Abstract

Heavy-duty vehicles are a major contributor to CO2 emissions in the transportation sector, and it is necessary to develop clean and green technologies to replace diesel trucks. Electric trucks have not reached a breakthrough in the German market. In addition to technology development, customer acceptance of new technologies is a critical factor in the success of sustainable transportation policies. This study aims to fill this knowledge gap by investigating the perceptions regarding electric trucks and providing insights into the acceptance of these technologies. Data and arguments on the expected risks and benefits of heavy-duty electric trucks, with a special focus on the battery swapping solution, were collected through a survey and expert interviews in the German commercial transport sector. The authors collected a sample of 146 qualitative responses and 61 individual statements on the expected risks and benefits of electric trucks and battery swapping. While the responses to the classified questions are overwhelmingly positive, the individual statements show that there are still many open questions.

1. Introduction

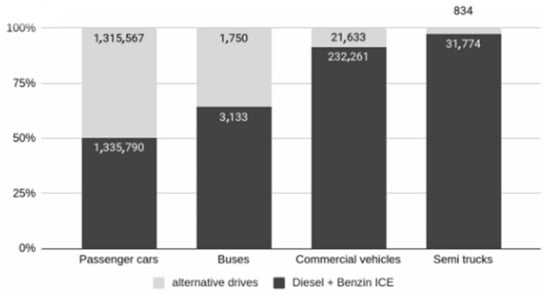

The number of electric vehicles in Germany and the EU is growing and has reached a significant share of passenger cars. For buses and some types of commercial vehicles, electric drives are also the leading alternative to internal combustion engines (ICE), as discussed in Section 2.2. The typical use of heavy trucks is still a challenge for electric drives; they carry heavy loads, travel long distances, and have changing destinations.

TU Berlin is involved in projects for applied science to research and develop electric trucks and battery swapping systems. The purpose of this paper is to provide insight into the subjective perception of electric heavy-duty trucks and their battery charging methods. To this end, we have defined two main research questions: What is the perception of electric heavy trucks in terms of technical, economic, and environmental aspects? And what is the perception of battery swapping stations in terms of perceived risks and benefits? These questions were analyzed through a survey (N = 146) and interviews (N = 4) with experts who are working with e-trucks, from logistics companies, research and development, and mechanical engineering.

In the EU, heavy-duty vehicles (HDV) including trucks, city buses, and long-distance buses generate over 25% of greenhouse gas (GHG) emissions from road transportation, and they make up more than 6% of the total GHG emissions in the region. These emissions have been steadily rising, particularly in the field of freight transport [1]. The European Union aims to reduce transport-related GHG emissions, air pollution, and energy dependence on imported fossil fuels. To achieve this goal, alternative drives should replace fossil fuels as the power source for HDV [2].

Customer acceptance is a key success factor for new technology and the implementation of policy objectives. Currently, heavy trucks highly depend on diesel fuel. It is an open race as to which alternative power source for HDV will be used in the future. The major truck manufacturers have developed electric versions of even the largest articulated semi-trucks, and new companies, which are specialized in e-trucks, are entering the market. However, the number of registrations of heavy electric trucks is still very low. Many studies have been published on the technical and economic aspects of electric trucks [3,4,5,6], but there is a lack of information on user acceptance. This paper examines the perception of e-trucks in the German market to provide insight into the acceptance of this technology. Previous research on the acceptance of technology has indicated that the way individuals perceive concerns and risks plays a significant role in shaping their attitudes toward new technologies [7,8,9,10]. Lee defined attitude as an individual’s positive or negative thoughts about performing a particular behavior [9]. Classical technology acceptance models such as the Technology Acceptance Model (TAM) [11] and the Theory of Planned Behavior [12] suggest that a person’s attitude towards an object determines, among other factors, their intention to use it. In addition to concerns and risks, studies on technology acceptance have shown that attitudes towards emerging technologies that people have not experienced before are influenced by perceptions of their advantages and potential benefits [8,9,11]. These studies indicate how customers’ perceptions of the different dimensions of the benefits and usefulness affect their willingness to use them in the future.

User Acceptance of Electric Vehicles

Electric trucks are still new and rare (see Section 2.5); therefore, there is a lack of knowledge about user experiences and expectations. Few scientific studies deal with this topic. Existing studies about user experiences and preferences mainly focus on passenger cars [13,14] and refer to a lack of knowledge [15].

The German National Platform Future of Mobility (NPM) published a report in 2021 arguing that customer acceptance is the key to the market ramp-up of electric passenger cars [16]. The argument was based on the results of a representative survey (N > 1000) and interviews with experts. They gave a few, clear reasons for buying an electric vehicle (EV); these are:

- financial reasons (subsidies, lower total cost of ownership (TCO)),

- test-driving and driving pleasure,

- and environmental considerations.

According to this report, the reasons against EVs are diffuse and not clearly shaped. Apart from subsidies, the keys to growing acceptance of EV passenger cars are spreading knowledge, providing testing opportunities, and expanding the charging infrastructure.

In contrast to this, a study from Switzerland (N = 4149) with drivers of conventional cars questions the substantial effects of better information and test drives on EV adoption [17]. Most of the studies focusing on electric trucks deal with calculated economic or technical aspects [3,18,19,20] rather than user acceptance and expectations. Only one recent study, which was published in Hungary in 2021 [21], deals with major barriers to the adoption of electric trucks in the logistics system. This research is based on a survey among 60 professionals from the logistics industry in Budapest. The authors argue that the difference in the total costs of ownership (TCO) between e-trucks and diesel trucks is already marginal. Barriers are related to operational and infrastructural challenges such as a shorter range, a lack of charging infrastructure, and long charging times. Technological constraints are seen as a major barrier for e-trucks, including battery capacity and longevity, charging speed, and accessibility of charging points. A total of 67% of the respondents of the Hungarian survey were concerned about the short range, while 33% were concerned about a lack of charging infrastructure. Furthermore, high investment costs and a lack of incentives are reasons to avoid buying e-trucks. Investment costs for e-trucks are higher than for diesel trucks, but there is disinformation about the TCO.

An important global political initiative is called ‘Global Drive to Zero’. Governments from Europe, the Americas, and New Zealand launched this in 2021 by signing a Memorandum of Understanding to accelerate the growth of global zero-emission commercial vehicles. The program is supported by companies and regional bodies (such as Berlin Partner, a local public–private partnership for economic and technological development in the German capital). The goal is a full transition to ZE-MHDV (zero-emission medium- and heavy-duty vehicles) in new fleets by 2040 and net-zero carbon emissions by 2050 [22].

2. Regulations and Market Analysis

The legal and economic framework conditions are briefly presented below to introduce the topic.

2.1. Legal Requirements for Clean Transport Vehicles in the EU

The term “clean vehicles” has different definitions for different categories of vehicles in the European Union legislation. The definition in Art. 4 (4) (b) of Directive (EU) 2019/1161 is: “clean vehicles” of categories N2 and N3 are those that use alternative fuels, as defined in Art. 2 (1) and (2) of the Directive 2014/94/EU. These alternative fuels include electric vehicles but also liquid and gaseous fuels that have the potential to contribute to the decarbonization and improvement of the environmental performance of the transport sector. Such fuels include hydrogen, biofuels, synthetic and paraffinic fuels, natural gas (compressed natural gas (CNG) and liquefied natural gas (LNG)), and liquefied petroleum gas (LPG). This means that clean trucks under Directive (EU) 2019/1161 do not have to be zero-emission vehicles. Instead, gaseous fossil fuels will still cause CO2 emissions and air pollutants from combustion.

- Zero-emission HDV are those with a power source—electricity, hydrogen fuel cell, or ICE—that emits <1 g CO2/kWh.

- Low-emission HDV are those with an ICE powered by hydrogen combustion, biofuels, synthetic and paraffinic fuels, compressed natural gas (CNG), liquefied natural gas (LNG), or liquefied petroleum gas (LPG).

The relevant legislation is presented in the following two subsections and in Table 1.

Table 1.

Legal acts in the EU for clean transport vehicles.

2.2. EU Directive for Clean and Energy-Efficient Road Transport Vehicles

To promote the use of clean and energy-efficient road transport vehicles, the EU has set minimum procurement targets for such vehicles in the Directive (EU) 2019/1161. The targets are different for each member state and for each vehicle class. Germany is one of the EU member states with the highest targets. For Germany, the minimum procurement target for the share of clean vehicles for heavy trucks (vehicle category N2 and N3) is 10% from 2021 to 2025 and 15% from 2026 to 2030 (Directive (EU) 2019/1161). The vehicle categories are defined in Article 4 of Regulation (EU) 2018/858. Category N vehicles are used for the carriage of goods. Category N2 are those with a maximum mass between 3.5 and 12 tonnes; category N3 are those above 12 tonnes including trailers.

The minimum procurement target of 15% for clean trucks by 2030 applies to 12 EU member states: Luxembourg, Sweden, Denmark, Finland, Germany, France, the Netherlands, Austria, Belgium, Italy, Ireland, and Malta.

2.3. EU Regulation Setting CO2-Emission Performance Standards for New Heavy-Duty Vehicles

Regulation (EU) 2019/1242 applies to the manufacturers of heavy-duty vehicles of categories N2 and N3 with a maximum permissible mass exceeding 16 tonnes, 6 × 2 axle configuration, and tractor units. Manufacturers must reduce the specific emissions of their fleets by 15% for the reporting periods starting in 2025 and by 30% for the reporting periods starting in 2030 (Art. 1 lit. a and b). The reference period is from 1 July 2019 to 30 June 2020.

2.4. Market for Commercial Vehicles and Trucks—Data Analysis

By 1 January 2023, a total number of 3,641,755 vehicles used for the carriage of goods and a further 227,938 semi-truck tractor units were officially registered in Germany with the Federal Motor Transport Authority (Kraftfahrtbundesamt, KBA) [23]. Of this number, 85% had a technically permissible maximum laden mass below 3.5 t. Table 2 shows the number of vehicles for each segment and new registrations in 2022.

Table 2.

Stock and new registrations of transport vehicles in Germany (2022) [23].

For long hauling, mainly articulated semi-trucks are used. The renewal rate is significantly higher than for smaller commercial vehicles. The annual figures published by KBA on the stock and new registrations make it possible to calculate the renewal rate and average period of use. Table 3 shows the number of semi-trucks in recent years.

Table 3.

Renewal rate and average usage time for semi-trucks in Germany over time (2018–2023 [23]).

The renewal rate (R) is calculated by dividing new registrations in a given year (NY) by the stock in the following year (SY+1), to take account of the annual increase (decrease in 2020). The average usage time (T) in years is the inversion of this result. The renewal rate and the average usage time are calculated using the following equations:

The renewal rate dropped significantly during the COVID-19 pandemic in 2020. The pandemic and its economic consequences (closures, disruption of delivery chains, and shortages of inputs) affected both the transport industry on the demand side, as buyers and users of trucks, and the automotive industry, as manufacturers and suppliers. In 2021 and 2022, the renewal rate increased slightly but has not reached the status quo ante yet. In 2018 and 2019, the average time in use of semi-trucks was less than 6 years. In 2022, it was 7.0 years. This does not necessarily mean that the trucks are scrapped; some may be sold to other countries. The data show that most of the heavy trucks that will be in use in 2030 have not yet been produced.

2.5. Alternative Drives for Heavy Trucks

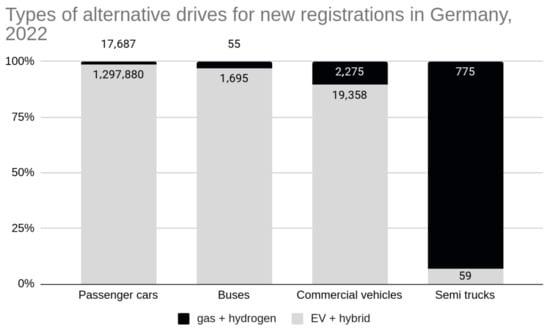

Alternative powertrains for semi-trucks are still very rare. In 2022, only 52 battery-electric, 7 hybrid, 775 fossil gas, and 0 hydrogen-powered semi-trucks were newly registered in Germany. The share of alternative powertrains in new registrations was 2.6%. The situation is different for rigid trucks and vans. Of the 253,894 new registrations of trucks and vans in 2022, 8.5% (21,633) had an alternative drive. Most of these were battery-electric vehicles (a total of 18,322 = 7.2%). Smaller proportions used H2 fuel cells (30), fossil gas (2245), or were plug-in hybrids (77) or non-plug-in hybrids (959). Gas supply disruptions and rising prices in 2022 could give electric trucks a better position in the coming years [23]. Detailed figures for the different vehicle classes can be found in Table 4, while Figure 1 and Figure 2 illustrate the large differences between semi-trucks and other vehicles.

Table 4.

Alternative drives for different vehicle classes in Germany, 2022 [23].

Figure 1.

Share of alternative drives for new registrations in Germany by vehicle classes in 2022 [23].

Figure 2.

Types of alternative drives (gas + hydrogen vs. EV + hybrid) for new registrations in Germany by vehicle classes in 2022 [23].

Although the number of registrations of electric semi-trucks is low, all the major companies already offer this type of vehicle, and there are new companies specializing in this segment. MAN and Scania both belong to the Traton Group, which is part of Volkswagen AG. Daimler and VW together cover 70% of the market for semi-trucks in Germany; with DAF and Volvo, the share rises to 94%. More details can be found in Table 5.

Table 5.

Semi-truck market shares in Germany, 2022 [23].

3. Materials and Methods

Electric passenger cars are an emotive topic in Germany, and many people have reservations about them. In March 2023, the European Commission and member states agreed to ban the sale of polluting cars and vans in 2035. Before the decision was made, the German government blocked a compromise and demanded an exemption for ICE cars using synthetic e-fuels [24,25]. The question is whether there are similar reservations about electric trucks. A survey was conducted to find out the motives and fears for the use of heavy e-trucks.

3.1. STEEP Analysis

In order to find relevant topics for a survey on user perceptions of heavy e-trucks, the authors carried out a STEEP analysis. STEEP is an acronym for Social, Technological, Economic, Environmental, and Political factors. It is used to scan the business environment on a certain topic, such as e-trucks, and to find relevant aspects related to each factor. STEEP is a variant and extension of the classic PEST analysis, developed by Francis J. Aguilar [26], by adding the factor of environmental issues. Relevant STEEP factors and related aspects are shown in Table 6. The results are presented in Table 6 below.

Table 6.

STEEP factors and related aspects for e-trucks.

3.2. Questionnaire

The questionnaire consisted of four demographic questions (see Table 7), 33 questions with a 1-to-5 scale (see Table 8, Table 9 and Table 10 and Figure 3, Figure 4 and Figure 5), and one open text field. To keep it simple and user-friendly, the questions related to the five STEEP categories were grouped into three main segments: economic, technological, and social potential advantages. Environmental and political issues are integrated within these. The first page was in three languages: German, English, and Polish. This was followed by three pages of questions for each language. The questions were identical for each language. The questionnaire was created on Google Forms and was available online from November 2022 to March 2023. Participation was voluntary and no personal data was collected.

Table 7.

Demographic results.

Table 8.

Results for opinions on e-trucks (mean score and standard deviation). A lower score means more agreement (1 is strongly agree); a higher score means more disagreement with a statement (5 is strongly disagree).

Table 9.

Results for rollout and usage of e-trucks (mean score and standard deviation).

Table 10.

Results for statements related to battery swapping (mean score and standard deviation).

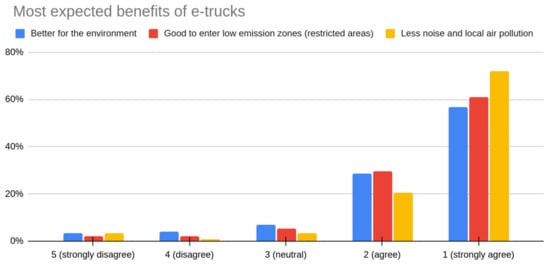

Figure 3.

Histogram of most-expected benefits of e-trucks.

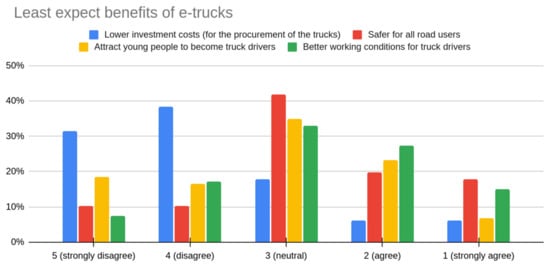

Figure 4.

Histogram of least-expected benefits of e-trucks.

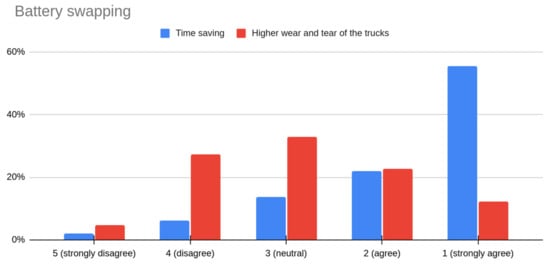

Figure 5.

Histogram of most-expected benefit (time saving) and least-expected risk (higher wear and tear) for battery swapping.

The survey was announced personally at several events (seminars for students of TU Berlin, workshops for public consultations on sustainability issues in Berlin, working group meetings for applied science for e-trucks), and it was distributed in truck driver online forums on Facebook and other websites. The questionnaire was filled out 149 times, and 3 sets of answers were deleted because fewer than half of the questions were answered.

4. Results

The response option for the questionnaire was a 1-to-5 scale. A lower number indicates agreement with the statement, and a higher number indicates disagreement.

4.1. Opinions on Electric Trucks

The first 15 questions were to solicit opinions on electric trucks in general. The mean scores and standard deviations for all the questions are shown in Table 8.

The most-expected advantages of e-trucks compared to diesel trucks are all related to ecological factors: less noise and air pollution (1.43); good to enter low emission zones (1.55); better for the environment (1.68); a contribution to global climate protection (1.81).

The least-expected advantages of e-trucks compared to diesel are related to economic and social factors: lower investment costs (3.83); attract young people to become truck drivers (3.16); safer for all road users (2.75); better working conditions for truck drivers (2.75).

The histograms, Figure 3 and Figure 4, show the distribution of responses for the most- and least-expected benefits. The histograms show a clear disagreement with the statement that e-trucks could have lower investment costs. Other ideas with a high average score are rated neutral by a majority of respondents.

4.2. Roll-Out and Usage of Electric Trucks

The following five questions were related to the rollout and usage of e-trucks. The participants were asked to suppose they work in a transport company. How do they rate the following developments? The results are shown in Table 9.

The agreement for having one e-truck to gain experience is very high (1.66), slightly lower when someone is asked personally to be the first user of the new vehicle. The agreement is still high for an immediate low share of e-trucks (10% of new purchases) and for the long-term goals (100% e-trucks from 2040). The lowest agreement is for 100% e-trucks from 2030 (2.34).

4.3. Battery Swapping Compared to Direct Charging

The last 13 questions were about battery swapping. An explanation and a short video from a swapping station in China [27] were given as an introduction to the topic. The explanation was:

“Battery swapping for e-trucks is successfully used in some countries. Empty batteries can be charged directly as usual. Or they are exchanged for full ones and charged outside the vehicle, and the truck can continue driving immediately. Please watch the short video (24 s). It shows a time-lapse example of how a mobile exchange station is set up and the batteries are exchanged”.

The mean scores are shown in Table 10. It is expected that transport companies (2.17) and truck drivers (2.23) will have advantages from battery swapping. The most expected benefit is time saving (1.77). There is also hope for higher flexibility (2.31) and that it will allow for driving long distances (2.37). The most-expected risk is that there will be too few swapping stations (2.10). The least-expected risk is higher wear and tear.

The histogram, Figure 5, shows the distribution of responses for the two most outstanding results.

As a conclusion, the results of the survey for the STEEP factors (see Table 6 above) are shown in Table 11.

Table 11.

Results of the survey related to STEEP factors.

4.4. Analysis of Individual Comments and Remarks

The last question was: “Do you expect other benefits or risks of battery swapping?”. The participants could write an individual response in an open text field. A total of 61 participants in the survey (42%) made individual statements. Nine comments such as “I don’t know” were not included. Some statements had more than one argument, so 67 arguments were identified to be useful for further consideration: 20 expected benefits and 47 expected risks. Some risks or benefits were mentioned by more than one participant.

SWOT is an acronym for Strengths, Weaknesses, Opportunities, and Threats. A SWOT analysis is a planning tool to identify these aspects for companies or organizations. It will be used here to order the individual remarks and comments.

For a SWOT analysis, it is important to choose a point of view. One side’s opportunity could be the other side’s threat; rising energy prices could be an opportunity for energy providers and a threat to transport companies. For the purpose of this work—technology acceptance of heavy e-trucks—it is the user’s perspective, i.e., trucking companies and truck drivers.

- Aspects that are helpful for freight transport companies are strengths and opportunities, whereas harmful aspects are weaknesses and threats.

- Aspects with an internal origin belong to strengths and weaknesses, while opportunities and threats have an external origin.

The basic scheme of a SWOT analysis is shown in Table 12. The numbers indicate how many arguments are mentioned in each category. It is noteworthy that 20 benefits and 46 risks are mentioned. This could be an indicator that, despite the positive results of the quantitative survey, there is a higher awareness of risks, more concerns, and underlying reservations than positive expectations of the new technology.

Table 12.

SWOT analysis, number of comments for each section.

For further analysis, some arguments are clustered under a distinctive keyword. For qualitative analysis, it is not decisive how often an argument is mentioned, but the number is still given in brackets. For each keyword, one or a selection of statements are quoted.

It is important to remember that these are participants’ views and not necessarily scientifically accepted benefits or risks. For example, five people mention an increased risk of fire. The German Insurance Association (GDV) disagrees with this. According to the data, there is no evidence that EV passenger cars have a higher risk of catching fire than ICE vehicles [28]. The Swedish Civil Contingencies Agency (MSB) published data proving that EVs are less likely to catch fire than ICE cars, and the number of fires per car in EVs has decreased over the last three years [29,30].

4.4.1. Expected Strengths

- Participation in technical progress and risk reduction (5): “You don’t have to worry about the condition of the batteries, and you always have new models of batteries”.

- Cheaper energy (3): “Battery replacement makes fast charging unnecessary. This eliminates very high costs for these charging stations; fast charging electricity is usually much more expensive per kWh and generates much higher charging losses in the battery and charging system”.

- Faster (3): “Changing batteries could possibly be quicker than refueling. So, time saving”.

- Lighter (2): “Weight savings, as it is not always necessary to drive with the largest battery”.

4.4.2. Expected Weaknesses

- Mechanical problems (6): “I think that a crushing accident can occur while swapping battery”. “Wear and tear due to constant installation and removal of batteries”.

- Safety concerns, fire threat (5): “There are greater risks of fires with trucks. It is more difficult to fight fires with batteries”.

- Shortage of swapping stations (4): “Congestion and energy bottlenecks at such stations”; “Imagine a traffic jam that lasted about 8 or 12 h which is a common occurrence, unfortunately”.

- Higher total costs (4): “In total, there must be significantly more battery systems than e-trucks, and someone has to pay for that. Battery rental increases overall maintenance costs”, “Higher prices, because the rental company has to earn money”.

- Driver’s problems (2): “More time pressure, less break time for drivers”; “Not really necessary as it can be charged during the breaks that are necessary anyway”.

4.4.3. Expected Opportunities

- Easier to reuse/recycle (3): “Better second-life use of standardized exchangeable batteries”.

- Electricity grid integration (2): “A great many batteries have to stand around unused in many places as a stockpile—but they can also be used as grid storage”.

- Easier to maintain: “Large number of batteries should be maintained at one time in case of battery swapping”.

- Political goals: “Battery replacement can be a good complement to the 100% target for commercial vehicles”.

4.4.4. Expected Threats

- Threat of no common standard (8): “Disadvantage: Most of the OEMs have to join in order to have a uniform interface/standardization”; “Through standardization, a concerted, cross-brand development strategy is conceivable. But there is also a danger of monopolization and price dictation”.

- Problems with the market introduction (6): “Introduction scenario difficult to imagine: standardization (monopoly?) and (international?) area-wide infrastructure prerequisite for use by early adopters, who however generate too little demand for the necessary investments”.

- “I see a risk in the comprehensive market penetration and the long road to standardization on the part of the OEMs. Since there is already an agreement on MCS standardization, and all OEMs and infrastructure operators are already stepping on the gas, swapping may come very late”. [MCS—Megawatt Charging System]

- Limited raw materials and environmental problems (4): “Limited materials for manufacturing batteries will be a risk, which will affect other sectors that use the same materials in their production processes”.

- “More batteries needed than the number of vehicles, which might cause more waste”.

- Space problems and grid dependency (3): “It takes up a lot of space”.

- Limitations in the vehicle design (3): “Exchangeable batteries prevent space-optimized installations, e.g., under the driver’s cab; the battery position on a 3-axle tractor shown in the video is impractical in Germany; 3-axle tractors are practically not used”.

- Neglect of alternative modes of transport (1): “I hope that long overland journeys with trucks and lorries will soon be a thing of the past, and more traffic will be shifted to rail and inland waterways”.

5. Discussion

The results of the survey in the section on the subjective perception of the economic aspects of e-trucks show a relatively high level of disagreement with the idea that e-trucks have lower investment costs compared to diesel trucks. A score of 3.83 suggests that there is a moderate level of skepticism or disagreement about the cost benefits associated with purchasing e-trucks. On the other hand, a score of 2.21 suggests that there is a notable level of acceptance or agreement with the notion that e-trucks can provide cost savings in terms of operational expenses. Overall, the results of the perception of the technical aspects of e-trucks show a generally positive perception of e-trucks across several factors. There is agreement that e-trucks require less maintenance effort, are better for the environment, are just as reliable as traditional trucks, and offer safety benefits for road users. However, there is relatively less agreement that e-trucks are better than those powered by alternative fuels.

While there is a relatively low level of agreement or acceptance for attracting young people to become truck drivers and improving working conditions for truck drivers, there is a higher level of agreement for e-trucks being seen as good vehicles for entering low-emission zones, making a significant contribution to global climate protection, and effectively reducing noise and local air pollution.

The level of agreement is significantly high for the decision to purchase one e-truck to gain experience (1.66), although it decreases slightly when individuals are asked to personally become the first user of the new vehicle. However, there is still a notable level of agreement for the immediate adoption of a small proportion of e-trucks (10% of new purchases) and for the long-term objective of moving to 100% e-trucks by 2040. The lowest level of agreement is observed for the proposal to reach 100% e-trucks by 2030.

The results of the perceived benefits and risks of a battery swapping solution indicate that both transport companies (2.17) and truck drivers (2.23) will benefit from battery swapping. The most anticipated advantage is time saving (1.77), with additional hopes for increased flexibility (2.31), and the ability to drive long distances (2.37). However, the biggest concern is the potential scarcity of swapping stations (2.10), while the least-expected risk is increased wear and tear on vehicles.

For the European trucking industry, different paths to the future are possible. Infrastructure is a major challenge for the introduction of alternative power sources in the trucking industry, as there is limited space for refueling or recharging facilities. When it comes to battery swapping, the availability of standardized batteries becomes a critical factor in determining success or failure. The establishment of a common standard can be driven by either OEMs or EU policy.

6. Conclusions

In conclusion, the pressing issue of CO2 emissions from heavy-duty vehicles in the transportation sector necessitates the development of clean technologies to replace diesel trucks. This work aimed to study the critical role of customer acceptance in sustainable transportation policies. By investigating perceptions and acceptance of electric trucks, the study sheds light on potential pathways for adoption.

Through a survey and expert interviews within the German commercial transport sector, the study collected insights on heavy-duty electric trucks’ anticipated benefits and risks and on battery swapping technology. While the classified responses generally exhibit positivity, individual statements reveal lingering uncertainties.

The perceptions regarding the economic aspects of e-trucks are mixed, with skepticism around investment costs but notable agreement on operational expense savings. The technical aspects are generally favorably perceived, including maintenance, environmental benefits, reliability, and road safety. However, alignment is relatively lower regarding e-truck superiority over alternative fuel vehicles.

Notably, e-trucks find strong support as vehicles for low-emission zones, climate protection, noise reduction, and local air pollution mitigation. The gradual transition to e-trucks enjoys significant agreement, while specific timelines, such as achieving 100% e-truck adoption by 2030, show less consensus.

Exploring the battery swapping solution highlights potential advantages for time saving, flexibility, and long-distance driving. Concerns mainly revolve around the scarcity of swapping stations, while wear and tear risks are less anticipated.

Ultimately, the study underscores the crucial role of standardized batteries and infrastructure availability in shaping the future of the European trucking industry. Successful implementation of alternative power sources hinges on collaboration between OEMs and EU policies. As the commercial transport sector seeks to reduce its carbon footprint, understanding perceptions and addressing acceptance barriers will be pivotal in shaping a cleaner and more sustainable future for heavy-duty vehicles.

Author Contributions

Conceptualization, F.N. and H.M.; methodology, F.N. and H.M.; formal analysis, F.N.; data curation, F.N. and H.M.; writing—original draft preparation, F.N. and H.M.; writing—review and editing, F.N. and H.M.; visualization, F.N. supervision, H.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding, and the APC was funded by the Technical University of Berlin.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

We acknowledge support from the German Research Foundation and the Open Access Publication Fund of the Technical University of Berlin.

Conflicts of Interest

The authors declare no conflict of interest.

References

- European Commission Q&A: CO2 Emission Standards for Heavy-Duty Vehicles. Available online: https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_763 (accessed on 30 June 2023).

- European Commission Reducing CO2 Emissions from Heavy-Duty Vehicles. Available online: https://climate.ec.europa.eu/eu-action/transport-emissions/road-transport-reducing-co2-emissions-vehicles/reducing-co2-emissions-heavy-duty-vehicles_en (accessed on 31 July 2023).

- Bhardwaj, S.; Mostofi, H. Technical and Business Aspects of Battery Electric Trucks—A Systematic Review. Future Transp. 2022, 2, 382–401. [Google Scholar] [CrossRef]

- Karlsson, J.; Grauers, A. Energy Distribution Diagram Used for Cost-Effective Battery Sizing of Electric Trucks. Energies 2023, 16, 779. [Google Scholar] [CrossRef]

- Jahangir Samet, M.; Liimatainen, H.; van Vliet, O.P.R.; Pöllänen, M. Road Freight Transport Electrification Potential by Using Battery Electric Trucks in Finland and Switzerland. Energies 2021, 14, 823. [Google Scholar] [CrossRef]

- Tol, D.; Frateur, T.; Verbeek, M.; Riemersma, I.; Mulder, H. Techno-Economic Uptake Potential of Zero-Emission Trucks in Europe; TNO: Den Haag, The Netherlands, 2022. [Google Scholar]

- Bauer, R.A. Consumer Behavior as Risk Taking. In Risk Taking and Information Handling in Consumer Behavior; Harvard University Press: Cambridge, MA, USA, 1960; pp. 389–398. [Google Scholar]

- Vijayasarathy, L.R. Predicting Consumer Intentions to Use On-Line Shopping: The Case for an Augmented Technology Acceptance Model. Inf. Manag. 2004, 41, 747–762. [Google Scholar] [CrossRef]

- Lee, M.-C. Factors Influencing the Adoption of Internet Banking: An Integration of TAM and TPB with Perceived Risk and Perceived Benefit. Electron. Commer. Res. Appl. 2009, 8, 130–141. [Google Scholar] [CrossRef]

- Im, I.; Kim, Y.; Han, H.-J. The Effects of Perceived Risk and Technology Type on Users’ Acceptance of Technologies. Inf. Manag. 2008, 45, 1–9. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Q. 1989, 13, 319. [Google Scholar] [CrossRef]

- Ajzen, I. The Theory of Planned Behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Daramy-Williams, E.; Anable, J.; Grant-Muller, S. A Systematic Review of the Evidence on Plug-in Electric Vehicle User Experience. Transp. Res. Part D Transp. Environ. 2019, 71, 22–36. [Google Scholar] [CrossRef]

- Hardman, S.; Jenn, A.; Tal, G.; Axsen, J.; Beard, G.; Daina, N.; Figenbaum, E.; Jakobsson, N.; Jochem, P.; Kinnear, N.; et al. A Review of Consumer Preferences of and Interactions with Electric Vehicle Charging Infrastructure. Transp. Res. Part D Transp. Environ. 2018, 62, 508–523. [Google Scholar] [CrossRef]

- Wicki, M.; Brückmann, G.; Quoss, F.; Bernauer, T. What Do We Really Know about the Acceptance of Battery Electric Vehicles?—Turns out, Not Much. Transp. Rev. 2023, 43, 62–87. [Google Scholar] [CrossRef]

- Nationale Plattform Zukunft der Mobilität. Kundenakzeptanz als Schlüssel für den Markthochlauf der Elektromobilität; Arbeitsgruppe 2 “Alternative Antriebe und Kraftstoffe für nachhaltige Mobilität”; Nationale Plattform Zukunft der Mobilität: Berlin, Germany, 2021. [Google Scholar]

- Brückmann, G. Test-Drives & Information Might Not Boost Actual Battery Electric Vehicle Uptake? Transp. Res. Part A Policy Pract. 2022, 160, 204–218. [Google Scholar] [CrossRef]

- Çabukoglu, E.; Georges, G.; Küng, L.; Pareschi, G.; Boulouchos, K. Battery Electric Propulsion: An Option for Heavy-Duty Vehicles? Results from a Swiss Case-Study. Transp. Res. Part C Emerg. Technol. 2018, 88, 107–123. [Google Scholar] [CrossRef]

- Shoman, W.; Yeh, S.; Sprei, F.; Plötz, P.; Speth, D. Battery Electric Long-Haul Trucks in Europe: Public Charging, Energy, and Power Requirements. Transp. Res. Part D Transp. Environ. 2023, 121, 103825. [Google Scholar] [CrossRef]

- Schneider, J.; Teichert, O.; Zähringer, M.; Balke, G.; Lienkamp, M. The Novel Megawatt Charging System Standard: Impact on Battery Size and Cell Requirements for Battery-Electric Long-Haul Trucks. eTransportation 2023, 17, 100253. [Google Scholar] [CrossRef]

- Qasim, M.; Csiszar, C. Major Barriers in Adoption of Electric Trucks in Logistics System. Promet 2021, 33, 833–846. [Google Scholar] [CrossRef]

- Drive to Zero Global Memorandum of Understanding on Zero-Emission Medium- and Heavy-Duty Vehicles. Available online: https://globaldrivetozero.org/mou-nations/ (accessed on 31 March 2023).

- Kraftfahrt-Bundesamt Statistics—Vehicles. Available online: https://www.kba.de/EN/Statistik_en/Fahrzeuge_Vehicles/vehicles_node.html (accessed on 31 March 2023).

- Liboreiro, J. In Win for Germany, EU Agrees to Exempt e-Fuels from 2035 Ban on New Sales of Combustion-Engine Cars. Euronews. 2023. Available online: https://www.euronews.com/my-europe/2023/03/28/in-win-for-germany-eu-agrees-to-exempt-e-fuels-from-2035-ban-on-new-sales-of-combustion-en (accessed on 21 August 2023).

- Posaner, J. Brussels and Berlin Strike Deal on 2035 Combustion-Engine Ban. Politico. Available online: https://www.politico.eu/article/brussels-and-berlin-strike-car-engine-combustion-zero-emissions-ban-deal/ (accessed on 21 August 2023).

- Aguilar, F.J. Scanning the Business Environment; Macmillan: New York, NY, USA, 1967. [Google Scholar]

- XCMGGroup. XCMG Logistic Vehicle Battery Swap Station; XCMGGroup: Xuzhou, China, 2020. [Google Scholar]

- Gesamtverband der Deutschen Versicherungswirtschaft E-Autos in Tiefgaragen: Keine Erhöhte Brandgefahr Feststellbar. Available online: https://www.gdv.de/gdv/medien/medieninformationen/e-autos-in-tiefgaragen-keine-erhoehte-brandgefahr-feststellbar-66230 (accessed on 31 March 2023).

- Bleakley, D. Petrol and Diesel Cars 20 Times More Likely to Catch Fire than EVs. Available online: https://thedriven.io/2023/05/16/petrol-and-diesel-cars-20-times-more-likely-to-catch-fire-than-evs/ (accessed on 31 July 2023).

- MSB Bränder i Eltransportmedel under 2022. Available online: https://www.msb.se/sv/aktuellt/nyheter/2023/maj/brander-i-eltransportmedel-under-2022/ (accessed on 31 July 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).