Driver Countries in Global Banking Network

Abstract

1. Introduction

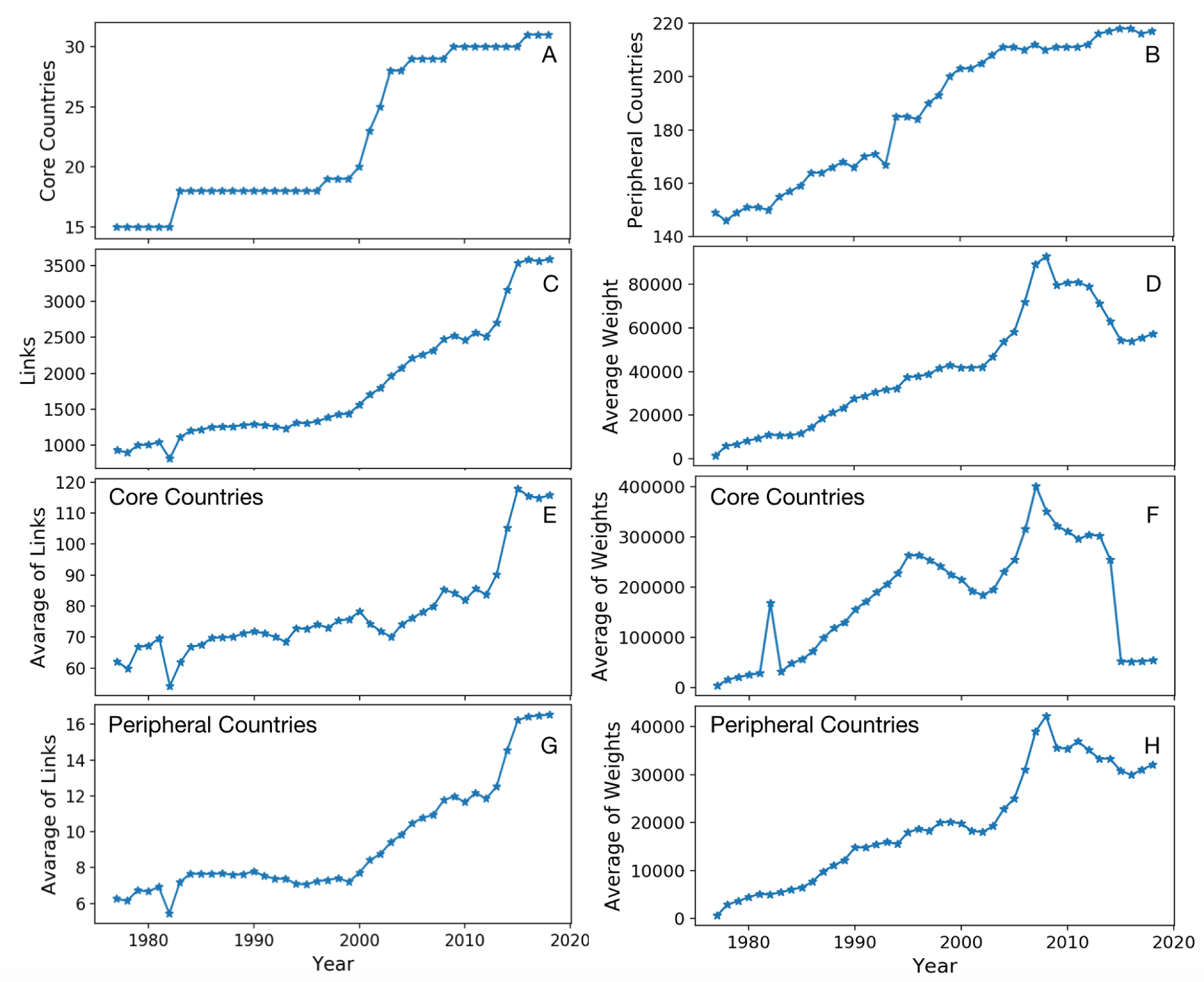

2. Materials and Methods

2.1. Data

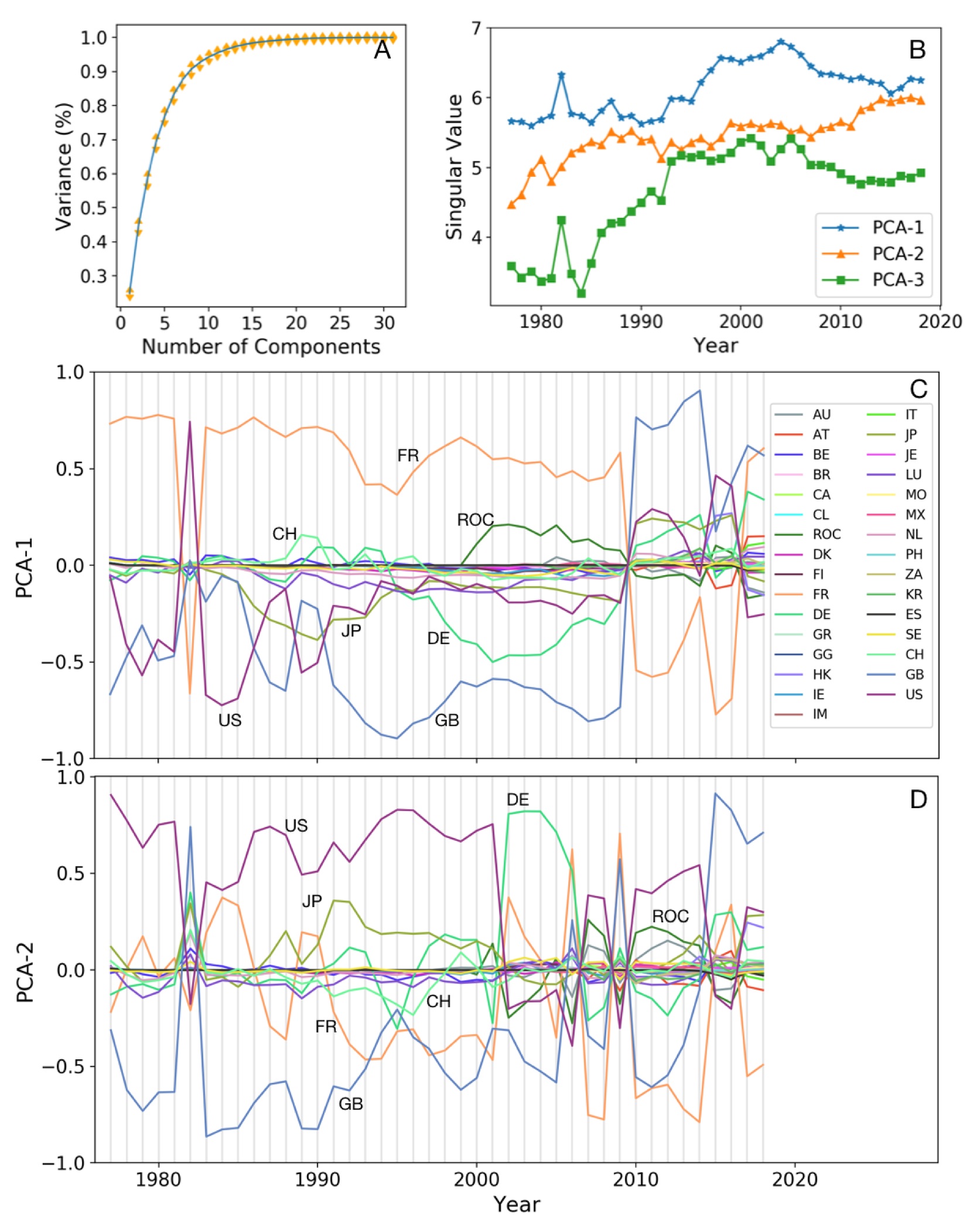

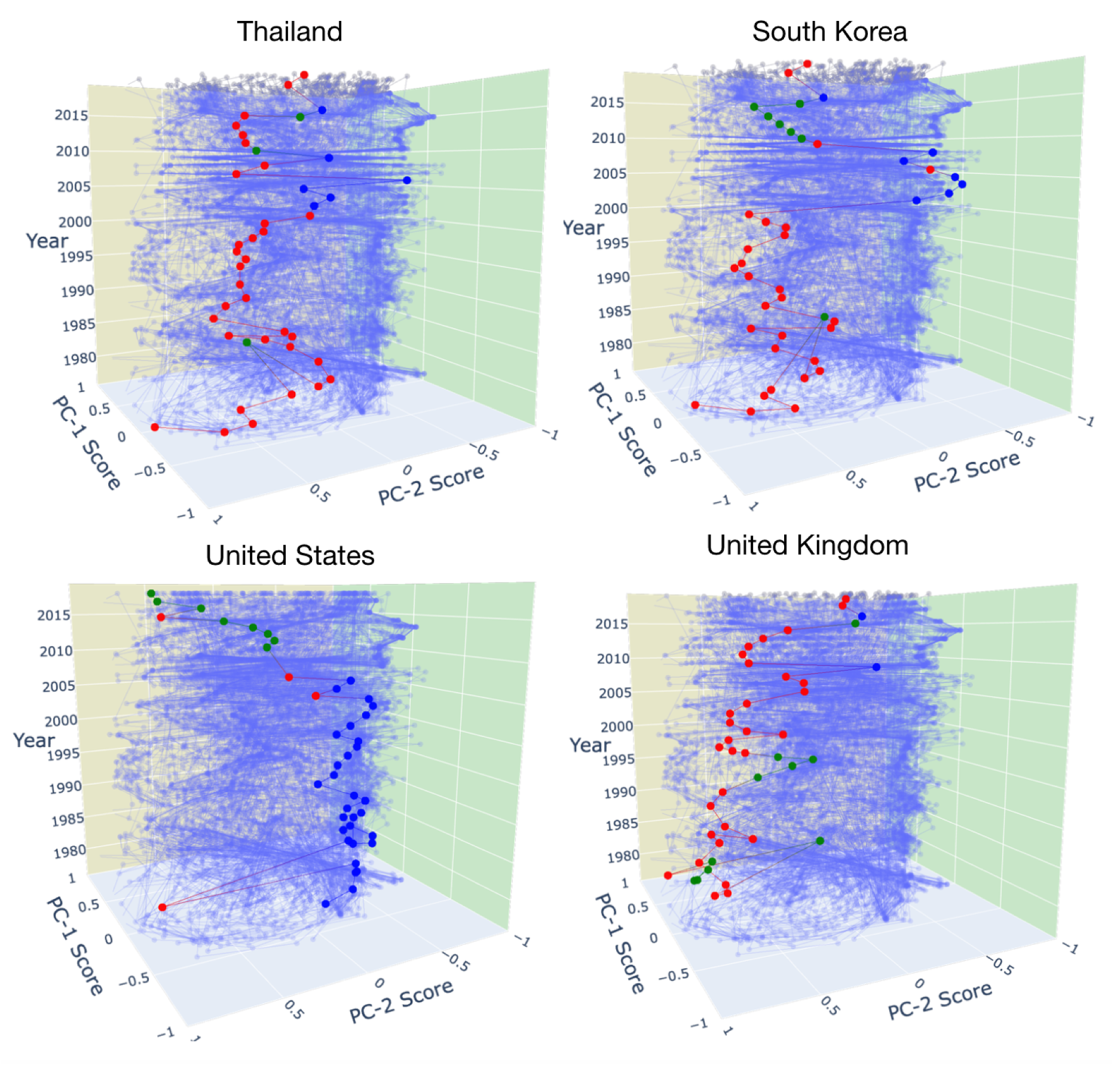

2.2. Principal Component Analysis

3. Results and Discussions

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Cerutti, E.; Hale, G.; Minoiu, C. Financial crises and the composition of cross-border lending. J. Int. Money Financ. 2015, 52, 60–81. [Google Scholar] [CrossRef]

- Hale, G.; Kapan, T.; Minoiu, C. Crisis Transmission through the Global Banking Network; Federal Reserve Bank of San Francisco: San Francisco, CA, USA, 2016. [Google Scholar]

- Hu, X.; Zhao, H.; Zheng, S.; Wang, L. CBOL: Cross-Bank Over-Loan Prevention, Revisited. Entropy 2020, 22, 619. [Google Scholar] [CrossRef]

- Yue, P.; Fan, Y.; Batten, J.; Zhou, W. Information transfer between stock market sectors: A comparison between the USA and China. Entropy 2020, 22, 194. [Google Scholar] [CrossRef]

- Huang, R.; Ratnovski, L. The dark side of bank wholesale funding. J. Financ. Intermed. 2011, 20, 248–263. [Google Scholar] [CrossRef]

- Hale, G.; Kapan, T.; Minoiu, C. Shock transmission through cross-border bank lending: Credit and real effects. Rev. Financ. Stud. 2019. [Google Scholar] [CrossRef]

- DasGupta, B.; Kaligounder, L. On global stability of financial networks. J. Complex Netw. 2014, 2, 313–354. [Google Scholar] [CrossRef]

- Berardi, S.; Tedeschi, G. From banks’ strategies to financial (in) stability. Int. Rev. Econ. Financ. 2017, 47, 255–272. [Google Scholar] [CrossRef]

- Muñoz, M.S.; Scuzzarella, M.R.; Cihák, M.M. The Bright and the Dark Side of Cross-Border Banking Linkages; Number 11-186; International Monetary Fund: Washington, DC, USA, 2011. [Google Scholar]

- Minoiu, C.; Kang, C.; Subrahmanian, V.; Berea, A. Does financial connectedness predict crises? Quant. Financ. 2015, 15, 607–624. [Google Scholar] [CrossRef]

- Nier, E.; Yang, J.; Yorulmazer, T.; Alentorn, A. Network models and financial stability. J. Econ. Dynam. Control 2007, 31, 2033–2060. [Google Scholar] [CrossRef]

- Poledna, S.; Hinteregger, A.; Thurner, S. Identifying systemically important companies by using the credit network of an entire nation. Entropy 2018, 20, 792. [Google Scholar] [CrossRef]

- Poledna, S.; Hinteregger, A.; Thurner, S. Measuring Global Financial Linkages: A Network Entropy Approach. Sustainability 2019, 11, 4691. [Google Scholar]

- Akhtar, Y.; Kayani, G.; Yousaf, T. The Effects of Regulatory Capital Requirements and Ownership Structure on Bank Lending in Emerging Asian Markets. J. Risk Financ. Manag. 2019, 12, 142. [Google Scholar] [CrossRef]

- Hattori, M.; Suda, Y. Developments in a cross-border bank exposure network. In Proceedings of the CGFS Workshop Held at the Bank for International Settlements, Switzerland, 18–19 June 2007. [Google Scholar]

- Minoiu, C.; Reyes, J.A. A Network Analysis of Global Banking: 1978–2009; International Monetary Fund: Washington, DC, USA, 2011; pp. 1–41. [Google Scholar]

- Minoiu, C.; Reyes, J.A. A network analysis of global banking: 1978–2010. J. Financ. Stab. 2013, 9, 168–184. [Google Scholar] [CrossRef]

- Peltonen, T.A.; Rancan, M.; Sarlin, P. Interconnectedness of the banking sector as a vulnerability to crises. Int. J. Finance Econ. 2019, 24, 963–990. [Google Scholar] [CrossRef]

- Hargreaves, C.A.; Mani, C.K. The Selection of winning stocks using principal component analysis. Am. J. Market. Res. 2015, 1, 183–188. [Google Scholar]

- Rahayu, S.; Sugiarto, T.; Madu, L.; Holiawati; Subagyo, A. Application of Principal Component Analysis (PCA) to Reduce Multicollinearity Exchange Rate Currency of Some Countries in Asia Period 2004–2014. Int. J. Educ. Method. 2017, 3, 75–83. [Google Scholar]

- Li, Y.; Zhang, Q. The application of principal component analysis on financial analysis in real estate listed company. Procedia Eng. 2011, 15, 4499–4503. [Google Scholar] [CrossRef][Green Version]

- Yang, L. An Application of Principal Component Analysis to Stock Portfolio Management; University of Canterbury: Christchurch, New Zealand, 2015. [Google Scholar]

- Pasini, G. Principal Component Analysis for stock portfolio management. Int. J. Pure Appl. Math. 2017, 115, 153–167. [Google Scholar] [CrossRef]

- Avdjiev, S.; Hale, G. US monetary policy and fluctuations of international bank lending. J. Int. Money Finance 2019, 95, 251–268. [Google Scholar] [CrossRef]

- Filardo, A.J.; Siklos, P.L. The cross-border credit channel and lending standards surveys. SSRN 2018, 723, 1–49. [Google Scholar]

- Saeedian, M.; Jamali, T.; Kamali, M.; Bayani, H.; Yasseri, T.; Jafari, G. Emergence of world-stock-market network. Phys. A Stat. Mech. Its Applic. 2019, 526, 120792. [Google Scholar] [CrossRef]

- International Banking Statistics. 1977–2018. Available online: https://www.bis.org/statistics/bankstats.htm (accessed on 1 July 2020).

- Pearson, K. LIII. On lines and planes of closest fit to systems of points in space. Lond. Edinb. Dublin Philosoph. Magaz. J. Sci. 1901, 2, 559–572. [Google Scholar] [CrossRef]

- Hotelling, H. Analysis of a complex of statistical variables into principal components. J. Educ. Psychol. 1933, 24, 417. [Google Scholar] [CrossRef]

- Jackson, J.E. A User’s Guide to Principal Components; John Wiley & Sons: Hoboken, NJ, USA, 2005; Volume 587. [Google Scholar]

- Jolliffe, I.T.; Cadima, J. Principal component analysis: A review and recent developments. Philosoph. Trans. R. Soc. A Math. Phys. Eng. Sci. 2016, 374, 20150202. [Google Scholar] [CrossRef] [PubMed]

- Saporta, G.; Niang, N. Principal component analysis: Application to statistical process control. Data Anal. 2009, 1–23. [Google Scholar] [CrossRef]

- Abdi, H.; Williams, L.J. Principal component analysis. Wiley Interdiscip. Rev. Comput. Stat. 2010, 2, 433–459. [Google Scholar] [CrossRef]

- Belasco, E.; Philips, B.U.; Gong, G.; Sanguansat, P. The Health Care Access Index as a determinant of delayed cancer detection through principal component analysis. In Principal Component Analysis-Multidisciplinary Applications; Intech: London, UK, 2012. [Google Scholar]

- Furman-Haran, E.; Feinberg, M.S.; Badikhi, D.; Eyal, E.; Zehavi, T.; Degani, H. Standardization of radiological evaluation of dynamic contrast enhanced MRI: Application in breast cancer diagnosis. Technol. Cancer Res. Treat. 2014, 13, 445–454. [Google Scholar] [CrossRef]

- Giuliani, A.; Benigni, R. Principal Component Analysis for Descriptive Epidemiology. In Proceedings of the International Symposium on Medical Data Analysis, Frankfurt am Main, Germany, 29–30 September 2000; Springer: Berlin/Heidelberg, Germany, 2000; pp. 308–313. [Google Scholar]

- Martis, R.J.; Acharya, U.R.; Min, L.C. ECG beat classification using PCA, LDA, ICA and discrete wavelet transform. Biomed. Signal Process. Control 2013, 8, 437–448. [Google Scholar] [CrossRef]

- Agarwal, S.; Jacobs, D.R.; Vaidya, D.; Sibley, C.T.; Jorgensen, N.W.; Rotter, J.I.; Chen, Y.D.I.; Liu, Y.; Andrews, J.S.; Kritchevsky, S.; et al. Metabolic syndrome derived from principal component analysis and incident cardiovascular events: The multi ethnic study of atherosclerosis (MESA) and health, aging, and body composition (Health ABC). Cardiol. Res. Pract. 2012, 2012. [Google Scholar] [CrossRef]

- Klyuzhin, I.S.; Fu, J.F.; Hong, A.; Sacheli, M.; Shenkov, N.; Matarazzo, M.; Rahmim, A.; Stoessl, A.J.; Sossi, V. Data-driven, voxel-based analysis of brain PET images: Application of PCA and LASSO methods to visualize and quantify patterns of neurodegeneration. PLoS ONE 2018, 13, e0206607. [Google Scholar] [CrossRef]

- Kolasa-Więcek, A. Application of PCA in the analysis of parameters related to agricultural greenhouse gases emissions in Europe. J. Res. Applic. Agric. Eng. 2012, 57, 77–79. [Google Scholar]

- Ahmadfaraj, M.; Mirmohammadi, M.; Afzal, P. Application of fractal modeling and PCA method for hydrothermal alteration mapping in the Saveh area (Central Iran) based on ASTER multispectral data. Int. J. Min. Geo Eng. 2016, 50, 37–48. [Google Scholar]

- Raskin, R.; Terry, H. A principal-components analysis of the Narcissistic Personality Inventory and further evidence of its construct validity. J. Personal. Soc. Psychol. 1988, 54, 890. [Google Scholar] [CrossRef]

- Pandey, P.K.; Singh, Y.; Tripathi, S. Image processing using principle component analysis. Int. J. Comp. Applic. 2011, 15, 37–40. [Google Scholar]

- Hernandez, W.; Mendez, A. Application of Principle Component Analysis to Image Compression. Stat. Grow. Data Sets Grow. Demand Stat. 2018, 107–137. [Google Scholar] [CrossRef]

- Hedayatifar, L.; Rigg, R.A.; Bar-Yam, Y.; Morales, A.J. US social fragmentation at multiple scales. J. R. Soc. Interface 2019, 16, 20190509. [Google Scholar] [CrossRef]

- Poon, B.; Amin, M.A.; Yan, H. PCA based face recognition and testing criteria. In Proceedings of the 2009 International Conference on Machine Learning and Cybernetics, Hebei, China, 12–15 July 2009; Volume 5, pp. 2945–2949. [Google Scholar]

- Hladnik, A. Image compression and face recognition: Two image processing applications of principal component analysis. Int. Circ. Graph. Educ. Res. 2013, 6, 56–61. [Google Scholar]

- Battiston, S.; Gatti, D.D.; Gallegati, M.; Greenwald, B.; Stiglitz, J.E. Liaisons dangereuses: Increasing connectivity, risk sharing, and systemic risk. J. Economic Dyn. Control 2012, 36, 1121–1141. [Google Scholar] [CrossRef]

- Georg, C.P. The effect of the interbank network structure on contagion and common shocks. J. Bank. Financ. 2013, 37, 2216–2228. [Google Scholar] [CrossRef]

- Fujii, M.; Takaoka, M. Structure of the financial system and the contagion effect: A network approach. Public Policy Rev. 2011, 7, 27–50. [Google Scholar]

- Allen, F.; Gale, D. Financial contagion. J. Polit. Econ. 2000, 108, 1–33. [Google Scholar] [CrossRef]

- Gai, P.; Kapadia, S. Contagion in financial networks. Proc. R. Soc. A Math. Phys. Eng. Sci. 2010, 466, 2401–2423. [Google Scholar] [CrossRef]

- Martínez-Jaramillo, S.; Pérez, O.P.; Embriz, F.A.; Dey, F.L.G. Systemic risk, financial contagion and financial fragility. J. Econ. Dyn. Control 2010, 34, 2358–2374. [Google Scholar] [CrossRef]

- Sole, M.J.; Espinosa-Vega, M.A. Cross-Border Financial Surveillance: A Network Perspective; Number 10-105; International Monetary Fund: Washington, DC, USA, 2010. [Google Scholar]

- Tamura, M.; Tsujita, S. A study on the number of principal components and sensitivity of fault detection using PCA. Comp. Chem. Eng. 2007, 31, 1035–1046. [Google Scholar] [CrossRef]

| Abbreviation | Country Name | Abbreviation | Country Name |

|---|---|---|---|

| AU | Australia | IT | Italy |

| AT | Austria | JP | Japan |

| BE | Belgium | JE | Jersey |

| BR | Brazil | LU | Luxembourg |

| CA | Canada | MO | Macao SAR |

| CL | Chile | MX | Mexico |

| ROC | Chinese Taipei | NL | Netherlands |

| DK | Denmark | PH | Philippines |

| FL | Finland | ZA | South Africa |

| FR | France | KR | South Korea |

| DE | Germany | ES | Spain |

| GR | Greece | SE | Sweden |

| GG | Guernsey | CH | Switzerland |

| HK | Hong Kong SAR | GB | United Kingdom |

| IE | Ireland | US | United States |

| IM | Ise of Man |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Atyabi, F.; Buchel, O.; Hedayatifar, L. Driver Countries in Global Banking Network. Entropy 2020, 22, 810. https://doi.org/10.3390/e22080810

Atyabi F, Buchel O, Hedayatifar L. Driver Countries in Global Banking Network. Entropy. 2020; 22(8):810. https://doi.org/10.3390/e22080810

Chicago/Turabian StyleAtyabi, Farzaneh, Olha Buchel, and Leila Hedayatifar. 2020. "Driver Countries in Global Banking Network" Entropy 22, no. 8: 810. https://doi.org/10.3390/e22080810

APA StyleAtyabi, F., Buchel, O., & Hedayatifar, L. (2020). Driver Countries in Global Banking Network. Entropy, 22(8), 810. https://doi.org/10.3390/e22080810