Abstract

This study analyzes the impact of financial institution quality (FIQ) and financial stability (FSI) on trade-adjusted carbon emissions (TAE) in G7 countries from 2000 to 2022. It also examines whether green innovation (GI) and environmental taxes (ET) moderate this relationship. In the study, long-term coefficient estimations were conducted using the Seemingly Unrelated Regressions (SUR), Panel-Corrected Standard Errors (PCSE), and Driscoll-Kraay standard error estimator methods. The results show that GI, ET, FIQ and FSI variables have a negative and significant effect on TAE. Green innovation and environmental taxes reduce carbon emissions, while strong financial institutions and stable financial systems enhance environmental performance by supporting sustainable investments. The Dumitrescu-Hurlin (D-H) causality test results indicate a unidirectional causal relationship between these variables to carbon emissions. These results highlight the significance of integrating environmental policies with financial systems and promoting GI for sustainable development.

1. Introduction

Environmental deterioration poses a major challenge worldwide, drawing significant attention from governments due to its impact on global warming and its potential to disrupt the global carbon cycle [1,2]. Recently, interest in GI has increased significantly due to its capacity to contribute to the elimination of environmental problems [3,4]. GI can contribute to reducing environmental costs, promoting environmentally-friendly (E-F) technologies, and supporting efforts to mitigate environmental degradation [5]. Additionally, GI can aid in reducing emissions and waste, as well as fostering the use of cleaner technologies [6].

An environmental tax (ET) is one probable remedy to the issue of greenhouse gas (GHG) emissions [7,8,9]. An ET can fully or partially correct environmental issues by improving incentives for alternative behaviors [10]. In other words, CO2 concentration may potentially decline as the ET rate increases [11]. While there are various methods to reduce carbon emissions (CO2), ETs can contribute to this process by supporting the use of clean energy and reducing energy consumption [12]. Many studies have found that CO2 can be significantly minimized by ETs [13,14,15]. Nevertheless, ref. [16] argued that an optimal tax level existed to minimize CO2 and that ETs will be more effective in reducing CO2 when lower-cost advanced technologies are used.

The financial sector substantially aids in ensuring economic stability while driving growth [17]. Although it contributes significantly to economic expansion and stability in each country, one must also consider its possible adverse environmental consequences [18,19]. Financial development (FD) can help to reduce financial risks and borrowing costs, improving information symmetry between lenders and borrowers, promoting availability of financial capital, and encouraging the adoption of advanced technologies and energy-efficient products [20]. Moreover, the expansion of the financial sector can stimulate industrial growth by boosting the availability of investment resources and broadening the production base. Financial institutions and market efficiency can stimulate industrial growth and help create new infrastructure facilities, which in turn can positively affect energy consumption [21].

Financial institutions (FI) have taken their place among the main actors by helping to accomplish the targets of sustainable development goals. For example, the banking sector can contribute significantly to a country’s sustainability performance by employing innovative technologies such as online banking, green banking, and blockchain, and supporting a range of E-F projects [22,23]. The efficiency and sophistication of FI and markets encourage the expenditure of renewable energy (RE) and can assist to reducing CO2 [24]. Conversely, while stronger FI can facilitate access to credit, which in turn may support industrial activities that contribute to CO2, this relationship is indirect. The increase in CO2 is primarily a result of industrial processes, not directly caused by financial access [25]. However, when financial markets encourage investment in environmentally friendly (E-F) sectors, they can help promote environmental quality (EQ) and contribute to addressing sustainable development (SD) challenges [26].

The structure and efficiency of the financial system hold a vital position in SD and environmental policies. FI quality can contribute to increasing environmental investments and reducing CO2 by enhancing investor confidence and providing long-term financing for sustainable projects [27]. High-quality FI encourage firms to engage in green projects through transparent regulations and risk management mechanisms [28]. In particular, studies have found that strong FI significantly contribute to CO2 reductions in developed countries [29]. Meanwhile, financial stability (FS) is a crucial factor in ensuring the sustainable growth of the economy. During periods of financial instability, firms tend to focus on short-term profit-oriented investments, whereas in countries with higher FS, there is an increased tendency toward long-term sustainable investments [30]. This difference is particularly impactful in financing RE projects and facilitating the transition to a low-carbon economy [31]. Therefore, maintaining FS can facilitate the support of environmentally friendly projects, thereby contributing to the reduction of CO2.

This study aims to analyze the impact of financial FIQ and FS on TAE in G7 countries. Global economies are striving to integrate environmental policies with financial systems to achieve SD and carbon neutrality. In this context, how the strength of FI and market stability contribute to environmental sustainability is an important area of research. Strong FI can encourage environmentally friendly investments, finance low-carbon projects, and support sustainable growth. However, when determining the impact of financial systems on CO2, the role of GI and ET in shaping this relationship should also be considered. In the study, long-term analyses were conducted using SUR, PCSE, and Driscoll-Kraay estimation methods using G7 country data between 2000 and 2022 to identify these relationships.

The G7 countries are the largest actors in the global economic system and are also responsible for a significant portion of CO2 worldwide. These countries have a decisive role in environmental transformation with their strong financial systems, advanced institutional structures and increasing commitments to sustainability policies. The FS and institutional quality of the G7 countries are critical to the effective implementation of green financing policies, the encouragement of low-carbon investments and the achievement of sustainable economic growth. In addition, since these countries are in a leading position in global markets, the findings obtained here can also be a guide for other developed and developing economies. Therefore, conducting this study within the scope of the G7 countries is of significant value in terms of understanding the effects of financial systems on environmental sustainability and developing applicable strategies for policy makers.

The study aims to fill the gaps identified in the literature at four different points. (i) The research on the impact of FIQ and FS on TAE is quite limited. While much of the existing literature has primarily focused on the relationship between FD and CO2, the role of FS and institutional quality in promoting sustainability has not been sufficiently explored. This study seeks to fill this important gap by providing empirical analyses that evaluate the environmental impacts of financial systems. (ii) While GI is a critical factor in reducing CO2, its moderating role in the relationship between financial systems and environmental sustainability (ES) has been largely overlooked in most studies. This research offers a new perspective by examining how green technologies and innovative investments, together with FS and institutional quality, shape CO2 from the standpoint of environmental policy and technological development. (iii) The study provides significant implications for promoting sustainable investments within banks and FI. Maintaining FS and fostering strong FI can support the expansion of green financing mechanisms and increase loans that contribute to the transition to a low-carbon economy. Moreover, it underscores the need for banks and investors to develop effective risk management strategies for sustainable projects. (iv) Finally, the study offers concrete recommendations for policymakers, particularly in G7 countries, by demonstrating the impact of ET and financial regulations CO2. It suggests that promoting green finance instruments and strengthening sustainable funds could assist in diminishing CO2.

This study comprises five sections. After the introduction, Section 2 reviews the literature on FIQ, FS, GI, and CO2, offering a comparative analysis. Section 3 outlines the study’s variables, and methods. Section 4 presents and discusses the estimation results in relation to the literature. The final section provides a general evaluation, policy recommendations, and strategic insights for enhancing financial systems’ role in SD.

2. Literature Review

Climate change and increasing fossil fuel consumption have brought the relationship between ES and economic growth to the forefront, and in this context, the effects of factors such as GI, ET, FD and institutional quality on EQ have become the focus of academic studies. While [32] draws attention to the role of green finance in the transition to a low-carbon economy, financial market efficiency and how environmental disclosures affect risk perception in markets are also increasingly discussed [33,34,35,36]. According to these studies, environmental disclosures and green finance can contribute to market stability by reducing investor uncertainty.

2.1. Green Innovation and EQ

Lately, there has been a rising volume of studies addressing the impact of GI on ES [37] found a bidirectional relationship between air pollution and innovation, while ref. [38] found that fossil fuel-based patents were not effective in reducing CO2, but green patents significantly reduced CO2. Similarly, ref. [39] found a long-term link between energy intensity innovation and RE use, and ref. [40] showed that GI was effective in reducing CO2 using Chinese data. However, ref. [41] found that there are different views in the literature, arguing that GI increases environmental efficiency but does not directly reduce CE.

Studies on the contribution of GI in minimizing environmental pollution also reveal different results. Refs. [6,42] stated that GI saves energy and reduces waste and CO2, while ref. [43] emphasized that innovation is critical in reducing CO2. This view has also been supported by [44,45,46]. Refs. [47,48] have shown that R&D investments in environmental technologies contribute to SD by increasing the competitiveness of companies.

Technological innovation and financial technologies have great potential in terms of increasing ES. Ref. [49] argue that fintech increases environmental performance and service efficiency, while ref. [50] stated that financial depth should be expanded for ES. Ref. [51] The link between technological innovation and ES was examined and the impact of environmentally friendly technologies on ecological performance was highlighted [52,53] found that fintech improves environmental performance through green financing and investment.

The impact of R&D investments, GI and RE R&D activities on reducing trade-related CO2 in developed countries has been examined [54]. They found that higher investments in environmental R&D and GI significantly contribute to reducing TAE. Their study emphasized the importance of integrating RE technologies and innovative practices to mitigate the environmental impacts of trade in developed economies. Similarly, ref. [55] investigated the impact of technological innovation on TAE, highlighting that technological advancements, particularly in clean energy technologies, play a key role in reducing CO2 associated with international trade. Both studies underline the pivotal role of innovation and R&D in addressing the environmental challenges posed by trade. As a result, the following hypothesis has been developed:

H1:

Green innovation has a positive impact on ES.

2.2. Environmental Taxes and EQ

There is also no consensus in the literature on the relationship between ET and CO2. While refs. [56,57,58] argue that strict ET policies reduce CO2 and direct companies to more sustainable production methods, refs. [59,60,61] have similarly shown that ETs are effective in reducing GHG. On the other hand, some studies have indicated that ETs can negatively affect EQ [62]. Refs. [63,64] argued that ETs can encourage technological development to combat high CO2.

The influence of ET on EQ and CO2 has been widely examined in academic research. For example, ref. [65] has shown that ET reduce CO2 in Türkiye. Similarly, ref. [66] a study has shown that ET are effective in reducing CO2, while the use of RE improves EQ. Additionally, ref. [67] emphasized the significance of GI, energy efficiency, and ET in mitigating CO2 within advanced economies, highlighting their role as essential instruments for ES. Furthermore, ref. [68] explored the effects of environmental innovation and ET on achieving carbon neutrality in E7 economies, demonstrating their substantial contribution to reducing CO2.

Another important study by [69] found that ET and stricter environmental policies reduced CO2 in seven developing economies. These findings show that ET are effective not only in developed countries but also in developing economies in limiting CO2. Furthermore, ref. [70] suggested in their study on Turkey that ET have a nonlinear effect on ecological footprint and CO2 and that ET could improve environmental indicators in the long term. Finally, ref. [71] found that environmental tax reforms in resource-based cities in China promoted carbon reduction, emphasizing that ET are an effective policy tool for limiting CO2. These studies emphasize the vital importance of ET in promoting ES and their considerable impact on various economies.

The relationship between ET and TAE has become an important research topic in recent years. Ref. [72] found that ET, combined with energy efficiency, contribute to SD and contribute substantially to the reduction of TAE. Similarly, ref. [73] highlighted the restrictive impact of ET on TAE, emphasizing that these taxes are an effective policy tool for controlling CO2. Additionally, ref. [74] demonstrated that RE and fiscal policies, in conjunction with environmental policy stringency, reduce TAE, with ET playing a crucial role in this process. Ref. [75] examined the effect of environmental R&D and international trade on TAE, finding that environmental R&D investments help reduce CO2 associated with trade. This finding highlights the potential of trade to reduce environmental impacts and the important role of environmental R&D. In their study, ref. [76] showed that TAE capture environmental mishandling more effectively in the world’s most complex economies, and environmental tax policies are effective in reducing CO2. These studies demonstrate that ET, when combined with RE policies and environmental R&D, can help reduce TAE and serve as a vital tool for SD. As a result, the following hypothesis has been developed:

H2:

Environmental taxes have a positive impact on ES.

2.3. Financial Institution Quality and EQ

The effects of institutional structures and financial developments on EQ are increasingly being studied [77,78,79,80,81,82,83]. Refs. [84,85,86] showed that good governance and strong institutions reduce CO2, while [87,88] argued that countries with high institutional quality reduce environmental costs and promote SD. However, refs. [89,90] argued that institutional structures can lead to environmental degradation. The role of financial systems on environmental performance has also become increasingly important. Ref. [24] showed that developed financial markets reduce CO2 by increasing RE investments, and similar results were supported by [91,92]. However, some studies suggest that FD can increase CO2 [92,93,94].

The impact of FIQ on ES has been increasingly investigated in the literature. Ref. [95], in his study of Belt and Road Initiative (B&R) countries, examined the effects of environmental R&D investments and international trade on trade-driven CO2. The study found that environmental R&D plays a crucial role in reducing the environmental impacts of trade, and the adoption of eco-friendly technologies in emerging economies is effective in limiting trade-related CO2. It has also been stated that international trade has the capacity to promote ES, but this should be supported by environmentally friendly innovation and R&D investments [96]. Global studies have shown that improving institutional quality reduces CO2 and increases ES [97]. It has been found that institutional quality plays an important role in reducing CO2 in Sub-Saharan African countries, but low levels of FD limit this effect.

Similarly, ref. [98] assessed the impact of FI on ES in Africa, finding that countries with strong financial structures have increased eco-friendly investments and reduced CO2. Ref. [99] examined the impact of institutional quality on natural resource use, RE, and FD on ecological footprints in China, showing that high-quality FI can implement ES policies more effectively. Ref. [100] investigated how institutional quality mediates the relationship between FD and EQ, revealing that in countries with low institutional quality, FD may have adverse effects on the environment, but strong FI can counterbalance these negative impacts. In summary, the existing literature shows that high institutional quality promotes sustainable finance and reduces CO2by enhancing ES. However, the effectiveness of institutional structures and the level of economic development of countries are significant factors determining the strength of this relationship. In this context, our study aims to contribute to the literature by analyzing the impact of FIQ and FSI on CO2 in G7 countries and the role of GI. As a result, the following hypothesis has been developed:

H3:

Financial institution quality has a positive impact on ES.

2.4. Financial Stability and EQ

The impact of FS on EQ, particularly CO2, ecological footprint, and other environmental indicators, has been explored in several studies. Ref. [101] examined the relationship between FS and CO2 in E-7 countries, finding that FS, along with economic growth and trade, plays a significant role in limiting CO2 and enhancing ES. Similarly, ref. [102] highlighted how FS plays an important role in achieving environmental goals by contributing to sustainable environmental practices by supporting RE investments and technological innovation [103] a study examining the asymmetric effects of FS on ecological degradation in Norway showed that FS promotes ES, but financial crises can have negative effects on the environment. This finding highlights the importance of FS in implementing effective environmental policies. Similarly, ref. [104] noted the role of FS in reducing environmental degradation and noted that green economic policies can help mitigate the negative effects of climate change while improving EQ.

Moreover, ref. [105] investigated the role of FS in addressing climate risks and mitigating climate change. Their findings suggest that FS fosters green economic recovery, contributing to the reduction of CO2. Additionally, ref. [106] analyzed the Asia-Pacific Economic Cooperation (APEC) countries and demonstrated that FS, in combination with RE investments, serves an important function in lessening CO2 and promoting ES.

Furthermore, refs. [107] emphasize the importance of FS in improving EQ. Studies have shown that FS, combined with investments in RE and clean technologies, plays an important role in reducing CO2 and increasing ES. These studies argue that FS is an effective factor in achieving environmental goals and significantly encourages the adoption of environmentally friendly practices. In conclusion, the studies reviewed collectively highlight that FS is a crucial factor in improving EQ. FS not only supports investments in RE and green technologies but also ensures the successful implementation of environmental policies aimed at reducing CO2 and mitigating environmental degradation. As a result, the following hypothesis has been developed:

H4:

Financial stability has a positive impact on ES.

3. Methodology

3.1. Dataset

This study aims to analyze the impact of FIQ and FS on TAE in G-7 countries over the period 2000–2022, while examining the moderating role of GI. As global economies strive for SD and carbon neutrality, understanding how financial systems influence environmental outcomes becomes crucial. Given that G-7 countries are among the world’s largest economies and major contributors to global CO2, their financial structure and stability play a significant role in shaping environmental policies. Strong FI can enhance sustainable investment flows, regulate environmentally harmful activities, and promote green finance, while FS ensures long-term support for low-carbon economic transitions. This study investigates whether high-quality FI and stable financial markets contribute to reducing CO2 when trade adjustments are considered. Furthermore, the research explores how GI moderates these relationships, assessing whether technological advancements in cleaner production, energy efficiency, and eco-friendly investments amplify the positive impact of FD on carbon mitigation. By employing data from 2000 to 2022, the study provides empirical insights into how financial and environmental policies can be integrated to enhance sustainability.

In this study, TAE were used as the dependent variable in line with literature. TAE is an indicator used to more accurately assess the true environmental impact of a country by taking into account emission transfers resulting from trade [75,76,108,109,110,111,112]. Ref. [75], in their study examining the relationship between environmental R&D and TAE, stated that TAE more accurately reflects a country’s environmental impact associated with international trade. Instead of considering only domestic production, TAE accounts for the environmental burdens a country transfers to others through trade, providing a more realistic assessment of environmental impacts. Similarly, ref. [112] argued that TAE offers a more comprehensive evaluation compared to production-based emissions. While production-based emissions rely solely on domestic production activities, TAE considers the environmental effects of imports and exports, allowing for a more precise measurement of a country’s environmental footprint. Ref. [109] emphasized that TAE provides a broader assessment by taking into account the environmental impacts of international trade. Ref. [74] highlighted that TAE more accurately reflects the effects of environmental policies and energy strategies, demonstrating that environmental policies are shaped not only at the local level but also by the influence of global trade. These studies indicate that TAE not only encompasses production- and consumption-based emissions but also more accurately accounts for a country’s global environmental impact through trade. Therefore, TAE is considered a more appropriate and accurate tool for comprehensively examining the environmental impacts of trade compared to other CO2 measurement methods.

The first independent variable used in the study is the quality of FI. This variable was measured with “The average non-performing loan of banks in a country” in line with the literature [113]. FSI was created as the second independent variable. FS expresses the resilience of the financial system to shocks and its capacity to prevent serious contractions in economic activity [114]. The FSI, created using various indicators, became more widespread by being adopted by the IMF and ECB in 2008 and 2010 [103,112,113].

In this study, an index was created with eight different variables using financial strength, FD and financial fragility indicators. Financial strength indicators include liquidity (liquid assets/deposit ratio), profitability (return on assets—ROA) and capital adequacy (capital/asset ratio, risk-weighted capital adequacy—CRAR). FD indicators are M3 monetary expansion, domestic credit to GDP and stock market capitalization. The current account balance was used as the financial fragility indicator. After all variables were standardized, the FSI was created using the Principal Component Analysis (PCA) method [101,113]. This index evaluates the FS levels of G-7 countries and provides an important indicator for policy makers and economic experts.

Firstly, we constructed a comprehensive Aggregate FSI for G7 countries by utilizing annual data spanning from 2000 to 2022. This index has been constructed to comprehensively assess the financial stability levels of these economies. Similar to the methodology employed by Nasreen [113] and Safi et al. [101], the Aggregate FSI is derived from the aggregation of three key sub-indices: financial sector development, soundness and vulnerability. These sub-indices incorporate various macroeconomic and financial indicators to evaluate the resilience and fragility of the financial system. For empirical analysis, the variance equal weighting method was used to compute the AFSI. Additionally, to test the robustness of the results, the AFSI was also calculated using the Principal Component Analysis (PCA) method. Both approaches yielded similar findings, reinforcing the reliability of the methodology applied in assessing FS.

FSI is calculated using the PCA technique. PCA is a method that transforms multiple correlated variables into fewer independent components and tries to minimize data loss during this transformation. This approach analyzes the joint movement of the variables that make up the index, identifies the first component that explains the maximum variance, and calculates the index based on this component; the index is calculated using the following formula:

FSI = Xa(i)

Here, a represents the weight vector of the individual indicators, while Xi denotes the values of the variables used in constructing the index. The weight coefficients determine the contribution of each variable to the common movement, with variables having the greatest impact carrying more weight in the formation of the index. In this study, the correlation coefficient between the indices calculated with the variance-equal weighted method and PCA was analyzed in order to evaluate the reliability of the results. The correlation coefficients range from 0.84 to 0.95, which confirms the robustness of the results.

As a result, the summary of the variables used in the study is shown in Table 1. In addition, following the empirical studies conducted by [54,103,104], the logarithmic regression model is used to estimate the relationships in question as follows:

Table 1.

Summary of Variables.

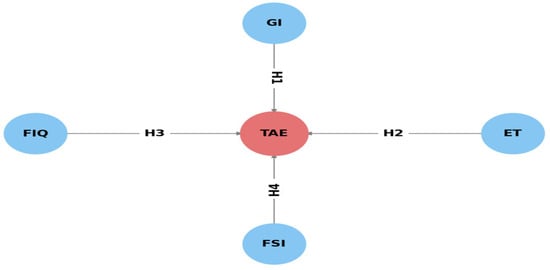

Figure 1 presents the conceptual causality model proposed in the study. The model includes TAE as the dependent variable, while the independent variables are GI, ET, FIQ, and FSI. The hypotheses (H1, H2, H3, H4) test the impact of these variables on TAE.

Figure 1.

Conceptual Causality Model Based on Hypotheses.

3.2. Method

In the study, cross-sectional dependency (CSD) was primarily examined. In this context, LM test [115] and Scaled LM () test [116] were used. However, these tests may give deviant results under certain conditions. Ref. [117] developed the deviant corrected LM test (LMadj) by adding variance and mean corrections to the test statistics in order to eliminate this deviation. The relevant equations are calculated as shown in Equations (3)–(6).

After examining the CSD, slope homogeneity (SH) is evaluated with [118] Δ tests. However, in cases of heteroskedasticity and serial correlation, [119] Δ tests are preferred. The relevant calculations are shown in Equations (7)–(10).

In this study, we employed the Cross-Sectionally Augmented ADF (CADF) and Cross-Sectionally Augmented IPS (CIPS) panel unit root tests, as introduced by [120], following the assessment of CSD. CADF unit root test and its calculation methods and CIPS statistic are calculated in Equations (11)–(15):

An appropriate panel cointegration test should be selected to detect the long-term relationship between the variables. In this study, the tests developed by [121,122,123] were used. In addition, the long-run relationship between the variables was also analysed with the [124] cointegration test. Ref. [124] test consists of four basic test statistics based on structural dynamics: ve group statistics and ve panel statistics. When calculating the group statistics, error correction coefficients are evaluated separately for each horizontal cross-section. The relevant cointegration equation is shown in Equation (16).

In this study, long-run elasticity coefficients are estimated by Seemingly Unrelated Regressions (SUR) method and [125] method. SUR and Driscoll and Kraay model are chosen as the most appropriate estimators since they solve the endogeneity problem, take heterogeneity and inter-unit correlation into account, and the cross-sectional dimension is smaller than the time dimension [126]. The formulas for the SUR model are shown in Equations (17)–(20).

The study also utilises the PCSE method developed by [127]. This estimator allows for consistent estimation of parameters under heteroskedastic, autocorrelated and inter-unit correlated error terms using Driscoll-Kraay pooled ECM. The relevant calculations are shown in Equations (21)–(23):

In the final part of the study, the panel causality test suggested by [128] was used and applied according to the formula specified in Equation (24).

In Equation (23), and represent the stationary variables for each unit at time period t.

4. Empirical Findings

In this section, TAE, GI, ET, FIQ and FSI variables are analyzed. Firstly, the horizontal CSD of these variables is tested, and then their stationarity status is analyzed by applying unit root tests. Finally, the long and short run relationships between the variables are evaluated and empirical findings are presented.

The results of all tests reveal significant CSD among the variables (Table 2). Additionally, Bias-Corrected Scaled LM the and Pesaran Scaled LM tests are significant for all variables, indicating the influence of common shocks across the units. The Pesaran CD test results further confirm that the variables in the panel data set are interrelated. Similarly, the CSD test results in Table 3 suggest CSD in the long-run models at the 1% significance level. This implies that common shocks or interdependencies between units must be considered in the model.

Table 2.

CDS test results for Variables.

Table 3.

CSD test results for long-run models.

The SH test results presented in Table 4 indicate the presence of slope heterogeneity in the panel data model. In the analysis using the HAC-based delta tests developed by [122], the null hypothesis is rejected, i.e., there is no homogeneous structure among the variables. This result reveals that the panel data set has a heterogeneous structure and heterogeneous panel models should be preferred in the analysis.

Table 4.

Testing for SH.

In this study, the stationarity of the series for the G7 countries is analyzed with CADF and CIPS tests developed by [120]. The results presented in Table 5 indicate that the series are non-stationary in their level form but achieve stationarity after taking their first differences. CADF and CIPS test statistics are statistically significant at 1% and 5% significance levels, especially at first differences. This indicates that the analyzed variables contain unit root and have I(1) process.

Table 5.

Findings of CIPS and CADF analysis.

Various panel cointegration tests, accounting for cross-sectional dependence, were applied to analyze the sustained linkage among variables. The results confirm cointegration, with multiple test statistics significant at the 1% level, indicating a stable equilibrium relationship. Additionally, the ECM cointegration test proposed by [124] was used. Table 6 results confirm cointegration, with all Pedroni and Kao test statistics significant at the 1% level. The ECM test results presented in Table 7 show that all test statistics are significant at the 1% level with the data obtained from [124] and the null hypothesis (H0) is rejected. This result supports the existence of a cointegration relationship that exhibits long-term co-movement between the variables. In general, the findings reveal the existence of a stable long-term relationship between the independent and dependent variables and that the model effectively captures the long-term dynamics. In other words, despite the effects of external shocks, the variables follow a common equilibrium path over time and exhibit a consistent movement in the long run.

Table 6.

Cointegration test results.

Table 7.

Westerlund (2007) test results [124].

In the study, PCSE, Driscoll-Kraay and SUR methods were used to estimate the elasticity coefficients in Table 8. The study analyses the long-run relationships between the TAE dependent variable and the GI, ET, FIQ and FSI independent variables. The analyses are based on data from G7 countries for the period 2000–2022. The results show that all independent variables have statistically significant and negative effects on TAE.

Table 8.

Long Run Estimator Results.

- This suggests that GI contributes to lowering TAE. Consistent with these results, previous studies in the literature have also highlighted the role of GI in enhancing ES and mitigating CO2. For instance, ref. [129] emphasized that green patents significantly contribute to reducing CO2, while [114] found that GI plays a crucial role in decreasing CO2 in the Chinese economy. The results of this study reinforce the argument that GI is a vital instrument in facilitating the transition to a low-carbon economy, underscoring the necessity of promoting environmentally friendly technological advancements.

- It is found that ET have a negative and significant effect on TAE. This finding supports that ET are an effective policy instrument in reducing CO2. Ref. [59] find that a 1% increase in per capita environmental tax revenues in OECD countries reduces CO2 by 0.033%. Moreover, ref. [130] show that one-euro increase in energy taxes leads to a 0.73% reduction in CO2 from fossil fuel use.

- It shows that FIQ has a negative and significant effect on TAE. This suggests that improving the quality of FI can reduce CO2. Ref. [84] stated that good governance and strong institutions reduce CO2. Similarly, ref. [85] argue that countries with high institutional quality reduce environmental costs and promote SD.

- It reveals that FSI has a negative and significant effect on TAE. This suggests that increased FS can reduce CO2. Ref. [24] show that improved financial markets reduce CO2 by increasing RE investments. Similarly, ref. [21] stated that FD improves environmental performance.

In conclusion, the findings of the study show that GI, ET, FIQ, and FS are important factors contributing to the reduction in TAE. These findings align with existing studies in the literature and highlight the need for policymakers to consider these factors as part of their efforts to reduce CO2.

The D-H panel causality test results in Table 9 show that TAE are affected by various economic and financial variables, but not directly by these variables. There is a unidirectional causality from GI, ET, FIQ and FSI to CO2. These findings suggest that environmental policies, the quality of FI, and FS may play a significant role in contributing to the reduction of CO2. In particular, GI is found to be determinant in reducing CO2. This result supports that the diffusion of environmentally friendly technologies and sustainable production methods can reduce the carbon footprint. Similarly, ET also emerge as an important policy instrument affecting CO2. This suggests that regulations such as carbon tax may direct firms towards more sustainable production methods. In terms of financial variables, FIQ and FS have a significant and unidirectional effect on CO2. This finding suggests that strong FI and a stable economic structure can increase ES by supporting green investments.

Table 9.

D-H panel causality test results.

5. Conclusions and Discussion

This study examines the effects of FIQ and FS on TAE in G7 countries between 2000 and 2022, and analyzes the moderating role of GI in this relationship. In the study, long-term coefficient estimates are made with SUR, PCSE and Driscoll-Kraay methods, while the causal relationships between the variables are evaluated with D-H panel causality test. As a result of the analyses, all the developed hypotheses have been accepted. The findings reveal that GI, ET, FIQ and FS contribute greatly to reducing CO2. While GI accelerates sustainable transformation in the sector by encouraging the use of clean energy, ET stand out as an effective policy tool that directs firms to environmentally friendly production methods. Carbon taxes and incentives do not directly reduce CO2; rather, they play a key factor in mitigating CO2 by encouraging investments in RE. Strong FI accelerate the transition to a low-carbon economy by supporting sustainable financing mechanisms that take environmental risks into account. Maintaining FS increases the effectiveness of environmental policies by creating a secure environment for RE investments. In conclusion, the integration of environmental policies and financial regulations plays a critical role in reducing CO2 and promoting SD.

Strong FI and stable financial systems play a critical role for the success of SD and policies to reduce CO2. Improving the quality of FI can incentivise green investments, provide sustainable projects with access to lower-cost financing and expand lending for environmentally friendly technologies. Supporting FI with regulatory frameworks will contribute to the development of credit mechanisms that take into account environmental and social risks. Moreover, ensuring FS will allow for sustainable financing of long-term low-carbon investments, mitigating the negative impacts of economic uncertainties on green transformation. Policymakers should strengthen sustainable financing policies and develop strategies such as mainstreaming green bonds, implementing stress tests that incorporate environmental risks, and enhancing the banking sector’s compliance with sustainable finance principles. In addition, mechanisms that encourage GI can accelerate the transition to a low-carbon economy as well as ensure FS. In this context, advanced financial infrastructures and sustainability-oriented financial policies should be considered as effective tools to reduce CO2 and achieve environmental goals. The results also emphasize the importance of FS in global efforts to reduce CO2. In large economies such as the G7 countries, reducing uncertainties in financial markets and providing support for long-term environmental investments can promote SD. However, the interactions between GI and FS need to be investigated more comprehensively.

This study highlights the critical role of FIQ and FS in shaping environmental outcomes, specifically TAE. The findings contribute to the growing body of literature on the intersection of finance and sustainability, demonstrating that financial systems, particularly strong FI and stable markets, play a significant role in enhancing environmental performance. The study draws attention to the critical role of GI in the transition to a low-carbon economy and argues that technological developments and innovative solutions are indispensable in reducing CO2. The unidirectional causal link between these financial elements and CO2 suggests that strengthening financial infrastructure and disseminating green technologies can reduce CO2 in line with the theoretical framework combining environmental and financial performance. From a policy and practice perspective, the results suggest that strengthening FI and ensuring FS are key to promoting SD and reducing CO2. Policymakers should consider implementing regulations that support green investments, such as incentives for RE projects, and strengthening the resilience of financial systems against environmental risks. Supporting GI should be considered as an important way to accelerate the spread of sustainable technologies and practices in industries. In addition, ET are an effective mechanism to direct businesses to more environmentally friendly production methods and can contribute to reducing CO2. In conclusion, the integration of environmental policies with financial regulations, alongside incentives for GI, will be crucial in achieving long-term sustainability and addressing climate change.

Future research could explore the impact of financial systems on ES in greater detail, particularly in across developing economies, where financial infrastructure may differ significantly from developed nations. In line with the findings of this study, future investigations could focus on understanding how specific financial policies and regulations—such as green bonds, sustainable financing mechanisms, and environmental risk assessments—can effectively promote green investments. In addition, analyzing the impact of FI in the transition to a low-carbon economy and how FS can contribute to long-term ES goals under various economic conditions can be considered as an important research area.

Author Contributions

Conceptualization, M.R. and A.M.Y.; methodology, M.D.; software, A.T.; validation, M.Ö., A.T. and M.R.; formal analysis, M.D.; investigation, A.M.Y.; resources, A.T.; data curation, M.D.; writing—original draft preparation, M.Ö.; writing—review and editing, M.R.; visualization, M.D.; supervision, M.D.; project administration, A.M.Y.; funding acquisition, M.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used to support the findings of this study are available from the corresponding author upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Adebayo, T.S.; Kirikkaleli, D. Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: Application of wavelet tools. Environ. Dev. Sustain. 2021, 23, 16057–16082. [Google Scholar]

- Sarker, A.; Kim, J.-E.; Islam, A.R.M.T.; Bilal, M.; Rakib, M.R.J.; Nandi, R.; Rahman, M.M. Heavy metals contamination and associated health risks in food webs—A review focuses on food safety and environmental sustainability in Bangladesh. Environ. Sci. Pollut. Res. 2022, 29, 3230–3245. [Google Scholar]

- Jun, W.; Ali, W.; Bhutto, M.Y.; Hussain, H.; Khan, N.A. Examining the determinants of green innovation adoption in SMEs: A PLS-SEM approach. Eur. J. Innov. Manag. 2021, 24, 67–87. [Google Scholar]

- Wen, J.; Ali, W.; Hussain, J.; Khan, N.A.; Hussain, H.; Ali, N.; Akhtar, R. Dynamics between green innovation and environmental quality: New insights into South Asian economies. Econ. Politica 2021, 39, 543–565. [Google Scholar]

- Ekins, P.; Zenghelis, D. The costs and benefits of environmental sustainability. Sustain. Sci. 2021, 16, 949–965. [Google Scholar] [PubMed]

- Zhu, Q.; Sarkis, J. Relationships between operational practices and performance among early adopters of green supply chain management practices in Chinese manufacturing enterprises. J. Oper. Manag. 2004, 22, 265–289. [Google Scholar]

- Ghaith, A.F.; Epplin, F.M. Consequences of a carbon tax on household electricity use and cost, carbon emissions, and economics of household solar and wind. Energy Econ. 2017, 67, 159–168. [Google Scholar]

- Babatunde, O.A.; Ibukun, A.O.; Oyeyemi, O.G. Taxation revenue and economic growth in Africa. J. Account. Tax. 2017, 9, 11–22. [Google Scholar]

- Niu, T.; Yao, X.; Shao, S.; Li, D.; Wang, W. Environmental tax shocks and carbon emissions: An estimated DSGE model. Struct. Change Econ. Dyn. 2018, 47, 9–17. [Google Scholar]

- Elkins, P.; Baker, T. Carbon taxes and carbon emissions trading. J. Econ. Surv. 2001, 15, 325–376. [Google Scholar]

- Sundar, S. Modeling and analysis of the survival of a biological species in a polluted environment: Effect of environmental tax. Comput. Ecol. Softw. 2015, 5, 201. [Google Scholar]

- Calderón, S.; Alvarez, A.C.; Loboguerrero, A.M.; Arango, S.; Calvin, K.; Kober, T.; Daenzer, K.; Fisher-Vanden, K. Achieving CO2 reductions in Colombia: Effects of carbon taxes and abatement targets. Energy Econ. 2016, 56, 575–586. [Google Scholar] [CrossRef]

- Jiang, Z.; Shao, S. Distributional effects of a carbon tax on Chinese households: A case of Shanghai. Energy Policy 2014, 73, 269–277. [Google Scholar] [CrossRef]

- Guo, Z.; Zhang, X.; Zheng, Y.; Rao, R. Exploring the impacts of a carbon tax on the Chinese economy using a CGE model with a detailed disaggregation of energy sectors. Energy Econ. 2014, 45, 455–462. [Google Scholar] [CrossRef]

- Chen, M.; Jiandong, W.; Saleem, H. The role of environmental taxes and stringent environmental policies in attaining the environmental quality: Evidence from OECD and non-OECD countries. Front. Environ. Sci. 2022, 10, 972354. [Google Scholar] [CrossRef]

- Tamura, H.; Nakanishi, R.; Hatono, I.; Umano, M. Is environmental tax effective for total emission control of carbon dioxide?: -Systems analysis of an environmental-economic model-. IFAC Proc. Vol. 1996, 29, 5435–5440. [Google Scholar] [CrossRef]

- Shahbaz, M.; Bhattacharya, M.; Mahalik, M.K. Financial development, industrialization, the role of institutions and government: A comparative analysis between India and China. Appl. Econ. 2018, 50, 1952–1977. [Google Scholar]

- Nasir, M.A.; Canh, N.P.; Le TN, L. Environmental degradation & role of financialisation, economic development, industrialisation and trade liberalisation. J. Environ. Manag. 2021, 277, 111471. [Google Scholar]

- Qalati, S.A.; Kumari, S.; Tajeddini, K.; Bajaj, N.K.; Ali, R. Innocent devils: The varying impacts of trade, renewable energy and financial development on environmental damage: Nonlinearly exploring the disparity between developed and developing nations. J. Clean. Prod. 2023, 386, 135729. [Google Scholar]

- Sadorsky, P. The impact of financial development on energy consumption in emerging economies. Energy Policy 2010, 38, 2528–2535. [Google Scholar]

- Farhani, S.; Solarin, S.A. Financial development and energy demand in the United States: New evidence from combined cointegration and asymmetric causality tests. Energy 2017, 134, 1029–1037. [Google Scholar]

- Zheng, G.W.; Siddik, A.B.; Masukujjaman, M.; Fatema, N. Factors affecting the sustainability performance of financial institutions in Bangladesh: The role of green finance. Sustainability 2021, 13, 10165. [Google Scholar] [CrossRef]

- Akter, R.; Ahmad, S.; Islam, M.S. CAMELS model application of non-bank financial institution: Bangladesh perspective. Acad. Account. Financ. Stud. J. 2018, 22, 1–10. [Google Scholar]

- Zhang, B.; Zhou, P. Financial development and economic growth in a microfounded small open economy model. N. Am. J. Econ. Financ. 2021, 58, 101544. [Google Scholar]

- Ahmad, A.; Ishak MS, I. Shari’ah governance of Islamic non-banking financial institutions in Malaysia: A conceptual review. J. Manag. Theory Pract. JMTP 2021, 2, 70–77. [Google Scholar]

- Yuxiang, K.; Chen, Z. Financial development and environmental performance: Evidence from China. Environ. Dev. Econ. 2011, 16, 93–111. [Google Scholar]

- Shen, Y.; Su, Z.W.; Malik, M.Y.; Umar, M.; Khan, Z.; Khan, M. Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 2021, 755, 142538. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N. Sustainable solutions for green financing and investment in renewable energy projects. Energies 2020, 13, 788. [Google Scholar] [CrossRef]

- Zafar, M.W.; Shahbaz, M.; Hou, F.; Sinha, A. From nonrenewable to renewable energy and its impact on economic growth: The role of research & development expenditures in Asia-Pacific Economic Cooperation countries. J. Clean. Prod. 2019, 212, 1166–1178. [Google Scholar]

- Ziolo, M.; Ghoul, M.B.G.B.; Aydın, H.İ. Financial stability vs. sustainable development and its financing. In Regaining Global Stability After the Financial Crisis; IGI Global: Hershey, PA, USA, 2018; pp. 88–107. [Google Scholar]

- Polzin, F.; Sanders, M. How to finance the transition to low-carbon energy in Europe? Energy Policy 2020, 147, 111863. [Google Scholar]

- Liesen, A.; Hoepner, A.G.; Patten, D.M.; Figge, F. Does stakeholder pressure influence corporate GHG emissions reporting? Empirical evidence from Europe. Account. Audit. Account. J. 2015, 28, 1047–1074. [Google Scholar]

- Fama, E.F. Efficient capital markets. J. Financ. 1970, 25, 383–417. [Google Scholar]

- Bansal, P.; Clelland, I. Talking trash: Legitimacy, impression management, and unsystematic risk in the context of the natural environment. Acad. Manag. J. 2004, 47, 93–103. [Google Scholar]

- Sharfman, M.P.; Fernando, C.S. Environmental risk management and the cost of capital. Strateg. Manag. J. 2008, 29, 569–592. [Google Scholar]

- Aerts, W.; Cormier, D.; Magnan, M. Corporate environmental disclosure, financial markets and the media: An international perspective. Ecol. Econ. 2008, 64, 643–659. [Google Scholar]

- Carrión-Flores, C.E.; Innes, R. Environmental innovation and environmental performance. J. Environ. Econ. Manag. 2010, 59, 27–42. [Google Scholar]

- Wang, Q.; Qu, J.; Wang, B.; Wang, P.; Yang, T. Green technology innovation development in China in 1990–2015. Sci. Total Environ. 2019, 696, 134008. [Google Scholar]

- Chakraborty, S.K.; Mazzanti, M. Energy intensity and green energy innovation: Checking heterogeneous country effects in the OECD. Struct. Change Econ. Dyn. 2020, 52, 328–343. [Google Scholar]

- Yuan, B.; Cao, X. Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 2022, 68, 101868. [Google Scholar]

- Weina, A.; Yanling, Y. Role of knowledge management on the sustainable environment: Assessing the moderating effect of innovative culture. Front. Psychol. 2022, 13, 861813. [Google Scholar]

- Shrivastava, P.; Hart, S. Creating sustainable corporations. Bus. Strategy Environ. 1995, 4, 154–165. [Google Scholar] [CrossRef]

- Hart, O. Firms, Contracts, and Financial Structure; Clarendon Press: Oxford, UK, 1995. [Google Scholar]

- Klassen, R.D.; McLaughlin, C.P. The impact of environmental management on firm performance. Manag. Sci. 1996, 42, 1199–1214. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J.; Cordeiro, J.J.; Lai, K.H. Firm-level correlates of emergent green supply chain management practices in the Chinese context. Omega 2008, 36, 577–591. [Google Scholar] [CrossRef]

- De Giovanni, P.; Vinzi, V.E. Covariance versus component-based estimations of performance in green supply chain management. Int. J. Prod. Econ. 2012, 135, 907–916. [Google Scholar] [CrossRef]

- Acemoglu, D.; Gallego, F.A.; Robinson, J.A. Institutions, human capital, and development. Annu. Rev. Econ. 2014, 6, 875–912. [Google Scholar]

- Ali, H.; Khan, H.A.; Pecht, M.G. Circular economy of Li Batteries: Technologies and trends. J. Energy Storage 2021, 40, 102690. [Google Scholar]

- Yan, C.; Siddik, A.B.; Akter, N.; Dong, Q. Factors influencing the adoption intention of using mobile financial service during the COVID-19 pandemic: The role of FinTech. Environ. Sci. Pollut. Res. 2021, 30, 61271–61289. [Google Scholar]

- Li, G.; Wang, X.; Bi, D.; Hou, J. Risk measurement of the financial credit industry driven by data: Based on DAE-LSTM deep learning algorithm. J. Glob. Inf. Manag. JGIM 2022, 30, 1–20. [Google Scholar]

- Severo, E.A.; Guimarães JC, F.D.; Dellarmelin, M.L.; Ribeiro, R.P. The influence of social networks on environmental awareness and the social responsibility of generations. BBR. Braz. Bus. Rev. 2019, 16, 500–518. [Google Scholar] [CrossRef]

- Zhou, G.; Zhu, J.; Luo, S. The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecol. Econ. 2022, 193, 107308. [Google Scholar] [CrossRef]

- Guang-Wen, Z.; Siddik, A.B. The effect of Fintech adoption on green finance and environmental performance of banking institutions during the COVID-19 pandemic: The role of green innovation. Environ. Sci. Pollut. Res. 2023, 30, 25959–25971. [Google Scholar]

- Jiang, Y.; Hossain, M.R.; Khan, Z.; Chen, J.; Badeeb, R.A. Revisiting research and development expenditures and trade adjusted emissions: Green innovation and renewable energy R&D role for developed countries. J. Knowl. Econ. 2024, 15, 2156–2191. [Google Scholar]

- Wahab, S. Does technological innovation limit trade-adjusted carbon emissions? Environ. Sci. Pollut. Res. 2021, 28, 38043–38053. [Google Scholar]

- Loganathan, N.; Ahmad, N.; Subramaniam, T.; Taha, R. The dynamic effects of growth, financial development and trade openness on tax revenue in Malaysia. Int. J. Bus. Soc. 2020, 21, 42–62. [Google Scholar]

- Ghazouani, A.; Jebli, M.B.; Shahzad, U. Impacts of environmental taxes and technologies on greenhouse gas emissions: Contextual evidence from leading emitter European countries. Environ. Sci. Pollut. Res. 2021, 28, 22758–22767. [Google Scholar] [CrossRef]

- Doğan, B.; Chu, L.K.; Ghosh, S.; Truong HH, D.; Balsalobre-Lorente, D. How environmental taxes and carbon emissions are related in the G7 economies? Renew. Energy 2022, 187, 645–656. [Google Scholar]

- Hashmi, R.; Alam, K. Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: A panel investigation. J. Clean. Prod. 2019, 231, 1100–1109. [Google Scholar]

- King, M.; Tarbush, B.; Teytelboym, A. Targeted carbon tax reforms. Eur. Econ. Rev. 2019, 119, 526–547. [Google Scholar] [CrossRef]

- Farooq, U.; Subhani, B.H.; Shafiq, M.N.; Gillani, S. Assessing the environmental impacts of environmental tax rate and corporate statutory tax rate: Empirical evidence from industry-intensive economies. Energy Rep. 2023, 9, 6241–6250. [Google Scholar]

- Morley, B. Empirical evidence on the effectiveness of environmental taxes. Appl. Econ. Lett. 2012, 19, 1817–1820. [Google Scholar]

- Borozan, D. Unveiling the heterogeneous effect of energy taxes and income on residential energy consumption. Energy Policy 2019, 129, 13–22. [Google Scholar]

- Ciaschini, M.; Pretaroli, R.; Severini, F.; Socci, C. Regional double dividend from environmental tax reform: An application for the Italian economy. Res. Econ. 2012, 66, 273–283. [Google Scholar]

- Sarıgül, S.S.; Topcu, B.A. The impact of environmental taxes on carbon dioxide emissions in Turkey. Int. J. Bus. Econ. Stud. 2021, 3, 43–54. [Google Scholar]

- Altay Topcu, B. An empirical analysis of the impact of environmental taxes, renewable energy consumption, and economic growth on environmental quality: Evidence from twelve selected countries. BES J. Int. J. Bus. Econ. Stud. 2023, 5, 98–108. [Google Scholar]

- Xie, P.; Jamaani, F. Does green innovation, energy productivity and environmental taxes limit carbon emissions in developed economies: Implications for sustainable development. Struct. Change Econ. Dyn. 2022, 63, 66–78. [Google Scholar]

- Tao, R.; Umar, M.; Naseer, A.; Razi, U. The dynamic effect of eco-innovation and environmental taxes on carbon neutrality target in emerging seven (E7) economies. J. Environ. Manag. 2021, 299, 113525. [Google Scholar]

- Wolde-Rufael, Y.; Mulat-Weldemeskel, E. Do environmental taxes and environmental stringency policies reduce CO2 emissions? Evidence from 7 emerging economies. Environ. Sci. Pollut. Res. 2021, 28, 22392–22408. [Google Scholar]

- Telatar, O.M.; Birinci, N. The effects of environmental tax on ecological footprint and carbon dioxide emissions: A nonlinear cointegration analysis on Turkey. Environ. Sci. Pollut. Res. 2022, 29, 44335–44347. [Google Scholar]

- Guo, B.; Wang, Y.; Zhou, H.; Hu, F. Can environmental tax reform promote carbon abatement of resource-based cities? Evidence from a quasi-natural experiment in China. Environ. Sci. Pollut. Res. 2023, 30, 117037–117049. [Google Scholar]

- Zhang, Z.; Zheng, Q. Sustainable development via environmental taxes and efficiency in energy: Evaluating trade-adjusted carbon emissions. Sustain. Dev. 2023, 31, 415–425. [Google Scholar]

- Xin, N.; Xie, Z. Financial inclusion and trade-adjusted carbon emissions: Evaluating the role of environment-related taxes employing non-parametric panel methods. Sustain. Dev. 2023, 31, 78–90. [Google Scholar] [CrossRef]

- Li, S.; Samour, A.; Irfan, M.; Ali, M. Role of renewable energy and fiscal policy on trade-adjusted carbon emissions: Evaluating the role of environmental policy stringency. Renew. Energy 2023, 205, 156–165. [Google Scholar] [CrossRef]

- Jiang, S.; Chishti, M.Z.; Rjoub, H.; Rahim, S. Environmental R&D and trade-adjusted carbon emissions: Evaluating the role of international trade. Environ. Sci. Pollut. Res. 2022, 29, 63155–63170. [Google Scholar]

- Hossain, M.R.; Dash, D.P.; Das, N.; Hossain, M.E.; Haseeb, M.; Cifuentes-Faura, J. Do Trade-Adjusted Emissions Perform Better in Capturing Environmental Mishandling among the Most Complex Economies of the World? Environ. Model. Assess. 2024, 30, 87–105. [Google Scholar] [CrossRef]

- Jóźwik, B.; Doğan, M.; Gürsoy, S. The impact of renewable energy consumption on environmental quality in Central European countries: The mediating role of digitalization and financial development. Energies 2023, 16, 7041. [Google Scholar] [CrossRef]

- Saadaoui, H.; Dogan, M.; Omri, E. The impacts of hydroelectricity generation, financial development, geopolitical risk, income, and foreign direct investment on carbon emissions in Turkey. Environ. Econ. Policy Stud. 2024, 26, 239–261. [Google Scholar] [CrossRef]

- Liu, P.; Ur Rahman, Z.; Jóźwik, B.; Doğan, M. Determining the environmental effect of Chinese FDI on the Belt and Road countries CO2 emissions: An EKC-based assessment in the context of pollution haven and halo hypotheses. Environ. Sci. Eur. 2024, 36, 48. [Google Scholar]

- Gürsoy, S.; Jóźwik, B.; Dogan, M.; Zeren, F.; Gulcan, N. Impact of climate policy uncertainty, clean energy index, and carbon emission allowance prices on Bitcoin returns. Sustainability 2024, 16, 3822. [Google Scholar] [CrossRef]

- Bekteshi, X.; Alshiqi, S.; Jóźwik, B.; Altin, F.G.; Dogan, M.; Petrossyants, T. The Impact of Shipping Connectivity on Environmental Quality, Financial Development, and Economic Growth in Regional Comprehensive Economic Partnership Countries. J. Risk Financ. Manag. 2024, 17, 559. [Google Scholar] [CrossRef]

- Ullah, A.; Tekbaş, M.; Doğan, M. The impact of economic growth, natural resources, urbanization and biocapacity on the ecological footprint: The case of Turkey. Sustainability 2023, 15, 12855. [Google Scholar] [CrossRef]

- Dogan, M.; Sahin, S.; Ullah, A.; Safi, A. Promoting environmental sustainability: A policy perspective on hydroelectric power generation, foreign direct investments, and financial development. Energy 2024, 312, 133576. [Google Scholar] [CrossRef]

- Wawrzyniak, D.; Doryń, W. Does the quality of institutions modify the economic growth-carbon dioxide emissions nexus? Evidence from a group of emerging and developing countries. Econ. Res. Ekon. Istraživanja 2020, 33, 124–144. [Google Scholar] [CrossRef]

- Bakhsh, S.; Yin, H.; Shabir, M. Foreign investment and CO2 emissions: Do technological innovation and institutional quality matter? Evidence from system GMM approach. Environ. Sci. Pollut. Res. 2021, 28, 19424–19438. [Google Scholar] [CrossRef]

- Zhang, X.; Husnain, M.; Yang, H.; Ullah, S.; Abbas, J.; Zhang, R. Corporate business strategy and tax avoidance culture: Moderating role of gender diversity in an emerging economy. Front. Psychol. 2022, 13, 827553. [Google Scholar] [CrossRef] [PubMed]

- Abid, M. Does economic, financial and institutional developments matter for environmental quality? A comparative analysis of EU and MEA countries. J. Environ. Manag. 2017, 188, 183–194. [Google Scholar] [CrossRef]

- Wang, Z.; Huo, J.; Duan, Y. Impact of government subsidies on pricing strategies in reverse supply chains of waste electrical and electronic equipment. Waste Manag. 2019, 95, 440–449. [Google Scholar] [CrossRef] [PubMed]

- Le, H.P.; Ozturk, I. The impacts of globalization, financial development, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environ. Sci. Pollut. Res. 2020, 27, 22680–22697. [Google Scholar] [CrossRef]

- Kousar, S.; Batool, S.A.; Batool, S.S.; Zafar, M. Do Government Expenditures on Education and Health Lead Toward Economic Growth? Evidence from Pakistan. J. Res. Reflect. Educ. (JRRE) 2020, 14, 53–63. [Google Scholar]

- Eregha, P.B.; Vo, X.V.; Nathaniel, S.P. Military spending, financial development, and ecological footprint in a developing country: Insights from bootstrap causality and Maki cointegration. Environ. Sci. Pollut. Res. 2022, 29, 83945–83955. [Google Scholar] [CrossRef]

- Baloch, M.A.; Zhang, J.; Iqbal, K.; Iqbal, Z. The effect of financial development on ecological footprint in BRI countries: Evidence from panel data estimation. Environ. Sci. Pollut. Res. 2019, 26, 6199–6208. [Google Scholar] [CrossRef]

- Saud, S.; Chen, S.; Haseeb, A. The role of financial development and globalization in the environment: Accounting ecological footprint indicators for selected one-belt-one-road initiative countries. J. Clean. Prod. 2020, 250, 119518. [Google Scholar] [CrossRef]

- Ahmad, M.; Ahmed, Z.; Yang, X.; Hussain, N.; Sinha, A. Financial development and environmental degradation: Do human capital and institutional quality make a difference? Gondwana Res. 2022, 105, 299–310. [Google Scholar]

- Jiang, Q.; Rahman, Z.U.; Zhang, X.; Guo, Z.; Xie, Q. An assessment of the impact of natural resources, energy, institutional quality, and financial development on CO2 emissions: Evidence from the B&R nations. Resour. Policy 2022, 76, 102716. [Google Scholar]

- Khan, H.; Weili, L.; Khan, I. Institutional quality, financial development and the influence of environmental factors on carbon emissions: Evidence from a global perspective. Environ. Sci. Pollut. Res. 2022, 29, 13356–13368. [Google Scholar]

- Karim, S.; Appiah, M.; Naeem, M.A.; Lucey, B.M.; Li, M. Modelling the role of institutional quality on carbon emissions in Sub-Saharan African countries. Renew. Energy 2022, 198, 213–221. [Google Scholar]

- Chen, G.S.; Manu, E.K.; Asante, D. Achieving environmental sustainability in Africa: The role of financial institutions development on carbon emissions. Sustain. Dev. 2023, 31, 3272–3290. [Google Scholar] [CrossRef]

- Makhdum MS, A.; Usman, M.; Kousar, R.; Cifuentes-Faura, J.; Radulescu, M.; Balsalobre-Lorente, D. How do institutional quality, natural resources, renewable energy, and financial development reduce ecological footprint without hindering economic growth trajectory? Evidence from China. Sustainability 2022, 14, 13910. [Google Scholar] [CrossRef]

- Hunjra, A.I.; Tayachi, T.; Chani, M.I.; Verhoeven, P.; Mehmood, A. The moderating effect of institutional quality on the financial development and environmental quality nexus. Sustainability 2020, 12, 3805. [Google Scholar] [CrossRef]

- Safi, A.; Wahab, S.; Zeb, F.; Amin, M.; Chen, Y. Does financial stability and renewable energy promote sustainable environment in G-7 Countries? The role of income and international trade. Environ. Sci. Pollut. Res. 2021, 28, 47628–47640. [Google Scholar]

- Wahab, S.; Imran, M.; Safi, A.; Wahab, Z.; Kirikkaleli, D. Role of financial stability, technological innovation, and renewable energy in achieving sustainable development goals in BRICS countries. Environ. Sci. Pollut. Res. 2022, 29, 48827–48838. [Google Scholar]

- Kirikkaleli, D.; Castanho, R.A. The asymmetric and long-run effect of financial stability on environmental degradation in Norway. Sustainability 2022, 14, 10131. [Google Scholar] [CrossRef]

- Kirikkaleli, D.; Castanho, R.A.; Genc, S.Y.; Oyebanji, M.O.; Couto, G. Does financial stability matter for environmental degradation? Geol. J. 2023, 58, 3268–3277. [Google Scholar]

- Sun, L.; Fang, S.; Iqbal, S.; Bilal, A.R. Financial stability role on climate risks, and climate change mitigation: Implications for green economic recovery. Environ. Sci. Pollut. Res. 2022, 29, 33063–33074. [Google Scholar] [CrossRef]

- Hasni, R.; Dridi, D.; Ben Jebli, M. Do financial development, financial stability and renewable energy disturb carbon emissions? Evidence from Asia–Pacific Economic Cooperation economics. Environ. Sci. Pollut. Res. 2023, 30, 83198–83213. [Google Scholar]

- Topalcık, O.; Kirikkaleli, D. Financial stability and environment degradation in Turkey: Evidence from fourier ARDL approach. Front. Environ. Sci. 2024, 12, 1420019. [Google Scholar]

- Antwi, F.; Kong, Y.; Donkor, M. Greening African economies: Investigating the role of financial development, green investments, and institutional quality. Sustain. Dev. 2024, 32, 5659–5676. [Google Scholar]

- Azam, M.; Raza, A. Does foreign direct investment limit trade-adjusted carbon emissions: Fresh evidence from global data. Environ. Sci. Pollut. Res. 2022, 29, 37827–37841. [Google Scholar] [CrossRef]

- Nguyen, Q.K.; Dang, V.C. Renewable energy consumption, carbon dioxide emission and financial stability: Does institutional quality matter? Appl. Econ. 2024, 56, 8820–8837. [Google Scholar]

- Zou, X.; Dai, W.; Meng, S. The Impacts of Digital Finance on Economic Resilience. Sustainability 2024, 16, 7305. [Google Scholar] [CrossRef]

- Hanschel, E.; Monnin, P. Measuring and forecasting stress in the banking sector: Evidence from Switzerland. BIS Pap. 2005, 22, 431–449. [Google Scholar]

- Nasreen, S.; Anwar, S.; Ozturk, I. Financial stability, energy consumption and environmental quality: Evidence from South Asian economies. Renew. Sustain. Energy Rev. 2017, 67, 1105–1122. [Google Scholar]

- Yuan, B.; Li, C.; Yin, H.; Zeng, M. Green innovation and China’s CO2 emissions–the moderating effect of institutional quality. J. Environ. Plan. Manag. 2022, 65, 877–906. [Google Scholar] [CrossRef]

- Breusch, T.S.; Pagan, A.R. The Lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 1980, 47, 239–253. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Schuermann, T.; Weiner, S.M. Modeling regional interdependencies using a global error-correcting macroeconometric model. J. Bus. Econ. Stat. 2004, 22, 129–162. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Ullah, A.; Yamagata, T. A bias-adjusted LM test of error cross-section independence. Econom. J. 2008, 11, 105–127. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Blomquist, J.; Westerlund, J. Testing slope homogeneity in large panels with serial correlation. Econ. Lett. 2013, 121, 374–378. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Pedroni, P. Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom. Theory 2004, 20, 597–625. [Google Scholar] [CrossRef]

- Westerlund, J. New simple tests for panel cointegration. Econom. Rev. 2005, 24, 297–316. [Google Scholar] [CrossRef]

- Westerlund, J. Testing for error correction in panel data. Oxf. Bull. Econ. Stat. 2007, 69, 709–748. [Google Scholar] [CrossRef]

- Driscoll, J.C.; Kraay, A.C. Consistent covariance matrix estimation with spatially dependent panel data. Rev. Econ. Stat. 1998, 80, 549–560. [Google Scholar] [CrossRef]

- Mark, N.C.; Ogaki, M.; Sul, D. Dynamic seemingly unrelated cointegrating regressions. Rev. Econ. Stud. 2005, 72, 797–820. [Google Scholar] [CrossRef]

- Beck, N.; Katz, J.N. What to do (and not to do) with time-series cross-section data. Am. Political Sci. Rev. 1995, 89, 634–647. [Google Scholar] [CrossRef]

- Dumitrescu, E.I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Cho, J.H.; Sohn, S.Y. A novel decomposition analysis of green patent applications for the evaluation of R&D efforts to reduce CO2 emissions from fossil fuel energy consumption. J. Clean. Prod. 2018, 193, 290–299. [Google Scholar]

- Sen, S.; Vollebergh, H. The effectiveness of taxing the carbon content of energy consumption. J. Environ. Econ. Manag. 2018, 92, 74–99. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).