With the aim of mitigating the risk of infections brought by international air travel various policies have been practised that affected aviation. These policies related to COVID-19 can be divided into two categories: (a) policies about passenger movements, especially across international borders and domestic travel and (b) policies assisting the restart of aviation. The two categories aim to stimulate the demand for air travel safely and facilitate the delivery of the travel services via supporting the survival of the severely impacted air traffic.

2.1. Policy Measures Affecting International Passenger Entry and Domestic Travel

Yu and Chen suggest that policies against COVID-19 transmission via air travel vary from country to country due to unequal public health preparedness levels, socioeconomic and political environment differences [

23]. The USA imposed entry screening at designated airports for international passengers and banned non-US citizen travellers from the EU, China and Iran. EU Member states also imposed travel restrictions, leading to a significant reduction of capacity.

According to the UNWTO (United Nations World Tourism Organization) in May 2020 at 217 destinations worldwide, 97 (45%) of them partially or completely closed their borders to tourists, 65 destinations (30%) suspended international flights partially or completely and 39 destinations (18%) banned the entry of passengers from specific countries of origin or passengers who had transited through specific destinations [

24]. Thus the pandemic has caused a significant loss in city-pair connectivity, an essential element for vital economic activities.

With the scientific understanding of the pandemic gradually increasing, countries showing signs of control of its spread eased their entry restrictions. In June 2020, the European Union adopted a coordinated approach of gradually lifting the temporary restrictions on non-essential travel into the EU. Based on this approach, member states have three common criteria (i.e., notification, test positivity and testing rate) [

25]. Passengers are obliged to complete a passenger’s locator form and, in some cases to undergo quarantine/self-quarantine; and/or take a test for COVID-19 infection before or after arrival. Another policy measure adopted by some countries is bilateral agreements that allow vaccinated individuals to visit the other state (e.g., Greece-Israel agreement). The EU has put in place the EU Digital COVID Certificate, which permits individuals, who have been vaccinated, received a negative test result, or recovered from COVID-19, to travel more easily and support the restart of air travel.

Vaccination roll-outs are pivotal for easing entry restrictions and restarting air travel. Sun et al. suggest that vaccination passports are required for reviving international connectivity [

26]. On 22 July 2020, the COVID-19 vaccination roll-out started in China. As of 12 November 2021, a total of 2,337,700,250 vaccine doses had been administered, with 151.45 doses administered per 100 population in China. As of 18 November 2021, a total of 7,370,902,499 vaccine doses had been administered worldwide (WHO, 2021). Airlines select to fly to places with high vaccination rates. So as vaccination roll-outs have been intensified, restrictions have been easing worldwide, with the exceptions of Myanmar, Libya, Greenland, Afghanistan, Lao People’s Democratic Republic, North Korea and Papua New Guinea that still restrict travelling completely. On the other end, Mexico and Colombia do not impose any travel restrictions.

Zhang et al. suggest that the slow recovery of passenger traffic in most counties can be explained by the governments’ adoption of a “curve flattening” strategy. States would relax restrictions firstly within their territory before coordinating with other authorities to allow inter-State travel.

2.2. Policy Interventions for Aviation Recovery

Public policy interventions worldwide during COVID-19 have taken three forms, according to OECD [

27]. Untargeted support schemes, including job-retention schemes, provide liquidity to firms. Sectoral schemes support a specific sector like airlines in Australia and firm-specific support measures, including partial or total nationalisation. Several countries have offered financial support to aviation, in the form of government-backed commercial loans and government guarantees; recapitalisation through state equity; flight subsidies, nationalisation; deferral and/or waiver of taxes and charges; grants; and private equity (Abate et al., 2020) [

14].

The nationalisation of airlines is often implemented to save airlines from bankruptcy and protect the tourism industry [

28]. Law changes are also another step followed in extreme cases of volatility. Germany, for example, to sustain airlines against insolvency and protect them from bankruptcy, at the outbreak of COVID-19, changed its insolvency law through the COVID-19 Act. This temporarily suspends the obligation to file for insolvency and limits the liability of directors where insolvency is caused by COVID-19.

According to IATA Economics, the airline industry has survived thanks to financial aid, with airlines having received

$243 billion of financial aid worldwide so far (

Table 1) [

29]. The aid has been primarily provided to airlines in the USA, Europe, and Asia, and limited or no support has been provided for Latin American and African carriers. In 2020, over 40 commercial airlines failed or completely ceased operations (Kim and Sohn, 2021). Considering the severity of the impact and the long and winding recovery, government funds are not enough to keep airlines afloat, and external cash injections were sought by airlines (Dube et al., 2021).

The involvement of governments in the aviation recovery of private aviation companies affects the market environment and competition. Some government financial packages to individual airlines and airports have caused disputes (e.g., Ryanair’s court case against the state aid to KLM and TAP), citing unfair competition and special treatment. In their analysis of Virgin Australia bailout, Zhang and Zhang conclude that while the government should refrain from giving direct financial aid to a failing firm, if the private sale deal failed, the cost for Australian consumers and regional communities would be substantial [

30].

Both national governments and international organisations support the recovery of domestic and international aviation. Kim and Sohn (2021) state that the Korean government’s support is similar to other countries and includes relaxing slot allocation rules, reducing and exemption of airports charges, airline ticket prepayments, subsidies, and loans. International organisations like ICAO, IATA, Airports Council International (ACI) and UNWTO provide support in the form of market intelligence reports, guidance documents, standards, and recommended practices.

2.3. China’s Policy Interventions

As with other countries, China has introduced policies related to control of passenger movements and the recovery of aviation. Domestic travel has been very much affected by national policies pertaining to lockdowns, strict testing and quarantine requirements with domestic outbreaks, and travel restrictions. A prime example of this is during the Chinese New Year celebrations of January/February 2021. There was not a blanket travel ban for all domestic travel, but instead, there were extensive testing and quarantine requirements. Moreover, certain states offered financial incentives to workers to stay at home, gave free admission to cultural venues/facilities or offered shopping coupons or discounted rent—all trying to encourage residents to stay local [

31]. This did defer travel somewhat, but most scholars agree that the domestic market is not far off pre-COVID-19 levels (Warnock-Smith et al., 2021; Czerny, 2021).

Policies related to international passenger movements have been very different. In the early months of 2020 when COVID-19 cases in China were very high, many other countries closed borders, introduced travel restrictions and health checks with flights from China. However, as COVID-19 spread elsewhere, the Civil Aviation Administration of China (CAAC) progressively introduced a number of policies aimed at preventing and controlling the COVID-19 cases (

Table 2). This began on 12 March 2022 when there was a new international flight schedule which replaced the routes and flight frequency agreed in the air service agreements and on 19 March the number of flights were only allowed to decrease rather than increase. A few days later on 22 March all passenger flights destined to Beijing were diverted to various designated first entry points in order to control the risk of importing the pandemic to the capital.

As the pandemic spread worldwide more radical policies were introduced on 26 March with the so-called ‘Five One’ rule. This limited Chinese airlines to serving one route to any specific country with no more than one flight per week, and for foreign airlines to serving one route to China with no more than one weekly flight—hence strongly influencing the range of services that could be provided (Liu et al., 2021). At the same time load factors could be not higher than 75% with the aim to prevent infection. On 4 June, some more novel policies were added, with the CAAC imposing penalties for international flights found to carry passengers testing positive for COVID-19. Airlines found to have at least five passengers testing positive were to have their operations suspended for one week. If the positive tests reached 10, their operations were to be suspended for four weeks. This policy was known as a ‘circuit breaker’ or the ‘fusing’ of flights. At the same time there were incentives when if there were zero test results for three consecutive weeks, the number of flights could be increased by one flight per week (subject to the route operation licence), up to a maximum of two flights per week. The circuit breaker policy was changed in December 2020 when airlines had to suspend their operations for two rather than one week if they had at least five passengers testing positive (the four weeks suspension for 10 infected passengers remained the same). It was further changed in April 2021, when airlines found to carry more than five COVID-19 positive passengers could choose between two types of restrictions: frequency-based, or load factor-based. For frequency-based penalties, the airline would have to suspend operating into China for two weeks, whereas for load factor restrictions, the airline would only be allowed to operate at no higher than 40% passenger load factor for four weeks. However for flights with 10 or more infections this load factor penalty was not permitted and flights had to be suspended.

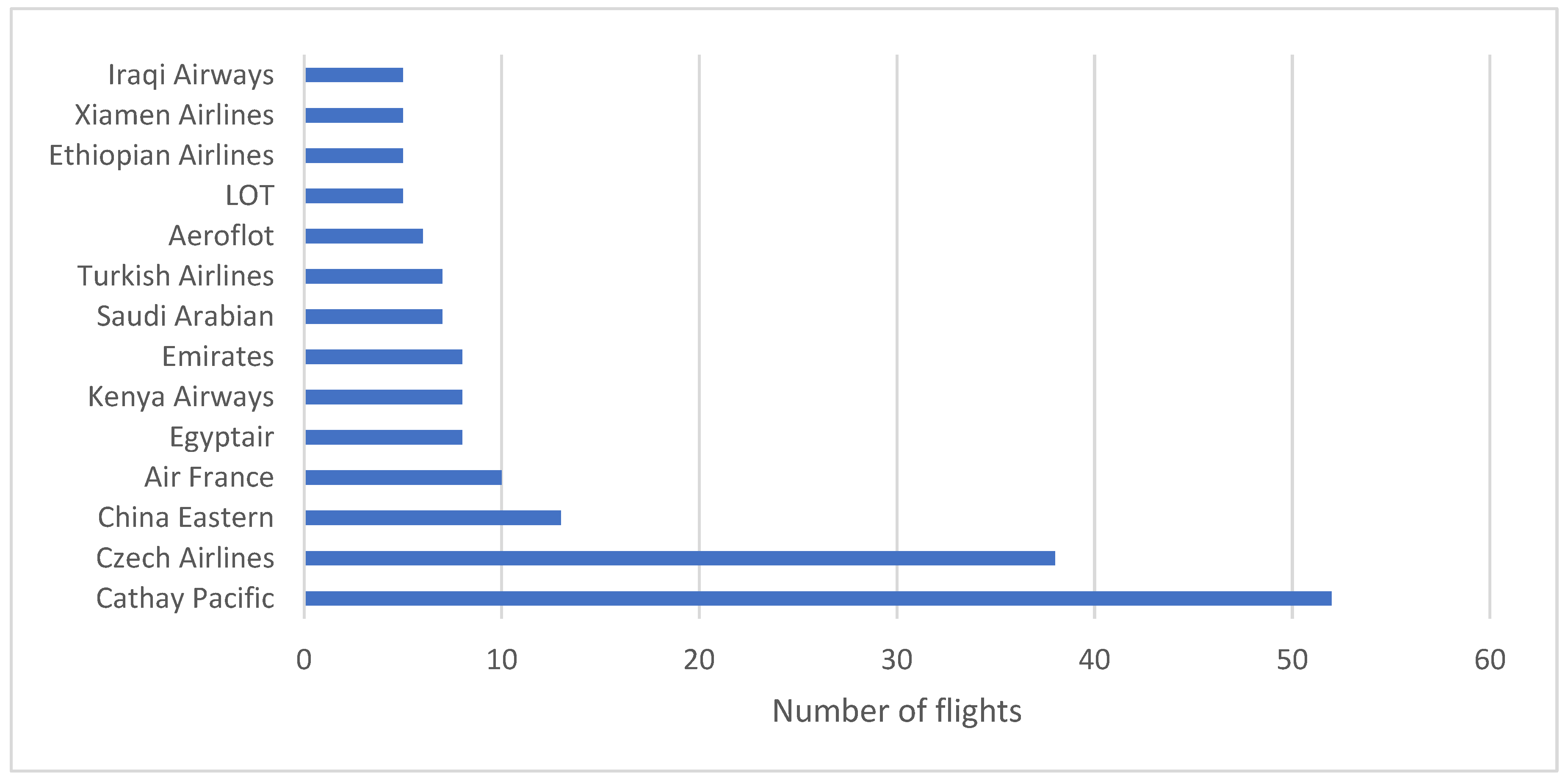

The impact of this fusing policy for individual airlines through time is shown in

Figure 1 and quite clearly Cathay Pacific has been the most severely affected by this. The five one and fusing policy was described by Czerny et al. as outcome-based regulation by which the government tried to deal with improving international connectivity whilst at the same time tightly controlling the spread of COVID-19 cases. It received criticism from the US government stating that it violates the nations’ air services agreement and places undue culpability on carriers. In addition, China introduced travel bans to certain countries, stringent health checks and mandatory quarantine to limit the infection rates of the virus. It implemented a double negative tests policy, like some other countries, where all passengers flying to China needed to take both nucleic acid, IgM anti-body tests and apply for green health codes or certified health declaration forms within 48 h before boarding the flight. Yu and Chen (2021) found that the fusing policy was not effective to reduce the number of imported cases, whereas this double negative test policy was.

In the early months of 2020 when all traffic was severely depressed the Chinese government introduced various measures to provide relief to the airlines, by reducing costs and promoting growth. A payment scheme was introduced of US

$0.0027 per available seat-kilometre (ASK) for flights on routes served by multiple airlines, and US

$0.0081 per ASK for a route where the carrier was a sole operator to encourage the airlines to keep flying [

32]. In addition, Class 1 airports (with passenger numbers >4% of total passengers) and Class 2 airports (with passengers between 1–4% of total) had their landing charges cut by 10% and parking fees waived, and there were reductions in air traffic control fees and fuel costs as well (Flightglobal, 2020). Moreover, the government waived mandated contributions from passengers and airlines to the Civil Aviation Development Fund (Czerney et al., 2021). Hong Kong airport (operated by the Hong Kong government) also introduced relief measures such as fee reductions and rental concessions/waivers targeted at airlines, retail and catering outlets, ground handling agents and others (Warnock-Smith et al., 2021) in an effort to support the industry which suffered even stricter COVID-19 measures at this airport than in mainland China [

33].

There were also other efforts to specifically strengthen domestic traffic. Secondary airports were affected less by COVID-19 due to their smaller dependence on international traffic but at the same time due to their limited capital reserves were more vulnerable to external shocks [

34]. Hou et al. (2021) state that this is also the case for Chinese small airports that mainly live on government subsidies. As a measure to reduce the pandemic impact on the small airports, the Chinese government launched special subsidy programs, where small airports in Southwestern and Northern regions received more subsidies due to their more adverse traffic drop and importance to local communities, though this measure was removed quite swiftly.

Moreover, further liberalisation in the form of access to new routes can support aviation recovery. The CAAC removed capacity constraints of the Beijing, Shanghai and Guangzhou hub airports and granted small airport access to hub airports enhancing, therefore, domestic traffic. According to the new rule, carriers can apply for slots in Beijing, Shanghai and Guangzhou to serve small airports with an annual passenger throughput of less than 1 million, as long as the airlines operate at least 15 routes from the hub airports (Hou et al., 2021).

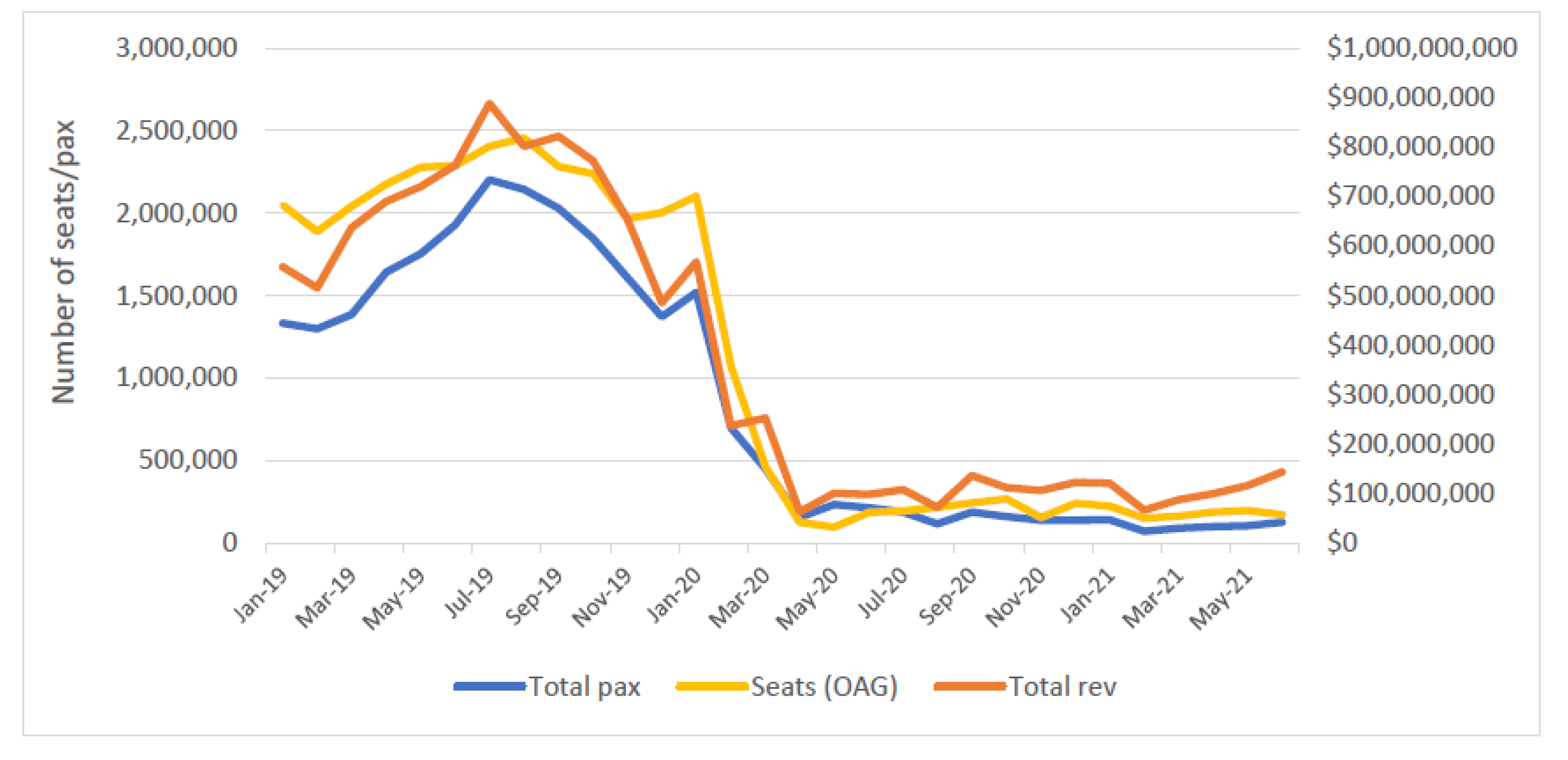

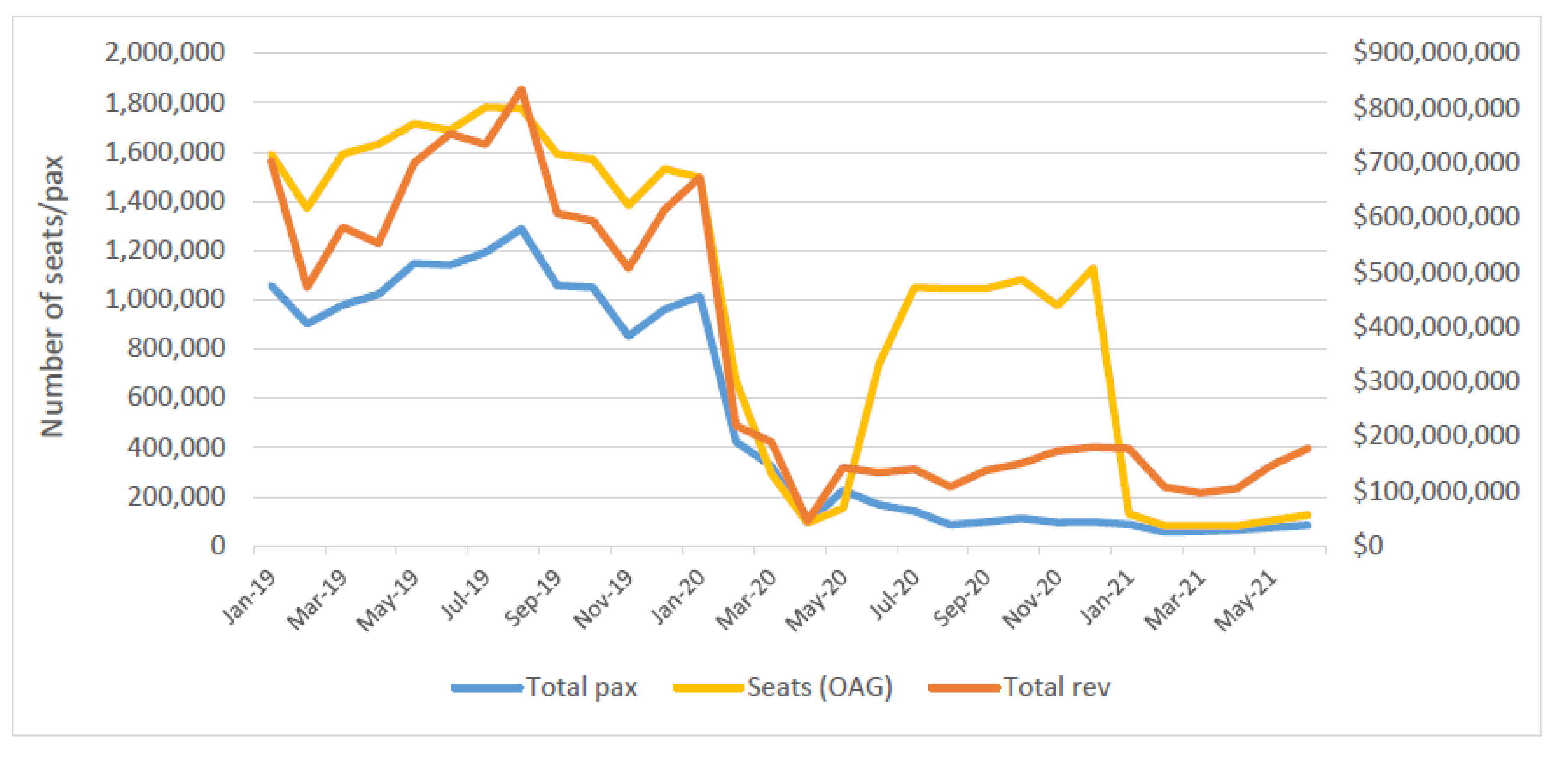

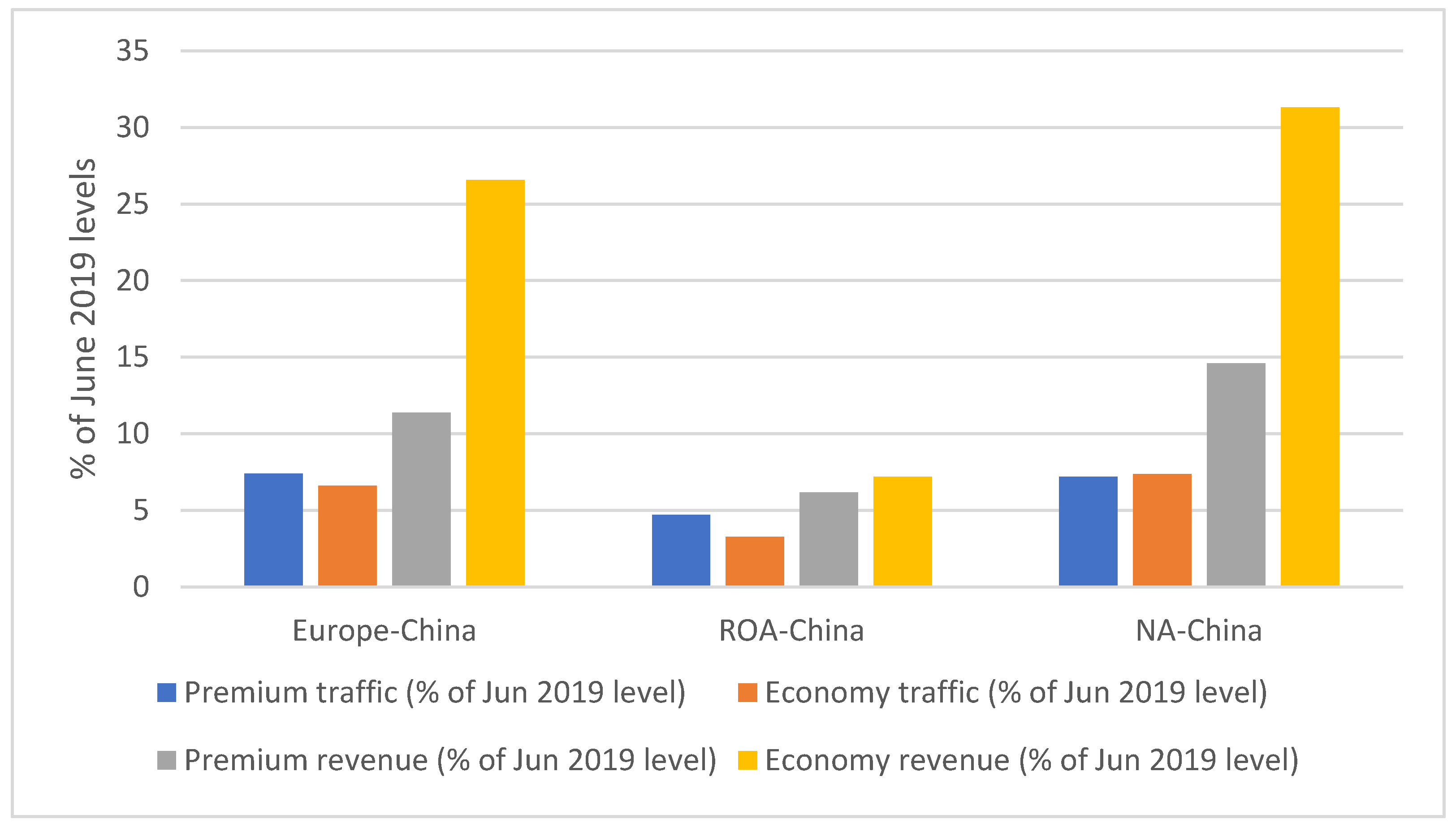

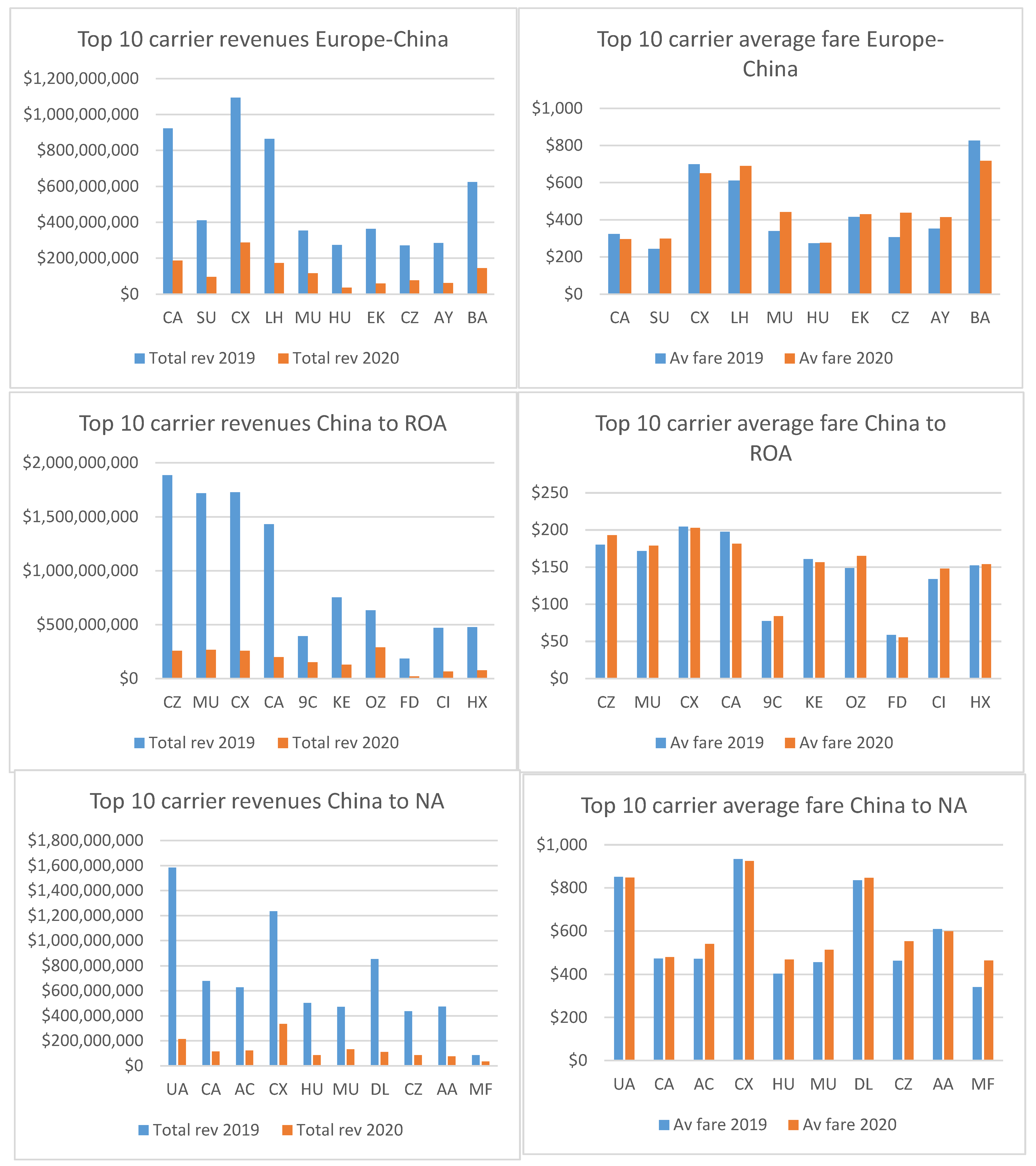

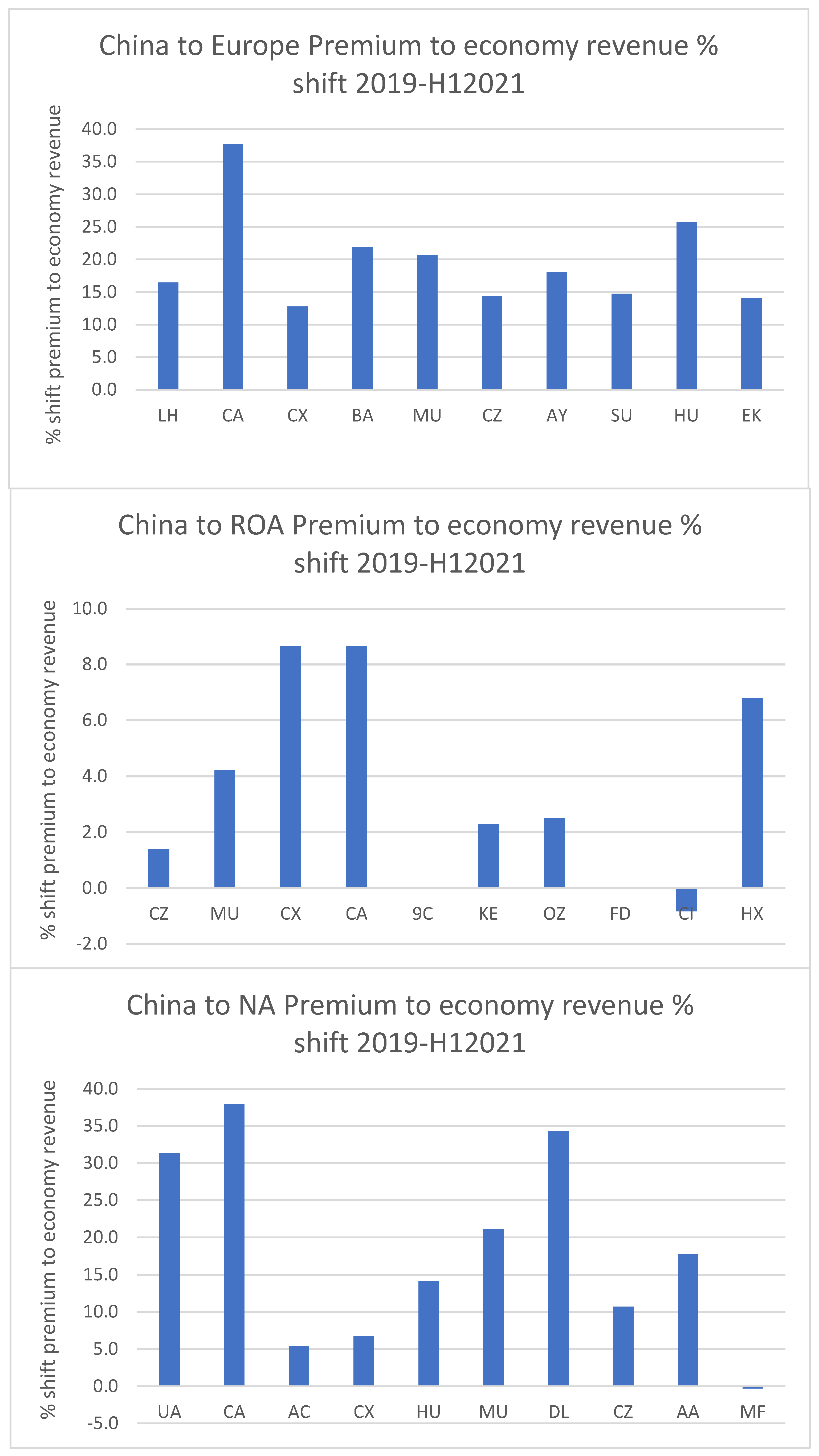

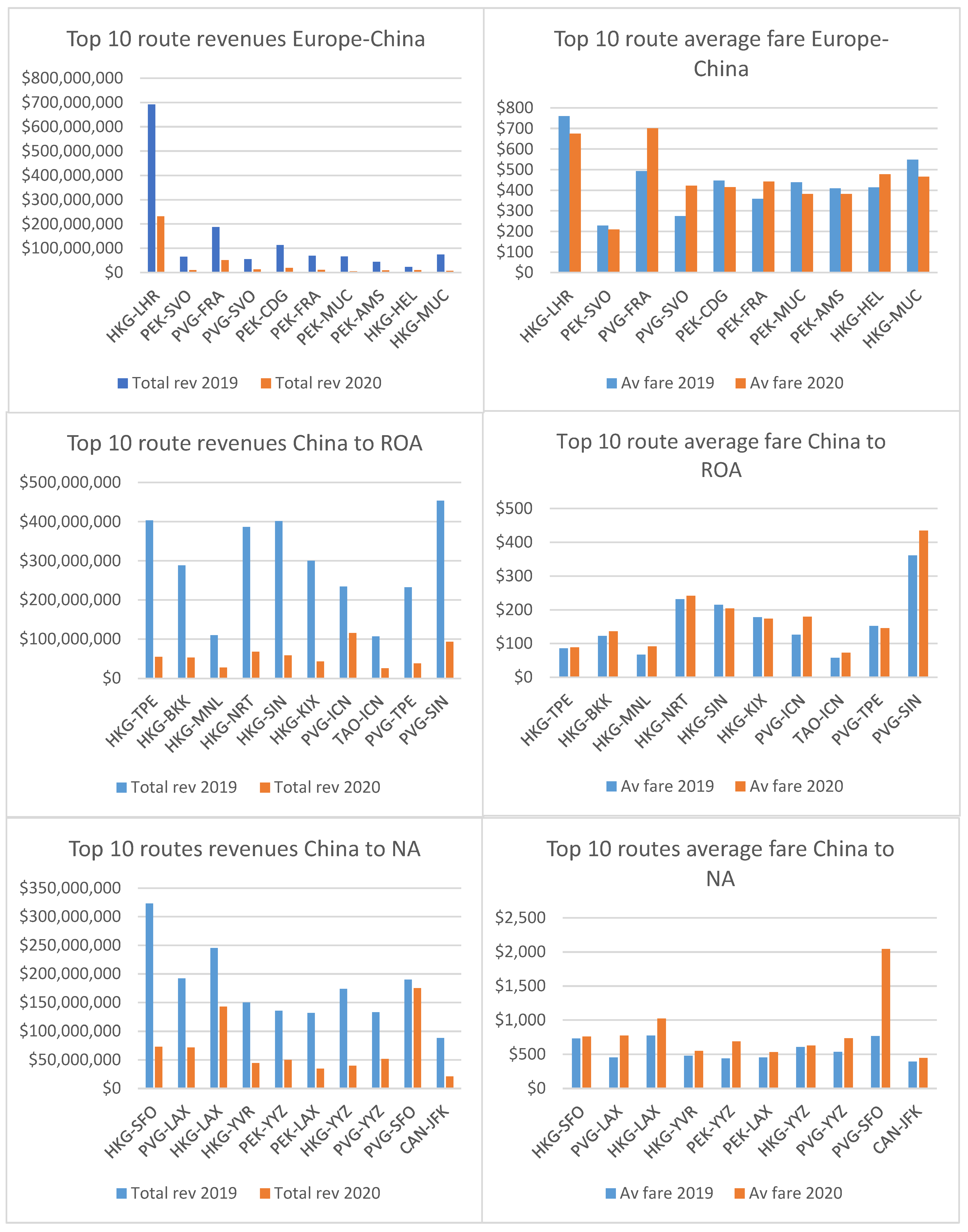

In terms of fares, press reports indicated that in May 2020 fares between China and US were up to ten times higher than those before COVID-19 [

35] whereas in August 2021 they were reported to be five times more expensive that in August 2020 [

36]. It was argued that much of this was due to the shortage of flight supply and many Chinese and overseas students wanting to return to China. Whilst there is also some similar evidence for a few other specific routes, there exists no systematic verification of this trend and so this is one of the aims of this research.

Meanwhile, Hong Kong which had separate COVID-19 policies maintained some of the world’s strictest border rules including blocking non-residents from entry and enforcing 21 day quarantines for travellers. It also had its own circuit breaker policies in relation to air transport. In 2020 it introduced a flight-specific mechanism which prohibited flights from serving Hong Kong for 14 days if:-

Five or more passengers arriving on the same flight at Hong Kong had a positive COVID-19 test; or

Three or more passengers on two consecutive flights with the same airline from the same place had a positive COVID-19 test; or

One or more passengers arriving on the same flight had a positive COVID-19 test with one or more passengers failing to comply with the requirement(s) specified under the the Prevention and Control of Disease (Regulation of Cross-boundary Conveyances and Travellers) Regulation.

This policy was tightened on 14 April 2021 by replacing ‘five or more’ with ‘three or more’ in condition 1, and ‘three or more’ with ‘two or more’ in condition 2, and then again in December 2021 when condition 2 was replaced with ‘four or more passengers on any flights of the same airline from the same place within a seven-day period had a positive COVID-19 test’. Also in April 2021, a new place-specific suspension mechanism was added. With this if five or more passengers on all flights from the same place, regardless of airline, were confirmed to be COVID-19 positive within a seven-day period, all passenger flights from that place were banned for 14 days. Various passenger restrictions and quarantine conditions were also imposed on passengers from this place which would be specified as very high-risk [

37]. Since then this mechanism has been used for various countries. For example, it was first introduced in April 2020 for India, Pakistan and the Philippines. The UK was one of a number of countries that has been on this very high-risk list, with flight bans imposed in December 2020, July 2021 and then in January 2022 along with US, Australia, Canada, France, India, Pakistan and the Philippines. Most recently the Government announced that from 1 April 2022 the place-specific suspension mechanism would be lifted although the flight-specific suspension mechanism would continue with some adjustments [

38]. This move was most welcomed by the airlines who have viewed the policies as being very restrictive.