Abstract

We examine the relationship between board gender diversity and human capital efficiency and further consider the moderating role of workforce environment quality from the perspectives of profit-making and loss-making firms. Using a sample of 2700 firm-year observations from listed Australian firms for the period 2008–2019, we found a positive relationship between the presence of females on boards and human capital efficiency which was more pronounced for loss-making firms as against profit-making firms. Additionally, the relationship between gender diversity and human capital efficiency was moderated by the quality of workforce environment with the moderating effect being more pronounced for loss-making firms as compared to profit-making firms. Board gender diversity plays a substitutive role in the management of human capital efficiency for loss-making firms where investment in human capital development is limited.

1. Introduction

Human capital efficiency which encapsulates the skills and motivation required to accomplish an assigned task effectively, has become a topical issue for corporations in their bid to maintain and improve upon their competitive advantage in recent times (see ; ). This notion is evidenced by the findings of () who assert the growing importance of human capital for firm value. Specifically, human capital is approximated to constitute 52% of firm value (). Consequently, both mandatory1 and voluntary disclosures of human capital have evolved in recent times. The growing interest in human capital has prompted academic scholars to investigate the role of human capital in shaping firm performance. () report a positive relationship between human capital and firm performance. () also assert that equity funds with higher human capital efficiency outperform their counterparts with lower human capital efficiency. Furthermore, () confirm the positive relationship between human capital efficiency and firm performance for Vietnamese firms across sectors.

Despite the growing importance of human capital efficiency for a firm’s competitive advantage and firm value (see ), the literature on determinants of human capital efficiency remains limited and largely explored at the national level (See ; ; ) rather than at the firm level, except for (). () report a positive relationship between human capital efficiency and board gender diversity among UK listed firms. However, this study did not consider two important parameters (investment and environment) of firms which are deemed to be relevant in shaping a firm’s human capital efficiency (see ). () suggest that human capital efficiency increases in the presence of higher firm investment in human capital and in the presence of an enabling work environment.

As () and () have indicated the significant relevance of human capital to firm value and sustainable competitive advantage, respectively, it is important to understand some of the internal dynamics of firms which have implications for human capital efficiency. A greater understanding of factors that promote human capital management would enhance our knowledge of human capital management for better organizational outcomes ().

Consequently, our study extends the analysis of board gender diversity and human capital efficiency to the Australian context with consideration of the work environment and the potential level of investment in human capital. Specifically, we seek to highlight some of the relevant internal attributes of firms that have implications for human capital efficiency. Premised on the arguments of agency theory and resource dependency theory, board gender diversity is expected to be positively related to organizational outcomes such as firm performance and firm value (; ) due to its monitoring effectiveness and superior attributes for effective decision-making. We extend these arguments to human capital efficiency for Australian listed firms and posit a positive relationship between board gender diversity and human capital efficiency. Further to this, we imply the relevance of the work environment and level of investment in human capital to the relationship between board gender diversity and human capital efficiency (see ).

Many scholars and practitioners have suggested that a supportive workforce environment not only helps firms keep talented employees (; ), but also motivates employees to be more cooperative and efficient (). Firms with a supportive workforce environment have high performance and valuation levels (; ) and are more innovative compared to firms with a non-supportive workforce environment (). Impliedly, a supportive workforce environment could be interpreted as a signal of higher levels of organizational effectiveness including employee engagement, commitment, and efficiency. Building on these studies, we posit that firms with a supportive workforce environment is likely to have an impact on the relationship between human capital efficiency and board gender diversity.

Additionally, as a firm’s level of investment in human capital in the form of expenses incurred for training, education, and development of knowledge affects human capital efficiency, we consider our analysis from the perspectives of loss-making firms relative to profitable firms (). Premised on the notion that loss-making firms are more likely to be financially constrained, investment in human capital would be limited. On the other hand, profitable firms would be less constrained in their financial commitment to invest in human capital. Consequently, the profit-making status of a firm is indicative of a firm’s potential to invest more or less resources in human capital development (see ). Thus, we posit that the relationship between board gender diversity and human capital efficiency is likely to be dependent on the profit-making status of a firm.

We filled the gap in the human capital efficiency literature by examining the relationship between human capital efficiency and board gender diversity in the context of the profit-making status of firms with further consideration for the moderating effect of relevant internal dynamics of firms.

We used data from Australian firms which were listed on ASX from 2008 and not delisted as of 2019.

Our findings contribute to the literature and practice in numerous ways. First, we extend the literature on gender diversity by examining the effect of gender-diverse board as one of the important monitoring mechanisms on human capital efficiency in the context of financially constrained firms. Secondly, our study is the first to examine the moderating effect of the workforce environment on the relationship between female presence on boards and human capital efficiency. Thirdly, the Australian Government is committed to increase female representation on boards as evidenced by gender diversity reforms initiated by the ASX Corporate Governance Council in 2010 and the further enactment of the Workplace Gender Equality Act of 2012. Consequently, Australia provides us with an interesting setting to examine the practical implications of whether females on boards add value to the decision-making process of boards, as reflected in human capital efficiency and highlight the circumstances under which this outcome is most probable. In this regard, our findings provide some understanding of the impact of public reforms that are geared towards helping women to occupy positions at the top of the corporate hierarchy. Lastly, given the increased attention on the low representation of women on corporate boards, it is necessary to provide more clarity on the implications of gender diversity for corporate governance and highlight the context under which its implementation is more effective. Consequently, our study contributes to the corporate governance literature by examining the effect of gender-diverse boards, as one of the important governance mechanisms, on human capital efficiency.

This paper is organized as follows. In Section 2, we review the prior literature and formulate our hypotheses. We examine the research methodology in Section 3, followed by descriptive statistics, empirical results, and further tests in Section 4. Section 5 summarizes the main themes discussed here and concludes the paper.

2. Prior Related Literature and Hypotheses Development

2.1. Related Concepts

2.1.1. Human Capital

As business models have become more centered on people, intellectual capital, and technology, human capital is now perceived as a key driver for firms’ growth and success. This notion of human capital is consistent with the ideas of human capital presented in the seminal work of () and other assertions of later research works (, , ). Human capital encapsulates the various skills employed by workers in the performance of their assigned tasks by a firm. It embodies an individual’s capabilities, knowledge, skills, and experience and their relevance to the task they must perform (). In addition, it reflects an organization’s investment in its human resources to help increase its efficiency ().

Human capital as a resource of a firm has been analyzed from two main perspectives: the accumulation of skills and capacity building perspective and the creation of enabling environment for its utilization. () assert the relevance of the level of investment and environment to explain the extent to which human capital is likely to be efficient. While investment in human capital helps to equip individuals with the requisite skills and capabilities for accomplishing assigned tasks successfully, the enabling environment offer employees the appropriate conditions for the proper execution of assigned tasks.

In recent times, the relevance of human capital to the overall success of corporate entities has been noted (see ). () asserts the increasing trend in investment in the stock of human capital across countries. Additionally, there is an increasing pressure from government bodies around the world for corporate entities to report on their human capital.2 The current empirical evidence shows that firms with superior human capital practices perform better and provide good return to shareholders (; ). () also assert that human skill is important at all levels of management in a firm as it is linked to an entity’s ability to gain sustainable competitive advantage and efficiency.

Further to this, human capital is positively associated with a higher degree of radicalness in firm innovative endeavors (). () also suggest a positive and significant relationship between human capital and firm performance. This assertion is further confirmed by () who report the positive impact of human capital efficiency on equity fund performance. Furthermore, () provide evidence that human capital plays an important role in increasing firm value in the services industry. Premised on the documented benefits of human capital, most firms strive to create an enabling atmosphere to harness the competitive advantage associated with well-developed human capital (See ).

2.1.2. Female Directors

The importance of female directors to the overall success of a firm has been widely noted in the literature on board gender diversity over time (see ; ; ; ). The empirical evidence on the role of female directors suggests that they possess certain psychological and social attributes which enhance their decision-making processes for a more effective board. Specifically, female directors have been noted to be associated with a higher degree of concern for ethical conduct and greater concern for cooperation and interpersonal skills relative to their male counterparts (; ; ; ).

Premised on empirical findings and the quest to promote gender equity, there have been numerous regulatory reforms to promote gender diversity on corporate boardrooms in most countries. While some countries have opted for mandatory requirements for gender diversity, other countries have voluntary requirements regarding gender diversity (See ; ). In the context of Australia, the reporting requirements of ASX Corporate Governance Council’s Principles and Recommendations in 2010 and the Workplace Gender Equality Act of 2012 have contributed to an increasing trend in the number of females on corporate board.

Specifically, the second and third editions of ASX Corporate Governance Council’s Principles and Recommendations make provision for the establishment of a diversity policy which includes requirements for the board or a relevant committee of the board to set measurable objectives for achieving gender diversity and to assess annually both the objectives and the entity’s progress in achieving them (Recommendations 3.3 and 1.5 of the second and third editions, respectively, of ASX Corporate Governance Council’s Principles and Recommendations). As the board or a relevant committee of the board is expected to determine the benchmarks for diversity, the policy recommendations of the ASX Corporate Governance Council reflect a soft regulatory stance with no mandatory target or quota for diversity. Thus, as much as firms are encouraged to improve their diversity initiatives, they determine the nature and content of their policies for diversity.

2.1.3. Workforce Environment

Recently, the need to maintain a friendly, cooperative, motivated, and productive environment for work has been deemed to be essential for organizational effectiveness and efficiency (see ; ). () suggest that a supportive work environment where knowledge can be created, shared, and applied is essential for organizational success. These assertions are premised on the notion that the creation of a supportive workforce environment helps an organization to effectively harness the competitive advantage associated with well-managed human capital.

Consistent with empirical evidence and coupled with regulatory requirements, corporate entities have recently sought to create an enabling environment for higher employee job performance (). () suggest that rapid changes in the business environment call for the need to rethink workforce elements and workforce management for effectiveness in achieving business success. Conceptually, the workforce environment encompasses employee recognition and reward systems, the provision of employee support, responding to employee concerns, and providing direction (see ). A firm which creates a workforce environment with well-constituted elements has a supportive environment for organizational success ().

In the context of Australia, the workforce environment is deemed to be the most important non-financial factor in employees’ decision regarding job acceptance.3 Consequently, Australian business leaders are working actively to improve workplace culture for a better workplace environment ().

2.2. Female Directors, Workforce Environment Quality and Human Capital Efficiency

2.2.1. Theoretical Perspectives

We identified two theoretical perspectives which are relevant to the study of the relationship between human capital efficiency and board gender diversity, the profit-making status of firms and the moderating role of workforce environment quality for corporate entities, namely, agency theory and resource-based theory. Proponents of agency theory suggest that potential opportunistic behaviors of management due to the existence of a conflict of interest between management and its stakeholders call for the establishment of corporate mechanisms to achieve goal congruence (see ; ). This notion describes the agency problem of modern corporations and their associated monitoring and bonding mechanisms. According to agency theory, corporate governance attributes may serve as a monitoring mechanism to curb the adverse effect of the agency problem (see ) and promote positive organizational outcomes. Thus, we posit that firms with a more gender diverse board, which is a corporate governance attribute, are likely to be associated with a higher degree of human capital efficiency. This is based on the asserted improvement in monitoring effectiveness of a more gender-diverse board.

Resource-based theory, on the other hand, points to the internal sources of a firm’s sustained competitive advantage which reflect the bundle of resources harnessed by a firm for its ultimate success (). The central argument of this theory suggests that the ability of a firm to acquire and maintain resources which cannot be easily duplicated is highly fundamental to its sustained competitive advantage (). Impliedly, the internal dynamics of an entity’s processes and procedures for managing its resources may be critical for firm effectiveness and efficiency. Arguments premised on resource-based theory suggest that workforce environment quality of a firm may constituent a resource for sustained competitive advantage due to its ability to enhance organizational competencies for firm success (). Workforce environment practices such as employee recognition and reward systems, the provision of employee support, and the provision of adequate responses to employee concerns among others are common practices for attaining organizational efficiency. In this regard, we posit that workforce environment quality is likely to influence the relationship between human capital efficiency and board gender diversity as a resource for overall effectiveness and efficiency.

Further to this, the availability of funds constitutes a critical resource to achieving the investment goals of a firm. Profitable firms with more financial resources are better positioned to invest more financial resources in human capital as compared to loss-making firms. Premised on the arguments of resource-based theory, we posit that the profit-making status of a firm is likely to influence the relationship between human capital efficiency and board gender diversity.

2.2.2. Hypothesis Development

The primary duty of the board of directors is to monitor and evaluate top management team and company performance in general, as well as to protect shareholders’ interests (). Nevertheless, the board of directors’ involvement has increased significantly in all phases of the strategic planning process (; ). It is expected that the board will implement policies, processes, and systems to ensure the effective use of firm’s resources including human capital.

Research suggests that females’ directors have different outlook for solving problems and completing tasks (). Consequently, they improve board decision making and enhance a firm’s legitimacy (). Females tend to perform better than men on group problem-solving and decision-makings tasks requiring discussion and consensus ().

Female board directors provide better scrutiny and adequate oversight for ethical conduct as compared to their male counterparts (). Furthermore, females are more caring, empathetic, nurturing, and cooperative with a focus on interpersonal skills which makes them more communal then agentic4 (). Additionally, females can inspire confidence among peers and subordinates, bring people together, and respond to challenges (). Females also have multitasking abilities and are equipped with interpersonal and leadership skills ().

Moreover, female directors represent a key monitoring mechanism that serves as an important device in reducing agency costs of firms in less competitive markets (), and they work in a similar manner to independent directors on boards (). They bring unique functional expertise onto the board () and are perceived to be more participative, democratic, and demonstrate a transformational style of leadership (; ; ). Consequently, board gender diversity is likely to foster higher human capital efficiency due to its potential as an effective corporate governance attribute.

Additionally, the profit-making status of a firm is likely to influence the relationship between human capital efficiency and board gender diversity. Premised on the arguments of (), profitable firms with more financial resources would have the tendency to make more investment in human capital. Comparatively, loss-making firms with less financial resources have the tendency to make limited investment in human capital. Thus, while more investment in human capital creates a conducive environment for enhanced human capital efficiency through better training and higher skill development, less investment in human capital minimizes its efficiency. However, the nature of the impact is dependent on whether the relationship between board gender diversity and the profit-making status of a firm is complementary or substitutive. In a complementary relationship, the profit-making status of a firm would enhance the relationship between board gender diversity and human capital efficiency. On the contrary, in a substitutive relationship, the profit-making status would adversely affect the relationship between board gender diversity and human capital efficiency.

Further to this, the relationship between human capital and gender diversity is likely to be moderated by the quality of the workforce environment. As noted by (), in a supportive workplace, employees are motivated and well equipped to undertake assigned task more effectively. Consistent with this assertion, () and () also suggest that employees tend to put in more effort and perform better in a good workforce environment. In this regard, female directors will be well-motivated and resourced to undertake their task of ensuring organizational success. Impliedly, female directors are likely to be more effective in the performance of their governance role in a high-quality workforce environment. However, as the profit-making status is relevant to the relationship between board gender diversity and human capital efficiency, the nature of the moderating role of workforce environment is likely to vary between profit-making firms and loss-making firms.

Premised on the above arguments, females on boards might have a positive impact on human capital efficiency due to the presence of the above-mentioned skills and characteristics of females and this relationship is likely to be enhanced in the presence of a high-quality workforce environment. On the other hand, the profit-making status of a firm may either enhance or limit the relationship between board gender diversity and human capital efficiency. Thus, the following relationships are hypothesized:

H1a:

Female representation on corporate boards is positively associated with the human capital efficiency of listed Australian firms;

H1b:

The positive relationship between female representation on corporate boards and the human capital efficiency of listed Australian firms may be enhanced or limited in the context of the profit-making status of a given firm;

H2a:

The positive relationship between female representation on corporate boards and the human capital efficiency of listed Australian firms is stronger in the presence of a high-quality workforce environment;

H2b:

The moderating effect of a high-quality workforce environment on the relationship between female representation on corporate boards and human capital efficiency may be enhanced or limited in the context of the profit-making status of a given firm.

3. Research Methodology

3.1. Sample and Data Collection

Our study focuses on listed Australian firms for the period 2008 to 2019. The sample period used was influenced by the availability of data on workforce environment and human capital on Refinitiv Eikon DataStream and ESG databases for listed Australian firms. The initial sample consisted of 288 firms which were listed as of 2008 and not delisted as of 2019. Out of 288 firms, 48 firms were deleted due to missing data. The final sample consisted of 240 firms with data over a 12-year period which resulted in firm-year observations of 2700. We then split our sample into loss-making and profit-making firms based on the nature of a firm’s profit. Firms which recorded a net loss for at least 70% of the sample period are categorized as loss-making firms or otherwise they are labelled as profit-making firms. Of the 240 firms, 162 were loss-making while the remaining 72 firms were profit-making with associated firm-year observations of 1747 and 953, respectively. In line with the research questions of interest, data on gender diversity, workforce environment, human capital efficiency, and financial attributes were collected from Refinitiv Eikon DataStream and ESG databases. We supplemented our data with corporate governance data of listed Australian firms collected manually from annual reports. Table 1 shows the sample selection process and the associated sample distribution based on year and industry. Firms from the Material (42.33) and Health Care (11.74) sectors dominate the sample distribution over the period of the study. On the other hand, firms in the Utilities sector have the least firm-year observations.

Table 1.

Sample selection process and distribution and year.

3.2. Variable Measurements

3.2.1. Dependent Variable

The dependent variable, human capital efficiency (HCE), was measured and defined using the utilization criteria of human capital (see ). We followed the arguments of () and () who assert that the utilization criterion of human capital allows for the capture of the productivity of knowledge workers in the measurement process. Specifically, () state that it is a performance measurement which reflects the productivity of knowledge workers and the creation of new value generated from them. Consequently, we measured human capital efficiency (HCE) as the ratio of valued added to capital invested in knowledge workers (salary). This conceptual operationalization of human capital efficiency (HCE) is consistent with measurement proxies used in prior studies such as (), (), and ().

3.2.2. Independent Variable

Gender diversity (PFD) and workforce environment quality were the key independent variables of our study. We measured gender diversity as the ratio of the number of women on corporate boards to board size. The measurement proxy is consistent with gender diversity (PFD) measure used in prior studies (see ; ). To further check the robustness of the results, we also use the alternative proxies of gender diversity: firstly, the Blau Index (Blau) developed by (); and secondly, the number of female directors on the board (NFD).

We followed () in measuring our proxy for workforce environment quality (WFEQ). Consistent with (), we collected data on the 20 list items used in measuring workforce environment quality and applied the same measurement procedure to determine workforce environment quality for listed Australian firms in our sample. Workforce environment quality is the sum of a firm’s score out of 20.5 A firm with a high workforce score is deemed to have a supportive workforce environment.

3.2.3. Control Variables

We included several control variables that were likely to affect a firm’s level of human capital efficiency. We controlled for firm characteristics and corporate governance attributes in line with (). For instance, human capital efficiency (HCE) is likely to be affected by board characteristics such as CEO duality (Ceod), board meeting attendance (Bmeet), board independence (Bind), and board size (Bsize) as these attributes can have significant implications for a firm’s strategic decisions regarding human capital investment and policies. CEO duality may have an impact on human capital efficiency since a CEO who is the chairman of the board has the power to influence the strategic decisions of the firm with respect to its investments and policies regarding human capital. CEO duality is measured as a dummy variable of 1 where the CEO is the same as the chairman of the board or otherwise coded as 0. Board meetings are expected to be relevant in shaping a firm’s human capital efficiency. Board meetings afford board members the opportunity to deliberate on strategic investments and policies. We thus controlled for board meeting attendance (Bmeet) which was measured as the number of meetings attended by members of the board. Additionally, we also controlled for board independence (Bind) as a corporate board with a higher number of independent directors is deemed to be more effective in guiding the strategic decisions and policies of a firm. Board independence presents the proportion of independent directors to the total number of directors. We also controlled for board size (BSize) which is measured as the number of board of directors.

In the context of firm characteristics, we controlled for firm age (Fage), firm size (Fsize), leverage (Lev), and financial risk (ZFS). Regarding firm size, large firms are more likely to have the resources to invest and manage human capital for higher efficiency (). Firm size is measured as the natural logarithm of total asset. Likewise, older firms are more likely to have the experience and the capability to invest and manage their human capital with greater efficiency due to their learning curve in human resource management. Firm age is measured as log of 1 plus the years of the firm since its inception. Additionally, we also controlled for firm leverage and financial risk associated with a firm as these attributes are likely to affect a firm’s ability to raise capital for investing and operating activities. Leverage equals ratio of long-term debt to total assets, while financial risk is measured using the () Financial Score6. Finally, we controlled for firm performance as more profitable firms are likely to invest in human capital development and to further control for the dominance of non-profitable firms in our sample. We used return on asset (Roa) which is calculated as the proportion of net income to year-end total assets as our measure for a firm’s performance. All variables are defined in detail under Appendix B.

3.2.4. Empirical Model

We employed unbalanced panel data using the fixed effect model to examine the relationship between human capital efficiency and gender diversity and the moderating effect of workforce environment quality. We estimated the following model in line with the determinants of human capital efficiency:

where HCE represents the yearly human capital efficiency of a firm (i) at time (t). We expected the coefficient (α1) of PFD to be significant if there was a relationship between PFD and HCE. We controlled for firm characteristics and other corporate governance attributes. α2 is the vector of coefficients on firm-specific and corporate governance control variables. η and ε are unobserved time-invariant firm effects and error terms for firm i at time t, respectively.

To test for the moderation effect of workforce environment quality, we included an interaction term for workforce environment quality and gender diversity and restate the model as follows:

If WFEQ has a moderating effect on PFD, we expect α3 to be significant.

Due to the possibility of our results being biased by correlated omitted variables, measurement error or other sources of simultaneity, we employed a Heckman two-step model, the System Generalized Method of Moments (GMM), and a propensity score matching model to address these concerns.

With regards to our models of analysis, we checked to ensure the avoidance of the violation of statistical analysis assumptions regarding normality, multicollinearity, and heteroskedasticity. We performed a residual test/histogram for normality and observed a bell-shaped curve which is consistent with the normality assumption. We employed the correlation matrix. Table 2 presents the correlation matrix for the explanatory variables.

Table 2.

Pairwise Correlation.

4. Data Analysis

4.1. Descriptive Statistics

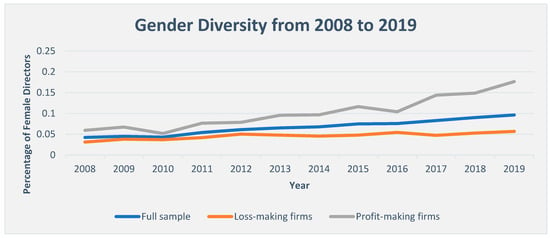

Table 3 presents the descriptive statistics of the dependent, independent, and control variables of the sample used in this study which have been Winsorized at 1% (excluding logarithmic and indicator variables) to minimize the impact of outliers. The proportion of female directors for the full sample had a recorded mean (median) of 6.63% (0.00%) which is lower than the recorded mean value recorded by () of 8.97%. While () focused on a sample of ASX top 500 firms with a relatively higher female representation on corporate boards, our sample included some non-ASX top 500 firms with a relatively lower female representation on corporate boards. Nonetheless, the trend of female representation has been increasing over the period for the sample of this study which is consistent with findings of prior studies (; ). Furthermore, profit-making firms recorded a higher mean value for percentage of female directors on the board (10.04%) as compared to loss-making firms with recorded mean values of 4.77%. Nonetheless, both sub-samples showed an increasing trend in the percentage of female directors over the period. Figure 1 shows the yearly trend over time for our full sample and sub-samples.

Table 3.

Summary statistics.

Figure 1.

Gender Diversity from 2008 to 2019. Source: Data from Annual Report.

Human capital efficiency on the other hand had a mean (median) value of −1.29 (0.04) which is indicative of unfavorable level of human capital efficiency for the firms in our sample on average. While the highest mean value of −0.30 was record in 2008, the lowest mean value of −2.17 was recorded in 2013. The negative values for human capital efficiency are indicative of the dominance of firms with negative net income in sample of this study.7 However, based on our sub-samples, while the loss-making firms recorded a mean value of −4.03, the profit-making firms recorded a mean value of 3.72 for the sample period. This outcome is consistent with our expectation that profitable firms with more resources for investment in human capital would be associated with higher human capital efficiency (see ). Figure 2 shows the yearly mixed trend in human capital efficiency from 2008 to 2019.

Figure 2.

Human Capital Efficiency from 2008 to 2019. Source: Data from Refinitiv Eikon DataStream.

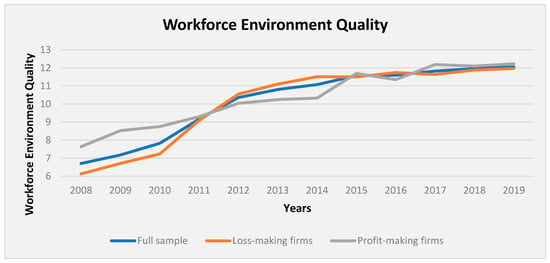

Figure 3 shows the yearly mean values for workforce environment quality from 2008 to 2019. Workforce environment quality increased from 6.71 in 2008 to 12.06 in 2019 on average. This is indicative of the continual investment by listed firms in Australia to improve the working conditions of their employees. Between 2011 and 2016, loss-making firms in the sample recorded higher mean values for workforce environment quality relative to their profit-making counterparts. Figure 3 below shows the workforce environment quality.

Figure 3.

Workforce Environment Quality from 2008 to 2019. Source: Data from Refinitiv Eikon ESG.

Regarding other variables, the mean value recorded for board independence (Bind) is 48.72%, a mean value of 9.09 for board meeting attendance (Bmeet), a mean value of 0.09 for CEO duality (Ceod), and the mean value recorded for firm age (Fage) is 22.68 for our full sample. The loss-making firms of our sample are made up of relatively younger and smaller firms with a smaller board size and a higher level of CEO duality relative to the profit-making firms. Table 3 below presents the descriptive statistics for all the variables of the study.

See Appendix B for variable definitions. All variables, excluding indicator variables and firm size measured as the natural logarithm of total sales and firm age measured as the log of 1 plus the years of the firm since its inception, are Winsorized at the 1 and 99 percentiles. Standard errors are robust and clustered by firm and year.

4.2. Females on Boards and Human Capital Efficiency

Hypothesis 1a suggests that female representation on corporate boards is positively associated with human capital efficiency among listed Australian firms. Table 4, column 1 reports the regression results for H1a. There is a positive and significant relationship between the proportion of female directors and human capital efficiency. The coefficient of 2.501 on PFD in column 1 (t-statistic = 2.34) suggests that there is 22.04 times (2.501/0.1135) of standard deviation of human capital efficiency for the presence of female directors on corporate boards. This outcome indicates the economic significance of PFD for human capital efficiency. It could be said that the value-enhancing proposition of board gender diversity under agency theory extends to the proper management of human capital among listed Australian firms. Columns 2 and 3 of Table 4 present the regression results for hypothesis 1b which examines the relationship between female representation on corporate boards and human capital efficiency among profit-making firms and loss-making firms. For loss-making firms, there is a positive and significant relationship between the proportion of female directors and human capital efficiency. The coefficient of 3.877 on PFD in column 2 (t-statistic = 2.26) suggests that there is 38.23 times (3.877/0.1014)8 of the standard deviation of human capital efficiency for the presence of female directors on corporate boards for loss-making firms. This outcome indicates the economic significance of PFD for human capital efficiency among loss-making firms. On the other hand, the relationship between female representation on corporate boards and human capital efficiency is insignificant for profit-making firms. Impliedly, board gender diversity serves as a substituting mechanism for human capital management in the absence of a potentially sufficient level of investment for human capital efficiency. Meanwhile, in the presence of a potentially sufficient level of investment for human capital, board gender diversity is irrelevant for human capital efficiency.

Table 4.

Females on boards and human capital efficiency.

Consistent with the learning curve argument, firm age is positively related to human capital efficiency but statistically insignificant. Return on assets is also positively and insignificantly related to human capital efficiency. Firm size, leverage, board independence, and CEO duality (Ceod) variables are positively and significantly associated with human capital efficiency. On the other hand, financial risk (ZFS) is negative and significantly related to human capital efficiency.

4.3. Moderating Effect of Workforce Environment Quality

Hypothesis 2a suggests that the relationship between female representation on corporate boards and human capital efficiency is moderated by workforce environment quality. Table 5 column 1 reports the regression results for H2a. The relationship between female representation on corporate boards and human capital efficiency is moderated by the workforce environment quality. The coefficient of the interaction term (PFD×WFEQ) is positive and marginally significant. Impliedly, our finding marginally supports the resource-based view of workforce environment for the relationship between board diversity and human capital efficiency for our full sample. With a regression coefficient of 3.342 and standard deviation of 0.0878, the moderating effect of workforce environment quality is economically significant as the coefficient is 37.59 times (3.342/0.0889) of the standard deviation of human capital efficiency for the presence of the interaction term, PFD×WFEQ. Furthermore, the moderating effect of workforce environment quality is positive and significant for loss-making firms which is also economically significant as the coefficient is 81.93 times (5.784/0.0706) of standard deviation of human capital efficiency for the presence of the interaction term, PFD×WFEQ. On the contrary, the moderating effect of workforce environment quality is negative and insignificant for profit-making firms.

Table 5.

Moderating effect of workforce environment quality.

The results for the control variables are consistent with our previous findings.

4.4. Robustness Tests and Further Analysis

4.4.1. Robustness Tests

In this section, we report the results of numerous sensitivity tests performed. First, we adopted three approaches to address the possible endogenous relationships between board gender diversity and human capital efficiency: the Heckman two-stage model; System Generalized Method of Moments (GMM) estimation, and the propensity score matching model.

Regarding the application of the Heckman two-step model, we included a variable that satisfied the exclusion restriction in the first-stage model as an additional independent variable; mean industry proportion of female executive directors (MIPFEXD). Additionally, we included all the control variables of our main model in our first-stage model. Then, we used the Inverse Mills Ratio (IMR) estimated from the first-stage model as an additional independent variable in Equation (1). Our first-stage probit model is specified below:

where Pr(FD) is the probability of the presence of female directors on corporate boards.

Pr(FD)i,t = α + α1 × MIPFEXDit + Ʃα2 × Controlsit + year + industry + ηi + εi,t,

Table 6 presents the results of the Heckman two-step model. In column 1, MIPFEXD is positively and significantly (p < 0.01) associated with Pr(FD), consistent with our expectations. All the remaining variables, board meetings, and return on assets, are also significantly related to Pr(FD). In the second stage for the PFD test (columns 2 and 3), the coefficient of PFD remains positive and significant (coefficient = 2.501, p-value < 0.05; coefficient = 3.786, p-value < 0.05), consistent with the presence of female directors on corporate boards. Furthermore, the second stage for the PDF×WFEQ test (columns 5 and 6) remain positive and significant (coefficient = 3.115, p-value < 0.10; coefficient = 5.348, p-value < 0.05), consistent with the moderating effect of the interaction term.

Table 6.

Heckman Two-Stage Analysis.

Furthermore, Table 7 presents the results of the propensity score matching (PSM) model. The PSM model focuses on the matched sample of firms with female directors and those without female directors for firm-year observations for the period of our study. We identify our treatment firms as the firm-year observations with female directors for our sample and firm-year observations without female directors as our control sample. We match the two subsamples based on the following characteristics: firm age, firm size, leverage, board size, board independence number of board meetings and CEO duality to ensure that our treatment firms and control firms are not statistically different from each other in terms of these key firm characteristics. We use the propensity scores obtained from PSM model with a caliper of 0.05 without replacement to derive our paired sample. From column 1 of Table 7, the relationship between PFD and HCE is positive and statistically significant (coefficient = 0.505, t-statistic = 2.22). This result is consistent with our main findings.

Table 7.

Propensity Score Matching (PSM) Model—Paired Sample.

Furthermore, we employed a generalized method of moments to address potential issues of endogeneity in our data set. Table 8 presents system GMM. The system GMM estimation provides powerful instrument that address unobserved heterogeneity and simultaneity and helps in minimizing any endogeneity concerns (). Furthermore, we followed ()’s use of computed bias estimators in the first-order condition to minimize the potential effects of Nickell bias. Consistent with the arguments of () and (), we estimated our system GMM model as follows:

where we included the first lag of the dependent variable and further used the lags (the second to fourth lags) of dependent and independent variables as instruments for the first differences equation and levels equation. We ensured validity for our model specification with the Arellano–Bond test and Hansen test. The results are reported in Table 8. The results of system GMM model is consistent with that of the main analysis. Impliedly, our results are not biased by issues of endogeneity.

Table 8.

Two-Step System Generalized Method of Moments.

4.4.2. Sensitivity Analysis

We re-estimated Equation (1) using two alternative measures of gender diversity to test the sensitivity of our results to the measurement approach used in this study. In line with (), we employed the Blau index (Blau) and the number of female directors (NFD). We calculated Blau as , where i = (1,2) number of gender categories which is 2, and Pi is the proportion of board members in each category. Table 9 and Table 10 present the results of the sensitivity tests undertaken. In columns 1 and 2 of Table 9, the relationship between board gender diversity and human capital efficiency is positive and significant (coefficient = 0.431, p-value < 0.05 for full sample; coefficient = 0.682, p-value < 0.05 for loss-making firms) using number of females. For profit-making firms, we observed a negative and marginally significant relationship between board gender diversity and human capital efficiency. These results indicate that our main findings are not sensitive to our choice of proxy for board gender diversity.

Table 9.

Sensitivity Analysis—Number of female directors.

Table 10.

Sensitivity Analysis—Blau Index.

Additionally, we recorded a consistent result using the Blau index as our measure for board gender diversity. Columns 1 and 2 of Table 10 show a positive and significant relationship between board gender diversity and human capital efficiency.

Similarly, we re-ran Equation (2) using two alternative measures of gender diversity to test the sensitivity of our results to the measurement approach used in the study. Table 11 and Table 12 present the results of the sensitivity tests undertaken. In columns 1 and 2 of Table 11, the moderating effect of workforce environment quality is positive and significant (coefficient = 0.515, p-value < 0.05 for full sample; coefficient = 1.364, p-value < 0.01 for loss-making firms) using the number of females. For profit-making firms, we observed an insignificant relationship between board gender diversity and human capital efficiency. These results indicate that our main findings are not sensitive to our choice of proxy for board gender diversity.

Table 11.

Sensitivity Analysis—Interaction term with number of females.

Table 12.

Sensitivity Analysis—Interaction term with Blau index.

In the context of the use of the Blau index, we also recorded a positive and significant relationship for the interaction effect of board gender diversity and workforce environment quality on human capital efficiency. In columns 1 and 2 of Table 12, the moderating effect of workforce environment quality is positive and significant (coefficient = 2.521, p-value < 0.05 for full sample; coefficient = 4.043, p-value < 0.05 for loss-making firms). For profit-making firms, we observed a negative and insignificant relationship between board gender diversity and human capital efficiency. These results indicate that our main findings are not sensitive to our choice of proxy for board gender diversity.

5. Conclusions

The significance of human capital in strengthening firm value and establishing a sustainable competitive advantage is increasing with each passing day. Therefore, it is important to consider the pertinent factors that influence a firm’s human capital efficiency. Moreover, it is widely recognized that having a supportive and motivating workplace environment is instrumental in fostering employee cooperation. Based on the prior evidence suggesting that gender diversity on boards serves as an effective corporate governance attribute, we examined the association between gender diversity on boards and human capital efficiency. Our study also highlighted the moderating effect of workforce environment on this association as well as the implication of financial constraints.

Using data from listed Australian firms from 2008 to 2019, the empirical results reveal a significant and positive relation between gender diversity and human capital efficiency and highlight that the positive relationship is more pronounced for loss-making firms as against profit-making firms. Further analysis reveals that this positive relationship between the board gender diversity and human capital efficiency is stronger in the presence of increasing workforce environment quality. It can be said that the concern of female directors for the environment and social outcome also extends to the well-being of human capital, and this concern does not diminish even in periods of financial difficulties.

We acknowledge that endogeneity is a major concern in our setting. We addressed this concern in multiple ways. First, we used the Heckman two-stage model and further employed the system GMM model. We also used the PSM model. These robustness tests together help to rule out the potential problem of endogeneity and omitted variables.

Like any empirical research, our study has some limitations. Specifically, the findings of our study are limited by the potential measurement errors inherent in the proxy used to measure human capital efficiency. Moreover, we were unable to incorporate the critical mass theory into our analysis of board gender diversity. Additionally, it is important to note that the findings of our study are context-specific and may not be readily generalized. Nonetheless, we believe our evidence on the role of board gender diversity as an effective corporate governance mechanism would be an element of interest to regulators, corporations, and other relevant stakeholders as it provides insight into gender diversity and the social outcome of firms.

Since our study focuses on the listed firms, which are generally considered more transparent, the findings may be difficult to apply in other settings, such as non-listed firms. Hence, future research could investigate the impact of board gender diversity on human capital efficiency in non-listed firms.

Author Contributions

Conceptualization, S.M. and V.O.; methodology, S.M. and V.O.; formal analysis, S.M. and V.O.; writing—original draft preparation, S.M. and V.O.; writing—review and editing, S.M. and V.O.; visualization, S.M. and V.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data are available from the specific databases cited in the text.

Acknowledgments

We thank delegates at the Financial Markets and Corporate Governance (FMCG) and Accounting and Finance Association of Australia and New Zealand (AFAANZ) conferences 2022 for their helpful comments and suggestions.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Workforce Environment

| No. | Compliance (%) | |

| 1 | Does the company have a policy to drive diversity and equal opportunity? | 61.19% |

| 2 | Has the company set targets or objectives to be achieved on diversity and equal opportunity? | 41.93% |

| 3 | Does the company claim to provide flexible working hours or working hours that promote a work–life balance? | 22.78% |

| 4 | Does the company have a policy to improve employee health and safety within the company and its supply chain? | 74.11% |

| 5 | Does the company have an employee health and safety team? | 57.44% |

| 6 | Does the company have health and safety management systems in place like the OHSAS 18001 (Occupational Health and Safety Management System)? | 50.74% |

| 7 | Does the company claim to provide day care services for its employees? | 5.37% |

| 8 | Does the company report on policies or programs on HIV/AIDS for the workplace or beyond? | 5.14% |

| 9 | Does the company have a policy to improve the skills training of its employees? | 34.93% |

| 10 | Does the company train its executives or key employees on health and safety? | 61.19% |

| 11 | Does the company train its executives or key employees on employee health and safety in the supply chain? | 42.33% |

| 12 | Does the company have a policy to improve the career development paths of its employees? | 30.96% |

| 13 | Does the company claim to favor promotion from within? | 20.41% |

| 14 | Does the company claim to provide regular staff and business management training for its managers? | 34.19% |

| 15 | Does the company provide training in environmental, social, or governance factors for its suppliers? | 28.81% |

| 16 | Does the company have a policy to support the skills training or career development of its employees? | 47.89% |

| 17 | Is the company under the spotlight of the media because of a controversy linked to the company’s employees, contractors or suppliers due to wage, layoff disputes or working conditions? | 98.41% |

| 18 | Has there has been a strike or an industrial dispute that led to lost working days? | 99.00% |

| 19 | Has an important executive management team member or a key team member announced a voluntary departure (other than for retirement) or has been ousted? | 97.89% |

| 20 | Total number of announced lay-offs by the company divided by the total number of employees. | 99.04% |

Appendix B. Definitions of Variables

| Variable | Definition |

| Dependent variable | |

| HCE | Value added divided by total salary and wages, where value added is the sum of net income, salary and wages, interest expense, tax and depreciation and amortization |

| Test variables | |

| PFD | Measures as percentage of female directors to directors on board |

| NFD | Total number of females on board. |

| Blau | , where i = (1,2) number of gender categories which is 2, and Pi is the proportions of board members in each category |

| PFD×WFEQ | An interaction term for PFD and WFEQ |

| MIPFEXD | Industry mean of the proportion of female executive directors |

| Moderating variable | |

| WFEQ | The sum of workforce environment items for the year (see Appendix A for details) |

| Control variables | |

| Fage | Log of one plus number of years since the firm’s inception |

| Fsize | Natural logarithm of total sales |

| Lev | Long-term debt to total assets for the year |

| ZFS | () Financial Score |

| Bsize | Total number of directors on board |

| Bmeet | Number of board meetings attended by the board annually |

| Bind | The percentage of independent directors to total directors |

| Ceod | Dummy variable equals 1 if CEO is also chairman of the board, otherwise 0 |

| IMR | Inverse Mills ratio |

| Roa | Net income divided by the year-end total assets |

| Year | A dummy variable for the years 2008–2019 |

| Industry | A dummy variable to control for industry-specific effects |

Notes

| 1 | Effective from 9 November 2020, the US Securities and Exchange Commission (SEC) requires public companies to make disclosures on their human capital “to the extent such disclosures would be material to an understanding of the [company’s business, including] measures or objectives that address the attraction, development, and retention of personnel”. |

| 2 | In August 2020, the US SEC adopted rule amendments to modernize financial reporting in the country. As per this, from November 2020, the US listed companies are required to provide human capital disclosures in their annual report (). |

| 3 | A total of 71% of Australian workers consider workplace environment to be one of the most important non-remunerative aspects when considering a new job (). |

| 4 | Communal behavior is described as caring, empathetic, and nurturing whereas agentic behavior includes self-sufficiency, dominance, aggression and task-orientation (). |

| 5 | See Appendix A for details. |

| 6 | Zmijewski Financial Score (ZFS) is constructed based on an index calculation incorporating multiple financial ratios representing firm profitability, leverage, and liquidity, as follows: ZFS = −4.336 − 4.513 (net income/total assets) + 5.679 (total debt/total assets) − 0.004 (current assets/current liabilities). A higher score indicates the firm is experiencing a greater level of financial distress severity. |

| 7 | A total of 64.7% of the firm-year observations have negative net income for the sample period. |

| 8 | The ratio of the regression coefficient to the standard deviation of gender diversity. |

References

- Adams, Renée B., and Daniel Ferreira. 2009. Women in the boardroom and their impact on governance and performance. Journal of Financial Economy 94: 291–309. [Google Scholar] [CrossRef]

- Agyemang-Mintah, Peter, and Hannu Schadewitz. 2019. Gender diversity and firm value: Evidence from UK financial institutions. International Journal of Accounting and Information Management 27: 2–26. [Google Scholar] [CrossRef]

- Ahmed, Ammad, Reza M. Monem, Deborah Delaney, and Chew Ng. 2017. Gender diversity in corporate boards and continuous disclosure: Evidence from Australia. Journal of Contemporary Accounting and Economics 13: 89–107. [Google Scholar] [CrossRef]

- Barney, Jay B., and Delwyn N. Clark. 2007. Resource-Based Theory: Creating and Sustaining Competitive Advantage. Oxford: Oxford University Press. [Google Scholar]

- Bear, Stephen, Noushi Rahman, and Corinne Post. 2010. The impact of diversity and gender composition on corporate social responsibility and firm reputation. Journal of Business Ethics 97: 207–21. [Google Scholar] [CrossRef]

- Becker, Gary S. 1964. Human Capital: A Theoretical and Empirical Analysis, with Special Reference to Education. New York: National Bureau of Economic Research: Distributed by Columbia University Press. [Google Scholar]

- Becker, Gary S. 1992. Human capital and the economy. Proceedings of the American Philosophical Society 136: 85–92. [Google Scholar]

- Becker, Gary S. 2002. The age of human capital. In Education in the Twenty-First Century. Edited by Edward P. Lazear. Palo Alto: Hoover Institution Press, pp. 3–8. [Google Scholar]

- Becker, Gary S. 2009. Human Capital: A Theoretical and Empirical Analysis, with Special Reference to Education, 3rd ed. Chicago: University of Chicago Press. [Google Scholar]

- Bildirici, Melike, Seçkin Sunal, Elcin Aykac Alp, and Melda Orcan. 2005. Determinants of human capital theory, growth and brain drain: An econometric analysis for 77 countries. Applied Econometrics and International Development 5: 109–40. [Google Scholar]

- Blau, Peter Michael. 1977. Inequality and Heterogeneity: A Primitive Theory of Social Structure. New York: Free Press. [Google Scholar]

- Bloom, Nick, Tobias Kretschmer, and John Van Reenen. 2011. Are family-friendly workplace practices a valuable firm resource? Strategic Management Journal 32: 343–67. [Google Scholar] [CrossRef]

- Brahma, Sanjukta, Chioma Nwafor, and Agyenim Boateng. 2021. Board gender diversity and firm performance: The UK evidence. International Journal of Finance & Economics 26: 5704–19. [Google Scholar]

- Brown, David A.H., and Debra L. Brown. 2001. Canadian Directorship Practices 2001. Ottawa: The Conference Board of Canada. [Google Scholar]

- Burud, Sandra, and Marie Tumolo. 2004. Leveraging the New Human Capital: Adaptive Strategies, Results Achieved, and Stories of Transformation. Boston: Nicolas Brealey America. [Google Scholar]

- Carli, Linda L. 2001. Gender and social influence. Journal of Social Issues 57: 725–41. [Google Scholar] [CrossRef]

- Chang, Chia-Hua, and Dung Nguyen-Van. 2021. Human capital and firm Innovation: New evidence from Asean countries. Romanian Journal for Economic Forecasting 3: 52–71. [Google Scholar]

- Chen, Tsung-Kang, Yan-Shing Chen, and Hsiao-Lin Yang. 2019. Employee treatment and its implications for bondholders. European Financial Management 25: 1047–79. [Google Scholar] [CrossRef]

- Crook, T. Russell, Samuel Y. Todd, James G. Combs, David J. Woehr, and David J. Ketchen, Jr. 2011. Does human capital matter? A meta-analysis of the relationship between human capital and firm performance. Journal of Applied Psychology 96: 443–56. [Google Scholar] [CrossRef] [PubMed]

- Dalal, Reeshad S., Michael Baysinger, Bradley J. Brummel, and James M. LeBreton. 2012. The relative importance of employee engagement, other job attitudes, and trait affect as predictors of job performance. Journal of Applied Psychology 42: 295–325. [Google Scholar] [CrossRef]

- Dalton, Dan R., Catherine M. Daily, Alan E. Ellstrand, and Jonathan L. Johnson. 1998. Meta-analytic review of board composition, leadership structure and financial performance. Strategic Management Journal 19: 269–90. [Google Scholar] [CrossRef]

- Dhal, Sarita, Dhyanadipta Panda, and Nishi Kanta Mishra. 2021. Challenges on the workplace due to changing nature of workforce management: An analysis on the future of work. Parikalpana: KIIT Journal of Management 17: 87–94. [Google Scholar] [CrossRef]

- Eagly, Alice H., and Blair T. Johnson. 1990. Gender and leadership style: A meta-analysis. Psychological Bulletin 108: 233–56. [Google Scholar] [CrossRef]

- Eagly, Alice H., Mary C. Johannesen-Schmidt, and Marloes L. Van Engen. 2003. Transformational, transactional, and laissez-faire leadership styles: A meta-analysis comparing women and men. Psychological Bulletin 129: 569–91. [Google Scholar] [CrossRef]

- Edmans, Alex. 2011. Does the stock market fully value intangibles? Employee satisfaction and equity prices. Journal of Financial Economics 101: 621–40. [Google Scholar] [CrossRef]

- Eisenhardt, Kathleen M. 1989. Agency theory: An assessment and review. Academy of Management Review 14: 57–74. [Google Scholar] [CrossRef]

- Fehr, Ernst, and Simon Gächter. 2000. Fairness and retaliation: The economics of reciprocity. Journal of Economic Perspectives 14: 159–81. [Google Scholar] [CrossRef]

- Fields, Thomas D., Thomas Z. Lys, and Linda Vincent. 2001. Empirical research on accounting choice. Journal of Accounting and Economics 31: 255–307. [Google Scholar] [CrossRef]

- Gangi, Francesco, Lucia Michela Daniele, Nicola Varrone, Francesca Vicentini, and Maria Coscia. 2021. Equity mutual funds’ interest in the environmental, social and governance policies of target firms: Does gender diversity in management teams matter? Corporate Social Responsibility and Environmental Management 28: 1018–31. [Google Scholar] [CrossRef]

- Goldin, Claudia D. 2016. Human Capital. In Handbook of Cliometrics, 1st ed. Edited by Claude Diebolt and Michael Haupert. Heidelberg: Springer, pp. 55–86. [Google Scholar]

- Habib, Ahsan, Mabel D. Costa, Hedy J. Huang, and Xuan S. Sun. 2021. Financial Constraints and workforce environment: An international investigation. International Review of Finance 21: 1056–67. [Google Scholar] [CrossRef]

- Hasnaoui, Jamila Abaidi, Syed Kumail Abbas Rizvi, Krishna Reddy, Nawazish Mirza, and Bushra Naqvi. 2021. Human capital efficiency, performance, market, and volatility timing of Asian equity funds during COVID-19 outbreak. Journal of Asset Management 22: 360–75. [Google Scholar] [CrossRef]

- Hausman, Jerry A., and Maxim Pinkovskiy. 2017. Estimating Dynamic Panel Models: Backing out the Nickell Bias. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3066691 (accessed on 10 March 2023).

- Hom, Peter W., Thomas W. Lee, Jason D. Shaw, and John P. Hausknecht. 2017. One hundred years of employee turnover theory and research. Journal of Applied Psychology 102: 530–45. [Google Scholar] [CrossRef] [PubMed]

- Hurst, David K., James C. Rush, and Roderick E. White. 1989. Top management teams and organizational renewal. Strategic Management Journal 10: 87–105. [Google Scholar] [CrossRef]

- Iazzolino, Gianpaolo, and Domenico Laise. 2013. Value added intellectual coefficient (VAIC): A methodological and critical review. Journal of Intellectual Capital 14: 547–63. [Google Scholar] [CrossRef]

- Jafari-Sadeghi, Vahid, Salman Kimiagari, and Paolo Pietro Biancone. 2019. Level of education and knowledge, foresight competency and international entrepreneurship: A study of human capital determinants in the European countries. European Business Review 32: 46–68. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior agency costs and ownership structure. Journal of Financial Economics 3: 306–60. [Google Scholar] [CrossRef]

- Judge, William Q., and Carl P. Zeithaml. 1992. Institutional and Strategic Choice Perspectives on Board Involvement in the Strategic Decision Process. Academy of Management Journal 35: 766–94. [Google Scholar] [CrossRef]

- Jurkus, Anthony F., Jung Chul Park, and Lorraine S. Woodard. 2011. Women in top management and agency costs. Journal of Business Research 64: 180–86. [Google Scholar] [CrossRef]

- Khan, Habib-Uz-Zaman. 2010. The effect of corporate governance elements on corporate social responsibility (CSR) reporting: Empirical evidence from private commercial banks of Bangladesh. International Journal of Law and Management 52: 82–109. [Google Scholar] [CrossRef]

- Kim, Daehyun, and Laura T. Starks. 2016. Gender diversity on corporate boards: Do women contribute unique skills? American Economic Review 106: 267–71. [Google Scholar] [CrossRef]

- Klemash, Steve, Bridget M. Neill, and Jamie C. Smith. 2019. How and Why Human Capital Disclosures Are Evolving. Harvard Law Forum on Corporate Governance. Available online: https://corpgov.law.harvard.edu/2019/11/15/how-and-why-human-capital-disclosures-are-evolving/ (accessed on 11 February 2022).

- Koys, Daniel J., and Thomas A. DeCotiis. 2015. Does a good workforce influence restaurant performance or does good restaurant performance influence the workforce? Journal of Human Resources in Hospitality & Tourism 14: 339–56. [Google Scholar]

- Kraaijenbrink, Jeroen, J-C. Spender, and Aard J. Groen. 2010. The resource-based view: A review and assessment of its critiques. Journal of Management 36: 349–72. [Google Scholar] [CrossRef]

- Kucharcikova, Alzbeta, Lubica Konusikova, and Emese Tokarcikova. 2016. Approaches to the quantification of the human capital efficiency in enterprises. Communications-Scientific Letters of the University of Zilina 18: 49–54. [Google Scholar] [CrossRef]

- Kundu, Subhash C., and Kusum Lata. 2017. Effects of supportive work environment on employee retention: Mediating role of organizational engagement. International Journal of Organizational Analysis 25: 703–22. [Google Scholar] [CrossRef]

- Lauenstein, Milton, Ahmad Tashakori, and William Boulton. 1983. A look at the board’s role in planning. Journal of Business Strategy 3: 64–70. [Google Scholar] [CrossRef]

- Levine, David L. 1992. Public policy implications of imperfections in the market for worker participation. Economic and Industrial Democracy 13: 183–206. [Google Scholar] [CrossRef]

- Liu, Xiangmin, Danielle D. Van Jaarsveld, Rosemary Batt, and Ann C. Frost. 2014. The influence of capital structure on strategic human capital: Evidence from US and Canadian firms. Journal of Management 40: 422–48. [Google Scholar] [CrossRef]

- Low, Jonathan, Pamela Kalafut, and Pam Cohen Kalafut. 2002. Invisible Advantage: How Intangibles are Driving Business Performance. New York: Perseus Publishing. [Google Scholar]

- Mahsud, Rubina, Gary Yukl, and Gregory E. Prussia. 2011. Human capital, efficiency, and innovative adaptation as strategic determinants of firm performance. Journal of Leadership & Organizational Studies 18: 229–46. [Google Scholar]

- Marinova, Joana, Janneke Plantenga, and Chantal Remery. 2016. Gender diversity and firm performance: Evidence from Dutch and Danish boardrooms. The International Journal of Human Resource Management 27: 1777–790. [Google Scholar] [CrossRef]

- Mensi-Klarbach, Heike, Cathrine Seierstad, and Patricia Gabaldon. 2017. Setting the scene: Women on boards in countries with quota regulations. In Gender Diversity in the Boardroom. Cham: Palgrave Macmillan, pp. 1–10. [Google Scholar]

- Milliken, Frances J., and Luis L. Martins. 1996. Searching for common threads: Understanding the multiple effects of diversity in organizational groups. The Academy of Management Review 21: 402–33. [Google Scholar] [CrossRef]

- Nadeem, Muhammad, John Dumay, and Maurizio Massaro. 2019a. If you can measure it, you can manage it: A case of intellectual capital. Australian Accounting Review 29: 395–407. [Google Scholar] [CrossRef]

- Nadeem, Muhammad, Muhammad Bilal Farooq, and Ammad Ahmed. 2019b. Does female representation on corporate boards improve intellectual efficiency? Journal of Intellectual Capital 20: 680–700. [Google Scholar] [CrossRef]

- Pasban, Mohammad, and Sadegheh Hosseinzadeh Nojedeh. 2016. A review of the role of human capital in the organization. Procedia-Social and Behavioral Sciences 230: 249–53. [Google Scholar] [CrossRef]

- Pfau, Bruce N., and Ira T. Kay. 2002. The Human Capital Edge: 21 People Management Practices Your Company Must Implement (or Avoid) to Maximize Shareholder Value. New York: McGraw-Hill. [Google Scholar]

- Press Release Desk. 2020. Work Environment the Main Reason Australian Workers Would Consider Quitting Their Current Role, Says New Robert Half Research. March 17. Available online: https://busycontinent.com/work-environment-main-reason-australian-workers-would-consider-quitting-their-current-role/ (accessed on 30 November 2021).

- Pulic, Ante. 2000. VAIC™–an accounting tool for IC management. International Journal of Technology Management 20: 702–14. [Google Scholar] [CrossRef]

- Quiggin, John. 1999. Human capital theory and education policy in Australia. Australian Economic Review 32: 130–44. [Google Scholar] [CrossRef]

- Rastogi, Charu, and Sanjaykumar M. Gaikwad. 2017. A study on determinants of human capital development in BRICS nations. FIIB Business Review 6: 38–50. [Google Scholar] [CrossRef]

- Ruderman, Marian N., Patricia J. Ohlott, Kate Panzer, and Sara N. King. 2002. Benefits of multiple roles for managerial women. Academy of Management Journal 45: 369–86. [Google Scholar] [CrossRef]

- Rudman, Laurie A., and Peter Glick. 2002. Prescriptive gender stereotypes and backlash toward agentic women. Journal of Social Issues 57: 743–62. [Google Scholar] [CrossRef]

- Scafarto, Vincenzo, Federica Ricci, and Francesco Scafarto. 2016. Intellectual capital and firm performance in the global agribusiness industry: The moderating role of human capital. Journal of Intellectual Capital 17: 530–52. [Google Scholar] [CrossRef]

- Son, Hyun H. 2010. Human Capital Development. Asian Development Bank Economics Working Paper Series 225; Amsterdam: Elsevier. [Google Scholar]

- Stiles, Philip, and Somboon Kulvisaechana. 2003. Human Capital and Performance: A Literature Review. Cambridge: University of Cambridge. [Google Scholar]

- Sun, Xuan Sean, Ahsan Habib, and Md Borhan Uddin Bhuiyan. 2020. Workforce environment and audit fees: International evidence. Journal of Contemporary Accounting & Economics 16: 100182. [Google Scholar]

- The Global Recruiter (GR). 2020. Work Environment the Main Reason Australian Workers Would Consider Quitting Their Current Role. March 15. Available online: https://www.theglobalrecruiter.com/work-environment-the-main-reason-australian-workers-would-consider-quitting-their-current-role/ (accessed on 1 December 2021).

- Tran, Ngoc Phu, and Duc Hong Vo. 2020. Human capital efficiency and firm performance across sectors in an emerging market. Cogent Business & Management 7: 1738832. [Google Scholar]

- U.S. Securities and Exchange Commission (US SEC). 2020. SEC Adopts Rule Amendments to Modernize Disclosures of Business Legal Proceedings, and Risk Factors under Regulation S-K. August 26. Available online: https://www.sec.gov/news/press-release/2020-192 (accessed on 10 March 2023).

- Vomberg, Arnd, Christian Homburg, and Torsten Bornemann. 2015. Talented people and strong brands: The contribution of human capital and brand equity to firm value. Strategic Management Journal 36: 2122–31. [Google Scholar] [CrossRef]

- Wintoki, M. Babajide, James S. Linck, and Jeffry M. Netter. 2012. Endogeneity and the dynamics of internal corporate governance. Journal of Financial Economics 105: 581–606. [Google Scholar] [CrossRef]

- Wood, Wendy, Darlene Polek, and Cheryl Aiken. 1985. Sex differences in group task performance. Journal of Personality and Social Psychology 48: 63–71. [Google Scholar] [CrossRef]

- Yarovaya, Larisa, Nawazish Mirza, Jamila Abaidi, and Amir Hasnaoui. 2021. Human capital efficiency and equity funds’ performance during the COVID-19 pandemic. International Review of Economics and Finance 71: 584–91. [Google Scholar] [CrossRef]

- Zmijewski, Mark E. 1984. Methodological issues related to the estimation of financial distress prediction models. Journal of Accounting Research 22: 59–82. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).