Abstract

With climate warming, the human living environment faces significant challenges, and global environmental protection and sustainable development are accelerating. As a result, ESG has become an essential area of research. This study explores the impact of employees’ perceptions of corporate ESG performance on green innovation, focusing on the moderating role of digital transformation. A survey was conducted among 316 employees from the wholesale, retail, IT, and computer services industries to validate this study. Research results show that employees’ cognitions of corporate ESG performance have a positive impact on green innovation. In addition, digital transformation plays a positive moderating role in the impact of the environmental (E) and social (S) dimensions of ESG performance on green innovation. These findings not only highlight the critical role of personal awareness and ESG management concepts in future corporate strategies but also indicate the importance of the extent of digital transformation in companies to improve innovation performance.

1. Introduction

Climate change significantly impacts Earth’s ecosystems and humans, as evidenced by melting glaciers, increased incidence of forest fires, and the expansion of desert areas [1]. Existing literature shows that large amounts of greenhouse gas (GHG) emissions caused by human activities are the leading cause of climate change [2]. The extensive economic development model caused severe environmental damage [3]. As a result of the global focus on sustainable development, international businesses are recognizing the importance of environmental, social, and governance (ESG)-related issues [4].

As an essential part of social and economic progress, enterprises bear inevitable social obligations [5]. As public expectations for corporate environmental, social, and ethical responsibilities continue to increase, companies must focus on the management of ESG strategies [6]. Not only that, companies need to seriously consider how to improve their understanding of ESG to promote ecological innovation and achieve sustainable development goals [7]. Green innovation is an essential path for enterprises to pursue sustainable development, which requires firm support and leadership from enterprises, as well as the participation and recognition of enterprise executives and a wide range of employees. However, green innovation often faces challenges such as high investment, risks, and long-term returns [8]. In this scenario, organizational members’ cognitive attitudes toward corporate ESG performance will significantly affect green innovation. This relationship has yet to be explored in depth and is also the subject of our research. As an essential psychological concept, cognition involves an individual’s perception, reasoning, and thinking construction of environmental and organizational stimuli and is the basis for decision-making and behavior [9]. Cognitive theory emphasizes that human behavior is the product of the interaction between the self-system and the external environment [10]. As the core of the organizational structure, the cognition and behavior of organizational members play a crucial role in affecting the enterprise’s economic performance [11]. However, despite the importance of ESG standards for corporate social responsibility and sustainable development [12], there needs to be more research on how organizational members’ perceptions of ESG affect corporate green innovation.

To realize digital transformation, enterprises proactively harness digital technologies and reform their organizational architectures and business operations to adapt to the swiftly expanding digital economy [13]. Digital transformation promotes enterprises to control costs and improve resource utilization efficiency [14]. Notably, the correlation between ESG performance and green innovation varies among enterprises with different levels of digitizing [15]. Specifically, the augmentation of digitizing levels contributes to the diminution of management, innovation transactions, and contracting expenses, easing financial outcomes and fostering the advancement of green innovation [16]. Moreover, highly digital enterprises can optimize the integration of production factors and digital technologies, improving the efficiency of data collection, analysis, and reporting, further accelerating the process of green innovation [17]. This phenomenon reinforces the correlation between ESG performance and green innovation [18]. Conversely, in enterprises with lower levels of digitizing, the efficiency of data utilization is lower, and the costs are higher, which is not conducive to converting the resources brought by ESG performance into the realization of green innovation.

This study focuses on the influence of organizational members’ cognition of corporate ESG performance on green innovation outcomes, examining the moderating effect of digital transformation within this dynamic. The findings of this study are expected to have significant implications for your professional development. First, although some research results have been obtained on the impact of ESG performance on financial performance [19,20,21], the relationship between the perception of ESG performance and green innovation needs to be further explored, which is conducive to exploring effective, sustainable development paths for enterprises. Secondly, although some research results have been obtained on the impact of ESG cognition of corporate executives on green innovation [22], there needs to be more research on the effects of ESG cognition of employees on green innovation. Adopting a cognitive approach to studying green innovation at the organizational level is innovative. It will help managers in both private and state-owned enterprises engage more proactively in managing strategic innovation for sustainability. Finally, with the development of the digital economy, improving the competitiveness of enterprises through digital transformation has become a prudent issue, and the impact of digital transformation on the path of sustainable development of enterprises needs to be further revealed. Therefore, this study helps to answer this question.

2. Theoretical Background and Hypothesis

2.1. ESG

The apprehensions regarding corporate ESG matters are progressively swaying stock market investors, who perceive ESG as integral to sustainable development and diminution of risks, concurrently ensuring accountability towards society and the environment [23]. In terms of environmental, the focus is mainly on carbon footprint management, resource management, and ecological conservation [24]. In terms of social, the emphasis is on employee rights, community involvement, and diversity and inclusion. Corporate governance focuses on transparency and ethics, board independence, and shareholder rights [25]. In the 1960s, the concept of socially responsible investing began to emerge. Subsequently, in 1992, the UNEP (United Nations Environment Programme) Finance Initiative advocated for financial institutions to integrate social, governance, and environmental considerations into their decision-making processes [26]. In 2004, a report titled “Who Cares Wins” was published by 20 financial institutions, introducing the ESG concept [27]. It defined ESG as the disclosure of information by corporations for regulatory bodies and stakeholders’ interests regarding societal demands in environmental, social, and governance aspects [28]. In the research on ESG, scholars have explored its definition and content from multiple perspectives. Jebe defined ESG as the disclosure of information, including environmental, social, and corporate governance factors, considering it a concept that could affect the implementation of corporate strategies and enhance corporate value [29]. Gillan posits that ESG provides enterprises and investors with a comprehensive framework for incorporating environmental, social, and corporate governance considerations [30]. ESG stems from responsible investing, incorporating ESG factors into investment decisions and active ownership strategies and practices. Therefore, investors often use ESG performance to evaluate a company’s future financial performance. In addition, a company’s social reputation and sustainable development may be gauged by its ESG performance [31].

In recent years, research on ESG has gradually attracted attention, with scholars exploring its relationship with financial performance, corporate value, financing costs, and risk management. Friede summarized and analyzed many studies related to ESG, discovering that a favorable association between ESG and financial success was found in roughly 90% of the research [28]. Regarding risk management, ESG enhances a company’s ability to withstand various risks, such as stock crashes and specific risks [32]. Meanwhile, scholars have also started to focus on the relationship between ESG and corporate green innovation, suggesting that excellent ESG performance can help promote the development of corporate green innovation [33].

In summary, research on ESG not only helps us better understand corporate social responsibility and sustainable development but also aids in enhancing corporate value and competitiveness. However, many challenges and unresolved issues in ESG research still require further in-depth study and exploration.

2.2. Digital Transformation

DT refers to businesses of all sizes using a blend of information, computing, communications, and connectivity technologies to improve the efficiency of their products, services, customer experiences, workflows, and decision-making processes [34,35]. Digitization can improve business information transparency, reduce transaction costs, and gain economic value by reducing information asymmetry [36]. In Ghasemaghaei and Calic’s study, they explore the impact of digital transformation on corporate innovation performance and find that strategic agility plays a crucial role in this context. The authors found that digital transformation improves innovation performance by enhancing the strategic agility of enterprises [37]. Enterprise digital transformation enhances green innovation by easing financing constraints, reducing agency costs, and stimulating growth potential [38]. Not only that, digital transformation improves corporate ESG performance through environmentally friendly digital technology and becomes a “technical reservoir” that supports green development [39]. Digital transformation is consistent with green development and provides the internal driving force for corporate green technology innovation [40]. In addition, some scholars found by constructing enterprise digital transformation measurement indicators that there is a significant positive correlation between the digital transformation of Chinese-listed companies and green technology innovation, and the CEO’s IT background and tax incentives play a positive regulatory role [41]. Furthermore, some scholars point out that digital transformation can increase green innovation, especially in the context of insufficient internal controls and limited institutional ownership [42].

2.3. ESG and Green Innovation

With increasing global consumer preference for eco-friendly products, some manufacturing companies manage their green supply chains to generate green innovations and produce more environmentally friendly products [43]. Green innovation has long-term advantages: firstly, it helps companies establish solid technological barriers, making them more competitive in the market. Secondly, green innovation also aids in building a positive image and reputation, enhancing long-term competitive advantages [44]. Empirical research has found that successful management of green supply chains by enterprises positively impacts green product innovation, process innovation, and management innovation [45]. Companies with high ESG performance are more favored by stakeholders and thus have easier access to resources needed for innovation. For instance, fulfilling social responsibilities enhances relationships across the supply chain, fosters collaboration, and amplifies the efficiency of green innovation [46]. When studying carbon-intensive-listed companies in China, Li et al. pointed out that the new media environment and media attention are conducive to enterprise ESG information disclosure, thus promoting green technology innovation [47]. Corporate ESG ratings significantly promote the quantity and quality of green innovations within enterprises [48]. In other words, the higher the corporate ESG rating, the more pronounced the effect on fostering green innovation within the enterprise. This contributes to the sustainable acquisition of resources necessary for green technological innovation, engaging in innovative activities, and enhancing competitive advantages [49]. Based on the connotations of ESG, the exemplary performance of enterprises in environmental responsibility implies an increased emphasis on environmental protection. This reflects the likelihood of companies integrating sustainable development into their corporate vision, strategy, and culture, thereby improving resource allocation towards promoting green innovation [50]. Some scholars have pointed out that green human resource management can motivate employees to behave green. It is a new business model that helps enterprises realize green organizational citizenship behaviors and promotes enterprises to improve their sustainable development capabilities [51].

According to agency theory, in situations involving high objective and subjective risks, agency problems hinder research and development innovation. For instance, short tenures of senior management, limited equity incentives, and agents’ risk aversion exacerbate this issue [52]. Consequently, mitigating agency dilemmas and reducing agency costs are essential in advancing corporate green innovation. Enterprises improve board governance and strengthen management incentive arrangements by increasing the board size and independent director proportion and enhancing gender and age diversity [53,54]. Based on this, the following hypotheses are proposed:

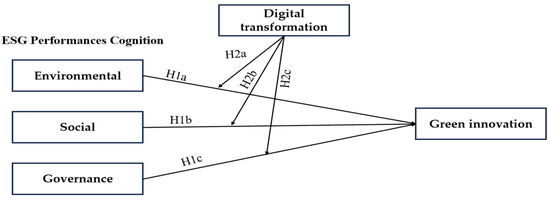

H1.

ESG Performance cognition will have a positive (+) effect on green innovation.

H1a.

E in ESG cognition will have a positive (+) effect on green innovation.

H1b.

S in ESG cognition will have a positive (+) effect on green innovation.

H1c.

G in ESG cognition will have a positive (+) effect on green innovation.

2.4. The Moderating Effect of DT

Raising digitizing levels and undertaking green innovation activities share similarities, possessing the potential for long-term benefits. Digital transformation not only helps reduce energy consumption in the economy and society, achieving green development goals for ecological and environmental protection, but also, through the efficient integration of data and information, overcomes “spatial and temporal limitations”, achieving optimal resource allocation between different regions or organizations [55,56]. Corporate digital transformation can alleviate financing constraints and enhance financing capabilities, promoting green innovation. This is because big data analysis can identify potential changes in the company reporting process to make it more effective, thus providing greater information transparency for shareholders and all stakeholders [57]. Digital transformation helps reduce supervisory costs in innovation activities. The recordability and traceability of big data and Blockchain technology can address information asymmetry issues [58] and increase public supervision of companies. Digital transformation enables companies to strengthen corporate governance and enhance shareholder information transparency, helping to alleviate shareholder concerns about agency issues and information risk [59].

Green innovation endeavors are typically intricate and protracted, necessitating robust resource integration and optimization capabilities for firms. Digital technology facilitates a more efficient and expedited exchange of information within and outside the company [58]. The application of digital technologies can effectively reduce information transmission costs, promote collaboration between companies, improve resource allocation efficiency, enhance the sustainable growth capability of companies, and inject endogenous vitality into green innovation activities [60,61]. Firstly, through digital transformation, companies apply advanced digital technologies to improve the monitoring level of supply chain integration systems, enhance the integration of specific resources in the supply chain, and respond quickly to market demand changes [62]. Improving resource allocation and coordination efficiency helps companies meet green innovation activities’ demands. Secondly, corporate digital transformation promotes information sharing and knowledge integration, thereby generating new information and knowledge [63], helping to enhance corporate intellectual capital, stimulate innovation vitality, and expand investment opportunities for companies [64]. This transformation is important in the continuous improvement and innovation of environmental technologies and methods. Based on this, the following hypotheses are proposed:

H2.

DT will moderate the positive relationship between ESG performance cognition and green innovation. The higher the DT, the stronger this relationship.

H2a.

DT will moderate the positive relationship between (E) cognition of ESG and green innovation. The higher the DT, the stronger this relationship.

H2b.

DT will moderate the positive relationship between (S) cognition of ESG and green innovation. The higher the DT, the stronger this relationship.

H2c.

DT will moderate the positive relationship between (G) cognition of ESG and green innovation. The higher the DT, the stronger this relationship.

Figure 1 presents the conceptual framework of this study, summarizing the hypotheses above.

Figure 1.

Research model.

3. Methods

3.1. Sample and Data Collection

This study conducted a targeted sampling survey in different industries from 18 September to 25 October 2023. The industries surveyed include manufacturing; finance and insurance; culture; sports and entertainment; wholesale, retail, and service industries; real estate; information transmission; computer services; technical services; energy; health and social security; transportation; and education. Questionnaires were distributed in Suzhou, Qingdao, Weihai, Shenzhen, Hangzhou, Shanghai, and Beijing. The questionnaire and related content were clearly explained to participants before the survey. All responses were ensured to be collected anonymously, and confidentiality was strictly maintained to protect participant privacy and data integrity. During this period, 322 questionnaires were collected, and six invalid questionnaires were eliminated (e.g., a considerable number of questions were not answered, and the answers to the questionnaire did not change; we also selected employees from various industries who are interested in the environment, corporate social responsibility, and ESG), leaving 316 questionnaires from these industries for research and analysis. To test the hypotheses proposed in this study, SPSS21.0 and AMOS24 statistical analysis software, were used to conduct descriptive statistical analysis, correlation analysis, reliability, and validity analysis, and the hypotheses were confirmed through path analysis and regression analysis.

Based on the collected sample data of 316, the demographic data are shown in Table 1. At the gender level, there were 145 male participants, accounting for 45.9%, and 171 female participants, accounting for 54.1%. Regarding age distribution, the research samples are mainly concentrated in the 31–40 and 20–30 age groups, accounting for 40.8% and 32.3%, respectively. Regarding education level, most participants had a bachelor’s degree, accounting for 52.8%. More than half of the respondents have a bachelor’s degree or above, and their understanding of the questionnaire will have a certain degree of reliability. In terms of work experience, about 85% of the participants have more than 5 years of work experience, indicating that the research subjects have accumulated specific expertise in the workplace and have a particular understanding of corporate strategy and operations. From the perspective of industry distribution, the wholesale, retail, and service, and finance and insurance industries account for relatively high proportions, accounting for 15.5% and 17.1%, respectively. Finally, in terms of enterprise types, private enterprises accounted for the highest proportion at 44.9%, and state-owned enterprises accounted for 33.9%.

Table 1.

Descriptive analysis of participants.

3.2. Measurement of Variables

We first operationalized the research variables to verify the research hypotheses we proposed. First, the independent variable ESG performance cognition was used. The 24 question items on ESG performance of the scale in [65] were used to meet the needs of this study. With certain modifications, the six questions E are in [65], with a reliability of 0.884 and a validity of 0.633; the reliability of the 12 questions measuring S is 0.940, and the validity is 0.603; the reliability of the six questions measuring G is 0.892 and the validity is 0.651.

For the measurement of the dependent variable DT, this study’s questionnaire used 10 questions from the [66] scale, as detailed in “Leading Digital: Transforming Technology into Business Transformation”, published by Harvard Business Press, to assert the questionnaire’s reliability and validity in capturing the essence of technology.

For the measurement of the moderating variable of green innovation, we chose to use 8 questions from the [67] study. The reliability and validity of these questions were 0.822 and 0.708, respectively. The reliability and validity of the above scales all meet the basic requirements of statistics. The survey in this article adopts a 5-point Likert scale, where 1 to 5 correspond to ‘strongly disagree’, ‘disagree’, ‘neutral’, ‘agree’, and ‘strongly agree’. Details of the specific items for each question are shown in Table 2.

Table 2.

Measurement of variables.

4. Results

4.1. Measurement Reliability and Validity Assessment

To more precisely determine the validity and reliability of measurements and whether assumptions made based on theory or pre-specified models match the collected data, this study first conducted an exploratory factor analysis (EFA) on the data and then performed a confirmatory factor analysis (CFA). Before proceeding with hypothesis testing, we analyzed the correlation, mean, and variance between the various research variables. Finally, we used AMOS and SPSS to verify Hypothesis 1 and Hypothesis 2 through path analysis and multi-level regression analysis, respectively.

The EFA results are detailed in Table 3, and four factors were identified. The Cronbach’s α value of each scale significantly exceeded the critical value of 0.70 specified by Fornell and Larcker (1981), thus affirming the high reliability of the questionnaire and confirming its appropriateness for our investigation [68]. The analysis confirmed the necessary internal consistency for hypothesis testing, with all variables having values above 0.50, exceeding the generally accepted significance threshold of 0.40. To assess the reliability of the scale, we calculated Cronbach’s alpha coefficients and obtained the following results: Green Innovation (GI) = 0.938, ESG (Environment) = 0.906, ESG (Social) = 0.948, ESG (Governance) = 0.911, and Digital Transformation (DT) = 0.944.

Table 3.

Results of exploratory factor analysis.

The confirmatory factor analysis (CFA) results are shown in Table 4. It shows that the model shows satisfactory consistency with the data (CMIN/DF = 1.100 < 2, p < 0.001; CFI = 0.992 > 0.9; TLI = 0.992 > 0.9; IFI = 0.992 > 0.9; NFI = 0.920 >0.9; RMSEA = 0.018 < 0.08), as expected. Furthermore, all factor loadings were highly significant (p < 0.001), and the composite reliabilities (CR) of E = 0.911, S = 0.920, G = 0.951, DT = 0.951, and Green Innovation (GI) = 0.946 all exceeded the 0.70 threshold for constructing reliable measures. Furthermore, the average variance extracted (AVE) of these constructs (E = 0.631, S = 0.616, G = 0.656, DT = 0.662, and Green Innovation = 0.688) all exceeded the 0.50 mark, emphasizing the adequate convergent validity and reliability of these measures [68].

Table 4.

Results of confirmatory factor analysis.

The analysis results are shown in Table 5. Employees’ cognition of environment, social, and governance (ESG) performance all show a significant positive correlation with digital transformation (r = 0.402, 0.482, 0.495, p < 0.01). Similarly, E, S, and G showed a significant positive correlation with green innovation (r = 0.490, 0.471, 0.511, p < 0.01). Furthermore, a significant positive correlation exists between DT and green innovation (r = 0.492, p < 0.01). Together, these findings indicate a significant positive correlation between the variables investigated, thus laying the foundation for further model and hypothesis testing in this study.

Table 5.

Mean, standardized deviation, and correlations.

4.2. Hypothesis Testing

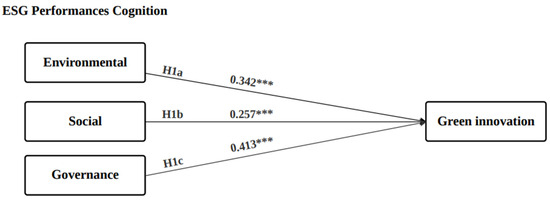

The results of hypothesis testing are presented in Table 6.and Figure 2. The structural model demonstrated good-fit indices: CMIN/DF = 1.571 (<2), p < 0.001; CFI = 0.965 (>0.9); TLI = 0.963 (>0.9); IFI = 0.965 (>0.9); GFI = 0.878; NFI = 0.910 (>0.9); root mean square error of approximation (RMSEA) = 0.042 (<0.08). These findings suggest a well-fitting model.

Table 6.

The results of H1 (H1a, H1b, H1c).

Figure 2.

The results of H1 (H1a, H1b, H1c). *** p < 0.001.

Results of hypotheses testing:

H1. ESG performance cognition has a positive (+) effect on green innovation. Hypothesis 1a: E in ESG performance cognition has a positive (+) effect on green innovation. (β = 0.342, t = 5.550, p < 0.001), thereby supporting Hypothesis 1a. Hypothesis 1b: S in ESG performance cognition has a positive (+) effect on green innovation. (β = 0.257, t = 4.556, p < 0.001), thereby supporting Hypothesis 1b. Hypothesis 1c: G in ESG performance cognition has a positive (+) effect on green innovation. (β = 0.413, t = 6.790, p < 0.001), thereby supporting Hypothesis 1c. This result shows that from an economic perspective, companies that improve employees’ awareness of ESG performance not only help improve environmental and social values but also enhance green innovation and bring sustainable development value and future economic benefits to the company.

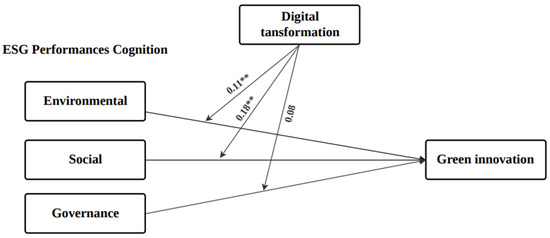

This study employs hierarchical regression models to test Hypotheses 2 (H2a, H2b, H2c). DT will moderate the positive relationship between ESG performance cognition and green innovation. The higher the DT, the stronger this relationship. The investigation primarily involves the construction of three hierarchical regression models to examine the moderating effects of Hypothesis 2. In Model 1, the independent variables E, S, and G are inputted to assess their impact on green innovation. Model 2 builds upon Model 1 by introducing the moderating variable digital transformation (DT) to explore the combined influence of E, S, G, and DT on green innovation. In Model 3, based on Model 2, the interaction terms of E, S, G, and the moderating variable DT are introduced to examine the moderating effect of DT. Mean centering was applied to the independent variables to mitigate the issue of multicollinearity. The results are presented in Table 7 and Figure 3.

Table 7.

Results of the moderated regression analysis.

Figure 3.

The moderating effects of DT. ** p ≤ 0.01.

Data from Table 6 indicate that in Model 3 when the interaction term of ESG (E) and the product of the moderating variable DT is inputted, the interaction term (β = 0.108, t = 2.100, p < 0.05) significantly positively impacts green innovation. This supports Hypothesis 2a, which states that DT moderates the positive relationship between environmental (E) cognition of ESG and green innovation. The higher the DT, the stronger this relationship. Similarly, when the interaction term of ESG (S) and the product of DT is introduced, the interaction term (β = 0.177, t = 3.343, p < 0.05) significantly positively impacts green innovation, supporting Hypothesis 2b that DT moderates the positive relationship between social (S) cognition of ESG and green innovation. The higher the DT, the stronger this relationship. However, when the interaction term of ESG (G) and the product of DT is introduced, the interaction term does not yield significant results. Hence, Hypothesis 2c, DT moderates the positive relationship between governance (G) cognition of ESG and green innovation, is not supported. This result shows that from an economic perspective, companies that improve employees’ awareness of ESG performance not only help improve environmental and social values, but also enhance green innovation and bring sustainable development value and future economic benefits to the company. In addition, the moderating effect of digital transformation reveals how technological progress further strengthens the relationship between ESG awareness and green innovation by optimizing resource allocation and enhancing information transparency. These findings provide economic evidence for the importance of companies considering increasing the degree of digital transformation in the ESG management process when formulating strategies and suggest that companies should also pay attention to their social and environmental responsibilities while pursuing economic benefits.

5. Discussion

5.1. Theoretical and Practical Implications

Climate change is already one of the most important topics discussed globally by world leaders. Countries meet regularly to seek solutions and advocate for policy actions to mitigate its impacts [69]. This study explores the implications of organizational employees’ cognitions of corporate ESG performance on green innovation outcomes and examines the moderating role of digital transformation in this dynamic. Different from previous ESG research that focuses on its impact on corporate financial performance and uses it as an investment criterion, when we study employees’ cognition of corporate ESG performance and the practical significance of corporate greening, we pay more attention to employees’ understanding and practice of the connotation of ESG. We believe that the penetration of ESG in an enterprise should be through every employee’s actual knowledge and understanding of ESG.

Firstly, by validating the positive relationship between employees’ cognition of corporate ESG performance and green innovation, we further emphasize the critical role of ESG standards in corporate sustainable development. This not only provides empirical support for the ESG theoretical framework but also deepens the understanding of the intrinsic mechanisms of ESG within corporate operations [70]. The results of this study offer more specific and actionable theoretical foundations for how ESG performance affects corporate green innovation.

Secondly, by introducing the concept of digital transformation, we have injected new theoretical elements into the field of ESG research. Digital transformation is not just a technological change but an all-encompassing transformation affecting organizational culture, decision-making, and employee interaction [71]. From this theoretical perspective, we focus on the correlation between ESG performance cognition and green innovation and turn our attention to how digital transformation influences this relationship. Therefore, this study provides a broader space for future theoretical construction in the ESG domain, inspiring researchers to contemplate corporate sustainable development in the digital age deeply.

Corporate governance (G) performance did not show a meaningful moderating effect in the moderating role of digital transformation. Some scholars pointed out that the digital transformation process presents regional imbalance and industry differences, and enterprises should thoroughly combine their own realities in pursuing digital transformation because risks, opportunities, and challenges coexist [72]. Some scholars have found that digitizing is a double-edged sword, and digital transformation only sometimes benefits corporate innovation performance [73]. For example, Ghasemaghaei and Calic argue that although digital transformation reduces information asymmetry, it also intensifies the exposure of negative information [37]. This exposure not only exacerbates the financial vulnerability of businesses, but also reduces the availability and diversity of capital, adversely affecting corporate innovation performance.

Additionally, Pang Ruizhi and Liu Dongge note that digital transformation requires substantial capital support, which may lead to a “crowding out” effect on the main business and worsen the balance sheet, inhibiting innovative development [74]. Digital transformation affects the risk of corporate stock price collapse by increasing agency costs and encouraging management overconfidence. Further research has found that small and non-high-tech companies have higher financial risks during digital transformation, thus hindering the innovative development of enterprises [75].

Based on the research results, we summarize the following practical implications:

Firstly, every company needs innovation, especially regarding global warming, where many companies have already started focusing on green innovation, practicing zero carbon emission innovations, and reforms. Green innovation will become a core competitiveness of a company. When leading companies begin to practice green innovation and emphasize environmental protection, it will encourage other companies to emulate and learn, prompting more companies worldwide to emphasize green innovation and develop and implement green innovation strategies. Of course, enhancing ESG performance can improve green innovation, so employees’ cognition of corporate ESG performance is critical in this regard. Managers can inspire employees’ enthusiasm for participating in sustainable development by strengthening internal communication, training, and education, enhancing employees’ understanding and identification with the company’s ESG efforts. Since ESG practices require the collaboration of company employees, when employees correctly identify ESG performance, we believe it will enhance the company’s green innovation, encourage employees to choose greener production methods and tools, provide more environmentally friendly services, or produce more environmentally friendly products—enhancing corporate competitiveness and achieving sustainable development. Moreover, as companies better fulfill their social responsibilities, we believe more stakeholders will identify with the ESG concept, fostering more consumers to choose green products and collectively promoting effective global warming control within this century.

Secondly, this study also highlighted the critical role of digital transformation in moderating the relationship between employees’ cognition of ESG and corporate green innovation. Therefore, companies can increase investment in digital technologies and improve data collection and analysis capabilities to better track and showcase ESG performance. Through digital means, companies can achieve more comprehensive and real-time monitoring of ESG efforts, enhancing employees’ visibility of corporate sustainability efforts and thereby strengthening employees’ positive cognition. This helps improve ESG performance and enables companies to better adapt to changing market demands. Additionally, the moderating effect of digital transformation has differentiated impacts across the three dimensions of ESG, and companies facing governance risks and challenges during digital transformation must fully consider their conditions and actual development. If the conditions are not met or the timing of transformation is inappropriate, it will not only exacerbate the risks of digital transformation, but also hurt the orderly operation and healthy development of the company.

5.2. Limitations

While our study provides valuable insights, it also faces limitations worth considering. First, our quantitative research approach may not capture the nuanced effects of employees’ ESG perceptions fully. Additionally, our sampling methods and the limited availability of resources may need to be revised to generalize the theory. There is also the issue of standard method bias due to the reliance on self-reported surveys, which might affect the validity of measuring employees’ perceptions of ESG performance through a single analysis method. However, we recognize this limitation and plan to address it by incorporating mixed research methods in future studies, such as the interview method, etc. We will also consider more detailed scales to refine what involves stakeholders (e.g., add customers, employees, suppliers, shareholders, competitors, and communities). Secondly, the diversity of various industries is covered in our study, but our sample size has undeniable limitations in the explanatory validity of multiple industries. In future research, we will be committed to improving our survey methods, surveying target companies, and surveying a number of samples to make substantial contributions to companies in penetrating the concept of ESG management.

Author Contributions

Conceptualization, Q.S. and Y.L.; Methodology, Y.L. and A.H.; Software, Y.L.; Investigation, A.H.; Resources, Q.S.; Writing—original draft, Q.S.; Writing—review & editing, Y.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Lin, B.; Ma, R. Green technology innovations, urban innovation environment and CO2 emission reduction in China: Fresh evidence from a partially linear functional-coefficient panel model. Technol. Forecast. Soc. Chang. 2022, 176, 121434. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Satrovic, E.; Kehinde, M.N. The anthropogenic consequences of energy consumption in the presence of uncertainties and complexities: Evidence from World Bank income clusters. Environ. Sci. Pollut. Res. 2022, 29, 23264–23279. [Google Scholar] [CrossRef]

- Awan, A.G. Relationship between environment and sustainable economic development: A theoretical approach to environmental problems. Int. J. Asian Soc. Sci. 2013, 3, 741–761. [Google Scholar]

- Chopra, S.S.; Senadheera, S.S.; Dissanayake, P.D.; Withana, P.A.; Chib, R.; Rhee, J.H.; Ok, Y.S. Navigating the Challenges of Environmental, Social, and Governance (ESG) Reporting: The Path to Broader Sustainable Development. Sustainability 2024, 16, 606. [Google Scholar] [CrossRef]

- Thao, V.T.T.; Tien, N.H.; Anh, D.B.H. Sustainability Issues in Social Model of Coporate Social Responsibility Theoretical Analysis and Practical Implication. J. Adv. Res. Manag. 2019, 10, 17–29. [Google Scholar]

- Steyn, B.; Niemann, L. Strategic role of public relations in enterprise strategy, governance and sustainability—A normative framework. Public Relat. Rev. 2014, 40, 171–183. [Google Scholar] [CrossRef]

- Hoang, T.G.; Nguyen, G.N.T.; Le, D.A. Developments in financial technologies for achieving the Sustainable Development Goals (SDGs): FinTech and SDGs. In Disruptive Technologies and Eco-Innovation for Sustainable Development; IGI Global: Hershey, PA, USA, 2022; pp. 1–19. [Google Scholar] [CrossRef]

- Zhang, X.; Song, Y.; Zhang, M. Exploring the relationship of green investment and green innovation: Evidence from Chinese corporate performance. J. Clean. Prod. 2023, 412, 137444. [Google Scholar] [CrossRef]

- Schunk, D.H.; DiBenedetto, M.K. Motivation and social cognitive theory. Contemp. Educ. Psychol. 2020, 60, 101832. [Google Scholar] [CrossRef]

- Bandura, A. Social cognitive theory of self-regulation. Organ. Behav. Hum. Decis. Process. 1991, 50, 248–287. [Google Scholar] [CrossRef]

- Khaw, K.W.; Alnoor, A.; Al-Abrrow, H.; Tiberius, V.; Ganesan, Y.; Atshan, N.A. Reactions towards organizational change: A systematic literature review. Curr. Psychol. 2023, 42, 19137–19160. [Google Scholar] [CrossRef] [PubMed]

- Serikakhmetova, A.B.; Adambekova, A.A. Corporate Social Responsibility in the Context of ESG: Development and Current Trends. Farabi J. Soc. Sci. 2022, 8, 24–32. [Google Scholar] [CrossRef]

- Han, X.; Zheng, Y. Driving Elements of Enterprise Digital Transformation Based on the Perspective of Dynamic Evolution. Sustainability 2022, 14, 9915. [Google Scholar] [CrossRef]

- Guo, L.; Xu, L. The effects of digital transformation on firm performance: Evidence from China’s manufacturing sector. Sustainability 2021, 13, 12844. [Google Scholar] [CrossRef]

- Long, H.; Feng, G.-F.; Chang, C.-P. How does ESG performance promote corporate green innovation? Econ. Chang. Restruct. 2023, 56, 2889–2913. [Google Scholar] [CrossRef]

- Wang, X.; Luan, X.; Zhang, S. Research and Development Investment, ESG Performance, and Market Value of Enterprises: The Moderating Effect of Corporate Digitalization. Sci. Res. 2023, 41, 896–904. [Google Scholar]

- Fang, L.; Li, Z. Corporate digitalization and green innovation: Evidence from textual analysis of firm annual reports and corporate green patent data in China. Bus. Strategy Environ. 2024. [Google Scholar] [CrossRef]

- Wang, Z.; Chu, E.; Hao, Y. Towards sustainable development: How does ESG performance promotes corporate green transformation. Int. Rev. Financ. Anal. 2024, 91, 102982. [Google Scholar] [CrossRef]

- Velte, P. Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

- Zhou, G.; Liu, L.; Luo, S. Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Bus. Strategy Environ. 2022, 31, 3371–3387. [Google Scholar] [CrossRef]

- Ahmad, N.; Mobarek, A.; Roni, N.N. Revisiting the impact of ESG on financial performance of FTSE350 UK firms: Static and dynamic panel data analysis. Cogent Bus. Manag. 2021, 8, 1900500. [Google Scholar] [CrossRef]

- Wang, D.; Luo, Y.; Hu, S.; Yang, Q. Executives’ ESG cognition and enterprise green innovation: Evidence based on executives’ personal microblogs. Front. Psychol. 2022, 13, 1053105. [Google Scholar] [CrossRef] [PubMed]

- Sultana, S.; Zulkifli, N.; Zainal, D. Environmental, social and governance (ESG) and investment decision in Bangladesh. Sustainability 2018, 10, 1831. [Google Scholar] [CrossRef]

- Doni, F.; Johannsdottir, L. Environmental social and governance (ESG) ratings. In Climate Action; Springer: Cham, Switzerland, 2020; pp. 435–449. [Google Scholar] [CrossRef]

- Kandpal, V.; Jaswal, A.; Gonzalez, E.D.R.S.; Agarwal, N. Corporate Social Responsibility (CSR) and ESG Reporting: Redefining Business in the Twenty-First Century. In Sustainable Energy Transition: Circular Economy and Sustainable Financing for Environmental, Social and Governance (ESG) Practices; Springer Nature: Cham, Switzerland, 2024; pp. 239–272. [Google Scholar] [CrossRef]

- Wang, M.L.; Phillips-Fein, K. Environmental, Social, and Corporate Governance: A History of ESG Standardization from 1970s to the Present. Undergraduate. Senior Thesis, Columbia University, New York, NY, USA, 2023. [Google Scholar]

- Bialkowski, J.; Starks, L.T.; Wagner, M. Who cares wins: The rise of socially responsible investing. PRI Acad. Netw. Week 2021, 1–52. [Google Scholar]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Jebe, R. The convergence of financial and ESG materiality: Taking sustainability mainstream. Am. Bus. Law J. 2019, 56, 645–702. [Google Scholar] [CrossRef]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- Li, T.-T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research progress and future prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Luo, W.; Tian, Z.; Fang, X.; Deng, M. Can good ESG performance reduce stock price crash risk? Evidence from Chinese listed companies. Corp. Soc. Responsib. Environ. Manag. 2023. [Google Scholar] [CrossRef]

- Lian, Y.; Li, Y.; Cao, H. How does corporate ESG performance affect sustainable development: A green innovation perspective. Front. Environ. Sci. 2023, 11, 430. [Google Scholar] [CrossRef]

- Kraus, S.; Jones, P.; Kailer, N.; Weinmann, A.; Chaparro-Banegas, N.; Roig-Tierno, N. Digital transformation: An overview of the current state of the art of research. Sage Open 2021, 11, 21582440211047576. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. In Managing Digital Transformation; Routledge: London, UK, 2021; pp. 13–66. [Google Scholar] [CrossRef]

- Gouvea, R.; Li, S.; Montoya, M. Does transitioning to a digital economy imply lower levels of corruption? Thunderbird Int. Bus. Rev. 2022, 64, 221–233. [Google Scholar] [CrossRef]

- Ghasemaghaei, M.; Calic, G. Assessing the impact of big data on firm innovation performance: Big data is not always better data. J. Bus. Res. 2020, 108, 147–162. [Google Scholar] [CrossRef]

- Chen, W.; Zhu, C.; Cheung, Q.; Wu, S.; Zhang, J.; Cao, J. How does digitization enable green innovation? Evidence from Chinese listed companies. Bus. Strategy Environ. 2024. [Google Scholar] [CrossRef]

- Razzaq, A.; Yang, X. Digital finance and green growth in China: Appraising inclusive digital finance using web crawler technology and big data. Technol. Forecast. Soc. Chang. 2023, 188, 122262. [Google Scholar] [CrossRef]

- Ren, Y.; Li, B. Digital transformation, green technology innovation and enterprise financial performance: Empirical evidence from the textual analysis of the annual reports of listed renewable energy enterprises in China. Sustainability 2022, 15, 712. [Google Scholar] [CrossRef]

- Tang, L.; Jiang, H.; Hou, S.; Zheng, J.; Miao, L. The Effect of Enterprise Digital Transformation on Green Technology Innovation: A Quantitative Study on Chinese Listed Companies. Sustainability 2023, 15, 10036. [Google Scholar] [CrossRef]

- Li, D.; Shen, W. Can corporate digitalization promote green innovation? The moderating roles of internal control and institutional ownership. Sustainability 2021, 13, 13983. [Google Scholar] [CrossRef]

- Burki, U. Green supply chain management, green innovations, and green practices. In Innovative Solutions for Sustainable Supply Chains; Springer: Cham, Switzerland, 2018; pp. 81–109. [Google Scholar] [CrossRef]

- Aragón-Correa, J.A.; Sharma, S. A contingent resource-based view of proactive corporate environmental strategy. Acad. Manag. Rev. 2003, 28, 71–88. [Google Scholar] [CrossRef]

- Abdallah, A.B.; Al-Ghwayeen, W.S.; Al-Amayreh, E.M.; Sweis, R.J. The Impact of Green Supply Chain Management on Circular Economy Performance: The Mediating Roles of Green Innovations. Logistics 2024, 8, 20. [Google Scholar] [CrossRef]

- Harrison, J.S.; Bosse, D.A.; Phillips, R.A. Managing for stakeholders, stakeholder utility functions, and competitive advantage. Strateg. Manag. J. 2010, 31, 58–74. [Google Scholar] [CrossRef]

- Li, Z.; Huang, Z.; Su, Y. New media environment, environmental regulation and corporate green technology innovation: Evidence from China. Energy Econ. 2023, 119, 106545. [Google Scholar] [CrossRef]

- Liu, H.; Lyu, C. Can ESG ratings stimulate corporate green innovation? Evidence from China. Sustainability 2022, 14, 12516. [Google Scholar] [CrossRef]

- Tan, Y.; Zhu, Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 2022, 68, 101906. [Google Scholar] [CrossRef]

- Song, W.; Yu, H. Green innovation strategy and green innovation: The roles of green creativity and green organizational identity. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 135–150. [Google Scholar] [CrossRef]

- Papademetriou, C.; Ragazou, K.; Garefalakis, A.; Passas, I. Green human resource management: Mapping the research trends for sustainable and agile human resources in SMEs. Sustainability 2023, 15, 5636. [Google Scholar] [CrossRef]

- Zona, F.; Zamarian, M. The behavioral agency model and innovation investment: Examining the combined effects of CEO and board ownership. Group Organ. Manag. 2022, 47, 647–678. [Google Scholar] [CrossRef]

- Naveed, K.; Voinea, C.L.; Roijakkers, N. Board Gender Diversity, Corporate Social Responsibility Disclosure, and Firm’s Green Innovation Performance: Evidence from China. Front. Psychol. 2022, 13, 892551. [Google Scholar] [CrossRef] [PubMed]

- Belloc, F. Corporate governance and innovation: A survey. J. Econ. Surv. 2012, 26, 835–864. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Dong, J.Q.; Fabian, N.; Haenlein, M. Digital transformation: A multidisciplinary reflection and research agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Nadkarni, S.; Prügl, R. Digital transformation: A review, synthesis and opportunities for future research. Manag. Rev. Q. 2021, 71, 233–341. [Google Scholar] [CrossRef]

- Lombardi, R.; Secundo, G. The digital transformation of corporate reporting–a systematic literature review and avenues for future research. Meditari Account. Res. 2021, 29, 1179–1208. [Google Scholar] [CrossRef]

- Nambisan, S.; Wright, M.; Feldman, M. The digital transformation of innovation and entrepreneurship: Progress, challenges and key themes. Res. Policy 2019, 48, 103773. [Google Scholar] [CrossRef]

- Zhang, C.; Wang, Y. Is enterprise digital transformation beneficial to shareholders? Insights from the cost of equity capital. Int. Rev. Financ. Anal. 2024, 92, 103104. [Google Scholar] [CrossRef]

- Sun, C.; Zhang, Z.; Vochozka, M.; Vozňáková, I. Enterprise digital transformation and debt financing cost in China’s A-share listed companies. Oeconomia Copernic. 2022, 13, 783–829. [Google Scholar] [CrossRef]

- Huang, Y.; Lau, C. Can digital transformation promote the green innovation quality of enterprises? Empirical evidence from China. PLoS ONE 2024, 19, e0296058. [Google Scholar] [CrossRef]

- Rai, A.; Patnayakuni, R.; Seth, N. Firm performance impacts of digitally enabled supply chain integration capabilities. MIS Q. 2006, 30, 225–246. [Google Scholar] [CrossRef]

- Qi, H.J.; Cao, X.Q.; Liu, Y.X. The impact of digital economy on corporate governance-based on the perspective of information asymmetry and managers’ irrational behavior. Reform 2020, 4, 50–64. [Google Scholar]

- Zhidong, T.; Xun, Z.; Jun, P.; Jianhua, T. The Value of Digital Transformation: From the Perspective of Corporate Cash Holdings. J. Financ. Econ. 2022, 48, 64–78. [Google Scholar]

- Zhu, J.; Huang, F. Transformational leadership, organizational innovation, and ESG performance: Evidence from SMEs in China. Sustainability 2023, 15, 5756. [Google Scholar] [CrossRef]

- Westerman, G.; Bonnet, D.; McAfee, A. Leading Digital: Turning Technology into Business Transformation; Harvard Business Press: Boston, MA, USA, 2014. [Google Scholar]

- Chang, C.H.; Chen, Y.S. Green organizational identity and green innovation. Manag. Decis. 2013, 51, 1056–1070. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Idowu, A.; Ohikhuare, O.M.; Chowdhury, M.A. Does industrialization trigger carbon emissions through energy consumption? Evidence from OPEC countries and high industrialised countries. Quant. Financ. Econ. 2023, 7, 165–186. [Google Scholar] [CrossRef]

- Friedman, H.L.; Heinle, M.S.; Luneva, I. A Theoretical Framework for ESG Reporting to Investors. Available SSRN 3932689 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3932689 (accessed on 2 January 2024).

- Hanelt, A.; Bohnsack, R.; Marz, D.; Marante, C.A. A systematic review of the literature on digital transformation: Insights and implications for strategy and organizational change. J. Manag. Stud. 2021, 58, 1159–1197. [Google Scholar] [CrossRef]

- Li, C.; Long, G.; Li, S. Research on measurement and disequilibrium of manufacturing digital transformation: Based on the text mining data of A-share listed companies. Data Sci. Financ. Econ. 2023, 3, 30–54. [Google Scholar] [CrossRef]

- Lee, G.; Shao, B.; Vinze, A. The role of ICT as a double-edged sword in fostering societal transformations. J. Assoc. Inf. Syst. 2018, 19, 1. [Google Scholar] [CrossRef]

- Pang, R.Z.; Liu, D.G. The paradox of digitalization and innovation: Does digitalization promote corporate innovation—An explanation based on open innovation theory. South Econ. 2022, 41, 97–117. [Google Scholar]

- Ai, Y.; Chi, Z.; Sun, G.; Zhou, H.; Kong, T. The research on non-linear relationship between enterprise digital transformation and stock price crash risk. N. Am. J. Econ. Financ. 2023, 68, 101984. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).