Analyzing the Impact of Vision 2030’s Economic Reforms on Saudi Arabia’s Consumer Price Index

Abstract

1. Introduction

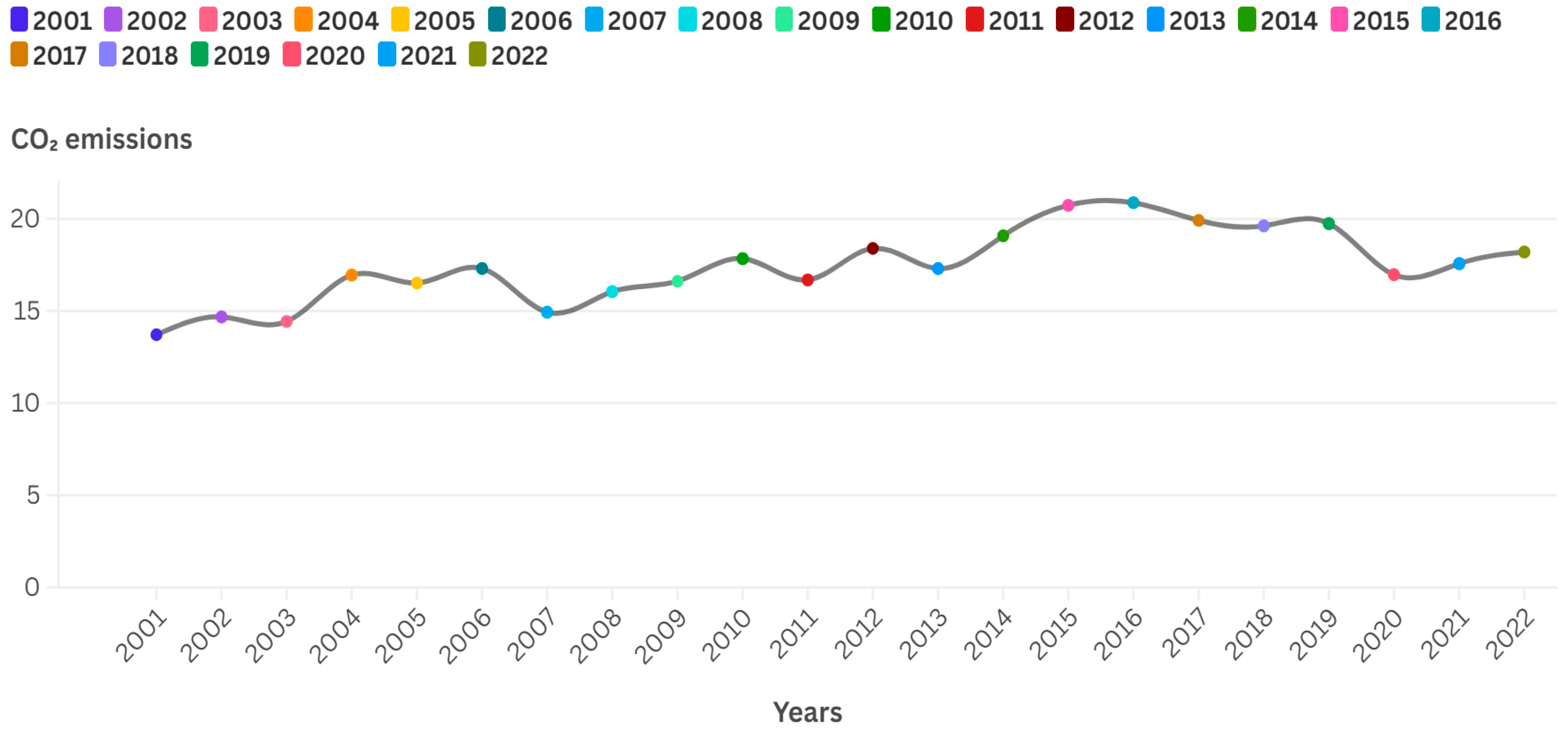

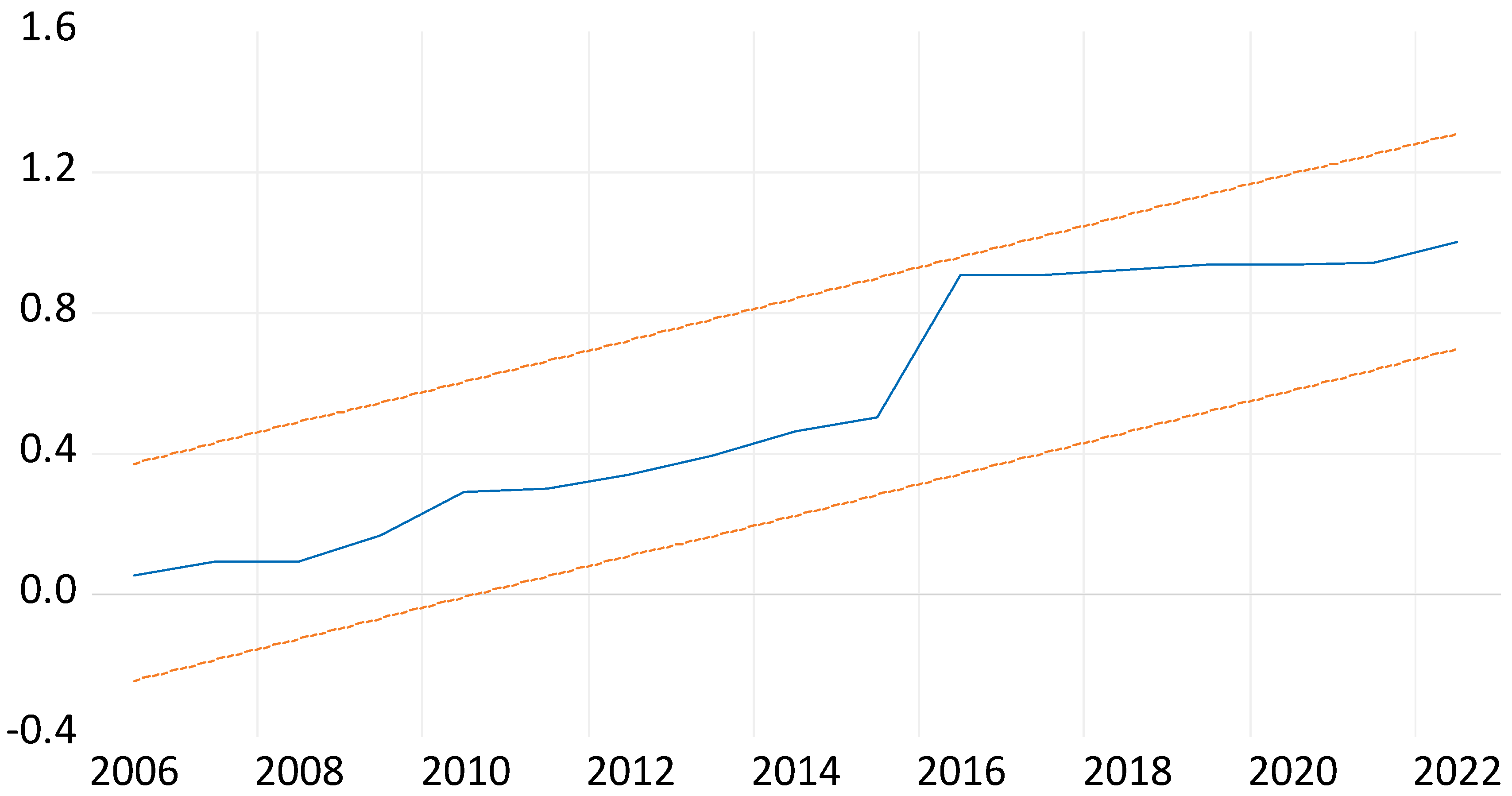

Overview of CO2 Emissions and Consumer Price Index in Saudi Arabia

2. Literature Review

2.1. CO2 Emission and Consumer Price Index

2.2. Labor Force and Consumer Price Index

2.3. Foreign Direct Investment (FDI) and Consumer Price Index

2.4. Trade Openness and Consumer Price Index

2.5. Theoretical Framework

3. Data and Methodology

3.1. Data

3.2. Methodology

3.2.1. Unit Root

3.2.2. NARDL Model

3.2.3. Diagnostic Analysis

3.2.4. Stability Test

4. Results and Discussion

4.1. Unit Root Results

4.2. Diagnostic Test of the Model

4.3. Model Stability Results

5. Discussion

6. Conclusions

6.1. Practical Implications

6.2. Theoretical Implications

6.3. Limitations and Future Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Correction Statement

References

- Ali, S.; Yusop, Z.; Kaliappan, S.R.; Chin, L.; Meo, M.S. Impact of trade openness, human capital, public expenditure and institutional performance on unemployment: Evidence from OIC countries. Int. J. Manpow. 2022, 43, 1108–1125. [Google Scholar]

- Amran, Y.A.; Amran, Y.M.; Alyousef, R.; Alabduljabbar, H. Renewable and sustainable energy production in Saudi Arabia according to Saudi Vision 2030; Current status and future prospects. J. Clean. Prod. 2020, 247, 119602. [Google Scholar]

- Rahman, R.; Qattan, A. Vision 2030 and sustainable development: State capacity to revitalize the healthcare system in Saudi Arabia. INQUIRY J. Health Care Organ. Provis. Financ. 2021, 58, 1–23. [Google Scholar] [CrossRef] [PubMed]

- Chowdhury, S.; Mok, D.; Leenen, L. Transformation of health care and the new model of care in Saudi Arabia: Kingdom’s Vision 2030. J. Med. Life 2021, 14, 347. [Google Scholar] [PubMed]

- Chen, Y.; Lee, C.-C. Does technological innovation reduce CO2 emissions? Cross-country evidence. J. Clean. Prod. 2020, 263, 121550. [Google Scholar]

- Shi, Q.; Zheng, B.; Zheng, Y.; Tong, D.; Liu, Y.; Ma, H.; Hong, C.; Geng, G.; Guan, D.; He, K.; et al. Co-benefits of CO2 emission reduction from China’s clean air actions between 2013–2020. Nat. Commun. 2022, 13, 5061. [Google Scholar]

- Ritchie, H.; Roser, M. Who Has Contributed Most to Global CO2 Emissions? Available online: https://ourworldindata.org/contributed-most-global-co2?fbclid=IwAR3wFPB_uJPxtA9jX6EPy9OPRhvDmZ7sir7sq2MLFO6xZbLMGkrtb5E77GQ (accessed on 3 July 2024).

- Yoro, K.O.; Daramola, M.O. CO2 emission sources, greenhouse gases, and the global warming effect. In Advances in Carbon Capture; Elsevier: Amsterdam, The Netherlands, 2020; pp. 3–28. [Google Scholar]

- Yao, Y.; Ivanovski, K.; Inekwe, J.; Smyth, R. Human capital and CO2 emissions in the long run. Energy Econ. 2020, 91, 104907. [Google Scholar]

- Zubair, A.O.; Samad, A.-R.A.; Dankumo, A.M. Does gross domestic income, trade integration, FDI inflows, GDP, and capital reduces CO2 emissions? An empirical evidence from Nigeria. Curr. Res. Environ. Sustain. 2020, 2, 100009. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, C.; Su, Z.; Zhu, M.; Ren, H. New structural economic growth model and labor income share. J. Bus. Res. 2023, 160, 113644. [Google Scholar] [CrossRef]

- Le Quéré, C.; Peters, G.P.; Friedlingstein, P.; Andrew, R.M.; Canadell, J.G.; Davis, S.J.; Jackson, R.B.; Jones, M.W. Fossil CO2 emissions in the post-COVID-19 era. Nat. Clim. Chang. 2021, 11, 197–199. [Google Scholar] [CrossRef]

- Knížat, P. Web scraped data in consumer price indices. Stat. J. IAOS 2023, 39, 203–212. [Google Scholar] [CrossRef]

- Fox, K.J.; Levell, P.; O’Connell, M. Multilateral Index Number Methods for Consumer Price Statistics; Economic Statistics Centre of Excellence (ESCoE): London, UK, 2022. [Google Scholar]

- Li, G.; Luo, J.; Liu, S. Performance evaluation of economic relocation effect for environmental non-governmental organizations: Evidence from China. Economics 2024, 18, 20220080. [Google Scholar] [CrossRef]

- Esaku, S. The long-and short-run relationship between the shadow economy and trade openness in Uganda. Cogent Econ. Financ. 2021, 9, 1930886. [Google Scholar] [CrossRef]

- Mead, D.; Ransom, K.; Reed, S.B.; Sager, S. The impact of the COVID-19 pandemic on food price indexes and data collection. Mon. Labor Rev. 2020, 143, 1. [Google Scholar] [CrossRef]

- Antonio, M.S.; Rusydiana, A.S.; Soeparno, W.S.I.; Rani, L.N.; Pratomo, W.A.; Nasution, A.A. The impact of oil price and other macroeconomic variables on the islamic and conventional stock index in indonesia. Int. J. Energy Econ. Policy 2021, 11, 418–424. [Google Scholar] [CrossRef]

- Voumik, L.C.; Rahman, M.H.; Islam, M.A.; Chowdhury, M.A.S.; Zimon, G. The impact of female education, trade openness, per capita GDP, and urbanization on women’s employment in South Asia: Application of CS-ARDL model. Systems 2023, 11, 97. [Google Scholar] [CrossRef]

- Shahnazi, R.; Shabani, Z.D. The effects of renewable energy, spatial spillover of CO2 emissions and economic freedom on CO2 emissions in the EU. Renew. Energy 2021, 169, 293–307. [Google Scholar] [CrossRef]

- Imrani, O.; Hamich, M.; Boulaksili, A. The consumer price index and it effect in the new ecosystems and energy consumption during the sanitary confinement: The case of an emerging country. In IOP Conference Series: Earth and Environmental Science, Proceedings of the First International Conference on Physical Geography and Physical Processes Landscapes, Jember, Indonesia, 6–17 October 2021; IOP Publishing: Bristol, UK, 2022; Volume 975, p. 012006. [Google Scholar]

- Kacou, K.Y.T.; Kassouri, Y.; Evrard, T.H.; Altuntaş, M. Trade openness, export structure, and labor productivity in developing countries: Evidence from panel VAR approach. Struct. Chang. Econ. Dyn. 2022, 60, 194–205. [Google Scholar] [CrossRef]

- Dix-Carneiro, R.; Goldberg, P.; Meghir, C.; Ulyssea, G. Trade and informality in the presence of labor market frictions and regulations. Econ. Res. Initiat. Duke (ERID) Work. Pap. 2021, 302. [Google Scholar] [CrossRef]

- Baccini, L.; Guidi, M.; Poletti, A.; Yildirim, A.B. Trade liberalization and labor market institutions. Int. Organ. 2022, 76, 70–104. [Google Scholar] [CrossRef]

- Bai, Y.; Costlow, L.; Ebel, A.; Laves, S.; Ueda, Y.; Volin, N.; Zamek, M.; Herforth, A.; Masters, W.A. Retail consumer price data reveal gaps and opportunities to monitor food systems for nutrition. Food Policy 2021, 104, 102148. [Google Scholar] [CrossRef]

- Kim, M. The Price Effect of Trade: Evidence of the China Shock and Canadian Consumer Prices; Centre for the Study of Living Standards: Ottawa, ON, Canada, 2020. [Google Scholar]

- Chaback, B. Ben-Joe Consumer Price Index. In Proceedings of the Discovery Day—Daytona Beach Campus, Daytona Beach, FL, USA, 10 April 2021. [Google Scholar]

- Li, T.; Yu, L.; Ma, Y.; Duan, T.; Huang, W.; Zhou, Y.; Jin, D.; Li, Y.; Jiang, T. Carbon emissions of 5G mobile networks in China. Nat. Sustain. 2023, 6, 1620–1631. [Google Scholar] [CrossRef]

- Fatima, S.; Chen, B.; Ramzan, M.; Abbas, Q. The nexus between trade openness and GDP growth: Analyzing the role of human capital accumulation. Sage Open 2020, 10, 2158244020967377. [Google Scholar] [CrossRef]

- Chang, S.H.; Soonhui, L.E.E. Note on Pattern Changes in Consumer Price Index (CPI) Year-On-Year (YoY) of the Republic of Korea Since the COVID-19 Pandemic via Statistical Analysis. Indian J. Econ. Bus. 2023, 22. Available online: http://www.ashwinanokha.com/resources/1.%20-Seok%20Ho%20CHANG%20and%20Soonhui%20LEE%20-%20final%20version.pdf (accessed on 3 July 2024).

- Schwalm, C.R.; Glendon, S.; Duffy, P.B. RCP8. 5 tracks cumulative CO2 emissions. Proc. Natl. Acad. Sci. USA 2020, 117, 19656–19657. [Google Scholar] [CrossRef]

- Rahman, A.; Wanita, F.; Arisha, R.; Kusuma, A.H.P.; Azhary, Z. Python-Powered Precision: Unraveling Consumer Price Index Trends in Makassar City through a Duel of Long Short-Term Memory and Gated Recurrent Unit Models. Ceddi J. Inf. Syst. Technol. (JST) 2023, 2, 44–50. [Google Scholar] [CrossRef]

- Leblebicioğlu, A.; Weinberger, A. Openness and factor shares: Is globalization always bad for labor? J. Int. Econ. 2021, 128, 103406. [Google Scholar]

- Mishra, P.; Alakkari, K.; Abotaleb, M.; Singh, P.K.; Singh, S.; Ray, M.; Das, S.S.; Rahman, U.H.; Othman, A.J.; Ibragimova, N.A. Nowcasting India Economic Growth Using a Mixed-Data Sampling (MIDAS) Model (Empirical Study with Economic Policy Uncertainty–Consumer Prices Index). Data 2021, 6, 113. [Google Scholar] [CrossRef]

- Brutger, R.; Guisinger, A. Labor market volatility, gender, and trade preferences. J. Exp. Political Sci. 2022, 9, 189–202. [Google Scholar] [CrossRef]

- Abdul-Mumuni, A.; Amakye, K.; Abukari, A.-L.; Insaidoo, M. Modeling trade openness–unemployment nexus in sub-Saharan Africa: The role of asymmetries. Afr. J. Econ. Manag. Stud. 2023, 14, 792–805. [Google Scholar] [CrossRef]

- Reinsdorf, M.; Schreyer, P. Measuring consumer inflation in a digital economy. In Measuring Economic Growth and Productivity; Elsevier: Amsterdam, The Netherlands, 2020; pp. 339–362. [Google Scholar]

- Li, L. An empirical analysis of rural labor transfer and household income growth in China. J. Chin. Hum. Resour. Manag. 2023, 14, 106–116. [Google Scholar] [CrossRef]

- Gonçalves, E.; Taveira, J.G.; Labrador, A.; Pio, J.G. Is trade openness a carrier of knowledge spillovers for developed and developing countries? Struct. Chang. Econ. Dyn. 2021, 58, 66–75. [Google Scholar] [CrossRef]

- Haqqoni, M.G.A.; Pramana, S. Implementation of marketplace data in the production of Consumer Price Index in Indonesia. Data Sci. 2022, 5, 79–95. [Google Scholar] [CrossRef]

- Anser, M.K.; Syed, Q.R.; Apergis, N. Does geopolitical risk escalate CO2 emissions? Evidence from the BRICS countries. Environ. Sci. Pollut. Res. 2021, 28, 48011–48021. [Google Scholar] [CrossRef]

- Amna Intisar, R.; Yaseen, M.R.; Kousar, R.; Usman, M.; Makhdum, M.S.A. Impact of trade openness and human capital on economic growth: A comparative investigation of Asian countries. Sustainability 2020, 12, 2930. [Google Scholar] [CrossRef]

- Veckalne, R.; Humbatov, H. Impact of oil prices on the consumer price index: In the case of azerbaijan, latvia and uzbekistan. TURAN Strat. Arastirmalar Merk. 2023, 15, 341–355. [Google Scholar]

- Liu, Z.; Ngo, T.Q.; Saydaliev, H.B.; He, H.; Ali, S. How do trade openness, public expenditure and institutional performance affect unemployment in OIC countries? Evidence from the DCCE approach. Econ. Syst. 2022, 46, 101023. [Google Scholar] [CrossRef]

- Handel, M.J. Growth trends for selected occupations considered at risk from automation. Growth 2022, 32, 1–24. [Google Scholar] [CrossRef]

- Harrison, A.; Segelhorst, A. Do consumer price indices in oil-producing economies respond differently to oil market shocks? Evidence from Canada. Empir. Econ. 2024, 21, 1–38. [Google Scholar] [CrossRef]

- Riofrio, J.; Infante, S.; Hernández, A. Forecasting the Consumer Price Index of Ecuador using Classical and Advanced Time Series Models. In Conference on Information and Communication Technologies of Ecuador, Proceedings of the 11th Ecuadorian Conference (TICEC 2023), Cuenca, Ecuador, 18–20 October 2023; Springer: Berlin/Heidelberg, Germany, 2023; pp. 128–144. [Google Scholar]

- Yu, B.; Gao, Y. Forecast and Analysis of Shanghai Consumer Price Index based on Markov chain. In Proceedings of the 2nd International Conference on Bigdata Blockchain and Economy Management (ICBBEM 2023), Hangzhou, China, 19–21 May 2023. [Google Scholar]

- Palumbo, L.; Laureti, T. Finding the goldilocks data collection frequency for the consumer price index. Soc. Sci. Res. Netw. 2024, 33, 23–38. [Google Scholar] [CrossRef]

- Zheng, C.; Chen, H. Revisiting the linkage between financial inclusion and energy productivity: Technology implications for climate change. Sustain. Energy Technol. Assess. 2023, 57, 103275. [Google Scholar] [CrossRef]

- Dankumo, A.M.; Ishak, S.; Bani, Y.; Hamzah, H.Z. Relationship between governance and trade: Evidence from Sub-Saharan African countries. Res. World Econ. 2020, 11, 139–154. [Google Scholar] [CrossRef]

- Kong, Q.; Peng, D.; Ni, Y.; Jiang, X.; Wang, Z. Trade openness and economic growth quality of China: Empirical analysis using ARDL model. Financ. Res. Lett. 2021, 38, 101488. [Google Scholar] [CrossRef]

- Ngouhouo, I.; Nchofoung, T.N. Does trade openness affects employment in Cameroon? Foreign Trade Rev. 2021, 56, 105–116. [Google Scholar] [CrossRef]

- Rois, R.; Basak, T.; Rahman, M.M.; Majumder, A.K. Modified Breusch-Godfrey Test for restricted higher order autocorrelation in dynamic linear model-a distance based approach. Int. J. Bus. Manag. 2012, 7, 88. [Google Scholar] [CrossRef]

- Sun, L.; Wang, K.; Xu, L.; Zhang, C.; Balezentis, T. A time-varying distance based interval-valued functional principal component analysis method–A case study of consumer price index. Inf. Sci. 2022, 589, 94–116. [Google Scholar] [CrossRef]

- Ndlovu, S.E. The High-Frequency Response of the Johannesburg Stock Exchange All Share Index to South African Trade Balance and Consumer Price Index Announcements: An Event Study Approach. Master’s Thesis, University of the Witwatersrand, Johannesburg, South Africa, 2022. [Google Scholar]

- Cobbinah, M.; Alnaggar, A. An attention encoder-decoder RNN model with teacher forcing for predicting consumer price index. J. Data Inf. Manag. 2024, 6, 65–83. [Google Scholar] [CrossRef]

- Costales, J.A. Cost Modeling and Analysis of the Consumer Price Index in the Philippines. In Proceedings of the 10th International Conference on Software and Computer Applications, Kuala Lumpur, Malaysia, 26 February 2021; pp. 32–38. [Google Scholar]

- Dorn, F.; Fuest, C.; Potrafke, N. Trade openness and income inequality: New empirical evidence. Econ. Inq. 2022, 60, 202–223. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 1979, 74, 427–431. [Google Scholar]

- Kniss, A.R.; Vassios, J.D.; Nissen, S.J.; Ritz, C. Nonlinear regression analysis of herbicide absorption studies. Weed Sci. 2011, 59, 601–610. [Google Scholar] [CrossRef]

- Milliken, G.A. Nonlinear Regression Analysis and Its Applications; Taylor & Francis: Abingdon, UK, 1990. [Google Scholar]

- Smyth, G.K. Nonlinear regression. Encycl. Environmetrics 2002, 3, 1405–1411. [Google Scholar]

- Shin, N.-H.; Lee, S.-H.; Kim, C.-S. Moving window regression: A novel approach to ordinal regression. In Proceedings of the IEEE/CVF Conference on Computer Vision and Pattern Recognition, New Orleans, LA, USA, 19–20 June 2022; pp. 18760–18769. [Google Scholar]

- He, Y.-L.; Wang, X.-Z.; Huang, J.Z. Fuzzy nonlinear regression analysis using a random weight network. Inf. Sci. 2016, 364, 222–240. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D.; Shahbaz, M.; Roubaud, D.; Farhani, S. How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 2018, 113, 356–367. [Google Scholar] [CrossRef]

- Szabó-Szentgróti, G.; Végvári, B.; Varga, J. Impact of Industry 4.0 and digitization on labor market for 2030-verification of Keynes’ prediction. Sustainability 2021, 13, 7703. [Google Scholar] [CrossRef]

- Brown, R.L.; Durbin, J.; Evans, J.M. Techniques for testing the constancy of regression relationships over time. J. R. Stat. Soc. Ser. B Stat. Methodol. 1975, 37, 149–163. [Google Scholar] [CrossRef]

- Hamsal, M. The Effect of Paradoxical Strategies on Firms’ Positional Advantage and Performance: The Case of Indonesian Banking Industry. In Proceedings of the International Conference on Economics and Business Management (EBM-2015), Phuket, Thailand, 29–30 July 2015. [Google Scholar]

- Iyoha, M. Macroeconomics Theory and Policy; Mindex Publishing: Benin City, Nigeria, 2004. [Google Scholar]

- Coddington, A. Keynesian economics: The search for first principles. J. Econ. Lit. 1976, 14, 1258–1273. [Google Scholar]

| Variable | Symbol | Units | Source |

|---|---|---|---|

| Consumer Price Index | CPI | annual % | WDI |

| CO2 emissions | CO2 | mt per capita | GCB |

| Labor Force | LF | Total | WDI |

| Foreign Direct Investment | FDI | net inflow (% of GDP) | WDI |

| Trade Openness | GDP | % of GDP | WDI |

| Variables | CPI | CO2 | FDI | LF | TO |

|---|---|---|---|---|---|

| Mean | 0.7625 | 2.8532 | −0.5485 | 16.2492 | 4.2812 |

| Median | 0.8521 | 2.8506 | −0.4549 | 16.2913 | 4.2823 |

| Maximum | 2.2895 | 3.0383 | 1.1928 | 16.6259 | 4.5654 |

| Minimum | −1.3976 | 2.6178 | −4.5407 | 15.8079 | 3.9062 |

| SD | 0.8974 | 0.1165 | 1.2890 | 0.2650 | 0.1817 |

| Correlation Matrix | |||||

| CPI | 1 | ||||

| CO2 | 0.1631 | 1 | |||

| FDI | −0.0146 | 0.3148 | 1 | ||

| LF | 0.4264 | 0.7449 | 0.2719 | 1 | |

| TO | 0.2680 | −0.2577 | 0.1247 | −0.4824 | 1 |

| Variable | Augmented Dickey–Fuller | Decision | Phillips–Perron | Decision | ||

|---|---|---|---|---|---|---|

| I(0) | I(1) | I(0) | I(1) | |||

| CPI | −4.3653 ** (0.0036) | I(0) | −1.9468 (0.3061) | −6.4573 *** (0.0000) | I(1) | |

| CO2 | −2.3882 (0.1566) | −6.1981 *** (0.0001) | I(1) | −2.3717 (0.1610) | −6.1981 *** (0.0001) | I(1) |

| FDI | −6.167151 *** (0.0001) | I(0) | −7.5974 *** (0.0000) | I(0) | ||

| LF | −1.8321 (0.3556) | −2.9437 * (0.0580) | I(1) | −1.8451 (0.3499) | −2.8811 * (0.0653) | I(1) |

| TO | −1.0875 (0.7007) | −3.0619 ** (0.0461) | I(1) | −1.2407 (0.6364) | −3.0232 ** (0.0497) | I(1) |

| Lag | AIC | SC | HQ |

|---|---|---|---|

| 0 | 0.7482 | 0.9971 | 0.7968 |

| 1 | −5.6791 | −4.1855 | −5.3875 * |

| 2 | −5.8958 ** | −3.1576 | −5.3613 |

| Diagnostic Statistics Test | F-Statistics (Probability) | Result |

|---|---|---|

| Breusch–Godfrey LM test | 0.7955 | No problem with serial correlations |

| Breusch–Pagan–Godfrey | 0.6318 | No problem of heteroscedasticity |

| ARCH | 0.1789 | No problem of heteroscedasticity |

| Jarque–Bera test | 0.5897 | Estimated residuals are normal |

| R2 | 0.9096 | The model fit is very good |

| Test Statistics | Value | K |

| F-statistics | 13.9407 | 5 |

| Critical bound values | ||

| Significance | I(0) | I(1) |

| 10% | 2.26 | 3.35 |

| 5% | 2.62 | 3.79 |

| 2.5% | 2.96 | 4.18 |

| 1% | 3.41 | 4.68 |

| Dependent Variable: CPI | ||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| Short-term Asymmetric Relationship | ||||

| D(CO2) | −5.0989 | 0.4594 | −11.0986 | 0.0001 ** |

| D(FDI) | 0.0029 | 0.0313 | 0.0926 | 0.9298 |

| D(FDI(−1)) | 0.2187 | 0.0324 | 6.7354 | 0.0011 ** |

| D(LF) | −9.7582 | 14.5290 | −2.6716 | 0.0710 * |

| D(T) | −5.3582 | 1.1414 | −6.4686 | 0.0013 ** |

| D(T) | −1.4690 | 0.6727 | −2.1837 | 0.0807 * |

| CointEq(−1) | −1.3803 | 0.1067 | −12.9340 | 0.0000 *** |

| Long-term Asymmetric Relationship | ||||

| CO2 | −3.1383 | 1.0844 | −2.8940 | 0.0340 ** |

| FDI | −0.2165 | 0.2209 | −0.9803 | 0.3719 |

| LF | −6.9980 | 1.4975 | −4.6731 | 0.0055 ** |

| T | 11.0188 | 1.1775 | 9.3575 | 0.0002 ** |

| T | −2.3373 | 0.8111 | −2.8816 | 0.0345 ** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bilal, M.; Alawadh, A.; Rafi, N.; Akhtar, S. Analyzing the Impact of Vision 2030’s Economic Reforms on Saudi Arabia’s Consumer Price Index. Sustainability 2024, 16, 9163. https://doi.org/10.3390/su16219163

Bilal M, Alawadh A, Rafi N, Akhtar S. Analyzing the Impact of Vision 2030’s Economic Reforms on Saudi Arabia’s Consumer Price Index. Sustainability. 2024; 16(21):9163. https://doi.org/10.3390/su16219163

Chicago/Turabian StyleBilal, Muddassar, Ammar Alawadh, Nosheen Rafi, and Shamim Akhtar. 2024. "Analyzing the Impact of Vision 2030’s Economic Reforms on Saudi Arabia’s Consumer Price Index" Sustainability 16, no. 21: 9163. https://doi.org/10.3390/su16219163

APA StyleBilal, M., Alawadh, A., Rafi, N., & Akhtar, S. (2024). Analyzing the Impact of Vision 2030’s Economic Reforms on Saudi Arabia’s Consumer Price Index. Sustainability, 16(21), 9163. https://doi.org/10.3390/su16219163