Abstract

Using the “Policy Pressure-Innovation Alignment-Performance Transformation” theory, this paper looks at how ESG ratings, green innovation, and corporate dual-organizational performance are linked. This study uses a multi-period Difference-in-Differences (DID) model in conjunction with a conditional mediation effect model to examine how ESG ratings causally influence substantive green innovation, which in turn improves corporate financial and environmental performance. Regression results show that corporate ESG ratings have a big effect on the performance of both organizations. ESG ratings have a bigger effect on financial performance, while ESG scores have a bigger effect on environmental performance. Looking at the sub-dimensions shows that policy ratings have immediate effects on environmental performance and delayed effects on financial performance. The conclusion that the internalization response of corporate environmental costs is timely, while the market revaluation has a delayed transmission effect, holds true after being tested through parallel trend analysis and synthetic DID testing. More research shows that differences in ESG ratings hurt financial performance but help environmental performance. This means that differences in ESG ratings may lead to more real green innovation activities, which have a direct effect on the environment and, in the end, lead to bigger improvements in environmental performance. The moderating effect test shows that being aware of the environment makes substantive green innovation more focused on quality by making people feel responsible for their actions. Also, environmental management leads to more corporate green patents, which has resource displacement effects and makes green patent innovations less effective. Heterogeneity analysis shows that state-owned businesses use their institutional advantages to improve the “quality-quantity” of substantive green innovation, which helps their corporate green development performance. Declining businesses push for green innovation to fix problems that are already there, but mature businesses don’t like ESG rating policies because they are stuck in their ways, which stops them from making real progress in green innovation. This paper ends with micro-level evidence and theoretical support to solve the “greenwashing” problem of ESG and come up with “harmonious coexistence” policy combinations that work for businesses.

1. Introduction

Due to resource limitations, the “dual carbon” targets, and the speeding pace of climate change, businesses must go green in order to support sustainable development. The “Policy Pressure-Innovation Alignment-Performance Transformation” theory is especially pertinent in this situation. The logic of “external pressure–green innovation–firm performance,” which emphasizes the role of external stakeholders like governments, investors, and consumers in driving corporate green innovation, is frequently applied in green development research. As noted by Hojnik and Ruzzier (2016) [1], stakeholder and institutional theories primarily explain how external forces, such as market demand and regulatory pressures, motivate firms to adopt green practices. One important strategic component of this shift is substantive green innovation, which depends on combining management optimization and technological innovation to quickly reshape enterprise operational models and development patterns [2]. As the main tactic of corporate green transformation, it combines “economic development” and “environmental protection” in order to accomplish sustainability and green development objectives through management advancements and technological innovation. Strategic and substantive innovation are the two categories into which the academic community separates substantive green innovation. The former deals with short-term compliance requirements, which could restrict technological advancements due to short-term symbolic innovation [3,4]. The latter emphasizes systemic changes and ground-breaking technological advancements. Substantial green innovation in this context breaks the constraints of the conventional “end-of-pipe” governance model and establishes a useful synergy between environmental and financial performance by promoting green technology R&D, production process restructuring, and full life-cycle management [2,5]. Substantial green innovation, as opposed to traditional models, prioritizes systemic change and long-term environmental benefits over immediate financial gains. It also places an emphasis on energy conservation, emission reduction, and resource efficiency [6]. The external institutional environment and corporate strategic decisions both limit its efficacy, highlighting the ESG rating system’s increasing significance.

An important tool for corporate strategic decision-making is the ESG (Environmental, Social, and Governance) framework, which evaluates a company’s performance in these three crucial areas. ESG supports the goal of long-term corporate sustainability in addition to risk identification, mitigation, and resource allocation optimization. ESG ratings are therefore a “universal” tool for assessing corporate sustainability performance as well as a benchmark that is becoming more and more significant for stakeholder trust and capital market value assessment. Higher ESG ratings can lower financing costs, improve stakeholder relations, and secure innovation capacity, all of which help businesses accomplish significant green innovation from a sustainability standpoint. In a dynamic feedback loop, substantial green innovation and ESG optimization support one another. Policies aimed at reducing carbon emissions and recycling resources encourage businesses to invest in research and development for green technologies, while the results of substantive green innovation improve ESG profiles and foster more sustainable business growth. This process is not without difficulties, though. Some businesses may engage in “green-washing,” which is the practice of exaggerating or strategically framing significant green innovations in order to artificially raise ESG ratings. Such speculative activity casts doubt on the legitimacy of sustainability-driven strategies and undercuts sincere environmental initiatives. All things considered, green innovation facilitates the shift from short-term compliance-oriented practices to long-term sustainable development pathways when it is integrated into a company’s larger sustainability strategy. By aligning financial and environmental outcomes, these pathways enhance societal welfare and organizational performance. Even though this dual role is becoming more widely acknowledged, little theoretical and empirical research has been done on how corporate dual-organizational performance and ESG ratings interact to shape sustainable outcomes. By examining the internal mechanisms that connect sustainability-oriented organizational performance, green innovation, and ESG ratings, this study aims to close this gap.

With unclear boundaries, the current research gap mainly focuses on topics like the paradox of “signaling effects” and the “resource curse” in relation to ESG ratings’ effects on green innovation. Existing research on the relationship between financial performance and environmental performance primarily focuses on correlation analysis rather than dynamically analyzing the mediating role of significant green innovation [7,8]. The impact of corporate heterogeneity—such as firm size, ownership structure, and governance models—on the choice of green innovation pathways also needs to be investigated empirically. The tension between the short-term financial pressures associated with ESG investments and the long-term orientation of substantive green innovation is one of the main obstacles to achieving sustainable corporate development. To better understand how different corporate characteristics impact green innovation trajectories, it is crucial to take firm-specific ESG dynamics into account, according to a recent study by He et al. (2025), published in Advanced Engineering Informatics [9]. Investigating the underlying transmission mechanisms among substantive green innovation, ESG ratings, and dual dimensions of corporate performance provides not only theoretical support for policymakers in formulating tailored incentive mechanisms but also practical guidance for corporate managers in optimizing innovation resource allocation [10].

This work presents novel advances in mechanism analysis and the theoretical framework. Studies that have already been done on ESG have mostly looked at financial and environmental results independently, ignoring any possible interactions or synergies between these two aspects of business performance. The mediating role of substantive green innovation has also rarely been examined in a multifaceted manner in previous research, especially when it comes to differentiating between innovation quantity and quality. Methodologically speaking, a large number of studies utilizing the difference-in-differences (DID) approach have mostly concentrated on the direct effects of treatment, giving little consideration to the mechanisms by which policies are transmitted dynamically or the potential trade-offs between innovation quality and compliance pressure. Additionally, there is little data on how firm heterogeneity, such as ownership structure or life cycle stage, influences the impact of ESG ratings, which understates the diverse policy outcomes.

This study contributes in a number of ways to fill these gaps. By examining the synergy mechanism between financial and environmental outcomes, it first broadens the performance perspective and emphasizes how ESG ratings have a coordinated impact on dual organizational performance. Second, by breaking down significant green innovation into two dimensions, namely quantity (as represented by patent applications and authorizations) and quality (as reflected in patent citation impact), it improves knowledge of the relationship between ESG and performance and identifies unique transmission pathways. Third, by combining a synthetic DID framework with conditional mediation analysis and a multi-period DID model, it enhances methodological practice by making it possible to identify dynamic mechanisms and elucidate the compliance-driven but quality-suppressing effects of environmental penalties. Lastly, by showing that state-owned businesses can use policy resources to balance innovation quantity and quality and that firms in decline phases are better able to adapt to external pressures than those in growth phases, it contributes to the body of knowledge on corporate heterogeneity. These results offer theoretical understandings as well as useful recommendations for enhancing ESG assessment criteria and creating unique innovation incentive schemes.

2. Research Hypotheses

2.1. ESG Ratings and Corporate Dual-Organizational Performance

The governance paradigm of listed companies has changed significantly in response to the recent escalation of global sustainable development issues. This has caused businesses to shift from traditional financial-oriented approaches to governance models that prioritize sustainability and multifaceted value creation. An increasingly important external metric for evaluating corporate social responsibility, governance standards, and environmental performance is the Environmental, Social, and Governance (ESG) rating. Additionally, they are having an increasing impact on stakeholders, investors, and regulatory bodies’ decision-making processes. The logic of “external pressure–green innovation–firm performance” has been widely emphasized in green development research (Hojnik and Ruzzier, 2016) [1], in accordance with stakeholder and institutional theories. As important external stakeholders, governments, investors, and consumers exert market and regulatory pressure on businesses to embrace green practices. By taking into account these outside expectations, ESG ratings play a significant role in promoting strategic green transformation in addition to being a tool for performance evaluation.

ESG-oriented performance evaluations are introduced to address short-term managerial behavior and improve long-term capital returns, as per agency theory [11]. This encourages management to make sustainable investments and improvements in production, operation, and management. In addition to encouraging coordinated improvements in the environmental and social dimensions, this change in corporate governance logic pushes businesses toward development that strikes a balance between the benefits of governance, the environment, and society.

According to the resource-based view, a company’s ability to develop and acquire rare, unique, and irreplaceable resources is what determines its ability to maintain a competitive edge over time [12]. Substantial green innovation is a crucial tactic used by companies to meet legal obligations and environmental demands. By generating opportunities in emerging markets, lowering environmental costs and marginal benefits, and increasing resource allocation efficiency, this strategy increases the potential for a sustainable market. Research indicates that corporate innovation propels green transformation, which is further accelerated by external environmental regulations and social responsibility pressures [13]. Companies are motivated to change internal resource allocation and improve green R&D and innovation strategies by ESG ratings, which serve as external indicators of corporate environmental performance and social responsibility fulfillment [13]. This leads to improvements in both financial and environmental performance [14]. A rise in ESG ratings can guarantee a steady flow of funding for innovation, lessen financing challenges, and lessen agency conflicts and market information asymmetry [15]. Together with the realization of social value and environmental sustainability, a well-designed governance system fosters the allocation of innovation resources by increasing corporate transparency, fostering collaboration among investors, employees, and end users, and establishing management trust. ESG ratings support long-term social responsibility and environmental sustainability goals, boost external financing, and encourage internal innovation, as shown by Fatemi et al. (2015) [16].

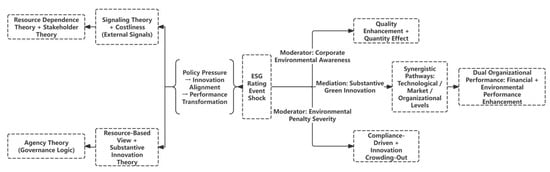

According to resource dependence theory, a company’s capacity to acquire and trade limited external resources is essential to its survival and growth. In this sense, a high ESG rating serves as a reputation signal for social responsibility and good governance, improving capital market standing, facilitating access to resources and policy support, and increasing the appeal of talent recruitment and supply chain collaboration [14]. High ESG performance promotes cooperation and resource acquisition by lowering stakeholder uncertainty and information asymmetry [17], allowing businesses to increase organizational capacity and pursue sustainable development and green transformation. However, risk mitigation is another way that ESG ratings work. According to insights from stakeholder perspectives and corporate resilience, proactive engagement with environmental and social responsibilities builds stakeholder trust while lowering reputational, legal, and compliance risks. High ESG ratings are therefore trustworthy markers of governance quality and sustainability commitment, and strong governance and standardized disclosure also assist businesses in identifying risks and making effective adjustments to responses [18]. They have a bigger impact on resource allocation, stakeholder confidence, and risk reduction than ratings with lower scores [19]. Lastly, from a signaling standpoint, companies operating in unpredictable environments must communicate unambiguous and trustworthy promises in order to acquire legitimacy and resource access. Such signals are provided by high ESG ratings, which support capital access, policy benefits, and reputation. To illustrate the underlying mechanism, we developed a conceptual framework shown in Figure 1. In light of these factors, we propose the following theory:

H1.

There is a significant positive correlation between corporate ESG ratings and dual-organizational performance (CSP).

Figure 1.

Mechanism Analysis Framework.

2.2. Mediating Mechanism of Substantive Green Innovation

The external environment influences corporate strategy decisions; internal resource incentives, external market penalties, and regulatory pressures all drive significant green innovation. A low ESG rating leads to capital deprivation, as resource allocation and misallocation are made worse by environmental risk pricing (green financing premium) in capital markets. According to the logic of preventive governance, stricter compliance reviews increase the hidden costs of the business [20]. Businesses must react to this pressure by implementing significant green innovation in order to handle external market and regulatory obstacles.

In order to signal technological compliance to the capital market and reduce adverse selection, businesses typically concentrate on increasing the number of green patents (applications/authorizations) as well as the caliber of patent citations. In order to adhere to more stringent regulations and prevent operational challenges, businesses frequently implement process improvements. With significant green innovation acting as a vital instrument for resolving environmental pressures, this process strikes a balance between corporate legitimacy and resource limitations [21]. Corporate dual-organizational performance is greatly improved by substantive green innovation because it allows for dynamic extensibility and reshapes the resource base. By replacing energy-intensive processes, cutting compliance costs, and increasing business competitiveness through innovation compensation effects, substantive green innovation technically creates technological barriers (Porter hypothesis) [22,23]. The market’s income structure is improved by raising environmental premiums through consumer green preferences and establishing a competitive moat through green product patents. By combining resources to create industrial metabolic systems (closed-loop supply chains), it improves resource circulation at the organizational level [24]. The impact of substantive green innovation on dual organizational performance depends on both the quantity and quality of green innovation (CSP) when patents reach a significant volume and citation quality, internalizing environmental costs and revealing economic benefits [25].

In reaction to outside pressures, businesses may occasionally overproduce strategic green innovation, resulting in symbolic compliance that compromises actual effectiveness. According to agency cost theory, companies may use low-quality green patents (such as utility models) to gain legitimacy. This can momentarily increase external recognition, but it comes at the expense of devoting R&D resources. This emphasis on “useless patents” not only lessens the possibility of ground-breaking inventions but also runs the risk of causing “compliance fatigue” [26], which deters businesses from addressing important environmental issues and slows the uptake of green technologies [27]. In the long run, this kind of strategic compliance stifles innovation and dual-organizational performance improvement, even though it might temporarily improve ESG scores.

Aside from these agency concerns, signaling mechanisms are crucial in assessing the market value of true green innovation in situations where information is asymmetric [28]. According to the signal transmission theory, leading companies can increase the legitimacy of their innovations by using more complex certification frameworks. For example, they can disclose external environmental certifications to prove their dependability [29], submit patents with citation matrices to prove their originality, or align with international certification systems (like EPD) to increase recognition. By mitigating asymmetry, lowering information rents, and stabilizing market expectations, these strategies improve the efficacy of ESG transformation. Based on this, we put forth the following theory:

H2.

Substantive green innovation serves as a mediating mechanism between ESG rating events and corporate dual-organizational performance (CSP).

2.3. Moderating Mechanism of Corporate Environmental Awareness and Environmental Penalty Intensity

The way that ESG ratings promote meaningful green innovation is significantly moderated in a positive way by corporate environmental awareness, a crucial internal cognitive factor. Companies with a high level of environmental consciousness are more likely to see ESG ratings as a strategic framework rather than just a compliance requirement, according to a strategic focus perspective [30]. By putting in place a methodical process for identifying environmental opportunities, the management of these businesses can successfully spot external green transformation opportunities and convert ESG improvement requirements into ground-breaking innovation objectives. Therefore, raising ESG ratings has a greater effect on encouraging the creation of superior green patents. This process speeds up the company’s reaction to outside green demands while also generating notable increases in the volume and caliber of green innovation.

The ability of ESG ratings to dynamically moderate resource allocation for green innovation is strengthened by increased environmental awareness, according to the resource orchestration perspective. First, green technology innovation projects that closely align with the ESG environmental dimension (E-dimension) and have high conversion potential are given priority by companies with high environmental awareness. Consequently, green innovation investments yield greater marginal returns. By creating cross-departmental networks for green innovation, companies also break down barriers between research and development and implementation, enabling lab-developed technologies to swiftly become commercial patents [31]. As a result, by increasing the number and caliber of green patents, greater environmental consciousness reinforces the impact of ESG ratings on significant green innovation [32].

Through two mechanisms, deterrence and reconstruction, external institutional pressure, such as environmental penalties, moderates the path dependence of ESG ratings in promoting green innovation [33], in contrast to internal drivers. On the one hand, severe environmental penalties lead to survival pressure from infractions, which forces businesses to connect passive defensive innovation and ESG incentives. This accelerates end-of-pipe technologies to rapidly increase the number of green patents [5]. This illustrates how compliance-driven innovation under severe environmental penalties is immediate and path-dependent. Increasing environmental penalties, however, might have the opposite effect of encouraging innovation. Due to a lack of funding, businesses are forced to focus on compliance innovation, which takes resources away from exploratory green R&D and reduces the incentive for high-caliber, ground-breaking innovation that ESG ratings provide. Stated differently, the amount of green innovation will rise under severe penalties, but the drive to improve quality will wane.

In conclusion, corporate environmental awareness is reshaped by both external institutional pressures and internal strategic cognition, which moderates the amount and caliber of green innovation. While environmental penalties exhibit a dual relationship, increasing quantity while stifling quality growth, environmental awareness generally increases both the quantity and quality of green innovation. In light of this, we put forth the following theories:

H3a.

The positive association between ESG rating event shock and dual-organizational performance is strengthened by corporate environmental awareness.

H3b.

The positive association between ESG rating event shock and multi-dimensional green innovation is strengthened by corporate environmental awareness.

H4a.

The positive association between ESG rating event shock and dual-organizational performance is strengthened by environmental penalty intensity.

H4b.

The positive association between ESG rating event shock and the quantity of green patents is strengthened by environmental penalty intensity.

H4c.

The negative association between ESG rating event shock and the quality of green patents is strengthened by environmental penalty intensity.

3. Model Setup and Indicator Selection

3.1. Sample Selection

In order to examine the impact of ESG rating events on green innovation, this study builds a firm-year panel dataset of Chinese A-share listed companies from 2009 to 2023. The World Intellectual Property Organisation (WIPO) created the IPC Green Inventory [33], which allows for the standard classification of patents pertaining to environmental sustainability, including technologies aimed at resource efficiency, pollution prevention, and energy conservation. This inventory is used to identify green patent data. The China National Intellectual Property Administration (CNIPA) serves as the main source of patent data, which is then cross-validated using the China National Research Data Service Platform’s (CNRDS) Green Patent Research Database to guarantee data completeness and accuracy [34]. Two well-known Chinese agencies, Hexun and the Huazheng Index, provide ESG rating data, while CSMAR, Wind, the EPS database, and provincial statistical yearbooks provide firm-level financial indicators and control variables. For a clearer understanding of the data collection and processing steps, please refer to Appendix A. A strong basis for assessing how ESG-related information shocks affect firm-level green innovation outcomes in various macroeconomic and policy contexts is provided by this multi-source integration.

A methodical screening procedure is used to guarantee the validity and quality of the data. Because of their unique regulatory environment and financial reporting standards, financial industry firms are not included in ESG-related analysis because they cannot be compared to industrial firms. In order to prevent potential bias from financially distressed or irregularly operating firms, firms flagged as ST (Special Treatment), *ST (Risk of Delisting), or PT (Suspended Listing) in any given year are also eliminated. To lessen the impact of outliers, continuous variables are winsorized at the first and 99th percentiles. 34,135 firm-year observations from 2719 listed firms make up the final unbalanced panel after observations with significant missing data in important variables are eliminated. Heterogeneous green patent activity over time, variations in the timing of ESG rating coverage, and staggered firm listing and delisting all contribute to the panel’s unbalanced nature. Our multi-period difference-in-differences (DID) design is methodologically suitable for this unbalanced structure since it maintains the cross-sectional and temporal variation required for reliable causal identification.

3.2. Variable Definitions

3.2.1. Dependent Variable

Based on the framework and theory of Xi Long Sheng et al. (2022) [35], this study measures corporate environmental performance using the natural logarithm of the environmental score from the He xun ESG rating system. To mitigate reverse causality, the ESG rating coverage is operationalized as a time-specific variable, reflecting a firm’s initial inclusion and subsequent years. The ESG rating event variable serves as a policy shock, which significantly differs from the quantitatively measured ESG scores. For robustness, we also incorporate Shang Dao Rong LV’s actual ESG scores as an alternative specification. The theory of organizational ambidexterity defines dual-organizational performance as a company’s capacity to balance and generate combined value from its financial performance and environmental/social responsibility performance, particularly when resource constraints are present. This approach emphasizes managing financial goals and social and environmental responsibilities at the same time. To measure dual-organizational performance, the company’s financial and environmental/social performance are first independently standardized on a 0–1 scale. This standardization ensures comparability across different businesses and situations. The formula for standardization is: . Using the dual-formula from Xie, X. & Zhu, Q. (2021) [36], this study transforms the standardized financial and environmental/social performance into dual-organizational performance (tdp1) using the formula: . In this equation, the standardized environmental/social performance is called Envi, and the standardized financial performance is called Econ. The formula calculates the absolute difference between Econ and Envi using the square root of their product. This demonstrates how the two dimensions coexist peacefully. The outcome is normalized by dividing by 1 to ensure that the dual-organizational performance metric is on a comparable scale. The robustness test will explore the impact mechanism of ESG ratings, the Shang Dao Rong LV environmental score logarithm (Envi2), and ROA (Econ2) standardized composite indicators on corporate dual-organizational performance (Tdp2). The specific variables are presented in Table 1.

Table 1.

Variable explanation.

3.2.2. Independent Variable

Being a formal signatory to the United Nations Principles for Responsible Investment and playing a strategically important role in international capital markets, Shang Dao Rong LV is renowned for being the first green financial services company in China to incorporate international ESG standards. Its flagship publications, the A-share Listed Company ESG Rating Analysis Report and the China Responsible Investment Annual Report, are now widely cited in academic research and investment practice as authoritative sources for assessing the ESG performance of Chinese listed companies. By methodically addressing three governance dimensions, six social dimensions, and five environmental dimensions, these reports expand the scope and depth of ESG assessment frameworks. The ESG assessment system used by Shang Dao Rong LV adapts its methodology to the particular socioeconomic circumstances of China while drawing on internationally recognized benchmarks. In order to guarantee accuracy and cross-sector relevance, the framework integrates roughly 700 data points and more than 200 ESG indicators, backed by 51 quantitative models tailored to individual industries. Each company is given an ESG score between 0 and 100 by this all-inclusive system, which also uses a rating scale from A+ to D to classify them. The methodology guarantees a refined degree of granularity in ESG performance analysis, methodological rigor, and consistency in indicator selection.

This study uses a multi-period Difference-in-Differences (DID) approach to construct the core independent variable, operationalized as the interaction term Treat × Post, in accordance with Wang Haijun et al. (2023) [37]. The variable While Post indicates the time frame during and following a firm’s involvement in the ESG rating system, Treat is a binary indicator that distinguishes between firms exposed to ESG rating disclosures (treatment group) and those not (control group). By adjusting for time-specific shocks and unobserved heterogeneity that could otherwise skew the results, the multi-period DID framework makes it possible to estimate the dynamic causal effects of implementing ESG policies. The conclusion that Shang Dao Rong LV’s introduction of ESG ratings greatly increases the intensity, caliber, and effectiveness of substantive green innovation among midstream enterprises is supported by empirical data from the baseline regression. To further assess the robustness of these findings and the multidimensional impacts of ESG engagement on corporate financial and environmental performance, additional analyses are conducted using continuous ESG rating scores as alternative specifications of the treatment variable.

3.2.3. Control Variables

The following control variables are chosen for empirical regression based on previous research (Tian and Yu 2017) [6]: (1) Firm Size (Size): the total market value expressed as a natural logarithm; (3) Cash Ratio (Cash): Net cash flow from operating activities divided by total assets; (2) Book-to-Market Ratio (BM): Net assets divided by total market value; (4) Institutional Investor Ownership (Inst): the proportion of total shares held by institutional investors; (5) Ownership Concentration (Top10): the proportion of total shares held by the top 10 shareholders; (6) GDP per capita at the regional level of economic development; (7) Per Capita Sales (Psale): Sales income divided by the number of workers.

3.3. Model Construction

Using a multi-period Difference-in-Differences (DID) model, we first demonstrate the causal relationship between the financial and environmental performance of corporations and the adoption of ESG policies. Although some of the hypotheses appear to test “correlations” in their wording, our goal is to ascertain whether there is a statistically significant and policy-induced change in performance outcomes before and after ESG-related policies, in comparison to a control group. Therefore, by adjusting for time-invariant firm characteristics and common trends, which a correlation analysis would miss, the DID framework is used to identify the policy effect rather than evaluate simple correlations. This approach ensures that our findings are not driven by re-verse causality or unobserved confounders, as we are comparing the changes over time across different firms in response to the policy implementation. By doing so, we isolate the effect of ESG ratings and scores from other external factors. The dual-organizational performance, environmental performance, and financial performance of firm I in year t are represented by the dependent variables Tdpit, Enviit, and Econit, respectively. The dual-organizational performance of firm I in year t, combining financial and environmental aspects, is represented by Tdpit in Equation (1). While Econit shows the company’s financial performance for the same year, Enviit refers to the environmental performance. The primary independent variable is ESGit. ESGit equals 1 if Shang Dao Rong LV releases the firm I rating data in year t; if not, ESGit equals 0. ui stands for the individual fixed effect, ηt for the time fixed effect, εit for the random error term, and Xit for a set of control variables.

In accordance with Jiang Ting (2022) [25], we build the regression equation as indicated in Equation (2), where Anuctd stands for the citation quality of green patent authorizations, Green1 for the company’s green patent application data, and Green for the company’s green patent authorization data. Equation (1) is consistent with the remaining terms.

This paper will investigate how the quantity of green patent authorizations, application numbers, and citation quality under the ESG rating policy integration path affect the “harmonious coexistence” of enterprises in order to confirm whether the theoretically analyzed mechanisms hold true. Additionally, it will look at the severity of environmental penalties on the first-half path mechanism as well as the active and passive components of corporate environmental awareness. We will then look at the conditional mediation model in light of this. The direct and first-half paths are impacted by corporate environmental awareness and the severity of environmental penalties, if both c3 and a3 in the formula are significant.

4. Empirical Analysis and Results

4.1. Descriptive Statistics

Based on the results in Table 2, a more thorough performance analysis reveals that the treatment group significantly outperforms the control group in terms of dual-organizational performance (i.e., the dual consideration of economic and environmental benefits) (0.142) and environmental performance (i.e., the company’s performance in environmental protection and resource conservation) (4.166), despite the fact that the mean differences between the treatment and control groups on several important variables are not significant, indicating some similarities in basic characteristics. The environmental performance (3.967) and dual-organizational performance (0.116) of the control group are inferior. This implies that corporate dual-organizational performance is positively impacted by significant green innovation strategies.

Table 2.

Descriptive statistics.

The treatment group’s financial performance, as determined by return on assets, profit growth rate, and related indicators (1.844), is slightly worse than that of the control group (2.094), despite the fact that it performs remarkably well in terms of sustainability and environmental performance. According to this research, significant green innovation initiatives might have an immediate impact on financial results. The fundamental cause is the significant up-front expenses and resource reallocation needed for meaningful green innovation: businesses must raise money for long-term environmental projects, pay for internal resource conversion costs, and restructure strategically in response to regulatory requirements. Despite the simultaneous increase in ESG ratings and environmental accomplishments, financial indicators are momentarily depressed by these immediate investments and the inertia inherent in organizational behavior. These effects are temporary, though. The parallel trend analysis shows that there are noticeable lag effects in the performance response, with the benefits of the policy usually becoming apparent after two to three periods. This delayed effect is a result of firms’ gradual adaptation process and institutional rigidity in policy transmission, wherein innovation adoption and strategic adjustments take time to become ingrained in business practices. Crucially, this adaptation period should not be seen as a sign that policies are ineffective; rather, it shows that businesses need time to adjust to external pressures, reorganize internal processes, and reallocate resources in ways that will increase their long-term competitiveness. Financial performance steadily improves along with environmental outcomes as the policy effect becomes more ingrained in businesses’ organizational structures, indicating that ESG-driven innovation fosters a dynamic transformation process. The enduring policy value of ESG evaluation mechanisms is highlighted by the substantial positive effects that ESG policy shocks have over time on both aspects of dual-organizational performance.

4.2. Correlation Analysis

ESG rating policies have a positive correlation with corporate dual-organizational performance and environmental performance, according to the empirical results in Table 3 (β1 = 0.085, p1 < 0.05; β2 = 0.104, p2 < 0.05). Additionally, there is a positive correlation between the number of green innovation applications or authorizations and ESG ratings (β1 = 0.167, p1 < 0.05; β2 = 0.215, p2 < 0.05). These findings back up the theoretical justifications of the study hypotheses with empirical data. The moderating effect of external factors on the dual-organizational performance model is further supported by the significant positive impact these factors have on dual-organizational performance, including market competition, media exposure, and environmental regulation [38].

Table 3.

Correlation analysis.

Market competition factors, external pressures, and stringent compliance requirements are all intertwined. Stakeholders are at the heart of the green development concept, and their mutual support strengthens the external synergy and internal consistency between environmental and financial performance. This encourages the effective application of green development and transformation strategies in the areas of corporate finance and the environment.

4.3. Multi-Period Difference-in-Differences Test

The regression results of the multi-period difference-in-differences method examining the impact of Environmental, Social, and Governance ratings on corporate performance are presented in the columns (1) to (3) of Table 4. The regression results of particular ESG rating scores on different facets of corporate performance are displayed in columns (4)–(6), and the regression results taking into account the moderating effect of ESG rating discrepancies are displayed in columns (7)–(9).

Table 4.

Multi-period difference-in-differences regression results.

Corporate dual-organizational performance is significantly improved by both ESG ratings and specific scores (β1 = 0.015, p1 < 0.002; β2 = 0.001, p2 < 0.000). This research indicates that corporate dual-organizational performance is significantly impacted by ESG ratings. This study standardizes the full-model regression coefficients to remove dimensional and magnitude differences, allowing for a more accurate comparison of their effects across performance dimensions and allowing to further investigate the relative effects of ESG ratings and specific scores on corporate financial and environmental performance. According to the standardized results, the impact of ESG ratings on environmental performance (β = 0.067, p < 0.01) is significantly lower than that of ESG scores (β = 0.026, p < 0.01). However, compared to ESG ratings (β = 0.040, p < 0.01), the impact of ESG scores on financial performance is substantially smaller (β = 0.001, p > 0.1). This discrepancy suggests that ESG scores and ratings have distinct effects on environmental and financial performance, supporting Hypothesis H1.

A closer look at columns (7)–(9) shows that differences in ESG ratings (ESGU) have a negative effect on corporate sustainable growth and financial performance while significantly improving environmental performance. This is explained by the way rating discrepancies affect business decision-making, which may result in a lack of agreement and reduce the efficiency of resource distribution. These differences could make financial sector decision-making more difficult. Rating discrepancies, however, offer more freedom and options for environmental decision-making, which may encourage companies to take on significant green innovation projects.

With respect to the interaction term between ESG policy time points (ESG) and ESG rating discrepancies (ESGU) (w1), there was a significant negative impact on environmental performance (β = −0.006, p < 0.05) and a significant positive impact on financial performance (β = 0.011, p < 0.05), but no significant effect on dual-organizational performance (β = 0.000, p > 0.1). Additionally, this study demonstrates that greater ESG scores and smaller rating discrepancies promote financial stability, especially by increasing resilience and stabilizing corporate financial performance [39]. These findings’ generalizability, however, might differ depending on the institutional setting. Rating disparities may have a more noticeable detrimental effect on environmental performance in nations with uneven or laxer ESG enforcement. According to research by Christensen et al. (2019), in areas with weak ESG regulatory frameworks, inconsistent implementation results in ineffective green governance, which ultimately hinders the accomplishment of green governance goals [40]. Because businesses might not feel pressured to align their practices with the intended environmental goals of ESG ratings, this inconsistent implementation could lead to less significant environmental improvements. Therefore, in nations with weaker ESG enforcement systems, the correlation between ESG ratings and environmental performance may be weaker.

4.4. Robustness Test

4.4.1. Parallel Trend Test

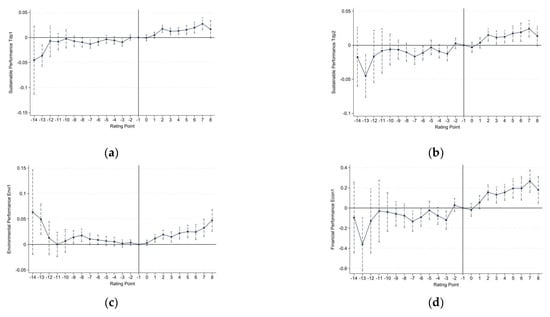

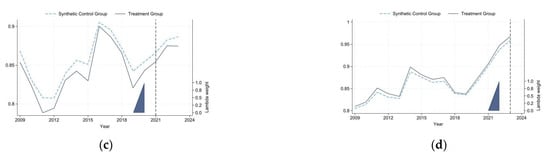

In order to determine whether corporate sustainable performance shows varied changes prior to and following the adoption of the ESG rating policy, we first employ event study methodology and conduct a multi-period DID test. The results show no discernible difference in sustainability performance indicators (Tdp1, Tdp2) between the pre-policy control group and the post-policy treatment group after tracking from the pre-policy period to 14 post-policy periods and 8 post-policy periods (as indicated above) (see Figure 2). However, the post-policy treatment group outperformed the control group in performance indicators following the implementation of the ESG rating policy, suggesting that the policy plays a significant role in enhancing corporate performance.

Figure 2.

Parallel trend test results for the impact of ESG. (a) Effect of ESG on Tdp1. (b) Effect of ESG on Tdp2. (c) Effect of ESG on Envi1. (d) Effect of ESG on Econ1.

Additional analysis of the performance response lag reveals that the policy effect takes two to three periods to manifest. This implies that institutional rigidity factors affecting organizational behavior should be taken into account during the policy transmission process. Businesses need time to adjust to new regulations, which includes making strategic changes and allocating internal resources. The reason for this lag is behavioral inertia, in which businesses show resistance to institutional changes, delaying the implementation of policies and the reallocation of resources, which impacts the promptness of corporate performance.

It is crucial to remember that the existence of this adaptation period does not imply that policy effects do not exist; rather, it indicates that companies’ internal structural and strategic adjustments in response to external policy pressures are a component of their response. Organizational adaptation through policy response, resource reallocation, and strategic modifications in innovation activities are all part of the process. Firms respond more forcefully as the policy’s effects take time to manifest, and performance gains become more noticeable as well. This implies that the policy’s influence extends into the internal operational and structural mechanisms of the company and affects many aspects of corporate performance. As a result, even though adaptation may take some time, the ESG rating policy is essential for encouraging the steady and sustainable growth of businesses.

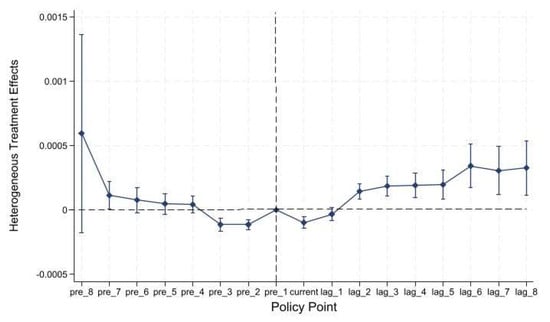

4.4.2. Heterogeneous Treatment Effects

Researchers have noted that the multi-period DID model implicitly assumes homogeneous treatment effects by calculating a weighted average of effects across groups at various times. Whether the context is static or dynamic, estimating with the traditional two-way fixed-effects model frequently introduces potential bias. In order to confirm whether the multi-period DID two-way fixed-effects estimates are still significant under heterogeneous treatment effects [41], this study uses the analysis method of De Chaisemartin and D’Haultfoeuille (2020) [42], dissecting all weights (see Figure 3). The reliability of the results was confirmed by the analysis, which showed that 5191 of the 5234 2 × 2 DID pairs had positive weights and only 43 had negative weights (less than 5%). A better-corrected average treatment effect (β = 0.0001295, p < 0.01) was obtained by estimating the weighted average effects of the “good” control groups after the “bad” control groups were eliminated.

Figure 3.

Event Study by De Chaisemartin and D’ Haultfoeuille [40].

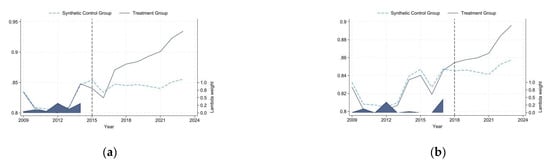

The driving effects of the ESG rating policy on corporate “dual-organizational performance” systems are systematically assessed in this study using the multi-period synthetic difference-in-differences (SDID) model and its dynamic extension framework. The study focuses on the robustness of policy transmission in the “harmonious coexistence” dimension. The SDID method accurately quantifies the distribution characteristics of policy effects across corporate heterogeneity by mitigating sample self-selection bias and policy endogeneity through the introduction of counterfactual weight matrices and covariate balancing constraints. Without adjusting for covariates, the average treatment effect of the SDID estimates is β1 = 0.02490 (SE = 0.00528, p < 0.01), according to the static model estimation results (see Table 5). With the effect size greatly exceeding that of the conventional multi-period DID model (β = 0.0152, SE = 0.00227, p < 0.01), it remains β2 = 0.03339 (SE = 0.00514, p < 0.01) after adjusting for covariates, demonstrating the statistical robustness of the SDID framework in detecting heterogeneous treatment effects. The robustness and consistency of the policy effect are confirmed by the core treatment effect coefficients, which converge to β = 0.02098 (SE = 0.00221, p < 0.01) and β = 0.02119 (SE = 0.00235, p < 0.01) with and without controlling for covariates, using alternative dependent variables for robustness checks (Columns (3)–(4)).

Table 5.

Multi-period SDID estimates.

Important empirical patterns are revealed by the visualization analysis (see Figure 4). The treatment and synthetic control groups had comparable paths before the policy intervention. However, ESG performance measures showed clear structural breaks after the policy shock as the treatment group’s ESG ratings fell sharply compared with the synthetic control group. These results imply that corporate dual organizational performance and its sub-dimensions are positively impacted by ESG rating policies, which is in line with the benchmark regression results. ESG rating policies result in significant improvements in the composite dimensions of corporate dual organizational performance through mechanisms like resource reallocation and the transmission of institutional pressure. Despite possible model misspecification, this conclusion is still strong.

Figure 4.

SDID trend graphs for the impact points in different years. (a) SDID trend for 2015 impact point. (b) SDID trend for 2018 impact point. (c) SDID trend for 2021 impact point. (d) SDID trend for 2023 impact point.

4.4.3. Other Robustness Tests

This study uses the percentage of female members and executives with a financial education background in the corporate management team as instrumental variables to address potential issues of omitted variables, measurement errors, reverse causality, and sample selection bias between ESG ratings and corporate dual-organizational performance. These variables are known for their “correlation” and “exclusivity” characteristics. With Cragg–Donald Wald F-statistic values above the 10% error tolerance threshold, the results in Table 6 (columns (1) and (2)) demonstrate that the first-stage instrumental variables significantly improve the tested variables, satisfying the correlation requirement. The Green Finance Reform and Innovation Pilot Zone DID policy shock is used as the instrumental variable in column (3). Its legitimacy is based on the following reasoning: on the one hand, the green finance reform policy has a direct impact on the availability of financing for businesses and the effectiveness of allocating green resources, which has a major motivating effect on raising ESG ratings and meeting the “relevance” requirement of an instrumental variable. However, as a regionally specific institutional arrangement, the policy only indirectly affects corporate dual-organizational performance through its impact on ESG ratings; it does not directly determine financial or environmental outcomes, which satisfies the “exogeneity” criterion. The results show that this instrumental variable significantly affects ESG rating levels, and the Cragg-Donald Wald F statistic is well above the 10% tolerance threshold, thereby confirming the validity of the instrument.

Table 6.

Other robustness test results.

ESG policy time points and the extent of ESG rating discrepancies are the two main independent variables, and they are both legitimate tools. The composite dual-organizational performance, which is determined by standardizing the Hua Zheng Index and Tobin’s Q Index, is used in column (4) in place of the dependent variable (Tdp5). Since external shocks and time lags can affect ESG rating policies, using corporate dual-organizational performance data from the current period alone might not adequately capture the delayed effects of policy implementation. As a result, a multi-period weighted average method is used to combine performance data from each time point with data from nearby periods. This approach better captures the policy’s long-term and progressive effects. In particular, the weights of the data for years t, t + 1, and t + 2 are 0.3, 0.4, and 0.3, respectively. After calculating the weighted average, the dependent variable (Tdp1_w) is the natural logarithm. The weighted treatment’s dependability and efficacy in resolving endogeneity concerns are further supported by the final regression results, which are displayed in Column (5).

5. Conditional Mediation Model

5.1. Path Analysis

By increasing the quantity and caliber of green patent applications, the aforementioned theoretical analysis shows that the ESG rating policy has a positive impact on corporate dual-organizational performance (financial and environmental performance). Testing hypotheses H3 and H4 is the next stage. This study employs standard testing procedures found in the literature, with reference to Jiang Ting’s (2022) two-step mediation effect testing procedure [25]. The baseline regression’s first column, which is mentioned separately in this section, is displayed in column (1) of Table 7. At the 1% significance level, the ESG rating policy has a significant positive impact on green patent authorizations, applications, and citation quality, as indicated by columns (2) through (4) (β1 = 14.422, p1 < 0.01; β2 = 8.180, p2 < 0.01; β3 = 0.354, p3 < 0.01). Concurrently, the citation quality of green patents is more positively impacted by the standardized ESG rating (β1 = 0.1322, p1 < 0.01) than are the authorization and application quantities (β1 = 0.3455, p1 < 0.01; β2 = 0.1777, p2 < 0.01). Put another way, under the combined influence of ESG policy pressure and benefits, the corporate strategic orientation of substantive green innovation shifts towards optimizing quality, focusing on producing high-tech innovations, as opposed to meeting rating requirements through the number of green patents. This illustrates how businesses have naturally shifted their strategic focus to meaningful green innovation in order to satisfy external ESG standards.

Table 7.

Mediation mechanism and direct-indirect moderation path analysis.

Corporate environmental awareness (Sum) and environmental penalty intensity (Pub) significantly reinforce the positive direct relationship between ESG ratings (ESG) and corporate dual-organizational performance (Tdp), according to the moderation regression results displayed in columns (5) and (9), respectively. According to Li Wanhong et al. (2023) [43] and Li Li et al. (2019) [44], environmental awareness encompasses the environmental disclosures made by businesses, such as their philosophy, goals, management systems, training, emergency preparedness, and recognition. According to Li Hong et al. (2021) [38], front-end path analysis in columns (6)–(8) shows that environmental consciousness has a positive impact on the amount and caliber of substantive green innovation, as measured by green invention patents. Environmental penalty intensity, measured by the logarithm of annual environmental penalties from the Beida Fabao judicial case database, reflects external institutional pressure and exhibits a complex moderating effect, both amplifying and constraining the intensity of green patent citations and applications, as documented in prior studies [45].

This inconsistent outcome suggests that environmental penalties under ESG rating conditions can boost the amount of significant green innovation produced by businesses while reducing the technical intensity of those outputs. The reasoning behind this is that, as a dual external constraint under ESG policies, environmental penalties compel businesses to adopt low-investment, low-barrier green innovation practices in order to swiftly restore their ratings and reputation. Even with high regulatory levels, companies reduce sustained investments in high-quality green innovations due to crowding-out effects and higher compliance costs, which lessens the technical intensity and impact of green innovation results. This is in contrast to the loss of quality. This result reflects the “quantity expansion + quality loss” strategic trade-off in corporate green innovation under policy and regulatory pressure [46].

5.2. Further Analysis

“Green patent bubbles” may be created as a result of the rapid increase in green patents [39], which does not always indicate an improvement in patent quality. In order to measure the company’s green innovation bubble, this study standardizes the calculation of the difference between the quantity and quality of green patents. The company’s green innovation bubble is more severe when this indicator’s value is higher. A regression analysis is carried out to look more closely at how different environmental conditions under ESG rating policies impact the distinction between the quantity and quality of green patents, as indicated in Table 8.

Table 8.

Regression analysis of moderating variables and ESG rating sensitivity to corporate green innovation bubble.

The number of green patent applications or authorizations is the metric used in this study from a quantitative standpoint. In order to evaluate the quality of green patent applications or authorizations, it uses Li Hong et al.’s (2021) knowledge breadth method [38]. First, a company’s internal differences within its green patents may not be accurately reflected by counting the number of main classification numbers in patents, which could lead to an overestimation of the industry’s patent quality.

Thus, a company’s knowledge breadth, which is determined using the Herfindahl index method, serves as a gauge for the overall quality of its green patents:

where Zit is the total number of green patent applications filed by company I in group mmm up to year t, and Zit is the total number of green patent applications filed by company i in all groups up to year t. A higher Pkit value reflects higher green patent quality since it shows a wider range of knowledge in the company’s green patents.

This study examines how ESG rating policies affect the amount and caliber of corporate green innovation, with a particular focus on the formation of green innovation bubbles. The regression analysis assesses how ESG rating policies affect the growth of these green innovation bubbles by looking at a number of moderating factors, including environmental awareness and the severity of environmental penalties.

Green innovation bubbles and ESG rating policies are positively correlated, according to the regression results (β1 = 0.240, p1 < 0.10; β2 = 0.285, p2 < 0.10). This shows that although ESG ratings push businesses to submit more green patent applications and get more green patents, more patents do not always translate into better innovation. As a result, businesses tend to prioritize increasing the quantity of green patents over enhancing their technical content and quality, mainly to meet ESG rating requirements.

Further analysis reveals that although green patenting activities are positively impacted by environmental awareness (w10) and the interaction with ESG rating policies (β1 = 0.053, p1 < 0.01; β2 = 0.068, p2 < 0.01), the corresponding improvement in innovation quality is still modest. This trend implies that while more patents are filed in response to ESG pressures, significant technological advancement is not always the result. Furthermore, this tendency is reinforced by environmental penalties (w9), which are significantly associated with green innovation bubbles (β1 = 0.045, p1 > 0.1; β2 = 0.062, p2 < 0.05). Instead of investing resources to improve the quality of innovation, companies seem to purposefully increase their patent counts in these situations in order to signal compliance and repair reputational harm.

Three mechanisms account for the quality decline under penalty pressure. First, businesses frequently use compliance-driven tactics, focusing on inexpensive, easily accessible patents that pass external inspection but are shallow technologically. Second, the cost of regulatory compliance and the financial burden of penalties discourage investment in better R&D projects, limiting the potential for ground-breaking innovation. Third, firms prioritize volume over substance due to the symbolic role of patents in signaling legitimacy, resulting in a trade-off between long-term innovative capacity and immediate reputational repair. This explains why environmental penalties ultimately result in a dilution of innovation quality and help create green innovation bubbles, even though they encourage more patenting activity.

5.3. Path Testing

This study uses the Process plugin and the Bootstrap method suggested by Preacher and Hayes (2004) with 5000 bootstrap samples and a 90% confidence interval to further validate the effects of moderating variables on the direct and front-end paths of the mediation mechanism [15]. Table 9 displays the test results. The mediation effect of ESG rating policies on the direct path between corporate dual-organizational performance is significantly positively moderated by environmental awareness and environmental penalty intensity (β1 = 0.0231, CI1 = [0.0198,0.0264]; β2 = 0.0217, CI2 = [0.0182,0.0252]), supporting hypotheses H3a and H4a. The quantity of green patent authorizations, applications, and citation quality are all significantly moderated by environmental awareness (β1 = 1.8422, CI1 = [1.3595,2.3742]; β2 = 4.6452, CI2 = [3.5601,5.8538]; β3 = 0.0408, CI3 = [0.0184,0.0627]), supporting hypothesis H3b. However, only the citation quality dimension of green patents is significantly moderated by the intensity of environmental penalties (β = −0.1200, CI= [0.0675,0.1750]), supporting hypothesis H4c. Hypothesis H4b is not validated because it does not significantly moderate the number of green patent authorizations and applications (β1 = −0.1644, CI1 = [−0.8801,0.5823]; β2 = 1.2489, CI2 = [−0.7643,3.6582]).

Table 9.

Mediation mechanism and direct path moderation test.

As a positive moderating factor, environmental awareness effectively promotes the quantity and quality of green patents, which in turn drives improvements in corporate dual-organizational performance, according to the specific mechanism analysis. The effects of the severity of environmental penalties are more complex, though. Compared to environmental awareness, which can be impacted by a number of internal and external factors, the indirect role of environmental penalties in encouraging corporate green innovation is demonstrated by their less noticeable impact. Consistent with the findings of earlier analyses, environmental awareness (β1 = −0.0818, CI1 = [0.0407,0.1275]; β2 = 0.0857, CI2 = [0.0409,0.1353]) and environmental penalty intensity (β1 = 0.1512, CI1 = [0.1131,0.1944]; β2 = 0.1394, CI2 = [0.1053,0.1757]) both significantly positively moderate the effect with regard to the green innovation bubble.

6. Heterogeneity Analysis

6.1. ESG Rating Discrepancy

As indicated in dimension one of Table 10, this study empirically investigates the effects of environmental regulations and ESG rating policies on the number of corporate green patent authorizations, applications, and citation quality across different ESG rating discrepancy intervals. We also use Fisher’s combination test to determine whether group differences are significant. The results show that the larger the ESG rating difference, the stronger the impact of environmental regulations and ESG policies on corporate green patent authorization and application numbers, and the more significant the coefficient between groups. At the 1% level, the interaction term (Regu-ESG) exhibits a statistically significant negative correlation. This implies that rather than enhancing one another, the relationship between environmental regulations and ESG policies replaces one another when ESG rating discrepancies are significant. Conflicts arise from the overlap of the two external policies in corporate green patent activities, which could reduce the impact of green patents and applications. The development and use of green patents may be hampered by uneven environmental requirements from outside governments in regions with significant ESG rating disparities. This finding also implies that in order to fully utilize the synergies between environmental regulations and ESG policies in fostering significant green innovation, a stronger connection between them needs to be made.

Table 10.

Environmental regulation and ESG rating—sensitivity regression analysis of substantive green innovation dimensions and ESG rating discrepancy.

6.2. Ownership Structure

According to the analysis of the heterogeneous effect of corporate ownership structure in the second dimension (see Meckling and Jensen, 1976 [11]) (see Table 11), state-owned businesses exhibit a substantially stronger interaction effect between environmental regulation policies and ESG rating policies than non-state-owned businesses. This is probably due to state-owned businesses’ superior policy guidance, better resource capabilities, and stronger institutional support, which make it easier for them to translate external policy dividends into meaningful green innovation outcomes, particularly in terms of the quantity and use of green patents. However, there are no discernible group differences in the quality of green patent citations, suggesting that external policies do not entirely propel improvements in the caliber of innovation. The innovation process is complicated by the interaction of elements like internal strategies, market demand, technical underpinnings, and R&D capabilities. Coordination and methodical internal and external improvement are therefore necessary to ensure the quality of green patents. To achieve “win-win” results, external policymakers must optimize their companies’ internal innovation systems; they cannot directly improve the quality of innovation on their own. Although the ownership structure is the main factor in the current analysis, other external institutional factors, such as political connections, subsidies, and access to capital, may also have an effect on these outcomes. Furthermore, the findings’ generalizability may differ depending on the institutional setting. For example, the impact of environmental regulations and ESG ratings may be less noticeable in nations with weaker ESG enforcement mechanisms because enforcement issues can reduce the efficacy of these policies. Future studies could examine how ownership structure and these outside variables interact, especially in nations with varying degrees of ESG policy.

Table 11.

Environmental regulation and ESG rating—sensitivity regression analysis of substantive green innovation dimensions and corporate ownership structure.

6.3. Corporate Life Cycle

As demonstrated in dimension three, regression analysis reveals that there is notable heterogeneity in corporate green innovation output across various life cycle stages in the relationship between media supervision and ESG ratings. Specifically, Table 12 shows that the coefficient of the interaction term in the decline stage is significantly higher in the Green model and Green1 regression results. The results indicate that firms in the decline stage—characterized by legitimacy challenges and the depletion of strategic resources—are more acutely responsive to external institutional pressures, particularly media supervision. Due to the combined effects of institutional restraints and reputational incentives, these companies are more likely to use green patenting as a calculated tactic to regain credibility and gain access to vital resources. It is crucial to take into account the possible endogeneity between media attention and innovative activity, even though the analysis backs up the claim that media supervision is a significant external driver of green innovation. Our empirical results, which are based on robust regression analysis, demonstrate the catalytic role of media oversight in promoting substantive green innovation, particularly during periods of organizational decline when internal drivers are weakened. This is true even though innovative firms may naturally attract greater media scrutiny. The growth stage’s interaction term coefficient is noticeably positive, demonstrating that media oversight encourages green R&D spending, boosting the amount and caliber of significant green innovation. The interaction term coefficient for established businesses, on the other hand, is smaller, suggesting that they are less subject to external reputational pressure, have fewer institutional restraints, and are less inclined to engage in significant green innovation [47].

Table 12.

Media supervision and ESG rating—sensitivity regression analysis of substantive green innovation dimensions and corporate life cycle.

The results, which are shown in Table 12, indicate that media oversight and ESG ratings both have significant moderating effects based on the stage of the company’s life cycle. Reputation, resource base, and institutional pressure all contribute to these effects. The limitations placed on businesses by outside media and ESG ratings are referred to as institutional pressure. The need to find new resources and regain competitive advantages is what motivates substantial green innovation in businesses that are in the decline stage. The reputation effect illustrates how media oversight shapes a company’s image and directs its environmentally friendly actions.

7. Discussion, Conclusions, and Policy Recommendations

7.1. Discussion

Using data from a multi-period DID model and conditional mediation analysis, this study examines the dynamic relationship between ESG ratings, substantive green innovation, and dual organizational performance. In order to investigate the relationships between ESG ratings, corporate sustainability performance (CSP), green innovation, environmental awareness, and regulatory pressures, we tested hypotheses H1–H4c. Although the effects differ across dimensions, the results support H1, which states that ESG ratings considerably raise CSP. While financial performance shows a longer-term improvement, consistent with the gradual market revaluation of sustainability investments, environmental performance improves in the short term, reflecting adherence to environmental standards and governance measures.

The results provide more evidence in favor of H2, demonstrating that substantive green innovation plays a mediating role in the relationship between ESG and CSP. Although resource limitations frequently result in declining returns in patent quality, higher ESG ratings encourage businesses to submit more green patent applications, indicating a bias toward quantity-driven innovation rather than substantive depth. The contradictory function of ESG rating differences supports this interpretation: although they worsen financial outcomes and capital market frictions, they also generate competitive pressures that push businesses to increase their green patent holdings. However, such expansion runs the risk of reducing the substantive quality of innovation when it is not in line with the availability of resources.

Regarding the moderating effects, H3a and H3b are supported, demonstrating that greater environmental consciousness increases managerial accountability and strategic alignment, which amplifies the impact of ESG ratings on CSP directly as well as indirectly through innovation. The findings for H4a–H4c also demonstrate the conflicting effects of environmental sanctions. Tougher penalties boost patent production and strengthen the ESG–CSP connection, but they also lower the quality of patent citations, suggesting a compliance-driven approach that puts quantity before quality. This dichotomy highlights the trade-offs associated with using external regulation as a catalyst for green innovation: penalties may increase the number of green technologies, but they may also create “green innovation bubbles” by discouraging innovative, high-quality ideas.

Lastly, by showing how ownership structures and firm life cycles influence ESG effectiveness, the heterogeneity analysis adds even more nuance. Due to their greater policy sensitivity and stronger resource endowments, state-owned enterprises are better able to balance the quantity and quality of innovation, reducing the adverse effects of rating divergences. In contrast, mature firms show organizational inertia, which decreases their responsiveness to ESG policies, while declining firms gain more from external media supervision, which activates compensatory innovation mechanisms. When taken as a whole, these results not only support the hypotheses put forth but also show the various ways that ESG ratings affect the performance of two organizations.

However, there are still certain restrictions. Readers may find it challenging to quickly identify the most innovative contributions due to the results’ relatively dense presentation. The narrative sometimes compromises readability for comprehensiveness because multiple insights are grouped together in lengthy, intricate sentences. Linking heterogeneity findings to more targeted, policy-oriented recommendations could further benefit the study because the discussion of practical implications is broader. These restrictions imply that although the study provides valuable theoretical and empirical insights, its impact and clarity could be improved by future presentation and implementation design improvements.

7.2. Conclusions

The impact mechanisms of ESG ratings, substantive green innovation, and corporate dual organizational performance are examined in this paper using a multi-period Difference-in-Differences (DID) model and a conditional mediation effect model. The findings indicate that corporate dual organizational performance is greatly enhanced by ESG ratings, with the effect being moderated by differences in ESG ratings. By creating information overload in the capital market, rating disparities have a detrimental impact on the enhancement of a company’s value in relation to its financial performance. In terms of environmental performance, rating discrepancies’ competitive effect encourages more green patents; however, because of resource limitations, patent quality may see diminishing returns. Lastly, a number of robustness tests and the parallel trend test validate these results.

According to conditional process analysis, substantive green innovation exhibits a “quality improvement” feature when ESG policy pressure and motivation coincide, demonstrating the potential of ESG mechanisms to promote sustainable development. Environmental awareness and the severity of environmental penalties are both important moderators in the “ESG Rating—Dual Organizational Performance” pathway. The positive impact of ESG ratings on financial and environmental outcomes is reinforced by stricter penalties that compel companies to reallocate resources and increased environmental awareness that improves strategic alignment and responsibility. However, significant trade-offs are revealed. While penalties are effective in increasing the number of green patents, they undermine the quality of those patents, indicating a shift toward low-value patents driven by compliance. In contrast, environmental awareness lessens the over-reliance on ESG policies to spur innovation. The danger of “green innovation bubbles,” where quantity growth conceals deteriorating quality, is highlighted by this imbalance. Therefore, in order to ensure long-term corporate sustainability rather than short-term compliance gains, ESG policies should not only encourage innovation numbers but also protect innovation quality.

Corporate ownership structure and life cycle stages have a major impact on the effects of ESG policies, according to heterogeneity analysis. State-owned businesses can improve the balance between innovation quantity and quality by reducing the negative effects of ESG rating discrepancies because they have larger resource endowments and are more sensitive to policy. On the other hand, media supervision has a more compensatory effect on declining businesses than on growth-stage businesses, and organizational rigidity causes mature businesses to exhibit inertia in their response to ESG policies. The “Policy Pressure—Innovation Matching—Performance Transformation” theoretical framework, which offers micro-level decision-making references to harmonize multi-dimensional ESG evaluation indicators and improve the synergy of substantive green innovation policies, is proposed in the study’s conclusion.

7.3. Policy Recommendations

This paper makes the following policy recommendations in light of the aforementioned findings.

7.3.1. Encouraging the Integration of Green Patent Quality Assessment into the ESG Evaluation System

The quality of innovation should be given more weight in the evaluation system. For instance, in order to lessen dependence on quantitative measures and prevent “greenwashing,” the environmental dimension should include extra indicators like conversion rates and technological impact. A cooperative mechanism involving several departments should be established to create a thorough list of important ESG issues, with precise evaluation metrics defined based on industry differences, in order to decrease rating discrepancies. Enhancing corporate green innovation quality can help the capital market become less sensitive to “greenwashing,” which will make it easier to find funding for green innovation initiatives and draw in long-term capital investment.

7.3.2. Adopting a “Dual Incentive-Constraint” Policy Tool to Regulate Environmental Behavior