Abstract

This study proposes a generalized grey Lotka–Volterra model with a finite number of variables. The model is obtained by applying the grey modelling method to estimate the parameters of a finite dimensional quadratic Lotka–Volterra system. Subsequently, the model is used to analyze the competition and cooperation relationship between four macroeconomic indicators, namely Gross Domestic Product, Export, Import and Investment, and to obtain short-time forecasting for them. The data used in the empirical investigation cover the time periods 2005–2022 and 2011–2022, for the European Union. The empirical results are compared to the ones obtained by using the grey model and the two-dimensional grey Lotka–Volterra model. Finally, economic interpretations of the empirical findings are formulated.

Keywords:

grey model; generalized grey Lotka–Volterra model; gross domestic product; export; import; investment; EU MSC:

37N40; 39A60; 34A60; 91B84

1. Introduction

Grey prediction models have been widely and successfully applied in various fields (industry, science and technology, economy and others). With more and more in-depth research in the field of economics, economic research approaches the grey theory by identifying the important role it can play in the economy. Grey prediction models have proven to be efficient and providing appropriate methodologies to handle economic problems that are very complex, due to their ability to adapt to model uncertainty and sometimes insufficient information for prediction and decision making [1,2,3,4,5,6,7,8,9].

In recent years, extended and modified grey prediction models have been developed based on the grey model motivated by the practicality and accuracy of prediction.

However, the grey model focuses mainly on linear relations and seasonal characteristics, ignoring nonlinear effects, such as competition and cooperation. Thus, due to the complexity of the economic system, research has permanently improved the basic grey models by adding multivariate prediction problems to them. The Lotka–Volterra model is viable in cyclical relationships. Since the economic system is characterized by a series of cycles, this model finds applicability in the economy. Lotka–Volterra equations can be useful in analyzing the long-term relationship between economic variables and predicting their values. Based on the grey modeling method, a grey Lotka–Volterra model was developed starting from the two-dimensional Lotka–Volterra Predator–Prey model [10,11,12,13].

This study has two main objectives. Firstly, it aims to obtain a generalized grey Lotka–Volterra model for a finite number of variables. The new model is derived by applying the grey direct modeling method in order to obtain a discrete model and to estimate the parameters of a finite dimensional quadratic Lotka–Volterra model. The coefficients of the model are estimated considering the criterion of minimizing the sum of squared errors. The accuracy of the estimations is established by using the mean absolute percentage error value.

The second objective of the study is to test the applicability and reliability of the theoretical model on a system of four macroeconomic indicators: Gross Domestic Product, Investment, Import and Export.

The impact of gross domestic product (GDP) elements (calculated by the expenditure method) on the economic growth of a country or group of countries has been studied by numerous authors. Different results were identified depending on the interval studied, the level of development of the states and the methods used. Investment and international trade are essential elements for the stable operation and long-term growth of the national economy. At the same time, due to the important role it plays in the process of economic development and social progress, many researchers have created different forecasting models to provide effective support to governments in the formulation of economic policies.

In general, studies have focused on analyzing the relationship between these variables and prediction on statistical methods (Linear regression model, ARIMA) and artificial intelligence, and less on grey prediction methods [14,15,16,17,18,19,20,21,22,23,24,25].

The generalized -dimensional grey Lotka–Volterra model () derived in this study is used to estimate a system of four economic variables (GDP, Investment, Import and Export), thus taking into account nonlinear effects and the mechanism of competition and cooperation between them. The purpose of the case study is to analyze the evolution and relationship between the economic variables using a model. The empirical results are compared with the ones obtained using the and for pairs of two variables, aiming to verify in this context the validity of the new theoretically presented model.

The paper’s novelty consists in the development of a new model, obtained by generalizing the two-dimensional grey Lotka–Volterra model, and in analyzing the competition and cooperation relationship between four macroeconomic variables, by using this new model in the four-dimensional case.

The paper is organized as follows: After a review of the pursued objectives and the novelty of the study described in Section 1, in Section 2 the and the two-dimensional grey Lotka–Volterra models are reviewed. In Section 3 the new model based on the generalization of the model is presented. In Section 4, the model is used to estimate the evolution and the relationships between for four economic indicators (GDP, Investment, Export and Import). The results of the estimates and forecasts are compared to the ones obtained using model for each indicator. The estimated relationships are compared to the ones obtained using models for pairs of the four considered economic indicators. The performance of the model and the results are discussed. Economic interpretations of the empirical results are formulated. Section 5 contains conclusions and further research directions.

2. About the and Grey Lotka–Volterra Models

Together with many statistical methods, the grey model predicts the future values of a single variable, starting with a sequence of existing values. However, as in many fields (such as economy or sociology) where two or more variables interact, the models concerning a single variable cannot suggest the relationship between these variables. This is why more complicated grey-type models were developed [6,7].

2.1. The Grey Model

In order to forecast the future behavior of a variable, the model starts with a data sequence [2,3,8]:

Considering the accumulated sequence (also called Accumulating Generation Operator [7]):

and the mean generation of consecutive neighbors of sequence:

then the model reads [9]:

Theorem 1

([9]). The least square estimates of the grey difference Equation (4) satisfy

where and are given by

Consider the linear differential equation:

with the initial condition , possessing the unique solution:

If the coefficients a and b are given by (5) and then the values of the sequence are discrete values of the solution of Cauchy problem for Equation (6). Consequently, the estimated values of the sequence are:

The mean absolute percentage error () of the estimation is computed as follows:

The accuracy of the model is given by the values of as in Table 1.

Table 1.

The accuracy of the grey model.

2.2. The Grey Lotka–Volterra Model

In order to estimate the evolution of two coexisting variables, the grey model can be applied for each of them, to obtain predicted values. However, the relationship between the variables which interact may be emphasized using the two-dimensional grey Lotka–Volterra model, denoted .

Consider the quadratic Lotka–Volterra system of differential equations:

where are the variables, functions of time , , are real coefficients, while the dot over quantities signifies differentiation with respect to the time .

Theorem 2

([10,11]). The functions and that verify

are solutions of system (10).

As a consequence, the continuous model (10) can be converted to the following Lotka–Volterra difference equations [10]:

where the parameters , , , are giving by (11).

Consider with two data sequences:

the accumulating sequences

and the mean generation of consecutive neighbors sequences:

Applying the grey method to the Lotka–Volterra system (10), the following approximations are obtained:

This is the two-dimensional grey Lotka–Volterra model.

Estimators for the coefficients in system (15), such that the sum of the squared errors between the given and predicted values should be minimum, are found into the form:

where the matrices are given by:

Thus, estimators of the values from the sequences (12) are obtained as:

where, estimators for can be obtained, using (11) with and , as follows:

Finally, the mean absolute percentage error () is computed for both sequence:

The relationship between the variables depending on the signs of the coefficients and is emphasized in Table 2.

Table 2.

Relationship between the variables of the Lotka–Volterra model [12].

3. Generalization of the Grey Method for a -Dimensional Lotka–Volterra Model

Because in most of real-world situations, more than two variables interact, a generalization of the model is useful. An extension of the grey method to a three-dimensional quadratic Lotka–Volterra system can be found in [13].

In this section the grey method for the Lotka–Volterra model, exposed in Section 2, is generalized for a -dimensional Lotka–Volterra model.

Consider the -dimensional quadratic Lotka–Volterra system of differential equations:

where , , , are real parameters.

In the following we generalize the results in [10] for the -dimensional system (20).

Theorem 3.

The functions satisfying for every :

with

are solutions of system (20).

Proof.

As we get

As , it follows that . In addition, and so we have:

Thus, that is system (20) is verified. □

Taking into (21), (22) it follows:

Corollary 1.

The discrete system corresponding to (20) is:

with

Next, we generalize the grey method for the -dimensional system Lotka–Volterra (20).

Consider data sequences:

the accumulating sequences

and the mean generation of consecutive neighbors sequences:

For , we make the following approximations:

Applying the Lagrange theorem on the interval , there exists such that Approximating for by , we get:

Replacing (27) and (28) into system (20) we get for every :

Model (30) will be called -dimensional grey Lotka–Volterra model, and it will be denoted .

Theorem 4.

The least square estimates , of the grey Lotka–Volterra model (30) satisfy

where and are given by

Proof.

For every , consider the approximate value of and the errors , for . Thus:

The error vectors read:

equivalent to:

In order to have the minimum of , we put . As

it follows that

Solving the equation , estimators of the parameters in system (30) are obtained into the form (31). □

Corollary 2.

Using (23), estimators of can be obtained as follows:

while, according to (24), the coefficients are given by

As a consequence, estimators of the values from the sequence (25) are given by:

Finally, the mean absolute percentage error () is computed for every sequence as:

The accuracy of the model is given by the values of as specified in Table 1.

4. Case Study: Application to GDP, Export, Import and Investment for the European Union

In this section a model is used to analyze the competition and cooperation relationship between four macroeconomic indicators, namely GDP, Investment, Import and Export, and to obtain short-time forecasting for them. The data used in the study correspond to values of these four economic variables for the European Union (EU), covering two periods of time, namely 2005–2022 and 2011–2022.

The case study pursues the following objectives:

- -

- To assess the estimation accuracy of the model and to compare the estimated values and forecasts with the ones obtained using the grey model ;

- -

- To determine, using the model, the type of cooperation or competition relationships between pairs of economic variables;

- -

- To compare the empirical relationships obtained for the two different time periods, on one hand, and with the ones resulted using the model for pairs of two variables, on the other hand;

- -

- To derive economic interpretations for the empirically obtained results and to compare them with the ones identified in the literature.

4.1. Economic Background Analysis

Gross domestic product (GDP) measures economic activity, indicating the strength of an economy, by determining the value of all final goods and services produced within an economy, in a given period of time. GDP is defined as the monetary value of all final goods and services produced within the borders of a specific country in a given time period [14].

GDP is calculated using three methods: the value added method (or the production method), the expenditure method (or the use of final production) and the income method. We chose to work with the GDP determined by the expenditure method, expressed in value at market prices (millions of euros), being the only possibility to sum up the heterogeneous goods realized at the level of the national economy. The expression of GDP, in current market prices, eliminates the differences between the price level in different countries and allows it to be used as a tool for comparing living standards, or for monitoring the convergence process in the European Union.

The expenditure approach calculates GDP using total expenditure on domestic goods, respectively, expenditure on private consumption, investment, government spending and net exports. In this sense, starting from this method, the following variables were considered in the study: GDP, investments, import and export. This approach was motivated by the lack of a cumulative analysis of the 4 indicators. In general, other research considered the analysis of only certain types of expenditures on GDP.

A survey of the specialized literature, showed that international trade (import and export) as well as investment have a significant impact on the GDP of a nation.

Investments are acquisitions of goods that will be utilized to create wealth in the future. Foreign investment are transfers of investment made by natural or legal persons from one nation to another nation or nations [15]. Foreign direct investment can bring innovations in the activity of firms through technology transfer having a strong impact on GDP [26]. Thus, for Central and Eastern Europe, it was found that the growth of foreign investments is the determining factor in the development and coherence of the economy [17]. Public and private investment play a central role in production functions, providing the capital needed for development [16]. Investment can stimulate a country’s economic growth in two ways: it provides host countries with capital that stimulates the expansion of investment and production; through the advanced technology and the experience brought, it causes the enterprises of the host country to optimize their production efficiency [27]. Various studies have demonstrated the positive and significant effect of investment on economic growth [17,18,19,20,21,22,23,24,25,28,29,30,31,32]. At the same time, although investments have a causal impact on economic growth, causality from GDP to investments is not confirmed [19].

Some studies identify a mutually beneficial relationship between GDP and investment in the long run, but in the short run investment limits economic development [1].

Trade plays a significant role among the factors of economic growth [33]. Imports and exports are essential components for estimating the GDP of a country, being referred to as “Net Exports”. Net exports are calculated as the difference between the estimated total exports and the estimated total imports. A positive value of net exports indicates a trade surplus, and a negative value a trade deficit. International trade is basically represented by net exports in the expenditure model for calculating GDP. In this approach, since GDP measures domestic production, imports should have no impact on GDP. However, there is an important influence of imports on economic sustainability [34].

Economic growth is significantly boosted by greater openness to trade. Accumulation of imports can be a sign of a growing economy, as higher demand for foreign goods may be an indication of an increase in income and consumer spending [35].

Exports are goods and services that are produced domestically but sold to buyers in other countries which brings an inflow of funds into the country. Thus, exports have a positive impact on economic growth, and international trade can strongly increase incomes by improving living standards [36,37]. Exporting stimulates economic growth from the demand side and produces an efficiency gain on the supply side [38]. Therefore, nations that implement export-oriented strategies continuously absorb the flow of foreign currency, producing more output [39].

Investment plays a critical role in economic development and export growth [17,23,24]. Due to the visible benefits of investment to the national economy, countries adopt various policies that facilitate the flow of investment, such as investment incentives and facilitation of foreign trade procedures [40].

The results of the investigation into the relationship between economic growth, investment and exports were mixed. Thus, for developing countries exports and foreign direct investment are of great importance for economic development [18]. Some research has found that there is no long-run equilibrium relationship between the growth rate of real gross domestic product (GDP), investment and exports but only between exports and GDP [41]. Others have identified that investment and export lead to economic growth [38] but the reciprocal is not true [42]. In general, countries are open to international trade to achieve high economic growth, as there is a long- and short-run causal relationship between investment, GDP and exports [43]. According to [44], there is bidirectional causality between exports and GDP and investment has unidirectional effects on GDP directly and indirectly through exports. The trade war has two consequences: on the one hand, it causes a decline in exports and a rise in GDP, but on the other hand, it creates an opportunity for investment to emerge that could benefit the economy [45]. At the same time, the decrease in exports can lead to a decrease in GDP, because it can be affected by several economic variables [46].

Imports are the goods and services purchased from other countries which implies an outflow of funds from the country. Although the value of imports seems that they should not be taken into consideration in the analysis of the influence on GDP (it measures domestic production), a bidirectional causality is found between imports and GDP, which highlights the significant influence of imports on economic growth, but also the importance of GDP, whose growth causes an increase in imports.

Imports due to the transfer of technology and innovation enable high productivity, formation and accumulation of capital and thus lead to economic growth. Thus, for developing countries, imports allow domestic industries to obtain advanced technologies, tools and machinery from developed countries which contributes to their economic growth [34].

Analysis of the relationship between exports, imports and GDP indicates that imports significantly promote economic growth, while GDP growth stimulates export growth [47]. At the same time, some studies have found that imports have a greater effect on production growth than exports [48,49]. The increase in exports contributes to the increase in imports because it builds up foreign exchange reserves used to pay for imports. GDP has an important role in the growth of exports and is significantly affected by imports [34].

In the long run, GDP and import growth are driven by exports. Thus, the increase in exports accelerates not only economic growth, but also the capacity to import [34]. Significant economic growth is seen in countries where investment and trade have increased [50].

The different results of the studies that analyzed the relationship between the economic indicators under analysis are due to the models used in the analysis. Most of the research focuses on statistical methods and artificial intelligence and to a lesser extent on grey models.

The role of the investment factor in economic growth is highlighted by econometric models on groups of countries [51,52,53,54], identifying different types of causality between investment and GDP (bidirectional, unidirectional and no causality) according to the countries and periods analyzed [29,34,55]. Using the autoregressive distributed lag (ARDL) test some studies find that there is a unidirectional long-run relationship from investment to economic growth [20], and others find that there is no significant causal relationship between them [56].

Although statistical and AI-based approaches are the main time series prediction techniques, they are not accurate for nonlinear problems. Moreover, these models need a large number of samples and are too complex to be used in predicting future values [57]. In such conditions, grey models are more effective methods for time series prediction [58].

Some authors have used the generalized method of moments (GMM) to estimate the positive interaction between investment and economic growth [25]. The use of neural networks [59] and grey Lotka–Volterra models [1] shows improved forecast accuracy. Analysis of factors influencing GDP through GMM demonstrated the positive influence of investment and trade, showing that exports increase economic fluctuations, while imports decrease them [60].

Grey Lotka–Volterra models were used to test trade relations (import–export) [61].

4.2. Data

The empirical study was performed for the European Union. Four macroeconomic indicators were taken into account: gross domestic product (GDP), Investment, Export and Import expressed in billions of euros. The values of the indicators are taken from the Euro-stat database for two periods 2005–2022 and 2011–2022. The indicators are expressed in billions of euros [62].

The construction of the database was achieved by using SDMX web services, at the level of the Eurostat database, based on the ETL (Extract–Transform–Load) process. The algorithms described by the methodology were implemented in source codes using the scientific software products Wolfram Research Mathematica 9.0 (Wolfram, Champaign, IL, USA) and Maple 18 (Waterloo Maple (Maplesoft), Waterloo, ON, Canada), which were also used for the data processing.

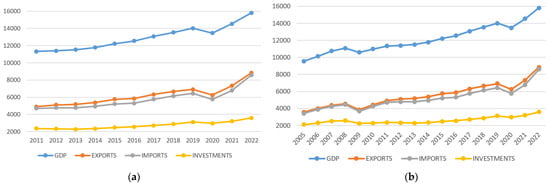

As illustrated in Figure 1, for the analyzed periods, the macroeconomic indicators subjected to the analysis have an increasing tendency. For the period 2011–2022, there is an increase in them with a syncope in 2020 due to the COVID-19 pandemic. The period 2005–2022 is characterized by the presence of two crises, the financial crisis and the COVID crisis, so that we have two moments in which there are decreases in the values of the analyzed macroeconomic indicators (2009 and 2020).

Figure 1.

Evolution of macroeconomic indicators (a) period 2011–2022; (b) the period 2005–2022.

4.3. Methods and Methodology

The estimation of the evolution of the considered indicators is performed using three models.

Firstly, the grey forecasting model is used in order to estimate and forecast short and long-time the individual evolution of each indicator, independently. For each of the four considered economic indicators, the following steps are performed: step (1) start with the initial data ; step (2) generate the accumulation sequence, as in Formula (2); step (3) generate the adjacent mean value sequence by Formula (3); step (4) compute the estimators of the parameters by means of Formula (5); step (5) compute the estimated values , using Formula (8).

In the above algorithm, for the data corresponding to 2011–2022, and for the data corresponding to 2005–2022.

The estimation accuracy is evaluated using the mean absolute percentage error (), given by (9), and the mean squared error (), given by:

The is used to ascertain the performance of the models and to appreciate how close estimates or forecasts are to the actual values. The lower the , the closer the forecast is to the actual values. The can be used as a baseline to see if the model’s accuracy is improving over time or not.

Secondly, the model is used to estimate the competition and cooperation relationship between each of the six different pairs of the considered economic indicator. For each pair of the four considered economic indicators, the following steps are performed: step (1) start with two sequence of data , as in (12); step (2) generate the accumulation sequences , using Formula (13); step (3) generate the adjacent mean value sequences by Formula (14); step (4) compute the estimators of the coefficients , using (16); step (5) compute the estimated values , using Formula (17), with , given by (18).

The algorithm is applied for each pair of indicators, for the two series of data corresponding to 2011–2022, and to 2005–2022, respectively. The relationship between each pair of indicators is established by taking into account the interpretations in Table 2.

Finally, the model is used to estimate the qualitative interactions between the four indicators.

For each of the two periods of time, 2005–2022 and 2012–2022, the following steps are performed: step (1) start with four sequence of data , as in (25); step (2) generate the accumulation sequences , using Formula (26); step (3) generate the adjacent mean value sequences by Formula (27); step (4) compute the estimators of the , parameters in (30) using Formulae (31); step (5) compute the estimated values of the accumulation sequences , using Formula (33), and the estimators ,, given by (35).

The estimation accuracy is evaluated using the mean absolute percentage error for each indicator (), given by (36), and the mean squared error (), while the relationship between each pair of indicators is established by taking into account the interpretations in Table 2, considering and .

The results of the empirical estimations obtained using the three mentioned models, with data corresponding to two time periods are compared. The performance of the model and the results are discussed.

4.4. Empirical Estimations and Results

4.4.1. Estimations Using the Model

The estimated values for EU GDP, Export, Import and Investment based on data collected for the two periods 2005–2022 and 2011–2022, using model are given in Table 3 and Table 4. A forecast for the values of these economic indicators, based on the model, for 2023 is also provided in the last line in Table 3 and Table 4. Note that the model can be used to obtain long-term forecasts of the variables, using the estimation Formula (8).

Table 3.

Estimated values for GDP, Export, Import and Investment EU for 2011–2022, with model; data for 2011–2022, forecasting 2023.

Table 4.

Estimated values for GDP, Export, Import and Investment EU for 2005–2022, with model; data for 2005–2022, forecasting 2023.

The estimated values from Table 3 and Table 4 show that these values are very close to the actual values for both periods.

The forecasting values for 2023 show an increase for all variables. The increase is more moderate for the forecast made for the longer data series (18 years).

4.4.2. Estimations Using , for Pairs of the Indicators

The application of the model for pairs of two indicators, following the algorithm described in Section 4.3, provides the values of the estimating coefficients for the periods 2011–2022 and 2005–2022, given in Table 5 and Table 6, respectively.

Table 5.

Estimated coefficients for pairs of indicators, using the model; data for 2011–2022.

Table 6.

Estimated coefficients for pairs of indicators, using the model; data for 2005–2022.

The analysis of the empirical estimation results of the model in Table 5 and Table 6 shows that the variation in the accumulated GDP sequence is positively influenced by the variation in the other three indicators.

The variation in the accumulated Export is influenced positively by Investment and Import and negatively by GDP.

Exports are negatively influenced by GDP for both periods. The influence of Investment and Import is positive on Export for the 12-year period, and negative for the 18-year period. Import is negatively influenced by GDP and Investment for both analyzed periods, while the influence of Export is negative for the 12 year-period and positive for the 18-year period. The Investments are positively influenced by Import and negatively by Export and GDP for the 12-year period, while for the 18-year period, there are positively influenced by Import and Export and negatively by GDP.

According to the interpretation given in Table 2 to the signs of the coefficients and , the relationships between the accumulated values for pairs of the 6 indicators for the analyzed periods are presented in Table 7.

Table 7.

The type of relationship between indicators, as results of the estimation using the model, data for 2011–2022 and 2005–2022.

Between the pairs GDP—Export, GDP—Import and GDP—Investment it is observed that for both periods there is a Predator–Prey type relationship. Practically these pairs condition each other. GDP growth is based on Investment and trade.

Between the pairs Export—Investment and Export—Import for the 12-year period the relationship is Predator–Prey, which means that Export benefits from the interaction with Investment and Import. For the 18-year period, the relationship is of the Prey–Predator type, which means that for longer periods Export can be affected by Investment and Import.

The relationship between Import—Investment for both periods is Prey–Predator, which means that Investment can benefit from Import.

The interpretation in Table 7 shows a change in the bilateral relations corresponding to the two periods in the case of some of the pairs, as is also highlighted in the paper [11].

4.4.3. Estimations Using the Model

The actual values and the empirical estimations for the four indicators, obtained as results of the application of the model presented in Section 3, for the data from 2011 to 2022, are presented in Table 8, while the estimations corresponding to the data in the 2005–2022 period are given in Table 9. The last line in Table 8 and Table 9 contains the forecasting values for the year 2023.

Table 8.

Data for GDP, Export, Import and Investment EU, and estimated values with model data for 2011–2022, forecasting 2023.

Table 9.

Data for GDP, Export, Import and Investment EU, and estimated values with model; data for 2005–2022, forecasting 2023.

The estimated values for the coefficients , and obtained empirically applying the model (30), are given in Table 10 and Table 11.

Table 10.

Estimated coefficients using the model; data for period 2011–2022.

Table 11.

Estimated coefficients using the model; data for period 2005–2022.

Following the analysis of the sign of the empirically estimated coefficients for the period 2011–2022 in Table 10, it is found that the variation in GDP accumulation is positively influenced by the accumulated value of Export and Investment and negatively by that of Import. For the 18-year period, the variation in GDP accumulation is positively influenced only by the accumulated value of Export and negatively by the accumulated value of Import and Investment.

The variation in Export accumulation for the period 2011–2022 is influenced negatively by the value of GDP and Import accumulation and positively by that of Investment. For the period 2005–2022, it is negatively influenced by the value of the accumulation of the other three indicators: GDP, Import and Investment.

The analysis of the variation in Import accumulation for the 12-year period is positively influenced by the accumulation of Export and Investment and negatively by that of GDP. For the 18-year period, the variation in Import accumulation is positively influenced only by the Export accumulation and negatively by that of GDP and Investment. Regarding the variation in accumulated Investment for both analyzed periods, it is found that it is positively influenced by the accumulation of Export and negatively by that of GDP and Import.

According to the interpretation given in Table 2 to the signs of the coefficients and , applied for pairs of coefficients and , the relationships between the accumulated sequences for pairs of the six indicators for the two analyzed periods are presented in Table 12.

Table 12.

The type of relationship between indicators according to the model.

In establishing the type of relationship between the pairs of indicators by using the model, the impact of the evolution of the other indicators is also taken into account. Thus, analyzing of the types of relationships between indicators with the model for the two periods, the following are found:

- -

- Between the GDP—Export pair, for both periods there is a Predator–Prey relationship, that is, GDP benefits from Export;

- -

- Between GDP—Import there is a competition relationship for both periods. This type of relationship shows that the two indicators coexist, both can lead to economic growth in the conditions where Import are used for economic development (add value to domestic production);

- -

- The pair GDP—Investment exhibits a Predator–Prey relationship for the shorter period, respectively, GDP can benefit from the Investment. For the period of 18 years, it can be observed that there is a Competition-type relationship, thus making them coexist;

- -

- Between the Export—Import pair there are Prey–Predator relationships in both periods. Thus, the Import benefits from the realization of Export, because a greater source of income from Export can be used for the realization of Import;

- -

- The relationship between Export—Investment for the period 2011–2022 is of Mutualism type. This demonstrates the mandatory relationship between the two indicators, as a result of which both indicators are positively affected, not being able to exist separately. For the period 2005–2022, the relationship is of the Prey–Predator type, the respective Investment benefit from Export;

- -

- Between the pair Import—Investment for the period of 12 years there is a Predator–prey relationship, Investment may suffer as a result of the allocation of funds for Import. For the longer period (18 years) the 2 indicators are in a competition relationship, which shows that both indicators need funds for development and the best solution is to coexist.

4.4.4. The Accuracy of the Estimations

To assess the accuracy of the models, and were used. According to Table 13, all values are in the interval [3,8] when using the model (so inferior to 10), thus the ) model shows “High accuracy”.

Table 13.

Values for MAPE and MSE.

The coefficients for the estimations obtained with the model show a “Good accuracy”, from theoretical point of view (as ). Nevertheless, the expected values for the year 2023 predicted by the two simulations are quite different and far from the values predicted by the model. This shows that, for this set of economic indicators, the model is not quite appropriate for forecast. Yet, it offers good indications between the interdependence between indicators.

Regarding the analysis, it can be seen that the values for the 18-year period are lower, for all indicators, except for Investment, which means that the accuracy of the model is improving when larger time-series data are considered.

The and values prove the level of accuracy of the proposed model for establishing the types of relationships between indicators.

4.5. Comparison between the Types of Relationships Identified with GLV(2) vs. GLV(4)

Comparing the type of relationships identified by the model and the model estimations, the following is found.

- -

- A Predator—Prey relationship was identified between GDP and Export, with both models and for both periods. Thus, it is found that Export have a positive impact on economic growth, results also found by other authors [38,39]. Through the model, it is found that the increase in Export accelerates not only economic growth, but also the ability to Import and make Investment, results also found by other studies [34,41,49].

- -

- In what concerns the GDP—Import pair, the model shows a Predator–Prey relationship for both periods, which confirms the influence of Import on economic growth [34]. The estimations obtained using the model lead to a Competition-type relationship, which demonstrates that the evolution of the other indicators influences the relationship between economic growth and Import [34,47].

- -

- For the GDP and Investment pair, a Predator–Prey relationship is identified for the 12-year period by both models. This confirms the important role of Investment in production functions, providing the necessary capital for development [16,20,21,22]. For the period of 18 years, the type of relationship identified with the model is Competition, which proves that in the long term the coexistence between economic growth and Investment is also influenced by the evolution of Import and Export, results confirmed by the results of other works [38,40,43,45]. There is thus a mutually beneficial relationship between GDP and long-term Investment [1].

- -

- The relationship between the Export and Import indicators for the period 2011–2022 using the model is of Predator–Prey type. For the 18-year period, this relationship is of the Prey–Predator type, being identical to the one resulting when applying the ) model for both periods. The existence of this type of relationship shows that for longer periods, Export can be affected by Import, results also found by other studies [62]. At the same time, according to the model, the relationship is also influenced by the evolution of Investment and GDP. Import are important factors for Export, Export can accelerate the realization of Import in the long-term facilitating the realization of Investment and the growth of GDP [34].

- -

- The type of relationship between Export—Investment pair for the analyzed period of 12 years with the model is Predator–Prey, and with the type of relationship is Mutualism, which proves that the other indicators compete for the existence of a positive relationship between Export and Investment. For the period 2005–2022 with both models, a Prey–Predator relationship between the indicators is identified, demonstrating that both the studied period and the other indicators influence the type of relationship, Export being affected by the evolution of Investment. Thus, Investment have an important impact on Export potential, results confirmed by other authors [17,23].

- -

- Regarding the type of relationship between Import—Investment, there are major differences between the results of the two models. If, following the model, the relationship is of the Prey–Predator type for both periods, applying the model, the results are different. For the period 2011–2022 there is a relationship of type Predator–Prey, while for 2005–2022 the relationship is of type Competition. It is found, as in other studies, that in the long term the coexistence between Import and Investment is also influenced by the evolution of Export and economic growth [49].

The results of empirical estimations obtained using the model confirm the results of other research studies. According to the study presented in this paper, there is a non-linear relationship between financial development and economic growth. The findings are in accordance with the research provided by [21,25,28,29,30,32,54] who indicated that Investment has a positive and direct impact on economic growth, and greater openness to international trade can significantly influence economic growth. At the same time, Investment and Export lead to economic growth, which is in agreement with other researches [18,38,42]. Import have a significant effect on economic growth [48] and GDP growth stimulates Export growth [47].

The results show that, compared to other models, the generalized model can describe more accurately the type of nonlinear relationships at the level of macroeconomic indicators, thus improving the prediction accuracy of real data series. At the same time, due to the good interpretability of the model, the relationship between the indicators can be analyzed from a qualitative point of view.

5. Conclusions

The relevance of the study consists in the fact that it adds value to existing research by achieving two main objectives.

Firstly, a generalization of the model was realized, by applying the grey method to a -dimensional quadratic Lotka–Volterra system. The generalized grey Lotka–Volterra model can be applied for an arbitrary number of variables in any field.

Secondly, the accuracy and applicability of the model was tested in a particular case, using four economic indicators. In this study, the reliability of the model was tested by identifying the significance of the relationships between four macroeconomic indicators, namely, GDP, import, export and investment.

The model and, more generally, the model provide a new methodological research paradigm for identifying the relationship between economic indicators.

This research presents a number of practical and theoretical implications that may be relevant.

5.1. Theoretical Implications

Various research studies have shown that grey Lotka–Volterra models are effective and suitable for handling difficult problems, possessing the ability to adapt to uncertainty and insufficient information needed for decision making. Starting from the fact that in the real world several variables interact, in this study a generalization of the two-dimensional grey Lotka Volterra model was performed.

The new derived model was tested on a system of four macroeconomic indicators. This research used the proposed multidimensional grey Lotka–Volterra model, designed to analyze the effect of long-term competition and cooperation between the four considered indicators. The choice was motivated by the fact that in recent years the economic development process has been marked by uncertainty (the COVID-19 pandemic, the Russian–Ukrainian war) more than ever, which makes the accuracy of establishing the relationships between the indicators critical.

The study has a series of theoretical implications arising from the identification of the relationship between the four macroeconomic indicators at the EU level, based on the generalized grey Lotka–Volterra model applied in this particular case.

Much of the specialized literature was oriented towards identifying the relationship between GDP and investment or GDP and international trade, or GDP and export and investment, but they did not study the relationship between the four macroeconomic indicators. At the same time, research has focused on determining the role of investments or international trade on GDP using statistical methods or neural networks in most cases.

The current research contributes to the specialized literature by identifying cooperative or competitive relationships between the studied indicators. Previous studies have only highlighted the existence of some relationships between some of the indicators and the role they play in economic development.

This research adds value to existing research by approaching the (4), which identifies the meaning of the relationship between indicators, this being a novelty in the specialized literature. This study has the potential to change the perspectives of EU countries regarding GDP, Import, Export and Investment at the national and international level, and can be a valuable guide for researchers.

5.2. Practical Implications

We believe that the study has a series of practical implications that can be relevant considering that the analyzed indicators are of significant importance for the European Union to achieve a significant development that ensures a better future for community members.

The practical implications of the empirical research at the EU level confirmed that over different periods of time GDP, Investment, Import and Export can have different, positive or negative influences on each other. Thus, the results of the study can be used for other research, having an important role in establishing economic policy strategies at the national and implicitly European level to stimulate economic growth.

The 2019 coronavirus pandemic has caused declines in the values of the analyzed macroeconomic indicators, so the accuracy of forecasts and relationships between indicators based on existing data may not be the most reliable. In this sense, the accuracy of the identification of the types of relationships made on the basis of is noteworthy. Due to the good interpretability of the model, the relationship between different types of economic indicators can be analyzed qualitatively.

The experimental results of analyzing GDP, Import, Export and Investment show that the accuracy of the model is high and the results are reasonable. The type of relationships established between indicators with this model shows their interdependence.

The results of this study could play an essential role in establishing economic policy strategies at the European level to stimulate economic growth and to implement stimulus programs at the level of the economic development of all member states.

In order for the EU and its member countries to establish optimal development plans, a clear understanding of the relationship between economic indicators and their development trend is essential. In this sense, the results of the analysis made with the model could guide government decision making.

The findings from this study have the potential to indirectly affect the economic performance of the European Union and implicitly the member states and to increase the perspective of decision makers related to investments and trade. Identifying relationships between the studied variables can guide decision makers in planning strategic actions. Thus, based on the type of relationships (Predator–Prey, Prey–Predator, Competition or Mutualism) identified between the economic indicators, a series of political implications for international trade and investments can be determined. In this sense, at the level of the European Union, the importance of exports in its sustainable economic growth must still be taken into account. The political factors at the level of the member states of the European Union should continuously exploit the implications of the export expansion strategy in the other states on the other continents for the perspectives of economic development. Trade remains an engine of economic growth, and domestic demand and consumption effectively drive economic prosperity. In the face of potentially negative shocks or economic threats (the COVID-19 pandemic, the Russian–Ukrainian war), state governments must focus on both domestic and international circulation. This research also highlights the importance of developing investor-friendly policies to attract investors to the country. Therefore, this research indirectly encourages decisions that can make countries more competitive and productive.

5.3. Limitations and Further Developments

The limitation of this study is that the research sample is limited to the European Union, and the situation of the member countries can show significant differences with each other and with the states of other continents. At the same time, only four were considered macroeconomic indicators in the generalized grey Lotka–Volterra model.

Consequently, in the future we aim to apply the multidimensional model to a larger sample of countries. Moreover, this research model can be enriched by adding other variables. We encourage other researchers to conduct research by considering multiple quantitative indicators related to the state of the economy.

Author Contributions

Conceptualization, C.R., G.S. and M.S.; methodology, C.R. and M.S.; software, A.M., C.R. and M.S.; validation, G.S., A.M. and M.S.; formal analysis, C.R. and M.S.; investigation, A.M. and G.S.; resources, A.M. and G.S.; data curation, A.M. and G.S.; writing—original draft preparation, C.R., G.S. and M.S.; writing—review and editing, A.M. and M.S.; visualization, A.M.; supervision, G.S. and M.S.; project administration, G.S. and C.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data are available online: https://ec.europa.eu/eurostat/databrowser/view/NAMA_10_GDP__custom_6265327/default/table (accessed on 12 May 2023).

Acknowledgments

C.R. and M.S. are partially supported in this research by Horizon2020-2017-RISE-777911 project.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Wu, L.F.; Liu, S.F. Using grey Lotka-Volterra model to analyze the relationship between the gross domestic products and the foreign direct investment of Ningbo city. In Proceedings of the 2013 IEEE International Conference on Grey Systems and Intelligent Services (GSIS), Macau, China, 15–17 November 2023; Liu, S., Ed.; pp. 265–268. [Google Scholar]

- Zhou, W.; He, J.M. Generalized GM (1,1) model and its application in forecasting of fuel production. Appl. Math. Model. 2013, 37, 6234–6243. [Google Scholar] [CrossRef]

- Javed, S.A.; Liu, S. Predicting the research output/growth of selected countries: Application of even GM (1, 1) and ndgm models. Scientometrics 2018, 115, 395–413. [Google Scholar] [CrossRef]

- Zeng, B.; Tan, Y.; Xu, H.; Quan, J.; Wang, L.; Zhou, X. Forecasting the electricity consumption of commercial sector in Hong Kong using a novel grey dynamic prediction model. J. Grey Syst. 2018, 30, 159–174. [Google Scholar]

- Ene, S.; Ozturk, N. Grey modelling based forecasting system for return flow of end-of-life vehicles. Technol. Forecast. Soc. Chang. 2018, 117, 155–166. [Google Scholar] [CrossRef]

- Liu, S.F.; Lin, Y. An Introduction to Grey Systems; IIGS Academic Publisher: Slippery Rock, PA, USA, 1998. [Google Scholar]

- Liu, S.F.; Yang, Y.J.; Forrest, J. Grey Data Analysis Methods, Models and Applications; Springer: Berlin, Germany, 2016. [Google Scholar]

- Zeng, B.; Ma, X.; Shi, J. Modeling Method of the Grey GM(1,1) Model with Interval Grey Action Quantity and Its Application. Complexity 2020, 2020, 6514236. [Google Scholar] [CrossRef]

- Deng, J.L. Control problems of grey systems. Syst. Control Lett. 1982, 1, 288–294. [Google Scholar]

- Leslie, P.H. A stochastic model for studying the properties of certain biological systems by numerical methods. Biometrika 1957, 45, 16–31. [Google Scholar] [CrossRef]

- Wu, L.; Liu, S.; Wang, Y. Grey Lotka–Volterra model and its application. Technol. Forecast. Soc. Chang. 2012, 79, 1720–1730. [Google Scholar] [CrossRef]

- Marasco, A.; Picucci, A.; Romano, A. Market share dynamics using Lotka-Volterra models. Technol. Forecast. Soc. Chang. 2016, 105, 49–62. [Google Scholar] [CrossRef]

- Gatabazi, P.; Mba, J.C.; Pindza, E.; Labuschagne, C. Grey Lotka–Volterra models with application to cryptocurrencies adoption. Chaos Solitons Fractals 2019, 122, 47–57. [Google Scholar] [CrossRef]

- Uca, N.; Civelek, M.E.; Cemberci, M. Yolsuzluk Algisinin Gayrisafi Yurt Ici Hasila Uzerine Etkisinde Lojistik Performans ile Kuresel Rekabetin Ara Degis ken Rolu: Turkiye Degerlendirmesi. OPUS Int. J. Soc. Res. 2019, 10, 1229–1261. [Google Scholar]

- Yucel, M.F.; Keskin, H.; Cemberci, M. Dogrudan Yabanci Yatirimlarin GSYIH Uzerindeki Etkisinde Girisimciligin ve Yenilikciligin Rolu. In Proceedings of the Uluslararası Marmara Fen ve Sosyal BilimlerKongresi, Kocaeli, Turkey, 26–28 April 2019; Volume 1, pp. 690–697. Available online: https://avesis.yildiz.edu.tr/yayin/2568fe11-a346-400c-8fd2-eb1e672d8d9f/dogrudan-yabanci-yatirimlarin-gsyih-uzerindeki-etkisindegirisimciligin-ve-yenilikciligin-rolu (accessed on 12 May 2023).

- Ari, I.; Koc, M. Economic Growth, Public and Private Investment: A Comparative Study of China and the United States. Sustainability 2020, 12, 2243. [Google Scholar] [CrossRef]

- Hlavacek, P.; Bal-Domanska, B. Impact of Foreign Direct Investment on Economic Growth in Central and Eastern European Countries. Inz. Ekon. 2016, 27, 294–303. [Google Scholar] [CrossRef]

- Sargsyan, L.N. Export, Foreign Direct Investment and Gross Domestic Product: Case of the Commonwealth of Independent States Countries and Armenia. Regionology 2019, 2, 206–223. [Google Scholar] [CrossRef]

- Sothan, S. Causality between foreign direct investment and economic growth for Cambodia. Cogent Econ. Financ. 2017, 5, 1277860. [Google Scholar] [CrossRef]

- Kalai, M.; Zghidi, N. Foreign direct investment, trade, and economic growth in MENA countries: Empirical analysis using ARDL bounds testing approach. J. Knowl. Econ. 2019, 10, 397–421. [Google Scholar] [CrossRef]

- Zeng, S.; Zhou, Y. Foreign direct investment’s impact on China’s economic growth, technological innovation and pollution. Int. J. Environ. Res. Public Health 2021, 18, 2839. [Google Scholar] [CrossRef] [PubMed]

- Sinha, M.; Chaudhury, A.R.; Sengupta, P.P. An empirical analysis on FDI and ICT in India. In Smart Intelligent Computing and Applications; Satapathy, S., Bhateja, V., Mohanty, J., Udgata, S., Eds.; Springer: Singapore, 2020; pp. 93–102. [Google Scholar]

- Pelinescu, E.; Radulescu, M. The impact of foreign direct investment on the economic growth and countries’ export potential. Rom. J. Econ. Forecast. 2009, 4, 153–169. Available online: http://www.ipe.ro/rjef/rjef4_09/rjef4_09_9.pdf (accessed on 12 May 2023).

- Zekarias, S.M. The Impact of Foreign Direct Investment (FDI) on Economic Growth in Eastern Africa: Evidence from Panel Data Analysis. Appl. Econ. Financ. 2016, 3, 145–160. Available online: http://redfame.com/journal/index.php/aef/article/view/1317/1330 (accessed on 12 May 2023). [CrossRef]

- Hong, L. Does and how does FDI promote the economic growth? Evidence from dynamic panel data of prefecture city in China. IERI Procedia 2014, 6, 57–62. [Google Scholar] [CrossRef]

- Jiang, H.; Liang, Y.; Pan, S. Foreign direct investment and regional innovation: Evidence from China. World Econ. 2021, 45, 1876–1909. [Google Scholar] [CrossRef]

- Pegkas, P. The impact of FDI on economic growth in Eurozone countries. J. Econ. Asymmetries 2015, 12, 124–132. [Google Scholar] [CrossRef]

- Yue, S.; Yang, Y.; Hu, Y. Does foreign direct investment affect green growth? Evidence from China’s experience. Sustainability 2016, 8, 158. [Google Scholar] [CrossRef]

- Peng, H.; Tan, X.; Li, Y.; Hu, L. Economic growth, foreign direct investment and CO2 emissions in China: A panel granger causality analysis. Sustainability 2016, 8, 233. [Google Scholar] [CrossRef]

- Gutiérrez-Portilla, P.; Maza, A.; Villaverde, J. A spatial approach to the FDI-growth nexus in Spain: Dealing with the headquaters effect. Int. Bus. Rev. 2019, 28, 101597. [Google Scholar] [CrossRef]

- Doğan, B.; Balsalobre-Lorente, D.; Nasir, M.A. European commitment to COP21 and the role of energy consumption, FDI, trade and economic complexity in sustaining economic growth. J. Environ. Manag. 2020, 273, 111146. [Google Scholar] [CrossRef]

- Omri, A.; Kahouli, B. Causal relationships between energy consumption, foreign direct investment and economic growth: Fresh evidence from dynamic simultaneous-equations models. Energy Policy 2014, 67, 913–922. [Google Scholar] [CrossRef]

- Kuo, K.H.; Lee, C.T.; Chen, F. Free Trade and Economic Growth. Aust. Econ. Pap. 2014, 53, 69–76. [Google Scholar] [CrossRef]

- Ji, X.; Dong, F.; Zheng, C.; Bu, N. The Influences of International Trade on Sustainable Economic Growth: An Economic Policy Perspective. Sustainability 2022, 14, 2781. [Google Scholar] [CrossRef]

- European Commission. Import into the EU. Rules and Procedures on Importing Products into the EU, Tariff Information, Information on Customs Duties, and Requirements for Live Animal and Fish Imports. Available online: https://commission.europa.eu/business-economy-euro/trade-non-eu-countries/import-eu_en (accessed on 12 May 2023).

- Ee, C.Y. Export-Led Growth Hypothesis: Empirical Evidence from Selected Sub-Saharan African Countries. Procedia Econ. Financ. 2016, 35, 232–240. [Google Scholar] [CrossRef]

- Frankel, J.A.; Romer, D.H. Does Trade Cause Growth? Am. Econ. Rev. 1999, 89, 379–399. [Google Scholar] [CrossRef]

- Marantika, A.; Hasan, S.; Fasa, M.I.; Faizah, I. The Nexus Between Foreign Direct Investment And Export Toward Economic Growth of Indonesia, China, and India. Int. J. Future Gener. Commun. Netw. 2020, 13, 2398–2406. Available online: https://www.researchgate.net/publication/343696761 (accessed on 12 May 2023).

- Dilek, T.D.; Aytaç, D. Export-led economic growth and the case of Brazil: An empirical research. J. Transnatl. Manag. 2019, 24, 122–141. [Google Scholar] [CrossRef]

- Mohamed, M.M.A.; Liu, P.; Nie, G. Are Technological Innovation and Foreign Direct Investment a Way to Boost Economic Growth? An Egyptian Case Study Using the Autoregressive Distributed Lag (ARDL) Model. Sustainability 2021, 13, 3265. [Google Scholar] [CrossRef]

- Bilas, V.; Franc, S.; Coric, M.S. The Relationship Between Foreign Direct Investments, Exports And Economic Growth. Zb. Veleuc. Rijeci-J. Polytech. Rij. 2022, 10, 147–164. [Google Scholar] [CrossRef]

- Yayachandran, G.; Seilan, A.A. Causal Relationship between Trade, Foreign Direct Investment and Economic Growth for India. Int. Res. J. Financ. Econ. 2010, 42, 74–88. Available online: https://www.researchgate.net/publication/265401945_A_Causal_Relationship_between_Trade_Foreign_Direct_Investment_and_Economic_Growth_for_India (accessed on 12 May 2023).

- Cora, A.N.D.; Wen, L.C. The relationship between foreign direct investment, export and GDP growth in Indonesia. Palarch’s J. Archaeol. Egypt/Egyptol. 2020, 17, 2679–2691. Available online: https://archives.palarch.nl/index.php/jae/article/view/1581/1590 (accessed on 12 May 2023).

- Hsiao, F.S.T.; Hsiao, M.W. FDI, exports, and GDP in East and Southeast Asia—Panel data versus time-series causality analyses. J. Asian Econ. 2006, 17, 1082–1106. [Google Scholar] [CrossRef]

- Aba, F.X.L. Institutional Change and Macroeconomic Variables in the ASEAN—Indonesia, Vietnam, and Cambodia: The Effects of a Trade War between China and USA. Economies 2021, 9, 195. [Google Scholar] [CrossRef]

- Malesky, E.; McCulloch, N.; Nhat, N.D. The impact of governance and transparency on firm investment in Vietnam. Econ. Transit. 2015, 23, 677–715. [Google Scholar] [CrossRef]

- Awokuse, T.O. Trade openness and economic growth: Is growth export-led or import-led? Appl. Econ. 2008, 40, 161–173. [Google Scholar] [CrossRef]

- Thangavelu, S.M.; Rajaguru, G. Is there an export or import-led productivity growth in rapidly developing Asian countries? A multivariate VAR analysis. Appl. Econ. 2004, 36, 1083–1093. [Google Scholar] [CrossRef]

- Pikhart, Z.; Pikhartova, S. Import intensities of final demand components and their implications for economic openness: The case of the Czech Republic. Acta Oeconomica 2023, 73, 145–170. [Google Scholar] [CrossRef]

- Makki, S.S.; Somwaru, A. Impact of Foreign Direct Investment and Trade on Economic Growth. Am. J. Agric. Econ. 2004, 86, 795–801. [Google Scholar] [CrossRef]

- Humbatova, S.I.Q.; Hajiyev, N.Q.O. The Research of Investment Factor in Economic Growth. In Proceedings of the 37th International Scientific Conference on Economic and Social Development—Socio Economic Problems of Sustainable Development (ESD 2019), Baku, Azerbaijan, 14–15 February 2019; Ibrahimov, M., Aleksic, A., Dukic, D., Eds.; pp. 1322–1329. [Google Scholar]

- Ahmed, E.M. Are the FDI inflow spillover effects on Malaysia’s economic growth input driven? Econ. Model. 2012, 29, 1498–1504. [Google Scholar] [CrossRef]

- Comes, C.A.; Bunduchi, E.; Vasile, V.; Stefan, D. The impact of foreign direct investments and remittances on economic growth: A case study in Central and Eastern Europe. Sustainability 2018, 10, 238. [Google Scholar] [CrossRef]

- Lee, J.W. The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 2013, 55, 483–489. [Google Scholar] [CrossRef]

- Habibi, F.; Karimi, M.S. Foreign direct investment and economic growth: Evidence from Iran and GCC. Iran. Econ. Rev. 2017, 21, 601–620. [Google Scholar] [CrossRef]

- Belloumi, M. The relationship between trade, FDI and economic growth in Tunisia: An application of the autoregressive distributed lag model. Econ. Syst. 2014, 38, 269–287. [Google Scholar] [CrossRef]

- Amigo, J.M.; Hirata, Y.; Aihara, K. On the limits of probabilistic forecasting in nonlinear time series analysis II: Differential entropy. Chaos 2017, 27, 083125. [Google Scholar] [CrossRef]

- Huang, J.C. Application of grey system theory in telecare. Comput. Biol. Med. 2011, 41, 302–306. [Google Scholar] [CrossRef] [PubMed]

- Saman, C. Scenarios of the romanian GDP evolution with neural models. Rom. J. Econ. Forecast. 2011, 14, 129–140. Available online: http://www.ipe.ro/rjef/rjef4_11/rjef4_2011p129-140.pdf (accessed on 12 May 2023).

- Nguyen, C.; Frederick, H.; Nguyen, H. Female entrepreneurship in rural Vietnam: An exploratory study. Int. J. Gend. Entrep. 2014, 6, 50–67. [Google Scholar] [CrossRef]

- Wang, Z.X.; Zhu, H.T. Testing the trade relationships between China, Singapore, Malaysia and Thailand using grey Lotka-Volterra competition model. Kybernetes 2016, 45, 931–945. [Google Scholar] [CrossRef]

- Eurostat Database. Available online: https://ec.europa.eu/eurostat/databrowser/view/NAMA_10_GDP__custom_6265327/default/table (accessed on 12 May 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).