Abstract

Privatization has played an important role in national economic reform in Vietnam. However, unlike other transitional countries in Central and Eastern Europe, Vietnam has chosen a partial and gradual privatization where the government still holds significant ownership in most privatized firms. Whether partial privatization can enhance privatized firms’ performance or full privatization should have been implemented is a critical question that needs to be answered. This paper utilizes semiparametric regressions to study the relationship between residual state ownership and firm performance. The results indicate an inverted U relationship between state ownership and firm performance. We show that the performance of privatized firms improves with an increase in the level of state ownership until around 40%, after which the effect of state ownership on firm performance tends to decline. This demonstrates that in a transitional context, relinquishing governmental control via privatization can significantly benefit privatized firm performance. However, further reduction of state ownership may decrease the performance of privatized firms. Overall, the study contributes significantly to the growing body of evidence on the nonlinear effects of state ownership. This suggests that in the transitional context of Vietnam, due to weak corporate governance and limited protection of minority shareholders, there could be a temporary optimal position where state and private investors hold balanced ownership to simultaneously supervise operations and promote the performance of privatized firms.

1. Introduction

The state sector, even in the 21st century, constitutes a significant portion of economies, especially in emerging economies (Megginson 2017). In transitional economies such as those of China and Vietnam, the state sector accounts for up to 30% of total GDP (Nem Singh and Chen 2018). In addition, the success of the state-led economy of China has renewed interests in studies of state-owned economies. Over 50% of studies on state ownership have been conducted in the context of China (Daiser et al. 2017). The impact of state ownership is a controversial topic. In the 1990s, the consensus was that state ownership is harmful to an economy and privatization was the trend all over the world, especially in Central and Eastern Europe. However, since the 2000s and the rise of Asian nations with state-led economies (especially China), there are renewed interests in studying the impact of government ownership on firm performance and its role in economic development.

The literature shows that there are both beneficial and detrimental effects of state ownership on firm performance (Boubakri et al. 2018). Generally, most state ownership studies suggest that state-owned enterprises (SOEs) tend to be inefficient since SOEs may pursue sociopolitical goals rather than pure profit maximization. In addition, managers of SOEs may have less incentive to run SOEs in the most effective way. These issues are reinforced by the incompetency and weak incentive of citizens in monitoring the performance of SOEs. Supporters of state ownership, on the other hand, argue that governments have interests in enhancing firm performance to guarantee their tax revenues and to maximize the value of state investments. Hence, governments often provide SOEs with a “helping hand” and act as a monitor to supervise managers’ behaviors. Besides, since SOEs have to pursue both economic and sociopolitical goals, evaluating the efficiency of SOEs via mere profitability might underestimate their performance. Somewhere in the middle, there are economists who argue that institutional contexts matter when assessing the impact of state ownership (Dharwadkar et al. 2000; Shleifer and Vishny 1997) and the impact of state ownership on firms may depend on the degree of market failure in specific cases (Megginson and Netter 2001). As a result, the net impact of residual state ownership1 cannot be generalized.

In Vietnam over the last 30 years, the country has experienced high economic growth among developing nations. It is projected by PwC that in 2050 Vietnam will be the 20th largest economy (by PPPs) in the world2. Privatization of state-owned enterprises as part of the economic reform started in 1986 has contributed a significant part to the economic growth of Vietnam. The success of privatization has been mainly explained by less governmental interference in day-to-day business and providing more incentives to managers to promote profit goals (Loc et al. 2006; Ngo et al. 2015). Unlike other transitional economies in Central and Eastern Europe, Vietnam has chosen a “socialist-oriented market economy”. The government has pursued gradual and partial privatization and remained in dominant control of most privatized firms. Recently, the state sector still contributed one-third to the Vietnamese GDP3. However, the efficiency of SOEs and privatized firms is still a concern as the shares of pre-tax profits and net turnover of the state sector in the total economy were relatively low in comparison with its share of total assets4. Therefore, the question of whether the government should pursue the current partial and gradual privatization strategy or full privatization is important for both policymakers and shareholders of privatized firms. Furthermore, if the government pursues a partial privatization strategy, how much residual state ownership is optimal to enhance the performance of privatized firms.

The theoretical arguments and empirical evidence of the net impact of residual state ownership in Vietnamese privatized firms is limited and inconclusive (Hoang et al. 2017; Kubo and Phan 2019; Ngo et al. 2014; Phung and Mishra 2016; Vu and Pratoomsuwan 2019). Thus, this paper aims to contribute to the existing literature by shedding more light on the effect of state ownership in transitional economies, especially Vietnam. In our study, we apply semiparametric regressions to study the impact of residual state ownership on the performance of partially privatized firms. In comparison with previous studies, this methodology provides flexibility since it does not impose any a priori functional forms on the regression function, which is especially suitable since there is little agreement about the sign and the shape of the impact of residual state ownership. We additionally implement semiparametric regression with an instrumental variable to deal with the potential endogeneity issue of state ownership. Comparing to previous studies, our research model also controls a variety of ownership structure variables comprising managerial ownership, board ownership, domestic institutional ownership, and foreign institutional ownership. As privatization is performed by issuing new shares for investors or selling a proportion of the SOE’s current stakes, new investors in privatized firms may play an important role contributing to firm performance. Thus, the ownership structure during the post-privatization period should be considered when assessing the net impact of state ownership, especially when those variables are documented to have a significant impact on firm performance (Bhagat and Bolton 2008; Lin and Fu 2017; McKnight and Weir 2009).

Our results indicate that, up to a moderate level, state ownership has a positive impact on firm performance. This can be explained by the “monitoring” effect of the state. Like private shareholders, the government could act as a powerful monitor to guarantee that the decisions made by managers are aligned with the wealth maximization objectives and the state may also monitor the other largest shareholders to prevent them from expropriation. However, we found that when state ownership becomes dominant (over 40% in this study), the positive “monitoring” effect of the state tends to be outweighed by its negative “expropriation” effect. In the Vietnamese context, when an investor holds ownership of over 35%, he/she lawfully has the veto right to any business activity. Thus, when the state holds dominant control (i.e., over 40% of ownership) of privatized firms, the state may actively control the management and divert firms’ resources to pursue sociopolitical goals rather than pure economic objectives (e.g., excessive employment or social investments). Besides, when the ownership of minority shareholders is small, it is hard for nonstate investors to stand against governmental intervention in the day-to-day business of privatized firms.

Our study contributes to the existing literature by providing further evidence supporting the positive effects of privatization. Evidence from our research indicates that relinquishing dominant control of privatized firms can significantly improve the performance of privatized firms. However, our study also provides evidence that in the transitional context of Vietnam, state ownership is not merely a source of inefficiency, and the effect of state ownership is nonlinear even after controlling various ownership structure variables. We also reliably point out that state ownership can generate the most effective performance when state ownership is in the optimal range of around 40%, based on the results from our semiparametric regressions.

This paper is organized into seven sections. Section 2 provides an overview of the literature on the role of state ownership. Section 3 discusses data and methodologies used. The empirical results and robustness checks are discussed in Section 4 and Section 5, respectively. Section 6 and Section 7 provide some discussion and conclusions.

2. The Related Literature

The role of state ownership in enterprises and in economies has been a subject of study for decades. However, since the beginning of the 21st century, there has been a renewed interest in this topic due to the rise of “state capitalism”. Instead of a uniformly linear negative impact, there is a growing body of evidence indicating that the impact of state ownership is context specific and has a netting effect of various factors.

Most studies, especially those conducted in the 1990s, provide evidence against SOEs and support the idea that state ownership is detrimental to firm performance. These findings have been justified based on the agency theory developed by Jensen and Meckling (1976). They propose two main agency problems arising from state ownership that may lead to inefficiency among SOEs. One is the agency problem between SOE managers and citizens who are the true owners of SOEs, and another is the agency conflict between state shareholder and other minority shareholders (Khatib et al. 2022).

Indeed, SOEs are managed by bureaucrats who are not the owners of the firm and, given the self-interest nature of humans, managers are likely to pursue their own interest which may not align with the interest of citizens who are the true owners of SOEs. There are studies confirming state ownership as a source of agency problems that result in weak corporate governance and inefficient performance (Megginson 2017; Megginson and Netter 2001; Shleifer and Vishny 1997). There is also good evidence that the link between managerial compensation and performance is significantly weaker among SOEs. This may result in lower managerial incentives to enhance performance (Liu et al. 2012). Another issue that may lead to inefficiency in SOEs is the soft budget constraint. The government is unlikely to let SOEs go bankrupt and tends to bail them out in times of financial distress. Therefore, SOE managers feel less pressure to uphold effective performance and are likely to seek personal benefits from SOEs (Laffont and Tirole 1991; Megginson and Netter 2001; Schmidt 1996; Sheshinski and López-Calva 2003).

Secondly, there is an agency problem between state and minority shareholders since governments tend to impose socioeconomic objectives on SOEs and these objectives might contradict profit maximization objectives of minority shareholders (Vickers and Yarrow 1991). For instance, the government might direct SOEs to maintain high levels of employment which might have a counter-effect on firm performance (Bennedsen 2000; Boycko et al. 1996; Laffont and Tirole 1991). For transitional economies such as China’s, Bo et al. (2009) suggested that despite the corporatization reform, SOEs are still ineffective since social objectives of SOEs still dominate profit concerns, although their findings showed that social objectives are becoming less important as time progresses.

Contrary to the above body of research, some scholars have found evidence indicating that government-controlled firms have higher value and profitability than non-government-controlled firms (Ang and Ding 2006; Boubakri et al. 2018; Tan et al. 2015). Besides, not all privatizations have led to better performance. Chen et al. (2006) provide evidence of a decline in profitability and asset utilization in the five years after privatization. In terms of the residual state ownership among partially privatized firms, there is some evidence of a positive link between the percentage of state ownership and firm performance (Le and Buck 2011; Liao and Young 2012). To explain the potential positive effect of state ownership on firm performance, scholars propose two main explanations including the “helping hand” and the “monitoring role” of governments.

Firstly, in terms of the “helping hand”, the government may implement strategic influence and provide financial and political resources to enhance SOEs’ performance. Specifically, these supports may include preferential regulations, favorable taxation, easy credit, and even subsidies to SOEs (Shleifer and Vishny 1998). In transitional countries where the involvement of the state in the economies is prevalent, the strategic influence of government on SOEs and privatized firms is found to be a significant factor contributing to firm performance (Gordon and Li 2003). Besides, as they have a close connection with the government, SOE managers are at an advantage to exploit their strategic relationship with the government to enhance competitive advantage and firm performance (Park and Luo 2001; Peng and Luo 2000). Consistent with “soft budget constraint” theory, there is some evidence indicating that governments tend to support politically connected enterprises by offering subsidies or tax concessions (e.g., deferral, reduction, or remission of taxes), or grant privileged access to credit. Scholars found that politically connected firms borrow more than non-connected firms (Mian 2005); moreover, they borrow with less collateral (Charumilind et al. 2006). Regarding the financing costs, some studies have demonstrated that despite a lower accounting disclosure, politically connected firms still experience a lower cost of debt, especially during financial crises (Borisova et al. 2015; Chaney et al. 2011). There is also evidence of a higher likelihood of government bail-out among politically connected firms (Faccio et al. 2006).

Secondly, governments may act as monitoring agents to mitigate principal–agent conflicts. If the ownership is dispersed and spread out, it is highly improbable for owners to monitor the management teams and enforce their property rights. This divergence of ownership and control creates a free-rider problem in which managers are free to implement rent-seeking activities at the costs of shareholders. In this case, the state may potentially act as a strategic block holder to monitor managers to protect its investments. The state has a high incentive to boost firm performance to extract tax revenues and maximize the value of its investments. Hence, just like private shareholders, the government may act as a powerful monitor to guarantee all decisions made by managers are aligned with the interests of shareholders. Moreover, compared to individual shareholders, the state has an ability to recruit or fire managers to enhance firm performance. In China, there is a policy guideline to discharge managers from firms with dominant state ownership if they are found responsible for losses over three consecutive years (Tian and Estrin 2008). In addition, the state may play an important role in monitoring block holders and mitigating the principal–principal agency conflicts by preventing the largest shareholders from expropriating minority shareholders (Chang and Wong 2004).

In between, there are some studies providing evidence for a nonmonotonic impact of state ownership on firm performance. However, the evidence is also contradictory since there are both studies proposing a convex (Ng et al. 2009; Phung and Mishra 2016; Tian and Estrin 2008; Wei et al. 2005; Yu 2013) and concave relationship between state ownership and firm performance (Boubakri et al. 2018; Hoang et al. 2017; Le et al. 2019; Sun et al. 2002).

For Vietnam, a majority of the studies confirmed the success of privatization by comparing firm performance between pre- and post-privatization (Loc et al. 2006; Ngo et al. 2015). Nevertheless, studies on the role of residual state ownership in partially privatized firms in the Vietnamese context are limited and of mixed conclusions. Vo et al. (2013) found that privatized firms with state ownership less than 30% and higher than 50% perform better than those with state ownership between 30% and 50%. From a different angle, Ngo et al. (2014) found a negative effect of state ownership on firm profitability and labor productivity. However, the impact is moderated by firm size, where they found state ownership enhances profitability and labor productivity for large firms. Le et al. (2019) found some evidence of an inverted U-shaped relationship between state ownership and firm total factor productivity, whereas Phung and Mishra (2016) found that state ownership has a convex relationship with firm performance. Kubo and Phan (2019) provided evidence of the nonlinear relationship between state ownership and firm performance, and also how the effects of state ownership vary depending on the type of state ownership.

Due to the limited and mixed results, further studies on the impact of residual state ownership on privatized firms, specially in the Vietnamese context, are necessary. In our paper, to overcome the limitations of previous studies, we only use audited data of listed firms and cover a longer period from 2007 to 2017, which includes both the GFC5 and post-GFC period, since some studies indicated that the impact of state ownership is moderated by the economic cycle (Beuselinck et al. 2017; Borisova et al. 2015). Compared to previous studies, our study also controls a variety of ownership structure variables comprising managerial ownership, board ownership, domestic institutional ownership, and foreign institutional ownership, as according to the literature we noticed that theses variables along with state ownership have a significant impact on firm performance (Bhagat and Bolton 2008; Lin and Fu 2017; McKnight and Weir 2009). Additionally, to better analyze the impact of residual state ownership on privatized firm performance, this paper applies semiparametric regression models. The advantage of semiparametric regression is that it does not impose any a priori functional forms on the variable of interest. Thus, it is very suitable to be used when there is controversial evidence, as is the case with the role of residual state ownership in Vietnamese privatized firms. In addition, we integrate semiparametric regression with an instrumental variable to deal with endogeneity due to a potential causality issue between state ownership and firm performance (Chen et al. 2009; Ng et al. 2009). With these unique contributions, we expect to properly assess the net impact of residual state ownership on Vietnamese privatized firms.

3. Methodology

As argued in the literature review, the empirical evidence of the role of residual state ownership for Vietnamese privatized firms is mixed. There are studies supporting either a positive, a negative, or a nonlinear relationship between state ownership and firm performance. Thus, to better depict the relationship between residual state ownership and firm performance among privatized firms, this paper used non- and semiparametric regression to analyze and visualize the relation between residual state ownership and privatized firm performance.

3.1. Data

The dataset covered all 742 non-financial firms listed on the Ho Chi Minh City Stock Exchange (HSX) and Hanoi Stock Exchange (HNX) during the period from 2007 to 2017. All financial firms including banks and insurance firms are excluded from the dataset since their financial and operating characteristics differ substantially from those of other firms. Data on firms’ financial characteristics and ownership structure were collected from Thomson Reuters, as were firms’ annual reports and financial statements.

Next, we removed all observations with missing values and implemented the trimming of outliers by winsorizing extreme (1st and 99th) percentiles of ROA, ROE, ROS, Tobin’s Q, market to book value, firm size, and leverage to exclude the effect of outliers since we observed several observations with extreme values. The winsorization technique is commonly used in corporate governance research, such as studies by Fan et al. (2007) or Erkens et al. (2012).

Finally, to specifically analyze the impact of residual state ownership among partially privatized firms, we removed all listed firms without state ownership in the dataset and came up with a sample of 439 partially privatized firms from 76 industries, excluding the financial industry. As a result, we achieved the final dataset comprising 3006 firm-year observations.

3.2. Model Specification and Estimation

3.2.1. Semiparametric Regression

A nonparametric analysis might be useful since there is little agreement on the shape of the relationship between state ownership and firm performance. However, nonparametric regression suffers from the “curse of dimensionality”, caused by the sparsity of data in high-dimensional spaces. To overcome the issue, this study used a semiparametric regression model to depict the impact of residual state ownership on firm performance. Under this methodology, firm performance (FP) is assumed to be an unknown nonlinear function of state ownership [i.e., f(SO)], and a linear function of a set of other control variables:

where FP is firm performance; SO is state ownership; and X includes control variables comprising firm size, firm leverage, managerial ownership, board ownership, domestic institutional ownership, foreign institutional ownership, industry dummies, year dummies and exchange dummies. β represents a vector of coefficients and ε is an error term where E(ε|X,SO) = 0.

FP = X β + f(SO) + ε

There are several ways to estimate partially linear models (see, e.g., Li and Racine 2007). This study follows Robinson’s (1988) double residual estimating technique as one of the most popular approaches. Note that we can write:

where E denotes expectation. Given that E(ε|SO) = 0, subtracting (2) from (1) gives:

E(FP|SO) = E(X|SO) β+ f(SO) + E(ε|SO)

FP − E(FP|SO) = (X − E(X|SO)) β + ε

It is possible to estimate E(FP|SO) and E(X|SO) using a nonparametric regression method (e.g., kernel) and substitute them in the above equation. Thus, β can be consistently estimated without modelling f(SO) explicitly as follows:

Finally, f(SO) can be estimated by regressing (FP − X) on SO nonparametrically. Robinson (1988) has proved that the above estimator for β and f(SO) are consistent and statistically efficient.

3.2.2. Semiparametric Regression with Instrumental Variables

A potential problem when estimating the relationship between residual state ownership and privatized firm performance is the endogeneity. Residual state ownership may affect firm performance; however, firm performance might also be an important factor influencing the state in deciding the level of state ownership. Besides, there might be unobservable factors that affect both the level of residual state ownership and privatized firm performance. Thus, it is necessary to account for the endogeneity problem. The semiparametric model with endogeneity (with respect to state ownership) can be written as:

FP = βX + f(SO) + ε where E(ε|X) = 0 but E(ε|SO) ≠ 0

To estimate this model, a modified version of Robinson’s method is required. This can be performed by employing a “control function” approach to an instrumental variable estimation (see, e.g., Blundell and Powell 2003). When applying the standard double residual method, the expected value is conditioned on SO as in Equation (2).

However, the conventional double residual method does not work since SO is endogenous and E(FP|SO) and E(X|SO) cannot be consistently estimated using a standard nonparametric regression. A solution can be obtained by conditioning instead on instrumental variables W where we can have:

E(FP|W) = E(X|W) β + E(f(SO)|W) + E(ε|W)

If W is correlated to SO but not ε, we have:

SO = Wπ + υ and E(υ|SO) = 0

In addition, if E(ε|SO,υ) = ρυ, then ε = ρυ + η; thus the semiparametric model (1) becomes:

FP = βX + f(SO) + ρυ + η

Applying the double residual estimator principle, we obtain:

where υ is estimated via the residuals fitted from SO = Wπ + υ.

FP − E(FP|SO) = (X − E(X|SO)) β + ρ(υ − E(υ|SO)) + η

3.3. Variables Description

3.3.1. Dependent Variable: Firm Performance

There are a variety of proxies that can capture the notion of firm performance. Each proxy tends to reflect one aspect of firm performance. In this study, we evaluated the impact of residual state ownership on privatized firm performance based on the two criteria of firm profitability and firm market performance.

In most studies, firm profitability has been proxied with returns on assets (ROA), returns on equities (ROE), and returns on sales (ROS) (Boubakri et al. 2005; Chen et al. 2006; Le and Buck 2011; Zengji et al. 2016). In this study, we also used the three profitability ratios of ROA, ROE, and ROS as our measures of firm performance. Here, ROA, ROE, and ROS are calculated by dividing earnings before tax over total assets, total equities, and net sales, respectively. The logic behind utilizing income before tax (instead of income after tax) is to remove the effect of corporate income tax in comparing firm profitability since favorable tax policies might have been applied to some firms.

Apart from the above measures, some scholars have used market to book value (Beuselinck et al. 2017; Boubakri et al. 2018) and Tobin’s Q (Ang and Ding 2006; Liao and Young 2012; Tian and Estrin 2008; Wu et al. 2012; Yu 2013) to evaluate the market performance of firms. Following these studies, we also evaluated privatized firm market performance via Tobin’s Q and market to book value ratio.

3.3.2. Independent Variable: State Ownership

The main objective of this study is to evaluate the effect of residual state ownership on privatized firm performance. As in Zengji et al. (2016), state ownership is represented by the shares invested and controlled by the central government, local governments, or other entities which have a natural connection to the government. Most studies measure the state ownership directly via the percentage of shares owned by the state (Ben-Nasr et al. 2012; Beuselinck et al. 2017; Borisova et al. 2015; Haider et al. 2018; Lin and Bo 2012). In the Vietnamese context, state-owned shares are shares owned by the government at central and provincial levels, and shares owned by institutions which are directly owned by the state. However, this measurement of state ownership may potentially fail to capture the exact level of government control in privatized firms since privatized firms might be owned by entities that are partially owned or controlled by the state. These cross-ownership and pyramid control phenomena may result in underestimating the precise impact of government control on privatized firms. Nevertheless, such as in previous studies, this research used the percentage of state ownership publicly published among listed firms as a measure of state ownership due to the lack of detailed information on cross-ownership and the pyramid control. Besides, in the Vietnamese context, only large shareholders who own over 5% of total outstanding shares of a listed firm are required to publicly announce their holdings. Thus, the data on privatized firms’ state ownership are collected only when state ownership is over the threshold of 5%; when state ownership is less than 5%, the firm’s state ownership is recorded as 0%.

3.3.3. Control Variables

Managerial ownership: According to the agency theory proposed by Jensen and Meckling (1976), managerial ownership is strongly associated with agency problems which influence firm performance. It is suggested that managerial ownership could enhance the incentives of managers to pursue firm value maximization objectives and, thus, increase the efficiency of firms. Empirically, managerial ownership has been widely demonstrated to have an impact on firm performance, as in Ang et al. (2000); Singh and Davidson III (2003); McKnight and Weir (2009). Therefore, this study controlled for managerial ownership when evaluating the relationship between residual state ownership and privatized firm performance. Following previous studies, this research measured managerial ownership by the total percentage of shares held by a firm’s management board.

Board ownership: Similar to managerial ownership, there is some evidence that the ownership of board members can enhance incentives, which consequently help boost operating performance and increase the probability of disciplinary management turnover in poorly performing firms (Bhagat and Bolton 2008). Therefore, this study aimed to control the level of ownership of board members when evaluating the impact of residual state ownership on privatized firm performance. In this study, board ownership was measured by the total percentage of shares held by board members.

Institutional ownership: It is widely accepted that institutional ownership, the ownership by an institution such as a mutual fund, a pension fund, or a large institutional investor, is an important corporate governance mechanism to mitigate agency costs and which improves firm performance (Cornett et al. 2007). Supporters suggest that institutional investors have the ability, incentive, discipline, and resources to monitor and influence corporate managers. Shleifer and Vishny (1986) support the strong effect of monitoring by large shareholders, especially institutional investors. There is substantial evidence confirming a positive relationship between institutional ownership and firm performance (Elyasiani and Jia 2010; McConnell and Servaes 1990). From a slightly different angle, some scholars suggest that there is a difference between the impacts of domestic and foreign institutional investors. The results of Ferreira and Matos (2008) suggest that firms with higher ownership by foreign and independent institutions have higher firm valuations, better operating performance, and lower capital expenditures. Lin and Fu (2017) found that institutional ownership positively affects firm performance. However, their results indicate some differences between the effects of foreign institutional shareholders and that of domestic institutional shareholders. Thus, in our study we controlled for domestic and foreign institutional ownership separately. In terms of data collection, data for institutional ownership were only collected above a threshold of 5% due to information disclosure regulation.

Size: Previous studies suggest that firm size may have an impact on firm performance since large firms might have more advantages in terms of economies of scale, or market power. Thus, most studies related to firm performance tend to control for firm size, as in Gedajlovic and Shapiro (2002) and Ang et al. (2000). Furthermore, the total assets, total sales, and total number of employees are commonly used by scholars to capture firm size (Boubakri et al. 2005; Chen et al. 2021; Le and Buck 2011). Following previous studies, we also controlled for firm size when investigating the impact of state ownership. Among the three measurements above, this study decided to utilize a natural logarithm of total assets as a proxy for firm size.

Leverage: There is a large number of studies demonstrating the relationship between capital structure and firm performance. According to the trade-off theory proposed by Kraus and Litzenberger (1973), a firm will have to trade off the costs and benefits of debt. The benefits of debt primarily originate from tax shields (Modigliani and Miller 1963), whereas the costs of debt are mainly driven by bankruptcy costs (i.e., financial distress costs) associated with a firm’s increasing financial risk as a result of debt. Besides, debt is also considered to be negatively associated with firms’ agency problems; therefore, it can help in promoting firm performance (Jensen and Meckling 1976). Thus, we attempted to control for the effect of leverage measured by the liabilities to equities ratio in assessing the impact of residual state ownership on privatized firm performance.

Industry characteristics: It has been demonstrated that industry characteristics affect firm performance (Dess et al. 1990). According to Dess et al. (1990), industry effects should be measured and incorporated into management studies in order to avoid misleading results. In the context of transitional economies where government intervention is relatively significant, governments often pursue encouraging policies in some industries, but not in others. Thus, most studies on the impact of state ownership consider the effects of industry (Lin and Su 2008; Liu et al. 2012; Souza et al. 2005). Similarly, we controlled for industry effects when analyzing the impact of residual state ownership on privatized firm performance. We classified the firms into 76 industries based on the Thomson Reuters Business Classification (TRBC) and used a set of 75 industry dummies, representing those 76 industries accordingly, to control for industry-specific effects.

Year: Due to economic cycles and time-variant factors, firm performance might be different in different years. There is a large number of studies incorporating year dummies when assessing the effect of state ownership on firms (Qi et al. 2000; Yu 2013). Following previous studies, we also controlled for the year effects by utilizing 10 year dummies for the years from 2008 to 2017, with 2007 as the reference category.

Stock exchange: In the Vietnamese context, firms are listed on the Hanoi Stock Exchange (HNX) and Ho Chi Minh Stock Exchange (HSX). Each exchange has different regulations and requirements for firms to be listed. Thus, firms from different stock exchanges tend to have different characteristics. Therefore, we also incorporated a stock exchange dummy, which takes 1 if firms are listed on the HSX, and 0 if firms are listed on the HNX, to account for the different characteristics.

4. Empirical Results

4.1. Data Description

Table 1 below presents the descriptive statistics of the dataset. For our privatized firms, the average state ownership, managerial ownership, board ownership, domestic institutional ownership, and foreign institutional ownership were equivalent to 41.70%, 2.37%, 4.68%, 5.27%, and 2.60%, respectively. On average, the natural logarithm of the total assets of privatized firms was 26.92. The leverage of these privatized firms was on average 1.63.

Table 1.

Descriptive statistics of variables.

Regarding the performance of privatized firms, the average ROA, ROE, and ROS of privatized firms was at 8.34%, 17.20%, and 10.16% respectively. Privatized firms’ average Tobin’s Q was 1.10, whereas their average market to book value ratio was 1.17.

The testing of correlations between variables is implemented and presented in Table A1 in Appendix A. The results indicate that the correlations between variables were low except for pairs of proxies of dependent variables. Therefore, multicollinearity was not an issue in our study.

Next, the semiparametric regression was estimated via two steps. First, firm performance was regressed against parametric parts including managerial ownership, board ownership, domestic institutional ownership, foreign institutional ownership, size, leverage, industry dummies, year dummies, and exchange dummies in order to obtain the nonparametric part of firm performance. Secondly, the nonparametric part of firm performance was regressed against residual state ownership. The results are presented in the following subsections.

4.2. Residual State Ownership and Partially Privatized Firm Profitability

Table 2 provides results from the semiparametric regressions of privatized firm profitability against residual state ownership and control variables. According to this table, managerial ownership and board ownership seemed to have a weak impact on partially privatized firm performance. In terms of institutional ownership, both domestic and foreign institutional ownership were demonstrated to have a significant positive effect on firm performance; however, foreign institutional ownership had a much stronger effect than domestic institutional ownership. The results indicate that if domestic institutional ownership increases by 1 percentage point, ROA goes up by 0.0199 percentage points. Nevertheless, a 1 percentage point increase in foreign institutional ownership led ROA, ROE, and ROS to increase by 0.0851, 0.1352, and 0.1582 percentage points, respectively.

Table 2.

Semiparametric regression models of partially privatized firm profitability on residual state ownership.

Firm size was positively associated with privatized firms’ profitability, but the effect of firm size was relatively small. The results show that a 1 percent increase in firm assets resulted in ROE and ROS increasing by approximately 0.0086 and 0.0113 percentage points, respectively. This might be due to the fact that large firms tend to benefit from economies of scale or market power.

Firm leverage was shown to have a negative relationship with partially privatized firm profitability. Specifically, the results indicate that if the leverage (i.e., liabilities to equities ratio) increases by 1, ROA and ROS decrease by 1.7517 and 2.3478 percentage points, respectively. This is consistent with Le and Phan (2017)’s findings. In that study, the authors suggested that when the leverage increases, the costs of financial distress and liquidity issues might outweigh the benefits of debt from a tax shield among listed firms in the Vietnamese context.

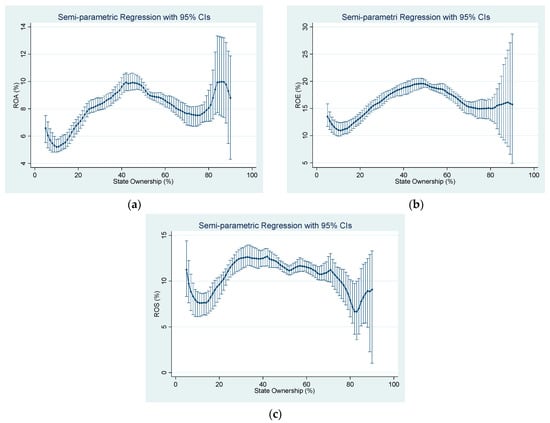

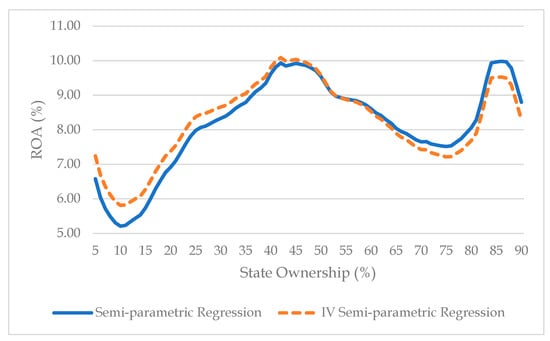

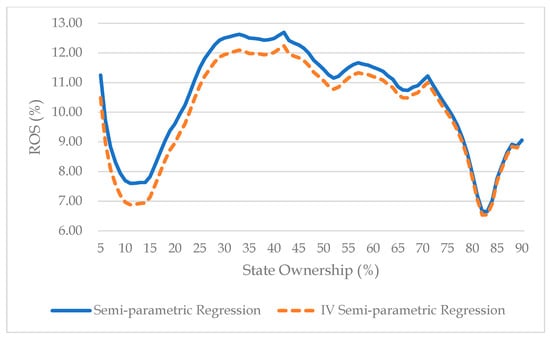

Figure 1 below presents the marginal effects of residual state ownership on privatized firm profitability which was generated from the semiparametric regression. Figure 1 shows an inverted U relationship between residual state ownership and partially privatized firm profitability proxied by ROA (%), ROE (%), and ROS (%). According to Figure 1, when keeping control variables constant at their means, state ownership increased together with privatized firm profitability over the range of 10% to 40%. ROA, ROE, and ROS increased approximately from 5.21% to 9.62%, from 11.02% to 18.83%, and from 7.69% to 12.49%, respectively, when state ownership climbed from 10% to 40%. When state ownership was in the range of 40% to 80%, the relationship between state ownership and privatized firm profitability measured by ROA, ROE, and ROS turned out to be downward sloping. ROA, ROE, and ROS dropped from 9.62% to 8.06%, from 18.83% to 15.00%, and from 12.49% to 7.92%, respectively, when the level of state ownership changed from 40% to 80%. When state ownership was over 80% or less than 10%, the relationship between state ownership and profitability proxied by ROA, ROE, and ROS was not clearly supported since the confidence intervals were too wide, perhaps due to a limited number of observations over this range.

Figure 1.

Semiparametric estimates of firm’s ROA (a), ROE (b), and ROS (c) on state ownership (%). This figure presents the marginal effect of state ownership on partially privatized firm’s ROA (%), ROE (%), and ROS (%). The continuous lines correspond to the estimates, whereas the capped spikes correspond to the 95% confidence intervals.

4.3. Residual State Ownership and Partially Privatized Firm Market Performance

In Section 4.3, we implemented semiparametric regressions of privatized firm market performance (Tobin’s Q and market to book value) against residual state ownership and control variables.

Table 3 below shows a weak link between managerial ownership and the market performance of privatized firms. Board ownership was demonstrated to have a positive impact on privatized firm market performance, but only limited to the proxy of market to book value ratio. The result indicates that a 1 percentage point increase in board ownership resulted in an increase in the market to book value ratio of 0.0069.

Table 3.

Semiparametric regressions of partially privatized firm market performance against residual state ownership and control variables.

The results also demonstrate the importance of institutional ownership. It is indicated that a 1 percentage point increase in domestic institutional ownership caused the Tobin’s Q and market to book value to climb by 0.0033 and 0.0066, respectively. In addition, if foreign institutional ownership goes up by 1 percentage point, Tobin’s Q and market to book value tend to increase by 0.0073 and 0.0126, respectively.

According to results presented in Table 3, the firm size had a positive effect on privatized firms’ market performance. Tobin’s Q and market to book value rose by around 0.0004 and 0.0008, respectively, because of a 1-percent increase in firm assets.

Leverage was shown to have a negative impact on partially privatized firm market performance. Specifically, the results indicate that when leverage (i.e., liabilities to equities ratio) rose by 1, Tobin’s Q experienced a drop of 0.0100.

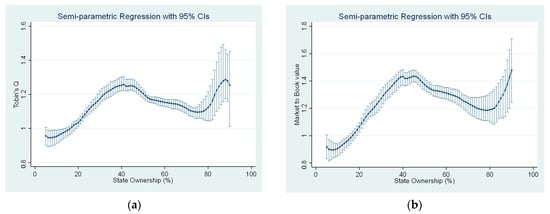

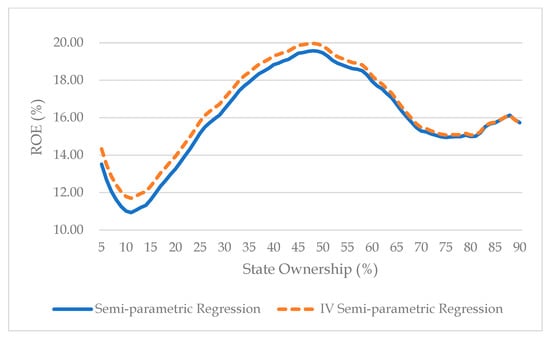

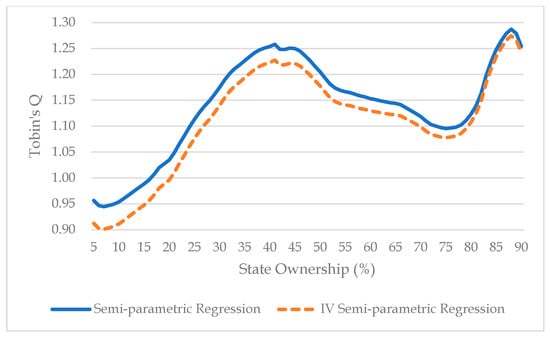

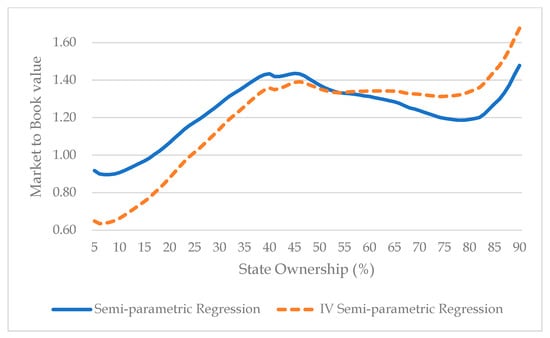

Next, we generated Figure 2 to characterize the marginal impact of residual state ownership on Tobin’s Q and market to book value when keeping control variables constant at their means.

Figure 2.

Semiparametric estimates of firm’s Tobin’s Q (a) and market to book value ratio (b) against state ownership (%). This figure presents the marginal effect of state ownership on partially privatized firm’s Tobin’s Q and market to book value ratio. The continuous lines correspond to the estimates, whereas the capped spikes correspond to the 95% confidence intervals.

The results from semiparametric regressions (Figure 2) indicate that the residual state ownership and Tobin’s Q (and market to book value) had an inverted U-shaped relationship. When state ownership climbed from 10% to 40%, Tobin’s Q and market to book value ratio rose from 0.95 to 1.25 and from 0.91 to 1.43, respectively. A negative association between residual state ownership and valuation ratios was observed when state ownership was above the range of 40–80%. Tobin’s Q and market to book value ratio tended to drop from 1.25 to 1.12 and from 1.43 to 1.19 when state ownership changed from 40% to 80%. When state ownership was over 80% or less than 10%, the confidence intervals were widened substantially due to the limited number of observations.

5. Robustness Check

Endogeneity is a prevalent issue in corporate governance quantitative research and is likely to be present in the relationship between state ownership and firm performance. Firstly, the direction of causality is not well-established. Secondly, the models may fail to include a variable(s) influencing both firm performance and state ownership. This issue may result in the correlation between an endogenous variable (i.e., state ownership) and the error term; therefore, the results from our models may suffer from a bias. In order to deal with the potential endogeneity issue, we used a two-stage least squares regression technique. Following the idea of Boubakri et al. (2018), in which the country-industry average of state ownership is used as an instrumental variable for state ownership, our study utilized the industry-year average of residual state ownership as an instrumental variable for state ownership in the instrument variable (IV) semiparametric regression. The industry-year average of state ownership could be a valid instrument since the state may decide the level of state ownership in privatized firms according to the state’s industry preference; however, it is not likely that the industry-year average of state ownership influences individual privatized firm performance.

We conducted IV semiparametric regression models, where in the first stage, we regressed residual state ownership on the industry-year average of state ownership and all other variables including managerial ownership, board ownership, domestic institutional ownership, foreign institutional ownership, firm size, leverage, industry dummies, year dummies, and exchange dummies to achieve the first-stage residual. The results indicate a significant positive relationship between residual state ownership and industry-year average of state ownership (p-value < 0.01). Importantly, the F-statistics of the model was 36.08, which was greater than 10; this may indicate that the industry-year average of state ownership is not a weak instrument (see, e.g., Staiger and Stock 1997).

At the second stage, we added the first-stage residual to the semiparametric regression models of firm performance proxies against state ownership and control variables. Our results indicate a non-significant relationship between proxies of firm performance and the first-stage residual; this asserts that state ownership is not potentially endogenous, and the endogeneity problem is not a serious issue.

Indeed, when we performed IV semiparametric regression models of firm performance on residual state ownership with the industry-year average of state ownership instrument, the results produced from IV semiparametric regression models were quite similar to those from ordinary semiparametric regression models.

Table 4 below presents the IV semiparametric regressions of firm profitability against residual state ownership. The results supported a positive effect of foreign institutional ownership. Size was shown to be positively related with firm profitability, whereas leverage was, in contrast, negatively related with firm profitability.

Table 4.

IV semiparametric regression models of partially privatized firm profitability on residual state ownership.

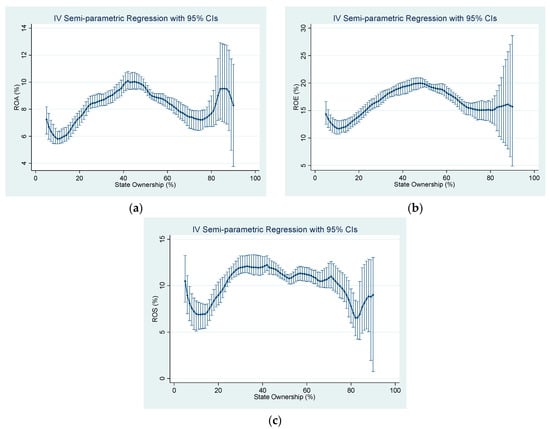

To specifically assess the net impact of residual state ownership, we generated Figure 3 to describe the marginal effect of residual state ownership on privatized firm profitability when keeping other control variables constant at their means.

Figure 3.

Semiparametric IV estimates of firm’s ROA (a), ROE (b), and ROS (c) on state ownership. This figure presents the marginal effect of state ownership on partially privatized firm’s ROA (%), ROE (%), and ROS (%). The continuous lines correspond to the estimates, whereas the capped spikes correspond to the 95% confidence intervals.

As observed in Figure 3, the IV semiparametric regression models confirmed the inverted U relationship between residual state ownership and partially privatized firm profitability, where the firm profitability reached the peak when state ownership was around the level of 40%. According to Figure 3, when state ownership climbed from 10% to 40%, ROA, ROE, and ROS increased from 5.81% to 9.81%, 11.79% to 19.31%, and from 6.96% to 12.02%, respectively. Over the pivotal point of 40%, the relationship between residual state ownership and firm profitability turned from positive to negative. When state ownership was in the range from 40% to 80%, ROA, ROE, and ROS dropped from 9.81% to 7.68%, from 19.31% to 15.08%, and from 12.02% to 7.79%, respectively. When state ownership was outside the range of 10–80%, the confidence bands were quite wide due to a limited number of observations in this range.

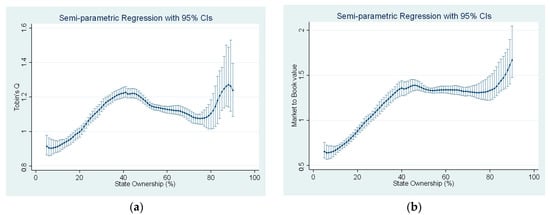

Next, IV semiparametric regressions of privatized firm market performance against residual state ownership were implemented and the results are presented in Table 5 below. As presented in Table 5, board ownership, domestic institutional ownership, and foreign institutional ownership were demonstrated to have positive effects on firm market performance. As expected, the effect of size and leverage were also positive and negative, respectively.

Table 5.

IV Semiparametric regression models of partially privatized firm market performance on residual state ownership.

Figure 4 below illustrates the marginal effect of residual state ownership on firm market performance under the IV semiparametric regressions. These results mostly re-affirm the results from original semiparametric regression models where the relationship between residual state ownership and privatized firm market performance is an inverted U-shape. When state ownership was less than 40%, the impact of residual state ownership was significantly positive as state ownership climbed from 10% to 40%, and Tobin’s Q and market to book value increased from 0.91 to 1.22 and from 0.66 to 1.36, respectively. However, when state ownership was higher than the pivotal point of 40%, the impact of residual state ownership on market performance tended to be weakened or even negative. Specifically, Tobin’s Q and market to book value dropped from 1.22 to 1.11 and from 1.36 to 1.34, respectively, when state ownership was in the range of 40–80%. Outside the range of 10–80%, the explanatory power of state ownership failed as the confidence bands were too wide, most likely due to a small number of observations in this range.

Figure 4.

Semiparametric IV estimates of firm’s Tobin’s Q (a) and market to book value ratio (b) on state ownership (%). This figure presents the marginal effect of state ownership on partially privatized firm’s Tobin’s Q and market to book value ratio. The continuous lines correspond to the estimates, whereas the capped spikes correspond to the 95% confidence intervals.

In summary, the results from our two-stage least squares semiparametric regression models were almost identical with those from ordinary semiparametric regression models. Figure A1, Figure A2, Figure A3, Figure A4 and Figure A5 in Appendix A compare results between semiparametric regression models and IV semiparametric regression models. Both indicate an inverted U relationship between residual state ownership and partially privatized firm performance in terms of profitability and market performance.

For a further robustness check, we also conducted linear, quadratic, and cubic regressions of firm performance against residual state ownership to validate the inverted U association between state ownership and the performance of privatized firms. Table A2 and Table A3 in the Appendix A present the linear, quadratic, and cubic regression models. The results are in favor of the inverted U relationship between state ownership and firm performance and indicate that the quadratic regression model is a preferable model in comparison to linear and cubic regression models according to the Akaike information criterion (AIC)’s estimates.

6. Discussion

The empirical results of this study suggest that for privatized firms with residual state ownership, when the residual state ownership goes up to 40%, it tends to have a positive effect on firm performance. This can be explained by the “helping hand” and “monitoring” effect of government ownership. Indeed, some scholars supposed that the state has a strong incentive to maximize the value of state assets in privatized firms. Thus, the state may provide a “helping hand” via financial support and political lending to enhance the performance of privatized firms even though this may lead to inefficient resource allocation at a national level. The “helping hand” effect of government over privatized firms is well documented in the literature (Gordon and Li 2003; Shleifer and Vishny 1998; Zengji et al. 2016). In addition, in order to protect its investment, the state may enforce a “monitoring” role to prevent wrongdoings of privatized firms’ managers and expropriation activities of other block holders. Some scholars argued that in the nowadays corporate context, agency problems are prevalent in both large state enterprises and private enterprises. Shareholders, especially minority ones, have difficulties in monitoring management teams and enforcing their property rights as ownership tends to be dispersed and spread out. In these cases, the state may potentially act like private controlling shareholders to monitor management activities to assure the sound performance of privatized firms and to protect its interests during the post-privatization period (Chang 2007; Tian and Estrin 2008).

On the contrary, our findings indicate that when state ownership is over 40%, the positive effect of state ownership tends to be reversed (i.e., when state ownership increases, the firm performance declines). One potential explanation for the negative effect of government ownership is the “expropriation” effect, which is also documented by scholars (Bo et al. 2009; Boycko et al. 1996; Lin and Su 2008). In the Vietnamese context, according to the Law on Enterprises (2014), when an investor holds over 35% ownership, he/she has the right to veto any business issue of the firm (e.g., operation, organizational structure, investment, or even firm dissolution). Therefore, when the state holds dominant control of over 40%, it may actively control the operations of privatized firms. In this case, the state may direct firms to pursue some political or social objectives in addition to economic objectives. According to our results, the “expropriation” effect possibly outweighs the benefits of the “monitoring” effect of state ownership and influences the performance of partially privatized firms in a negative way when state ownership becomes dominant.

The result of the nonmonotonic impact of state ownership is also quite consistent with previous studies which suggest that in countries associated with a weak corporate governance system and limited protection of minority shareholders, privatization may not bring a universally positive effect (Dharwadkar et al. 2000; Megginson and Netter 2001; Shleifer and Vishny 1997). In these contexts, the further reduction of state ownership might lead to the rise of the agency problem of managerial control, which may outweigh the reduction of political control during the post-privatization period. Therefore, in some transitional economies associated with a weak rule of law and corporate governance system, the partial and gradual privatization might be a temporarily optimal strategy. In these temporarily optimal cases (state ownership of around 40% as in our study), state ownership implements a “monitoring” role to prevent both the wrongdoings of managers and the expropriation behavior of other block holders; however, the state’s holdings are not large enough to divert firms’ resources to pursue political objectives. Moreover, this creates an opportunity for both state and other shareholders to balance their control to simultaneously supervise the management activities of privatized firms and maximize the performance of these firms during the post-privatization period.

In comparison with previous studies in the Vietnamese context, these results share some similarities with Ngo et al. (2014), where the authors found some signs of an inverted U-shaped relationship between state ownership and firm profitability (ROA and ROE); however, their dataset was based on the survey of Vietnamese enterprises conducted by the General Statistics Office (GSO), which is rich in data but is not officially audited. Our results are also consistent with Hoang et al. (2017) and Kubo and Phan (2019) in indicating an inverted U-shaped relationship between state ownership and firm performance, despite the fact that their studies did not control various ownership structure variables like ours. As documented in the literature, state ownership, managerial ownership, board ownership, domestic institutional ownership, and foreign institutional ownership tend to have a significant impact on the performance of privatized firms (Bhagat and Bolton 2008; Lin and Fu 2017; McKnight and Weir 2009).

In contrast, our study casts some doubt on Phung and Mishra’s (2016) hypothesis that state ownership and Tobin’s Q have a U-shaped relationship. From our point of view, the contrasting results of Phung and Mishra (2016) may come from the fact that this study has not controlled for industry-specific effects and the data only covered the short period of 2007–2012, which quite coincidently was the period of the global financial crisis. The literature showed that the impact of state ownership might be moderated by the economic cycle (Beuselinck et al. 2017; Borisova et al. 2015). However, further studies are needed to confirm our claims.

In the global context, our findings are relatively consistent with Boubakri et al. (2018), who conducted a multi-country study which focuses on nine East Asian economies (Hong Kong, Indonesia, Japan, Korea, Malaysia, Philippines, Singapore, Taiwan, and Thailand). This study indicates that state ownership and firm market performance has an inverted U-shaped relationship with the reflection point of around 38%, which is also very close to our results.

7. Conclusions

The results of this study indicate an inverted U relationship between state ownership and firm performance. Specifically, up to a moderate level of state ownership, the state acts as a monitor to ensure that privatized firms are managed efficiently to maximize state assets. However, when state ownership reaches a dominant level (over 40%), the positive effect of state ownership tends to be reversed. In these cases, the “expropriation” effect emerges as the state may divert firms’ resources to pursue political or social objectives rather than pure profit maximization objectives. At the dominant level of state ownership, this “expropriation” effect may outweigh the “monitoring” effect and negatively influence the performance of privatized firms during the post-privatization period.

Results from our study provide the theoretical implication that state ownership should not be considered as linearly beneficial or detrimental to firm performance. Instead, the impact of residual state ownership among privatized firms is nonlinear, at least in the context of the transitional country of Vietnam. In terms of managerial implications, our findings provide suggestive comments that in the Vietnamese context, which is associated with weak corporate governance and rule of law, the gradual and partial privatization is possibly a temporarily optimal strategy that provides an opportunity for state and private investors to hold balanced control while simultaneously supervising the management of privatized firms during the post-privatization period.

In our study, we conducted rigorous research on the net impact of residual state ownership by applying recent econometric techniques; however, the study has several potential limitations regarding the measurements and generalizability of the results. First, we measured state ownership via the percentage of direct ownership by the central government, local governments, line ministries, and government institutions. This measurement may fail to account for indirect control by the state due to pyramid shareholding and cross-ownership. Second, we only measured the performance of privatized firms via profitability and market performance. However, some scholars argue that measuring privatized firm performance only via financial benchmarks could underestimate the performance of these firms, since SOEs may pursue both social and economic objectives (King and Pitchford 1998). Third, the results of this study were built in the context of the transitional country of Vietnam. It is not obvious to what extent our results are generalizable to other transitional economies, especially when there is some evidence that the effects of state ownership are context specific (Megginson and Netter 2001).

For future research directions, we suppose measuring the performance of privatized firms via both economic and social scales should be considered. Besides, in addition to privatization, governments apply several policies/mechanisms to enhance the performance of SOEs. These policies/mechanisms may moderate the impact of state ownership. Therefore, it is important to assess the impacts of state ownership from a broader view. It is also necessary to validate the moderating role of these policies/mechanisms on the relationship between state ownership and firm performance. As a result, policy makers and managers of SOEs can develop policies which may enhance the positive effect of state ownership, as well as minimize its negative effect.

Author Contributions

Conceptualization, T.Q.V.; methodology, M.H.N.; software, M.H.N.; validation, M.H.N.; formal analysis, M.H.N.; investigation, M.H.N.; resources, M.H.N.; data curation, M.H.N.; writing—original draft preparation, M.H.N.; writing—review and editing, T.Q.V.; visualization, M.H.N.; supervision, T.Q.V.; project administration, T.Q.V.; funding acquisition, T.Q.V. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data are available from the corresponding author upon request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Correlation matrix.

Table A1.

Correlation matrix.

| ROA (%) | ROE (%) | ROS (%) | Tobin’s Q | Market to Book Value | State Ownership (%) | Managerial Ownership (%) | Board Ownership (%) | Domestic Institutional Ownership (%) | Foreign Institutional Ownership (%) | SIZE (Natural Logarithm of Assets) | LEV (Liabilities to Equities Ratio) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA (%) | 1 | |||||||||||

| ROE (%) | 0.7913 | 1 | ||||||||||

| ROS (%) | 0.522 | 0.3692 | 1 | |||||||||

| Tobin’s Q | 0.5198 | 0.4312 | 0.3218 | 1 | ||||||||

| Market to book value | 0.4322 | 0.4465 | 0.267 | 0.9073 | 1 | |||||||

| State ownership (%) | 0.0454 | 0.0914 | 0.0148 | 0.0229 | 0.0215 | 1 | ||||||

| Managerial ownership (%) | −0.0616 | −0.0344 | −0.1107 | −0.0409 | −0.0228 | −0.3374 | 1 | |||||

| Board ownership (%) | −0.0905 | −0.0719 | −0.1061 | −0.0548 | −0.0303 | −0.3991 | 0.7708 | 1 | ||||

| Domestic institutional ownership (%) | 0.0039 | −0.068 | 0.0444 | 0.0313 | 0.0155 | −0.2865 | −0.0505 | −0.0451 | 1 | |||

| Foreign institutional ownership (%) | 0.1362 | 0.0575 | 0.1671 | 0.1662 | 0.118 | −0.1934 | −0.0462 | −0.0523 | −0.0264 | 1 | ||

| SIZE (natural logarithm of assets) | −0.1266 | 0.0259 | 0.1318 | 0.0567 | 0.0436 | 0.1603 | −0.162 | −0.1966 | 0.0051 | 0.1835 | 1 | |

| LEV (liabilities to equities ratio) | −0.4499 | −0.0313 | −0.2963 | −0.1328 | −0.0944 | 0.072 | 0.0278 | 0.0332 | −0.1126 | −0.1418 | 0.2999 | 1 |

Figure A1.

The marginal effect of state ownership (%) on partially privatized firm’s ROA (%) according to both semiparametric regression model and IV semiparametric regression model.

Figure A2.

The marginal effect of state ownership (%) on partially privatized firm’s ROE (%) according to both semiparametric regression model and IV semiparametric regression model.

Figure A3.

The marginal effect of state ownership (%) on partially privatized firm’s ROS (%) according to both semiparametric regression model and IV semiparametric regression model.

Figure A4.

The marginal effect of state ownership (%) on partially privatized firm’s Tobin’s Q according to both semiparametric regression model and IV semiparametric regression model.

Figure A5.

The marginal effect of state ownership (%) on partially privatized firm’s market to book value according to both semiparametric regression model and IV semiparametric regression model.

Table A2.

Linear, quadratic, and cubic regressions of partially privatized firm profitability on residual state ownership.

Table A2.

Linear, quadratic, and cubic regressions of partially privatized firm profitability on residual state ownership.

| Variable | ROA (%) | ROE (%) | ROS (%) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| State ownership | 0.0441 *** | 0.2258 *** | 0.2801 *** | 0.0914 *** | 0.4759 *** | 0.3110 ** | 0.0256 * | 0.2360 *** | 0.3078 ** |

| Square of state ownership | −0.0022 *** | −0.0037 ** | −0.0047 *** | −0.0003 | −0.0026 *** | −0.0045 | |||

| Cube of state ownership | 0.0000 | 0.0000 | 0.0000 | ||||||

| Managerial ownership | 0.0447 | 0.0567 | 0.0586 | 0.1109 | 0.1377 * | 0.1323 * | −0.0707 | −0.0572 | −0.0549 |

| Board ownership | −0.0286 | −0.0174 | −0.0182 | −0.0247 | −0.0013 | 0.0010 | 0.0205 | 0.0341 | 0.0332 |

| Domestic institutional ownership | 0.0079 | 0.0150 | 0.0158 | 0.0149 | 0.0294 | 0.0269 | −0.0137 | −0.0059 | −0.0049 |

| Foreign institutional ownership | 0.0942 *** | 0.0868 *** | 0.0867 *** | 0.1531 *** | 0.1370 *** | 0.1373 *** | 0.1728 *** | 0.1636 *** | 0.1635 *** |

| Size | −0.1211 | 0.0946 | 0.0963 | 0.4175 | 0.8780 *** | 0.8724 *** | 0.8149 *** | 1.0670 *** | 1.0696 *** |

| Leverage | −1.7680 *** | −1.7836 *** | −1.7842 *** | −0.3007 | −0.3231 * | −0.3208 * | −2.4440 *** | −2.4601 *** | −2.4601 *** |

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Exchange dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 14.7514 *** | 5.6257 | 5.0400 | 16.5886 ** | −2.8347 | −1.0529 | −10.5700 | −21.2051 *** | −21.9915 *** |

| R2 | 0.3858 | 0.3961 | 0.3963 | 0.2209 | 0.2362 | 0.2367 | 0.3986 | 0.4026 | 0.4027 |

| N | 2844 | 2844 | 2844 | 2852 | 2852 | 2852 | 2863 | 2863 | 2863 |

| AIC | 18,329 | 18,283 | 18,284 | 22,206 | 22,151 | 22,152 | 21,916 | 21,899 | 21,901 |

This table reports linear, quadratic, and cubic regressions of privatized firm profitability proxied by ROA, ROE, and ROS on state ownership and a set of control variables defined in Section 3.3. * denotes p-value < 0.10; ** denotes p-value < 0.05; and *** denotes p-value < 0.01.

Table A3.

Linear, quadratic, and cubic regressions of partially privatized firm market performance on residual state ownership.

Table A3.

Linear, quadratic, and cubic regressions of partially privatized firm market performance on residual state ownership.

| Variable | Tobin’s Q | Market to Book Value | ||||

|---|---|---|---|---|---|---|

| State ownership | 0.0027 *** | 0.0150 *** | 0.0253 *** | 0.0056 *** | 0.0278 *** | 0.0360 *** |

| Square of state ownership | −0.0002 *** | −0.0004 *** | −0.0003 *** | −0.0005 *** | ||

| Cube of state ownership | 0.0000 *** | 0.0000 | ||||

| Managerial ownership | 0.0015 | 0.0023 | 0.0027 | 0.0027 | 0.0042 | 0.0045 |

| Board ownership | 0.0006 | 0.0014 | 0.0013 | 0.0059 ** | 0.0071 *** | 0.0070 *** |

| Domestic institutional ownership | 0.0024 *** | 0.0029 *** | 0.0031 *** | 0.0052 *** | 0.0061 *** | 0.0062 *** |

| Foreign institutional ownership | 0.0078 *** | 0.0073 *** | 0.0072 *** | 0.0133 *** | 0.0123 *** | 0.0123 *** |

| Size | 0.0215 *** | 0.0368 *** | 0.0373 *** | 0.0586 *** | 0.0849 *** | 0.0853 *** |

| Leverage | −0.0113 ** | −0.0124 ** | −0.0127 ** | −0.0070 | −0.0087 | −0.0089 |

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Exchange dummies | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | 1.5572 *** | 0.9231 *** | 0.8103 *** | 2.0290 *** | 0.9140 ** | 0.8228 * |

| R2 | 0.4556 | 0.4678 | 0.4691 | 0.5395 | 0.5500 | 0.5502 |

| N | 2855 | 2855 | 2855 | 2852 | 2852 | 2852 |

| AIC | 2204 | 2142 | 2137 | 5461 | 5397 | 5398 |

This table reports results from linear, quadratic, and cubic regressions of privatized firm market performance proxied by Tobin’s Q and market to book value ratio on state ownership and a set of control variables defined in Section 3.3. * denotes p-value < 0.10; ** denotes p-value < 0.05; and *** denotes p-value < 0.01.

Notes

| 1 | Residual state ownership in our study is defined as the percentage of state ownership remaining in a privatized firm after privatization has taken place (Liu and Xu 2021; Vaaler and Schrage 2009). |

| 2 | According to the report “The World in 2050”, issued by PricewaterhouseCoopers (PwC). |

| 3 | Data achievied from the General Statistics Office, Vietnam. |

| 4 | See Note 3 above. |

| 5 | The global financial crisis (GFC), or the financial crisis of 2007–2008, was a severe worldwide economic crisis that occurred in the late 2000s. |

References

- Ang, James S., and David K. Ding. 2006. Government ownership and the performance of government-linked companies: The case of Singapore.(Report). Journal of Multinational Financial Management 16: 64. [Google Scholar] [CrossRef]

- Ang, James S., Rebel A. Cole, and James W. Lin. 2000. Agency costs and ownership structure. Journal of Finance 55: 81–106. [Google Scholar] [CrossRef]

- Ben-Nasr, Hamdi, Narjess Boubakri, and Jean-Claude C. Cosset. 2012. The political determinants of the cost of equity: Evidence from newly privatized firms. Journal of Accounting Research 50: 605–46. [Google Scholar] [CrossRef]

- Bennedsen, Morten. 2000. Political ownership. Journal of Public Economics 76: 559–81. [Google Scholar] [CrossRef]

- Beuselinck, Cristof, Lihong Cao, Marc Deloof, and Xinping Xia. 2017. The value of government ownership during the global financial crisis. Journal of Corporate Finance 42: 481–93. [Google Scholar] [CrossRef]

- Bhagat, Sanjai, and Brian Bolton. 2008. Corporate governance and firm performance. Journal of Corporate Finance 14: 257–73. [Google Scholar] [CrossRef]

- Blundell, Richard, and James L. Powell. 2003. Endogeneity in Nonparametric and Semiparametric Regression Models. In Advances in Economics and Econometrics: Theory and Applications, Eighth World Congress. Edited by L. P. Hansen, M. Dewatripont and S. J. Turnovsky. Cambridge, MA: Cambridge University Press, vol. 2, pp. 312–57. [Google Scholar]

- Bo, Hong, Tao Li, and Linda A. Toolsema. 2009. Corporate social responsibility investment and social objectives: An examination on social welfare investment of Chinese state-owned enterprises. Scottish Journal of Political Economy 56: 267–95. [Google Scholar] [CrossRef]

- Borisova, Ginka, Veljko Fotak, Kateryna Holland, and William. L. Megginson. 2015. Government ownership and the cost of debt: Evidence from government investments in publicly traded firms. Journal of Financial Economics 118: 168–91. [Google Scholar] [CrossRef]

- Boubakri, Narjess, Jean-Claude Cosset, and Omrane Guedhami. 2005. Postprivatization corporate governance: The role of ownership structure and investor protection. Journal of Financial Economics 76: 369–99. [Google Scholar] [CrossRef]

- Boubakri, Narjess, Sadok El Ghoul, Omrane Guedhami, and William L. Megginson. 2018. The market value of government ownership. Journal of Corporate Finance 50: 44–65. [Google Scholar] [CrossRef]

- Boycko, Maxim, Andrei Shleifer, and Robert W. Vishny. 1996. A theory of privatisation. The Economic Journal 106: 309–19. [Google Scholar] [CrossRef]

- Chaney, Paul K., Mara Faccio, and David Parsley. 2011. The quality of accounting information in politically connected firms. Journal of Accounting and Economics 51: 58–76. [Google Scholar] [CrossRef]

- Chang, Eric C., and Sonia M. L. Wong. 2004. Political control and performance in China’s listed firms. Journal of Comparative Economics 32: 617–36. [Google Scholar] [CrossRef]

- Chang, Ha-Joon. 2007. State-Owned Enterprise Reform. Available online: https://EconPapers.repec.org/RePEc:une:pnotes:4 (accessed on 22 July 2021).

- Charumilind, Chutatong, Raja Kali, and Yupana Wiwattanakantang. 2006. Connected lending: Thailand before the financial crisis. The Journal of Business 79: 181–218. [Google Scholar] [CrossRef]

- Chen, Gongmeng, Michael Firth, and Liping Xu. 2009. Does the type of ownership control matter? Evidence from China’s listed companies. Journal of Banking and Finance 33: 171–81. [Google Scholar] [CrossRef]

- Chen, G., Michael Firth, and Oliver Rui. 2006. Have China’s enterprise reforms led to improved efficiency and profitability? Emerging Markets Review 7: 82–109. [Google Scholar] [CrossRef]

- Chen, Ruiyuan, Sadok E. Ghoul, Omrane Guedhami, Chuck Kwok, and Robert Nash. 2021. International evidence on state ownership and trade credit: Opportunities and motivations. Journal of International Business Studies 52: 1121–58. [Google Scholar] [CrossRef]

- Cornett, Marcia M., Alan J. Marcus, Anthony Saunders, and Hassan Tehranian. 2007. The impact of institutional ownership on corporate operating performance. Journal of Banking and Finance 31: 1771–94. [Google Scholar] [CrossRef]

- Daiser, Peter, Tamyko Ysa, and Daniel Schmitt. 2017. Corporate governance of state-owned enterprises: A systematic analysis of empirical literature. International Journal of Public Sector Management 30: 447–66. [Google Scholar] [CrossRef]

- Dess, Gregory G., R. Duane Ireland, and Michael A. Hitt. 1990. Industry effects and strategic management research. Journal of Management 16: 7–27. [Google Scholar] [CrossRef]

- Dharwadkar, Ravi, Gerard George, and Pamela Brandes. 2000. Privatization in emerging economies: An agency theory perspective. The Academy of Management Review 25: 650–69. [Google Scholar] [CrossRef]

- Elyasiani, Elyas, and Jingyi Jia. 2010. Distribution of institutional ownership and corporate firm performance. Journal of Banking and Finance 34: 606–20. [Google Scholar] [CrossRef]

- Erkens, David H., Mingyi Hung, and Pedro Matos. 2012. Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance 18: 389–411. [Google Scholar] [CrossRef]

- Faccio, Mara, Roland W. Masulis, and John J. McConnell. 2006. Political connections and corporate bailouts. Journal of Finance 61: 2597–635. [Google Scholar] [CrossRef]

- Fan, Joseph P. H., T. J. Wong, and Tianyu Zhang. 2007. Politically connected CEOs, corporate governance, and Post-IPO performance of China’s newly partially privatized firms. Journal of Financial Economics 84: 330–57. [Google Scholar] [CrossRef]

- Ferreira, Miguel A., and Pedro Matos. 2008. The colors of investors’ money: The role of institutional investors around the world. Journal of Financial Economics 88: 499–533. [Google Scholar] [CrossRef]

- Gedajlovic, Eric, and Daniel M. Shapiro. 2002. Ownership structure and firm profitability in Japan. The Academy of Management Journal 45: 565–75. [Google Scholar] [CrossRef]

- Gordon, Roger H., and Wei Li. 2003. Government as a discriminating monopolist in the financial market: The case of China. Journal of Public Economics 87: 283–312. [Google Scholar] [CrossRef]

- Haider, Zulfiquer A., Mingzhi Liu, Yefeng Wang, and Ying Zhang. 2018. Government ownership, financial constraint, corruption, and corporate performance: International evidence. Journal of International Financial Markets, Institutions and Money 53: 76–93. [Google Scholar] [CrossRef]

- Hoang, Lai Trung, Cuong Cao Nguyen, and Baiding Hu. 2017. Ownership structure and firm performance improvement: Does it matter in the Vietnamese stock market? Economic Papers: A Journal of Applied Economics and Policy 36: 416–28. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Khatib, Saleh F. A., Dewi F. Abdullah, Ahmed Elamer, and Saddam A. Hazaea. 2022. The development of corporate governance literature in Malaysia: A systematic literature review and research agenda. Corporate Governance: The International Journal of Business in Society. [Google Scholar] [CrossRef]

- King, Stephen, and Rohan Pitchford. 1998. Privatisation in Australia: Understanding the Incentives in Public and Private Firms. Australian Economic Review 31: 313–28. [Google Scholar] [CrossRef]

- Kraus, Alan, and Robert H. Litzenberger. 1973. A state-preference model of optimal financial leverage. The Journal of Finance 28: 911–22. [Google Scholar] [CrossRef]

- Kubo, Katsuyuki, and Huu Viet Phan. 2019. State ownership, sovereign wealth fund and their effects on firm performance: Empirical evidence from Vietnam. Pacific-Basin Finance Journal 58: 101220. [Google Scholar] [CrossRef]

- Laffont, Jean-Jacques, and Jean Tirole. 1991. Privatization and incentives. Journal of Law, Economics, and Organization 7: 84–105. [Google Scholar] [CrossRef]

- Law on Enterprises. 2014. Available online: https://vbpl.vn/TW/Pages/vbpqen-toanvan.aspx?ItemID=11033 (accessed on 9 April 2022).

- Le, Manh-Duc, Fabio Pieri, and Enrico Zaninotto. 2019. From central planning towards a market economy: The role of ownership and competition in Vietnamese firms’ productivity. Journal of Comparative Economics 47: 693–716. [Google Scholar] [CrossRef]

- Le, Trien, and Trevor Buck. 2011. State ownership and listed firm performance: A universally negative governance relationship? Journal of Management and Governance 15: 227–48. [Google Scholar] [CrossRef]

- Le, Thi Phuong Vy, and Thi Bich Nguyet Phan. 2017. Capital structure and firm performance: Empirical evidence from a small transition country. Research in International Business and Finance 42: 710–26. [Google Scholar] [CrossRef]

- Li, Qi, and Jeffrey Racine. 2007. Nonparametric Econometrics: Theory and Practice. Princeton: Princeton University Press. [Google Scholar]

- Liao, Jing, and Martin Young. 2012. The impact of residual government ownership in privatized firms: New evidence from China. Emerging Markets Review 13: 338–51. [Google Scholar] [CrossRef]

- Lin, Chen, and Dongwei Su. 2008. Industrial diversification, partial privatization and firm valuation: Evidence from publicly listed firms in China. Journal of Corporate Finance 14: 405–17. [Google Scholar] [CrossRef]