Abstract

In recent years, extensive research has focused on the relationship between corporate social responsibility (CSR) and financial performance. While past studies have explored this connection, they often faced challenges in quantitatively assessing the effectiveness of CSR initiatives. However, advancements in research methodologies and the development of Environmental, Social, and Governance (ESG) measurement dimensions have led to the creation of more robust evaluation criteria. These criteria use ESG scores as primary reference indicators for assessing the effectiveness of CSR activities. This study aims to utilize ESG indicators from the ESG InfoHub website of the Taiwan Stock Exchange Corporation (TSEC) as benchmarks, comprising 15 items from the environmental (E), social (S), and governance (G) dimensions to form the CSR effectiveness indicators and predict financial performance. The data cover the years 2021–2022 for listed companies, using return on assets (ROA) and return on equity (ROE) as measures of financial performance. With the rapid development of artificial intelligence in recent years, the applications of machine learning and deep learning (DL) have proliferated across many fields. However, the use of machine learning to analyze ESG data remains rare. Therefore, this study employs machine learning models to predict financial performance based on ESG performance, utilizing both classification and regression approaches. Numerical results indicate that two deep learning models, Long Short-Term Memory (LSTM) and Convolutional Neural Network (CNN), outperform other models in regression and classification tasks, respectively. Consequently, deep learning techniques prove to be feasible, effective, and efficient alternatives for predicting corporations’ financial performance based on ESG metrics.

1. Introduction

For decades, there have been various viewpoints on whether companies should bear social responsibilities beyond generating profits for their investors. Friedman [1] famously argued that the sole responsibility of businesses is to maximize profits for shareholders. However, with environmental changes and the advent of globalization, a growing number of people now believe that companies should also fulfill their responsibilities as global citizens by making positive impacts on society and the environment. This perspective envisions a triple-win scenario for employees, businesses, and society, fostering sustainable development.

Corporate social responsibility (CSR) has gained increasing global significance in recent years. The concept of CSR was first proposed by British scholar Sheldon [2] and further elaborated by Bowen [3]. Bowen provided an initial definition of the social responsibility of businessmen, asserting that corporate decisions affect the well-being of employees, customers, and stakeholders, and have a direct impact on society as a whole. Consequently, companies must voluntarily engage in socially responsible activities to contribute positively to society. Companies should not only focus on profitability and legal compliance but also embrace ethical practices and actively support society through philanthropic efforts [4]. Elkington [5] introduced the triple bottom line, which encompasses three key pillars: social responsibility, environmental responsibility, and economic responsibility. This framework underscores the importance of balancing these dimensions to achieve sustainable business practices. Porter and Kramer [6] argued that an organization’s involvement in CSR should be guided not only by the worthiness of a cause but also by the potential for shared value creation for both the organization and its stakeholders. In recent years, Environmental, Social, and Governance (ESG) metrics have emerged as key indicators of corporate sustainability performance. These metrics reflect the outcomes of CSR initiatives and help evaluate their effectiveness. The adoption of the United Nations’ 2030 Agenda for Sustainable Development in September 2015, encompassing 17 Sustainable Development Goals (SDGs) and 169 targets, has further emphasized the importance of sustainability worldwide.

Taiwan has actively aligned with international trends to promote CSR. The Taiwan Stock Exchange Corporation (TSEC) implemented regulations in 2014, mandating listed companies to disclose CSR practices through standardized reporting frameworks, such as the Global Reporting Initiative (GRI). Since 2021, these reports have included quantified ESG metrics, aligning with global standards like the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB). These measures aim to enhance transparency and encourage companies to prioritize ESG concerns. Fulfilling CSR has become a global trend. The goal of business operations is not solely to maximize shareholder interests but also to consider other stakeholders, support vulnerable groups in society, participate in community welfare activities, and promote environmental protection, thereby improving living conditions for everyone. As the saying goes, “good things happen to good people”. This raises the following question: Can fulfilling CSR obligations enhance corporate financial performance?

To address this question, this study reviews the literature on CSR and ESG, proposing an architecture for forecasting corporate financial performance using deep learning models with ESG data. The hyperparameters of the deep learning models are optimized using a hyperparameter optimization framework, and the results are compared with those of other machine learning models. This approach provides a practical application for financial performance forecasting, offering valuable insights for academic research and stakeholders in evaluating corporate financial performance and sustainability. The structure of the study is outlined as follows. Section 2 reviews the relevant literature, Section 3 introduces the proposed forecasting framework using ESG data, Section 4 presents the results and discussion, and Section 5 concludes with key insights and directions for future research.

2. Related Literature

Existing research on the relationship between ESG, CSR, and corporate performance presents mixed findings. While some studies demonstrate a positive correlation between ESG initiatives and financial performance [7,8,9,10,11,12,13,14,15,16,17], others demonstrate negative associations [18,19,20,21,22,23,24], and some find neutral and insignificant relationship [25,26,27,28,29,30,31,32,33]. This divergence highlights the need for more nuanced and context-specific analyses.

Regarding studies that demonstrate positive relationships, Xie et al. [10] investigated the link between specific ESG activities and corporate financial performance (CFP), including corporate efficiency, return on assets (ROA), and market value. They found that most ESG activities show a nonnegative relationship with corporate financial performance. Alareeni and Hamdan [11] performed a regression analysis using data from US S&P 500-listed companies from 2009 to 2018. Their results indicated that ESG disclosure positively affects a firm’s performance measures. Notably, firms with high assets and financial leverage tend to have higher ESG and CSR levels, and greater ESG and CSR disclosure correlates with higher ROA and return on equity (ROE). Ahmad et al. [12] examined the impact of ESG on the financial performance of UK firms, using a sample of 351 firms from the FTSE350 for the period 2002–2018. Their findings indicated that overall ESG performance has a positive and significant impact on firm financial performance. Mohammad and Wasiuzzaman [14] investigated the effects of ESG disclosures on firm performance, analyzing a sample of 3966 firm-year observations from 661 firms listed on Bursa Malaysia over the period 2012–2017. Their findings indicated that ESG disclosure enhances firm performance, even after accounting for competitive advantage. Chen et al. [15] explored how ESG drives corporate financial performance using a sample of 3321 listed companies worldwide over a 10-year period, from 2011 to 2020. By constructing a panel regression model with Refinitiv’s ESG ratings and financial data, the study demonstrated a positive correlation between ESG performance and corporate performance. Ismail and Azman [16] examined the impact of ESG performance on financial performance through the lens of Stakeholder Theory. They analyzed ESG scores and financial data from 351 listed companies in Japan from 2018 to 2022, using data from the Thomson Reuters Eikon data stream. Their regression analysis revealed that ESG performance each positively and significantly affect profitability, specifically ROE. Additionally, their findings showed a positive correlation among all ESG performance metrics, underscoring the importance of adopting ESG policies to enhance financial performance. Xu and Zhu [17] utilized data from A-share listed companies in Shanghai and Shenzhen, China, from 2009 to 2021. They employed a two-way fixed effects model with fixed time and industry effects to explore the relationship and underlying mechanisms between ESG performance and financial performance. Their study found that ESG performance positively influences corporate financial performance by promoting corporate innovation. Firms with strong long-term ESG performance tend to achieve better financial outcomes. Similar research results have been reported by Waddock and Graves [7], Fatemi et al. [8], Ramić [9], and Ding et al. [13].

Conversely, studies have also identified negative relationships between ESG, CSR and corporate performance have been investigated. Liao et al. [20] investigated the short-term relationship between corporate social performance (CSP) and CFP, using semantic longitudinal data from 2009 to 2014. Their findings revealed a negative association between CSP and CFP over the six-year period within the construction industry. Duque-Grisales and Aguilera-Caracuel [21] performed a regression analysis on data from multinational companies in Latin American countries, finding a negative correlation between ESG scores and financial performance. Similarly, Ruan and Liu [22] examined ESG rating data from Shanghai and Shenzhen A-share listed companies for the period 2015 to 2019 and found that corporate ESG activities had a significantly negative impact on firm performance. Their research further indicated that non-state-owned enterprises and non-environmentally sensitive enterprises showed stronger evidence of this negative impact compared to state-owned and environmentally sensitive enterprises. Zahid et al. [23] conducted a study using data from 620 firms headquartered in Western Europe from 2010 to 2019. Their results demonstrated that ESG had a significantly negative effect on a firm’s financial performance, as measured by ROA. This supports the trade-off hypothesis, which posits that investing in ESG activities increases business costs. Nareswari et al. [24] analyzed non-financial companies listed on the Indonesia Stock Exchange and found a negative effect of ESG scores on financial performance. The increase in ESG scores led to decreased financial performance due to higher investment and opportunity costs. Comparable findings have also been reported in earlier studies by Vance [18] and Hillman and Keim [19].

Some studies have found a neutral and insignificant relationship between ESG, CSR and corporate performance. Velte [28] investigated the impact of ESG performance on financial performance using a sample of 412 firm-year observations from firms listed on the German Prime Standard between 2010 and 2014. The research concluded that ESG performance had no effect on Tobin’s Q. Atan et al. [29] examined the influence of ESG factors on the performance of Malaysian public companies, focusing on profitability, firm value, and cost of capital. Their findings revealed no significant relationship between individual or combined ESG factors and firm profitability or firm value. Lopez-de-Silanes et al. [31] conducted a multi-country study that demonstrated ESG scores had little or no impact on risk-adjusted financial performance. Similarly, Kalia and Aggarwal [32] analyzed data from 468 healthcare firms for the business year 2020, sourced from Thomson Reuters, and found that the relationship between ESG scores and financial performance could not be generalized. Their results indicated that while ESG activities positively impact firm performance in healthcare companies in developed economies, this relationship may be negative or insignificant in developing economies. Narula et al. [33] studied the effect of ESG disclosure scores on firm performance using data from Indian firms during the critical COVID-19 period. Their empirical evidence from the world’s fifth-largest economy showed that all components of ESG were not significantly related to firm performance. They concluded that the tangible impact of ESG-related activities on firm performance had yet to be observed. Other studies, including those by McGuire et al. [25], Mahoney and Roberts [26], Goukasian and Whitney [30], and Kang et al. [27], also reported no significant relationship between ESG, CSR scores and financial performance.

The divergence in the findings of the above studies regarding the relationship between CSR or ESG and corporate financial performance underscores the need for more detailed and context-specific analyses. Notably, recent advancements in artificial intelligence have significantly accelerated research and applications in machine learning and deep learning [34,35,36]. Teoh et al. [37] developed several machine learning models to explore the relationship between ESG scores and a firm’s ROE. They utilized models such as Support Vector Machine (SVM), Random Forest (RF), Naive Bayesian (NB), Multilayer Perceptron (MLP) Neural Networks, and Long Short-Term Memory (LSTM) Neural Networks. Neural Network-based models generally demonstrated strong performance, with the MLP model achieving the highest accuracy of 81.08%. De Lucia et al. [38] found that machine learning (ML) models accurately predicted ROA and ROE, and identified a positive relationship between ESG practices and these financial indicators through ordered logistic regression. Lachuer and Jabeur [39] investigated the relationship between CSR and CFP in a bullish market. Using an innovative approach involving explainable artificial intelligence (XAI), they discovered that CSR was negatively related to financial market performance in a bullish market. Their analysis with XAI demonstrated that CSR improvements were limited to the most sustainable companies. Chowdhury et al. [40] focused on predicting ESG ratings for firms using six machine learning algorithms. Analyzing a global data sample of 6166 firms across 73 countries from 2005 to 2019, they found that the Random Forest Classifier achieved the highest accuracy at 78.50%. D’Amato et al. [41] examined a sample of approximately 400 companies listed on the EuroStoxx 600 index from 2011 to 2020, applying various machine learning models. They investigated the relationship between ESG scores and earnings before interest and taxes (EBIT) using machine learning interpretability tools, such as partial dependence plots and individual conditional expectation. Their findings indicated that ESG scores are promising predictors of EBIT, achieving high accuracy compared to traditional accounting variables. Han et al. [42] explored the effect of digital CSR communications on financial performance, incorporating deep learning techniques to analyze CSR-related content on social media. By employing advanced deep learning-based natural language processing (NLP) models to identify CSR-related tweets, their research highlighted a positive but time-lagged influence of digital CSR communications on financial performance, viewed through the lens of agenda-setting theory. Liang et al. [43] constructed one-dimensional convolutional neural network (1D-CNN) and LSTM deep learning models to forecast corporate financial performance. Using data from Chinese A-share listed companies from 2015 to 2021, they found that deep learning models effectively extracted time-series information from corporate data, enabling accurate predictions of financial performance. Lee et al. [44] integrated ESG sentiment and technical indicators to predict the S&P 500 Index using deep learning models. Their results demonstrated that bidirectional long short-term memory (Bi-LSTM) networks outperformed bidirectional recurrent neural networks (Bi-RNN). Furthermore, the integration of ESG news sentiment, technical indicators, and historical prices significantly improved predictive performance compared to models relying solely on technical indicators or historical prices. This study underscores the potential of combining ESG sentiment with technical indicators to enhance stock market behavior predictions. Jin [45] employed a random forest model to analyze the impacts of ESG pillars on the CFP of publicly listed companies in Korea. During model training, hyperparameters such as the number of trees and the number of variables considered at each split were optimized. The findings revealed significant differences in the direction, magnitude, and nature of the effects of each ESG pillar on CFP. Additionally, the study highlighted the nonlinear relationships between CFP and the varying intensities of each ESG pillar. These methods used to investigate the relationship between ESG, CSR and corporate performance are summarized in Table 1.

Table 1.

Research methods of ESG, CSR and corporate performance.

Based on the reviewed literature, the relationship between ESG, CSR, and corporate performance remains inconclusive. The advancements in AI, however, present new opportunities to explore these relationships in greater depth. Additionally, there is a notable lack of quantitative methods for assessing the effectiveness of CSR initiatives. To address this gap, this study utilizes ESG indicators from the Taiwan Stock Exchange ESG InfoHub website [46] as benchmarks. These indicators encompass 15 items across the Environmental (E), Social (S), and Governance (G) dimensions to develop CSR effectiveness metrics and predict financial performance. ROA and ROE are used as measures of financial performance. In terms of research methodology, this study leverages advancements in artificial intelligence, particularly the growing applications of machine learning and deep learning. In addition to using a multiple linear regression model for prediction, machine learning and deep learning techniques are applied to forecast corporate financial performance. The results demonstrate that deep learning models outperform both machine learning models and the multiple linear regression model in terms of prediction accuracy. This study provides valuable insights into various methodological approaches for investigating the relationship between ESG, CSR, and corporate financial performance, contributing to the academic discourse on this topic.

3. The Deep Learning Forecasting Architecture with Optuna in ESG Analysis

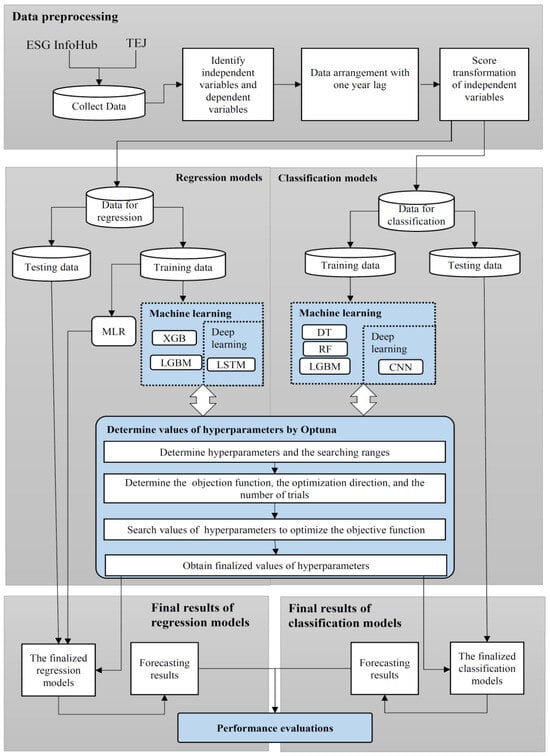

The relationship between ESG and CFP has become a critical area of interest in both academic research and industry practice. However, discrepancies in the existing literature regarding quantitative analysis and the underlying mechanisms of this relationship persist, with no consensus yet reached among scholars. To address this gap, this study introduces a novel CFP Forecasting Architecture that incorporates ESG factors as key determinants of financial performance. The framework employs deep learning models optimized through Optuna for hyperparameter tuning, ensuring enhanced predictive accuracy. Specifically, an LSTM model is applied to regression tasks, while a CNN model is utilized for classification tasks. The forecasting results are compared with traditional machine learning models, followed by a comprehensive evaluation and analysis of their performance. Figure 1 illustrates the proposed architecture for predicting the financial performance in terms of ROA and ROE of listed companies using supervised learning methods, including both regression and classification models, using ESG data as the primary input. The architecture is composed of three key components: data preprocessing, regression and classification models, and the performance evaluation of these models. Each step is depicted in the following sections.

Figure 1.

The architecture for predicting the financial performance of listed companies.

First, data are collected from ESG InfoHub and TEJ, with independent and dependent variables identified for analysis. The data are then aligned by introducing a one-year lag and transforming the independent variables into scores to serve as inputs for the models. For both regression and classification tasks, the data are divided into training and testing sets. Regression models utilize techniques such as Multiple Linear Regression (MLR), Extreme Gradient Boosting (XGB), Light Gradient Boosting Machine (LGBM), and LSTM for predictions, while classification models employ methods like Decision Tree (DT), Random Forest (RF), LGBM, and CNN for categorization. Optuna is employed to optimize the hyperparameters of both regression and classification models by defining the search space and objective functions. Finally, the forecasting performance of the regression and classification models is evaluated based on the results.

3.1. Data Preprocessing

3.1.1. Samples and Data Sources

The securities market in Taiwan is categorized into listed companies traded on the centralized exchange market, over-the-counter (OTC) companies, and companies listed on the Emerging Stock Market. Among these, listed companies on the centralized exchange market face the strictest listing standards, including rigorous regulations regarding financial disclosures such as capitalization, operating performance, and equity structure. Consequently, listed companies typically have better access to capital, which enhances their visibility, reputation, and overall company value. Given the representativeness and completeness of the data, this study focuses exclusively on companies listed on the Taiwan Stock Exchange Corporation. In this study, the financial performance indicators used are ROA and ROE. Financial performance data are sourced from the Taiwan Economic Journal (TEJ) [47], while ESG data for each dimension is obtained from the ESG InfoHub website of TSEC [46]. The study covers the period between 2021 and 2022. Table 2 presents the sample size, comprising 179 companies from 27 industry categories, after excluding incomplete data. This selection ensures the study’s representativeness and data completeness by focusing on companies listed on the TSEC. The classification into 27 industries enhances the generalizability of the findings across various sectors, offering a comprehensive perspective on the Taiwanese market. Additionally, these companies meet stringent listing standards, ensuring that their data are both reliable and suitable for analysis. The exclusion of incomplete data further enhances analytical precision, reinforcing the study’s methodological rigor.

Table 2.

The number of companies in each industry.

3.1.2. Definitions of Variables

In this study, ROA and ROE are employed as key variables to represent corporate financial performance. ROA assesses a company’s profitability by evaluating its ability to generate earnings from its assets. This ratio reflects how effectively a company is using its assets to generate profit. A higher ROA indicates greater efficiency in converting asset investments into profits, whereas a lower ROA may signal inefficiencies in asset utilization or reduced profitability. ROA is widely utilized by investors, analysts, and financial institutions to gauge a company’s financial health and compare it with industry peers. ROE, on the other hand, measures the return generated on shareholders’ equity, indicating how effectively a company is utilizing shareholder funds to produce profit. A higher ROE suggests that the company is more efficient at generating profits with the equity invested by shareholders, while a lower ROE may denote lower profitability or less efficient use of shareholder funds. Margolis and Walsh [48] reviewed 95 studies examining the relationship between CSR and corporate financial performance from 1972 to 2000. Among these, 28 studies utilized ROA, and 31 studies used ROE as measurement indicators, underscoring the representativeness of using ROA and ROE in this study. Additionally, to account for the delayed effects of ESG performance, ROA and ROE are analyzed using data from the preceding period.

The dependent and independent variables used in this study are summarized in Table 3.

Table 3.

Description of the main variables.

Regarding the variables related to each dimension of ESG, this study adopts the ESG dimensions from the ESG InfoHub website of TSEC as measurement indicators, including the E, S, and G dimensions, with a total of 15 items. Among the 15 items, 6 are proportion values, including Renewable Energy Percentage, The Ratio of Female Executive, The Ratio of Independent Directors vs. Directors The Ratio of Female Directors, Attendance of the Board of Directors, and The Ratio of Directors Meeting Directions for Continuing Education. The scoring method involves multiplying the proportion of each item by 100 to obtain a score. The remaining nine items are ranked by deciles based on Shu and Chiang’s [49] study, and assigned scores ranging from 100 to 10. Higher scores are assigned to items positively correlated with ESG and CSR performance. For example, the score for companies in the top decile of Average Expense of Employee Benefits is 100, while the score for companies in the bottom decile is 10. In contrast, the score for companies in the bottom decile of GHG Scope 1 Emissions is 100, while the score for companies in the top decile is 10.

3.2. Deep Learning with Optuna

In this study, deep learning models are developed to address two types of problems: predicting corporate financial performance and forecasting the direction of financial performance changes (i.e., whether it will increase or decrease). Specifically, the models are designed as both regression and classification models based on the nature of the problem. For regression models, the dependent variable is continuous, representing the financial performance metrics such as ROA and ROE. For classification models, the financial performance outcome is categorized into two classes: increase or decrease. In addition, the dataset is split into a training dataset and a test dataset with the number of 143 and 36 correspondingly. The training data are used for training the models, while the testing data are employed to evaluate the forecasting performance of models.

Deep learning is a subfield of machine learning, and the proper tuning of hyperparameters in prediction models is critical, as it directly influences model performance. In this study, deep learning models were developed using Optuna [50] to optimize hyperparameters. Specifically, Long Short-Term Memory with Optuna (LSTMOPT) and Convolutional Neural Network with Optuna (CNNOPT) were proposed for regression and classification tasks, respectively. The forecasting performance of LSTMOPT was compared with other regression models, including MLR, Extreme Gradient Boosting optimized with Optuna (R_XGBOPT), and Light Gradient Boosting Machine optimized with Optuna (R_LGBMOPT). Similarly, the forecasting results of CNNOPT were evaluated against other classification models, including Decision Tree optimized with Optuna (C_DTOPT), Random Forest optimized with Optuna (C_RFOPT), and Light Gradient Boosting Machine optimized with Optuna (C_LGBMOPT).

3.2.1. Long Short-Term Memory with Optuna (LSTMOPT) for Regression Model

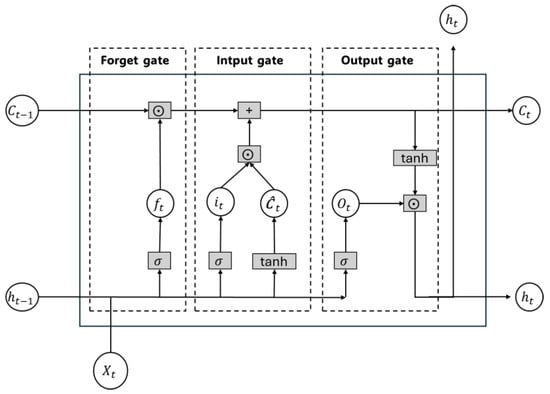

The Long Short-Term Memory model, introduced by Hochreiter and Schmidhuber [51], is an extension of Recurrent Neural Network (RNN). Its primary strength lies in its ability to record and utilize past states, effectively capturing long-range dependencies. The fundamental architecture of an LSTM unit consists of a memory cell that stores past information and a gate control mechanism that regulates how this information is updated and transmitted. This gating mechanism includes three components, namely the Forget Gate, the Input Gate, and the Output Gate. Together, these gates determine the flow of information within the LSTM unit, as illustrated in Figure 2. The basic unit of an LSTM is the memory block, each containing a cell state and a hidden state. The cell state serves as the primary pathway for data flow, enabling the data to move forward with minimal alterations. Each cell at time step processes the input , incorporating information from the previous hidden state and memory cell state .

Figure 2.

The LSTM Architecture.

The LSTM architecture has proven successful and efficient in addressing issues related to the vanishing gradient [52]. This efficiency is particularly notable in contexts requiring complex data handling and predictions such as predicting market dynamics and trends in cryptocurrencies like Bitcoin [53]. Similar predictive successes have been observed in financial domains, including predictions of bank soundness and profit optimization using deep learning techniques [54,55]. Moreover, LSTM applications in financial analysis show a broad range of utility, especially in the context of ESG issues. These models play a crucial role in assessing the volatility of environmentally focused companies and forecasting performance metrics such as the S&P Green Bond Index. The integration of LSTM with advanced data science methodologies, including neural networks and the Optuna hyperparameter optimization framework, highlights its pivotal role in tackling complex financial scenarios. This underscores the adaptability of LSTM models across various financial analyses and their significant impact on how ESG factors are incorporated and evaluated in financial decision-making [56,57].

The study utilizes LSTMOPT as a major deep learning regression model. The LSTM model consists of three layers, namely the LSTM layer, the Dropout layer, and the Dense layer. The first layer, the LSTM layer, processes the input sequence data and extracts features from the sequence. The second layer, the Dropout layer, acts as a regularization mechanism to prevent overfitting by randomly dropping a portion of the neurons’ outputs, thereby enhancing the model’s generalization ability. The third layer, the Dense layer, is a fully connected layer that outputs a single predicted value, making it suitable for regression tasks.

Given the significant influence of hyperparameter settings on prediction accuracy, identifying optimal hyperparameters is essential. To achieve this, the Optuna framework was employed to optimize the LSTM model’s hyperparameters, ensuring improved predictive performance. The hyperparameters optimized for the LSTM model include the optimizer, number of units, epochs, batch size, dropout rate, and learning rate. Table 4 details the hyperparameter search space configuration used with the Optuna framework for regression models, including R_XGBOPT, R_LGBMOPT, and LSTMOPT.

Table 4.

The hyperparameter search space configuration using Optuna for regression models.

The objective function of Optuna was defined as the Root Mean Square Error (RMSE), with the optimization direction set to minimize it. A total of 100 trials were conducted to determine the optimal hyperparameter settings for each model.

3.2.2. Convolutional Neural Network with Optuna (CNNOPT) for Classification Model

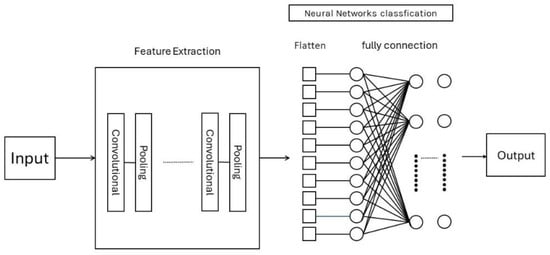

The Convolutional Neural Network [58] is a powerful tool for efficiently processing and classifying image data through its structured layers, as illustrated in Figure 3. This algorithm is specifically designed for image classification tasks. It begins with an input layer that captures raw data and proceeds through convolutional layers that apply filters for feature extraction. Pooling layers are then used to reduce data dimensionality while preserving essential information. The processed data are subsequently flattened into a vector and passed through fully connected layers for detailed classification. Finally, the output layer generates classification scores for each category, representing predictions based on the analyzed features.

Figure 3.

The CNN Model.

Initially developed for identifying features in images, the CNN algorithm has achieved significant success in a variety of image recognition tasks, such as deciphering postal handwritten characters and diagnosing cataract patient eye images due to its robust feature amplification and automatic extraction capabilities [59]. Recognizing its potent feature extraction abilities, researchers have extended CNN applications to a wide range of classification challenges [60,61,62]. Notably, CNNs have been adapted for use in the financial sector, demonstrating efficacy in processing one-dimensional (1D) data. This adaptation is evident in its integration into predictive models for enhancing commercial key performance indicators [63], stock investment strategies [64], and federated machine learning methods for risk assessment in supply chain financing [65]. Furthermore, CNNs are widely employed due to their proficiency in analyzing complex, multi-dimensional financial data, particularly in fraud detection and risk management. With the growing emphasis on sustainable investment practices and the need to incorporate non-financial performance metrics, there is an increasing momentum to integrate ESG factors into financial decision-making. The literature underscores the transformative impact of these technologies and methodologies, indicating a shift towards more responsible and technologically advanced financial systems. It also highlights existing gaps in the application of machine learning techniques within financial intermediation, providing valuable opportunities for future research [66].

The study employs CNNOPT as a primary deep learning classification model. The CNN model comprises six layers, namely the first Conv1D layer, the first MaxPooling1D layer, the second Conv1D layer, the second MaxPooling1D layer, the Flatten layer, and the Dense layers.

The first Conv1D layer is a convolutional layer designed to extract local sequence features, utilizing a kernel size of 3 and an optimized number of filters (filters_1) determined through the Optuna framework for optimal performance. The first MaxPooling1D layer follows, reducing the size of the feature map with a pooling size of 2. The second Conv1D layer further extracts higher-level local features, using a kernel size of 3 and an optimized number of filters (filters_2) to enhance performance. The second MaxPooling1D layer again reduces the feature map size, condensing critical information. The Flatten layer transforms the feature map into a 1D vector, preparing it for the fully connected dense layers. The Dense layers include a hidden layer and an output layer. The hidden layer is fully connected with 32 units, combining extracted features, while the output layer uses a sigmoid activation function to output a single probability value for binary classification.

The architecture effectively extracts, processes, and classifies features for binary classification tasks. Hyperparameters optimized for the CNN model using the Optuna framework include the learning rate, batch size, optimizer, filters_1, and filters_2. Table 5 outlines the hyperparameter search space configuration for classification models, including CNNOPT as the primary deep learning model and comparative machine learning models, namely C_DTOPT, C_RFOPT, and C_LGBMOPT.

Table 5.

The hyperparameter search space configuration using Optuna for classification models.

The objective function is defined as accuracy, with the optimization direction set to maximize it. A total of 100 trials were conducted to ensure a fair basis for comparison across all models.

4. Results and Discussion

4.1. Numerical Results

In this study, the LSTMOPT regression model and the CNNOPT classification model are employed to forecast Return on Assets and Return on Equity, respectively, using ESG data as factors to predict the financial performance of listed companies. The forecasting performance of the LSTMOPT regression model is compared against the MLR, R_XGBOPT, and R_LGBMOPT models. Similarly, the CNNOPT classification model is compared with C_DTOPT, C_RFOPT, and C_LGBMOPT models.

Three performance metrics, namely Root Mean Square Error (RMSE), Mean Absolute Error (MAE), and the Coefficient of Determination (R2), are employed to evaluate the effectiveness of regression models. These metrics are widely recognized for their utility in performance assessment. RMSE and MAE are key indicators used to quantify prediction errors, with lower values indicating higher prediction accuracy. R2 complements these measures by assessing the explanatory power of the predictions relative to the actual values, acting as an indicator of correlation [67,68,69,70]. An R2 value close to 1 indicates a strong explanatory capability of the model, whereas a value near 0 reflects poor explanatory power. A negative R2 value suggests that the residual sum of squares exceeds the total sum of squares, underscoring significant deficiencies in the model’s fit. Equations (1)–(3) outline the calculations for these performance metrics.

where n is the number of forecasting data, is the ith actual finance performance value as ROA or ROE, is the ith forecasting value, and is the mean value of actual finance performance value.

When solving classification problems, accuracy, precision, recall, specificity, and F1-score are used to evaluate the model performance for this study. The formulation can be computed as described in Equations (4)–(8).

where TP is True Positives, TN is True Negatives, FP is False Positives, and FN is False Negatives.

Table 6 and Table 7 present the optimal hyperparameters identified using Optuna for the regression and classification models, respectively. After constructing the optimal models for each method, 20% of the test data were used to evaluate the models’ performance in forecasting ROA and ROE. Table 8 shows the regression model forecasting results for ROA and ROE, measured by RMSE, MAE, and R2. The ROA and ROE results exhibit a consistent trend across the four regression models, with both machine learning and deep learning models outperforming MLR. Among these, LSTMOPT demonstrates the most outstanding performance, exhibiting the smallest RMSE and MAE, as well as the highest R2, indicating superior explanatory power of the predicted values relative to the actual values. The second-best results are achieved by the machine learning models, with R_LGBMOPT slightly outperforming R_XGBOPT. In the classification models, deep learning models also outperform machine learning models, similar to the regression models. Table 9 presents the performance of four classification models in predicting ROA and ROE. The CNNOPT models outperform the others, achieving the highest accuracy, precision, recall, sensitivity and F1-Score for both tasks. It is followed by the C_LGBMOPT model, with both significantly surpassing the performance of C_RFOPT and C_DTOPT.

Table 6.

The optimal hyperparameters result of regression models using Optuna.

Table 7.

The optimal hyperparameters result of classification models using Optuna.

Table 8.

The regression model forecasting performance for ROA and ROE.

Table 9.

The classification model forecasting performance for ROA and ROE.

In summary, the results of both the regression and classification models in predicting ROA and ROE indicate that deep learning models outperform machine learning models. Table A1 in Appendix A depicts abbreviations used in this study.

4.2. Discussion

ESG emphasizes that while companies pursue economic interests, they must also assume social and environmental responsibilities to achieve sustainable development. Promoting ESG not only benefits society and the environment but also enhances corporate reputation and creates shared value for companies and stakeholders. As global attention shifts toward sustainability, ESG has become a key measure of corporate responsibility, effectively embodying the principles of CSR. Although prior research has examined the relationships between ESG, CSR, and corporate performance, the findings remain inconclusive. The advent of machine learning and deep learning presents new opportunities for research in this area. This study leverages deep learning methodologies to predict corporate financial performance (CFP) in the next period based on this year’s ESG outcomes, addressing existing research gaps. CFP predictions are represented by return on assets (ROA) and return on equity (ROE). Beyond regression tasks, this study applies deep learning and machine learning techniques to solve classification problems and optimizes models using an automated hyperparameter optimization framework. Regression results reveal that, after hyperparameter optimization, the LSTMOPT model achieves the lowest RMSE values for both ROA (3.92) and ROE (7.43), producing predictions closest to the actual values. The optimal LSTMOPT configurations consistently select the Adam optimizer for both ROA and ROE predictions, highlighting Adam’s compatibility with this model. By fine-tuning hidden units, learning rates, and dropout rates, LSTM demonstrates adaptability to forecasting objectives. In contrast, traditional multiple linear regression (MLR) yields the highest RMSE and MAE values, with a negative R2 for ROA (−0.28), underscoring its inability to capture data variability and handle nonlinear problems. LSTM’s performance is comparable to R_XGBOPT and R_LGBMOPT, further showcasing its ability to extract deeper features from the data. In classification tasks, CNN outperforms other models for both ROA and ROE, highlighting its robust capability for processing complex data. C_LGBMOPT ranks second, excelling in handling nonlinear and high-dimensional data with faster training times. In comparison, traditional models like C_DTOPT and C_RFOPT perform poorly, struggling with complex data and proving suitable only for simpler structures.

In summary, deep learning models such as LSTM and CNN excel in both regression and classification tasks, showcasing exceptional capabilities for processing nonlinear and complex data. Hyperparameter optimization further enhances the predictive performance and stability of these models. When implementing these approaches, practitioners should carefully balance data characteristics, computational resources, and prediction objectives to achieve optimal results. Most of the existing literature employs statistical methods to predict ROA and ROE. While effective at modeling linear relationships, these methods struggle with nonlinear and complex relationships. This study adopts two deep learning approaches, yielding results that not only surpass the performance of statistical methods but also outperform traditional machine learning techniques. The findings underscore the potential of deep learning in financial performance analysis, addressing the limitations of conventional statistical methods and offering innovative perspectives and methodologies for future research and practical applications.

5. Conclusions and Future Research

The main objective of this study is to predict financial performance based on ESG performance. In addition to employing the commonly used multiple linear regression model, we also utilize machine learning and deep learning techniques for prediction. Models can be constructed as either regression or classification models, depending on the problem type. For both regression and classification models, the input data are split into 80% for training and 20% for testing. This split allows for model learning with the training data and prediction using the test data. Additionally, considering the deferred effect of ESG performance, ROA and ROE are studied using data from the preceding period. Summarizing the results of both regression and classification models in predicting ROA and ROE, this study found that deep learning models perform better than machine learning models.

Financial performance is the cornerstone of corporate survival, market competitiveness, and long-term sustainable development. Strong financial performance not only consolidates a company’s competitive advantage but also enhances stakeholder confidence, which is crucial for achieving growth and sustainability in an increasingly dynamic and competitive market environment. In recent years, Corporate Social Responsibility has gained widespread global attention. However, CSR only provides a broad framework for sustainable operations and lacks quantitative indicators to assess whether companies are progressing toward sustainability goals.

Over the past decade, and particularly in the last five years, the global rise in ESG factors has led ESG to become a key performance indicator for corporate sustainability. ESG helps assess whether companies are fulfilling their corporate social responsibilities and achieving sustainable development goals. Despite the rapid advancements in artificial intelligence and its widespread application across various fields, research on its use in predicting corporate financial performance remains relatively scarce. This study aims to fill this gap by using ESG performance to predict corporate financial performance, employing not only MLR models but also machine learning and deep learning techniques for predictive analysis.

The study introduces an innovative approach by using ESG performance as an indicator for predicting corporate financial performance—a method that remains relatively uncommon in current academic research. This methodology not only offers a novel perspective for practical applications in financial performance forecasting but also enriches the academic discourse in this field. The study’s findings present new opportunities for research while providing valuable insights for companies and stakeholders to evaluate corporate financial performance and sustainability. Additionally, the research combines regression and classification models with deep learning techniques, offering a dual analytical framework. By incorporating a time lag—using ESG performance from the preceding year to influence corporate financial performance predictions for the following year—, the study establishes a more realistic and robust analytical model. This approach advances the application of artificial intelligence in ESG and financial performance forecasting, contributing to the sustainable development of these fields.

While the model proposed in this study demonstrates significant predictive ability and practical value, it is not without its limitations. For instance, as the data utilized in this research are derived from publicly available corporate reports, future studies could enhance robustness by incorporating longer timeframes and more diverse datasets. Furthermore, this study focuses exclusively on ESG indicators as input variables. Future research could explore the integration of other influential factors, such as macroeconomic conditions, industry characteristics, or company size, to offer a more comprehensive analysis of corporate financial performance. Although the LSTMOPT and CNNOPT models excel in regression and classification tasks, respectively, their performance is highly dependent on specific hyperparameter settings and the characteristics of the data. One potential direction for future research is to employ other deep learning and machine learning models to explore the possibility of improving forecasting performance. Another direction for further research could involve using other financial performance indicators. In addition to ROA and ROE, commonly used indicators in past research include Earnings Per Share (EPS), Net Income, Stock Price, and the Price/Earnings (P/E) ratio. These could serve as dependent variables in the forecasting models to evaluate the robustness of the models. A third avenue for future research could involve exploring the use of large language models to analyze ESG factors as independent variables.

Author Contributions

Conceptualization, P.-F.P. and W.-L.H.; data curation W.-L.H.; methodology, P.-F.P., W.-L.H., Y.-L.L. and Y.-H.L.; software, Y.-L.L., J.-P.L. and Y.-H.L.; formal analysis, W.-L.H., Y.-L.L., J.-P.L. and Y.-H.L.; writing—original draft preparation, W.-L.H., Y.-L.L., Y.-H.L. and P.-F.P.; writing—review and editing, P.-F.P.; visualization, W.-L.H., Y.-L.L. and Y.-H.L.; supervision, P.-F.P. and J.-P.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by National Science and Technology Council Taiwan with the grant number NSTC 113-2221-E-260 -013 -MY2.

Data Availability Statement

The data are contained within the article.

Acknowledgments

This work was supported by Hsun-Yi Huang and Chun-Tai Huang through data analysis.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

List of abbreviations.

Table A1.

List of abbreviations.

| # | Abbreviation | Description |

|---|---|---|

| Sustainability and Corporate Responsibility | ||

| 1 | CSR | Corporate Social Responsibility |

| 2 | ESG | Environmental, Social, and Governance |

| 3 | CFP | Corporate Financial Performance |

| 4 | CSP | Corporate Social Performance |

| 5 | GRI | Global Reporting Initiative |

| 6 | SASB | Sustainability Accounting Standards Board |

| 7 | TCFD | Task Force on Climate-related Financial Disclosures |

| Financial and Economic Metrics | ||

| 1 | ROA | Return on Assets |

| 2 | ROE | Return on Equity |

| 3 | EBIT | Earnings Before Interest and Taxes |

| Data and Market Terms | ||

| 1 | TSEC | Taiwan Stock Exchange Corporation |

| 2 | OTC | Over the Counter |

| 3 | TEJ | Taiwan Economic Journal |

| Statistical, Machine Learning and Deep Learning Models | ||

| 1 | MLR | Multiple Linear Regression |

| 2 | RR | Ridge Regression |

| 3 | LR | Logistic Regression |

| 4 | NB | Naive Bayesian |

| 5 | ML | Machine Learning |

| 6 | DL | Deep Learning |

| 7 | SVR | Support Vector Regression |

| 8 | SVM | Support Vector Machine |

| 9 | DT | Decision Tree |

| 10 | RF | Random Forest |

| 11 | XGB | Extreme Gradient Boosting |

| 12 | LGBM | Light Gradient Boosting Machine |

| 13 | KNN | K Nearest Neighbor |

| 14 | MLP | Multi-layer Perceptron |

| 15 | ANN | Artificial Neural Network |

| 16 | RNN | Recurrent Neural Network |

| 17 | LSTM | Long Short-Term Memory |

| 18 | CNN | Convolutional Neural Network |

| 19 | XAI | Explainable Artificial Intelligence |

| 20 | 1D-CNN | One-Dimensional Convolutional Neural Network |

| Optimized Models | ||

| 1 | LSTMOPT | Long Short-Term Memory with Optuna |

| 2 | CNNOPT | Convolutional Neural Network with Optuna |

| 3 | R_XGBOPT | Extreme Gradient Boosting optimized with Optuna for Regression |

| 4 | R_LGBMOPT | Light Gradient Boosting Machine optimized with Optuna for Regression |

| 5 | C_DTOPT | Decision Tree optimized with Optuna for Classification |

| 6 | C_RFOPT | Random Forest optimized with Optuna for Classification |

| 7 | C_LGBMOPT | Light Gradient Boosting Machine optimized with Optuna for Classification |

| Evaluation Metrics | ||

| 1 | RMSE | Root Mean Square Error |

| 2 | MAE | Mean Absolute Error |

| 3 | R2 | Coefficient of Determination |

References

- Friedman, M. The social responsibility of business is to increase its profits. The New York Times Magazine, 13 September 1970; pp. 32–33, 122–124. [Google Scholar]

- Sheldon, O. The Philosophy of Management; Kenneth Thompson: London, UK, 1923. [Google Scholar]

- Bowen, H.R. Social Responsibilities of the Businessman; Harper and Brothers: New York, NY, USA, 1953. [Google Scholar]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone Publishing: Oxford, UK, 1997. [Google Scholar]

- Porter, M.E.; Kramer, M.R. Strategy and society: The link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar] [PubMed]

- Waddock, S.A.; Graves, S.B. The corporate social performance–financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. Esg performance and firm value: The moderating role of disclosure. Glob. Financ. J. 2018, 38, 45–64. [Google Scholar] [CrossRef]

- Ramić, H. Relationship Between Esg Performance and Financial Performance of Companies: An Overview of the Issue. Master’s Thesis, University of Lausanne, Lausanne, Switzerland, 2019. [Google Scholar]

- Xie, J.; Nozawa, W.; Yagi, M.; Fujii, H.; Managi, S. Do environmental, social, and governance activities improve corporate financial performance? Bus. Strategy Environ. 2019, 28, 286–300. [Google Scholar] [CrossRef]

- Alareeni, B.A.; Hamdan, A. Esg impact on performance of us s&p 500-listed firms. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 1409–1428. [Google Scholar]

- Ahmad, N.; Mobarek, A.; Roni, N.N. Revisiting the impact of esg on financial performance of ftse350 uk firms: Static and dynamic panel data analysis. Cogent Bus. Manag. 2021, 8, 1900500. [Google Scholar] [CrossRef]

- Ding, W.; Levine, R.; Lin, C.; Xie, W. Corporate immunity to the COVID-19 pandemic. J. Financ. Econ. 2021, 141, 802–830. [Google Scholar] [CrossRef]

- Mohammad, W.M.W.; Wasiuzzaman, S. Environmental, social and governance (esg) disclosure, competitive advantage and performance of firms in malaysia. Clean. Environ. Syst. 2021, 2, 100015. [Google Scholar] [CrossRef]

- Chen, S.; Song, Y.; Gao, P. Environmental, social, and governance (esg) performance and financial outcomes: Analyzing the impact of esg on financial performance. J. Environ. Manag. 2023, 345, 118829. [Google Scholar] [CrossRef] [PubMed]

- Ismail, A.M.; Azman, K.B.B. The impact of environmental, social, and governance performance on financial performance: Evidence from japanese companies. Edelweiss Appl. Sci. Technol. 2024, 8, 236–258. [Google Scholar] [CrossRef]

- Xu, Y.; Zhu, N. The effect of environmental, social, and governance (esg) performance on corporate financial performance in china: Based on the perspective of innovation and financial constraints. Sustainability 2024, 16, 3329. [Google Scholar] [CrossRef]

- Vance, S.G. Are socially responsible corporations good investment risks? Manag. Rev. 1975, 64, 18. [Google Scholar]

- Hillman, A.J.; Keim, G.D. Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strateg. Manag. J. 2001, 22, 125–139. [Google Scholar] [CrossRef]

- Liao, P.-C.; Shih, Y.-N.; Wu, C.-L.; Zhang, X.-L.; Wang, Y. Does corporate social performance pay back quickly? A longitudinal content analysis on international contractors. J. Clean. Prod. 2018, 170, 1328–1337. [Google Scholar] [CrossRef]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, social and governance (esg) scores and financial performance of multilatinas: Moderating effects of geographic international diversification and financial slack. J. Bus. Ethics 2021, 168, 315–334. [Google Scholar] [CrossRef]

- Ruan, L.; Liu, H. Environmental, social, governance activities and firm performance: Evidence from china. Sustainability 2021, 13, 767. [Google Scholar] [CrossRef]

- Zahid, R.A.; Khan, M.K.; Anwar, W.; Maqsood, U.S. The role of audit quality in the esg-corporate financial performance nexus: Empirical evidence from western european companies. Borsa Istanb. Rev. 2022, 22, S200–S212. [Google Scholar] [CrossRef]

- Nareswari, N.; Tarczyńska-Łuniewska, M.; Al Hashfi, R.U. Analysis of environmental, social, and governance performance in indonesia: Role of esg on corporate performance. Procedia Comput. Sci. 2023, 225, 1748–1756. [Google Scholar] [CrossRef]

- McGuire, J.B.; Sundgren, A.; Schneeweis, T. Corporate social responsibility and firm financial performance. Acad. Manag. J. 1988, 31, 854–872. [Google Scholar] [CrossRef]

- Mahoney, L.; Roberts, R.W. Corporate social performance, financial performance and institutional ownership in canadian firms. Account. Forum 2007, 31, 233–253. [Google Scholar] [CrossRef]

- Kang, K.H.; Lee, S.; Huh, C. Impacts of positive and negative corporate social responsibility activities on company performance in the hospitality industry. Int. J. Hosp. Manag. 2010, 29, 72–82. [Google Scholar] [CrossRef]

- Velte, P. Does esg performance have an impact on financial performance? Evidence from germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

- Atan, R.; Alam, M.M.; Said, J.; Zamri, M. The impacts of environmental, social, and governance factors on firm performance: Panel study of malaysian companies. Manag. Environ. Qual. Int. J. 2018, 29, 182–194. [Google Scholar] [CrossRef]

- Goukasian, L.; Whitney, L.K. Corporate Socially Responsible Firms Perform Well! Evidence from Financial and Operating Performances. SSRN: 2019. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=972649 (accessed on 11 January 2025).

- Lopez-de-Silanes, F.; McCahery, J.A.; Pudschedl, P.C. Esg performance and disclosure: A cross-country analysis. Singap. J. Leg. Stud. 2020, 217–241. [Google Scholar]

- Kalia, D.; Aggarwal, D. Examining impact of esg score on financial performance of healthcare companies. J. Glob. Responsib. 2023, 14, 155–176. [Google Scholar] [CrossRef]

- Narula, R.; Rao, P.; Kumar, S.; Matta, R. Esg scores and firm performance-evidence from emerging market. Int. Rev. Econ. Financ. 2024, 89, 1170–1184. [Google Scholar] [CrossRef]

- Biju, A.K.V.N.; Thomas, A.S.; Thasneem, J. Examining the research taxonomy of artificial intelligence, deep learning & machine learning in the financial sphere—A bibliometric analysis. Qual. Quant. 2024, 58, 849–878. [Google Scholar]

- Lim, T. Environmental, social, and governance (esg) and artificial intelligence in finance: State-of-the-art and research takeaways. Artif. Intell. Rev. 2024, 57, 76. [Google Scholar] [CrossRef]

- Zhang, C.; Yang, J. Artificial intelligence and corporate esg performance. Int. Rev. Econ. Financ. 2024, 96, 103713. [Google Scholar] [CrossRef]

- Teoh, T.-T.; Heng, Q.; Chia, J.J.; Shie, J.; Liaw, S.; Yang, M.; Nguwi, Y.-Y. Machine learning-based corporate social responsibility prediction. In Proceedings of the 2019 IEEE International Conference on Cybernetics and Intelligent Systems (CIS) and IEEE Conference on Robotics, Automation and Mechatronics (RAM), Bangkok, Thailand, 18–20 November 2019; IEEE: New York, NY, USA, 2019; pp. 501–505. [Google Scholar]

- De Lucia, C.; Pazienza, P.; Bartlett, M. Does good esg lead to better financial performances by firms? Machine learning and logistic regression models of public enterprises in europe. Sustainability 2020, 12, 5317. [Google Scholar] [CrossRef]

- Lachuer, J.; Jabeur, S.B. Explainable artificial intelligence modeling for corporate social responsibility and financial performance. J. Asset Manag. 2022, 23, 619. [Google Scholar] [CrossRef]

- Chowdhury, M.A.F.; Abdullah, M.; Azad, M.A.K.; Sulong, Z.; Islam, M.N. Environmental, social and governance (esg) rating prediction using machine learning approaches. Ann. Oper. Res. 2023, 1–25. [Google Scholar] [CrossRef]

- D’Amato, V.; D’Ecclesia, R.; Levantesi, S. Firms’ profitability and esg score: A machine learning approach. Appl. Stoch. Models Bus. Ind. 2024, 40, 243–261. [Google Scholar] [CrossRef]

- Han, S.; Liu, Z.; Deng, Z.; Gupta, S.; Mikalef, P. Exploring the effect of digital csr communication on firm performance: A deep learning approach. Decis. Support Syst. 2024, 176, 114047. [Google Scholar] [CrossRef]

- Liang, L.; Liu, B.; Su, Z.; Cai, X. Forecasting corporate financial performance with deep learning and interpretable ale method: Evidence from China. J. Forecast. 2024, 43, 2540–2571. [Google Scholar] [CrossRef]

- Lee, H.; Kim, J.H.; Jung, H.S. Deep-learning-based stock market prediction incorporating esg sentiment and technical indicators. Sci. Rep. 2024, 14, 10262. [Google Scholar] [CrossRef] [PubMed]

- Jin, Y. Distinctive impacts of esg pillars on corporate financial performance: A random forest analysis of korean listed firms. Financ. Res. Lett. 2025, 71, 106395. [Google Scholar] [CrossRef]

- Taiwan Stock Exchange Esg Infohub Website. Available online: https://esg.twse.com.tw/ESG/front/tw/#/main/home (accessed on 17 March 2024).

- Tej (Taiwan Economic Journal). Available online: https://schplus.tej.com.tw/ (accessed on 17 March 2024).

- Margolis, J.D.; Walsh, J.P. People and Profits? The Search for a Link Between a Company’s Social and Financial Performance; Lawrence Erlbaum Associates: Mahwah, NY, USA, 2001. [Google Scholar]

- Shu, P.-G.; Chiang, S.-J. The impact of corporate governance on corporate social performance: Cases from listed firms in taiwan. Pac. -Basin Financ. J. 2020, 61, 101332. [Google Scholar] [CrossRef]

- Akiba, T.; Sano, S.; Yanase, T.; Ohta, T.; Koyama, M. Optuna: A next-generation hyperparameter optimization framework. In Proceedings of the 25th ACM SIGKDD International Conference on Knowledge Discovery & Data Mining, Anchorage, AK, USA, 4–8 August 2019; pp. 2623–2631. [Google Scholar]

- Hochreiter, S.; Schmidhuber, J. Long short-term memory. Neural Comput. 1997, 9, 1735–1780. [Google Scholar] [CrossRef]

- You, Y. Forecasting stock price: A deep learning approach with lstm and hyperparameter optimization. Highlights Sci. Eng. Technol. 2024, 85, 328–338. [Google Scholar] [CrossRef]

- Yildirim, B.; Taskiran, M. Optuna based optimized transformer model approach in bitcoin time series analysis. In Proceedings of the 2024 26th International Conference on Digital Signal Processing and its Applications (DSPA), Moscow, Russia, 27–29 March 2024; IEEE: New York, NY, USA, 2024; pp. 1–6. [Google Scholar]

- Maharani, S.N.; Sugeng, B.; Makaryanawati, M.; Ali, M.M. Bank soundness level prediction: Anfis vs. deep learning. J. Appl. Data Sci. 2023, 4, 175–189. [Google Scholar] [CrossRef]

- Tang, W.; Yang, S.; Khishe, M. Profit prediction optimization using financial accounting information system by optimized dlstm. Heliyon 2023, 9, e19431. [Google Scholar] [CrossRef] [PubMed]

- Chollete, L.; Hughen, K.; Lu, C.-C.; Peng, W. Assessing the volatility of green firms. Financ. Res. Lett. 2024, 64, 105372. [Google Scholar] [CrossRef]

- Dey, D. Time series analysis of gss bonds. Br. Actuar. J. 2024, 29, e3. [Google Scholar] [CrossRef]

- LeCun, Y.; Boser, B.; Denker, J.S.; Henderson, D.; Howard, R.E.; Hubbard, W.; Jackel, L.D. Backpropagation applied to handwritten zip code recognition. Neural Comput. 1989, 1, 541–551. [Google Scholar] [CrossRef]

- Lai, C.-J.; Pai, P.-F.; Marvin, M.; Hung, H.-H.; Wang, S.-H.; Chen, D.-N. The use of convolutional neural networks and digital camera images in cataract detection. Electronics 2022, 11, 887. [Google Scholar] [CrossRef]

- Khan, A.; Sohail, A.; Zahoora, U.; Qureshi, A.S. A survey of the recent architectures of deep convolutional neural networks. Artif. Intell. Rev. 2020, 53, 5455–5516. [Google Scholar] [CrossRef]

- Alzubaidi, L.; Zhang, J.; Humaidi, A.J.; Al-Dujaili, A.; Duan, Y.; Al-Shamma, O.; Santamaría, J.; Fadhel, M.A.; Al-Amidie, M.; Farhan, L. Review of deep learning: Concepts, cnn architectures, challenges, applications, future directions. J. Big Data 2021, 8, 53. [Google Scholar] [CrossRef]

- Bhatt, D.; Patel, C.; Talsania, H.; Patel, J.; Vaghela, R.; Pandya, S.; Modi, K.; Ghayvat, H. Cnn variants for computer vision: History, architecture, application, challenges and future scope. Electronics 2021, 10, 2470. [Google Scholar] [CrossRef]

- Tavera Rodríguez, J.W. Towards a predictive model that supports the achievement of more assertive commercial kpis case: Wood trading company. In Proceedings of the Colombian Conference on Computing 2023, Medellin, Colombia, 10–11 August 2023; Springer: Berlin/Heidelberg, Germany, 2023; pp. 350–366. [Google Scholar]

- Jun, S.Y.; Kim, D.S.; Jung, S.Y.; Jun, S.G.; Kim, J.W. Stock investment strategy combining earnings power index and machine learning. Int. J. Account. Inf. Syst. 2022, 47, 100576. [Google Scholar] [CrossRef]

- Kong, L.; Zheng, G.; Brintrup, A. A federated machine learning approach for order-level risk prediction in supply chain financing. Int. J. Prod. Econ. 2024, 268, 109095. [Google Scholar] [CrossRef]

- Kanaparthi, V. Transformational application of artificial intelligence and machine learning in financial technologies and financial services: A bibliometric review. arXiv 2024, arXiv:2401.15710. [Google Scholar] [CrossRef]

- Gogineni, A.; Rout, M.D.; Shubham, K. Evaluating machine learning algorithms for predicting compressive strength of concrete with mineral admixture using long short-term memory (lstm) technique. Asian J. Civ. Eng. 2024, 25, 1921–1933. [Google Scholar] [CrossRef]

- Huang, S.; Liu, Q.; Wu, Y.; Chen, M.; Yin, H.; Zhao, J. Edible mushroom greenhouse environment prediction model based on attention cnn-lstm. Agronomy 2024, 14, 473. [Google Scholar] [CrossRef]

- Shi, X.; Chen, S.; Wang, Q.; Lu, Y.; Ren, S.; Huang, J. Mechanical framework for geopolymer gels construction: An optimized lstm technique to predict compressive strength of fly ash-based geopolymer gels concrete. Gels 2024, 10, 148. [Google Scholar] [CrossRef] [PubMed]

- Utama, A.B.P.; Wibawa, A.P.; Handayani, A.N.; Irianto, W.S.G.; Nyoto, A. Improving time-series forecasting performance using imputation techniques in deep learning. In Proceedings of the 2024 International Conference on Smart Computing, IoT and Machine Learning (SIML), Surakarta, Indonesia, 6–7 June 2024; IEEE: New York, NY, USA, 2024; pp. 232–238. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).