Abstract

This study aims to test financial literacy and credit conditions in determining formal credit access to determine the performance of MSMEs. This research includes the type of associative research that is accompanied by hypothesis testing. This research was conducted on MSMEs of as many as 324 creative industry players in four cities in East Java (Mojokerto, Pasuruan, Gresik, and Sidoarjo) with a sample size of 100 actors who had accessed formal credit using the stratified random sampling method for data collection. The results of Smart PLS analysis show that financial literacy and credit terms directly and significantly affect access to formal credit and MSME performance; formal credit access directly and significantly affects MSME performance. Likewise, financial literacy and credit terms indirectly affect the performance of MSMEs. These results mean that financial literacy and credit terms have a strategic role in explaining why access to formal credit is growing and is attracting MSMEs to strengthen capital to improve performance.

JEL Classification:

A2; G2; I2*

1. Introduction

Micro, small, and medium enterprises (MSMEs) are important assets for economic sustainability in Indonesia. The sector is essential in encouraging economic growth and creating new jobs for the Indonesian population (Susan 2020). The contribution of MSMEs is quite large, especially as a provider of employment and an increase in regional income (Irman et al. 2021). The success of MSMEs in Indonesia is reflected in their performance. Financing from financial institutions is very much needed to improve the performance of MSMEs and government support in access to additional capital (Sriary and Nyoman 2020). The role played by financial institutions in the economic growth and development of economies is widely acknowledged and cannot be overemphasized. Financial institutions contribute significantly to employment and poverty alleviation through job creation and economic growth (Baidoo et al. 2020). Based on data from the East Java Provincial Economic Report (LPP) by Bank Indonesia (BI), credit for micro, small, and medium enterprises (MSMEs) in East Java in the second quarter of 2021 experienced an increase of 3.95 percent. The positive growth trend in MSME lending was supported by growth in investigation credit and working capital credit for MSMEs.

The COVID-19 vaccination, which has been running since the beginning of this year, has also boosted the perception of business actors, which has implications for the broader opening of productive economic sectors with health protocols in the second quarter of 2021, including the MSME sector. According to him, the share of MSME loans to total loans in East Java also continued to increase, which grew 29.42 percent in the second quarter. Meanwhile, in the first quarter, the growth was 29.03 percent. In order to increase the ease of financing for MSMEs, the government is expanding MSME financing facilities in Indonesia with the People’s Business Credit program. People’s Business Credit aims to facilitate the capital of MSME actors, but it has not yet been fully realized. By November 2021, the distribution of KUR was only Rp. 34.1 trillion, with Bank Jatim targeting an increase of 5–6 percent; however, not all MSMEs noticed the distribution of KUR. The lack of credit disbursement experienced by small businesses was driven by the limited access to credit. According to Nkundabanyanga et al. (2014), the one thing that affects credit access by small businesses is the credit terms offered by formal credit providers. The credit terms include the loan repayment period, guarantee, and interest rate. Small businesses are hesitant to access credit when they do not understand why a guarantee should be a loan condition. Meanwhile, formal credit providers prefer borrowers who can provide guarantees.

Technological developments occur rapidly along with the industry 4.0 trend. Current technologies have successfully influenced people’s lifestyles, one of which is a transaction payment mechanism (Foster et al. 2022). Credit markets play essential roles in financial institutions. In developing countries, especially in emerging market countries that are in the process of restructuring industry, it is essential to efficiently identify the reasons for credit constraints to facilitate the economic transaction (Tang and Guo 2017). As economic development proceeds, the need for credit increases. Consequentially, credit institutions have been evolving significantly in recent years (Tang and Guo 2017).

Defining the problem of access to finance poses a significant problem because financial services are highly heterogeneous, including all sorts of savings, payments, insurance, and credit, each of which has unique costs, risks, and production functions (Ibenta 2021). The SME banking model that the banks adopt in emerging nations differs from that of developed nations. The banks in emerging economies mainly follow these two types of SME banking models: “credit-led proposition with low-cost physical distribution “and “payment-led proposition with direct channel distribution”, as they have to maintain a tradeoff between the operating cost and profit (Maiti 2018). In developing countries, a common feature of rural credit markets is the coexistence of formal and informal credit (Tang and Guo 2017).

(Ahmad and Shah 2022) define financial literacy as “a person’s ability to understand and make use of financial concepts”. Financial literacy refers to skills and knowledge that enable individuals to make informed and effective decisions with all their financial resources (Chileshe 2019). Financial literacy is the level of personal expertise in understanding the basics of a financial subject (Nathan et al. 2022). The financial literacy of the entrepreneur plays a crucial role in the relationship between the lender and the borrower (Burchi et al. 2021). The results of the 2019 Financial Services Authority (OJK) survey showed that the level of financial literacy in Indonesia was still low, only reaching 38 percent. The low level of financial literacy poses many challenges, particularly for debt management, savings and credit, and planning for the future. Understanding financial literacy is necessary for MSMEs to avoid financial risk (Irman et al. 2021). Several researchers have studied credit access and its relationship to financial literacy (Nkundabanyanga et al. 2014). In addition, access to credit is also found to be positively correlated with the household head’s education status. Inevitably, obtaining credit from any legitimate financial institution requires paperwork and submission of documents, which may dissuade less educated farmers from approaching the banks (Kumar et al. 2021).

On the other hand, a prior study stated that factors significantly influence credit demand generally are education, group membership, and household size; formal, semi-formal, and non-formal credit sources are education and information on sources of credit (Silong and Gadanakis 2020). Financial regulators are forced to improve the efficiency and quality of financial services in dealing with educated people. This is because financially literate investors pressure financial institutions to offer more appropriately priced and transparent services (Chileshe 2019). A prior study found that a low literacy rate makes MSME financing difficult for the SME finance business (Maiti 2018).

This paper is closely related to the literature on the determinants of MSME formal credit accessibility. A previous study has focused on the role of financial literacy in the performance of MSMEs (Li and Qian 2020). Our paper extends this literature by providing evidence that financial literacy and credit terms affect access to formal credit and performance MSME in Indonesia. This paper also extends to the studies by providing evidence to find the effect of access to formal credit on MSME performance.

2. Hypotheses Development

With the growth in access to credit by MSMEs, in addition to helping stabilize the economy, credit is also beneficial for MSMEs as a safe and sustainable source of funding. MSME performance results from work achieved by individuals in a certain period. It is related to the size of the value or standard of the company where the individual works while simultaneously confirming that performance is the organization’s success in realizing the strategic goals that have been set previously with good behavior. The organization expects that a good performance produced by an MSME will enable it to be stronger and become the backbone of the economy and play an increasingly important role in the national economy.

In recent years, the issue of financial literacy has been hotly debated. Special attention to financial literacy is caused by the government’s desire to have quality residents and good financial intelligence, which will positively impact the economy. Financial literacy is financial knowledge to achieve prosperity (Lusardi and Mitchell 2017). Financial literacy relates to a person’s ability to manage and plan finances. According to the Financial Services Authority (OJK), financial planning is about how to live a simple life according to one’s financial capabilities and prepare for a prosperous future. Ignorance of the importance of financial literacy can result in a lack of access to financial institutions so that sellers of financial products easily influence them, which can hinder the country’s economic development. In everyday life, not everyone has sufficient financial knowledge or is said to be well literate. Several studies have found that the general public’s financial literacy level is still low (Lusardi and Mitchell 2017).

A prior study emphasized that credit terms are standards set by credit provider institutions that debtors must meet. These conditions are used to determine the debtor’s ability to repay credit (Kumar et al. 2021). From the point of view of the credit provider, credit terms are used to assess creditworthiness and as collateral for credit risk that the debtor may not pay off. Credit terms that are too complicated will lead to the debtor being uninterested in applying for a loan from a formal credit provider. This is because MSMEs tend to be hesitant to fulfill credit requirements. After all, they do not understand the relationship between their credit needs and the credit conditions imposed on them. In the context of MSMEs, formal financial institutions are very interested in providing credit to MSME owners who can contribute a portion of the starting capital or provide some sort of collateral worth the credit (Asah et al. 2020). The risk of business failure in MSMEs makes formal credit provider institutions require credit in such a form of risk owned by formal credit providers in providing credit to MSMEs.

2.1. The Effect of Literacy on Access to Formal Credit

Prior research shows that education level is one factor that relates to financial literacy, debt management, savings and credit, and financial planning in the future (Ismanto et al. 2019). A previous study stated that financial literacy affects the access to finance of MSMEs (Susan 2020). Lack of financial literacy is also associated with a lack of access to financial products and often the failure to use them (Nkundabanyanga et al. 2014). Based on this, MSME actors have limitations in accessing credit because their financial literacy is low due to high financial literacy. Strongly influences banking behavior. This finding is supported by research that states that people with high financial knowledge tend to regulate their financial patterns and make financial decisions based on their financial records (Guzman et al. 2019). In addition, individuals with limited education cannot make effective financial product choices, limiting their credit access.

Hypothesis 1 (H1).

Financial literacy significantly affects access to formal credit.

2.2. The Effect of Literacy on MSME Performance

A prior study provides owners or managers of MSMEs with valuable financial literacy insights (Susan 2020). Previous studies also revealed that the empirical results demonstrate that financial literacy significantly positively affects entrepreneurial participation and performance (Li and Qian 2020). Another previous study showed that financial literacy and capital substantially affect performance (Sohilauw et al. 2020). A survey conducted by the Financial Services Authority stated that the contribution of the MSME sector in Indonesia has proven to be very significant for the national economy by contributing 60 percent of the Gross Domestic Product and absorbing 97 percent of the national workforce. The role of the MSME sector in supporting economic growth requires the strengthening of MSMEs. One form of strengthening MSMEs is to increase the ability to manage finances and expand financial access for MSMEs.. Financial literacy is defined as knowledge, beliefs, and skills that influence attitudes and behavior to improve the quality of decision-making and financial management in the context of welfare. With this understanding, it is hoped that financial services business actors, product consumers, and the wider community will not only know and understand financial services but also increase their ability to make decisions. The result of research conducted by Agyei (2018) state that financial literacy has a positive effect on MSME performance.

Hypothesis 2 (H2).

Financial literacy has a significant effect on the performance of MSMEs.

2.3. The Influence of Credit Terms on Access to Formal Credit

The willingness of MSME actors to access formal credit depends on how complicated the requirements are. Collateral requirements have a great opportunity to limit access to credit. Formal credit provider institutions usually provide credit in more amounts, longer payment periods, and lower interest rates when prospective debtors offer guarantees (Nkundabanyanga et al. 2014). Debtors who offer more guarantees will receive good treatment from formal credit providers and easier credit access. This explanation concludes that credit requirements in the form of collateral, positively influence access to formal credit.

On the other hand, unsecured debtors will have a negative impact on access to formal credit. Credit repayment was also one of the essential factors in accessing formal credit. Nkundabanyanga (Nkundabanyanga et al. 2014) found that the credit payback period had a negative effect on access to credit. This means that when MSMEs feel that the payment period is inflexible, they are less likely to access credit. It can be concluded that access to formal credit is caused by the credit repayment period. This study also stated that lending terms have a significant and positive effect on access to formal credit by SMEs (Nkundabanyanga et al. 2014).

Another thing that limits access to formal credit is the interest rate charged on credit. If the interest rate is deemed not in line with the expectations of MSME actors, then MSME will not apply for credit at a formal credit provider.

Hypothesis 3 (H3).

Credit terms significantly affect access to formal credit.

2.4. The Effect of Credit Terms on MSME Performance

Previous research emphasized that a large or small business cannot be separated from capital problems, especially in the MSME sector (Buchdadi et al. 2020). There are still quite a lot of MSMEs that are constrained by capital in their development efforts. On the one hand, MSMEs have difficulty accessing credit because the conditions are complicated. When applying for credit, the condition that MSMEs take into consideration the most is the ease of credit terms and interest rates compared to the loan repayment period. According to (Hansen et al. 2021), credit terms affect business development, so it is necessary to make it easy to obtain business capital with affordable interest rates.

Hypothesis 4 (H4).

Credit terms significantly affect MSME performance.

2.5. The Effect of Access to Formal Credit on MSME Performance

As a result, the World Bank consistently advocated banking sector reform, and credit programs have been a popular intervention by governments and donors for decades. In addition, with the increasing focus on blended finance in development assistance, many donors consider support to private banks in the form of loan guarantees to be an increasingly attractive instrument for MSME development. However, the development impact of micro-loans to enterprises and guarantee schemes to banks was somewhat smaller than expected (Fafchamps and Woodruff 2017). A prior study found that credit accessibility has a significant positive effect on financial performance (Munguti and Wamugo 2020). One reason is that the performance of MSMEs is very heterogeneous in this situation. Selecting and supporting companies with growth potential is very important. However, this is a formidable task; entrepreneurial ability and other traits of company owners and managers are valuable predictors. In particular, (Agyei 2018) stated that competent owners have a significant marginal return on capital, while (Fafchamps and Woodruff 2017) and (Mckenzie and Woodruff 2015) found that business management ability can predict company growth.

Hypothesis 5 (H5).

Access to formal credit significantly affects MSME performance.

3. Method, Data, and Analysis

This quantitative research includes explanatory/associative research accompanied by hypothesis testing; the population is 324 Micro, Small, and Medium Enterprises (MSMEs) in four cities in East Java (Sidoarjo, Mojokerto, Pasuruan, and Gresik) that have taken credit from the formal sector. The sample size in this study was 100 MSME actors with the criteria that they were still active in the business until December 2021, are MSME actors as well as owners, and have been active in business for at least ten years. The MSME sector in this study included: handicrafts, shoes, bags, wallets, suitcases, accessories, headscarves, Muslim clothing, and delivery. This study uses four variables. First, financial literacy is an independent variable. Financial management errors occur due to a lack of understanding of financial literacy. Second, credit terms are independent variables. The willingness and ability of MSME actors to access financial products are based on how complicated the requirements that MSME actors must meet are. The dimensions used to measure credit requirements in this study are the value of the guarantee, the period of loan repayment, and the interest rate. The three dimensions of the credit terms variable come from research (Susan 2012), which states that the collateral value, loan repayment period, and interest rates contribute the highest number of dimensions in explaining the variable. Third, access to formal credit is the dependent variable. MSME actors in accessing financial products are based on the complexity of the requirements. Guarantee requirements have a high chance of limiting access to credit. Formal lending institutions generally provide more credit, longer payment periods, and lower interest rates when prospective debtors offer guarantees.

The loan repayment period is also one of the important things in accessing formal credit. (Nkundabanyanga et al. 2014). Another thing that limits access to formal credit is the interest rate charged on credit. If the interest rate is deemed not in line with the expectations of MSME actors, then MSMEs will not apply for credit at a formal credit provider. Fourth, the performance of MSMEs is the dependent variable. Access to formal credit will have an impact on the capital owned by MSMEs. Meanwhile, capital has an essential role in improving the performance of MSMEs.

Collecting data using a questionnaire with a Linkert scale of 1 to 5. All statements in the questionnaire are based on indicators from each variable studied. Respondents’ answers were collected and recapitulated. This research uses Smart Partial Least Square (SMART PLS) analysis. Validity is measured by Outer Loading > 0.70, meaning the statement is declared valid. The construct is reported reliable in reality tests if the composite reliability value and Cronbach alpha > 0.70 (Ghozali 2014). The structure of the model shows three criteria that measure the effect: R-Square, F-Square, and Path Coefficient Estimation. R-Square is a fit model; if the R-Square values are 0.75, 0.50, and 0.25, it can be said that the model is strong, moderate, and weak, respectively (Ghozali 2014). F-Square if the F-Square value is 0.02, 0.15, or 0.35, it means that the predictor variable has a respective weak, moderate, and substantial effect on the structure (). The path coefficient sees the significant influence between variables by looking at the parameter coefficient values and the statistical significance value t through the bootstrap method. The definition of operational variables is given in Table 1.

Table 1.

Definition of Operational Variables.

4. Result

This study used a sample of 100 respondents among MSMEs who had access to formal credit.

4.1. Descriptive Analysis

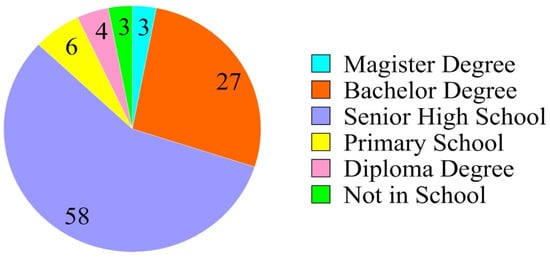

In terms of the latest education (Figure 1), it was explained that the majority of respondents graduated from high school, as many as 58 people (58%), 27 people graduated from S1 (27%), junior high school graduates 10 people (10%), elementary school graduates 6 people (6%), master’s degree graduates totaled 6 people 3 (3%), diploma 4 people (4%), and no school 3 (3%). So, it can be concluded that most respondents do not have an accounting or financial education background.

Figure 1.

The latest education of respondents.

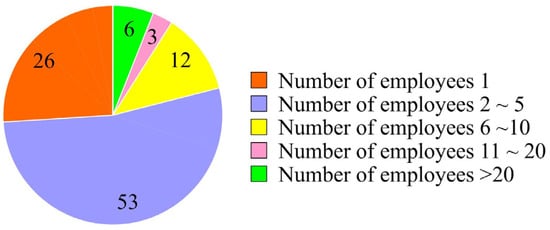

In terms of the number of employees (Figure 2), it was explained that the majority of respondents had 2–5 employees in as many as 53 MSMEs (53%), 1 employee in as many as 26 MSMEs (26%), 6–10 employees in as many as 12 MSMEs (12%), 11–20 employees in as many as 3 MSMEs (3%), and > 20 employees in as many as 6 MSMEs. So, it can be concluded that most MSMEs have employees ranging from 1 to 5 people, meaning that they do not have time to prepare financial reports. The following are descriptive statistical data of research variables (Table 2).

Figure 2.

The number of employees.

Table 2.

Descriptive Statistics.

The results of descriptive statistics show some interesting information. First, financial literacy has a minimum score of 2 out of a maximum score of 5, with an average score of 3.5155. The average score is 70.31% of the maximum score of five. This means that the understanding of financial literacy is only 70.31% and is not maximized, so it can still be increased by 29.69%. The average score of financial literacy is the lowest among the four variables. Second, credit terms have a minimum score of 2.80 out of a maximum score of 5 with an average value of 4.0580, where the average value of credit terms is equivalent to 81.16% of a maximum score of 5, meaning that the understanding of credit terms still has to be increased by 18.84%. The minimum value of credit terms is the highest of the other four variables. Third, access to formal credit has a minimum score of 2.10 out of a maximum score of 5, with an average score of 3.7950. The average score is 79.90% of the maximum score of 5, meaning that access to formal credit can still be increased by 20.10%. This shows that MSMEs in East Java have relatively high access to formal credit. Fourth, MSME performance has a minimum score of 2.67 from a maximum score of 5, with an average score of 4.0667. The average score is equivalent to 81.33% of a score of five. This means that the performance of MSMEs can still be improved by 18.67%; the average score and achievement of MSME performance are the highest scores of the four other variables.

4.2. Test the Quality of Research Data

Table 3 shows that the outer loadings of the four variables show results between 0.713 and 0.825 with a positive value greater than 0.70. Likewise, with Cronbach’s Alpha, the four variables have values between 0.791 and 0.841 greater than 0.70. Thus, the value of outer loadings and Cronbach’s alpha indicates that the research instrument used in collecting data from respondents is valid and reliable.

Table 3.

Validity and Reliability Test Results.

Testing the structural model of this study using Partial Least Square (PLS) analysis. The software used is Smart PLS. The result of the R Square value for formal credit access is 0.50, which can be categorized as moderate, and the performance variable of 0.85 can be categorized as strong. From the results of the F test for all variables greater than 0.05, it can be concluded that the model used in this study is feasible to use.

Furthermore, the test results used to see the significance of the influence between variables have significant results for all hypothesis testing; here are the results of testing the research hypothesis.

The results of hypothesis testing (Table 4) can be explained as follows. It proves the first hypothesis that financial literacy significantly affects access to formal credit. Personal financial management with financial literacy can help make intelligent decisions. One of the impacts of having good financial literacy is that someone will be encouraged to have access to formal credit because formal credit has larger funds that can be channeled than non-formal credit. This study supports the results of previous studies (Hakim et al. 2018).

Table 4.

Hypothesis Testing.

The second hypothesis proves that financial literacy significantly affects the performance of MSMEs. Financial literacy’s important role can help MSMEs improve performance by using three indicators: sales growth, customer growth, and profit growth. The results of this study support and complement the research conducted (Buchdadi et al. 2020; Sohilauw et al. 2020; Ye and Kulathunga 2019).

The third hypothesis proves that credit terms significantly affect access to formal credit. The stricter the credit conditions set by credit providers in the formal sector, the fewer MSMEs will obtain credit, and vice versa; the lighter the credit conditions, the more MSMEs will obtain credit. So, credit terms have a significant adverse effect on access to formal credit.

Proving the fourth hypothesis that credit terms significantly affect the performance of MSMEs. Determination of credit terms will significantly affect the development or decline of a business due to funding. So, the credit terms significantly affect the acquisition of MSME funds in order to improve performance. The results of this study support and complement the research conducted (Hansen et al. 2021).

Proving the fifth hypothesis that formal credit access significantly affects the performance of MSMEs. Access to formal credit is essential in maintaining the survival and performance of MSMEs because the financial process is the heart of business activities regardless of how well managed. A business will neither survive nor thrive without sufficient funds for working capital needs and investment in fixed assets to achieve sales, customer, and profit growth. The results of this study support and complement the research conducted (Cheong et al. 2020; Ye and Kulathunga 2019).

5. Discussion

5.1. The Effect of Financial Literacy on Access to Formal Credit

The calculation results show that financial literacy significantly affects access to formal credit because the P-Value value of 0.016 is smaller than 0.05; thus, the first hypothesis is accepted. This result is supported by (Xu et al. 2020), who found that financial literacy positively affects access to formal credit. This proves that the financial literacy of MSME owners influences access to formal credit. The more MSME owners have high financial literacy, the more MSME owners will increasingly access credit at formal credit providers institutions, such as banks, cooperatives, and state-owned loans. On the other hand, groups without financial literacy cannot make effective financial decisions, thus limiting their access to credit.

Based on descriptive analysis, it is known that the last education of the majority of respondents was in high school. In making financial reports, of course, they need knowledge of good financial records. However, MSMEs do not have to have a recent accounting-based educational background to gain access to formal credit. This result shows that the educational background of MSME owners only affects the absorption of accounting knowledge but does not describe their behavior towards financial products such as accessing credit. This result could occur in this study because of education in Indonesia, where the depth of learning is adjusted to the level of education. In this study, the respondents were high school students, so the knowledge gained was only the basics, not too deep. This is also in line with a previous study that states that college students who have taken subjects related to financial management do not seem to have sufficient financial knowledge (Susan 2018). It can be concluded that the last education of MSME owners and financial literacy possession is a different matter. However, the results of the first hypothesis show that financial literacy has a positive effect on access to formal credit. These results indicate that although most MSMEs do not have an accounting education background, MSMEs can still access formal credit. The absence of a background in accounting is an obstacle for MSME owners in managing their finances, so it is necessary to have employees who specifically handle accounting even though MSMEs can still access formal credit.

Based on the financial literacy variable with debt literacy and financial planning dimensions, the average respondent’s answer is 3.14, which is categorized as good enough, which means that respondents can still access formal credit even though their financial literacy is deemed to be only quite good. The highest average indicator in the variable shows that respondents agree that they always compare debt terms when going into debt. However, respondents are also classified as being unable to make good financial reports.

Individuals who do not have financial literacy face more significant challenges in managing debt, savings, and credit, as well as a lack of financial planning for the future, which can affect the individual’s participation in financial products (Abad-Segura and González-Zamar 2019). This statement supports the results of the research hypothesis that financial literacy has a positive effect on access to formal credit providers. Based on the mean of the financial literacy variable, the indicator with the statement that the respondent compares the terms of the debt before the debt means that the respondent is careful in determining the type of credit suitable for his business.

The acceptance of the first hypothesis confirms the statement in previous research by (Nkundabanyanga et al. 2014) that MSME financial literacy plays an essential role in determining financial decisions taken by MSMEs, especially sources of financing for businesses. In Indonesia, financial literacy is one of the barriers for people to access credit. High financial literacy will affect MSMEs’ credit access to increase their capital sources. The fear MSMEs feel in accessing credit is the inability to pay off debt. Therefore, it is necessary to know about managing debt because financial literacy is important as it is related to the welfare of the MSMEs themselves.

5.2. The Effect of Financial Literacy on MSME Performance

The calculation results show that financial literacy significantly affects the performance of MSMEs because the P-value of 0.032 is smaller than 0.05; thus, the second hypothesis is accepted. This proves that the financial literacy of MSME owners influences performance. The more MSME owners have high financial literacy, the more they will be able to make smart decisions to improve their performance. These results support research conducted by (Agyei 2018; Buchdadi et al. 2020). The President of the Republic of Indonesia prepared a national strategy related to financial literacy. This raises awareness for MSMEs about the importance of financial literacy in increasing their business. This is important because MSMEs are the backbone of ASEAN countries in absorbing labor and foreign investment. A previous study revealed a positive effect of Financial Literacy on Access to Finance of MSMEs. Financial literacy also positively impacts the Growth of MSMEs (Susan 2020).

5.3. The Effect of Credit Terms on Access to Formal Credit

The calculation results show that credit terms significantly affect access to formal credit because the p-Value value is 0.023 < 0.05. Thus, the third hypothesis is accepted. It can be concluded that the credit requirements that formal credit-providing institutions have set influence credit access to formal credit-providing institutions, meaning that if formal credit providers provide easy credit terms, MSMEs will further increase their access to credit at formal credit-providing institutions. These results follow the study of Nkundabanyanga et al. (2014), which states that credit requirements significantly affect access to formal credit. According to (Maiti 2018), when MSMEs feel that the requirements imposed by formal credit-providing institutions are too complicated and cannot be met, MSMEs will look for other sources of capital. However, if the requirements imposed by the formal credit-providing institution are easy, then MSMEs will confidently access credit at the formal credit provider institution.

A study by (Oktavianti and Hakim 2017) indicated that trust is one of the important elements between debtors (MSMEs) and credit providers (formal credit providers). When MSMEs feel comfortable with the credit they apply, the formal credit provider institutions can be considered a source of sustainable business financing. Research (Nkundabanyanga et al. 2014) states that MSMEs will always complain that the credit requirements imposed on their businesses are complicated even though they can meet the credit requirements that have been determined. This statement follows the finding that the highest mean on the credit terms variable indicates the guarantees owned by MSMEs. This means that MSMEs agree that they have the guarantees required by formal credit-providing institutions. Still, based on the suggestions written in the questionnaire, it is stated that MSMEs want lighter guarantee terms. This means other factors that affect access to formal credit are not explained in the study.

The mean on the credit terms variable with dimensions of collateral value, interest rate, and payment planning is 4.05, meaning that respondents feel that the credit requirements imposed on their business are appropriate. This follows the breadth of MSME financing sources. Most MSMEs access credit through micro-credit and cooperatives, where the two credit-providing institutions provide relatively easy requirements even though the interest rates charged by micro-credit-providing banks are still relatively high. Based on this statement, it can be concluded that other factors not included in this study cause MSMEs to continue to access credit even though they still feel that the interest rate charged to their business is too high, even though they can fulfill it. In addition, although MSMEs feel that the guarantee imposed on their business is too large, credit provider institutions will provide a larger amount of credit, a longer loan repayment period, and lower loan interest rates when the debtor provides guarantees following the provisions

5.4. The Effect of Credit Terms on Access to MSME Performance

The calculation results show that credit terms significantly affect the performance of MSMEs because the p-Value value is 0.000 < 0.05. Thus, the fourth hypothesis is accepted. It can be concluded that the credit requirements set by formal credit-providing institutions influence credit access to formal credit-providing institutions, meaning that if formal credit providers provide easy credit terms, MSMEs will further increase their access to credit at formal credit-provider institutions. Many studies have been carried out on the role and performance of MSMEs, especially concerning their contribution to advancing the national and regional economy. Performance analysis is needed to provide feedback on improving the role and position of a company. The role of MSMEs in the last few decades has been considered strategic. Still, it is considered that their performance has not been maximized in facing competition and overall production growth in a country. Analysis of the influence of many variables on SMEs’ performance is critical. Some studies show that the problems MSMEs face today are the capital aspect.

5.5. The Effect of Access to Formal Credit on MSME Performance

The calculation results show that credit terms significantly affect access to formal credit because the p-Value value is 0.018 < 0.05. Thus, the fifth hypothesis is accepted. It can be concluded that the credit requirements that formal credit-providing institutions have set influence credit access to formal credit-providing institutions, meaning that if formal credit providers provide easy credit terms, MSMEs will further increase their access to credit at formal credit-provider institutions. These results support the research. In Indonesia, various seminars and meetings have been held to make it easier for MSME businesses to access financial institutions to improve performance (Dorfleitner et al. 2017). It is also a national strategy to encourage MSME business growth. Several studies conducted by the World Bank in various countries found that financial inclusion plays an important role in alleviating poverty and encouraging the growth of MSMEs (Martono and Riyanto 2017).

The mean of the formal credit access variable with the dimensions of the number of credits and the frequency of taking credit has a value of 3.795, which means that respondents who, in this case, are MSMEs, feel that access to formal credit is easy. This facility is certainly beneficial for SMEs in increasing their business. Based on this statement, other factors cause MSME performance to increase (Martono and Riyanto 2017).

6. Conclusions, Limitations, and Suggestions

6.1. Conclusions

Financial literacy has a significant effect on access to formal credit. The first hypothesis stating that financial literacy significantly affects access to formal credit is accepted. This result, supported by (Xu et al. 2020), found that owners’ financial literacy contributes to informal businesses’ formal credit accessibility. Therefore, the higher the MSME owners’ financial literacy, the easier MSME owners will find it to access credit at formal credit providers institutions, such as banks, cooperatives, and state-owned loans.

Financial literacy has a significant effect on the performance of MSMEs. The second hypothesis stating that financial literacy significantly affects the performance of MSMEs is accepted. Therefore, the higher the MSME owners’ financial literacy, the smarter they will be in planning and managing finances to improve performance. This result, supported by (Tuffour et al. 2022), revealed a significant effect of financial literacy on firm performance (both financial and non-financial performance).

Credit terms have a significant effect on access to formal credit. The third hypothesis stating that credit terms affect access to formal credit is accepted. So, it can be concluded that the credit requirements that formal credit-providing institutions have set influence credit access to formal credit-providing institutions, meaning that if formal credit providers provide easy credit terms, MSMEs will further increase their credit access to formal credit-providing institutions. On the other hand, the more complicated the credit requirements set by the credit provider, the fewer MSMEs will access formal credit.

Credit terms have a significant effect on the performance of MSMEs. The fourth hypothesis stating that credit terms significantly affect the performance of MSMEs is accepted. So, it can be concluded that the determination of credit terms that consider the business capabilities of MSMEs will improve performance.

Access to formal credit has a significant effect on the performance of MSMEs. The fifth hypothesis stating that credit access has a significant effect on the performance of MSMEs is accepted. So, it can be concluded that as access to formal credit is expanded, MSME businesses can improve their operational activities, which will significantly support their performance.

The fulfillment of the five hypotheses above indicates that improving the quality of financial literacy and credit terms needs to be undertaken in Indonesia, especially in SMEs. This is in line with previous research, especially in research by (Nkundabanyanga et al. 2014), which stated a positive and significant relationship between perceived commercial bank lending terms, financial literacy, and access to formal credit.

The results provide initial evidence of the aggregate explanatory power of financial literacy, credit terms, and access to formal credit by MSMEs’ performance in Indonesia. The findings also imply that efforts by the stakeholders to improve financial literacy, credit terms, and access to formal credit of SMEs performance are to be enhanced.

6.2. Limitations and Suggestions

From the F test, it can be seen that the research model has not been maximized, it is proven that the coefficient of determination is still 50% and 85%, so this research can still be reviewed. For further study, human resource competence and financial behavior need to be added as independent variables to complete the model that affects formal credit access and performance because credit access and performance are closely related to the human resource competence and financial behavior of MSME owners. Access to formal credit will be more accessible, and performance will be higher if it is balanced with adequate human resource competencies and good financial behavior. In this study, the role of the government is not discussed in too much depth; this can happen because, during a pandemic, the government is very focused on tackling the pandemic, so it is hoped that MSMEs will be independent to survive. Future research is expected to discuss the role of government in-depth and to build interesting collaborations between the government and SMEs.

Based on the study results, it is necessary to focus on a specific business field, since different business industries might have different characteristics and environments. Future studies may consider a specific business of the industry. Furthermore, the study focused on Financial Literacy and credit terms as an independent variable. Future studies may consider other independent variables, which could include either internal or external factors of the MSMEs with a broader location in Indonesia.

This study’s results will impact subsequent research, especially related to financial literacy that is being developed in Indonesia. This research hopes to provide changes in knowledge about modern finance in MSMEs in Indonesia.

The government and companies providing financial products and services must carry out activities to improve literacy, such as education about credit terms, access to formal credit, and training in good financial management.

Author Contributions

Conceptualization, M.W. and Y.B.H.; methodology, M.W. and D.Y.Y.F.; software, D.Y.Y.F.; validation, M.W., Y.B.H. and D.Y.Y.F.; formal analysis, M.W. and D.Y.Y.F.; investigation, M.W. and D.Y.Y.F.; resources, Y.B.H.; data curation, M.W.; writing—original draft preparation, M.W. and D.Y.Y.F.; writing—review and editing, Y.B.H.; visualization, M.W.; supervision, Y.B.H.; project administration, D.Y.Y.F.; funding acquisition, Y.B.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

The study did not involve humans.

Data Availability Statement

All data have been provided in the manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abad-Segura, Emilio, and Mariana Daniela González-Zamar. 2019. Effects of financial education and financial literacy on creative entrepreneurship: A worldwide research. Education Sciences 9: 238. [Google Scholar] [CrossRef]

- Agyei, Samuel Kwaku. 2018. Culture, financial literacy, and SME performance in Ghana. Cogent Economics and Finance 6: 1–16. [Google Scholar] [CrossRef]

- Ahmad, Maqsood, and Syed Zulfikar Ali Shah. 2022. Overconfidence heuristic-driven bias in investment decision-making and performance: Mediating effects of risk perception and moderating effects of financial literacy. Journal of Economic and Administrative Sciences 38: 60–90. [Google Scholar] [CrossRef]

- Asah, Francis T., Lynette Louw, and John Williams. 2020. The availability of credit from the formal financial sector to small and medium enterprises in South Africa. Journal of Economic and Financial Sciences 13: 1–10. [Google Scholar] [CrossRef]

- Baidoo, Samuel Tawiah, Hadrat Yusif, and Enock Kodo Ayesu. 2020. Improving loan repayment in Ghana: Does financial literacy matter? Cogent Economics and Finance 8: 1787693. [Google Scholar] [CrossRef]

- Buchdadi, Agung Dharmawan, Amelia Sholeha, Gatot Nasir Ahmad, and Mukson. 2020. The Influence of Financial Literacy on Smes Performance Through Access To Finance and Financial Risk Attitude As Mediation Variables. Academy of Accounting and Financial Studies Journal 24: 1–16. [Google Scholar]

- Burchi, Alberto, Bogdan Włodarczyk, Marek Szturo, and Duccio Martelli. 2021. The effects of financial literacy on sustainable entrepreneurship. Sustainability 13: 5070. [Google Scholar] [CrossRef]

- Cheong, Jian, Siva Muthali, Mudiarasan Kupusamy, and Cheng Han. 2020. The study of online reviews and its relationship to online purchase intention for electronic products among the millennials in Malaysia. Asia Pacific Journal of Marketing and Logistics. [Google Scholar] [CrossRef]

- Chileshe, Victor. 2019. The Effect of Financial Literacy on the Growth of Small and Medium Enterprises: A Case study of Mbala District. Amsterdam: Elsevier. [Google Scholar]

- Dorfleitner, Gregor, Lars Hornuf, Matthias Schmitt, and Martina Weber. 2017. The FinTech Market in Germany. In FinTech in Germany. New York: Springer, pp. 13–46. [Google Scholar]

- Fafchamps, Marcel, and Christopher Woodruff. 2017. Identifying gazelles: Expert panels vs. surveys as a means to identify firms with rapid growth potential. World Bank Economic Review 31: 670–86. [Google Scholar] [CrossRef]

- Foster, Bob, Sukono, and Muhamad Deni Johansyah. 2022. Analysis of the effect of financial literacy, practicality and consumer lifestyle on the use of chip-based electronic money using sem. Sustainability 14: 32. [Google Scholar] [CrossRef]

- Ghozali, Imam. 2014. Aplikasi Analisis Multivariate Dengan Program SPSS. Semarang: Badan Penerbit UNDIP. [Google Scholar]

- Guzman, Francisco, Audhesh Paswan, and Niranjan Tripathy. 2019. Consumer centric antecedents to personal financial planning. Journal of Consumer Marketing 36: 858–68. [Google Scholar] [CrossRef]

- Hakim, Muhammad Saiful, V. Oktavianti, and I. K. Gunarta. 2018. Determining factors that contribute to financial literacy for small and medium enterprises. Paper presented at IOP Conference Series: Materials Science and Engineering, Denpasar, Indonesia, August 29–30. [Google Scholar] [CrossRef]

- Hansen, Henrik, John Rand, Finn Tarp, and Neda Trifkovic. 2021. On the Link Between Managerial Attributes and Firm Access to Formal Credit in Myanmar. European Journal of Development Research 33: 1768–94. [Google Scholar] [CrossRef]

- Ibenta, Steve N. O. 2021. Financial Inclusion Strategy and Access to Credit by Micro Small and Medium Scale Enterprise (MSMEs) in Nigeria. European Journal of Business and Management 13: 52–63. [Google Scholar] [CrossRef]

- Irman, Mimelientesa, Budiyanto Budiyanto, and Suwitho Suwitho. 2021. Increasing Financial Inclusion through Financial Literacy and Financial Technology on MSMEs. International Journal of Economics Development Research (IJEDR) 2: 126–41. [Google Scholar] [CrossRef]

- Ismanto, Hadi, Harjum Muharam, Irene Rini, D. Pangestuti, Anna Widiastuti, and Fathur Rofiq. 2019. The Nexus Between Financial Literacy. Financial. Available online: https://www.econstor.eu/handle/10419/231684%0Ahttps://www.econstor.eu/bitstream/10419/231684/1/1687454132.pdf (accessed on 15 June 2022).

- Kumar, Anjani, Raya Das, K. S. Aditya, Seema Bathla, and Girish K. Jha. 2021. Examining institutional credit access among agricultural households in Eastern India: Trends, patterns and determinants. Agricultural Finance Review 81: 250–64. [Google Scholar] [CrossRef]

- Li, Rui, and Yanhong Qian. 2020. Entrepreneurial participation and performance: The role of financial literacy. Management Decision 58: 583–99. [Google Scholar] [CrossRef]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2017. How Ordinary Consumers Make Complex Economic Decisions: Financial Literacy and Retirement Readiness. Quarterly Journal of Finance 7: 1–31. [Google Scholar] [CrossRef]

- Lusimbo, E. N., and W. Muturi. 2016. Financial Literacy and the Growth of Small Enterprises in Kenya: A Case of Kakamega Central Sub-County, Kenya. International Journal of Economics, Commerce and Management 4: 828–45. [Google Scholar]

- Maiti, Moniak. 2018. Article information: Scope for alternative avenues to promote financial access to MSMEs in developing nation evidence from India Moinak Maiti Department of Banking Technology. International Journal of Law and Management 60: 1210–22. [Google Scholar] [CrossRef]

- Martono, Trisno, and Guntur Riyanto. 2017. Analisis Pengaruh Kompetensi Sumber Daya Manusia, Modal Sosial Dan Modal Finansial Terhadap Kinerja Umkm Bidang Garmen Di Kabupaten Klaten. Journal of Chemical Information and Modeling 53: 1689–99. [Google Scholar]

- Mckenzie, David, and Christopher Woodruff. 2015. Nber Working Paper Series Business Practices in Small Firms in Developing Countries. Available online: http://www.nber.org/papers/w21505 (accessed on 14 May 2022).

- Munguti, Muema Joseph, and Lucy Wamugo. 2020. Microfinance Credit Accessibility and Financial Performance of Small and Medium Enterprises in Machakos County, Kenya. Integrated Journal of Business and Economics 4: 71. [Google Scholar] [CrossRef]

- Nathan, Robert Jeyakumar, Budi Setiawan, and Mac Nhu Quynh. 2022. Fintech and Financial Health in Vietnam during the COVID-19 Pandemic: In-Depth Descriptive Analysis. Journal of Risk and Financial Management 15: 125. [Google Scholar] [CrossRef]

- Nkundabanyanga, Stephen Korutaro, Denis Kasozi, Irene Nalukenge, and Venacio Tauringana. 2014. Lending terms, financial literacy and formal credit accessibility. International Journal of Social Economics 41: 342–61. [Google Scholar] [CrossRef]

- Oktavianti, Venny, and Muhammad Saiful Hakim. 2017. Pengaruh Literasi Keuangan dan Persyaratan Kredit terhadap Akses Kredit Formal pada UMKM di Surabaya. Jurnal Sains Dan Seni ITS 6: 1–5. [Google Scholar] [CrossRef]

- Silong, Asenanth Kotugan Fada, and Yiorgos Gadanakis. 2020. Credit sources, access and factors influencing credit demand among rural livestock farmers in Nigeria. Agricultural Finance Review 80: 68–90. [Google Scholar] [CrossRef]

- Sohilauw, Muhammad Irfai, Mursalim Nohong, and Andi Sylvana. 2020. The relationship between financial literacy, rational financing decision, and financial performance: An empirical study of small and medium enterprises in makassar. Jurnal Pengurusan 59: 1–15. [Google Scholar] [CrossRef]

- Sriary, Bhegawati Desak Ayu, and Yuliarmi Ni Nyoman. 2020. Strategy for improving the performance of MSMEs through access to financial institutions. Eurasia: Economics and Business 12: 17–28. [Google Scholar] [CrossRef]

- Susan, Marcellia. 2018. Financial behavior and problems among college student in Indonesia: The role of financial knowledge. International Journal of Engineering and Technology(UAE) 7: 133–37. [Google Scholar] [CrossRef]

- Susan, Marcellia. 2020. Financial literacy and growth of micro, small, and medium enterprises in west java, indonesia. International Symposia in Economic Theory and Econometrics 27: 39–48. [Google Scholar] [CrossRef]

- Susan, Nyangoma Pamela. 2012. Credit Terms, Access To Finance and Financial Performance of Smes in Kampala a Dissertation Submitted To Graduate Research Centre in Partial Fulfilment for the Award of Degree of Master of Science in Accounting and Finance of Makerere University. Kampala: Makarere University. [Google Scholar]

- Tang, Sai, and Sijia Guo. 2017. Formal and informal credit markets and rural credit demand in China. Paper presented at 4th International Conference on Industrial Economics System and Industrial Security Engineering, Kyoto, Japan, July 24–27. [Google Scholar]

- Tuffour, Joseph Kwadwo, Awurabena Asantewa Amoako, and Ernestina Otuko Amartey. 2022. Assessing the Effect of Financial Literacy Among Managers on the Performance of Small-Scale Enterprises. Global Business Review 23: 1200–17. [Google Scholar] [CrossRef]

- Xu, Nana, Jingye Shi, Rong Zhao, and Yan Yuan. 2020. Financial literacy and formal credit accessibility: Evidence from informal businesses in China. Finance Research Letters 36: 101327. [Google Scholar] [CrossRef]

- Ye, Jianmu, and K. M. Kulathunga. 2019. How does financial literacy promote sustainability in SMEs? A developing country perspective. Sustainability 11: 2990. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).