Abstract

The economic growth of China has been driven by the development of its real estate market, especially after the 2008 crisis. This growth is mostly related to the huge housing bubble and growing amounts of sovereign debt that have been redirected to corporations in the sector. Evergrande is one of those corporations; it is a Chinese company in the construction and real estate sector, a global giant with investments in many parts of the world. Its bond default in September 2021 sounded alerts in financial markets. Several news outlets spoke of the “next Lehman Brothers”, and apprehension was very high, especially in Asian markets. This research work aims to evaluate the impact of Evergrande’s bond default on six Asian stock markets, using an event study approach. The results show a strong reaction from the markets towards the event in study, even anticipating it. Furthermore, it is worth mentioning a quick reversion to “normal” behavior, indicating the rapid absorption of information by the markets.

1. Introduction

The financial literature states that leveraged bubbles typically precede financial crises, and when a financial crisis nears, there is a lift-off in debt-servicing costs (Virtanen et al. 2018). Therefore, when Evergrande announced difficulties in paying its bonds, the markets were alert and expectant. Many in the media remembered the crisis triggered by Lehman Brothers.

“As of the end of June, Evergrande had nearly 2 trillion yuan of debt on its books, plus an unknown amount of off-books debt. The property giant is on the verge of a dramatic debt restructuring, or even bankruptcy, many institutions believe. A bankruptcy would amount to a financial tsunami, or as some analysts put it, “China’s Lehman Brothers.” The American investment bank’s 2008 collapse helped trigger a global financial crisis.” (Jing et al. 2021).

The Evergrande Real Estate Group Limited (formerly Hendga Group) is China’s second largest estate company by sales, ranked 122nd in the Fortune Global 500. This company has more than 800 projects in more than 280 cities (see https://www.forbes.com/companies/china-evergrande-group/?sh=6d03e6785668, accessed on 20 June 2022). It was established on the 8th of February 1997, with its headquarters in Nanshan District, Shenzhen. Although principally engaged in property development, it has a wide range of business activities. Its business is operated through four segments: property development, property investment, property management, and other businesses. The last is engaged in property construction, the provision of hotel and other properties’ development-related services, insurance, and fast-moving consumer product business. It also has some subsidiaries, which allow the company to be also engaged in mineral water and food production, electric vehicles, tourism (with the creation of “Evergrande world of water” and “Evergrande world of children”), sports (with the acquisition of Guangzhou Evergrande FC in 2010), and television and video production units. Thus, according to the China Evergrande Group Annual Report of 2020, in that year, it completed the transformation from real estate to “diversified industries + digital technology”, linking the eight major industry platforms.

According to the China Evergrande Group Annual Report of 2020, in 2020, the Evergrande Group had total assets of 2,301,159 million yuan renminbi (RMB) (RMB 396,225 million non-current assets and RMB 1,904,934 million current assets) and total liabilities of RMB 1,905,728 million (RMB 443,475 million of non-current liabilities and the remainder of current liabilities). It had total equity of RMB 350,431 million.

Referring to the income statement, the group had annual revenues of RMB 507,248 million (increasing 6.22% compared to 2019), a total net income of RMB 31,305 million (RMB 8076 million attributed to shareholders of the company, and 23,324 of non-controlling interests) and earnings per share of RMB 0.610. Operating, investing, and financing cash-flows were RMB 110,063 million, RMB −24,128 million, and RMB −76,885 million, respectively (Evergrande 2020).

The group had 123,276 employees, making it one of the top real estate companies in the world. Due to a decrease in the average selling prices caused by nationwide (Chinese) sales promotion activities and sales price concessions of the group as a result of COVID-19, the gross profit of the group (RMB 122,605 million) decreased compared to 2019.

Assets of the Evergrande Group evaluated at RMB 523,602 million were given on guarantee of borrowing RMB 388,349 million (Evergrande 2020). At the end of 2020, the borrowings of the group amounted to RMB 716,521 million (46.8% with a maturity of less than a year and 10.9% with a maturity of more than five years). From these borrowings, about 75.19% were denominated in RMB, and the remainder in USD and HKD. This high amount of borrowings and interest-bearings, with the above-mentioned competing business interests, may have brought Evergrande to its current predicament. Furthermore, China’s Three Red Lines policy for the real estate industry cannot be forgotten. According to them, public real estate firms (Evergrande went public in 2009) in China had to keep their liability-to-asset ratio below 70%, their debt-to-equity ratio less than 100%, and their cash-to-short-term debt ratio less than 100%. Evergrande breached all three red lines in the fiscal year ending 2020, being thus forced to deleverage.

It is a giant group (see Evergrande (2020)) for further details about the ownership structure, financing, income, and relationships), with strong economic, political, and social importance in China and many other countries with which it has a direct relationship. As already mentioned, Evergrande and its businesses have a global scale in terms of investment and financing. However, given its primary activity in real estate, we believe that the Asian financial markets could be more affected and are therefore the target of this study.

Stock markets normally act as barometers of the economy, politics, and many other factors, even constituting “predictors” of various events, since they often anticipate them in addition to reacting. The study of the reaction or anticipation of the financial markets to certain events can be carried out through event windows or event studies.

The event study approach has been used in different fields, such as accounting or finance. For example, Larson (2005) used this approach to test its main hypothesis that extreme, one-day price declines for real estate trusts are associated with reversals. The author concluded that stock price reversals are associated with extreme stock price declines for real estate trusts. Égert (2007) used the same approach to analyze the effectiveness of foreign exchange interventions in Croatia, the Czech Republic, Hungary, Romania, Slovakia, and Turkey. The author showed that the exchange rate of the Czech, Hungarian, and Polish currencies had suffered a significant effect of central bank interventions coupled with communications (and backed by interest rate news). Ragin and Halek (2016) analyzed the 43 largest disasters in insurance since 1970 based on equilibrium price and quantity and found that insurance brokers received abnormal stock returns on the day of the incident. Lanfear et al. (2019) used an event study approach to examine the impact of all 39 US landfall North Atlantic hurricanes in the 28-year period from 1990 to 2017 on stock returns and found that emergencies affecting consumer growth impact the stock market.

The literature on the impact of emergencies on stock markets is quite broad. Chen et al. (2007) examined the effect of the SARS epidemic on eight Taiwanese hotel stock price movements and found that seven of those publicly traded hotel companies experienced steep declines in earnings and stock price during the SARS outbreak period. He et al. (2020) applied this approach to study Chinese industries’ market performance and response trends to the COVID-19 pandemic. More recently, Rahman et al. (2021) examined how the Australian stock market, represented by the top two hundred companies listed in the Australian Stock Exchange (ASX) in terms of their market capitalization, responded to the COVID-19 pandemic and the stimulus package offered by the government. They focused on two negative events and two positive events and found a negative stock market reaction to the pandemic announcement.

In order to analyze the impact of Evergrande’s bond default in September 2021 on six Asian stock indexes (to consider the possible stock market integration), we use an event study approach. Although this methodology has been widely used in the financial literature to assess the impact of unanticipated events, as we can notice, excluding the study of Altman et al. (2022), which is only focused on Chinese markets, this is the first study to apply this methodology to analyze the impact of Evergrande’s September 2021 bond default on various Asian financial markets. In addition, we analyze the indexes before and after the event date and compare return means and variances to find possible differences in the behavior of the series under analysis.

Our research work is of particular importance given the dimension of Evergrande, in terms of not only business volume but also its importance in financial markets. It provides important contributions to the literature and to investment practice. First, we answer the question of the impact of the Evergrande’s bond default on Asian stock markets. Second, we provide the information about that impact, not only for China, but also for other stock markets considered important to Evergrande’s business and actuation. Third, taking into account that the housing market is a strong predictor of China’s economy and because China is the second-largest economy in the world, understanding the potential impact of future similar events will be important in making decisions in terms of investment and financing.

This paper is organized as follows. The introduction section presents the motivation for this study, the explanation for the selection of the stock markets and dates, some background theory, and the main contributions. Section 2 provides an overview of the methodology. Section 3 presents the results and their discussion, and finally, Section 4 provides some concluding remarks.

2. Data and Methodology

In this section, we begin by presenting the data. A univariate analysis is made, with the main goal of better understanding the individual behavior of each index through the analysis of stationarity, serial dependence, descriptive statistics, and inference about possible changes in behavior before and after Evergrande’s bond default. After that, we present event study procedures for the six indexes under study.

2.1. The Data

We aim to understand the impact of Evergrande’s bond default in September 2021 on some Asian equity markets, namely (i) the S&P BSE SENSEX INDEX (BSESN), from India; (ii) the SHANGHAI SHENZHEN CSI 300 (CSI300), from the People’s Republic of China; (iii) the HANG SENG INDEX (HSI), from Hong Kong; (iv) the TOKYO SE JPX—NIKKEI INDEX 400 (JPXNK400), from Japan; (v) the KARACHI STOCK EXCHANGE 100 (KSE100), from Pakistan; and (vi) the FTSE STRAITS TIMES INDEX (STI) from Singapore. The index quotes were retrieved from Datastream. The markets were selected considering the following criteria: i. markets with intraday data available at Datastream; ii. markets that cover developed (Hong Kong, Japan, and Singapore) and emerging (India, China, and Pakistan) Asian stock markets; and iii. Different stock market sizes among the selected markets. As a result of these criteria, we selected the two biggest and one of the minor stock indices in terms of size of the total commercial real estate market (according to EPRA (2021)) in December 2020.

The sample period covers the period from the 1st of June 2021 to the 5th of November 2021. We selected this period as our main focus is the recent events faced by Evergrande related to its bond default in September 2021.

The beginning date was selected in order to have a significantly greater number of observations in the “estimation window” than the “event window” (see Figure 1 for details) to make it reasonable to assume that the contribution of the second component to the variance of the abnormal return is zero, as stated in MacKinlay (1997). Hence, our estimation window covers the period from the 1st of June 2021 to the 15th of September 2021, and our event window began on the 16th of September 2021 and went to the 22nd, 23rd, or the 24th of September 2021 (see Table 1 for further details).

Figure 1.

Timeline for an event study.

Table 1.

Event window per each index, with the event date in bold.

It was supposed that Evergrande Group would repay RMB 232 million (close to USD 32 million) of debt owed on the 23rd of September 2021. However, on Saturday the 18th of September 2021, China Evergrande Group kicked off a process to repay investors in its overdue investment products with discounted properties. According to MacKinlay (1997), for inferences with event-date uncertainty, such as when the event announcement appears in the news, one cannot be certain if the market was informed prior to the close of the market the prior trading day. If this is the case, then the prior day is the event day. If not, then the current day is the event day. As we do not know if the market was informed before the 18th of September, we chose the next business day as the event date, that is, the 20th of September 2021, for the majority of the indexes used (i.e., BSESN, HSI, KSE100, and STI), the 21st and the 22nd of September 2021, respectively, for CSI300 and JPXNK400, because due to the holiday on the 20th of September 2021, the latter markets were closed for negotiation.

With event-date uncertainty, MacKinlay (1997) also suggests using an extended event window from two days before the event date to one day after this date. Given the above, we used an event window (specified in Table 1) of 65 observations per index, with 13 intraday quotes of 30 min.

The levels of each of the six indexes are transformed into the traditional log-returns , with an equal number of observations per index.

2.2. Univariate Methods

In order to evaluate the stationarity, we performed an augmented Dickey–Fuller (ADF) test for the prices and returns series. To test whether the returns series is normally distributed, we performed the Jarque–Bera (JB) statistic test on Eviews, which measures the difference between the skewness and kurtosis of the series and those from the normal distribution. We also evaluate the behavior before and after the event date by testing the equality of mean returns and the variance of returns for both sub-periods. Given the large number of observations, we use the t-statistics to compare means and the F-Snedecor statistics to compare variances. The main goal is to find possible evidence of different behavior after the event date using a simple and widely known approach.

Many studies point to a relation between financial prices and information, particularly focusing on efficiency in financial markets. The efficient market hypothesis (EMH) is the cornerstone of financial economics. It is based on the work of Bachelier in the early 20th century and on Fama (1970). According to Fama (1970, p. 383), a market is said to be efficient if “prices always ‘fully reflect’ available information”. To the author, informational efficiency could be weak, semi-strong, or strong. In its weak form, a financial market is said to be efficient if prices fully reflect the historical price series, meaning that it is not possible to predict prices based only on historical price information. In its semi-strong form, a market is said to be efficient if prices reflect all the publicly available information. Finally, a market is efficient in its strong form if prices reflect all the public and private available information, meaning that all the relevant information about the asset or the market is quickly and accurately reflected in the market price. However, the strong-form EMH is quite difficult to test.

Because market efficiency could hold in the presence of non-iid processes (see also Mandelbrot 1963; Mandelbrot and Wallis 1969; Samuelson 1965), it is possible to find in the literature the use of martingales, which are a less restrictive model compared to a random walk. In fact, a martingale only implies that the first moment of returns is independent of the existing information, i.e., E(rt|rt−1, …, r1) = 0. For higher moments, the use of higher moments could be predictable, although without violating the EMH, even being possible to detect eventual non-linearities or time dependence (Andreou et al. 2001; or McCauley et al. 2008).

As EMH is an extremely restrictive theory, Peters (1994) created the fractal markets hypothesis (FMH), assuming that stock market prices exhibit properties similar to fractals that vary in time horizons and information among investors. This is an extension of the widely utilized EMH, assuming the complexity of the markets. However, FMH has the problem with respective quantifications, related to the decision about the length of time that the “fractal” pattern should be repeated in trying to project the market direction.

The concepts of temporal dependence and predictability are central to EMH and FMH. In order to evaluate serial dependence in both subperiods, we use detrended fluctuation analysis (DFA), which allows the spurious detection of long-range dependence to be avoided, evaluating financial market behavior and testing its efficiency in a linear and nonlinear way. The main goal of DFA (see Peng et al. (1994) and Peng et al. (1995) for algorithm details) is to evaluate temporal autocorrelation at different time moments. Thus, it is frequently applied to the study of financial market behavior (David et al. 2020; Tiwari et al. 2018; Sukpitak and Hengpunya 2016; Liu et al. 1997; among others), even in the case of non-stationarity. The DFA procedure aims to estimate the log–log relationship between the fluctuation function () and the dimension , with this relationship being a power-law of , equal to , meaning that increases with the box size (). The exponent corresponds to the slope of the line relating to , and it can be used to identify the level of persistence. If , the time series could be described as a random walk; there is no long-range dependence, and the autocorrelation function is zero for any period. This is consistent with the EMH, and the market could be considered efficient. If , the time-series could present anti-persistent behavior () or persistent behavior (), meaning, respectively, negative long-range dependence and positive long-range dependence, which are both related to the market’s inefficiency.

This paper will complement the univariate analysis of each period and the search for differences in terms of behavior after the event date with the event study approach.

2.3. Event Study

Revolutionary changes have taken place in the global stock markets because of innovations in communication and information technology and due to the presence of more liberalized financial activities. Authorities around the world are challenged by the globalization of the financial sector (Hildebrand 2008). Stock markets are increasingly becoming more integrated and interlinked. Thus, a crisis in one country spreads out exponentially to other countries (Morales and Andreosso-O’Callaghan 2012).

Financial contagion can arise from indirect interconnections between financial institutions mediated by financial markets (Poledna et al. 2021). However, it is important to clarify that the intention is to assess not the contagion between markets but rather the impact on each of them. In order to respond to this objective, we use an event study approach.

The impact of an economic or political event on stock markets may be analyzed from the perspective of the EMH, with the above-mentioned three sets of efficiency. Referring to semi-strong form efficiency, all publicly available information should be reflected in prices. Given the fact that we are not trying to strictly test the efficiency of Asian stock markets, we considered event studies the most appropriate method to analyze and evaluate the impact of Evergrande’s bond defaults. Does the Evergrande debt crisis impact stock returns and thus reveal if there are any useful patterns for trading decisions? We consider the announcement of Evergrande’s fall as our study event. Our motivation is to examine if stock movements after the event manifest any abnormal returns, i.e., returns in excess of expected returns after recompensing for risk.

An event study refers to a set of tests to determine the impact of an economic or political event on stock prices, to quantify abnormal or unexpected returns, and to evaluate its behavior. Generally, event study analysis is used with two main goals: to test whether any new information is efficiently incorporated by the markets and to examine the effect of an event on the security holder’s wealth, assuming that the EMH holds true, at least with respect to publicly available information (Binder 1998). At the same time, it allows analysis of whether the correlation between the variables is positive or negative. Hence, event study analysis is widely used in finance literature. Event studies have been applied to stock splits (Dolley 1933), dividend announcements (Brown and Warner 1980, 1985; Fama et al. 1969), mergers and acquisitions, investments strategies, and index revisions (see for example Basdas and Oran (2014) for an in-depth literature review about this issue).

The basics of this method may be found in MacKinlay (1997) or in Campbell et al. (1997), who define the following steps: (i) event definition; (ii) choice of selection criteria; (iii) selection of the estimation method; (iv) calculus of expected and abnormal returns; (v) testing procedures; and (vi) results and interpretation.

Most event studies are based on daily observations, although Marshall et al. (2019) argue that intraday data may present some advantages. According to these authors, linking an event to a particular moment within the day and considering the reaction of some variables (namely price) around that moment may reduce the risk of confounding events or of obtaining an obscure impact of the event under study. Besides this, there is evidence that stock markets become more efficient over time, with information being imbibed more quickly. For example, Chordia et al. (2005) conclude that serial dependence in returns is removed after 5–60 min. Several studies use intraday data to evaluate the impact of a specific event (e.g., Lee 1992; Lee et al. 1993; Busse and Green 2002; Lim et al. 2006; Altınkılıç and Hansen 2009; Kočenda and Moravcová 2018; among others). Most of these studies conclude that the use of intraday data is the best way to evaluate the impact of an event of interest, noting that, after some minutes, the changes are dissipated in the markets. The development of tech-based trading mechanisms has dynamically enriched the speed of price responses to new information and thus the breadth of information processed in the equity market. Therefore, the phenomenon of event study using intraday data is increasingly becoming a new standard on the grounds that the reaction of stock market variables (price or volume) in response to a particular event takes place within the early period of the trading day. These effects tend to gradually disappear in the latter part of the same trading day or on the next day.

Marshall et al. (2019) investigate the specification and power of intraday event study test statistics, concluding that the models based on intraday data are well specified for these studies. The authors also realize that for volume and turnover event study models, there are some misspecifications, which may decrease the robustness of respective conclusions.

We define the event date around the 20th of September, and the event window has an amplitude of 65 observations, which corresponds to two days of quotations (26 observations) before the first quotation at the beginning of the event and two more days after its end (26 observations). It should be noted that each day presents 13 intraday quotes of 30 min. The timing sequence is illustrated with a timeline in Figure 1.

Since we are working directly with stock market indexes, using a market model is not possible. Given this, in order to estimate the expected returns of the event window, we base our analysis on autoregressive models on the estimation window observations, where the number of lags is selected according to Akaike information criterion (AIC) and Bayesian information criterion (BIC) (Equation (1)). With being the return of index on moment calculated by the difference of logarithms, the autoregressive model of order k may be defined as:

The expected return will be given by:

The next step is to calculate the abnormal returns :

where is the abnormal return on stock i on day t, is the actual return on stock i on day t, and is the expected return on stock i on day t.

The abnormal return observations should be aggregated in order to promote overall inferences about the event under study. The concept of a cumulative abnormal return (CAR) is necessary to accommodate a multiple-period event window (MacKinlay 1997). If we define the cumulative abnormal return as the sum of abnormal returns in the event window,

and the variance of the is

then, the distribution of the cumulative abnormal return under is:

For each separate index, we can test the significance of cumulative abnormal returns. The null hypothesis that the average of is null may be evaluated using a statistic, given by:

where is the average of cumulative abnormal returns for each index.

The abnormal intraday returns for each index are aggregated to analyze the common reaction of the six stock indexes to the event under study. The aggregation is performed for the 65 observations of the event window. The average abnormal return is calculated as follows:

where is the average abnormal return on moment and is the number of indexes.

The are used to calculate the cumulative average abnormal return (). The objective is to obtain the cross-sectional and the time series aggregation for the event period. Again, we can use the statistics for and (for an in-depth explanation of this test, see for example MacKinlay (1997) or Pandey and Kumari (2021)).

3. Results and Discussion

3.1. Univariate Methods

All the return series revealed stationarity, allowing us to reject the null hypothesis in the ADF test performed (results available upon request). It was possible to identify a structural break for the analyzed indexes on the event date. Furthermore, a higher negative structural break can be highlighted for CSI300 and its indexes, which are both Chinese indexes (the first one for PRC and the second one for Hong Kong, which is a special administrative region of PRC).

In terms of descriptive statistics, all the return series present near-zero mean returns. Before the event date, only CSI300 and HSI showed negative mean returns that became positive after the event date. After the event date, only JPXNK400 revealed a negative mean return, while the other indexes were revealed to be positive, meaning that all the other indexes increased their values after the event date. Extreme values also occurred, as can be seen by the minimum and maximum values. With exceptions for CSI300 and JPXNK400, all the other indexes showed higher skewness values after the event date, meaning that higher returns become more frequent than lower returns in this period. Finally, all the indexes showed high kurtosis values, meaning they have leptokurtic distributions, a common stylized fact in financial markets (see Table 2).

Table 2.

Descriptive statistics, JB test for normality, DFA results for long-range dependence, T-test and F-test for equal mean and variance.

The normality of the data was evaluated through a JB test, and the results (all with p-values smaller than 0.01) allowed us to reject the null hypothesis for all the indexes in both periods, meaning that return series do not follow a normal distribution, revealing the existence of fat tails.

Those facts may point to a higher probability of extreme events than would be expected if returns were normally distributed. According to Cont (2001), it can also mean that return series are not and parsimoniously lead us to reject the EMH.

We applied the DFA procedure for each index in both periods. Analyzing the results, we can highlight the following: (i) before the event date, only BSESN presented an alpha value near 0.5, meaning that during the sample period, this index could be considered close to an efficient index. All the other indexes showed , with a positive long-range dependence for CSI300 and HSI and a negative long-range dependence for the remainder, pointing to a possible lack of efficiency for these indexes during the sample period; (ii) after the event date, a shift occurred in the behavior of half of the analyzed indexes, highlighting the importance of this event for the markets analyzed. During this period, all the indexes showed the same pattern, an anti-persistent behavior (), which is also a pattern related to the market’s inefficiency. Except for KSE100 and CSI300 (as its α value is closer to 0.5 than before the event date), the α exponent leads us to conclude that this event probably contributed to increased market inefficiency. Of course, there is the possibility that more factors underlie this stock market’s behavior. However, given the short periods under analysis and the fact we are using intraday data, we believe that the main driver is the Evergrande default.

In order to evaluate the behavior before and after the event date, we test the equality of mean returns and variance in returns for both subperiods. Assuming a 5% significance level, the results showed that the null hypothesis of the equal mean is not rejected for all the analyzed indexes, and only the null hypothesis of equal variance to CSI and HSI indexes is rejected. From these tests, it can be concluded that return means do not differ in both subperiods, although risk and uncertainty are not equal.

3.2. The Evergrande Event Study

The market-wide variations in stock returns are triggered by the release of information that concerns all firms (Ball and Brown 1968). If in fact equity prices do adjust rapidly to new information as it becomes available, then changes in equity prices will reflect the flow of information to the market. The event study methodology was adopted as it allows us to identify the reaction of an equity index following each event, being focused on the examination of specific events that occur in the event window (Fatum and Hutchison 2003).

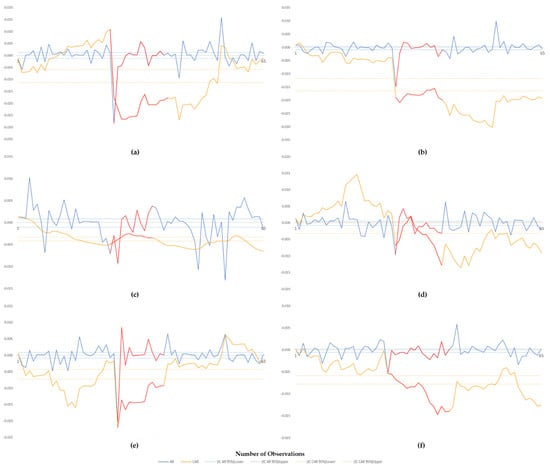

All the graphs displayed in Figure 2 show (through the AR line) an immediate reaction of each index at the beginning of the event day (when the markets are open for negotiation).

Figure 2.

Abnormal returns (AR) and cumulative abnormal returns (CAR) on the event window for the following indices: (a) HSI, (b) JPXNK400, (c) KSE100, (d) BSESN, (e) CSI300, and (f) STI.

Post-event analysis provides us with information about market efficiency because, if nonzero abnormal returns following an event can be systematically obtained, this is thus inconsistent with market efficiency, implying a profitable trading rule (not considering trading costs). The CAR analysis provides an aggregate assessment and shows the pattern of each index reaction. We can highlight that HSI and JPXNK400 are the indexes that reach the lowest CAR values, meaning that the possible overall impact of Evergrande’s bond default is stronger for these indexes, evidencing potentially smaller levels of efficiency (in line with the DFA results).

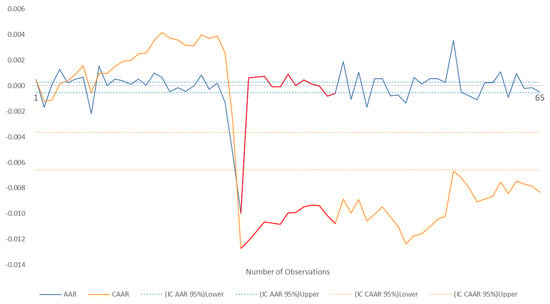

If the aggregated abnormal return (AAR) and cumulative aggregated abnormal return (CAAR) results are positive (or negative) and statistically significant, it can be inferred that the analyzed markets present an overreaction to the new information. Figure 3 shows that markets at the end of the prior day to the event day evidence deeply negative AAR, maybe reflecting an overreaction to the announcements of the possible Evergrande bond default. During the event day, we found five significant AARs, three of them negative.

Figure 3.

Aggregated abnormal returns (AAR) and cumulative aggregated abnormal returns (CAAR) over the event window for the sample covered.

The CAAR line is negative after the event day, supporting the hypothesis that Evergrande’s bond default negatively impacted Asian stock markets. Even so, it is worth mentioning a tendency to revert to normal behavior, or at least to what is considered to be expected in the context of zero returns and efficient behavior.

4. Concluding Remarks

The aim of the research is to analyze the immediate ramifications of Evergrande debt defaults in September 2021 on six Asian stock markets. The univariate analysis shows that the return series of all stock indexes are not normally distributed, highlighting the presence of fat-tailed distributions. The DFA analysis indicates that before the event date, all the markets tend not to be efficient, except BSESN. However, we found a change in the behavioral patterns of all indexes, an anti-persistent behavior, which could mean that the event contributed to the increased level of market inefficiency for the majority of the stock markets. We conducted a test of equal mean returns and variance in returns for both subperiods (before and after the event). The results imply that mean returns do not deviate much for all stock indexes despite their risk components changing.

We employed an event study approach using intraday data to understand the reaction of an equity index, focusing on the pattern of abnormal returns following the unprecedented Evergrande debt crisis event. The findings show that the cumulative abnormal returns (CAR) were represented by negative values for each stock index after the event date and it seems to be much stronger for HSI and JPXNK400. The empirical results of aggregate cumulative abnormal returns (CAAR) explicitly indicate that Evergrande debt defaults had adverse effects on each Asian stock market. This may be attributed to the worsened sentiment of investors in all stock markets triggered by the possible fear of contagion effects. It can also be deduced that each Asian stock market overreacted to the announcement of the Evergrande crisis but tended to revert to its normal behavior. It can be concluded that each market is smart enough to absorb the information quickly as it arrives.

The subprime crisis and the Lehman Brothers bankruptcy are not yet so long past, so this result should be taken into account by retail and institutional investors, regulators, sovereign wealth managers, and policymakers to define accurate strategies that minimize the impacts of these external shocks, preventing another global crisis.

China is now one of the world’s richest countries, overtaking America (according to a report by McKinsey & Company released in November 2021). Evergrande is China’s second-largest Shenzhen-based property developer and the most debt-ridden company in the world (in the sector). The key implication of the study is that Evergrande’s debt crunch induced spillover effects in many other sectors and in the Asian economy overall. The fallout of Evergrande could also impact global financial markets since foreign banks, other institutions, and businesses are directly and indirectly exposed to it. The central Chinese government has been remained mostly quiet on the Evergrande issue. However, allowing Evergrande to fail could have ripple effects throughout China and all over the world, leading to both national and international financial turmoil. Thus, the government should come up with strategic actions to prevent a possible global financial crisis.

Another implication is that results evidence some disagreement with the efficient market hypothesis (EMH) and show that these Asian stock markets have possible profitable trading rules, at least ignoring the trading costs. The findings are consistent with other studies (Mobarek et al. 2008; Michael 2014; Tiwari and Kyophilavong 2014; Panyagometh 2020; Liu et al. 2020). Despite this evidence, it is important to note that it is obtained through the use of linear regressions, which is more in line with the approach of the random walk than with martingales, as discussed in the section on theoretical issues. The use of non-linear approaches could help, in future research, to discuss the possible difference between considering random walks or martingales as the data generators of the analyzed processes.

Finally, the results have implications for regulators, equity market participants, CEOs of financial institutions and other businesses, and fund managers in effectively handling the possible Evergrande debt crisis in their decision-making processes.

Author Contributions

Conceptualization, A.D. and M.E.H.; Formal analysis, D.A. and A.D.; Investigation, D.A., A.D., M.E.H. and P.F.; Methodology, A.D.; Validation, P.F.; Visualization, D.A., A.D. and M.E.H.; Writing—original draft, D.A., A.D., M.E.H. and P.F.; Writing—review and editing, D.A., A.D., M.E.H. and P.F. All authors have read and agreed to the published version of the manuscript.

Funding

Dora Almeida, Andreia Dionísio and Paulo Ferreira are pleased to acknowledge financial support from Fundação para a Ciência e a Tecnologia [(grant UIDB/04007/2020)]. Paulo Ferreira also acknowledges the financial support of Fundação para a Ciência e a Tecnologia [(grant UIDB/05064/2020)].

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Altınkılıç, Oya, and Robert S. Hansen. 2009. On the information role of stock recommendation revisions. Journal of Accounting and Economics 48: 17–36. [Google Scholar] [CrossRef]

- Altman, Edward I., Xiaolu Hu, and Jing Yu. 2022. Has the Evergrande Debt Crisis Rattled Chinese Capital Markets? A Series of Event Studies and Their Implications. April 22. Available online: https://ssrn.com/abstract=4072111 (accessed on 20 June 2022).

- Andreou, Elena, Nikitas Pittis, and Aris Spanos. 2001. On modelling speculative prices: The empirical literature. Journal of Economic Surveys 15: 187–220. [Google Scholar] [CrossRef]

- Ball, Ray, and Philip Brown. 1968. An empirical evaluation of accounting income numbers. Journal of Accounting Research 6: 159–78. [Google Scholar] [CrossRef]

- Basdas, Ulkem, and Adil Oran. 2014. Event studies in Turkey. Borsa Istanbul Review 14: 167–88. [Google Scholar] [CrossRef]

- Binder, John. 1998. The event study methodology since 1969. Review of Quantitative Finance and Accounting 11: 111–37. [Google Scholar] [CrossRef]

- Brown, Stephen J., and Jerold B. Warner. 1980. Measuring security price performance. Journal of Financial Economics 8: 205–58. [Google Scholar] [CrossRef]

- Brown, Stephen J., and Jerold B. Warner. 1985. Using daily stock returns: The case of event studies. Journal of Financial Economics 14: 3–31. [Google Scholar] [CrossRef]

- Busse, Jeffrey A., and T. Clifton Green. 2002. Market efficiency in real time. Journal of Financial Economics 65: 415–37. [Google Scholar] [CrossRef]

- Campbell, John Y., Andrew W. Lo, and A. Craig MacKinlay. 1997. The Econometrics of Financial Markets. Princeton: Princeton University Press. [Google Scholar]

- Chen, Ming-Hsiang, Soo Cheong (Shawn) Jang, and Woo Gon Kim. 2007. The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach. International Journal of Hospitality Management 26: 200–12. [Google Scholar] [CrossRef]

- Chordia, Tarun, Richard Roll, and Avanidhar Subrahmanyam. 2005. Evidence on the Speed of Convergence to Market Efficiency. Journal of Financial Economics 76: 271–92. [Google Scholar] [CrossRef]

- Cont, Rama. 2001. Empirical Properties of Asset Returns: Stylized Facts and Statistical Issues. Quantitative Finance 1: 223–36. [Google Scholar] [CrossRef]

- David, Sérgio Adriani, Claudio Inacio, Derick David Quintino, and José A. Tenreiro Machado. 2020. Measuring the Brazilian ethanol and gasoline market efficiency using DFA-Hurst and fractal dimension. Energy Economics 85: 104614. [Google Scholar] [CrossRef]

- Dolley, James C. 1933. Common stock split-ups—Motives and effects. Harvard Business Review 12: 70–81. [Google Scholar]

- Égert, Balázs. 2007. Central bank interventions, communication and interest rate policy in emerging European economies. Journal of Comparative Economics 35: 387–413. [Google Scholar] [CrossRef][Green Version]

- EPRA. 2021. Global Real Estate Total Markets Table Q2-2021. Brussels: European Public Real Estate Association, October. [Google Scholar]

- Evergrande. 2020. China Evergrande Group—Annual Report 2020. Available online: https://doc.irasia.com/listco/hk/evergrande/annual/2020/ar2020.pdf (accessed on 20 June 2022).

- Fama, Eugene F. 1970. Efficient Capital Markets: A Review of Theory and Empirical work. Journal of Finance 25: 443–62. [Google Scholar] [CrossRef]

- Fama, Eugene F., Lawrence Fisher, Michael C. Jensen, and Richard Roll. 1969. The adjustment of stock prices to new information. International Economic Review 10: 1–21. [Google Scholar] [CrossRef]

- Fatum, Rasmis, and Michael Hutchison. 2003. Is sterilised foreign exchange intervention effective after all? An event study approach. The Economic Journal 113: 390–411. [Google Scholar] [CrossRef]

- He, Pinglin, Yulong Sun, Ying Zhang, and Tao Li. 2020. COVID–19′s Impact on Stock Prices Across Different Sectors—An Event Study Based on the Chinese Stock Market. Emerging Markets Finance and Trade 56: 2198–212. [Google Scholar] [CrossRef]

- Hildebrand, Philipp M. 2008. The sub-prime crisis: A central banker’s perspective. Journal of Financial Stability 4: 313–20. [Google Scholar] [CrossRef]

- Jing, Wang, Chen Bo, Yu Ning, Zhu Liangtao, Wang Juanjuan, Zhou Wenmin, and Denise Jia. 2021. How Evergrande Could Turn into ‘China’s Lehman Brothers’. Caixin. Available online: https://asia.nikkei.com/Spotlight/Caixin/How-Evergrande-could-turn-into-China-s-Lehman-Brothers (accessed on 20 November 2021).

- Kočenda, Evžen, and Michala Moravcová. 2018. Intraday effect of news on emerging European forex markets: An event study analysis. Economic Systems 42: 597–615. [Google Scholar] [CrossRef]

- Lanfear, Matthew, Abraham Lioui, and Mark Siebert. 2019. Market anomalies and disaster risk: Evidence from extreme weather events. Journal of Financial Markets 46: 100477. [Google Scholar] [CrossRef]

- Larson, Stephen. 2005. Real estate investment trusts and stock price reversals. Journal of Real Estate Finance and Economics 30: 81–88. [Google Scholar] [CrossRef]

- Lee, Charles. 1992. Earnings news and small traders: An intraday analysis. Journal of Accounting and Economics 15: 265–302. [Google Scholar] [CrossRef]

- Lee, Charles, Belinda Mucklow, and Mark Ready. 1993. Spreads, depths, and the impact of earnings information: An intraday analysis. The Review of Financial Studies 6: 345–74. [Google Scholar] [CrossRef]

- Lim, Kian-Ping, Melvin Hinich, and Robert D. Brooks. 2006. Events That Shook the Market: An Insight from Nonlinear Serial Dependencies in Intraday Returns. Available online: https://ssrn.com/abstract=912603 (accessed on 20 June 2022).

- Liu, HaiYue, Aqsa Manzoor, CangYu Wang, Lei Zhang, and Zaira Manzoor. 2020. The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health 17: 2800. [Google Scholar] [CrossRef]

- Liu, Yanhui, Pierre Cizeau, Martin Meyer, Chung-Kang Peng, and Harry Eugene Stanley. 1997. Correlations in economic time series. Physica A: Statistical Mechanics and Its Applications 245: 437–40. [Google Scholar] [CrossRef]

- MacKinlay, A. Craig. 1997. Event studies in economics and finance. Journal of Economic Literature 35: 13–39. [Google Scholar]

- Mandelbrot, Benoit. 1963. The variation of certain speculative prices. The Journal of Business 36: 394–419. [Google Scholar] [CrossRef]

- Mandelbrot, Benoit, and James Wallis. 1969. Some long-run properties of geophysical records. Water Resources Research 5: 321–40. [Google Scholar] [CrossRef]

- Marshall, Ben, Nick Nguyen, and Nuttawat Visaltanachoti. 2019. A Note on Intraday Event Studies. European Accounting Review 28: 605–19. [Google Scholar] [CrossRef]

- McCauley, Joseph, Kevin Bassler, and Gemunu Gunaratne. 2008. Martingales, detrending data, and the efficient market hypothesis. Physica A Statistical Mechanics and Its Applications 387: 202–16. [Google Scholar] [CrossRef][Green Version]

- Michael, Nwidobie. 2014. The random walk theory: An empirical test in the Nigerian capital market. Asian Economic and Financial Review 4: 1840–48. [Google Scholar]

- Mobarek, Asma, A. Sabur Mollah, and Rafiqul Bhuyan. 2008. Market efficiency in emerging stock market: Evidence from Bangladesh. Journal of Emerging Market Finance 7: 17–41. [Google Scholar] [CrossRef]

- Morales, Lúcia, and Bernadette Andreosso-O’Callaghan. 2012. The current global financial crisis: Do Asian stock markets show contagion or interdependence effects? Journal of Asian Economics 23: 616–26. [Google Scholar] [CrossRef]

- Pandey, Dharen, and Vineeta Kumari. 2021. Event study on the reaction of the developed and emerging stock markets to the 2019-nCoV outbreak. International Review of Economics & Finance 71: 467–83. [Google Scholar]

- Panyagometh, Kamphol. 2020. The effects of pandemic event on the stock exchange of Thailand. Economies 8: 90. [Google Scholar] [CrossRef]

- Peng, Chung-Kang, Sergey Buldyrev, Shlomo Havlin, Mark Simons, Harry Eugene Stanley, and Ary Goldberger. 1994. Mosaic organization of DNA nucleotides. Physical Review E 49: 1685. [Google Scholar] [CrossRef]

- Peng, Chung-Kang, Shlomo Havlin, Harry Eugene Stanley, and Ary Goldberger. 1995. Quantification of scaling exponents and crossover phenomena in nonstationary heartbeat time series. Chaos An Interdisciplinary Journal of Nonlinear Science 5: 82–87. [Google Scholar] [CrossRef]

- Peters, Edgar. 1994. Fractal Market Analysis: Applying Chaos Theory to Investment and Economics. New York: Wiley. [Google Scholar]

- Poledna, Sebastian, Serafín Martínez-Jaramillo, Fabio Caccioli, and Stefan Thurner. 2021. Quantification of systemic risk from overlapping portfolios in the financial system. Journal of Financial Stability 52: 100808. [Google Scholar] [CrossRef]

- Rahman, Md Lutfur, Abu Amin, and Mohammed Abdullah Al Mamun. 2021. The COVID-19 outbreak and stock market reactions: Evidence from Australia. Finance Research Letters 38: 101832. [Google Scholar] [CrossRef]

- Ragin, Marc, and Martin Halek. 2016. Market Expectations Following Catastrophes: An Examination of Insurance Broker Returns. Journal of Risk and Insurance 83: 849–76. [Google Scholar] [CrossRef]

- Samuelson, Paul. 1965. Proof that properly anticipated prices fluctuate randomly. Industrial Management Review 6: 41–49. [Google Scholar]

- Sukpitak, Jessada, and Varagorn Hengpunya. 2016. Efficiency of Thai stock markets: Detrended fluctuation analysis. Physica A Statistical Mechanics and Its Applications 458: 204–9. [Google Scholar] [CrossRef]

- Tiwari, Aviral Kumar, Rabin Jana, Debojyoti Das, and David Roubaud. 2018. Informational efficiency of Bitcoin—An extension. Economics Letters 163: 106–9. [Google Scholar] [CrossRef]

- Tiwari, Aviral Kumar, and Phouphet Kyophilavong. 2014. New evidence from the random walk hypothesis for BRICS stock indices: A wavelet unit root test approach. Economic Modelling 43: 38–41. [Google Scholar] [CrossRef]

- Virtanen, Timo, Eero Tölö, Matti Virén, and Katja Taipalus. 2018. Can bubble theory foresee banking crises? Journal of Financial Stability 36: 66–81. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).