Abstract

The increased focus on environmental (E), social (S), and governance (G) (ESG) disclosure has become a necessary step toward the integration of sustainability practices into firms’ culture to meet the expectations of stakeholders. The social and environmental implications of firm activities on the environment and surrounding communities have led to the growing demand for useful non-financial information. This paper investigates the impacts of the board’s corporate social responsibility (CSR) strategy and CSR orientation, GRI, and the country–cultural dimensions, based on Hofstede’s measures of ESG disclosure practices within Europe. Using a European dataset from Bloomberg and Refinitiv Eikon, this paper adopts a quantitative research methodology to test the research hypotheses through a statistical analysis of 7840 observations from European companies to analyze the extent of the relationship between micro- and macro-variables and the disclosure of company ESG. Our findings suggest that both board CSR orientation and strategy and the GRI have positively and significantly affected the overall disclosure of ESG practices within Europe. When examining country–cultural dimensions, we find that individualism and feminine cultures are positively associated with increased levels of ESG disclosure. Our findings shed light on factors affecting ESG disclosure practices within Europe and could be of interest to companies, policy makers, and other stakeholders.

1. Introduction

It is undeniable that non-financial information produced by companies has gained an increasing interest in the research sphere of accounting and sustainability in recent years [1,2,3,4,5]. The reporting of this sustainability information is prepared through information on corporate social performance (CSP), sustainability strategy, and goals evaluated by ESG factors [6]. This increase in reporting of nonfinancial information originates from increased societal attention and demand on how firms operate, with society questioning how firm activities affect the environment [1,2,3,4,5]. This need for transparency from larger stakeholders leads to the need for comparable non-financial information to assess company sustainability performance [7]. The inclusion of sustainability reports includes information related to emissions, waste, human rights, and corporate governance factors that are not captured in financial reports [2,3,5]. Sustainability reports target a wider audience of users, from governments to investors, customers, suppliers, and employees [4]. ESG disclosure scores are practices that can be used to satisfy investors’ information needs requirements. At a firm level, an increased level of non-financial information mitigates risk and can increase corporate financial performance from risk mitigation due to the reduction of the cost of capital by disclosing more non-financial information [8]. As suggested by Ioannou and Serafeim, the disclosure of ESGs varies between firms and countries [9]. Therefore, this research will further this investigation to determine factors that affect ESG disclosure practices in Europe. Within the Europe region, European managers view ESG practices in a different way. Influenced by country-level factors such as cultural systems, the differences in ESG disclosure practices create an interesting discussion and analysis. The absence of the standardization of ESG reporting requires an investigation into why firms disclose ESG information and what factors play a mediating role in this disclosure [8].

In light of this, the study aims to investigate the determinants that affect higher levels of ESG disclosure. In this research paper, we investigate the impact of the CSR orientation of the board, the CSR strategy of the board, the GRI and the country–culture dimensions on the level of ESG disclosure practices of firms in Europe. When analyzing board characteristics, we expect there to be a link between board orientation and its three components, the presence of an audit committee with financial expertise, board independence, and if there is gender diversity in the board, captured by the works of Liao et al. [10]. Previous studies by Shaukat et al. have suggested that these three board attributes increase firm CSR activities and their environmental performance [11]. Further research on the orientation of the CSR board from Helfaya and Moussa suggests that a strong level of board orientation is more likely to be more environmentally responsible. Therefore, ESG scores have become a key component of CSR [12,13]. Additionally, Shaukat et al. use the board CSR strategy score and find that firms with a more clear and comprehensive CSR strategy lead to higher environmental performance due to long-term orientation. This long-term orientation means that ESG areas are considered [10]. In recent years, numerous studies have measured and evaluated the impact of both firm (i.e., micro-level) and country (i.e., macro-level) factors on ESG disclosure practices. However, these micro and macro factors that jointly affect such levels of ESG disclosure remain unexplored, as there are an increasing number of factors that affect such levels, especially in cross-country studies. Alternatively, disclosed ESG information can affect the value of the firm if investors see such information as greenwashing risks faced by the firm [5]. Cucari et al. highlights the importance of CSR influences, such as the role of the CSR committee and the number of women on the board, having influence on ESG scores in an Italian context [12]. Toumi et al. explore the region of origin of the director for CSR disclosure linking with its cultural context by separating the representation between Anglo–American and European directors in France [14].

Based on a sample of 784 European firms during the period of 2011 and 2020, this paper makes several contributions to the literature. Although this previous literature on ESG disclosure is a highly researched field, we argue that the use of country–culture dimensions based on Hofstede’s cultural dimensions dummy variables, adapted from Li et al.’s classifications of Hofstede’s 2010 descriptive values, adds a new contribution to the literature, as previous studies use index numbers [15]. Second, the relationship between our impacts on CSR characteristics and ESG disclosure scores further expands the theoretical contribution of the CSR literature to the CSR strategy and orientation within CSR research [14].

Our results indicate that effective CSR-orientated firms that consider long-term strategies and promote a high level of board CSR orientation and a high level of CSR strategy led to a positive effect on the quality of ESG disclosure. Furthermore, the existence of a firm that follows the GRI guidelines has a significant effect on the level of ESG disclosure within our sample. Within this research, we further present the study not only with ESG as a whole component but within the individual pillars. We find that ESG disclosure is intricately linked to these internal characteristics that are linked to CSR-orientated directors creating such a positive link. Within the cultural element of this research, our results indicate that firms headquartered within cultural dimensions that exhibit feminine with long-term collaborative concern for social and environmental issues see an increased level of ESG disclosure scores. This research also further strengthens the link between firm and country-level attributes and ESG quality disclosure scores. These results support the theories of legitimacy, stakeholder, signaling, agency, and institutional. Thus, this paper extends the predicative power to these overlapping theories. Our research findings provide a link between both firm-level and country-level factors that affect the level of European ESG disclosure practices.

The remainder of this paper is structured as follows. Section 2 presents the relevant review of the literature, followed by a discussion of the theoretical framework and the development of the main research hypotheses in Section 3. Section 4 describes the research methodology. Section 5 discusses our empirical results, followed by concluding remarks in Section 6.

2. Literature Review

The term ‘ESG’ was introduced in 2004 in ‘Who Cares Wins’ and was introduced to find ways to incorporate the aspects of ESG into the capital market [16]. From this point on, ESG is seen as an extension of traditional CSR and socially responsible investment (SRI) [1,2]. The growing public awareness of corporate recognition of actions toward the planet has led to this increase in the implementation of sustainability strategies. Within this, an increasing number of firms have now revealed their ESG information to the public [8]. The concern around ESG issues has grown into the realm of climate change, concern over poor working conditions such as safety violations, etc. [17]. Interest in ESG is also seen from the corporate perspective, identified by the Governance and Accountability Institute. For example, in their 2018 report, the institute found that 86% of the S&P 500 companies released sustainability reports [18]. These figures reflect the increase in sustainability reporting growth and how disclosure of ESG has become a tool for communicating sustainability activities [5,9]. This increase in the number of standalone sustainability reports published and/or CSR sections in annual reports is not only seen by investors and corporate management [18]; Helfaya and Whittington note that disclosure of ESG is desirable both from a private and public perspective. From a theoretical point of view, the link between the integration of the ESG strategy and cultural values can be seen [19]. From a theoretical point of view, the link between the integration of the ESG strategy and cultural values can be seen. Toumi et al. note that the cultural system within the country has effects on managerial decision-making processes [14]. This is further examined by Baldini et al. note that culture affects voluntary and mandatory disclosure of sustainability information [20]. Ioannoi and Serafeim note that within countries operating with a low level of social cohesion and unequal distribution of opportunities, managers feel a greater obligation within key stakeholders to enforce key increase in corporate disclosure through ESG reporting [9]. There are motivations behind reporting on ESG practices, within the capital markets; such disclosure is seen as effective risk management tool [1].

2.1. Importance of ESG Disclosure

Growing concerns about corporate CSR and sustainable development practices have been of central importance in meeting stakeholders’ expectations [21]. Therefore, the integration of a sustainable business strategy into the culture of the organization is believed to fulfil the varied expectations of stakeholders. Integration of ESG into strategic business operations has become vital when evaluating a firm’s performance [21]. In this vein, socially responsible investing is an investment strategy that considers two main components: (1) sustainable financial return, which focusses on long-term financial performance to create shareholder value; (2) nonfinancial returns to protect the interests of no shareholder stakeholders [22]. Therefore, stakeholders are increasingly exerting pressure on companies to minimize their negative impacts on society. Stakeholders also exert pressure to report increasingly detailed information on said practices through ESG disclosure [23]. This increased level of transparency ensures that companies act visibly and report on their activities, holding companies responsible for their actions [2,4]. Within this, the Sustainability Accounting Standards Board (SASB) developed ESG financial materiality standards. Khan et al. propose that the value of ESG is industry-sensitive and may not be important in some industries [24]. Furthermore, Williams also found this link within the disclosure of ESG and materiality within industries [25]. The work of Schiehll et al.’s integrated SASB content analysis and identified stock price information is sensitive to ESG disclosure components. This indicates that industry-specific materiality should be considered in sustainability reports [26]. The findings also suggest that as ESG disclosure is industry-driven, stakeholders base non-equal weights on ESG disclosure based on the industry they are in, i.e., high or low industry impact.

Disclosure of ESG has become increasingly important for the reputation, brand image, and investment decision-making of a firm [27]. The ESG activities of a firm are considered crucial to institutional and individual investors, as disclosure of ESG serves the opportunities and risks faced by the firm. For example, Ellili’s study states that investors now use ESG information to decide whether to invest in a firm or not. Consequently, ESG disclosure plays an important role in the growing need to satisfy investors’ demands for non-financial information and corporate compliance, such as the GRI sustainability reporting framework [28]. The interplay between firm-level and country-level attributes is also significant within ESG disclosure performance. For example, Schiehll et al. found that cross-national governance has equated governance effectiveness with shareholder wealth. Within other cross-country literature [29], the research found that investor protection from the firm ownership structure is important for higher levels of governance within firms. The overall governance of the firm is highly influenced by voluntary codes, relationships, and the social norms seen in the country headquarters that establish the president for the internal governance systems in place [29]. In fact, there are several sustainability reporting frameworks, such as GRI and the International Integrated Reporting Council (IIRC) framework that covers ESG; these frameworks aim to provide reliable reporting guidelines that create comparability between firms [30]. However, the production of reports means that an effective corporate governance system must be in place. These build trust with end users of this information that fosters innovation in the capital market through the achievement of sustainable financial performance [31]. The overall objective of the disclosure of ESG used as a sustainable development mechanism is to create a long-term solution to the needs of society and protect the ecosystem [32]. Within the global sustainability agenda, the mitigation of climate change and the social shift to social and governance factors have become permanent characteristics of investors [33]. Furthermore, the ‘Triple Bottom Line’ model aims to protect and sustain society and the environment for future generations by achieving positive profit, making people happy and protecting the planet (i.e., 3Ps). This also involves maximizing the objective of market capitalization [34]. The focus on sustainability strategy means that it must be financially secure to create long-term value from reducing environmental impact through product innovation and activities to create a strategy that creates a competitive advantage. In summary, disclosure of ESG is considered necessary to create sustainable growth and provide market metrics for investment decisions [32].

2.2. EU Context of Sustainability

In light of significant differences in mentalities between different member states, the current EU framework on the disclosure of non-financial information does not provide a one-size-fits-all reporting of corporate narratives [35]. The perception of European governments is drawn from a myriad of intelligent and reflexive tools and guidance for responsible business practices that are continually drawn from EU institutions [35]. In the same context, Deegan states, governments tend to believe that social and environmental practices should remain voluntary and be determined by capital market forces and take the side of businesses when it comes to expanding corporate accountability [36]. In addition, social and environmental practices have been criticized in the social accounting literature for their lack of relevance and for their failure to affect sustainable development [36,37]. In the past, ESG disclosure has been offered on a voluntary basis in addition to traditional regulations to address domestic and global issues. In the absence of regulation for companies, there is limited motivation and incentive for companies to disclose more ESG information [38]. Furthermore, societies pay the benefits of ESG disclosures, and the company pays the cost of preparing and publishing this ESG information to the public [38]. This absence of regulation means that individual rating agencies have different weightings for ESG disclosure, therefore ratings for the same company due to different weightings, and decreased comparability between different rating agencies, as the information is based on different key words creating biases [39].

The importance and need for non-financial information for internal and external stakeholders has increased [40]. Within the European context, on 12 June 2013, the EU adopted Directive 2013/50/EU, which amended the previous transparency directive 92004/109/EC) [41]. This amendment addressed stakeholders’ concerns that ESG disclosure practices should be required in conjunction with mandatory financial requirements for EU firms [41]. The implementation of the revised EU Directive 95/2014 is the first towards the transition from voluntary to mandatory reporting requirements of nonfinancial information. The purpose of this European Directive is to increase the overall integration of nonfinancial information into business strategies that enable the monitoring and communication of suitability efforts through this mandatory reporting [42]. This EU Directive also encompasses a broader strategy for promoting CSR within European firms. This creates a strong instrument for a more proactive system, where a softer approach to non-financial reporting has not been as effective with CSR integration [43]. In general, this directive requires large and listed companies with more than 500 employees in Europe to address nonfinancial issues such as social themes, staffing issues, human and labor rights, diversity policies, and business practices [43]. Cooper and Owen, for example, debate the choice between mandatory and voluntary reporting based on the EU directive. The authors argue that it is difficult to gauge the correct level of detail of the mandatory requirements in each included company [44]. This lack of sufficient information leads to a failure to change the regulation. However, one of the key points behind the EU Directive (2014/95/EU) is that all countries must follow the same rules for ESG information to increase the comparability and usefulness of the information for stakeholders [43].

3. Theoretical Framework and Hypothesis Development

3.1. Theoretical Framework

Research on ESG disclosure has increased significantly in recent years with a multiple theoretical framework underpinning research such as agency, stakeholder, signaling, institutional, and legitimacy theory. Agency theory stresses the existence of agency problems and information asymmetry between principals (i.e., shareholders) and agents (i.e., managers) [8]. According to agency theory, the principal delegates management power to the agent, who should be in the best interest of the principal, but usually pursues his own objectives to determine the interests of the principal [45], while stakeholder theory suggests that all actors of the firm should be accountable to shareholders and other stakeholders [46]. Moreover, signaling theory is concerned with market signals to address information asymmetry, which increases the likelihood of informed decisions between two parties. Scott and Meyer suggest that there are organizational practices adopted because they correspond to institutionalized expectations that are not under firm control. This is closely related to the theory of legitimacy, as firms constantly seek to ensure that they operate within the limits of social norms [47]. Therefore, in this study, we adopted a multi-theoretical framework that comprises agency, stakeholder, signaling, institutional, and legitimacy theory to understand ESG disclosure practice and its determinants in Europe. Firstly, agency theory is one of the most widely used theoretical perspectives to explain the relationship between corporate governance characteristics and corporate disclosure practices [7]. Agency theory is frequently related to ESG disclosure practices and their impact on corporate performance [31]. This theory argues that managers engage in ESG activities and disclosure to pursue their wishes. Moral hazards, for example, occur in the presence of asymmetry information, where management (the agent) knows more information about the company and decides to withhold this information from investors (the principal) [48]. Regarding ESG disclosure, firms disclose additional information to increase communication between management and investors, minimising the principal-agent problem [49]. In this regard, the disclosure of ESG information represents a tool capable of reducing information asymmetry, therefore mitigating risk [48]. Managers who disclose their ESG performance can reduce exposure to future risks, such as environmental risk, litigation costs, and bad reputation [50].

Second, stakeholder theory focuses on the need to manage stakeholder expectations, which have the power to provide firms with the required resources (e.g., financial, manufacturing, social, human, and environmental capitals) which are essential to ensure the going concern of the business [49]. Stakeholder theory promotes the use of an internal management tool which focusses on strategies towards non-financial goals such as seeking to improve social welfare and surrounding environments. Such value maximizing governance practices can incorporate shareholder values due to good management practice [51,52].

Third, signaling theory is concerned with reducing information asymmetry. With this, the increase in communication channels increases the information available between the company and the users, thus reducing the information asymmetry [52]. The end user of this information chooses how to interpret the information, the signal sent by the company [53]. ESG disclosure information is used as a tool to provide voluntary information on sustainability efforts and disclosure of ESG performance indicators [54]. Flynn and Thorton argued that signaling theory suggests that voluntary disclosure decisions lead to value-related information on ESG performance. This voluntary nonfinancial disclosure helps investors predict economic earnings; therefore, firms use it to signal their sustainability achievements, legitimize their existence, and maintain or regain their corporate reputation [12,55].

Fourth, institutional theory is a frequently adopted framework in the literature on ESG, since disclosure of ESG plays an important role in portraying the reputation of corporate sustainability [56]. Therefore, institutional theory reflects the impact of social and environmental performance on corporate success [57]. Campbell notes that within the institutional theory paradigm, companies are perceived as economic units operating within such frameworks constructed by institutions with expectations [56]. Firms that operate in countries with similar institutional structures tend to adopt similar behavior forms, such as ethical behavior. Scott considers ethical behavior a normative institution, as it includes informal rules associated with morals and values [58].

Finally, from a legitimacy perspective, corporate legitimacy is gained by releasing more useful information on ESG that helps stakeholders assess the impact of their companies on society and the environment [12]. Reber et al. found that sustainability reporting is a key form of corporate communication that companies engage in with their strategic objective, thus increasing the legitimacy of the firm [59]. Using ESG reporting, organizations such show the public their compliance with societal norms [11]. Therefore, legitimacy theory is an important motivator for companies to disclose more ESG information to legitimize their existence and achieve sustainable growth through the social acceptance of their communities [11]. This disclosure of ESG can be used to convince societies that companies are working in accordance with their social norms to meet their expectations [50].

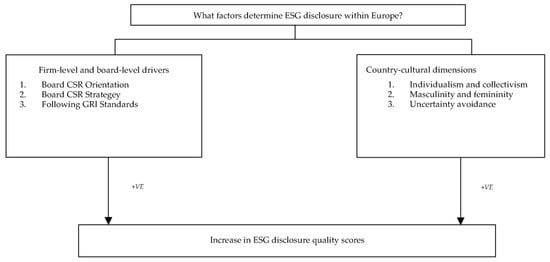

Based on the above discussion, this study will use these five theories to provide explanations for the ESG disclosure practices of EU companies. Therefore, these five theories are connected to each other to create a structure for the disclosure of the ESG of firms. Therefore, the disclosure of ESG can be used to convince the society that companies are working in accordance with social expectations [11]. Figure 1 represents the four following hypotheses with firm and board level drivers of ESG and country cultural drivers.

Figure 1.

Research schema of expected relationship between firm-level and country-level cultural dimensions and ESG disclosure quality scores.

3.2. Hypothesis Development

3.2.1. Board CSR Orientation

Board CSR orientation is known as corporate directors’ acknowledgment of the importance of the environmental concerns facing their companies [12]. Helfaya and Moussa found that board CSR orientation enhances sustainability activities and performance of companies [12]. Previous studies suggest that corporate board characteristics may be present among directors who have a positive impact on firm ESG disclosure practices, such as board independence, gender diversity, and the presence of at least one financial expert in the audit committee [11,12]. In the following, we discuss the rationale for the inclusion of each of the three characteristics of the board.

Board Independence—From an agency perspective, Fama and Jensen state that boards should consist of a greater proportion of non-executive directors (NEDs) to aid in decision-making as well as an increased level of monitoring potential conflicts of interest between managers and shareholders [60]. In fact, corporate executives have the ability and potential to be more attentive to short- and medium-term financial goals, while NEDs may feel that social and environmental issues are as important as profit maximization [60]. The presence of NEDs in boardrooms helps challenge decision-making, bringing different stakeholder perspectives [61]. Similarly, from the stakeholder perspective, greater board independence means that there are NEDs on the board who encourage management activities to maximize long-term value and higher levels of transparency [13]. Regarding ESG disclosure practices, previous literature has found that board independence plays a crucial role in mediating and promoting ESG disclosure practices to enhance transparency and build trust with stakeholders [62,63]. Similarly, Cuccari states that the more NEDs in the boardroom, the more investments in sustainability activities [13]. Both legitimacy and signaling theories support the debate that NEDs are very interested in considering the CSR activities and performance of their firms and, therefore, that they are disclosing more information about ESG to carry out their social and environmental responsibility to stakeholders [4,12]. Consequently, we argue that there is a positive association between the ESG disclosure score and the existence of board independence.

Board Gender Diversity—Boardroom gender diversity is increasingly recognized within the ESG and sustainability agenda. The role women play in corporate boardrooms is multifaceted [12]. First, according to the literature on board gender diversity, male directors are likely to be characterized by agentic attributes, while female directors have more communal characteristics [64]. In practical terms, women are concerned with the welfare of the entire society rather than shareholders; thus, women directors address the interests of all stakeholders. Therefore, having more women on board affects the business agenda of their company with respect to social and environmental issues [65]. Second, compared to male directors, female directors have different experiences, as female directors tend to gain board experience with smaller firms [66]. This experience and diverse business background lead to contributing to the sustainability strategy and activities of their companies [67]. The presence of a female on board is also related to legitimacy, signaling, and institutional theory, as the presence is generally perceived as a signal of compliance with expectations of society, governance regulations, and capital markets requirements [67]. From the above, it is argued that board gender diversity is positively related to the ESG disclosure score [48,50].

The presence of financial expert in the Audit Committee—Iyer et al. define the presence of a financial expert in the audit committee as a director having an accounting or auditing background or any relevant financial experience [68]. It is argued that the efficiency of the audit committee is enhanced by the presence of at least one financial expert, as it ensures the effective operations of the audit committee and increases the effective monitoring of all financial matters [68]. In reality, boardroom directors with financial experience and qualifications will challenge managers and accounting and finance teams to comply fully with accounting standards and financial regulations to improve the credibility of all accounting records, including corporate reports [68]. In the same way as enhancing the credibility of corporate financial reporting, they will also consider other non-financial matters, including CSR reporting [48]. Previous empirical studies have shown a positive relationship between the presence of at least one financial expert on the audit committee and ESG disclosure scores [68]. According to both stakeholder and legitimacy theories, the presence of the financial expert in the audit committee will improve the quality of CSR disclosure practice [68]. In the same vein, the agency theory suggests that members with financial experience and qualifications will work to improve the ability of the audit committee to evaluate the judgments of auditors, and this can be an instrumental tool in controlling risk management, etc. [68]. Based on the above discussion, we expect a positive relationship between the board’s CSR orientation and the ESG disclosure score. So, our first hypothesis is the following:

H1:

There is a positive association between board CSR orientation and ESG disclosure score.

3.2.2. Board CSR Strategy

Board CSR strategy is defined by Banerjee, [69] (p. 106), as ‘the extent to which environmental issues are integrated into a firm’s strategic plans’. Firms should adopt an effective board CSR strategy to achieve their long-term strategic and sustainable business goals. Isaksson and Steimle provide evidence that companies with effective CSR strategies have better sustainability performance [70]. These results are also mirrored by the Helfaya and Moussa study which finds a positive association between effective board CSR strategies and corporate sustainability practices [12]. In fact, an effective CSR strategy on the board leads to better sustainability performance [12]. In relation to the theoretical framework, board CSR strategy has close ties to legitimacy theory as the presence of the board CSR strategy will help the corporate boardrooms to set and achieve their long-term goals and renew their licenses to operate [21]. This decision for a CSR strategy establishes a strategy to enhance the relationship between an organization and its stakeholders with which it operates according to stakeholder theory and legitimacy theory [71].

Based on the above debate, we expect a positive relationship between board CSR strategy and the ESG disclosure score. Accordingly, our second hypothesis is the following.

H2:

There is a positive association between the board’s CSR strategy and the ESG disclosure score.

3.2.3. Global Reporting Initiative

The GRI framework is for non-financial reporting that covers aspects of ESG reporting and performance. The GRI guidelines were initially published in 2000, with the purpose of supporting companies in creating sustainability reports that present the impacts of business operations and activities on society and the environment [72]. The GRI is a voluntary sustainability reporting framework for organizations to prepare their sustainability reports [73]. Previous research indicates that the adoption of GRI sustainability reporting guidelines is on the rise and likely to increase despite current methodological difficulties and information gaps based on its voluntary reporting basis [73,74]. Based on the perspective of legitimacy theory, companies will legitimize their existence by following the GRI sustainability reporting guidelines to communicate their sustainability activities and performance, such as fighting climate change, respecting human and labor rights, fighting corruption, etc., to the public [75]. Similarly, according to signaling theory, companies can use GRI as an effective management tool to signal their commitment to long-term sustainability policies to meet the expectations of their stakeholders. Furthermore, such sustainable disclosure practices signal to stakeholders and society the strong corporate governance practices that are implemented that provide strong transparency, achieve long-term financial and non-financial goals, and improve overall participation of stakeholders [70].

On the basis of the above dialogue, we expect a positive relationship between the adoption of GRI and the ESG disclosure score. Therefore, our third hypothesis is the following.

H3:

There is a positive association between the adoption of the Global Reporting Initiative (GRI) and the ESG Disclosure Score.

3.2.4. Country–Cultural Dimensions

Muttakin (p. 23) defines culture as ‘the collective programming of the mind that distinguishes the members of one human ground from those of another’ [76]. The author stated that these cultural dimensions such as the power distance index, individualism versus collectivism, uncertainty avoidance, masculinity versus femininity, long-term orientation versus short-term orientation, and indulgence versus restraint are integrated into consumer practices and corporate governance [76]. Drawing on these cultural dimensions, the current study encompasses three of the above six dimensions, namely (1) individualism and collectivism; (2) masculinity and femininity; and (3) uncertainty avoidance.

Individualism and collectivism—Individualism versus collectivism is related to the degree of independence among people in a society where society is seen as loosely knit and concerned with themselves and the immediate family [77]. Collectivism, in contrast, emphasizes the importance of community and community interest over individual interests and is expected to place the community first [77]. Shin et al. states that countries with higher collectivism, ESG practices are more likely to be embedded in societies obligations [78]. However, an individualism culture receives greater financial gains from disclosing ESG information.

Masculinity and Femininity—Raimo et al. notes that masculinity reflects a culture where there are dominant values present such as material goods and success [79]. In contrast, a feminine society reflects a more caring view and harmonization of the values and norms of others. At the firm level, masculine societies consider maximizing profits as social norm compared to feminine societies that focus on society members [79]. A feminine society may see the disclosure of ESG as an obligation to society; therefore, creates less incentive toward the disclosure of ESG as it is to maintain legitimacy rather than to create it [78]. Compared to a masculine society, ESG information is seen as a competitive advantage because the focus is placed on profit maximization for most firms. Shin et al.’s research found that masculine societies exhibit a stronger relationship between ESG performance and financial performance due to the competitive advantage seen by masculine cultures focusing on ESG disclosure cultures characterized by masculinity; thus, they are less likely to perceive ethical transgressions in business transactions, and this tolerance of unethical behavior creates conditions that are conducive to widespread corruption [80]. According to the adopted theoretical framework, institutional theory, for example, is considered ESG disclosure practice as an institutional factor that focusses on the role of social beliefs, values relations, and expectations constraints [80]. This argues that corporations are embedded in a nexus of formal and informal rules [81]. The dimensions of the country–culture are based on Hofstede’s constructs and represent a proxy for the deeper aspects of culture related to differences in institutional functioning. Within a femininity culture, the stakeholder perspective is characterized as femininity representing the social needs and harmonization of stakeholders at a holistic level.

Uncertainty avoidance low and high—Hofstede refers to uncertainty avoidance as ‘the extent to which members of a culture feel threatened by uncertain or unknown situations’ (p. 46). We base our country–culture dimensions on this [77]. Uncertainty avoidance deals with the tolerance of people for ambiguity and uncertainty. There is a strong positive correlation between risk taking attitude (i.e., uncertainty accepting behaviour) and unethical actions [82]. Singhapakdi’s article concludes that there is a strong positive correlation between the attitude of people towards risk and unethical actions [81]. Uncertainty avoidant societies mean that risk taking is discouraged and societies are likely to have an increased demand for information. Countries with high uncertainty avoidance, such as Japan, prefer a structured environment such as a clear hierarchy, strict laws, and rules to minimize uncertainty. Therefore, a higher level of information on ESG is significantly associated with cultures characterized by a greater power distance (i.e., less likely to tolerate questionable business practices [83]. Within the theoretical framework adopted and the underpinning of uncertainty avoidance high and low, the institutional perspective is based on Hofstede’s cross-country–cultural dimensions to successfully be perceived as legitimate actors [84].

Based on the above discussion, we expect a positive relationship between the cultural dimensions of the country and the ESG disclosure score. Consequently, our fourth hypothesis is divided into three sub-hypotheses as follows:

H4a:

There is a positive association between the country-level cultural dimension of individualism and the ESG disclosure score.

H4b:

There is a positive association between the country-level cultural dimension of femininity culture and ESG disclosure score.

H4c:

There is a positive association between the country-level cultural dimension of low uncertainty avoidance culture and ESG disclosure score.

4. Research Methodology

4.1. Sample and Data

This study aims to investigate the ESG disclosure quality practices and its determinants in Europe. Europe was chosen on the basis of EU directive 95/2014. The introduction of this mandatory reporting for certain large organizations allows for their transition from voluntary to mandatory non-financial disclosure [85]. The current research is based on panel data from 784 companies covering the period 2011–2020. These sampled firms represent the highest market capitalization firms in each country headquartered in Europe as classified by the Refinitiv Eikon database. The sample represents the available data from 2011 to 2020 from Refinitiv Eikon based on highest market capitalization at the individual country of headquarters. For example, more data was available from companies with headquarters in the UK, than ones with company headquarters in the Czech Republic based on the highest market capitalization representative of each of the countries. The sample also includes Eastern and Western Europe, further affecting the distribution of the number of companies represented in each country. There are three main data sources used for the construction of the dataset. First, we gathered financial and non-financial information from both Refinitiv Eikon and Bloomberg databases. The main set of data was subsequently collected from Bloomberg, including governance factors such as the number of directors, the number of board meetings, etc. The Refinitiv Eikon database was used because it is the main international databank and comprises one of the most complete ESG databases, counting more than 450 different ESG metrics. This database has a strong and clear procedure for the availability of ESG data on its website and is frequently used by researchers [4,12,78]. Alongside these two databases, a third data supply was used for macro-government data, the Worldwide Governance Indicators (WGI) project (https://info.worldbank.org/governance/wgi/ accessed on 27 November 2022). The size of the research sample is designed to be the largest 100 companies within each country. However, after considering the unavailability of some data due to the study time period, 2011–2020, and the nature of sustainability reporting in certain countries, the final sample covers 21 European countries rather than 28 members. These companies are companies listed in the Refinitiv Eikon database with consolidated accounts. Table 1 below presents the distribution of the companies per country, totaling 21 countries and 7840 firm observations. For each year of the sample, the number of observations is the same.

Table 1.

Firms included in the sample per country.

4.2. Dependent Variables

This study uses ESG disclosure scores collected from the Bloomberg database as the dependent variable. The breakdown of the score with the individual pillars of the environmental disclosure score, the social disclosure score, and the governance disclosure score is as follows. These scores also represent the quality of the disclosure of ESGs, as they reflect the in-depth coverage of ESG issues over more than 900 data points across varying indicators. So, the ESG disclosure score ranges from ‘0’ to ‘100’.

4.3. Independent Variables

The main independent variables used in this study combine both micro and macro variables with the use of social governance performance indicators. The micro-level variables are board CSR orientation, board CSR strategy, and the adoption of the GRI sustainability reporting guidelines, while the macro-level variables are country–cultural dimensions based on the work of Hofstede’s measures: individualism and collectivism, masculinity and femininity, and uncertainty avoidance. The study variables are explained in Table 2 below.

Table 2.

Variable Definitions.

4.4. Control Variables

We used some control variables to avoid misspecification of the model and to limit its impact on the disclosure practices of ESG [48]. These control variables are the presence/absence of the CSR committee (CSR_Com), board size (B_SIZE), and the number of board meetings taken place in that reporting year (B_MEET). Tobin Q (TQ) to measure financial performance, enforcement index (ENFORCE) to measure the audit environment enforcement activities, and regulatory quality (REQ_QUALITY) to measure governments implementation of policies.

5. Results

5.1. Descriptive Statistics

Table 3 reports the descriptive statistics for all the variables used in the regression model. It is evident that the firms, overall, disclosed an average score of 48 of the total ESG disclosure score, with a minimum of 5.4 and a maximum score of 72 indicating the wide disclosure level in the quality of the disclosure score. We also find that the mean of environmental disclosure (ED) is 41 with ED ranging from a minimum of 2.3 to a maximum of 74 scores, again indicating how firm disclosures are at both ends of the spectrum. These results are mirrored by social disclosure (SD), with a mean score of 52, which social disclosure varies from a minimum of 3.5 to a maximum of 82. Finally, governance disclosure (GD) in firms on average had a disclosure score of 52, with a minimum score of 2.3 and a maximum of 82. These results indicate within the sample that ESG disclosure still differs in results with, on average, governance disclosure having the highest level of disclosure quality score, suggesting that most firms adopt higher governance practices.

Table 3.

Descriptive statistics.

Table 3 further shows that the mean value of the CSR board orientation (B_ORINT) ranging from 0 to 3, has an average of 2.6. This is related to the results seen in Helfaya and Moussa [11], the results showed an average of 2.104 in their UK sample. The mean value for board CSR strategy (B_STRAT) is 7.6 with a range from 0 to 12. The mean value for GRI is 0.66 which has a range of 0 to 1. Regarding country–cultural dimensions, the mean values of individualism (INDIV) range from 0 to 1 with an average of 0.065. Masculinity (MAS) ranges from 0 to 1, respectively, and has an average of 0.81. The third dimension of country–cultural dimensions is uncertainty avoidance (UAI), with an average of 0.81 and a minimum and maximum ranging from 0 to 1.

Table 4 shows the correlation matrix for the variables used in our analysis. It is evident that the disclosure of ESG and the three individual pillars of ESG are significant and positively related to H1, H2, H3, and H4a, c. Table 4 also shows H4b with a negative correlation between GD and the dimension of masculinity and femininity (MAS). Table 4 further shows low correlations between the independent variables. This low correlation implies that multicollinearity is unlikely to be a concern for this dataset.

Table 4.

Correlation matrix.

5.2. Regression Results and Discussion

Table 5 shows the regression results of examining the impact of board CSR orientation, board strategy, GRI, and country–cultural dimensions including individualism, masculinity or femininity, and uncertainty avoidance in the country on the disclosure of ESG information, and at an individual level of ED, SD, and GD scores.

Table 5.

Regression results.

5.2.1. Board CSR Orientation (H1)

The results show that the board’s CSR orientation has a significant and positive association with the overall ESG disclosure score. This supports the hypothesis that there is a positive relationship between board CSR and the ESG disclosure score. Our evidence suggests that boardrooms with more independent directors, audit committee directors with financial expertise, and female directors on the board are significantly impactful in disclosing more sustainability information to the public. Our results suggest that within the scope of ESG, such board members focus more on the overall ESG with less attention to the social issues, as there is a focus more on the other levels, environmental, and governance ones. This result is consistent with previous studies [24,61]. Within the existence of the three fundamentals of board CSR orientation, our evidence supports Zhuang et al. that the presence of females on the board means that there are more communal characteristics, which increases the firm’s sensitivity to environmental and sustainability issues for larger stakeholders [64]. Our results are also consistent with Iyer et al. that the presence of financial expertise means that such members can debate and challenge managers as to the greater scope of how such non-financial data are reported [67,68]. For example, Roberts et al. found that independent and diverse boards create greater representation, leading to the encouragement of management activities to focus on longer-term value and a higher level of transparency at the top level [61]. The evidence of multivariate regression is consistent with the theory of stakeholders in that board independence plays a crucial role in mediating and promoting sustainability quality disclosure, further increasing transparency and increasing the trust of stakeholders [62,63]. Furthermore, legitimacy theory suggests that the presence of board independence, financial expertise, and females on the board means that firms follow corporate governance codes within board independence and promote gender equality at the boardroom level.

5.2.2. Board CSR Strategy (H2)

The results show that the board CSR strategy has a significant and positive association with the disclosure of ESG quality as fundamental to the three pillars individually. This supports H2 that there is a significant and positive association between board CSR strategy and ESG quality disclosure scores. Our evidence suggests that the presence of a CSR board strategy discusses environmental and social issues and integrates them into the firm’s strategic plans. The results show that there is a positive association between the presence of a board strategy and the levels of ESG disclosure [72]. Specifically, Helfaya and Moussa find that there is an overall positive association between the presence of the board’s CSR strategy and overall sustainable business practices [12]. Our evidence of an overall positive association is also consistent with findings from Wickert et al.; the presence of the board CSR strategy enhances the long-term relationship between organization and stakeholders due to the focus on CSR for wider stakeholders and for the internal organization [71]. The results also provide support for the theoretical frameworks for signaling and stakeholder theories. Within the presence and orientation of the CSR strategy, signaling theory maintains an instrumental view of CSR initiatives that determine the firm’s strategy and create signals for capital markets [71]. Board CSR strategy also encompasses legitimacy theory as the firms seek legitimacy through the act of having a board CSR strategy of long-term sustainable goals for the organization [21].

5.2.3. Global Reporting Initiative (H3)

The results show that the impact of adopting the GRI initiative on ESG quality disclosure practices has mixed results for the regression analysis. Overall, Table 5 shows that GRI is not negatively significantly correlated to SD and GD. However, it is positively correlated with ESG and ED at a p-value of 0.01. The results suggest that there is a positive association between ESG and the ED pillar, since the GRI strongly focusses on environmental factors, while sustainability reporting is driven by following the GRI sustainability reporting guidelines. As there is a positive significant correlation between GRI and general disclosure of ESG, our evidence supports the previous literature that shows that the adoption of GRI increases disclosure scores for ESG [72]. Our results also support previous literature in which there are current methodological difficulties and information gaps within the voluntary disclosure of GRI, and this is seen through the mixed results of the disclosures [66,67]. The results also further support the theoretical framework of ESG disclosure for signaling and legitimacy theories since the following GRI reporting demonstrates effective management and long-term communication to develop further sustainability practices and overall stakeholder participation [70]. Sustainable disclosure practices signal to stakeholders and society the strong corporate governance practices that are implemented, providing strong transparency, long-term goals, and overall stakeholder engagement as such relating to the stakeholder theory.

5.2.4. Country–cultural Dimensions (H4)

The results show that country–cultural dimensions have mixed results within the disclosure of ESG. Within the regressions, country–cultural dimensions adapt dummy variables based on Li et al. summary of cultural dimensions for the country [15]. Regarding Hypothesis 4a with individualism and collectivist country–cultural dimension, there is a positive relationship with cultures with an individualism culture with a correlation of environmental disclosure score of 0.285, identifying how environmental disclosure is higher with individualism and is seen as the most important factor, within this culture, with respect to gaining the highest firm benefits. Regarding Hypothesis 4b, there is a positive association between femininity culture and the disclosure of ESG. However, there is no significant negative correlation with the GD score of −0.0175. These results suggest that a culture of femininity is significant in the disclosure of ESG scores. This result is consistent with feminine societies that focus on other members of the society [8]. Our results mirror previous reports that a country with a feminine society may see ESG disclosure as an obligation to society; thus, this creates less incentive towards ESG disclosure as it is to maintain legitimacy rather than create it [78]. As such, a feminine society sees social needs and harmonization of stakeholders. For Hypothesis 4c, the association between low uncertainty avoidance and the ESG disclosure score is rejected, as there is only a significant level in the SD score. ESG and ESD are 0.00451 and −0.00997, showing very low correlations with uncertainty and ESG disclosure scores. This result mirrors previous literature focused on the social pillar; uncertainty avoidant societies mean that risk-taking is discouraged, and societies are likely to have an increased demand for information focusing mainly on the social level of ESG disclosure as seen in our results [77]. The results provide further empirical support for our multi-theoretical framework, which provides insights into legitimacy and institutional theories. For example, the country–cultural dimensions of firms depend on the social structure already encompassed at the country-level. Keeping such practices provides legitimacy as it is following the norms of that culture. Table 5 shows that the overall disclosure of ESG is positively associated with the four hypotheses.

6. Conclusions

This study investigates the effects of the board CSR orientation, board CSR strategy, the adoption of the GRI sustainability reporting framework, and country–cultural dimensions, namely, individualism and collectivism, masculinity and femininity, and uncertainty avoidance, on ESG disclosure scores. Based on a European sample of 21 countries and 784 companies, we found that board CSR orientation, board CSR strategy, and GRI are positively and significantly related to the ESG disclosure score and positively and significantly related to the individual pillars of E, S, and G. Our findings also suggest that country–cultural dimensions have mixed results within the ESG quality disclosure score. These results lend support to the theoretical frameworks of agency, stakeholder, signaling, institutional, and legitimacy theories. Furthermore, boards with higher levels of CSR orientation, CSR strategy, and adoption of the GRI sustainability reporting framework are considered unique governance mechanisms that help firms disclose high-quality information on ESG at all levels [21]. Boards seeking these levels of higher CSR initiatives seek to develop prominent levels of legitimacy and stakeholder satisfaction by increasing transparency throughout the firm at all levels [12]. Our findings also suggest that country–cultural variables, such as femininity and individualistic culture, create higher levels of disclosure of ESG, which helps firms create higher levels of quality disclosure due to institutional pressures facing firms, albeit due to different pressures and responses [58]. The research also emphasizes the key interplay between firm-level and country-level cultural dimensions, suggesting that firms are influenced by the country-level governance factors as firm behavior tends to be in line with social norms, economic patterns, and investor protection of that country [29]. Firms with an individualistic culture are seen to have higher levels of ESG disclosure quality [29]. This study contributes to the literature by providing empirical evidence on the importance of a prominent level of adoption for the board’s CSR strategy, the CSR orientation of the board, and the adoption of GRI sustainability reporting guidelines. At the country level for the European dataset, the study highlights the importance of three key county-cultural dimensions and their importance for the degree of quality disclosure of more ESG information in the European context. From an economic perspective, firms that follow and integrate CSR strategies into their operations are more orientated to long-term responsible investments, which align with the broader objectives of society and thus increase financial returns due to rational investors [89].

Our findings have several implications for several groups. For example, internally for corporate directors, our results suggest that firms should consider the benefits of having high levels of board CSR strategy and board CSR orientation, establishing an effective corporate boardroom that has some directors with financial experience and qualifications, and the presence of female directors on the board to create higher levels of ESG disclosure scores. The presence of females on the board also creates several advantages for companies, such as setting and adopting new sustainablility-orientated ideas to create long-term success [12,89]. The findings also disclose the main factors that are positive in the reporting of ESG. For example, following the GRI sustainability reporting guidelines, firms can increase their own ESG disclosure scores compared to their peers. Regulators and policymakers could set or reform their policies within countries that examine positively related country–cultural dimensions to introduce policies that mitigate the negative aspects of each country. This could include, within a masculine country, having more females on the board to contribute to the quality of the ESG quality reporting practices. This would potentially help mitigate the masculine characteristics of that country. For ESG and CSR scholars, the multitheoretical perspective and the European dataset used in this study could be used further to conduct further research to explore what other factors have contributed to ESG quality disclosures within Europe.

This paper is subject to a number of limitations and there are multiple avenues for future research. First, we examine a sample of 784 companies in 21 countries within Europe. Future research could examine all 44 European countries to generalize the results on a wide scale. Based on this, future research could also expand to large companies in emerging countries to determine whether micro- and macro-factors change when the sample countries change. This sample could also include country factors, such as the legal system, with a further longitudinal study. Moreover, our sample includes countries with few companies, such as Belgium and the Czech Republic, which may raise doubt about generalization in those countries. Second, in our analysis of board CSR orientation, the study uses female directors as a measure of board diversity, but this does not account for other measures of diversity within the boardroom. Diversity could be measured using other factors such as age, level of education, and ethnic group to see how this diversity plays a role in ESG disclosure [12]. Due to the growing interest in the materiality of ESG disclosure scores, further research could address this materiality as part of the quality of disclosure within firms [25]. Finally, within our research, we used only three out of the six Hofstede measures for country–cultural dimensions; in future research, all country–cultural dimensions could be used to provide more information on how culture affects ESG disclosure across different countries, rather than focusing solely on our country–culture dimensions. Moreover, endogeneity is an unavoidable issue in business research. Due to this, future research may consider an alternative research design to mitigate the potential endogeneity between ESG and governance and country-level variables.

Despite the limitations of this research, this study contributes to the literature by providing evidence that board CSR orientation, CSR strategy, and adoption of the GRI sustainability reporting framework have a significant and positive association with the quality of ESG quality disclosure scores.

Author Contributions

All authors (A.H., R.M., A.A.) have contributed equally to this research. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

We would like to thank the journal’s academic editor and the anonymous reviewers for their valuable comments and suggestions. The first and third authors acknowledge the financial support provided by both Damanhour and Beni-Suef Universities, Egypt. All remaining errors are our own.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aboud, A.; Diab, A. The Impact of Social, Environmental and Corporate Governance Disclosures on Firm Value: Evidence from Egypt. J. Account. Emerg. Econ. 2018, 8, 442–458. [Google Scholar] [CrossRef]

- Aboud, A.; Diab, A. The Financial and Market Consequences of Environmental, Social and Governance Ratings: The Implications of Recent Political Volatility in Egypt. Sustain. Account. Manag. Policy J. 2019, 10, 498–520. [Google Scholar] [CrossRef]

- Helfaya, A.; Whittington, M.; Alawattage, C. Exploring the Quality of Corporate Environmental Reporting: Surveying Preparers’ and Users’ Perceptions. Account. Audit. Account. J. 2019, 32, 163–193. [Google Scholar] [CrossRef]

- Moussa, T.; Kotb, A.; Helfaya, A. An Empirical Investigation of U.K. Environmental Targets Disclosure: The Role of Environmental Governance and Performance. Eur. Account. Rev. 2021, 31, 937–971. [Google Scholar] [CrossRef]

- Helfaya, A.; Bui, P. Exploring the Status Quo of Adopting the 17 UN SDGs in a Developing Country—Evidence from Vietnam. Sustainability 2022, 14, 15358. [Google Scholar] [CrossRef]

- Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á.; Rivera-Lirio, J.M.; Escrig-Olmedo, E. Can Environmental, Social, and Governance Rating Agencies Favor Business Models That Promote a More Sustainable Development? Corp. Soc. Responsib. Environ. Manag. 2019, 26, 439–452. [Google Scholar] [CrossRef]

- Tarmuji, I.; Maelah, R.; Tarmuji, N.H. The Impact of Environmental, Social and Governance Practices (ESG) on Economic Performance: Evidence from ESG Score. Int. J. Trade Econ. Financ. 2016, 7, 67. [Google Scholar] [CrossRef]

- Raimo, N.; Caragnano, A.; Zito, M.; Vitolla, F.; Mariani, M. Extending the Benefits of ESG Disclosure: The Effect on the Cost of Debt Financing. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1412–1421. [Google Scholar] [CrossRef]

- Ioannis, I.; Serafeim, G. What Drives Corporate Social Performance? The Role of Nation-Level Institutions. J. Int. Bus. Stud. 2012, 43, 834–864. [Google Scholar] [CrossRef]

- Liao, L.; Luo, L.; Tang, Q. Gender Diversity, Board Independence, Environmental Committee and Greenhouse Gas Disclosure. Br. Account. Rev. 2015, 47, 409–424. [Google Scholar] [CrossRef]

- Shaukat, A.; Qiu, Y.; Trojanowski, G. Board Attributes, Corporate Social Responsibility Strategy, and Corporate Environmental and Social Performance. J. Bus. Ethics 2016, 135, 569–585. [Google Scholar] [CrossRef]

- Helfaya, A.; Moussa, T. Do Board’s Corporate Social Responsibility Strategy and Orientation Influence Environmental Sustainability Disclosure? UK Evidence. Bus. Strategy Environ. 2017, 26, 1061–1077. [Google Scholar] [CrossRef]

- Cucari, N.; Esposito de Falco, S.; Orlando, B. Diversity of Board of Directors and Environmental Social Governance: Evidence from Italian Listed Companies. Corp. Soc. Responsib. Environ. Manag. 2018, 25, 250–266. [Google Scholar] [CrossRef]

- Toumi, N.B.F.; Khemiri, R.; Makni, Y.F. Board Directors’ Home Regions and CSR Disclosure: Evidence from France. J. Appl. Account. Res. 2022, 23, 509–539. [Google Scholar] [CrossRef]

- Li, T.-T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research Progress and Future Prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Swiss Federal Department United Nations of Foreign Affairs and United Nations. Who Cares Wins: Connecting Financial Markets to a Changing World. 2004. Available online: https://www.unglobalcompact.org/docs/issues_doc/Financial_markets/who_cares_who_wins.pdf (accessed on 1 January 2023).

- Singhania, M.; Saini, N. Institutional Framework of ESG Disclosures: Comparative Analysis of Developed and Developing Countries. J. Sustain. Financ. Investig. 2021, 13, 519–559. [Google Scholar] [CrossRef]

- Tamimi, N.; Sebastianelli, R. Transparency among S&P 500 Companies: An Analysis of ESG Disclosure Scores. Manag. Decis. 2017, 55, 1660–1680. [Google Scholar] [CrossRef]

- Helfaya, A.; Whittington, M. Does Designing Environmental Sustainability Disclosure Quality Measures Make a Difference? Bus. Strategy Environ. 2019, 28, 525–541. [Google Scholar] [CrossRef]

- Baldini, M.; Maso, L.D.; Liberatore, G.; Mazzi, F.; Terzani, S. Role of Country- and Firm-Level Determinants in Environmental, Social, and Governance Disclosure. J. Bus. Ethics 2018, 150, 79–98. [Google Scholar] [CrossRef]

- Tanimoto, K. Do Multi-Stakeholder Initiatives Make for Better CSR. Corp. Gov. Int. J. Bus. Soc. 2019, 19, 704–716. [Google Scholar] [CrossRef]

- Zumente, I.; Bistrova, J. ESG Importance for Long-Term Shareholder Value Creation: Literature vs. Practice. J. Open Innov. Technol. Mark. Complex. 2021, 7, 127. [Google Scholar] [CrossRef]

- Kotsantonis, S.; Pinney, C.; Serafeim, G. ESG Integration in Investment Management: Myths and Realities. J. Appl. Corp. Financ. 2016, 28, 10–16. [Google Scholar] [CrossRef]

- Khan, A.; Muttakin, M.B.; Siddiqui, J. Corporate Governance and Corporate Social Responsibility Disclosures: Evidence from an Emerging Economy. J. Bus. Ethics 2013, 114, 207–223. [Google Scholar] [CrossRef]

- Williams, Z.C. The Materiality Challenge of ESG Ratings. Econ. Cult. 2022, 19, 97–108. [Google Scholar] [CrossRef]

- Schiehll, E.; Kolahgar, S. Financial Materiality in the Informativeness of Sustainability Reporting. Bus. Strategy Environ. 2021, 30, 840–855. [Google Scholar] [CrossRef]

- Balmer, J. Corporate Identity, Corporate Branding and Corporate Marketing-Seeing through the Fog. Eur. J. Mark. 2001, 35, 248–291. [Google Scholar] [CrossRef]

- Ellili, N.O.D. Impact of ESG Disclosure and Financial Reporting Quality on Investment Efficiency. Int. J. Bus. Soc. 2022, 22, 1094–1111. [Google Scholar] [CrossRef]

- Schiehll, E.; Martins, H.C. Cross-national Governance Research: A Systematic Review and Assessment. Corp. Gov. Int. Rev. 2016, 24, 181–199. [Google Scholar] [CrossRef]

- Lokuwaduge, C.S.D.S.; Heenetigala, K. Integrating Environmental, Social and Governance (ESG) Disclosure for a Sustainable Development: An Australian Study. Bus. Strategy Environ. 2017, 26, 438–450. [Google Scholar] [CrossRef]

- Alsayegh, M.F.; Rahman, R.A.; Homayoun, S. Corporate Economic, Environmental, and Social Sustainability Performance Transformation through ESG Disclosure. Sustainability 2020, 12, 3910. [Google Scholar] [CrossRef]

- De Lucia, C.; Pazienza, P.; Bartlett, M. Does Good ESG Lead to Better Financial Performances by Firms? Machine Learning and Logistic Regression Models of Public Enterprises in Europe. Sustainability 2020, 12, 5317. [Google Scholar] [CrossRef]

- Hopwood, B.; Mellor, M.; O’Brien, G. Sustainable Development: Mapping Different Approaches. Sustain. Dev. 2005, 13, 38–52. [Google Scholar] [CrossRef]

- Jamali, D. Insights into Triple Bottom Line Integration from a Learning Organization Perspective. Bus. Process Manag. J. 2006, 12, 809–821. [Google Scholar] [CrossRef]

- Camilleri, M.A. Environmental, Social and Governance Disclosures in Europe. Sustain. Account. Manag. Policy J. 2015, 6, 224–242. [Google Scholar] [CrossRef]

- Deegan, C. Twenty Five Years of Social and Environmental Accounting Research within Critical Perspectives of Accounting: Hits, Misses and Ways Forward. Crit. Perspect. Account. 2017, 43, 65–87. [Google Scholar] [CrossRef]

- Schaltegger, S.; Bennett, M.; Burritt, R. Sustainability Accounting and Reporting: Development, Linkages and Reflection. An Introduction. Sustain. Account. Rep. 2006, 31, 1–33. [Google Scholar] [CrossRef]

- Arvidsson, S. Communication of Corporate Social Responsibility: A Study of the Views of Management Teams in Large Companies. J. Bus. Ethics 2010, 96, 339–354. [Google Scholar] [CrossRef]

- Abhayawansa, S.; Tyagi, S. Sustainable Investing: The Black Box of Environmental, Social, and Governance (ESG) Ratings. J. Wealth Manag. 2021, 24, 49–54. [Google Scholar] [CrossRef]

- Almeyda, R.; Darmansya, A. The Influence of Environmental, Social, and Governance (ESG) Disclosure on Firm Financial Performance. IPTEK J. Proc. Ser. 2019, 25, 278–290. [Google Scholar] [CrossRef]

- Cordazzo, M.; Bini, L.; Marzo, G. Does the EU Directive on Non-financial Information Influence the Value Relevance of ESG Disclosure? Italian Evidence. Bus. Strategy Environ. 2020, 29, 3470–3483. [Google Scholar] [CrossRef]

- Di Vaio, A.; Palladino, R.; Hassan, R.; Alvino, F. Human Resources Disclosure in the EU Directive 2014/95/EU Perspective: A Systematic Literature Review. J. Clean. Prod. 2020, 257, 120509–120527. [Google Scholar] [CrossRef]

- Doni, F.; Martini, S.B.; Corvino, A.; Mazzoni, M. Voluntary versus Mandatory Non-Financial Disclosure: EU Directive 95/2014 and Sustainability Reporting Practices Based on Empirical Evidence from Italy. Meditari Account. Res. 2020, 28, 781–802. [Google Scholar] [CrossRef]

- Cooper, S.M.; Owen, D.L. Corporate Social Reporting and Stakeholder Accountability: The Missing Link. Account. Organ. Soc. 2007, 32, 649–667. [Google Scholar] [CrossRef]

- Carnini Pulino, S.; Ciaburr, M.; Sveva Magnanelli, B.; Nasta, L. Does ESG Disclosure Influence Firm Performance? Sustainability 2022, 14, 7596. [Google Scholar]

- Freeman, R.E. The Politics of Stakeholder Theory: Some Future Directions. Bus. Ethics Q. 1994, 4, 409–421. [Google Scholar] [CrossRef]

- Scott, W.R.; Meyer, W.J. Institutional Environments and Organizations: Structural Complexity and Individualism; Sage: New York, NY, USA, 1994. [Google Scholar]

- Manita, R.; Bruna, M.G.; Dang, R.; Houanti, L. Board Gender Diversity and ESG Disclosure: Evidence from the USA. J. Appl. Account. Res. 2018, 19, 207–224. [Google Scholar] [CrossRef]

- Connelly, B.; Certo, T.S.; Dunae Ireland, R.; Reutzel, R.C. Signaling Theory: A Review and Assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Eccles, N.S.; Viviers, S. The Origins and Meanings of Names Describing Investment Practices That Integrate a Consideration of ESG Issues in the Academic Literature. J. Bus. Ethics 2011, 104, 389–402. [Google Scholar] [CrossRef]

- Peng, L.S.; Isa, M. Environmental, Social and Governance (ESG) Practices and Performance in Shariah Firms: Agency or Stakeholder Theory? Asian Acad. Manag. J. Account. Finanace 2020, 16, 1–34. [Google Scholar] [CrossRef]

- Rezaee, Z. Business Sustainability Research: A Theoretical and Integrated Perspective. J. Account. Lit. 2016, 36, 48–64. [Google Scholar] [CrossRef]

- Healy, P.M.; Palepu, K.G. Information Asymmetry, Corporate Disclosure, and the Capital Markets: A Review of the Empirical Disclosure Literature. J. Account. Econ. 2001, 31, 405–440. [Google Scholar] [CrossRef]

- Lys, T.; Naughton, J.P.; Wang, C. Signaling through Corporate Accountability Reporting. J. Account. Econ. 2015, 60, 56–72. [Google Scholar] [CrossRef]

- Thornton, P.H.; Flynn, K.H. Entrepreneurship, Networks, and Geographies. In Handbook of Entrepreneurship Research: An Interdisciplinary Survey and Introduction; Springer: Boston, MA, USA, 2003. [Google Scholar]

- Campbell, J.L. Why Would Corporations Behave in Socially Responsible Ways? An Institutional Theory of Corporate Social Responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Bilyay-Erdogan, S. Corporate ESG Engagement and Information Asymmetry: The Moderating Role of Country-Level Institutional Differences. J. Sustain. Financ. Investig. 2022, 1–37. [Google Scholar] [CrossRef]

- Scott, W.R. Institutions and Organizations: Ideas, Interests, and Identities; SAGE Publications: New York, NY, USA, 2013; Available online: https://books.google.co.uk/books?hl=en&lr=&id=NbQgAQAAQBAJ&oi=fnd&pg=PP1&dq=+Institutions+and+organizations+scott+2001&ots=hGVafGoj_E&sig=ItBTKCHceiIRffis2nTtX4Qme9M&redir_esc=y#v=onepage&q=Institutions%20and%20organizations%20scott%202001&f=false (accessed on 10 January 2023).

- Reber, B.; Gold, A.; Gold, S. ESG Disclosure and Idiosyncratic Risk in Initial Public Offerings. J. Bus. Ethics 2022, 179, 867–886. [Google Scholar] [CrossRef]

- Fama, E.F.; Jensen, M.C. Agency Problems and Residual Claims. J. Law Econ. 1983, 26, 327–349. [Google Scholar] [CrossRef]

- Roberts, J.; McNulty, T.; Stiles, P. Beyond Agency Conceptions of the Work of the Non-executive Director: Creating Accountability in the Boardroom. Br. J. Manag. 2005, 16, 5–26. [Google Scholar] [CrossRef]

- Adams, R.B.; Licht, A.N.; Sagiv, L. Shareholders and Stakeholders: How Do Directors Decide? Strateg. Manag. J. 2011, 32, 1331–1355. [Google Scholar] [CrossRef]

- Eagly, A.H.; Johannesen-Schmidt, M.C.; Engen, M.L. Van Transformational, Transactional, and Laissez-Faire Leadership Styles: A Meta-Analysis Comparing Women and Men. Psychol. Bull. 2003, 129, 569–591. [Google Scholar] [CrossRef]

- Zhuang, Y.; Chang, X.; Lee, Y. Board Composition and Corporate Social Responsibility Performance: Evidence from Chinese Public Firms. Sustainability 2018, 10, 2752. [Google Scholar] [CrossRef]

- Baxter, P.; Cotter, J. Audit Committees and Earnings Quality. Account. Financ. 2009, 49, 267–290. [Google Scholar] [CrossRef]

- Homburg, C.; Stierl, M.; Bornemann, T. Corporate Social Responsibility in Business-to-Business Markets: How Organizational Customers Account for Supplier Corporate Social Responsibility Engagement. J. Mark. 2013, 77, 54–72. [Google Scholar] [CrossRef]

- Rao, K.; Tilt, C. Board Composition and Corporate Social Responsibility: The Role of Diversity, Gender, Strategy and Decision Making. J. Bus. Ethics 2016, 138, 327–347. [Google Scholar] [CrossRef]

- Iyer, V.; Bamber, M.; Griffin, J. Characteristics of Audit Committee Financial Experts: An Empirical Study. Manag. Audit. J. 2013, 28, 65–78. [Google Scholar] [CrossRef]

- Banerjee, S.B. Who Sustains Whose Development? Sustainable Development and the Reinvention of Nature. Organ. Stud. 2003, 24, 143–180. [Google Scholar] [CrossRef]

- Isaksson, R.; Steimle, U. What Does GRI-reporting Tell Us about Corporate Sustainability? TQM J. 2009, 21, 168–181. [Google Scholar] [CrossRef]

- Wickert, C.; Georg Scherer, A.; Spence, L.J. Walking and Talking Corporate Social Responsibility: Implications of Firm Size and Organizational Cost. Manag. Stud. 2016, 53, 1169–1196. [Google Scholar] [CrossRef]

- Fonseca, A.; McAllister, M.L.; Fitzpatric, P. Sustainability Reporting among Mining Corporations: A Constructive Critique of the GRI Approach. J. Clean. Prod. 2014, 84, 70–83. [Google Scholar] [CrossRef]

- Solikhah, B. An Overview of Legitimacy Theory on the Influence of Company Size and Industry Sensitivity towards CSR Disclosure. Int. J. Appl. Bus. Econ. Res. 2016, 14, 3013–3023. [Google Scholar]

- Baraibar-Diez, E.; Odriozola, M.D. CSR Committees and Their Effect on ESG Performance in UK, France, Germany, and Spain. Sustainability 2019, 11, 5077. [Google Scholar] [CrossRef]

- Jo, H.; Harjoto, M.A. Corporate Governance and Firm Value: The Impact of Corporate Social Responsibility. J. Bus. Ethics 2011, 103, 351–383. [Google Scholar] [CrossRef]

- Muttakin, M.B.; Rana, T.; Mihret, D.G. Democracy, National Culture and Greenhouse Gas Emissions: An International Study. Bus Strategy Environ. 2022, 31, 2978–2991. [Google Scholar] [CrossRef]

- Hofstede, G. Dimensionalizing Cultures: The Hofstede Model in Context. Online Read. Psychol. Cult. 2011, 2, 2307-0919. [Google Scholar] [CrossRef]

- Shin, J.; Moon, J.J.; Kang, J. Where Does ESG Pay? The Role of National Culture in Moderating the Relationship between ESG Performance and Financial Performance. Intern. Bus. Rev. 2022, 32, 102071. [Google Scholar]

- Raimo, N.; Vitolla, F.; Marrone, A.; Rubino, M. Do Audit Committee Attributes Influence Integrated Reporting Quality? An Agency Theory Viewpoint. Bus Strategy Environ. 2021, 30, 522–534. [Google Scholar] [CrossRef]

- Yan, J.; Hunt, J. A Cross Cultural Perspective on Perceived Leadership Effectiveness. A Cross Cult. Perspect. Perceived Leadersh. Eff. 2005, 5, 49–66. [Google Scholar] [CrossRef]

- North, D.C. A Transaction Cost Theory of Politics. J. Polit. 1990, 2, 355–367. [Google Scholar] [CrossRef]

- Singhapakdi, A.; Kraft, K.L.; Vitell, S.J.; Rallapalli, K.C. The Perceived Importance of Ethics and Social Responsibility on Organizational Effectiveness: A Survey of Marketers. J. Acad. Mark. Sci. 1994, 23, 49–56. [Google Scholar] [CrossRef]

- Ho, F.N.; Wang, D.H.-M.; Vitell, S.J. A Global Analysis of Corporate Social Performance: The Effects of Cultural and Geographic Environments. A Glob. Anal. Corp. Soc. Perform. Eff. Cult. Geogr. Environ. 2012, 107, 423–433. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing Legitimacy: Strategic and Institutional Approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Lombardi, R.; Cosentino, A.; Sura, A.; Galeotti, M. The Impact of the EU Directive on Non-Financial Information: Novel Features of the Italian Case. Meditari Account. Res. 2021, 30, 1419–1448. [Google Scholar] [CrossRef]

- Roy, A.; Mukherjee, P. Does National Culture Influence Corporate ESG Disclosures? Evidence from Cross-Country Study. Vision 2022, 3, 09722629221074914. [Google Scholar] [CrossRef]

- Velte, P. Does ESG Performance Have an Impact on Financial Performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]