Intended Use of IPO Proceeds and Survival of Listed Companies in Malaysia

Abstract

:1. Introduction

2. Literature Review

2.1. Survival of Companies

2.2. Intended Use of IPO Proceeds and Survival of Companies

3. Data and Methodology

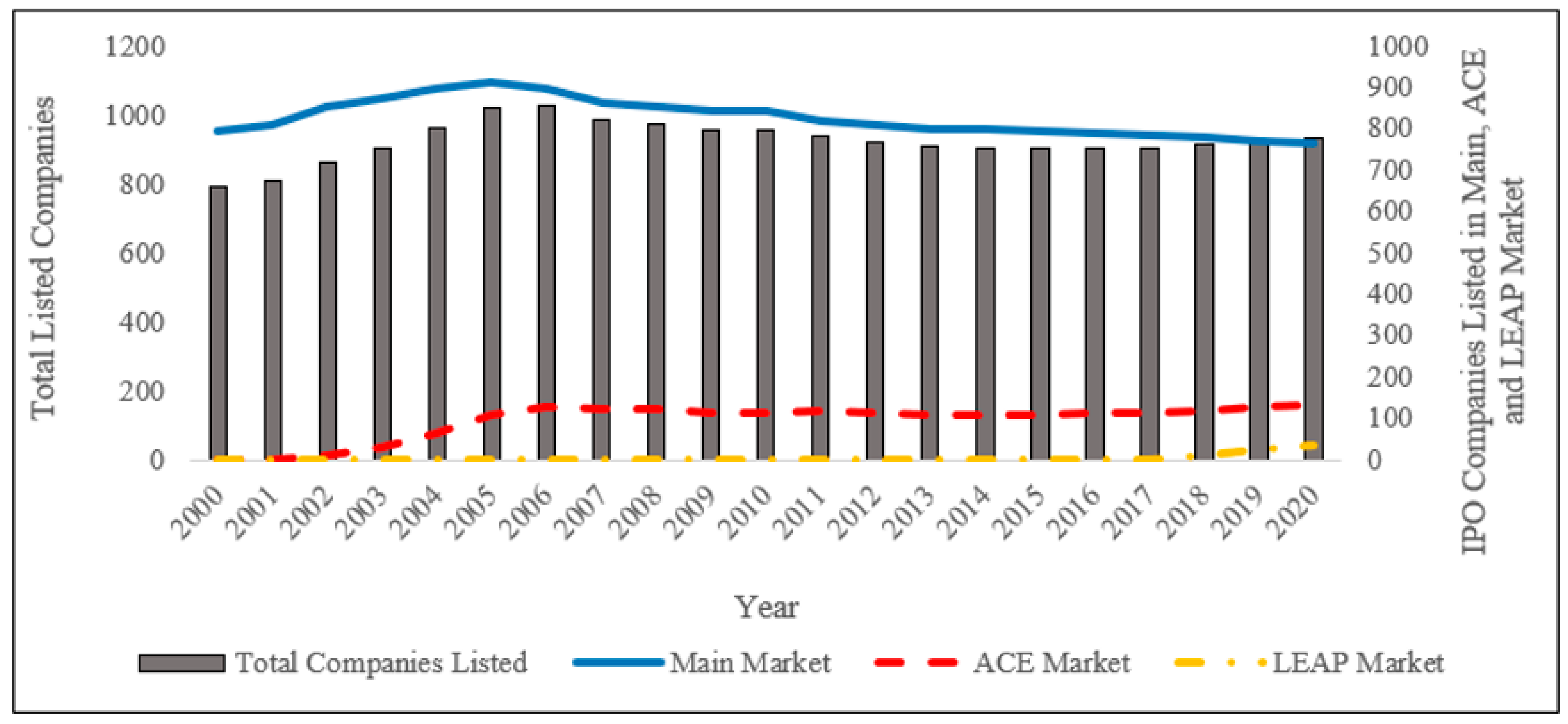

3.1. Data and Sources

3.2. Measurement of Variables

- STi = survival time of ith Company

- t1i = last month of survival observation for ith Company

- t0i = listing date (or month) of ith Company

| Non-Censored = “0” |

- DSurviveii = censored data of ith Company using dummy survive

4. Methodology

- S(ti) = probability of surviving in month ti.

- S(ti−1) = probability of surviving in month ti−1.

- ni = sample size at the month beginning ti.

- di = number of sample non-surviving at the month ti.

- Ln(ST) = natural logarithm of time-to-survive (in months)

- i = ith company

- α = constant term

- β = coefficient of the respective independent variable

- GROPP = growth opportunities

- DERE = debt repayment

- WOCA = working capital

- INPER = initial performance

- RISK = risk of company

- QUALITY = quality of company

- RETAIN = shareholders retention

- MARSEN = market sentiment

- ɛi = error term

5. Results

5.1. Variance Inflation Factor

5.2. Kaplan–Meier Survival Estimates

5.3. Multiple Regression Analysis Using AFT Model

6. Discussion

7. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | The Kuala Lumpur Composit Index (KLCI), under the “Selection of FTSE Bursa Malaysia KLCI Constituents” of Bursa Malaysia website. |

| 2 | The information is available in Company’s Announcement, on Bursa Malaysia website. |

| 3 | Tanah Makmur Berhad has the lowest survival period over the observation of 21 years, at 32 months. The company was listed on 17 July 2014 and delisted on 27 March 2017 from Bursa Malaysia due to corporate proposal. Further information is available in Company’s Announcement, on Bursa Malaysia website. |

| 4 | A prospectus is a primary informational document developed by the IPO issuers containing all information needed for investors to make informed investment strategies (Kecskés and Halász 2015), which it is made compulsory for all companies pursuing for first-time equity offerings. The information required depends on the guidelines provided in the most recent revised SCM Prospectus Guidelines (PG). |

| 5 | In the context of this study, hiccups come from several criteria (insiders possessing lower than 25 % of companies’ equity and companies’ subsidiary asset account for 50 % of the companies’ total assets) triggered by companies to be listed or listed in the Practice Note and Guidance Note. |

| 6 | Other survival distributions reports: Exponential distribution (940.47), Log-normal distribution (872.87), Log-logistics distribution (838.15). |

References

- Abdul Rahman, Siti Suhaila, and Norliza Che-Yahya. 2019. Initial and long-term performance of IPOs. Does growth opportunity of issuing firm matter? Journal of Business and Eonomic Horizons 15: 276–91. [Google Scholar]

- Abdul-Rahim, Ruzita, and Nor Azizan Che-Embi. 2013. Initial Returns of Shariah versus Non-Shariah IPOs: Are There Any Differences? Jurnal Pengurusan 39: 37–50. [Google Scholar] [CrossRef]

- Ahmad, Wasim, and Ranko Jelic. 2014. Lockup Agreements and Survival of UK IPOs. Journal of Business Finance and Accounting 41: 717–42. [Google Scholar] [CrossRef] [Green Version]

- Ahmad, Iftikhar, Izlin Ismail, and Shahrin Saaid Shaharuddin. 2021. Predictive Role of Ex Ante Strategic Firm Characteristics for Sustainable Initial Public Offering (IPO) Survival. Sustainability 13: 8063. [Google Scholar] [CrossRef]

- Ahmad-Zaluki, Nurwati Ashikkin, and Bazeet Olayemi Badru. 2020. Intended use of IPO proceeds and initial returns. Journal of Financial Reporting and Accounting 36: 184–210. [Google Scholar] [CrossRef]

- Amor, Salma Ben, and Maher Kooli. 2017. Intended use of proceeds and post-IPO performance. The Quarterly Review of Economics and Finance 65: 168–81. [Google Scholar] [CrossRef]

- Andriansyah, Andriansyah, and George Messinis. 2016. Intended use of IPO proceeds and firm performance: A quantile regression approach. Pacific-Basin Finance Journal 36: 14–30. [Google Scholar] [CrossRef]

- Asteriou, Dimitrios, and Stephen George Frederick Hall. 2011. Applied Econometrics, 2nd ed. London: PALGRAVE MACMILLAN. [Google Scholar]

- Badru, Bazeet Olayemi. 2021. Decomposition of Intended Use of Initial Public Offering Proceeds: Evidence from Malaysia. Gadjah Mada International Journal of Business 23: 76–90. [Google Scholar] [CrossRef]

- Balatbat, Maria Cleofas, and Scott Bertinshaw. 2008. Use of Proceeds Disclosures in IPO Prospectuses: Do Issuers Come Clean? The FINISIA Journal of Applied Finance 2: 17–21. [Google Scholar]

- Baluja, Garima. 2018. Does Size Matter for IPO Survival? Empirical Evidence from India. Vision: The Journal of Business Perspective 22: 88–104. [Google Scholar] [CrossRef]

- Baluja, Garima, and Balwinder Singh. 2016. The Survival Analysis of Initial Public Offerings in India. Journal of Advances in Management Research 13: 23–41. [Google Scholar] [CrossRef]

- Bradburn, Mike, Taane Clark, Sharon Love, and Douglas Graham Altman. 2003. Survival Analysis Part II: Multivariate Data Analysis: An introduction to concepts and methods. British Journal of Cancer 89: 431–36. [Google Scholar] [CrossRef] [PubMed]

- Bursa Malaysia. 2021. Selection of FTSE Bursa Malaysia KLCI Constituents. Kuala Lumpur: Bursa Malaysia. [Google Scholar]

- Chancharat, Nongnit, Chandrasekhar Krishnamurti, and Gary Tian. 2012. Board Structure and Survival of New Economy IPO Firms. Corporate Governance: An International Review 20: 144–63. [Google Scholar] [CrossRef] [Green Version]

- Chin-Chi, Liu. 2020. Intended Use of Proceeds and Long-run Performance of Reverse Mergers: Evidence from Taiwan. Journal of Economics and Management 16: 33–49. [Google Scholar]

- Cleves, Mario, William Gould, and Yulia Marchenko. 2016. An Introduction to Survival Analysis Using Stata, Rev. 3rd ed. College Station: Stata Press. [Google Scholar]

- Espenlaub, Susanne, Arif Khurshed, and Abdulkadir Mohamed. 2012. IPO Survival in a Reputational Market. Journal of Business Finance and Accounting 39: 427–63. [Google Scholar] [CrossRef]

- Espenlaub, Susanne, Abhinav Goyal, and Abdulkadir Mohamed. 2016. Impact of legal institutions on IPO survival: A global perspective. Journal of Financial Stability 25: 98–112. [Google Scholar] [CrossRef]

- Fan, Qintao. 2007. Earnings Management and Ownership Retention for Initial Public Offering Firms: Theory and Evidence. The Accounting Review 82: 27–64. [Google Scholar] [CrossRef]

- Fan, Pengda. 2019. Debt retirement at IPO and firm growth. Journal of Economics and Business 101: 1–16. [Google Scholar] [CrossRef]

- Hamza, Olfa, and Maher Kooli. 2010. Does Venture Capitalists Reputation Improve the Survival Profile of IPO Firms? SSRN Electronic Journal. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1857012 (accessed on 17 January 2021).

- Helbing, Pia. 2019. The determinants of IPO withdrawal—Evidence from Europe. International Review of Financial Analysis 62: 200–208. [Google Scholar] [CrossRef]

- Hensler, Douglas, Ronald Rutherford, and Thomas Springer. 1997. The Survival of Initial Public Offerings in the Aftermarket. The Journal of Financial Research 20: 93–110. [Google Scholar] [CrossRef]

- Jain, Bharat, and Omesh Kini. 2000. Does the Presence of Venture Capitalists Improve the Survival Profile of IPO firms? Journal of Business Finance and Accounting 27: 1139–76. [Google Scholar] [CrossRef]

- Kao, Lanfeng, and Anlin Chen. 2020. How A Pre-IPO Audit Committee Improves IPO Pricing Efficiency in An Economy with Little Value Uncertainty and Information Asymmetry. Journal of Banking and Finance 110: 105688. [Google Scholar] [CrossRef]

- Kecskés, András, and Vendel Halász. 2015. The Role of Prospectus Documentation and Prospectus Liability. Pravni Vjesnik 31: 167–84. [Google Scholar]

- Kim, Woojin, and Michael Weisbach. 2008. Motivations for public equity offers: An international perspective. Journal of Financial Economics 87: 281–307. [Google Scholar] [CrossRef] [Green Version]

- Kooli, Maher, and Siham Meknassi. 2007. The Survival of U.S. IPO Issuers 1985–2005. The Journal of Wealth Management 10: 105–19. [Google Scholar] [CrossRef]

- Lamberto, Andre Paul, and Subhrendu Rath. 2010. The Survival of Initial Public Offerings in Australia. The International Journal of Business and Finance Research 4: 133–47. [Google Scholar]

- Leone, Andrew, Steve Rock, and Michael Willenborg. 2007. Disclosure of Intended Use of Proceeds and Underpricing in Initial Public Offerings. Journal of Accounting Research 45: 111–53. [Google Scholar] [CrossRef]

- Ljungqvist, Alexander, and William Jr. Wilhelm. 2003. IPO Pricing in the Dot-com Bubble. The Journal of Finance 58: 723–52. [Google Scholar] [CrossRef] [Green Version]

- Luo, Xueming. 2009. Quantifying the Long-Term Impact of Negative Word of Mouth on Cash Flows and Stock Prices. Marketing Science 28: 148–65. [Google Scholar] [CrossRef] [Green Version]

- McGuinness, Paul. 2019. Risk factor and use of proceeds declarations and their effects on IPO subscription, price ‘fixings’, liquidity and aftermarket returns. The European Journal of Finance 25: 1122–46. [Google Scholar] [CrossRef]

- Mohd-Rashid, Rasidah, Ruzita Abdul-Rahim, and Norliza Che-Yahya. 2019. The Influence of Information Asymmetry on IPO Lock-up Provisions: Evidence from Malaysian Market. Global Business Review 20: 613–26. [Google Scholar] [CrossRef]

- Neneh, Brownhilder Ngek, and Van Aardt Smit. 2014. Determinants of IPO Survival on the Johannesburg Securities Exchange. Risk Governance & Control: Financial Markers & Institutions 4: 71–83. [Google Scholar]

- Paleari, Stefano, Enrico Pellizzoni, and Silvio Vismara. 2008. The Going Public Decision: Evidence from the IPOs in Italy and in the UK. International Journal Applied Decision Sciences 1: 131–52. [Google Scholar] [CrossRef]

- Peristiani, Stavros, and Gijoon Hong. 2004. Pre-IPO Financial Performance and Aftermarket Survival. Current Issues in Economics and Finance 10: 1–7. [Google Scholar]

- Pour, Eilnaz Kashefi. 2015. IPO survival and CEOs’ decision-making power: The evidence of China. Research in International Business and Finance 33: 247–67. [Google Scholar] [CrossRef]

- Pour, Eilnaz Kashefi, and Meziane Lasfer. 2013. Why do companies delist voluntarily from the stock market? Journal of Banking and Finance 37: 4850–60. [Google Scholar] [CrossRef]

- Schultz, Paul. 1993. Unit Initial Public Offerings. Journal of Financial Economics 34: 199–229. [Google Scholar] [CrossRef]

- Serio, Gianluigi Serio, Maria Michela Dickson, Diego Giuliani, and Giuseppe Espa. 2020. Green Production as a Factor of Survival for Innovative Startups: Evidence from Italy. Sustainability 12: 9464. [Google Scholar] [CrossRef]

- Shari, Wahidah. 2019. Survival of the Malaysian Initial Public Offerings. Management Science Letters 9: 607–20. [Google Scholar] [CrossRef]

- Tajuddin, Ahmad Hakimi, Nur Adiana Hiau Abdullah, and Kamarun Nisham Taufil-Mohd. 2016. Does Growth Opportunity Matter in Explaining the Oversubscription Phenomena of Malaysian IPO? Procedia—Social and Behavioral Sciences 219: 748–54. [Google Scholar] [CrossRef] [Green Version]

- Varghese, Ann, Ponnu Sibby, and Kavitha Jayakumar. 2020. IPO Mobilisation and Allocation: An Empirical Analysis. Mukt Shabd Journal 9: 3462–72. [Google Scholar]

- Valaskova, Katarina, Tomas Kliestik, and Dominika Gajdosikova. 2021. Distinctive determinants of financial indebtedness: Evidence from Slovak and Czech enterprises. Equilibrium 16: 639–59. [Google Scholar] [CrossRef]

- Wyatt, Anne. 2014. Is there useful information in the ‘use of proceeds’ disclosures in IPO prospectuses? Journal of Accounting and Finance 54: 625–67. [Google Scholar] [CrossRef]

- Zhang, Dongyang, Wenping Zheng, and Lutao Ning. 2018. Does innovation facilitate firm survival? Evidence from Chinese high-tech firms. Economic Modelling 75: 458–68. [Google Scholar] [CrossRef]

| No. | Variables | Notation | Definition | Measurements |

|---|---|---|---|---|

| 1. | Growth Opportunities | GROPP | IPO proceeds for growth activities (%) | |

| 2. | Debt Repayment | DERE | IPO proceeds for relieving, reducing or retiring indebtedness (%) | |

| 3. | Working Capital | WOCA | IPO proceeds for working capital and daily activities (%) | |

| 4. | Initial Performance | INPER | Initial return (%) | |

| 5. | Risk of Company | RISK | Offer Size (Ln) | |

| 6. | Quality of Company | QUALITY | Oversubscription Ratio (times) | |

| 7. | Shareholder Retention | RETAIN | Insiders’ ownership (%) | |

| 8. | Market Sentiment | MARSEN | Dummy Hot (“1” or “0”) | = IF, NOSLt ≥ ANOSLt = “1” IF, NOSLt < ANOSLt = “0” |

| Variables | VIF | 1/VIF |

|---|---|---|

| GROPP | 2.39 | 0.4177 |

| DERE | 1.90 | 0.5251 |

| WOCA | 1.78 | 0.5613 |

| INPER | 1.27 | 0.7878 |

| RISK | 1.44 | 0.6928 |

| QUALITY | 1.30 | 0.7670 |

| RETAIN | 1.04 | 0.9632 |

| MARSEN | 1.15 | 0.8670 |

| Categories | No. of Companies | Cumulative Survival Rates (%) | ST Median (50%) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | |||

| Panel A: Full Sample | |||||||||

| Total | 423 | 81.80 | 74.23 | 69.03 | 62.88 | 59.81 | 56.26 | 53.18 | 101 |

| Panel B: Category of IPO Proceeds | |||||||||

| Growth Opportunities | |||||||||

| (0–50%) | 248 | 83.06 | 73.79 | 71.37 | 64.11 | 60.89 | 58.06 | 55.24 | 104 |

| (51–100%) | 175 | 80.00 | 74.86 | 65.71 | 61.14 | 58.29 | 53.71 | 50.27 | 90 |

| Debt Repayment | |||||||||

| (0–50%) | 374 | 81.28 | 74.06 | 68.45 | 62.83 | 59.63 | 56.42 | 53.73 | 104 |

| (51–100%) | 49 | 85.71 | 75.51 | 73.47 | 63.27 | 61.22 | 55.10 | 48.98 | 82 |

| Working Capital | |||||||||

| (0–50%) | 308 | 81.17 | 76.30 | 70.13 | 64.61 | 61.69 | 57.79 | 54.86 | 106 |

| (51–100%) | 115 | 83.48 | 68.70 | 66.09 | 58.26 | 54.78 | 52.17 | 48.70 | 81 |

| Variables | Time Ratio | p-Value | Coefficient |

|---|---|---|---|

| GROPP (%) | 0.9960 | 0.05 | −0.0040 ** |

| DERE (%) | 0.9963 | 0.09 | −0.0037 * |

| WOCA (%) | 0.9976 | 0.26 | −0.0024 |

| INPER (%) | 1.0022 | 0.01 | 0.0022 ** |

| RISK (Ln) | 1.0008 | 0.98 | 0.0008 |

| QUALITY (times) | 0.9986 | 0.04 | −0.0014 ** |

| RETAIN (%) | 0.9946 | 0.10 | −0.0054 * |

| MARSEN (D) | 0.7424 | 0.00 | −0.2979 *** |

| Constant | 12.6981 | 0.00 | 2.5414 |

| Akaike Information Criterion | 810.79 | ||

| Log-likelihood | −395.39 | ||

| Time at Risk | 1682.86 | ||

| Observations | 423 | ||

| Link test (hatsq p-value) | 0.85 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alyasa-Gan, S.S.; Che-Yahya, N. Intended Use of IPO Proceeds and Survival of Listed Companies in Malaysia. J. Risk Financial Manag. 2022, 15, 145. https://doi.org/10.3390/jrfm15030145

Alyasa-Gan SS, Che-Yahya N. Intended Use of IPO Proceeds and Survival of Listed Companies in Malaysia. Journal of Risk and Financial Management. 2022; 15(3):145. https://doi.org/10.3390/jrfm15030145

Chicago/Turabian StyleAlyasa-Gan, Siti Sarah, and Norliza Che-Yahya. 2022. "Intended Use of IPO Proceeds and Survival of Listed Companies in Malaysia" Journal of Risk and Financial Management 15, no. 3: 145. https://doi.org/10.3390/jrfm15030145

APA StyleAlyasa-Gan, S. S., & Che-Yahya, N. (2022). Intended Use of IPO Proceeds and Survival of Listed Companies in Malaysia. Journal of Risk and Financial Management, 15(3), 145. https://doi.org/10.3390/jrfm15030145