Abstract

As it is predicted that there will be a decrease in production at the oil and gas facilities that are currently operating, it becomes necessary to start developing new oil and gas fields. This results in changes to the state’s policy regarding the participation of private companies in the development and implementation of oil and gas offshore exploration and production new projects. Access to unique fields can be provided to the most socially responsible companies. The purpose of this study is to present the author’s methodology for assessing the dynamics of corporate sustainability. The methodology is based on the assessment of individual, well-founded indicators of sustainable development of companies. The proposed methodology takes into account factors in areas such as occupational health and safety, environmental protection and economic efficiency and identifies two performance indicators. The first indicator is an aggregated index for three groups of factors to assess company ratings relative to the performance of the best company. The second indicator is an assessment of the dynamics within the company relative to the previous values of indicators of corporate social responsibility. The research results obtained using the proposed methodology show that oil and gas companies differ significantly in terms of corporate sustainability. The developed methodology for assessing corporate sustainability is of practical importance and can be used by companies in the analysis and planning of operating and investment activities that ensure the achievement of goals of corporate social responsibility.

1. Introduction

At present, corporate social responsibility (CSR), a sustainable development (SD) assessment, is a rather difficult procedure for a number of reasons. Theoretical and methodological approaches to measuring corporate indicators for assessing sustainability (CS) and CSR are being actively developed, but this is happening in a somewhat haphazard way. There are several reasons for this. First, SD is predominately studied at the global and national levels, with CS concepts being hardly developed. Second, the relationship between CS and CSR has not been studied thoroughly enough. Third, there is a variety of CS assessment indicators, which is a result of various concepts underlying research methodologies and the fact that there is no single definition of CS. It follows that the methodology for assessing SD effectiveness requires further research and development (Ponomarenko et al. 2020; Szewrański and Kazak 2020).

Corporate sustainability assessment methods differ in the number and composition of indicators, the degree of aggregation, the method of calculating the resulting value, weighting factors and assessing the degree of the company’s progress in corporate sustainability. Official methods are universal and can be applied to all companies regardless of their specifics. However, some researchers have proposed methods that take into account the specifics of the industry but they are hardly used in practice and have not been officially recognized. The peculiarity of corporate sustainability assessment methods lies in the fact that the algorithm is usually unknown for selecting the criteria, weighting factors and calculation rules and the reliability of the procedure should be verified by disclosing information on the approach to collecting and verifying information relevant for research.

The purpose of this study is to develop a methodology for assessing corporate sustainability and changes in the field of sustainable development and benchmark oil and gas companies using social and environmental indicators in order to reveal potential participants in the joint development of oil and gas fields.

The article provides an analysis and systematization of corporate sustainability assessment methods aimed at identifying the limitations and possibilities of using the methodology for assessing the level of CSR in oil and gas companies. A new methodology is proposed for assessing corporate sustainability in order to analyze the level of and changes in corporate sustainability taking into account target indicators. The results are given and conclusions are made on testing the methodology using a case study of oil and gas companies. The article discusses the limitations of the methodology for assessing the level of CSR and reflects on how it can be developed in the future.

The structure of the article includes:

Section 1 (“Corporate sustainability: definition and assessment methods”), which discusses some interpretations of corporate sustainability in comparison with corporate social responsibility and sustainable development, as well as characteristics of the most popular methods for assessing corporate sustainability.

Section 2 (“Materials and Methods”), which presents the details of the methodology that was developed by the authors, including the set of methods for assessing, the selection of indicators and the development of integral indicators for assessing corporate sustainability. The technique, which was chosen as the main one for the further development of the author’s technique, is analyzed. The choice of mining companies as a base for testing the method is substantiated.

Section 3 (“Results”), which contains the details of the methodology that was developed by the authors, including the selection of indicators and the development of integral indicators for assessing corporate sustainability at present and over time; analytical and graphical results of assessing corporate sustainability in six Russian oil and gas companies.

Section 4 (“Discussion”) includes a study of the place that the proposed methodology takes in the classification of methods for assessing corporate sustainability based on various criteria and identifies the limitations of the methodology.

Section 5 (“Conclusion”) contains the key findings of the study.

1.1. Definitions of Corporate Sustainability, Corporate Social Responsibility and Sustainable Development

Despite a geometric growth of works on this issue, there has not been a common definition of CS for 30 years of the concept development. Many researchers confuse the concepts of corporate social responsibility (CSR) and corporate sustainability (CS), while others replace corporate sustainability by environmental sustainability; thus, corporate sustainability is the most uncertain among the related categories. It results from the logical course of the concept development: from environmental and social sustainability to CS based on a threefold approach. The weakest theoretical points of CS are non-formalized relations between various CS spheres and an unaccounted-for long-term nature of CS. In the existing systems of indicators, the proportion of each sphere has no rational backing and a long-term nature of CS is practically not counted. Apart from that, the fact that oil and gas companies use public-owned valuable mineral resources and have a special environmental impact (soil, air, water, biodiversity) complicates creation of a valid system of indicators.

Theoretical and methodological approaches to measuring corporate indicators used in CS assessment are being actively developed but they do not form a system. This is due to a number of circumstances. First, in various studies on the issue, the relationship between CS and CSR has not been analyzed thoroughly enough. Second, there is a variety of CS assessment indicators, which results from the fact that there is no universally accepted definition of CS and the concept itself is analyzed from different points of view.

Over the past three decades, a lot of attention has been paid by academic circles to different CS aspects.

Development of the stakeholder approach, according to the theory of E. Freeman (Freeman 1984), is based on an expanding interest range of stakeholders and their obligations to the society (Smol et al. 2020; Tulaeva et al. 2019; Novikova 2020).

An institutional approach to CSR, development of the concepts of corporate citizenship, corporate susceptibility and corporate activity as a result of expanding spheres of influence and functions of large businesses (Montiel and Delgado-Ceballos 2014; Freeman 1984).

From 1987 (Brundtland reports) until the middle of 1990 the research of CS was aimed at identifying and formulating signs of CS; later (until mid-2000) strategic management research was focused on finding tools and strategies of CS and maximizing the level of CS. Then, the concept of CS became comprehensive and combined all three spheres. The theoretical background of CS includes: a stakeholder and institutional theory, a resource-oriented concept, a new theory of “sustaincentrism”. A stakeholder theory explains CS drivers by satisfied respective interests of stakeholders; an institutional theory explains evolution and diffusion of institutions into various areas of CS; a resource approach identifies what resources a company needs for an effective CS strategy; while the new CS theory formulates a detailed definition of CS and focuses on a shift from anthropocentric to a “sustainable centric” approach (Drucker 1984; Berman et al. 1999; Margolis and Walsh 2003; Johnson 2003; Halme and Laurila 2009; Blagov 2011; Nedosekin et al. 2019).

In this article, we treat corporate sustainability as a successful establishment of a company in three traditional spheres of sustainable development (economic, social and environmental), taking into account long-term relations of these spheres and a comprehensive concept of CS. When determining CS of a mining company, we should take into account whether the corporate economic quantitative and qualitative profile complies with environmental and social requirements, how the company responses to relevant challenges in the long term. Thus, the idea of socially responsible business is becoming mandatory in modern conditions.

A review of literature on the issue of sustainable development at the micro level (corporate sustainability) shows that there has been a significant interest in this issue for decades, which led to the emergence and development of various ideas and views. At the same time, the variety of studies in this area stems from the fact that there is no universally accepted definition of the basic concept of sustainable development at the micro level (i.e., corporate sustainability), with this term being used along with similar ones, such as corporate social responsibility, sustainable development and others.

By systemizing the approaches to defining the concept of corporate sustainability presented in current foreign literature on the topic (Endovickij et al. 2017), the following types were identified:

(1) corporate sustainability in relation to and in connection with corporate social responsibility (CSR):

- corporate sustainability in the sense that is synonymous with CSR;

- corporate sustainability in the sense that is not synonymous with CSR;

- CSR as a factor ensuring corporate sustainability;

(2) a monofocal definition of corporate sustainability:

- corporate sustainability is the observance of moral standards;

- corporate sustainability is a strategy implemented by executives;

(3) umbrella approaches to defining corporate sustainability:

- corporate sustainability is determined by many indicators and characteristics of a company (economic growth, product quality, business reputation, organizational structure, stakeholder relationships, environmental protection and others) simultaneously;

- the triune concept of corporate sustainability (based on TBL);

- corporate sustainability as a driver of economic results;

- corporate sustainability as a consequence of achieving particular results that are measured using instruments developed by organizations (for example, the Dow Jones Sustainability Index, the Shanghai Stock Exchange Sustainable Development Industry Index).

A closer look at these interpretations shows that there is some confusion between corporate sustainability and CSR, but attempts are made to identify the specific features of corporate sustainability; the emphasis is placed on the activity (both strategic and operational) aimed at achieving sustainability, its long-term nature and the creation of different values at the company level. The most important task is to identify the range of issues discussed within the framework of corporate sustainability, relationships between them and their significance. Two approaches can be distinguished here.

Proponents of the first approach understand by corporate sustainability the company’s economic sustainability which manifests itself in its long-term economic performance (Epstein and Roy 2003), sustaining its competitive advantages, profitability, a high market capitalization, highly priced stocks and successful risk management. This approach generally corresponds with strategic management but even though it is long-term oriented, its focus is on economic performance. It is known that today’s strategic and operational management takes into account the combination of goals and tools for achieving them in the economic, environmental and social spheres (Klimova et al. 2018). In the approach discussed above, environmental and social factors become boundaries and they are not equal to economic factors in terms of their importance. At the same time, quantitative research proves that there is a relationship between companies’ performance indicators and the implementation of corporate sustainability practices (see, for example, (Ivashkovskaya 2009) I.V. Ivashkovskaya puts emphasis on the influence of environmental and social factors on the value of a company).

In the second approach, corporate sustainability is understood as a holistic view of the company in the context of achieving economic, environmental and social goals. This raises the issue of developing a balanced assessment system covering different types of the company’s activities, including those in the economic, social and environmental spheres, giving an overall assessment and solving all management problems in the context of corporate sustainability at both the strategic and operational levels.

Analysis of scientific publications and official materials (GOST R ISO 9004 2010; GOST R ISO 20121 2014; GOST R 54598.1 2015) of organizations engaged in methodological guidance of SD showed that all methods differ in the number and set of assessment indicators, degree of their aggregation, methods for value calculation, proportion of indicators and assessment of corporate progress degree in CS. Official methods have a universal nature and can be applied to all companies without regard to their type of business. At the same time, methods of individual researchers have little practical application and are not officially recognized, although many of them are industry-specific and, therefore, show a certain progress in the scientific understanding of CS. What is distinct about CS assessing methods is that the algorithm for selecting the criteria, proportions of indicators and rules of calculations is unknown, so consistency and reliability of assessing procedures must be confirmed by explaining the approach to collection of reasonable information and a verification system.

Analysis of CSR and CS assessment methods showed that according to the target orientation and selection of key indicators or the main indicator (index), they can be divided into the following groups: (1) methods focused on collection of environmental information; (2) methods focused on assessment of social welfare, calculation of social indicators and indicators of social efficiency; (3) methods based on a comprehensive assessment of CSR; (4) methods of assessing corporate sustainability with a comprehensive assessment of corporate activities in environmental, social and economic areas (Table 1).

Table 1.

The development of CSR concepts. Source: compiled by the authors. (Ponomarenko et al. 2020; Szewrański and Kazak 2020; Smol et al. 2020; Tulaeva et al. 2019; Novikova 2020; Montiel and Delgado-Ceballos 2014; Freeman 1984; Drucker 1984; Berman et al. 1999; Margolis and Walsh 2003; Johnson 2003; Halme and Laurila 2009; Blagov 2011; Nedosekin et al. 2019; Endovickij et al. 2017; Epstein and Roy 2003; Klimova et al. 2018; Ivashkovskaya 2009).

The methodology proposed by the authors for assessing corporate sustainability in mining companies was developed taking into account the essence, principles and methods of stakeholder theory, corporate social performance and corporate citizenship. The principles of stakeholder theory that was used includes resource mobilization, creating competitive advantages and creating stakeholders’ well-being. According to the principles of corporate social performance, three aspects of interaction are assessed—economic, environmental and social—along with “inputs” (resource consumption) and “outputs” (impact). The concept of corporate citizenship takes into account the link between the regional and national levels of sustainable development, which was reflected in the choice of indicators that can be aggregated starting from the corporate level.

1.2. Methods Focused on Collection of Environmental Information and Calculation of Environmental Indicators

Such methods exist due to the fact that for several decades the environmental approach to SD assessment had dominated, with its close relations to the stakeholder theory, popular and clear definition of many environmental indicators. However, such methods are only aimed at the environmental side of activities of the companies (Larsena et al. 2018). An example of this is Carbon Disclosure Project (CDP) (CDP 2015), an independent non-profit organization that maintains the world’s largest climate change database. CDP is the author of disclosure guidelines, as well as several environmental ratings (Carbon Disclosure Leaders Index—CDLI and Carbon Performance Leaders Index—CPLI). The world’s largest companies measure and publish climate change and gas emission data using a CDP survey-based method in order to set emission-reducing goals as part of their CS strategies. International principles for assessing social consequences and results (IAIA, International Association for Impact Assessment).

Of course, the issue of greenhouse gas emissions is one of the key environmental problems, it is very grave for companies in the mineral, oil and gas industry and allows us to assess the company’s contribution to reduction of hydrocarbon emissions at a global level; however, this method does not allow consideration of the SD of companies in social and economic aspects.

1.3. Methods Focused on Assessment of Social Welfare, Calculation of Social Indicators and Indicators of Social Efficiency

Such methods are focused solely on social results that can be assessed by such parameters as demography, health and income, poverty level, educational level, migration, etc. “A high aggregation of social parameters makes them universal and allows adapting them to a particular country, collecting and summarizing a large array of statistical information” (Kanaeva 2018). One of the challenges for using such methods is a constant complication of social indicators (index). For example, introduction of such indicators as “degree of vulnerability”, “social insecurity”, “level of material and social inequality” and “level of public resilience to weather and climate anomalies” require a new justification of criteria, methods for their calculation and possible modification. Apart from that, existing systems of social indicators used at the global level sometimes cannot objectively assess social results at national levels, since they do not take into account geographical and climatic features of the countries and related national, traditional and cultural characteristics of natural resources consumption, need for social benefits, etc.

Methods focused on assessment of public welfare, calculation of social indicators and indicators of social efficiency include (Prokopov and Feoktistova 2008):

- Social Impact Assessment (SIA), which is a method for considering social impacts and a way to assess the impact of certain projects on society (roads, industrial facilities, mines, dams, ports, airports and others);

- Among methods for assessing social effectiveness, based mainly on a qualitative data analysis, it is worth noting SRA (Social Return Assessment);

- The LBG model allows assessing the value and achievements of corporate investment into the community, as well as properly report to stakeholders. This model presents a matrix, which can be used to summarize and obtain quantitative information on the results of work with local communities. Dividing corporate activity into elements, the matrix offers a detailed study of various types of resource inputs, determines immediate or intermediate results/products (outputs) and, ultimately, presents the nature and degree of environment impacts (LBG Model 2017).

1.4. Methods Based on a Comprehensive Assessment of CSR

- The SROI (Social Return on Investment) is based on the SCBA method and allows calculation of social efficiency of investments (social return on investment) (Emerson et al. 2000; Lingane and Olsen 2004). Social results are determined given the interests of stakeholders and are assessed by using subjective and objective indicators that most fully reflect the results obtained (A Guide 2012). This method does not use any sustainable indicators or results selected for specific conditions, company or project. However, this approach is focused on projects and does not allow assessing effectiveness of CSR of an operating company.

- The SCBA (Social Costs-Benefit Analysis) is a tool of the welfare economy and it assesses social costs-benefits. As a rule, it is used to justify a state support of large socially significant projects (Wells 1975). It is supposed to make monetary assessment of private and external social costs (including environmental ones) (Manning et al. 2016). The disadvantage of this method in assessing CSR is that it cannot take into account qualitative results to the full extent.

- The DEA (Data Envelopment Analysis) is used to evaluate CSR activities in order to determine effectiveness of management decisions based on profitability criterion. This method presents only final ratings.

- Since 1991 the KLD (Dowling 2013) index has been one of the most widely-used company analysis indices in seven areas: product quality and safety, relations with employees, corporate management, relations with the local community, human rights, environment, diversity, thus covering all main directions of SD. The method links social and financial indicators and demonstrates only final ratings.

- Econometric Impact Index, offered by Smith O’Brien, allows assessing the total impact of the company on the local community. This index can be used both by the companies and local authorities involved in assessing the impact of those companies on the local community, including expanding or reducing production, pricing policy, tax payments and the impact on decision-making in regional development.

1.5. Methods for Assessing Corporate Sustainability with a Comprehensive Assessment of Corporate Activities in Environmental, Social and Economic Areas

The fourth group combines in-company methods of assessing corporate sustainability and comprehensive assessment of corporate activities in all areas of SD: environmental, social and economic. Assessment of CS indicators means assessment of economic results, impact on society (CSR) and impact on the environment.

The most common rating methods are as follows:

- The ISS-oekom corporate rating (ISS-oekom Universe) includes assessment of more than 3900 companies; Oekom Corporate Ratings assess companies by using 100 social, managerial and environmental criteria (ISS-oekom 2019) weighted, aggregated and presented as a score, which makes up the background of rating of the companies;

- ESG ratings are based on assessing the optimal set of special indicators reflecting the level of the company’s impact on the natural and social environment, as well as the degree of corporate exposure to social and managerial risks (ESG Rating 2020);

- DJSI Index (The Dow Jones Sustainability Index) is a set of indicators for assessing sustainability of large public companies-stock market players, selected under the corporate sustainability assessment made by RobecoSAM agency. DJSI indices are global benchmarks based on a set of criteria for assessing environmental, social and economic capacities of companies (JSI/CSA 2020), including weighting factors. The content and number of indicators within each criterion, as well as their weight factors can be adjusted in accordance with the recommendations of RobecoSAM;

- The RobecoSAM agency methods are used not only to evaluate DJSI, but also to assess sustainable development of companies given their industrial profile. In this case, assessment uses specific industry criteria. For example, for mineral companies, economic criterion included payment transparency, environmental one—mineral waste mgmt., water related risks, biodiversity, social one—asset closure mgmt, community impact, stakeholder engagement (Corporate 2018).

Despite high popularity of SAM and DJSI methods, they have a drawback: information can be distorted as a result of self-assessment of companies (RepRisk provides ESG 2014; Rahdari and Anvary Rostamy 2015);

- 5.

- Fortune ranking is based on comparison with the “top companies” and presents the final ranking data. It limits the ability of companies to self-evaluate and analyze internal effects, relies on fixed indicators not ranked by their significance, that is, it does not count for effectiveness as a reason of certain social investments;

- 6.

- The 2008 World Business Council for Sustainable Development (WBCSD) Guidelines together with the International Finance Corporation (IFC) define universal framework principles for identifying, measuring, assessing and prioritizing social effects, as well as indicators by value chain elements (WBCSD 2017).

Among national methods, the following are worth noting:

- (a)

- method for assessing basic performance indicators (BPI), developed by the Russian Union of Industrialists and Entrepreneurs (RUIE) under the Global Reporting Initiative (GRI) and intended for preparing corporate non-financial reports (social, sustainable development, environmental ones) and for corporate management systems in order to organize monitoring, control and assessment of key performance results. Basic performance indicators include 48 indicators in economic, social and environmental areas of the company (Global 2014);

- (b)

- The Social Reporting of Enterprises and Organizations Registered in the Russian Federation. Guidelines Standard prepared by the Chamber of Industry and Commerce under AA 1000 and GRI principles (Prokopov and Feoktistova 2008).

2. Methodology

The purpose of the study was to develop a method for assessment of corporate sustainability (CS) based on accumulated assessment tools.

For this purpose, more than 100 CSR and CS methods were analysed (Table 2). For analysis purposes the following methodologies were selected:

Table 2.

Classification of CS methods, ratings, indices. Source: (Wong et al. 2019; ESG 2019; ESG Factors in Investment, MIRBIS 2019; Rate the Raters 2020; Corporate 2018; RepRisk provides ESG 2014; International Integrated Reporting Council ‘IIRC’ 2021; Leadership GRI SRS 2013; Global 2014; LBG Model 2017; Borzakov 2016; Sklyar and Zverkovich 2007; Pence and Furs 2008; Saprykina 2012; Endovitsky et al. 2014; Ponomarenko et al. 2020) compiled by the authors.

- International methods for assessing CS and social performance

- Methods for assessing CS and social performance with the industry specifics

- Methods and approaches for assessing social performance

- Russian rating methods for assessing CS and social performance

- Individual researchers’ methods of assessing companies’ performance.

The methodology of express assessment of CSR methodology Barzakova D.I. was chosen as the basis for the development of the methodology for assessing corporate governance. In the method of Barzakov D.I., the author proposes assessment indicators harmonized with the provisions of the global standard Global Reporting Initiative G4 (GRI G4) and combined into three groups: interaction with personnel, interaction with the local community and environmental protection. The final indicator is determined based on the point assessment of the dynamics of growth/decline of the GRI G4 indicators. The methodology allows for diagnostics and comparative analysis of companies in the field of CSR.

In our methodology, in addition to indicators from the Global Reporting Initiative G4 standard, economic indicators from the company’s profit and loss statement have been added to focus more on the company’s sustainability and not just corporate social responsibility. The proposed methodology takes into account three groups of indicators in the areas: labor protection, environmental protection and economic efficiency. Three indicators were selected in each group to create a balanced system of indicators.

Thorough consideration was given to the specific features of oil and gas companies.

Among the social indicators, three indicators were chosen that reflect social impact and the impact of the company on its employees (data on occupational injuries, Deloitte surveys), the local community (company reports) and the population at the regional and national levels, as they all form a single ecosystem. All the indicators correspond with the stakeholder approach.

Among the environmental indicators, three indicators were chosen that characterize the consumption of key natural resources and the impact on the environment) (Cherepovitsyn et al. 2018; Lipina et al. 2018; Ilinova et al. 2020), including energy consumption (as well as CO2 emissions), water consumption (which is high in oil and gas companies) and waste (Vasilev et al. 2019; Ivanova 2020; Kirsanova et al. 2020). In the economic area, such indicators were chosen as cost-to-revenue ratio as a key indicator of economic performance, revenue as an indicator of the cumulative effect and oil and gas reserve life as a key factor connected with resources (Carayannis et al. 2021; Litvinenko et al. 2020; Rudakov et al. 2021).

The effectiveness of CS is assessed by two final indicators. The first indicator is an aggregated index for three groups of factors to assess the ratings of companies relative to the performance of the best company. The second indicator is an assessment of the dynamics within the company relative to the previous values of the indicators of corporate social responsibility.

Methodology: analysis of CS assessment methods; systematization of assessment methods for mining companies in order to identify limitations and opportunities for application of CS assessment methods in mining companies; development of a method for CS assessment in order to determine the achieved level and dynamics of CS indicators in terms of the target industry indicators; assessment and analysis of CS results using data from oil companies.

We selected oil and gas companies, on the one hand, due to an important role of the oil and gas industry for the Russian economy in general and for the regions of operation, in particular, plus the ability to use high-quality secondary sources of available and accessible information and, on the other hand, because of a significant environmental impact of such companies. An important factor for selection of oil and gas companies is the fact that, for example, in Gazprom PJSC, the number of employees makes up almost half of the total number of employees in the mining sector. We formed a database using the reports of oil and gas companies published on the Russian Union of Industrialists and Entrepreneurs website, in particular, reports on sustainable development. We assessed CS taking data from six largest Russian oil and gas companies: PJSC NK Rosneft, PJSC Gazprom, PJSC NOVATEK, PJSC Tatneft, PJSC Lukoil and PJSC Surgutneftegas, over 5 years (National Register 2020).

In order to comprehensively assess the CS level of oil and gas companies and the degree of progress towards the target industry indicators, we developed and applied a method to assess the achieved level and dynamics of changes in CS indicators. The choice of oil and gas companies for the study was based on the availability of sustainability reports that needed to be used to collect source data. These oil and gas companies are among the biggest ones in Russia. Three of them are controlled by the government and another three are private.

3. Results

Based on an analysis of CS concepts, existing methods, recommendations given in the GRI G4 standard and disclosure requirements concerning non-financial information, a set of indicators reflecting the specific features of oil and gas companies was selected as the initial data for developing a methodology for CS assessment.

The choice of indicators stems from the fact that it is essential to meet two requirements: to assess impact in three spheres (economy, ecology and environment) and to characterize the long-term development of a company (by analyzing revenue, profitability and natural resource assets).

The indicators are grouped by three areas (environmental, social and economic) and divided into two groups based on the desired trends (ESG 2019; Rate the Raters 2020; Corporate 2018; Borzakov 2016; Ponomarenko et al. 2020):

- indicators that should be minimized: energy consumption per unit, water consumption, production waste, occupational injury frequency rate;

- indicators that should be maximized: average cost-to-revenue ratio, revenues, oil and gas reserve life, investment in environmental protection and costs associated with supporting local communities.

Information for developing a system of CS (Corporate Sustainability) assessment indicators was obtained from several sources: CSR (Corporate Social Responsibility) and SD (Sustainable Development) reports, annual corporate reports and annual financial reports.

Indicators , their desired trends and information sources are shown in Table 3.

Table 3.

Set of CS assessment indicators. Source: compiled by the authors.

3.1. Calculating the Aggregate CS Index

Aggregation is carried out based on equal weights and assessments are given in points to ensure that parameters which differ in units of measurement can be compared. The aggregate CS index is meant for ranking companies in relation to the best one in the industry. To find the aggregate CS index, it is necessary to replace quantitative indicators with points.

Scores ) of indicators ) are determined proportionally to the maximum value of i-indicator of CS assessment in t-year. The maximum value of the indicator corresponds to the maximum score of 10 points.

Assessment of the achieved CS level is determined by summing up the scores of CS assessment indicators :

where —is the score of i-indicator of CS assessment in t-year.

Points are assigned to the indicators in proportion to the maximum (minimum) value of the i-th indicator of the top company in the industry. The maximum or minimum value (depending on the desired trend) corresponds to the maximum score, which is 10 points.

3.2. Assessment of Changes in Companies’ CS Indicators

The assessment of changes in CS is based on information on the companies’ CS indicators covering a period of three years. Taking each company’s indicators separately, change (deviation) (+/−) relative to the previous period is found.

where is the value of the score of i-indicator of CS assessment in t-year.

The absolute change is then converted to relative change, which will be presented in percentage. In order to analyze indicators in dynamics, we calculated the Percentage change () for each indicator, which has a certain number of scores (from 1 to 10) by the scale (see Table 4). The rating of sustainable development indicators, given their dynamics, is determined by summing up the scores () of each indicator in a year.

Table 4.

Score scale. Source: compiled by the authors.

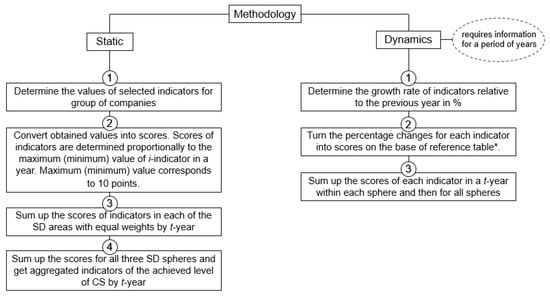

The methodology for assessing CSR is presented in Figure 1.

Figure 1.

Methodology for assessing corporate social responsibility. Source: compiled by the authors.

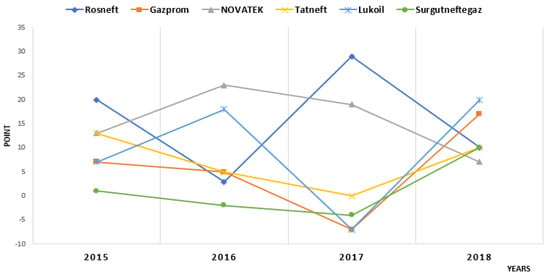

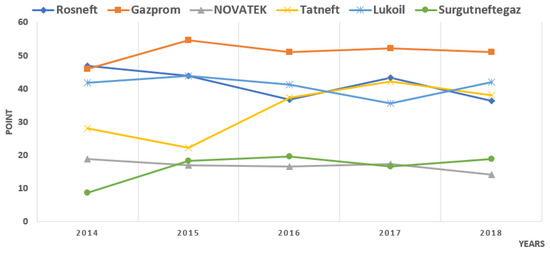

To see how this method is applied, we shall consider creation of a system of economic indicators for the three largest Russian oil and gas companies: PJSC NK Rosneft, PJSC Gazprom, PJSC NOVATEK, PJSC Tatneft, PJSC Lukoil, PJSC Surgutneftegas over 5 years. The final indicators of CSR assessment are shown in the Figure 2 and Figure 3. Intermediate calculation indicators are presented in the Appendix A (Table A1, Table A2 and Table A3).

Figure 2.

Assessment of the rate of change CS (economic, environmental and social indicators) oil and gas companies on the dynamics of change of indicators.

Figure 3.

Assessment of the level of CSR (economic, environmental and social indicators) oil and gas companies on the absolute value of the indicators.

When being tested, the methodology showed significant deviations in SD indicators, which means that additional analysis of the results at a qualitative level is required.

According to the final indicator of social corporate sustainability, the company can be ranked in the following order:

- (1)

- PJSC Gazprom (2018-the level of CSR-41)

- (2)

- PJSC Lukoil (2018, the level of CSR-38)

- (3)

- PJSC NK Rosneft (2018-the level of CSR-32)

- (4)

- PJSC Tatneft (2018-the level of CSR-31)

- (5)

- PJSC Surgutneftegas (2018-the level of CSR-18)

- (6)

- PJSC NOVATEK (2018-the level of CSR-8)

All calculations and graphs show that for the companies the dynamics of changes in indicators (rate of change) is differently directed. Within the study period, Gazprom PJSC has had a tendency for increasing indicators; however, the indicator values themselves were minimal compared to other companies. In terms of the achieved CS level among the analyzed companies, the leading position belongs to Lukoil PJSC, with the average score of 38 points. This allows us to conclude that this Lukoil PJSC is the most sustainable (after Gazprom PJSC), because the absolute value of the indicator plays a more important role than the dynamics of its change, since it reflects the actual status of the company by a certain indicator and allows comparing companies with each other.

4. Discussion

As you can see, the leading position in terms of static values is occupied by PJSC Gazprom with a margin of about 28% from its closest competitors (Rosneft and LUKOIL) (in terms of points). The maximum number of scores the company had for the social component, which can be correlated with the scale of implemented social programs and joint activities with the state.

In terms of dynamics, the most effective activity was performed by PJSC NOVATEK, followed by PJSC Rosneft. To ask why Gazprom does not show a leading position here, it should be understood that showing the highest values among all the considered companies, GAZPROM just may not have reserves for noticeable leaps in development.

In the process of evaluating and analyzing the results, we concluded that the methodology requires further work. For example, it would be good to consider the issue of weighting factors and then mechanism for mutual influence of spheres (for example, PJSC Gazprom with 29 points in social sphere has only 1.7 points for the environmental component, which means unstable development). We also aim to work with the technique of estimation in dynamics so that the obtained results can be interpreted more effectively.

The review and analysis of methods for assessing CSR and CS that, despite a great number and variety of methods, they can be classified by the following categories:

- By the area of research—the methods are aimed at study and assessment of corporate activity areas. Based on this criterion, there are methods focused on assessing environmental sustainability or social component of SD in the CSR system, methods of integrated (socio-environmental) assessment of CSR, integrated methods for assessing CSD combined with the analysis of environmental, social and economic components.

- By the objectives—the methods are aimed at monitoring of the situation in the areas of research; assessment of social and environmental results of projects or activities of the companies; making company ratings (comparative assessment).

- By applicable assessment criteria and indicators—the methods for making assessment criteria and indicators include: -quantitative indicators, for example, emissions in assessing environmental impact; cost performance indicators of companies; quantitative indicators for business areas of the company; quality indicators for assessing social and environmental effects; aggregate indicators (indices); score-rating indicators.

- By sources of information for CS assessment—secondary sources (open); primary sources (special surveys of companies); primary sources (special surveys for local communities).

- By rapid and detailed assessment of CS—rapid assessment generates an overall idea of socially responsible activities of the company confirmed by facts and non-financial reports and serves as an informational background for subsequent analysis, identification of potential risks and making informed decisions. The list of rapid assessment indicators includes the most important indicators characterizing social, economic and environmental role of the company.

The analyzed methods for CS level assessment have several disadvantages, since they do not take into account many factors affecting oil and gas companies. For example, one of the CSR level assessment methods based on non-financial reporting reflects only dynamics of changes in indicators for a particular company. Thus, the rapid assessment only counts for the rate of change in the indicators used for that method, but it does not compare companies with each other by the achieved CSR level. This fact does not allow for making an objective conclusion regarding the CSR level of the companies.

In order to comprehensively assess the CS level of oil and gas companies and the degree of progress towards the target industry indicators (according to the “Energy Strategy of Russia for the Period until 2030”), we developed and applied a method for assessing the achieved CS level and dynamics of changes in CS indicators.

An analysis of CS assessment methods showed that only the fourth group offers a comprehensive assessment. Methods based on environmental information focus only on the environment. Methods based on social welfare deal with the impact on society. Methods based on CSR predominantly focus on social issues, with environmental ones also taken into account. CS assessment methods cover three areas of sustainable development and three groups of indicators.

Three indicators were selected in each group to create a balanced system of indicators. Thorough consideration was given to the specific features of oil and gas companies. Among the social indicators, three indicators were chosen that reflect social impact and the impact of the company on its employees (data on occupational injuries, Deloitte surveys), the local community (company reports) and the population at the regional and national levels, as they all form a single ecosystem. All the indicators correspond with the stakeholder approach.

Among the environmental indicators, three indicators were chosen that characterize the consumption of key natural resources and the impact on the environment), including energy consumption (as well as CO2 emissions), water consumption (which is high in oil and gas companies) and waste.

In the economic area, such indicators were chosen as cost-to-revenue ratio as a key indicator of economic performance, revenue as an indicator of the cumulative effect and oil and gas reserve life as a key factor connected with resources.

The choice of all these indicators makes it possible to subsequently trace the relationship between CS and SD at the national level.

A limited combination of indicators was chosen in order to give a brief assessment of the main “outputs” of the company. In this kind of assessment, a number of indicators are not taken into account.

The developed method for CS assessment and can be used by large companies in the analysis and planning of operational and investment activities that ensure achievement of CS goals and growth. Oil and gas companies can use the method for CS assessment to achieve their strategic goals and strengthen their market positions by investing in certain problem areas. In this regard, oil and gas companies are advised to monitor the CS level, effectively manage interaction with various stakeholders and involve the local community in solving environmental and social issues.

In practice, oil and gas companies can use the methodology for benchmarking between both companies and separate spheres based on the values for a particular moment. For example, scores in different CS spheres enable companies to make conclusions about their status and progress.

An interesting feature of the methodology is that it provides for analyzing changes in the company’s indicators in comparison with those of other companies. This is an indirect measure of its competitiveness.

The methodology provides tools for achieving CS goals related to the global SDGs. Many companies discuss the SDGs in their reports but do not assess whether they can be achieved.

The methodology takes into account the resource and stakeholder ideologies.

The limitation of the proposed methodology lies in the fact that additional qualitative analysis is required that will characterize the causes of significant deviations in corporate sustainability indicators. The set of indicators consists of multidirectional SD indicators that are combined into an aggregate index, which makes it difficult to find the reason for such deviations. Another limitation is that companies should provide CSR reports compiled according to the GRI standards since the source data for different companies must be comparable to each other. In addition, comparisons should be made within one industry, for example, oil and gas production, mining metal ores or coal mining as different industries are characterized by different environmental indicators. A survey should be conducted among oil and gas companies to see whether this methodology proves useful in their practice.

The author’s technique presented in the article is truly applicable for the mining industry in general. The special features of the methodology are that we have chosen indicators that characterize the features of the activities of mining companies from many indicators of GRI. Since, to date, many companies do not use GRI indicators in their reports, we have shown the applicability of our methodology to oil and gas companies. Large oil and gas companies report regularly. Coal, gold and copper mining companies publish reports only in fragments. To use the proposed methodology, it is necessary to have the dynamics of indicators, which already creates certain limitations in choosing companies for analysis.

5. Conclusions

- The main shortcomings of certain CS assessment methods are their static nature; lack of relation of social–environmental results to economic indicators characterizing a dynamic development of the company; lack of feedback from the companies; lack of count for industry specifics and differences in the level of disclosure and quality of information.

- For oil and gas companies, the set of CS indicators should include indicators reflecting business in harsh climatic conditions, increased injuries, generation of a large amount of various wastes, exploitation of mineral resources, vast economic impact of companies on the regional development, value of GDP and budgets.

- The method for CS assessment of mining companies is developed taking into account the stakeholder approach, institutional theory, the resource approach and the new theory of corporate sustainability.

- Analysis of CS indicators allows determining the place of CSR in the system of corporate values, identify the relations between CSR and corporate sustainability, explore the nature of relations with external stakeholders of mining companies and main directions of social programs, analyze the results achieved and the dynamics of the main performance indicators in CS. Comparing mining companies in terms of values and changes in CS indicators by industry reveals problems and creates incentives for further sustainable development of companies.

- The relevance of the study aimed at assessing corporate sustainable development in oil and gas companies operating stems from the fact that they have significant impact on the environment, the development of areas where they operate and the social landscape, which is accompanied by specific technological, macroeconomic and regulatory conditions for the development of oil and gas fields. Analysis of the integrated reporting showed that the volume of corporate social responsibility of mining companies is different and is characterized by different indicators that reflect the impact of companies on the society: impact on the social, environmental and economic sphere. In the voluntary reporting on sustainable development of the mining companies, CSR monitoring indicators are distributed in the following areas: participation in development, communities, human rights, environmental protection, economic impact, staff development, labor relations and management.

- Taking into account the purpose of this work to develop a methodology for assessing the CSR of oil and gas companies, the authors proposed the principles and method of assessment. The methodological principles are focused on the specifics of the industry and the long-term development of the company. The methodology contains indicators that allow to assess the impact in three areas (economy, ecology and environment) and characterize the prospects for long-term development of the company (by analyzing revenue, profitability and natural resource assets). The aggregate CS index is meant for ranking companies in relation to the best one in the industry. Assessment of changes in companies’ CS indicators determines the dynamics of indicators relative to previous periods for the company.

6. Patents

Program of Corporate Sustainability Rating for Mining Companies: Certificate of registration of the computer program 2021611713, 03.02.2021. Application No. 2021610736 dated 28.01.2021.

Author Contributions

Conceptualization, T.P. and O.M.; methodology, T.P. and O.M.; software, M.N.; validation, T.P. and M.N.; formal analysis, M.N. and O.M.; investigation, T.P. and O.M.; resources, M.N.; writing—original draft preparation, T.P. and O.M.; writing—review and editing, M.N. and O.M.; visualization, O.M., K.K.; funding acquisition, T.P. and M.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by RFBR and MCESSM, grant number № 19-510-44013\19.

Data Availability Statement

Data available in a publicly accessible repository. The data presented in this study are openly available in (National Register of corporate non-financial reports, 2020 https://рспп.рф/activity/social/registr/ (accessed on 6 April 2021)).

Acknowledgments

Special thanks to the following people for providing valuable guidance: Cherepovitsyn A., Ilinova A. A., Savelyeva N.

Conflicts of Interest

The authors declare no conflict of interest the results.

Appendix A

Table A1.

Economic, Social and Environmental Indicators of Corporate Sustainability.

Table A1.

Economic, Social and Environmental Indicators of Corporate Sustainability.

| Actual Figures | Points | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | PJSC NK Rosneft | PJSC Gazprom | PJSC NOVATEK | PJSC Tatneft | PJSC Lukoil | PJSC Surgutneftegas | PJSC NK Rosneft | PJSC Gazprom | PJSC NOVATEK | PJSC Tatneft | PJSC Lukoil | PJSC Surgutneftegas |

| Economic | ||||||||||||

| average product profitobility, % | ||||||||||||

| 2014 | 19.2 | 1.54 | 14.53 | 20.5 | 11.4 | - | 9.37 | 0.75 | 7.09 | 10 | 5.56 | 0 |

| 2015 | 23.8 | 5 | 10.6 | 19.1 | 9.7 | - | 10 | 2.1 | 4.45 | 8.03 | 4.08 | 0 |

| 2016 | 25 | 6 | 29.29 | 18.3 | 15 | 76 | 3.29 | 0.79 | 3.85 | 2.41 | 1.97 | 10 |

| 2017 | 22.6 | 4 | 16.23 | 18.2 | 8.1 | 16.6 | 10 | 1.77 | 7.18 | 8.05 | 3.58 | 7.35 |

| 2018 | 24.8 | 8 | 15.68 | 23.2 | 10.25 | 54.7 | 4.53 | 1.46 | 2.87 | 4.24 | 1.87 | 10 |

| revenue, billion rubles | ||||||||||||

| 2014 | 5503 | 5589.8 | 357.6 | 476.36 | 1710 | - | 9.84 | 10 | 0.64 | 0.85 | 3.06 | 0 |

| 2015 | 5150 | 6073.3 | 475.3 | 552.712 | 1877 | 1020.8 | 8.48 | 10 | 0.78 | 0.91 | 3.09 | 1.68 |

| 2016 | 4988 | 6111.1 | 537.5 | 580.127 | 5227 | 1002.6 | 8.16 | 10 | 0.88 | 0.95 | 8.55 | 1.64 |

| 2017 | 6011 | 6546.1 | 583 | 681.159 | 5936.7 | 1175 | 9.18 | 10 | 0.89 | 1.04 | 9.07 | 1.79 |

| 2018 | 8238 | 8224.2 | 832 | 910.534 | 8035.9 | 1556 | 10 | 9.98 | 1.01 | 1.11 | 9.75 | 1.89 |

| availability of mineral resources, years | ||||||||||||

| 2014 | 16.6 | 51.6 | 27.5 | 32 | 20.6 | 0 | 3.21 | 10 | 5.33 | 6.15 | 4 | 0 |

| 2015 | 18.2 | 49.6 | 24.6 | 32 | 18.9 | 0 | 3.67 | 10 | 4.96 | 6.45 | 3.81 | 0 |

| 2016 | 19.3 | 54.1 | 23.8 | 30.4 | 20.4 | 0 | 3.57 | 10 | 4.4 | 5.62 | 3.77 | 0 |

| 2017 | 19.4 | 49.5 | 29.4 | 30 | 19 | 0 | 3.92 | 10 | 5.94 | 6.06 | 3.84 | 0 |

| 2018 | 19.9 | 47.5 | 28.8 | 31.4 | 18.9 | 0 | 4.19 | 10 | 6.06 | 6.61 | 3.98 | 0 |

| Social | ||||||||||||

| frequency factor of industrial injuries | ||||||||||||

| 2014 | 0.33 | 0.18 | 0.4 | 0.1 | 0.13 | - | 3.03 | 5.56 | 2.5 | 10 | 7.69 | 0 |

| 2015 | 0.327 | 0.17 | 0.5 | 0.3 | 0.28 | - | 5.2 | 10 | 3.4 | 5.67 | 6.07 | 0 |

| 2016 | 0.21 | 0.16 | 0.3 | 0.14 | 0.21 | - | 6.67 | 8.75 | 4.67 | 10 | 6.67 | 0 |

| 2017 | 0.36 | 0.11 | 1.27 | 0.1 | 0.19 | - | 2.78 | 9.09 | 0.79 | 10 | 5.26 | 0 |

| 2018 | 0.41 | 0.17 | 0.79 | 0.14 | 0.19 | - | 3.41 | 8.24 | 1.77 | 10 | 7.37 | 0 |

| increased costs of local community support, million rubles | ||||||||||||

| 2014 | 8000 | 46,429 | 727 | 135.87 | 290.6 | - | 1.72 | 10 | 0.16 | 0.03 | 0.06 | 0 |

| 2015 | 9000 | 32,485 | 1000 | 165.7 | 304.9 | - | 2.77 | 10 | 0.31 | 0.05 | 0.09 | 0 |

| 2016 | 11,000 | 35,516 | 1324 | 195.65 | 304.3 | - | 3.1 | 10 | 0.37 | 0.06 | 0.09 | 0 |

| 2017 | 19,000 | 34,461 | 1377 | 281.64 | 341.9 | - | 5.51 | 10 | 0.4 | 0.08 | 0.1 | 0 |

| 2018 | 23,000 | 42,789 | 2000 | 257 | 384 | - | 5.38 | 10 | 0.47 | 0.06 | 0.09 | 0 |

| costs and investment into environmental protection, billion rubles | ||||||||||||

| 2014 | 36.93 | 48.98 | 0.63 | 5.8 | 59 | 18.58 | 6.26 | 8.3 | 0.11 | 0.98 | 10 | 3.15 |

| 2015 | 44.65 | 49.71 | 0.77 | 5.7 | 48 | 17.89 | 8.98 | 10 | 0.15 | 1.15 | 9.66 | 3.6 |

| 2016 | 47.14 | 57.47 | 1.19 | 13.29 | 53 | 17.73 | 8.2 | 10 | 0.21 | 2.31 | 9.22 | 3.09 |

| 2017 | 67.24 | 70.82 | 2.06 | 13.63 | 23 | 21.1 | 9.49 | 10 | 0.29 | 1.92 | 3.25 | 2.98 |

| 2018 | 45.61 | 68.96 | 2.4 | 11.68 | 58 | 17.4 | 6.61 | 10 | 0.35 | 1.69 | 8.41 | 2.52 |

| Environmental | ||||||||||||

| water consumption per unit of production/activity; m3/tons | ||||||||||||

| 2014 | 1.159 | 4.895 | 1.347 | - | 0.4 | 1.49 | 3.45 | 0.82 | 2.97 | 0 | 10 | 2.68 |

| 2015 | 1.467 | 4.511 | 1.716 | - | 0.5 | 1.63 | 3.41 | 1.11 | 2.91 | 0 | 10 | 3.07 |

| 2016 | 1.679 | 4.538 | 2.701 | 1.018 | 0.6 | 1.65 | 3.57 | 1.32 | 2.22 | 5.89 | 10 | 3.64 |

| 2017 | 2.26 | 4.523 | 2.779 | 1.005 | 0.5 | 1.418 | 2.21 | 1.11 | 1.8 | 4.98 | 10 | 3.53 |

| 2018 | 2.28 | 4.28 | 2.993 | 1.134 | 0.5 | 1.408 | 2.19 | 1.17 | 1.67 | 4.41 | 10 | 3.55 |

| mass of waste generated, thousand tons | ||||||||||||

| 2014 | 208 | 4831 | - | - | 1437 | 716.1 | 10 | 0.43 | 0 | 0 | 1.45 | 2.9 |

| 2015 | 5393 | 4954 | - | - | 1015 | 725.8 | 1.35 | 1.47 | 0 | 0 | 7.15 | 10 |

| 2016 | 5377 | 4289 | - | 92.7 | 1033 | 714 | 0.17 | 0.22 | 0 | 10 | 0.9 | 1.3 |

| 2017 | 6325 | 4130 | - | 80.1 | 1434 | 837.66 | 0.13 | 0.19 | 0 | 10 | 0.56 | 0.96 |

| 2018 | 7155 | 3555 | - | 78.6 | 1529 | 824.49 | 0.11 | 0.22 | 0 | 10 | 0.51 | 0.95 |

Table A2.

Total Company Ratings by years (Statics).

Table A2.

Total Company Ratings by years (Statics).

| Year | PJSC NK Rosneft | PJSC Gazprom | PJSC NOVATEK | PJSC Tatneft | PJSC Lukoil | PJSC Surgutneftegas |

|---|---|---|---|---|---|---|

| Economic | ||||||

| 2014 | 22.42 | 20.75 | 13.06 | 17 | 12.62 | 0 |

| 2015 | 22.15 | 22.1 | 10.19 | 15.9 | 10.98 | 1.68 |

| 2016 | 15.02 | 20.79 | 9.13 | 8.98 | 14.29 | 11.64 |

| 2017 | 23.1 | 21.77 | 14.01 | 15.15 | 16.49 | 9.14 |

| 2018 | 18.72 | 21.44 | 9.94 | 11.96 | 15.6 | 11.89 |

| Total | 101.41 | 106.85 | 56.33 | 68.48 | 69.98 | 34.35 |

| Social | ||||||

| 2014 | 11.01 | 23.86 | 2.76 | 11.01 | 17.75 | 3.15 |

| 2015 | 16.95 | 30 | 3.86 | 6.86 | 15.82 | 3.6 |

| 2016 | 17.97 | 28.75 | 5.25 | 12.37 | 15.97 | 3.09 |

| 2017 | 17.79 | 29.09 | 1.48 | 12.01 | 8.61 | 2.98 |

| 2018 | 15.4 | 28.24 | 2.59 | 11.75 | 15.87 | 2.52 |

| Total | 79.12 | 139.94 | 15.94 | 54 | 74.02 | 15.34 |

| Environmental | ||||||

| 2014 | 13.45 | 1.25 | 2.97 | 0 | 11.45 | 5.59 |

| 2015 | 4.75 | 2.57 | 2.91 | 0 | 17.15 | 13.07 |

| 2016 | 3.75 | 1.54 | 2.22 | 15.89 | 10.9 | 4.93 |

| 2017 | 2.34 | 1.3 | 1.8 | 14.98 | 10.56 | 4.48 |

| 2018 | 2.3 | 1.39 | 1.67 | 14.41 | 10.51 | 4.5 |

| Total | 26.59 | 8.05 | 11.57 | 45.28 | 60.57 | 32.57 |

Table A3.

Total Company Ratings by years (Dynamics).

Table A3.

Total Company Ratings by years (Dynamics).

| Actual Figures | Growth Rate (Points) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | Rosneft | Gazprom | NOVATEK | Tatneft | Lukoil | Surgutneftegaz | Rosneft | Gazprom | NOVATEK | Tatneft | Lukoil | Surgutneftegaz |

| Economic | ||||||||||||

| average product profitobility, % | ||||||||||||

| 2014 | 19.2 | 1.54 | 14.53 | 20.5 | 11.4 | - | - | - | - | - | - | - |

| 2015 | 23.8 | 5 | 10.6 | 19.1 | 9.7 | - | 0.24 | 2.25 | −0.27 | −0.07 | −0.15 | - |

| 2016 | 25 | 6 | 29.29 | 18.3 | 15 | 76 | 0.05 | 0.20 | 1.76 | −0.04 | 0.55 | - |

| 2017 | 22.6 | 4 | 16.23 | 18.2 | 8.1 | 16.6 | −0.10 | −0.33 | −0.45 | −0.01 | −0.46 | −0.78 |

| 2018 | 24.8 | 8 | 15.68 | 23.2 | 10.25 | 54.7 | 0.10 | 1.00 | −0.03 | 0.27 | 0.27 | 2.30 |

| revenue, billion rubles | ||||||||||||

| 2014 | 5503 | 5589.8 | 357.6 | 47.36 | 1710 | - | - | - | - | - | - | - |

| 2015 | 5150 | 6073.3 | 475.3 | 552.712 | 1877 | 1020.8 | −0.06 | 0.09 | 0.33 | 0.16 | 0.10 | - |

| 2016 | 4988 | 6111.1 | 537.5 | 580.127 | 5227 | 1002.6 | −0.03 | 0.01 | 0.13 | 0.05 | 1.78 | −0.02 |

| 2017 | 6011 | 6546.1 | 583 | 681.159 | 5936.7 | 1175 | 0.21 | 0.07 | 0.08 | 0.17 | 0.14 | 0.17 |

| 2018 | 8238 | 8224.2 | 832 | 910.534 | 8035.9 | 1556 | 0.37 | 0.26 | 0.43 | 0.34 | 0.35 | 0.32 |

| availability of mineral resources, years | ||||||||||||

| 2014 | 16.6 | 51.6 | 27.5 | 32 | 20.6 | 0 | - | - | - | - | - | - |

| 2015 | 18.2 | 49.6 | 24.6 | 32 | 18.9 | 0 | 0.10 | −0.04 | −0.11 | 0.00 | −0.08 | - |

| 2016 | 19.3 | 54.1 | 23.8 | 30.4 | 20.4 | 0 | 0.06 | 0.09 | −0.03 | −0.05 | 0.08 | - |

| 2017 | 19.4 | 49.5 | 29.4 | 30 | 19 | 0 | 0.01 | −0.09 | 0.24 | −0.01 | −0.07 | - |

| 2018 | 19.9 | 47.5 | 28.8 | 31.4 | 18.9 | 0 | 0.03 | −0.04 | −0.02 | 0.05 | −0.01 | - |

| Social | ||||||||||||

| frequency factor of industrial injuries | ||||||||||||

| 2014 | 0.33 | 0.18 | 0.4 | 0.1 | 0.13 | - | - | - | - | - | - | - |

| 2015 | 0.327 | 0.17 | 0.5 | 0.3 | 0.28 | - | −0.01 | −0.06 | 0.25 | 2.00 | 1.15 | - |

| 2016 | 0.21 | 0.16 | 0.3 | 0.14 | 0.21 | - | −0.36 | −0.06 | −0.40 | −0.53 | −0.25 | - |

| 2017 | 0.36 | 0.11 | 1.27 | 0.1 | 0.19 | - | 0.71 | −0.31 | 3.23 | −0.29 | −0.10 | - |

| 2018 | 0.41 | 0.17 | 0.79 | 0.14 | 0.19 | - | 0.14 | 0.55 | −0.38 | 0.40 | 0.00 | - |

| increased costs of local community support, million rubles | ||||||||||||

| 2014 | 8000 | 46,429 | 727 | 135.87 | 290.6 | - | - | - | - | - | - | - |

| 2015 | 9000 | 32,485 | 1000 | 165.7 | 304.9 | - | 0.13 | −0.30 | 0.38 | 0.22 | 0.05 | - |

| 2016 | 11,000 | 35,516 | 1324 | 195.65 | 304.3 | - | 0.22 | 0.09 | 0.32 | 0.18 | 0.00 | - |

| 2017 | 19,000 | 34,461 | 1377 | 281.64 | 341.9 | - | 0.73 | −0.03 | 0.04 | 0.44 | 0.12 | - |

| 2018 | 23,000 | 42,789 | 2000 | 257 | 384 | - | 0.21 | 0.24 | 0.45 | −0.09 | 0.12 | - |

| costs and investment into environmental protection, billion rubles | ||||||||||||

| 2014 | 36.93 | 48.98 | 0.63 | 5.8 | 59 | 18.58 | - | - | - | - | - | - |

| 2015 | 44.65 | 49.71 | 0.77 | 5.7 | 48 | 17.89 | 0.21 | 0.01 | 0.22 | −0.2 | −0.19 | −0.04 |

| 2016 | 47.14 | 57.47 | 1.19 | 13.29 | 53 | 17.73 | 0.06 | 0.16 | 0.55 | 1.33 | 0.10 | −0.01 |

| 2017 | 67.24 | 70.82 | 2.06 | 13.63 | 23 | 21.1 | 0.43 | 0.23 | 0.73 | 0.03 | −0.57 | 0.19 |

| 2018 | 45.61 | 68.96 | 2.4 | 11.68 | 58 | 17.4 | −0.32 | −0.03 | 0.17 | −0.14 | 1.52 | −0.18 |

| Environmental | ||||||||||||

| water consumption per unit of production/activity; m3/tons | ||||||||||||

| 2014 | 1.159 | 4.895 | 1.347 | - | 0.4 | 1.49 | - | - | - | - | - | - |

| 2015 | 1.467 | 4.511 | 1.716 | - | 0.5 | 1.63 | 0.27 | −0.08 | 0.27 | - | 0.25 | 0.09 |

| 2016 | 1.679 | 4.538 | 2.701 | 1.018 | 0.6 | 1.65 | 0.14 | 0.01 | 0.57 | - | 0.20 | 0.01 |

| 2017 | 2.26 | 4.523 | 2.779 | 1.005 | 0.5 | 1.418 | 0.35 | 0.00 | 0.03 | −0.01 | −0.17 | −0.14 |

| 2018 | 2.28 | 4.28 | 2.993 | 1.134 | 0.5 | 1.408 | 0.01 | −0.05 | 0.08 | 0.13 | 0.00 | −0.01 |

| mass of waste generated, thousand tons | ||||||||||||

| 2014 | 208 | 4831 | - | - | 1437 | 716.1 | - | - | - | - | - | - |

| 2015 | 5393 | 4954 | - | - | 1015 | 725.8 | 24.93 | 0.03 | - | - | −0.29 | 0.01 |

| 2016 | 5377 | 4289 | - | 92.7 | 1033 | 714 | 0.00 | −0.13 | - | - | 0.02 | −0.02 |

| 2017 | 6325 | 4130 | - | 80.1 | 1434 | 837.66 | 0.18 | −0.04 | - | −0.14 | 0.39 | 0.17 |

| 2018 | 7155 | 3555 | - | 78.6 | 1529 | 824.49 | 0.13 | −0.14 | - | −0.02 | 0.07 | −0.02 |

References

- A Guide. 2012. A Guide to Social Return on Investment. Available online: http://www.socialvalueuk.org/app/uploads/2016/03/The%20Guide%20to%20Social%20Return%20on%20Investment%202015.pdf (accessed on 28 June 2020).

- Berman, Shawn, Andrew C. Wicks, Suresh Kotha, and Thomas M. Jones. 1999. Does stakeholder orientation matter? The relationship between stakeholder management models and firm performance. Academy of Management Journal 42: 488–506. [Google Scholar]

- Blagov, Yu E. 2011. Corporate Social Responsibility: The Evolution of the Concept, 2nd ed. Saint Petersburg: Higher School of Management Publishing House. 272p. [Google Scholar]

- Borzakov, D. V. 2016. Control and Assessment of Corporate Social Responsibility in the Management of Organizations. Ph.D. dissertation, Voronezh South-West State University, Voronezh, Russia. [Google Scholar]

- Carayannis, Elias G., Alina Ilinova, and Alexey Cherepovitsyn. 2021. The Future of Energy and the Case of the Arctic Offshore: The Role of Strategic Management. Journal of Marine Science and Engineering 9: 134. [Google Scholar] [CrossRef]

- CDP. 2015. Climate Change. Information Request. Available online: https://www.cpr.ca/en/about-cp-site/Documents/cdp-program-submission-2015.pdf (accessed on 28 June 2020).

- Cherepovitsyn, Aleksey E., Svetlana A. Lipina, and Olga O. Evseeva. 2018. Innovative approach to the development of mineral raw materials of the arctic zone of the Russian federation. Journal of Mining Institute 232: 438. [Google Scholar]

- Corporate. 2018. Corporate Sustainability Assessment & Corporate Public Reporting Annelies Poolman. Available online: https://zebra-group.ru/download/ru/news/news-70/news-image-id-70-content-1.pdf (accessed on 7 March 2021).

- Dowling Grahame. 2013. The Curious Case of Corporate Tax Avoidance: Is it Socially Irresponsible? Journal of Business Ethics 124: 173–84. [Google Scholar]

- Drucker, Peter F. 1984. The new meaning of corporate social responsibility. California Management Review 26: 53–63. [Google Scholar] [CrossRef]

- Emerson, Jed, Jay Wachowicz, and Suzi Chun. 2000. Social Return Social Return on Investment: On Investment. Exploring Exploring Aspects of Aspects of Value Creation Value Creation in the Nonprofit in the Nonprofit Sector. Available online: https://hbswk.hbs.edu/archive/social-return-on-investment-sroi-exploring-aspects-of-value-creation (accessed on 28 June 2020).

- Endovickij, D. A., I. V. Panina, and M. V. Ponkratova. 2017. Analiz sushchnosti korporativnoj ustojchivosti kak reakcii na civilizacionnye izmeneniya. Ekonomicheskij Analiz: Teoriya i Praktika 16: 1043–60. [Google Scholar]

- Endovitsky, D. A., L. M. Nikitina, and D. V. Borzakov. 2014. Assessment of corporate social responsibility of Russian companies based on a comprehensive analysis of non-financial reporting. Economic Analysis: Theory and Practice 8: 2–10. [Google Scholar]

- Epstein, Marc J., and Marie-Jose Roy. 2003. Making the business case for sustainability. Linking social and environmental actions to financial performance. Journal of Corporate Citizenship 9: 79–96. [Google Scholar] [CrossRef]

- ESG. 2019. Expert Views on ESG Ratings. Available online: https://sustainability.com/our-work/reports/rate-raters-2019 (accessed on 7 March 2021).

- ESG Factors in Investment, MIRBIS. 2019. Available online: https://www.pwc.ru/ru/sustainability/assets/pwc-responsible-investment.pdf (accessed on 7 March 2021).

- ESG Rating. 2020. Available online: https://www.msci.com/esg-ratings (accessed on 28 June 2020).

- Freeman, Edward. 1984. Stakeholder Management: A Stakeholder Approach. Marshfield: Pitman Publishing, p. 292. [Google Scholar]

- Global. 2014. Global Competitiveness Report 2013–2014. Available online: http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2013-14.pdf (accessed on 28 June 2020).

- GOST R 54598.1. 2015. Management of Sustainable Development. Part 1. Guide 2016. Available online: http://docs.cntd.ru/document/1200127235 (accessed on 28 June 2020).

- GOST R ISO 20121. 2014. Systems of Management of a Sustainable Development. Requirements and Practical Guidance on Management of Stability of Events. Available online: http://docs.cntd.ru/document/1200113801 (accessed on 28 June 2020).

- GOST R ISO 9004. 2010. Managing for the Sustained Success of an Organization. A Quality Management Approach. Available online: http://docs.cntd.ru/document/gost-r-iso-9004-2010 (accessed on 28 June 2020).

- Halme, Minna, and Juha Laurila. 2009. Philanthropy, integration or innovation? Exploring the financial and societal outcomes of different types of corporate responsibility. Journal of Business Ethics 84: 325–39. [Google Scholar] [CrossRef]

- Ilinova, A., A. Chanysheva, and V. Solovyova. 2020. Arctic oil and gas offshore projects: How to forecast their future. Paper presented at IOP Conference Series: Earth and Environmental Science, St. Petersburg, Russia, March 18–19. [Google Scholar]

- International Integrated Reporting Council (‘IIRC’). 2021. Available online: https://integratedreporting.org/wp-content/uploads/2021/01/InternationalIntegratedReportingFramework.pdf (accessed on 7 March 2021).

- ISS-oekom. 2019. Corporate Rating. Available online: https://www.aiib.org/en/treasury/_common/_download/oekomCompanyReport_2019-5-3.pdf (accessed on 28 June 2020).

- Ivanova, D. 2020. Risk management and its contribution to sustainable development of mining enterprises. Scientific and Practical Studies of Raw Material Issues 2020: 182–91. [Google Scholar]

- Ivashkovskaya, I. V. 2009. Modelirovanie Stoimosti Kompanii. In Strategicheskaya Otvetstvennost’ Sovetov Direktorov. Moscow: INFRA-M. [Google Scholar]

- Johnson, H. 2003. Does it pay to be good? Social responsibility and financial performance. Business Horizons 46: 34–40. [Google Scholar] [CrossRef]

- Kanaeva, O. A. 2018. Social’nye imperativy ustojchivogo razvitiya. Vestnik SPbGU. Ekonomika 34: 26–58. [Google Scholar]

- Kirsanova, Natalia, Olga Lenkovets, and Muhammad Hafeez. 2020. Issue of Accumulation and Redistribution of Oil and Gas Rental Income in the Context of Exhaustible Natural Resources in Arctic Zone of Russian Federation. Journal of Marine Science and Engineering 8: 1006. [Google Scholar] [CrossRef]

- Klimova, Nina I., Dina Kh Krasnoselskaya, and Dilya R. Khamzina. 2018. An empirical study on the relationships between sales revenue of oil company and industry specific and exogenous characteristics. Journal of Applied Economic Sciences 8: 2261–68. [Google Scholar]

- Larsena, Sanne Vammen, Anne Merrild Hansen, and Helle Nedergaard Nielsen. 2018. The role of EIA and weak assessments of social impacts in conflicts over implementation of renewable energy policies. Energy Policy 115: 43–53. [Google Scholar] [CrossRef]

- LBG Model. 2017. The LBG Model—A GLOBAL VALUE Tool Showcase. Technical Report. Available online: https://www.researchgate.net/publication/323935384_The_LBG_Model_-_a_GLOBAL_VALUE_tool_showcase (accessed on 28 June 2020).

- Leadership GRI SRS. 2013. Available online: https://www.globalreporting.org/standards/gri-standards-download-center/consolidated-set-of-gri-standards/ (accessed on 7 March 2021).

- Lingane, Alison, and Sara Olsen. 2004. Guidelines for social return on investment. California Management Review 46: 116–35. [Google Scholar] [CrossRef]

- Lipina, Svetlana A., Lina K. Bocharova, and Lyubov A. Belyaevskaya-Plotnik. 2018. Analysis of Government Support Tools for Mining Companies in the Russian Arctic Zone. Zapiski Gornogo Instituta 230: 217–22. [Google Scholar] [CrossRef]

- Litvinenko, Vladimir S., Pavel S. Tsvetkov, Mikhail V. Dvoynikov, and Georgii V. Buslaev. 2020. Barriers to implementation of hydrogen initi-atives in the context of global energy sustainable development. Journal of Mining Institute 244: 428–38. [Google Scholar] [CrossRef]

- Manning, Matthew, Shane D. Johnson, Nick Tilley, Gabriel T. W. Wong, and Margarita Vorsina. 2016. Cost-Benefit Analysis (CBA) Economic Analysis and Efficiency in Policing, Criminal Justice and Crime Reduction: What Works? Berlin/Heidelberg: Springer, pp. 35–50. [Google Scholar]

- Margolis, Joshua D., and James P. Walsh. 2003. Misery Loves Companies: Rethinking Social Initiatives by Business. Administrative Science Quarterly 48: 268–305. [Google Scholar] [CrossRef]

- Montiel, Ivan, and Javier Delgado-Ceballos. 2014. Defining and Measuring Corporate Sustainability: Are We There Yet? Organization and Environment 27: 113–39. [Google Scholar] [CrossRef]

- National Register. 2020. National Register of Corporate Non-Financial Reports. Available online: https://рспп.рф/activity/social/registr/ (accessed on 7 March 2021).

- Nedosekin, Aleksei O., Elena I. Rejshahrit, and Aleksandr N. Kozlovskiy. 2019. Strategic Approach to Assessing Economic Sustainability Objects of Mineral Resources Sector of Russia. Journal of Mining Institute 237: 354–60. [Google Scholar] [CrossRef]

- Novikova, Natalya. 2020. Pipeline Neighbors: How Can We Avoid Conflicts? Resources 9: 13. [Google Scholar] [CrossRef]

- Pence, I. Sh, and S. A. Furs. 2008. Corporate Governance in Modern Russian Industry: State and Factors of Improvement. Moscow: LLC “Nedra Communications Ltd.”, p. 120. [Google Scholar]

- Ponomarenko, Tatyana, Marina Nevskaya, and Oksana Marinina. 2020. An Assessment of the Applicability of Sustainability Measurement Tools to Resource-Based Economies of the Commonwealth of Independent States. Sustainability 12: 5582. [Google Scholar] [CrossRef]

- Prokopov, F., and E. Feoktistova. 2008. Bazovye Indikatory Rezul’tativnosti. Rekomendacii po Ispol’zovaniyu v Praktike Upravleniya i -Korporativnoj Nefinansovoj Otchetnosti. Moscow: RSPP. 68p. [Google Scholar]

- Rahdari, Amir Hossein, and Ali Asghar Anvary Rostamy. 2015. Designing a general set of sustainability indicators at the corporate level. Journal of Cleaner Production 108: 757–71. [Google Scholar] [CrossRef]

- Rate the Raters. 2020. Investor Survey and Interview Results. Available online: https://sustainability.com/wp-content/uploads/2020/03/sustainability-ratetheraters2020-report.pdf (accessed on 7 March 2021).

- RepRisk Provides ESG. 2014. Intelligence for Dow Jones Sustainability Indices. Institutional Asset Manager. Available online: https://www.businesswire.com/news/home/20140910005040/en/RepRisk-ESG-Intelligence-Dow-Jones-Sustainability-Indices (accessed on 28 June 2020).

- Rudakov, Marat, Elena Gridina, and Jürgen Kretschmann. 2021. Kretschmann, Risk-based thinking as a basis for efficient occupational safety management in the mining industry. Sustainability 13: 470. [Google Scholar] [CrossRef]

- Saprykina, O. A. 2012. Multilevel assessment of the company’s performance in the field of corporate social responsibility. Transport business in Russia. Management 5: 74–78. [Google Scholar]

- Sklyar, E. N., and I. O. Zverkovich. 2007. Metodicheskie aspekty upravleniya razvitiem sotsialnogo potentsiala promyshlennyh predpriyatiy. Creative Economy 1: 74–81. [Google Scholar]

- Smol, Marzena, Paulina Marcinek, Joanna Duda, and Dominika Szołdrowska. 2020. Importance of Sustainable Mineral Resource Management in Implementing the Circular Economy (CE) Model and the European Green Deal Strategy. Resource 9: 55. [Google Scholar] [CrossRef]

- Szewrański, Szymon, and Jan K. Kazak. 2020. Socio-Environmental Vulnerability Assessment for Sustainable Management. Sustainability 12: 7906. [Google Scholar] [CrossRef]

- Tulaeva, Svetlana A., Maria S. Tysiachniouk, Laura A. Henry, and Leah S. Horowitz. 2019. Horowitz. Globalizing Extraction and Indigenous Rights in the Russian Arctic: The Enduring Role of the State in Natural Resource Governance. Resources 8: 179. [Google Scholar] [CrossRef]

- Vasilev, Yurii, Polina Vasileva, and Anna Tsvetkova. 2019. International review of public perception of ccs technologies. Paper presented at 19th International Multidisciplinary Scientific GeoConference SGEM, Albena, Bulgaria, June 28–July 7, vol. 19, pp. 415–22. [Google Scholar] [CrossRef]

- WBCSD. 2017. Measuring Impact Framework. Available online: https://www.wbcsd.org/Programs/People/Social-Impact/Resources/WBCSD-Measuring-Impact (accessed on 28 June 2020).

- Wells, Louis T., Jr. 1975. Social Cost/Benefit Analysis for MNCs, Harvard Business Review. Available online: https://hbr.org/1975/03/social-costbenefit-analysis-for-mncs (accessed on 28 June 2020).

- Wong, Christina, Aiste Brackley, and Erika Petroy. 2019. Rate the Raters 2019: Expert Views on ESG Ratings February. Available online: https://www.sustainability.com/globalassets/sustainability.com/thinking/pdfs/sa-ratetheraters-2019-1.pdf (accessed on 7 March 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).