Abstract

This paper presents potential improvements through utilizing the cyclical nature of clusters by human capital, technology, policies, and management. A historical review of the formation and sustainable development of clusters in the US, Europe, Japan, China, and other regions is carried out to achieve this. The aim was to identify and assess the prominent occurrence cases, the central institutional actors, the indicators of their innovative activity, and the schematics of successful cluster management. The theory section covers current classification methods and typology of innovation-territorial economic associations. Consequently, a regression analysis model is produced to identify the potential dominant success factors in implementing the innovation policy of the most successful innovative clusters. Comments on the influence of these predictors on the competitiveness and level of innovative development of the 50 inspected countries follow. As a result of qualitative and quantitative analysis, an overview of the best world practice, the new vision, and its priorities are proposed to improve the efficiency at the level of management structures of innovation clusters.

1. Introduction

Clusters acquire the status of a stable and competitive infrastructure through the realization of their production potential. Long-term practices show that innovation-territorial clusters are the basis of the most competitive economy. As is customary, the programs of each innovation cluster and their associations are developed geographically. They aim to integrate research and industry to optimize the transformation of innovations integrated with the operational chain into full-fledged or experimental products.

The main topic of this paper is the direction of improving the policy of a country to achieve the maximum efficiency and sustainability of clustering in the country. Attention will be focused on the cyclical nature of this part of the economy and the perceived priorities for the optimal development of clusters through human capital, management, and technology.

The literature overview performed by the author confirms the presence of a research gap in this area. No academic work explores the global innovative economy and its development problems on this scale using quantitative methods. In addition, current archives are dominated by publications that lost their analytical relevance some time ago. Therefore, many factors deserve a place in updated analyses. In addition, there has yet to be a qualitative and empirical study of the factors of innovative performance of countries and regions that are carried out to create an optimal managerial scheme for the global and local levels of cluster management.

The expectations set by the government and management methods deployed in the current cluster policy prove to be underwhelming. This is the problem statement for this research, which concretizes successful and effective ways to maintain innovative clusters.

This work aims to propose measures for the initial and continuous improvement of the work of innovation clusters based on the literature review, a regression analysis of factors, and the effects of successful management of economic and industrial clustering.

The relevance of the research topic is characterized by the expected potential and proven effectiveness of clustering world economic entities. When extensive globalization prevails in the transition to new modes of production, it is necessary to study the appropriate management methods that will intensify scientific and technological progress to increase the competitiveness of companies and states. Many economists and writers position the cyclical nature of the ongoing changes as the main priority in studying business actors at various levels of the economy. Cluster systematization of the business environment opens new opportunities for stabilizing national innovation systems and protecting them from external economic factors. These trends in the functioning of the world economy are omnipresent and, by their existence, support the study’s relevance.

Based on the literature review and identified research gap, the following research questions were developed:

- What are the distinct qualities of innovation clusters?

- a.

- Are there strongly defined symptoms of successful clustering that could be learned through the new practices and domestic history of various national economies worldwide?

- b.

- The clusters from which industries and segments appear to be the most productive and thriving globally?

- c.

- The need to form which new institutions and investment developments are the most apparent when looking at the clusters?

- 2.

- What critical innovation indices propel the country’s innovativeness and competitiveness forward?

- a.

- What is their significance when looking at the local and global picture of the country’s innovative and competitive success?

- b.

- What is possible when creating new regional mechanisms and financial and investment platforms that minimize the cluster’s dependency on the regional budget funds?

2. Literature Review

2.1. Theoretical Foundation of Innovative Clustering Worldwide

The intellectual premises of the theory of clusters go back to Alfred Marshall. He characterized these industrial territories as the “concentration of specialized industries in certain places” [1]. With the neoclassical approach, the consideration of regions has come out of the main trends in economic theory.

According to varying terminology, a cluster characterizes an industrial group, which, at the core, are one or several leading industries. Moreover, this paper focuses on the interpretations from theorists, one of whom is Michael Porter, who provides a similar definition of a cluster: “A cluster is a group of interactive companies according to the criterion of geographic approximation with organizations that operate in a certain area. The activity of these companies is characterized by a complex interconnectedness of the general activity with a complementary product line” [2]. In 1990, Michael Porter defined a cluster as a geographically concentrated group of interrelated companies, service providers, specialized suppliers, companies in related industries, and organizations operating in more than one area related to their activities [3].

It stems from classical economic theory that the active implementation of cluster policy makes it possible to eliminate market shortcomings, reduce transaction costs due to the close cooperation of subjects, level information asymmetry, transfer knowledge, and attract the necessary specialists while constantly improving their skills and competence. When implementing cluster projects, the transfer and rotation of knowledge are stimulated, and the cooperation of subjects is intensified [2]. In addition, participants are privileged by private and public funding, which contributes to the achievement of dynamic economic development of the regions. Variable definitions of the territorial innovation cluster, which can be traced in the fundamental economic literature, shown in Table 1.

Table 1.

Definition of the industrial and innovative clusters.

The argument that clusters are the best environment for the generation, implementation, and dissemination of innovations is supported by the described characteristics from the analyzed literature [5]:

- Location of quality human resources with the established network for disseminating new technologies, knowledge, and products.

- Geographic proximity facilitates the dissemination of information related to the studied discipline and minimizes innovation costs.

- Flexible structure in the form of large but also small- and medium-sized enterprises promotes innovative growth in clusters.

Awareness of the role of clusters in developing economic innovations has gradually spread to the economies of individual countries and at the global level. Currently, the geographic extent of clusters varies from one city or region to one country or several neighboring countries. It is determined that clusters have different shapes based on the basis and complexity. Goods-producing companies or service firms, specialized factor suppliers of components, corporate producers, financial institutions, educational establishments, and many others are different participants who form production clusters worldwide [17].

As highlighted by Porter in the management literature, geography has received mostly superficial attention. Geographical issues were prioritized through the influence of cultural, social, and demographic nuances when implementing economic activities on a microeconomic scale. The corporation’s location was seen as a passive or irrelevant issue in the context of the managerial activity. Furthermore, with the intensification of globalization processes, the question of the initial location of the subject was considered to be less and less significant [2].

Other studies have focused on the geographical concentration of companies that operate in a particular area, which can be positioned as unique options for the existence of clusters. In certain countries, industrial areas dominated by small- and medium-sized firms appear as a cluster. In others, there is a combination of massive firms based in the country and large firms owned by foreign owners. However, in popular situations, with some commitment, there are small companies in large numbers [4].

If one looks at the cluster formation activities of the historically leading countries, the main feature of the cluster is revealed—its productive innovation orientation. On the territory of the United States, where Silicon Valley was formed with state support, industrial innovation clusters were created at the regional level. The interconnectedness of industries reached its maximum concentration, which provided and continues to provide the state with the following beforementioned privileges [18].

Thus, the cluster concept emphasizes that regional industrial clusters are critical not only for the national economy, but also for developing small and large businesses, as they remove restrictions on access to capital for participating industrial enterprises [4]. In addition, in these concentrated zones, the process of exchanging ideas and transmitting information from specialists to entrepreneurs, and from entrepreneurs to the state, is actively reproduced.

The founders of Silicon Valley are rightfully credited with the successful use of the cluster approach. Among the reputable universities and more than 7000 high-tech companies, the organizations in this region are recognized as industry leaders. Many of these high-tech projects are characterized by high production intensity and successful commercialization of innovations [19]. The region’s history of successful start-ups and rich professional potential meant that most people who wanted to start a computer technology company did so in Silicon Valley. The growth in the number and size of Silicon Valley companies has led to similar growth in venture capital firms in the region, prompting more entrepreneurs to locate personal businesses in the region. These processes have turned into a positive feedback loop that has yet to end.

The US, earlier than other countries, began to apply a cluster approach to regional economic development. It is necessary to note that Arizona, Florida, Minnesota, California, North Carolina, Ohio, Oregon, and Washington were the first to adapt regional development programs successfully and are leaders in the formation of clusters. To provide administrative and incentive support, states form committees to begin building clusters based on the findings and recommendations of research centers and universities [20]. The committee identifies participants in future clusters, helps them overcome emerging organizational and financial problems, and contributes to the strengthening and developing of existing clusters. For this purpose, initial funding is usually provided by the national authority, and then funding comes from private companies [21].

Currently, the vertical orientation of the “bottom-up” cluster initiative, in which companies, universities, or public organizations act as initiators, and the state takes the minor financial participation, dominates in the US [22].

In Europe, according to a study conducted by the WEF (World Economic Forum) in 2003, Finland ranked first in the future and current competitiveness rankings, ahead of industrial centers such as the US, Japan, and the UK [18]. Within that context, the Finnish economists have rightly identified nine main cluster-drivers of the economy: forestry, information and telecommunications, metallurgy, energy, business services, healthcare, engineering, food, and construction.

The clusters contributed to the narrow specialization of several EU countries in the world market, specifically the Scandinavian countries. UNIDO pursued the goals of technological and industrial development based on the capabilities of each region. Because of the success, in this segment of the world economy, in contrast to the system of innovation leadership autonomous from the state, the vertical orientation of the “top-down” cluster initiative with the maximum financial participation of the state still prevails [23].

The merits of the international competitiveness of the products from the EU clusters in the world market were described in the reports as: the share of the products of the cluster in the world market exceeds the country’s total share in the total volume of world trade, and the industry’s exports exceed imports. Clusters were differentiated into the categories of “strong clusters,” “sustainable clusters,” and “potential clusters.” A balanced development of primary and auxiliary industries, intense internal competition, first-class innovation potential, and intensive interaction within the cluster framework of joint projects and interdepartmental organizational work characterizes the first type of cluster. Clusters from the other categories have yet to achieve similar results [23].

It should be noted that the “strong clusters” in Finland had an unusually high market share of telecommunications products, which accounted for about 30% of the mobile device market and about 40% of the mobile phone market, and its competitiveness was extremely high at the time [24]. Meanwhile, the “Sustainable clusters,” including energy, metallurgical and machine-building showed positive dynamics in forming all cluster elements but have not yet reached the level of development necessary for a confident gain from clustering. Engineering clusters were an excellent example of sustainable cluster capitalization. The intensive development of specialized mechanical engineering in Finland led to forming an independent cluster with many suppliers, service and engineering companies, and research and innovation centers.

In Southeast and East Asia, clusters were actively developed in Japan in the 1960s, when the government began to move from state support for all industries to a selective industrial policy. All this took place against the background of the 1960s—until the mid-1980s, when economic development was mainly associated with industrial development. Under the terms of the established policy, “new industrial cities” and “special industrial zones” were constructed in the country, forming large industrial centers on the Pacific coast [25].

Japan’s cluster policy was one of the first to adopt active support for venture capital. In Japan, unlike in the United States, venture capital was born in the early years, but the infrastructure to support it still needed to be implemented. These functions were assigned to the created clusters. Among other things, a vital role in organizing industrial clusters in Japan was establishing international relations and strengthening ties with industrial companies, research institutes, and universities [20].

The key feature of the Japanese cluster is the leadership role of large companies that apply the concept of internal economies of scale and are at the forefront of new technologies. In Japan, regional clustering is a direct system of links between a large number of large enterprises and a strictly hierarchical network of small- and medium-sized enterprises. Here, the policy of active development of high-tech fields contributes to the formation and development of clusters.

It should be noted that the dominant clusters in China were created based on the Pudong Special Economic Zone, which is equivalent in its advantages to the special economic zone at the national level [26].

The parent company in the region is SAIC (Shanghai Automotive Industry Corporation) incorporated the joint ventures of General Motors and Volkswagen in the automotive industry. The production of parts and components for foreign brands (Bosch, China) is concentrated in the large regions of Guangdong, Hong Kong, and Macau. Foreign Asian automakers (Nissan, Mitsubishi, Honda), which are also concentrated in the same region, entered a relatively new market in 2004–2006 [27].

Meanwhile, clusters have proven themselves in many areas of the economy and industry in China. One of the critical areas to support China’s global competitiveness in this world region is the Shanghai Automotive Cluster, where world-famous auto parts manufacturers are concentrated [28]. The experience of China shows that the arrival of multinational companies specializing in the production of automotive and high-tech products can become a driving force behind the creation of specialized innovation clusters around them. Following this success, leading innovative transnational companies to have structural divisions in different countries, operate as creators and carriers of world-class technologies, and contribute to their distribution worldwide, collaborating with national enterprises to bring technological changes forward. Cluster systems have now received various classifications and academic descriptions, as shown in Table 2.

Table 2.

Authors’ classification of innovation clusters.

According to this classification, the main clusters of the world economy have the prevailing characteristics of successful public policy. These epicenters of synergistic interaction are generators of ideas but not only create but also consume innovations, have a horizontal structure of production, and, with continuous development, maintain the status of leadership with the support of state apparatuses.

It is becoming increasingly popular in the conditions of the modern world economy to prevent costs for transnational corporations when mobilizing the resources of small and medium-sized enterprises, as well as organizing regional networks that form the basis of competitiveness in the global economy. Observations of international clusters’ commercial and state analysis show that North America, the European Union, China, and Japan have the highest concentration of successful clusters [29].

A strong emphasis is now placed on multidisciplinary collaborations in regions previously dominated by traditional industrial clusters. Examples of such countries are the successes of Denmark and Norway in forestry and marine and agricultural development [28]. New projects are initiated through international cooperation of clusters that effectively connect the potential of clusters of various industries to achieve constructive results in collective economic missions. For example, European clusters cooperate with clusters in China to solve environmental problems today [29]. In addition, international practice shows that cluster formation has intensified over the past eight years. For example, more than half of businesses in the US operate in clusters, currently accounting for 70% of the GDP [30]. There are more than 2950 clusters in the EU, which, since 2008, employ more than 40% of the workforce [31].

2.2. Analysis of Innovative Trends of the Leading Countries

It is possible to assess the innovative situation of the world economy clusters through the analysis of data presented in the annual publication of the Global Innovation Index by the World Intellectual Property Organization (WIPO). Throughout 2021, many observations can be found there. Only some countries are now consistently achieving top results in innovation. Only Switzerland and Sweden have been in the top three innovation rankings for over a decade. Switzerland, Sweden, the USA, and the UK have been in the top five for the past 3 years, and the Republic of Korea entered the top five of the GII for the first time in 2021 [32,33,34,35].

In addition, the GII 2021 demonstrates that investment in innovation has shown greater resilience during the COVID-19 pandemic, often reaching new peaks, but these vary by sector and region. Investment in innovation reached an all-time high before the pandemic thanks to research and development. R&D grew by an exceptional 8.5 percent in 2019. However, historical evidence shows a slight decline in investment in innovation afterward. However, despite the loss of life and the economic shock caused by the pandemic, scientific output, R&D spending, intellectual property applications, and venture capital (VC) deals continued to rise in 2020, based on pre-crisis peaks [36].

To summarize, the fundamental models of innovation and development in different countries strongly resonate with the cluster philosophy [37]:

- (1)

- Emphasis on the dissemination of innovations by creating a favorable environment and a rational economic structure;

- (2)

- focus on leading R&D and development of targeted large-scale projects covering all stages of the scientific and production cycle;

- (3)

- promoting innovation through improving infrastructure and coordinating the activities of various science-intensive sectors and industries based on borrowing foreign technologies.

In 2020, the WIPO ranked countries by the number of patents. The US, China, and Japan stand out, which support the largest generation and large-scale commercialization of advanced technologies. The intensive development of innovation in the US led to the creation back in 2010 of a special commission on territorial innovation clusters, as well as doubling federal spending on innovation and expanding tax incentives for private innovation firms [36].

Thus, the US and China in 2021 are characterized by significant scientific potential, substantial investment in R&D, the high innovative activity of firms, and the level and scale of patenting. In these countries, the state is a constructive participant in innovative development, primarily through tax incentives and other economic benefits that help offset the adverse effects of insufficient foreign investment inflow and imperfect capital accumulation as a percentage of GDP [37]. These activities aim to secure a competitive advantage in future growth areas such as green technologies, energy, environmental and climate protection, and human health, the indicators of which are currently forming the negative aspects of the Chinese economy. In the American model, competition between cluster members is typical. In contrast, in the Chinese model, the cluster functions based on active state support and the potential attraction of large-scale foreign direct investment from leading transnational companies. However, the second attribute of this policy has been less effective in recent years.

Meanwhile, in Europe, UNIDO (United Nations Industrial Development Organization), through its Private Sector Development Unit, has developed a set of recommendations aimed at strengthening cooperation between EU governments and businesses in the development and implementation of regional clustering strategies [38].

The key feature of the Japanese cluster is the leadership role of large companies that apply the concept of internal economies of scale and are at the forefront of new technologies. In Japan, regional clustering is a direct system of links between a large number of large enterprises and a strictly hierarchical network of small- and medium-sized enterprises. Here, the policy of active development of high-tech fields contributes to the formation and development of clusters [38].

Information about the industrial distribution of successful city-clusters of variable innovative leadership in different countries is presented in Table 3.

Table 3.

Top Science–Technology clusters of the leading countries.

3. Materials and Methods

To assess the factors of influence of cluster elements and management organizations on innovative development and the level of competitiveness of national innovation systems, an experimental decision was made to implement statistical analysis using multiple linear regression models [39].

After a considerable overview of the literature and related data focused on the topic, the authors have defined the following assumptions:

- The innovation clusters have unique attributes that make them the leading choice when creating a business association in the country;

- There are assets of cluster development reflected by the vital innovation indices that propel the country’s innovativeness and competitiveness forward on the global innovation and competitiveness lists.

The empirical objectives of the study favored the determination of the following hypotheses, which reflect the meaning of the updated research questions.

- The first null hypothesis (H0-1) is related to the research question one—there is no statistical effect from the factors of institutional development, human capital, and research, infrastructure, market development, business development, knowledge and technology, creative results on the innovation index of the leading countries in innovative development;

- The first alternative hypothesis (H1-1) is a statistical effect of institutional development, human capital, research, infrastructure, market development, business development, knowledge and technology, and creative results on the innovation index of the leading countries in innovative development;

- The second null hypothesis (H0-2) is related to the research question two—there is no statistical effect from institutional development, human capital, research, infrastructure, market development, business development, knowledge and technology, and creative results on the level of competitiveness of countries leading innovative development;

- The second alternative hypothesis (H1-2) is a statistical effect of institutional development, human capital, research, infrastructure, market development, business development, knowledge and technologies, and creative results on the competitiveness of countries-leaders of innovative development.

3.1. Qualitative and Quantitative Research

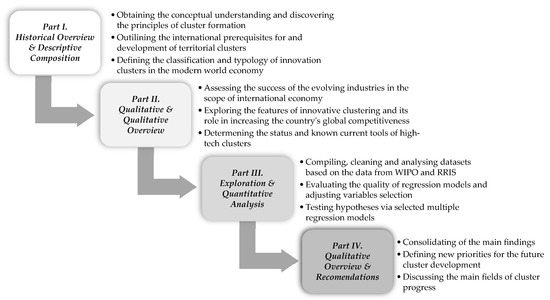

The results of the quantitative analysis tie into the earlier descriptive work when the authors attempted to elaborate on the findings and provide directions for future policy development. The described research process in stages can be seen in Figure 1.

Figure 1.

Deconstruction of the research design. Source: figure of the research flow designed and used by the authors.

The explanation for referred indices from GII 2021 used as variables is provided in Table A1 in the Appendix A.

3.2. Data and Foundation for the Regression Analysis

For the implementation of statistical analysis, 29 linear regression models were created with the participation of 119 variables, which were constructed from 9 databases containing 6656 values. The values of innovation sub-indices and the Global Innovation Index (GII) were found on the WIPO page, and the competitiveness ratings of states were found in the data from International Institute for Management Development (IMD) World Competitiveness Center [36]. All data came out in 2021 and represented the most recent information provided by the publishers. This decision was made due to the need for an alternative option found in free Internet access.

The formula of the multiple linear regression is the following:

where, for = observations:

dependent variable

explanatory variables

y-intercept (constant term)

slope coefficients for each explanatory variable

the model’s error term (also known as the residuals)

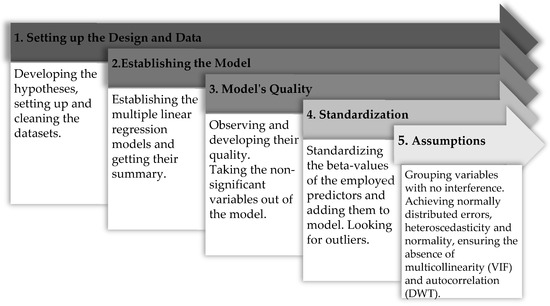

To avoid the adverse effects of autocorrelation [40], multicollinearity [41], heteroscedasticity, and the size of outliers [42] on the objectivity of the obtained statistical results, tests were carried out on the assumptions of the quality of the used models [39]. The Durbin–Watson test was used, the test on variance inflation factor studied the coefficients, and the graphical analysis was produced. For this reason, 23 models were assessed and established, which leveled out the variables’ conflicting interactions in the regression analysis implementation [43]. The workflow of the operations performed in the context of regression analysis can be seen in Figure 2.

Figure 2.

Methodical thinking behind the regression analysis. Source: the figure and research were designed and carried out by the authors.

The threat of unreliability of the obtained results is potentially present due to the limited number of observations, which eliminates the possibility of removing every cause of the statistical outliers when improving the quality of regression models. Another source of doubt about the validity of the obtained results is the indices from WIPO and IMD, on which databases the analysis was executed [44]. Furthermore, the adequacy of using the WIPO’s data regarding the countries’ innovation achievements to represent the success of the countries’ clusters can come under scrutiny. However, after conducting the qualitative analysis, the authors believe this approach can be justified as the innovation clusters significantly impact the countries’ innovation development.

4. Results

4.1. Regression Analysis Results for the First Hypothesis

The first section of the study used information on 50 countries of innovation leadership based on the results of WIPO, which includes Sweden, Switzerland, the United States, Great Britain, South Korea, the Netherlands, Finland, Singapore, Israel, Austria, Italy, Hungary, Russia, and 37 other states [32,33,34,35,36,37].

The following empirical analysis section explores the effect of variable predictors on the innovation status of the leading countries. Indexes from the WIPO database are examined to confirm or reject the first hypothesis. New regression models are created to identify likely relationships with the Global Innovation Index (GII).

The potential relationship between the dependent variable, which is the global innovation index of countries, and grouped indices from the same list are analyzed.

The predictors from the group are indicators of the political environment, the regulatory environment of the country, the business environment, education, higher education, research and development (R&D), information and communication technologies, general infrastructure, environmental sustainability, credit, investment, market scale, and trade diversification, knowledge workers, innovation links, level of knowledge absorption, level of knowledge creation, the influence of knowledge, dissemination of knowledge, intangible assets, creative goods and services, and internet creativity.

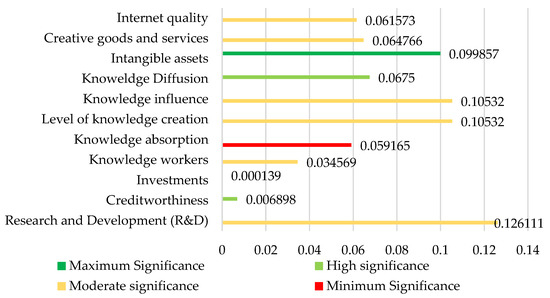

Based on the results of the analysis, the following predictors have an effect on GII, with regard to the common significance levels which are 0.10 (1 chance in 10), 0.05 (1 chance in 20), and 0.01 (1 chance in 100): research and development (R&D)—moderate significance (0.028193) and influence (0.126111); solvency—high significance (0.006898) and effect (0.055343); investments—maximum significance (0.000139) with influence (0.070270); knowledge workers—moderate significance (0.034569) and influence (0.098623); knowledge absorption—minimal significance (0.076929) with influence (0.059165); level of knowledge creation—moderate statistical significance (0.011486) and impact (0.105320); influence of knowledge—moderate significance (0.029204) and influence (0.075818); dissemination of knowledge—high significance (0.005334) and impact (0.067500); intangible assets—maximum significance (0.000818) and impact (0.099857); creative goods and services—moderate significance (0.035786) and influence (0.064766); Internet creativity—moderate significance (0.031478) and influence (0.061573) as it can be observed in Figure 3. The above predictors increase the outcome variable when other factors remain unchanged. The results that the group has a relationship with the dependent variable can be statistically explained and accepted.

Figure 3.

Predictors’ influence on innovation index by significance levels. Source: figure created by the authors based on the results’ significance.

Based on the adjusted R-square [45] value (0.971), the fitted model explains 97.1% of the statistical relationships of the linear regression variables. In addition, the p-value (0.00000000000000022 < 0.05) of the model demonstrates high confidence in rejecting the null hypothesis of no predictor influencing the outcome. Documented findings from RStudio are shown in Table 4.

Table 4.

First group’s generalized variables’ influence on the leading countries’ GII.

The effect on the global innovation index is analyzed with these variables in mind: political and operational stability, government effectiveness, regulatory framework, regulatory quality, the rule of law, cost of redundancy, business environment, ease of starting a business, and ease of resolution of insolvency. The results of statistical processing from RStudio are presented in Table A2 in the Appendix A.

The regression analysis shows that government efficiency has a maximum statistical significance (0.000132) with an effect on GII of (0.595766). Political and operational stability with minimal significance (0.086977) affects (−0.163871) the main innovation index. These predictors raise and lower the leading indicator when other factors remain unchanged.

Based on the adjusted R-square value (0.6774), the fitted model explains 67.74% of the statistical relationships of the linear regression variables. Moreso, the p-value (0.0000000006534 < 0.05) of the model provokes high confidence in the rejection of the null hypothesis about the absence of predictor effects on the final result.

The next step of the analysis considers the ratio of education spending (% GDP); ratios of public funding per student; secondary education (% GDP/number); school life (years); PISA scale for reading, math, and natural sciences; the ratio of students and teachers (average) as the influencers on the dependent indicator—the global innovation index 50 countries. The statistical output from RStudio can be seen in Table A3 in the Appendix A. The “PISA Reading, Math, and Science” variable was found to have the maximum statistical significance (0.000168) with a substantive effect on GII of (0.470633). This predictor increases the dependent variable when other factors remain constant. The adjusted R-squared value (0.3377) suggests that the fitted model explains 33.77% of the statistical relationships of the linear regression variables. Moreover, the model’s p-value (0.0002591 < 0.05) verifies representative stability in confirming the alternative hypothesis.

Table A4 in the Appendix A summarizes the results from RStudio using these variables as predictors of the global innovation index from WIPO: enrollment in higher educational institutions, % gross; graduates in science and technology, %; incoming tertiary mobility, %; researchers, FTE/million population; gross expenditure on R&D, % of GDP; global corporate investors in R&D, top three, USD million; and QS university ranking, top three.

According to the analysis results, gross expenditure on R&D, % of GDP, has a high statistical significance (0.0034) with a substantive effect on GII (0.399705). Furthermore, the incoming tertiary mobility (%) has a minimal significance (0.0699) with an impact in size (0.084239). Moderate significance (0.0174) with an effect (0.342458) on the dependent variable determined by researchers (FTE/million population). Commented predictors increase the dependent variable when other factors remain unchanged.

The adjusted R-squared value (0.7551) suggests that the fitted model explains 75.51% of the statistical relationships of the linear regression variables. Further, the p-value (0.000000000002455 < 0.05) of the model demonstrates solid confidence in confirming the alternative hypothesis.

Table A5 in the Appendix A introduces the summarized results from RStudio using these variables as predictors of the global innovation index: access to ICT; use of ICT; government online service; e-participation; electricity generation, GWh/million population; logistic performance; gross capital formation, % of GDP; GDP per unit of energy consumption; environmental indicators; and environmental certificates ISO 14001/bn GDP PPP.

According to the analysis results, the logistic performance affects the GII by 0.292538 with a maximum statistical significance of 0.00117. The use of ICT is of moderate significance (0.01100) with a substantial impact (0.323226). These predictors increase the main index when other factors remain unchanged. The adjusted R-squared value (0.6937) suggests that the fitted model explains 69.37% of the statistical relationships of the linear regression variables. Moreso, the p-value (0.000000003774 < 0.05) of the model provides solid confidence in confirming the alternative hypothesis.

Table A6 in the Appendix A presents the summarized results from RStudio, involving the following indices as predictors: measures of ease of credit, domestic private sector credit (%GDP), gross microfinance loans (%GDP), ease of protecting minority investors, market capitalization (%GDP), venture capital investors (deals/bn GDP at USD PPP), recipients of venture capital (transactions/bn GDP at USD PPP), applied tariff rate (weighted average,%), diversification of the domestic industry on the scale of the domestic market (billion USD PPP).

Venture investors (transactions/billion GDP at USD PPP) affect GII in the amount of 0.281821 with high statistical significance (0.00262). Furthermore, the scale of the domestic market (billion USD PPP) has a high significance (0.00625) with a significant impact of (0.281821). The main index of domestic credit to the private sector (%GDP) shows an effect of 0.127132 with moderate significance (0.02563). They raise the dependent variable when other factor variables remain constant. The adjusted R-squared value (0.6522) suggests that the fitted model explains 65.22% of the statistical relationships of the linear regression variables. However, the model’s p-value (0.00000003809 < 0.05) provokes slight doubt when failing to reject the alternative hypothesis.

Table A7 in the Appendix A shows the results from RStudio that were achieved by using the following variables in the regression model as predictors: knowledge workers; firms offering formal training, %; Gross domestic Expenditure on Research and Experimental Development (GERD) for business, % of GDP; VRNIK financed by business, %; women employed with academic degrees, %; cooperation between the university and industry in the field of R&D; state of development and depth of the cluster; GERD financed from abroad, % of GDP; joint ventures/strategic alliances/bn GDP at PPP; patent families/bn GDP PPP in dollars; payments for intellectual property, % of the total volume of trade; high-tech imports, % of total trade; import of ICT services, % of total trade; net inflow of FDI, % of GDP; research talent, % in business.

Firms offering formal training (%) have a high statistical significance (0.00763) and influence (0.095343) on the global innovation index. Moreso, gross domestic expenditure on R&D has a high significance (0.00320) with an impact of 0.342999. Patent families/billion PPP dollar GDP (moderate significance—0.01914, impact—0.170581) and net FDI inflows (moderate significance—0.02624, impact—0.047350) are also relevant. These predictors increase the global innovation index when other factors remain constant. The adjusted R-squared value (0.8964) suggests that the fitted model explains 89.64% of the statistical relationships of the linear regression variables. Further, the p-value (0.000000000000004386 < 0.05) of the model demonstrates confidence in confirming the hypothesis about the presence of the influence of predictors on the dependent variable.

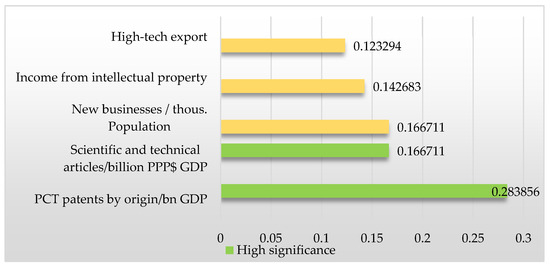

Table A8 in the Appendix A presents the results from RStudio, which are achieved by the use of the newly selected predictors for the next regression model: Patents by origin/billion GDP PPP in USD; PCT Patents by Origin/Billion GDP PPP in USD—high significance (0.00106) and Impact (0.283856); Utility models by origin/billion GDP at PPP in dollars; Scientific and technical articles/billion USD PPP of GDP—high significance (0.00270) and impact (0.166711); Documents cited H-index; Growth of labor productivity, %; New businesses/thousand. Population—moderate significance (0.03762) and influence (0.073564); Expenditure on software, % GDP; Quality certificates ISO 9001/bn GDP PPP—moderate significance (0.02054) and impact (−0.114786); High-tech production, %; Receipts from intellectual property, % of total trade—moderate significance (0.02953) and impact (0.142683); Complexity of production and export; High-tech exports, % of total trade—moderate significance (0.03809) and impact (0.123294); and Export of ICT services, % of total trade. The predictors with commented values that increase the leading indicator when other factors remain unchanged can be seen in Figure 4.

Figure 4.

Predictors’ influence on the countries’ GII by significance levels.

The adjusted R-square equal to 0.8561 suggests that the fitted model explains 85.61% of the statistical relationships of the linear regression variables. Additionally, the p-value (0.0000000000003222 < 0.05) of the model demonstrates tremendous confidence in confirming the alternative hypothesis.

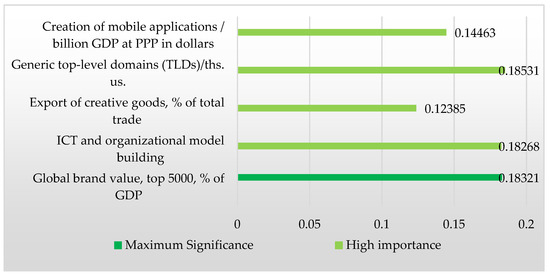

Table A9 in the Appendix A in this section represents the statistical processing results from RStudio. These results are achieved by using the newly selected predictors in the regression model: Trademarks by origin/billion GDP PPP USD; Global brand value, top 5000, %GDP—utmost significance (0.0000712) with an impact of (0.18321); Industrial designs by origin/billion GDP PPP in USD; ICT and organizational model building—high importance (0.00175) and influence (0.18268); Export of cultural and creative services, % of total trade; National feature films/thousands; Entertainment and media market/thousands; Printing and other media, % of production; Export of creative goods, % of total trade—high predictor significance (0.00639) and influence (0.12385); Generic top-level domains (TLDs)/thousands—high significance (0.00266) and influence (0.18531); TLD with country code/thousands; Editions of Wikipedia/mn; Creation of mobile applications/billion GDP at PPP in dollars—high significance (0.00441) and impact (0.14463).

Predictors with commented values increase the global innovation index when other factors remain unchanged. Their influence and significance are shown in Figure 5.

Figure 5.

Eighth group’s variables’ impact on the countries’ GII. Source: figure created by the authors based on the results’ significance.

The adjusted R-squared value (0.8256) suggests that the fitted model explains 82.56% of the statistical relationships of the linear regression variables. In addition, the p-value (0.000000000002914 < 0.05) of the model shows tremendous confidence in confirming the alternative hypothesis.

4.2. Regression Analysis Results for the Second Hypothesis

Using a similar configuration of predictors, an analysis was conducted to register the statistical relationship between the selected predictors and the competitiveness index of the leading countries. Due to the lack of competitiveness indices in the IMD ranking tables, four participants were removed in the third section of this work. These countries are Malta, the United Arab Emirates, Vietnam, and Montenegro [40].

The next part of the empirical analysis examines the effect of similar predictors in Table A10 in the Appendix A on the competitiveness status of the top countries. Indices from the WIPO database are examined to confirm or reject the third hypothesis. New models are being created to identify likely relationships to a column of new values with the content of the IMD World Competitiveness Center Competitiveness Index.

With a p-value of 0.0000009499 and an R-square of 0.7812, which explains 78.12% of the results, the level of investment is found to have a high significance (0.00504) with an impact of 0.173309 on the country’s competitiveness. There is also an influence of 0.306327 with a high significance (0.00961) of the knowledge absorption on the dependent outcome. Other variables do not show a similar correlation.

Table A11 in the Appendix A examines the effect of the predictors on the competitiveness status of the top countries. In the study of the third hypothesis, the seventh model is organized to identify probable relationships with the competitiveness index.

In the model with a p-value of 0.0000000006534 and an R-square that explains 76.44% of the results, government efficiency, regulatory quality, and the rule of law possess a statistical effect on the leading regression indicator. The first predictor has a maximum p-value of 0.000334 with an estimator of 0.62615. When the second has a moderate p-value (0.049016), and an influence of −0.36924, and the third has a moderate significance of 0.034656 and an influence of 0.46789.

The following Table A12 in the Appendix A examines the effect of the predictors on the same dependent variable. A similar model is organized to identify likely relationships of the independent variables with the competitiveness index. The regression model with a p-value of 0.001777 and an uncertain R-square of 0.292 assumes the lack of objectivity of the obtained values. However, it was found that PISA scales in reading, mathematics, and science have a statistical effect of 0.46905 with a high significance of 0.00213 on the global competitiveness index.

Table A13 in the Appendix A of the statistical analysis examines the effect of the predictors from Table A13 on the competitiveness status of the top countries. The model with a p-value of 0.001777 and an R-square of 0.5792 assumes that the obtained values are objective. There is a moderate significance (0.0339) and effect (0.48812) coming from researchers (FTE/million population), as well as moderate significance (0.0189) with influence (0.27677) from QS university rankings. This explains the dependence of competitiveness on factors of human capital and research.

By analogy with the earlier groups of predictors, Table A14 in the Appendix A examines the relationship with the competitiveness of the leading countries. This model, with a p-value of 0.0000003852 and a quality of 64.14%, is expected to yield potentially fair values. The following variables are related to the dependent outcome: ICT use—high significance (0.00179) and impact of 0.54250; logistic productivity—high significance (0.00134) and effect of 0.44315; environmental certificates ISO 14001/bn GDP PPP—the moderate significance of 0.02765 and adverse effect (0.14832).

Similarly, Table A15 in the Appendix A contains the values of the fifth group of variables, whose relationship with the competitiveness of the leading countries is analyzed. The model with an impressive p-value of 0.000000001925 and a quality of 74.07% is expected to show objective values. The high significance of 0.002100 and the effect of 0.18872 from domestic credit to the private sector, as well as the utmost significance of 0.000139 and the effect of 0.38458 from venture capital investors (deals/billion GDP, PPP USD) on the competitiveness of the innovation leader countries, were found when using the multiple linear regression this time.

Table A16 in the Appendix A contains the values of the sixth group of predictors. A model with an impressive p-value of 0.0000000006987 and a quality of 81.99% ensures to confirm the alternate hypothesis. The created table follows:

- firms offering formal training, %—moderate significance (0.0170) and impact of 0.136176;

- university–industry collaboration in R&D—the maximum significance of 0.0000486 and estimator (0.361615);

- joint ventures/strategic alliances/bn GDP PPP—the moderate significance of 0.0120 with impact (0.146760).

Table A17 in the Appendix A contains the values of the seventh group of variables. Using this model with an impressive p-value of 0.000001989 and a quality of 66.50%, more or less reliable values are to be expected. The following is observed in the model:

- Patents by origin/billion GDP at PPP in USD—moderate significance (0.01450) and adverse effect (0.29440);

- PCT patents by origin/billion GDP PPP in USD—high significance (0.00187) and impact (0.60954);

- Quality certificates ISO 9001/bn GDP PPP—moderate significance (0.01291) and impact (−0.22761).

Table A18 in the Appendix A examines the eighth group of variables with the addition of IMD World Competitiveness Index values [46]. The linear regression model with a hefty p-value of 0.00000004825 and a quality of 72.88% suggests a statistically solid result. These observations are documented after looking at the model’s summary:

- Global brand value, top 5000, %GDP—moderate significance (0.03835) with an influence of 0.17840;

- ICT and organizational model building—moderate significance (0.02342) and impact (0.23437);

- Creation of mobile applications/billion GDP at PPP in dollars—high significance (0.00555) and impact (0.22703).

5. The Main Findings

5.1. Regression Analysis Results for the Hypotheses

The statistical analysis based on the empirical studies for the first hypothesis directs to renovating many elements of countries’ innovative development. The significance of these factors can be observed in Table 5.

Table 5.

Prioritizing the leading countries’ factors of innovation by statistical significance.

To be ranked high on the WIPO’s list of global innovation, it is essential to have government efficiency. The country’s achievements in achieving more innovation are expected to relate to the showings in PISA scales for reading, math, and sciences. In addition, the means to sustain exceptional logistic performance and achieve the brand’s global value are essential when aiming for leadership on the list. After conducting the regression analysis for the second hypothesis, it is clear that to maintain and maximize global competitiveness, it is essential to establish an emphasis on the areas of economic functioning, which can be found in Table 6.

Table 6.

Prioritizing the most competitive countries’ factors of innovation by significance.

Curiously enough, when referring to global competitiveness, government efficiency, venture deals, and cooperation between universities and industry in R&D are among the essential prerequisites for being a successful competitor.

5.2. Defining the New Priorities

Based on the experience of the studied countries of innovation leadership, it is necessary to implement these changes in the innovation policy:

- expand the scope and intensity of funding for high-tech research and priority areas in R&D centers and commercial institutions from the regional budget;

- reallocate budgetary resources towards increasing the share of funds allocated on competitive terms to stimulate greater effectiveness of scientific research and development,

- improve information and socio-cultural awareness systems to attract new innovative companies and small businesses to participate in scientific cooperation;

- significantly improve systems for encouraging scientists, mainly in the public sector, to define robust mechanisms for motivating talented people in high-tech disciplines;

- competitively motivate the population to increase the patent activity of Russian inventors abroad;

- create more favorable financial and technological conditions for motivating development institutions to support innovative projects;

- based on the best world experience, deepen the integration of science and education, improve the quality of training in high-tech areas, as well as in academics;

- optimize the contract and volunteer systems for training and recruiting specialists in innovative fields of activity supported by the boosted demand;

- reorganize the communication and management structure of executive, government, research, and commercial institutions;

- promote the participation of the local commercial market in the use of domestic innovations;

- intensify the export of goods and services coming from heavily specialized innovation clusters;

- establish more excellent political stability through increased government efficiency that strongly follows the need for renovation;

- accumulate a large proportion of researchers through the motivation of the population to increase incoming tertiary mobility;

- simplify procedures for obtaining domestic credit by the private sector and organize a new system of economic incentives for starting a new business;

- establish new diplomatic contacts for economic cooperation with clusters from other countries and create conditions for optimizing the net inflow of foreign direct investments in innovation;

- increase gross expenditure on R&D in an attempt to gradually expand the domestic market, providing more creative and high-tech in total trade;

- organize social and economic platforms to boost revenue from newly popularized intellectual property;

- open new programs for formal training through innovative firms, as well as create incentives for the activation of venture capital investors;

- initiate socio-cultural programs to popularize the use of information and communication technologies in order to increase interest in scientific and technical journalism;

- provide access to essential tools for creating mobile applications and modernizing the organizational model of communications;

- work towards continual improvement in the quality of primary, secondary, and vocational education to increase levels of competence in reading, mathematics, and other sciences;

- optimize the logistics infrastructure and intensify the interconnectivity of cluster regions;

- create regulatory and economic incentives to increase global awareness and value of domestic brands;

- optimize digital information channels to intensify the absorption of circulating scientific and educational information in the public domain;

- to implement new cultural programs to raise the authority of the administrative representatives of the state, improve the regular quality of the country and solidify the rule of law;

- constructively work on the quality of education in vocational schools to achieve new positions in the university rankings from QS World University Ranking;

- create pragmatic and attractive conditions for intensifying investment activity in innovative products in the regions;

- make cooperation between universities and industry in the field of R&D more omnipresent.

6. Results Discussion

Discussing Main Fields of Cluster Development

Developing a series of specific measures anchored in the territorial planning documents and the context of variable legal acts is necessary. It is necessary to compile and adopt legislation that will provide optimal conditions for enhancing investment flows in the priority sectors of the cluster economy.

In addition, the government needs to create new processes to support investors who direct money to projects with a significant socio-economic effect. This is achievable by providing tax incentives and affordable preferential tariffs as collateral for obtaining loans to pay for utilities and state and municipal property. In this situation, a more favorable subsidized interest rate could allow reimbursement of the costs of acquiring new equipment following lease agreements. This, in turn, will contribute to the regional improvement of the quality of life of the districts through a cyclical attraction of successful investments.

For the above changes, it is necessary to consider the spatial conditions of the companies and the region. This is critical in the formation of investment legislation. With a correct assessment of local problems and potentials, it is possible to minimize regional disproportions and eliminate social tension and industrial homogeneity, which are fundamental to productive economic growth.

At this stage, it also makes sense to create new separate coordinating bodies at state, regional, and municipal levels to manage the development of priority areas and achieve more substantial critical socio-economic indicators. The functional areas of these agencies should include the coordination of structural subdivisions of regional administrations for implementing the discussed priorities, updating the leading indicators, monitoring the performance of target indicators by cluster participants, and identifying and eliminating the reasons that impede the achievement of personal and government innovation goals. Additionally, the new bodies would provide organizations with scientific resources to participate in developing a cluster development strategy. Teamwork involves minimizing risk and increasing an attractive investment volume.

Measures to modernize cluster investment development could be divided into four categories: improving the investment in manufacturing enterprises, developing cluster and network forms that integrate new production processes, activating municipal investment processes, and altering the functionality of existing investment development institutions in the region.

Of course, with the ambition to develop production on an interregional level, a more specific characterization of transformational initiatives is needed. A further study of the typical nuances of cluster entities could open new individual solutions for implementing effective changes in the real economy of every region.

Thus, when analyzing innovative regions, it is most appropriate to define the relevance of measures for the successful implementation of innovative activities by the institutions of financial development in each region. The authors assume the existence and use of the following directions for the organizational activity.

- Design and implement the new management methods and tools to achieve greater efficiency of investment development institutions in a region. The same should with the investments that go towards the financial institutions themselves;

- Conceptualization and interconnected formation of new institutions of investment development in regions;

- Applying a more concrete project specification of investment proposals when allocating the productive capacities in infrastructure and social projects;

- Creation and support of mechanisms for financing and development of investment platforms. These mechanisms will minimize the participation of the regional budget in the construction of innovative clusters;

- Design in greater detail the development plans for each participant of the investment cluster and outline the future growth of regions within a more extended period;

- Organize incentives for financing R&D from alternative sources, including incentive taxation;

- Modify the information base and improve researchers’ technical and instrumental equipment with better telecommunications;

- Implement unilateral support to improve scientific professions’ status and close participants’ socio-democratic gaps in research and international relations;

- Simplify the procedure for obtaining a patent and registering an industrial design.

The consequences of such structural and optimization changes suggest an increase in the efficiency of corporations. In the free market, they could act as a singular regional operator when developing investment sites and innovation clusters in the region. All this will ensure an increase in the performance of successful enterprises in each investment region and the national economy.

7. Conclusions

In the connotation of this paper, the theoretical foundations of innovative clustering were studied. Theoretical and methodological nuances of the classification and typology of modern innovation clusters were revealed. This made it possible to clarify the methodological approaches based on the theory. The research questions were answered, the original assumptions were justified, and the established hypotheses were tested. All was carried out to propose new answers to traditional and non-traditional problems to increase the competitiveness and innovative development of a country.

This work considered various takes on the conceptual approach to understanding the essence and principles of cluster formation. As a result of the study, it was found that individual countries differ significantly in the principles, forms, and methods of cluster policy. This adjusted the expectations when analyzing the history and prerequisites for the emergence of innovation clusters in various countries. It was found that the increasing focus on innovative cluster development transforms its role and functions in the system of modern international economic relations.

The authors revealed the features of the transformation of the innovation policy of developed countries under the influence of multiple predictors in the economy and developed directions for improvement of the cluster policy. This work also concretizes the fundamental theoretical and methodological provisions that reveal the essence of clusters and their advantages and identify factors for transforming industry clusters into global clusters. In addition, the innovative development of high-tech industries in the international economy was assessed through statistical and qualitative analysis methods.

A qualitative analysis made it possible to identify the features of innovative clustering and its role in increasing the country’s global competitiveness. The authors were able to assess the factors of influence of cluster elements and management organizations on the innovative development of national innovation systems. The sources of a positive impact on the productivity of innovation policy were identified: a high level of education of the population and a high fundamental scientific potential. The interdisciplinary research system of the institutions could be excellent with the improvement of the policies and proper equipment for the innovation projects.

When considering the possibilities of clustering strategies, an assessment of changes in the fundamentals of research activity inside the regional economy revealed the success factors of regional innovation clusters. Based on the foreign experience of the leading countries, recommendations have been developed in cluster policy.

As a conclusion of the empirical work, some proposals are given to increase the efficiency of development by creating a favorable innovation atmosphere in the economy: increasing the efficiency of production through the technological and informational renewal of industrial enterprises, stimulating an innovative culture of the society and business entities, introducing new controlling and supporting management bodies, supporting the existing businesses’ ability to cover their R&D costs, building an institutional base that promotes the growth of innovative activity, as well as removing administrative barriers to the growth of the venture capital market.

When assessing the significance of the parameters on economic development, the authors deduced new promising key areas for reforming clusters in developed countries. Instead of heavily supporting the traditional industries, it is strongly recommended to dedicate the state budget to innovative drivers in cluster policy, which are made from the human and technological capital under the new managerial paradigm.

Still, some limitations prevent the paper from reaching its full potential. One is the substantial unavailability of relevant statistical data about world innovative territorial clusters. This alone could hugely undermine the quality of the produced results. In addition, the used methodology of the regression model does not consider the time-varying nature of the predictors, which could be essential for producing more conclusive results. Because of the time restrictions, it was decided to minimize the sample size of the regression analysis of clusters, which in turn could hide more detailed results.

As for future research directions, they are many options. For example, it is possible to expand on the main idea or apply the concept of the research to the other market with different settings. More observations could be used to get more conclusive results from the statistical analysis. In addition, changing the methodology to a longitudinal one can rectify the problems with the time dependence of the employed regression model. Another direction could be conducting the research based on the data from other sources and comparing the results to ensure the study’s reliability.

Author Contributions

Formal analysis, V.S.; Writing—review & editing, T.H.; Supervision, V.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Indices used from the Global Innovation Index 2021 report.

Table A1.

Indices used from the Global Innovation Index 2021 report.

| Group | Variable | Explanation |

|---|---|---|

| Group 1. Generalized variables’ influence on the leading countries’ GII and GCR. Variables represent the following fields: Institutions, Human capital, research, Infrastructure, Market sophistication, Business Sophistication, Innovation linkages, Knowledge and technology outputs, and creative outputs. | pol_envt_1_1 | Political environment |

| reg_envt_1_2 | Regulatory environment | |

| bus_envt_1_3 | Business environment | |

| edcn_2_1 | Education | |

| trt_edcn_2_2 | Tertiary education | |

| res_dev_2_3 | Research and development (R&D) | |

| info_commn_tech_3_1 | Information and communication technologies (ICTs) | |

| gnrl_infra_3_2 | General infrastructure | |

| eco_sust_3_3 | Ecological sustainability | |

| crdt_4_1 | Credit | |

| invest_4_2 | Investment | |

| trd_div_mark_scl_4_3 | Trade, diversification, and market scale | |

| know_works_5_1 | Knowledge workers | |

| innov_linkgs_5_2 | Innovation linkages | |

| know_absrb_5_3 | Knowledge absorption | |

| know_creat_6_1 | Knowledge creation | |

| know_impct_6_2 | Knowledge impact | |

| know_difsn_6_3 | Knowledge diffusion | |

| intang_assts_7_1 | Intangible assets | |

| creat_gds_servs_7_2 | Creative goods and services | |

| online_creat_7_3 | Online creativity | |

| Group 1. Complex variables’ influence on the leading countries’ GII and GCR. Variables represent the following fields: The political environment, Regulatory environment, and Business environment. | pol_oper_stab_1_1_1 | Political and operational stability |

| gov_effects_1_1_2 | Government effectiveness | |

| reg_qual_1_2_1 | Regulatory quality | |

| rul_law_1_2_2 | The rule of law | |

| cst_redcy_disms_1_2_3 | Cost of redundancy dismissal | |

| eas_start_bus_1_3_1 | Ease of starting a business | |

| eas_resol_insolv_1_3_2 | Ease of resolving insolvency | |

| Group 2. Complex variables’ influence on the leading countries’ GII and GCR. Variables represent the following fields: Education. | expd_edc_2_1_1 | Expenditure on education, % GDP |

| gov_fun_ppl_sec_2_1_2 | Government funding/pupil, secondary, % GDP/cap | |

| schl_lif_exp_2_1_3 | School life expectancy, years | |

| pisa_scls_rd_mth_sci_2_1_4 | PISA scales in reading, maths, and science | |

| ppl_tch_rat_sec_2_1_5 | Pupil-teacher ratio, secondary | |

| Group 3. Detailed variables’ impact on the leading countries’ GII and GCR. Variables represent the following fields: Tertiary education, Research, and Development. | trt_enrl_grs_2_2_1 | Tertiary enrolment, % gross |

| grad_sci_engin_2_2_2 | Graduates in science and engineering, % | |

| trt_inb_mob_2_2_3 | Tertiary inbound mobility, % | |

| resrs_fte_2_3_1 | Researchers, FTE/mn pop. | |

| grs_expd_res_dev_2_3_2 | Gross expenditure on R&D, % GDP | |

| glob_corp_r_d_invst_top_2_3_3 | Global corporate R&D investors, top three, mn USD | |

| qs_uni_rank_top3_2_3_4 | QS university ranking, top three | |

| Group 4. Complex variables’ impact on the leading countries’ GII and GCR. Variables represent the following fields: Information and communication technologies, General infrastructure, Ecological sustainability. | ict_accss_3_1_1 | ICT access |

| ict_use_3_1_2 | ICT use | |

| gov_onilne_srvc_3_1_3 | Government’s online service | |

| e_part_3_1_4 | E-participation | |

| elctro_outpt_3_2_1 | Electricity output, GWh/mn pop. | |

| logs_perf_3_2_2 | Logistics performance | |

| grs_cap_frm_gdp_3_2_3 | Gross capital formation, % GDP | |

| gdp_unt_ener_use_3_3_1 | GDP/unit of energy use | |

| envir_perf_3_3_2 | Environmental performance | |

| iso_14001_envir_cert_3_3_3 | ISO 14001 environmental certificates/bn PPP USD GDP | |

| Group 5. Detailed variables’ influence on the leading countries’ GII and GCR. Variables represent the following fields: Credit, Investment, Trade, diversification, and market scale. | eas_getng_creds_4_1_1 | Ease of getting credit |

| dom_cred_priv_sectr_gdp_4_1_2 | Domestic credit to private sector, % GDP | |

| mcrfin_grs_lns_gdp_4_1_3 | Microfinance gross loans, % GDP | |

| eas_prtc_mnr_invst_4_2_1 | Ease of protecting minority investors | |

| mrkt_cap_gdp_4_2_2 | Market capitalization, % GDP | |

| vntr_cap_invst_dls_gdp_4_2_3 | Venture capital investors, deals/bn PPP USD GDP | |

| vent_cap_recipnts_dls_gdp_4_2_4 | Venture capital recipients, deals/bn PPP USD GDP | |

| appd_trf_rte_wght_avg_4_3_1 | Applied tariff rate, weighted avg., % | |

| dom_ind_div_4_3_2 | Domestic industry diversification | |

| dom_mrkt_scl_4_3_3 | Domestic market scale, bn PPP USD | |

| Group 6. Detailed variables’ impact on the leading countries’ GII and GCR. Variables represent the following fields: Knowledge workers, Innovation linkages, Knowledge absorption. | know_int_empl_5_1_1 | Knowledge-intensive employment, % |

| frm_offgs_form_train_5_1_2 | Firms offering formal training, % | |

| gerd_perf_bus_gdp_5_1_3 | GERD performed by business, % GDP | |

| gerd_fin_bus_5_1_4 | GERD financed by business, % | |

| fem_empld_adv_dgrs_5_1_5 | Females employed w/advanced degrees, % | |

| uni_indry_r_d_col_5_2_1 | University–industry R&D collaboration †| |

| stte_clst_dev_dpth_5_2_2 | State of cluster development and depth †| |

| gerd_fin_abrd_gdp_5_2_3 | GERD financed abroad, % GDP | |

| joint_vent_strt_alli_dls_gdp_5_2_4 | Joint venture/strategic alliance deals/bn PPP USD GDP | |

| pat_fam_gdp_5_2_5 | Patent families/bn PPP USD GDP | |

| intel_prpt_pay_ttl_trd_5_3_1 | Intellectual property payments, % total trade | |

| hi_tech_imp_ttl_trd_5_3_2 | High-tech imports, % total trade | |

| ict_servs_imprt_ttl_trd_5_3_3 | ICT services imports, % total trade | |

| fdi_net_infls_gdp_5_3_4 | FDI net inflows, % GDP | |

| resch_tlnt_buss_5_3_5 | Research talent, % in businesses | |

| Group 7. Detailed variables’ influence on the leading countries’ GII and GCR. Variables represent the following fields: Knowledge creation, Knowledge impact, Knowledge diffusion. | ptnts_orgn_gdp_6_1_1 | Patents by origin/bn PPP USD GDP |

| pct_pat_orgn_gdp_6_1_2 | PCT patents by origin/bn PPP USD GDP | |

| util_mdls_orgn_gdp_6_1_3 | Utility models by origin/bn PPP USD GDP | |

| sci_tech_articl_gfp_6_1_4 | Scientific and technical articles/bn PPP USD GDP | |

| cit_doc_h_indx_6_1_5 | Citable documents H-index | |

| lbr_prod_grwth_6_2_1 | Labor productivity growth, % | |

| new_buss_th_pop_6_2_2 | New businesses/thousands pop. | |

| sftwre_spend_gdp_6_2_3 | Software spending, % GDP | |

| iso_9001_qual_cert_gdp_6_2_4 | ISO 9001 quality certificates/bn PPP USD GDP | |

| hi_tech_mnfct_6_2_5 | High-tech manufacturing, % | |

| intel_prop_rcipts_ttl_trd_6_3_1 | Intellectual property receipts, % total trade | |

| prodn_exp_cmplx_6_3_2 | Production and export complexity | |

| hi_tech_exp_ttl_trd_6_3_3 | High-tech exports, % total trade | |

| ict_srvs_exp_ttl_trd_6_3_4 | ICT services exports, % total trade | |

| Group 8. Detailed variables’ influence on the leading countries’ GII and GCR. Variables represent the following fields: Intangible assets, Creative goods, and services, Online creativity. | trdmks_orgn_gdp_7_1_1 | Trademarks by origin/bn PPP USD GDP |

| glob_brnd_val_top_5000_gdp_7_1_2 | Global brand value, top 5000% of GDP | |

| indust_dsgn_orgn_gdp_7_1_3 | Industrial designs by origin/bn PPP USD GDP | |

| ict_organ_mdl_creats_7_1_4 | ICTs and organizational model creation | |

| cult_creat_servs_exp_ttl_trd_7_2_1 | Cultural and creative services exports, % total trade | |

| ntnl_feat_films_7_2_2 | National feature films/mn pop. | |

| entermt_med_mrkt_7_2_3 | Entertainment and media market/thousand pop. | |

| print_othr_med_mnfrng_7_2_4 | Printing and other media, % manufacturing | |

| creat_gds_exprt_ttl_trd_7_2_5 | Creative goods exports, % total trade | |

| gen_top_lvl_dmns_tlds_7_3_1 | Generic top-level domains (TLDs)/thousand pop. | |

| country_tlds_7_3_2 | Country-code TLDs/thousand pop. | |

| wiki_edit_7_3_3 | Wikipedia edits/mn pop. | |

| mbl_app_creat_7_3_4 | Mobile app creation/bn PPP USD GDP |

Source: Construction of the authors based on [36].

Table A2.

First group’s detailed variables’ influence on the leading countries’ GII.

Table A2.

First group’s detailed variables’ influence on the leading countries’ GII.

| Multiple Linear Regression on Detailed World Cluster Indicators | |||||

|---|---|---|---|---|---|

| lm(formula = glob_innov_indx ~ pol_oper_stab_1_1_1 + gov_effects_1_1_2 + reg_qual_1_2_1 + rul_law_1_2_2 + cst_redcy_disms_1_2_3 +eas_start_bus_1_3_1 + eas_resol_insolv_1_3_2, data = clustdata_3) | |||||

| Residuals: | Min | 1Q | Median | 3Q | Max |

| −17.292 | −5.508 | −0.295 | 6.732 | 13.706 | |

| Coefficients | Estimate | Standard Error | t-value | Pr (>|t|) | Significance |

| pol_oper_stab_1_1_1 | −0.163871 | 0.093504 | −1.753 | 0.086977 | . |

| gov_effects_1_1_2 | 0.595766 | 0.141547 | 4.209 | 0.000132 | *** |

| reg_qual_1_2_1 | −0.157317 | 0.146073 | −1.077 | 0.287639 | |

| rul_law_1_2_2 | 0.207007 | 0.180931 | 1.144 | 0.259052 | |

| cst_redcy_disms_1_2_3 | −0.009371 | 0.035143 | −0.267 | 0.791038 | |

| eas_start_bus_1_3_1 | −0.005171 | 0.045881 | −0.113 | 0.910810 | |

| eas_resol_insolv_1_3_2 | 0.055890 | 0.051916 | 1.077 | 0.287824 | |

| Significance codes | 0 ‘***’ | 0.001 ‘**’ | 0.01 ‘*’ | 0.05 ‘.’ | 0.1 ‘’ |

| Residual standard error: | 8.28 on 42 degrees of freedom | ||||

| Multiple R-squared | 0.7234 | Adjusted R-squared | 0.6774 | ||

| F-statistic | 15.7 on 7 and 42 DF | p-value | 0.0000000006534 | ||

Note: All abbreviations of coefficients are explained in Table A1 in the Appendix A. Source: Table compiled by the authors based on the summary from RStudio.

Table A3.

Second group’s detailed variables’ influence on the leading countries’ GII.

Table A3.

Second group’s detailed variables’ influence on the leading countries’ GII.

| Multiple Linear Regression on Detailed World Cluster Indicators | |||||

|---|---|---|---|---|---|

| lm(formula = glob_innov_indx ~ expd_edc_2_1_1 + gov_fun_ppl_sec_2_1_2 + schl_lif_exp_2_1_3 + pisa_scls_rd_mth_sci_2_1_4 + ppl_tch_rat_sec_2_1_5, data = clustdata_3) | |||||

| Residuals: | Min | 1Q | Median | 3Q | Max |

| −21.537 | −7.888 | −1.685 | 6.288 | 25.553 | |

| Coefficients | Estimate | Standard Error | t-value | Pr (>|t|) | Significance |

| expd_edc_2_1_1 | 0.081222 | 0.061687 | 1.317 | 0.194762 | |

| gov_fun_ppl_sec_2_1_2 | −0.005316 | 0.076400 | −0.070 | 0.944838 | |

| schl_lif_exp_2_1_3 | 0.114208 | 0.079670 | 1.434 | 0.158780 | |

| pisa_scls_rd_mth_sci_2_1_4 | 0.470633 | 0.114425 | 4.113 | 0.000168 | *** |

| ppl_tch_rat_sec_2_1_5 | −0.015419 | 0.063405 | −0.243 | 0.809000 | |

| Significance codes | 0 ‘***’ | 0.001 ‘**’ | 0.01 ‘*’ | 0.05 ‘.’ | 0.1 ‘’ |

| Residual standard error: | 11.86 on 44 degrees of freedom | ||||

| Multiple R-squared | 0.4053 | Adjusted R-squared | 0.3377 | ||

| F-statistic | 5.997 on 5 and 44 DF | p-value | 0.0002591 | ||

Note: All abbreviations of coefficients are explained in Table A1 in the Appendix A. Source: Table compiled by the authors based on the summary from RStudio.

Table A4.

Third group’s detailed variables’ impact on the leading countries’ GII.

Table A4.

Third group’s detailed variables’ impact on the leading countries’ GII.

| Multiple Linear Regression on Detailed World Cluster Indicators | |||||

|---|---|---|---|---|---|

| lm(formula = glob_innov_indx ~ trt_enrl_grs_2_2_1 + grad_sci_engin_2_2_2 + trt_inb_mob_2_2_3 + resrs_fte_2_3_1 + grs_expd_res_dev_2_3_2 + glob_corp_r_d_invst_top_2_3_3 + qs_uni_rank_top3_2_3_4, data = clustdata_3) | |||||

| Residuals: | Min | 1Q | Median | 3Q | Max |

| −13.938 | −4.511 | 1.361 | 4.714 | 12.002 | |

| Coefficients | Estimate | Standard Error | t-value | Pr (>|t|) | Significance |