How Enterprise Resilience Affects Enterprise Sustainable Development—Empirical Evidence from Listed Companies in China

Abstract

1. Introduction

2. Literature Review

2.1. Related Research on Enterprise Resilience

2.2. Related Research to Enterprise Sustainable Development

3. Theoretical Analysis and Research Hypothesis

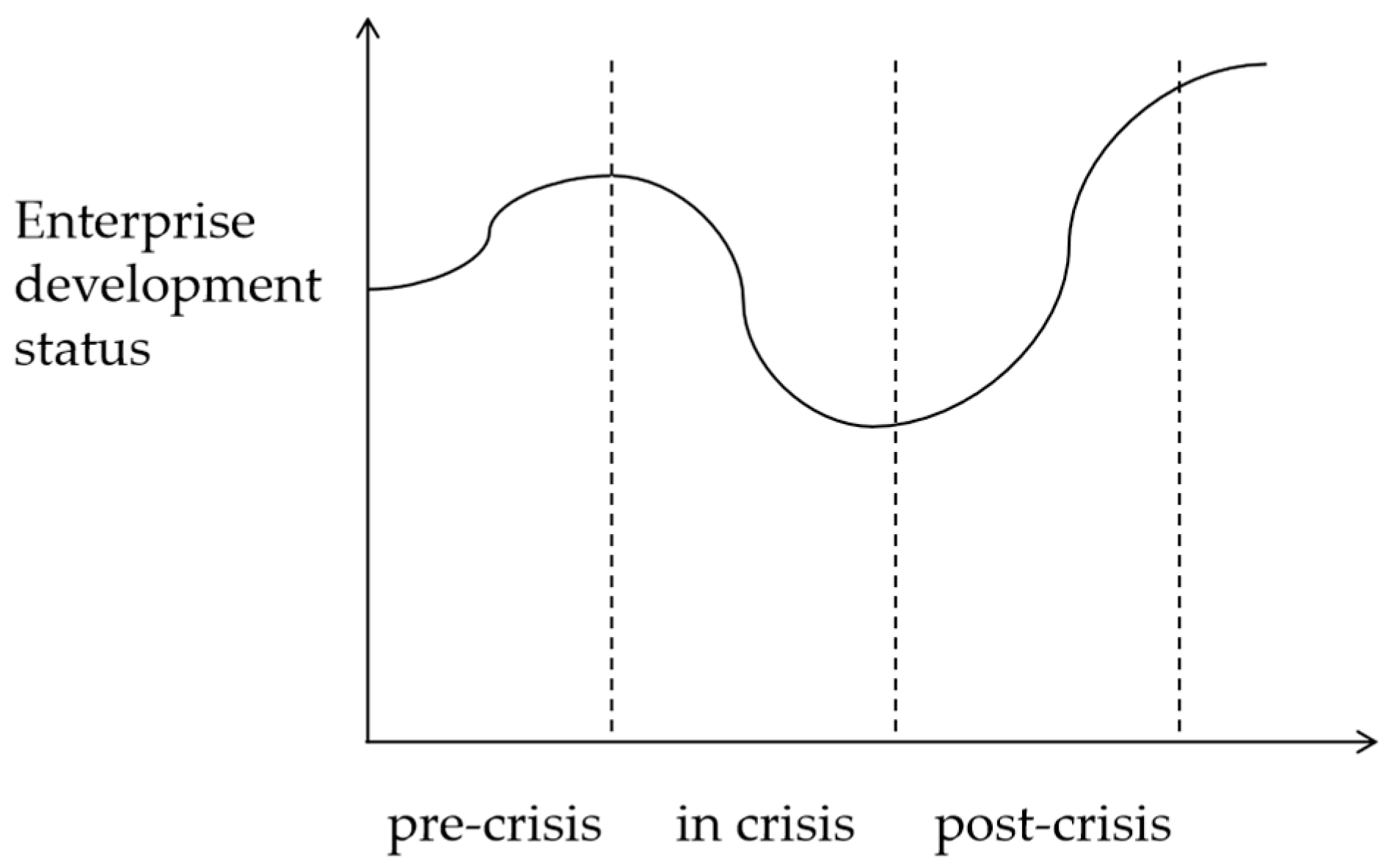

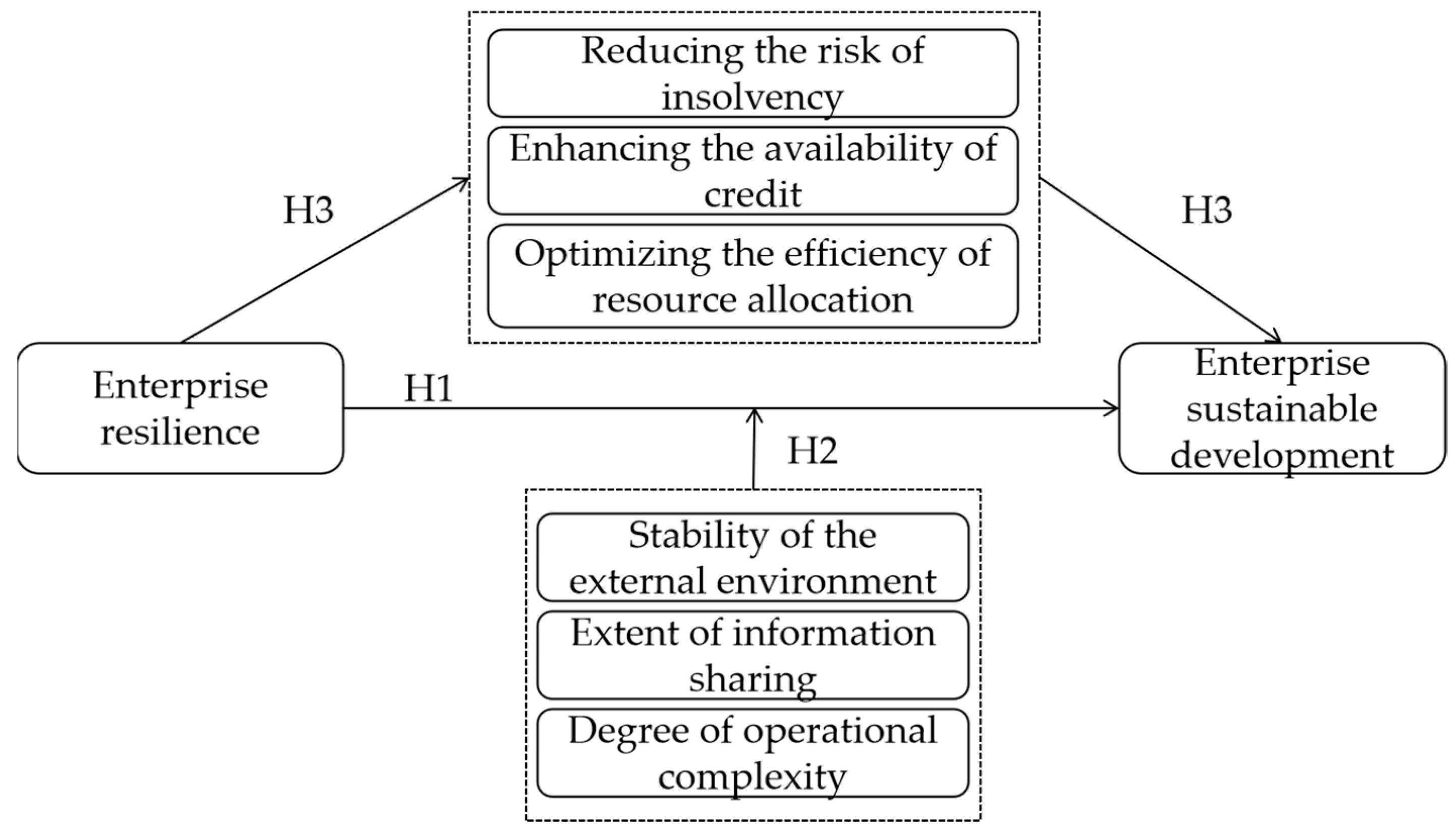

3.1. Direct Effects Analysis

3.2. Indirect Effects Analysis

4. Research Design

4.1. Variable Selection

4.2. Model Building

4.3. Source of Data

5. Empirical Analysis

5.1. Descriptive Statistics

5.2. Regression to Baseline

5.3. Robustness Checks

5.3.1. Replacement of Variables

5.3.2. Endogeneity Test

5.3.3. Other Robustness Tests

6. Heterogeneity Analysis and Mechanism Testing

6.1. Heterogeneity Analysis

6.2. Mechanism Testing

7. Discussions and Conclusions

7.1. Discussions

7.1.1. Theoretical Contributions

7.1.2. Practical Contributions

7.2. Conclusions

7.3. Research Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Sharma, A.; Rangarajan, D.; Paesbrugghe, B. Increasing Resilience by Creating an Adaptive Salesforce. Ind. Market. Manag. 2020, 88, 238–246. [Google Scholar] [CrossRef]

- Belhadi, A.; Kamble, S.; Jabbour, C.J.C.; Gunasekaran, A.; Ndubisi, N.O.; Venkatesh, M. Manufacturing and Service Supply Chain Resilience to the COVID-19 Outbreak: Lessons Learned from the Automobile and Airline Industries. Technol. Forecast. Soc. Chang. 2021, 163, 120447. [Google Scholar] [CrossRef]

- Zhao, Y.; Dou, J.; You, X.; Sun, D. A Review of the Context of Organizational Resilience Research and a Cross-Level Integrated Analysis. J. Zhejiang Univ. (Humanit. Soc. Sci.) 2024, 54, 64–85. [Google Scholar]

- Ortiz-de-Mandojana, N.; Bansal, P. The Long-Term Benefits of Organizational Resilience Through Sustainable Business Practices. Strateg. Manag. J. 2016, 37, 1615–1631. [Google Scholar] [CrossRef]

- Sahebjamnia, N.; Torabi, S.A.; Mansouri, S.A. Building Organizational Resilience in the Face of Multiple Disruptions. Int. J. Prod. Econ. 2018, 197, 63–83. [Google Scholar] [CrossRef]

- Sobaih, A.E.E.; Elshaer, I.; Hasanein, A.M.; Abdelaziz, A.S. Responses to COVID-19: The Role of Performance in the Relationship between Small Hospitality Enterprises’ Resilience and Sustainable Tourism Development. Int. J. Hosp. Manag. 2021, 94, 102824. [Google Scholar] [CrossRef]

- Sajko, M.; Boone, C.; Buyl, T. CEO Greed, Corporate Social Responsibility, and Organizational Resilience to Systemic Shocks. J. Manag. 2021, 47, 957–992. [Google Scholar] [CrossRef]

- Feng, T.; Xue, Z. The Impact of Government Subsidies on Corporate Resilience: Evidence from the COVID-19 Shock. Econ. Change Restruct. 2023, 56, 4199–4221. [Google Scholar] [CrossRef]

- Wang, H.; Jiao, S.; Ma, C. The Impact of ESG Responsibility Performance on Corporate Resilience. Int. Rev. Econ. Financ. 2024, 93, 1115–1129. [Google Scholar] [CrossRef]

- Zhang, X.; Liu, D.; Chen, J. Managerial Overconfidence and Corporate Resilience. Financ. Res. Lett. 2024, 62, 105087. [Google Scholar] [CrossRef]

- Álvarez Jaramillo, J.; Zartha Sossa, J.W.; Orozco Mendoza, G.L. Barriers to Sustainability for Small and Medium Enterprises in the Framework of Sustainable Development—Literature Review. Bus. Strateg. Environ. 2018, 28, 512–524. [Google Scholar] [CrossRef]

- Pieloch-Babiarz, A.; Misztal, A.; Kowalska, M. An Impact of Macroeconomic Stabilization on the Sustainable Development of Manufacturing Enterprises: The Case of Central and Eastern European Countries. Environ. Dev. Sustain. 2020, 23, 8669–8698. [Google Scholar] [CrossRef]

- Ye, M.; Hao, F.; Shahzad, M.; Kamran, H.W. How Green Organizational Strategy and Environmental CSR Affect Organizational Sustainable Performance Through Green Technology Innovation amid COVID-19. Front. Environ. Sci. 2022, 10, 959260. [Google Scholar] [CrossRef]

- Inthavong, P.; Rehman, K.U.; Masood, K.; Shaukat, Z.; Hnydiuk-Stefan, A.; Ray, S. Impact of Organizational Learning on Sustainable Firm Performance: Intervening Effect of Organizational Networking and Innovation. Heliyon 2023, 9, e16177. [Google Scholar] [CrossRef] [PubMed]

- Folqué, M.; Escrig-Olmedo, E.; Corzo Santamaría, M.T. Contribution of Sustainable Investment to Sustainable Development Within the Framework of the SDGS: The Role of the Asset Management Industry. Sustain. Account. Manag. Policy J. 2023, 14, 1075–1100. [Google Scholar] [CrossRef]

- Yang, J.; Wu, R.; Yang, H. Digital Transformation and Enterprise Sustainability: The Moderating Role of Regional Virtual Agglomeration. Sustainability 2023, 15, 7597. [Google Scholar] [CrossRef]

- Liang, L.; Li, Y. The Double-Edged Sword Effect of Organizational Resilience on ESG Performance. Corp. Soc. Responsib. Environ. 2023, 30, 2852–2872. [Google Scholar] [CrossRef]

- McCarthy, I.P.; Collard, M.; Johnson, M. Adaptive Organizational Resilience: An Evolutionary Perspective. Curr. Opin. Environ. Sustain. 2017, 28, 33–40. [Google Scholar] [CrossRef]

- Rai, S.S.; Rai, S.; Singh, N.K. Organizational Resilience and Social-Economic Sustainability: COVID-19 Perspective. Environ. Dev. Sustain. 2021, 23, 12006–12023. [Google Scholar] [CrossRef]

- Zabłocka-Kluczka, A.; Sałamacha, A.K. Organizational Resilience as the Mediator of Relation Between Brand Performance and Organizational Performance—Reflections from the Perspective of Crisis Times. J. Organ. Chang. Manag. 2023, 36, 932–949. [Google Scholar] [CrossRef]

- Kantur, D.; Iseri-Say, A. Measuring Organizational Resilience: A Scale Development. Pressacademia 2015, 4, 456. [Google Scholar] [CrossRef]

- Bonfim, D.; Custódio, C.; Raposo, C. Supporting Small Firms through Recessions and Recoveries. J. Financ. Econ. 2023, 147, 658–688. [Google Scholar] [CrossRef]

- Bravo, O.; Hernández, D. Measuring Organizational Resilience: Tracing Disruptive Events Facing Unconventional Oil and Gas Enterprise Performance in the Americas. Energy Res. Soc. Sci. 2021, 80, 102187. [Google Scholar] [CrossRef]

- Wu, H.; Zhang, K.; Li, R. ESG Score, Analyst Coverage and Corporate Resilience. Financ. Res. Lett. 2024, 62, 105248. [Google Scholar] [CrossRef]

- Secretary General UN, World Commission on Environment and Development. Report of the World Commission on Environment and Development: Our Common Future. 1987. Available online: https://digitallibrary.un.org/record/139811 (accessed on 22 January 2025).

- Trianni, A.; Cagno, E.; Neri, A. Modelling Barriers to the Adoption of Industrial Sustainability Measures. J. Clean. Prod. 2017, 168, 1482–1504. [Google Scholar] [CrossRef]

- Dong, Z.; Zhang, Z. Does the Business Environment Improve the Sustainable Development of Enterprises? Sustainability 2022, 14, 13499. [Google Scholar] [CrossRef]

- Chang, A.-Y.; Cheng, Y.-T. Analysis Model of the Sustainability Development of Manufacturing Small and Medium- Sized Enterprises in Taiwan. J. Clean. Prod. 2019, 207, 458–473. [Google Scholar] [CrossRef]

- Higgins, R.C. How Much Growth Can a Firm Afford? Finan. Manag. 1977, 6, 7. [Google Scholar] [CrossRef]

- Van Horne, J.C.; Wachowicz, J.M. Fundamentals of Financial Management; Prentice Hall: Hoboken, NJ, USA, 2004; ISBN 978-0-273-68598-2. [Google Scholar]

- Hu, H.; Bai, Z.; Wang, A. Supply Chain Shareholding and High Quality Development of Enterprises—Based on Total Factor Productivity Perspective. China’s Ind. Econ. 2024, 137–155. [Google Scholar] [CrossRef]

- Alexopoulos, I.; Kounetas, K.; Tzelepis, D. Environmental and Financial Performance. Is There a Win-Win or a Win-Loss Situation? Evidence from the Greek Manufacturing. J. Clean. Prod. 2018, 197, 1275–1283. [Google Scholar] [CrossRef]

- Xie, X.; Zhu, Q. How to Solve the “Harmonious Coexistence” Problem in Corporate Green Innovation Practices? Manag. World 2021, 37, 128–149+9. [Google Scholar] [CrossRef]

- Liu, J.; Guo, L. Research on the Impact of Digital Transformation on Corporate Sustainable Development Performance. Financ. Theory Pract. 2023, 1–13. Available online: https://link.cnki.net/urlid/41.1078.F.20240115.1626.002 (accessed on 22 January 2025).

- Wang, H.; Wang, Z.; Xia, F.; Zhang, Y. Can the Carbon Emission Trading Mechanism Improve Corporate Sustainable Development Performance?—Based on a Quasi-Natural Experiment of Carbon Emission Pilot Policies. Financ. Theory Pract. 2023, 22–38. Available online: https://link.cnki.net/urlid/41.1078.F.20230823.0942 (accessed on 22 January 2025).

- Baumgartner, R.J. Organizational Culture and Leadership: Preconditions for the Development of a Sustainable Corporation. Sustain. Dev. 2009, 17, 102–113. [Google Scholar] [CrossRef]

- Ji, K.; Liu, X.; Xu, J. Digital Economy and the Sustainable Development of China’s Manufacturing Industry: From the Perspective of Industry Performance and Green Development. Sustainability 2023, 15, 5121. [Google Scholar] [CrossRef]

- Gajdzik, B.; Grabowska, S.; Saniuk, S.; Wieczorek, T. Sustainable Development and Industry 4.0: A Bibliometric Analysis Identifying Key Scientific Problems of the Sustainable Industry 4.0. Energies 2020, 13, 4254. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Iranmanesh, M.; Grybauskas, A.; Vilkas, M.; Petraitė, M. Industry 4.0, Innovation, and Sustainable Development: A Systematic Review and a Roadmap to Sustainable Innovation. Bus. Strategy Environ. 2021, 30, 4237–4257. [Google Scholar] [CrossRef]

- Khan, I.S.; Ahmad, M.O.; Majava, J. Industry 4.0 and Sustainable Development: A Systematic Mapping of Triple Bottom Line, Circular Economy and Sustainable Business Models Perspectives. J. Clean. Prod. 2021, 297, 126655. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Iranmanesh, M.; Mubarak, M.F.; Mubarik, M.; Rejeb, A.; Nilashi, M. Identifying Industry 5.0 Contributions to Sustainable Development: A Strategy Roadmap for Delivering Sustainability Values. Sustain. Prod. Consum. 2022, 33, 716–737. [Google Scholar] [CrossRef]

- Bloom, N.; Bond, S.; Van Reenen, J. Uncertainty and Investment Dynamics. Rev. Econom. Stud. 2007, 74, 391–415. [Google Scholar] [CrossRef]

- Almeida, H.; Campello, M. Financial Constraints, Asset Tangibility, and Corporate Investment. Rev. Financ. Stud. 2007, 20, 1429–1460. [Google Scholar] [CrossRef]

- Ma, Z.; Xiao, L.; Yin, J. Toward a Dynamic Model of Organizational Resilience. Nankai Bus. Rev. Int. 2018, 9, 246–263. [Google Scholar] [CrossRef]

- Lv, W.; Wei, Y.; Li, X.; Lin, L. What Dimension of CSR Matters to Organizational Resilience? Evidence from China. Sustainability 2019, 11, 1561. [Google Scholar] [CrossRef]

- Li, E.; Zhang, C.; Wan, X. Innovation Decision-Making Under Economic Policy Uncertainty: The Perspective of Corporate Resilience. Contemp. Financ. 2022, 102–114. [Google Scholar] [CrossRef]

- Wernerfelt, B. A Resource-Based View of the Firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Li, P.; Zhu, J. Organizational Resilience: A Review of Recent Literature. Foreign Econ. Manag. 2021, 43, 25–41. [Google Scholar]

- Barasa, E.; Mbau, R.; Gilson, L. What Is Resilience and How Can It Be Nurtured? A Systematic Review of Empirical Literature on Organizational Resilience. Int. J. Health Policy Manag. 2018, 7, 491–503. [Google Scholar] [CrossRef]

- Martin, R. Regional Economic Resilience, Hysteresis and Recessionary Shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar] [CrossRef]

- DesJardine, M.; Bansal, P.; Yang, Y. Bouncing Back: Building Resilience Through Social and Environmental Practices in the Context of the 2008 Global Financial Crisis. J. Manag. 2019, 45, 1434–1460. [Google Scholar] [CrossRef]

- Levine, R.; Lin, C.; Xie, W. Spare Tire? Stock Markets, Banking Crises, and Economic Recoveries. J. Financ. Econ. 2016, 120, 81–101. [Google Scholar] [CrossRef]

- Albuquerque, R.; Koskinen, Y.; Yang, S.; Zhang, C. Resiliency of Environmental and Social Stocks: An Analysis of the Exogenous COVID-19 Market Crash. Rev. Corp. Financ. Stud. 2020, 9, 593–621. [Google Scholar] [CrossRef]

- Fisman, R.; Svensson, J. Are Corruption and Taxation Really Harmful to Growth? Firm Level Evidence. J. Dev. Econ. 2007, 83, 63–75. [Google Scholar] [CrossRef]

- Ghosh, D.; Olsen, L. Environmental Uncertainty and Managers’ Use of Discretionary Accruals. Account. Organ. Soc. 2009, 34, 188–205. [Google Scholar] [CrossRef]

- Darkow, P.M. Beyond “Bouncing Back”: Towards an Integral, Capability-Based Understanding of Organizational Resilience. J. Contingencies Crisis Manag. 2019, 27, 145–156. [Google Scholar] [CrossRef]

- Amihud, Y.; Mendelson, H. Asset Pricing and the Bid-Ask Spread. J. Financ. Econ. 1986, 17, 223–249. [Google Scholar] [CrossRef]

- Gong, Q.; Li, O.Z.; Lin, Y.; Wu, L. On the Benefits of Audit Market Consolidation: Evidence from Merged Audit Firms. Account. Rev. 2016, 91, 463–488. [Google Scholar] [CrossRef]

- Ohlson, J.A. Financial Ratios and the Probabilistic Prediction of Bankruptcy. J. Acc. Res. 1980, 18, 109. [Google Scholar] [CrossRef]

- Huang, S.; Yu, J.; Xu, Z. Leverage Ratio and Firm Productivity: From the Perspective of Credit Mismatch. China Ind. Econ. 2022, 159–177. [Google Scholar] [CrossRef]

| Variables | Observations | Mean | Standard Deviation | Minimum | Median | Maximum |

|---|---|---|---|---|---|---|

| En_SD | 36,619 | 0.074 | 0.073 | −0.022 | 0.055 | 0.420 |

| En_RES | 36,619 | 2.070 | 6.407 | −9.038 | 0.845 | 45.994 |

| LT | 36,619 | 10.032 | 7.057 | 1.000 | 9.000 | 27.000 |

| OR | 36,619 | 21.473 | 1.434 | 18.322 | 21.329 | 25.568 |

| SIZE | 36,619 | 8.308 | 1.279 | 5.900 | 8.130 | 12.264 |

| LEV | 36,619 | 0.429 | 0.198 | 0.057 | 0.427 | 0.864 |

| THR | 36,619 | 58.391 | 14.905 | 23.360 | 59.300 | 90.190 |

| MBP | 36,619 | 11.508 | 18.649 | 0.000 | 0.113 | 67.349 |

| GN | 36,619 | 0.157 | 0.243 | −0.234 | 0.099 | 1.407 |

| PV | 36,619 | 0.030 | 0.038 | 0.001 | 0.017 | 0.240 |

| CR | 36,619 | 2.328 | 2.271 | 0.319 | 1.611 | 14.655 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| En_SD | En_SD | En_SD | En_SD | |

| En_RES | 0.002 *** | 0.002 *** | 0.001 *** | 0.001 *** |

| (32.80) | (32.77) | (15.25) | (12.96) | |

| LT | 0.000 *** | 0.007 *** | ||

| (2.79) | (3.32) | |||

| OR | 0.032 *** | 0.045 *** | ||

| (46.28) | (47.02) | |||

| SIZE | −0.029 *** | −0.045 *** | ||

| (−36.37) | (−39.59) | |||

| LEV | 0.042 *** | 0.049 *** | ||

| (14.40) | (13.39) | |||

| THR | 0.000 *** | 0.000 *** | ||

| (6.69) | (9.11) | |||

| MBP | −0.000 | −0.000 | ||

| (−0.68) | (−0.76) | |||

| GN | 0.047 *** | 0.043 *** | ||

| (32.41) | (28.31) | |||

| PV | 0.459 *** | 0.428 *** | ||

| (49.97) | (43.47) | |||

| CR | 0.001 *** | 0.000 | ||

| (4.11) | (1.25) | |||

| Constant | 0.070 *** | 0.053 *** | −0.433 *** | −0.603 *** |

| (108.38) | (26.13) | (−42.52) | (−40.35) | |

| Observations | 36,619 | 36,619 | 36,619 | 36,619 |

| R-squared | 0.054 | 0.178 | ||

| ID | NO | YES | NO | YES |

| Year | NO | YES | NO | YES |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Substitution of Explanatory Variables | Replacement of Explained Variables | Instrumental Variable Approach | System GMM | ||

| En_SD | En_SD | S | En_SD | En_SD | |

| En_RES | 0.000 *** | 0.001 *** | 0.001 *** | ||

| (6.74) | (8.63) | (6.22) | |||

| En_Res1 | 0.014 *** | ||||

| (16.76) | |||||

| Stock_P | 0.000 *** | ||||

| (3.47) | |||||

| LT | 0.007 *** | 0.007 *** | 0.000 | 0.001 *** | 0.000 |

| (3.31) | (3.31) | (0.15) | (4.37) | (0.21) | |

| OR | 0.044 *** | 0.048 *** | −0.001 *** | 0.021 *** | 0.042 *** |

| (45.83) | (50.85) | (−6.38) | (20.59) | (8.54) | |

| SIZE | −0.044 *** | −0.047 *** | −0.002 *** | −0.015 *** | −0.039 *** |

| (−38.48) | (−41.60) | (−7.54) | (−12.62) | (−6.48) | |

| LEV | 0.048 *** | 0.049 *** | 0.009 *** | 0.030 *** | 0.063 *** |

| (13.33) | (13.47) | (13.61) | (5.99) | (2.73) | |

| THR | 0.000 *** | 0.000 *** | 0.000 | 0.000 *** | 0.001 *** |

| (9.48) | (10.19) | (1.10) | (5.40) | (2.64) | |

| MBP | −0.000 | −0.000 | −0.000 *** | 0.000 * | 0.000 |

| (−1.07) | (−0.73) | (−9.42) | (1.90) | (0.10) | |

| GN | 0.044 *** | 0.049 *** | −0.002 *** | 0.052 *** | 0.052 *** |

| (29.52) | (33.43) | (−5.60) | (20.13) | (5.59) | |

| PV | 0.446 *** | 0.435 *** | 0.029 *** | 0.474 *** | 0.282 *** |

| (45.51) | (44.12) | (16.64) | (24.72) | (5.95) | |

| CR | 0.000 | 0.000 | −0.000 *** | 0.001 *** | 0.006 *** |

| (1.01) | (0.85) | (−3.58) | (3.22) | (2.83) | |

| Constant | −0.602 *** | −0.646 *** | 0.133 *** | −0.319 *** | −0.629 *** |

| (−40.75) | (−44.25) | (43.82) | (−21.05) | (−9.01) | |

| Observations | 36,619 | 36,599 | 30,834 | 36,619 | 29,351 |

| AR (1) | 0.000 *** | ||||

| AR (2) | 0.712 | ||||

| Hansen | 0.189 | ||||

| R-squared | 0.181 | 0.174 | 0.058 | 0.188 | |

| ID | YES | YES | YES | YES | YES |

| Year | YES | YES | YES | YES | YES |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Excluding the 2020 Sample | Excluding the 2015 Sample | Excluding the 2008 Sample | Retention of Samples with More Than Five Consecutive Years of Occurrence | Control Industry | Control Province | |

| En_SD | En_SD | En_SD | En_SD | En_SD | En_SD | |

| En_RES | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** | 0.001 *** |

| (11.61) | (14.20) | (12.96) | (11.81) | (12.76) | (12.94) | |

| LT | 0.008 *** | 0.007 *** | 0.007 *** | 0.005 ** | 0.008 *** | 0.008 *** |

| (3.56) | (3.34) | (3.33) | (2.30) | (3.43) | (3.49) | |

| OR | 0.045 *** | 0.044 *** | 0.045 *** | 0.046 *** | 0.047 *** | 0.045 *** |

| (44.76) | (44.64) | (46.41) | (45.15) | (47.96) | (46.83) | |

| SIZE | −0.045 *** | −0.044 *** | −0.045 *** | −0.043 *** | −0.048 *** | −0.045 *** |

| (−38.07) | (−37.74) | (−38.98) | (−36.29) | (−40.97) | (−39.38) | |

| LEV | 0.048 *** | 0.047 *** | 0.048 *** | 0.039 *** | 0.049 *** | 0.050 *** |

| (12.57) | (12.52) | (12.98) | (10.17) | (13.33) | (13.61) | |

| THR | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| (9.67) | (8.91) | (8.20) | (8.35) | (8.55) | (9.07) | |

| MBP | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| (−0.80) | (−1.01) | (−0.75) | (−0.66) | (−0.47) | (−0.84) | |

| GN | 0.044 *** | 0.046 *** | 0.042 *** | 0.045 *** | 0.044 *** | 0.043 *** |

| (27.54) | (28.31) | (27.51) | (27.50) | (28.65) | (28.20) | |

| PV | 0.438 *** | 0.421 *** | 0.420 *** | 0.436 *** | 0.421 *** | 0.430 *** |

| (41.54) | (41.49) | (42.18) | (39.83) | (42.68) | (43.57) | |

| CR | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| (0.91) | (1.00) | (1.07) | (0.27) | (1.02) | (1.29) | |

| Constant | −0.603 *** | −0.591 *** | −0.599 *** | −0.626 *** | −0.679 *** | −0.668 *** |

| (−38.80) | (−38.25) | (−39.44) | (−40.28) | (−25.55) | (−25.12) | |

| Observations | 33,819 | 34,615 | 35,552 | 31,376 | 36,619 | 36,614 |

| R-squared | 0.178 | 0.180 | 0.177 | 0.178 | 0.453 | 0.448 |

| ID | YES | YES | YES | YES | YES | YES |

| Year | YES | YES | YES | YES | YES | YES |

| IND | YES | |||||

| PROVINCE | YES |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| En_SD | En_SD | En_SD | |

| En_RES | 0.001 *** | 0.001 *** | 0.001 *** |

| (12.50) | (12.52) | (12.73) | |

| AIEU | 0.004 *** | ||

| (9.56) | |||

| AIEUEn_RES | −0.000 *** | ||

| (−8.97) | |||

| ASY | −0.056 *** | ||

| (−31.75) | |||

| ASYEn_RES | −0.000 *** | ||

| (−3.00) | |||

| SEG | −0.002 *** | ||

| (−3.15) | |||

| SEGEn_RES | 0.000 * | ||

| (1.83) | |||

| LT | 0.007 *** | 0.007 *** | 0.007 *** |

| (3.09) | (3.07) | (3.27) | |

| OR | 0.046 *** | 0.044 *** | 0.046 *** |

| (46.78) | (41.34) | (47.78) | |

| SIZE | −0.045 *** | −0.056 *** | −0.043 *** |

| (−39.42) | (−44.63) | (−37.21) | |

| LEV | 0.047 *** | 0.074 *** | 0.036 *** |

| (12.70) | (18.86) | (9.63) | |

| THR | 0.000 *** | 0.001 *** | 0.000 *** |

| (7.99) | (17.60) | (7.74) | |

| MBP | −0.000 | −0.000 ** | −0.000 |

| (−0.80) | (−2.20) | (−0.85) | |

| GN | 0.043 *** | 0.038*** | 0.046 *** |

| (27.50) | (24.51) | (30.00) | |

| PV | 0.409 *** | 0.414 *** | 0.415 *** |

| (40.02) | (40.82) | (39.05) | |

| CR | 0.000 * | 0.000 * | 0.000 |

| (1.73) | (1.76) | (0.26) | |

| Constant | −0.614 *** | −0.496 *** | −0.629 *** |

| (−39.93) | (−29.33) | (−40.62) | |

| Observations | 35,313 | 33,607 | 35,455 |

| R-squared | 0.181 | 0.211 | 0.177 |

| ID | YES | YES | YES |

| Year | YES | YES | YES |

| Variables | (1) | (2) | (3) |

|---|---|---|---|

| Bankruptcy Risk | Credit Availability | Resource Allocation Efficiency | |

| OScore | Flex | TFP | |

| En_RES | −0.014 *** | 0.003 *** | 0.002 *** |

| (−13.50) | (23.91) | (8.85) | |

| LT | 0.036 | 0.000 | −0.004 |

| (0.94) | (0.07) | (−0.53) | |

| OR | −0.587 *** | −0.036 *** | 0.939 *** |

| (−32.84) | (−16.08) | (307.02) | |

| SIZE | 0.047 ** | 0.031 *** | −0.273 *** |

| (2.22) | (11.79) | (−75.85) | |

| LEV | 8.087 *** | 0.336 *** | 0.097 *** |

| (116.97) | (39.11) | (8.49) | |

| THR | −0.000 | 0.001 *** | 0.001 *** |

| (−0.22) | (6.76) | (6.08) | |

| MBP | −0.002 * | 0.001 *** | 0.000 |

| (−1.73) | (6.70) | (0.90) | |

| GN | −0.310 *** | 0.310 *** | 0.102 *** |

| (−11.03) | (88.20) | (21.50) | |

| PV | −4.314 *** | −0.397 *** | 0.205 *** |

| (−21.15) | (−16.15) | (6.63) | |

| CR | −0.329 *** | 0.002 *** | 0.026 *** |

| (−61.60) | (3.30) | (30.68) | |

| Constant | 0.700 ** | 0.353 *** | −9.903 *** |

| (2.52) | (9.97) | (−208.65) | |

| Observations | 33,077 | 35,745 | 35,037 |

| R-squared | 0.543 | 0.343 | 0.913 |

| ID | YES | YES | YES |

| Year | YES | YES | YES |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, L.; Dou, Y.; Wang, H. How Enterprise Resilience Affects Enterprise Sustainable Development—Empirical Evidence from Listed Companies in China. Sustainability 2025, 17, 988. https://doi.org/10.3390/su17030988

Zhang L, Dou Y, Wang H. How Enterprise Resilience Affects Enterprise Sustainable Development—Empirical Evidence from Listed Companies in China. Sustainability. 2025; 17(3):988. https://doi.org/10.3390/su17030988

Chicago/Turabian StyleZhang, Lingfu, Yongfang Dou, and Hailing Wang. 2025. "How Enterprise Resilience Affects Enterprise Sustainable Development—Empirical Evidence from Listed Companies in China" Sustainability 17, no. 3: 988. https://doi.org/10.3390/su17030988

APA StyleZhang, L., Dou, Y., & Wang, H. (2025). How Enterprise Resilience Affects Enterprise Sustainable Development—Empirical Evidence from Listed Companies in China. Sustainability, 17(3), 988. https://doi.org/10.3390/su17030988