Abstract

This paper reviews the decisions, coordination contract, and altruistic preference of an e-commerce supply chain (eSC) composed of a manufacturer and a third-party e-commerce platform (platform). The research derives optimal decisions in a decentralized model with altruistic preference; it is indicated that altruistic preference can help increase the sales price and sales service level. Although the platform’s altruistic preference is not beneficial to its own profits, it can help increase the manufacturer’s profits. Moreover, when the degree of altruistic preference is kept within a limit, the profit of the decentralized system is higher in a model with altruistic preferences, which indicates that altruistic preference can contribute toward maintaining a friendly, harmonious, and cooperative a relationship between the platform and manufacturers. Contrary to a traditional offline supply chain, where the sales price is the lowest in the centralized model, the sales price is highest in a centralized eSC model. In the proposed coordination contract, the platform with a certain degree of altruistic preference offers zero-commission sales service and charges a certain amount for a fixed professional service fee. The proposed contract is more applicable to products whose market demands are less affected by sales prices and more affected by the sales service level.

1. Introduction

The rapid innovation of network technologies has enabled e-commerce to expand with convenience and fast responsiveness. Enterprises cooperate with third-party e-commerce platforms, such as Jingdong and Amazon, forming the e-commerce supply chain (eSC) [1]. Manufacturers usually play a decisive role and coordinate the interests of all members to ensure more efficient operations in traditional supply chains [2,3]. However, in eSC, e-commerce platforms—as rule-makers of the operation and leaders of the system—often control commodity flows, information flows, and capital flows, and occupy a favorable position. Moreover, because of the high cost of establishing and maintaining a platform, a dominance of e-commerce platforms has gradually formed.

Powerful economic forces allow these large-scale e-commerce platforms to have solid control over the overall eSC. The interests of manufacturers during decision-making processes have been ignored because of overall control, which seriously undermines the stability of supply chains and damages the legitimate rights and interests of manufacturers. For instance, from August to October 2017, many clothing brands and electronics companies left Jingdong because Jingdong forced manufacturers to participate in promotional activities, and seriously infringed on the interests of the involved manufacturers. In this context, the leading e-commerce platforms would take the profits of settled enterprises into account when making decisions, rather than pursue the maximization of profits. The platform’s concern on the profit of the manufacturer is called altruistic preference in this study.

Altruistic preference is a kind of social preference; it is under the premise that the leading and subordinate enterprises often conflict due to the problem of profit distribution. The leading enterprises pay attention to the profits of the subordinateenterprises to increase enthusiasm of cooperation. Altruistic preference behavior is a common strategy to enhance economic cooperation in eSC. Yikuyi, a e-commerce platform, values supply chain management services and is committed to helping small- and medium-sized manufacturers (SMMs) engage with suppliers. By forming a bargaining advantage, at first, the platform allows SMMs to enjoy excellent service provided by larger authorized distributors (the blog post can be found at http://www.sohu.com/a/135701168_132567 (accessed on 22 April 2017)). Since April 2018, eBay has been responsible for customer returns to sellers who joined the eBay Plus program, providing a 20% discount on the sales commissions for sellers whose return processing times are less than one business day. Tmall Supermarket provides a convenient delivery service in one hour, allowing enterprises to quickly deliver goods to customers in the country without building a huge logistics distribution system.

However, most mathematical research on social preferences in the context of supply chain focuses on fairness concern, and the altruistic preference is rarely involved. The fairness concern, a kind of behavior that assumes that enterprises not only aim to maximize their own profit, but also care about the fairness of profit allocation in the supply chain. Generally, subordinate enterprises show the fairness concern and take the profit of the leading enterprise, as a reference to reflect their reactions to the inequity of profit. Fairness concerns have been extensively studied in traditional offline supply chains, which are based on the Fehr and Schmidtinequity aversion model (F-S model), established by Fehr and Schmidt [4,5,6]. Fairness concern and altruistic preference are different, in terms of motivation, model, and main conclusions, which are as shown in Table 1.

Table 1.

Differences between fairness concern and altruistic preference.

The fairness concern in traditional supply chain is different from altruistic preference in eSC, and the existing results of the fairness concern, which show that an enterprise with fairness concern can decrease the profit of the other enterprise [13], have limited guidance on the decision-making of the platform’s altruistic preference. Moreover, only a few scholars pay attention to altruistic preference in the supply chain [14], let alone in the context of eSC. This study intends to fill this research gap by examining the quantitative relationship between the altruistic preference and decisions of the eSC. This study is motivated by the real-world practice of e-commerce platforms and the research of Loch and Wu [15] on the relationship preference. They first conducted an experimental study in a supply chain and found that when enterprises consider social preferences, relationship preference can promote cooperation and enhance coordination efficiency. This study develops the decision models of eSC with an e-commerce platform’s altruistic preference, to answer the following research questions: (1) how the platform’s altruistic preference affects decisions; (2) how to design coordination contract in the eSC since the altruistic preference can promote cooperation between enterprises [10,11].

In order to answer the above questions, an eSC, where the manufacturer relies on the third-party platform (hereinafter, the platform) for product sales is constructed. The operation mode, where the manufacturer sells products directly to consumers and the platform provides sales service, is similar to the revenue sharing between the manufacturer and the platform in Zhang et al. [16], who explored the platform’s operating models, but they did not consider the platform’s sales service. In this study, the sales service level is used as the decision variable of the platform for analysis. In regards to online sales services, although Shen et al. [17] studied differentiated services for luxury goods, the impact of the service cost coefficient was not considered for model analysis. To fill this research gap, the sales service cost coefficient is taken into consideration and the relationship between the feasible interval of the coordination contract and the sales service cost coefficient is analyzed and discussed. Based on the comparative analysis of benchmark models, and the model with altruistic preference, a coordination contract is proposed in light of the altruistic preference, and the operation mode that the platform profits from providing sales service.

In the eSC, the platform shares the profit from product sales and decides sales services, which is similar to the revenue-sharing contract, but different from existing studies, in that the commission rate is set to be a monopolistic exogenous variable [18,19]. It is illustrated that the commission rate can be zero in the coordination contract using the altruistic preference coefficient as a coordinating variable, while the revenue sharing coefficient cannot be zero in the revenue-sharing contract. Moreover, the fixed professional service fee charged by the platform is incorporated into decision models and is used as a coordinating variable to analyze the applicability of the contract, which can provide insights for the coordination of eSC.

In the current operation of the e-commerce supply chain, the platform has developed rapidly due to the cost advantages of the economies of scale, and gradually embodies the characteristics of an oligarch. In order to ensure the healthy and long-term development of the eSC, the platform takes the initiative to let manufacturers benefit from the cooperation process under the requirements of the market environment. However, the existing literature has not studied the altruistic preference of the eSC, nor has it explored the design of the coordination contract under the altruistic preference. This study is the first to study altruistic preference of the platform and design a coordination contract through altruistic preference. The contributions are as follows. First, a model of eSC—taking the sales service level into account—is constructed to investigate how the platform’s altruistic preference affects decisions. Because the platform cooperates with multiple manufacturers and the simplified model constructed in this study, the reference point of manufacturer is introduced in the decision model with altruistic preference. Second, a contract involving an altruistic preference joint commission rate, where the commission rate and the altruistic preference coefficient are used as coordination tools, is quantitatively designed to achieve coordination. Moreover, the analysis of fixed professional service fees is conducted to show how system parameters affect the coordination contract. Third, discussion on the implementation of a coordination contract and managerial insights are presented to provide a reference for enterprises of eSC.

The results show that the platform’s altruistic preference for the profits of participating manufacturers can increase service level, sales price, and manufacturer profit. Besides, when the degree of altruistic preference is kept within a reasonable limit, the platform’s altruistic preference can contribute to a friendly and harmonious cooperative relationship between the platform manufacturers with increased system profit and efficiency. Moreover, the service level, sales price, and system profit are the highest in the centralized model of the eSC. If the platform’s altruistic preference coefficient is set to a specific value, the platform can achieve coordination with the manufacturer by providing the best sales service, with zero-commission, only charging a certain amount of a fixed professional service fee.

The rest of this paper is organized as follows. Section 2 briefly provides a literature review. Based on problem descriptions and assumptions, models are developed and a comparison is presented in Section 3 for the benchmark models and the model with the platform’s altruistic preference. Section 4 proposes a coordination contract of an altruistic preference joint commission rate. Numerical analysis and discussion are given in Section 5. Finally, Section 6 concludes the paper.

2. Literature Review

The existing research related to this study mainly focuses on three aspects: decisions of eSC, coordination of eSC, and the altruistic preference of supply chains.

2.1. Decisions of E-Commerce Supply Chains

The first stream of studies focused on the operational strategy of eSC. Considering the impact of promoting new products online, Luo and Sun [20] designed optimal product design strategies for manufacturers. Aiming at specified delivery time limits of e-commerce supply chains, Leung et al. [21] proposed an intelligent system for optimizing the processing flow of electronic waybills. Zhang et al. [22] investigated the batching, distribution, sorting, and transportation of online orders in a Business-to-Customer (B2C) e-commerce model for effectively reducing costs. The second stream of eSC studies focuses on pricing strategies. The development of eSC has caused reactions from traditional offline supply chains. Xiao and Shi [2] studied pricing strategies and channel prioritization strategies for two kinds of supply chains in the case of stochastic returns, resulting in supply shortages. Considering two scenarios of differential pricing and non-differential pricing, Zhou et al. [23] analyzed how free-riding behaviors in eSC influence pricing and service strategies. Regarding a retailer’s cost of sales services, Zhang and Wang [24] developed a dynamic pricing strategy and analyzed the impact on fixed costs in the two-tariff contract.

The existing literature considers that platforms have the same functions as retailers in traditional offline supply chains, such as ordering and inventory, but does not consider the platform’s sales service strategy. With the advancement of technology and economic development, product quality and pricing tend to be identical in online sales, so the sales service level has become an essential differentiator in business efficiency and competitiveness [25]. In contrast to previous literature, the platform’s sales service level is considered in this study and is reflected in the market demand function of products.

2.2. Coordination of E-Commerce Supply Chains

Most current research on coordination strategies is based on a dual-channel supply chain, exploring how to solve channel conflicts through coordination contracts [26,27,28]. Panda et al. [18] used a revenue-sharing contract by adjusting the wholesale price to solve the conflict between the traditional sales channels and online sales channels. Shao et al. [29] showed that a differentiated fee rebate coordination policy could alleviate demand congestion and achieve better social welfare. Xie et al. [19] combined revenue sharing and cost-sharing to solve the sales channel conflicts, and it was shown that the proposed coordination contract can help recycle used products. Most existing studies assume that the manufacturer opens a direct online sales channel, and do not involve the case where the manufacturer sells products on the platform.

However, with the enhancement of sales services, the operation of platforms is different from that of traditional retailers. Therefore, an exploration of the new coordination contract for eSC is needed. Furthermore, existing eSC studies assume that decision-makers are completely rational. However, many supply chain members are far from rational in their decision-making. This study is different from the previous research, as it explores a new coordination contract for eSC, in which an altruistic preference coefficient and a commission rate are used as coordination tools.

2.3. Altruistic Preference of Supply Chains

The history of introducing the behavioral factors of decision-makers into the supply chain has been in existence for a long time, and current research focuses on fairness concerns [5,6]. However, the altruistic preference has been extensively studied in experimental economics [30,31]; the research in supply chains is limited. Loch and Wu [15] introduced the altruistic preference into the supply chain, and the social preference of utility function includes relationship and status. The proposed relationship preference can promote cooperation and improve the performance of individuals and systems, while the status preference plays the opposite role. Ge and Hu [8] proposed the basic form of the utility function for altruistic preference, which is the weighted sum of the altruistic preference subject profit and system profit. Later, Fan et al. [11] showed that the retailer’s altruistic preference can make the manufacturer reduce carbon emissions and increase the manufacturer’s profit. From the perspective of system profit, Huang et al. [12] showed that manufacturers should set a higher altruistic preference, while the retailer is supposed to adopt a lower altruistic preference. Moreover, it is found that altruistic preference is beneficial to increase the greenness of products.

In eSC, the platform tends to show altruistic preference to strengthen cooperation. Therefore, it is meaningful to explore the impact of the platform’s altruistic preference on decisions of eSC. This study differs from the existing literature on altruistic preference as follows. First, differing from the utility function in studies by Loch and Wu [15], Ge and Hu [8], and Wang et al. [14], it is assumed that the utility function of the platform is weighted by its own profit and the manufacturer’s profit. Second, the reference point of the manufacturer’s profit is incorporated into the utility function to make the model more realistic. Finally, unlike the ex-post payment contract and “revenue sharing + franchise fee” contract proposed by Liu et al. [10], this study puts forward a coordination contract involving an altruistic preference joint commission rate to coordinate the eSC.

3. Problem Description and Modeling

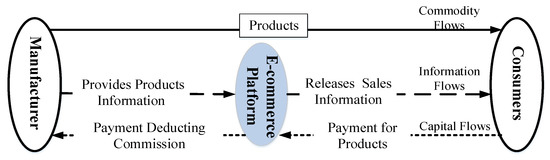

This paper studies an eSC illustrated in Figure 1. The manufacturer is provided with a direct sales online shop in which consumers can browse product information, purchase products, and pay money to the platform. After consumers confirm receipt of ordered products, the platform forwards payment to the manufacturer, after deducting the commission, which is a reward for providing sales services [13].

Figure 1.

The model structure.

When a manufacturer enters a platform, there are two types of fees that the manufacturer has to pay. The first type is the fixed professional service fee, which must be paid if the manufacturer wants to sell products, such as the annual software service fee of Tmall. The other type is the commission, such as a software service fee of Tmall (this is different from the annual software service fee and is charged based on sales). Typically, the platform provides promotion services to manufacturers, especially for the advertising and promotion of stores. For example, a cost per click (CPC) advertising service is provided by Amazon. At present, Tmall, Jingdong, Amazon, eBay, and other e-commerce platforms provide differentiated promotion services for manufacturers and charge fees based on sales.

The notations are as follows in Table 2.

Table 2.

Notations.

In the eSC operation, commission is an important source of revenue for the platforms, such as Taobao and Amazon. In order to study the decision-making of the platform, the commission revenue must be considered in the model. In eSC operations, the platform sets different commission rates for different categories. The commission rate is not a decision variable, but is set when the merchant enters the platform, and will not change in the subsequent sales process. The commission rate in current platforms, such as the software service rate of Tmall and sale on platform open plan (SOP) SOP commission deduction points of Suning, is set in advance before sales, and the commission income will follow the product at the end of the year. The commission revenue changes with the sales, but not the commission rate. Therefore, the commission rate is set as an exogenous variable. Moreover, it can be observed that the commission rate is generally less than 25%.

To ensure that the problem can be solved, the parameters meet:

(i) , ensuring that the optimal decisions of the centralized model can be derived.

(ii) The fixed professional service fee satisfies and it is limited to a quarter of the manufacturer’s revenue in the decentralized model, which means that the fixed professional service fees are within the acceptable range of the manufacturer.

(iii) Considering that the current e-commerce supply chain system is developed and the information exchange between the platform and the manufacturer is frequent, it is assumed that the platform and the manufacturer have symmetric information, and both are risk-neutral.

The manufacturer’s profit:

In Equation (1), the first term is the revenue of products sales, the second term is the production cost, and the third term is the fixed professional service fee.

The platform’s profit:

In Equation (2), the first term is the commission revenue from the manufacturer, the second term is the sales service cost, and the third term is the fixed professional service fee.

The overall eSC profit:

The overall eSC profit is the sum of the manufacturer’s profit and the platform’s profit. In Equation (3), the first term is the revenue of product sales and the second term is the sales service cost.

The decision parties, the manufacturer and the platform, constitute a Stackelberg model, where the platform makes the decision first then the manufacturer makes the decision. In the decentralized model without altruistic preference, the platform first decides the sales service level to maximize its own profit and then the manufacturer decides sales price to maximize its own profit. In the decentralized model with the platform’s altruistic preference, the platform first decides the sales service level to maximize its own utility and then the manufacturer decides the sales price to maximize its own profit.

3.1. Benchmark Models

This section provides benchmark models for the later comparison and analysis, including the decentralized model without altruistic preference and the centralized model.

3.1.1. Decentralized Model without Altruistic Preference

When the platform does not consider the altruistic preference, the manufacturer and the platform make decisions that aim to maximize their own profits. The decision parties constitute a Stackelberg model where the platform first decides the sales service level and then the manufacturer decides sales price.

According to Equation (1), can be derived, which means that has the maximal value. By solving , It can be obtained

Substituting Equation (4) into Equation (2), can be derived, has the maximal value. By solving , the optimal sales service level is:

Substituting Equation (5) into Equation (4), optimal decisions can be derived as follows:

The superscript denotes the decentralized model without altruistic preference.

3.1.2. Centralized Model

In eSC, if the two parties can jointly maximize system profit as the cooperation is deepened, the system decision-making process will constitute a centralized model, and the decision function is Equation (3).

According to Equation (3), the Hessian matrix of . , , . Since and , the Hessian matrix of is a negative definite matrix, and has the maximal value. The optimal decisions of the centralized model can be derived by solving and . The optimal decisions are as follows:

The superscript denotes the centralized model.

3.2. Decentralized Model with the Platform’s Altruistic Preference

The platform considers the profit of the manufacturer when making the decision, which is, it shows altruistic preference to the manufacturer. Following the utility function of Bester and Güth [12] on altruism, the platform’s utility function is assumed to be:

The denotes the platform’s altruistic preference cc preference coefficient and . indicates the degree of importance attached to the manufacturer in the platform’s decision function, which is, the degree of altruistic preference. The closer is to 0, the weaker the degree of altruistic preference. Conversely, the closer is to 1, the stronger the degree of altruistic preference. Different existing studies on altruistic preference use the sum of platfom’s profit and times of the manufacturer’s profit, this study uses the sum of times of the platform’s profit and times of the manufacturer’s profit as the utility function. In the utility function, the reference point of the manufacturer’s profit, , is also introduced to reflect that the e-commerce platform has the characteristics of economies of scale as a shared platform. Moreover, satisfies , which ensures the optimal decisions can be solved.

In this scenario, the platform first makes decisions based on the utility function, then the manufacturer determines the sales price to maximize profit. Substituting Equation (4) into Equation (6), the optimal sales service level can be derived by solving . The optimal decisions derived by the backward induction are:

The superscript denotes the decentralized model with altruistic preference.

Proposition 1.

, , , andare positively related to, is negatively related to.

Proof of Proposition 1.

Similarly, , , . □

Proposition 1 reveals that in the eSC, all optimal decisions and profits increase with , except the platform’s profit. When the platform determines the sales service level with altruistic preference in mind, the platform realizes that an increase in the sales service level can improve product demand, so the platform sets a higher sales service level than the case without altruistic preference. The increased demand will motivate the manufacturer to increase the sales price for a higher profit. Because the increase in demand driven by the higher sales service level is greater than the decrease in demand caused by the increase in sales price, the demand increases. Moreover, the profit of the manufacturer increases after the platform with the altruistic preference increases the sales service level. However, the platform would profit less than the case without the altruistic preference due to extra service cost. This reduced profit is the reason why e-commerce platforms are in general reluctant to consider altruistic preference and may do it only when under pressure from market regulators who have a desire to maintain the long-term stability of supply chain.

Proposition 2.

When, is positively related to; when, is negatively related to.

Proof of Proposition 2.

Because , obviously, when , there is . Therefore, when , and when,. □

Proposition 2 indicates that the system profit of eSC is positively related with (if ) and is negatively related with (if), so, , the system profit is maximized. This further demonstrates that the platform should consider altruistic preference ( is kept within a reasonable range, i.e.,) when making decisions. When , the platform sacrifices profit by altruistic preference in exchange for good market utility, which is believed that it can promote close cooperation with manufacturers and is beneficial to the system operation. With the prosperity of e-commerce and the introduction of relevant national policies, the fair and impartial requirements for the platform-led network economy competitive market have been put forward, which makes the leading platform consider the operational status of upstream and downstream enterprises because of unique operational characteristics. Therefore, it is necessary to sacrifice the platform’s profit in exchange for a good market utility to ensure the efficient and stable operation of the e-commerce supply chain.

In summary, the platform’s altruistic preference only when can help increase system profit and plays a positive role in facilitating the coordinated operation of the e-commerce supply chain. Therefore, in practice, the platform will implement altruistic preferences to ensure that .

3.3. Model Comparison

Comparing the optimal decisions of three decision models, Observations 1 and 2 can be obtained.

Observation 1.

; .

Proof of Observation 1.

Because , when , .

When , and . From Proposition 1, and are positively related to , so there are and . □

When the coefficient of altruistic preference is relatively small, i.e.,, the centralized model has the highest sales price and the highest sales service level, which is inconsistent with the conclusions in traditional supply chains without altruistic preference—that the sales price is the lowest in the centralized model [32]. With the transparency of sales prices in different platforms, the product demand is easily affected by the sales service level in a circumstance where the change range of sales price is diminishing. In order to improve sales, the platform would be committed to providing high-quality services in the centralized model, which increases service cost. Thus the sales price is the highest.

According to solutions of the centralized model and Proposition 1, Observation 2 can be obtained for profitability across models.

Observation 2.

, . When, , whereand

Proof of Observation 2.

According to Proposition 1, are positively related to, but is negatively related to . Since and are the special cases that and when , and can be derived.

According to Proposition 2, when , has maximum value and , it can be derived that .

Similarly, is the special case that when . When , When , . Therefore, there is making , and it can be derived by solving . □

This observation shows that: (1) the system obtains the highest profit in the centralized model; and (2) compared to the model without altruistic preference, the manufacturer’s profit is greater, while the platform’s profit is smaller when the platform has altruistic preference, which is consistent with Proposition 1. In the decentralized model that considers a platform’s altruistic preference on the manufacturer’s profitability, the platform provides a higher sales service level. Therefore, the market demand effectively increases, and so does the profit for the manufacturer. Although the platform suffers from profit loss, the increased profit of the manufacturer promotes a cooperative relationship and contributes to cooperation. Moreover, the platform’s appropriate altruistic preference, , can help increase system profit of decentralized model (it can be proved that when).

4. Coordination Contract

The comparative analysis shows that the altruistic preference of platform can help increase system profit (). Therefore, the altruistic preference coefficient, the commission rate, and the fixed professional service fee are used in developing a coordination contract—an altruistic preference joint commission rate contract. The main idea of the “altruistic preference joint commission rate” contract is as follows. First, the platform increases the service level to reach the level required in the centralized model by providing a higher degree of altruistic preference. Then, the platform adjusts the commission rate and prompts the manufacturer to set the sales price as the price in the centralized model. Hence, the optimal decisions in the centralized model can be obtained. Moreover, by changing the fixed professional service fee, the profit distribution is adjusted to make the profits of both parties in the coordination contract greater than in the decentralized models. In the coordination contract, , and denote the platform’s altruistic preference coefficient, the fixed professional service fee, and the commission rate, respectively.

According to the solution in Section 3.2, in the decentralized model with the platform’s altruistic preference, the optimal sales service level , the optimal sales price .

When and , there are:

Therefore, the decision model with the platform’s altruistic preference can achieve the sales service level and sales price in the centralized model. In the coordination contract, the platform uses the altruistic preference coefficient and the commission rate as variables to achieve the optimal decisions of the centralized model (i.e., the incentive compatibility). should satisfy individual rationality constraints of the platform and the manufacturer (i.e., profits of the manufacturer and the platform are higher than profits without altruistic preference).

After implementing coordination, and , so the manufacturer’s profit is , and the platform’s profit is . To ensure the contract can be accepted, and should be satisfied, i.e., . Rearranging inequalities, satisfies .

Therefore, Observation 3 summarize the coordination contract as follows.

Observation 3.

If, the altruistic preference joint commission rate contract can coordinate the eSC.

In the proposed coordination contract, the platform provides the highest sales service and charges the manufacturer a certain amount of the fixed professional service fee. Moreover, the altruistic preference coefficient is at , which is also consistent with Proposition 2 where the system profit can achieve the profit in the centralized model. The and satisfy the platform’s incentive compatibility and satisfies individual rationality constraints of the platform and the manufacturer. It should be noted that the coordination contract is based on the decentralized model with altruistic preference, so the individual rationality constraints are that the profits of the manufacturer and the platform are higher than profits without altruistic preference.

It is apparent that the altruistic preference coefficient in the coordination contract is negatively related to the reference point of the manufacturer’s profit, indicating that the more the platform values the manufacturer, the smaller the altruistic preference coefficient. This coordination contract is evidenced by several practices. For example, Taobao (www.taobao.com (accessed on 22 April 2017)) does not charge enterprise stores a commission fee. The manufacturers stationed at www.jiyoujia.com (accessed on 22 April 2017) do not pay the resident fee or commission. Through giving up part of the profit, the platform’s zero-commission sales service can reduce manufacturers’ operating costs and strengthen cooperation.

Proposition 3.

In the altruistic preference joint commission rate contract,is negatively related withand, and positively related withand pre-coordination.

Proof of Proposition 3.

According to Observation 3, the conditions for the adjusted fixed professional service fee can be simplified to , where , . So there are and .

Similarly, , , , , and .

Since , it can be demonstrated that makes . Because and , , which means that the adjusted fixed professional service fee decreases with the increase in service cost elastic coefficient.

Similarly, it can be proved that has a negative relation with and has positive relations with and. □

Proposition 3 indicates that as increases, the cost for the unit sales service level increases, the fixed professional service fee in the coordination contract will decrease. It is widely believed that the higher the platform’s cost, the higher the service fee that will be charged from the manufacturers to alleviate the cost pressure. In the coordination contract, however, the platform will consider the altruistic preference to favor the manufacturer, which reduces the fixed professional service fee. On the other hand, the higher the commission rate before implementing the coordination contract, the greater the increase in the fixed professional service fee after implementing the coordination contract. Because there is no commission income in the coordination contract, the platform can only gain profit by increasing the fixed professional service fee.

As increases, the fixed professional service fee shows a downward trend. The more sensitive consumers are to the sales price, the higher the market demand fluctuation will be. Therefore, the platform’s altruistic preference reduces the fixed professional service fee to relieve the fluctuation faced by manufacturers. With respect to , the fixed professional service fee presents an upward trend as increases. The platform’s behavior of improving the sales service level is conducive to improving product sales, so the fixed professional service fee will be enhanced to guarantee the improvement in service quality.

Proposition 4.

In the altruistic preference joint commission rate contract, the difference in the fixed professional service fee paid by the manufacturer before and after coordination is negatively related withand, and positively related with.

Proof of Proposition 4.

Because , satisfies , where , . According to Proposition 3, there are, , and . □

It is indicated that the difference in the fixed professional service fee paid by the manufacturer is consistent with the change in the fixed professional service fee after coordination. With the increase of and , the range of the increase in the fixed professional service fee becomes smaller; and becomes bigger as increases.

5. Numerical Analysis and Discussion on Coordination Contract

5.1. Numerical Analysis

Numerical analysis is conducted to gain more insights into the altruistic preference joint commission rate contract. Similar to Wang et al. [33], Xie et al. [3], and Tang et al. [34], general products are considered for the numerical analysis with the following parameter values. The following four numerical experiments have , , , , , and as the base case [35]. There are three main constraints mentioned in “Problem Description and Modeling” and “Decentralized Model with the Platform’s Altruistic Preference”, namely, , and . The values of parameters should satisfy these three constraints. Moreover, considering that the optimal decisions should have practical significance, values of parameters also make sure optimal decisions are positive.

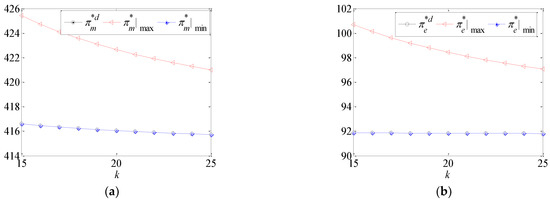

(i) The manufacturer’s profit and the platform’s profit after the implementation of the coordination contract when are presented in Figure 2, where and denote the manufacturer’s profit and the platform’s profit after coordination, respectively. According to , should satisfy so is feasible. The feasible range of is and the feasible range of is . It can be observed that the coordination contract can improve both parties’ profits compared with the decentralized model. The increase in the platform’s profit is significantly higher than that in the manufacturer’s profit, further validating the feasibility of the coordination contract under the assumption that the platform is a leader. Moreover, increased profits indicate that the altruistic preference joint commission rate contract can realize Pareto improvement and achieve coordination.

Figure 2.

Coordination results of and . (a) Coordination results of ; (b) Coordination results of .

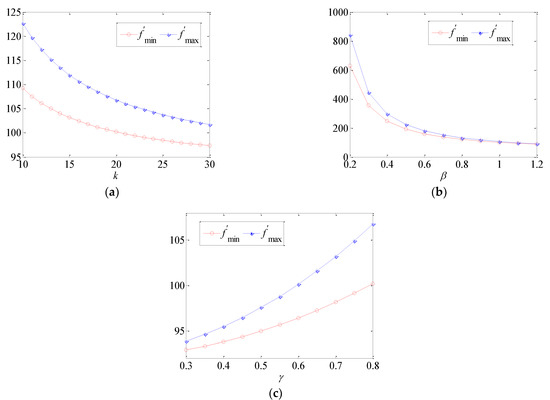

(ii) The impact of on the feasible range of () in the coordination contract is illustrated in Figure 3a. According to , should satisfy so is feasible. It shows that decreases in and the declining rate tends to be flatter with greater . Moreover, the upper limit of decreases faster than the lower limit, which means that the coordination space becomes smaller.

Figure 3.

Effects of , , and on. (a) Effect of on. (b) Effect of on . (c) Effect of on .

(iii) Let and , the impact of on the feasible range of () is illustrated in Figure 3b. According to , should satisfy so is feasible. It is shown that is negatively related with, and as increases, the declining rate gradually slows down. Moreover, the upper limit of decreases faster than the lower limit, and makes the coordination space smaller.

(iv) Let and , the impact of on the feasible range of () is illustrated in Figure 3c. According to , should satisfy so is feasible. It shows that increases in, and the growing rate of the upper limit of is faster than that of the lower limit. The feasible range of the coordination contract gradually increases, indicating the growing negotiation space.

Although an increase in the service cost elasticity coefficient or the sales price elasticity coefficient can reduce the fixed professional service fee, the increase will lead to a smaller negotiation space between the platform and the manufacturer. It means that larger values of and may not facilitate the coordination implementation. However, an increase of the sales service level elasticity coefficient will not only increase the fixed professional service fee, but also broaden the negotiation space of the coordination contract, which will promote the mechanism implementation.

5.2. Discussion

Based on consumers’ sensitivity to the sales price and the sales service level, some products sold by e-commerce platforms can be roughly classified into four categories in Table 3 [36].

Table 3.

Products classification based on elasticity coefficient.

According to Figure 3, the altruistic preference joint commission rate contract is more applicable to products whose market demands are less affected by sales prices and more affected by the sales service level, such as consumer electronics and customized products. However, for products whose market demands are more affected by sales prices rather than the sales service level, such as jewelry, watches, and bags, their small negotiation space makes the implementation of the proposed coordination contract difficult. For daily necessities, whose market demands are less affected by the sales price and the sales service level, the coordination effect of the proposed contract is not clear because their market demands are less volatile. Therefore, when employing the altruistic preference joint commission rate contract, the e-commerce platform should consider product categories and the impact of elasticity coefficients.

Following the products classification in Table 3, the contract effect is illustrated by the sales data for some products of an e-commerce platform in China (here, the contract effect is reflected by the market demand, which refers to sales of products in the table). The sales data of several types of products in the platform from July to September 2019 are compared in Table 4.

Table 4.

Sales of products from July to September.

Table 4 shows that the monthly sales of phones increased during the three months. The growth was mainly caused by a nationwide pick-up service launched by the platform in June 2019 to handle the after-sales service issues. The pick-up service can help the participating manufacturers address the problem of slow after-sales logistics. The leading e-commerce platform, by considering the interest of manufacturers, improves market sales and the sales service level, and enhances the shopping experience of consumers. It also shows that the coordination contract is more suitable for products with a large sales service level elasticity coefficient. The example indicates that a platform’s altruistic preference that favors the manufacturer can benefit the system operation and improve efficiency. However, the growth rate of Swiss watches, jade, travel bags, and other products is uncertain, while the sales of home décor have declined. This observation indicates that the altruistic preference joint commission rate contract does not show obvious effects for products whose market demand is less affected by the sales service level.

However, in practice, some e-commerce platforms do not provide a zero-commission sales service. For example, Gome once promised manufacturers who met the requirements to be exempted from the first-year commission. Although this action attracted a large number of manufacturers to join their platform, the platform continued to charge commissions in the second year. Currently, Suning only refunds commissions for clothing, sportswear, bags, jewelry, and other categories that meet specific requirements. At Tmall, manufacturers that satisfy discount conditions for sales are given 50% or 100% discounts of annual fees, but commissions still not being refunded. The main reasons for difficulties in implementing commission-free policies in practice are as follows.

(i) The commission is the main income for platforms providing sales services. The commission-free policy can attract more manufacturers to join a platform, but the gap between platforms and manufacturers grows over time. Therefore, e-commerce platforms do not implement a commission-free policy for a long time to make more profits.

(ii) Altruistic preference is the reflection of the decision-maker’s willingness to concede in the decision-making process, but the degree of altruistic preference is limited. E-commerce platforms may consider altruistic preference only under the pressure of government policies and with the motivation to maintain the long-term stability of theeSC. Therefore, the degree of altruistic preference is not high in practice, and lower than the proposed altruistic preference coefficient ().

Because a fair and stable competitive environment is the basis for the healthy and benign development of the network economy, it is necessary to do the following to build a good market competitive environment. (1) For e-commerce platforms: they should concentrate on improving service quality and gaining more traffic of online shoppers to maintain a competitive advantage. As suggested in this study, e-commerce platforms should consider the altruistic preference issue for the long-term ecosystem stability, and may consider the coordination contract and the commission-free policy, according to product categories. Reduced sales cost pressure can help manufacturers focus on providing high-quality products to consumers and, therefore, enhance the competitiveness and sustainability of e-commerce platforms. (2) For governments and regulators: it is necessary to introduce policies and regulations for online transaction dishonesty and fraud in the current network market. Governments may guide e-commerce platforms to strengthen their cooperation with manufacturers and encourage large-scale e-commerce platforms to consider the interest of manufacturers. Some possible policies, such as tax reductions and exemptions, can promote a cooperative ecosystem for eSC.

6. Conclusions

An eSC is modeled in this study, where the sales service level is incorporated into the platform’s decision-making. Benchmark models and a decentralized model with the platform’s altruistic preference, are established, analyzed, and compared. Based on the comparison, the altruistic preference joint commission rate contract is proposed to coordinate the eSC and is validated by numerical analyses. The major findings are as follows. First, the platform’s altruistic preference can increase sales service level, sales price, and manufacturers’ profits. When the altruistic preference coefficient is kept within a reasonable range, the platform’s altruistic preference can contribute to a friendly and harmonious cooperative relationship between the platform and manufacturers with increased system profit and efficiency. Second, the sales service level, sales price, and system profit are the highest in the centralized model, and the platform’s altruistic preference can help realize coordination. Finally, a particular value of the platform’s altruistic preference coefficient (i.e., ) can ensure the most effective operation of the system and achieve coordination. In this coordination contract, the platform provides the manufacturer the best sales service, with zero-commission, and charges a certain amount of fixed professional service fee.

The conclusions bring various managerial insights to eSC stakeholders.

On the one hand, due to the high sales price and sales service level in the centralized model, the relatively low sales price of e-commerce platforms has been unable to attract more traffic of digital shoppers, whereas consumers demand better service quality of e-commerce platforms. With the popularity and development of e-commerce, consumers are more sensitive to service quality in the e-commerce market, so it is critical to improve the sales service provided by e-commerce platforms. Therefore, while cooperating with more manufacturers, e-commerce platforms should pay attention to the enhancement of service capabilities and the improvement of shopping experience to enhance consumer stickiness, which can help them become more competitive.

On the other hand, it has been illustrated that the platform’s consideration of altruistic preference can benefit manufacturers and can effectively improve system efficiency to a certain extent. Thus, closer cooperation between e-commerce platforms and manufacturers can be developed by the altruistic preference. At present, the introduction of relevant macro policies in many countries and dynamic market environments have made clear requirements for the decision-making behaviors of e-commerce platforms. Therefore, as the leader of e-commerce supply chains, e-commerce platforms must follow the principles of openness, fairness, and justice, and endeavor to maintain an orderly and fair operation of e-commerce markets through the altruistic preference.

Moreover, based on the platform’s altruistic preference, this study proposes a coordination contract to instruct a leading platform on how to adjust the altruistic preference coefficient, the commission rate, and the fixed technical service fee, to reach the highest system profit. In the e-commerce cooperation, manufacturers and platforms need to strengthen cooperation and coordinate eSC operation.

This study only considers the platform’s altruistic preference, but manufacturers also have fairness concerns in practice, which is mentioned by Wang et al. [13]. On the basis of this study, more realistic insights can be obtained by analyzing manufacturers’ fairness concerns together, following the experimental studies by Kohler [31]. Moreover, this study only considers the e-commerce supply chain, research on dual-channel supply chains considering altruistic preference will also be in the next research direction [3,6].

Author Contributions

Conceptualization, Y.W.; methodology, Y.W. and L.S.; software, Z.Y.; formal analysis, Z.Y.; data curation, Z.Y.; visualization, Z.Y.; writing—original draft preparation, Z.Y., Y.W., and L.S.; writing—review and editing, L.S. and W.D.; funding acquisition Y.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China, grant number 71971129 and Science and Technology Support Program for Youth Innovation of Colleges and Universities in Shandong Province, grant number 2019RWG017.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Siddiqui, A.W.; Raza, S.A. Electronic supply chains: Status & perspective. Comput. Ind. Eng. 2015, 88, 536–556. [Google Scholar] [CrossRef]

- Xiao, T.; Shi, J. Pricing and supply priority in a dual-channel supply chain. Eur. J. Oper. Res. 2016, 254, 813–823. [Google Scholar] [CrossRef]

- Xie, J.; Liang, L.; Liu, L.; Ieromonachou, P. Coordination contracts of dual-channel with cooperation advertising in closed-loop supply chains. Int. J. Prod. Econ. 2017, 183, 528–538. [Google Scholar] [CrossRef]

- Fehr, E.; Schmidt, K.M. A theory of fairness, competition, and cooperation. Q. J. Econ. 1999, 114, 817–868. [Google Scholar] [CrossRef]

- Nie, T.; Du, S. Dual-fairness supply chain with quantity discount contracts. Eur. J. Oper. Res. 2017, 258, 491–500. [Google Scholar] [CrossRef]

- Zhang, F.; Wang, C. Dynamic pricing strategy and coordination in a dual-channel supply chain considering service value. Appl. Math. Model. 2018, 54, 722–742. [Google Scholar] [CrossRef]

- Bester, H.; Güth, W. Is altruism evolutionarily stable? J. Econ. Behav. Organ. 1998, 34, 193–209. [Google Scholar] [CrossRef]

- Ge, Z.; Hu, Q. Who benefits from altruism in supply chain management. Am. J. Oper. Res. 2012, 2, 59–72. [Google Scholar] [CrossRef]

- Shi, K.; Jiang, F.; Ouyang, Q. Altruism and pricing strategy in dual-channel supply chains. Am. J. Oper. Res. 2013, 3, 402–412. [Google Scholar] [CrossRef]

- Liu, W.; Yan, X.; Wei, W.; Xie, D.; Wang, D. Altruistic preference for investment decisions in the logistics service supply chain. Eur. J. Ind. Eng. 2018, 12, 598–635. [Google Scholar] [CrossRef]

- Fan, R.; Lin, J.; Zhu, K. Study of game models and the complex dynamics of a low-carbon supply chain with an altruistic retailer under consumers’ low-carbon preference. Physica A 2019, 528, 121460. [Google Scholar] [CrossRef]

- Huang, H.; Zhang, J.; Ren, X.; Zhou, X. Greenness and pricing decisions of cooperative supply chains considering altruistic preferences. Int. J. Environ. Res. Public Health 2019, 16, 51. [Google Scholar] [CrossRef] [PubMed]

- Wang, Y.; Yu, Z.; Shen, L. Study on the decision-makingand coordination of an e-commerce supply chain with manufacturer fairness concerns. Int. J. Prod. Res. 2019, 57, 2788–2808. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, Z.; Shen, L.; Fan, R.; Tang, R. Decisions and coordination in e-commerce supply chain under logistics outsourcing and altruistic preferences. Mathematics 2021, 9, 253. [Google Scholar] [CrossRef]

- Loch, C.H.; Wu, Y. Social preferences and supply chain performance: An experimental study. Manag. Sci. 2008, 54, 1835–1849. [Google Scholar] [CrossRef]

- Zhang, J.; Cao, Q.; He, X. Contract and product quality in platform selling. Eur. J. Oper. Res. 2019, 272, 928–944. [Google Scholar] [CrossRef]

- Shen, B.; Qian, R.; Choi, T.M. Selling luxury fashion online with social influences considerations: Demand changes and supply chain coordination. Int. J. Prod. Econ. 2017, 185, 89–99. [Google Scholar] [CrossRef]

- Panda, S.; Modak, N.M.; Sana, S.S.; Basu, M. Pricing and replenishment policies in dual-channel supply chain under continuous unit cost decrease. Appl. Math. Comput. 2015, 256, 913–929. [Google Scholar] [CrossRef]

- Xie, J.; Zhang, W.; Liang, L.; Xia, Y.; Yin, J.; Yang, G. The revenue and cost sharing contract of pricing and servicing policies in a dual-channel closed-loop supply chain. J. Clean. Prod. 2018, 191, 361–383. [Google Scholar] [CrossRef]

- Luo, L.; Sun, J. New product design under channel acceptance: Brick-and-mortar, online exclusive, or brick-and-click. Prod. Oper. Manag. 2016, 25, 2014–2034. [Google Scholar] [CrossRef]

- Leung, K.H.; Choy, K.L.; Siu, P.K.Y.; Ho, G.T.S.; Lam, H.Y.; Lee, C.K.M. A b2c e-commerce intelligent system for re-engineering the e-order fulfilment process. Expert Syst. Appl. 2018, 91, 386–401. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, X.; Huang, K. On-line scheduling of order picking and delivery with multiple zones and limited vehicle capacity. Omega 2018, 79, 104–115. [Google Scholar] [CrossRef]

- Zhou, Y.; Guo, J.; Zhou, W. Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. Int. J. Prod. Econ. 2018, 196, 198–210. [Google Scholar] [CrossRef]

- Zhang, T.; Wang, X. The impact of fairness concern on the three-party supply chain coordination. Ind. Mark. Manag. 2018, 73, 99–115. [Google Scholar] [CrossRef]

- Cai, J.; Hu, X.; Tadikamalla, P.R.; Shang, J. Flexible contract design for vmi supply chain with service-sensitive demand: Revenue-sharing and supplier subsidy. Eur. J. Oper. Res. 2017, 261, 143–153. [Google Scholar] [CrossRef]

- Johari, M.; Hosseini-Motlagh, S. Coordination contract for a competitive pharmaceutical supply chain considering corporate social responsibility and pricing decisions. RAIRO Oper. Res. 2020, 54, 1515–1535. [Google Scholar] [CrossRef]

- Malik, A.I.; Sarkar, B. Coordination supply chain management under flexible manufacturing, stochastic leadtime demand, and mixture of inventory. Mathematics 2020, 8, 911. [Google Scholar] [CrossRef]

- Saha, S.; Sarmah, S.P.; Moon, I. Dual channel closed-loop supply chain coordination with a reward-driven remanufacturing policy. Int. J. Prod. Res. 2015, 54, 1503–1517. [Google Scholar] [CrossRef]

- Shao, J.; Yang, H.; Xing, X.; Yang, L. E-commerce and traffic congestion: An economic and policy analysis. Transp. Res. Part B Methodol. 2016, 83, 91–103. [Google Scholar] [CrossRef]

- Fehr, E.; Schmidt, K.M. The economics of fairness, reciprocity and altruism—Experimental evidence and new theories. In Handbook of the Economics of Giving, Altruism and Reciprocity; Elsevier Science: New York, NY, USA, 2006; Volume 1, pp. 615–691. [Google Scholar] [CrossRef]

- Kohler, S. Altruism and fairness in experimental decisions. J. Econ. Behav. Organ. 2011, 80, 101–109. [Google Scholar] [CrossRef]

- Hong, X.; Xu, L.; Du, P.; Wang, W. Joint advertising, pricing and collection decisions in a closed-loop supply chain. Int. J. Prod. Econ. 2015, 167, 12–22. [Google Scholar] [CrossRef]

- Wang, L.; Song, H.; Wang, Y. Pricing and service decisions of complementary products in a dual-channel supply chain. Comput. Ind. Eng. 2017, 105, 223–233. [Google Scholar] [CrossRef]

- Tang, J.; Li, B.Y.; Li, K.W.; Liu, Z.; Huang, J. Pricing and warranty decisions in a two-period closed-loop supply chain. Int. J. Prod. Res. 2020, 58, 1688–1704. [Google Scholar] [CrossRef]

- Wang, Y.; Fan, R.; Shen, L.; Jin, M. Decisions and coordination of green e-commerce supply chain considering green manufacturer’s fairness concerns. Int. J. Prod. Res. 2020, 58, 7471–7489. [Google Scholar] [CrossRef]

- Varian, H.R. Intermediate Microeconomics: A Modern Approach, 5th ed.; Norton: New York, NY, USA, 1999. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).