The Cognitive Cost of Motor Control: A Systematic Review and Meta-Analysis of Parkinson’s Disease Treatments and Financial Decision-Making

Abstract

1. Introduction

2. Materials and Methods

2.1. Search Strategy

2.2. Eligibility Criteria

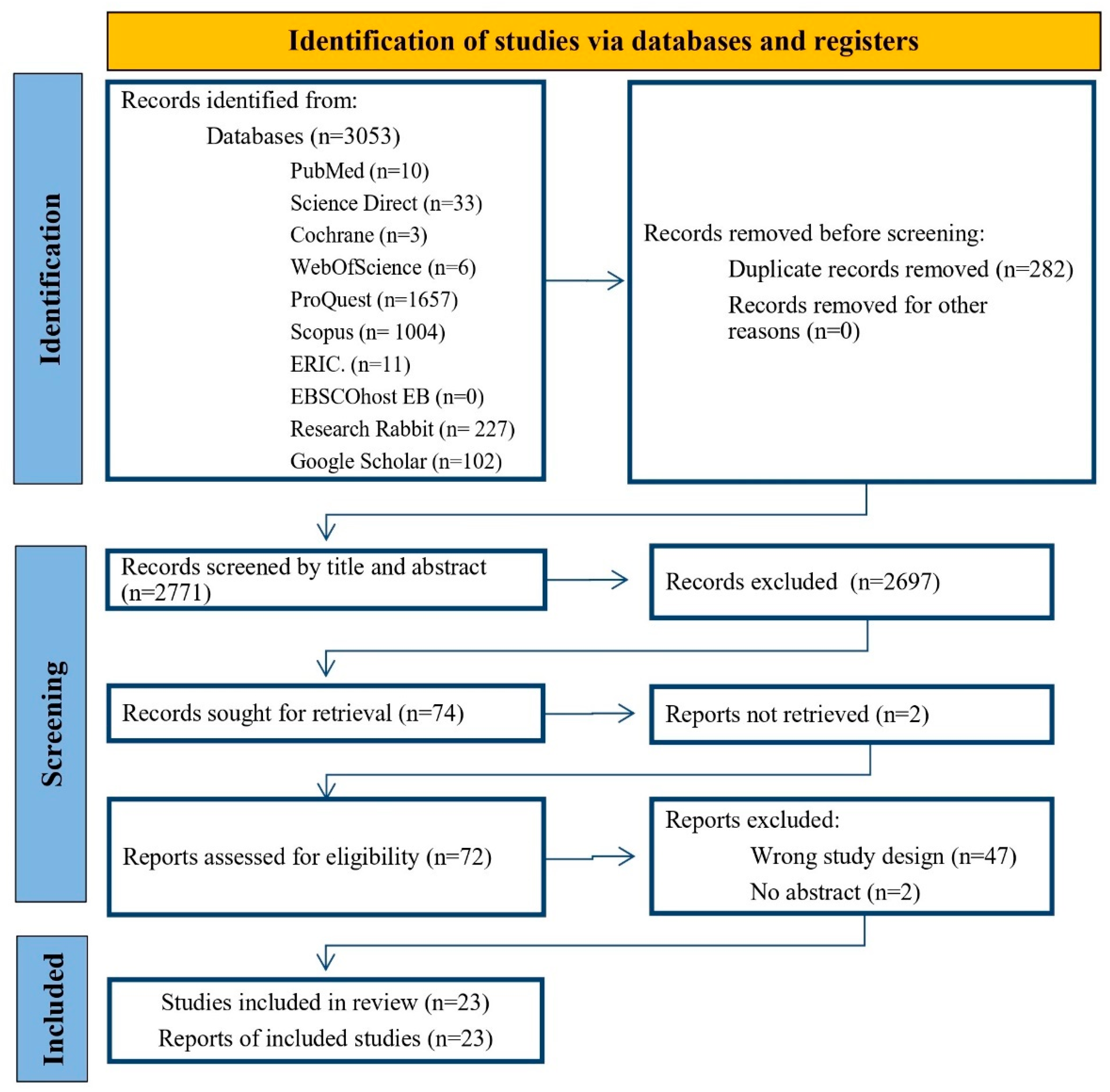

2.3. Study Selection

2.4. Data Extraction

2.5. Risk of Bias Assessment

2.6. Data Synthesis

2.7. Ethical Considerations

3. Results

3.1. Search Results

3.2. Summary of Included Studies

3.3. Direct Financial Capacity Assessments

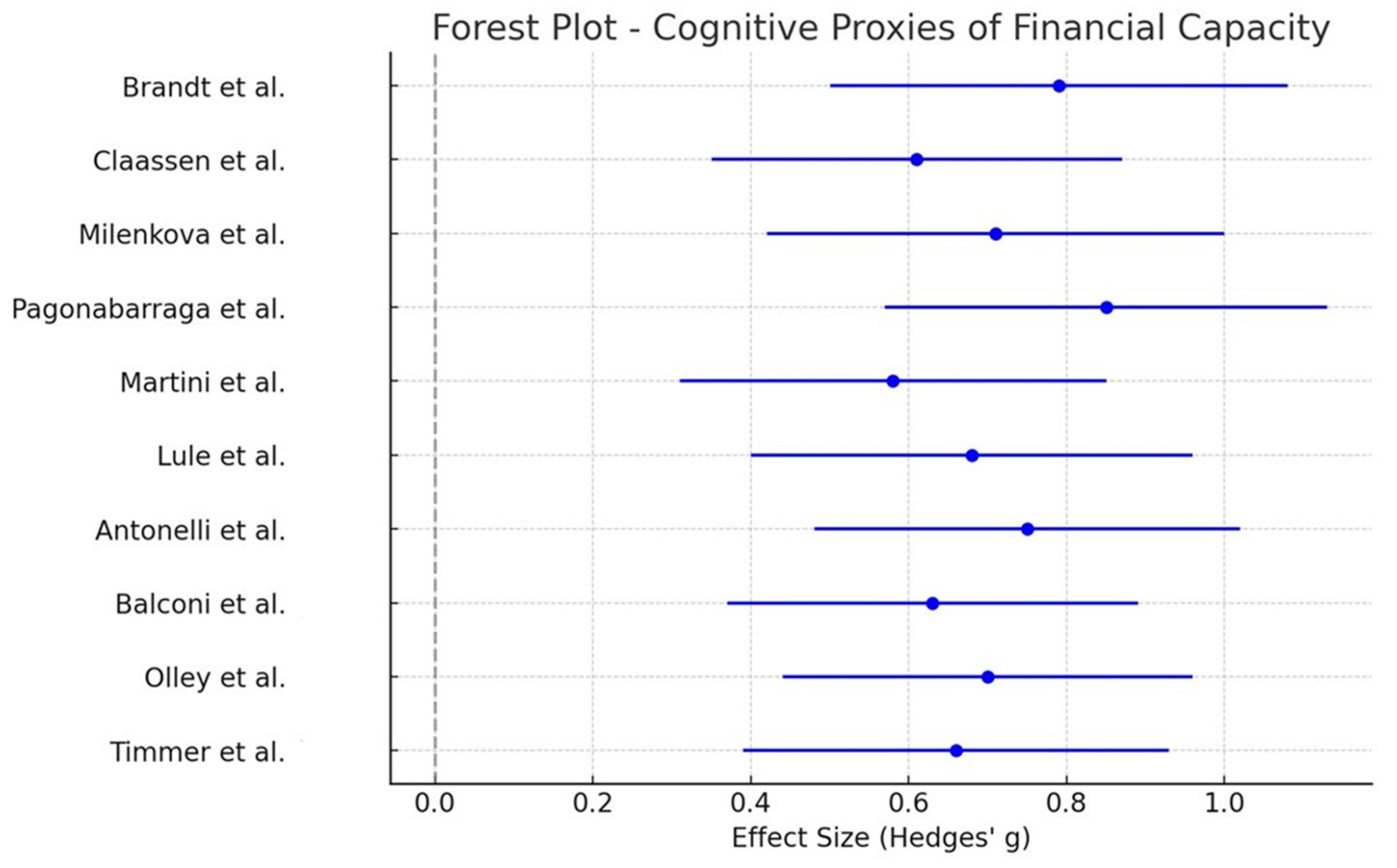

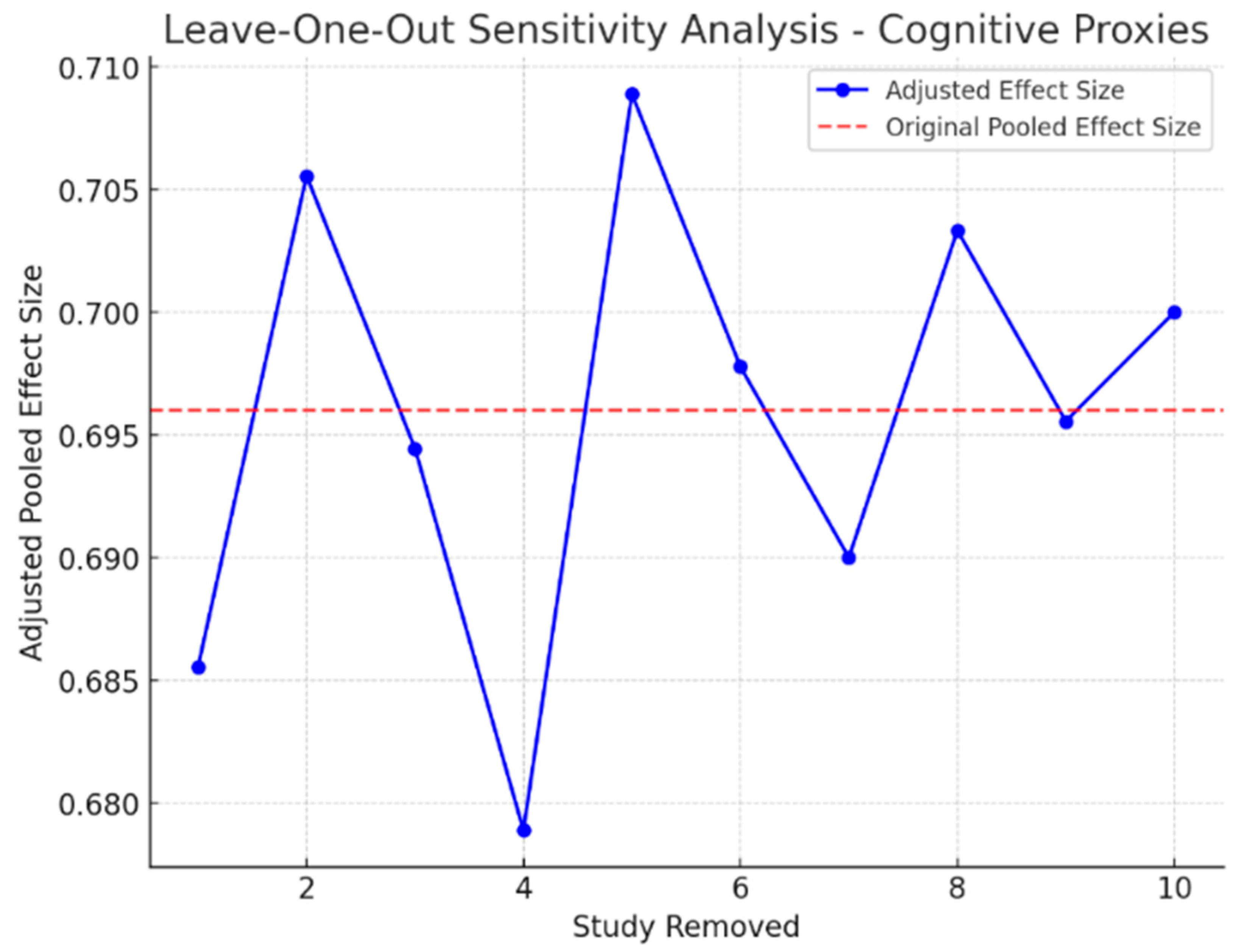

3.4. Cognitive Proxies of Financial Capacity

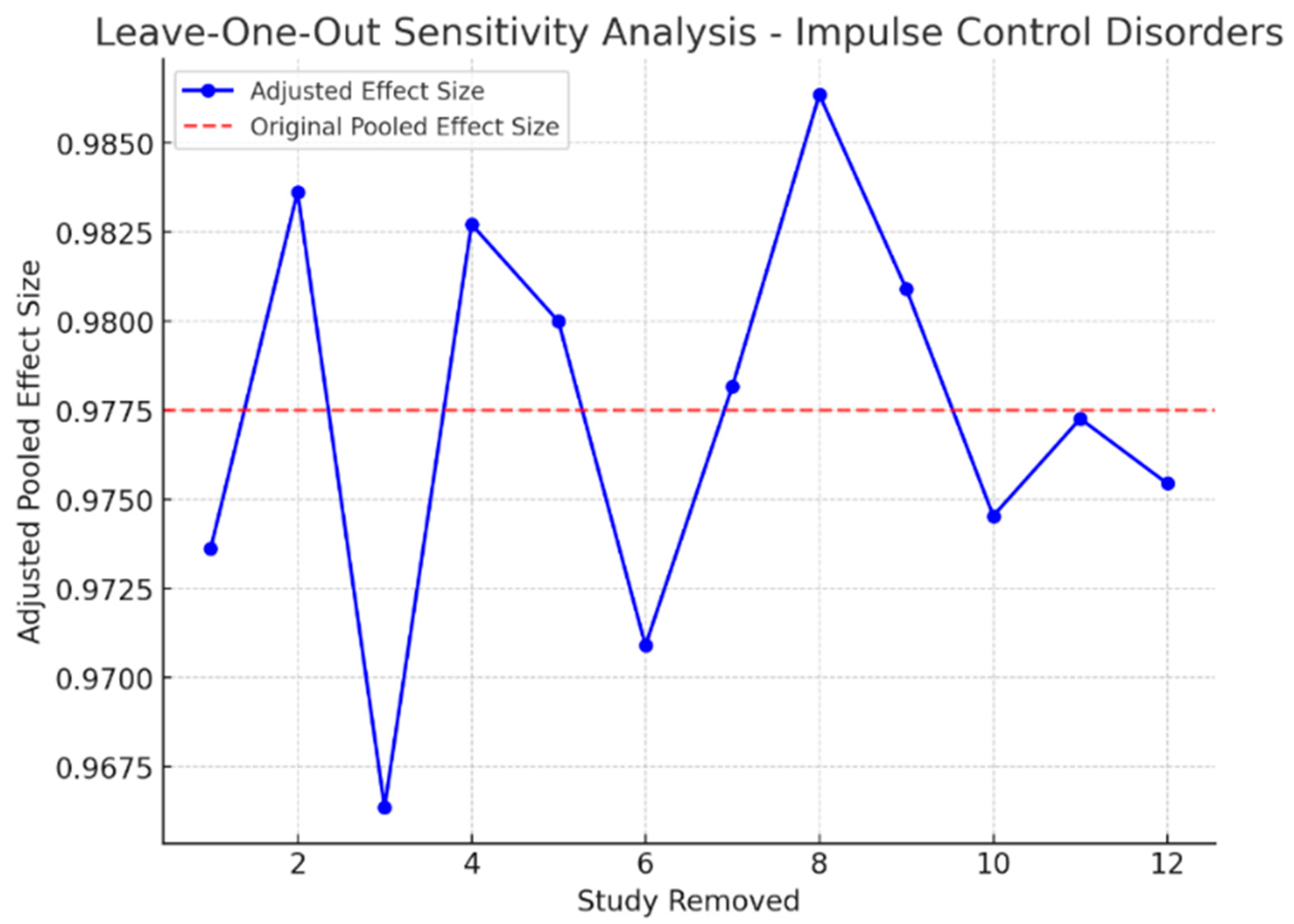

3.5. Impulse Control Disorders and Financial Risk

3.6. Narrative Review

Direct Financial Capacity Assessment

3.7. Meta-Analysis Results

Pooled Effect Size and Statistical Significance

3.8. Heterogeneity Assessment

3.9. Sensitivity Analysis

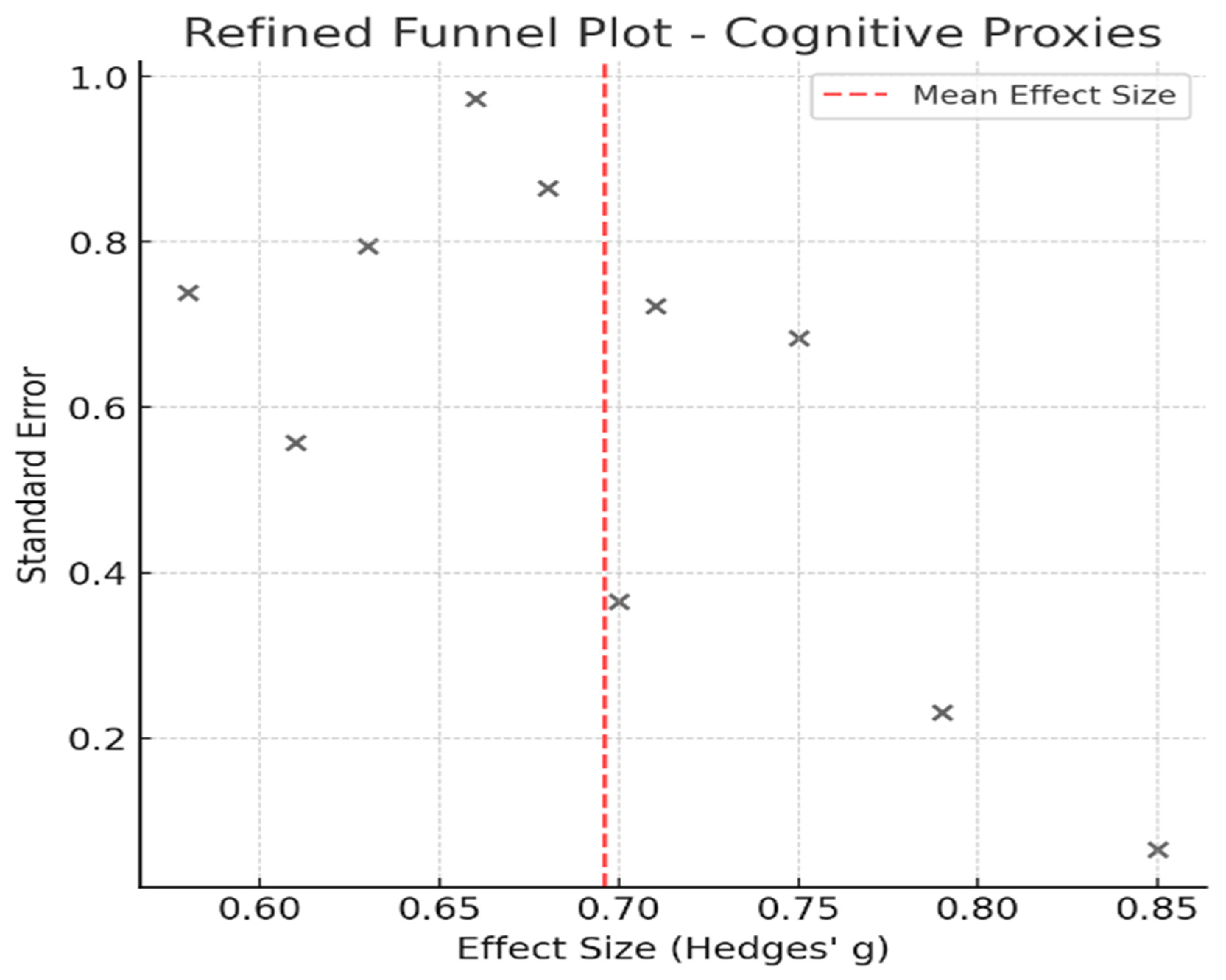

4. Publication Bias Assessment

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Dorsey, E.R.; Sherer, T.; Okun, M.S.; Bloem, B.R. The emerging evidence of the Parkinson pandemic. J. Park. Dis. 2018, 8, S3–S8. [Google Scholar] [CrossRef]

- Bloem, B.R.; Okun, M.S.; Klein, C. Parkinson’s disease. Lancet 2021, 397, 2284–2303. [Google Scholar] [CrossRef] [PubMed]

- Postuma, R.B.; Berg, D.; Stern, M.; Poewe, W.; Olanow, C.W.; Oertel, W.; Obeso, J.; Marek, K.; Litvan, I.; Lang, A.E.; et al. MDS clinical diagnostic criteria for Parkinson’s disease. Mov. Disord. 2015, 30, 1591–1601. [Google Scholar] [CrossRef]

- Chaudhuri, K.R.; Healy, D.G.; Schapira, A.H.V. Non-motor symptoms of Parkinson’s disease: Diagnosis and management. Lancet Neurol. 2006, 5, 235–245. [Google Scholar] [CrossRef]

- Pont-Sunyer, C.; Hotter, A.; Gaig, C.; Seppi, K.; Compta, Y.; Katzenschlager, R.; Mas, N.; Hofeneder, D.; Brücke, T.; Bayés, A.; et al. The Onset of Nonmotor Symptoms in Parkinson’s disease (The ONSET PD Study). Mov. Disord. 2015, 30, 229–237. [Google Scholar] [CrossRef]

- Emre, M.; Ford, P.J.; Bilgiç, B.; Uç, E.Y. Cognitive impairment and dementia in Parkinson’s disease: Practical issues and management. Mov. Disord. 2014, 29, 663–672. [Google Scholar] [CrossRef]

- Muslimović, D.; Post, B.; Speelman, J.D.; Schmand, B. Cognitive decline in Parkinson’s disease: A prospective longitudinal study. J. Int. Neuropsychol. Soc. 2009, 15, 426–437. [Google Scholar] [CrossRef]

- Martin, R.C.; Triebel, K.L.; Kennedy, R.E.; Nicholas, A.P.; Watts, R.L.; Stover, N.P.; Brandon, M.; Marson, D.C. Impaired financial abilities in Parkinson’s disease patients with mild cognitive impairment and dementia. Park. Relat. Disord. 2013, 19, 986–990. [Google Scholar] [CrossRef]

- Mico-Amigo, M.E.; King, S.T.; Godfrey, A. Capturing changes in mobility, cognition, and frailty with advanced wearable sensors. Gait Posture 2019, 68, 104–110. [Google Scholar]

- Widera, E. Finances in the Older Patient with Cognitive Impairment. JAMA 2011, 305, 698. [Google Scholar] [CrossRef]

- Dauer, W.; Przedborski, S. Parkinson’s disease: Mechanisms and models. Neuron 2003, 39, 889–909. [Google Scholar] [CrossRef]

- Poletti, M.; Bonuccelli, U. Acute and chronic cognitive effects of levodopa and dopamine agonists on patients with Parkinson’s disease: A review. Ther. Adv. Psychopharmacol. 2013, 3, 101–113. [Google Scholar] [CrossRef]

- Sharma, S.; Moon, H.; Marshall, S. Prescription patterns in Parkinson’s disease: A cross-sectional study in older adults. J. Geriatr. Med. 2014, 23, 85–90. [Google Scholar]

- Dams, J.; Zapp, J.J.; König, H.H. Modelling the cost effectiveness of treatments for Parkinson’s disease: An updated methodological review. Pharmacoeconomics 2023, 41, 1205–1228. [Google Scholar] [CrossRef]

- Marsili, L.; Bologna, M.; Miyasaki, J.M.; Colosimo, C. Parkinson’s disease advanced therapies-a systematic review: More unanswered questions than guidance. Park. Relat. Disord. 2021, 83, 132–139. [Google Scholar] [CrossRef] [PubMed]

- Marson, D.C. Clinical and ethical aspects of financial capacity in dementia: A commentary. Am. J. Geriatr. Psychiatry 2013, 21, 382–390. [Google Scholar] [CrossRef] [PubMed]

- Zesiewicz, T.A.; Sullivan, K.L.; Hauser, R.A. Nonmotor symptoms of Parkinson’s disease. Expert Rev. Neurother. 2006, 6, 1811–1822. [Google Scholar] [CrossRef]

- Scheife, R.T.; Schumock, G.T.; Burstein, A. Impact of Parkinson’s disease and its pharmacologic treatment on quality of life and economic outcomes. Am. J. Health-Syst. Pharm. 2000, 57, 953–962. [Google Scholar] [CrossRef]

- Cools, R.; Barker, R.A.; Sahakian, B.J.; Robbins, T.W. Enhanced or impaired cognitive function in Parkinson’s disease as a function of dopaminergic medication and task demands. Cereb. Cortex 2001, 11, 1136–1143. [Google Scholar] [CrossRef]

- Voon, V.; Hassan, K.; Zurowski, M.; Duff-Canning, S.; De Souza, M.; Fox, S.; Lang, A.E.; Miyasaki, J. Prospective prevalence of pathologic gambling and medication association in Parkinson disease. Neurology 2006, 66, 1750–1752. [Google Scholar] [CrossRef]

- Darby, R.R.; Dickerson, B.C. Dementia, decision-making, and capacity. Harv. Rev. Psychiatry 2017, 25, 270–278. [Google Scholar] [CrossRef] [PubMed]

- Weiss, H.D.; Marsh, L. Impulse control disorders and compulsive behaviors associated with dopaminergic therapies in Parkinson disease. Neurol. Clin. Pract. 2012, 2, 267–274. [Google Scholar] [CrossRef]

- Milenkova, M.; Mohammadi, B.; Kollewe, K.; Schrader, C.; Fellbrich, A.; Wittfoth, M.; Dengler, R.; Münte, T.F. Intertemporal choice in Parkinson’s disease. Mov. Disord. 2011, 26, 2027–2034. [Google Scholar] [CrossRef]

- Herz, D.M. Neuroscience: Therapy modulates decision-making in Parkinson’s disease. Curr. Biol. 2024, 34, R148–R150. [Google Scholar] [CrossRef]

- Mitchell, K.T.; Ostrem, J.L. Indications and outcomes of deep brain stimulation in Parkinson’s disease. In Movement Disorders; Wiley-Blackwell: Hoboken, NJ, USA, 2020; pp. 56–68. [Google Scholar]

- Witt, K.; Daniels, C.; Reiff, J.; Krack, P.; Volkmann, J.; Pinsker, M.O.; Krause, M.; Tronnier, V.; Kloss, M.; Schnitzler, A.; et al. Neuropsychological and psychiatric changes after deep brain stimulation for Parkinson’s disease: A randomised, multicentre study. Lancet Neurol. 2008, 7, 605–614. [Google Scholar] [CrossRef]

- Colautti, L.; Lieu, J.; Choi, H.J.; Glicksman, M.E.; Delgado-Peraza, F.; Patrick, C. The effects of exercise on neuroplasticity in Parkinson’s disease: A review. NeuroRehabilitation 2021, 48, 155–165. [Google Scholar]

- Kapel, A.; De Bondt, K.; Smits, T.; Vandenberghe, W. Impact of COVID-19 lockdown on motor and non-motor symptoms in Parkinson’s disease. Park. Relat. Disord. 2021, 89, 107–109. [Google Scholar]

- Brandt, J.; Rogerson, M.; Al-Joudi, H.; Reckess, G.; Shpritz, B.; Umeh, C.C.; Aljehani, N.; Mills, K.; Mari, Z. Betting on DBS: Effects of subthalamic nucleus deep brain stimulation on risk taking and decision making in patients with Parkinson’s disease. Neuropsychology 2015, 29, 622. [Google Scholar] [CrossRef] [PubMed]

- Weintraub, D. Dopamine and impulse control disorders in Parkinson’s disease. Ann. Neurol. Off. J. Am. Neurol. Assoc. Child Neurol. Soc. 2008, 64, S93–S100. [Google Scholar] [CrossRef]

- Weintraub, D.; Koester, J.; Potenza, M.N.; Siderowf, A.D.; Stacy, M.; Voon, V.; Whetteckey, J.; Wunderlich, G.R.; Lang, A.E. Impulse control disorders in Parkinson disease: A cross-sectional study of 3090 patients. Arch. Neurol. 2010, 67, 589–595. [Google Scholar] [CrossRef] [PubMed]

- Giannouli, V.; Tsolaki, M. Depression and financial capacity assessment in Parkinson’s disease with dementia: Overlooking an important factor? Psychiatriki 2019, 30, 66–70. [Google Scholar] [CrossRef]

- Zafar, M.; Bozzorg, A.; Hackney, M.E. Adapted Tango improves aspects of participation in older adults versus individuals with Parkinson’s disease. Disabil. Rehabil. 2017, 39, 2294–2301. [Google Scholar] [CrossRef]

- Gibson, L.L.; Weintraub, D.; Lemmen, R.; Perera, G.; Chaudhuri, K.R.; Svenningsson, P.; Aarsland, D. Risk of Dementia in Parkinson’s Disease: A Systematic Review and Meta-Analysis. Mov. Disord. 2024, 39, 1697–1709. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An Updated Guideline for Reporting Systematic Reviews. Br. Med. J. 2021, 372, n71. [Google Scholar] [CrossRef] [PubMed]

- Wells, G.A. The Newcastle-Ottawa Scale (NOS) for Assessing the Quality of Nonrandomised Studies in Meta-Analyses. Ottawa Hospital Research Institute. 2014. Available online: http://www.ohri.ca/programs/clinical_epidemiology/oxford.asp (accessed on 28 May 2025).

- Lo, C.K.L.; Mertz, D.; Loeb, M. Newcastle-Ottawa Scale: Comparing reviewers’ to authors’ assessments. BMC Med. Res. Methodol. 2014, 14, 45. [Google Scholar] [CrossRef]

- Claassen, D.O.; van den Wildenberg, W.P.; Ridderinkhof, K.R.; Jessup, C.K.; Harrison, M.B.; Wooten, G.F.; Wylie, S.A. The risky business of dopamine agonists in Parkinson disease and impulse control disorders. Behav. Neurosci. 2011, 125, 492. [Google Scholar] [CrossRef] [PubMed]

- Pagonabarraga, J.; García-Sánchez, C.; Llebaria, G.; Pascual-Sedano, B.; Gironell, A.; Kulisevsky, J. Controlled study of decision-making and cognitive impairment in Parkinson’s disease. Mov. Disord. Off. J. Mov. Disord. Soc. 2007, 22, 1430–1435. [Google Scholar] [CrossRef]

- Martini, A.; Ellis, S.J.; Grange, J.A.; Tamburin, S.; Dal Lago, D.; Vianello, G.; Edelstyn, N.M. Risky decision-making and affective features of impulse control disorders in Parkinson’s disease. J. Neural Transm. 2018, 125, 131–143. [Google Scholar] [CrossRef] [PubMed]

- Lulé, D.; Heimrath, J.; Pinkhardt, E.H.; Ludolph, A.C.; Uttner, I.; Kassubek, J. Deep brain stimulation and behavioural changes: Is comedication the most important factor? Neurodegener. Dis. 2011, 9, 18–24. [Google Scholar] [CrossRef]

- Antonelli, F.; Ko, J.H.; Miyasaki, J.; Lang, A.E.; Houle, S.; Valzania, F.; Ray, N.J.; Strafella, A.P. Dopamine-agonists and impulsivity in Parkinson’s disease: Impulsive choices vs. impulsive actions. Hum. Brain Mapp. 2014, 35, 2499–2506. [Google Scholar] [CrossRef]

- Balconi, M.; Angioletti, L.; Siri, C.; Meucci, N.; Pezzoli, G. Gambling behavior in Parkinson’s Disease: Impulsivity, reward mechanism and cortical brain oscillations. Psychiatry Res. 2018, 270, 974–980. [Google Scholar] [CrossRef]

- Olley, J.; Blaszczynski, A.; Lewis, S. Dopaminergic medication in Parkinson’s disease and problem gambling. J. Gambl. Stud. 2015, 31, 1085–1106. [Google Scholar] [CrossRef]

- Timmer, M.H.; Sescousse, G.; Esselink, R.A.; Piray, P.; Cools, R. Mechanisms underlying dopamine-induced risky choice in Parkinson’s disease with and without depression (history). Comput. Psychiatry 2018, 2, 11. [Google Scholar] [CrossRef]

- Dodd, M.L.; Klos, K.J.; Bower, J.H.; Geda, Y.E.; Josephs, K.A.; Ahlskog, J.E. Pathological gambling caused by drugs used to treat Parkinson disease. Arch. Neurol. 2005, 62, 1377–1381. [Google Scholar] [CrossRef]

- Bharmal, A.; Lu, C.; Quickfall, J.; Crockford, D.; Suchowersky, O. Outcomes of patients with Parkinson disease and pathological gambling. Can. J. Neurol. Sci. 2010, 37, 473–477. [Google Scholar] [CrossRef]

- Cilia, R.; Siri, C.; Marotta, G.; Isaias, I.U.; De Gaspari, D.; Canesi, M.; Pezzoli, G.; Antonini, A. Functional abnormalities underlying pathological gambling in Parkinson disease. Arch. Neurol. 2008, 65, 1604–1611. [Google Scholar] [CrossRef]

- Rossi, M.; Gerschcovich, E.R.; De Achaval, D.; Perez-Lloret, S.; Cerquetti, D.; Cammarota, A.; Nouzeilles, M.I.; Fahrer, R.; Merello, M.; Leiguarda, R. Decision-making in Parkinson’s disease patients with and without pathological gambling. Eur. J. Neurol. 2010, 17, 97–102. [Google Scholar] [CrossRef] [PubMed]

- Rosa, M.; Fumagalli, M.; Giannicola, G.; Marceglia, S.; Lucchiari, C.; Servello, D.; Franzini, A.; Pacchetti, C.; Romito, L.; Albanese, A.; et al. Pathological gambling in Parkinson’s disease: Subthalamic oscillations during economics decisions. Mov. Disord. 2013, 28, 1644–1652. [Google Scholar] [CrossRef] [PubMed]

- Voon, V.; Thomsen, T.; Miyasaki, J.M.; de Souza, M.; Shafro, A.; Fox, S.H.; Duff-Canning, S.; Lang, A.E.; Zurowski, M. Factors associated with dopaminergic drug–related pathological gambling in Parkinson disease. Arch. Neurol. 2007, 64, 212–216. [Google Scholar] [CrossRef] [PubMed]

- Voon, V.; Gao, J.; Brezing, C.; Symmonds, M.; Ekanayake, V.; Fernandez, H.; Dolan, R.J.; Hallett, M. Dopamine agonists and risk: Impulse control disorders in Parkinson’s; disease. Brain 2011, 134, 1438–1446. [Google Scholar] [CrossRef]

- Oyama, G.; Shimo, Y.; Natori, S.; Nakajima, M.; Ishii, H.; Arai, H.; Hattori, N. Acute effects of bilateral subthalamic stimulation on decision-making in Parkinson’s disease. Park. Relat. Disord. 2011, 17, 189–193. [Google Scholar] [CrossRef]

- Simioni, A.C.; Dagher, A.; Fellows, L.K. Dissecting the effects of disease and treatment on impulsivity in Parkinson’s disease. J. Int. Neuropsychol. Soc. 2012, 18, 942–951. [Google Scholar] [CrossRef]

- Van Eimeren, T.; Ballanger, B.; Pellecchia, G.; Miyasaki, J.M.; Lang, A.E.; Strafella, A.P. Dopamine agonists diminish value sensitivity of the orbitofrontal cortex: A trigger for pathological gambling in Parkinson’s disease? Neuropsychopharmacology 2009, 34, 2758–2766. [Google Scholar] [CrossRef] [PubMed]

- Yoo, H.B.; Lee, J.Y.; Lee, J.S.; Kang, H.; Kim, Y.K.; Song, I.C.; Lee, D.S.; Jeon, B.S. Whole-brain diffusion-tensor changes in parkinsonian patients with impulse control disorders. J. Clin. Neurol. 2015, 11, 42. [Google Scholar] [CrossRef] [PubMed]

- Hall, A.; Weightman, M.; Jenkinson, N.; MacDonald, H.J. Performance on the balloon analogue risk task and anticipatory response inhibition task is associated with severity of impulse control behaviours in people with Parkinson’s disease. Exp. Brain Res. 2023, 241, 1159–1172. [Google Scholar] [CrossRef]

- Hendriks, M.; Vinke, S.; Berlot, R.; Benedičič, M.; Jahansahi, M.; Trošt, M.; Georgiev, D. In Parkinson’s disease dopaminergic medication and deep brain stimulation of the subthalamic nucleus increase motor, but not reflection and cognitive impulsivity. Front. Neurosci. 2024, 18, 1378614. [Google Scholar] [CrossRef]

- Arten, T.L.D.S.; Hamdan, A.C. Executive Functions in Parkinson’s disease with and without Deep Brain Stimulation (DBS): A systematic review. Dement. Neuropsychol. 2020, 14, 178–185. [Google Scholar] [CrossRef]

- Marson, D.C.; Sawrie, S.M.; Snyder, S.; McInturff, B.; Stalvey, T.; Boothe, A.; Aldridge, T.; Chatterjee, A.; Harrell, L.E. Assessing financial capacity in patients with Alzheimer disease: A conceptual model and prototype instrument. Arch. Neurol. 2000, 57, 877–884. [Google Scholar] [CrossRef]

- Giannouli, Β.Ν. Neuropsychological Assessment for the Determination of Legal Capacity and Decision-Making in Patients with Dementia. Doctoral Dissertation, Aristotle University of Thessaloniki, Thessaloniki, Greece, 2015. [Google Scholar]

| Construct | Definition | Example Assessment Types | Common Study Focus |

|---|---|---|---|

| Financial Capacity | Ability to independently manage real-life financial tasks | Legal Capacity for Property Law Transactions Assessment Scale (LCPLTAS), Financial Capacity Instrument (FCI) | Real-world competence (e.g., bill payment, fraud detection) |

| Financial Decision-Making | Cognitive processes involved in evaluating monetary options under uncertainty | Iowa Gambling Task (IGT), Game of Dice Task, Delay Discounting Task | Executive function and reward evaluation |

| Financial Risk-Taking | Impulsive or reward-driven monetary behaviors, often linked to impulse control disorders | Clinical interviews (e.g., DSM criteria for gambling), PGSI, CPGI | Pathological gambling, compulsive spending |

| Study (Author, Year) | Selection (0–4) | Comparability (0–2) | Outcome (0–3) | Total Score (0–9) | Risk of Bias |

|---|---|---|---|---|---|

| Milenkova et al. [23] | 3 | 2 | 3 | 8 | Low |

| Brandt et al. [29] | 4 | 2 | 3 | 9 | Low |

| Giannouli & Tsolaki [32] | 4 | 2 | 3 | 9 | Low |

| Claassen et al. [38] | 3 | 2 | 2 | 7 | Moderate |

| Pagonabarraga et al. [39] | 4 | 2 | 2 | 8 | Low |

| Martini et al. [40] | 3 | 1 | 3 | 7 | Moderate |

| Lulé et al. [41] | 3 | 1 | 2 | 6 | Moderate |

| Antonelli et al. [42] | 3 | 1 | 2 | 6 | Moderate |

| Balconi et al. [43] | 3 | 2 | 3 | 8 | Low |

| Olley et al. [44] | 3 | 1 | 2 | 6 | Moderate |

| Timmer et al. [45] | 3 | 2 | 2 | 7 | Moderate |

| Dodd et al. [46] | 4 | 2 | 3 | 9 | Low |

| Bharmal et al. [47] | 3 | 2 | 3 | 8 | Low |

| Cilia et al. [48] | 4 | 2 | 3 | 9 | Low |

| Rossi et al. [49] | 3 | 1 | 2 | 6 | Moderate |

| Rosa et al. [50] | 3 | 1 | 2 | 6 | Moderate |

| Voon et al. [51] | 3 | 2 | 2 | 7 | Moderate |

| Voon et al. [52] | 3 | 2 | 3 | 8 | Low |

| Oyama et al. [53] | 3 | 1 | 2 | 6 | Moderate |

| Simioni et al. [54] | 3 | 2 | 3 | 8 | Low |

| van Eimeren et al. [55] | 3 | 1 | 2 | 6 | Moderate |

| Yoo et al. [56] | 4 | 2 | 3 | 9 | Low |

| Hall et al. [57] | 3 | 2 | 3 | 8 | Low |

| Study (Author, Year) | Study Design | Population | Intervention | Comparator | Financial Capacity Outcome | Assessment Tool(s) | Key Findings | Risk of Bias |

|---|---|---|---|---|---|---|---|---|

| Milenkova et al. [23] | Cross-sectional experimental | PD patients on DA therapy (n = 17), healthy controls (n = 17) | Dopamine agonists (pramipexole, ropinirole, piribedil), ON vs. OFF medication | PD patients ON vs. OFF medication; healthy controls | Delay discounting (financial impulsivity) | Intertemporal Choice Task (monetary rewards) | PD patients showed increased impulsivity in financial decisions compared to controls, discounting future rewards more steeply, but no significant difference between ON vs. OFF medication conditions. | Moderate |

| Brandt et al. [29] | Cross-sectional experimental | PD patients treated with bilateral STN-DBS (n = 15), mean age 67.15 years (SD 6.28), without dementia | STN-DBS (with stimulators on vs. off conditions, at least 6 months post-implantation) | PD patients on medication (n = 15); healthy controls (n = 15) | Financial decision-making and risk-taking behavior | Game of Dice Task (GDT), Deal or No-Deal (DND), Framing Paradigm | DBS patients showed higher risk-taking tendencies in explicit-risk tasks compared to healthy controls; DBS-on state slightly reduced risk-taking in explicit tasks but increased conservative behavior in ambiguous-risk tasks, resulting in smaller winnings. Suggests complex effects of DBS on financial decision-making. | Moderate |

| Giannouli & Tsolaki [32] | Cross-sectional observational | PDD patients (n = 30), healthy controls (n = 30); mean age: 74–77 years | Levodopa treatment (≥2 years, stable dose) | PDD patients with vs. without depression | Financial capacity performance in real-life monetary tasks | Legal Capacity for Property Law Transactions Assessment Scale (LCPLTAS) | PDD patients performed significantly worse in financial capacity than healthy controls; PDD with depression had even greater impairment. | Moderate |

| Claassen et al. [38] | Cross-sectional experimental | PD patients (n = 41) (with ICDs n = 22, without ICDs n = 19) | Dopamine agonists (ON vs. OFF medication conditions) | PD patients ON vs. OFF dopamine agonists | Financial risk-taking behavior | Balloon Analogue Risk Task (BART) | Dopamine agonists significantly increased risk-taking in PD patients with ICDs but had no effect on PD patients without ICDs. Higher DA doses were associated with greater risk-taking. | Moderate |

| Pagonabarraga et al. [39] | Observational cross-sectional | PD patients without ICDs (n = 35), healthy controls (n = 31) | Dopamine replacement therapy (levodopa, dopamine agonists, LEDD recorded) | PD patients vs. healthy controls | Financial risk-taking and decision-making, cognitive function | Iowa Gambling Task (IGT), Stroop Test, Verbal Fluency Tests | PD patients performed worse on the IGT, making riskier financial decisions compared to controls. No direct link between decision-making impairment and LEDD was found. | Moderate |

| Martini et al. [40] | Cross-sectional experimental | PD patients with ICDs (n = 13), PD without ICDs (n = 12), healthy controls (n = 17) | Not an interventional study, but assesses risky financial decision-making in ICD + PD patients | PD patients without ICDs and healthy controls | Risky financial decision-making, negative feedback processing | Balloon Analogue Risk Task (BART), cognitive battery | ICD + patients had impaired negative feedback sensitivity, showing increased risk-taking even after financial losses. No difference in overall risk-taking compared to ICD− or healthy controls. | Moderate |

| Lulé et al. [41] | Cross-sectional experimental | PD patients with DBS (n = 15), PD patients on DA medication only (n = 15) | DBS (STN stimulation, ON/OFF conditions) and DA medication (levodopa, dopamine agonists) | DBS patients vs. DA-treated PD patients | Financial risk-taking and decision-making in gambling tasks | Iowa Gambling Task (IGT), Neuropsychological assessments | PD patients on higher DA medication doses made riskier financial decisions compared to DBS-treated patients with lower DA doses. DBS-on had a minor effect on impulsivity. | Moderate |

| Antonelli et al. [42] | Cross-sectional experimental | PD patients (n = 7); mean age: 58.6 years (SD: 6); without dementia | Pramipexole (1 mg single administration before task performance) | PD patients OFF pramipexole medication | Cognitive impulsivity (Delay Discounting Task—impulsive choices related to monetary rewards) | Delay Discounting Task (DDT), PET imaging | Pramipexole significantly increased impulsivity in decisions involving monetary reward magnitude (larger rewards), demonstrating altered neural activity in reward-related brain areas. | Moderate |

| Balconi et al. [43] | Observational cross-sectional | PD patients (n = 52) (with PG n = 17, remitted PG n = 15, without PG n = 20) | Dopamine replacement therapy (levodopa, dopamine agonists, LEDD recorded) | PD patients with PG vs. remitted PG vs. PD-only group | Financial decision-making, reward processing, impulsivity | Iowa Gambling Task (IGT), EEG, BIS-11 | PD patients with PG showed increased impulsivity and riskier decision-making on the IGT, with abnormal frontal EEG activity compared to other groups. | Moderate |

| Olley et al. [44] | Cross-sectional observational | PD patients (n = 40) (with PG n = 20, without PG n = 20) | Dopaminergic medication (dopamine agonists, levodopa, LEDD recorded) | PD patients with problem gambling vs. PD patients without problem gambling | Problem gambling behavior, impulsivity, financial risk-taking | Canadian Problem Gambling Index (CPGI), Problem Gambling Severity Index (PGSI), Timeline Follow-Back Interview | Increased gambling behavior was observed after medication initiation in some PD patients; some cases ceased after medication changes, but others had underlying premorbid risk factors influencing gambling. | Moderate |

| Timmer et al. [45] | Cross-sectional experimental | 21 PD patients with depression history, 22 nondepressed PD patients, 23 healthy controls | Dopaminergic treatment ON vs. OFF conditions | PD patients ON vs. OFF DA, compared to controls | Financial decision-making, loss aversion, gambling behavior | Prospect Theory computational modeling, Risky Choice Paradigm | Dopaminergic medication increased a value-independent gambling bias in nondepressed PD patients, leading to increased risky financial choices. In PD patients with depression history, medication effects on loss aversion were associated with depression severity. | Moderate |

| Dodd et al. [46] | Observational (case series) | Idiopathic PD patients (n = 11), Hoehn &Yahr stages 2–3 | Dopamine agonists (pramipexole mainly, dosage varied from 4.5–13.5 mg/day) | PD patients without gambling | Pathological gambling related to dopamine agonist therapy (financially relevant impulsive behavior) | Clinical interviews based on DSM-IV-TR criteria for pathological gambling | Pathological gambling emerged following dopamine agonist initiation or dose escalation. Symptoms resolved after agonist reduction or discontinuation. Strong implication of dopamine agonist use (especially pramipexole) | Moderate |

| Bharmal et al. [47] | Observational cohort | PD patients treated with dopamine agonists (n = 146), mean age: 55 years at PG onset | Dopamine agonists (pramipexole, ropinirole, pergolide); dosages varied (e.g., pramipexole 3.3–7.5 mg/day) | PD patients on dopamine agonists without pathological gambling | Pathological gambling behaviors and related financial outcomes (financial losses, management of personal finances) | DSM-IV-TR criteria, clinical follow-up | DA treatment significantly associated with PG; substantial financial losses (≥$100,000) observed in 50% of PG patients despite treatment changes, suggesting long-lasting financial impacts. | Low |

| Cilia et al. [48] | Case-control, functional imaging study | 11 PD patients with pathological gambling, 40 PD without PG, 29 healthy controls | Dopaminergic therapy (chronic), PG + patients selected based on clinical features | PD without PG and healthy controls | Pathological gambling (financial ICB) used as proxy for impaired financial capacity | SPECT (rCBF), MMSE, FAB, GDS, RPM, SOGS | PD gamblers had hyperactivation in OFC, amygdala, hippocampus, right ventral basal ganglia, left insula, bilateral precuneus, extending to the cuneus and the posterior cingulate cortex—areas linked to reward and financial decision-making. Suggested MCL pathway dysfunction due to dopaminergic overstimulation. | Low |

| Rossi et al. [49] | Cross-sectional observational | PD patients (n = 20; gamblers n = 7, non-gamblers n = 13) | Dopamine replacement therapy (dopamine agonists, levodopa, LEDD recorded) | PD patients with vs. without gambling | Financial decision-making, impulsivity, risk-taking | Iowa Gambling Task (IGT), Game of Dice Task (GDT), Investment Task | PD patients with gambling problems performed worse on the IGT, making riskier financial decisions; they showed higher impulsivity and poor adaptation to losses. | Moderate |

| Rosa et al. [50] | Cross-sectional experimental | PD patients with STN-DBS (n = 17) (without PG n = 9, with PG n = 8) | Subthalamic nucleus DBS (ON vs. OFF conditions) | PD patients with PG vs. without PG, STN-DBS ON vs. OFF | Financial decision-making, risk-taking behavior | Local Field Potential (LFP) recording, economic decision-making task | PD patients with PG exhibited distinct subthalamic low-frequency oscillatory activity during risk-based decisions, reflecting impaired conflict resolution and increased impulsivity. STN-DBS modulated economic decision-making. | Moderate |

| Voon et al. [51] | Case-control observational | PD patients with PG (n = 21), PD patients without PG (n = 42) | Dopamine agonists (pramipexole, ropinirole, pergolide), LEDD recorded | PD patients with PG vs. without PG | Pathological gambling, impulsivity, financial decision-making | DSM-IV PG criteria, Barratt Impulsivity Scale (BIS), Novelty-Seeking Scale | Younger PD onset, high novelty-seeking traits, and a history of alcohol use disorders were strongly associated with PG. DA therapy increased PG risk, but no specific dose–response relationship was found. | Low |

| Voon et al. [52] | Cross-sectional experimental | PD patients (n = 28), PD patients with ICDs (n = 14), PD controls (n = 14) | Dopamine agonists (ON vs. OFF medication conditions) | PD patients ON vs. OFF dopamine agonists | Financial risk-taking, reward processing | Functional MRI (fMRI), Novel Risk Task | Dopamine agonists enhanced risk-taking behavior in PD patients with ICDs, leading to higher impulsive financial decisions. Reduced activity in the orbitofrontal cortex and anterior cingulate was linked to increased risk-taking. | Moderate |

| Oyama et al. [53] | Cross-sectional experimental | PD patients undergoing STN-DBS (n = 16), PD controls (n = 16) | STN-DBS (ON vs. OFF conditions), tested post-operatively | PD patients before vs. after DBS surgery, PD controls without DBS | Financial risk-taking and decision-making | Iowa Gambling Task (IGT) | PD patients with STN-DBS ON performed worse in decision-making compared to OFF condition, showing higher impulsivity and poorer financial risk assessment. | Moderate |

| van Eimeren et al. [55] | Cross-sectional experimental | PD patients (n = 8) undergoing three medication conditions | Dopaminergic treatments: pramipexole (DA), levodopa (LD), OFF medication (withdrawn ≥12 hrs) | PD patients OFF vs. LD vs. DA | Financial decision-making, risk-taking behavior, reward sensitivity | Functional MRI (fMRI), probabilistic financial reward task | Dopamine agonists significantly reduced value sensitivity in the OFC, impairing negative feedback processing and increasing risk-taking in financial decisions. Levodopa did not have the same effect. | Moderate |

| Yoo et al. [56] | Case-control neuroimaging | 10 PD patients with ICD, 9 PD patients without ICD, 18 healthy controls | Chronic dopamine replacement therapy (with and without ICD symptoms) | PD-nonICD and healthy controls | Indirect via ICD-related brain changes, not direct financial capacity | Diffusion-tensor imaging (FA, MD), MMSE, UPDRS, GDS | PD-ICD patients showed higher FA in anterior corpus callosum, right dorsal and posterior cingula, partial left and right thalamic radiations, right internal capsule (genu and posterior limbs), and right superior temporo-occipital lobes, suggesting more intact reward circuitry. No MD differences observed. | Low |

| Hall et al. [57] | Cross-sectional observational | 58 PD patients on DA therapy, 25 PD patients without DA | Dopamine agonists (various types), evaluated for duration and dosage | PD patients ON vs. OFF dopamine agonists | Impulsive choice and action, financial decision-making | BART, ARIT, QUIP-RS | PD patients on DA medication displayed significantly higher financial impulsivity and ICB severity. Increased DA exposure over time correlated with worsening impulsivity. However, genetic predisposition (DGRS) was not a strong predictor of ICB severity. | Low |

| Simioni et al. [54] | Cross-sectional experimental with follow-up (subset longitudinal) | 23 mild-to-moderate PD patients and 20 healthy controls | Dopamine replacement therapy ON vs. OFF | PD patients ON vs. OFF medication, and vs. healthy controls | Indirectly assessed through impulsivity-related decision-making (not direct financial capacity) | Balloon Analogue Risk Task (BART) and Temporal Discounting (TD) task | PD patients showed no difference from controls in baseline BART performance, but risk-taking increased over trials ON medication. No significant effect of PD or medication on TD rates. Findings suggest differential dopamine modulation of risk-taking versus delay discounting behaviors. | Low |

| Meta-Analysis Group | Number of Studies | I2 Statistic (%) | Cochran’s Q | p-Value (Heterogeneity) | Adjusted I2 After Sensitivity Analysis (%) |

|---|---|---|---|---|---|

| Cognitive Proxies of Financial Capacity | 10 | 45.8 | 14.2 | 0.062 | 40.1 |

| Impulse Control Disorders and Financial Risk | 12 | 60.5 | 23.1 | 0.017 | 52.3 |

| Meta-Analysis Group | Egger’s Test p-Value | Publication Bias Detected |

|---|---|---|

| Cognitive Proxies of Financial Capacity | 0.081 | No |

| Impulse Control Disorders and Financial Risk | 0.027 | Yes (possible bias) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kandylaki, N.; Patrikelis, P.; Konitsiotis, S.; Messinis, L.; Folia, V. The Cognitive Cost of Motor Control: A Systematic Review and Meta-Analysis of Parkinson’s Disease Treatments and Financial Decision-Making. Healthcare 2025, 13, 1850. https://doi.org/10.3390/healthcare13151850

Kandylaki N, Patrikelis P, Konitsiotis S, Messinis L, Folia V. The Cognitive Cost of Motor Control: A Systematic Review and Meta-Analysis of Parkinson’s Disease Treatments and Financial Decision-Making. Healthcare. 2025; 13(15):1850. https://doi.org/10.3390/healthcare13151850

Chicago/Turabian StyleKandylaki, Nektaria, Panayiotis Patrikelis, Spiros Konitsiotis, Lambros Messinis, and Vasiliki Folia. 2025. "The Cognitive Cost of Motor Control: A Systematic Review and Meta-Analysis of Parkinson’s Disease Treatments and Financial Decision-Making" Healthcare 13, no. 15: 1850. https://doi.org/10.3390/healthcare13151850

APA StyleKandylaki, N., Patrikelis, P., Konitsiotis, S., Messinis, L., & Folia, V. (2025). The Cognitive Cost of Motor Control: A Systematic Review and Meta-Analysis of Parkinson’s Disease Treatments and Financial Decision-Making. Healthcare, 13(15), 1850. https://doi.org/10.3390/healthcare13151850