Optimism in Financial Markets: Stock Market Returns and Investor Sentiments

Abstract

1. Introduction

2. Literature Review

2.1. Investor Sentiment

2.2. Empirical Investigation

3. Methodology

3.1. Indices and Models

- -

- Close-end fund discount rate (CEFD);

- -

- Share turnover (TURN);

- -

- Number of IPOs (NIPO);

- -

- First-day returns of IPOs (RIPO);

- -

- Dividend premium (PDND); and

- -

- Equity share in new issues (EQTI).

3.2. Data

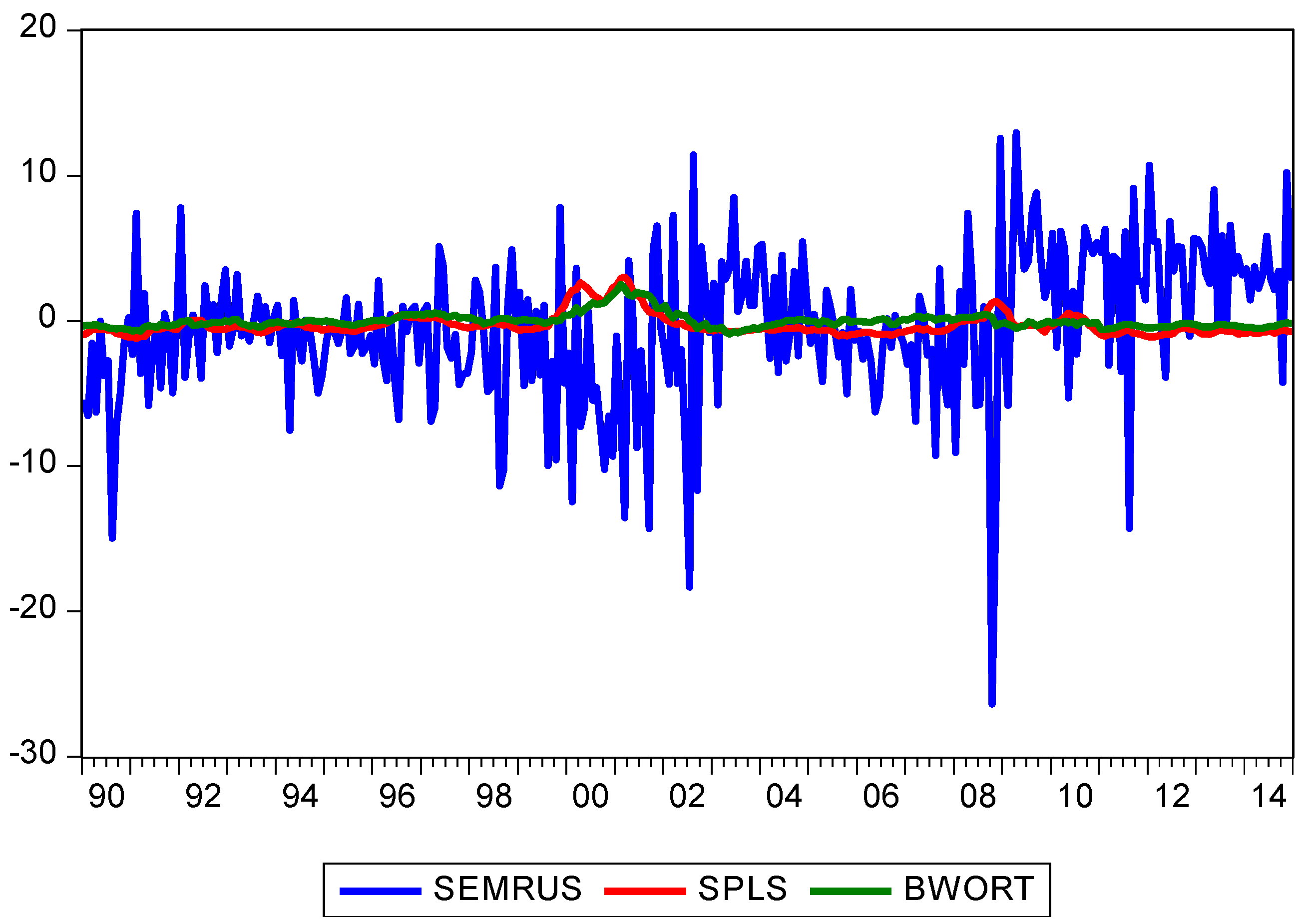

- Stock excess market returns of U.S. market, SEMRUS: calculated from price of S&P500, including dividends and in excess of the risk free rate (3-month US treasury bill);

- Continuous compounding of S&P500, COMPOUND: calculated without dividends, in excess of risk free rate (10-year US treasury bill);

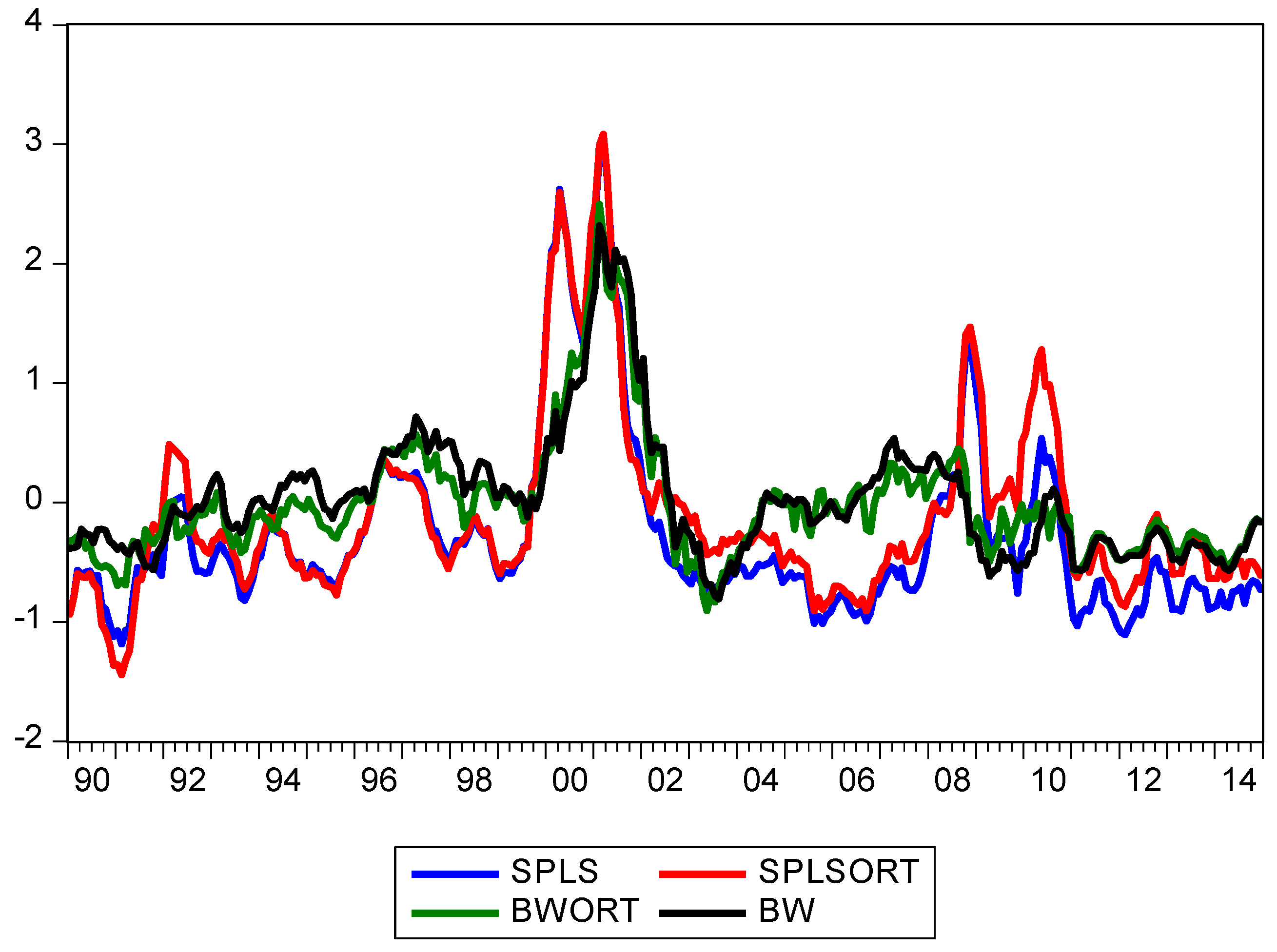

- Investor sentiment index, BW: calculated by (Baker and Wurgler 2006), through the PC method;

- Orthogonalised investor sentiment index, BWORT: calculated by (Baker and Wurgler 2006), the orthogonalisation is applied in order to reduce the systematic risk;

- Aligned investor sentiment index, SPLS: calculated by (Huang et al. 2014), through the PLS method;

- Orthogonalised aligned investor sentiment index, SPLSORT: calculated by (Huang et al. 2014), the orthogonalisation is applied for the same reasons as before;

- Conference Board Consumer Confidence Index of US, CB_CONS: calculated through surveys on expectations about business conditions, employment and income, from consumers over a six-month horizon;

- CBOE’s Volatility of S&P500, VIX: annualised standard deviation, also known as uncertainty index, it is calculated from near expectations (one-month horizon) about stock market volatility.

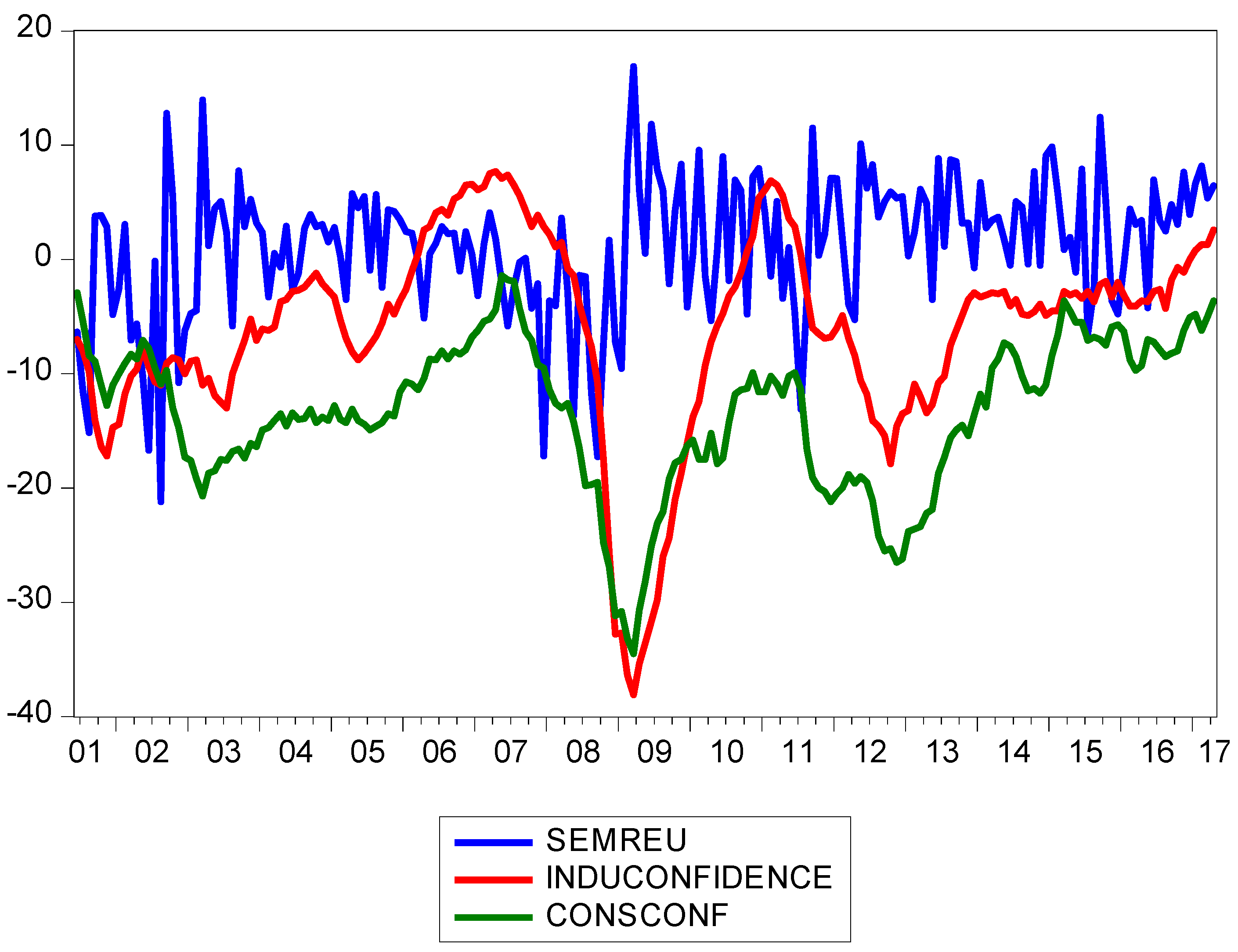

- Stock excess market returns of EU market, SEMREU: calculated from price of Euro Stoxx 50, including dividends and in excess of the risk free rate (3-month Euribor);

- Continuous compounding of Euro Stoxx 50, COMPOUND: calculated without dividends, in excess of risk free rate (10-year German government bond);

- Economic Sentiment Indicator of European countries, ESI_EU: published monthly by the European Commission, it consists of five sectoral confidence indicators (based on results from business surveys), which are: industry (40%), services (30%), consumers (20%), construction (5%) and retail trade (5%);

- Economic Sentiment Indicator of Eurozone, ESI_EUZONE: composite calculated only for the Eurozone countries;

- Consumer Confidence Indicator of Europe, CONSCONF: calculated from surveys on the financial situation of households, the general economic situation, unemployment expectations and savings, over one year horizon;

- Industrial Confidence Indicator of Europe, INDUCONF: calculated from surveys on production expectations, order books and stocks of finished products;

- Economic Sentiment Indicator of Germany, ZEW_DEU: calculated from surveys on expectations about macroeconomic development, financial and industrial profit situation over the following six months;

- Ifo Business Climate Index, IFO: dealing with the assessments of business situation and future expectations, it is calculated from surveys on different sectors from enterprises, such as manufacturing, construction, wholesaling and retailing, over a six-month horizon.

3.3. Empirical Results

3.3.1. The U.S. Market

3.3.2. The European Market

3.3.3. Spillover Effect

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Baker, Malcom, and Jeffrey Wurgler. 2006. Investor sentiment and the cross-section of stock returns. The Journal of Finance 61: 1645–80. [Google Scholar] [CrossRef]

- Baker, Malcom, and Jeffrey Wurgler. 2007. Investor sentiment in the stock market. Journal of Economic Perspectives 21: 129–51. [Google Scholar] [CrossRef]

- Barberis, Nicholas. 2000. Investing for the long run when returns are predictable. Journal of Finance 55: 225–64. [Google Scholar] [CrossRef]

- Barberis, Nicholas, and Richard Thaler. 2003. A Survey of behavioral finance. In Handbook of the Economics of Finance, (1051–1121). Edited by George M. Constantinides, Milton Harris and René Stulz. Amsterdam: Elsevier Science B.V. [Google Scholar]

- Barberis, Nicholas, Andrei Shleifer, and Robert Vishny. 1998. A model of investor sentiment. Journal of Financial Economics 49: 307–43. [Google Scholar] [CrossRef]

- Brown, Gregory, and Michael Cliff. 2005. Investor sentiment and asset valuation. Journal of Business 78: 405–40. [Google Scholar] [CrossRef]

- Chung, San-Lin, Chi-Hsou Hung, and Chung-Ying Yeh. 2012. When does investor sentiment predict stock returns? Journal of Empirical Finance 19: 217–40. [Google Scholar] [CrossRef]

- Diebold, Francis Xavier, and Robert Mariano. 1995. Comparing predictive accuracy. Journal of Business and Economic Statistics 13: 253–63. [Google Scholar]

- Fernandes, Carla Manuela de Assunção, Paulo Miguel Marquez Gonçalves, and Elisabete Fatima Simões Vieira. 2013. Does sentiment matter for stock market returns? Evidence from a small European market. Journal of Behavioral Finance 14: 253–67. [Google Scholar] [CrossRef]

- Fisher, Kenneth, and Meir Statman. 2000. Investor sentiment and stock returns. Financial Analysts Journal 56: 16–23. [Google Scholar] [CrossRef]

- Hodrick, Robert. 1992. Dividend yields and expected stock returns: Alternative procedures for inference and measurement. Review of Financial Studies 5: 357–86. [Google Scholar] [CrossRef]

- Huang, Dashan, Fuwei Jiang, Jun Tu, and Guofu Zhou. 2014. Investor sentiment aligned: A powerful predictor of stock returns. Review of Financial Studies 28: 791–37. [Google Scholar] [CrossRef]

- Kandel, Shmuel, and Robert Stambaugh. 1996. On the predictability of stock returns: An asset allocation perspective. Journal of Finance 51: 385–424. [Google Scholar] [CrossRef]

- Koop, Gary. 2003. Bayesian Econometrics. Hoboken: Wiley. [Google Scholar]

- Lemmon, Michael, and Evgenia Portniaguina. 2006. Consumer confidence and asset prices: some empirical evidence. Review of Financial Studies 19: 1499–529. [Google Scholar] [CrossRef]

- Pettenuzzo, Davide, Allan Timmermann, and Rosen Valkanov. 2014. Forecasting stock returns under economic constraints. Journal of Financial Economics 114: 517–53. [Google Scholar] [CrossRef]

- Schmeling, Michael. 2009. Investor sentiment and stock returns: Some international evidence. Journal of Empirical Finance 16: 394–408. [Google Scholar] [CrossRef]

- Verma, Rahul, and Gökçe Soydemir. 2006. The Impact of U.S. individual and institutional investor sentiment on foreign stock markets. Journal of Behavioral Finance 7: 128–44. [Google Scholar] [CrossRef]

- Verma, Rahul, Hasan Baklaci, and Gökçe Soydemir. 2008. The impact of rational and irrational sentiments of individual and institutional investors on DJIA and S&P500 index returns. Applied Financial Economics 18: 1303–17. [Google Scholar]

- Welch, Ivo, and Amit Goyal. 2008. A comprehensive look at the empirical performance of equity premium prediction. Review of Financial Studies 21: 1455–508. [Google Scholar] [CrossRef]

- West, Kenneth. 1996. Asymptotic inference about predictive ability. Econometrica 64: 1067–84. [Google Scholar] [CrossRef]

| 1. | We also investigate uniform flat priors. For the US example the results are almost identical; for the EU exercise we find large parameter uncertainties and lower forecast accuracy. |

| Variable | Post Mean ß | Bayesian t-Stat | Positive Post. Distr. | MSPE Ratio |

|---|---|---|---|---|

| SPLS | −1.079 | −1.965 | 0.050 | 0.933 ** |

| BW | −2.200 | −3.149 | 0.002 | 0.926 ** |

| SPLSORT | −1.041 | −2.068 | 0.040 | 0.940 ** |

| BWORT | −2.350 | −3.318 | 0.001 | 0.939 ** |

| CB_CONS | −0.046 | −1.685 | 0.093 | 0.938 ** |

| VIX | −0.259 | −5.150 | 0.000 | 0.954 ** |

| Variable | Post Mean ß | Bayesian t-Stat | Positive Post. Distr. | MSPE Ratio |

|---|---|---|---|---|

| ESI_EU | −0.040 | −0.410 | 0.663 | 1.000 |

| ESI_EUZONE | −0.040 | −0.332 | 0.740 | 0.999 |

| CONSCONF | −0.490 | −2.690 | 0.006 | 1.000 |

| INDUCONF | 0.012 | 0.143 | 0.894 | 1.002 |

| ZEW_DEU | 0.013 | 0.723 | 0.463 | 1.036 |

| IFO | 0.052 | 0.503 | 0.584 | 1.030 |

| Variable | Post Mean ß | Bayesian t-Stat | Positive Post. Distr. | MSPE Ratio |

|---|---|---|---|---|

| SPLS | −3.880 | −3.061 | 0.003 | 1.095 |

| BW | −3.195 | −3.055 | 0.003 | 0.990 |

| SPLSORT | −4.964 | −3.588 | 0.001 | 1.064 |

| BWORT | −3.283 | −2.902 | 0.005 | 1.018 |

| CB_CONS | 0.097 | 2.224 | 0.029 | 1.037 |

| VIX | −0.161 | −1.566 | 0.121 | 1.037 |

| Variable | Post Mean ß | Bayesian t-Stat | Positive Post. Distr. | MSPE Ratio |

|---|---|---|---|---|

| ESI_EU | −0.120 | −3.997 | 0.000 | 1.021 |

| ESI_EUZONE | −0.127 | −4.387 | 0.000 | 0.997 |

| CONSCONF | −0.191 | −4.862 | 0.000 | 0.976 * |

| INDUCONF | −0.117 | −3.550 | 0.001 | 1.060 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Limongi Concetto, C.; Ravazzolo, F. Optimism in Financial Markets: Stock Market Returns and Investor Sentiments. J. Risk Financial Manag. 2019, 12, 85. https://doi.org/10.3390/jrfm12020085

Limongi Concetto C, Ravazzolo F. Optimism in Financial Markets: Stock Market Returns and Investor Sentiments. Journal of Risk and Financial Management. 2019; 12(2):85. https://doi.org/10.3390/jrfm12020085

Chicago/Turabian StyleLimongi Concetto, Chiara, and Francesco Ravazzolo. 2019. "Optimism in Financial Markets: Stock Market Returns and Investor Sentiments" Journal of Risk and Financial Management 12, no. 2: 85. https://doi.org/10.3390/jrfm12020085

APA StyleLimongi Concetto, C., & Ravazzolo, F. (2019). Optimism in Financial Markets: Stock Market Returns and Investor Sentiments. Journal of Risk and Financial Management, 12(2), 85. https://doi.org/10.3390/jrfm12020085