Abstract

This model extends the classical economic production quantity (EPQ) model to address the complexities within a two-echelon supply chain system. The model integrates the cost of raw materials necessary for production and takes into account the presence of imperfect quality items within the acquired raw materials. Upon receipt of the raw material, a thorough screening process is conducted to identify imperfect quality items. Combining imperfect raw material and the concept of shifting production rate, two different inventory models for deteriorating products are formulated under imperfect production with demand dependent on the stock level. In the first model, the imperfect raw materials are sold at a discounted price at the end of the screening period, whereas in the second one, imperfect items are kept in stock until the end of the inventory cycle and then returned to the supplier. Numerical analysis reveals that selling imperfect raw materials yields a favourable financial outcome, with an optimal inventory level = 11,774 units, optimal cycle time h, and a total profit per hour of USD 183, while keeping the imperfect raw materials to return them to the supplier results in a negative profit of USD per hour, indicating an unfavourable financial outcome with the optimal inventory level and optimal cycle time T of 26,349 units and 4702.6 h, respectively. The findings show the importance of selling imperfect raw materials rather than returning them and provide valuable insights for inventory management in systems with deteriorating products and imperfect production processes. Sensitivity analysis further demonstrates the robustness of the model. This study contributes to satisfying the need for inventory models that consider both the procurement of imperfect raw materials, stock-dependent demand, and deteriorating products, along with shifts in production rates in a multi-echelon supply chain.

1. Introduction

In today’s fast-paced and volatile business environment, organisations face numerous challenges when it comes to effectively managing their production and inventory. Managing inventory systems is crucial for any organisation, especially if the organisation deals with perishable products and experiences variable demand. The economic production quantity (EPQ) model has been widely used in practice because of its simplicity; however, there are some drawbacks to the assumptions of the classical EPQ model and many scholars have attempted to relax these assumptions for relevant situations to integrate new concepts, such as deterioration imperfect quality of the inventory, availability of equipment, dependent demand functions, and effectiveness of machines, among others. Many inventory models have been developed under the assumption that the lifetime of an item is infinite while it is in storage. The classical inventory model [1], rehashed in Wilson [2], assumes that the depletion of inventory is due to a constant demand rate only. In real life, decay or deterioration of items is a natural phenomenon. Vegetables, fruits, foods, perfumes, chemicals, pharmaceuticals, radioactive substances, and electronic equipment are examples of items that lose value over time through deterioration. Whitin [3] was the first to consider the effect of deterioration on fashion items after a prescribed date. Dave and Patel [4] developed an inventory model for deteriorating items with a deterioration rate which is a constant fraction of the on-hand inventory. Benkherouf [5] presented an optimal replenishment policy for constant deterioration rate with a known and finite planning horizon. Srivastava and Gupta [6] studied an EOQ model for deteriorating items with constant deterioration rate while considering both constant and time-dependent demand rates and no shortages. Mishra et al. [7] developed an inventory model for deteriorating items with a time-proportional deterioration rate and time-varying holding cost under partial backlogging. Majumder et al. [8] developed an economic production quantity (EPQ) model for deteriorating items under a partial trade credit policy. Singh et al. [9] developed an EOQ inventory model for deteriorating items with a time-proportional deterioration rate as well as both constant and time-dependent linear demand rates. Halim et al. [10] discussed a production inventory model for deteriorating items along with an overtime production opportunity. Jain and Singh [11] examined the effect of frequent inspections in a lot-sizing under partial advance payment and deterioration to reduce food wastage due to spoilage. Hou et al. [12] investigated an inventory-pricing problem of two vendors selling perishable products across two consecutive periods: the regular selling season and the clearance season. During the regular selling season, each vendor charges a standard price for the product, with a unit cost of . In the clearance season, the product experiences some degree of value depreciation and is sold at a discounted price . The products offered by the two vendors are partially substitutable, and the prices are constrained. Moshtagh et al. [13] examined a dynamic inventory-pricing system for perishable goods with multiple freshness levels. The model is developed as a Markov decision process, where the product assortment changes dynamically based on the available item’s freshness. Pathak et al. [14] proposed an economic production quantity model for decaying items with price-dependent demand, time-dependent deterioration rate and time-dependent backlogging rate.

The quality of items is another issue that has not been considered in the classic EPQ model. However, in a real production environment, this assumption does not accurately reflect the reality. The assumption of perfect quality often falls short, as production processes are prone to errors, imperfections, defects, and variability. El-Kassar et al. [15] investigated an Economic Production Quantity model that considers the cost of raw materials essential for production. The model assumes that the supplier’s raw materials contain a certain percentage of imperfect quality items. Upon receipt, a screening process with a 100% detection rate for imperfect items is carried out at the start of each inventory cycle. Two scenarios are explored: in one, imperfect items are sold at a discounted price after screening, and in the other scenario, imperfect items are kept in stock until the end of the cycle and then returned to the supplier upon receiving the next order. Urban [16] formulated models that account for both positive and negative learning curve effects in production processes by modelling the defect rate of the process as a function of the run length. Salameh and Jaber [17] considered a special inventory situation where items, received or produced, are not of perfect quality. Chan et al. [18] developed a model that integrates lower pricing, reworking and rejection into an EPQ model. Lee [19] presented a cost/benefit model for investments in inventory and preventive maintenance in an imperfect production system to increase product and service quality. Hou [20] considered an EPQ model with imperfect production processes in which the setup cost and process quality are functions of capital expenditure. Nobil and Tiwari [21] developed a multi-product economic production quantity (EPQ) inventory model for a defective production system on a single machine with a rework process and auction. Ozturk et al. [22] developed a production inventory system with a fuzzy cycle time and inspection process to scrutinise defective items both during production and post-production. Asadkhani et al. [23] developed an EOQ model with different types of imperfect items, such as salvage, scrap, and reject. Chen and You [24] used differential equations theory to develop an optimal control model for managing perishable products with exponentially declining quality. The model incorporates dynamic pricing and inventory management strategies and accounts for the influence of reference price and reference quality on product demand. Reference price and reference quality are modelled as functions of consumers’ past purchasing experiences. Nobil et al. [25] examined an inventory-manufacturing system in industries with quality inspection, such as aerospace, pharmaceuticals, electronics, medical devices, and textiles. They developed three models under strict quality inspection conditions: one with discarded items but no shortages, another with reworked items but no shortages, and a third with both discarded and reworkable items, but with backorders. Hossain et al. [26] examined the challenges of managing imperfect items in manufacturing and proposed an inventory model that incorporates the effects of imperfect items to explore relationships between demand forecasting, production planning, quality, and inventory policies.

The classic EPQ model also assumes that the demand rate is fixed. However, marketing researchers and practitioners have come to recognise that the demand for many items is directly dependent on the season, the amount of stock displayed, the product quality, the price, the freshness condition or some combination of these. Datta and Paul [27] discussed an inventory model with both price and stock-dependent demand under a finite time horizon. Pal et al. [28] developed a deteriorating inventory problem with demand rate dependent on stock level, selling price, and frequency of advertisement, in which partial back-ordering is considered. The paper by Panda et al. [29] deals with an EPQ model for seasonal products with stock-dependent demand. Lee and Dye [30] formulated a deteriorating inventory model with stock-dependent demand by allowing preservation technology cost as a decision variable in conjunction with a replacement policy. Ghiami et al. [31] investigated a two-echelon supply chain model for deteriorating inventory with stock-dependent demand and partial backlogging in which the retailer’s warehouse has a limited capacity. Yang [32] investigated an inventory control policy with a stock-dependent demand rate and stock-dependent holding cost rate with partial back-ordering. Singh and Pattnayak [33] presented a two-warehouse inventory model with conditionally permissible delay in payment by considering the linear demand rate. Avinadav et al. [34] proposed an optimal ordering and pricing policy to maximise profits given a deterministic demand function that is affected by both price and inventory age. San-José et al. [35] analysed an inventory system with discrete scheduling periods, time-dependent demand, and backlogged shortages. Cárdenas-Barrón et al. [36] studied an EOQ inventory model with non-linear stock-dependent holding cost, non-linear stock-dependent demand, and trade credit. Khan et al. [37] described mathematical models for perishable items with advance payment, linearly time-dependent holding cost, and demand that is dependent on advertisement and selling price. San-José et al. [38] formulated an inventory system integrating time-dependent demand and partial back-ordering, in which the return on inventory investment is maximised. Rodríguez-Mazo and Ruiz-Benítez [39] investigated a deterministic modular replenishment model for retail inventory management in a system with multiple warehouses, including an own warehouse (OW) and rented warehouses (RW) of custom capacities under price and stock-dependent demand. Doğruöz and Güllü [40] considered an inventory model under intermittent demand where the demand occurrence depends on the price and the yield uncertainty of the item. Jauhari et al. [41] proposed a mathematical inventory model for a closed-loop supply chain consisting of a single manufacturer and a single retailer under stochastic demand and imperfect production to find the optimal shipment quantity, number of deliveries, safety factor, and green investment to minimise the joint total cost of the system.

Various production factors such as flexibility, availability of machines, the state of the equipment, and variable setup time have received attention from researchers. In real manufacturing situations, the state of the equipment is usually dynamic. While the effect of the degradation of machines has been initially ignored by researchers, a growing body of literature now considers numerous situations that may occur during the lifetime of the production system. Such systems may be “in a state of control” or “out of control”. If, from the production point of view, a system is conceived in a way that at the occurrence of any failure, a reconfiguration is undertaken automatically, allowing the degraded or deteriorated machine or any other equipment to be functional, but with a decrease in the service delivered, we refer to this as a multi-state system (MSS). Thus, a third state is added to the two previous states, which is referred to as the degraded state. The concept of flexible manufacturing systems with unreliable machines, failures and repairs presented in the form of a Markov process was first introduced by Rishel [42] and then Olsder and Suri [43]. Schweitzer and Seidmann [44] introduced the concept of flexibility to discuss the optimisation of the processing rate for a flexible machine in a manufacturing system. Khouja [45] reformulated some inventory models to allow for adjustments (minor setups) to the manufacturing resource within the production cycle without interrupting the system. These adjustments do not involve performing all activities of a full set-up and incur only a fraction of a full set-up cost and time. Sana et al. [46] studied a flexible economic manufacturing quantity (EMQ) model with a reduction in the selling price in an imperfect production system. Ben-Daya et al. [47] studied an EPQ model with a shifting production rate under stoppages due to speed losses. Sarkar et al. [48] discussed an economic manufacturing quantity model of an imperfect production process with time-dependent demand subject to machine breakdown. Emami-Mehrgani et al. [49] studied production systems with machines subject to random breakdowns and repairs under preventive maintenance with human error. Omar and Yeo [50] proposed a model for a continuous time-varying inventory system that satisfies the demand for finished products over a known and finite planning horizon by supplying both new and repaired items under multiple setups. Ganesan and Uthayakumar [51] proposed EPQ models for an imperfect manufacturing system, considering warm-up production runs, shortages during the hybrid maintenance period, and partial back-ordering. Tshinangi et al. [52] described a lot-sizing model for a multi-state system (MSS) with deteriorating items, variable production rates, and imperfect quality.

A summary of the relevant published models is provided in Table 1. The table shows that currently, there are not any lot-sizing models in the literature for integrated multi-state systems in inventory models for perishable products, which considers re-configurable systems, wherein the machine used for manufacturing deteriorates and continues to function even in the presence of faults. Traditional models use binary states. This simplification fails to capture some real-world complexities of dynamic systems, such as mineral processing, power grid control, and food industries, which operate in more than just two states, “in a state of control”, “degraded state”, and “out of control”. Although some studies have begun to address machine degradation and its impact on production, they frequently neglect essential features, such as price-dependent demand, stock-level-dependent demand, freshness-dependent demand, and quality control. Moreover, existing MSS models do not consider multi-echelon supply chain structures.

Table 1.

Comparison of the study with related works in the literature.

This paper introduces a novel model by integrating multi-state systems with multi-echelon supply chain inventory models for perishable products, incorporating key factors, such as imperfect raw materials, stock-dependent demand, and variable production setups. Unlike previous work, this model incorporates the degraded state of machines, where machines remain operational but with reduced efficiency, and examines its impact on the overall performance of the inventory system. The production process is assumed to have a variable production rate, and the raw materials received are subject to a proportion of imperfect quality. Two distinct inventory models are developed: in the first model, imperfect raw materials are kept in stock after screening and sold at a salvage value, while in the second model, imperfect materials are kept in stock until the end of the inventory cycle and then returned to the supplier. In both models, demand for the product is dependent on the current stock level. The paper is structured into five main sections. Section 2 defines the assumptions and notations used. Section 3 describes the model, considering two cases of imperfect raw materials. In Section 4, the solution approach is presented and numerical experiments are conducted to analyse the performance of the model. Section 5 discusses the sensitivity analysis and managerial insights and practical relevance. Finally, the paper concludes with a summary of the research and suggestions for future work in Section 6.

2. Assumptions and Notations

2.1. Notations

The following notations are used during the development of the models presented in this paper:

| A | Demand parameter |

| Aggregation parameter for some known variables | |

| Deterioration cost per item | |

| Unit cost of raw material | |

| Demand for the product | |

| Proportion of defective units produced | |

| Aggregation parameter for some known variables | |

| Raw material ordering cost | |

| Fixed set-up cost associated with stage i | |

| Inventory carrying cost per item produced per time | |

| Inventory carrying cost per unit of raw material per time | |

| Hessian Matrix | |

| Instantaneous inventory level | |

| Optimal inventory level | |

| Initial production rate at the start of the cycle | |

| Production rate following the shift respectively | |

| Increase in unit machining cost due to increase in the production rate | |

| Unit production cost at the start | |

| Unit production cost after the machine’s production rate has been scaled down | |

| Lost production cost per product | |

| Q | Production batch size |

| Quantity of good products sold at a normal price | |

| Optimal batch size | |

| Quantity of deteriorated products | |

| q | Fixed proportion of raw materials that are of imperfect quality |

| Per unit cost of running the machine independent of the production rate | |

| including labour and energy costs | |

| Market selling price of the product | |

| Discounted unit selling price of imperfect finished products | |

| Discounted unit selling price of imperfect raw material | |

| T | Cycle time |

| Optimal cycle time | |

| Time duration of each phase of the cycle | |

| Screening period | |

| Total purchase cost of raw material | |

| Total carrying cost of raw material | |

| Total carrying cost of finished products | |

| Total deterioration cost | |

| Total production cost | |

| Total set-up cost | |

| Lost production cost | |

| Average revenue per time | |

| Average total cost per cycle | |

| Average revenue per cycle | |

| Total deterioration cost | |

| Total production cost | |

| Total set-up cost | |

| Lost production cost | |

| Average revenue per time | |

| Average total cost per cycle | |

| Average revenue per cycle |

| Average profit per cycle | |

| Deterioration rate per unit per time | |

| Demand enhancement parameter for inventory level | |

| Aggregation parameters for some known variables | |

| x | Screening rate for imperfect raw material |

| y | Raw material order size |

2.2. Assumptions

Several assumptions are made to model the proposed inventory system. These assumptions include:

- A single type of product is considered.

- Deterioration is observed on manufactured products only.

- The quality of all items produced does not always meet the quality standard; therefore, a proportion is considered to be defective in each stage of the production cycle.

Where

- The entire cycle time T consists of three distinct time intervals: , , and .

Where and

- In the first interval , production occurs at the production rate while consumption happens at the demand rate .

- In the second interval , production continues at the rate , with consumption still occurring at the demand rate .

- In the third interval , production stops completely, and only consumption takes place

- At the start of the process, a production rate of is employed. After a time, , the decision maker switches to a lower production rate of .

With .

- The demand rate is dependent on the on-hand inventory and is of the formwhere is the base demand rate, independent of the inventory level, and is the demand enhancement parameter for inventory level .

- The production cost per unit is of the formwhere , and are non-negative constants. The cost of production is a combination of the following factors:

- is the fixed cost per unit produced, independent of the batch size

- The factor indicates that there is a cost associated with the economy of scale in the batch that affects the unit fixed cost of production. As the production rate decreases, some costs like labour, energy, etc., increase.

- The factor is associated with machine and technology costs and is proportional to the production rate.

- All the good products are sold at a unit selling price .

- Process deterioration occurs in the production run period.

- The changeover cost and time from to is assumed to be negligible.

- The discounted unit selling price of imperfect raw material () is always greater than the unit purchasing cost of raw material .

- Some manufactured products are of imperfect quality and have to be discounted as a batch at a discounted price at the end of the cycle at a unit selling price .

- The manufactured products are subject to deterioration. The deterioration function is of the form

- It is assumed that the raw material does not deteriorate but contains a proportion q that is considered to be of imperfect quality.

- There is no rework or replacement of poor quality products since it is handled by using in-house capacity.

3. Problem Description

3.1. First Scenario’s Formulation

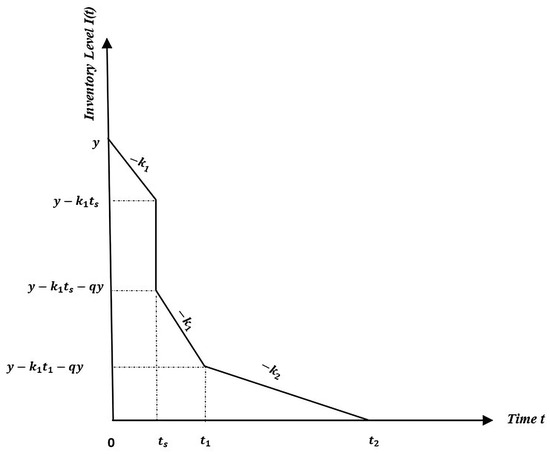

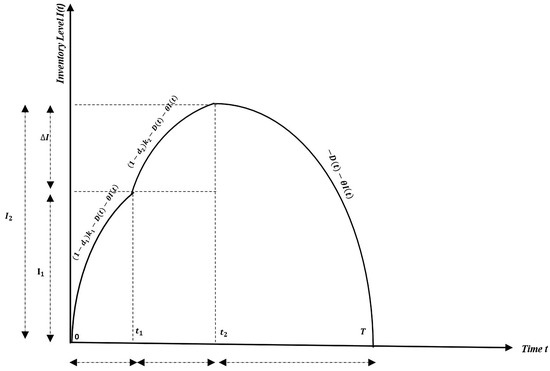

We begin with the first scenario. This scenario is represented by Figure 1 and Figure 2. Figure 1 illustrates the inventory of raw materials, showing how perfect materials are separated from imperfect ones which are then used for production. Figure 2 depicts the inventory profile of finished goods produced. In this first scenario, it is assumed that the system starts production at a rate of (Figure 1). During the first part of the cycle, inventory accumulates at a rate , while the imperfect quality items accumulate at the rate and are sold at a discounted price as a single batch at the end of the cycle. An order of size y of raw materials is assumed to be placed and received prior to the start of the cycle because the production process requires input materials. However, the raw material delivered by the supplier for production contains a fixed percentage q that is assumed to be of poor quality. Therefore, a quantity is deemed to be of imperfect quality and only units of raw materials received are used during the production cycle (Figure 1). It is also assumed that once the order is received, a screening process is conducted at a rate x, where . Therefore, the length of the screening period is:

Figure 1.

Raw material inventory level with imperfect items sold at a discount.

Figure 2.

Inventory profile with a shift in production rate and stock-dependent demand.

Throughout the screening process, materials of perfect quality are separated from the imperfect ones and only perfect materials are used to produce items that are used to satisfy the demand. Therefore, the stock level of raw material used for production is depleted at a rate of until the end of the screening cycle. By this point, the production of finished products has already started at the rate (Figure 2), and the inventory of finished goods builds up until time . When the screening process stops, the quantity of raw material reaches a level of

The imperfect raw materials are separated from the perfect ones and sold as a single batch at a discounted price . Thus, the level of raw material in Equation (5) drops further by a quantity , as shown if Figure 1. The quantity of raw material left is

Moreover, the production continues at the rate until the end of the first production cycle (Figure 2). At time , the raw material level in Equation (6) drops by a quantity

At this time during the cycle, the number of perfect quality items produced reaches a level of inventory . However, it is assumed that the production rate switches over at (Figure 2), just after reaching the inventory level , and the system is automatically reconfigured to continue to be operational but at a lower production rate, , to ensure the continuity of the service. The raw material in Equation (8) continues to decrease at a rate to produce finished products (Figure 2) until it reaches zero at the end of production cycle as described in Figure 1, and the inventory of perfect items produced accumulates at the rate until a level () is reached (Figure 2). In this section, the quantity of imperfect quality items accumulates at the rate . The production is then stopped at and good products are consumed up until the end of the cycle at time T. The cycle then repeats itself after time T.

The differential equations that represent the state of the production system in the interval are given by

Solving Equation (9a), we obtain

From Equation (10) under the boundary condition, , we obtain

Solving Equation (9b), we obtain

From Equation (13) under the boundary condition, , we obtain

Solving Equation (9c), leads to

From Equation (16) under the boundary condition, , we obtain

From Equation (18), the inventory level, , at time can be described by the following equation

On the other hand, From Equation (15), we obtain

From Taylor’s series expansion, and the assumption that (neglecting higher powers of , the expansion of the logarithmic function of Equation (25) leads to the following approximation

With

Thus, the time can be written in terms of the inventory, and so, is not a decision variable.

From Equation (15), under the boundary condition , we obtain

subtracting both sides of Equation (28) by leads to

From Taylor’s series expansion, and the assumption (neglecting higher powers of , the expansion of the logarithmic function of Equation (34) leads to the following approximation

with

Thus, the time, can be written in terms of the inventory levels and . Therefore, is not a decision variable.

From Equation (18), under the boundary condition , we obtain

For small values of and using Taylor series approximation, we expand the logarithmic function in Equation (40) to obtain T as follows:

The inventory, can be written in terms of and T. Therefore, is not a decision variable.

3.2. Manufacturer’s Cost Components

To find the optimal quantities, we first calculate the total cost per inventory cycle, which is the sum of the ordering cost, deterioration cost, production cost, setup cost for production, inventory holding, lost sales cost, lost production cost, shortage cost, and purchasing cost.

3.2.1. Manufacturer’s Ordering Cost of Raw Material

The ordering cost of raw materials is considered fixed and is represented by

3.2.2. Manufacturer’s Inventory Holding Cost of Raw Material

The holding cost of raw material is the product of the average inventory and the holding cost per unit of raw material per unit time (). To find the average inventory of raw materials, we considered the area in Figure 1 and divided it by the cycle length. The graph in Figure 1 was decomposed into two trapezoids and a triangle, and then the area of each trapezoid was calculated and summed up to find the total area. Hence, the total area representing the inventory of raw material is given by

The quantity of raw material required for the exact production in each cycle is given by

Hence, the inventory holding cost of raw materials is given by

3.2.3. Manufacturer’s Purchasing Cost of Raw Material

To calculate the cost of procuring raw materials, , we multiplied the unit cost by the quantity y required for one production cycle. That is

3.2.4. Manufacturer’s Set up

The setup cost in the manufacturing process varies over different intervals, denoted as , with specific values assigned during distinct periods. In the initial interval, from 0 to , the setup cost is represented by , reflecting the corresponding requirements and expenses during that phase. Subsequently, in the interval to , the setup cost transitions to , capturing the distinctive characteristics of the manufacturing setup during this later time frame

Therefore, the total setup cost is given by the following:

3.2.5. Manufacturer’s Inventory Holding Cost

The manufacturer incurs a holding cost, , which is the product of the total holding inventory and the cost of holding a single unit per time unit . Thus,

Multiplying both sides of Equation (23) by leads to

Multiplying both sides of Equation (28) by results in

3.2.6. Manufacturer’s Deterioration Cost

The total number of deteriorated items is obtained by integrating the deterioration function over the interval . Therefore,

In order to evaluate the total number of deteriorating products (), we proceed by solving each integral in Equation (71).

Equation (75) can be integrated separately as follows:

Combining Equations (77), (79), and (82) yields the revised form of Equation Equation (75), which can be expressed as

Summing up Equations (74), (83), and (86) yields the total quantity of degraded products throughout the entire cycle. This is represented by

Hence, the manufacturer’s cost for deteriorating inventory, , is obtained by multiplying the quantity of deteriorated products by the unit cost of a deteriorating unit

3.2.7. Manufacturer’s Production Cost

The total production cost over the period is given by

3.2.8. Manufacturer’s Lost Production Cost

In many practical cases, a penalty is incurred if the producer fails to deliver the agreed quantity in time. The lost production cost captures the penalty involved due to the above reasons and it represents the opportunity cost for not producing the planned quantity, . Mathematically, it can be written as

3.2.9. Manufacturer’s Total Cost per Time

3.2.10. Manufacturer’s Total Revenue per Time

The total revenue function () represents the sum of revenue from sales of finished products with perfect quality and discounted sales of imperfect items produced, as well as imperfect raw materials. That is

With representing the total quantity of products of good quality sold, which is obtained by integrating the demand function, , over the specified time intervals , , and , respectively. Hence, the quantity is

The solution of the second integral is

Lastly, the third integral yields

Therefore, the total revenue is

Dividing the above equation by T, we obtain the average revenue per cycle

3.2.11. Manufacturer’s Net Profit per Time

The net profit per time is obtained by subtracting the total cost per time from the total revenue generated. That is

3.3. Second Scenario’s Formulation

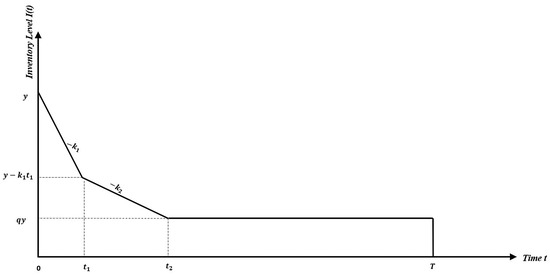

Now, we develop the mathematical model for the second scenario. In this scenario, imperfect raw materials that have been screened are retained until the end of the cycle and returned to the supplier upon arrival of the next order. The inventory profile of raw materials is shown in Figure 3.

Figure 3.

Raw material inventory level with imperfect items returned to supplier.

To find the total profit inventory levels, we calculate the total cost per cycle, which is identical to that of the first scenario except for the holding cost of the raw material. The area under the curve representing the inventory level in Figure 3 is

Manufacturer’s Inventory Holding Cost of Raw Material

The inventory cost of holding raw material is calculated by multiplying the unit holding cost of the raw material by the area represented in Figure 3, resulting in the total holding cost of raw material. Hence, the total holding cost of raw material is

3.4. Manufacturer’s Total Cost per Time

3.5. Manufacturer’s Total Revenue per Time

Since a portion of the scanned raw material is of poor quality and the decision-maker chooses to retain it until the end of the cycle and return it to the supplier, rather than selling it and recovering a portion of the cost of purchasing raw materials, the mathematical expression of the total revenue per time for this new scenario is thus defined as follows:

3.6. Manufacturer’s Net Profit per Time

The net profit generated is the difference between the revenue generated and the total cost incurred across the entire system. The mathematical formulation of the proposed scenario is thus,

4. Solution

4.1. Determination of the Decision Variables

The aim is to determine the optimum values of and T to maximize the total profit of the inventory system. The optimum values of and T for the maximum profit are the solutions of the equations

4.2. Solution Methodology

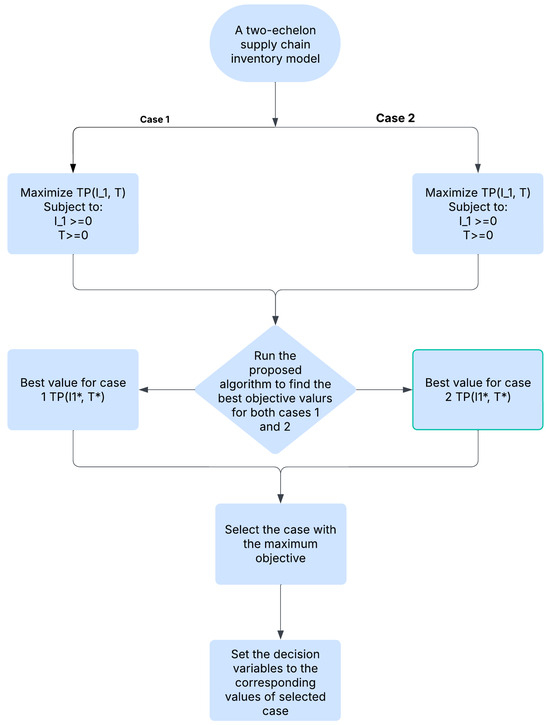

Due to the highly non-linear nature of the model, an analytical approach was infeasible. Thus, we employed a numerical optimisation approach using the Newton–Raphson algorithm to determine the optimal values of the decision variables and T. The solution methodology, as illustrated in Figure 4, begins with the definition of the problem for both scenarios. An optimisation algorithm is then employed to maximise the profit functions and for each scenario by finding the optimum values of the stock levels and cycle time T. The optimal profits from both scenarios are compared, and the scenario yielding the higher profit is selected as the best-case solution.

Figure 4.

The flowchart of the solution methodology.

4.3. Optimality Condition

Now, the problem is to determine the optimal values of and T which maximise the net profit function, . Since is a function of two variables and T, where both are continuous variables, for any optimal value of and T, the necessary conditions have to be met

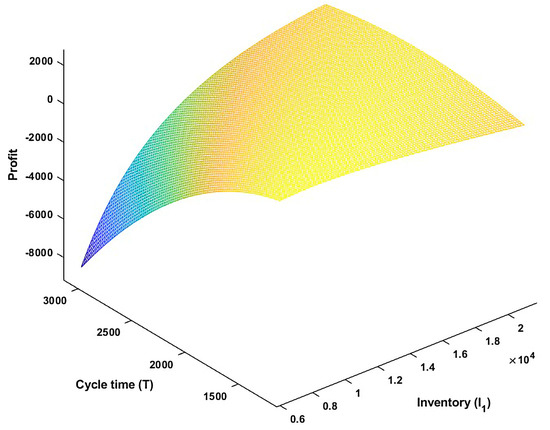

which is verified numerically. The nature of the objective function is also shown graphically in Figure 5.

Figure 5.

Graph of the net profit function of the two echelons supply chain per quantity, per time.

4.4. Numerical Results

This section presents a numerical example to illustrate the applicability of the proposed inventory model. The input parameters for this model are provided in Table 2.

Table 2.

Numerical input parameters.

Upon evaluating the policy in which imperfect quality items are sold, the optimal inventory level and optimal cycle time T are 11,774 units and 2140 h, respectively. The optimal number of items produced during a production cycle is 91,606, with an optimal order quantity of 101,785 units (see Table 3). The initial production period is denoted as h, while the entire production period is represented by h. The maximum stock level attained, denoted as , amounts to 25,688 units. The total cost is calculated as USD 7300.2 per hour, while the total revenue per hour is USD 7483. Consequently, the maximum total profit per hour is determined to be USD 183.

Table 3.

Summary of the results from the numerical example.

In contrast, when the imperfect quality items are returned, the optimal inventory level and optimal cycle time T are 26,349 units and 4702.6 h respectively. The optimal number of items produced during the production cycle is found to be , with an optimal order quantity of units of raw material. The first production period denoted as , amounts to h, while the entire production period is calculated as h. The total inventory carried during this scenario, , is determined to be 56,711.7 units. The total cost per time is assessed as USD 17,426.2, whereas the total revenue per time is USD 13,017.8. The total profit per time is estimated to be USD . In the case where imperfect quality items are returned, the negative maximum total profit per cycle indicates that the overall financial outcome is unfavourable. This means that the costs of managing such a system outweigh the potential revenue generated from the sale.

Based on the analysis in Table 3, the optimal operating policy suggests selling the imperfect raw material instead of returning it to the supplier when the subsequent order is received. The return scenario results in a negative profit, suggesting that managing the imperfect raw material by keeping it in stock leads to higher costs than the revenue generated.

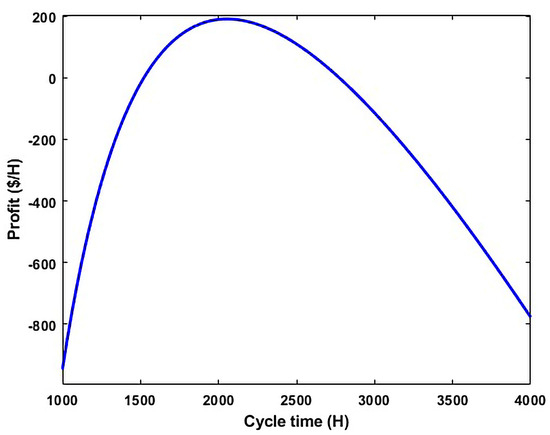

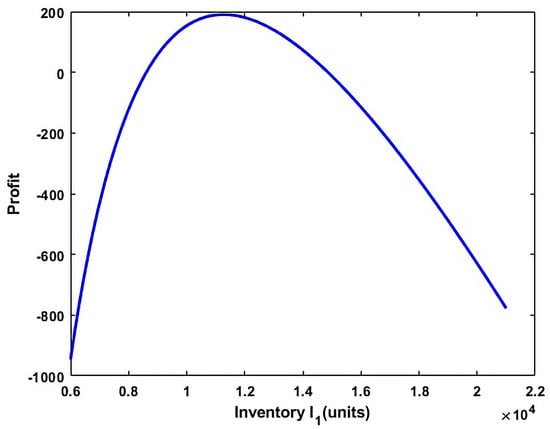

To verify whether the solution obtained from the profit function per hour in Equations (108) and (117) are truly optimal, the sufficiency conditions for optimality are established by substituting the provided data into Equations (120) and (122). The results confirm that all the two minors in Equation (108) satisfy the necessary conditions and , indicating that the profit function is positive (semi)definite. The graphical representation is presented in Figure 5, Figure 6 and Figure 7 to illustrate the relationship between the profit function and the two decision variables.

Figure 6.

TP with respect to cycle time.

Figure 7.

TP with respect to inventory.

5. Sensitivity Analysis and Managerial Implications

5.1. Sensitivity Analysis

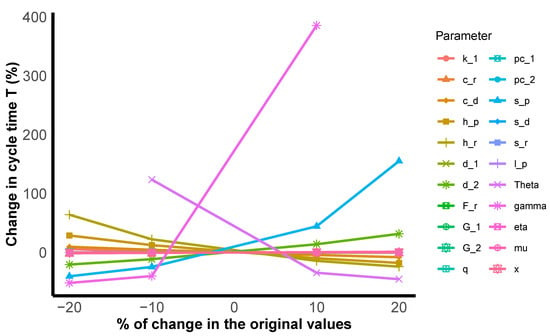

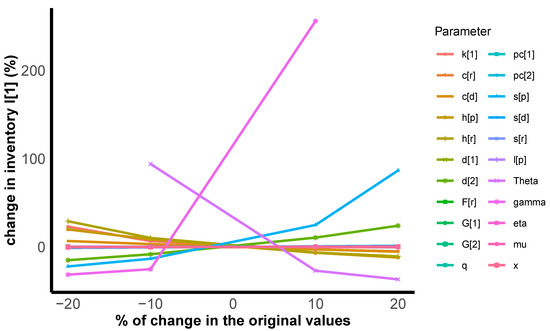

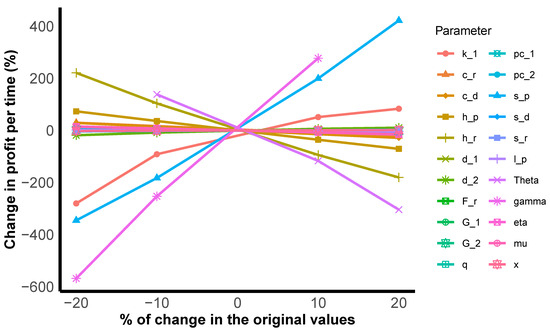

A sensitivity analysis is performed to assess the impact of various parameters. To perform the sensitivity analysis, one parameter is varied at a time within a range of −20% to +20%, while keeping all other parameters constant. The influence of these parameters on , T and is detailed in Table 4. Figure 8, Figure 9 and Figure 10 provide graphical representations of how these variations affect the inventory , the cycle time, T and the total profit per hour, . Based on these results, the following inferences can be drawn

- The stock level, is insensitive to and .

- The stock level, , is moderately sensitive to changes in and .

- The stock level, , is highly sensitive to changes in and . It is highly sensitive in a positive way to the demand enhancement parameter, and in a negative way to the deterioration parameter, (Figure 8).

- The cycle time, T is insensitive to and .

- The cycle time, T, is moderately sensitive to changes in and .

- The cycle time, T, is highly sensitive to changes in and . The most significant changes occur with respect to and (Figure 9).

- The profit per time is insensitive to changes .

- The profit per time is moderately sensitive to changes in and q.

- The profit per time is highly sensitive to changes in and (Figure 10).

Table 4.

Sensitivity analysis for various inventory model parameters.

Table 4.

Sensitivity analysis for various inventory model parameters.

| % Change | Inventory Level | Inventory Level | Production Time | Production Cycle | Cycle Time T | Profit Per Time TP | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Units | % Change | Units | % Change | Hours | % Change | Hours | % Change | Hours | % Change | USD | % Change | ||

| Base | 11,774 | 25,688 | 308.2 | 1497.4 | 2139.6 | 182.7 | |||||||

| −20 | 14,431 | 23% | 25,825.18 | −1% | 639.672 | 108% | 1613.533 | 8% | 2259.163 | 6% | −329.162 | −280.10% | |

| −10 | 12,548.26 | 6.6% | 25,578.64 | −0.4% | 413.0436 | 34.01% | 1526.751 | 1.96% | 2166.217 | 1.24% | 15.88079 | −91.31% | |

| 10 | 11,381.29 | −3% | 25,863.59 | 1% | 247.3118 | −20% | 1485.116 | −1% | 2131.705 | 0% | 276.4899 | 51.28% | |

| 20 | 11,150.04 | −5% | 26,037.09 | 1% | 207.0958 | −33% | 1479.493 | −1% | 2130.42 | 0% | 335.1853 | 83.40% | |

| −20 | * | * | * | * | * | * | * | * | * | * | * | * | |

| −10 | * | * | * | * | * | * | * | * | * | * | * | * | |

| 10 | * | * | * | * | * | * | * | * | * | * | * | * | |

| 20 | * | * | * | * | * | * | * | * | * | * | * | * | |

| −20 | 11,733.18 | −0.3% | 25,665.84 | −0.1% | 307.1513 | −0.3% | 1497.977 | 0.0% | 2139.622 | 0.0% | 236.8467 | 29.6% | |

| −10 | 11,732.17 | −0.4% | 25,665.29 | −0.1% | 307.1248 | −0.4% | 1497.99 | 0.0% | 2139.622 | 0.0% | 213.2236 | 16.7% | |

| 10 | 11,730.14 | −0.4% | 25,664.2 | −0.1% | 307.0717 | −0.4% | 1498.017 | 0.0% | 2139.622 | 0.0% | 165.9775 | −9.2% | |

| 20 | 11,729.12 | −0.4% | 25,663.66 | −0.1% | 307.0451 | −0.4% | 1498.031 | 0.0% | 2139.622 | 0.0% | 142.3545 | −22.1% | |

| −20 | 12,556.9 | 6.7% | 27,990.24 | 9.0% | 328.7146 | 6.7% | 1647.804 | 10.0% | 2347.56 | 9.7% | 235.7489 | 29.0% | |

| −10 | 12,145.42 | 3.2% | 26,780.65 | 4.3% | 317.9429 | 3.2% | 1568.818 | 4.8% | 2238.334 | 4.6% | 209.1534 | 14.4% | |

| 10 | 11,436.55 | −2.9% | 24,695.65 | −3.9% | 299.3861 | −2.9% | 1432.643 | −4.3% | 2050.034 | −4.2% | 156.5705 | −14.3% | |

| 20 | 11,129.06 | −5.5% | 23,790.6 | −7.4% | 291.3366 | −5.5% | 1373.519 | −8.3% | 1968.284 | −8.0% | 130.5657 | −28.6% | |

| −20 | 14,107.49 | 19.8% | 32,545.61 | 26.7% | 369.3061 | 19.8% | 1945.213 | 29.9% | 2758.854 | 28.9% | 316.8687 | 73.4% | |

| −10 | 12,779.66 | 8.5% | 28,644.91 | 11.5% | 334.546 | 8.5% | 1690.551 | 12.9% | 2406.673 | 12.5% | 249.1267 | 36.3% | |

| 10 | 10,985.27 | −6.7% | 23,367.21 | −9.0% | 287.5725 | −6.7% | 1345.858 | −10.1% | 1930.039 | −9.8% | 117.6313 | −35.6% | |

| 20 | 10,350.4 | −12.1% | 21,496.2 | −16.3% | 270.9528 | −12.1% | 1223.585 | −18.3% | 1760.99 | −17.7% | 53.60253 | −70.7% | |

| −20 | 15,198.3 | 29.1% | 39,955.74 | 55.5% | 397.8614 | 29.1% | 2513.881 | 67.9% | 3512.775 | 64.2% | 586.8514 | 221.1% | |

| −10 | 12,966.25 | 10.1% | 30,671.6 | 19.4% | 339.4307 | 10.1% | 1852.708 | 23.7% | 2619.499 | 22.4% | 372.6779 | 103.9% | |

| 10 | 11,022.99 | −6.4% | 22,538.3 | −12.3% | 288.56 | −6.4% | 1272.775 | −15.0% | 1836.232 | −14.2% | 10.87292 | −94.1% | |

| 20 | 10,501.85 | −10.8% | 20,347.14 | −20.8% | 274.9175 | −10.8% | 1116.395 | −25.4% | 1625.074 | −24.0% | −146.916 | −180.4% | |

| −20 | 11,703.26 | −0.6% | 25,766.78 | 0.3% | 295.8356 | −4.0% | 1497.846 | 0.0% | 2142.016 | 0.1% | 198.3613 | 8.5% | |

| −10 | 11,737.78 | −0.3% | 25,728.08 | 0.2% | 301.8977 | −2.0% | 1497.649 | 0.0% | 2140.851 | 0.1% | 190.769 | 4.4% | |

| 10 | 11,811.46 | 0.3% | 25,646.1 | −0.2% | 314.8044 | 2.1% | 1497.253 | 0.0% | 2138.405 | −0.1% | 174.3176 | −4.6% | |

| 20 | 11,850.83 | 0.7% | 25,602.65 | −0.3% | 321.6837 | 4.4% | 1497.053 | 0.0% | 2137.119 | −0.1% | 165.4014 | −9.5% | |

| −20 | 9996.045 | −15.1% | 21,230.36 | −17.4% | 261.6766 | −15.1% | 1170.602 | −21.8% | 1701.361 | −20.5% | 149.1516 | −18.4% | |

| −10 | 10,790.05 | −8.4% | 23,243.49 | −9.5% | 282.4621 | −8.4% | 1317.661 | −12.0% | 1898.748 | −11.3% | 167.5612 | −8.3% | |

| 10 | 13,012.18 | 10.5% | 28,708.31 | 11.8% | 340.6331 | 10.5% | 1721.119 | 14.9% | 2438.826 | 14.0% | 194.3493 | 6.3% | |

| 20 | 14,602.21 | 24.0% | 32,520.75 | 26.6% | 382.2567 | 24.0% | 2005.313 | 33.9% | 2818.332 | 31.7% | 201.8617 | 10.4% | |

| % Change | Inventory Level | Inventory Level | Production Time | Production Cycle | Cycle Time T | Profit Per Time TP | |||||||

| Units | % Change | Units | % Change | Hours | % Change | Hours | % Change | Hours | % Change | USD | % Change | ||

| Base | 11,774 | 25,688 | 308.2 | 1497.4 | 2139.6 | 182.7 | |||||||

| −20 | 11,797.8 | 0.2% | 26,350.57 | 0.3% | 243.7562 | 0.2% | 1487.582 | 0.3% | 2146.347 | 0.3% | 265.8479 | 1.0% | |

| −10 | 11,797.94 | 0.2% | 26,351.09 | 0.3% | 243.7592 | 0.2% | 1487.618 | 0.3% | 2146.395 | 0.3% | 265.7768 | 1.0% | |

| 10 | 11,798.23 | 0.2% | 26,352.14 | 0.3% | 243.765 | 0.2% | 1487.689 | 0.3% | 2146.492 | 0.3% | 259.5417 | −1.4% | |

| 20 | 11,798.37 | 0.2% | 26,352.66 | 0.3% | 243.768 | 0.2% | 1487.724 | 0.3% | 2146.541 | 0.3% | 259.4705 | −1.4% | |

| −20 | 11,797.8 | 0.2% | 26,350.57 | 0.3% | 243.7562 | 0.2% | 1487.582 | 0.3% | 2146.347 | 0.3% | 265.8479 | 1.0% | |

| −10 | 11,797.94 | 0.2% | 26,351.09 | 0.3% | 243.7592 | 0.2% | 1487.618 | 0.3% | 2146.395 | 0.3% | 265.7768 | 1.0% | |

| 10 | 11,798.23 | 0.2% | 26,352.14 | 0.3% | 243.765 | 0.2% | 1487.689 | 0.3% | 2146.492 | 0.3% | 259.5417 | −1.4% | |

| 20 | 11,798.37 | 0.2% | 26,352.66 | 0.3% | 243.768 | 0.2% | 1487.724 | 0.3% | 2146.541 | 0.3% | 259.4705 | −1.4% | |

| −20 | 11,797.8 | 0.2% | 26,350.57 | 0.3% | 243.7562 | 0.2% | 1487.582 | 0.3% | 2146.347 | 0.3% | 265.8479 | 1.0% | |

| −10 | 11,797.94 | 0.2% | 26,351.09 | 0.3% | 243.7592 | 0.2% | 1487.618 | 0.3% | 2146.395 | 0.3% | 265.7768 | 1.0% | |

| 10 | 11,798.23 | 0.2% | 26,352.14 | 0.3% | 243.765 | 0.2% | 1487.689 | 0.3% | 2146.492 | 0.3% | 259.5417 | −1.5% | |

| 20 | 11,798.37 | 0.2% | 26,352.66 | 0.3% | 243.768 | 0.2% | 1487.724 | 0.3% | 2146.541 | 0.3% | 259.4705 | −1.4% | |

| q | −20 | 11,797.31 | 0.2% | 25,759.49 | 0.3% | 308.8302 | 0.2% | 1502.179 | 0.3% | 2146.166 | 0.3% | 195.9731 | 7.2% |

| −10 | 11,785.73 | 0.1% | 25,724.33 | 0.1% | 308.5269 | 0.1% | 1499.861 | 0.2% | 2142.969 | 0.2% | 189.4729 | 3.7% | |

| 10 | 11,761.56 | −0.1% | 25,650.07 | −0.1% | 307.8943 | −0.1% | 1494.947 | −0.2% | 2136.198 | −0.2% | 175.837 | −3.8% | |

| 20 | 11,748.95 | −0.2% | 25,610.84 | −0.3% | 307.5641 | −0.2% | 1492.341 | −0.3% | 2132.612 | −0.3% | 168.6847 | −7.7% | |

| −20 | 11,805.95 | 0.2% | 26,356.15 | 0.3% | 243.9246 | 0.2% | 1487.531 | 0.3% | 2146.435 | 0.3% | 265.8479 | 1.0% | |

| −10 | 11,805.95 | 0.2% | 26,356.15 | 0.3% | 243.9246 | 0.2% | 1487.531 | 0.3% | 2146.435 | 0.3% | 265.7768 | 1.0% | |

| 10 | 11,794.15 | 0.1% | 26,349.34 | 0.3% | 243.6808 | 0.1% | 1487.714 | 0.3% | 2146.447 | 0.3% | 259.1424 | −1.5% | |

| 20 | 11,790.21 | 0.1% | 26,347.05 | 0.3% | 243.5995 | 0.1% | 1487.774 | 0.3% | 2146.45 | 0.3% | 258.7189 | −1.7% | |

| −20 | 11,763.03 | −0.1% | 25,682.15 | 0.0% | 307.9326 | −0.1% | 1497.602 | 0.0% | 2139.656 | 0.0% | 194.0107 | 6.2% | |

| −10 | 11,768.42 | 0.0% | 25,685.02 | 0.0% | 308.0739 | 0.0% | 1497.527 | 0.0% | 2139.652 | 0.0% | 188.3864 | 3.1% | |

| 10 | 11,779.21 | 0.0% | 25,690.73 | 0.0% | 308.3562 | 0.0% | 1497.375 | 0.0% | 2139.644 | 0.0% | 177.142 | −3.1% | |

| 20 | 11,784.6 | 0.1% | 25,693.57 | 0.0% | 308.4973 | 0.1% | 1497.298 | 0.0% | 2139.638 | 0.0% | 171.5219 | −6.2% | |

| -20 | 9162.811 | −22.2% | 16,467.65 | −35.9% | 239.8642 | −22.2% | 864.2094 | −42.3% | 1275.901 | −40.4% | −448.272 | −345.3% | |

| −10 | 10,190.6 | −13.4% | 20,087.36 | −21.8% | 266.7697 | −13.4% | 1112.646 | −25.7% | 1614.83 | −24.5% | −150.709 | −182.5% | |

| 10 | 14,697.98 | 24.8% | 35,875.79 | 39.7% | 384.764 | 24.8% | 2194.833 | 46.6% | 3091.728 | 44.5% | 547.3447 | 199.5% | |

| 20 | 21,974.57 | 86.6% | 61,238.88 | 138.4% | 575.2506 | 86.6% | 3931.175 | 162.5% | 5462.147 | 155.3% | 954.2402 | 422.1% | |

| −20 | 11,643.96 | −1.1% | 25,407.7 | −1.1% | 304.8158 | −1.1% | 1481.203 | −1.1% | 2116.396 | −1.1% | 176.6317 | −3.4% | |

| −10 | 11,714.28 | −0.5% | 25,550.63 | −0.5% | 306.6566 | −0.5% | 1489.251 | −0.5% | 2128.017 | −0.5% | 178.8303 | −2.2% | |

| 10 | 11,844.14 | 0.6% | 25,830.83 | 0.6% | 310.0559 | 0.6% | 1505.5 | 0.5% | 2151.271 | 0.5% | 184.9625 | 1.2% | |

| 20 | 11,914.46 | 1.2% | 25,973.78 | 1.1% | 311.8967 | 1.2% | 1513.548 | 1.1% | 2162.893 | 1.1% | 187.1615 | 2.4% | |

| % Change | Inventory Level | Inventory Level | Production Time | Production Cycle | Cycle Time T | Profit Per Time TP | |||||||

| Units | % Change | Units | % Change | Hours | % Change | Hours | % Change | Hours | % Change | USD | % Change | ||

| Base | 11,774 | 25,688 | 308.2 | 1497.4 | 2139.6 | 182.7 | |||||||

| −20 | 11,758.82 | −0.1% | 25,656.21 | −0.1% | 307.8225 | −0.1% | 1495.634 | −0.1% | 2137.039 | −0.1% | 182.5303 | −0.1% | |

| −10 | 11,782.52 | 0.1% | 25,692.48 | 0.0% | 308.4429 | 0.1% | 1497.328 | 0.0% | 2139.64 | 0.0% | 183.1972 | 0.0% | |

| 10 | 11,842.75 | 0.1% | 26,414.68 | 0.1% | 244.685 | 0.1% | 1490.148 | 0.1% | 2150.515 | 0.1% | 402.0893 | 0.0% | |

| 20 | 11,855.25 | 0.2% | 26,441.69 | 0.2% | 244.9432 | 0.2% | 1491.648 | 0.2% | 2152.69 | 0.2% | 402.2808 | 0.1% | |

| −20 | 11,780.44 | 0.1% | 25,691.38 | 0.0% | 308.3885 | 0.1% | 1497.358 | 0.0% | 2139.642 | 0.0% | 185.3657 | 1.4% | |

| −10 | 11,782.52 | 0.1% | 25,692.48 | 0.0% | 308.4429 | 0.1% | 1497.328 | 0.0% | 2139.64 | 0.0% | 183.1972 | 0.2% | |

| 10 | 11,786.68 | 0.1% | 25,694.66 | 0.0% | 308.5517 | 0.1% | 1497.269 | 0.0% | 2139.635 | 0.0% | 178.8608 | −2.1% | |

| 20 | 11,788.75 | 0.1% | 25,695.76 | 0.0% | 308.6061 | 0.1% | 1497.239 | 0.0% | 2139.633 | 0.0% | 176.693 | −3.3% | |

| −20 | * | * | * | * | * | * | * | * | * | * | * | * | |

| −10 | 22,847.58 | 94.1% | 55,609.58 | 116.5% | 598.1041 | 94.1% | 3398.276 | 126.9% | 4788.515 | 123.8% | 435.4929 | 138.3% | |

| 10 | 8594.993 | −27.0% | 17,325.09 | −32.6% | 224.9998 | −27.0% | 971.1622 | −35.1% | 1404.289 | −34.4% | −30.6755 | −116.8% | |

| 20 | 7439.443 | −36.8% | 14,587.4 | −43.2% | 194.7498 | −36.8% | 805.6861 | −46.2% | 1170.371 | −45.3% | −372.906 | −304.0% | |

| −20 | 8069.15 | −31.5% | 13,683.08 | −46.7% | 211.2343 | −31.5% | 691.0573 | −53.9% | 1033.134 | −51.7% | −855.452 | −568.1% | |

| −10 | 8792.166 | −25.3% | 16,346.28 | −36.4% | 230.1614 | −25.3% | 875.812 | −41.5% | 1284.469 | −40.0% | −279.244 | −252.8% | |

| 10 | 41,927.51 | 256.1% | 116,572 | 353.8% | 1097.579 | 256.1% | 7477.451 | 399.3% | 10,391.75 | 385.7% | 689.3271 | 277.2% | |

| 20 | * | * | * | * | * | * | * | * | * | * | * | * | |

| −20 | 11,786.08 | 0.1% | 25,694.35 | 0.0% | 308.5361 | 0.1% | 1497.277 | 0.0% | 2139.636 | 0.0% | 211.0402 | 15.5% | |

| −10 | 11,779 | 0.0% | 25,684.79 | 0.0% | 308.3508 | 0.0% | 1496.88 | 0.0% | 2139 | 0.0% | 197.105 | 7.8% | |

| 10 | 11,767 | −0.1% | 25,678.35 | 0.0% | 308.0366 | −0.1% | 1497.041 | 0.0% | 2139 | 0.0% | 168.7895 | −7.6% | |

| 20 | 11,761 | −0.1% | 25,675.13 | 0.0% | 307.8796 | −0.1% | 1497.122 | 0.0% | 2139 | 0.0% | 154.6335 | −15.4% | |

| −20 | 11723 | −0.4% | 25428.43 | −1.0% | 306.8848 | −0.4% | 1478.289 | −1.3% | 2114 | −1.2% | 208.4103 | 14.0% | |

| −10 | 11,748 | −0.2% | 25,559.53 | −0.5% | 307.5393 | −0.2% | 1488.012 | −0.6% | 2127 | −0.6% | 195.6739 | 7.1% | |

| 10 | 11,800 | 0.2% | 25,818.27 | 0.5% | 308.9005 | 0.2% | 1507.043 | 0.6% | 2152.5 | 0.6% | 169.715 | −7.1% | |

| 20 | 11,825.79 | 0.4% | 25,948.94 | 1.0% | 309.5758 | 0.4% | 1516.682 | 1.3% | 2165.406 | 1.2% | 156.6598 | −14.3% | |

| x | −20 | 11,743.6 | −0.3% | 25,580.22 | −0.4% | 307.4242 | −0.3% | 1490.041 | −0.5% | 2129.547 | −0.5% | 178.7839 | −2.2% |

| −10 | 11,760.35 | −0.1% | 25,639.88 | −0.2% | 307.8625 | −0.1% | 1494.148 | −0.2% | 2135.145 | −0.2% | 180.9939 | −1.0% | |

| 10 | 11,784.89 | 0.1% | 25,727.34 | 0.2% | 308.5049 | 0.1% | 1500.167 | 0.2% | 2143.35 | 0.2% | 184.2126 | 0.8% | |

| 20 | 11,794.15 | 0.2% | 25,760.34 | 0.3% | 308.7474 | 0.2% | 1502.439 | 0.3% | 2146.447 | 0.3% | 185.4209 | 1.5% | |

Figure 8.

The sensitivity of inventory with respect to change in parameters.

Figure 9.

The sensitivity of cycle time with respect to change in parameters.

Figure 10.

The sensitivity of the profit function with respect to change in parameters.

5.2. Managerial Insights

Based on the sensitivity analysis, the following managerial insights can be derived:

- The selling price has the greatest positive impact on the total profit. As the price increases, the profit per cycle increases dramatically, especially at higher price points. Therefore, managers should consider their unit selling price when making decisions in order to maximise their profit.

- The parameter for demand enhancement has the second greatest impact on profit over time. An increase in makes demand more sensitive to changes in inventory levels, indicating that customers are strongly influenced by product availability. This positive effect on profit suggests that manufacturers should align supply with demand effectively to capitalise on revenue opportunities.

- The deterioration rate has the greatest negative impact on the total profit, followed by the holding cost of raw materials. A higher value of causes a decrease in profitability because more finished goods spoil before they can be sold, leading to higher deterioration costs and reduced revenue. Managers should aim to keep the deterioration rate as low as possible to minimise spoilage in order to maintain higher profitability.

- When the inventory holding cost increases for both raw materials and finished products, manufacturers respond by holding less stock of raw materials. This results in lower availability of finished goods, reduced sales, and a negative impact on overall profit. Managers should consider working with lower holding cost rates when making decisions on inventory management, as reducing holding costs can increase the availability of raw materials and finished goods which can boost sales and ultimately maximise profit.

6. Conclusions

The model presented in this paper extends the classic economic production quantity (EPQ) model to the case where raw material with imperfect quality items are used during the production process. This model considered both deterioration of products and a flexible production process. This later effect is captured by using the concept of shifts in production rate. In addition, the traditional assumption of constant demand is relaxed to a stock-dependent demand function, reflecting the impact of current inventory levels on demand to provide a more realistic representation of how customers respond to the availability of certain goods. Two scenarios for this model were considered. The optimal operating policy was derived by maximising the total profit per unit of time. The uniqueness of the optimal solutions was demonstrated through a numerical example and the sensitivity analysis of the model was analysed. One of the unique contributions of this model is considering the effect of shifts in production rate in conjunction with the ordering of imperfect raw material in a two-echelon supply chain. The analysis revealed several key factors that significantly influence the overall profitability of the production process. The most critical factor is the selling price, which has a substantial positive effect on profit. As the price increases, profit per cycle increases dramatically, especially at higher price points. The demand sensitivity parameter, which reflects how demand responds to inventory levels, also plays a crucial role in influencing profitability. On the negative side, the deterioration rate negatively impacts profit; higher deterioration rates lead to increased spoilage of finished goods, thus reducing profitability.

The practical implications of this model are critical for real-world decision-making. Manufacturers can leverage the insights derived from the model, such as optimising the production rate and managing imperfect raw materials to improve operational efficiency. The findings not only help guide inventory management but also encourage the adoption of strategies like salvaging defective products, which could be a valuable revenue stream under certain circumstances. Furthermore, the study contributes to bridging the gap between theoretical models and industry practices by demonstrating how shifts in production rates and the incorporation of imperfect materials can be strategically used to optimise production processes. These contributions show the potential for improved decision-making in managing perishable products and can serve as a foundation for more advanced studies on production systems with varying performance levels.

This paper contributes to the existing research on managing perishable product inventory with demand dependent on stock levels. However, there are limitations in the model presented that suggest opportunities for further exploration and expansion. For instance, in this model, the rate of imperfect products is modelled by a constant parameter that is proportional to the rate of production. A possible extension of the model could be to adopt other forms of defective rates, such as the exponential increase over time. Another possible interesting extension could be to use the probability density function to capture the percentage of imperfect raw material contained in the lot size. We could consider using a multiplicative model of stock-level components instead of the additive. In this model, demand for the product is assumed to remain positive as long as there is still some inventory displayed on the shelf. However, this assumption limits the applicability of the results obtained by suggesting that the product is always removed from the shelf due to deterioration. This suggests a new research opportunity, considering a variable parameter for demand sensitivity to the current level of inventory that decreases with time until reaching zero. To enhance realism in this model, one could introduce elements such as stochastic timing of shifts, probabilistic production rates, and uncertain durations for production by modelling these factors as random variables with probability distributions. Other extensions could include incorporating freshness degradation, non-instantaneous deteriorating products, and introducing discount schemes or advertising efforts to gain further insights. Additionally, future research could explore the impact of competitors’ pricing strategies on profit-maximisation.

Author Contributions

Conceptualisation, K.T., O.A. and S.Y.; methodology, K.T.; software, K.T.; validation, K.T., O.A. and S.Y.; formal analysis, K.T.; investigation, K.T.; writing—original draft preparation, K.T.; writing—review and editing, K.T., O.A. and S.Y.; visualisation, K.T.; supervision, O.A. and S.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Harris, F.W. Operations and cost. Fact. Manag. Ser. 1915, 2, 48–52. [Google Scholar]

- Wilson, R.H. A Scientific Routine for Stock Control; Harvard University: Cambridge, MA, USA, 1934. [Google Scholar]

- Whitin, T.M. The Theory of Inventory Management, 2nd ed.; Princeton University Press: Princeton, NJ, USA, 1957. [Google Scholar]

- Dave, U.; Patel, L.K. (T,Si) policy inventory model for deteriorating items with time proportional demand. J. Oper. Res. Soc. 1981, 32, 137–142. [Google Scholar] [CrossRef]

- Benkherouf, L. On an inventory model with deteriorating items and decreasing time-varying demand and shortages. Eur. J. Oper. Res. 1995, 86, 293–299. [Google Scholar] [CrossRef]

- Srivastava, M.; Gupta, R. EOQ Model for deteriorating items having constant and time-dependent demand rate. Opsearch 2007, 44, 251–260, Int. J. Prod. Econ.1997, 49, 205–213. [Google Scholar] [CrossRef]

- Mishra, V.K.; Singh, L.S.; Kumar, R. An inventory model for deteriorating items with time-dependent demand and time-varying holding cost under partial backlogging. J. Ind. Eng. Int. 2013, 9, 1–5. [Google Scholar] [CrossRef]

- Majumder, P.; Bera, U.K.; Maiti, M. An EPQ model of deteriorating items under partial trade credit financing and demand declining market in crisp and fuzzy environment. Procedia Comput. Sci. 2015, 45, 780–789. [Google Scholar] [CrossRef]

- Singh, T.; Mishra, P.J.; Pattanayak, H. An optimal policy for deteriorating items with time-proportional deterioration rate and constant and time-dependent linear demand rate. J. Ind. Eng. Int. 2017, 13, 455–463. [Google Scholar] [CrossRef]

- Halim, M.A.; Paul, A.; Mahmoud, M.; Alshahrani, B.; Alazzawi, A.Y.; Ismail, G.M. An overtime production inventory model for deteriorating items with nonlinear price and stock dependent demand. Alex. Eng. J. 2021, 60, 2779–2786. [Google Scholar] [CrossRef]

- Jain, M.; Singh, P. Optimal inspection and advance payment policy for deteriorating items using differential evolution metaheuristic. Appl. Soft Comput. 2022, 128, 109475. [Google Scholar] [CrossRef]

- Hou, L.; Nie, T.; Zhang, J. Pricing and inventory strategies for perishable products in a competitive market considering strategic consumers. Transp. Res. Part E Logist. Transp. Rev. 2024, 184, 103478. [Google Scholar] [CrossRef]

- Moshtagh, M.S.; Zhou, Y.; Verma, M. Dynamic inventory and pricing control of a perishable product with multiple shelf life phases. Transp. Res. Part E Logist. Transp. Rev. 2025, 195, 103960. [Google Scholar] [CrossRef]

- Pathak, G.; Kumar, V.; Gupta, C.B. An inventory model for deterioration items with imperfect production and price sensitive demand under partial backlogging. Int. J. 2017, 5, 8. [Google Scholar]

- El-Kassar, A.-N.; Salameh, M.; Bitar, M. EPQ model with imperfect quality raw material. Math. Balkan. 2012, 26, 123–132. [Google Scholar]

- Urban, T.L. Analysis of production systems when run length influences product quality. Int. J. Prod. Res. 1998, 36, 3085–3094. [Google Scholar] [CrossRef]

- Salameh, M.K.; Jaber, M.Y. Economic production quantity model for items with imperfect quality. Int. J. Prod. Econ. 2000, 64, 59–64. [Google Scholar] [CrossRef]

- Chan, W.M.; Ibrahim, R.N.; Lochert, P.B. A new EPQ model: Integrating lower pricing, rework and reject situations. Prod. Plan. Control 2003, 14, 588–595. [Google Scholar] [CrossRef]

- Lee, H.H. A cost/benefit model for investments in inventory and preventive maintenance in an imperfect production system. Comput. Ind. Eng. 2005, 48, 55–68. [Google Scholar] [CrossRef]

- Hou, K.L. An EPQ model with setup cost and process quality as functions of capital expenditure. Appl. Math. Model. 2007, 31, 10–17. [Google Scholar] [CrossRef]

- Nobil, A.H.; Tiwari, S.; Tajik, F. Economic production quantity model considering warm-up period in a cleaner production environment. Int. J. Prod. Res. 2019, 57, 4547–4560. [Google Scholar] [CrossRef]

- Ozturk, H.; Aytar, S.A.L.I.H.; Senel, F.A. An EPQ model for an imperfect production process with fuzzy cycle time and quality screening. Iran. J. Fuzzy Syst. 2019, 16, 169–185. [Google Scholar]

- Asadkhani, J.; Mokhtari, H.; Tahmasebpoor, S. Optimal lot-sizing under learning effect in inspection errors with different types of imperfect quality items. Oper. Res. 2022, 22, 2631–2665. [Google Scholar] [CrossRef]

- Chen, X.; You, C. Dynamic pricing and inventory model for perishable products with reference price and reference quality. J. Comput. Appl. Math. 2025, 458, 116338. [Google Scholar] [CrossRef]

- Nobil, A.H.; Nobil, E.; Sedigh, A.H.A.; Cárdenas-Barrón, L.E.; Garza-Núñez, D.; Treviño-Garza, G.; Céspedes-Mota, A.; de Jesús, L.-H.I.; Smith, N.R. Economic production quantity models for an imperfect manufacturing system with strict inspection. Ain Shams Eng. J. 2024, 15, 102714. [Google Scholar] [CrossRef]

- Hossain, M.; Das, M.; Rahaman, M.; Alam, S. A profit-cost ratio maximization approach for a manufacturing inventory model having stock-dependent production rate and stock and price-dependent demand rate. Results Control Optim. 2024, 15, 100408. [Google Scholar] [CrossRef]

- Datta, T.K.; Paul, K. An inventory system with stock-dependent, price-sensitive demand rate. Prod. Plan. Control 2001, 12, 13–20. [Google Scholar] [CrossRef]

- Pal, A.K.; Bhunia, A.K.; Mukherjee, R.N. Optimal lot size model for deteriorating items with demand rate dependent on displayed stock level (DSL) and partial backordering. Eur. J. Oper. Res. 2006, 175, 977–991. [Google Scholar] [CrossRef]

- Panda, S.; Saha, S.; Basu, M. A note on EPQ model for seasonal perishable products with stock dependent demand. Asia-Pac. J. Oper. Res. 2008, 25, 301–315. [Google Scholar] [CrossRef]

- Lee, Y.P.; Dye, C.Y. An inventory model for deteriorating items under stock-dependent demand and controllable deterioration rate. Comput. Ind. Eng. 2012, 63, 474–482. [Google Scholar] [CrossRef]

- Ghiami, Y.; Williams, T.; Wu, Y. A two-echelon inventory model for a deteriorating item with stock-dependent demand, partial backlogging and capacity constraints. Eur. J. Oper. Res. 2013, 231, 587–597. [Google Scholar] [CrossRef]

- Yang, C.T. An inventory model with both stock-dependent demand rate and stock-dependent holding cost rate. Int. J. Prod. Econ. 2014, 155, 214–221. [Google Scholar] [CrossRef]

- Singh, T.; Pattnayak, H. A two-warehouse inventory model for deteriorating items with linear demand under conditionally permissible delay in payment. Int. J. Manag. Sci. Eng. Manag. 2014, 9, 104–113. [Google Scholar] [CrossRef]

- Avinadav, T.; Herbon, A.; Spiegel, U. Optimal ordering and pricing policy for demand functions that are separable into price and inventory age. Int. J. Prod. Econ. 2014, 155, 406–417. [Google Scholar] [CrossRef]

- San-José, L.A.; Sicilia, J.; González-De-la-Rosa, M.; Febles-Acosta, J. Analysis of an inventory system with discrete scheduling period, time-dependent demand and backlogged shortages. Comput. Oper. Res. 2019, 109, 200–208. [Google Scholar] [CrossRef]

- Cárdenas-Barrón, L.E.; Shaikh, A.A.; Tiwari, S.; Treviño-Garza, G. An EOQ inventory model with nonlinear stock dependent holding cost, nonlinear stock dependent demand and trade credit. Comput. Ind. Eng. 2020, 139, 105557. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Shaikh, A.A.; Konstantaras, I.; Bhunia, A.K.; Cárdenas-Barrón, L.E. Inventory models for perishable items with advanced payment, linearly time-dependent holding cost and demand dependent on advertisement and selling price. Int. J. Prod. Econ. 2020, 230, 107804. [Google Scholar] [CrossRef]

- San-José, L.A.; Sicilia, J.; Pando, V.; Alcaide-López-de-Pablo, D. An inventory system with time-dependent demand and partial backordering under return on inventory investment maximization. Comput. Oper. Res. 2022, 145, 105861. [Google Scholar] [CrossRef]

- Rodríguez-Mazo, J.; Ruiz-Benítez, R. A multi-warehouse inventory model under hybrid-price-stock dependent demand and a bulk release pattern. Comput. Oper. Res. 2024, 170, 106764. [Google Scholar] [CrossRef]

- Doğruöz, E.; Güllü, R. Analysis of an all-or-nothing inventory model with price-dependent intermittent demand and supply uncertainty. Comput. Ind. Eng. 2025, 187, 110883. [Google Scholar] [CrossRef]

- Jauhari, W.A.; Affifah, D.N.; Laksono, P.W.; Utama, D.M. A closed-loop supply chain inventory model with stochastic demand, exchange rate, green investment, and carbon tax. Clean. Logist. Supply Chain 2024, 13, 100168. [Google Scholar] [CrossRef]

- Rishel, R. Control of systems with jump Markov disturbances. IEEE Trans. Autom. Control 1975, 20, 241–244. [Google Scholar] [CrossRef]

- Olsder, G.J.; Suri, R. Time-optimal control of parts-routing in a manufacturing system with failure-prone machines. In Proceedings of the 1980 19th IEEE Conference on Decision and Control including the Symposium on Adaptive Processes, Albuquerque, NM, USA, 10–12 December 1980; pp. 722–727. [Google Scholar]

- Schweitzer, P.J.; Seidmann, A. Optimizing processing rates for flexible manufacturing systems. Manage. Sci. 1991, 37, 454–466. [Google Scholar] [CrossRef]

- Khouja, M. The use of minor setups within production cycles to improve product quality and yield. Int. Trans. Oper. Res. 2005, 12, 403–416. [Google Scholar] [CrossRef]

- Sana, S.S.; Goyal, S.K.; Chaudhuri, K. An imperfect production process in a volume flexible inventory model. Int. J. Prod. Econ. 2007, 105, 548–559. [Google Scholar] [CrossRef]

- Ben-Daya, M.; Hariga, M.; Khursheed, S.N. Economic production quantity model with a shifting production rate. Int. Trans. Oper. Res. 2008, 15, 87–101. [Google Scholar] [CrossRef]

- Sarkar, B.; Mandal, P.; Sarkar, S. An EMQ model with price and time dependent demand under the effect of reliability and inflation. Appl. Math. Comput. 2014, 231, 414–421. [Google Scholar] [CrossRef]

- Emami-Mehrgani, B.; Nadeau, S.; Kenné, J.P. Optimal lockout/tagout, preventive maintenance, human error and production policies of manufacturing systems with passive redundancy. J. Qual. Maint. Eng. 2014, 20, 453–470. [Google Scholar] [CrossRef]

- Omar, M.; Yeo, I. A production–repair inventory model with time-varying demand and multiple setups. Int. J. Prod. Econ. 2014, 155, 398–405. [Google Scholar] [CrossRef]

- Ganesan, S.; Uthayakumar, R. EPQ models for an imperfect manufacturing system considering warm-up production run, shortages during hybrid maintenance period and partial backordering. Adv. Ind. Manuf. Eng. 2020, 1, 100005. [Google Scholar] [CrossRef]

- Tshinangi, K.; Adetunji, O.; Yadavalli, V.S.S. A Lot-Sizing Model for a Multi-State System with Deteriorating Items, Variable Production Rate, and Imperfect Quality. Int. J. Math. Eng. Manag. Sci. 2022, 7, 730. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).