (Aliu et al., 2018). External auditors tend to rely more on the work of internal auditors, which boosts the overall perception of the quality of these audits. This reliance hinges on the understanding that external auditors will objectively assess internal audit effectiveness (Herdiati et al., 2023). The independence of external auditors allows them to report any deficiencies or challenges identified in internal audits without fear of repercussion from management. This level of transparency is vital for upholding high standards within internal auditing and reinforces the credibility of the audit process (Zhang et al., 2024; Okechukwu & Ene, 2023). In this study, we propose our second hypothesis as follows:

H2:

There is a positive relationship between the external auditors’ independence and the perceived internal audit quality.

3.3. External Audit Methodologies and Perceived Internal Audit Quality

Previous studies highlight that well-defined, structured, and consistently applied procedures enhance the accuracy and comprehensiveness of audits (Alhazmi et al., 2024). Effective procedures guarantee that all critical areas are assessed, enhancing internal audit quality. The more robust these methods, the more consistent they are with auditing standards, and the better the internal audit quality assessment will be. External auditors objectively assess internal audit effectiveness and compliance with professional standards, which increases stakeholders’ confidence in the internal audit function. External quality assessments can also highlight areas for improvement and facilitate a culture of continuous improvement within the internal audit team. Through a systematic approach, external auditors can identify strengths and weaknesses in internal audit processes. This feedback is critical for continuous improvement and reinforces the value of internal audit as a tool for organizational governance and risk management (Samagaio & Felício, 2023).

On the other hand, according to Rogers and Johnson (2023), external auditors, who often use risk-based approaches to prioritize higher-risk areas, can provide a more relevant assessment of internal audit work by focusing more on significant risks and ensuring that critical areas are fully assessed. This targeted approach can lead to a higher perceived internal audit quality because stakeholders see that underlying risks are adequately addressed. Furthermore, proper dexternal methodologies, which often include structured communication strategies between external and internal auditors, ensure that both parties understand expectations and findings, leading to clearer reporting and improved perceived quality of internal audit performance (Rogers & Johnson, 2023). Consequently, we propose our third hypothesis as follows:

H3:

There is a positive relationship between the external audit methodologies and the perceived internal audit quality.

4. Research Methodology

4.1. Research Method

This research utilizes a quantitative approach with a cross-sectional design to assess the relationship between the perceived quality of internal audits and the characteristics of external auditors in Iranian and Iraqi banks. Our cross-sectional study aims to provide an overview of the population in 2024; thus, we collected data from external auditors (our participants) simultaneously this year. This study uses Partial Least Squares Structural Equation Modeling (PLS-SEM) to assess the proposed hypotheses. It adopts a causal-predictive approach within the framework of Structural Equation Modeling, focusing on predictive accuracy in estimating statistical models. These models are specifically designed to support the development of causal inferences (Hair et al., 2019; Sarstedt et al., 2021). PLS-SEM is often seen as an alternative to Jöreskog’s (1970) covariance-based structural equation modeling (CB-SEM), which is based on several assumptions that are frequently viewed as overly restrictive (Hair et al., 2011). This method effectively bridges the gap between explanatory research, commonly found in academia, and predictive modeling, which is crucial for guiding practical managerial decisions (Hair et al., 2019). The conceptual model being examined is illustrated in Figure 1.

Figure 1.

Conceptual Model.

4.2. Research Population

Cultural factors, such as hierarchical organizational structures and resistance to change, complicate the implementation of standardized audit practices (Andiola et al., 2020). Previous studies indicate that appropriate frameworks considering regional characteristics can enhance the effectiveness of internal audits in these countries (ALbawwat et al., 2021). Additionally, political instability, economic fluctuations, and varying degrees of regulatory enforcement significantly influence the internal audit environment (Al-Olimat & Al Shbail, 2021). This situation underscores the need for a comprehensive and consistent model to assess internal audit quality in Iran and Iraq. Khalil & Nehme (2023) emphasized the importance of enhanced transparency and timely submissions to strengthen the overall effectiveness of the internal audit function in these regions. Consequently, investigating the quality of internal auditing from the perspective of external auditors in Iran and Iraq presents unique challenges and improvement opportunities. Therefore, the external auditors of Iranian and Iraqi banks comprise our research population. There are 493 banks across Iran and Iraq, with approximately 94 actively considered in this study (54 banks in Iraq and 40 in Iran).

4.3. Sample and Data Collection

In this research, we used the following sample size formula to determine the sample size:

Likert scale-based survey questionnaires were distributed among the Iranian and Iraqi participants in 2024. Our extensive follow-up efforts to receive responses from external auditors of Iranian and Iraqi banks resulted in the receipt of 109 and 107 completed and usable questionnaires from Iranian and Iraqi banks, respectively. To ensure proportional representation in the effective sample size of 216, the allocation was based on the proportion of banks in each country. Iraq, contributing 57.4% of the active banks (54 out of 94), accounts for 124 samples, while Iran, contributing 42.6% (40 out of 94), accounts for 92 samples. This approach maintains a balanced and representative sample for analysis.

A structured questionnaire is used to collect data on two main areas: (1) characteristics of external auditors, including aspects such as competency, independence, and the methodologies they employ, and (2) perceived internal audit quality, which is assessed through internal audit procedures, reporting practices, and overall effectiveness as perceived by external auditors. This methodology allows for the collection of numerical data that can be statistically analyzed to examine the relationships between the variables of interest. The questionnaire was carefully constructed, drawing on key concepts and questions from various academic articles and field expert books on auditing and internal control systems. This process involved a thorough review of general sources, audit quality, the characteristics of external auditors, and the effectiveness of internal audits. Drawing from KPMG’s “Guide to Audit Quality” (KPMG, 2014), the “Quality Assessment Manual” developed by the Institute of Internal Auditors (IIA, 2024), and other previous research (Wehrhahn & Velte, 2024), the questionnaire was designed to incorporate recommended frameworks for assessing external auditor competencies, independence, and approaches. This alignment with industry standards ensures that the questionnaire provides a reliable and effective tool for evaluation. After developing the questionnaire, we discussed the questions with several academics and professionals, finalizing them based on their feedback.

The questionnaire was distributed either by email or in person, based on the accessibility of the respondents. Clear instructions were provided to ensure that participants understood how to complete the questionnaire. Additionally, respondents were assured of their anonymity and confidentiality to encourage honest and accurate answers.

4.4. Research Variables

The independent variable (attributes of external auditors) and the dependent variable (perceived quality of internal audits) in this study are measured based on the questions asked in the questionnaire. The questions related to each variable are displayed in Table 1.

Table 1.

Variable Definitions.

5. Results

We conducted the Exploratory Factor Analysis (EFA) to identify the underlying factors related to external auditor attributes and perceived internal audit quality. According to the results presented in Table 2, our variables correlate well with the questions presented.

Table 2.

Factor Analysis.

Table 3 shows the reliability analysis used to evaluate the internal consistency of various constructs using Cronbach’s Alpha. The analysis results show that all variables exhibit acceptable reliability, with Cronbach’s Alpha values exceeding 0.70. Competence and Effectiveness demonstrate high reliability, with Alpha values of 0.832 and 0.833, respectively. Similarly, Methodologies and Independence have values of 0.809 and 0.796, reflecting strong internal consistency. Procedures have a slightly lower Alpha of 0.757, which is still within the acceptable range, indicating moderate reliability. These results confirm that the scales used to assess these variables are reliable and suitable for further analysis. This analysis underscores the robustness of the measurement framework used for the study.

Table 3.

Reliability Analysis.

The demographic data were systematically encoded based on the parameters outlined in Table 4. Table 5 provides the descriptive statistics for the demographic variables.

Table 4.

Demographic Encoded Data.

Table 5.

Descriptive statistics.

The highest frequency in the age groups is observed in Age Group 2 (25–34 years) with 76 individuals, while the lowest frequency is found in Age Group 4 (45 years and above) with 37 individuals. Regarding gender, the sample consists of 153 males and 63 females. Position 2 (Senior External Auditor), with 125 individuals, has the highest representation, whereas Position 4 (Manager) has the lowest representation, with only 9 individuals. Regarding education level, the sample includes 155 individuals categorized under Education Level 1 (BA), 37 under Education Level 2 (MA), and 24 under Education Level 3 (Ph.D.), with a total of 216 individuals surveyed.

As mentioned before, this study used Partial Least Squares Structural Equation Modeling (PLS-SEM) to assess the proposed hypotheses. Perfect multicollinearity among a subset of questionnaire items poses a challenge to effectively implementing Partial Least Squares (PLS) regression. A dimensionality reduction procedure will be undertaken to address this, employing Principal Component Analysis (PCA) within the R statistical environment. It is a widely used multivariate statistical method employed across diverse scientific fields. It operates on datasets where observations are characterized by multiple, often correlated, quantitative variables. The primary objective of PCA is to reduce the dimensionality of the data by identifying a smaller set of uncorrelated variables, termed principal components, which capture the most significant variance within the original dataset. These components facilitate the visualization of both observation and variable similarities through graphical representations, typically in the form of two-dimensional or three-dimensional plots.

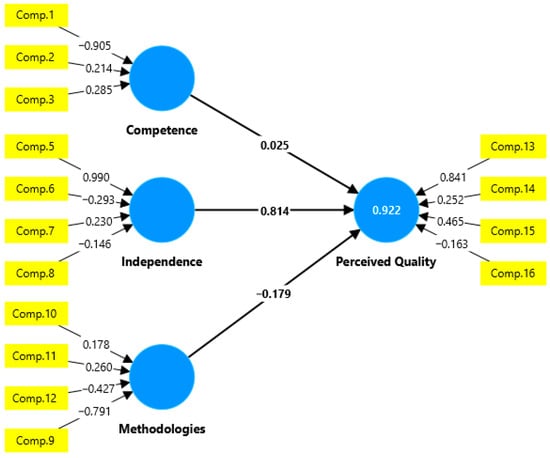

Furthermore, PCA simplifies the data structure and highlights underlying relationship patterns. Its historical roots extend back over a century, establishing it as one of the earliest multivariate techniques (Abdi & Williams, 2010; Saporta & Keita, 2009). This preprocessing step will be applied to the indicators associated with each latent variable. Following this, the regression analysis will be conducted. A key consideration is the shift in the measurement model necessitated by the PCA. While the original indicators are conceptualized as reflective, the derived principal components, owing to the inherent characteristics of PCA, will be treated as formative constructs within the subsequent PLS model. The results are presented in Figure 2.

Figure 2.

Regression Results.

Figure 2 presents our research findings, which have significant implications for the field of internal and external auditing. We discovered a strong positive correlation between external auditor independence and perceived internal audit quality (β = 0.814). The results of this study support the findings of Herdiati et al. (2023), which indicate that external auditors place greater trust in the work of internal auditors who assess their effectiveness independently and objectively. Additionally, these findings align with the conclusions of Zhang et al. (2024) and Okechukwu and Ene (2023), who argue that the independence of external auditors enables them to report any deficiencies or challenges identified during internal audits, thereby allowing them to evaluate the quality of those audits better.

Similarly, there is a positive but weak relationship between external auditor competence and perceived internal audit quality (β = 0.025). These findings are part of a growing consensus among researchers, including Zhang et al. (2024), Alhazmi et al. (2024), and Usman et al. (2023), who argue that competent external auditors are adept at making well-informed judgments about the reliability of internal audit work and also perceive a higher quality in the internal audit function. This result also aligns with the research of Nurdiono and Gamayuni (2018) and AL Fayi (2022), who state that highly competent external auditors are more trusted in internal audits and perceive a higher quality for them.

In contrast, external audit methods show a slight negative relationship with perceived internal audit quality (β = −0.179). Our analysis in this study offers results that differ from those of Rogers and Johnson (2023). They assert that external auditors, who frequently employ qualified audit methodologies and procedures, are able to deliver a more relevant evaluation of internal audit work and achieve a better understanding of internal audit quality.

Based on the obtained results, the first and second hypotheses of the study can be accepted, while the third hypothesis cannot. These findings, based on our study sample from Iranian and Iraqi banks, highlight the importance of external auditor competence and independence in enhancing perceived internal audit quality. Conversely, external audit methodologies may have a detrimental effect on perceived internal audit quality. The comparison of β among the three independent variables underscores external auditor independence as the dominant factor. These three independent variables, with an R-squared value of 0.922, explain a significant portion of the perceived variance in internal audit quality.

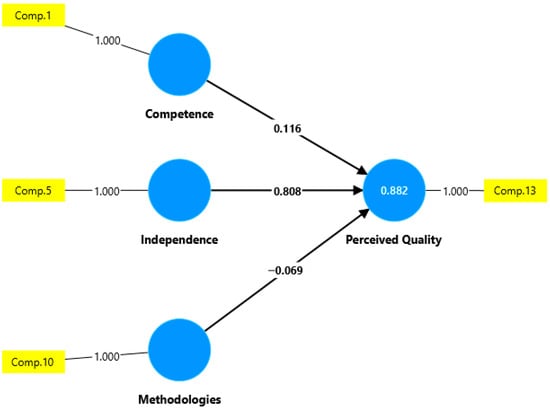

Robustness Test

To maintain the independent status of the indicators, they were treated as formative from a statistical perspective. However, theoretically, these indicators are reflective and were subsequently synthesized using Principal Component Analysis. Thus, within a theoretical framework, when only one component is included for each latent variable in the model, these components are considered reflective. To validate the results shown in Figure 2, the model has been modified to determine whether the theoretical and statistical approaches produce consistent outcomes. The results of this modification, i.e., the regression results for reflective indicators, are illustrated in Figure 3.

Figure 3.

Regression Results for Reflective Indicators.

We utilized the first principal components extracted from the PCA for each variable, as this technique dictates that the first component invariably possesses the highest explanatory power. However, in the case of the “Methodologies” construct, the ninth component exhibited perfect collinearity with the first component. Consequently, to circumvent this issue, we employed the second-ranked component, which was the tenth component.

The results indicate that our findings remained largely consistent across both models. The minor discrepancies observed can be attributed to the reduced number of components in Figure 3. These findings provide compelling evidence that neither the statistical nor the theoretical approach significantly altered the results.

6. Conclusions

The importance of internal auditing and its quality is undeniable. It is also important to examine the factors that affect this quality. One factor affecting internal audit quality is the relationship between internal and external auditors. External auditors can contribute considerably to improving internal auditing and thereby enhance the accountability of executive management to the board of directors. On the other hand, increasing the quality of internal audits perceived by external auditors can increase the reliance of external auditors on the work of internal auditors, thereby not only reducing external audit fees but also improving the accountability of the board of directors to shareholders by increasing the quality of financial reporting. Therefore, it is of great importance to study the impact of external auditor characteristics on the perceived quality of internal auditing.

The purpose of this study is to assess the impact of external auditors’ attributes on the perceived internal audit quality in Iranian and Iraqi banks. The external auditors’ competence, independence, and audit methodologies are considered as external auditor characteristics. Moreover, the perceived quality of internal audit procedures and reporting practices and their overall effectiveness are considered as surrogates for perceived internal audit quality. The data on the characteristics of external auditors and the perceived internal audit quality were gathered from external auditors at various banks in Iran and Iraq through a questionnaire in 2024. The collected data were analyzed using Partial Least Squares Structural Equation Modeling (PLS-SEM).

This study uncovers a complex interplay between external auditor competence, independence, methodology, and perceived internal audit quality. It reveals that while a positive yet weak link exists between external auditor competence and perceived internal audit quality, external auditor independence is the key player. It emerges as a dominant factor, showing a strong positive correlation and significantly influencing perceived internal audit quality. On the other hand, external auditor methodologies show a slight negative association, suggesting a potential adverse effect on perceived internal audit quality. These findings underscore the critical role of external auditor independence as a major determinant of perceived internal audit quality, with external auditor competence and methodology playing a relatively minor role. The results imply that strategies to enhance perceived internal audit quality should focus on bolstering external auditor independence, thereby highlighting the importance of this research in shaping future auditing practices.

This study contributes to the auditing literature in two ways, with a thorough examination. First, it scrutinizes how external auditors’ attributes influence internal audits’ perceived quality. Second, it focuses on the relationship between these factors within the economic contexts of Iran and Iraq, two neighboring countries with similar cultural and religious backgrounds and fluctuating economies. The research findings also offer several practical implications. First, regulators and professional organizations should consider developing or refining standards that emphasize the importance of external auditor independence. This may include implementing stricter regulations on auditor rotation, imposing restrictions on non-audit services provided by external auditors, and enhancing transparency in external auditor reporting. Second, public accounting firms should invest in continuous professional development and training for auditors to improve their skills and knowledge. This training should focus on ethical standards, independence, and the importance of objectivity in the auditing process. Third, external auditors are encouraged to collaborate more effectively with internal auditors. Such collaboration can lead to a better understanding of each other’s roles and responsibilities, fostering a culture of quality and integrity and ultimately enhancing the perceived quality of internal audits.

This research, like many others, has some limitations. Firstly, it relies on the perceptions of external auditors regarding the quality of internal audits, which may not provide a complete understanding of the situation. Future studies could benefit from including insights from other stakeholders, such as internal auditors, audit committees, boards of directors, or executive management. Secondly, this research uses a cross-sectional design, so future studies could employ longitudinal approaches to better understand how changes in external auditor characteristics affect internal audit quality over time. Lastly, since this research focuses on banks in Iran and Iraq, the generalizability of the findings is somewhat limited. Further research could be conducted in other countries and industries to expand on these results.

Author Contributions

Conceptualization, B.M. and Y.M.; Methodology, B.M.; Software, Y.M.; Validation, Y.M.; Formal analysis, Y.M.; Resources, B.M. and Y.M.; Writing—original draft, Y.M.; Writing—review & editing, B.M.; Supervision, B.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted according to the guidelines of the Declaration of Helsinki; however, ethical review and approval were waived for this research because it was conducted individually and independently by the institution where the researchers work, respecting the anonymity of the questionnaire correspondents.

Informed Consent Statement

Informed consent was obtained from all participants involved in the research.

Data Availability Statement

Data is contained within the article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abbott, L. J., Parker, S., & Peters, G. F. (2012). Audit fee reductions from internal audit-provided assistance: The incremental impact of internal audit characteristics. Contemporary Accounting Research, 29(1), 94–118. [Google Scholar] [CrossRef]

- Abdi, H., & Williams, L. J. (2010). Principal component analysis. Wiley Interdisciplinary Reviews: Computational Statistics, 2(4), 433–459. [Google Scholar] [CrossRef]

- Abdullah, R., Ismail, Z., & Smith, M. (2018). Audit committees’ involvement and the effects of quality in the internal audit function on corporate governance. International Journal of Auditing, 22(3), 385–403. [Google Scholar] [CrossRef]

- AL Fayi, S. M. (2022). Internal audit quality and resistance to pressure. Journal of Money and Business, 2(1), 57–69. [Google Scholar] [CrossRef]

- ALbawwat, I. E., AL-HAJAIA, M. E., & AL FRIJAT, Y. S. (2021). The Relationship Between Internal Auditors’ Personality Traits, Internal Audit Effectiveness, and Financial Reporting Quality: Empirical Evidence from Jordan. The Journal of Asian Finance, Economics and Business, 8(4), 797–808. [Google Scholar]

- Alhazmi, A. H. J., Islam, S., & Prokofieva, M. (2024). The Impact of Changing External Auditors, Auditor Tenure, and Audit Firm Type on the Quality of Financial Reports on the Saudi Stock Exchange. Journal of Risk and Financial Management, 17(9), 407. [Google Scholar] [CrossRef]

- Aliu, M., Okpanachi, J., & Mohammed, N. (2018). Auditor’s independence and audit quality: An empirical study. Accounting and Taxation Review, 2(2), 15–27. [Google Scholar]

- Al-Olimat, N. H., & Al Shbail, M. O. (2021). The mediating effect of external audit quality on the relationship between corporate governance and creative accounting. International Journal of Financial Research, 12(1), 149–157. [Google Scholar] [CrossRef]

- Andiola, L. M., Downey, D. H., & Westermann, K. D. (2020). Examining climate and culture in audit firms: Insights, practice implications, and future research directions. Auditing: A Journal of Practice & Theory, 39(4), 1–29. [Google Scholar]

- Appelbaum, D. A., Kogan, A., & Vasarhelyi, M. A. (2018). Analytical procedures in external auditing: A comprehensive literature survey and framework for external audit analytics. Journal of Accounting Literature, 40(1), 83–101. [Google Scholar] [CrossRef]

- Arel, B., Beaudoin, C. A., & Cianci, A. M. (2012). The impact of ethical leadership, the internal audit function, and moral intensity on a financial reporting decision. Journal of Business Ethics, 109(2012), 351–366. [Google Scholar] [CrossRef]

- Bae, G. S., Choi, S. U., Lamoreaux, P. T., & Lee, J. E. (2021). Auditors’ fee premiums and low-quality internal controls. Contemporary Accounting Research, 38(1), 586–620. [Google Scholar] [CrossRef]

- Basel Committee. (2012). The Internal Audit Function in Bank-Basel Committee on Banking Supervision. Bank for International Settlements. Available online: http://www.bis.org/publ/bcbs223.pdf (accessed on 1 February 2024).

- Boskou, G., Kirkos, E., & Spathis, C. (2019). Classifying internal audit quality using textual analysis: The case of auditor selection. Managerial Auditing Journal, 34(8), 924–950. [Google Scholar] [CrossRef]

- Deribe, W. J., & Regasa, D. G. (2014). Factors determining internal audit quality: Empirical evidence from Ethiopian commercial banks. Research Journal of Finance and Accounting, 5(23), 86–95. [Google Scholar]

- Erasmus, L., & Coetzee, P. (2018). Drivers of stakeholders’ view of internal audit effectiveness: Management versus audit committee. Managerial Auditing Journal, 33(1), 90–114. [Google Scholar] [CrossRef]

- Gramling, A. A., & Vandervelde, S. D. (2006). Assessing internal audit quality. Internal Auditing, 21(3), 26. [Google Scholar]

- Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice, 19(2), 139–152. [Google Scholar] [CrossRef]

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. [Google Scholar] [CrossRef]

- Hamza, M., & Damak-Ayadi, S. (2023). The perception of audit quality among financial statements users, preparers and auditors, in Tunisia. Accounting and Management Information Systems, 22(2), 202–224. [Google Scholar] [CrossRef]

- Hazaea, S. A., Tabash, M. I., Khatib, S. F., Zhu, J., & Al-Kuhali, A. A. (2020). The impact of internal audit quality on financial performance of Yemeni commercial banks: An empirical investigation. The Journal of Asian Finance, Economics and Business, 7(11), 867–875. [Google Scholar] [CrossRef]

- Herdiati, M. F., Yusnaini, Y., & Wahyudi, T. (2023). The Effect of Independence, Role Conflict, and Internal-External Auditor Relationship on Audit Quality: Case at Universities in Indonesia. Journal of Economics, Finance and Management Studies, 6(7), 3197–3205. [Google Scholar] [CrossRef]

- Jiang, L., André, P., & Richard, C. (2018). An international study of internal audit function quality. Accounting and Business Research, 48(3), 264–298. [Google Scholar] [CrossRef]

- Jöreskog, K. G. (1970). A general method for estimating a linear structural equation system. ETS Research Bulletin Series, 1970(2), i-41. [Google Scholar] [CrossRef]

- Khalil, S., & Nehme, R. (2023). Performance evaluations and junior auditors’ attitude to audit behavior: A gender and culture comparative study. Meditari Accountancy Research, 31(2), 239–257. [Google Scholar] [CrossRef]

- KPMG. (2014). Guide to audit quality and the external auditor. KPMG. Available online: https://assets.kpmg.com/content/dam/kpmg/pdf/2014/08/KPMG-NZ-Guide-to-audit-quality-and-external-auditor.pdf (accessed on 1 February 2024).

- Lenz, R., & Hahn, U. (2015). A synthesis of empirical internal audit effectiveness literature pointing to new research opportunities. Managerial Auditing Journal, 30(1), 5–33. [Google Scholar] [CrossRef]

- Mansouri, A., Pirayesh, R., & Salehi, M. (2009). Audit competence and audit quality: Case in emerging economy. International Journal of Business and Management, 4(2), 17–25. [Google Scholar] [CrossRef]

- Mashayekhi, B., Ghasemi Dashtaki, S., & Ahmadi, H. (2024). Banks’ financial performance analysis: An experience from an Islamic economy. Journal of Islamic Accounting and Business Research. [Google Scholar] [CrossRef]

- Mashayekhi, B., Jalali, F., & Rezaee, Z. (2022). The role of stakeholders’ perception in internal audit status: The case of Iran. Journal of Accounting in Emerging Economies, 12(4), 589–614. [Google Scholar] [CrossRef]

- Mashayekhi, B., Samavat, M., & Jahangard, A. (2023). Reviewing the Internal Audit Literature in the Public Sector: A Bibliometrics Analysis. Governmental Accounting, 9(2), 207–226. [Google Scholar]

- Mat Zain, M., Zaman, M., & Mohamed, Z. (2015). The Effect of Internal Audit Function Quality and Internal Audit Contribution to External Audit on Audit Fees. International Journal of Auditing, 19(3), 134–147. [Google Scholar] [CrossRef]

- Mazza, T., & Azzali, S. (2015). Effects of internal audit quality on the severity and persistence of controls deficiencies. International Journal of Auditing, 19(3), 148–165. [Google Scholar] [CrossRef]

- Messier, W. F., Jr., Reynolds, J. K., Simon, C. A., & Wood, D. A. (2011). The effect of using the internal audit function as a management training ground on the external auditor’s reliance decision. The Accounting Review, 86(6), 2131–2154. [Google Scholar] [CrossRef]

- Noordin, N. A., Hussainey, K., & Hayek, A. F. (2022). The use of artificial intelligence and audit quality: An analysis from the perspectives of external auditors in the UAE. Journal of Risk and Financial Management, 15(8), 339. [Google Scholar] [CrossRef]

- Nurdiono, N., & Gamayuni, R. R. (2018). The effect of internal auditor competency on internal audit quality and its implication on the accountability of local government. European Research Studies Journal, 21(4), 426–434. [Google Scholar] [CrossRef]

- Okechukwu, O., & Ene, E. C. (2023, February). Effect of auditor’s independence on audit quality of quoted consumer goods companies in Nigeria [Conference session]. 7th Annual International Academic Conference on Accounting and Finance Disruptive Technology: Accounting Practices, Financial and Sustainability Reporting, RIVERS State University of Science and Technology, Port Harcourt, Nigeria. [Google Scholar]

- Pizzini, M., Lin, S., & Ziegenfuss, D. E. (2015). The impact of internal audit function quality and contribution on audit delay. Auditing, 34(1), 25–58. [Google Scholar] [CrossRef]

- Prawitt, D. F., Smith, J. L., & Wood, D. A. (2009). Internal audit quality and earnings management. Accounting Review, 84(4), 1255–1280. [Google Scholar] [CrossRef]

- Rezaee, Z. (2005). Causes, consequences, and deterence of financial statement fraud. Critical Perspectives on Accounting, 16(3), 277–298. [Google Scholar] [CrossRef]

- Rogers, S., & Johnson, J. (2023). Auditors Abound: The Differences Between Internal and External Audit. Available online: https://www.jgacpa.com/auditors-abound (accessed on 1 February 2024).

- Samagaio, A., & Felício, T. (2023). The determinants of internal audit quality. European Journal of Management and Business Economics, 32(4), 417–435. [Google Scholar] [CrossRef]

- Saporta, G., & Keita, N. N. (2009). Principal component analysis: Application to statistical process control. Data Analysis, 1–23. [Google Scholar]

- Sarstedt, M., Ringle, C. M., & Hair, J. F. (2021). Partial least squares structural equation modeling. In Handbook of market research (pp. 587–632). Springer. [Google Scholar]

- Stewart, J., & Subramaniam, N. (2010). Internal audit independence and objectivity: Emerging research opportunities. Managerial Auditing Journal, 25(4), 328–360. [Google Scholar] [CrossRef]

- The Institute of Internal Auditors (IIA). (2015). Global Internal Audit Competency Framework. Institute of Internal Auditors (IIA). Available online: https://docs.ifaci.com/wp-content/uploads/2018/03/the-iia-global-internal-audit-competency-framework-2013.pdf (accessed on 1 March 2024).

- The Institute of Internal Auditors (IIA). (2024). Quality Assessment Manual: Chapter 4. Available online: https://www.theiia.org/globalassets/documents/quality/quality-assessment-manual-chapter-4.pdf (accessed on 1 March 2024).

- Usman, R., Rohman, A., & Ratmono, D. (2023). The relationship of internal auditors’ characteristics with external auditors’ reliance and its impact on audit efficiency: Empirical evidence from Indonesian government institutions. Cogent Business & Management, 10(1), 2191781. [Google Scholar]

- Waheed, A. A., & Sfan, A. M. D. (2024). Evaluating Internal Audit Quality (Evidence From Iraq). International Journal of Economics, Management and Accounting, 1(4), 230–257. [Google Scholar] [CrossRef]

- Wehrhahn, C., & Velte, P. (2024). The relationship between audit committees, external auditors, and internal control systems: A literature review and a research agenda. Journal of Financial Reporting and Accounting. ahead-of-print. [Google Scholar] [CrossRef]

- Zhang, C., Shah, S., Lau, Y. W., & Ngalim, S. M. (2024). The impact of independence, auditors’ competence and information technology usage on internal audit quality: Empirical evidence from chinese commercial banks. Corporate Ownership & Control, 21(3), 18–30. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).