Abstract

Civilization begins with rivers, and so does pollution. Examining and deciphering the possible ecological curse effect of abundant river resources has a profound impact on sustainable economic development. This paper empirically examines the impact of urban rivers on the environmental performance of listed companies by constructing indicators of urban river length and density and measuring river resources in prefecture-level cities with a sample of listed companies in China from 2011 to 2022. It is found that the richer the urban rivers are, the lower the environmental performance of listed companies in the region, and the conclusion still holds after the robustness and endogeneity tests, proving that rivers as important natural resources also have the ecological curse effect. Further mechanism analysis reveals that urban river resources will reduce the production cost of enterprises and generate path dependence, which will have a crowding-out effect on the green innovation of enterprises; at the same time, abundant river resources will induce market failure, and institutional weakness accelerates the polluting behavior of enterprises. The research in this paper enriches the micro impacts and mechanisms of the ecological curse and provides useful references for river pollution management.

1. Introduction

Natural resource endowment has long been regarded as an important advantage for a country’s economic development; however, since the mid-to-late 20th century, a large number of empirical studies have shown [1,2,3] that countries or regions rich in natural resources often do not achieve the expected economic growth, but instead fall into the predicament of slow economic growth, increasing social inequality, deterioration of the quality of the system, and environmental degradation, a phenomenon that has been referred to by academics as the “resource curse”. This theory profoundly reveals the nonlinear relationship between natural resource endowment and economic development, challenges the theoretical expectation of “resource dividend” for economic growth in traditional economics, and has gradually become an important research topic in the fields of development economics, resource economics, and political economy since it was first proposed by Auty [4,5]. It has become an important research topic in the fields of development economics, resource economics, and political economy, and the conduction mechanism and understanding the path of the curse of resources have become the hotspot and key to the development of regional economic transformation.

Domestic scholars have also tested whether the resource curse exists in China. The results of empirical analyses by Xu and Wang show that the resource abundance and economic growth rate are negatively correlated at the inter-provincial level in China [6]; Shao and Qi have studied the resource curse against the background of the development of the western region and analyzed the transmission mechanism [7]; Wang has empirically analyzed the relationship between resource abundance and economic growth by constructing an indicator of resource abundance represented by energy resources, and the study found that there is a resource curse problem at the inter-provincial level in China [8]. With the continuous deepening of the research, the research scope of the resource curse hypothesis has gradually extended to the field of sustainable development, which not only focuses on economic growth but also covers social issues such as the effective use of resources and ecological civilization [9,10]. Furthermore, the cursed object is also extended from a single variable of economic growth to the perspectives of total factor productivity, institutional efficiency, and green innovation [11,12], along with the degree of abundance of resources, which also extends from mineral resources to ecological resources. Zang put forward the ecological curse hypothesis under the perspective of generalized ecological well-being and carried out multi-scale empirical tests [13], and then Shen explored the existence of the resource curse effect of ecosystem services on urban green innovation by utilizing the data of green patents [14]. Sun empirically examined the effect of the ecological curse on agricultural carbon emission intensity at the initial stage, which pushed the study of the ecological curse to new heights [15].

The shift in research from the resource curse to the ecological curse also reveals the growing environmental problems in China and around the world. The formation and development of the ecological curse will definitely hinder the process of Chinese-style modernization and global sustainable development. However, there is no research on whether the ecological curse, the protagonist of environmental pollution and environmental governance, also plays a role in corporate environmental performance. It is imperative to identify and curb the spread of the ecological curse among firms.

Whether it is the resource curse or the ecological curse, the discussion of the transmission mechanism is undoubtedly more policy-relevant than the research on the existence test. Currently, there are several explanations for the transmission mechanism of the resource curse effect: (1) Crowding out effect—economic resources are concentrated in resource industries, which affects the development of industries such as manufacturing and the government’s investment in education, scientific research, innovation, etc. [16,17,18]. (2) Dutch disease effect—the higher profits of resource industries will lead to higher income levels and factor costs in the economy, resulting in higher exchange rates and lower export rates, which is not conducive to the long-term development of the economy [19,20]. (3) Resource product price effect—natural resource price elasticity and supply elasticity are small, while resource price fluctuation is large, so that the resource-based industry-led economy is facing greater uncertainty, reducing the willingness of social investment; at the same time, with technological progress, resources and other primary products relative to the price of manufactured goods are gradually reduced, resulting in the value of resources owned by the resource-rich area to be relatively low [21]. (4) Institutional weakness effect—in the case of unsound laws and irrational property rights systems, the resource industry is controlled by a few people, administrative corruption is present, the gap between the rich and the poor increases, and social conflicts intensify, so that the region lacks a peaceful and stable construction environment [22,23,24].

The definition of natural resources not only includes mineral resources but also covers all environmental elements that exist in nature and have value for human welfare now and in the future, including river resources. Urban rivers are the necessary basis for human life, industrial production, and social development and have the attributes of production factors and ecological services at the same time. From Du Neng’s location theory to China’s “river red line”, it is not difficult to find that industrial civilization began near the river, and industries are also gathered near the river’s densely populated areas, in order to fully reduce the cost of enterprises, but water resources and mineral resources are different; as public goods, due to the lack of clear property rights, weak environmental regulations, rent-seeking, corruption, etc., it is very easy to induce market failure, resulting in the serious pollution of rivers. The concealment of the ecological service capacity of the river itself and the tacit approval of the promotion mechanism of the officials inhibit the environmental performance expenditure of enterprises and encourage their sewage discharge behavior at the same time. It can be inferred that the degree of urban water resource affluence affects the fulfillment of environmental performance of enterprises in the jurisdiction.

Although the quantity and quality of empirical studies on the resource curse in China have been improving, there are still gaps: (1) existing literature focuses on the resource curse and its formation mechanism, and there is still room for testing the existence and potential mechanism of the ecological resource curse; (2) the samples of existing studies are mostly concentrated at the regional and city levels, and there is a lack of micro studies at the enterprise level; and (3) the choice of natural resources needs to be expanded.

Based on this, this paper constructs an urban river index and empirically tests the role of urban rivers on the environmental performance of listed companies using operating data to verify the existence of the ecological curse and to further discover the possible micro-mechanisms. The relevant marginal contributions are as follows: (1) the role of urban rivers on corporate environmental performance is empirically tested for the first time, confirming the resource curse effect from a micro perspective; and (2) the discovery of the conduction mechanism and the test of the moderating effect in this paper provide useful references for suppressing the resource curse and strengthening the fulfillment of corporate environmental performance.

2. Data and Methods

2.1. Data Sources

In order to test the impact of urban rivers on corporate environmental performance, this paper selects A-share listed companies in Shanghai and Shenzhen during the period of 2011–2022 as the research object. Considering that the non-public nature of the enterprise operation data of non-listed companies and the lack of comprehensiveness and continuity will affect the test results, this paper selects A-share listed companies in Shanghai and Shenzhen as the research samples in order to ensure the authenticity and reliability of the test data. In accordance with the convention, the initial sample is screened: (1) the samples of financial listed companies are excluded because of the special characteristics of their operating characteristics and accounting systems; (2) the samples of companies with abnormal operations such as ST and *ST are excluded; (3) the samples of listed companies with debt ratios less than or equal to 0 or greater than 1 are excluded; and (4) the samples of listed companies with missing main variables are excluded. After screening, the paper finally obtains a sample of 28,996, and all continuous variables are shrink-tailed at the 1% level. Prefecture-level and city-level control variables are obtained from the Statistical Yearbook of Prefecture-level Cities in China. Meteorological data are from CMA, and city river data are from the National Center for Basic Geographic Information.

2.2. Variables

2.2.1. EPI

Prior to 2008, environmental performance data of listed companies were largely non-disclosure. However, with the introduction of the China Securities Regulatory Commission’s (CSRC) Guidelines on Environmental Information Disclosure of Listed Companies (2008), listed companies began voluntarily disclosing more comprehensive environmental information, including pollutant emissions and resource consumption. By 2010, this trend had gained significant momentum, prompting this study to focus on the period from 2011 to 2022 for empirical analysis. The measurement of corporate environmental performance remains a contentious issue in the existing literature, with approaches broadly categorized into four methods: the evaluation system method, pollution emission method, environmental capital expenditure method, and eco-efficiency method [25]. In this study, we adopt the environmental responsibility score from Hexun.com as a proxy for corporate environmental performance. This score integrates multiple dimensions, including environmental awareness, environmental management systems, environmental protection investments, types of emissions, and energy efficiency, offering a comprehensive, objective, and representative measure of corporate environmental performance.

2.2.2. Urban Rivers

Because there are many indicators for measuring the richness of river resources and the data availability varies greatly, this paper takes the length and density of urban rivers as the first choice for evaluating urban river resources based on the River Continuum Concept and Stream Order Theory and constructs the urban river length (river1) and urban river density (river2) variables. The river length data were calculated based on the Chinese river vector, and then the river density was calculated based on the vector geographic information of urban administrative boundaries.

2.2.3. Control Variables

This paper also controls for other variables that affect environmental performance, including firm financial characteristic variables, corporate governance variables, and city-level control variables. In addition, the city extreme climate variable is added to exclude the interference of other geographic and natural elements. The definitions and measures of the relevant variables are shown in Table 1.

Table 1.

Variable definition.

2.3. Model

In order to test the impact of urban rivers on the environmental performance of listed companies, the baseline model and research framework diagram of this paper is set as follows:

where is the environmental performance score of the j listed company in the i city in year t, which is a firm-level variable. represents urban river resources, which is a municipality-level variable. is a firm-level control variable, is a municipality-level control variable, and is a random error term. In addition, industry and year fixed effects are controlled in this model to exclude the effect of industry and time level omitted variables on firms’ environmental performance. In this paper, urban rivers differ less within groups (prefecture-level cities), and here, the coefficient reflects inter-group differences, so multiple linear regressions and maximum likelihood estimation, etc., are used in the benchmark regression to reflect intra-group differences.

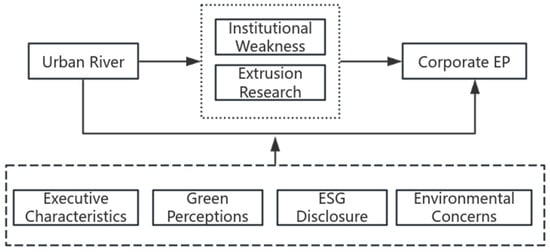

In order to further test the conduction path and regulation mechanism of the ecological curse of urban rivers, this paper adopts a two-step model, and the relevant models and research ideas (Figure 1) are as follows:

Figure 1.

Research framework diagram.

3. Results

3.1. Descriptive Statistics

Table 2 presents the results of descriptive statistics for each variable in the model. The mean value of environmental performance (EPI) is 23.98, with a maximum value of 90.87 and a minimum value of −18.45, which shows that there is a large gap in the environmental performance scores of companies and a large gap in the fulfillment of environmental responsibility of listed companies in different regions. The mean value of river1 is 3786, of which the minimum value is 95.5, the maximum value is 14,794, and the standard deviation is 3140; the mean value of river2 is 0.412, of which the minimum value is 0.004, the maximum value is 1.399, and the standard deviation is 0.350, which indicates that there are obvious differences between enterprises affected by the abundance of urban river resources. In addition, the distribution of all other variables is within reasonable limits.

Table 2.

Descriptive statistics.

3.2. Baseline Regression

Table 3 shows the results of the hypothesized regression of urban rivers and firms’ environmental performance. Columns (1) and (2) are OLS regression models, where the standard errors are clustered to the municipal level, with a coefficient of −0.138 for the river1 variable and a coefficient of −1.586 for the river2 variable, both of which are significantly negative at the 1% level, suggesting that an increase in the length or density of rivers causes a decrease in the environmental performance scores of listed firms in the region. Columns (2) and (3) estimate the model using the panel maximum likelihood estimation (MLE) method, which shows that the coefficient of urban rivers is significantly negative at the 10% level. Because the urban river variable in this paper varies less across years, columns (5) and (6) report the panel’s between-group estimates and reveal that the regression coefficients of the urban river variable are significantly negative at the 1% level. All the results in Table 3 preliminarily validate the research hypothesis of this paper that overall, urban river resources have a dampening effect on the environmental performance of listed companies, which to some extent proves the existence of the ecological curse effect.

Table 3.

Urban rivers and corporate EPI: baseline regression.

Turning to the other control variables. Firm size, return on equity, and Big Four audits have a positive facilitating effect on the corporate environment, while the leverage ratio, number of years on the market, and temperature extremes are found to have a dampening effect. The results are largely consistent with existing related studies.

3.3. Robustness Test

In the baseline regression, this paper has tried to add more control variables and change the model to improve the robustness of the results. On this basis, this paper further conducts robustness tests. First, the measure of the explanatory variables is replaced. Considering the one-sidedness of the evaluation of a single organization, this paper firstly replaces the measure of corporate environmental performance and adopts the Huazheng corporate environmental performance score to replace the explanatory variables in the benchmark regression. Second, new explanatory variables are constructed. The ecological curse of urban river resources is ultimately due to the path dependence triggered by the service value of water ecosystems. Therefore, this paper further calculates the value of urban water supply system services to replace urban river resources. Third, the replacement estimation model is constructed. Corporate environmental performance scores are right-skewed in distribution, so this paper continued to replace the estimation model and used the TOBIT model for testing. Fourth, a random sampling test is conducted. Table 4 reports the results of the above four robustness tests, and the urban river variable remains significantly negative, further improving the reliability of the benchmark regression results. In addition, this paper also conducts a nonlinear relationship test, and the results presented in Table 4 column (5) exclude the nonlinear relationship of urban rivers on firms’ environmental performance.

Table 4.

Urban rivers and corporate EPI: robustness test.

Table 4.

Urban rivers and corporate EPI: robustness test.

| Dependent Variable: EPI | Replace EPI | Replace River | TOBIT | Random Sample | Nonlinear |

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| River2 | −0.699 *** | −0.000 ** | −1.591 *** | −0.000 ** | −1.315 |

| (0.174) | (0.000) | (0.341) | (0.000) | (3.275) | |

| River2-squared | 0.509 | ||||

| (2.090) | |||||

| Industry/Year | YES | YES | YES | YES | YES |

| Control variables | YES | YES | YES | YES | YES |

| Observations | 28,996 | 28,996 | 28,996 | 14,498 | 28,996 |

| R-squared | 0.314 | 0.355 | 0.424 | 0.336 | 0.108 |

Table 5.

Urban river resources and EPI: instrumental variable.

Table 5.

Urban river resources and EPI: instrumental variable.

| Second-Stage Regression Results | ||

|---|---|---|

| Dependent Variable: EPI | OLS Two-Stage | GMM Two-Stage |

| (1) | (2) | |

| River | −4.584 *** | −4.584 *** |

| (1.645) | (1.645) | |

| Other control variables | YES | YES |

| Observations | 28,996 | 28,996 |

| Sargan’s test p-value | 0.000 | 0.000 |

| First-stage regression results | ||

| Relief | −0.085 *** | −0.085 *** |

| (0.002) | (0.002) | |

| Other control variables | YES | YES |

| F-value | 257.94 | 132.85 |

| R-squared | 0.541 | 0.377 |

Note: Standard errors in parentheses; *** p < 0.01.

Table 6.

Urban river resources and EPI: mechanisms.

Table 6.

Urban river resources and EPI: mechanisms.

| Dependent Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| ENV | EPI | R&D | EPI | Green | EPI | |

| River2 | −0.003 ** | −0.696 *** | −0.977 *** | −1.036 *** | −0.368 *** | −0.673 *** |

| (0.001) | (0.181) | (0.108) | (0.222) | (0.126) | (0.181) | |

| ENV | 2.481 *** | |||||

| (0.686) | ||||||

| R&D | −0.096 *** | |||||

| (0.013) | ||||||

| Green | 0.053 *** | |||||

| (0.009) | ||||||

| Control variables | YES | YES | YES | YES | YES | YES |

| Industry/Year | YES | YES | YES | YES | YES | YES |

| Observations | 28,996 | 28,996 | 28,996 | 28,996 | 28,996 | 28,996 |

| R-squared | 0.357 | 0.334 | 0.340 | 0.312 | 0.279 | 0.230 |

Note: Standard errors in parentheses; *** p < 0.01, ** p < 0.05.

3.4. Endogeneity Test

In order to avoid endogeneity bias due to omitted variables, reverse causation, and other factors, the instrumental variable method was used in this paper. The degree of urban surface undulation affects the distribution of rivers to a certain extent, meets the correlation requirement, and is strictly exogenous, so this paper selects urban surface volatility as an instrumental variable and re-runs the two-stage regression. Table 5 shows the test results under both OLS and GMM estimation methods. Columns (1) and (2) show the results of the first-stage regression, where the coefficient between the selected instrumental variable (surface undulation) and urban river resources is significantly negative, which proves the correlation of the instrumental variable. Furthermore, the F-statistic value is greater than 10, so the instrumental variable is valid. The second-stage regression results show that the regression coefficient of urban river resources (River) is −4.584, which is significantly negative at the 1% level, which is consistent with the previous conclusion, and this result alleviates the possible endogeneity problem to some extent.

4. Mechanism Analysis

The mechanism analysis focuses on four key pathways through which urban river resources may affect firms’ environmental performance: institutional weakness, environmental regulation, path dependence, and the crowding-out effect. These mechanisms were selected based on their relevance to the ’resource curse’ literature and their potential to explain the observed negative relationship between river resources and environmental performance. Considering the limited availability of data on listed companies, the mechanism of the ecological curse of urban river resources is examined from the following two aspects.

4.1. Institutional Weakness and Environmental Regulation

In addition to the function of production factors, urban river resources also have the function of ecological services, which plays an important role in environmental purification in the region. From the perspective of the classification of economic goods, they are categorized under the category of public goods [26]. Due to their unique non-exclusive and non-competitive qualities, such services are prone to triggering the failure of market allocation of public goods. Market failure in the field of public goods requires government intervention. The expansion of local government power is often accompanied by the strengthening of market intervention, which is easy with a variety of interest groups on the distribution and redistribution of their interests in the process of triggering a variety of legal or illegal gaming behavior [17], thus giving rise to the phenomenon of rent-seeking, triggered by the weakening effect of the government’s political system. Environmental regulation is the biggest external influencing factor for enterprises to fulfill their environmental responsibility, and the weakening of the governmental system will affect the intensity of regional environmental regulation: high-intensity environmental regulation can significantly and consistently improve the level of environmental protection investment of enterprises, while the same low intensity of environmental regulation will strengthen the polluting behavior of enterprises.

4.2. Path Dependence and Crowding-Out Effect

The public and ecological attributes of urban river resources and lax environmental regulations reduce the cost of natural resource use and the risk of environmental pollution penalties, which makes enterprises form cost dependence and give up green innovation. Secondly, whether an enterprise invests in environmental protection is a game process, which should fully consider the input–output benefits and environmental regulations. Enterprises that favor current certainty of profit and their own economic efficiency have difficulty using limited funds for environmental protection investment with low short-term economic benefits and greater future uncertainty, thus squeezing out environmental research investment [27]. When the enterprise’s environmental regulation cost is less than its factor endowment benefit, the enterprise will carry out production and operation activities under the government regulation policy [28] and will be even more inclined to accept the regulation and give up the environmental protection investment, thus inhibiting the enterprise’s environmental performance.

In order to test the mechanism of institutional weakness and research crowding out, the mechanism variables (Mit) of environmental regulation (ENV), enterprise R&D investment (R&D), and green innovation (Green) are constructed at prefecture-level cities.

Table 6 reports the results of the mechanism tests. Columns (1), (3), and (5) show the regression results of urban rivers on environmental regulation, R&D investment, and green innovation, respectively, all of which are significantly negative at the 1% level, suggesting that urban river resources inhibit environmental regulation, reduce firms’ R&D investment, and reduce green innovation. In columns (1) and (2), the urban river variable is significantly negative and the environmental regulation variable is significantly positive, indicating that environmental regulation has a facilitating effect on firms’ environmental performance, but urban rivers inhibit urban environmental regulation and thus firms’ environmental performance. Similarly, the regression results in columns (1), (2), (3), and (4) prove that the crowding-out effect of scientific research inhibits the green innovation of enterprises, thus inhibiting the environmental performance of enterprises.

5. Further Analysis

The distribution of urban rivers has geographical differences, and its effect on the ecological curse of companies may vary depending on the nature, capacity, geographical location, etc., or due to the characteristics of the company’s management, internal and external policies, etc. Whether the ecological curse effect of urban rivers will be affected needs further testing and analysis.

5.1. Heterogeneity Analysis

Firstly, the enterprises are divided into state-owned enterprises and private enterprises according to the nature of ownership, and the results are shown in Table 7 columns (1) and (2). The sample of private enterprises is more significant, which may be related to the greater cost pressure. Subsequently, the firms are divided into four groups according to whether they are high-tech industries and highly polluting firms, and the results in columns (3)–(6) show that urban rivers have the most significant effect on high-tech and non-heavily polluting firms. Finally, in order to examine the geographical differences, the enterprises were categorized into three groups according to their place of registration in the eastern, central, and western regions, and the results in columns (7)–(9) show that the effect of urban rivers on the environment of enterprises is more obvious in the eastern and central regions.

Table 7.

Urban river resources and EPI: heterogeneity analysis.

5.2. The Moderating Role of the Executive Team

Executives are the main decision-making body of corporate behavior, which is a key factor in determining the development of the enterprise, and the heterogeneity of the executive team (TMT) is an important factor affecting the behavior of executives. One of the main functions of executives is strategy formulation, implementation, and change, and the performance of the corporate environment is largely influenced by the behavior of executives [29]. Specifically, TMT characteristics, such as different ages, genders, education levels, and professional backgrounds, can lead to differences in their thinking and decision-making [30]. Therefore, in this paper, the variables of average age of executives (TMTAge), percentage of executives with overseas experience (OverseaBack), percentage of executives with financial background (FinBack), and executives’ green perceptions (GR) were selected and tested, and the results are shown in columns (1)–(4) of Table 8. The coefficients of the interaction terms of average age of executives, green perception of executives, and urban river are all significantly positive, indicating that the higher the average age and green perception of the executive team, the greater the suppression of the ecological curse effect, while the stronger the financial background of executives, the greater the exacerbation of the ecological curse; meanwhile, a moderating effect of executives’ overseas background is not identified.

Table 8.

Urban river resources and EPI: moderating analysis.

5.3. ESG Disclosure and Environmental Concerns

Environmental pollution events will enhance the public’s environmental awareness and environmental concerns and even require enterprises, especially highly polluting enterprises, to adhere to sustainable development. ESG, the concept of sustainable development, advocates that enterprises should pay more attention to environmental performance, social responsibility, and corporate governance in the process of development, and it has been gradually integrated into the practice of corporate governance since its formal proposal by the United Nations in 2004. It has been shown that ESG plays an important role in reducing the agency costs of enterprises, increasing total factor productivity, and improving corporate innovation [31]. Therefore, this paper further tests the moderating role of public environmental concern and corporate ESG evaluation. Drawing on [32], the Huazheng ESG composite rating is used to measure corporate ESG performance, and the Baidu environmental search index is used to measure urban environmental concern (EC). Columns (5) and (6) of Table 8 show that the coefficients of the interaction terms are significantly positive, confirming the positive moderating effect of ESG performance and environmental concern.

6. Discussion

According to the literature search, it is noted that whether the resource curse spreads to the ecological curse and how the transmission mechanism occurs have not been verified by related scholars at the micro level. Therefore, this paper focuses on the theory of the resource curse and empirically tests the role of urban river resources on the environmental performance of listed companies in the region where they are located, using panel data of listed companies. It is found that the richer the urban rivers are, the worse the environmental performance of enterprises is, which confirms the curse effect of river resources and accomplishes the objectives and hypotheses of this paper. Compared with the existing studies on the resource curse, the basic conclusions remain the same, but there is a breakthrough with this sample in that it is the first time to test the effect of the resource curse on listed companies, expanding this conclusion from the city and regional level to the micro enterprise level, which makes up for the shortcomings of the existing literature. Second, the scope of the resource curse is extended to environmental performance. Previous studies have mostly focused on economic growth and technological innovation at the city or regional level, but few studies have focused on environmental performance. This paper focuses on environmental indicators, measures the environmental performance of enterprises, and examines the inhibiting effect of urban river resources, which further pushes the resource curse effect to the ecological curse, which is of great significance to the development of the green economy.

Enterprises are the core force of economic green development, and the quality of their environmental performance is related to the sustainable development of the whole society. Domestic scholars have also widely discussed the influencing factors of listed companies’ environmental performance, mostly focusing on corporate governance and environmental policies, and no literature has paid attention to the role of urban resources, especially ecological resources, on the environmental performance of enterprises; thus, the findings of this paper’s benchmark regression enrich the influencing factors of listed companies’ environmental performance, which bridges this gap.

Based on the baseline regression, this paper further tests the mechanism. Referring to the transmission mechanism of the resource curse, the institutional weakness and research crowding-out path is confirmed, which is consistent with the existing findings. We do not produce innovations in the mechanism test, but the paths of institutional weakness and scientific research crowding out are confirmed in the sample of firms and also have an impact on the formulation of environmental policies to accelerate the promotion of the fulfillment of firms’ environmental performance.

Breaking the ecological curse effect and promoting corporate environmental performance fulfillment is the core issue of this paper, so we conducted tests of heterogeneity and moderating effects. The heterogeneity analysis finds that the curse effect of environmental performance of urban rivers is more significant in non-state-owned enterprises, non-heavily polluted enterprises, and high-tech enterprises, and this finding should draw our attention to the categorization of different types of enterprises. The moderating effect was further examined from the perspectives of internal corporate governance and external monitoring. It is found that the executive team has a moderating effect, with younger executives performing more positively, while the financial background of executives is shown to have an inhibitory effect, a finding that further complements the research on the moderating effect of the executive team on firms’ environmental performance. From the external monitoring perspective, corporate ESG disclosure and public monitoring can effectively inhibit the ecological curse effect and have a positive contribution to corporate environmental performance fulfillment. Related studies have confirmed that the executive team, ESG disclosure, and public concern have a positive impact on corporate environmental performance, and the test in this paper further confirms that they also play a value in cracking the ecological curse effect at the micro level.

The results of this paper provide ample evidence for the ecological curse, but there are still limitations. First, the reliance on data from listed companies may limit the generalizability of the findings, as the database mainly covers companies in specific regions. Future research could expand the scope of this study by including data from other sources or regions. Second, this study focused on measuring environmental performance through corporate disclosures, which may not fully reflect actual environmental practices. Finally, there is room for refining the testing of mechanisms. Future research could incorporate primary data collection, such as surveys or interviews, to provide a more complete picture of firms’ environmental behavior. Further refinement of the mechanisms, such as innovation data, etc., should be performed to test and discover new mechanisms.

7. Conclusions and Suggestions

7.1. Conclusions

This paper focuses on the production factor and environmental service value of urban river resources and explores the curse effect of urban river resources on firms’ environmental performance and its formation mechanism by using a two-way fixed model with the panel data of rivers and listed companies’ operations in prefecture-level cities in China from 2011 to 2022. The main conclusions are as follows:

- Urban river resources have a resource curse effect on firms’ innovation performance, i.e., the richer the river resources are in a city, the more pronounced is its inhibitory effect on firms’ environmental performance. This basic conclusion still holds after the indicators and models were replaced and the endogeneity problem was taken into account in the robustness test.

- The path test finds that urban river resources weaken environmental regulations, crowd out R&D investment, inhibit green innovation, and thus affect firms’ environmental performance scores.

- The heterogeneity analysis finds that the ecological curse effect of urban rivers varies geographically and by the nature of enterprises, with non-state-owned enterprises, high-tech enterprises, and non-high-pollution enterprises playing a more obvious role, and the curse effect is most significant in synchronized areas. The moderating effect is further examined from the perspectives of internal governance and external supervision. The heterogeneity of the executive team has a moderating effect, and a younger executive team weakens the curse effect of urban rivers on environmental performance, while the financial background of the executive team accelerates the curse; the corporate ESG disclosure and public concern will largely weaken the curse effect of urban rivers on the environmental performance of listed companies.

7.2. Suggestions

- In terms of policy, strengthening the rigidity and differentiation of environmental regulation is recommended. It is recommended that differentiated environmental regulatory policies be implemented in river-rich areas: (1) establish a dynamic environmental enforcement mechanism and set stepped discharge standards based on the ecological carrying capacity of rivers; (2) link local government environmental protection assessment directly to the ESG performance of enterprises and break the dependence on the development path of “resources for GDP”; (3) implement differentiated policies on green finance, with financing restrictions on high-polluting enterprises and subsidized loans on green innovation enterprises; (4) provide more research and development loans to affected groups such as high-tech enterprises and non-state-owned enterprises while increasing environmental supervision; (5) implement differentiated green finance policies, impose financing restrictions on high-polluting enterprises, and provide subsidized loans to green innovation enterprises; and (6) provide more R&D tax incentives to high-tech enterprises, non-state-owned enterprises, and other notably affected groups while increasing environmental oversight.

- On the corporate side, companies need to synergize internal governance reforms and external monitoring to weaken the curse effect: (1) in terms of internal governance, optimize the structure of the executive team, deploy young members and executives with environmental backgrounds, and implement “ESG equity incentives” to tie environmental performance to executive earnings and curb the short-sightedness of executives with financial backgrounds; (2) in terms of external supervision, implement mandatory disclosure of blockchain-traceable “water stress test report”, realizing real-time uploading of pollution data on the blockchain; develop a public participation platform linking corporate sewage and water quality data through GIS visualization and linking the green consumption index to influence the financing cost, forming a market-driven mechanism.

Author Contributions

J.-P.W.: Conceptualization, investigation, writing—review and editing. F.-Y.M.: Data collection and editing. H.W.: Conceptualization, investigation, data analysis, writing—original draft. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Foundation of the Science Research Project of Yunnan Education Department (2023J0207) and Yunnan Philosophy and Social Science Foundation (YB2023089).

Data Availability Statement

The datasets generated during the current study are available from the corresponding author on reasonable request.

Conflicts of Interest

The authors declare no competing interests.

References

- Sachs, J.D.; Warner, A.M. The curse of natural resources. Eur. Econ. Rev. 2001, 45, 827–838. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. Fundamental Sources of Long-run Growth. Am. Econ. Rev. 1997, 87, 184–188. [Google Scholar]

- Grier, B.R. Natural resource dependence and the accumulation of physical and human capital in Latin America. Resour. Policy 2012, 37, 281–295. [Google Scholar]

- Auty, R.M. Industrial policy, sectoral maturation, and postwar economic growth in Brazil: The resource curse. Econ. Geogr. 1995, 71, 195–217. [Google Scholar] [CrossRef]

- Auty, R.M. Sustaining Development in Mineral Economies: The Resource Curse Thesis; Routledge: London, UK, 1993. [Google Scholar]

- Xu, K.N.; Wang, J. An Empirical Study of a Linkage Between Natural Resource Abundance and Economic Development. Econ. Res. J. 2006, 1, 78–89. [Google Scholar]

- Shao, S.; Qi, Z.Y. Energy development and economic growth in western China, an empirical analysis based on the resource curse hypothesis. Econ. Res. J. 2008, 4, 147–160. [Google Scholar]

- Wang, S.J. An empirical study of China’s regional economic growth and the “resource curse”. Stat. Decis. 2014, 116–118. [Google Scholar]

- Wang, R.X.; Chen, J.C.; Li, M.H. Natural resource abundance, local government behavior and ecological civilization construction. Stat. Decis. 2023, 39, 51–56. [Google Scholar]

- Li, H.T. Research on the mechanism of the transformation of resource based economy to improve the efficiency of green development: Take Shanxi province as an example. Resour. Ind. 2024, 26, 100–112. [Google Scholar]

- Song, Y.; Chen, J.P. Government dominance, market segmentation and resource curse: A study on influence of natural resources endowment to economic growth. China Population. Resour. Environ. 2014, 24, 156–162. [Google Scholar]

- Zhang, L.; Gai, G.F. The impact of coal industry dependence on total factor productivity, based on the conditional ‘resource curse’ hypothesis. Res. Financ. Econ. Issues 2020, 3, 39–47. [Google Scholar]

- Zang, Z.; Zheng, D.F.; Sun, C.Z.; Zou, X.Q. Multi-scale empirical test of ecological curse effect in mainland of China. Geogr. Res. 2016, 35, 851–863. [Google Scholar]

- Shen, M.H.; Wu, Y.L. The Curse of Ecosystem Services for Green Innovation—Empirical Evidence from Chinese Cities. J. China Univ. Geosci. (Soc. Sci. Ed.) 2024, 24, 50–63. [Google Scholar]

- Sun, P.; Wang, J.M.; Ji, X.S. “Ecological Curse” or “Ecological Well-being”: On the Carbon Effects of Agroecological Carrying Capacity. J. Nanjing Agric. Univ. (Soc. Sci. Ed.) 2024, 24, 172–186. [Google Scholar]

- Miu, Y.; Dong, C.S. Natural Resources Exploitation, Economic Structure and Economic Increase. J. Cent. Univ. Financ. Econ. 2011, 9, 52–57. [Google Scholar]

- Shao, S.; Qi, Z.Y. Natural Resource Development, Regional Technological Innovation and Economic Growth, A Mechanism Interpretation and Empirical Test of Resource Curse. J. Zhongnan Univ. Econ. Law 2008, 4, 3–9. [Google Scholar]

- Zhao, K.J.; Jing, P.Q. Resource Dependence, Inadequate Capital Formation and Long-Term Economic Growth Stagnation—A Re-Test of the “Resource Curse” Proposition. Macroeconomics 2014, 3, 30–42. [Google Scholar]

- Lu, J.P.; Dong, D.K.; Gu, S.Z. “Resource Curse” Phenomenon Recognition of URRR based on “Dutch Disease” Effect, A Case Study in Bijie Prefecture of Guizhou Province. Resour. Sci. 2009, 31, 271–277. [Google Scholar]

- Aharonovitz, G.D. The Curse of Natural Resources: Substitution Effect and Trade Policy; Social Science Electronic Publishing: Rochester, NY, USA, 2009. [Google Scholar]

- Dong, G.H. The “worsening terms of trade” debate and development. Nankai Econ. Stud. 2001, 3, 11–14. [Google Scholar]

- Kronenberg, T. The curse of natural resources in the transition economies. Econ. Transit. 2004, 12, 399–426. [Google Scholar]

- Bhattacharyya, S.; Hodler, R. Natural resources, democracy and corruption. Eur. Econ. Rev. 2010, 54, 608–621. [Google Scholar]

- Bleaney, M.; Halland, H. Do Resource-Rich Countries Suffer from a Lack of Fiscal Discipline? Social Science Electronic Publishing: Rochester, NY, USA, 2016. [Google Scholar]

- Yu, L.C.; Wang, L. Can Digital Transformation Help Improve Corporate Environmental Performance? Financ. Trade Res. 2023, 34, 84–96. [Google Scholar]

- Shen, M.H.; Xie, H.M. Public Goods Problems and Their Solution Ideas-A Literature Review of Public Goods Theory. J. Zhejiang Univ. (Humanit. Soc. Sci.) 2009, 7, 45–56. [Google Scholar]

- Orsato, R.J. Competitive environmental strategies: When does it pay to be green? Calif. Manag. Rev. 2006, 48, 127–143. [Google Scholar]

- Copeland, B.R.; Taylor, M.S. Free trade and global warming: A trade theory view of the Kyoto protocol. J. Environ. Econ. Manag. 2005, 49, 205–234. [Google Scholar]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y. Digital transformation, a multidisciplinary reflection and research agenda. J. Bus. Res. 2019, 12, 35–83. [Google Scholar]

- Wu, Y.; Ding, L.; Somg, X. Top management team heterogeneity and performance of cross-border M&A. SAGE Open 2023, 13, 1175. [Google Scholar]

- Li, J.L.; Yang, Z.; Chen, J.; Cui, W.Q. Research on the Mechanism of ESG Promoting Corporate Performance—Based on the Perspective of Corporate Innovation. Sci. Sci. Technol. Manag. 2021, 42, 71–89. [Google Scholar]

- Fang, X.M.; Hou, D. Corporate ESG performance and innovation—Evidence from A-share listed companies. Econ. Res. 2023, 58, 91–106. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).