Abstract

Taking Turkey’s experience as a case study, this study provides further insights into the evaluation of time-varying Granger-causal relationships in the trade openness and economic performance nexus. We reinvestigated the Granger-causal relationships between trade openness and real economic growth in Turkey for the time period 1950–2014. We employed a rolling version of Breitung and Candelon’s frequency domain Granger-causality test, which allowed us to identify the changes in the nature of the causal relationships overtime. Hence, in the face of different results found in the literature overtime, our study provides a more unified evidence on the relationship between trade openness and real economic growth in Turkey. In addition, we found empirical evidence for the possibility of a distinct temporal ordering in a feedback relationship between trade openness and economic growth. We called this situation “sequential feedback”.

Keywords:

openness and economic growth; Granger-causality; frequency domain time series analysis; Turkey JEL Classification:

C32; F14; F43; O47

1. Introduction

Most developing economies undertook economic liberalization measures and implemented policies that increased their trade openness since the early-1980s. This was initiated partly by the debt crisis of the 1980s in developing countries and partly as a lesson from the examples of some of the Asian economies that pursued outward-oriented policies and achieved higher levels of real GDP growth. Hence, the relationship between economic growth and trade openness attracted the attention of policy makers and academicians.

The economic liberalization policies undertaken in many developing countries in the 1980s also included a financial liberalization dimension. However, Tornell et al. (2003) indicate that developing economies generally have started liberalization policies with trade liberalization first and then financial liberalization typically followed.

While the measurement issues on outward-oriented economic growth has its own literature e.g., Edwards (1992), trade openness that is usually taken as the ratio of the sum of exports and imports to GDP is used as a practical measure since it can serve as a proxy capture the ease of exchanging goods and services, capital, labor, information, and ideas across borders. In a recent review, Gräbner et al. (2018), for instance, classified trade openness as a de facto measure of outward-orientation. It is also important to note that higher levels of trade openness correlate with higher levels of international financial markets integration.

Economic theory suggests several channels through which an increase in trade openness might lead to higher economic growth rates. First, export revenues provide an important source of foreign exchange, which is crucial when domestic savings are inadequate for making imports of capital goods possible. Secondly, export growth might also trigger economic growth through the expansion of the efficient market size, bringing in substantial economies of scale that accelerate the rate of capital formation and technical change. Thirdly, outward-oriented policies are hypothesized to provide higher economic growth because they might increase overall productivity and efficiency in an economy due to productivity spillovers that result from the importation of more advanced technologies or by attracting foreign direct investment. Hye (2012) summarized the latter factors as the efficient allocation of scarce resources, technology spillover effects from developed countries to developing countries, and learning by doing effect that indicates a relationship between innovation and imitation.

Economic theory emphasizes two hypotheses, namely, trade-led growth (or, more commonly, export-led growth) and growth-led trade (or, more commonly, domestically-generated exports), to understand the relationship between trade openness and economic growth. The trade-led growth hypothesis indicates that trade openness affects economic growth by stimulating total factor productivity through adopting advance technology and know-how from the developed countries. Hence, the hypothesis suggests the presence of a causal link running from trade openness to economic growth. The growth-led trade hypothesis is based on neoclassical trade theory which indicates that economic growth leads to productivity growth which in turn leads to an increase in the international competitiveness of export products. Hence, this hypothesis suggests that the causal relationship runs from economic growth to trade growth. On the other hand, empirical studies also showed that bidirectional causality relation might exist between trade openness and economic growth. Nevertheless, Chang et al. (2009) argued that the relationship between trade openness and economic growth is not stable over the countries and structural characteristics of a country can significantly affect the nature of the causal relationships. Shayanewako (2018, p. 4) also states that “[i]t is evident from the existing literature that there is no consensus on the trade-growth link and the results are mixed across countries, data and empirical techniques.”

Given this background, our study particularly examines whether there exist changes in the (Granger-) causal dynamics between trade-openness and real economic growth in the case of Turkey. An in-depth understanding of the (Granger-) causal relationships between trade openness and real GDP growth in Turkey is not only important for Turkey but also for other developing countries since Turkey followed an import-substitution strategy until 1980 and switched to an outward-oriented strategy thereafter. Hence, an investigation of how the relationship between trade openness and real economic growth evolved in Turkey overtime (that is, over two opposing trade-orientation regimes) sheds further insights into the understanding of the relationship between trade openness and economic growth in general.

The economic liberalization policies in Turkey started with the liberalization of the foreign trade regime in 1980 (known as the 24th January 1980 decisions) and the financial liberalization was completed in 1989 by removing all price controls. During these periods, all government subsidies and tariffs were reduced, the tax system was revised and the government started to conduct trade policies that stimulate exports. Against this background, the aim of the paper is to examine the existence (or lack thereof) of Granger-causal relationship between economic growth and trade openness by means of Breitung and Candelon’s (2006) frequency domain causality test for the 1950–2014 periods.

In view of the argument by Chang et al. (2009) that the causal relationships (if any) between trade-openness and economic growth might change overtime as a country’s economic structure changes, we employ a rolling window version of Breitung and Candelon (2006) causality test to detect any time-varying characteristics of the causal relationships. This approach is also superior to using time dummy variables as they might lead to pre-test biases (Li et al. 2016). Given that a number of studies conducted overtime found different results on the trade openness and economic growth relationship in Turkey, our paper has the ability to provide a more unifying framework as we directly address and assess the time-varying nature of the causal relationships. As a second contribution to the literature, we detected evidence for the theoretical possibility of a distinct temporal ordering of variables in a causal feedback relationship, we call this case as a “sequential Granger-causal feedback”.

The rest of paper is organized as follows: Section 2 reviews the literature on the causality relation between economic growth and trade openness. In Section 3, we discuss the methodology employed in our paper. Section 4 presents the data characteristics and the results from causality analysis. Finally, Section 5 concludes.

2. Literature Review

The studies that have examined the relationships between trade openness and economic growth in the empirical literature can be classified into three groups. The first group has generally considered individual aggregate country data; another group of studies employed more recent panel data analyses; a further line of studies focused on industry-level effects. Giles and Williams (2000a, 2000b) provided a review of the literature until 2000. In what follows, we mainly review some of the studies on developing countries in the more recent periods.

Among studies on developing countries that used aggregate individual country-level data that examined the causal relationships between trade openness and economic performance, Awokuse (2008) emphasized that imports are important as well as exports when analyzing the relation between trade and economic growth. Therefore, he examined the relation between imports, exports and economic growth by means of Granger-causality tests and impulse-response functions in Argentina, Colombia, and Peru. Empirical results suggested that the causal link running from imports to real economic growth is stronger than the Granger-causal relationship running from exports to real economic growth. Moreover, Awokuse (2008) found evidence for the reverse causality relationship from economic growth to exports and imports; hence leading to a Granger-causal feedback between exports and economic growth. Klasra (2011) investigated the presence of long-run relationships between the determinants of economic growth for Pakistan and Turkey by employing the autoregressive distributed lags (ARDL) model. Empirical results suggested the existence of bidirectional causal relationship between trade openness economic growth for Pakistan and foreign direct investment and exports for Turkey in the short-run. Klasra (2011) also found that economic growth Granger-caused exports in Turkey and trade openness Granger-caused real economic growth in Pakistan in the long-run. Shahbaz (2012) analyzed the relationship between trade openness and economic growth by using a Cobb-Douglas production function for Pakistan. Shahbaz employed four different types of proxies for trade openness. The proxies used were exports, imports, terms of trade, and trade per capita (i.e., the sum of real exports per capita and real imports per capita). Shahbaz’s empirical results supported the growth-led-exports, growth-led-imports, and growth-led-trade hypotheses for Pakistan. Bojanic (2012) found that financial development and financial development are the Granger cause of economic growth for Bolivia during the periods of 1940–2010. Hye and Lau (2015) empirically examined the relation between trade openness and economic growth in India by using the ARDL model and rolling-window regression approach. They showed that the effect of trade openness on economic growth was time-varying over the sample period and that trade openness affected real economic growth positively in the short run. However, economic growth was negatively affected by trade openness in the long run, which corresponds in the literature to the growth-reducing exports (or openness) hypothesis.

The second group of studies examined the relation between trade openness and economic growth by employing cross-country or panel data. Accordingly, Gries et al. (2011) investigated causal link between finance, growth and trade openness for 13 Latin American and Caribbean countries. Their empirical results suggest that financial and trade openness are not preconditions of economic growth for the countries in questions. They also indicated that more balanced policy approach that also considers other fundamental factors of economic growth is more suitable for these countries. (Kim et al. 2012) investigated the presence of Granger-causal relationships between economic growth, financial development, and trade openness by using a simultaneous equation model for 63 countries. Kim et al. (2012) empirical findings showed that trade openness stimulates economic growth in high-income, low-inflation, and non-agricultural countries. Although the effects of financial development on trade were positive, financial development was negatively affected by higher trade openness in countries with low-income, with high-inflation, or with larger agricultural sectors. Tekin (2012) examined the presence of Granger-causal relationships among the real GDP, real exports and real net foreign direct investment (FDI) inflows for the least developed countries for the period between 1970 and 2009 by means of panel causality test suggested by Kónya (2006). Hossain and Mitra (2013) analyzed the presence of Granger-causal relationships between trade openness, foreign aid, domestic investment, external debt, government spending, and economic growth in 33 highly aid-dependent African countries for the periods of 1974–2009. Although bidirectional causal links between trade openness and economic growth were found in the short run, an increase in the trade openness triggered economic growth in the long run. Menyah et al. (2014) analyzed the Granger-causal relationships between the level of financial development, trade openness, and economic growth for 21 Sub-Saharan African countries by using panel Granger-causality tests. They found that financial development is a Granger-cause of economic growth only in three countries and the causal link between financial development and trade openness was limited. Overall, empirical results suggest that financial development and trade openness do not Granger-cause real economic growth for Sub-Saharan Africa. Sakyi et al. (2015) analyzed the relationship between trade openness and income levels in 115 developing countries for the period 1970–2009 using non-stationary heterogeneous panel cointegration tests. Their findings indicated the presence of a bi-directional or a feedback relationship both in the short- and in the long-run.

The third line of studies in the trade openness and economic growth literature employs industry or sector-level analyses. Some examples of this approach for developing countries are Ghatak et al. (1997) for Malaysia; Parida and Sahoo (2007) for South Asian countries; Sahoo et al. (2014) for India; Toyin (2016) for South Africa; and Aslan and Topcu (2018) for Turkey. Despite different time period covered and different countries involved in the analyses, the outcome of the sectoral-level studies is no different than the aggregate country-level studies: that is, there is no clear Granger-causal relationship between exports or trade openness and real economic performance in developing countries.

There is also a growing literature that focus on Granger-causal relationships between trade and economic growth in Turkey. Hatemi-J and Irandoust (2000) employed vector autoregressions (VARs) to examine the relationship between exports and economic growth in Turkey, Greece, Mexico, Ireland, and Portugal. Their findings on Turkey indicated no Granger-causal relationships between exports and economic growth. Yanikkaya (2003) explored the relation between economic growth and trade openness for Turkey. He considered two types of openness measures that include trade volumes and intensity. Yanikkaya’s results showed that trade promotes economic growth through a number of channels such as technology transfers, scale economies, and by creating comparative advantage. Utkulu and Kahyaoğlu (2005) examined the effect of trade and financial openness on economic growth in Turkey by means of threshold autoregressive (TAR) models and Markov regime-switching models. Their empirical findings indicated that increases in financial openness cause lead to a higher probability of remaining in a recession. Conversely, trade openness has a positive impact on economic growth in Turkey. On the other hand, Yapraklı (2007) found that the relationship between trade and financial openness and economic growth has different effects in the short- and long-run in Turkey. Whereas increases in trade openness and financial openness stimulate economic growth in the long run, there is evidence in favor of a bidirectional causality (feedback) relationship in the short run. Korkmaz et al. (2010) analyzed the effect of financial openness on economic growth and financial crisis simultaneously in Turkey and concluded that financial openness increased both economic growth and likelihood of a financial crisis. On the other hand, the effect of trade openness on economic growth is higher than its effect on the likelihood of a financial crisis. Kıran and Güriş (2011) analyzed the relation among trade and finance openness and economic growth by using the Bond test and the Toda-Yamamoto causality test in Turkey. They found evidence in favor of a bidirectional Granger-causal relationship between trade openness and economic growth. They also found that financial openness did not Granger-cause economic growth. Kar et al. (2014) analyzed the relation among trade liberalization, financial development and economic growth in Turkey for the periods of 1989–2007 by using both linear and nonlinear Granger-causality tests. Their empirical results suggested the presence of bidirectional causal relation among trade, financial development, and economic growth in Turkey. Çeliköz et al. (2017) used cointegration tests and a vector error correction model (VECM) to examine the Granger-causal relationships between trade openness and economic growth in Turkey for the 1980–2016 period. Çeliköz et al. (2017) detected unidirectional Granger-causality from trade openness to economic growth in the short-run. On the other hand, Eren and Ergin-Ünal (2019) examined the Granger-causal relationships between trade openness and economic growth in Turkey for a longer time period—from 1960 to 2016—using Engle-Granger and Gregory-Hansen cointegration tests and Toda-Yamamoto Granger causality tests. Their findings showed no evidence in favor of a long-run relationship but indicated unidirectional causality from economic growth to trade openness.

At the disaggregate level, there is some evidence that—at least in the post-1980 period—there might be a positive Granger-causal relationship from exports originating from the manufacturing sectors to real economic growth in Turkey. Aslan and Topcu (2018) reviews the evidence at the disaggregate level; see the analyses by Aslan and Topcu (2018, Table 3), which indicate similar findings.

One interesting line of literature examining the statistical relationships between (trade-) openness and economic growth includes the role of the foreign direct investment (FDI) variable. The question is to what extent (trade-) openness already stands as proxy for a more favorable foreign investment environment that might enhance economic growth as well; or whether FDI has a separate additional causal effect on economic growth dynamics. In the context of Turkey and this paper, the general conclusion from the findings in the literature is that the FDI variable does not significantly enter the relationship when trade-openness is included. Karış and Ayla (2018), for instance, used cointegration and Granger-causality tests and find a unidirectional Granger-causal link from trade openness to foreign direct investment in Turkey for the 1980–2016 period. Karış and Ayla (2018, p. 256) conclude that “[t]rade openness acts as a stimulant in terms of foreign direct investment flows.” Erkişi (2018) used quarterly data from 1998Q1 to 2018Q1 to examine the contributions of exports, imports, and foreign direct investment to real GDP growth in Turkey. The variance decomposition analyses indicate that real GDP growth is mostly explained by its own history (75%). Imports have a 20% contribution and the contributions of exports and foreign direct investment are 5% each. These findings also indicate that trade openness overall has a much larger effect on real GDP growth than foreign direct investment. Overall, it can be said that trade-openness serves as a (de facto) proxy for other variables that are associated with outward-orientation; hence FDI does not have much significant individual explanatory power on economic growth.

3. Econometric Methodology

After the seminal paper of Granger (1969), a large number of studies have empirically analyzed the causal relationships between various economic and financial time series. Several improvements in testing methodology have been made in the literature. For instance, Granger (1988) proposed a cointegration test for nonstationary time series in which causal relationships can be examined by using an error correction model (ECM). Toda and Yamamoto (1995) suggested a test procedure based on an augmented-VAR model to examine the (Granger-) causal relationships between variables.

A further recent development on the Granger-causality test has been its extension by Breitung and Candelon (2006) in the frequency domain. Note that Granger’s (1969) original analysis also used the frequency domain. The frequency-based decomposition of spectral density is based on Geweke (1982) and Hosoya (1991), and employs a Wald-type testing procedure for detecting causality at given frequencies. Nevertheless, this testing procedure has some drawbacks because testing for causality entails a complicated set of nonlinear restrictions on the autoregressive parameters. To overcome these issues, Yao and Hosoya (2000) proposed a delta method based on numerical derivatives in the frequency-based causality test. Recently, Breitung and Candelon (2006) suggested a test procedure based on frequency-domain causality measure by using a bivariate vector autoregressive (VAR) model and they showed that the test procedure is superior other frequency-domain approaches. In addition, Breitung and Candelon (2006) showed that the test procedure could be generalized to allow for cointegrating relationships and higher-dimensional systems.

Technically speaking, the testing procedure by Geweke (1982), Yao and Hosoya (2000), and Hosoya (2001) can be outlined as follows.

Let be a two-dimensional vector of time series observed at t = 1, …, T where yt and xt are economic growth and trade openness respectively. It is assumed that ht has a finite-order VAR representation of the form:

where is a 2 × 2 lag polynomial with . It is assumed that the error vector εt is white noise with and , where Σ is positive definite. Let G be the lower triangular matrix of the Cholesky decomposition such that and . If the system is assumed to be stationary, the MA representation of the system can be formulated as following:

where and . Using this representation, the spectral density of xt can be expressed as:

Geweke (1982) and Hosoya (2001) defined the measure of causality as the following:

If , it can be said that y does not Granger cause x at frequency ω. Note that Yao and Hosoya (2000) suggested to estimate by replacing and with estimates obtained from the fitted VAR model and then the delta method can be applied for testing the null hypothesis. On the other hand, it is based on complicated nonlinear restrictions in the VAR parameters and hence this testing procedure is very difficult.

The methodology by Breitung and Candelon (2006), on the other hand, proposed a much simpler approach to test the null hypothesis, namely, that y does not Granger-cause x at frequency ω:

where g22 is the lower diagonal element of G−1 and is the determinant of . It follows that y does not Granger-cause x at frequency ω if:

where is the (1,2)-element of . Thus, a necessary and sufficient set of conditions can be written as following: is:

The approach is based on the linear restrictions above equations. To simplify the notation, we let and so that the VAR equation for xt is written as:

The hypothesis is equivalent to linear restriction:

where and:

In order to the test the null of no causality, the ordinary F statistic, which is approximately distributed as F(2, T-2p), for can be calculated. It should be noted that the testing methodology can be extended for the higher-dimensional systems. For instance, if we consider the effect of third (or common) variable on the causality relation between economic growth and trade openness, the causality relation in a three dimensional system can be formulated as follows:

where zt is third variable such as capital, labor, government expenditure, and terms of trade. Hosoya (2001) suggested that the causality measure is identical to the bivariate causality measure between ut and vt as follows:

where and . Hence, the testing procedure for higher-dimensional system can be formulated as a bivariate causality measure with appropriately transformed variables.

4. Data and Estimation Results

The aim of this study was to investigate the causality relation between economic growth and trade openness by means of rolling window frequency domain test proposed by Breitung and Candelon (2006). We used annual data that were obtained from Feenstra et al. (2015): Penn World Tables (PWT) 9.0 covering the period from 1950 to 2014. The Penn World Tables data have the advantage of being calculated on time-wise and country-wise consistent definitions. We took the real GDP variable (at 2011 prices) to represent real economic growth and the sum of exports and imports to GDP ratio as a proxy for trade openness. Despite the fact that we tested for the bivariate Granger-causal relationships between trade openness and economic growth, we introduced additional control variables such as capital, labor, government expenditure, and terms of trade developments into the test equations. Hence, while we examined the bivariate frequency-domain Granger-causal relationships between trade openness and real economic growth in Turkey, we took into account the effects of third variables that stem from a production function framework. This framework also helps prevent the detection of possibly spurious Granger-causality results that might emerge from not including third variables that affect both economic growth and trade openness variables. Using the PWT 9.0 database, we used the capital-stock-to-GDP ratio, the number of people engaged in working, government-consumption-to-GDP ratio, and the ratio of exports prices to imports prices (terms of trade) variables as control variables. We have also considered including the foreign direct investment (FDI) variable in the control variable set. Nevertheless, the FDI variable was not included in the PWT 9.0. The FDI series on Turkey from the World Bank starts in 1974, leading to a much shorter sample period. Given the resulting much shorter sample and the results from the earlier literature that FDI does not significantly affect economic growth in Turkey (as discussed above), we did not include the FDI variable among the control variables.

Our study differs from earlier studies as we test for the presence of Granger-causal links between economic growth and trade openness in the frequency domain not only for the overall sample (1950–2014), but also for different sample periods based on a rolling estimation window. This approach allows us to determine how the Granger-causal relationships evolve over time while at the same time yielding further information on the short- and long-term nature of (if any) Granger-causal relationships at given estimation windows.

We start our analysis by first testing for the stationarity of the variables by means of the augmented Dickey-Fuller (ADF) and Phillips-Perron (PP) unit root tests. We included a constant term and trend in the specification of the unit root tests and select the optimal lag lengths according to the Akaike information criterion (AIC). The unit root test results are presented in Table 1.

Table 1.

Unit Root Tests.

The test results in Table 1 show that real GDP, labor, and terms of trade are stationary at 1% significance level. Although capital was found be stationary at 10% significance level, we can reject the null hypothesis for the trade openness and expenditure at first differences. It should be noted that Breitung and Candelon (2006) indicated that the frequency domain test is robust for the lag-augmented Granger-causality test proposed by Toda and Yamamoto (1995), and hence, we considered one for the maximum order of integration of variables in the test procedure.

After confirming the integration levels of the variables, we employ a bivariate VAR model with control variables and with lag-lengths determined according to the AIC. Then, we employed (in line with Breitung and Candelon 2006) a frequency-domain-based test to determine the Granger-causal linkages between economic growth and trade openness.

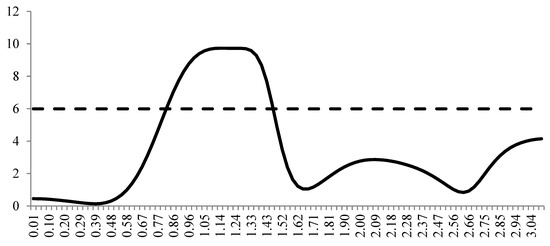

The test results for the Granger-causal linkages running from trade openness to economic growth for the complete sample period (1950–2014) are shown Figure 1. Notice that frequency-based causality test is employed for all frequencies in the interval (0, π). The null hypothesis of no causal relationship running from trade openness to economic growth can be rejected at 5% significance level in the range of ω ∈ [0.83, 1.46], which corresponds to a cycle length between 4.3 and 7.5 years. Hence, it can be said that trade openness was the Granger cause of economic growth in the medium-run when the complete sample period is used.

Figure 1.

Breitung-Candelon-Granger Causality test results running from trade openness to real GDP growth in Turkey (1950–2014). The vertical axis shows the p-values. The p-value is the estimated probability to reject the null hypothesis of no Granger-causality. Dashed line indicates 5% statistical significance level. Lag lengths in the model specification are determined as 7. The VAR model is estimated with p + 1 lags.

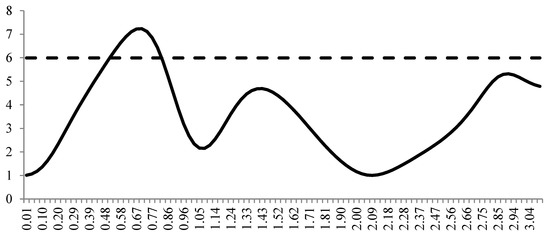

The frequency domain causality test results for the null hypothesis that economic growth does not Granger-cause trade openness are presented in Figure 2. The results in Figure 2 suggest that economic growth is found to Granger-cause trade openness in the frequency range of [0.48, 0.83], which corresponds to 7.5 and 13 years. Please note that we also estimated the model for the 1974–2014 period with the FDI variable included in the control variables set. We found that the Granger-causality results from a model which includes FDI do not differ significantly from a model which does not include the FDI variable.

Figure 2.

Breitung-Candelon-Granger Causality test results running from real GDP growth trade openness in Turkey (1950–2014). The vertical axis shows the p-values. The p-value is the estimated probability to reject the null hypothesis of no Granger-causality. Dashed line indicates 5% statistical significance level. Lag lengths in the model specification are determined as 7. The VAR model is estimated with p + 1 lags.

Our findings for the full-sample between 1950 and 2014 suggest that economic growth is the Granger-cause of trade openness only in the long-run. The results presented in Figure 1 and Figure 2 contradict the findings by Hatemi-J and Irandoust (2000) on Turkey, which indicated no Granger-causal relationships between exports and economic growth. The detected relationship in our study supports a feedback relationship between trade openness and economic growth (albeit at different time horizons) during the 1950–2014 period. Our results indicating the long-run time horizon on the effects of trade openness on economic growth partly confirm Yanikkaya (2003), who showed that trade promotes economic growth through a number of channels, and Utkulu and Kahyaoğlu (2005), who found that trade openness has a positive impact on economic growth in Turkey. We also confirmed the feedback relationship found by Yapraklı (2007); however, we differ in the timing of the causal effects.

A key additional information obtained by using the frequency domain analysis is that it also yields the timing and the sequence of causal effects. This is different from the time domain approach in which one must rather select optimal lag lengths. A further examination of Figure 1 and Figure 2 suggests that the trade openness’s Granger-causal effect on economic growth comes in earlier than the economic growth’s Granger-causal effect on trade openness. Qualitatively, there exists a causal feedback relationship; however, the effects of each variable on the other one are non-overlapping in time. This interesting phenomenon, where there is a temporal ordering in a feedback relationship might be called a “sequential Granger-causal feedback relationship”. As such, our analysis might provide further insights into a better understanding of the Granger-causal feedback relationships in the literature as this information is not available in the usual time domain approaches discussed above.

It is also interesting to note that the overall sample period shows a Granger-causal link from trade openness to economic growth in Turkey given that the period from 1950 to 1980 is considered to be an import-substitution era in Turkey. According to the World Bank’s World Development Report (The World Bank 1987, Figure 5.1, p. 83), Turkey is classified as “strongly inward-oriented” in the 1965–1973 period, while it is considered to be “moderately outward-oriented” in 1973–1985. However, it must be noted that the period 1973 to 1979 is still recognized as a continuation of the import-substitution regime in Turkey and the switch to outward-orientation occurred after the 24 January 1980 decisions in Turkey. According to the Penn World Tables 9.0 data (PWT9.0) from Feenstra et al. (2015), the average annual real growth rate was about 2.5 per cent between 1950 and 1979. During this period, the ratio of exports and imports to GDP was about 5.7 per cent. After 1980, the trade openness ratio increased substantially registering an average of 22.5 per cent and reaching a maximum of 43.8 per cent in 2008. Trade openness declined to 34.2 per cent in 2009 due to the effects of the global financial crisis and stayed in the around 36–39 per cent range afterwards. Real GDP growth did not seem to match the increase in trade openness as it suffered from a number of economic and financial crises in 1980s, in 1990s, and in 2000s. Real GDP growth registered an average annual growth rate of about 1.8 per cent between 1980 and 2014. It should be noted that these figures are calculated from the PWT9.0; it might differ from the figures from other sources.

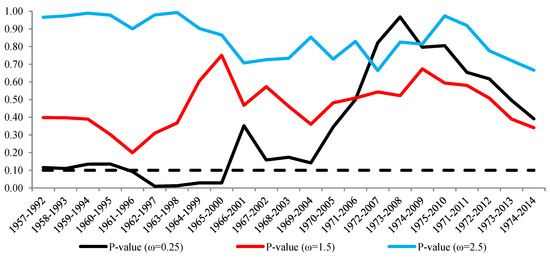

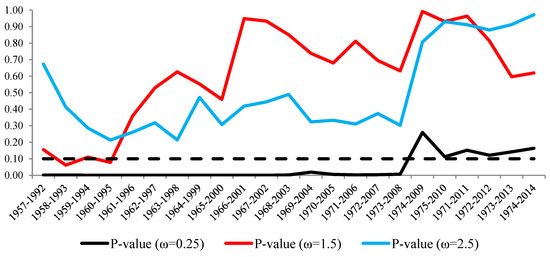

Since the Turkish economy experienced several policy regime changes over the course of the sample period, the relationship between economic growth and trade openness might indeed be time-varying. Therefore, we employed a rolling-window frequency-domain Granger-causality test to determine whether there are time-varying dynamic relationships between the variables in question. For calculating the time-varying frequency domain causality test, we first needed to determine an appropriate rolling sample size. In this context, a small sample size might lead to inefficient and non-robust results; on the other hand, a large rolling sample size may cause a long delay in detecting the changes in the nature of Granger-causal relationships. In view of these trade-offs and in order to ensure the robustness of our findings, we experimented with several rolling sample sizes and we found that optimal sample size to be 35 years. Whether in the frequency domain or not, another important task for running time-varying Granger-causality tests is to determine the optimal lag lengths. We used the Akaike information criteria (AIC) and seven lags were determined to render residuals to be white noise processes. The AIC led to more parsimonious lag structures and provided increased efficiency for the test results. We present the time-varying causality test results in Figure 3 and Figure 4.

Figure 3.

Time-varying Granger-Breitung-Candelon Causality test results running from trade openness to real GDP growth with a rolling-window of 35 years. The vertical axis shows the p-values. The p-value is the estimated probability to reject the null hypothesis of no Granger-causality. Dashed line indicates 10% statistical significance level. Lag lengths in the model specification are determined as 7. The VAR model is estimated with p + 1 lags.

Figure 4.

Time-varying Granger-Breitung-Candelon Causality test results running from real GDP growth to trade openness with a rolling-window of 35 years. The vertical axis shows the p-values. The p-value is the estimated probability to reject the null hypothesis of no Granger-causality. Dashed line indicates 10% statistical significance level. Lag lengths in the model specification are determined as 7. The VAR model is estimated with p + 1 lags.

It should be noted that we employed time-varying Granger-Candelon-Breitung-causality test for several frequency points (such as ω = 0.25, 0.5, 1.0, 1.5, 2.0, and 2.5 and it represents t = 25.1, 12.5, 6.2, 4.1, 3.14, and 2.5 years, respectively) and we found similar results for different frequency points. Therefore, we present the test results only for three frequency points; the results for other frequencies are available upon request. In Figure 3, we present the probabilities for the null hypothesis of trade openness is not Granger cause of GDP. The results in the Figure 3 indicate that the null hypothesis of “trade openness does not Granger-cause economic growth” can be rejected only at a low frequency (ω = 0.25 and t = 25.1 year) and at specific time periods. These findings suggest that trade openness Grange-cause real GDP growth for the periods of 1961–2000 in Turkey and that this can be evaluated as rather long-run Granger-causal relationship. Note that we cannot reject the null hypothesis at higher frequencies. Hence, these results indicate the lack of a Granger-causal link running from trade openness to real economic growth in the short-run.

We present the time-varying Granger causality test results running from GDP to trade openness in Figure 4 and the test results suggest that there is a Granger-causal link running from real GDP growth to trade openness in the long-run until 2007. In the sub-samples containing the periods after 2008, we can reject the null hypothesis at low frequency (ω = 0.25 and t = 25.1 year). This might be because the global financial crisis might have affected or weakened the Granger-causal relation from trade openness to economic growth in general. It should be noted that we can also reject the null hypothesis at the beginning of the sample at a middle frequency (ω = 1.5 and t = 4.1 year). We cannot find any causal link at high frequency and these results suggest evidence in favor of growth-led trade hypothesis in the long-run.

In view of the results obtained from the rolling-sample analyses as depicted in Figure 3 and Figure 4, it can be said that our results support Korkmaz et al. (2010), who found that trade openness has a positive effect on economic growth. Nevertheless, in our case, we also detect a feedback relationship from economic growth to trade openness. This is more in line with Kıran and Güriş (2011) and Kar et al. (2014), who found a bidirectional Granger-causal relationship between trade openness and economic growth. On the other hand, we differ from Çeliköz et al. (2017), who detected only unidirectional Granger-causality from trade openness to economic growth in the short-run. Furthermore, we also differ from Eren and Ergin-Ünal (2019), who did not find a long-run relationship but indicated only unidirectional causality from economic growth to trade openness.

It should be noted that the differences between our results and the earlier findings in the literature might arise due to a number of factors, such as the types of models used, the variables included in the models, and even due to data revisions. Two important features of our methodology is the use of exogenous control variables in testing for the bivariate Granger-causal relationships between real economic growth and trade openness. This allows us to test for the independent effects of trade openness on economic growth (and vice versa) after controlling for growth in other factors of production. In addition, the earlier studies employed time domain tests for Granger-causality. The frequency domain approach employed in our study enables us to distinguish the timing of the Granger-causal effects better and provides additional insights, such as the detection of a sequential feedback relationship. Last, but not least, the rolling sample Granger-causality tests allows for the detection of changes in the Granger-causal relationships overtime and provides a framework to compare the results of the current study to the ones conducted in earlier time periods.

5. Conclusions

The relationship between economic growth and trade openness have been widely examined in the literature because economic theory suggests that trade openness might contribute to real economic growth in several ways such as: a more efficient allocation of scarce resources, technology spillover effects from developed countries to developing countries, learning-by-doing effects, as well as the more conventional foreign-exchange-providing effects. The literature on the relationship between trade openness and economic growth emphasizes two main hypotheses: export- or trade-led economic growth and economic growth-led trade growth. The observed positive correlation between export growth and economic growth is inadequate to indicate the direct of the causal link if there exists any.

This study focused on the particular case of Turkey and analyzed the relationships between trade openness and economic growth using a frequency domain causality test; namely, the Breitung and Candelon (2006) approach for the Granger-causality test. The literature on the relationship between and exports and economic growth or trade openness and economic growth in Turkey using aggregate data generally found a feedback relationship between trade and economic growth in the more recent periods. Nevertheless, there are also studies that do not find a link from trade to economic growth, but rather from economic growth to trade. Turkey presents an interesting case as the country switched from a rather strongly-inward orientation before 1980 to a moderately outward oriented economic growth model in the post-1980 period.

One problem with combining the results from different studies in the literature is that they cover different time periods and the data used in the studies might indeed not be compatible due to the changes in the definitions in the variables. Our study addresses these problems by employing the consistent and time-wise comparable data from the Penn World Tables (9.0) and also by running a rolling-window estimation approach. As such, we are able to detect the changes in the nature of the Granger-causal relationships over time and that the results obtained for each sub-sample are comparable to other sub-sample periods.

Our findings indicate that trade openness Granger-causes real economic growth and economic growth also Granger-causes trade openness; hence, there is evidence of a feedback relationship. Although our findings appear in line with the results in the literature at first sight; there are a number of differences and further insights as well.

First, our finding that trade openness Granger-causes real economic growth holds valid even when the sample includes the pre-1980 periods, which is generally considered to be counter-intuitive since the Turkish economy followed inward-oriented growth strategies prior to 1980. Hatemi-J and Irandoust (2000), for instance, did not find any Granger-causal relationships between exports and economic growth. However, our model includes additional variables that account for the developments in the factors of production. Hence, the Granger-causal link from trade openness to economic growth are found to be present in the pre-1980 periods as well once the developments in the factors of production are accounted or controlled for.

Secondly, the frequency domain approach allows us to distinguish between short-run and long-run causality and provide a time framework for the causal effects to set in. The results presented in Figure 1 and Figure 2, for instance, indicate that trade openness Granger-causes real economic growth in a time-window of 4.3 to 7.5 years; while real economic growth Granger-causes trade openness in a time-window of 7.5 to 13 years. Therefore, it can be said that the detected relationships are qualitatively a feedback relationship (i.e., the causal relationships run in both directions); however, from a quantitative aspect, the effect of trade openness on economic growth takes shorter time than the effect of economic growth on trade openness. Indeed, they do not overlap and present a clear temporal ordering. This phenomenon suggests the presence of a “sequential feedback relationship” between the variables. This might be an important point to consider in evaluating the Granger-causal feedback mechanisms in the literature.

From an economic theory point of view, it is possible that increased trade openness has effects on real economic growth sooner than the effects of economic growth on trade openness. First, increased exports provide foreign exchange—relieving foreign exchange gaps, and increased imports (especially of capital and intermediary goods) lead to higher output in the short-run. In the medium term, increased openness might lead to productivity and efficiency increases as well. On the other hand, trade openness is measured as a ratio to GDP. For economic growth to bring about significant level changes in the ratio of trade to GDP, changes in economic structure of a country is needed; this would take a longer time period.

Third, further analysis presented in Figure 3 and Figure 4 using a rolling estimation window indicates that the Granger-causal feedback relationship between trade openness and real economic growth exists only until the year 2000. Between 2000 and 2008, there was a unidirectional Granger-causal link from economic growth to exports. After 2008, there is no Granger-causal relationship between trade openness and economic growth once the developments in other factors of production are considered. The global financial crisis might also have affected the Granger-causal relationships between the variables. The time-varying nature of the Granger-causal relationships between trade openness and real economic growth would not have been possible without employing a rolling time series analysis.

Overall, taking Turkey’s experience as a case study, this study provides further insights into the evaluation of time-varying Granger-causal relationships in the trade openness and economic performance nexus.

Author Contributions

Conceptualization, E.İ.Ç., E.A. and T.K.; Data curation, E.İ.Ç. and E.A.; Formal analysis, E.İ.Ç., E.A. and T.K.; Investigation, E.İ.Ç., E.A. and T.K.; Methodology, E.İ.Ç., E.A. and T.K.; Software, E.İ.Ç.; Writing—original draft, E.İ.Ç., E.A. and T.K.

Funding

This research received no external funding.

Acknowledgments

We thank two anonymous reviewers for their valuable comments that led to many improvements.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aslan, Alper, and Ebru Topcu. 2018. The relationship between export and growth: Panel Data Evidence from Turkish Sectors. Economies 6: 22. [Google Scholar] [CrossRef]

- Awokuse, Titus O. 2008. Trade openness and economic growth: Is growth export-led or import-led? Applied Economics 40: 161–73. [Google Scholar] [CrossRef]

- Bojanic, Antonio N. 2012. The impact of financial development and trade on the economic growth of Bolivia. Journal of Applied Economics 15: 51–70. [Google Scholar] [CrossRef]

- Breitung, Jörg, and Bertrand Candelon. 2006. Testing for short and long-run causality: A frequency domain approach. Journal of Econometrics 132: 363–78. [Google Scholar] [CrossRef]

- Chang, Roberto, Linda Kaltani, and Norman V. Loayza. 2009. Openness can be good for growth: The role of policy complementarities. Journal of Development Economics 90: 33–49. [Google Scholar] [CrossRef]

- Çeliköz, Yıldız Sağlam, Emre Barutçu, and Mahmut Şaban Afsal. 2017. The relationship between trade openness and economic growth; The case of Turkey. Route Educational and Social Science Journal 4: 104–17. [Google Scholar]

- Edwards, Sebastian. 1992. Trade orientation, distortions, and growth in developing countries. Journal of Development Economics 39: 31–57. [Google Scholar] [CrossRef]

- Eren, Mehmet Vahit, and Ayşe Ergin Ünal. 2019. Analysis of the relationship between trade openness and economic growth: The case of Turkey. Sosyoekonomi 27: 81–93. (In Turkish). [Google Scholar] [CrossRef]

- Erkişi, Kemal. 2018. Foreign direct investment, trade openness and economic growth: A case of Turkey. The Academic Elegance (Akademik Hassasiyetler) 5: 189–202. [Google Scholar]

- Feenstra, Robert C., Robert Inklaar, and Marcel P. Timmer. 2015. The next generation of the Penn World Table. American Economic Review 105: 3150–82. Available online: https://www.rug.nl/ggdc/productivity/pwt/ (accessed on 29 April 2019). [CrossRef]

- Geweke, John. 1982. Measurement of linear dependence and feedback between multiple time series. Journal of the American Statistical Association 77: 304–24. [Google Scholar] [CrossRef]

- Ghatak, Subrata, Chris Milner, and Utku Utkulu. 1997. Exports, export composition and growth: Cointegration and causality evidence for Malaysia. Applied Economics 29: 213–23. [Google Scholar] [CrossRef]

- Giles, Judith A., and Cara L. Williams. 2000a. Export-led growth: A survey of the literature and some non-causality results—Part 1. The Journal of International Trade and Economic Development 9: 261–337. [Google Scholar] [CrossRef]

- Giles, Judith A., and Cara L. Williams. 2000b. Export-led growth: A survey of the literature and some non-causality results—Part 2. The Journal of International Trade and Economic Development 9: 445–70. [Google Scholar] [CrossRef]

- Gräbner, Claudius, Philipp Heimberger, Jakob Kapeller, and Florian Springholz. 2018. Measuring Economic Openness: A Review of Existing Measures and Empirical Practices. Institute of the Comprehensive Analysis of the Economy (ICAE) Working Paper Series—No. 84; Linz: Johannes Kepler University. [Google Scholar]

- Granger, Clive W. J. 1969. Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37: 424–38. [Google Scholar] [CrossRef]

- Granger, Clive W. J. 1988. Recent developments in the concept of causality. Journal of Econometrics 37: 199–211. [Google Scholar] [CrossRef]

- Gries, Thomas, Manfred Kraft, and Daniel Meierrieks. 2011. Financial deepening, trade openness and economic growth in Latin America and the Caribbean. Applied Economics 43: 4729–39. [Google Scholar] [CrossRef]

- Hatemi-J, Abdulnasser, and Manuchehr Irandoust. 2000. Time-Series evidence for Balassa’s export-led growth hypothesis. The Journal of International Trade and Economic Development 9: 355–65. [Google Scholar] [CrossRef]

- Hosoya, Yuzo. 1991. The decomposition and measurement of the interdependence between second-order stationary process. Probability Theory and Related Fields 88: 429–44. [Google Scholar] [CrossRef]

- Hosoya, Yuzo. 2001. Elimination of third-series effect and defining partial measures of causality. Journal of Time Series Analysis 22: 537–54. [Google Scholar] [CrossRef]

- Hossain, Sharif, and Rajarshi Mitra. 2013. The Determinants of economic growth in Africa: A dynamic causality and panel cointegration analysis. Economic Analysis and Policy 43: 217–26. [Google Scholar] [CrossRef]

- Hye, Qazi Muhammad Adnan. 2012. Long-term effect of trade openness on economic growth in case of Pakistan. Quality & Quantity 46: 1137–49. [Google Scholar]

- Hye, Qazi Muhammad Adnan, and Wee-Yeap Lau. 2015. Trade openness and economic growth: Empirical evidence from India. Journal of Business Economics and Management 161: 188–205. [Google Scholar] [CrossRef]

- Kar, Muhsin, Şaban Nazlıoğlu, and Hüseyin Ağır. 2014. Trade openness, financial development and economic growth in Turkey: Linear and nonlinear causality test. BDDK Bankacılık ve Finansal Piyasalar 8: 63–86. [Google Scholar]

- Karış, Çiğdem, and Dilara Ayla. 2018. Econometric Analysis of the relationship between foreign direct investment and trade openness in Turkey. Bingöl Üniversitesi Sosyal Bilimler Enstitüsü Dergisi 8: 255–71. Available online: http://busbed.bingol.edu.tr/issue/39173/447782 (accessed on 29 April 2019). (In Turkish).

- Kim, Dong-Hyeon, Shu-Chin Lin, and Yu-Bo Suen. 2012. The simultaneous evolution of economic growth, financial development, and trade openness. The Journal of International Trade & Economic Development 2: 513–37. [Google Scholar]

- Kıran, Burcu, and Burak Güriş. 2011. Türkiye’de ticari ve finansal dışa açıklığın büyümeye etkisi: 1992–2006 dönemi üzerine bir inceleme. Anadolu Üniversitesi Sosyal Bilimler Dergisi 11: 69–80. (In Turkish). [Google Scholar]

- Klasra, Mushtaq Ahmad. 2011. Foreign direct investment, trade openness and economic growth in Pakistan and Turkey: An investigation using bounds test. Quality & Quantity 45: 223–31. [Google Scholar]

- Kónya, László. 2006. Exports and growth: Granger causality analysis on OECD countries with a panel data approach. Economic Modelling 23: 978–92. [Google Scholar] [CrossRef]

- Korkmaz, Turhan, Emrah İsmail Çevik, and Elif Birkan. 2010. Finansal dışa açıklığın ekonomik büyüme ve finansal krizler üzerindeki etkisi: Türkiye örneği. Journal of Yasar University 17: 2821–31. (In Turkish). [Google Scholar]

- Li, Xiao-Lin, Mehmet Balcilar, Rangan Gupta, and Tsangyao Chang. 2016. The causal relationship between economic policy uncertainty and stock Returns in China and India: Evidence from a bootstrap rolling window approach. Emerging Markets Finance and Trade 52: 674–89. [Google Scholar] [CrossRef]

- Menyah, Kojo, Saban Nazlioglu, and Yemane Wolde-Rufael. 2014. Financial development, trade openness and economic growth in African countries: New insights from a panel causality approach. Economic Modelling 37: 386–94. [Google Scholar] [CrossRef]

- Parida, Purna Chandra, and Paravakar Sahoo. 2007. Export-led growth in South Asia: A panel cointegration analysis. International Economic Journal 21: 155–75. [Google Scholar] [CrossRef]

- Sahoo, Auro Kumar, Dukhabandhu Sahoo, and Naresh Chandra Sahu. 2014. Mining exports, industrial production and economic growth: A cointegration and causality analysis for India. Resources Policy 42: 27–34. [Google Scholar] [CrossRef]

- Sakyi, Daniel, Jose Villaverdi, and Adolfo Maza. 2015. Trade openness, income levels, and economic growth: The case of developing countries, 1970–2009. Journal of International Trade and Economic Development 24: 860–82. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad. 2012. Does trade openness affect long run growth? Cointegration, causality and forecast error variance decomposition tests for Pakistan. Economic Modelling 29: 2325–39. [Google Scholar] [CrossRef]

- Shayanewako, Varaidzo Batsirai. 2018. The relationship between trade openness and economic growth: The case of BRICS countries. Journal of Global Economics 6: 289. [Google Scholar] [CrossRef]

- Tekin, Rıfat Barış. 2012. Economic growth, exports and foreign direct investment in Least Developed Countries: A panel Granger causality analysis. Economic Modelling 29: 868–78. [Google Scholar] [CrossRef]

- The World Bank. 1987. World Development Report. New York: Oxford University Press. [Google Scholar]

- Toda, Hiro Y., and Taku Yamamoto. 1995. Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics 66: 225–50. [Google Scholar] [CrossRef]

- Tornell, Aaron, Frank Westermann, and Lorenzo Martinez. 2003. Liberalization, Growth, and Financial Crises: Evidence from the Developing World. Brookings Papers on Economic Activity 2: 1–112. [Google Scholar] [CrossRef]

- Toyin, Megbowon Ebenezer. 2016. Causality relationship between agricultural exports and economic growth: Evidence from South Africa. Journal of Social Sciences 48: 129–36. [Google Scholar] [CrossRef]

- Utkulu, Utku, and Hakan Kahyaoğlu. 2005. Ticari ve Finansal dışa açıklık Türkiyede Büyümeyi ne Yönde Etkiledi? Discussion Paper, No. 2005/13. Ankara: Turkish Economic Association. Available online: https://www.econstor.eu/handle/10419/83223 (accessed on 29 April 2019). (In Turkish)

- Yanikkaya, Halit. 2003. Trade openness and economic growth: A cross-country empirical investigation. Journal of Development Economics 72: 57–89. [Google Scholar] [CrossRef]

- Yao, Feng, and Yuzo Hosoya. 2000. Inference on one-way effect and evidence in Japanese macroeconomic data. Journal of Econometrics 98: 225–55. [Google Scholar] [CrossRef]

- Yapraklı, Sevda. 2007. Ticari ve finansal dışa açıklık ile ekonomik büyüme arasındaki ilişki: Türkiye üzerine bir uygulama. Ekonometri ve İstatistik 5: 67–89. (In Turkish). [Google Scholar]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).